Abstract

Evolutionary Finance (EF) explores financial markets as evolving biological systems. Investors pursuing diverse investment strategies compete for the market capital. Some “survive” and some “become extinct”. A central goal is to identify evolutionary stable (in one sense or another) investment strategies. The problem is analyzed in a framework combining stochastic dynamics and evolutionary game theory. Most of the models currently considered in EF assume that asset payoffs are exogenous and depend only on the underlying stochastic process of states of the world. The present work develops a model where the payoffs are endogenous: they depend on the share of total market wealth invested in the asset.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

As Orr (2018) statedFootnote 1 in this journal, the study of economics, including mathematical finance, and the study of biological evolution have interacted extensively throughout their histories. On the one hand, Thomas Malthus and Adam Smith influenced the thinking of Charles Darwin (Schweber, 1977). On the other hand many authors have created various versions of “ evolutionary finance,”in which natural selection is used to identify investment strategies that can competitively displace alternative strategies. And as Orr (2018) continues, the resulting literature is voluminous. Contemporary approaches began with Alchian (1950), who was concerned primarily with competition among firms. Finally, as Orr (2018) wrote, given that economics and evolutionary biology are both concerned with competition among agents, this interaction is hardly surprising.

Evolutionary finance (EF), in its modern form, is a rapidly developing research area at the interface of Financial Economics and Mathematical Finance applying the evolutionary approach to the modeling of stochastic dynamics of financial markets. The classical theory (Radner, 1972, 1982) relies upon the hypothesis of full rationality of market players, who are assumed to maximize their utilities subject to budget constraints, i.e. solve well-defined and precisely stated constrained optimization problems. EF models abandon this hypothesis and permit market players to have patterns of investment behavior determined by their individual psychology, not necessarily describable in terms of utility maximization. In a recent paper in this journal, Burnham and Phelan (2023) argue convincingly that the assumption of utility maximization does not have any biological foundation. Moreover, they make pretty clear that not absolute payoffs but relative payoffs matter in evolution. Thus, Burnham and Phelan (2023) give very good arguments for the two most fundamental modeling choices of EF: not relying on utility functions and considering relative preferences.

EF realizes in the context of financial economics Aumann’s (2019) program of synthesizing mainstream (welfare) and behavioral economics. Aumann writes (ibid. p. 667):

Quotation

Mainstream economic theory is based on the rationality assumption: that people act as best they can to promote their interests. In contrast, behavioural economics holds that people act by behavioural rules of thumb, often with poor results.... People indeed act by rules, which usually work well, but may work poorly in exceptional or contrived scenarios. The reason is that like physical features, behavioural rules are the product of evolutionary processes; and evolution works on the usual, the common—not the exception, not the contrived scenario.

In EF models asset prices are determined endogenously via a short-run equilibrium of supply and demand. Dynamic equilibrium is formed consecutively in each time period in the course of interaction of investment strategies of competing market participants. It is defined directly via the set of strategies of the market players describing their investment behavior. An important feature of EF models is that they employ only objectively observable market data and do not use hidden individual agents’ characteristics, such as their utilities and beliefs, which makes them amenable for quantitative practical applications (Schnetzer & Hens, 2022).

The main focus of studies in the field is on questions of survival and extinction of investment strategies in the market selection process. A central goal is to identify those strategies which survive in this process and/or are evolutionary stable in one sense or another. Typical results show that under very general assumptions, such strategies exist, are asymptotically unique and easily computable.

Important contributions to the formation of modern EF as a research area were made in Anderson et al. (1988), Blume and Easley (1992), Arthur et al. (1997), Farmer and Lo (1999), Farmer (2002), Lo (2004, 2005, 2012, 2017), Bottazzi et al. (2005), Brock et al. (2005), Sciubba (2005, 2006), Coury and Sciubba (2012), Bottazzi and Dindo (2013a, b), Zhang et al. (2014), Bottazzi et al. (2018), Lo et al. (2018). A recent general survey on EF is provided by Holtfort (2019). An elementary textbook introduction can be found in Evstigneev et al. (2015, Ch. 20).

EF models invoke ideas related to behavioral economics and finance (Kahneman & Tversky, 1979; Shiller, 1981; Tversky & Kahneman, 1992; Shiller, 2003; Bachmann et al., 2018), evolutionary game theory (Weibull, 1995; Samuelson, 1997; Kojima, 2006; Gintis, 2009) and games of survival (Milnor & Shapley, 1957; Shubik & Thompson, 1959). Another important source for EF is capital growth theory, or the theory of growth-optimal investments: Kelly (1956), Breiman (1961), Algoet and Cover (1988), and others. For a comprehensive discussion of the biological roots of EF see (Levin & Lo, 2021) Introduction to PNAS Special Issue “Evolutionary Models of Financial Markets”.

The model studied in this paper pertains to the family of EF models that has its roots in the papers by Amir et al. (2011, 2013), which initiated a game-theoretic strand in the EF literature. The former paper deals with long-lived dividend-paying assets, while the latter considers short-lived assets. A survey describing the state of the art in this line of research by 2016 and putting forward a program for further studies was given in Evstigneev et al. (2016). For recent progress in the field see Evstigneev et al. (2020), Zhitlukhin (2021a, b), Hens and Naebi (2022), Schnetzer and Hens (2022), Zhitlukhin (2022a, b), and references therein.

In nearly all EF models considered in the literature, asset payoffs or dividends are given exogenously and do not depend on the investment strategies of market players. In reality, however, such a dependence is more of a rule than an exception, see e.g. Lintner (1965), Tobin (1969), Tobin and Brainard (1977), and Li et al. (2009). One of the key general open problems in EF is to develop game-theoretic models of financial markets that would take into account the endogenous nature of asset payoffs. The first step in this direction was made in Amir et al. (2021), where a game-theoretic framework for the analysis of markets with long-lived dividend-paying securities was developed. In the present paper we conduct a similar study for a model with short-lived (one-period) assets.

