Abstract

This study provides evidence for the USA that the secular decline in the labor share is not only explained by technical change or globalization, but also by the dynamics of factor taxation, automation capital (robots), and population growth. First, we empirically find indications of co-integration for the period from the last quarter of the 20th to the first decade of the twenty-first century. Permanent effects on factor shares emanate from relative factor taxation. The latter also have a lasting effect on the use of robots. Variance decompositions reveal that taxing contributes to changes in the two income shares and in automation capital. Second, we analyze and calibrate a neoclassical growth model extended to include factor taxation, automation capital, and capital adjustment costs. Labor and automation capital are perfect substitutes, whereas labor and traditional capital are complements. The model replicates the dynamics of the observed functional income distribution in the USA during the 1965–2015 period. Counterfactual experiments suggest that the fall in the labor share would have been significantly smaller if labor and capital income tax rates had remained at their respective level of the 1960s.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The functional income distribution in most OECD countries has changed significantly over recent decades. Figure 1 displays the labor share of the USA, Japan, and the Euro Area (EA-12) from 1960 to 2018. During this period, these labor shares declined by roughly 5–15 percentage points.

The existing literature emphasizes the role of several factors that contributed to this decline. They include skill-biased technological change (Goldin & Katz, 2008), declining investment good prices (Karabarbounis & Neiman, 2014), a sufficiently high elasticity of substitution between capital and labor (Piketty, 2014), globalization (Elsby et al., 2013; Helpman, 2018), rising profit shares of monopolistic firms and “superstar firm” dynamics (Eggertsson et al., 2019; Autor et al., 2020), or population aging (Irmen, 2021). In contrast with these studies, the present paper emphasizes the effect of taxation and population growth on the implementation of automation capital and the labor share.

The focus of our analysis is on the USA where two related evolutions accompany the decline in the labor share. First, as shown in the left panel of Fig. 2, the difference in the effective tax rates on income from capital and labor shrinks from 1947 to 2010. Over this time span, capital income is taxed more heavily with an average effective tax rate of 41% compared to 23% for labor income. However, compared to their respective levels in 1947 the effective tax rate on income from capital is much lower in 2010, whereas the one for labor income is much higher. Moreover, in the recent past, labor is even taxed more heavily than capital. Second, as shown in the right panel of Fig. 2, in parallel with the declining labor share the population growth rate has fallen, in annualized terms, from 1.7% in 1950 to 0.7% in recent years.

Sources: Left panel: https://paulgomme.github.io; right panel: BEA for population growth, seasonal adjustment: X12-ARIMA

Left panel: Quarterly US tax rates on income from labor and capital (%); right panel: US population growth rates (%)

Intuitively, the shrinking difference in the taxation of capital and labor and the decline in population growth induce firms to choose production processes that replace labor more and more with automation capital. On the one hand, the downward trend in the capital income tax rate increases the incentive to build up capital. As long as different types of capital are tied by a no-arbitrage condition, some of the additional capital will come in the form of automation capital.

On the other hand, the labor supply declines at the intensive margin if the labor income tax rate increases. In addition, a declining population growth rate reduces the labor supply at the extensive margin. As argued, e. g., by Heer and Irmen (2014), the relative decline in the labor force at both margins pushes wages up and, therefore, boosts the incentive to engage in labor-saving automation investments.

Hence, these tendencies strengthen the comparative advantage of automation capital in production. This leads to the prediction that the amount of automation capital per worker should increase. Figure 3 confirms this prediction: the time series of automation capital proxied by the (nowcasted) stock of robots per 1000 (full-time) employees in the USA from 1975 to 2010 is clearly increasing. Finally, as automation capital replaces labor, the labor share is expected to decline.

Robots per 1K workers in the USA: annual and nowcasted quarterly data. Note: Dotted data points up to 1985:q4 are own calculations based on Tani (1989) and CPS; from 1994:q4 onwards they are obtained from Acemoglu and Restrepo (2019), original source: International Federation of Robotics (IFR); Solid blue line: nowcasted (pseudo-)quarterly data; detail on nowcasting is given in Appendix A.1.

Our analysis derives two main sets of results. First, we provide empirical evidence for the USA supporting the explanation for a declining labor share set out above. We find indications for cointegrating relationships over the period from the first quarter of 1974 to the fourth quarter of 2008 (henceforth, 1974:q1–2008:q4). Permanent effects on factor shares emanate from shocks in relative factor taxation. Changes in relative factor taxation also permanently and sizably affect the use of automation capital. The forecast error variance decomposition (FEVD) analysis of fitted vector error correction (VEC) models reveals that taxing policies account for up to roughly 22% of observed changes in the two income shares and for up to about 35% of the dynamics in automation capital.

The second set of results emanates from the quantitative analysis of a dynamic general equilibrium model that replicates the downward trend in the US labor share from 1965 to 2015. We derive these findings in a new variant of the neoclassical growth model where taxes on capital and labor income as well as population growth play a key role for the dynamics of the functional income distribution. We follow Steigum (2011) and distinguish two types of capital, traditional capital and automation capital (robots). While traditional capital is complementary to labor and automation capital, the latter two factors of production are perfect substitutes. Hence, automation capital substitutes linearly for labor. We extend Steigum’s framework in three directions. First, both types of capital investments are subject to adjustment costs. Second, we allow for an endogenous labor supply and, finally, include an active government that charges taxes to finance its consumption.

We use this model to compute the dynamics of the labor share, the stocks of traditional and automation capital, and the evolution of the (endogenous) labor supply over the period 1965–2029. We maintain that automation capital was not introduced into production processes until 1965.Footnote 1 Our calibration incorporates the time series of effective capital and labor income tax rates as well as of the population growth rates that are displayed in Fig. 2. The use of quadratic adjustment costs for both types of capital investments is in the tradition of Hayashi (1982). As a result, our model is able to closely replicate the downward trend in the labor share. In particular, in line with the data, we match the actual drop in the labor share from 62 to 57% between 1965 and 2015.

The present paper is related to several strands of the literature. First, our empirical analysis contributes to a young and growing empirical literature that studies the interplay between automation and institutional as well as macroeconomic variables in the context of economic growth. To some extent, this literature has revived an old debate about the secular stagnation hypothesis (Hansen, 1939). Acemoglu and Restrepo (2017) find evidence that supports the view that population ageing induces higher GDP per capita growth through automation. This contrasts with the conclusions drawn in Aksoy et al. (2019). So far, the main focus of this literature has been on longitudinal data. The seminal study by Graetz and Michaels (2018) covers 14 years and 14 sectors in 17 countries. It is longitudinal with two cross-sectional dimensions, economies and industries. Acemoglu and Restrepo (2019) are also longitudinal in nature using data on robots and exploiting the geographic variation within the USA. In the context of the rise of robots in China, Cheng et al. (2019) rely on longitudinal survey-based manufacturing firm-level data, too. These studies reveal insightful and, in parts, even causal statistical associations between automation, institutional policies, and macroeconomic variables. However, the empirical establishment of long run—in the sense of cointegrating—relationships between these variables is missing.Footnote 2 The present paper seeks to fill this gap.

Second, our theoretical analysis shows that an appropriately augmented variant of Steigum (2011)’s model provides a tractable framework of analysis for macroeconomic phenomena related to the substitution of labor with automation capital that may serve as an alternative to existing models used in the literature including, among others, Acemoglu and Restrepo (2018), Berg et al. (2018), Eden and Gaggl (2018), Irmen (2021), or Hémous and Olsen (2022). Our quantitative analysis suggests that the inclusion of adjustment costs in the spirit of Hayashi (1982) for both types of capital into Steigum’s model proves particularly useful for a realistic description of the introduction and the buildup of robots.

Finally, and relatedly, our calibration analysis highlights an important role of factor taxation for the incentives to automate and the evolution of the US functional income distribution. This adds a new positive explanation for the observed decline in the US labor share to the literature mentioned above. In particular, our counterfactual experiments suggest that the labor share in 2015 could have been substantially higher had the tax rates on capital and labor income remained at their 1965 level. These findings support the normative assessment of Acemoglu et al. (2020) who argue that the US tax system generates excessive automation incentives and implies a suboptimally low labor share. In a similar vein, we conclude from a simple welfare experiment that an optimal tax on capital income could be quite high.

The paper is organized as follows. In Sect. 2, we present and interpret the time series evidence for the US economy relying on cointegration analysis and VEC models. Section 3 studies a variant of the neoclassical growth model that distinguishes between traditional and automation capital and allows for factor taxation and capital adjustment costs. Sections 3.1–3.4 introduce the model and define the competitive equilibrium with dynamic taxation. Section 3.5 provides an analysis of the steady state without automation capital and analyzes the properties of the asymptotic balanced growth path with automation capital. Section 3.6 explains how we calibrate the model. Section 3.7 features our results on the transition dynamics. Here, we first devise a calibration that replicates the actual decline of the US labor share during the period 1965–2015. Second, we conduct counterfactual experiments suggesting that the effective tax rates on capital and labor income had a significant effect on the labor share over the considered period. Section 3.8 discusses the role of tax policies from a normative point of view. Section 4 concludes. The Appendix includes details on and discussions of our empirical (Sects. A.1–A.4) and our theoretical analysis (Sect. A.5).

