Abstract

This study investigates the competitive factors of software firms that participated in the Korea Software Firm Competitiveness Awards, a nationwide project supported by the Ministry of Knowledge Economy that studies the performance of software firms in Korea. The study applies concepts from hierarchical multiple regression analysis to develop a model to assess the relationship between the competitive factors of software firms and firm performance. The developed model was validated through a field survey of 79 software firms in Korea. The survey results show a significant relationship between competitive factors and firm performance, as well as the relative influence of significant variables. The findings provide two important implications: first, from a management perspective, software firms in Korea focus on human resources based on technology development in the domestic market, and second, from a policy perspective, the government supports the establishment of external capabilities (internationalization and partnerships) for software firms. These findings are available to researchers, policy makers, software developers, and other market players, and contribute to the literature on the importance of competitive factors.

Similar content being viewed by others

Explore related subjects

Find the latest articles, discoveries, and news in related topics.Avoid common mistakes on your manuscript.

1 Introduction

The origins of the software industry can be tracked down to the decision by IBM to unbundle some secondary parts of its computer development to independent software companies [9]. In its early stages, computing software development was considered a secondary industry serving the core business, which was computer hardware manufacturing. As a matter of fact, this is still evident in the approach of both global information and communication technology (ICT) giants such as IBM, and major professional and scientific establishments in the field, such as ACM.

Firms in the software industry produce and sell software applications and related systems. As software runs the computers and networks that support the flow of information in the global economy, competition in the software industry affects firms in all other user industries [27].

Recently, a new development has been observed, namely, software businesses being conducted by industrial companies. Research on this phenomenon has recently started, and is being conducted at the industry level (e.g., [45, 46]).

However, research on software firm competitiveness has not yet been conducted at the firm level, and prior studies on commercial software enterprises have employed industry-level analyses or have focused on major players in the industry. While industry-level analyses reveal generalities and trends, and software innovation in large organizations such as Microsoft [49] and IBM [38] have been the subject of study, very little is known about the IT capabilities of small-to-medium-sized software enterprises (SMSEs), which are arguably the wellsprings of innovation [6]. It is imperative, therefore, to explore and understand capability development in such firms, and the influence of social, institutional, and organizational factors on their development [36]. Similarly, in the information system field, Agarwal et al. [1] argue that “While the importance of strong IT competence is rarely argued, the means by which firms develop such competence is not clearly understood.”

This study explores the relationship between competitive factors (human resources, market resources, technology capability, internationalization capability, and customer satisfaction) and the performance of software firms. This relationship has neither been a focus of serious conceptual discussion nor has it been tested with robust methodology and data. Among the various competitive factors, this paper deals with the performance implications of strategies for internal resources (human resources and market resources) and capabilities (technology capability and internationalization capability) and for customer satisfaction (product satisfaction and service satisfaction).

2 The software industry in Korea

2.1 Competitiveness of the software industry

Korea’s software industry has witnessed a remarkable growth. The South Korean software market garnered total revenues of US$2.3 billion in 2009, representing a compounded annual growth rate (CAGR) of 7.5% for the period spanning 2005–2009. Moreover, general business productivity and the sales of home-use applications proved the most lucrative for the South Korean software market in 2009, with total revenues of US$902.9 million, equivalent to 38.9% of the market’s overall value. Based on qualitative and quantitative leap to ease strengths of the strong market environment, various sectors of the system tend to be early adapters of new technology proposed. Top world-class IT infrastructure and e-government, and related IT services sectors, in particular, have seen considerable development. However, with the exception of large enterprises that are globally competitive, other smaller enterprises face a shortage of experienced software professionals. In terms of the competitiveness in the software industry, Korea ranks a dismal 14 out of 19 Organisation for Economic Co-operation and Development (OECD) countries [31].

In terms of size, the Korean software industry is ranked 10, at US$21.3 billion. Though R&D investment places Korea in the 7th place, Korea’s R&D investment is significantly low in terms of its absolute size compared to other advanced players such as the United States, Japan, and England [42].

