Abstract

This research examines the impact of occupational choices and tax evasion on the tax administration policy in a hierarchical tax model. The economy has two sectors, wage-earners and self-employment, with evasion only possible in the latter. Incorporating occupational decisions produces a smaller marginal tax rate and a larger budget for the IRS. However, the resources are still insufficient to audit all self-employed, resulting in distortions in occupational choices favoring self-employment. These distortions prevent production efficiency from achieving the optimum level, indicating that the Diamond-Mirrlees theorem is not applicable in this context. Finally, applying differential taxation represents a Pareto improvement, but it results in higher taxes for self-employment.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Increasing tax revenue has been an essential topic for governments. For instance, after the economic crisis of 2008, developed countries focused on combating tax evasion and understanding its mechanisms to increase tax revenues (Slemrod, 2019). This is mainly because fighting against tax evasion increases tax revenue through effectiveness instead of changing tax policy. Along this line, Keen and Slemrod (2017) study the characteristics of a tax administration policy beyond its design, pointing out the relevance of the relationship between enforcement cost and tax revenue. Therefore, a central scope in tax policy is finding ways to make compliance policy more efficient.

However, different occupations do not provide the same tax evasion opportunities. Kleven et al. (2011) and Slemrod (2007) show that evasion in third-party income reports is low, and the problem arises mainly in occupations with income self-reporting. Self-reporting could produce bunching (see Kleven 2016, for a review), which could be connected with agents’ ability (Bastani & Waldenström, 2021), and strategic declaration to avoid forceful audits (Almunia & Lopez-Rodriguez, 2018). Hence, occupations with income self-reporting are prone to evasion since agents can strategically declare income to pay fewer taxes. For this reason, in the design of a tax administration policy, it is necessary to consider different evasion opportunities across occupations and agents’ occupational choices. Still, the literature has not placed enough emphasis on inquiring about both issues in the same context, producing a lack of information about distortions because of coexisting evasion and different occupations.

The current study tries to close this gap by incorporating occupational decisions - self-employment and wage-earner - and tax evasion into a tax policy design model. Considering both elements in a tax policy design model captures the idea that different sectors have different evasion opportunities. The main interest is to study distortions in audits, the marginal tax rate, and the budget for the IRS, as well as its consequences for occupational decisions. The setting is a hierarchical model similar as in Sánchez and Sobel (1993), in which a government interacts with a tax agency (the IRS henceforth), and this agency with taxpayers. Since hierarchical models help perform normative analyses (Melumad & Mookherjee, 1989), this paper focuses on the normative implications of including evasion and occupational choices in tax policy design.

This paper solves a three-stage game in which the government, the IRS, and a continuum of risk-neutral taxpayers interact. Taxpayers choose to be self-employed or wage-earners, and evasion is only possible in self-employment. In the first stage, a social welfare-maximizing government commits to a marginal tax rate, a public good provision, and a budget for the IRS. In the second stage, the IRS commits to an audit function. The IRS is entrusted to maximize the expected tax collection. Finally, in the third stage, taxpayers maximize their utility by choosing an occupation. If they are self-employed, they also decide their income declaration.

The IRS finds a direct incentive-compatible mechanism composed of an audit function and effective taxes, which are the agents’ tax liability, to enforce a true income declaration. Since productivity is private information, the revelation principle (Myerson, 1979, 1981) is used to find a mechanism that incentivizes agents to reveal their income. The audit function depends on the budget of the IRS but always takes the maximum possible value. All self-employed are audited with a large enough budget, but only low and middle-income self-employed are audited in an underbudgeted situation. If an agent is audited, its effective tax is the same as the government committed, otherwise it pays the same tax as the last audited taxpayer. In the underbudgeted case, those results distort occupational decisions for (potential) high-income self-employed in favor of self-employment. The same results are obtained if the audit cost is monotonically non-decreasing in the self-employment income and with a fine rate increasing in the self-employment income but with a slope bounded from above.

The public good provision depends on the government’s redistributive motives. Redistribute motives are captured by the social weight that shows the relevance of the agent’s consumption change in public funds terms. When the average social weight is different than one, the public good provision is biased from the first-best.

The marginal tax rate is lower than in the case without occupational decisions and can be characterized by two effects: welfare and revenue. This means taxes are upward biased if the government does not consider occupational decisions. The difference emerges because higher taxes raise tax revenue and downward welfare, increasing the incentive to evade. Hence, welfare and revenue effects due to occupational decisions produce lower taxes. Differential taxation (one marginal tax rate for each occupation) is a Pareto improvement, but it implies a higher marginal tax rate in self-employment. This is explained by a rise in self-employment taxes inducing taxpayers to move to the wage-earner sector, reducing evasion incentives.

The IRS budget is larger than in the case without occupational decisions, and three effects characterize its level: behavioral, mechanical, and welfare. This result comes from the marginal gains for an extra dollar/euro to the IRS. When audit increases, more taxpayers decide their occupation efficiently, paying higher taxes and increasing the effective tax for those not audited. However, this effect is decreasing in the extra budget, making marginal costs higher than benefits at some point. Therefore, it is not optimal to audit the entire self-employment sector.

Distortions through audits mean that the Diamond-Mirrlees theorem (Diamond & Mirrlees, 1971a1971b ) does not apply in this setting. This is because attaining production efficiency in a second-best tax scheme is impossible. At the equilibrium, the IRS is underbudgeted, and (potential) high-income self-employed have incentives to be self-employed. Differential taxation does not solve this result, producing more distortions under this scheme. Hence, because of the institutional design, high-skilled wage-earner workers move to their less productive occupation, which in this setting is self-employment. The critical element for this result is the non-optimality of giving enough resources to the IRS.

This study brings together two strands of literature. First, it expands the theoretical tax administration literature by demonstrating and explaining distortions due to coexisting evasion and occupational decisions. In this area, all papers build on the classical contributions of Allingham and Sandmo (1972) and Srinivasan (1973), and the extension of Yitzhaki (1974). Most papers focus on the evasion effect on self-employment, modeling only one sector and demonstrating the consequences of auditing and taxation.Footnote 1 Examples of models that assume auditing depends on declared income, similar to this paper, are Reinganum and Wilde (1985, 1986); Scotchmer (1987); Border and Sobel (1987). In this line, Cremer et al. (1990) and Sánchez and Sobel (1993) model hierarchical situations focusing on one occupation. Particularly, Sánchez and Sobel (1993) characterized the solution to the IRS’s problem and the tax policy, being the closest benchmark for our results. General conclusions from those studies are that audits have to be strongest in sectors more prone to finding evaders, and the tax system becomes regressive because of evasion. Regarding the tax administration models, Chander and Wilde (1998) provides a general characterization, and Keen and Slemrod (2017) study its components, showing the trade-offs beyond it and the elements that must be analyzed in its design. This paper expands this literature by incorporating occupational choices and showing that this produces lower taxes and a larger budget for the IRS, and differential taxation is a Pareto improvement.

The second strand of literature relies on the evasion effect on the labor market, particularly on the extensive margin decision, in a setting with tax administration policy. This line began with Sandmo (1981), later followed by theoretical developments by Boadway et al. (1991); Cowell (1985) and Pestieau and Possen (1991), Parker (1999) includes a simulation for the UK, and Watson (1985) and Kesselman (1989) use a general equilibrium framework. Recently, Casamatta (2021) incorporated occupational decisions in an optimal income taxation model similar to Chander and Wilde (1998), but without an IRS. Therefore, this paper contributes by studying distortions in occupational decisions in a hierarchical model. In this sense, the underbudgeted IRS result is critical because it raises the incentives to become self-employed. Moreover, and in a similar vein as Gomes et al. (2017) and Best et al. (2015), it is demonstrated that those distortions affect production efficiency in the second-best optimal taxation setting.

The rest of the paper is organized as follows. Section 2 presents the model and provides the first-best as a benchmark. Section 3 solves the IRS’s problem, showing the characterization of the audit policy and the effective tax. Section 4 solves the government’s problem, obtaining the marginal tax rate, the IRS budget, and the provision of public goods. Section 5 explains the consequences of the equilibrium and connects it with some empirical results. Section 6 describes the optimality of differential taxation and extensions over the audit cost and fine rate. Finally, Sect. 7 concludes.

2 Model

The economy has three agents: the government, the IRS, and a continuum of risk-neutral taxpayers of mass one. Two sectors exist: self-employment and wage-earner, indexed by \(i \in \lbrace s, d \rbrace\), where taxpayers decide where to work. While in sector d, employers report taxpayers’ income; in sector s, taxpayers self-report their income. It is assumed that in sector d, cooperation between firms and workers to underreport wages and divide the evaded amount is impossible. However, tax evasion is possible in sector s. The IRS knows perfectly which sector each taxpayer works in, and, because of evasion, needs to incur a cost to monitor income declarations in sector s. It is assumed that the government has no resources (technology, knowledge, and expertise, among other things) to perform the audit process efficiently. Therefore, a specialized agency to enforce tax compliance is necessary.