2 Empirical analysis

This section provides a test for and a quantification of long-run equilibrium relationships between the US income shares and factor taxation, automation capital, and population growth. Here, ‘equilibrium’ does not refer to market clearing. Rather, it defines a state of rest. Long-run equilibrium relationships entail systematic movements of macroeconomic variables that an empirical model—compatible with non-stationary, long-run dynamics of time series—seeks to test for. Cointegration suggests the presence of some long-run equilibrium relations that tie the constituents of the modeled system even though some developments may cause permanent changes. Correspondingly, a neoclassical (stochastic) growth model implies several steady-state relations among the natural logarithms of its central variables. A conditio sine qua non to fledge such a model with dynamic taxes and automation capital to study functional distribution outcomes is to establish such long-run relationships empirically. A VEC model framework allows for the determination of the dimension of the cointegrating space and for tests of such structures. Thus, the theory of cointegrated time series can provide a test-based justification for the specification of a neoclassical growth model.

Our empirical analysis finds permanent effects of factor taxation and population growth on factor shares and the use of robots, respectively. Pairwise error correcting, i. e., cointegrating, relationships are established for the following pairs of variables: (1) relative factor taxation and the capital share, (2) use of robots and the capital share, and (3) population growth and the labor share. The relationships (1) and (3) are statistically significant at conventional levels. Relationship (2) holds only at a 68% level of confidence which, however, is not unusual in a time series context (see, e. g., Baumeister and Hamilton 2018).

Establishing equilibrium restoring mechanisms in the short and medium-run requires historical series of adequate length and frequency. We document issues related to the compilation and the construction of such time series in the next section. Then, relevant details concerning our methodological framework and the identification strategy are provided. The section ends with an illustration of the responses of factor shares and automation capital to factor taxation and population growth. Detail on the contribution to variance of relative factor taxation to income shares and to the use of robots is provided.

2.1 Time series

We work with time series in quarterly frequency for the US economy ranging from the first quarter of 1974 to the fourth quarter of 2008. The limiting factor with regard to the span of our sample period is the automation capital series. Tani (1989) provides the numerator of the first part of actual datapoints for the nowcast of the automation capital series as shown in Fig. 3. Underlying is a series of biannual frequency for the 1970s and, from 1980 to 1985, of annual frequency. This series states the industrial robot population in the USA, where an industrial robot is defined by the Industrial Organization for Standardization (ISO).Footnote 3 The denominator in the construction of datapoints prior to 1986 shown in Fig. 3 is the corresponding annual average of the seasonally adjusted (SA) number of full-time employees in the USA as collected in the Current Population Survey (CPS). The ISO normed definition of robots and the expression in units of “per thousand workers” allows us to combine it with the corresponding annual data from the International Federation of Robotics (IFR) as provided by Acemoglu and Restrepo (2019) and to nowcast a quarterly series of automation capital. Our nowcast is based on the procedure proposed by Shumway and Stoffer (2008). It relies on the Kalman filter in combination with the expectation maximization (EM) algorithm. A detailed outline of this technique is contained in Appendix A.1. The quarterly series for US effective tax rates on income from capital and labor are provided by Gomme et al. (2011). The construction of the tax rates series is based on the National Income and Product Accounts (NIPA). However, taxes levied on capital and paid by households have to be imputed. The imputation follows a methodology that is generally accepted in the empirical macroeconomic literature (Gomme et al. 2011, p. 266). For further details on the setup of the two series, the interested reader is referred to Appendix A.1.

Fernald (2014) provides the capital share series in quarterly frequency. Quarterly series for the US population (in thousand) stem from the BEA and are provided in the FRED database. We seasonally adjust this series by means of an X12-ARIMA and consider its log first differences transform. Also from FRED we retrieve the BEA series of the US quarterly gross compensation of employees in the form of paid wages and salaries as well as the corresponding GDP series.

These procedures prepare the data set for a multivariate cointegration analysis. It comprises series of quarterly frequency for the US income shares, factor taxation, population growth, and automation capital. The sample period covers all quarters from 1974 to 2008.

2.2 VEC model analysis

We rely on the maximum likelihood (ML) based framework for estimation and inference in cointegrating systems often referred to as the “Johansen approach” (Johansen, 1995). The variables of interest include the two effective tax rates as well as the two factor shares. Due to the natural log transformation, it is technically feasible to jointly consider the shares of labor and capital income. However, a (near perfect) collinearity prevents the joint integration of both income tax rates into a particular VECM specification. An alternative to including both tax rates is the construction and use of the labor-tax-to-capital-tax ratio (LCTR, Fig. 4) which serves as a workaround in our VECM specifications. It organically takes care of the historical tax policy mix.

Source: Gomme et al. (2011)

Labor-tax-to-capital-tax ratio (LCTR), 1954:q1 to 2008:q4. Note: black—levels (left ordinate); gray—log first differences (right ordinate);

Our reduced form (RF) VECM space consists of three dimensions: a relatively exogenous variable \(X_{t}\) (population growth), a policy variable \(Y_{t}\) (the factor tax policy mix, i. e., the LCTR), and a multivariate group of response variables \({{\textbf {W}}}_{t}\) (our automation capital proxy and the two factor shares), making it

In standard VEC notation this becomes

where \(\Gamma _{i}=\left( {\textbf {I}}-{\textbf {A}}_{1}-{\textbf {A}}_{2}-\cdots -{\textbf {A}} _{p}\right) \) for all \(i=1,\ldots ,p\). \(\Pi \) may be thought of as consisting of an adjustment speed matrix \({\textbf {a}}\) and a long-run coefficient matrix \({\textbf {b}}\). Then, \(\Pi ={\textbf {ab}}^{\prime }\), where \({\textbf {b}}^{\prime } {\textbf {Z}}_{t-1}\) is the vectorial analogue of the error correction term in the Engel-Granger approach.

2.3 Identification strategy

Our identification scheme for the \(\Delta {\textbf {Z}}\) vector autoregression (VAR) part of the VECM specification—modeling the short to medium term cyclical dynamics—resembles what has become known as “Slow-r-Fast” scheme in the literature (Stock and Watson 2016, p. 455, pp. 477–478).Footnote 4 It delivers a block recursive scheme with an ordering of the respective elements of the partitioned \({\mathbf{Z}}_{t}\) vector that is not decisive for the system rotation matrix. In our application, population growth is supposed to be “the least” endogenous and does not respond to the policy variable, i. e., to the LCTR, and to any of the response variables within a quarter. The response variables are comprised of our automation capital measure and the two factor shares. As we focus on the responses to shocks in the tax policy variable, the ordering within \(\mathbf {W}_{t}\) is uncritical. For the \(\Delta {\textbf {Z}}\)/VAR-part of the respective VECM, the following block recursive scheme to identify responses to shocks \(\varepsilon \), with orthogonalized analogues \(\eta \), is implied

where \({\textbf {Z}}_{t}\) is partitioned \({\textbf {Z}}_{t}=\left( \begin{array}{ccc} X_{t}&Y_{t}&{\textbf {W}}_{t} \end{array} \right) ^{\prime }\), and \(H_{\textbf {WW}}\) is squared. Our lag order choice \(p=13\) for (2.1), (2.2) is supported by the adequate Likelihood ratio (LR) test.

2.4 Results

The Johansen testing procedure, detailed in “Appendix A.2,” fails to reject the null of at most three cointegrating equations of our VECM representation. The second cointegration equation in the Johansen normalization identification clearly indicates a statistically significant equilibrium relationship between the LCTR series and the two factor shares. Additionally, our specification is stable adhering to the implied eigenvalue stability condition.

Orthogonalized IR functions of factor shares to LCTR shock. Note: left (right) panel: impulse variable is LCTR; response variable is capital (labor) share of production. Solid lines represent IR functions obtained from a VEC model specification (2.1), (2.2) with a ’Slow-r-Fast’ identification scheme for its VAR-part, a cointegration rank of two, and a lag order of 13. The dashed lines depict 68% Hall’s percentile method-based bootstrap confidence intervals (see, Benkwitz et al. 2001 for details)

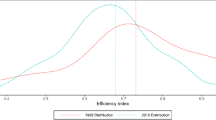

Impulse response (IR) functions of factor shares in response to a relative increase in taxing labor vis-à-vis capital, i. e., to a positive LCTR shock, are given in Fig. 5. A positive one percent LCTR shock implies a permanent increase in the capital share of production of about 0.64%. In contrast, the labor share response is negative (see the right schedule of Fig. 5). It is also permanent in nature and of similar size. However, the point estimate shows a reaction to a one percent LCTR impulse that lies slightly above a permanent decrease in the labor share of \(-0.64\)%. It amounts to approximately \(-0.59\)%. Nevertheless, in terms of its size, the decline in response to a one percent LCTR shock covers also \(-0.64\)% within the range of reasonable confidence. The latter is—in the time series context—frequently given by a 68% band (Fig. 5).