Furthermore, a vicious cycle of “small market—over-competition—low-cost orders—profitability deterioration—human resources departing” has been established in the Korean software industry, making it difficult for it to become globally competitive [33].

There are several reasons for this vicious cycle. For one, the domestic packaged-software market is dominated by globally competitive mega-corporations such as Microsoft, Oracle, and so on, which constitute approximately 64% of the Korean market. While Korean companies rely on markets with little competition from foreign companies, such as common markets, having too many participants results in competition and low-cost strategies, leading to a decline in profits which, in turn, leads to the deterioration of working conditions and investment [31].

Exports in the IT industry revolve mostly around hardware, with minimal software exports. A more detailed examination reveals that, although Korea was ranked number 1 among OECD countries in 2008 in IT hardware exports, accounting for 26.2% of total electronics manufacturing, it was also ranked number 27 in software exports, accounting for a mere 1.3% of total software exports [32].

Competition with global enterprises is inevitable in the Korean market as well as in world markets. However, there is a large gap between the size of Korean software companies and that of global enterprises. In 2009, Microsoft garnered US$62.5 billion in sales. However, Samsung SDS, a Korean mega-enterprise, made only US$3.6 billion in sales, while AhnLab, a medium-sized Korean company, made only US$618,000 in sales.

Furthermore, with global corporations such as Microsoft and Oracle dominating about 70% of the Korean packaged-software market, Korean companies have next to no competitive edge, with the exception of word processors and virus protection programs.

In Korea, client companies and software suppliers have a subordinate relationship, lacking specialization and mass production. In most cases, client companies plan the software they need, and suppliers simply produce it. Such customized software is virtually impossible to recycle, posing a limit to the growth of software enterprises and diverse software applications. In advanced countries such as the United States and Japan, however, an outsourcing system ensures that the roles of client companies and suppliers are clearly discernable [20].

With highly qualified workers avoiding entering the software field, and with software-related fields of study seeing a decrease in the number of students, Korea’s software industry has a shortage of human resources. As of 2008, 9379 workers (employed people) were needed in the Korean software industry, representing 9.7% of the total of 96,967 software specialists [41].

Software-related majors in major universities (computer science, computer engineering, software engineering, etc.) have seen a decrease in the total number of enrolled students, from 120–130 in 2000 to 30–70 in 2009 [31].

2.2 Challenges faced by Korean software firms

In Korea, large domestic software companies (Samsung SDS, LG CNS, etc.) are rather secretive, and, as a result, there are little data to assess determinants such as price, quality, service, and past performance that influence sales. Moreover, the government and public sector tend to buy software through open bidding, causing the software quality and service to deteriorate [22].

Lee [23] suggested enhancing international competitiveness of the Korean software industry by the theoretical consideration of company internationalization and through the analysis of competitive factors by comparing the current status of the software industry of both Korea and other countries (India and Ireland).

Kong’s [20] research presented strategic plans to promote the development of the software industry in Korea, which is a key infrastructure in a knowledge-based society. The plans were based on an analysis of the current situation and problems related to this industry, and the policies adopted in foreign countries with advanced software industries.

“Software Engineering – White Book: Korea 2010”, NIPA [34], explains inhibitory factors in the growth of the Korean software industry. SERI [42] in “Strategies for Enhancing Competitiveness on Korea Software Industry” explains several inhibitory factors both from the provider’s and the consumer’s perspective.

Table 1 shows that Korean software firms have several pervasive inhibitory factors on software firm competitiveness within the software and IT service market. The following inhibitory factors impact the accelerating factors of Korean software firms’ competitiveness.

3 Competitiveness factors of software firms and hypotheses

3.1 Evaluation framework for competitive factors of software firms

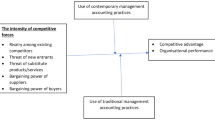

In this study, an evaluation framework for competitive factors of software firms consists of evaluation factors, attributes, and indices. The competitive factors of software firm are presented in Fig. 1 to show the structure of the evaluation framework and hypothesis.