Short-lived assets typically represent standardized contracts that are sold and purchased at the market prices at the beginning of each time period \([t-1,t]\) and by the end of it yield payoffs depending on random events that might occur by time t. The payoffs may come from the contract seller or from other sources. Typical examples include contracts involving production or delivery of a specific amount of a commodity, raw material or energy, contracts between wholesaler and retailer, derivative securities, service and insurance contracts, etc. Not infrequently, the payoffs of short-lived assets depend on externalities and are affected by oligopolistic competition of firms. Thereby the analysis of models dealing with such assets bridges finance and the theory of industrial organization, see, e.g., Singh and Vives (1984).

The main focus of our analysis in this paper is on questions of evolutionary stability of investment strategies (portfolio rules) in the market selection process. Consider a financial market with N participants \(i=1,...,N\) pursuing investment strategies \(\lambda ^{1},...,\lambda ^{N}\). A strategy \(\lambda ^{*}\) is called evolutionary stable if the following condition holds. Suppose \(N-1\) market players \(i=2,3,...,N\) (“non-mutants”) use the portfolio rule \(\lambda ^{*}\),

and investor 1 (“mutant”) employs some other portfolio rule

If the initial share of total market wealth of the mutant is small enough, then it will be driven out of the market by the non-mutants in the long run: its share of wealth will tend to zero with probability one as time goes to infinity.

This notion of evolutionary stability combines ideas from two fundamental solution concepts of evolutionary game theory proposed by Maynard Smith and Price (1973) for continuous populations and Schaffer (1988) for discrete ones. The main result of this work is an effective construction of an evolutionary stable strategy \(\lambda ^{*}\) for an EF model with short-lived assets and endogenous asset payoffs. The form of this result is analogous to that obtained in Amir et al. (2021) for a model with long-lived dividend-paying assets. Rigorous definitions of the above notions and the statements of the results are given in Sect. 3.

The remainder of the paper is organized as follows. Section 2 sets up the model. Section 3 states the main results. Section 4 derives the equations describing the financial market dynamics. Section 5 provides proofs of the main results. Section 6 analyzes an important special case of the model in which the endogenous asset payoffs are defined by affine functions. Section 7 illustrates and extends to some extent the results by a numerical example. Section 8 concludes.

2 The model

We consider a market where \(K\ge 2\) assets are traded at moments of time \(t=0,1,...\). Assets live for one period and are identically re-born at the beginning of the next period. The total volume of each asset \(k=1,...,K\) is constant (independent of time) and is denoted by \(V_{k}\). There are \(N\ge 2\) investors (traders) acting in the market. The market is influenced by random factors modeled in terms of a sequence of independent identically distributed elements \(s_{1},s_{2},...\) in a measurable space S. The random element \(s_{t}\) is interpreted as the “state of the world” at time/date t. The wealth of investor \(i=1,2,...,N\) at date \(t\ge 1\) is denoted by \(w_{t}^{i}=w_{t}^{i}(s^{t})\), where \(s^{t}:=(s_{1},...,s_{t})\) stands for the history of states of the world up to date t. Initial endowments \(w_{0}^{i}>0\) of all the investors at date 0 are given. An investment strategy (portfolio rule) of investor \(i=1,...,N\) is represented by a vector \(\lambda ^{i}=(\lambda _{1} ^{i},...,\lambda _{K}^{i})\) in the unit simplex

An investor i at each time t allocates her wealth \(w_{t}^{i}\) across assets \(k=1,...,K\) in constant (independent of time and random factors) proportions \(\lambda _{k}^{i}\).

Given the set of investment strategies \(\lambda ^{i}\), \(i=1,...,N\), the total amount allocated by all the investors \(i=1,...,N\) for purchasing asset k at time t is expressed as

We denote by

the fraction of total market wealth

allocated to asset \(k=1,...,K\). The payoffs

of assets \(k=1,...,K\) at time t depend on the fractions \(r_{t-1,k}\) of the total market wealth \(W_{t-1}\) invested in them and (in a linear way) on \(W_{t-1}\). It is assumed that the payoff functions \(D_{k}(s,b)\), \(b\in [0,1]\), are jointly measurable with respect to their arguments and satisfy

As shown in Amir et al. (2021), simple functions of this type have good empirical support for the US equity market.

According to (4), the ratios \(A_{t,k}/A_{t,m}\) of asset payoffs yielded by assets \(k,m=1,...,K\) depend only on the relative, rather than absolute, amounts of wealth allocated to these assets,Footnote 2 i.e. only on the variables \(r_{t-1,k}\), \(k=1,...,K\), rather than the variables \(w_{t-1,k}\), \(k=1,...,K\). This structure of asset payoffs, which is essential for the model to work, will be preserved if we replace \(W_{t-1}\) in formula (4) by any scaling factor \(Z_{t}\) given by an arbitrary jointly measurable function

This will change neither the equations of the market dynamics in the model at hand, nor the results. The choice of the scaling factor \(Z_{t}\) specifying the absolute values of asset payoffs might depend on the applied aspects and on the needs of the analysis of the model. For example, one can simply set \(Z_{t}=1\) [as in Amir et al. (2021)]. This will exclude from consideration redundant variables and simplify the description of the model, but at the same time might require explanations as those provided in the present paragraph. Our choice of \(W_{t-1}\) as the scaling factor in (4) makes the mapping \((w_{t-1,1},...,w_{t-1,K} )\mapsto (A_{t,1},...,A_{t,K})\) positively homogeneous, which has a clear economic meaning (constant returns to scale) and turns out to be useful in the mathematical analysis of the model, see Sect. 5.

We denote by \(p_{t}=p_{t}(s^{t})\in {\mathbb {R}}_{+}^{K}\) the vector of market prices of the assets. For each \(k=1,...,K\), the coordinate \(p_{t,k}\) of the vector \(p_{t}=(p_{t,1},...,p_{t,K})\) stands for the price of one unit of asset k at date t. Below we describe how these prices are formed in equilibrium over each time period. A portfolio of investor i at date \(t=0,1,...\) is specified by a vector \(x_{t}^{i}=(x_{t,1}^{i},...,x_{t,K} ^{i})\in {\mathbb {R}}_{+}^{K}\) where \(x_{t,k}^{i}\) is the amount (the number of units) of asset k in the portfolio \(x_{t}^{i}\). The scalar product \(\langle p_{t},x_{t}^{i}\rangle =\sum _{k=1}^{K}p_{t,k}x_{t,k}^{i}\) expresses the value of the investor i’s portfolio \(x_{t}^{i}\) at date t in terms of the prices \(p_{t,k}\). The portfolio vector \(x_{t}^{i}\) depends on the history \(s^{t}\) of states of the world: \(x_{t}^{i}=x_{t}^{i}(s^{t})\). This vector function of \(s^{t}\), as well as all the other functions of \(s^{t}\) we deal with, is measurable. To alleviate notation, we will often omit “\(s^{t} \)” in what follows.