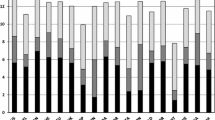

Table 1 shows FEVD statistics for the three response variables, the capital share, the labor share, and automation capital, given a positive LCTR shock. After about 30–40 quarters, relative factor taxation accounts for up to 9% (13%) of observed changes in the capital (labor) share and for up to 35% of the dynamics in the automation capital series. While the effect starts to peter out after 20 years (falling below 30%) for the use of robots, it only slightly falls for the two factor shares. Bear in mind, in contrast with the following model simulations of Sect. 3, these contributions rely on RF empirical models and empirical series. Thus, they do not truly isolate the effects of factor taxation. Nevertheless, the VECM analysis, following the generic Johansen procedure and resting on a “Slow-r-Fast”-style identification strategy for its VAR-part, has uncovered three significant long-run equilibrium correcting, i. e., cointegrating, relationships (see Appendix A.2 for details). These are given for the following three pairwise (cointegration) relationships: population growth and the labor share, relative factor taxation and the capital share of income, and the use of robots and the capital share of income.Footnote 5 This implies that the system is driven by two to three independent stochastic trends. Each of them is shared by the respective pair of cointegrated macroeconomic variables. It allows us to state that there exists, at least, an equilibrium relationship between population growth and the labor share and between relative factor taxation and the capital share, respectively. Each of the pairs of variables tends to develop—in the absence of shocks—in a lockstep that is proportional in nature. This is in the spirit of a long-run equilibrium relationship that entails a systematic co-movement among macroeconomic variables. For example, population growth tends to translate into a labor share dynamics that is proportional to it. This proportionality may only temporarily be perturbed by shocks and overlain by business cycle dynamics. Furthermore, we have illustrated that shocks to relative factor taxation have permanent effects on factor shares. Corresponding variance decompositions reveal that shock in the factor-tax policy mix contribute at some decade-long forecasting horizons to both changes in the two income shares and in automation capital.

3 A neoclassical growth model with dynamic taxes, automation capital, and adjustment costs

We conduct our analysis in a framework that extends the neoclassical growth model in three ways. First, we follow Steigum (2011) and distinguish two types of capital in the aggregate production function, i. e., traditional capital (structures, machines) and automation capital (robots). Traditional capital and labor are imperfect substitutes, whereas automation capital and labor are perfect substitutes. Second, we introduce adjustment costs associated with the installation of either type of capital. Finally and most importantly, we integrate dynamic taxes on capital and labor income to study their role for the installation of automation capital and the functional income distribution.

The economy comprises a household, a production, and a government sector in an infinite sequence of periods, \(t=0,1,2,\ldots ,\infty \). At all t, there is a single manufactured good that serves as numéraire. This good may be directly consumed by households, invested, or collected by the government in the form of taxes. If invested, it serves in the next period either as traditional capital or as automation capital. If collected by the government, it is a means to provide contemporaneous government services to each member of the population.

3.1 Household sector

There is a single representative household with \(N_t\) members. The household size grows at rate \(n_t\), i. e.,

The household’s inter-temporal utility is

where \(c_t\), \(l_t\), and \(g_t\) denote, respectively, per-capita consumption of the manufactured good, the individual supply of working hours, and the per-capita consumption of the services provided by the government at t. In each period, the household’s time budget is normalized to unity. Hence, \(1-l_t\) is leisure at t. We refer to \(g_t\) as individual government consumption at t.

The periodic utility of a household member is additively separable in the utility enjoyed from consumption and leisure, u(., .), and the utility derived from government consumption, \(\nu (g_t)\). Hence, government consumption, \(g_t\), does not affect the household’s optimization with respect to consumption and labor.

The utility function \(u:{\mathbb {R}}_+\times [0,1]\rightarrow {\mathbb {R}}\) is given by

where \(\theta \) and \(1-\theta \) denote the weights attached to consumption and leisure.

Households own two kinds of assets, traditional capital, \(k_t\), and automation capital, \(p_t\) (both in per capita terms). These stocks depreciate at the same rate, \(\delta \in (0,1)\), so that their respective accumulation is given by

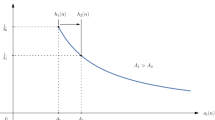

Here, \(i^k_t\) and \(i^p_t\) denote per-capita investments in traditional and in automation capital, respectively. Following Hayashi (1982), we allow for symmetrical and quadratic adjustment costs for either type of capital. More precisely, for \(x\in \{k,p\}\) an investment \(i^x_t\) requires

units of produced output at t where \(a_1>0\) and \(a_2>0\). The (small) constant \(a_2\) allows for the transition from a regime with \(p_t=0\) into one with \(p_t>0\).Footnote 6

Let \(w_t\) denote the real wage, \(r_t^k\) the rental rate of traditional capital, and \(r_t^p\) the rental rate of automation capital at t. Then, the household receives income from labor, \(w_t l_t\), taxed at rate \(\tau ^w_t\in (0,1)\), and interest income on traditional capital, \(r^k_t k_{t}\), and automation capital, \(r^p_t p_t\), both taxed at rate \(\tau ^r_t\in (0,1)\). In addition, the household receives lump-sum government transfers, \(tr_t\). Household income is spent on consumption, \(c_t\), taxed at the constant rate \(\tau ^c>0\), and on investment in both types of capital. Accordingly, the household’s periodic budget constraint is

For given values \(k_0>0\) and \(p_0\ge 0\), the representative household’s optimal plan is a sequence \(\{c_t,l_t,i^k_t,i_t^p,k_{t+1},p_{t+1}\}_{t=0}^{\infty }\) of per-capita variables that maximizes \(U_0\) subject to (3.4a), (3.4b), (3.6), \(l_t\in [0,1]\), and non-negativity constraints on \(c_t\), \(i^k_t\), \(i_t^p\), \(k_{t+1}\), \(p_{t+1}\). The first-order conditions of the household problem are (a detailed derivation of these conditions is found in Appendix A.5.1)

Here, \(\lambda _t\), \(q^k_t\), and \(q^p_t\) are the respective Lagrange multipliers on the periodic budget constraint (3.6) and on the capital accumulation equations (3.4a) and (3.4b).

Conditions (3.7a) and (3.7b) characterize the contemporaneous trade-off between the consumption demand and the labor supply of a household member. Since \(u(c,1-l)\) is strictly concave on its domain and satisfies the Inada conditions

the optimal plan involves \(c_t>0\) and \(l_t<1\). However, (3.7b) allows for a corner solution \(l_t=0\) that obtains if

Hence, the individual labor supply vanishes if \(c_t\), \(\tau _t^w\), or \(\tau ^c\) are sufficiently high relative to the wage.

Condition (3.7c) says that \(i^k_t>0\) if the marginal cost of producing one unit of traditional capital, \(1+ a_1 i^k_t/(a_2+k_t)\), expressed in period-t utility as \(\lambda _t\left( 1+ a_1 i^k_t/(a_2+k_t)\right) \) is equal to the marginal revenue from selling one unit of traditional capital expressed in period-t utility, \( q^k_t\times 1\). Moreover, \(i^k_t=0\) if the costs exceed the benefit for the first marginal unit of investment in traditional capital. Mutatis mutandis, the interpretation of condition (3.7d) for automation capital is the same.

Condition (3.7e) says that \(k_{t+1}>0\) if the return associated with one additional unit of traditional capital per-capita in \(t+1\) shared by a population that has grown by a factor \(1+n_t\) and expressed in period-t utility is equal to the marginal revenue from selling one unit of traditional capital expressed in period-t utility, \(q^k_t\times 1\).Footnote 7 Mutatis mutandis, the interpretation of condition (3.7f) for automation capital is the same.

Finally, conditions (3.7g) and (3.7h) state the transversality conditions on both types of capital.

3.2 Production sector

The production sector has a single competitive representative firm. Following Steigum (2011), this firm has access to the production function

where \(L_t\) is employed hours worked, \(P_t\) the amount of hired automation capital, and \(K_t\) the amount of hired traditional capital. Hours worked and automation capital are perfect substitutes with a marginal rate of substitution equal to \(\kappa \).Footnote 8

The representative firm’s optimal plan is a sequence \(\{K_t,L_t,P_t,Y_t\}_{t=0}^\infty \) of factor demands and output supplies that maximizes the net present value of all current and future profits. This comes down to the maximization of periodic profits, \(\Pi _t\), given by

The corresponding first-order conditions for all t are

These conditions reflect that \(K_t\) is essential but neither \(L_t\) nor \(P_t\) is.