An interesting way to analyze this setting is through differential taxation: one tax scheme for each occupation. This approach could encompass each occupation’s inherent differences, for instance, evasion. Along this line, Gomes et al. (2017) find the optimal differential taxation in an occupational decisions model without evasion. Appendix A uses Gomez and coauthors’ paper as a benchmark to demonstrate that introducing evasion in this setting is worth it. Indeed, evasion necessitates a tax compliance policy, which alters optimal taxes and increases government costs.

2.1 Agents

Nature randomly chooses a productivity \(n = (n^{s}, n^{d})\) for each taxpayer. Each term represents productivity in the self-employment and wage-earner sectors, respectively. Formally, n comes from a joint distribution function F with support \([\underline{n}^{i}, \overline{n}^{i}] \times [\underline{n}^{j}, \overline{n}^{j}]\), where \(i, j \in \lbrace s, d \rbrace\) and \(i \ne j\). It is assumed that F is twice continuously differentiable (positive derivative), and the distribution of each productivity is positive correlated. In particular, we assume that \(\overline{n}^{s} > \overline{n}^{d}\).Footnote 2 Also, let us define \(F_{i}\) as the marginal distribution respect to sector i (and \(f_{i}\) its density) and \(F_{i\mid j}\) the conditional distributions (and \(f_{i\mid j}\) its density), with \(i, j \in \lbrace s, d \rbrace\) and \(i \ne j\). These functions are common knowledge in the model.

Taxpayers consume a homogeneous good whose production is linear in labor, and its price is normalized to one. Also, it is assumed that this market is perfectly competitive. Hence, the wage in each sector is equal to one, and the agent’s income is the same as the agent’s productivity. Given this, we hereafter denominate \(n^{i}\) the taxpayer’s income in sector \(i \in \lbrace s, d \rbrace\).

Taxpayers decide their occupation by comparing both sectors and choosing which gives them the highest utility. Each taxpayer offers an inelastic labor supply equal to one in each sector. Since taxpayers are risk-neutral, their utility can be written as a quasi-linear function in consumption, \(C:[\underline{n}^{i}, \overline{n}^{i}] \rightarrow \mathbb {R}_{+}\), with \(i \in \lbrace s, d \rbrace\). Agents pay taxes over their reported income. Let us assume a linear tax scheme composed of a marginal tax rate \(\tau \le 1\).Footnote 3 Let \(R \in \mathbb {R}_{+}\) be a certain level of public goods, and \(\phi : R \rightarrow \mathbb {R}_{+}\) the function that captures the benefit for its provision, that is increasing and concave (\(\phi ^{\prime } > 0\) and \(\phi ^{\prime \prime } < 0\)). From these, the agents’ utility is \(U(n^{i}, R) = C(n^{i}) + \phi (R)\).

In the wage-earner sector, consumption equals the after-tax income, \(n^{d} (1 - \tau )\). Consequently, the utility in this sector is \(U^{d}(n^{d}, R) = n^{d} (1 - \tau ) + \phi (R)\). Note that since wage-earners do not make any decision, \(U^{d}(n^{d}, R)\) is their indirect utility.

In the self-employment sector, taxpayers make an income declaration \(w: [\underline{n}^{s}, \overline{n}^{s}] \rightarrow \mathbb {R}_{+}\). The IRS does not reward over-reporting, implying that any declaration above real productivity is a dominated strategy, hence \(w \le n^{s}\). Self-employed face an audit with probability \(\alpha \in [0,1]\), and if the IRS audits them, it immediately discovers whether they have evaded. Audited self-employed pay the penalty \(\rho \in \mathbb {R}\), composed by a fine rate \(\pi > 1\) over the evaded taxes. The penalty takes the following form

The penalty function establishes that the penalty is zero if a taxpayer declares their true income. Otherwise, the penalty is the evaded taxes \(\tau \left( n^{s} - w \right)\) expanded by the fine rate \(\pi\).

Let us define \(\bar{U}^{s}(n^{s}, R)\) as the utility with the optimal income declaration in sector s. Formally, this utility is given by the following

where \(w(n^{s})\) is the solution to this problem. In this case, \(C(n^{s}) = n^{s} - \tau w - \alpha (w) \max \left\{ \pi \tau \left( n^{s} - w \right) , 0 \right\}\).

2.2 IRS

The IRS chooses the audit function to maximize the expected tax collection. Define the audit function as \(\alpha : [\underline{n}^{s}, \overline{n}^{s}] \rightarrow [0,1]\). The IRS has a budget B to finance the cost of auditing, where the cost of auditing a taxpayer is c, linear, and constant. If the IRS does not use its entire budget, the excess must be returned to the government along with the tax collection. The problem that the IRS solves is as follow

where \(\mathcal {N}_{i}\) is the set of taxpayers that decide to work in the sector \(i = \lbrace s,d \rbrace\).

2.3 Government

The government chooses the marginal tax rate \(\tau \in [0,1]\), a public good provision \(R \in \mathbb {R}_{+}\), and the budget for the IRS \(B \in \mathbb {R}_{+}\), to maximize a social welfare function (SWF). Let us define G(U) as the SWF, and assume that \(G^{\prime } > 0\) and \(G^{\prime \prime } \le 0\). In this case, G depends on the agent’s utility instead of their sum. This assumption captures the government’s concern for each possible income realization.

The government has a budget constraint where the cost of providing one unit of a public good is one. Given this fact, the problem of the government is as follows

where \(\mathcal {N}_{i}\) is the set of taxpayers that decide to work in the sector \(i = \lbrace s,d \rbrace\). The first restriction is the budget constraint (BC), which states that the expected tax collection must be at least equal to the expenses in the public goods provision and the budget for the IRS. The final restriction is the limited liability (LL), which states that any agent has a non-negative utility.

2.4 Timing

In the first stage, the government chooses a marginal tax rate, \(\tau\), a budget for the IRS, B, and a level of public goods provision, R, to maximize social welfare. The IRS selects an audit function in the second stage, \(\alpha\), in order to maximize the expected tax collection. In the third stage, taxpayers decide in which sector to work, s or d, and if self-employed, also choose their income declaration w. Finally, taxpayers pay their taxes. Wage-earner and non-audited self-employed only pay taxes on their declared income and audited self-employed also pay penalties. Figure 1 shows this game.

2.5 Full-information solution

The first-best solution is obtained to provide a benchmark with some results. The government decides the sector in which each agent works, its consumption level, and a public good provision. Let us define a consumption function, \(C: [\underline{n}^{d}, \overline{n}^{d}]\times [\underline{n}^{s}, \overline{n}^{s}] \rightarrow \mathbb {R}_{+}\), a public good provision, \(R \in \mathbb {R}_{+}\), and an occupational choice function, \(Z: [\underline{n}^{d}, \overline{n}^{d}]\times [\underline{n}^{s}, \overline{n}^{s}] \rightarrow \lbrace s, d \rbrace\). The occupational choice function determines the sector in which each agent will optimally work.

Proposition 1

The first-best solution is given by \(\lbrace Z_{s}, Z_{d},\) \(R, C_{i}(n^{i}, n^{j}) \rbrace\), with \(i\ne j\) and \(i,j \in \lbrace s,d\rbrace\), and takes the following form

Proof

See Appendix D\(\square\)

Proposition 1 shows the first-best solution in this setting. The first and second equations show that each agent works in its most productive occupation. The next equation reflects the optimal provision of public goods, indicating that the marginal cost of providing the public goods equals the sum among agents of the marginal rate of substitution (MRS) between the public and consumption goods. This result is known as the Bowen-Lindahl-Samuelson (henceforth BLS) rule (Samuelson, 1954, 1955). The last two equations relate to the optimal consumption choice, meaning that two agents in different occupations with the same income should have the same consumption. This establishes an equality condition related to horizontal equality between occupations in this setting.

