Abstract

We quantify the fiscal impacts of earthquakes in Japan. In contrast with earlier research which examined national level aggregate spending in several countries, we are able to provide a detailed examination of separate budget categories within the local governments’ fiscal accounts. We do this using detailed line-budget expenditure data, and by comparing regions and towns affected and unaffected by the damage from earthquakes. Besides the obvious - that government spending increases in the short-term (one year) after a disaster event - we observe that the share of public spending on disaster relief, at the prefecture level, increases significantly, but with no corresponding change in the other budget lines. In contrast, at the lower administrative units, we observe a decrease in the share of spending going to finance other priorities. For the bigger cities, we observe a decrease in the share of spending targeting education, while for the smaller towns, we find that spending on construction and servicing public debt goes down. This evidence suggests that while at the prefecture level fiscal policy-making is robust enough to prevent presumably unwanted declines in public services, the same cannot be said for the city/town level.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Disasters, i.e., catastrophic events that are triggered by natural hazards such as tropical cyclones or earthquakes, have myriad economic impacts. These impacts are identifiable in macroeconomic aggregates and in micro-economic data that follows individuals, households, and firms before and after the event. In the past decade, a large literature has attempted to quantify the macroeconomic impacts, emphasizing mostly the impact of disasters on GDP (as a general proxy for economic functioning). More recently, starting with Lis and Nickel (2010) and Noy and Nualsri (2011), several papers have attempted to quantify the fiscal impacts of disasters in cross-country comparisons and with various empirical approaches (VARs and panel VARs, diff-and-diff, etc.). These papers have typically emphasized the aggregate amount of fiscal spending after a disaster event, net expenditure (i.e., the deficit), tax and tariff revenue, or government borrowing and the evolution of the stock of debt in the disaster’s aftermath (e.g., (Melecky and Raddatz, 2014), (Mohan et al., 2018), and (Klomp, 2019)). They generally conclude, maybe not surprisingly, that central government accounts deteriorate in a disaster’s aftermath, spending increases, tax revenue declines, debt increases, and the likelihood of a sovereign rating downgrade or even default rises.

Instead of using cross-country comparisons, a spate of more recent studies have looked at sub-national fiscal aggregate spending, e.g., Miao et al. (2020) for China’s provinces, Panwar and Sen (2020) for India’s states, Karim and Noy (2020) for Bangladesh’s sub-districts, Jerch et al. (2020) for US counties, Masiero and Santarossa (2020) for Italian municipalities, and Unterberger (2018) for municipalities in Austria.Footnote 1 We do the same for Japan, but, in contrast with these earlier papers, emphasize a detailed examination of the separate budget categories within the local fiscal accounts. Our contribution is therefore twofold: We analyze detailed data on different budgetary categories, and we trace the fiscal dynamics at a very detailed spatial scale (i.e., more than 1700 municipalities). We do this research by comparing prefectures and towns affected and unaffected by the damage from earthquakes.

The added value of our sub-national intra-country examination lies in our ability to delve deeper into the drivers of these aggregate changes in the fiscal accounts that result from the occurrence of disasters, rather than exclusively focusing on quantifying the magnitude of the change. In one related precursor to our work, Deryugina (2017) examined the impact of hurricanes in the South Eastern US on the evolution of social spending in the affected regions. She finds that the increased spending on unemployment benefits and other social programs outweighed the direct spending on post-disaster relief that followed these hurricanes. In addition, the social spending increases she documented persisted for a longer period than the direct disaster relief. As Deryugina (2017) observed, when examining the fiscal accounts of local authorities, one needs to account for transfers from central government, especially in countries where the center dominates fiscally through its ability to set and collect taxes. In this regard, del Valle et al. (2020) investigated the fiscal impact of central government transfers to local authorities in the aftermath of disaster events in Mexico. In the Mexican case, such transfers are guided by predetermined rules in a program called FONDEN. In most cases, however, these transfers are ad hoc and often dictated by political considerations.Footnote 2

We focus on Japan and ask what happens to local public spending by budget lines after a disaster. Japan is arguably an interesting case for several reasons. First, the most prevalent disaster type in Japan, the one we study here, is earthquakes. Unlike storms or floods, i.e., the hazard of note in almost all the papers cited earlier, earthquakes are not seasonal, their onset is unpredictable in terms of the temporal horizons that is relevant for policy, and in Japan they can occur just about everywhere (though with differing but imprecisely assessed frequencies). As a matter of fact, Japan is the country most exposed to earthquake risk globally and the one with the most earthquake disasters, so with fiscal data for one decade we can estimate their impacts.

Second, Japan has uniformly collected and publicly available data on local spending by budget line, where similar data only exist for very few other countries. Rather, unlike Japan, most bigger countries have a federal structure, which typically precludes a uniform budgetary system.