An evaluation framework for competitive factors of software firms is divided into five parts:

-

1.

Human resources

-

2.

Market resources

-

3.

Technology capability

-

4.

Internationalization capability

-

5.

Customer satisfaction

3.2 Human resource and performance in software firms

Human resources (A) has five attributes: management staff (AA), management assistance staff (AB), technical staff (AC), marketing staff (AD), and consulting staff (AD). The attributes of human resources are categorized to measure the five evaluation attributes of human resources. We developed ten measurements as shown in Table 2. These measurements were used to design questionnaires and conduct interviews.

Prior research (Table 3) related to human resources concentrate on the role of human resources in competitive advantage, and point out the importance of the firm’s organization in allowing it to exploit its human resources. This research states that the human capital theory distinguishes between general and firm-specific skills of human resources.

Tables 2 and 3 present research related to the human resources factors, and these arguments lead to the following hypotheses:

-

Hypothesis 1: The level (business ability) of human resources is positively associated with a software firm’s performance.

-

1a: The level (managerial ability) of management staff is positively associated with a software firm’s performance.

-

1b: The level (support ability) of management assistance staff is positively associated with a software firm’s performance.

-

1c: The level (R&D ability) of technical staff is positively associated with a software firm’s performance.

-

1d: The level of marketing staff is positively associated with a software firm’s performance.

-

1e: The level of consulting service staff is positively associated with a software firm’s performance.

3.3 Market resource and firm performance

Human resources (B) has two attributes: market scale (BA) and partnership (BB). The attributes of market resource are categorized to measure the two evaluation attributes of market resources. We developed four measurements as shown in Table 4. These measurements were used to design questionnaires and conduct interviews.

Table 5 provides prior research related to market-resources. Day [13] distinguishes a fuller picture of the attributes of a market-driven organization, highlighting the roles of culture, information utilization, and inter-functional coordination. Wade and Hulland [47], based on Day’s [13] categorization of resources and capabilities, distinguish between inside-out, spanning, and outside-in information system resources.

Tables 4 and 5 present research related to market resources factors, and these arguments lead to the following hypotheses:

-

Hypothesis 2: The level (market management ability) of market resources is positively associated with a software firm’s performance.

-

2a: The level (sales and growth) of market scale is positively associated with a software firm’s performance.

-

2b: The level (partnership management ability) of partnership is positively associated with a software firm’s performance.

3.4 Technology capability and firm performance

Technology capability (C) has three attributes: development experience (CA), development strategy (CB), and development environment (CC). The attributes of technology capability are categorized to measure the three evaluation attributes of technology capability. We developed eight measurements as shown in Table 6. These measurements were used to design questionnaires and conduct interviews.

Amit and Shoemaker [2] categorize technology capability as strategic assets (SA) and research conditions that can lead to sustainable economic rents, and argue that firms can have sustained economic rents based on the differences in resources and capabilities between companies. Butler [7] distinguishes between technical, financial, locational, and complementary resources; IT-based resources and IT human resources; and firm-specific and non-firm-specific resources when conducting research on software companies, IT resources, and IT competences. Cockburn et al. [10] reconcile competing perspectives on the origin of competitive advantage and state examples of organizational capabilities such as the ability to develop new products rapidly. Ray et al. [39] distinguish between tangible and intangible resources and capabilities and state that technology resources are valuable physical capital resources that may improve customer service performance. Lee et al. [24] feel that technological capabilities define the roots of a firm’s sustainable competitive advantage, as the capabilities comprise patents protected by law, technological knowledge, and production skills that are valuable and difficult for competitors to imitate. Besides, various researchers emphasized technology-capability as a competitive factor (Table 7).

Tables 6 and 7 present research related to the technology capability factors, and these arguments lead to the following hypotheses:

-

Hypothesis 3: The level (technology development ability) of technology capability is positively associated with a software firm’s performance.

-

3a: The level (technology development career) of development experience is positively associated with a software firm’s performance.

-

3b: The level (concentration-ability of technology) of development strategy is positively associated with a software firm’s performance.