2.6 Mechanism design approach

Since self-employed agents can hide information, the IRS needs to use a method that incentivizes them to declare their true income. Considering the revelation principle (Myerson, 1979, 1981), finding a direct incentive-compatible (IC) mechanism is without loss of generality. The mechanism \(\mathcal {M}: \lbrace \alpha , \mathcal {T} \rbrace\) is composed by \(\alpha\), the probability to audit an agent, and \(\mathcal {T}\) the effective tax paid, namely \(\mathcal {T}(n^{s}) = \tau w(n^{s})\).Footnote 4 Notice that if the audit function takes the value of \(\frac{1}{\pi }\), self-employed always reveal their real income (Scotchmer, 1987).Footnote 5 This result allows us to redefine the support for the audit function as \(\alpha \in [0, \frac{1}{\pi }]\). The direct IC mechanism is as follows

A direct IC mechanism in this setting results in self-employed declaring their real income, \(w(n^{s}) = n^{s}\). This means that the IRS perfectly knows the real income of all self-employed at the equilibrium, and this is given by the incentive structure behind the mechanism \(\mathcal {M}\).

Unless the mechanism follows the implementability requirements, some self-employed hide part of their income from the IRS. Let us define \(V^{s}(n^{s}, R; \mathcal {M})\) as the indirect utility in sector s given a mechanism \(\mathcal {M}\). Any implementable direct IC mechanism has the following characteristics

Lemma 2.1

The IC mechanism \(\mathcal {M}\) is implementable if and only if

-

1.

\(\alpha (n^{s})\) is non-increasing in \(n^{s}\)

-

2.

\(\mathcal {T}(n^{s}) = \dfrac{n^{s} ( 1 - \tau \alpha (n^{s})\pi ) + \phi (R) }{1 - \pi \alpha (n^{s})} - \dfrac{\int \limits _{j = \underline{n}}^{n^{s}} \left( 1 - \alpha (j) \pi \tau \right) dj}{1 - \pi \alpha (n^{s})} - \dfrac{V^{s}(\underline{n}, R; \mathcal {M})}{1 - \pi \alpha (n^{s})}\)

where \(\underline{n}\) is the first income level where the mechanism applies.

Proof

See Appendix B\(\square\)

The above Lemma describes the mechanism’s requirements to incentivize agents to reveal their true income. The first requirement is given by the incentive to underreport income, saying that audits cannot be increasing in self-employment wages.Footnote 6 In the opposite case, the IRS will audit high income reports more intensively, increasing the probability of non-auditing at low income levels and promoting evasion there. Therefore, the IRS must audit those income declaration levels where it is prone to find evaders.

The second requirement establishes the tax scheme incentivizing agents to reveal their actual income. This requirement shows the effect of evasion on the tax scheme and the impact of auditing on it. To promote truth-telling, the IRS should reward some declarations, depending on the audit level, allowing smaller tax payments than what taxpayers owe.

By using requirements in Lemma 2.1, it is possible to define the occupational choice rule and the threshold function in the agents’ occupational decisions. These elements are helpful in understanding distortions by IRS policy, as well as in simplifying the IRS’s problem.

Definition 1

(Occupational Choice Rule in an IC Mechanism). For any direct IC mechanism \(\mathcal {M}\), \(\mathcal {O}^{i}(\mathcal {M})\) is the set that results from agents’ occupational decisions and is defined by

This definition implicitly states that the mechanism \(\mathcal {M}\) defines agents’ occupational decisions. Agents compare their potential utility in each sector to decide where to work. The utility level given by \(\mathcal {M}\) determines the attractiveness of sector s compared to d, showing that the mechanism also determines occupational decisions.

Lemma 2.2

For any direct IC mechanism \(\mathcal {M}\), there exists a threshold function \(\kappa : [\underline{n}^{s}, \overline{n}^{s}] \rightarrow \mathbb {R}_{+}\) that establishes the minimum income to work as a wage-earner. Moreover, in equilibrium, the threshold function is characterized by

where \(X_{i}\) denotes the derivative of variable X with respect to i, and

where \(\hat{w}\) is the first income level that produces \(\kappa (n^{s}) = \overline{n}^{d}\).

Proof

See Appendix C\(\square\)

Consequently, the IRS incentivizes self-employed agents to reveal their real wages by choosing an audit function that maximizes the expected collection and holds conditions in Lemma 2.1. Formally, the problem of the IRS is as follows

The first restriction is the budget constraint, which asserts that the audit cost cannot be larger than the budget for the IRS. The second and third conditions are the implementability requirements for the mechanism \(\mathcal {M}\). Finally, the fourth condition is the threshold function’s definition, which defines the occupational choice rule. Also, since the direct IC mechanism is used, the IRS function does not have penalties and uses the effective tax instead.

3 IRS problem

The IRS chooses an audit function that maximizes the expected tax collection and holds with the IC conditions. As Lemma 2.1 states, the implementability conditions for any direct IC mechanism \(\mathcal {M}\) involve an audit function and an effective tax scheme. When choosing an audit function, the tax scheme is determined, and it is enough to design the monitoring policy to commit a specific tax scheme. Also, the monitoring process is required only on sector s because wage-earners report their incomes through their employers. This means that auditing affects only self-employment, and indirectly the wage-earner sector through agents’ occupational decisions.

The control theory is used to solve this problem.Footnote 7 This procedure is similar to one used in the optimal taxation literature (For instance Mirrlees 1971). This is motivated by the necessity for the self-employed indirect utility to follow a specific function, \(V^{s} _{n^{s}} (n^{s}, R; \mathcal {M}) = 1 - \pi \alpha (n^{s}) \tau\), a requirement for mechanism \(\mathcal {M}\). To incentivize self-employed real income declaration, the IRS needs to ensure a certain level of utility for each possible earnings, or that the increase in self-employed utility follows a specific pattern. Defining \(p(n^{s})\) as the adjoint function associated with the self-employed utility and \(\mu\) as the Lagrange multiplier associated with the budget constraint, the Lagrangian of this problem is

The linear effect of auditing gives the solution to this problem. Theoretically, this means that the audit should take the maximum or minimum value, depending on the budget constraint. The IRS audits with the maximum intensity until it spends all its budget. Consequently, all the budget B is used to audit and the IRS does not return money to the government. Also, this solution implies that some taxpayers are not audited if the budget is small enough. From this point comes the need to further explain this solution.

The audit function means that the IRS must monitor those earning levels that are prone to evasion more intensively. In this model, the self-employed have an incentive to underreport income. Without auditing, all agents will report the minimum possible earnings, \(\underline{n}^{s}\), and full misreporting exists. Taxpayers will report more earnings if the IRS audits them. The minimum level to discourage evasion is \(\frac{1}{\pi }\), meaning that any level between zero and this limit prevents full misreporting but does not incentive a real earning declaration. Let us assume that the IRS audits less than \(\frac{1}{\pi }\) in \(\underline{n}^{s}\) and does not use all its budget. The tax authority could increase tax collection by spending more resources on auditing and discouraging evasion at \(\underline{n}^{s}\). Suppose we repeat this exercise along the earning distribution. In that case, the IRS starts to discourage evasion at earning levels where it is more prone to find evaders until it uses all the budget B. Therefore, the IRS needs to audit more intensively at the earnings levels where agents are more incentivized to misreport. Examples of the same explanation modeling the same motivation to misreport are (Paramonova) Kuchumova, Y. (2017) and Sánchez and Sobel (1993), and studies using different incentives include Bigio and Zilberman (2011) and Zilberman (2016).

The budget constraint defines the last audited earning level when the IRS is underbudgeted (B is insufficient to audit all self-employed). This level is defined as \(w^{*}\). Hence, the IRS spends all its budget auditing until \(w^{*}\). Since this is the last income level audited, it separates the audit function between its extreme values. Below \(w^{*}\), the IRS audits with maximum intensity, \(\alpha (n^{s}) = \frac{1}{\pi }\). Above \(w^{*}\), the IRS does not audit, or \(\alpha (n^{s})=0\). Scotchmer (1987); Border and Sobel (1987) and Sánchez and Sobel (1993) find the same solution, showing that the pattern is related to the IRS’s objective and the agents’ incentive to evade. The following equation characterizes \(w^{*}\).

Proposition 2 formalizes the abovementioned elements and incorporates the effective tax formula. It is defined as a solution for the IRS, the mechanism \(\mathcal {M}\) that maximizes tax collection and fulfills the implementability requirements in Lemma 2.1.

Proposition 2

The direct IC mechanism \(\mathcal {M}\) which solves this problem is

where the threshold \(w^{*}\) is defined by equation (1)

Proof

See Appendix E\(\square\)

The audit function determines the effective tax scheme. The role of this tax scheme is to ensure that the agents’ utility is the same as a truth-telling agent, and in this sense is a tool to incentivize this behavior. Also, this scheme helps us see the effect of evasion, capturing the tax gap by comparing it with the tax owed. The effective tax equals the tax owed below the threshold. This comes from the audit level, which eliminates the incentive to evade taxes. On the contrary, agents with earnings higher than \(w^{*}\) pay fewer taxes than they owe. This comes from the zero audits in this zone, implying that to eliminate the incentive to misreport, agents pay the same as the last audited agent. Paying this effective tax level equals declaring an income equal to \(w^{*}\). Therefore, allowing them to pay this tax level causes the evasion gains to fall to zero, incentivizing a true income declaration and becoming a more regressive tax scheme. Cremer et al. (1990); Erard and Feinstein (1994) and Reinganum and Wilde (1986) obtain similar theoretical results about the regressivity of the system because of the existence of tax evasion.

