Abstract

Economists have adopted the Pigouvian approach to climate policy, which sets the carbon price to the social cost of carbon. We adjust this carbon price for macroeconomic uncertainty and disasters by deriving the risk-adjusted discount rate. We highlight ethics- versus market-based calibrations and discuss the effects of a falling term structure of the discount rate. Given the wide range of estimates used for marginal damages and the discount rate, it is unsurprising that negotiators and policy makers have rejected the Pigouvian approach and adopted a more pragmatic approach based on a temperature cap. The corresponding cap on cumulative emissions is lower if risk tolerance and temperature sensitivity are more uncertain. The carbon price then grows much faster than under the Pigouvian approach and discuss how this rate of growth is adjusted by economic and abatement cost risks. We then analyse how policy uncertainty and technological breakthrough can lead to the risk of stranded assets. Finally, we discuss various obstacles to successful carbon pricing.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

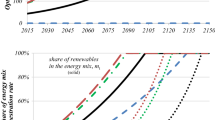

Global warming is in part caused by man-made emissions resulting from combustion of fossil fuel. Scientists know what needs to be done to avoid a climate catastrophe: emissions must be brought down now and rapidly. If nothing is done to curb the use of oil, gas, and coal and to replace these sources of energy by solar, wind, and other forms of renewable energy, the heating of the planet will continue relentlessly. Despite hopeful signs in Europe (mainly the European market for emissions permits) and the USA (the election of President Biden with an ambitious agenda for climate policy) and China’s commitment to go carbon net zero by 2060, India and various other countries rely on coal for cheap energy and will try to delay the green transition. Furthermore, oil-, gas- and coal-producing countries such as Saudi Arabia, Russia, Algeria, and others have no interest in the green transition either. Most economists recommend policy makers to implement a uniform carbon price throughout the globe and to have transfers from rich to poor countries to make sure all countries are on board. Furthermore, policy makers should commit to a path of rising carbon prices for the next three or four decades so businesses can plan their long-term investments to be in line with a carbon-free economy.

The most common approach used by economists has been to set the carbon price to its Pigouvian price, which in climate economics is called the social cost of carbon (SCC). The SCC is the expected present discounted value of all damages done to the economy resulting from emitting one ton of carbon today. We discuss this concept at length in Sect. 2 and derive a tractable expression for the SCC. We show how the SCC needs to be adjusted for macroeconomic uncertainty, the risk of macroeconomic disasters, but also depends on climatic and damage ratio uncertainties. We also discuss the effects of a declining term structure of the discount rate on the carbon price. We then calibrate and find using the latest econometric evidence on damages from global warming (Burke et al., 2015), a simple model relating temperature to cumulative emissions (e.g. Allen et al., 2009; Matthews et al., 2009), and the macroeconomic disaster model for a market-based estimate of the discount rate (Barro, 2006, 2009) that the optimal carbon price is about $100 per ton of emitted CO2. This price should subsequently grow at a rate equal to the trend rate of growth of the economy. If the risks of climatic tipping points are taken account of, the carbon price can become much higher again (Cai and Lontzek, 2016) and cascading tipping points can push up the carbon price much further (Lemoine & Traeger, 2016; Cai and Lontzek, 2016).

Given the debates about whether to use a prescriptive ethics- or descriptive market-based calibration of the discount rate and the much lower damages used in most integrated assessment models (e.g. around $15 per ton of CO2 in the DICE model of Nordhaus (2017)), there is an embarrassingly wide range of recommended carbon prices which is not very helpful for policy makers.

It is thus not surprising that policy makers and the negotiators of the Intergovernmental Panel on Climate Change have adopted a more pragmatic approach. At the Paris Agreement signed in 2016, it was agreed to keep global mean temperature growth well below 2° and to aim for a cap of 1.5 °C. We show in Sect. 3 that this temperature cap implies an upper limit on global cumulative emissions and shows how this upper limit is affected by temperature sensitivity uncertainty and risk tolerance. We show that this upper limit requires a time path of the carbon price that grows at a rate equal to the interest rate corrected for risks to the rate of economic growth and to marginal abatement costs. This so-called Hotelling rule is not welfare based but cap based and corresponds to a more pragmatic approach.

Risks in conducting climate policy not only derive from uncertainty about the climatic system, global warming damages, or economic growth prospects, but also from uncertainty about government policy and the risk of policy tipping or from uncertainty about the sudden drops in the cost of fossil fuel or renewable energy resulting from technological breakthroughs (e.g. the invention of horizontal drilling for shale gas). We show in Sect. 4 that this and more generally a disorderly transition to the green economy can lead to the risk of stranded assets provided investments once made are difficult to shift from carbon intensive to green sectors, and vice versa. This provides a case for financial regulators to regularly conduct climate stress tests.

Finally, we offer in Sect. 5 a brief review of the obstacles to successful carbon pricing and in Sect. 6 a brief conclusion and some suggestions for further research.

2 Adjusting the Pigouvian carbon price for economic and climatic risks

A very popular approach to finding the right price of carbon is to assume away all other market failures and imperfections and consider the optimal carbon pricing policy for the global economy. The revenues from the carbon tax (or from selling emission permits) are rebated in lump-sum fashion to the private sector. Hence, important problems such as unemployment, information failures leading to problems of adverse selection or moral hazard and attaining an equitable distribution of incomes within a generation are cast aside. Also, all countries are supposed to cooperate to avoid international free-rider problems or, alternatively, rich countries offer side payments to poorer countries to persuade them to have the same carbon price throughout the globe. The optimal carbon price is then set to the Pigouvian carbon price, also known as the social cost of carbon (SCC). The SCC is defined as the expected present discounted value of all present and future damages to GDP in the world economy resulting from emitting one ton of carbon today, where the discount rate used to evaluate this is called the risk-adjusted or stochastic discount rate (SDR). Since greenhouse mixes perfectly, it does not matter where in the world emissions takes place.

The outline of this section is as follows. Section 2.1 derives tractable expressions for the social discount rate and social cost of carbon when there is uncertainty about the rate of economic growth (i.e. consumption follows a geometric Brownian motion), damages as fraction of aggregate consumption are linear in temperature (cf. Burke et al., 2015), and temperature is a linear function of cumulative emissions (e.g. Allen et al., 2009; Matthews et al., 2009). Section 2.2 then calibrates the model and gives a quantitative assessment of the risk-adjusted social cost of carbon. Section 2.3 extends the model of Sect. 2.1 to allow for the risk of rare macroeconomic disasters (cf. Barro, 2006, 2009). Section 2.4 discusses market-based calibrations based on insights from asset pricing with ethics-based calibration and how these affect the way macroeconomic risks affect the social discount rate and cost of carbon. Section 2.5 discusses the effects of climate tipping points (e.g. melting of the Greenland Icesheet or of the permafrost) and how this affects the optimal carbon price. Finally, Sect. 2.6 explains why in practice the social discount rate might decline with the length of the horizon (i.e. has a declining term structure), and why this is so important for evaluating climate policy as this has consequences many decades or centuries ahead.