-

3c: The level (investment degree) of development environment is positively associated with a software firm’s performance.

3.5 Internationalization capability and firm performance

Internationalization capability (D) has two attributes: internationalization strategy (DA) and internationalization experience (DB). The attributes of internationalization capability are categorized in order to measure the two evaluation attributes of internationalization capability. We developed three measurements that are presented in Table 8. These measurements were used to design questionnaires and conduct interviews.

Table 9 provides prior research related to internationalization capability. Del Canto and González [14], in their research on the influence of resources and capabilities on a firm’s R&D activities, distinguish between tangible (including financial and physical) resources and intangible (including human and commercial) resources, stating that intangible resources are often the most important ones from a strategic point of view, and suggest that a firm’s commercial resources include the relationships with foreign clients, so that the firm’s degree of internationalization can also be included in this section. Miller’s [30] article is concerned with asymmetries, and with how companies can transform them into valuable resources or capabilities. According to Miller’s [30] research, capabilities, in general, include abilities to improve global capability. Sallinen [40], in her research on industrial software supplier firms, distinguishes between production capabilities, supporting process capabilities, business process capabilities, and relationship capabilities. She studies relationship capabilities (the ability to operate as a formally secure partner in customer relationships; the ability to take responsibility for operations; knowledge of how to operate as a subcontractor; contractual knowledge and negotiation skills; and increased ability to take responsibility for operations).

Tables 8 and 9 present research related to internationalization capability factors, and these arguments lead to the following hypotheses:

-

Hypothesis 4: The level of internationalization capability is positively associated with a software firm’s performance.

-

4a: The level of internationalization strategy is positively associated with a software firm’s performance.

-

4b: The level of internationalization experience is positively associated with a software firm’s performance.

3.6 Customer satisfaction and firm performance

Customer satisfaction (E) has two attributes: product satisfaction (EA) and service satisfaction (EB). The attributes of customer satisfaction are categorized in order to measure the two evaluation attributes of customer satisfaction. We developed seven measurements as shown in Table 12. These measurements were used to design questionnaires and conduct interviews.

Table 11 summarizes prior studies on customer satisfaction factors. Perceived quality is known as the difference between experienced quality and expected quality. Experienced quality can be influenced by two aspects: technical quality, which is affected by the results of a service, and functional quality, which accrues during the delivery of a service [18]. Cronin and Taylor [12], developers of the SERVPERF model, explain that customer satisfaction can be measured only by perceived quality. This model can reduce survey questions and improve the predictability of customer purchase intentions [12]. To utilize the practical values of prior models, the America Customer Satisfaction Indices (ACSI) model in the United States [35] and the National Customer Satisfaction Indices (NCSI) model in Korea [21] have been developed and currently applied to various areas.

Tables 10 and 11 present research related to customer satisfaction factor, and these arguments lead to the following hypotheses:

-

Hypothesis 5: The level (ability of product and service (P&S) satisfaction management) of customer satisfaction is positively associated with a software firm’s performance.

-

5a: The level (quality of technology and function) of product satisfaction is positively associated with a software firm’s performance.

-

5b: The level (quality of service) of service satisfaction is positively associated with a software firm’s performance.

4 A case study: 79 Korean software firms

4.1 Sampling and data collection

The unit of analysis is a firm, and samples were selected from firms that participated in the Korea Software Firm Competitiveness Awards (KSFCA) over the course of eight years (2004–2011), a nationwide project supported by Ministry of Knowledge Economy (MKE). In the project, software firms were classified into six areas: (1) ERP/SCM/CRM, (2) KMS/EDMS/BPM (3) Protection and security software, (4) Development and OS software, (5) Industry and science software, and (6) Other software. Table 15 presents the software classification in the project and the distribution of the initial participants.

The data used in this study were taken from surveys and interviews. Questionnaires were sent to corporate representatives (CEO or management staff) through e-mail, phone calls, and facsimiles. A total of 109 responses were returned out of 200 firms contacted, and 30 firms were removed owing to missing values, yielding a total of 79 sample firms with a response rate of 39.5%. Table 12 presents software classification and the distribution of firms.