At date \(t=0\) the investors’ budgets are given by their (non-random) initial endowments \(w_{0}^{i}>0\). Investor i’s budget/wealth at date \(t\ge 1\) is

where

The budget \(w_{t}^{i}\) at time t is constituted by the payoff \(\langle A_{t},x_{t-1}^{i}\rangle \) of the portfolio \(x_{t-1}^{i}\) that was created at time \(t-1\). If investor i allocates the fraction \(\lambda _{k}^{i}\) of wealth \(w_{t}^{i}\) to asset k, then the number of units of asset k that can be purchased for this amount is

Thus, by employing the portfolio rule \(\lambda ^{i}=(\lambda _{1}^{i},...,\lambda _{K}^{i})\), trader i constructs a portfolio whose positions are specified by (8).

Suppose that each investor i has selected some strategy \(\lambda ^{i}=(\lambda _{1}^{i},...,\lambda _{K}^{i})\in \Delta ^{K}\). Assume that the market is always in equilibrium: for all \(t=0,1,...\) and \(k=1,...,K\), total asset supply is equal to total asset demand

i.e.

(see (8)). Then we get

and so the equilibrium (market clearing) prices \(p_{t,k}\) are given by

Given a strategy profile \((\lambda ^{1},...,\lambda ^{N})\) of the investors and their initial endowments \(w_{0}^{1},...,w_{0}^{N}\), we can, by using Eqs. (6)–(12), generate recursively the path of the system specified by the sequences of variables

(the investors’ budgets)

(the fractions of wealth allocated to each of the assets k)

(the vectors of equilibrium asset prices) and

(the investors’ portfolios). The recursive procedure is as follows. For \(t=0\), the budgets \(w_{0}^{i}>0\) are given as initial endowments; \(r_{0,k}\) are computed by the formula \(r_{0,k}=\left\langle \lambda _{k},w_{0}\right\rangle /\sum _{j=1}^{K}\left\langle \lambda _{j},w_{0}\right\rangle \) (see (2)); the prices \(p_{0,k}\) and the portfolio positions \(x_{0,k}^{i}\) are obtained from equations (11) and (8):

Suppose the variables (13)–(16) are defined up to some \(t-1\). Then we define \(w_{t}^{i}\) by (6) and (7), and \(r_{t,k}\) by (2) (with t in place of \(t-1\)). The prices \(p_{t}\) are determined by the system of equations (12), and the investors’ portfolios by formula (8).

The above description of asset market dynamics requires clarification. Equations (10) and (8) make sense only if the equilibrium prices \(p_{t,k}\) are strictly positive. Under what assumptions can we guarantee this? Let us say that a strategy profile \((\lambda ^{1},...,\lambda ^{N})\) is admissible if for each asset k

This means that for each k there is an investor i allocating a strictly positive share \(\lambda _{k}^{i}\) of wealth to asset k. In what follows, we will deal only with admissible strategy profiles.

The hypothesis of admissibility guarantees that the random dynamical system we study is well-defined, in particular, the prices \(p_{t,k}\) are strictly positive. Under this hypothesis, we have

for all \(i=1,...,N\) and \(t=0,1,...\), which can be proved by induction. Indeed if \(t=0\), then the first relation in (19) holds by virtue of the assumption of strict positivity of the initial endowments, while the second and third ones follow from the first one and (17). Suppose the relations analogous to those in (19) hold for \(t-1\), and let us prove them for t. We have \(w_{t}^{i}=\langle A_{t},x_{t-1}^{i}\rangle >0\) because \(A_{t}>0\) (see (5)) and \(x_{t-1}^{i}\ne 0\). The inequality \(p_{t}>0\) holds by virtue of the admissibility assumption (18) and formula (12). Finally, the fact that \(x_{t}^{i}\ne 0\) follows from (8) because \(w_{t}^{i}>0\) and \(\lambda _{k}^{i}>0\) for some k.

Assumption (18) on an investors’ strategy profile is obviously fulfilled if for at least one market participant i all the investment proportions \(\lambda _{k}^{i}\) are strictly positive, i.e., the portfolio rule \(\lambda ^{i}\) is fully diversified. This is so for the strategy profiles we deal with in Theorem 1, the main result of the present paper. Thus in the context of Theorem 1 condition (18) is satisfied automatically and does not lead to a loss of generality.

3 The main results

Let \((\lambda ^{1},...,\lambda ^{N})\) be an admissible strategy profile of the investors. Consider the path (13)–(16) of the asset market generated by this strategy profile and the given initial endowments \(w_{0} ^{i}>0,\ i=1,...,N\). We are primarily interested in the long-run behavior of the relative wealth or the market shares

of the traders, where, as before,

is the total market wealth. The main concept we analyze in this paper is that of an evolutionary stable strategy.

Definition 1

A portfolio rule \(\lambda ^{*}\) is called evolutionary stable if it possesses the following property. Suppose all the investors except one, say \(i=1\), use the strategy \(\lambda ^{*}\), while investor 1 uses some other strategy \(\lambda \). Furthermore, suppose that the initial market share \(r_{0}^{1}\) of investor 1 is small enough: \(r_{0}^{1}<\delta \), where \(\delta >0\) is some random variable. Then the market share \(r_{t}^{1}\) of trader 1 will tend to 0 almost surely, i.e., trader 1 will be driven out of the market by the other traders (using \(\lambda ^{*}\)) with probability one.