Let \(LS_t\) denote the labor share at t. Using (3.10a)–(3.10c), the latter can be expressed as

Hence, in the presence of automation capital the labor share is smaller than \(1-\alpha \). Moreover, it declines in the automation capital intensity, \(P_t/L_t\). This is the result of two reinforcing effects that become visible if the labor share is expressed as the ratio of the marginal to the average product of hours worked, i. e., \(LS_t=w_t/(Y_t/L_t)\). A higher automation capital intensity reduces the marginal product of hours worked and boosts its average product.

3.3 Government sector

At all t, the government collects taxes and spends its receipts in the form of government consumption and lump-sum transfers while keeping its budget balanced. Let \(tax_t\) denote per-capita tax receipts. Then,

Moreover, the government budget constraint reads

3.4 Dynamic competitive equilibrium with dynamic taxes

Given \(K_0>0\), \(P_0\ge 0\), \(N_0>0\), \(N_{t}=(1+n)^t N_0\), and a sequence of tax rates \(\left\{ \tau ^c, \tau ^w_t,\tau ^k_t\right\} ^\infty _{t=0}\) the dynamic competitive equilibrium with dynamic taxes determines sequences of prices \(\left\{ w_t,r^k_t,r^p_t\right\} ^\infty _{t=0}\), allocations \(\left\{ c_t,l_t,i^k_t,i^p_t, k_{t+1},p_{t+1},K_t,L_t,P_t,Y_t\right\} _{t=0}^\infty \), and government activities \(\left\{ g_t, \mathrm{tax}_t,\mathrm{tr}_t\right\} _{t=0}^\infty \). The equilibrium sequences are determined by the following conditions for all \(t=0,1,2,\ldots ,\infty \):

-

(E1)

The plan of the representative household satisfies conditions (3.7a)–(3.7h).

-

(E2)

The plan of the representative firm satisfies (3.10a)–(3.10c).

- (E3)

-

(E4)

The labor market clears, i. e.,

$$\begin{aligned} w_t\ge 0,\quad L_t\le N_t l_t,\quad \text{ and }\quad w_t(L_t- N_t l_t)=0. \end{aligned}$$ -

(E5)

The market for both types of capital clear, i. e.,

$$\begin{aligned}&r^k_t\ge 0,\quad K_t\le N_t k_t, \quad \text{ and }\quad r^k_t(K_t- N_t k_t)=0,\\&r^p_t\ge 0, \quad P_t\le N_t p_t, \quad \text{ and }\quad r^p_t(P_t- N_t p_t)=0. \end{aligned}$$ -

(E6)

The market of the final good clears, i. e.,

$$\begin{aligned} c_t + g_t + \phi \left( i^k_t,k_t\right) +\phi (i^p_t,p_t)=y_t. \end{aligned}$$(3.14)

Since the production function (3.9) exhibits constant returns to scale and factor markets are competitive, (E2) implies \(\Pi _t=0\). (E4) and (E5) describe the usual factor market clearing conditions. The price of labor cannot be negative, demand must not exceed supply, and an excess supply requires \(w_t=0\). Similarly, for the two stocks of capital.

Below it becomes clear that we have to deal with the cases where either \(l_t=0\), i. e., the supply of labor vanishes, or \(p_t=0\), i. e., the supply of automation capital vanishes. In the former case, the demand for hours worked must vanish, too. This is the case for all wages above \(w_t=(1-\alpha )A(K_t/(\kappa P_t))^\alpha \) which is then the equilibrium wage consistent with \(L_t=0\). Combining the latter with Eq. (3.8), we obtain the equilibrium condition under which the individual labor supply vanishes as

Similarly, if the supply of automation capital is zero, then its demand must vanish. This is the case for all rental rates above \(r_t^p= (1-\alpha )\kappa A(K_t/L_t)^\alpha \) which is then the equilibrium rental rate for automation capital consistent with \(P_t=0\).

Finally, (E6) states the goods market equilibrium in per-capita terms, i. e., the supply of produced output is equal to private and government consumption demand plus investment outlays for both types of capital.

3.5 Initial steady state and asymptotic balanced growth path

Let period \(t=0\) correspond to the year 1965. Prior to this period, we assume that the economy is in steady state without automation capital. More precisely, the population growth rate \(n_0\), and the tax rates \(\tau _0^c\), \(\tau _0^w\), and \(\tau _0^r\) are constant and equal to the respective values prevailing in 1965. Moreover, the growth rate of the economy is set equal to zero, and labor share is \(LS=1-\alpha \) (see Appendix A.5.2 for details).

An asymptotic balanced growth path (ABGP) is defined as an equilibrium path to which the economy tends as \(t\rightarrow \infty \) that satisfies

for a constant population growth rate, \(n_t=n\), constant tax rates, \(\tau ^r_t=\tau ^r\) and \(\tau ^w_t=\tau ^w\), as well as a constant ratio \(g_t/y_t<1\). Here, \(\gamma >0\) is the asymptotic growth rate of per-capita variables.

We explain the derivation and the properties of the unique ABGP in Appendix A.5.2. Here, we simply note that in the limit \(t\rightarrow \infty \) the production function (3.9) becomes \(Y_t = A \left( \kappa P_t \right) ^{1-\alpha } K_t^\alpha \). As \(P_t\) and \(K_t\) grow at the same rate along the ABGP, the asymptotic behavior of the model mimics the one of the AK-models of, e. g., Frankel (1962) or Romer (1986), and \(\gamma >0\) will be endogenously determined.

3.6 Calibration

We calibrate the neoclassical growth model with dynamic taxes, automation capital, and adjustment costs to match empirical characteristics of the US economy for the time span from 1965 to 2010. Periods correspond to years. Our calibration strategy comprises four steps. First, a subset of preference and production parameters, \(\{\beta ,\eta ,\theta ,\alpha ,\delta \}\), is chosen in accordance with the initial steady state corresponding to the year 1965. Second, the adjustment costs parameters \(a_1\) and \(a_2\) are set in accordance with prior empirical estimates and the simulated series of automation capital during the initial phase of the transition. Third, the production parameters A and \(\kappa \) are jointly chosen to imply an asymptotic endogenous growth rate of per-capita variables, \(\gamma \), equal to the average annual growth rate during 1965–2010 and a labor share equal to 57% in 2010. Finally, the fiscal and population parameters are set in accordance with the time series evidence for the USA during 1965–2010. Table 2 summarizes the calibration.

Preferences We set \(\beta =0.96\) and \(\eta =2\). These values are commonly applied in dynamic general equilibrium models (see, e. g., in Heer and Maußner 2009). This calibration implies a steady-state real interest rate of 3.75% and an intertemporal elasticity of substitution equal to 1/2. The latter is approximately the midpoint of empirical estimates for \(1/\eta \). The weights of consumption and leisure in utility, \(\theta =0.3938\) and \(1-\theta =0.6062\), are chosen to generate an average labor supply equal to 0.30 in the initial steady state.

Production The production function parameters A and \(\kappa \) are chosen jointly to imply an asymptotic growth rate \(\gamma =2.0\%\) and a labor share equal to 57% in 2010.Footnote 9 The production elasticity of traditional capital, \(\alpha =0.38\), is set to imply a labor share equal to 62% in 1965. Following Trabandt and Uhlig (2011), the depreciation rate of capital is \(\delta =7.0\%\). The parameter of the adjustment cost function, \(a_1=12.0\), which governs the speed of adjustment in the two capital stocks, is taken from Heer and Schubert (2012). The adjustment cost parameter \(a_2\) is a small constant added mainly for numerical purposes. If \(a_2=0\), then the marginal adjustment costs in the initial steady state without automation capital, \(P_t=0.0\), would be infinite and the accumulation of automation capital would never take off. The long-run effect of the parameter \(a_2\) on aggregate variables is asymptotically zero. Moreover, its magnitude affects the growth rates of automation capital only in the initial phase of the transition. We, therefore, choose \(a_2=0.10\) so that the simulated growth rates of automation capital \(P_t\) (=10.9%) is approximately equal to the annual growth rate of the robots during the period 1974–1980 (=10.7%) as depicted in Fig. 3.

Government The time series of the two income tax rates, \(\tau ^r_t\) and \(\tau ^w_t\), are the estimates taken from Gomme et al. (2011) for the US economy during 1954–2010 that Fig. 2 displays. In 1965, \(\tau ^r_t\) and \(\tau ^w_t\) amount to 47.3% and 17.9%, in 2010 to 37.1% and 28.9% , respectively. The consumption tax rate \(\tau ^c=5.0\%\) and the government share G/Y are chosen as in Trabandt and Uhlig (2011).Footnote 10

3.7 Transition analysis

This section has two parts. First, we study the transition from 1965–2015 of our benchmark economy with automation capital, a strictly positive labor supply, and the dynamic tax rates.Footnote 11 The main result is that the model explains the actual drop in the labor share from 62% to 57% that took place between 1965 and 2015. Second, we run counterfactual experiments to highlight the role of the tax rates on capital and labor income for the decline in the labor share. We demonstrate that the labor share would have been several percentage points higher if either the tax rate on labor income alone or both tax rates had remained at their 1965 level.