4.2 Measurement

The research model specified above (Fig. 1) consists of 14 independent variables and one dependent variable. To facilitate cumulative research, the measurement items for these constructs were directly adopted from prior studies. There are several measurements on firm performance in the present literature, such as financial performance, strategy performance, and so on. Owing to the statistical data being distempered or many firms not willing to publish them, it is difficult to quantify. Therefore, in this study, the dependent variable specified in the model is firm performance. A firm’s performance was measured by annual sales growth rate during the eight-year period (2004–2011). Fourteen independent variables (Fig. 1) were considered in this study as factors that impinge on the competitiveness of software firms, and hence on performance.

In this study, we carried out a correlation analysis and hierarchical linear regression (HLR). The analysis based on HLR is a two-step process. The first step is an assessment of the measurement model (for reliability and validity). The second step entails testing the proposed hypotheses.

In this assessment of the measurement model is a type of reliability and validity test. The objective is to find out to what extent the indicators selected for the different measurement scales are reliable and valid. Reliability in this context refers to how consistent and stable the scores derived from a measurement scale are [15]. We assessed the reliability of each construct by means of composite reliability and Cronbach’s α coefficient; first, by considering the correlation of items within each scale, then correcting item-to-total (item-scale) correlations, and finally deleting the effects on reliability after items with low values of composite reliability and Cronbach’s α coefficient [15]. Table 15 captures the process of the reliability analysis by showing the original sets of measurement items associated with the major constructs, the items dropped from the original sets to increase alpha, and the reliability coefficients for the final set of scales. As shown in the table, Cronbach’s α coefficients ranged from 0.617 to 0.686. Hair et al. [19] recommended that Cronbach alpha values from 0.6 to 0.7 were deemed to be the lower limits of acceptability. Since the reliability measures must be greater than 0.60 to be considered satisfactory, all scales considered for this study were found to be reliable.

Table 13 presents the loadings and cross loadings of the constructs after a process of refinement of the constructs. The validity of a measurement scale is said to be convergent when items load highly (i.e., loading > 0.5) on their associated constructs. All the items loaded on their respective constructs from a lower bound of 0.533 to an upper bound of 0.888.

4.3 Result

Hierarchical multiple regression analysis was used to test the hypotheses of this study. We conducted a series of global tests comparing successive models by using incremental F-tests, as shown at the bottom of Table 14.

The set of variables [management staff (AA), management assistance staff (AB), technical staff (AC), marketing staff (AD), and consulting service staff (AE)] predicting human resources and constituting Model 1 (ΔR2 = 0.439, F = 5.217***), were first entered into the equation to test their effect on sales growth. Two variables were found to be significant. The beta values showed that management assistance staff (β = 0.261*) and technical staff (β = 0.327**) were significant predictors of sales growth. In other words, two attributes (management assistance staff and technical staff) of human resource factors (Table 4) had a positive influence on sales growth. Of these two attributes, technical staff had the strongest impact on sales growth. Therefore, H1a, H1b, and H1c were supported, while H1d and H1e were not supported.

In Model 2 (ΔR2 = 0.47, F = 4.427***), the market resource factors [market scale (BA) and partnership (BB)] were added to test their effect on sales growth. As shown in Table 15, the beta values showed that partnership (β = 0.286*) was the weakly significant predictor of sales growth. Therefore, while H2b was supported, H2a was not supported.

As shown in model 3 (ΔR2 = 0.616, F = 5.335***) of Table 15, development strategy, an attribute of technology capability was positive and statistically significant (β = 5.16***). However, the two attributes of technology capability (development experience and development environment were not statistically significant. Overall, among the technology capability factors, only H3b was partially supported, while H3a and H3c were not supported.

In Model 4 (ΔR2 = 0.616, F = 5.335***), we suggest that internationalization capability [international strategy (DA) and internationalization experience (BD)] effects sales growth. Internationalization experience, an attribute of internationalization capability is weakly positive and statistically significant (β = 2.95*).