Third, Japan is highly centralized and has a hierarchical system of central government, prefectures and municipalities ("Shi-cho-shon" in Japanese, i.e., cities, towns and villages). Each body is responsible for different public services and with some authority to collect taxes. Nevertheless, the central government is the most consequential level of governance, permitting only a small portion of autonomy for local governments by imposing regulations and top-down decision-makings (the so-called 30 percent local autonomy). More precisely, the central government deploys various financial schemes, subsidies, and tax transfers to local governments, to ensure a uniform quality of public services across Japan. Fiscal spending after a disaster is no exception in that the local governments are in charge of recovery and aid directly, but the central government provides several funding streams to aid them. In particular, for large-scale disasters, a special law dictates that the central government is required to provide special subsidies and provisions to local governments.

Our analysis relies on the official expenditure data available, combined with measured earthquake intensity, and modelled damages weighted by asset exposure. We use these panel data to estimate the impact of damages on fiscal expenditure using various levels of spatial dis-aggregation. Our results reveal a number of important differences across expenditure types and regional levels.

The next section provides information about the Japanese fiscal structure and practices related to spending, especially in the disaster recovery context. More explanations about the data and the methodology are available in the next two sections (sects. 3 and 4, respectively). Section 5 describes our results, while Sect. 6 discusses the implications of our findings, some caveats, and direction for future research .

2 Background

2.1 Regional units

Japan’s government is very centralized, with a hierarchical system from central government, to prefectures, and then municipalities. After WWII, the Constitution of Japan and the Local Autonomy Law became effective in 1947 which insured the autonomy of local government. Each prefecture and municipality has political, administrative, and fiscal system with a parliament and a governor or mayor directly elected by residential people. We analyze the two geo-spatial classifications: prefectures and municipalities. There are 47 prefectures and 1,718 municipalities as of 2020. Of the 1,718 municipalities, Metropolitan Tokyo (the national capital) is by far the largest and has different spending powers. There were 15 ’Designated’ cities as of 2007 ("Seireishitei-toshi"), where these are major cities with more than 500 thousands people. They include Sapporo, Sendai, Chiba, Saitama, Kawasaki, Yokohama, Sagamihara, Niigata, Shizuoka, Hamamatsu, Nagoya, Kyoto, Osaka, Sakai, Kobe, Okayama, Hiroshima, Fukuoka, Kitakyushu, and Kumamoto. There were 44 ’Core’ cities as of 2007 ("Chukaku-shi"), which are smaller than the designated cities and defined as cities with a population of more than 300 thousands.Footnote 3

2.2 The local fiscal system

In Japan, local government is responsible for the social and administrative infrastructure that determines much of daily life. Central and local government are thought of as the twin pillars of government spending (Ministry of Internal Affairs and Communication, 2020). In the 2018 fiscal year, 43 percent of total government spending (71.9 out of 169.2 trillion yen) was by central government while the rest was spent by the local authorities. The central government is responsible for spending on the military, foreign affairs, social insurance, universities, highways, major river-ways, and national roads, while the local government spends on local and regional roads, ports, public housing, urban planning, education, hygiene, health, water, local security, and residential administration. The two layers of the local government, prefectures, and municipalities are in charge of different administrative tasks. Prefectures spend on the management of public high schools, police, industrial waste, health care centers, pollution control, and urban planning. Municipalities finance the management of elementary and junior high schools, fire service, residential registration, sewage, water supply, and garbage disposal.

The Designated and Core cities have additional administrative responsibilities that are transferred to them from their prefecture. These include welfare programs (e.g., supervision of social welfare facilities), establishment of health care centers, urban planning, and environmental administration (e.g., industrial waste control, pollution control and water quality control).

The financial relationship between the center and municipalities is regulated at each budget category by the central government (Ministry of Internal Affairs and Telecommunication). Overall, the expense share for local government is more than half, but this division differs by budget line. Extreme cases are military spending (all by central government) and sanitation (almost all by local government).Footnote 4

2.3 Disaster spending by local government

In recent years, local governments have increased their spending on post-disaster recovery costs. At the same time, in the last decade, Japan has experienced a large number of damaging disasters, starting with the catastrophic 2011 earthquake and tsunami (the Great East Japan Earthquake), and continuing with typhoons, heavy rains, and several other less severe earthquakes.

Japan has a long history of legislated post-disaster management, in particular with respect to fiscal spending allocations.Footnote 5 Some laws on the rescue of victims from disasters date back to the 1870s. For instance, in 1899, the Law for Relief Funds was enacted, which specified the funding system for the local government, and the coverage of spending for rescue and recovery. After WWII, the Disaster Relief Act was passed in 1947, placing the local government in charge of spending on recovery from disasters, with some support provided by the central government.Footnote 6

Later, the scope of management by the central government was clearly specified in the Disaster Countermeasures Basic Act of 1961, which was enacted after the Ise Bay super-typhoon that hit Nagoya City in 1959 (Okubo and Strobl, 2021). The law outlined co-ordination for disaster prevention and post-disaster management by the central government. Subsequently, the Act concerning Special Financial Support to Deal with Designated Disasters of Extreme Severity was established in 1962, which specified the financial support that will be provided by the central government to municipalities when they experience a catastrophe.