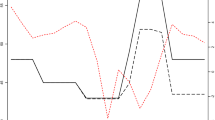

Figure 2 shows the results from Proposition 2 assuming a budget that does not allow auditing all self-employed. Panel (a) shows the audit function, Panel (b) the effective taxes, and Panel (c) the threshold function \(\kappa (n^{s})\) where \(\hat{w}\) is the first level that produces \(\kappa (n^{s}) = \overline{n}^{d}\). Given the audit function, agents with earnings above \(w^{*}\) pay the same taxes. This creates an increasing tax gap (\(\tau (n^{s} - w^{*})\)) because tax payment is the same for non-audited agents. The threshold \(w^{*}\) helps us to demonstrate why the audit function maximizes the expected tax collection. Let us move \(w^{*}\) to the left in Panel (a), causing more agents to not be audited. This makes \(\tau w^{*}\) decrease in the y-axis in Panel (b). Both effects end up in a smaller collection since a set of agents pays fewer taxes than in the initial situation. Therefore, auditing with the maximum intensity at each possible income level maximizes tax collection.

The occupational decisions are distorted because of the audit function and effective taxes. Panel (c) shows that the incentive to be self-employed rises for agents with income above \(w^{*}\). This comes from the tax gap. Since that agent pays fewer taxes, smaller earnings in the self-employment sector are required to equalize utilities between sectors. In particular, agents compare \(n^{d}(1-\tau )\) with \(n^{s} - \tau w^{*}\), generating the minimum wage-earner income to equalize utilities between sectors rises. This effect results in a distortion in occupational choices in incomes higher than \(w^{*}\), producing that some agents do not work in their most productive occupation.

The audit result drives the effect of the effective tax scheme and the distortions on occupational decisions. However, the result relies on an underbudgeted situation. This situation critically depends on audit costs and the budget for the IRS. Corollary 1 shows that if there is no audit cost, it is optimal for the IRS to audit the entire self-employment sector, and distortions vanish. This highlights the relevance of giving enough resources to the IRS to diminish the distortions in the labor market or improve the monitoring process’s effectiveness (similar to reducing the audit cost in the model).

Corollary 1

If the IRS has no audit cost (i.e., \(c = 0\)), the direct IC mechanism \(\mathcal {M}\) will be \(\alpha (n^{s}) = \frac{1}{\pi }\) and \(\mathcal {T}(n^{s}) = \tau n^{s}\), \(\forall n^{s} \in \left[ \underline{n}^{s}, \overline{n}^{s} \right]\).

Proof

See Appendix F\(\square\)

Summarizing, the best action for the IRS is to audit until \(w^{*}\). This level depends on three exogenous variables for the IRS: the audit cost, the fine rate, and its budget. Suppose those variables’ conjugation implies that auditing the entire self-employment sector is not optimal. In that case, distortions in occupational decisions will appear and come into play only for agents with earnings greater than \(w^{*}\). The result of these distortions is that the higher the marginal tax rate, the more agents decide to become self-employed (see Eq. (5)). This comes from the fact that the IRS needs to incentivize taxpayers to declare their real wages, and to do this, the effective tax for non-audited agents is constant. This increases the utility of working as self-employed, provoking distortions in occupational decisions.

4 Government problem

The social welfare-maximize government chooses a public good provision, the marginal tax rate, and a budget for the IRS. The procedure to solve the government problem uses the budget constraint and incorporates the rest of the restrictions into the solutions. Let \(\delta\) be the Lagrange multiplier for the government budget constraint. The Lagrangian for this problem is

Before showing the government’s policy, let us describe the threshold function to simplify the explanation of each policy instrument. The threshold function takes the following form

Both instruments, taxes and the IRS budget, modify the shape of the threshold function and the level where it takes the maximum, \(\hat{w}\). Any change in these instruments produces two effects: distortions in the incentives to be in some occupation, and changes in the mass of agents that always prefer being self-employed. Figure 6 Panel (b), in Appendix C, shows that all agents with productivity higher than \(\hat{w}\) always prefer being self-employed because their utility in sector s is always greater than in sector d. Finally, \(w^{*}\) could be equal to \(\hat{w}\), but this case depends on the budget for the IRS.

4.1 Optimal public goods provision

The public good provision is characterized by the Bowen-Lindhal-Samuelson (BLS) rule. To give a better interpretation, let us define \(g(n^{s})\) as the social value of consumption for an agent with income \(n^{i}\) expressed in terms of public funds. Formally, \(g(n^{d}) = \frac{G^{\prime }(U^{d})}{\delta }\), and \(g(n^{s}) = \frac{G^{\prime }(V^{s})}{\delta }\). This expression indicates the importance of an increase in the agent’s consumption concerning public funds. The following proposition shows the BLS rule in this setting.

Proposition 3

The Bowen-Lindahl-Samuelson rule is

Proof

See Appendix G.1\(\square\)

The public good provision could bias from the first-best in this setting. Proposition 3 shows that the average social weight \(g(n^{i})\) is critical to see if the public good provision is the same as the first-best. To simplify, define the average social weight as \(\mathbb {E}(g)\), Proposition 3 shows that \(\phi ^{\prime }(R) = \frac{1}{\mathbb {E}(g)}\). We recover the first-best solution if the average social weight reaches one. If the average social weight is greater than one, there is an under-provision, and if it is smaller than one there is an over-provision. This result critically depends on the tax structure. If the tax includes a demogrant or a lump-sum transfer, the BLS rule is the same as in the first-best.

This result states that public good provision relies on the government’s redistributive intentions. Let us provide some examples. If the government has a Utilitarian motive, \(g(n^{i}) = 1\), the BLS is the same as in the first-best. This means that the government is interested in the size of the economy, and to maximize it as much as possible, the best policy is to attain efficient public good provision. In another case, if the government follows a Rawlsian intention, \(g(n^{i}) = 1\) only for the person with the minor utility, there will be an over-provision of the public good. Considering that the mass of people at this income level is smaller than one, the average social weight is lower than one, producing over-provision. Since the government wants to increase the utility of the most impoverished agent, it is optimal to provide more public good than in the first-best. The public good is under-provided if the average weight is larger than one. In this case, the average social weight means that the government has a large worry about agents’ consumption changes. A way to diminish those fluctuations is to decrease public goods spending, producing less pressure on tax collection. Therefore, the public good provision responds to the government’s redistribution sense and the value it places on consumption fluctuation.

4.2 Optimal marginal tax rate

The marginal tax rate (MTR) captures the forces associated with efficiency and equity, and the marginal gains/losses from movements in the extensive labor margin. The design of the MTR involves equity and efficiency elements, named welfare and revenue, respectively, but also the inclusion of occupational decisions. Occupational decisions produce a trade-off for the tax design. On the one hand, increased MTR motivates agents not to be wage-earners, eroding revenue, but increasing revenue through higher taxes. On the other hand, reduces the MTR recovers efficiency (for a given audit function) but drives tax collection to zero. These forces are displayed in Proposition 4.

Proposition 4

The optimal marginal tax rate is characterized by

Proof

See Appendix G.2. \(\square\)

The marginal tax rate can be decomposed into two effects: welfare and revenue. The welfare effect shows the impact of change in the agent’s utility through the effect of taxes on consumption. When taxes rise, all agents face a larger tax liability than before and consume less. However, the reduction in their consumption depends on each consumer’s wage. This effect must be measured in public funds, and \(g(n^{i})n^{i}\) captures it. The revenue effect has two components. First, a rise in taxes increases the marginal tax liability, which is equal to the taxpayer’s wage. Hence, \((1-g(n^{i}))n^{i}\) captures the net monetary effect on agents’ welfare. Second, an increase in taxes causes some agents with income higher than \(w^{*}\) to change their occupation and pay a different tax level. When taxes rise, a taxpayer with a former wage \(\kappa (n^{s})\) moves from the wage-earner to the self-employment sector and pays \(\tau w^{*}\). The term which captures this effect is \(\tau (\kappa (n^{s}) - w^{*}) \kappa _{\tau }(n^{s}) f^{d}(\kappa (n^{s}))\). This effect comes from the introduction of occupational decisions. In equilibrium, the sum of all effects must be zero.