3.7.1 Benchmark

Figures 6 and 7 illustrate the transition dynamics of our model economy for the time span 1965–2030. The transition is computed under the following assumptions:

-

1.

The economy is in steady state prior to 1965 with a labor share equal to 62%. The tax rates on labor and capital income and the population growth rate are set equal to their value in 1965, i. e., 17.9%, 47.3%, and 1.7%, respectively.

-

2.

The transition starts in 1965. The initial capital stock is given by the steady-state stock of traditional capital. Households build up savings and supply labor according to their Euler equations for both types of capital and their first-order conditions with respect to consumption and labor.

-

3.

For the period 1965–2010, the tax rates and the population growth rates are equal to their empirical counterparts.

-

4.

In 1965, the household also starts to invest in automation capital.

-

5.

After 2010, the tax rates on labor and capital income as well as the population growth rate remain constant at 28.3%, 37.1%, and 0.9%, respectively.

The first row of Fig. 6 reveals that the household initially adjusts its asset portfolio and shifts wealth from traditional capital (upper left panel), \(k_t\), to automation capital (upper right panel), \(p_t\). After approximately 30 years, both types of capital start to grow over time. As we argue above, the asymptotic behavior of our model is similar to an AK-model, i. e., the economy converges to a balanced growth path with a growth rate of per-capita variables equal to 2.0%.

In the first year of the transition, the labor supply increases slightly from 0.3 in 1964 to 0.303 in 1965. As initially labor income taxes are low the household substitutes labor intertemporally so that \(l_t\) remains higher than 0.3 until 1973. Between 1965 and 2015, the labor supply drops from 0.303 to 0.262 (lower right panel).Footnote 12 This is the effect of two channels which operate simultaneously. First, automation capital replaces labor in production. Second, the incentive to supply labor falls with the increase in the tax rate on labor income. Experiment 1 below suggests that the increase in \(\tau ^l_t\) from 17.9 to 28.3% during 1965–2010 is the driving force behind the decline in \(l_t\).

Per-capita consumption (lower left panel in Fig. 6) falls between 1970 and 1985 for two reasons. First, the net wage income declines with a falling labor supply and increasing tax rates on labor income. During 2004–2010, the labor supply displays a hump-shaped increase which reflects the temporary fall in the labor income tax rate, \(\tau ^w_t\), during these years (see Fig. 2). Second, the household increases savings as, on average, the tax rates on capital income fall during 1965–2010 (see Fig. 2). Therefore, consumption declines during the first 30 years of the transition. Eventually, the growth effect sets in and consumption starts to increase after 2004. In the long run, consumption grows at the endogenous asymptotic growth rate. Notice the hump-shaped dynamics of consumption during the years 2004–2011 that mirrors the evolution of the labor supply and, hence, of (net) wage income.

The evolution of the factor prices \(w_t\) and \(r^k_t\) over 1965–2030 are displayed in the upper row of Fig. 7. Their evolution reflects the first-order conditions (3.10a)–(3.10c) that define a factor-price frontier linking \(r_t^k\), \(r_t^p\), and \(w_t\) according to

Since traditional capital, \(k_t\), decreases and automation capital increases during 1965–1980, the wage, \(w_t\), falls at the beginning of the transition. Consequently, the rental rate on traditional capital, \(r^k_t\), rises during this period.Footnote 13

The evolution of the labor share, \(LS_t\), is illustrated in Fig. 8. The model (broken green line) is able to replicate the downward trend of the labor share (solid red line) during 1965–2015. In fact, as observed empirically the model generates a drop in the labor share by five percentage points between 1965 and 2015. This effect is explained by the substitution of labor with automation capital. The income share accruing to these two production factors is constant and equal to \(1-\alpha =62\%\). However, the relative income share of automation capital increases over time at the expense of the residual share for labor.

3.7.2 Experiments

We conduct two counterfactual experiments. In Experiment 1 the tax rate on labor income remains constant at its (low) 1965 level of \(\tau ^w_t=\tau ^w=17.9\%\), whereas the tax on capital income varies in line with the empirical evidence shown in Fig. 2. Experiment 2 leaves both tax rates constant at their 1965 level, i. e., in addition the tax rate on capital income remains constant at its (high) 1965 level of \(\tau ^r_t=\tau ^r=37.1\%\). The counterfactual transition of the labor share is shown in Fig. 9. The actual US labor share and the labor share of our benchmark model appear again as the solid red and the broken green line. In Experiment 1 the decline of the labor share (broken dotted blue line) is less pronounced than in reality and the benchmark. In particular, in 2015 it is 1.3 percentage points higher at 57.9%. Experiment 2 generates an even shallower decline in the labor share to 60.9% (dashed black line).Footnote 14 We conclude that the observed increase in the tax on labor income and the decline in the tax on capital income from 1965 to 2015 played an important role for the evolution of the labor share over this period.

To understand the dynamics of the labor share in these experiments relative to the benchmark, it is instructive to compare the co-evolutions of the remaining endogenous variables. For this purpose, Fig. 10 illustrates the dynamics of traditional capital, \(k_t\), automation capital, \(p_t\), consumption, \(c_t\), the labor supply, \(l_t\), the wage, \(w_t\), and the rental rate of traditional capital, \(r^k_t\), (from the upper left to the lower right panel) in these experiments and the benchmark.

In Experiment 1, the lower labor income tax rate increases the labor supply in the year 2015 from 0.2605 in the benchmark to 0.292. As a consequence, net labor income increases which results in a strong rise of consumption and a moderate rise of savings (the sum of investments in traditional and automation capital, not presented). As is evident from the bottom-left panel of Fig. 10, the increase in the labor supply also implies a rise of the rental rate of capital, \(r^k_t\). Therefore, individual household members adjust their portfolio composition and shift wealth from automation to traditional capital over time. The top row of Fig. 10 reveals that \(k_t\) is larger and \(p_t\) lower in Experiment 1 than in the benchmark. Accordingly, with a higher labor supply, \(l_t\), and less automation capital, \(p_t\), the labor share increases.

In Experiment 2, the capital income tax rate is permanently higher than in Experiment 1. Therefore, the after-tax rate of return from traditional capital, \(k_t\), falls by approximately 25% in 2015 from 12.2% in Experiment 1 to 9.1% in Experiment 2. Since the growth rate of per-capita variables is endogenous and depends on the capital income tax rate, \(\tau ^k\), growth slows down and approaches asymptotically 0.85%. For this reason, output, consumption and investment are significantly smaller in Experiment 2 than in Experiment 1. In particular, in 2015, automation capital, \(p_t\), in Experiment 2 (1) only amounts to 0.29 (1.08) units of contemporaneous output which—after noticing that the labor supply does not react strongly to the higher capital income tax rate, \(\tau ^r_t\)—explains the much higher labor share of 60.9%.

3.8 Welfare and tax policies

What are the optimal tax rates on labor, automation and traditional capital that a benevolent planner would choose? In the context of our model this question is of interest since the accumulation of robots crowds out labor. In fact, from the year 2132 onwards firms completely dispense with labor so that government revenues can no longer rely on the taxation of wages. Therefore, the optimal capital income tax rate levied on robots and traditional capital in the long run cannot be zero as suggested by Chamley (1986) and Judd (1985). The government would no longer be in a position to finance its exogenous expenditure comprising its consumption and transfers (for a constant tax rate on consumption).Footnote 15

To derive welfare implications and optimal tax policies, \((\tau ^r_t,\tau ^w_t)\), we conduct a simple fiscal policy experiment following Grüner and Heer (2000). The government announces an unexpected once-and-for-all change in the capital income tax rate, \(\tau ^r\), in the year 2020. The labor income tax rate, \(\tau _t^w\), adjusts so that the fiscal budget is balanced. Moreover, we assume that - irrespective of the considered tax policy - the time paths of government consumption and transfers, \(G_t\) and \(Tr_t\), in absolute terms remain as in the benchmark equilibrium (see Grüner and Heer (2000) for a detailed discussion of this procedure). In addition, we stipulate that the transition from the year 2020 to the new ABGP is completed by 2080. Hence, from this period onward, the per-capita variables \(y_t\), \(k_t\), \(p_t\), and \(c_t\) grow at the endogenous growth rate \(\gamma \) which depends (negatively) on the capital income tax rate \(\tau ^r\).

In our simulation, we find that the optimal capital income tax rate is 38.2%, about one percentage point higher than in 2020. For the household with intertemporal utility (3.2) this implies a welfare gain of 0.26% of total consumption. Since the optimal capital income tax rate is close to its benchmark value the welfare gain is rather small.