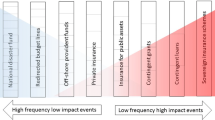

More recently, since the Kobe earthquake of 1995, several reforms of the fiscal allocation system have been completed. The fiscal aid and compensation responsibilities of the central government were clarified in that the central government now compensates disaster victims more. The central government also provides more financial support for recovery plans made by municipalities. In addition, by strategically using contingency funds in the national budget, the central government can immediately supply emergency financial aid to local governments within 3 days after a disaster.Footnote 7 These large-scale assistance policies are financed by issuing bonds and/or by increasing taxation.

During the post-disaster recovery period, there are fiscal rules that determine the allocation. Once a disaster happens, a local municipality estimates the costs for recovery and reports to the central government. In cases of moderate disaster damage-i.e., if the costs do not exceed 50 percent of a municipality’s annual local tax revenue-the central government will cover 2/3 of the total recovery costs. If the costs exceed half of the municipality’s annual tax revenue, the central government will spend 3/4 of the recovery costs. If the costs exceed twice the municipalities annual revenue, then the central government pays all of the recovery costs.Footnote 8

In addition, the local government can finance some of its costs by issuing local bonds. In general, bond issue for other purposes is restricted and difficult to get approval for. This is, in part, because in the long-term local authorities can utilize tax transfers from the central government for the redemption of most of the principal of the local bond they issued.Footnote 9Footnote 10

The procedures that must underpin every spending decision are also relevant. First, a mayor of city (or a governor of prefecture, depending at what level the spending is being planned for) makes and announces overall policy and a basic plan for budget allocation. Based on their policy guidance, the administrative officers produce a detailed budget plan. Each section in the local government office makes their own budget plans accordingly, and then the budget and finance unit makes any needed adjustments to determine the final plan. The mayor subsequently submits the budget plan to the parliament, which is required to approve it. As a consequence of this process, the prioritized categories in local municipality spending depend on the mayor’s leadership and priorities. The mayor and municipality, however, do not exert much control over the revenue side as this side of the ledger is largely regulated by the central government.Footnote 11

Recently, in a survey conducted by the Nippon Institute for Research Advancement, mayors were asked about their leadership, their prioritization of budget categories, and other political problems they faced in their localities. Around 800 out of 1100 municipal leaders answered. According to these responses, many mayors consider their first policy priority the support for child care, and the second priority disaster prevention.Footnote 12 We were unfortunately unable to gather any additional information about any other regulatory constraints on the budgetary processes that might determine post-disaster allocations (Figs. 1, 2 and 3).

3 Methodology

3.1 Damage modeling

To model earthquake damage, we utilize the same model used in Skoufias et al. (2021)Footnote 13 where earthquake maps of peak ground acceleration are combined with vulnerability curves, localized exposure, and building data, to model annual damages. More precisely, regional level earthquake damages ED in year t are constructed from local damage curves and exposure:

where \(e \in E\) are a set of earthquakes that take place in year t, \(i \in r\) are a set of locations in region r, and W is an asset exposure weight. To construct local measures of earthquake damage we use damage ratios DR that are building type b specific and depend on peak ground acceleration pga:

where s are the shares of building types (b) within prefecture r at time \(t-1\). The weights W in Eq. 1 are constructed as:

\(L_{i,r, t-1}\) is the asset exposure at location i in prefecture r at time \(t-1\), which we proxy by nightlight intensity.

3.2 Modeling the determinants of fiscal expenditures

We estimate two different regression models. The first model is a fixed effects model which analyzes the effect that earthquake damage has on aggregate real fiscal spending at the local level (excluding grants). This model is similar to the Jerch et al. (2020) estimations conducted for hurricanes using US county data. The model is defined as follows:

where \(\ln TE_{r, t}\) is the log of total real expensesFootnote 14 for region r in year t, \(ED_{r,t}\) is the regional annual damage value from Eq. 1 for the same prefecture or town and year, F is a dummy used in the town regressions to signify that the town was impacted by the Fukushima event (given its impacts are orders of magnitude larger), \(\lambda _t\) is a vector of year dummies, while \(\theta _r\) is the prefecture or town fixed effects and \(e_{r,t}\) is the error term. To correct for potential heteroskedasticity, we use Driscoll-Kraay standard errors (SE). We note that the Driscoll-Kraay SE are also robust to other forms of spatial or temporal dependence across observations. We are agnostic about the kinds of deviation we might encounter in these data and, therefore, decided to use the Driscoll-Kraay specifications for the standard errors.