Figure 3 shows the forces behind the design of the MTR. Panel (a) shows the consequences of increasing the MTR on the threshold function and occupational decisions. The red line indicates the initial situation, whereas the dashed green line illustrates a rise in the marginal tax. All agents with a productivity below the red (green) line (dashed line) are self-employed. An increase in taxes results in agents with productivity between \(w^{*}\) and \(\hat{w}^{1}\) changing their occupational choices, which is depicted by the blue area. However, \(w^{*}\) does not change because neither does the IRS budget.Footnote 8 These results yield an increase in the mass of self-employed agents. Additionally, an increase in the MTR reduces the productivity level \(\hat{w}\), from \(\hat{w}^{1}\) to \(\hat{w}^{2}\). The effects are twofold. Firstly, some agents change their occupations, modifying the proportion of agents in each occupation. Secondly, agents who change their occupation face new taxes, impacting the tax revenue and their utility.

Figure 3b shows the consequences of an increase in marginal tax on the taxes paid by agents and tax revenue. The red line represents the initial situation, and the green line refers to a tax rise. The solid line is for taxes paid in self-employment, and the dashed line is for the wage-earner sector. When taxes rise, all agents pay higher taxes than before, represented by the difference between the red and green lines, increasing tax revenue. However, some agents change their occupations and face fewer taxes. The agents who change their occupation are those who do not face audits: they bear taxes equal to \(\tau w^{*}\) instead of \(\tau n^{d}\). This change produces a revenue loss for the government, depicted by the blue zone. Moreover, the more significant the tax increase, the greater the revenue loss. Therefore, tax revenue rises and welfare loss, adding to the occupational choices effect on revenue (decrease) and welfare (increase), are the forces behind the optimal tax rate.

Including occupational choices results in a smaller MTR than in a situation with only self-employment. To see this, notice that we can rewrite Eq. (7) as \(\tau = \frac{A}{A+B}\), where A is the sum after the equal sign, and B is integral in the left-hand side. B is strictly positive since incomes are larger than threshold \(w^{*}\) and the threshold function increases with taxes (see Eq. (5)) in this zone. Therefore, the term B produces the tax rate decrease, showing that occupational decisions result in a smaller MTR. Particularly, \(\tau <1\). A situation where only one sector exists produces only similar terms as A and an MTR equal to one. Border and Sobel (1987) and Sánchez and Sobel (1993) obtain this result when only self-employment is considered. Therefore, occupational decisions create a downward force on the MTR, yielding \(\tau <1\).

The result of the MTR shows that not considering occupational decisions induces an upward bias in the tax rate. This is due to the forces behind the welfare and revenue effects, which go in opposite directions. Raising taxes mechanically increases tax collection but also reduces agents’ welfare. This yields a movement of agents to self-employment to pay fewer taxes and increase their utility, eroding tax revenue. This finding is evidence of the forces behind the Laffer curve. The marginal tax will increase if total revenue and welfare increase due to the effect of occupational decision changes. Otherwise, the marginal tax will decrease.

4.3 Optimal IRS budget

The budget for the IRS delimits the size of the tax authority. This is the channel through which this policy instrument affects tax compliance and agents’ decisions. Changes in the IRS budget induce changes in occupational choices and tax revenue through changes in the mass of audited agents. These are the forces behind the optimal budget for the IRS.

Proposition 5

The optimal budget for the IRS is characterized by

Proof

See Appendix G.3. \(\square\)

The budget comprises three effects: behavioral, mechanical, and welfare. The behavioral effect relates to the capacity to audit more (fewer) taxpayers, producing changes in agents’ occupational decisions. The term that captures the behavioral effect is \(\tau (w^{*} - \kappa (n^{s}))\), and comes from the inclusion of occupational decisions. The mechanical effect reflects the impact on non-audited agents’ taxes (\(\tau \frac{d w^{*}}{d B}\)) and the cost of changing the budget, which is equal to one. Since the threshold level has risen, taxpayers who do not face an audit pay more taxes than before, which is purely mechanical. This produces a fall in their consumption, captured by the budget effect on taxes, and also creates a welfare loss, which must be measured in terms of public funds (\(\tau \frac{\mathrm{{d}} w^{*}}{\mathrm{{d}} B} g(n^{s})\)). In equilibrium, the sum of the three effects must be zero, which provides the characterization in Proposition 5.

When the government gives a larger budget to the IRS, the audit threshold \(w^{*}\) rises. This means more agents are audited, increasing the zone where agents decide their work sector efficiently. Revenue increases because those agents pay higher taxes as wage-earners than as self-employed, and the tax paid in the zero-audit zone also rises since \(w^{*}\) is larger than before. Nevertheless, this also produces a welfare cost because those agents consume less. Hence, behind the optimal budget lie revenues raised from the behavioral and mechanical effects and costs from welfare and mechanical effects.

Since the government has a new channel to increase revenue, resources for the IRS are larger than in a context with only one sector. Let us use Eq. (8) to see this. This equation’s left-hand side (LHS) is the marginal cost for an increase of B, and the right-hand side (RHS) is the marginal benefit. The first term in the RHS is positive but decreasing.Footnote 9 In a model with only one sector, the first term in the RHS does not exist. Without this term, the RHS is smaller than the LHS, or the marginal benefits are smaller than the cost. Since the net benefits decrease after the optimal budget, this result shows that the budget in this setting is smaller than with occupational decisions.

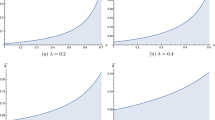

Figure 4 shows the last result. The blue line is the net benefit curve without occupational decisions and the green line is when occupational choices are considered. The optimal budget, \(B^{2}\), is larger than when occupational decisions are not considered, \(B^{1}\). This is because the behavioral effect on occupational decisions is positive, and the marginal cost of increasing the budget does not change compared to the case without occupational choices. In other words, because of more auditing process, agents are incentivized to be wage-earners at the margin, and the government can increase its revenue through this. However, this increase in the budget cannot attain the level of auditing all self-employed since the marginal cost lower-bound is one, and the marginal benefit is zero at this point.

In summary, the optimal budget shows relevant results. First, like in Sánchez and Sobel (1993), the IRS always has a smaller budget than would allow it to audit the entire self-employment sector. This is because the lower bound of the marginal cost for increasing the budget is always one, and the marginal gains are zero at that budget level. Second, as established in Slemrod and Yitzhaki (1987), the government must consider the effect on the agents’ tax burden when deciding the IRS budget, producing an impact on welfare. Finally, the budget is larger than the case without occupational decision because of the marginal gains due to the behavioral effect.

5 Equilibrium

The equilibrium in the model shows the effect of including occupational decisions and evasion in the design of tax policies. The marginal tax rate is lower than the tax without occupational choices and is smaller than one. This is due to the intent to diminish tax evasion gains. The budget for the IRS is larger than the case without occupational decisions, but not enough to audit the entire self-employment sector. This results in high-income self-employed not being audited, which increases the attractiveness of this occupation. Therefore, at the optimum, occupational decisions are distorted by the tax policy, and the tax system becomes regressive due to the incentives for truth-telling in the self-employment sector.

The equilibrium is sensitive to the government’s redistributive intentions, captured by \(g(n^{i})\) with \(i \in \left\{ s,d \right\}\). For a redistribution given by \(g(n^{i}) = 1\), which is a Utilitarian SWF, the public good provision reaches the first-best, but the MTR and the budget for the IRS are zero. Conversely, when \(g(n^{i}) = 1\) for the minimum utility and zero otherwise, a Ralwasian SWF, there is an over-provision of the public good, and the MTR and budget for the IRS reach the maximum possible value. Hence, when the redistribution intention increase, the public good, the MTR, and the budget for the IRS rise. The public good is the government’s redistribution instrument, thus redistribution implies increasing its provision. Regarding taxes and the size of the IRS, since \(g(n^{i})\) captures the relevance for the government of agents’ consumption changes, the more significant the average, the more minor the MTR and the budget for the IRS in order not to distort consumption.Footnote 10 This also shows that a progressive redistributive intention that gives more relevance to lower incomes produces larger taxes and budget for the IRS. To counteract the negative impact of tax evasion by high-income individuals, the IRS could receive a larger budget, which supports a progressive redistributive agenda.

At the optimum, the tax policy distorts agents’ occupational decisions in favor of self-employment. The connection between taxes and self-employment decisions has been studied extensively, showing a positive relationship.Footnote 11 However, the effect of evasion is always behind this fact. The forces behind the model’s equilibrium distortions help explain this evidence. The further the tax administration policy is from the optimum, the more extensive the distortions in occupational decisions, and this comes from the effect of taxes on evasion. Higher taxes and weak tax compliance capacity promote self-employment by increasing evasion’s marginal gains and facilitating this behavior. The model demonstrates that the lack of resources to audit all self-employed critically induces this mechanism.