2.1 The social cost of carbon under normal macroeconomic uncertainty

To make headway, it is easiest to learn from the asset pricing literature which uses an object called the stochastic discount factor (SDF) to obtain the share price by taking the expected present value of a stream of present and future dividends. In a similar vein, one can evaluate the SCC which corresponds to the expected present discounted value of the stream of present and future marginal damages resulting from emitting one ton of carbon today. We assume recursive utility which distinguishes the coefficient of relative risk aversion, γ, from the inverse of the elasticity of intertemporal substitution, η, and specifies a rate of time impatience (or utility discount rate), ρ. The function describing utility to go from time t onwards, denoted by Jt, is then defined recursively using an aggregator function \(f(C,J)\)(see Epstein and Zin (1989) for a discrete time and Duffie and Epstein (1992) for a continuous-time formulation). This recursive definition of utility to go is given by

Expected utility analysis is a special case corresponding to \(\gamma \eta = 1\) in which case policy makers maximise at time t the expected value of the usual discounted welfare loss function \(\int\limits_{t}^{\infty } {e^{{ - \rho (s - t)}} \left( {\frac{{C_{s} ^{{1 - \eta }} - 1}}{{1 - \eta }}} \right)ds} .\) This special case does not distinguish risk aversion from the inverse of the elasticity of intertemporal substitution and can be used in case there is no uncertainty. If there is uncertainty, this special case implies that policy makers have neither a preference for early nor for late resolution of uncertainty. For these reasons, the more general recursive utility specification is used. The general specification implies a preference for early resolution of uncertainty if risk aversion exceeds the inverse of the elasticity of intertemporal substitution, i.e. \(\gamma \eta > 1,\) which is in line with empirical evidence. As we will see in our calibration, the more general specification of recursive preferences allows a market-based calibration (e.g. Barro, 2009; Cai & Lontzek, 2019; Cai et al., 2016; Lontzek et al., 2015) which attempts to explain the equity premium puzzle whilst the simpler expected utility specification with \(\gamma \eta = 1\) allows for an ethics-based calibration (e.g. Arrow et al., 2014; Gollier, 2002, 2011).

We need three further assumptions about the endowment, damages, and temperature.

First, world consumption follows a geometric Brownian motion \(dC_{t} = \mu C_{t} dt + \sigma C_{t} dW_{t} ,\) where μ denotes the drift of this stochastic process and σ > 0 the volatility and Wt is a unit Wiener process. This gives the solution \(C_{s} = C_{t} \exp \left( {\left( {\mu - \frac{1}{2}\sigma ^{2} } \right)(s - t) + \sigma W_{s} } \right),\) so mean consumption is \(E\left[ {C_{s} } \right] = \exp \left( {\mu (s - t)} \right)C_{t}\) and expected consumption growth is \(E\left[ {\ln \left( {C_{s} /C_{t} } \right)} \right] = g(s - t)\) with \(g \equiv \mu - \frac{1}{2}\sigma ^{2} .\) It is important to account for uncertainty about the rate of economic growth, because this negatively affects the social discount rate and increases the social cost of carbon via the prudence effect in Eq. (3) discussed below. Furthermore, it positively affects the social discount rate and curbs the social cost of carbon via the insurance effect in Eq. (3) discussed below.

Second, damages resulting from a marginal increase in temperature are proportional to world consumption. The coefficient of proportionality is called the marginal damage ratio (MDR). We thus do not adopt the convex (quadratic) specification used for the DICE model by Nordhaus (2017), but the linear specification found in the detailed empirical evidence provided by Burke et al. (2015). We assume that these damages are known with certainty, but we will discuss the effects of damage uncertainty briefly at the end of this sub-section.

Third, temperature is a linear function of cumulative carbon emissions, where the marginal effect of cumulative emissions on temperature is the transient climate response to cumulative emissions or the TCRE. Recent insights in atmospheric science suggest that this is a good approximation to detailed models of the dynamics of carbon in the atmosphere and in the oceans and of the dynamics of temperature of the atmosphere and the oceans (e.g. Allen et al., 2009; Matthews et al., 2009).

Armed with these assumptions, the social cost of carbon is then defined by

where Hs denotes the stochastic discount factor to discount from time s to the present for preferences (1). It can be shown that Eq. (2) gives the optimal carbon price Pt or SCC at time t as

where the growth-adjusted SDR is given by \(r - g = \rho + (\eta ^{{ - 1}} - 1)(g - \frac{1}{2}\gamma \sigma ^{2} ).\) The SCC is proportional to the marginal damage ratio, the transient climate response to cumulative emissions, and current world consumption, and inversely proportional to the difference between the risk-adjusted discount rate and the growth rate. We correct the discount rate for the economic growth rate since global warming damages rise in line with world economic activity. Hence, this growing-damages effect pushes up the SCC and the carbon price.

The intuition of the drivers of the SDR and their effects on the SCC follow from rewriting the SDR as \(r = \rho + \eta ^{{ - 1}} g - \frac{1}{2}(1 + \eta ^{{ - 1}} )\gamma \sigma ^{2} + \gamma \sigma ^{2} .\) The term ρ is the impatience effect: more impatient policy makers use a higher discount rate and thus price carbon less vigorously. The term \(\eta ^{{ - 1}} g\) is the affluence effect: richer future generations and more intergenerational inequality aversion (or a lower elasticity of intertemporal substitution) boost the discount rate and depress the carbon price. The term \(- \frac{1}{2}(1 + \eta ^{{ - 1}} )\gamma \sigma ^{2}\) is the prudence effect: the more risk-averse policy makers and the bigger their coefficient of relative prudence \((1 + \eta ^{{ - 1}} )\) and the volatility of economic growth and emissions, the lower the social discount rate and the higher the carbon price. This term reflects precautionary saving in response to income uncertainty (cf. Kimball, 1990), but is typically small. These first three terms can in case of exponential utility (i.e. \(\gamma \eta = 1\)) be rewritten as \(\rho + IIA \times \mu - \frac{1}{2}IIA^{2} \times \sigma ^{2} ,\) where \(IIA = 1/\eta\) is the coefficient of relative intergenerational inequality aversion or the elasticity of intertemporal substitution (cf. Gollier, 2011, Eq. (10)). The final term in the expression for the risk-adjusted discount rate, \(\gamma \sigma ^{2} ,\) captures the insurance effect: in future states of nature where economic growth is high, damages are high too as damages are proportional to world economic activity. Since abatement is a procyclical investment with higher yields in good times, policy makers can take less climate action, which is reflected in a higher risk-adjusted discount rate and a lower SCC and carbon price, especially when risk aversion (γ) is large.

The growth-corrected social discount rate \(r - g = \rho + (\eta ^{{ - 1}} - 1)(g - \frac{1}{2}\gamma \sigma ^{2} )\) simplifies to \(r - g = \rho\) if the elasticity of intertemporal substitution η equals one in which case uncertainty has no impact whatsoever. If the elasticity of intertemporal substitution η exceeds (is less than one), uncertainty increases (depresses) the growth-corrected discount rate. This point is well known in the literature on asset pricing (cf. Smith, 1996a, 1996b; Svensson, 1989; Weil, 1990). It implies that uncertainty curbs (boosts) the social cost of carbon.