The second model is run at the budget category level. Given that the data are structured as a spatio-temporal panel, a fixed-effect regression methodology could be used, with the expenditure ratios as the dependent variable and the damage indices as independent variables. However, the different ratios are necessarily related to each other, and thus, to take account of this, we employ the seemingly unrelated regressions (SURE) method with Prais Winsten standard errors of autoregressive order one, as explained in Blackwell (2005), and based on Baltagi (2001), Judge et al. (1988) and Wooldridge (2002). This approach utilizes a system of SURE with error components, where one assumes that all coefficients of constant terms are the same across the system and all independent variables are quantitative and require restrictions across the panels in their equations, while fixed-effect dummies vary by panel. In our case, this translates into a set of equations:

where the left hand side is defined as the ratio:

where C is the expenditure in budget category j, \(\mu _{j,p}\) a vector of fixed effects, \(\lambda _{t}\) a vector of yearly dummy terms, and , \(e_{j,p,t}\) the error term.

We note that we do not include any additional regressors other than the damage measures and time and region fixed effects. There may of course potentially be other time-varying potential determinants of spending, at the local or regional levels, though there is no reason to expect these to be correlated with the earthquake damage measure. More specifically, since the earthquake measure is based on pre-event weights and the geophysical aspects of the earthquake, after taking account of fixed effects one can view earthquake events as random realizations of the distribution of possible (weighted) seismic activity and thus as exogenous. At any rate, it is noteworthy that since we estimate a short panel, the fixed effects already control for most of the variation in time-variant variables as well. For example, political economy variables such as the political affiliation of the local government may be an important determinant of spending. But, there are many political parties/affiliations in local politics, so we found it impossible to code them in any pattern that can be useful in a regression setting. Other variables, while potentially accessible, may be affected by the occurrence of the earthquake as well and, therefore, should not be included in our set-up; see Angrist andPischke (2008) . We therefore rely only on the set of fixed-effects as described in Eqs. (4), (5) and (6).

4 Data

4.1 Fiscal expenditure

The fiscal expenditure data are taken from the NikkeiNeeds data collected by Nikkei.Footnote 15 The data set covers, annually, the time period 2007-2014 and contains a detailed breakdown of 14 fiscal spending categories from 47 prefectures and 1,718 municipalities (city, town and village).Footnote 16 Due to computational constraints, we aggregated the 14 categories up to the following 6 categories:

-

Education

-

Public services: Health, Welfare, Labor and Fire/Police (when applicable)

-

Construction (public works)

-

Public Debt

-

Disaster Relief

-

Miscellaneous: Carry-over from previous year, Parliament costs, General Administration Costs, Agriculture and Fishery, Commerce, and Manufacturing.

Prefectures and municipalities are responsible for different levels of public services. In principle, the followings are typical task allocations:

-

Education: Prefectures are in charge of public high schools, permits for private schools, human resources, and wage payments for teachers in all public junior high and elementary schools. Municipalities are in charge of management of all public junior high and elementary schools, school lunch meal programs, construction and management of school facilities, and management of public halls and libraries.

-

Public services (Health, Welfare, Labor and Fire/Police): Prefectures are in charge of police, public hospitals, and medical services. Municipalities are in charge of fire, garbage disposal, social support programs for children, the elderly, disabled, and low-income people, and the management for pensions, social security, and national insurance.

-

Construction: Prefectures are in charge of building and managing national and prefectural roads, major rivers (first-class and second-class rivers), coast, levees, and dams. Municipalities are in charge of small streams, town/community roads, parks, and sewage.

4.2 Earthquake damages

To model earthquake damage, we utilize four different data sets that provide information on the intensity of the hazard, the vulnerability of the building stock, and population and asset exposed to it in the affected areas. The intensity measures are from the United States Geological Survey’s (USGS) ShakeMaps, which are contour maps automatically generated by using data from seismological ground stations. The station values are interpolated to point coordinates which are usually spaced 0.0167 degrees apart (approximately 1,500 meters). Each point includes several different parameters for intensity, such as peak ground acceleration (PGA), peak ground velocity (PGV), and modified Mercalli intensity (MMI).

The vulnerability of the building stock is derived from curves developed in Yamazaki and Murao (2000), where the authors surveyed the damages which buildings sustained during the 1995 Kobe Earthquake. The damage numbers are defined according to 6 building types and the construction period. The 6 building types are wood-frame, wooden-prefabricated, reinforced concrete, steel-frame, light-gauge steel-prefabricated and others.Footnote 17 Preferably one would want fragility curves that are localized, if construction standards differ locally. Here, we have assumed homogeneous vulnerability, per construction type, in all localities. The fragility curves are used on national building data, which is categorized into 4 categories: wood and wooden materials, reinforced concrete, steel, and other buildings.Footnote 18

The information about the construction period provided in the data depends on the building material, where for wood they are classified as pre-1970, 1971-1980, 1981-1990, 1991-2000 and post-2000, for concrete and steel the periods are pre-1970, 1971-1980 and post-1980 and for others there are no specific periods. Our source provides annual data (1992-2014) of the percentage share of buildings in each category in each of the 47 prefectures in Japan. Lacking further spatial dis-aggregation in terms of building characteristics, our working assumption is that all towns within a prefecture have an identical composition of the building stock, and that these only differ across prefectures.Footnote 19

