Abstract

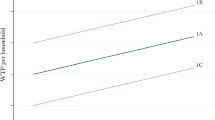

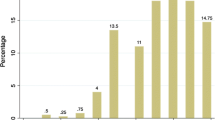

Biases in contingent valuation exercises are often difficult to quantify and to correct due to the hypothetical nature of the method itself. One common problem is hypothetical bias, which in recent years has been addressed in various ways, particularly through the inclusion of a certainty question in the questionnaire. We analyse the impact of applying differing corrections based on the certainty question for double-bounded dichotomous economic valuation exercises. The empirical application is based on data gathered from four surveys conducted with various groups to obtain the value allocated to a modern art museum: the Museo Patio Herreriano de Arte Contemporáneo Español, in the city of Valladolid (Spain). Findings indicate that estimates of Willingness to Pay are significantly reduced when a higher certainty threshold is required, in other words when individuals are more certain of their choices. Furthermore, correction through recoding proved more severe than correction through exclusion.

Similar content being viewed by others

Notes

Vossler and Kerkvliet (2003) conducted a thorough review and classification of existing works.

Cheap Talk does not seem to prove effective if short (Cummings and Taylor 1999, Poe et al. 2002; Aadland and Caplan 2003 and Brown et al. 2003) and when applied to respondents lacking experience (List 2001). Recent studies advocate applying this approach with caution, Aadland and Caplan (2006) evidencing that short and neutral cheap talk may increase bias rather than reducing it. Blumenschein et al. (2008) conclude that the effectiveness of cheap talk is low in comparison to other procedures that include different levels of certainty as a means of correcting hypothetical bias.

The initial recommendation to be found in NOAA (1994) posits the well-known “divide by 2” rule except when real market data are known.

In Spain 45.6% of museums are free (See Sect. 3.13 of the Internet address http://www.mcu.es/culturabase/cgi/um?L=0&N=&O=pcaxis&M=%2Ft11%2Fp11%2Fa2002%2F).

In Spain, around two-thirds of museums are public, and the remaining third private with only 2% being a combination of the two, as is our case study. Over half of the museums in Spain are free and those which are not charge a symbolic price. The entrance fee for the Museo Patio Herreriano is three euros.

In other words, in the manner used for funding public goods through aliquot contributions, deemed acceptable when valuing historical heritage and museums. See Bravi et al. (2002), Sanz (2004) and Báez (2006). The specific valuation question used in our research was: “Suppose that a special fund were to be set up to help finance the conservation and maintenance costs of the Museo Patio Herreriano and its activities. Suppose also that contributions to said special fund were to be made through a single annual donation. Bearing in mind the previously described situation, would you be willing to pay X € as a contribution to this special fund for the conservation and maintenance of the Museo Patio Herreriano?”. When affirmative answers were given, a higher amount was proposed and when a negative answer was given a lower amount was proposed.

Sanz et al. (2003) perform parametric, semi parametric and non-parametric estimations in several contingent valuation exercises, findings from which proved robust and similar across the different methods.

The amounts proposed in the valuation question were calculated on the basis of the annual amounts paid by the most representative Friends of the Museums associations in Spain. We consulted the annual friends quotas paid for the Museo Nacional Centro de Arte Reina Sofía (65 €), Museo Nacional de Escultura (30 €), Instituto Valenciano de Arte Moderno (36 €), Museo del Prado (70 €), etc.

The full range of possible answers to questions were: (1) I already contribute through my taxes, (2) Those who are most interested in such things should pay, (3) I don’t believe in this kind of contribution, (4) I’m not interested in such issues, (5) I’d like to but at the moment I can’t, (6) I prefer to give my money to other causes. As pointed out, only answers (1) and (5) were deemed real zeros, whereas the rest were interpreted as protest responses.

To obtain the adjusted data we used the Consumer Price Index drawn up by the Spanish National Statistics Institute.

Champ and Bishop (2001) point out that respondents who give a positive WTP with low certainty are responsible for hypothetical bias.

Loomis and Ekstrand (1998) also feel that hypothetical bias is mitigated when recoding only uncertain Yes answers.