Before we quantify the risk-adjusted social cost of carbon, we briefly discuss how Eq. (3) should be adjusted to allow for uncertainty in the damage ratio. Damages as fraction of consumption increase in temperature but also depend on potentially skewed shocks. Van den Bremer and van der Ploeg (2021) show that the expression of Eq. (3) is unaffected if the damage ratio uncertainty is not skewed, but that expression (3) needs to have a positive multiplicative markup if the distribution of damage ratio shocks is right skewed. The markup is then bigger if damage ratio shocks display a higher volatility and more mean reversion. More analysis of the effects of damage ratio uncertainty on the optimal social cost of carbon is given by Crost and Traeger (2014) who allow for uncertainty in the power coefficient on temperature in the damage function. Rudik (2020) assumes that the damage ratio increases in temperature to the power of some coefficient and investigates the effect of uncertainty in this coefficient on the social cost of carbon. He also studies the effects of learning and damage misspecification.

2.2 A quantification of the risk-adjusted carbon price

A numerical example gives further insights. Let us first ignore the econometric estimates of asset pricing and follow Ramsey (1928) and Stern (2007) who argue that discounting the welfare of future generations is ethically indefensible and therefore take a zero or very small rate of time impatience (say, ρ = 0) and let us also follow Gollier (2011) who assumes IIA = 2 (i.e. η = 0.5). In contrast, in asset pricing the rate of time impatience is empirically much higher and it is assumed that volatility curbs share prices and therefore the elasticity of intertemporal substitution η should exceed 1. We take risk aversion to be γ = 5, which implies a preference for early resolution of uncertainty. We assume that world economic activity in 2017 is about 80 trillion US dollars and trend growth of world consumption is g = 2% per year. Following Kocherlakota, 1996), we set the annual volatility to σ = 3.6%. We thus find that the risk-adjusted discount rate equals \(r = 2 \times 2 - 0.324 = 3.676\%\) per year. This adjustment for risk to the so-called Keynes–Ramsey rule for the discount rate seems modest (cf. Arrow et al., 2014; Gollier, 2002). When we split up the discount rate into its time impatience (zero), affluence (4% per year), prudence (− 0.972% per year), and insurance (0.648% per year) components, we see that the last two terms offset each other and that the net effect on the discount rate is quite small.

A typical figure for the TCRE is 1.8 °C per trillion tons of cumulative emissions (e.g. Allen et al., 2009; Matthews et al., 2009; van der Ploeg, 2018). To get an estimate of the marginal damage ratio, we deduce from (Burke et al., 2015, Fig. 5, panel (d)) an approximate figure of 12.5% damages to world economic activity for every increase in temperature by 1 °C so that we set MDR = 0.125. The carbon price then follows from Eq. (2) as $1074 per ton of carbon or $293 per ton emitted CO2. This is very much higher than the carbon prices that follow from DICE. There are two reasons for this. First, Nordhaus uses a higher rate of time impatience, ρ = 1.5% per year, in which case the growth- and risk-corrected discount rate is not 1.676% but the higher value of 3.176% per year. This depresses the carbon price from $293 to $155 per ton of CO2. Second, in contrast to Burke et al. (2015), the DICE specification for the ratio of damages to output is quadratic in temperature, and therefore, marginal damages are not constant but rise linearly with temperature. Evaluating the DICE marginal damages at reasonable temperature yields much lower marginal damage estimates than the ones of Burke et al. (2015), a factor 2.5–100 times smaller at 2 °C. Nordhaus (2017) calibrates damages as 0.236% loss in global income per degree Celsius squared, so that marginal damages are 2.1% and 8.5% of world GDP at, respectively, 3 and 6 °C. The marginal damage ratio thus equals 0.472% loss of global income per degree Celsius. At 2 °C, this gives for DICE a MDR of 0.944% instead of for Burke et al. (2015) a constant 12.5% of global economic activity. It follows that the SCC shrinks to $12 per ton of CO2. DICE also has a higher elasticity of intertemporal substitution of η = 2/3 and ignores growth uncertainty which implies that the SDR is 2.5% per year and the carbon price finally becomes $16 per ton of CO2. We summarise this quantitative assessment of the social cost of carbon in Table 1, and we will compare it in Sect. 2.3 when we also allow for the risk of small macroeconomic disasters.

In the remainder, we use the (Burke et al. 2015) estimate of the marginal damage ratio since their empirical work suggests that it is roughly constant and they obtained these estimates from detailed scientific estimates.Footnote 1 Although this estimate of the MDR is very large compared to the DICE estimate, it still does not include other economic damages associated with global warming such as tropical cyclones or sea-level rises which are typically included in other damage estimates such those of DICE. From panel (d) of Fig. 5 in Burke et al. (2015), we see that this estimate of the MDR also has a wide range from 0.06 to about 0.18, which includes our estimate of 0.125. Furthermore, the TCRE has a 5–95% probability range of 1.4–2.5 °C (Allen et al., 2009) or 1.0–2.1 °C per trillion tons of carbon (Matthews et al., 2018). Depending on the outcomes of the MDR and the TCRE, there is thus a wide range of the optimal carbon price varying from $78 to $586 per ton of CO2 which includes our figure of $293 per ton of CO2.Footnote 2

2.3 The role of the risk of macroeconomic disasters

In asset pricing (e.g. Lucas, 1978), trees grow fruits each year and the growth rate of the harvest is stochastic. The objective is to put a price on these trees. This metaphor is used to price assets, where the fruits correspond to a stream of unknown future dividends. But the climate is also an asset because the social cost of carbon corresponds to the expected present discounted value of all future marginal damages caused by emitting one ton of carbon today. Barro (2006, 2009) extends the stochastic process for consumption growth for the risk of macroeconomic disasters (e.g. virus outbreaks, recessions, wars, natural disasters). If the instantaneous probability of a disaster is π and the disaster destroys ln(1–b)Ct of the endowment, expected consumption growth is \(g = \mu + \frac{1}{2}\sigma ^{2} - \pi E\left[ b \right] < \mu + \frac{1}{2}\sigma ^{2} .\) The price-dividend ratio, V, is the expected present discounted value of a tree with the dividend an unleveraged claim on consumption. It follows that the dividend-price ratio is given by

(Barro, 2009). We thus generalise (3) and obtain the social cost of carbon or carbon price as

where \(r^{e} = 1/V + g\) is the expected return on unleveraged equity. The equity premium is

where \(r^{f}\) denotes the risk-free return. To explain the equity premium puzzle, one needs a high degree of risk aversion γ and a high risk of disasters. Uncertainty is seen to depress the price-dividend ratio so one needs η > 1 (see (4)). Barro (2009) sets the risk of disasters to π = 1.7%/year and the average shock size to E[b] = 0.29%. This gives \(E\left[ {(1 - b)^{{ - 4}} } \right] = 7.69\) and \(E\left[ {(1 - b)^{{ - 3}} } \right] = 4.05.\) Furthermore, the annual volatility and drift of consumption growth are set to σ = 2% and μ = 2.5%/year, respectively. Preferences are calibrated as γ = 4 > η = 2, and ρ = 5.2%/year. Note that η > 1 whilst most ethics-based calibrations have IIA = 1/η > 1 (e.g. Gollier, 2011). This gives trend growth of g = 2%/year, a price-dividend ratio of V = 20.7, a safe interest rate of rf = 1%/year, a return on risky assets of re = 6.9%/year, and a risk premium of 5.9% per year. Note that disaster risk has a much bigger impact than normal macroeconomic uncertainty: e.g. to compensate for a rise of the volatility σ by 10%, one needs an increase of only 0.38% in consumption for all years but to compensate for a 10% rise in disaster risk π this figure is 2.6%.