In Model 5 (ΔR2 = 0.616, F = 5.335***), product satisfaction (β = 0.009) and service satisfaction (β = −0.028) do not have a significant effect on sales growth. Therefore, H5a and H5b were not supported.

We evaluated the relative influence of significant variables on Model 5. Among these significant attributes, development strategy (β = 0.499) had the strongest impact on sales growth. The following variables were also observed to have an effect on the sales growth: the management assistance staff (β = 0.491), the technical staff (β = 0.343), the internationalization experience (β = 0.294), and the partnership (β = 0.246), constituting the second, third, fourth, and fifth variables, respectively.

4.4 Discussion

Table 15 represents a summary of the hypotheses and the outcome of the study. It shows each hypothesis, our conclusion, and the impact priority of significant variables.

The purpose of this study has been to investigate the relationship between the competitive capabilities of software firms and firm performance, and hence their influence on firm performance.

Altogether, 14 hypotheses were investigated in this study, of which 5 were supported, and 9 were not supported.

Regarding the human resources factor, two attributes [management assistance staff (H1b) and technical staff (H1c)] have a positive and significant relationship with firm performance. This finding contributes to the understanding of competitive factors considering the characteristics of the Korean software industry [20, 22, 42]. In other words, we suggest that among the main attributes of human resources, competitive factors are the power of management assistance and technical staff, as previous research [7] shows that competitive factors capture the firm-specific capabilities and assets of innovative SMSEs.

The finding on the market resources factor explains the power of partnership (scales and strategy of partner in market) and its influence on firm performance although previous researches focused on market resource and external capability [13, 14, 29, 47]. Since software firms in Korea have limited market orientation towards large companies such as Samsung SDS, LG CNS, etc., this finding explains that partnership with governments, competitors, and so on, rather than the quantitative scale of the market, is important. In South Korea, although many software firms are interested in the global market, they have difficulties finding funding, owing to an insufficient support system and so forth [20]. Owing to these problems, the finding on the international capability factor accentuates the importance of the internationalization experience for opportunities (cooperation with global company and so on) in the global market rather than planning strategy in an unstable domestic environment. In Korea, many software firms follow a form of public sector-oriented business, especially e-government, and the practice of accepting the lowest price-bid in public sectors aggravates the profitability of software firms [20, 22, 42]. Therefore, the findings on the technology capability factors suggests that software firms in Korea should concentrate on development strategy, rather than development experience and environment, to reinforce the technical capability for sustainable growth.

Prior studies (Del Canto and Gonzalez); [30, 43] emphasize internationalization capability to improve firm performance. In Korea, although many software firms are interested in the global market, they have funding difficulties, insufficient support systems, and so on [20]. Owing of these problems, the findings on the international capability factor present the importance of the internationalization experience for opportunities (cooperation with global companies, etc.) in the global market, rather than the planning strategy in an unstable domestic environment.

Customer satisfaction as a competitive factor is a traditional issue in the marketing domain and a broad concept that includes perceived evaluation of products and services [12, 18, 21, 25, 35, 37]. However, the finding on customer satisfaction factors presents no influence on firm performance. This finding explains that many software firms focus on project audits, rather than customer satisfaction in Korea [20, 22, 23].

Finally, we suggest impact priority on firm performance [development strategy (technology capability factor)] → management assistance staff (human resource factor) → technical staff (human resource factor) → internationalization experience (internationalization capability factor) → partnership (market capability factor). This finding has two implications: First, from a management perspective, software firms in Korea focused on human resources based on technology development in the domestic market. Second, from a policy perspective, governments will support the building up of external capabilities (internationalization experience and partnership) for software firms.

5 Limitations and conclusions

In this paper we attempted to uncover the competitive factors of medium and small software firms in Korea and how they affect performance. Our study, like any other study, suffers from some limitations. First, our sample size is not large enough to allow us to analyze the effects of all competitive factors. The sample consisted of only firms that participated in the KSFCA. Thus, without further research, the result cannot be expanded beyond these firms participating in KSFSA trade associations. A second limitation is that our study is based on data from medium and small firms. Ideally, we would have liked to include data from a few more global firms. However, getting access to such detailed data that is of great competitive significance is a difficult challenge.