The above definition of an evolutionary stable strategy combines two fundamental concepts of Evolutionary Game Theory: the classical definition of an evolutionary stable strategy (ESS) for continuous populations by Maynard Smith and Price (1973) and its version for discrete populations proposed by Schaffer (1988). The analogy with the former lies in the fact that the initial relative wealth of the “mutant” (\(\lambda \)-investor) is assumed to be small enough; under this assumption, the \(\lambda \)-investor cannot survive in competition with “non-mutants” (\(\lambda ^{*}\)-investors). A parallel with the latter is in the assumption that there is only one mutant type represented by the \(\lambda \)-investor 1; all the others, 2, 3, ..., N, are non-mutants. Relative wealth is the counterpart of the relative mass of a continuous population of mutants or non-mutants in the biological context. A fundamental distinction between the notion introduced and the classical ones is that in the present EF setting we are dealing with properties holding with probability one, while the classical biological notions of evolutionary stability are concerned with frequencies, probability distributions and properties holding on average.

To formulate the main result of this work (Theorem 1 below) we introduce some assumptions and notation. Denote by

the total payoff of all the assets k available in the market. Suppose that the following conditions hold:

(G1) For each s and k the functions \(g_{k}(s,b)\) (\(b\in [0,1]\)) are strictly positive, differentiable, strictly monotone increasing and concave in b.

(G2) For any \(\lambda =(\lambda _{1},...,\lambda _{K})\in \Delta ^{K}\), the functions \(g_{k}(s,\lambda _{k})\) are linearly independent, i.e., if for some constants \(a_{1},...,a_{K}\) the equality \(\sum a_{k}g_{k}(s_{t},\lambda _{k})=0\) holds almost surely (a.s.), then \(a_{1}=...=a_{K}=0\).

(G3) There exist constants \(g_{\max }^{\prime }>0\) and \(g_{\min }>0\) such that

and for all s, b and k we have

where \(g_{k}^{\prime }(s,b)\) stands for the derivative of the function \(g_{k}(s,b)\) with respect to b.

Assumption (G1) contains regularity conditions on the functions \(g_{k}(s,b)\) which are typical assumptions on a production function. Property (G2) means the absence of redundant assets: one cannot construct a “synthetic asset”, a portfolio with fixed weights consisting of assets \(j\ne k\), that yields the same payoffs as any given asset k. Condition (G3) says that although the growth of the total investment in an asset k leads to the growth of this asset’s payoff, this growth is moderate: its rate \(g_{k}^{\prime }(s,b)=V_{k}D_{k}^{\prime }(s,b)\) cannot exceed the constant specified in (21). Such an assumption is natural when, in addition to capital, a second production factor (e.g., labor) is essential.

Theorem 1

Under assumptions (G1)-(G3), there exists a unique solution \(\lambda ^{*}=(\lambda _{1}^{*},...,\lambda _{K}^{*})\in \Delta ^{K}\) to the system of equations

We have \(\lambda _{k}^{*}>0\), \(k=1,...,K\). The portfolio rule represented by the vector \(\lambda ^{*}\)is evolutionary stable.

In (22) s is a random element in the space S having the same distribution as \(s_{t}\) (independent of \(t=1,2,...\)). The symbol E stands for the expectation with respect to this distribution. The meaning of equation (22) is as follows. It says that the relative payoffs

corresponding to the allocation of wealth across assets in the proportions \(\lambda _{1}^{*},...,\lambda _{K}^{*}\) prescribed by the evolutionary stable portfolio rule \(\lambda ^{*}\) coincide on average with these proportions.

If, in contrary to our assumption (G1), the functions \(g_{k}(s,b)\) do not depend on b, then equations (22) boil down to

In this case \(\lambda ^{*}\) reduces to the prescription to invest in accordance with the expected relative payoffs. This is a generalization of the classical Kelly portfolio rule—“ betting your beliefs” (Kelly, 1956). In EF models with exogenous payoffs, stronger (global) versions of Theorem 1 were obtained in Evstigneev et al. (2008) and Amir et al. (2013).

4 Dynamics of the asset market

In this section we prove some auxiliary propositions needed for the proof of Theorem 1. They are concerned with the structure of the random dynamical system under consideration. In the next proposition, we derive a system of equations governing the dynamics of the market shares of the investors given their admissible strategy profile \((\lambda ^{1},...,\lambda ^{N})\). Consider the path (13)–(16) of the random dynamical system generated by the strategy profile \((\lambda ^{1},...,\lambda ^{N})\) and the sequence of vectors \(r_{t}=(r_{t}^{1},...,r_{t}^{N})\), where \(r_{t}^{i}\) is the investor i’s market share at date t.

Denote by \(R_{t,k}\) the relative payoffs

Note that \(R_{t,k}>0\) and \(\sum R_{t,k}=1\).

Proposition 1

The following equations hold:

\(i=1,...,N\),\(\;t\ge 0\).

Proof

where \(t\ge 1\), \(w_{t}:=(w_{t}^{1},...,w_{t}^{N})\) and \(\lambda _{k}:=(\lambda _{k}^{1},...,\lambda _{k}^{N})\). The analogous formulas for \(t=0\),

follow from (17). Consequently, we have

By summing up these equations over \(i=1,...,N\), we obtain:

Dividing both sides of equation (25) by \(W_{t+1}\), we get

which yields (24) by virtue of (23). \(\square \)

Let us observe that it is sufficient to prove Theorem 1 when \(N=2\), i.e., the general model can be reduced to the case of two investors. Indeed, suppose that investor 1 uses some strategy \(\lambda \) and all the others follow the strategy \(\lambda ^{*}\). By setting

we get \(r_{t}^{1}=1-r_{t}^{*}\), and from equations (24) we obtain

Thus the dynamics of the market share \(r_{t}^{1}\) of the \(\lambda \)-investor is the same as if she faces as the rival the \(\lambda ^{*}\)-investor with the market share equal to \(r_{t}^{1}=1-r_{t}^{*}=1-\sum _{i=2}^{N}r_{t}^{i}\). Our goal is to show that \(r_{t}^{1}\rightarrow 0\) with probability one as long as \(r_{0}^{1}\) is small enough.

The model with two investors will be examined by using Proposition 2 below. Assume that investors \(i=1,2\) use strategies \(\lambda ^{i}=(\lambda _{1} ^{i},...,\lambda _{K}^{i})\),\(\,i=1,2\), and denote by

the ratio of their market shares.