Finally, to determine the asset exposure of an area (i.e., how many buildings/assets there are), we use annual nightlight values from the Defense Meteorological Satellite Program (DMSP). The data are gathered via satellite from an altitude of approximately 800km twice every 24 hours. The raw values are fit into 30 arc-second grid-cells and are then averaged to construct an annual mean value, which is normalized, converted to a digital number from 0 to 63, and made publicly available by the U.S.’s National Oceanic and Atmospheric Administration (NOAA). We use the stable, cloud-free series for the years 1992–2013 described in Elvidge et al. (1997).Footnote 20

5 Results

5.1 Descriptive statistics

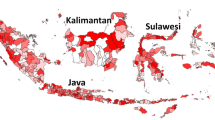

Tables 1 and 2 depict the descriptive statistics across total and expenditure categories, and by regional units (Prefectures, All Towns, Big Cities, and Smaller Towns). The top panel in each table shows the number of observations, mean, standard deviation and maximum value of each budget category, whereas the bottom panel provides the same descriptive statistics for total expenditures and earthquake damage. The budget composition between prefectures and towns is seen in the top panels. In percentage terms, prefectures spend on average a much larger share on education (25% vs. 11%) and Construction (19% vs. 11%), while towns on average spend much more on Public Services (39% vs. 19%). When comparing expenditures across the categories, the prefectures’ overall spending during this time period is a bit lower than the overall spending at the town/city level; 383 as compared to 403 trillion yen, respectively. Finally, we find that in our data, prefectures experience, on average 0.03% damage, while the corresponding figure for towns is 0.07%. This low average value may not be surprising since earthquakes are a geo-spatially constrained events.

The earthquakes that caused the most damage, according to our damage index, occurred in 2011 in Miyagi prefecture (the Great East Japan Earthquake - GEJE) and in Kariwa in Niigata prefecture in 2007 (Chuetsu offshore quake). The GEJE struck on 11 March 2011 and had a magnitude of 9.0−9.1 \(M_w\). The epicenter was 70 kilometers off the coast of the Tohoku region, and its most devastating damages were caused by a subsequent tsunami, which led to the nuclear meltdown at the Fukushima Daiichi Nuclear Power Plant. Overall, the earthquake and tsunami led to 18,426 casualties (confirmed dead and missing), almost 1 million damaged buildings and total economic costs in excess of USD 300 billion. In April 2011, the 7.1 \(M_w\) Miyagi earthquake occurred approximately 66 kilometers off the coast of Honshu. It was the strongest of the aftershocks following the GEJE catastrophe, and while there were no reported structural damages, our model will have calculated some minor damages making the aggregated damage for 2011 the highest in Miyagi prefecture.Footnote 21

5.2 Regression results

The results from the sets of level-of-spending regressions using the model in Eq. 4 are seen in Table 3. Each coefficient estimate represents a separate regression with the provided coefficient (and its accompanying standard error) describing the association of the earthquake damage variable with the budget category noted on the left. Thus, columns (1) represents estimates from 6 separate regressions; for each of the 6 budget categories, and for total fiscal spending. For example, the coefficient on the upper left (1.762) references the impact of earthquake damage on spending on education at the prefecture level.

These results show that in the prefecture sample (columns 1–2), earthquake damage is associated with more disaster relief, and consequently with higher total expenditure, but does not seem to affect any of the other spending categories. Column (3) replicates the prefecture regressions, but at the smaller administrative level. Indeed, the results obtained from the prefecture sample seems to hold. Even when examining spending at the lower administrative level, most of the increased spending that is statistically observable is for disaster relief (and miscellaneous spending). However, once we split the sample into the largest administrative units within that sample (the 59 biggest cities) in column (4), and the smaller towns in columns (5), we observe that the main fiscal impact of the earthquake events is observed for the bigger cities. For these, we observe increases in spending for all the budget categories, with the largest increase still observable in the disaster relief effort. We note that all of these regressions implicitly control for all national business cycle effects (with year dummies) and for the 3/11/2011 GEJE (since it is clearly an outlier).

Next, in Table 4, we investigate whether the earthquake is also associated with a delayed effect on the budget, in the following year. We see only weaker evidence for this. In almost all cases, the contemporaneous effect on total expenditure is statistically significant, but the lagged effect is significant only for the smaller town sample (and consequently also for the full ’all towns’ sample).

The calculated total fiscal expenditure we can expect, after an earthquake event, given past experience, is provided in Table 5, focusing on the mean earthquake and on the most damaging earthquake in our sample hitting the ’average’ prefecture and town. In other words, we calculate the assumed shift in expenditure following an earthquake with mean or maximum damage values, using the results described previously in Table 4. As can be expected, the numbers are highest if we examine the fiscal accounts of prefectures or large cities and are much higher for the most damaging earthquake than for the average one. The numbers in parentheses denote the percentage change in the fiscal spending, by category, that is associated with an average earthquake, and the largest one. We note that the increase in spending is very small for an average event, but a large event entails a potentially very large increase in spending. In the most extreme case, for small towns, a large event (in our sample, since we exclude the GEJE, this is still not a very large catastrophe) entails an increase in spending of 67 percent.