Moreover, a maturity model study for competitiveness is needed. In this study, we focused on competitive factors for software firms and did not set up a specific action plan to improve the level of competitiveness in software firms. Using a maturity model study, a theoretical basis must be secured on a competitiveness level, and for strategic and political support, a maturity model study considering the characteristics of the Korean software and IT service market is necessary.

We consider, as further study, an evaluation system of software competitiveness based on a corresponding maturity model by combining traditional software resources and capabilities assessment models with general competitive factors. Using the system, software firms can evaluate their own current competitiveness levels. Consequently, they can trace any changes in competitiveness levels in order to gain a more precise understanding of their competitive advantages.

In conclusion, the paper attempted to take an initial step in putting forth the importance of competitive factors in medium and small software firms and estimating their impact on performance. We hope that the findings of this paper in advocating the importance of contextually grounded studies on the competitiveness of software firms will spur further research along these lines in other industries.

References

Agarwal R, Ross J, Samamurthy V (1998) Sustaining innovations through IT-competent organizations: insights from practice’ in information systems: current issues and future changes. IFIP, Laxenburg, Austria, pp 529–535

Amit R, Shoemaker PJH (1993) Strategic assets and organizational rent. Strateg Manag J 14(1):33–46

Barney JB (1991) Firm resources and sustained competitive advantage. J Manag 17(1):99–120

Barney JB, Wright PM (1998) On becoming a strategic partner: the role of human resource in gaining competitive advantage. Hum Resour Manag 37(1):31–46

Barney JB, Wright PM, Ketchen DJJ (2001) The resource-based view of the firm: ten years after 1991. J Manag 27(6):625–641

Baskerville R, Pries-Heje J (1998) Managing knowledge capability and maturity. In: Information systems: current issues and future changes. IFIP, Laxenburg, pp 175–196

Butler T (2002) Building IT resources in post-industrial organizations: cases on the development and application of IT competencies. Unpublished thesis, University College Cork

Campbell PRJ, Ahmed F (2010) A three-dimensional view of software ecosystems. In: ACM international conference proceeding series, pp 81–84

Campbell-Kelly M (2004) From airline reservations to sonic the hedgehog. MIT Press, Cambridge

Cockburn MG, Zadnick J, Deapen D (2006) Developing epidemic of melanoma in the Hispanic population of California. Cancer 106:1162–1168

Combs JG, Ketchen DJ (1999) Explaining interfirm cooperation and performance: toward a reconciliation of predictions from the resource-based view and organizational economics. Strateg Manag J 20(9):867–888

Cronin JJ, Taylor SA (1992) Measuring service quality: a reexamination and extension. J Market 56:55–68

Day GS (1994) The capabilities of market-driven organizations. J Market 58:37–52

Del Canto JG, González IS (1999) A resource-based analysis of the factors determining a firm’s R&D activities. Res Policy 28(8):891–905

Dyba T (2005) An empirical investigation of the key factors for success in software process improvement. IEEE Trans Softw Eng 31(5):410–424

Ethiraj SK, Kale P, Krishnan MS, Singh JV (2005) Where do capabilities come from and how do they matter? A study in the software services industry. Strateg Manag J 26(1):25–45

Grant RM (1996) Prospering in dynamically-competitive environments: organizational capability as knowledge integration. Organ Sci 7(4):375–387

Gronroos C (1993) Towards a third phase in service quality research challenges and future directions. Adv Serv Market Manag 2:49–64

Hair JF, Anderson RE, Tatham RL, Black WC (1998) Multivariate data analysis. Prentice Hall, Englewood Cliffs, NJ

Kong JH (2009) A study on strategy for the development of software industry in Korea. Public Economics & Economic development the Graduate School of Economics Yonsei University

Korea Productivity Center (1997) Korea

Lee OH (2003) A study on the conditions and competitive edges of the software. Public Economics & Economic development the Graduate School of Economics Yonsei University