To develop some intuition for this result observe that capital income tax rates smaller than those prevailing in 2020, i. e., values of \(\tau ^r\) below 37%, are insufficient to finance government consumption and transfers until 2069 when labor has converged to zero. This reflects two effects of opposite sign that a lower capital income tax rate has on government revenues. First, as the growth rate of per-capita variables is higher than in the benchmark equilibrium, the tax base and government revenues increase. Second, government revenues decline since \(\tau ^r\) is lower. In our model the latter effect dominates. For \(\tau ^r<37\%\) this implies that the government can no longer finance its expenditure with higher levels of \(\tau _t^w\) once the convergence of the labor supply becomes sufficiently close to zero. For capital income tax rates higher than those prevailing in 2020, i. e., values of \(\tau ^r\) exceeding 37%, the growth rate of per-capita variables falls below 2% and, beyond a certain threshold tax level slightly above 40%, total income taxes become again insufficient to finance government expenditures until the year 2080. Hence, the admissible range of capital income tax rates is \([37\%,40\%]\). Over this range welfare is a concave function and peaks at \(\tau ^r=38.2\%\).

4 Conclusion

In the empirical part, we find three significant long-run equilibrium correcting, i. e., cointegrating, relationships for the 1974–2008 period. They are given for our factor-tax policy mix variable and the capital share, our use of robots variable and the capital share, and population growth and the labor share. Permanent effects on factor shares emanate from shocks in relative factor taxation. The latter also permanently affect the use of robots. Variance decompositions reveal that taxing factors contributes long-lastingly to the variation both in the two income shares and in automation capital. Overall, our findings give grounds for setting up and simulating a neoclassical growth model augmented by automation capital, capital adjustment costs, and factor taxation.

In our simulations, we find that tax rates on both labor and capital income have a significant effect on the functional income distribution and, in particular, on the labor share of income. For the US economy, the motivating empirical effect amounts to approximately 4 percentage points over the period 1965–2015. We demonstrate that this stylized fact can be reproduced by a neoclassical growth model with automation capital. Our growth model also predicts a continuing fall in the labor share over the coming decades. However, we would like to interpret this latter finding in a cautious way because we neglect other aggravating factors like artificial intelligence (AI). In our model, the productivity of the automation capital does not increase over time. In future research, we plan to endogenize the investment in AI and its effects on the functional income distribution.

Data availability

The authors confirm that the data supporting the findings of this study are available through sources quoted within the article or are available upon request.

Change history

18 February 2023

Missing Open Access funding information has been added.

Notes

Historical accounts suggest that the use of robots in the USA started slowly in the early 1960s. They were systematically introduced into US manufacturing only in the mid-to-late 1960s (see, e.g., Encyclopedia Britannica, https://www.britannica.com/technology/robot-technology, accessed April 25, 2022), Steigum (2011), p. 543, or Jeremy Gottlieb and David Leech Anderson (https://mind.ilstu.edu/curriculum/medical_robotics/robots_in_beginning.html, accessed April 25, 2022). Figure 3 suggests that robots basically amounted to zero prior to 1980 averaging at less than 1 robot per 5000 workers.

Bergholt et al. (2019) make an attempt in this direction. These authors estimate sign-restricted structural vector autoregressive (SVAR) models with permanent shocks to study “medium-run” trend relationships in this context.

Accordingly, an “industrial robot is an automatic position-controlled reprogrammable multifunctional manipulator having several degrees of freedom capable of handling materials, parts, tools, or specialized devices through variable programmed motions for the performance of a variety of tasks” (Tani 1989, p. 192).

The name stems from the order of partitioning of the dependent variables’ vector by nature of its, partially sub-vectorial, elements. It has been used, in particular, to identify monetary policy shocks (Bernanke et al., 2005). Under this scheme, so-called slow-moving variables such as output and prices do not respond to monetary policy rate dynamics or to movements in fast-moving variables, such as expectational variables, within the period.

Note, however, the last of these cointegration relationships is on the fence of being statistically significant (see Appendix A.2). It is significant only for a level of confidence of 68%. In the computation of IR functions shown in Fig. 5, we abstracted from the last of these cointegration relationships and based it on a rank 2 VECM.

The usual specification of adjustment costs has \(a_2=0\) (see, e. g., Heer and Scharrer 2018).

The return associated with one additional unit of traditional capital per-capita in \(t+1\) has three components. First, there is the after-tax rate of return \((1-\tau ^r_{t+1})r^k_{t+1}\). Second, given \(i^k_{t+1}\) adjustment costs decline by \(a_1 \left( i^k_{t+1}\right) ^2/\left( 2 (a_2+k_{t+1})^2\right) \). These returns can be consumed and add \(\lambda _{t+1}\left[ (1-\tau ^r_{t+1})r^k_{t+1}+a_1 \left( i^k_{t+1}\right) ^2/\left( 2 (a_2+k_{t+1})^2\right) \right] \) to period-\(t+1\) utility. Third, the remaining \(1-\delta \) units can be sold which generates a period-\(t+1\) utility return equal to \(q^k_{t+1} (1-\delta )\).

Below, we choose \(\kappa \) to be smaller than unity to obtain reasonable results in our calibrations. In contrast with the actual evolution of the labor share, a specification involving \(\kappa =1\) (and a corresponding value \(A=0.83\) that generates an asymptotic growth rate of 2%) predicts that the labor share drops to 46% after the first year during which automation capital is used, i. e., when \(P_t>0\).

The computation details are described in Appendix A.5.3.

Note that the government share was not constant during the period 1965–2020 but fell from 23% to 18%. As a robustness check, we analyzed whether the decline in government expenditures relative to GDP had a significant quantitative effect on the decline of the labor share and simulated the model accordingly. However, we find that the fall in the government share contributes only 0.04 percentage points to the decline in the labor share in 2010. Therefore, we excluded government consumption from the set of explanatory factors of the labor share decline.

In our numerical analysis, we compute the transition dynamics over the period 1965–2175. By 2175, the deviation of the final values from their asymptotic steady state values is less than 0.001%. For reasons of exposition, we only display the first part of the transition. Some additional details on the computation of the transitional dynamics are found in Appendix A.5.4.

Eventually, the labor supply vanishes completely. In our benchmark, \(l_t=0\) is reached in the year 2132.

Asymptotically, the rental rates of traditional and automation capital approach the value given in (A.5.9).

Section A.5.5 has a sensitivity analysis for different values of the Frisch labor supply elasticity. When this elasticity drops, e. g., from 1.64 [as in the benchmark case with utility function (3.3)] to a lower value of 0.64, then in the two experiments the labor shares decline to 57.6% and 60.9%, respectively.

The Gauss computer code is available from the authors upon request.

We also re-calibrated the parameter set \((\theta ,A,\kappa ,a_2) = (0.317,9.5,0.019,0.11)\) so that (1) the average labor supply in 1965 is equal to 0.30, (2) the asymptotic growth rate is equal to 2.0%, (3) automation capital grows at 10.9% during the initial years 1975–1980, and (4) the labor share amounts to 57% in 2010.

References

Acemoglu, D. (2017). Secular stagnation? The effect of aging on economic growth in the age of automation. American Economic Review, 107(5), 174–79.

Acemoglu, D., Manera, A., & Restrepo, P. (2020). Does the U.S. tax code favor automation? In Brookings papers on economic activity, conference draft, Spring.

Acemoglu, D., & Restrepo, P. (2018). The race between man and machine: Implications of technology for growth, factor shares, and employment. American Economic Review, 108(6), 1488–1542.

Acemoglu, D. & Restrepo, P. (2019). Robots and jobs: Evidence from US labor markets. Journal of Political Economy (forthcoming).

Aksoy, Y., Basso, H. S., Smith, R. P., & Grasl, T. (2019). Demographic structure and macroeconomic trends. American Economic Journal: Macroeconomics, 11(1), 193–222.

Altonij, J. G. (1986). Intertemporal substitution in labor supply: Evidence from micro data. Journal of Political Economy, 94, S176–S215.

Autor, D., Dorn, D., Katz, L. F., Patterson, C., & Reenen, J. V. (2020). The fall of the labor share and the rise of superstar firms. Quarterly Journal of Economics, 135, 645–709.

Baumeister, C., & Hamilton, J. D. (2018). Inference in structural vector autoregressions when the identifying assumptions are not fully believed: Re-evaluating the role of monetary policy in economic fluctuations. Journal of Monetary Economics, 100, 48–65.

Benkwitz, A., Lütkepohl, H., & Wolters, J. (2001). Comparison of bootstrap confidence intervals for impulse responses of German monetary systems. Macroeconomic Dynamics, 5, 81–100.

Berg, A., Buffie, E. F., & Zanna, L.-F. (2018). Should we fear the robot revolution? (The correct answer is yes). Journal of Monetary Economics, 97(C), 117–148.

Bergholt, D., Furlanetto, F., & Faccioli, N. M. (2019). The decline of the labor share: new empirical evidence. In Norges Bank Research Working Paper, 2019–2018.

Bernanke, B. S., Boivin, J., & Eliasz, P. (2005). Measuring the effects of monetary policy: A factor-augmented vector autoregressive (Favar) approach. Quarterly Journal of Economics, 120, 387–422.