References

Aadland, D., & Caplan, A. J. (2003). Willingness to pay for curbside recycling with detection and mitigation of hypothetical bias. American Journal of Agricultural Economics, 85(2), 492–502.

Aadland, D., & Caplan, A. J. (2006). Cheap talk reconsidered: New evidence from CVM. Journal of Economic Behavior and Organization, 60(4), 562–578.

Alberini, A., Boyle, K. J., & Welsh, M. P. (2003). Analysis of contingent valuation data with multiple bids and response options allowing respondents to express uncertainty. Journal of Environmental Economics and Management, 45(1), 40–62.

An, M. Y. & Ayala, R. A. (1996). A simple algorithm for nonparametric estimation of distribution functions with arbitrarily grouped data. Working Paper 9602, Department of Economics, Duke University, Durham.

Azjen, I., Brown, T. C., & Carbajal, F. (2004). Explaining the discrepancy between intentions and actions: The case of hypothetical bias in contingent valuation. Society for Personality and Social Psychology, 30(9), 1108–1121.

Báez, A. (2006). Aplicación de Técnicas de Valoración Contingente para la Evaluación del Patrimonio Histórico Urbano. El caso del Conjunto Histórico de la Ciudad de Valdivia (Chile), Tesis Doctoral, Departamento de Economía Aplicada, Universidad de Valladolid, Valladolid.

Berrens, R. P., Jenkins-Smith, H., Bohara, A. K., & Silva, C. L. (2002). Further investigation of voluntary contribution contingent valuation: Fair share, time of contribution, and respondent uncertainty. Journal of Environmental Economics and Management, 44(1), 144–168.

Bille Hansen, T. (1997). The willingness-to-pay for the royal theatre in Copenhagen. Journal of Cultural Economics, 21(1), 1–28.

Blumenschein, K., Blomquist, G., Johannensson, M., Horn, N., & Freeman, P. (2008). Eliciting willingness to pay without bias: Evidence from a field experiment. The Economic Journal, 118(1), 114–137.

Blumenschein, K., Johannesson, M., Blomquist, G. C., Liljas, B., & O′Conor, R. M. (1998). Experimental results on expressed certainty and hypothetical bias in contingent valuation. Southern Economic Journal, 65(1), 169–177.

Bravi, M., Scarpa, R., & Sirchia, G. (2002). Measuring WTP for cultural services in Italian Museums: A discrete choice contingent valuation analysis. In S. Navrud & R. C. Ready (Eds.), Valuing cultural heritage: Applying environmental valuation techniques to historic buildings, monuments and artifacts (pp. 184–199). Cheltenham: Edward Elgar.

Brown, T. C., Ajzen, I., & Hrubes, D. (2003). Further test of entreaties to avoid hypothetical bias in referendum contingent donations to a public good? Journal of Environmental Economics and Management, 46(2), 353–361.

Brown, T. C., Champ, P. A., Bishop, R. C., & McCollum, D. W. (1996). Which response format reveals the truth about donations to a public good? Land Economics, 72(2), 152–166.

Carson, R. T., Mitchell, R. C., Hanemann, W. M., Kopp, R. J., Presser, S. & Ruud, P. A. (1994). Contingent valuation and lost passive use: Damages from Exxon Valdez. Discussion paper 94-18, Resources for the Future, Washington DC.

Champ, P. A., & Bishop, R. C. (2001). Donation payment mechanisms and contingent valuation: An empirical study of hypothetical bias. Environmental and Resource Economics, 19(4), 383–402.

Champ, P. A., Bishop, R. C., Brown, T. C., & McCollum, D. W. (1997). Using donation mechanisms to value nonuse benefits from public goods. Journal of Environmental Economics and Management, 33(2), 151–162.

Cuccia, T., & Signorello, G. (2002). A contingent valuation study of willingness to pay for heritage visits: Case study of noto. In I. Rizzo & R. Towse (Eds.), The economics of heritage: A study in the political economy of culture in Sicily (pp. 147–163). Cheltenham: Edwar Elgar.

Cummings, R. G., Elliott, S., Harrison, G. W., & Murphy, J. (1997). Are hypothetical referenda incentive compatible? Journal of Political Economy, 105(3), 609–621.