The next set of regression results are shown in Table 6 and estimate the impact of the earthquake shocks on the budget shares for each category as share in the total budget as a SURE model, as described in Eq. 5. The motivation for these specifications is the observation that different budget lines are necessarily connected, since they all come from one single (and limited) source. Given what we have observed in Table 3, it is not surprising that the share of public spending on disaster relief increases significantly at the prefecture level, with no corresponding change in the other budget lines. At the lower administrative units (columns 3–5), however, there is a decrease in the share of spending going to finance other priorities. For the bigger cities (column 4), we observe a decrease in the share of spending targeting education, while for the smaller towns we see that spending on construction and on public debt has gone down, accompanied by an increase in spending on public services.

Why does spending on other items (other than direct disaster relief) go down in municipalities, and especially in the bigger cities, but not at the prefecture level? First, public services and administrative tasks are allocated between prefectures and municipalities. Although some tasks are shared by both, prefectures tend to be in charge of high-value and geographically broad-based tasks and municipalities tend to be in charge of services that are closer to daily life and the public services they depend on. Second, since municipalities are located on the ’post-disaster frontier,’ they end up responding to the many unexpected issues that plague recoveries. As such, they need to readjust budgets more and potentially reduce spending in some categories. Third, the total budget in municipalities is much smaller than in prefectures. Thus, the composition of spending is more likely to be affected from large negative shocks.

Furthermore, we observe some differences in spending patterns after disasters between larger and smaller municipalities. The share of educational spending in the bigger cities accounts for around 20 percent, but only around 10 percent for the smaller municipalities. Bigger cities can therefore reduce educational cost more easily. In terms of public debt, in case of natural disasters, the redemption period of public debt by municipalities can be postponed as special treatment. Thus, smaller cities tend to postpone it, which will reduce the immediate expenditure on public debt servicing. In addition, in case of disasters, bonds can be issued specifically for recovery and reconstruction under better terms than during more ’normal’ times. Municipalities can issue bonds to finance reconstruction, and this can reduce their usual debt spending.

Lastly, in Table 7, we now include three lags of the independent earthquake index variable (so each estimated equation is reported per row, in this case, and all are estimated as seemingly unrelated (SURE). We note that for the large cities sample, because of the relatively short T, and the inclusion of three lags, the identification now rests a lot on cross-city comparisons rather than across time. Still, we find that the impact of the earthquake indeed persists over time, and this finding is still true also in the larger sample of smaller towns (the bottom panel of Table 7). For the much bigger sample in the lower panel, we find that the decline in spending on public services is reversed quickly, but this is not true of education and public debt (both decrease), and disaster relief; a consistent increase in spending throughout the four years examined, relative to the benchmark, but with a declining magnitude.

In the appendix, we provide a few other alternative specification to examine the robustness of our results. Table 9 includes a specification similar to Table 3, but where the budget categories are specified in their original form, divided into 14 budget lines. Given the computational burden of estimating these SURE regressions, we show these estimates for the prefecture data set. As was the case with the 6 categories specification, it is the disaster relief budget line that is most clearly statistically significant and positive. In the 14 category specification, the labor variable is also statistically significant. However, since this is spending by prefecture on labor costs in a diverse set of sectors in which the prefectural government is involved, we cannot determine what is the primary determinant of these results (i.e., which sector), and the available data does not allow us to distinguish this any further.

In appendix B, we provide estimations that include the lagged dependent variable as a regressor. We note, however, that our panel is small T and large N, so shifting to a dynamic specification entails the loss of a significant number of observations. It also makes the interpretation of coefficients more challenging. In any case, we now report these specifications (lagged dependent variable as a covariate) in Table 10. The results are broadly similar, though the significance level has changed on some of the coefficients (mostly higher significance). The spending on servicing the public debt stock seems to have declined, and there is some evidence for a decline in construction spending.

6 Conclusion

Disasters have myriad consequences, not least of which is their impact on the government’s accounts. Previous papers have typically examined the aggregate amount of fiscal spending one can expect after a disaster event. These generally concluded that: the government accounts deteriorate in a disaster’s aftermath; spending increases and tax revenue declines, debt increases, and the likelihood of a sovereign rating downgrade or even default increases. In this paper, we focus on Japan and investigate what happens to public spending and its decomposition in prefectures and towns after earthquake disasters. More specifically, Japan is the country most exposed to earthquake disaster risk globally and we use its past earthquake experience together with detailed (by budget line) fiscal data for the past decade. Importantly, in Japan, each administrative level (prefectures and municipalities) is responsible for a different set of public services. After a disaster, the central government deploys various financial arrangements and subsidies with the local governments, in order to ensure the continuing provision of public services. In particular, for large-scale disasters, a special law specifies that the central government is required to provide special subsidies and special treatments to local governments. Arguably one should not expect a large pro-cyclical decline in spending as was previously observed post-disaster in low-income countries.