Chamley, C. (1986). Optimal taxation of capital income in general equilibrium with infinite lives. Econometrica, 54, 607–622.

Cheng, H., Jia, R., Li, D., & Li, H. (2019). The rise of robots in china. Journal of Economic Perspectives, 33(2), 71–88.

Costinot, A., & Werning, I. (2018). Robots,tTrade, and Luddism: A sufficient statistic approach to optimal technology regulation. NBER Working Paper No. 25103, National Bureau of Economic Research.

Domeij, D., & Floden, M. (2006). The labor supply elasticity and borrowing constraints: Why estimates are biased. Review of Economic Dynamics, 9, 242–262.

Eden, M., & Gaggl, P. (2018). On the welfare implications of automation. Review of Economic Dynamics, 29, 15–43.

Eggertsson, G. B., Mehrotra, N. R., & Robbins, J. A. (2019). A model of secular stagnation: Theory and quantitative evaluation. American Economic Journal: Macroeconomics, 11, 1–48.

Elsby, M., Hobijn, B., & Sahin, A. (2013). The decline of the U.S. labor share. Brookings Papers on Economic Activity, 44(2 (Fall)), 1–63.

Fehr, H., Kallweit, M., & Kindermann, F. (2013). Should pensions be progressive? European Economic Review, 63, 94–116.

Fernald, J. G. (2014). A quarterly, utilization-adjusted series on total factor productivity. In FRBSF working paper, 2012–2019.

Frankel, M. (1962). The production function in allocation and growth: A synthesis. American Economic Review, 52(5), 995–1022.

Glover, A., & Short, J. (2020). Can capital deepening explain the global decline in labor’s share? Review of Economic Dynamics, 35, 35–53.

Goldin, C., & Katz, L. (2008). The race between education and technology. Harvard University Press.

Gomme, P., Rvaikumar, B., & Rupert, P. (2011). The return to capital and the business cycle. Review of Economic Dynamics, 14(2), 262–278.

Graetz, G., & Michaels, G. (2018). Robots at work. Review of Economics and Statistics, 100(5), 753–768.

Grüner, H.-P., & Heer, B. (2000). Optimal flat-rate taxes on capital—A re-examination of lucas’ supply-side model. Oxford Economic Papers, 52, 289–305.

Guerreiro, J., Rebelo, S., & Teles, P. (2022). Should robots be taxed? Review of Economic Studies, 89, 279–311.

Hansen, A. H. (1939). Economic progress and declining population growth. The American Economic Review, 29(1), 1–15.

Hayashi, F. (1982). Tobin’s marginal $q$ and average $q$: A neoclassical interpretation. Econometrica, 50(1), 213–224.

Heer, B., & Irmen, A. (2014). Population, pensions and endogenous economic growth. Journal of Economic Dynamics and Control, 46, 50–72.

Heer, B., & Maußner, A. (2009). Dynamic general equilibrium modeling: Computational methods and applications (2nd ed.). Springer.

Heer, B., & Scharrer, C. (2018). The age-specific burdens of short-run fluctuations in government spending. Journal of Economic Dynamics and Control, 90, 45–75.

Heer, B., & Schubert, S. F. (2012). Unemployment and debt dynamics in a highly indebted small open economy. Journal of International Money and Finance, 31, 1392–1413.

Helpman, E. (2018). Globalization and inequality. Harvard University Press.

Hémous, D., & Olsen, M. (2022). The rise of the machines: automation, horizontal innovation, and income inequality. American Economic Journal: Macroeconomics, 14(1), 179–223.

Irmen, A. (2021). Automation, growth, and factor shares in the era of population aging. Journal of Economic Growth, 26, 415–453.

Johansen, S. (1995). Likelihood-based inference in cointegrated vector autoregressive models. Advanced texts in econometrics. Oxford University Press.

Judd, K. L. (1985). Redistributive taxation in a simple perfect-foresight model. Journal of Public Economics, 28, 59–83.

Karabarbounis, L., & Neiman, B. (2014). The global decline of the labor share. The Quarterly Journal of Economics, 129(1), 61–103.

Killingsworth, M. R. (1983). Labor supply. Cambridge University Press.

MaCurdy, T. E. (1981). An empirical model of labor supply in a life-cycle setting. Journal of Political Economy, 89, 1059–1085.

Piketty, T. (2014). Capital in the twenty-first century. Harvard University Press.

Romer, P. M. (1986). Increasing returns and long-run growth. Journal of Political Economy, 94, 1002–1037.

Schwert, G. W. (1989). Tests for unit roots: A Monte Carlo investigation. Journal of Business and Economic Statistics, 3, 147–159.

Shumway, R. H., & Stoffer, D. S. (2008). An approach to time series smoothing and forecasting using the EM algorithm. Journal of Time Series Analysis, 3, 253–264.

Slavík, C., & Yazici, H. (2014). Machines, buildings, and optimal dynamic taxes. Journal of Monetary Economics, 66, 47–61.

Steigum, E. (2011). Robotics and growth. In O. LaGrandville (Ed.), Economic growth and development (Frontiers of economics and globalization, volume 11) (pp. 543–555). Emerald Group Publishing Limited.

Stock, J., & Watson, M. W. (2016). Dynamic factor models, factor-augmented vector autoregressions, and structural vector autoregressions in macroeconomics. In J. B. Taylor & H. Uhlig (Eds.), Handbook of the macroeconomics (pp. 415–525). Elsevier.

Tani, A. (1989). International comparisons of industrial robot penetration. Technological Forecasting and Social Change, 34, 191–210.

Thuemmel, U. (2018). Optimal taxation of robots. CESifo Working Papers No. 7317, CESifo, Munich.

Trabandt, M., & Uhlig, H. (2011). The Laffer curve revisited. Journal of Monetary Economics, 58, 305–327.

Acknowledgements

We would like to thank the editor as well as two anonymous referees for their comments and suggestions.

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We would like to thank the editor as well as two anonymous referees for their comments and suggestions.

Appendix

Appendix

The Appendix includes methodological and mathematical details that complement our empirical (Sects. A.1–A.4) and theoretical (Sect. A.5) analysis.

1.1 A.1 Construction of central time series

1.1.1 A.1.1 Nowcasting (bi-)annual automation capital to obtain a quarterly series

A.1.1.1 Underlying time series

To-be-nowcasted time series The series we seek to nowcast—or to generate (pseudo-)quarterly data for—is the use of industrial robots per 1000 workers in the USA as provided in Acemoglu and Restrepo (2019). The original source is the IFR. This series is of annual frequency and starts in 1993. It ends in 2014. However, due to data limitations with regard to other series relevant for our analysis we end it in 2008. We merge these data with observations that we construct in the following way. Tani (1989) in Table 1 (col. 3, p. 193) provides data for the industrial robot population in the USA for the years 1974, 1976, 1978, and in annual frequency from 1980 to 1985. As Tani (1989) in Tab. 3 standardizes these data to workers in the manufacturing sector only, we refrain from using his standardized series, but divide the non-standardized robots figures through the respective annual averages of the US full time employees, SA (in 1K), data that we obtain from the CPS. The result is a series of mixed bi-annual, annual frequency with missing values for 1986–1992. Hence, covered years are 1974, 1976, 1978, 1980–1985, 1993–2008. Graphically this series is made of the dots shown in Fig. 3. As this series represents a stock variable (robots per 1000 employees) for particular years, we might interpret it as end-of-year or q4-values.

General strategy and information set series Given the (quasi-)q4-data of robots per 1000 workers, the procedure runs in two main steps. In the first step, the missing (quasi-)q4-, or annual, values are generated using information from other use of automation capital related variables, for which we have data over the entire period and, at best, at a quarterly observation frequency. In a second step, for the obtained complete annual frequency series, running from 1974 to 2008, an analogue nowcasting approach is followed to generate a (pseudo-)quarterly series. Our baseline information set essentially uses variables from the Fernald (2014) database in contemporaneous and first lag expression that recently have been shown by Graetz and Michaels (2018) to be profoundly and significantly associated with robots input: hours worked, labor productivity, different estimates of labor quality (i.e., labor composition), total factor productivity (TFP), and utilization-adjusted TFP. Additionally, we also consider the US tax rate on labor income provided by Gomme et al. (2011) as firms adopt robots mainly for saving on labor costs (besides ensuring uniform quality). Generally, labor costs depend on labor productivity and taxation.