To see what Barro’s market-based calibration with disaster risks implies for the optimal risk-adjusted carbon price, we use 1/V = 4.83% per year for the risk- and growth-corrected interest rate (instead of 1.676% per year) and find with our marginal damage estimate from Burke et al. (2015) that the carbon price drops from $293–$102 per ton of emitted CO2 (See final row of Table 1.) Hence, a price of about $100 per ton of CO2 can be justified based on the scientific evidence about the production damages presented in Burke et al. (2015) and the asset pricing with disaster risk evidence of Barro (2009). Despite a market-based calibration, it is a high carbon price. It is about four times higher than the current market price for European emission allowances.

Bansal and Yaron (2004) offer an alternative for explaining the equity premium puzzle to the macroeconomic disaster risk approach of Barro (2006, 2009). They use time-varying variance of shocks to the long-run economic growth rate which gives rise to long-run risks. Cai and Lontzek (2019) in their integrated assessment of climate policy under a wide range of economic and climate uncertainties and tipping points use Epstein–Zin preferences in their market-based calibration with η = 1.5 > 1, γ = 10 > 1/η and long-run risks as in Bansal and Yaron (2004). Their numerical policy simulations confirm our analytical findings that macroeconomic growth uncertainty depresses the optimal risk-adjusted carbon price (consistent with η > 1). This important paper also deals with climate tipping points (e.g. melting of Greenland or of the permafrost, or the reversal of the Gulf Stream) which differ from the risk of rare macroeconomic disasters discussed by Barro (2006, 2009) and are discussed in Sect. 2.5.

Here and in Sect. 2.1, we highlighted the role of risks of rare macroeconomic disasters and Epstein–Zin preferences, respectively, in explaining the equity premium puzzle. Long-run risks also help to explain this puzzle. In fact, there are various other methods that have been proposed such as habit persistence (Campbell & Cochrane, 1999), idiosyncratic risk (Constantinides & Duffie, 1996), and debt, balance sheets and institutional finance (Brunnermeier, 2009). Cochrane (2017) critically surveys all these methods and shows their similarities and discusses their merits and their problems.

2.4 Ethics-based versus market-based calibration

As we have seen, an ethics-based calibration typically sets the coefficient of intergenerational inequality aversion bigger than one (e.g. IIA = 2 and thus η = ½ < 1 as in Gollier (2011) and many other studies of optimal climate policy) in which case uncertainty boosts the optimal carbon price. A market-based calibration, in contrast, assumes that uncertainty depresses equity prices and thus sets the elasticity of intertemporal substitution η greater than 1 in which case macroeconomic uncertainty reduces the optimal carbon price. A market-based calibration gives a big role for the risk of macroeconomic disasters, which cuts the dividend-price ratio and thus the SDR much more than normal growth uncertainty. Hence, the risk of macroeconomic disasters has much bigger negative effects on the carbon price if η > 1. However, Epstein et al. (2014) argue that Epstein–Zin preferences are too restrictive because they cannot capture all three aspects of preferences, namely risk aversion, intertemporal substitution or intergenerational inequality aversion, and preference for early resolution of uncertainty. For example, one might calibrate γ and η to market data, but this may lead to an unrealistic preference for early resolution of uncertainty.

So, what should one use: an ethics-based or a market-based calibration? The choice seems to matter as the comparative statics results with respect to uncertainty depend on which one is chosen. The answer might well be that one needs to use both in the sense that the best approach may be to have a model where policy makers adopt ethics-based preferences with a near-zero impatience ρ (and possibly also an IIA > 1 or η < 1) and the private sector which is much less patient (and has an η > 1). It can be shown that, if stochastic shocks are ignored, more patient policy makers than private agents implies that the optimal policy consists of two components: a carbon price equal to the social cost of carbon and a capital subsidy to correct for the excessive impatience of private agents (Barrage, 2018). In such a context, if policy makers do not want to implement the required capital subsidy, carbon pricing is time inconsistent.

2.5 Effects of climate tipping points and tail risks on the optimal carbon price

Just like a small risk of rare macroeconomic disasters has a big effect on the SDR and thus on the carbon price (in contrast to the modest effect of conventional macroeconomic uncertainty), small risks of climatic tipping and abrupt shifts in the climatic regime (e.g. caused by melting of the Greenland or the Antarctic Ice Sheet, the melting of the permafrost, or the reversal of the Gulf Stream) generate big increases in the optimal risk-adjusted carbon price because a hotter planet increases the risk of tipping (e.g. Cai & Lontzek, 2019; Lemoine & Traeger, 2014; Lontzek et al., 2015; van der Ploeg & de Zeeuw, 2018). Policy makers must thus not only internalise the global warming externalities arising from damages to aggregate output but also internalise the adverse effect of temperature on the risk of climate disasters. The main insight is that the risk of climate tipping leads to very big increases in the optimal carbon price. To make things worse, if the setting off of one climate tipping point raises the likelihood of another tipping point being set off, the ensuing risk of cascading climate tipping points can boost the carbon price even more (Cai et al., 2016; Lemoine & Traeger, 2016).

Furthermore, it has been argued that the combination of fat-tailed distributions and power utility functions implies that the optimal carbon price is infinite in which case the world is willing to give up all national income to cut emissions (Weitzman, 2009, 2011). However, if there is a bound on marginal utility, the “dismal” theorem no longer holds. Pindyck (2011) surveys the effects of fat-tailed and thin-tailed uncertainty on climate policy. He argues that cost–benefit analysis of carbon pricing is fraught with difficulties as not even the probability distribution of future temperature impacts is known. Still, skewed uncertainties boost the carbon price a lot.

Before we move on, we want to point out that mitigating climate change via pricing carbon is important but in practice adaptation policies are essential too. Adaptation is especially important after a climate tipping point when large parts of the economy may be destroyed. The most important adaptation strategies are investment to protect against disasters and for people to move and migrate after a disaster has hit. Not taking account of this will lead to overestimates of the costs of global warming. For example, Desmet et al. (2021) show that ignoring adaptation leads to costs of 4.5% of GDP in 2200 compared to 0.11% of real GDP if there is adaptation. In case adaptation is infeasible after a macroeconomic disaster prudence and mitigation is even more important, and thus, the cost of carbon needs to be higher.