We find that the share of public spending on disaster relief, at the prefecture level, increases significantly, but with no corresponding change in the other budget lines. In contrast, at the lower administrative units, we do observe a decrease in the share of spending going to finance other priorities. For the bigger cities, we observe a decrease in the share of spending targeting education, while for the smaller towns we see that spending on construction and on public debt has gone down, accompanied by an increase in spending on public services (Table 8).

The evidence we present suggests that while, at the prefecture level, fiscal policy-making is robust enough to prevent presumably unwanted declines in spending on public services because of a disaster, the same cannot be said for the city/town level. There it seems that the fiscal allocation system in Japan is still not robust enough to prevent these decreases. Since we find that these are only short-term declines in some spending categories, the question of the likely longer-term impact of these declines in spending remains open. For example, would the decrease in spending on education culminate in lower educational achievement in the affected locality? Remarkably, while there is an international literature that documents decline in educational attainment post-disaster in low- and middle-income countries, there is little that connects any observed declines in educational attainment with reduced public spending on education (e.g., Gitter and Barham (2007) and Rush (2018)). We leave these questions for future research.

Notes

There are also some papers which investigate the fiscal details of specific catastrophic events, but these are less directly related to our focus-a recent example about the London Fire of 1666 is available in Coffman et al. (2022).

By 2020, there were 20 Designated cities and 62 Core cities. In 2014, the definition for Core cities was revised to be more than 200 thousands.

See also Cabinet Office (2002) for the history of disaster management policies in post-war Japan.

According to the Act, municipalities spend the cost for recovery in the case of small disasters, but prefectures mainly pay for the cost of large disasters.

On the revenue side, the central government allows firms to reduce tax payments on pre-disaster investments. Once a disaster happened, damaged firms and households are allowed to reduce and/or waive some tax payments.

National Government Deferment Act for Reconstruction of Disaster-Stricken Public Facilities, Article 4.

https://www.mlit.go.jp/river/hourei_tsutatsu/bousai/saigai/hukkyuu/ppt.pdf.

An example of this redemption is visible in the aggregate data in the case of Hyogo prefecture after the 1995 Kobe earthquake (duPont and Noy, 2015).

The mayor is directly elected by their municipal residents.

https://www.nira.or.jp/paper/nira_report20201224.pdf. See also Tsuji et al. (2022).

All monetary values are deflated to the base year of 2011.

Local Pubic Finance Part in Regional Economy Section.

Before 2007, there was a wave of municipality mergers.

The ’others’ category contain steel-frame reinforced concrete, light-gauge steel-frame, brick, concrete block, and steel prefabricated.

Data are from the Housing and Land Survey, prepared by the Ministry of Internal Affairs and Communications. We have assumed that wood and wooden materials have similar vulnerability as wood-frame and that steel-frame and steel-prefabricated are the same as steel-frame.

In countries where more detailed information about the building stock is available, it is possible to improve the precision of these calculations of exposure and vulnerability interactions.

In this series, intermittent lights such as fishing vessels and fires have been removed, and the final values have been corrected for solar glare and light, moonlight, and clouds.

Since our modelled damage is based on shakemaps, it greatly under-estimates the damage from the GEJE, as these damages were mostly associated with the tsunami (which we do not model). We therefore also conduct our estimates excluding this outlier GEJE event. Other than the GEJE, the 2007 Chuetsu offshore quake was the most damaging earthquake as modeled by the damage index we use here. The highest impact we identify using our algorithm was in Kariwa in Niigata prefecture, which corresponds to the post-earthquake damage reports. In total, the earthquake caused 11 deaths, more than 1,000 injured and the complete destruction of 342 buildings.

References

Angrist, Joshua D., & Pischke, Jörn-Steffen. (2008). Mostly harmless econometrics. In: Mostly Harmless Econometrics. Princeton university press.

Baltagi, Badi. (2001). Econometric analysis of panel data. Hoboken: John Wiley & Sons.

Blackwell, J Lloyd, et al. (2005). Estimation and testing of fixed-effect panel-data systems. Stata Journal, 5(2), 202–207.

Coffman, D’Maris, Stephenson, Judy Z., & Sussman, Nathan. 2022. Financing the rebuilding of the City of London after the Great Fire of 1666. Economic History Review, n/a(n/a).

Cole, Shawn, Healy, Andrew, & Werker, Eric. (2012). Do voters demand responsive governments? Evidence from Indian disaster relief. Journal of Development Economics, 97(2), 167–181.

del Valle, Alejandro, de Janvry, Alain, & Sadoulet, Elisabeth. (2020). Rules for recovery: Impact of indexed disaster funds on shock coping in Mexico. American Economic Journal: Applied Economics, 12(4), 164–95.

Deryugina, Tatyana. (2017). The fiscal cost of hurricanes: Disaster aid versus social insurance. American Economic Journal: Economic Policy, 9(3), 168–98.

duPont, William, & Noy, Ilan. (2015). What happened to Kobe? A reassessment of the impact of the 1995 earthquake in Japan. Economic Development and Cultural Change, 63(4), 777–812.