Proposition 2

The process \(x_{t}\) is governed by the random dynamical system

where

and

Proof

By using (24) with \(N=2\), we get

where \(i,j\in \{1,2\}\) and \(i\ne j\). Consequently,

which proves (27). Finally, by virtue of (7) and (20), we get

where (see (2))

which yields (28). \(\square \)

5 Proofs of the main results

In this section we give a proof of Theorem 1. We begin with proving the existence, uniqueness and strict positivity of the solution \(y=(y_{1},...,y_{K})\) to the system of equations

In fact, existence is straightforward from Brouwer’s fixed-point theorem, and strict positivity follows from the strict positivity of \(g_{k}\), so that we only need to establish uniqueness (however, the argument below yields existence as well).

We will fix s and omit it in the notation. Consider the mapping \(F(y)=F(s,y)\) assigning to a vector \(y=(y_{1},...,y_{K})\in {\mathbb {R}}_{+}^{K}\) the vector

where

and \(|y|=\sum _{k}y_{k}\). Observe that G(y) is homogeneous of degree 0, F(y) is homogeneous of degree 1, and if \(\left| y\right| =1\), then we have

Thus the mapping F(y) is a homogeneous of degree 1 extension (to the whole non-negative cone \({\mathbb {R}}_{+}^{K}\)) of the mapping of \(\Delta ^{K}\) into itself appearing under the sign of expectation in (30).

Suppose we have found \(y\in R_{+}^{K}\), \(y\ne 0\), such that

Then \(\lambda =1\), and \(z:=y\left| y\right| ^{-1}\) is a solution to (30). Indeed, if \(EF(y)=\left| y\right| EG(y)=\lambda y\), then

where \(\lambda =1\) because \(\left| z\right| =1\) and \(\left| EG(z)\right| =E\left| G(z)\right| =1\).

The existence and uniqueness of a solution to (31) follows from a nonlinear version of the Perron-Frobenius theorem, holding under the assumption of strict monotonicity of the mapping EF(y) (Kohlberg, 1982), which follows from the strict monotonicity of the mapping \(F(y)=F(s,y)\) holding for each s:

for each k,j and \(y\in {\mathbb {R}}_{+}^{K}\). To prove (32) put

We have

where

where

Since the function \(F_{k}(y)\) is homogeneous of degree 1, its partial derivatives are homogeneous of degree 0, and so we can assume without loss of generality that \(\left| y\right| =1\). In the chain of relations below, we use the inequalities \(g_{k}(y_{k})-g_{k}^{\prime }(y_{k})y_{k}\ge 0\), following from the concavity of \(g_{k}(b)\). We have from (33)

Finally, we get

where the last inequality follows from the assumption (G3).

To complete the proof of Theorem 1 it remains to prove the property of evolutionary stability of the portfolio rule \(\lambda ^{*}\). By virtue of (Evstigneev, et al. 2011, Theorem 1 and Section 6), it is sufficient to show that if \(\lambda \ne \lambda ^{*}\), then

where H(s, x) is defined by (27) and (28) with \(\lambda ^{1}=\lambda \) and \(\lambda ^{2}=\lambda ^{*}\). Thus we have

and

This yields

consequently,

where

Observe that

by virtue of (22). Further, note that the functions \(\mu _{k}^{*}(s)\) are linearly independent. Indeed, if

then

and so \(a_{1}=a_{2}=...=a_{K}=0\) in view of (G2).

To prove (35) we use Jensen’s inequality for the logarithmic function and write

where the last but one equality follows from (38). To complete the proof it remains to justify the strict inequality in the above chain of relations. Assume the contrary: we have equality “\(=\)”, rather than inequality “<”, in (39). This can happen only if the random variable \(\sum _{k=1}^{K}\mu _{k}^{*}(s)(\lambda _{k}/\lambda _{k}^{*})\) is in fact constant, i.e., coincides (a.s.) with its expectation \(\sum _{k=1}^{K}E\mu _{k}^{*}(s)(\lambda _{k}/\lambda _{k}^{*})\). But this expectation is equal to 1 (see (38)). Thus \(\sum _{k=1}^{K}\mu _{k}^{*}(s)\lambda _{k}/\lambda _{k}^{*}=1\) (a.s.) or equivalently, \(\sum _{k=1}^{K}\mu _{k}^{*}(s)[(\lambda _{k}/\lambda _{k}^{*})-1]=0\) (a.s.), which implies that \((\lambda _{k}/\lambda _{k}^{*})-1=0\) (a.s.) for all \(k=1,2,...,K\) because, as we have proved above, the functions \(\mu _{k}^{*}(s)\) are linearly independent. Consequently, \(\lambda =\lambda ^{*}\), which is a contradiction.\(\square \)

6 The affine model

In this section we examine an important special case of the model in which the payoff functions \(g_{k}(s,b)\) are affine:

The general results obtained above are based on certain simple sufficient conditions for the model to be workable and estimates that most probably can be improved. In the present, affine context we succeed in finding necessary and sufficient conditions and obtain exact estimates. In what follows, the parameter s will be fixed and omitted in the notation.

In the previous section, it was shown that the strict monotonicity of the operator F(y) (guaranteeing the existence and uniqueness of \(\lambda ^{*} \)) is equivalent to the strict positivity of the following expression

for all \(y=(y_{1},...,y_{K})\in \Delta ^{K}\) and all k and j. We wish to characterize the set of pairs of vectors \(a=(a_{1},...,a_{K})>0\) and \(c=(c_{1},...,c_{K})>0\) under which \(I_{k,j}(y)>0\) for any y, k and j. Let us call such pairs of vectors feasible.

To formulate the result we introduce some notation. Let us assume (without loss of generality) that \(a_{1}\ge a_{2}\ge ...\ge a_{K}\). Then

For those \(k=1,2,...,K-1\) for which \(a_{k}>a_{\min }^{k}\), we define

and

where

For each \(k=1,...,K\) we denote by \(\Psi _{k}(a,c)\) the minimum of the two numbers

Finally, we put

for \(k=1,...,K-1\) and \(U_{K}(a,c):=\Psi _{K}(a,c)\).

Proposition 3

A pair of vectors \(a=(a_{1},...,a_{K} )>0\) and \(c=(c_{1},...,c_{K})>0\) is feasible if and only if \(U_{k}(a,c)>0\) for all \(k=1,...,K\).