However, it is possible to improve these distortions when evasion and occupational decisions are considered in the tax policy design. First, the budget for the IRS should be larger to reduce the attractiveness of self-employment through stronger auditing. This result is in line with those of Jung et al. (2022) but still rests on the equality between marginal cost and benefits, producing the underbudget result. This policy produces an increase in revenue, reducing distortions in evasion and occupational decisions and improving the regressivity of the tax system. Second, the IRS must use audits to enforce tax compliance and as a threat to avoid income misreporting. Audits might be stronger at those income levels where it is likely to find evaders. This result is similar to other theoretical studies ((Paramonova) Kuchumova, Y., 2017; Sánchez & Sobel, 1993), and empirically, Almunia and Lopez-Rodriguez (2018) show that firms make strategic declarations to avoid more forceful audits. Moreover, if low-productivity agents have the motivation to report greater productivity or income, Bigio and Zilberman (2011) and Zilberman (2016) show that audits increase with the agents’ productivity. This reinforces the idea that auditing zones where there is more probability of finding evaders.

The effect on occupational decisions may explain the empirical relation between tax rates and income tax evasion. If the marginal tax falls, the threshold function will take smaller values, reducing the incentive to evade taxes and resulting in less incentive to be self-employed. Empirically, Berger et al. (2016) and Kleven et al. (2011) show a positive relationship between tax rates and evasion. This relationship indicates that the government must reduce incentives for evasion by cutting taxes or increasing the IRS budget. Along this line, this paper demonstrates that occupational decisions produce lower optimal taxes and a larger budget for the IRS. This mechanism is similar to previous findings in the general equilibrium literature (Watson, 1985; Kesselman, 1989), reinforcing the importance of taxes in discouraging tax evasion. The critical issue behind this result is distortions by auditing on occupational decisions resulting from the lack of resources for the IRS. Therefore, it is necessary to align the tax administration policy to disincentivize evasion and improve the labor market’s efficiency.

Distortions of occupational decisions affect the equality condition over consumption in Proposition 1, revealing the evasion effect on inequality. Because of the incentives to declare their actual income, high-income self-employed are gifted with lower effective taxes, increasing their consumption compared to similar wage-earners. This affects horizontal equality and could distort the income distribution that the authority sees. Through an allowed biased declaration, the authority does not see the actual distribution. Instead, some excess mass appears at some points (bunching). Evasion distorts the optimal allocation of consumption and goes against horizontal equality. Since consumption and income have different distributions because of bunching in the latter, some policy designs would be biased. Also, through an increase in consumption, some agents increase their welfare. This could imply a Pareto improvement if evasion does not raise taxes, dropping other agents’ consumption.Footnote 12

Agents have more incentives to be self-employed at the equilibrium, affecting production efficiency. If the system provides incentives to move resources from one sector to another, there would be a lack of productivity where the resources were first. In this model, firms would not find enough high-skilled workers in the wage-earner sector. This means the Diamond-Mirrlees theorem (Diamond & Mirrlees, 1971a, b) does not apply in this setting, in the sense that efficiency in productivity is not attained in the second-best. Although this takes place in a different environment, it is motivated by the underbudget result, since, as Corollary 1 pointed out, with enough resources, the IRS will audit all self-employed, and occupational decisions are not distorted. Gomes et al. (2017) find a similar conclusion in a model without tax evasion and IRS, and Best et al. (2015) find empirical evidence of the gains from inefficient productivity policies for improvement in tax compliance and tax revenue. In this case, the difference arises because providing enough resources to the IRS to conduct audits in the self-employment sector is not optimal.

This result, as established in Best et al. (2015), is based on the differences in tax capacity. Environments with lower tax capacities could benefit from inefficient productivity policies if these increased tax compliance and tax collection. Tax evasion is critical in explaining the distance from production efficiency. Taxpayers choose occupations or sectors, seeking to increase their utility, and higher evasion opportunities alter this choice. Also, since distortions persist at the equilibrium, a joint strategy between institutions (IRS and Governments) and policies (tax schemes, audits, penalties, among others) is necessary to recover productivity efficiency.

6 Extensions

Although the equilibrium in this model has already been shown, some questions are still open. Firstly, this section looks into imposing two different linear tax rates, one for each occupation. This extension could help to recover efficiency in allocating workers. Finally, the problem of achieving the same audit result with nonlinear audit costs and imposing an increasing fine rate is resolved.

6.1 Differential taxation

Let us define differential taxation as one MTR for each sector. Define \(t_{s}\) and \(t_{d}\) as the tax rates in the self-employment and the wage-earner sector, respectively. Also, assume that no rate can be higher than one. Using differential taxation, the threshold function changes, having the following form

Although this specification changes the threshold function, it does not alter the form of the audit function. This result comes from the conditions for solving the IRS problem. Differential taxation only changes the applicable tax rate to determine the threshold. This is to say, audit the entire self-employment sector or until \(w^{*}\).Footnote 13

The government solves a Lagrangian as in Sect. 4, choosing both tax rates. Since the focus is only on differential taxation, neither the optimal budget for the IRS nor public good provision is obtained.

Proposition 6

In a hierarchical model with occupational choices, differential taxation implies a higher marginal tax rate in the sector where evasion is possible. Moreover, differential taxation is a Pareto improvement from the situation with the same marginal tax rate for each occupation.

Proof

See Appendix H. \(\square\)

Figure 5 shows the basic idea behind Proposition 6. The red line represents the threshold function, and the blue dotted line represents the same wage in both sectors. Zone A represents revenue losses from agents who become wage-earners but pay higher taxes as self-employed. In contrast, zone B shows the increase in tax collection from agents who pay higher taxes in the wage-earner sector than in the self-employment sector. Differential taxation is possible only if zone A is smaller than zone B. Thus, differential taxation occurs if the increase in tax collection from agents above \(w^{*}\) is greater than the losses from agents below it. When the difference in the marginal taxes rises, the threshold function falls, increasing A and decreasing B. Thus, it is not optimal for the government to separate both marginal taxes significantly. Consequently, differential taxation aims to solve tax collection losses due to non-audited taxpayers on the top rather than improving the allocation of agents. This ends up distorting occupational decisions even more than in the former setting.

A higher tax in the self-employment sector means using tax incentives to eliminate the motivation to evade. A rise in the self-employment tax rate increases the incentive to be a wage-earner, decreasing evasion. The similarity with past policy recommendations on cutting taxes as a tax compliance policy relies upon this fact. However, in a context with different occupations and evasion possibilities, the incentive to misreport means that taxes must rise in the occupation with the greatest opportunities to evade.

Proposition 6 shows that dividing the tax system regarding the different occupations is a Pareto improvement. The reason comes from the evasion effect and the use of taxes to discourage it. Since evasion affects the marginal gains from evading, disparities in evasion opportunities should be treated individually depending on the context. This results in tax policy aligning with audits, discouraging evasion, and moving resources to occupations where evasion does not exist.

Differential taxation produces a worse allocation of workers than the former setting, generating a puzzle regarding production efficiency. As has been pointed out, distortions in occupational decisions mean that the Diamond-Mirrlees theorem does not apply in this setting. This extension does not resolve this. Instead, differential taxation makes the difference deeper. This result is produced by the linear tax system and the usefulness of moving taxpayers to the wage-earner sector. The linear tax assumption makes the government distort all agents to resolve problems in the zero-audit zone. Also, incentivizing workers to be wage-earners helps to solve evasion and can increase agents’ welfare due to lower taxes, which is a good policy for the government. Regarding this point, Gomes et al. (2017) show the optimality of moving taxpayers to a specific work sector in a nonlinear tax setting. Therefore, the welfare gains from this kind of policy against evasion could exist even in nonlinear tax policy models.

Corollary 2

In a hierarchical model with occupational choices and linear tax schemes, it is impossible to recover the efficiency of worker allocation.

Corollary 2 reflects that it is impossible to reconcile incentives for taxpayers to tell the truth with the incentive to choose their occupations efficiently. This result is essential for designing tax and audit policies. The possible solution to the audit scheme’s inefficiencies through differential taxation allows the government to improve economic efficiency and increase revenue. Hence, the government needs to find other policies to improve efficiency and increase revenue.

Finally, this result also provides evidence that a limited tax compliance context would benefit from distortionary policies regarding productivity, similar to Best et al. (2015). This arises because separating the tax system produces an increase in revenue and welfare but increases the inefficiency in productivity. In this case, the necessity to use taxes as a dissuasive tool for evasion causes the optimality of differential taxation. This increases productivity misallocation but implies a Pareto improvement.