Cummings, R. G., Harrison, G. W., & Rustrom, E. E. (1995). Homegrown values and hypothetical surveys: Is the dichotomous choice approach incentive-compatible? American Economic Review, 85(1), 260–266.

Cummings, R. G., & Taylor, L. (1999). Unbiased value estimates for environmental goods: A cheap talk design for the contingent valuation method. American Economic Review, 89(3), 649–665.

del Saz, S., & Montagud, J. (2005). Valuing cultural heritage: The social benefits of restoring and old Arab tower. Journal of Cultural Heritage, 6(1), 69–77.

EFTEC (2005). Valuation of the historic environment, Report prepared for English Heritage, London: The Heritage Lottery Fund, DCMS and the Department of Transport.

Ethier, R., Poe, G. L., Schulze, W. D., & Clark, J. (2000). A comparison of hypothetical phone and mail contingent valuation responses for green-pricing electricity programs. Land Economics, 76(1), 54–67.

Harrison, G. W. (2006). Experimental evidence on alternative environmental valuation methods. Environmental and Resource Economics, 34(1), 125–162.

Harrison, G. W., & Rutström, E. E. (2005). Experimental evidence on the existence of hypothetical bias in value elicitation methods. In C. R. Plott & V. L. Smith (Eds.), Handbook of experimental economics results. Amsterdam: North-Holland.

Johannesson, M., Liljas, B., & Johansson, P. O. (1998). An experimental comparison of dichotomous choice contingent valuation questions and real purchase decisions. Applied Economics, 30(5), 643–647.

Li, C. Z., & Mattsson, L. (1995). Discrete choice under preference uncertainty: An improved structural model for contingent valuation. Journal of Environmental Economics and Management, 28(2), 256–269.

List, J. A. (2001). Do explicit warnings eliminate the hypothetical bias in elicitation procedures? Evidence from field auctions for sportscards. American Economic Review, 91, 1498–1507.

List, J. A., & Gallet, C. A. (2001). What experimental protocol influence disparities between actual and hypothetical stated values? Environmental and Resource Economics, 20(3), 241–254.

List, J. A., & Shogren, J. F. (1998). Calibration of the difference between actual and hypothetical valuations in a field experiment. Journal of Economic Behavior and Organization, 37(2), 193–205.

Loomis, J. B., Brown, T., Lucero, B., & Peterson, G. (1996). Improving validity experiments of contingent valuation methods: Results of efforts to reduce the disparity of hypothetical and actual WTP. Land Economics, 72(4), 450–461.

Loomis, J. B., & Ekstrand, E. R. (1998). Alternative approaches for incorporating respondent uncertainty when estimating willingness-to-pay: The case of the Mexican spotted Owl. Ecological Economics, 29(1), 29–41.

Loomis, J. B., González-Caban, A., & Gregory, R. (1994). Substitutes and budget constraints in contingent valuation. Land Economics, 70(4), 499–506.

Mansfield, C. (1998). A consistent method for calibrating contingent value survey data. Southern Economic Journal, 64(3), 665–681.

Mourato, S. & Mazzanti, M. (2002). Economic valuation of cultural heritage: Evidence and prospects. In M. de la Torre (Ed.), Assessing the values of cultural heritage, (pp. 51–76). Los Angeles: Research Report, The Getty Conservation Institute.

Murphy, J. J., Allen, P. G., Stevens, T. H., & Weatherhead, D. (2005). A meta-analysis of hypothetical bias in stated preference valuation. Environmental and Resource Economics, 30(3), 313–325.

National Oceanographic Atmospheric Administration. (1994). Proposed rules for valuing environmental damages. Federal Register, 59(5), 1062–1191.

Navrud, S., & Ready, R. C. (Eds.). (2002). Valuing cultural heritage: Applying environmental valuation techniques to historic buildings, monuments and artifacts. Cheltenham: Edward Elgar.

Neil, H. R. (1995). The contest of the substitutes in CVM studies: Some empirical observations. Journal of Environmental Economics and Management, 29(3), 393–397.

Neil, H. R., Cummings, R. G., Ganderton, P. T., Harrison, G. W., & McGuckin, T. (1994). Hypothetical surveys and real economic commitments. Land Economics, 70(2), 145–154.