Proof

1st step. We begin with the following remark. If \(k=j\), then

Therefore if \(j=k\), then \(I_{k,j}(y)>0\) always, and we can exclude this case from consideration. Clearly, if \(k\ne j\), then

Thus our goal is to characterize pairs of vectors \(a=(a_{1},...,a_{K})>0\) and \(c=(c_{1},...,c_{K})>0\) such that this expression is strictly positive for all \(y=(y_{1},...,y_{K})\in \Delta ^{K}\) and all \(k\ne j\).

2nd step. In the model at hand (see (40)), we have

and so

Clearly, \(I_{k,j}(y)>0\) for all y and \(k\ne j\) if and only if

for all y and k.

Fix \(k=1,...,K\) and some \(\gamma \in [0,1]\), and put

For \(y\in \Delta ^{K}(\gamma )\), we have (see (45))

Thus a pair of vectors \((a_{1},...,a_{K})>0\) and \((c_{1},...,c_{K})>0\) is feasible if and only if

3rd step. Let us fix k and \(\gamma \) and regard the expression in (46) as a linear function of a \((K-1)\)-dimensional vector \((y_{1},...,y_{k-1},y_{k+1},...,y_{K})\) belonging to the set

This set is a convex polyhedron (simplex), and therefore any linear function attains its minimum on it at one of its vertices—that one for which the value of the linear function is the smallest. Therefore we have

where

Now our goal is to describe the set of pairs of vectors \(a=(a_{1},...,a_{K})>0\) and \(c=(c_{1},...,c_{K})>0\) such that

We will show that (48) is fulfilled if and only if the inequalities \(U_{k}(a,c)>0\) hold for all \(k=1,...,K\).

4th step. In view of (41), we have

and so the function \(J_{k}(\gamma )\) is convex quadratic or linear for \(k<K\) and concave quadratic or linear for \(k=K\). Fix some \(k<K\) and consider two cases: (i) \(a_{k}-a_{\min }^{k}>0\) and \(\gamma _{k}^{*}\in (0,1)\) (see (42)); (ii) either \(a_{k}-a_{\min }^{k}=0\) or \(a_{k}-a_{\min }^{k}>0\) and \(\gamma _{k}^{*}\notin (0,1)\).

In the first case, the strictly convex quadratic function (47) attains its minimum on [0, 1] at the point

(see (42)). This minimum is equal to

(see (43)).

In the second case, the function \(J_{k}(\gamma )\) is linear or convex quadratic with the stationary point \(\gamma _{k}^{*}\notin (0,1)\) (see (49)). Consequently, the minimum of this function on [0, 1] is attained either at 0 or at 1, i.e.,

where

which shows that \(J_{k}^{\min }=\Psi _{k}\) (see (44)).

It remains to consider the case \(k=K\). As we have noticed above, the function \(J_{K}(\gamma )\) is concave quadratic or linear. Therefore the arguments conducted in case (ii) and the relations in (50)-(52) apply to the case \(k=K\), which proves that \(J_{K}^{\min }=\Psi _{K}\). \(\square \)

We provide a simple sufficient condition (53) under which the (necessary and sufficient) condition in Proposition 3 holds. Define:

and recall that \(L=\sum _{m=1}^{K}c_{m}\). \(\square \)

Proposition 4

Suppose that

Then \(U_{k}(a,c)>0\) for all \(k=1,...,K\).

Proof

We show that for all \(k=1,...,K\) condition (53) ensures that \(\Psi _{k}>0\) and \(\Phi _{k}>0\) as long as \(\gamma _{k}^{*} \in (0,1)\), which implies that \(U_{k}>0\) for all k. Indeed, we have

and

which completes the proof. \(\square \)

The above proofs of Propositions 3 and 4 follow the arguments in (unpublished) Section 6 of preprint Amir et al. (2020), the abridged version of which was published as Amir et al. (2021).

7 A numerical example

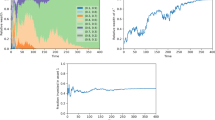

In Fig. 1 below, the results of a numerical example analogous to the one in Amir et al. (2021) are shown. The example has time-dependent investment strategies and is provided to illustrate which strategy has the highest growth rate of wealth for each particular initial distribution of wealth. We measure the expected growth of wealth over 20 periods for each combination of initial wealth across the three strategies. It turns out that \(\lambda ^{*}\) has the highest expected growth for all initial distributions. As an implication it follows that \(\lambda ^{*}\) is globally stable against the history-dependent momentum strategy and the noise trader. The example suggests, as it could be expected, that the following assumptions do not matter: (a) smallness of the initial wealth of a “mutant”; (b) the use of only fixed-mix strategies.

There are two assets in supply \(V_{k}=k\) and the payoffs \(D_{k}(s_{t},r_{t-1,k})=1+s_{t}r_{t-1,k}\), \(k=1,2\). The total amount of payoffs of asset k in period t is \(g_{k}(s_{t},r_{t-1,k})=V_{k}D_{k}(s_{t},r_{t-1,k})\). The random variables \(s_{t}\) are independent, identically distributed and log-normal with parameters (1, 1).

There are three investment strategies. First, the ESS \(\lambda ^{1} = \lambda ^{*} = (0.2, 0.8)\), which is fixed over time. Second, \(\lambda ^{2}_{t}\) is a history-dependent, trend chaser (momentum) strategy. Denote by \(R_{t-1,k}\) asset k’s realized return from period \(t - 2\) to \(t - 1\) and by \({\bar{R}}_{t-1}\) its average over \(k = 1, 2\). Then \(\lambda ^{2}_{t,1}:= \arctan (R_{t-1,1} - {\bar{R}}_{t-1})/\pi + 0.5\) and \(\lambda ^{2}_{t,2}:= \arctan (R_{t-1,2} - {\bar{R}}_{t-1})/\pi + 0.5 = 1 - \lambda ^{2}_{t,1}\). Since there are no previous returns in the initial period, the strategy is chosen randomly.

Third, a noise trader strategy varies from period to period. In each period this strategy is determined by randomly drawing \(\lambda ^{3}_{t,1}\) uniformly from [0, 1] and setting \(\lambda ^{3}_{t,2} = 1 - \lambda ^{3}_{t,1}\).