6.2 Audit results

6.2.1 Audit costs

This section extends the analysis by allowing the audit cost to depend on the agents’ earnings. It is assumed that the IRS knows the cost when the agent reveals its income. The audit cost is defined as \(c(n^{s})\), without any restriction a priori. From Appendix E, the condition to determine the solution’s form is the first necessary condition to solve the Lagrangian. In this condition, only the audit cost changes because neither the control variable nor the state variable changes.

A similar condition to a single-crossing is found. Let us derive the new first necessary condition regarding the self-employment wage. The following equation establishes the requirement for the same solution over the audit function.

where \(n^{s}\) is the level that produces \(\frac{\mathrm{{d}} \mathcal {L}}{\mathrm{{d}} V^{s}_{n^{s}}}=0\). The condition is held with a positive marginal cost or a strictly increasing cost because the right side is positive by definition. Hence, the threshold solution is maintained if the audit cost is monotonically non-decreasing in the self-employment income.

An increasing audit cost means that the IRS is auditing fewer taxpayers. Assuming the condition derived, auditing self-employed with larger incomes is more expensive, making the IRS use all its budget to audit fewer taxpayers (see Eq. (5)). This means that fewer high-income self-employed are audited, and the problem in the allocation of workers increases. However, it is natural to think that taxpayers with more resources find more sophisticated ways to shelter their income, and the auditing process becomes more complex or costly. This point shows that the problems discussed in Sect. 5 are more serious when we consider increasing auditing costs.

6.2.2 Fine rate

Now we analyze the case where the fine rate is not linear. This case regards the intention to deter tax evasion through high penalties. Two options are explored: the fine rate increase with the amount evaded, and the fine rate rise with the real income. These specifications allow the IRS to audit more taxpayers at a lower cost because a higher fine rate replaces the audit’s deterrence effect.

Given the direct IC mechanism, agents honestly report their income and any instrument that depends on an evaded level vanishes. Thus, a fine rate that depends on the amount of evaded taxes collapses to a linear fine rate in equilibrium. This situation is the same as in the model and results in an equal audit function as presented earlier.

As for a fine rate that depends on the real earnings, the result is different. In this case, a similar analysis of the audit cost is performed. Now, the fine rate depends on self-employment income. Deriving the new first necessary condition with respect to the self-employment income allows us to obtain the single-crossing condition.

As stated before, \(n^{s}\) is the wage level that produces \(\frac{d \mathcal {L}}{d V^{s}_{n^{s}}} = 0\). This expression shows that the marginal fine rate must be bounded from above to obtain the threshold form in the audit function. Therefore, imposing an increasing fine rate to place higher penalties on higher incomes, audit more agents, and improve the IRS’s effectiveness is possible.

7 Conclusion

This paper investigates distortions in the tax administration policy by jointly introducing occupational decisions and tax evasion. To do this, we modeled a hierarchical situation where the government entrusts tax compliance policy to the IRS and decides a marginal tax rate, a budget for the IRS, and a public good provision. The IRS collects taxes and conducts audits, interacting with taxpayers who choose between being self-employed or wage-earners. Income tax evasion is possible only in self-employment because such agents self-report their income. This means that tax compliance policy is conducted entirely in the self-employment sector.

The coexistence of occupational decisions and evasion distorts the tax administration policy. First, not considering occupational decisions produces an upward bias on taxes. Second, the budget for the IRS is larger than if occupational choices are not considered, but not enough to audit all self-employed. Both elements prove that a non-optimal policy favors evasion and distorts agents toward self-employment. This comes from audit distortions. The impossibility of auditing all self-employment results in the high-income self-employed paying the same taxes, increasing their utility, and distorting occupational decisions in this zone. Differential taxation is a Pareto improvement in this setting but implies higher taxes in the self-employment sector. This result distorts the allocation of workers even more than the former scenario. Finally, at the optimum, the optimal allocation of workers is slanted in favor of self-employment, and production efficiency is not attained in the second-best tax optimum. This result shows that the Diamond-Mirrlees theorem does not apply in this setting.

The previous results highlight the relevance of considering occupational decisions in tax administration design. If tax administration policy does not consider agents’ occupational choices, distortion in favor of evasion and self-employment appears. This paper demonstrates how the policy should be, providing clear policy recommendations. First, audits should be more vigorous at income levels where evaders are more prone to declare. Besides, supposing all occupations face the same tax scheme, the marginal tax rate should be lower, and the IRS size should be larger than the setting that does not consider occupational decisions. However, if differential taxation is allowed, the tax system should differ by occupation or group depending on the opportunity to evade taxes. Moreover, taxes must be higher in occupations where evasion incentives are greater.

Some problems remain at equilibrium, like tax system regressivity and productivity inefficiencies. It is essential to inquire about new instruments, mechanisms, and strategies to increase enforcement policies’ effectiveness at a lower economic cost. Examples can be focused on persuasion policies that accompany auditing. Since taxes and audits affect expected consumption and occupational choices, a non-pecuniary policy affects only the latter. Indeed, shaming policies (See Perez-Truglia and Troiano (2018) for instance) can be an excellent example of persuasion policies toward tax compliance.

Notes

This assumption is not restrictive. Afterwards, it will be shown to hold at the optimum.

For clarity, the same notation for audit is used.

If \(\alpha (n^{s}) = \frac{1}{\pi }\) the utility in the self-employment sector is \(U^{s}(n^{s}, R) = n^{s}(1 - \tau )\), implying that \(w(n^{s}) = n^{s}\).

The proof of this states that \(1-\alpha (n^{s}) \pi \tau \ge 0\). Rearranging terms yields \(\frac{1}{\alpha (n^{s}) \pi } \ge \tau\). The marginal tax is limited from above with a decreasing function on audits. The most restrictive limit is when the audit reaches its maximum value, producing \(1 \ge \tau\). This is the same assumption made earlier, showing that it is without loss of optimality.

The discussion of technical issues is omitted and left to Appendix E.

To show this, let us differentiate the threshold function with respect to \(\tau\) and \(w^{*}\), equalize it to zero, and divide by \(d \tau\), obtaining

$$\begin{aligned} \int \limits _{\underline{n}^{d}}^{\kappa (n^{s})} f_{s\mid d}(w^{*} \mid n^{d}) f_{d}(n^{d}) \dfrac{\mathrm{{d}} w^{*}}{\mathrm{{d}} \tau } dn^{d} + \int \limits ^{w^{*}}_{\underline{n}^{s}} \left( \dfrac{\partial \kappa }{\partial w^{*}} \dfrac{\mathrm{{d}} w^{*}}{\mathrm{{d}} \tau } + \dfrac{\partial \kappa }{\partial \tau } \right) f_{s\mid d}(n^{s} \mid \kappa (n^{s})) f_{d}(\kappa (n^{s})) dn^{s} = 0 \end{aligned}$$Note that, for \(n^{s} \in [\underline{n}^{s}, w^{*}]\) the threshold function is equal to agent’s income (\(\kappa (n^{s}) = n^{s}\)) producing that \(\dfrac{\mathrm{{d}} \kappa }{\mathrm{{d}} \tau } = 0\). Also, the densities are positive. Hence, given the equality to zero, \(\dfrac{\mathrm{{d}} w^{*}}{\mathrm{{d}} \tau } = 0\).

Formally, first note that \(\frac{\mathrm{{d}} w^{*}}{\mathrm{{d}} B}\) is positive. Later, as Fig. 3 Panel (a) shows, \(\kappa (n^{s}) \ge w^{*}\) in \(n^{s} \in [w^{*}, \hat{w}]\). Finally, B affects the threshold function through \(w^{*}\). From Eq. (5), it is clear that an increase in B reduces the second zone of the threshold function and reduces the slope in \(n^{s} \in [w^{*}, \hat{w}]\), producing a negative effect.

For the budget, it is necessary that the average social weight increase in the audited zone.

To see a similar conclusion, but in another context, refer to Canta et al. (2023).

To see this, note that in the Lagrangian from the problem of the IRS (Appendix E), conditions 2 and 3 do not change. Only condition 1 changes, using \(t_{s}\) instead of \(\tau\), and this does not change the form of the solution.