Lee EM (2008) (The) Effect of the perceived fit between company and CSR activities and between consumer and CSR activities on consumer responses: the mediating roles of consumer perception and identification. Ewha Womans University

Lee C, Lee K, Pennings JM (2001) Internal capabilities, external networks, and performance: a study on technology-based ventures. Strateg Manag J 22(6/7):615–640

Leem CS, Yoon YK (2004) A maturity model and an evaluation system of software customer satisfaction: the case of software companies in Korea. Ind Manag Data Syst 104:347–354

Levitin AV, Redman TC (1998) Data as a resource: properties, implications, and prescriptions. Sloan Manag Rev 40(1):89–101

Li S, Shang J, Slaughter S (2010) Why do software firms fail? Capabilities, competitive actions, and firm survival in the software industry from 1995 to 2007. Inf Syst Res 21(3):631–654

Markides CC, Williamson PJ (1994) Related diversification, core competencies and corporate performance. Strateg Manag J 15:149–165

Markides CC, Williamson PJ (1996) Corporate diversification and organizational structure: a resource-based view. Acad Manag J 39:340–367

Miller D (2003) An asymmetry-based view of advantage: towards an attainable sustainability. Strateg Manag J 24(10):961–976

Ministry of Knowledge Economy (2011) Korea

Ministry of Strategy and Finance (2010) Korea

National IT Industry Promotion Agency (2008) Korea

National IT Industry Promotion Agency (2010) Software engineering—white book: Korea 2010

National Quality Research Center (1995) Korea

Nonaka I, Takeuchi H (1995) The knowledge-creating company. Oxford University Press, New York

Parasuraman A, Zeithaml VA, B Leonard (1998) SERVQUAL: a multiple-item scale for measuring consumer perceptions of service quality. J Retail 64:12–40

Phan DD, Vogel DR, Nunamaker JF (1995) Empirical studies in software development projects: field survey and OS/400 study. Inf Manag 28:271–280

Ray G, Barney JB, Muhanna WA (2004) Capabilities, business processes, and competitive advantage: choosing the dependent variable in empirical tests of the resource-based view. Strateg Manag J 25(1):23–37

Sallinen S (2002) Development of industrial software supplier firms in the ICT cluster. Doctoral thesis, University of Oulu, Department of Marketing

Samsung Electronics Research Institute (2009) Korea

Samsung Electronics Research Institute (2011) Strategies for enhancing competitiveness on Korea software industry, Korea

Sanchez R, Heene A (1997) Reinventing strategic management: new theory and practice for competence-based competition. Eur Manag J 15(3):303–317

Teece DJ, Pisano G, Shuen A (1997) Dynamic capabilities and strategic management. Strateg Manag J 18(7):509–533

Tyrväinen P, Warsta J, Seppänen V (2004) Toimialakehitys Ohjelmistoteolisuuden Vauhdilla: Uutta Liiketoimintaa Lähialoilta. Helsinki, TEKES

Tyrväinen P, Warsta J, Seppänen V (2008) Evolution of secondary software business: understanding industry dynamics. IFIP International Federation for Information Processing, p 287

Wade M, Hulland J (2004) Review: the resource-based view and information systems research: review, extension, and suggestions for future research. MIS Q 28(1):107–142

Winter SG (2003) Understanding dynamic capabilities. Strateg Manag J 24(10):991–995

Zachary G (1994) Showstopper: the breakneck race to create Windows-NT and the next generation at Microsoft. The Free Press, New York

Acknowledgements

This work is financially supported by the Ministry of Knowledge Economy (MKE) and Korea Institute for Advancement in Technology (KIAT) through the Workforce Development Program in Strategic Technology.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Lee, S.H., Leem, C.S. & Bae, D.J. The impact of technology capability, human resources, internationalization, market resources, and customer satisfaction on annual sales growth rates of Korean software firms. Inf Technol Manag 19, 171–184 (2018). https://doi.org/10.1007/s10799-018-0287-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10799-018-0287-2