The simulation is carried out as follows. Strategies start with different initial wealth shares; no smallness assumption is imposed on the initial wealth of any strategy. In each period, the prices for both assets are computed by Eq. (11). Portfolios are defined according to (8). Next, we generate the random state of the world \(s_{t}\) and calculate the payoffs \(D_{k}(s_{t},r_{t-1,k})\). Afterwards, by using (6), we compute the new wealth for all strategies, as well as returns, which are needed for the trend chaser.

8 Conclusion

This paper advanced on the EF model of Evstigneev et al. (2016) by letting the payoff of short-lived assets depend on the wealth invested in them. We prove the existence of an evolutionary stable investment strategy that is determined by the relative payoffs of the assets. Simulations (see Sect. 7) show that this strategy might also be a survival strategy, i.e. a strategy which achieves the highest growth rate of wealth in competition with any other strategies—independently from where the dynamical process is started. Generally seen, the paper shows once more how fruitful the evolutionary reasoning is for finance.

The present study is only a first step in analyzing EF models with endogenous payoffs. An interesting (and possibly difficult) problem would be to extend the results obtained in this paper in the following directions: (a) introduce general, adaptive strategies in place of fixed-mix portfolio roles to reflect a whole variety of possible patterns of investment behavior; (b) establish the survival property of \(\lambda ^{*}\) without the assumption of smallness of the initial wealth of the rivals of the \(\lambda ^{*}\)-investors; (c) relax the assumptions of independence and identity of distributions of the states of the world \(s_{t}\). For the counterpart of the present framework with exogenous dividends, the problem of constructing a model satisfying all the above requirements has been resolved only recently in Evstigneev et al. (2020), which required the development of substantially new mathematical techniques.

Notes

As this paragraph is a shortened version of a similar paragraph in Orr (2018), we claim no originality for it. But we fully agree to his view, which could not have been expressed better.

A deep analysis of an evolutionary model of asset market dynamics described in terms of relative wealth was conducted by Lo et al. (2018).

References

Alchian, A. (1950). Uncertainty, evolution and economic theory. Journal of Political Economy, 58, 211–221.

Algoet, P. H., & Cover, T. M. (1988). Asymptotic optimality and asymptotic equipartition properties of log-optimum investment. Annals of Probability, 16, 876–898.

Amir, R., Evstigneev, I. V., Hens, T., Potapova, V., & Schenk-Hoppé, K. R. (2020). Evolution in pecunia. In Swiss Finance Institute Research Paper 20-44 Preprint of the paper 3 containing some auxiliary material which was not included in 3 and which we refer to in Section 6.

Amir, R., Evstigneev, I. V., Hens, T., Potapova, V., & Schenk-Hoppé, K. R. (2021). Evolution in pecunia. In Levin, S. A., & Lo, A. W., (Eds.) Proceedings of the National Academy of Sciences of the USA, 118 (26), e2016514118. Special Issue Evolutionary Models of Financial Markets.

Amir, R., Evstigneev, I. V., Hens, T., & Xu, L. (2011). Evolutionary finance and dynamic games. Mathematics and Financial Economics, 5, 161–184.

Amir, R., Evstigneev, I. V., & Schenk-Hoppé, K. R. (2013). Asset market games of survival: A synthesis of evolutionary and dynamic games. Annals of Finance, 9, 121–144.

Anderson, P. W., Arrow, K., & Pines, D. (Eds.). (1988). The economy as an evolving complex system. London: CRC Press.

Arthur, W. B., Durlauf, S., & Lane, D. (Eds.). (1997). The economy as an evolving complex system II. Menlo Park: Addison-Wesley.

Aumann, R. J. (2019). A synthesis of behavioural and mainstream economics. Nature Human Behavior, 3, 666–670.

Bachmann, K. K., De Giorgi, E. G., & Hens, T. (2018). Behavioral finance for private banking: From the art of advice to the science of advice (2nd ed.). New York: Wiley.

Blume, L., & Easley, D. (1992). Evolution and market behavior. Journal of Economic Theory, 58, 9–40.

Bottazzi, G., & Dindo, P. (2013a). Evolution and market behavior in economics and finance: Introduction to the special issue. Journal of Evolutionary Economics, 23, 507–512.

Bottazzi, G., & Dindo, P. (2013b). Selection in asset markets: The good, the bad, and the unknown. Journal of Evolutionary Economics, 23, 641–661.

Bottazzi, G., Dindo, P., & Giachini, D. (2018). Long-run heterogeneity in an exchange economy with fixed-mix traders. Economic Theory, 66, 407–447.

Bottazzi, G., Dosi, G., & Rebesco, I. (2005). Institutional architectures and behavioral ecologies in the dynamics of financial markets. Journal of Mathematical Economics, 41, 197–228.

Breiman, L. (1961). Optimal gambling systems for favorable games. Proceedings of the Fourth Berkeley Symposium on Mathematical Statistics and Probability, 1, 65–78.

Brock, A. W., Hommes, C. H., & Wagener, F. O. O. (2005). Evolutionary dynamics in markets with many trader types. Journal of Mathematical Economics, 41 (Special Issue on Evolutionary Finance), 7–42.

Burnham, T. C., & Phelan, J. (2023). Biological welfare economics: A natural science critique of normative economics. Journal of Bioeconomics, 25, 1–33.

Coury, T., & Sciubba, E. (2012). Belief heterogeneity and survival in incomplete markets. Economic Theory, 49, 37–58.

Evstigneev, I., Hens, T., Potapova, V., & Schenk-Hoppé, K. (2020). Behavioral equilibrium and evolutionary dynamics in asset markets. Journal of Mathematical Economics, 91, 121–135.

Evstigneev, I. V., Hens, T., & Schenk-Hoppé, K. R. (2008). Globally evolutionarily stable portfolio rules. Journal of Economic Theory, 140, 197–228.

Evstigneev, I. V., Hens, T., & Schenk-Hoppé, K. R. (2015). Mathematical financial economics: A basic introduction. Springer.

Evstigneev, I. V., Hens, T., & Schenk-Hoppé, K. R. (2016). Evolutionary behavioural finance. In Haven, E., Molyneux, P., Wilson, J. O., Fedotov, S., & Duygun, M. (Eds.) Handbook of post crisis financial modelling (pp. 214–234). Palgrave MacMillan.

Evstigneev, I. V., Pirogov, S. A., & Schenk-Hoppé, K. R. (2011). Linearization and local stability of random dynamical systems. Proceedings of the American Mathematical Society, 139, 1061–1072.