References

Allingham, M. G., & Sandmo, A. (1972). Income tax evasion: A theoretical analysis. Journal of Public Economics, 1(3), 323–338. https://doi.org/10.1016/0047-2727(72)90010-2

Almunia, M., & Lopez-Rodriguez, D. (2018). Under the radar: The effects of monitoring firms on tax compliance. American Economic Journal: Economic Policy, 10(1), 1–38. https://doi.org/10.1257/pol.20160229

Bastani, S., & Waldenström, D. (2021). The ability gradient in tax responsiveness. Journal of Public Economics Plus, 2, 100007. https://doi.org/10.1016/j.pubecp.2021.100007

Berger, M., Fellner-Röhling, G., Sausgruber, R., & Traxler, C. (2016). Higher taxes, more evasion? Evidence from border differentials in tv license fees. Journal of Public Economics, 135, 74–86. https://doi.org/10.1016/j.jpubeco.2016.01.007

Best, M. C., Brockmeyer, A., Kleven, H. J., Spinnewijn, J., & Waseem, M. (2015). Production versus revenue efficiency with limited tax capacity: Theory and evidence from Pakistan. Journal of Political Economy, 123(6), 1311–1355. https://doi.org/10.1086/683849

Bigio, S., & Zilberman, E. (2011). Optimal self-employment income tax enforcement. Journal of Public Economics, 95(9), 1021–1035. https://doi.org/10.1016/j.jpubeco.2010.06.011

Boadway, R., Marchand, M., & Pestieau, P. (1991). Optimal linear income taxation in models with occupational choice. Journal of Public Economics, 46(2), 133–162. https://doi.org/10.1016/0047-2727(91)90001-I

Border, K. C., & Sobel, J. (1987). Samurai accountant: A theory of auditing and plunder. The Review of Economic Studies, 54(4), 525–540. https://doi.org/10.2307/2297481

Bosch, N., & de Boer, H.-W. (2019). Income and occupational choice responses of the self-employed to tax rate changes: Heterogeneity across reforms and income. Labour Economics, 58, 1–20. https://doi.org/10.1016/j.labeco.2019.02.005

Bruce, D. (2000). Effects of the united states tax system on transitions into selfemployment. Labour Economics, 7(5), 545–574. https://doi.org/10.1016/S0927-5371(00)00013-0

Canta, C., Cremer, H., Gahvari, F. (2023). Welfare improving tax evasion. The Scandinavian Journal of Economics Accepted Author Manuscript. https:// https://doi.org/10.1111/sjoe.12539.

Casamatta, G. (2021). Optimal income taxation with tax avoidance. Journal of Public Economic Theory, 23(3), 534–550. https://doi.org/10.1111/jpet.12495

Chander, P., & Wilde, L. L. (1998). A general characterization of optimal income tax enforcement. The Review of Economic Studies, 65(1), 165–183. https://doi.org/10.1111/1467-937X.00040

Cowell, F. A. (1985). Tax evasion with labour income. Journal of Public Economics, 26(1), 19–34. https://doi.org/10.1016/0047-2727(85)90036-2

Cremer, H., Marchand, M., & Pestieau, P. (1990). Evading, auditing and taxing: The equity-compliance tradeoff. Journal of Public Economics, 43(1), 67–92. https://doi.org/10.1016/0047-2727(90)90051-I

Cullen, J. B., & Gordon, R. H. (2007). Taxes and entrepreneurial risk-taking: Theory and evidence for the U.S. Journal of Public Economics, 91(7), 1479–1505. https://doi.org/10.1016/j.jpubeco.2006.12.001

Diamond, P.A., & Mirrlees, J.A. (1971a). Optimal taxation and public production ii: Tax rules. The American Economic Review, 61 (3), 261-278, Retrieved from http://www.jstor.org/stable/1813425

Diamond, P.A., & Mirrlees, J.A. (1971b). Optimal taxation and public production i: Production efficiency. The American Economic Review, 61 (1), 8-27, Retrieved from http://www.jstor.org/stable/1910538

Erard, B., & Feinstein, J. S. (1994). Honesty and evasion in the tax compliance game. The Rand Journal of Economics, 25(1), 1–19. https://doi.org/10.2307/2555850

Fossen, F. M., & Steiner, V. (2009). Income taxes and entrepreneurial choice: Empirical evidence from two German natural experiments. Empirical Economics, 36(3), 487–513. https://doi.org/10.1007/s00181-008-0208-z

Gentry, W. M., & Hubbard, R. G. (2000). Tax policy and entrepreneurial entry. American Economic Review, 90(2), 283–287. https://doi.org/10.1257/aer.90.2.283

Gomes, R., Lozachmeur, J.-M., & Pavan, A. (2017). Differential taxation and occupational choice. The Review of Economic Studies, 85(1), 511–557. https://doi.org/10.1093/restud/rdx022

Guesnerie, R., & Laffont, J.-J. (1984). A complete solution to a class of principalagent problems with an application to the control of a self-managed firm. Journal of Public Economics, 25(3), 329–369. https://doi.org/10.1016/0047-2727(84)90060-4

Jung, H. M., Liang, M.-Y., & Yang, C. (2022). How much should we fund the IRS? Journal of Public Economic Theory, 24(1), 120–139. https://doi.org/10.1111/jpet.12532

Keen, M., & Slemrod, J. (2017). Optimal tax administration. Journal of Public Economics, 152, 133–142. https://doi.org/10.1016/j.jpubeco.2017.04.006

Kesselman, J. R. (1989). Income tax evasion: An intersectoral analysis. Journal of Pub- LIC Economics, 38(2), 137–182. https://doi.org/10.1016/0047-2727(89)90023-6

Kleven, H. J. (2016). Bunching. Annual Review of Economics, 8, 435–464. https://doi.org/10.1146/annurev-economics-080315-015234

Kleven, H. J., Knudsen, M. B., Kreiner, C. T., Pedersen, S., & Saez, E. (2011). Unwilling or unable to cheat? evidence from a tax audit experiment in Denmark. Econometrica, 79(3), 651–692. https://doi.org/10.3982/ECTA9113

Landsberger, M., Monderer, D., & Talmor, I. (2000). Feasible net income distributions under income tax evasion: An equilibrium analysis. Journal of Public Economic Theory, 2(1), 135–153. https://doi.org/10.1111/1097-3923.00032

Macho-Stadler, I., & Pérez-Castrillo, J. D. (1997). Optimal auditing with heterogeneous income sources. International Economic Review, 38(4), 951–968. https://doi.org/10.2307/2527224

Melumad, N. D., & Mookherjee, D. (1989). Delegation as commitment: The case of income tax audits. The RAND Journal of Economics, 20(2), 139–163. https://doi.org/10.2307/2555686

Mirrlees, J. A. (1971). An exploration in the theory of optimum income taxation. The Review of Economic Studies, 38(2), 175–208. https://doi.org/10.2307/2296779

Mookherjee, D., & Png, I. P. L. (1990). Enforcement costs and the optimal progressivity of income taxes. Journal of Law Economics and Organization, 6, 411. https://doi.org/10.1093/oxfordjournals.jleo.a036998

Myerson, R. B. (1979). Incentive compatibility and the bargaining problem. Econometrica, 47(1), 61–73. https://doi.org/10.2307/1912346

Myerson, R. B. (1981). Optimal auction design. Mathematics of Operations Research, 6(1), 58–73. https://doi.org/10.1287/moor.6.1.58

Kuchumova, Y. P. (2017). The optimal deterrence of tax evasion: The trade-off between information reporting and audits. Journal of Public Economics, 145, 162–180. https://doi.org/10.1016/j.jpubeco.2016.11.007

Parker, S. C. (1999). The optimal linear taxation of employment and self-employment incomes. Journal of Public Economics, 73(1), 107–123. https://doi.org/10.1016/S0047-2727(99)00005-5

Perez-Truglia, R., & Troiano, U. (2018). Shaming tax delinquents. Journal of Public Economics, 167, 120–137. https://doi.org/10.1016/j.jpubeco.2018.09.008

Pestieau, P., & Possen, U. M. (1991). Tax evasion and occupational choice. Journal of Public Economics, 45(1), 107–125. https://doi.org/10.1016/0047-2727(91)90050-C

Reinganum, J. F., & Wilde, L. L. (1985). Income tax compliance in a principal-agent framework. Journal of Public Economics, 26(1), 1–18. https://doi.org/10.1016/0047-2727(85)90035-0

Reinganum, J. F., & Wilde, L. L. (1986). Equilibrium verification and reporting policies in a model of tax compliance. International Economic Review, 27(3), 739–760. https://doi.org/10.2307/2526692

Samuelson, P. A. (1954). The pure theory of public expenditure. The Review of Economics and Statistics, 36(4), 387–389. https://doi.org/10.2307/1925895

Samuelson, P. A. (1955). Diagrammatic exposition of a theory of public expenditure. The Review of Economics and Statistics, 37(4), 350–356. https://doi.org/10.2307/1925849

Sandmo, A. (1981). Income tax evasion, labour supply, and the equity–efficiency tradeoff. Journal of Public Economics, 16 (3), 265- 288, https://doi.org/10.1016/0047-2727(81)90001-3 Retrieved from https://www.sciencedirect.com/science/article/pii/0047272781900013