2.6 Effects of a falling term structure for the social discount rate

Equations (3) and (4) imply a flat term structure for the SDR or the dividend-price ratio. In other words, the same rate is used to discount marginal damages from year 51 to 50 as from year 1 to 0. But many economists argue that the term structure of the SDR slopes downwards and that the one-year discount rate used in the future is lower than that used today (e.g. Arrow et al., 2014). If more distant discount rates are smaller, there is a downward-sloping term structure for the SDR. There are various reasons for a falling term structure.

The first reason is that, if shocks to consumption growth rates and the interest rate are positively correlated over time and thus persistent, the schedule of efficient discount rates may decline as the horizon lengthens (Vacisek, 1977). It then follows that the downward adjustment of the SDR due to uncertainty becomes bigger for longer horizons provided the autocorrelation coefficient of the process, φ, is between zero and one (e.g. Gollier, 2012). The positive correlation in consumption growth shocks makes future consumption riskier and thus makes the prudence effect in the SDR (see Sect. 2.1) bigger for more distant horizons. The prudence effect is multiplied by \((1 - \varphi )^{{ - 2}} > 1\) as the horizon tends to infinity. Hence, the more autocorrelation in shocks to consumption growth (higher φ), the bigger the amplification of the prudence effect at very long horizons.Footnote 3 However, estimated models with autocorrelation in consumption growth imply only modest declines in the SDR. But if subjective uncertainty about the trend and volatility of consumption growth is introduced, this can lead to more rapid declines in the SDR (e.g. Gollier, 2008; Weitzman, 2007). For example, if mean consumption growth is 1% or 3% per year with 50–50 chance (with zero impatience, ρ = 0 and risk aversion and intergenerational inequality aversion equal to two, γ = 1/η = 2), the SDR (excluding the insurance term, see Sect. 2.1) falls from 3.5% today to 2% per year in three centuries (Gollier, 2008).

The second reason for a declining term structure of the SDR argues that evaluating the expected net present value of a stream of uncertain marginal damages using a constant SDR is equivalent to calculating the net present value with a certain, but decreasing certainty-equivalent value of the SDR, i.e. \(- \ln \left( {E\left[ {e^{{ - SDR \times t}} } \right]} \right)/t\) if the horizon is t (Weitzman, 1998, 2001, 2007). Jensen’s inequality gives \(E\left[ {e^{{ - SDR \times t}} } \right] > e^{{ - E\left[ {SDR} \right]t}} ,\) so that the certainty-equivalent value of the SDR is less than \(E\left[ {SDR} \right]\) and this difference increases as the horizon lengthens. Table 2 gives the certainty-equivalent value of the SDR for different horizons when the SDR is 2%, 4% or 6%, each with a probability of one third. This value equals the mean value of the SDR (i.e. 4%) at infinitesimally small horizons and tends to the minimum value of the SDR (i.e. 2%) as the horizon becomes infinite. At very long horizons, the payoff with the lowest SDR dominates the payoffs under the other values of the SDR. Uncertainty about future discount rates thus calls for a decreasing term structure of the certainty-equivalent value of the SDR. This boosts the SCC and the carbon price.

3 Alternative: Temperature caps and the safe carbon budget

The Pigouvian approach leads to an embarrassingly wide range of figures for the carbon price to be implemented. This is due to disagreements and fundamental uncertainties about the size of the marginal damages, about the best social discount rate to use, and about the sensitivity of temperature to emissions. It is therefore no surprise that policy makers and climate negotiators have adopted a more pragmatic approach based on a temperature cap of say 1.5 or 2 °C. This is often justified by arguing that if temperature exceeds the cap, the risk of tipping points becomes intolerably large. Various authors have addressed the determination of the shadow price in the case where society imposes a maximum on the concentration of carbon in the atmosphere (e.g. Chakravorty et al., 2006, 2008). This leads to Hotelling paths for the optimal carbon price (and an interesting discussion about the optimal order of extracting different types of fossil fuel). Here we consider a temperature cap or cap on cumulative emissions, which also leads to a Hotelling path for carbon prices that ensure that temperature and emissions stay below the cap. To illustrate these points, we first present the trade-offs in the starkest possible way.

Let global warming be described by \(T = T_{0} + \mathop {TCRE}\limits^{{\_\_\_\_\_\_\_\_}} \times \varepsilon \times E,\) where E denotes cumulative emissions and ε is a lognormally distributed shock to the TCRE. If \(\ln \varepsilon \sim N( - \sigma ^{2} /2,\sigma ^{2} ),\) E[ε] = 1, then the mean of TCRE is \(\mathop {TCRE}\limits^{{\_\_\_\_\_\_\_\_\_}}\) and the standard deviation is \(\mathop {TCRE}\limits^{{\_\_\_\_\_\_\_\_}} \sqrt {\exp (\sigma ^{2} ) - 1} .\) If the temperature cap of say 2 °C must be met with a risk tolerance of 0 < β < 1, i.e. \({\text{prob}}\left[ {T \le 2} \right] = 1 - \beta ,\) we obtain the following cap on cumulative emissions:

where F(.) is the normal density and \(\bar{E}\) denotes the safe carbon budget (van der Ploeg, 2018). Hence, a tighter cap on temperature, a higher mean and variance of the TCRE, and a lower risk tolerance β imply that less carbon can be burnt and thus that the safe carbon budget is lower. Taking a slighter wider range for the TCRE than reported in Allen et al. (2009), i.e. 1.2–3.3 °C/TtC, we calibrate the mean and standard deviation of TCRE to be 2.0 °C and 0.508 °C, and the standard deviation to be σ = 0.25.

Table 3 indicates that with a cap of 2 °C and a risk tolerance of 1/3 (used by the IPCC), the safe carbon budget is 1,228 GtCO2. Tightening the risk tolerance to 10% or 1% cuts the safe carbon budget to 994 or 776 GtCO2. A cap of 1.5 °C drastically curbs the safe carbon budget. Given that current global use of fossil fuel is about 37 GtCO2, Table 1 reports in brackets how many years we have left and can go on using fossil fuel under business as usual. With a 2 °C cap and risk tolerance of 1/3, the point of no return will be reached in 2048. Much less time is left with a tighter temperature cap and tighter risk tolerance.

To find the cost-minimising time path of carbon prices that ensures that cumulative emissions stay below the safe carbon budget, one appeals to the Hotelling arbitrage principle. The cost of postponing emission of a ton of carbon is \(P_{{t'}} \times e^{{r(t' - t)}} ,\) which must equal the cost of emitting one ton today, \(P_{t} .\) Efficiency requires that one is indifferent between these two possibilities. It thus follows that the carbon price or social cost of carbon must grow at a rate equal to the rate of interest r. Let T denote the end of the fossil era, \(b^{R} > 0\) denote the production cost of one unit of renewable energy, and \(b^{F}\) denote the production cost of fossil fuel. We suppose that the production of fossil fuel exceeds that of renewable energy, \(b^{F} > b^{R} .\)Footnote 4 At the end of the fossil era, we have \(b^{R} = b^{F} + P_{T}\), and thus, the cost-minimising carbon-price time path is

where the end of the fossil era T occurs when cumulative emissions have exhausted the safe carbon budget. With a carbon budget of 994 GtCO2 corresponding to a 2 °C cap and a 10% risk tolerance and interest rate of 4.4% per year, the carbon price starts at $16 and rises in 47 years to $128/tCO2(van der Ploeg, 2018). Note that the carbon price (8) depends on relative costs of energy and the interest rate and via (7) on the temperature cap, TCRE and risk tolerance, but does not depend on marginal damages and internalising externalities as in Eq. (3) or (5).