Farmer, J. D. (2002). Market force, ecology and evolution. Industrial and Corporate Change, 11, 895–953.

Farmer, J. D., & Lo, A. W. (1999). Frontiers of finance: Evolution and efficient markets. Proceedings of the National Academy of Sciences of the USA, 96, 9991–9992.

Gintis, H. (2009). Game theory evolving: A problem-centered introduction to modeling strategic interaction (2nd ed.). Princeton: Princeton University Press.

Hens, T., & Naebi, F. (2022). Behavioral heterogeneity in the CAPM with evolutionary dynamics. Journal of Evolutionary Economics. https://doi.org/10.1007/s00191-022-00786-3

Holtfort, T. (2019). From standard to evolutionary finance: A literature survey. Management Review Quarterly, 69, 207–232.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decisions under risk. Econometrica, 47(2), 263–291.

Kelly, J. L. (1956). A new interpretation of information rate. Bell System Technical Journal, 35, 917–926.

Kohlberg, E. (1982). The Perron-Frobenius theorem without additivity. Journal of Mathematical Economics, 10, 299–303.

Kojima, F. (2006). Stability and instability of the unbeatable strategy in dynamic processes. International Journal of Economic Theory, 2, 41–53.

Levin, S. A., & Lo, A. W. (2021). Introduction to PNAS special issue on evolutionary models of financial markets. Proceedings of the National Academy of Sciences of the USA, 118(26), e2104800118.

Li, E., Livdan, D., & Zhang, L. (2009). Anomalies. Review of Financial Studies, 22, 4301–4334.

Lintner, J. (1965). The valuation of risk assets and the selection of risky investments in stock portfolios and capital budgets. Review of Economics and Statistics, 47, 13–37.

Lo, A. W. (2004). The adaptive markets hypothesis: Market efficiency from an evolutionary perspective. The Journal of Portfolio Management, 30, 15–29.

Lo, A. W. (2005). Reconciling efficient markets with behavioral finance: the adaptive market hypothesis. Journal of Investment Consulting, 7, 21–44.

Lo, A. W. (2012). Adaptive markets and the new world order. Financial Analyst Journal, 68, 18–29.

Lo, A. W. (2017). Adaptive markets: Financial evolution at the speed of thought. Princeton: Princeton University Press.

Lo, A. W., Orr, H. A., & Zhang, R. (2018). The growth of relative wealth and the Kelly criterion. Journal of Bioeconomics, 20, 49–67.

Maynard Smith, J., & Price, G. (1973). The logic of animal conflicts. Nature, 246, 15–18.

Milnor, J., & Shapley, L. S. (1957). On games of survival. In: Contributions to the theory of games III, Annals of mathematical studies (Vol. 39, pp. 15–45). Princeton University Press.

Orr, H. A. (2018). Evolution, finance, and the population genetics of relative wealth. Journal of Bioeconomics, 20, 29–48.

Radner, R. (1972). Existence of equilibrium of plans, prices, and price expectations in a sequence of markets. Econometrica, 40, 289–303.

Radner, R. (1982). Equilibrium under uncertainty. In K. J. Arrow & M. D. Intrilligator (Eds.), Handbook of mathematical economics II (pp. 923–1006). North Holland.

Samuelson, L. (1997). Evolutionary games and equilibrium selection. MIT Press.

Schaffer, M. (1988). Evolutionarily stable strategies for a finite population and a variable contest size. Journal of Theoretical Biology, 132, 469–478.

Schnetzer, M., & Hens, T. (2022). Evolutionary finance for multi asset investors. Financial Analysts Journal, 78, 115–127. https://doi.org/10.1080/0015198X.2022.2071581

Schweber, S. S. (1977). The origin of the origin revisited. Journal of the History of Biology, 10, 229–316.

Sciubba, E. (2005). Asymmetric information and survival in financial markets. Economic Theory, 25, 353–379.

Sciubba, E. (2006). The evolution of portfolio rules and the capital asset pricing model. Economic Theory, 29, 123–150.

Shiller, R. J. (1981). Do stock prices move too much to be justifed by subsequent changes in dividends? American Economic Review, 71(3), 421–436.

Shiller, R. J. (2003). From efficient markets theory to behavioral finance. Journal of Economic Perspectives, 17(1), 83–104.

Shubik, M., & Thompson, G. (1959). Games of economic survival. Naval Research Logistics Quarterly, 6, 111–123.

Singh, N., & Vives, X. (1984). Price and quantity competition in a differentiated duopoly. RAND Journal of Economics, 15, 546–554.

Tobin, J. (1969). A general equilibrium approach to monetary theory. Journal of Money, Credit and Banking, 1, 15–29.

Tobin, J., & Brainard, W. (1977). Asset market and cost of capital. In B. Balassa & R. Nelson (Eds.), Economic progress, private values and public policy, essays in honor of William Fellner (pp. 235–262). North-Holland.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5(4), 297–323.

Weibull, J. (1995). Evolutionary game theory. MIT Press.

Zhang, R., Brennan, T. J., & Lo, A. W. (2014). Group selection as behavioral adaptation to systematic risk. PLoS ONE, 9, 1–9.

Zhitlukhin, M. (2021a). Survival investment strategies in a continuous-time market model with competition. International Journal of Theoretical and Applied Finance, 24(1), 2150001.

Zhitlukhin, M. (2021b). Capital growth and survival strategies in a market with endogenous prices. SIAM Journal on Financial Mathematics. arXiv:2101.09777.

Zhitlukhin, M. (2022a). A continuous-time asset market game with short-lived assets. Finance and Stochastics, 26, 587–630.

Zhitlukhin, M. (2022b). Asymptotic minimization of expected time to reach a large wealth level in an asset market game. Stochastics. https://www.tandfonline.com/doi/abs/10.1080/17442508.2022.2041640.

Acknowledgements

The authors are grateful to Rabah Amir for helpful comments and fruitful discussions.

Funding

Open access funding provided by University of Zurich.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Evstigneev, I.V., Hens, T. & Vanaei, M.J. Evolutionary finance: a model with endogenous asset payoffs. J Bioecon 25, 117–143 (2023). https://doi.org/10.1007/s10818-023-09335-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10818-023-09335-9