A.1.1.2 Method

Starting point of the procedure is the notion of a general state space model for an n-dimensional time series \(\varvec{y}_t\) consisting of a measurement equation that relates the observed data to an m-dimensional state vector \(\varvec{\alpha }_t\). The generation of the state vector \(\varvec{\alpha }_t\) from the past state \(\varvec{\alpha }_{t-1}\), for \(t=1,\ldots ,T\), is determined by the state equation. The measurement equation has the form

In (A.1.1), \(\varvec{Z}_t\) is an \(n \times m\) matrix called measurement or observation matrix, \(\varvec{d}_t\) is an \(n \times 1\) vector and \(\varvec{u}_t \sim \text {iid } N(\varvec{0}, \varvec{H}_t)\) is an error vector. The state equation is given by

In (A.1.2), \(\varvec{T}_t\) is an \(m \times m\) matrix called transition matrix, \(\varvec{c}_t\) is an \(m \times 1\) vector, \(\varvec{R}_t\) is an \(m \times g\) matrix and \(\varvec{\nu }_t \sim \text {iid } N(\varvec{0},\varvec{Q}_t)\) is a \(g \times 1\) error vector. The matrices \(\varvec{Z}_t\), \(\varvec{d}_t\), \(\varvec{H}_t\), \(\varvec{T}_t\), \(\varvec{c}_t\), \(\varvec{R}_t\) and \(\varvec{Q}_t\) are referred to as system matrices. Usually, it is assumed that the errors of the measurement and the transition equation are uncorrelated, i.e.

Furthermore, it is assumed that the initial state is given by a normal vector

In our application of a state-space model, as defined by (A.1.1) and (A.1.2), we seek to generate estimators for the underlying unobserved signal \(\varvec{\alpha }_t\) given the data \(\varvec{y}_s\), for \(s=1,\ldots ,S\). Whenever \(s=t\) this problem is called filtering, while we speak of smoothing if \(s>t\) and forecasting in case \(s<t\). The problem of finding such estimators is solved by the Kalman Filter (KF), Kalman Smoother (KS) and forecasting recursions, respectively. The KF is a set of recursion equations (prediction equations and updating equations) that determine the optimal estimates for the state vector \(\varvec{\alpha }_t\) given the information available at t (henceforth, \(I_t\)). The following definitions are used

and

That is, \(\varvec{a}_t\) is the optimal estimator of \(\varvec{\alpha }_t\) based on \(I_t\) and \(\varvec{P}_t\) is the mean square error (MSE) matrix of \(\varvec{a}_t\).

Prediction equations Given \(\varvec{a}_{t-1}\) and \(\varvec{P}_{t-1}\),

And the optimal predictor of \(\varvec{y}_t\) is obtained from

The corresponding prediction error and its MSE matrix are

and

Updating equations The moment \(\varvec{y}_t\) is the optimal predictor observed and its MSE matrix are updated according to

Filter derivation The KF-derivation makes use of the following properties of a bivariate normal distribution. Given y, the distribution of x is normal with

For the state vector at \(t=1\),

with \(\varvec{\alpha }_0 \sim N(\varvec{a}_0,\varvec{P}_0)\), \(\varvec{\nu }_1 \sim N(\varvec{0},\varvec{Q}_1)\) and \(E[\varvec{\alpha }_0\varvec{\nu }_1']=\varvec{0}\). In a linear Gaussian state-space model the initial state vector is normally distributed with

From the measurement equation, it follows that

with \(\varvec{u}_1 \sim N(\varvec{0},\varvec{H}_1)\) s.t.

Equations (A.1.14) and (A.1.15) are the prediction equations for \(\varvec{\alpha }_1\) and \(\varvec{y}_1\) at \(t=0\).

In a next crucial step, one has to find the distribution of \(\varvec{\alpha }_1\) conditional on \(\varvec{y}_1\) being observed (updating). For this purpose, the joint normal distribution of \((\varvec{\alpha }_1',\varvec{y}_1')\) must be determined. In finding the joint normal distribution, we use

Note that since

In combination with (A.1.12) and (A.1.13), \((\varvec{\alpha }_1|\varvec{y}_1) \sim N(\varvec{a}_1,\varvec{P}_1)\) follows with

Note that (A.1.16) and (A.1.17) are the Kalman Filter updating equations for \(t=1\).

ML-estimation and EM algorithm Let \(\varvec{\theta }\) denote the parameters of the state-space model. These parameters are embodied in the system matrices. The likelihood of the state-space model is calculated based on the prediction errors \(\varvec{e}_t\) with \(t=1,\ldots ,T\). The prediction error decomposition of the (negative) log-likelihood is

Shumway and Stoffer (2008) proposed a procedure based on the EM algorithm that is conceptually simpler and more efficient than alternative procedures such as the Newton–Raphson algorithm. The basic idea is that if all states \(\varvec{\alpha }_T=\left\{ \varvec{\alpha }_t\right\} _{t=0}^T\) together with the observations \(\varvec{y}_T=\left\{ \varvec{y}_t\right\} _{t=1}^T\) were observed, one could consider the entire data space \(\left\{ \varvec{\alpha }_T,\varvec{y}_T\right\} \). The complete data likelihood might, thus, be written as

Given the complete data without any missing values and mostly in the desired (quarterly) frequency, one could easily obtain the ML-estimates of \(\varvec{\theta }\). However, as this is not the case, we may find the ML-estimates based on the incomplete data with short-fall by successively maximizing the conditional expectation of the complete data likelihood. This is done in the following steps:

-

1.

Find some initial values for parameters \(\varvec{\theta }^{(0)}\),

-

2.

Calculate the incomplete data likelihood \(-\text { ln }L(\varvec{\theta }^{(j-1)}|\varvec{y})\); see Eq. (A.1.18),

-

3.

At iteration \(j=1,2,\ldots \) use the KF and KS to obtain smoothed values for \(\varvec{\alpha }_t^{(S)}\), \(\varvec{P}_t^{(S)}\) and \(\varvec{P}_{t|t-1}^{(S)}\) for \(t=1,\ldots ,T\) based on the parameters \(\varvec{\theta }^{(j-1)}\). Use the smoothed values to calculate the conditional expectation of the complete data likelihood

$$\begin{aligned} \begin{aligned} Q(\varvec{\theta }|\varvec{\theta }^{(j-1)})&=E\left\{ -2\text { ln }L(\varvec{\theta }|\varvec{\alpha },\varvec{y})|\varvec{y}_n,\varvec{\theta }^{(j-1)}\right\} \\ &=\text { ln }|\varvec{F}_0|+\text { tr }\left\{ \varvec{F}_0^{-1}\left[ \varvec{P}_0^{(S)}+\left( \varvec{\alpha }_0^{(S)}-\varvec{a}_0\right) \left( \varvec{\alpha }_0^{(S)}-\varvec{a}_0\right) '\right] \right\} \\&\quad +n\text { ln }|\varvec{Q}_t|+\text { tr }\left\{ \varvec{Q}^{-1}\left[ S_{11}-S_{10}\varvec{Z}_t'-\varvec{Z}_tS_{10}+\varvec{Z}_tS_{00}\varvec{Z}_t'\right] \right\} \\&\quad +n\text { ln }\varvec{H} \\&\quad +\text { tr }\left\{ \varvec{H}^{-1}\sum \limits _{t=1}^T\left[ \left( \varvec{y}_t-\varvec{Z}_t\varvec{\alpha }_t^{(S)}\right) \left( \varvec{y}_t-\varvec{Z}_t\varvec{\alpha }_t^{(S)}\right) '+\varvec{Z}_t\varvec{P}_t^{(S)}\varvec{Z}_t'\right] \right\} , \end{aligned} \end{aligned}$$where

$$\begin{aligned} S_{11}&=\sum \limits _{t=1}^T\left( \varvec{\alpha }_t^{(S)}\varvec{\alpha }_t^{(S)'}+\varvec{P}_t^{(S)}\right) , \\ S_{10}&=\sum \limits _{t=1}^T\left( \varvec{\alpha }_t^{(S)}\varvec{\alpha }_{t|t-1}^{(S)'}+\varvec{P}_{t|t-1}^{(S)}\right) \text { and } \\ S_{00}&=\sum \limits _{t=1}^T\left( \varvec{\alpha }_{t|t-1}^{(S)}\varvec{\alpha }_{t|t-1}^{(S)'}+\varvec{P}_{t|t-1}^{(S)}\right) . \end{aligned}$$ -

4.

Update \(\varvec{\theta }_0\) according to

$$\begin{aligned} \varvec{T}_t^{(j)}&=S_{10}S_{00}^{-1}, \\ \varvec{Q}_t^{(j)}&=n^{-1}\left( S_{11}-S_{10}S_{00}^{-1}S_{10}'\right) \text { and } \\ \varvec{H}_t^{(j)}&=n^{-1}\sum \limits _{t=1}^T\left[ \left( \varvec{y}_t-\varvec{Z}_t\varvec{\alpha }_t^{(S)}\right) \left( \varvec{y}_t-\varvec{Z}_t\varvec{\alpha }_t^{(S)}\right) '+\varvec{Z}_t\varvec{P}_t^{(S)}\varvec{Z}_t'\right] \end{aligned}$$to obtain \(\varvec{\theta }^{(j)}\).

-

5.

Repeat steps 2 to 4 until convergence is achieved (i.e., until parameters or likelihood values stabilize in the sense of differing from their predecessor values by some predetermined small amount \(\kappa \) only).

A.1.1.3 Application