Practitioners of integrated assessment models use very high rates of growth of the carbon price (typically 7%, even up to 15% per year in the UK) with very low initial carbon prices as a result. But what interest rate to use and how to correct for conventional uncertainty and disaster risks about the rate of economic growth and for uncertainty about future abatement technologies? Gollier (2020) uses an intertemporal asset pricing approach to show that the appropriate risk-adjusted interest is about 3.75% per year. This is higher than the risk-free rate implying a positive carbon risk premium stemming from marginal abatement costs and aggregate consumption being positively correlated. In fact, the correlation between the growth in marginal abatement costs and consumption growth (the climate beta) is close to one so something close to the full risk premium must be used. The high growth rates of the carbon price typically used in integrated assessment models thus leads to intertemporally inefficient outcomes, thereby severely underestimating the efficient carbon price that is needed today. Although the temperature cap approach to carbon pricing is a lot easier to use and explain than the Pigouvian approach, economists must explain what the correct risk-adjusted interest rate to use is. There is the danger that politicians who have a taste for procrastination want to use for political reasons a too high rate of growth of carbon prices since this implies very low carbon prices to begin with, and thus, high carbon pricing is passed over to political successors.

4 Policy uncertainty, technological breakthroughs, and the risk of stranded assets

A disorderly transition from a fossil fuel-based to a carbon-free economy can cause havoc in financial markets. This may be due to a sudden change in climate policy (policy tipping), a sudden reduction in fossil fuel or renewable energy cost (disruptive innovation or technological breakthrough in shale or battery technology), or a sudden change in societal norms (social tipping). For such havoc to occur two conditions must be met: an unanticipated future change in conditions that affects the profitability of fossil fuel assets, and it must be costly or impossible to shift around the underlying capital stocks in the carbon-intensive industries to productive use elsewhere after the unexpected future change in conditions (e.g. van der Ploeg & Rezai, 2020).

Various disruptions to financial markets can be distinguished: (i) locking up fossil fuel if temperature is to stay below a cap (stranded fossil fuel reserves, see Sect. 3); (ii) writing off capital investments in the up- and downstream fossil fuel-based industries if the economy suddenly switches to the carbon-free era as asset value can turn negative well ahead of its anticipated useful life when assets suffer from unanticipated or premature write-offs, devaluations, or conversions to liabilities (stranded physical capital); (iii) prices of fossil fuel-based assets in the oil, gas, and coal industry and in other carbon-intensive industries respond long before their industry shuts down and climate policy is stepped up; (iv) the initial loss in value to carbon-intensive assets at the time of announcing stepping up of climate policy or innovations will be partially reversed if the announcement does not materialise (e.g. van der Ploeg, 2020).

The unanticipated credible announcement of a future stepping up of climate policy leads to green paradox effects as fossil fuel is pumped up more vigorously and global warming accelerates (Sinn, 2008). If politicians use renewable energy subsidies as second-best policy, there will also be green paradox effects. As owners of fossil fuel race to burn the last run, investment into the industry ebbs off. Lower returns send investors pursuing higher yields in the renewable sector. However, investors worrying about stranded fossil fuel-based assets will ensure that they have skin in the climate game which curbs short-run carbon emissions and softens the green paradox effect (Baldwin et al., 2020).

If carbon pricing is delayed, carbon prices must be higher to stay within the same carbon budget and to compensate for the extra (green paradox) emissions. As a result, exploitation investment, discoveries, and drilling are discouraged. Since profitability is preserved compared to under the immediate tax, owners of fossil wealth try to delay and hinder policy implementation. Whether an unanticipated announcement of tightening of climate policy causes immediate falls in market valuation depends on the credibility of this announcement. If agents attach some credibility, fossil fuel demand falls, and the scarcity rents and price of capital installed in the fossil industry drop as the announcement becomes known. Not much happened to share prices after the Paris agreement, which suggests that investors attached little credibility to the promises made under the Paris Agreement. It seems sensible to model climate policy as a tipping event, where the probability of policy makers tipping into action increases as temperature gets closer to the cap to which countries have committed. This transforms the issue of credibility to uncertainty about when stepping up of climate policy will occur.

Barnett (2020) shows that an uncertain arrival time of a policy change generates a “run on oil”, which leads to falls in the spot price of oil and market valuation of companies, an increase in renewable energy use, and higher temperatures. A carbon bubble might also potentially occur. The green transition is driven by carbon taxes and capital reallocation from carbon-intensive to green sectors of the economy in response to changes in the carbon-intensive and green Tobin Q’s (Hambel et al., 2020). Under no carbon pricing investors demand a higher return on carbon-intensive assets to be compensated for the risk of stranded assets (Bolton & Kacperczyk, 2021), but if carbon prices internalise global warming externalities this is no longer the case.

5 Obstacles to carbon pricing

Carbon pricing whether via a carbon tax or an emissions market works in fighting global warming by switching demand from fossil fuel to renewable energies and from coal and oil to less carbon-intensive gas, by making possible a market for carbon capture and sequestration, by encouraging green R&D, and by locking up more fossil fuel reserves in the crust of the earth. Also, carbon pricing gives local collateral benefits such as cleaner air in cities with clear political benefits. Permit trading ensures that emission cuts occur in the economic sectors and countries where this is realised in the most cost-effective way so cost per abated tonne of emitted carbon is minimised. By committing to a credible and growing path of carbon prices, business gets the right incentive to make the necessary investments for the green transition. Still, there are several stubborn obstacles to successful implementation of carbon pricing.

First, carbon pricing is subject to international free riding problems (as carbon mixes immediately and completely throughout the atmosphere). Side payments, border tax adjustments and climate clubs (Nordhaus, 2015) help against free riding, but not much progress has been made with such solutions. One of the problems is that if only a sub-set of countries puts up a carbon tax, part of it is borne by consumers and the other part by fossil fuel producers. Since non-participating countries face lower prices, they will increase fossil fuel consumption and emissions (e.g. van der Ploeg, 2016). This spatial carbon leakage can offset roughly 20% of emission reductions unless border tax adjustments or output-based rebates for industries that suffer from dirty competition from abroad are implemented.