Elvidge, Christopher, Baugh, Kimberly, Hobson, Vinita, Kihn, Eric, Kroehl, Herbert, Davis, Ethan, & Cocero, David. (1997). Satellite inventory of human settlements using nocturnal radiation emissions: A contribution for the global toolchest. Global Change Biology, 3(5), 387–395.

Gibson, John, Olivia, Susan, Boe-Gibson, Geua, & Li, Chao. (2021). Which night lights data should we use in economics, and where? Journal of Development Economics, 149, 102602.

Gitter, Seth R., & Barham, Bradford L. (2007). Credit, Natural Disasters, Coffee, and Educational Attainment in Rural Honduras. World Development, 35(3), 498–511.

Healy, Andrew, & Malhotra, Neil. (2009). Myopic voters and natural disaster policy. American Political Science Review, 103(3), 387–406.

Jerch, Rhiannon, Kahn, Matthew E, & Lin, Gary C. (2020). Local Public Finance Dynamics and Hurricane Shocks. Working Paper 28050. National Bureau of Economic Research.

Judge, George G, Hill, Rufus Carter, Griffiths, William, Lutkepohl, Helmut, & Lee, Tsoung Chao. (1988). Introduction to the Theory and Practice of Econometrics. New York New York John Wiley and Sons 1982.

Karim, Azreen, & Noy, Ilan. (2020). Risk, poverty or politics? The determinants of subnational public spending allocation for adaptive disaster risk reduction in Bangladesh. World Development, 129, 104901.

Klomp, Jeroen. (2019). Does government ideology shake or shape the public finances? Empirical evidence of disaster assistance. World Development, 118, 118–127.

Lis, E., & Nickel, C. (2010). The impact of extreme weather events on budget balances. International Tax and Public Finance, 17, 378–399.

Masiero, Giuliano, & Santarossa, Michael. (2020). Earthquakes, grants, and public expenditure: How municipalities respond to natural disasters. Journal of Regional Science, 60(3), 481–516.

Melecky, Martin, & Raddatz, Claudio. (2014). Fiscal responses after catastrophes and the enabling role of financial development. World Bank Economic Review, 29(1), 129–149.

Miao, Qing, Chen, Can, Lu, Yi., & Abrigo, Michael. (2020). Natural disasters and financial implications for subnational governments: Evidence from China. Public Finance Review, 48(1), 72–101.

Mohan, Preeya S., Ouattara, Bazoumana, & Strobl, Eric. (2018). Decomposing the macroeconomic effects of natural disasters: A national income accounting perspective. Ecological Economics, 146, 1–9.

Noy, I., & Nualsri, A. (2011). Fiscal storms: Public spending and revenues in the aftermath of natural disasters. Environment and Development Economics, 16(1), 113–128.

Okubo, Toshihiro, & Strobl, Eric. (2021). Natural disasters, firm survival and growth: Evidence from the Ise Bay Typhoon. Japan. Journal of Regional Science, 61(5), 944–970.

Panwar, Vikrant, & Sen, Subir. (2020). Fiscal repercussions of natural disasters: Stylized facts and panel data evidences from India. Natural Hazards Review, 21(2), 04020011.

Rush, J. V. (2018). The impact of natural disasters on education in Indonesia. Economics of Disasters and Climate Change, 2(2), 137–158.

Skoufias, Emmanuel, Strobl, Eric, & Tveit, Thomas. (2021). Can we rely on VIIRS nightlights to estimate the short-term impacts of natural hazards? Evidence from five South East Asian countries. Geomatics, Natural Hazards and Risk, 12(1), 381–404.

Tsuji, Takuya, Okubo, Toshihiro, & Nakagawa, Masayuki. 2022. Jinko Gensho Syakai ni Idomu Shichosoncho no Jituzou to Motomerareru Ri-da-shippu (written in Japanese), (Heads of Municipalities in the Depopulated Economy in Japan). NIRA Research Report, 2022-1.

Unterberger, Christian. (2018). How flood damages to public infrastructure affect municipal budget indicators. Economics of Disasters and Climate Change, 2(1), 5–20.

Wooldridge, Jeffrey M. (2002). Econometric analysis of cross section and panel data. Cambridge: MIT press.

Yamazaki, F., & Murao, O. (2000). Vulnerability Functions for Japanese Buildings based on Damage Data from the 1995 Kobe Earthquake. Pages 91–102 of: Elnashai, A S, & Antoniou, S (eds), Implications of Recent Earthquakes on Seismic Risk. Singapore, World Scientific.

Funding

Open Access funding enabled and organized by CAUL and its Member Institutions.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Noy, I., Okubo, T., Strobl, E. et al. The fiscal costs of earthquakes in Japan. Int Tax Public Finance 30, 1225–1250 (2023). https://doi.org/10.1007/s10797-022-09747-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-022-09747-9