Noonan, D. S. (2002). Contingent valuation studies in the arts and culture: An annotated bibliography. Working Paper, Cultural Policy Center, University of Chicago, Chicago.

Noonan, D. S. (2003). Contingent valuation and cultural resources: A meta-analytic review of the literature. Journal of Cultural Economics, 27(3–4), 159–176.

Pearce, D. S., Mourato, S., Navrud, S., & Ready, R. C. (2002). Review of existing studies, their policy use and future research needs. In S. Navrud & R. C. Ready (Eds.), Valuing cultural heritage: Applying environmental valuation techniques to historic buildings, monuments and artifacts (pp. 257–271). Cheltenham: Edward Elgar.

Poe, G. L., Clark, J. E., Rondeau, D., & Schulze, W. D. (2002). Provision point mechanisms and field validity test of contingent valuation. Environmental and Resource Economics, 23(1), 105–131.

Ready, R. C., Whitehead, J. C., & Blomquist, G. C. (1995). Contingent valuation when respondents are ambivalent. Journal of Environmental Economics and Management, 29(2), 181–196.

Samnaliev, M., Stevens, T. H., & More, T. (2006). A comparison of alternative certainty calibration techniques in contingent valuation. Ecological Economics, 57(3), 507–519.

Santagata, W., & Signorello, G. (2000). Contingent valuation of a cultural public good and policy design: The case of “Napoli Musei Aperti”. Journal of Cultural Economics, 24(3), 181–204.

Sanz, J. A. (2004). Valoración económica del patrimonio cultural. Gijón: Trea S. L.

Sanz, J. A., Herrero, L. C., & Bedate, A. M. (2003). Contingent valuation and semiparametric methods: A case study of the National Museum of Sculpture in Valladolid, Spain. Journal of Cultural Economics, 27(3–4), 241–257.

Schulze, W. D., D’Arge, R. C., & Brookshire, D. S. (1981). Valuing environmental commodities: Some recent experiments. Land Economics, 57(2), 151–172.

Snowball, J. D. (2008). Measuring the value of culture: Methods and examples in cultural economics. Berlin: Springer Verlag.

Thompson, E., Berger, M., Blomquist, G., & Allen, S. (2002). Valuing the arts: A contingent valuation approach. Journal of Cultural Economics, 26(2), 87–113.

Thompson, B. J., Throsby, C. D. & Withers, G. A. (1983). Measuring community benefits from the arts. Research Paper no 261, School of Economic and Financial Studies, Macquarie University, Sidney.

Throsby, C. D., & Withers, G. A. (1983). Measuring the demand for the arts as a public good: Theory and empirical results. In W. S. Hendon & J. L. Shanahan (Eds.), Economics of cultural decisions (pp. 177–191). Cambridge: Abt Books.

Vossler, C. A., Ethier, R., Poe, G. L., & Welsh, M. P. (2003). Payment certainty in discrete choice contingent valuation responses: Results from a field validity test. Southern Economic Journal, 69(4), 886–902.

Vossler, C. A., & Kerkvliet, J. (2003). A criterion validity test of the contingent valuation method: Comparing hypothetical and actual voting behavior for a public referendum. Journal of Environmental Economics and Management, 45(3), 631–649.

Wang, H. (1997). Treatment of ‘Don’t-Know’ responses in contingent valuation surveys: A random valuation model. Journal of Environmental Economics and Management, 32(2), 219–232.

Welsh, M. P., & Poe, G. L. (1998). Elicitation effects in contingent valuation: Comparisons to a multiple bounded discrete choice approach. Journal of Environmental Economics and Management, 36(2), 170–185.

Whitehead, J. C., Blomquist, G. C., Ready, R. C., & Huang, J. (1998). Construct validity of dichotomous choice contingent valuation questions. Environmental and Resource Economics, 11(1), 107–116.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bedate, A.M., Herrero, L.C. & Sanz, J.Á. Economic valuation of a contemporary art museum: correction of hypothetical bias using a certainty question. J Cult Econ 33, 185–199 (2009). https://doi.org/10.1007/s10824-009-9098-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10824-009-9098-y