Second, carbon pricing requires sacrifices from current generations to curb future global warming which benefits future, often richer generations. Extra government debt can help to compensate current generations and create win–win situations. This may require large additional taxes on future generations to finance tax cuts for current generations (Kotlikoff et al., 2019). A related problem is that politicians procrastinate and postpone carbon taxes. They also prefer the carrot to the stick by giving excessive solar and wind energy subsidies rather than price carbon. This leads to green paradox effects, where oil is pumped faster to avoid capital losses which accelerates global warming (Sinn, 2008). These effects are less if the price elasticity of fossil fuel supply is higher and that of demand is lower (van der Ploeg, 2016).

Third, carbon pricing is often seen to be regressive and hurts the poor relatively more. For example, explicit and implicit fossil fuel subsidies are around 6.5% of world GDP. These are often to keep coal and keep energy bills for the poor low, but it is tough to replace these inefficient and climate-threatening subsidies by more efficient tax deductions for the poor especially in less developed countries where income tax systems are less efficient. More generally, to avoid “yellow vests” protests policy makers must offset potential regressivity of carbon pricing by rebating the revenues via a visible carbon dividend for all citizens and lowering labour income taxes (e.g. Klenert et al., 2018).Footnote 5 However, such a policy may be counterproductive as it tends to depress labour supply and the income tax base so that it is important to investigate policies that optimally recycle carbon tax revenues and that maximise support in society for the green tax reform (e.g. Chiroleu-Assouline & Fodha, 2014; van der Ploeg et al., 2020). This requires that part of the carbon tax revenues must be recycled as lower labour income tax rates. Many studies assess empirically the distributional effects within groups and across groups of green tax reform, including how the regressivity is affected by how the revenue is recycled (e.g. Bento et al., 2009; Berry, 2019; Cronin et al., 2019; Flues & Thomas, 2015; Grainger & Kohlstad, 2010; Metcalf, 1999; Pizer & Sexton, 2019; Poterba, 1991; Rausch & Schwarz, 2016; West & Williams, 2004; Williams et al., 2015). Important is that the impact of carbon taxes on lifetime may be less regressive than on current income (e.g. Hassett et al., 2009; Rausch et al., 2011).

Remaining obstacles are the colossal spatial needs for windmills, solar panels, and CCS sites, the tendency of politicians to pick winners, succumb to lobbies, and use non-price controls that are susceptible to capture and corruption, and the emergence of populism and climate scepticism. Finally, the risk of stranded assets may strengthen lobbies against carbon pricing.

6 Conclusions

Economists have not been very successful in coming up with a unanimous advice on what carbon price to implement. This is due to wide ranges in the estimates of marginal damages from global warming, in the choice of social discount rate due to the use of ethics- or market-based calibrations, and in whether uncertainty and risks about the climate system, marginal damages and the economy are taken aboard or not. A typical market-based risk-adjusted estimate of the Pigouvian social cost of carbon and carbon tax based on the damage estimates of Burke et al. (2015) and the macroeconomic disaster model of Barro (2009) is $100 per ton emitted CO2 and this price should grow over time in tandem with economic activity. This is a lower bound because allowing for climatic and damage uncertainties and for climatic tipping points will boost the optimal carbon price even more. The DICE model of Nordhaus (2017) recommends much lower carbon prices. Given this range of views, it is not surprising that policy makers have adopted the more pragmatic approach of setting a cap on temperature or equivalently a cap on cumulative emissions. This requires a path for the carbon tax which grows at a rate equal to the risk-adjusted interest rate (about 3.5% per year), which is faster than the Pigouvian social cost of carbon. With tipping risks for climate policy or unanticipated technological breakthroughs leading to sudden drops in the costs of energy, there is the risk of stranding fossil fuel reserves, physical capital, and financial assets and this provides a strong motivation for financial regulators to conduct climate stress tests.

Here are some suggestions for further research. First, preferences of policy makers typically have lower rates of impatience and higher intergenerational inequality aversion than the market. It is important to conduct second-best analysis of climate policies where preferences of policy makers and private agents diverge, and policies are typically time inconsistent. Second, policy makers should use risk-adjusted discount rates that depend on the risk profile of different abatement projects; not doing so can lead to welfare losses of 15 to 45% of today’s consumption (Gollier, 2019). Third, more empirical work is needed on the term structure. For example, a recent study estimates a downward-sloping term structure for real estate with an average return of 6% and a discount rate for a century ahead of about 2.6% per year (Giglio et al., 2020). This study suggests a social discount rate for climate policy appraisal with similar horizons as real estate but a different risk profile. Since disasters are more likely during a boom and growth picks up after a disaster, this discount rate has in contrast to earlier studies an upward-sloping term structure. Furthermore, the discount rate is below the risk-free rate of 1–2% per year at all horizons. Finally, it is important to design Pareto-improving green tax reforms by taxing future generations to give transfers to current generations in a way that makes all generations better off (Kotlikoff et al., 2019).

Notes

The approximate linearity of damages results from the broad distribution of the temperature exposure within and across countries, which cause the country-weighted average derivative of the production function to change little as countries warm and prevents abrupt disruptions to output despite the contribution of individual productive units being highly nonlinear.

In van den Bremer and van der Ploeg (2021) the optimal risk-adjusted carbon price takes account of skewed uncertainty about the so-called climate sensitivity. This has a large positive effect on the carbon price, especially if the damage ratio is a convex function of temperature and shocks to the climate sensitivity are more persistent, volatile, and skewed. Also, uncertainty about the damage ratio only pushes up the carbon price if shocks to this ratio are skewed. The effects of these types of uncertainty on the carbon price can be very large.

Vasicek (1977) shows that, if the spot interest rate follows an Ornstein–Uhlenbeck process with positive serial correlation and the initial interest rate is high enough, the conditional expectation of the interest rate declines over time towards its long-term mean, and the term structure slopes downwards. If the initial interest rate is low enough, the term structure slopes upwards. For intermediate values of the initial interest rate, it is a humped curve.

Although renewable energy is getting almost as cheap as fossil fuel, once one factors in the cost of storage needed to deal with intermittence this need no longer be so.

Alternatively, it may be better to use the carbon tax revenue to finance insulation subsidies for low incomes or tax credits for energy-efficient buildings or to finance production-based rebates to those firms that are most subject to the risk of production being taken over by less regulated firms abroad (i.e. carbon leakage).

References

Allen, M. R., Frame, D. J., Huntingford, C., Jones, C. D., Lowe, J. A., Meinshausen, M., & Meinshausen, N. (2009). Warming caused by cumulative carbon emissions towards the trillionth tonne. Nature, 458(7242), 1163–1166.

Arrow, K. J., Cropper, M., Gollier, C., Groom, B., Heal, G., Newell, R., Nordhaus, W. D., Pindyck, R., Pizer, W., Portney, P., Sterner, T., Tol, R., & Weitzman, M. L. (2014). Should governments use a declining discount rate in project analysis? Review of Environmental Economics and Policy, 8(2014), 145–163.

Baldwin, E., Cai, Y., & Kuralbayeva, K. (2020). To build or not to build? Capital stocks and climate policy. Journal of Environmental Economics and Management., 100, 102235.

Bansal, R., & Yaron, A. (2004). Risks for the Long Run: A Potential Resolution of asset pricing puzzles. Journal of Finance, 59(4), 1481–1509.

Barnett, M. (2020). A run on oil? The implications of climate policy and stranded asset risk. mimeo: Arizona State University.

Barrage, L. (2018). Be careful what you calibrate for: Social discounting in general equilibrium. Journal of Public Economics, 160C, 33–49.

Barro, R. J. (2006). Rare disasters and assets markets in the twentieth century. Quarterly Journal of Economics, 121(3), 823–866.

Barro, R. J. (2009). Rare disasters, asset prices, and welfare costs. American Economic Review, 99(1), 243–264.

Bento, A., Goulder, L., Jacobson, M., & von Haefen, R. (2009). Distributional and efficiency impacts of increased US gasoline taxes. American Economic Review, 99(3), 667–699.

Berry, A. (2019). The distributional effects of a carbon tax and its impact on fuel poverty: A micro-simulation study in the French context. Energy Policy, 124, 81–94.

Bolton, P., & Kacperczyk, M. (2021). Do investors care about carbon risk? Journal of Financial Economics (in press)

Bremer, T. S., & van der Ploeg, F. (2021). The risk-adjusted carbon price. American Economic Review, September (in press)

Brunnermeier, M. K. (2009). Decyphering the liquidity and credit crunch 2007–08. Journal of Economic Perspectives, 23, 77–100.

Burke, M., Hsiang, S. M., & Miguel, E. (2015). Global non-linear effect of temperature on economic production. Nature, 527, 235–239.

Cai, Y., Lenton, T. M., & Lontzek, T. S. (2016). Risk of multiple climate tipping points should trigger a rapid reduction in CO2 emissions. Nature Climate Change, 6, 520–525.

Cai, Y., & Lontzek, T. S. (2019). The social cost of carbon with economic and climate risks. Journal of Political Economy, 127, 2684–2734.

Campbell, J. Y., & Cochrane, J. H. (1999). By force of habit: A consumption-based explanation of aggregate stock behavior. Journal of Political Economy, 107, 205–251.

Chakravorty, U., Magné, B., & Moreaux, M. (2006). A Hotelling model with a ceiling on the stock of pollution. Journal of Economic Dynamics and Control, 30, 2875–2904.

Chiroleu-Assouline, M., & Fodha, M. (2014). From regressive pollution taxes to progressive environmental tax reforms, European Economic Review, 69, C, 126–142.

Cochrane, J. H. (2017). Macro-finance. Review of Finance, 21, 945–985.

Constantinides, G. M., & Duffie, D. (1996). Asset pricing with heterogenous consumers. Journal of Political Economy, 104, 219–240.

Cronin, J. A., Fullerton, D., & Sexton, S. (2019). Vertical and horizontal distributions from a carbon tax and rebate. Journal of the Association of Environmental and Resource Economists, 6, 169–208.

Crost, B., & Traeger, C. P. (2014). Optimal CO2 mitigation under damage risk valuation. Nature Climate Change, 4, 631–636.

Desmet, K., Kopp, R. E., Kulp, S. A., Krisztian, D., Oppenheimer, M., Rossi-Hansberg, E., & Straus, B. H. (2021). Evaluating the economic costs of coastal flooding. American Economic Journal: Macroeconomics (forthcoming)

Duffie, D., & Epstein, L. G. (1992). Stochastic differential utility. Econometrica, 60(2), 353–394.

Epstein, L. G., & Zin, S. (1989). Substitution, risk aversion and the temporal modelling of asset returns: A theoretical framework. Econometrica, 57, 937–967.

Epstein, L. G., Farhi, E., & Strzalecki, T. (2014). How much would you pay to resolve long-run risk?”. American Economic Review, 104(9), 2680–2697.

Flues, F., & Thomas, A. (2015). The distributional effects of energy taxes, Technical Report 23. OECD.

Giglio, S., Maggiori, M., Rao, K., Stroebel, J., & Weber, A. (2020). Climate change and long-run discount rates: Evidence from real estate. mimeo Harvard University.

Gollier, C. (2002). Time horizon and the discount rate. Journal of Economic Theory, 107, 463–473.

Gollier, C. (2008). Discounting with fat-tailed economic growth. Journal of Risk and Uncertainty, 37, 171–186.

Gollier, C. (2011). On the underestimation of the precautionary effect in discounting. The Geneva Risk and Insurance Review, 36(2), 95–11.

Gollier, C. (2012). Pricing the Planet’s Future: The Economics of Discounting in an Uncertain World. Princeton University Press.

Gollier, C. (2019). The welfare cost of ignoring the beta. mimeo., Toulouse University.

Gollier, C. (2020). The cost-efficiency carbon pricing puzzle. mimeo. Toulouse University.

Grainger, C., & Kohlstad, C. (2010). Who pays a price on carbon. Environmental and Resource Economics, 46(3), 359–376.

Hambel, C., Kraft, H., & van der Ploeg, F. (2020). Asset market diversification versus climate policy, CEPR Discussion Paper, No. 14863, London.

Hassett, K. A., Mathur, A., & Metcalf, G. E. (2009). The incidence of a U S carbon tax: A lifetime and regional analysis. The Energy Journal., 30(2), 155–178.

Kimball, M. S. (1990). Precautionary saving in the small and in the large. Econometrica, 58, 53–73.

Klenert, D., Mattauch, L., Combet, E., Edenhofer, O., Hepburn, C., Rafaty, R., & Stern, N. (2018). Making carbon pricing work for citizens. Nature Climate Change, 8, 669–677.

Kocherlakota, N. R. (1996). The equity premium: It’s still a puzzle. Journal of Economic Literature, 34, 42–71.

Kotlikoff, L., Kubler, F., Polbin, A., Sachs, J. D., & Scheidegger, S. (2019). Making carbon taxation a generational win-win, Working Paper No. 25760, NBER, Cambridge, Mass.

Lemoine, D., & Traeger, C. (2014). Watch your step: Optimal policy in a tipping climate. American Economic Journal: Economic Policy, 6, 37–166.

Lemoine, D., & Traeger, C. P. (2016). Economics of tipping the climate dominoes. Nature Climate Change, 6, 514–519.

Lontzek, T. S., Cai, Y., Judd, K. L., & Lenton, T. M. (2015). Stochastic integrated assessment of climate tipping points indicates the need for strict climate policy. Nature Climate Change, 5, 441–444.

Lucas, R. E. (1978). Asset prices in an exchange economy. Econometrica, 46(6), 1429–1455.

Matthews, H. D., Gillett, N. P., Stott, P. A., & Zickfeld, K. (2009). The proportionality of global warming to cumulative carbon emissions. Nature, 459(7248), 829–832.

Matthews, H. D., Zickfeld, K., Knutti, R., & Allen, M. R. (2018). Focus on cumulative emissions, global carbon budgets and the implications for climate mitigation targets. Environmental Research Letters, 13, 010201.

Metcalf, G. (1999). A distributional analysis of green tax reforms. National Tax Journal, 52(4), 655–682.

Nordhaus, W. (2015). Climate clubs: Overcoming free-riding in international climate policy. American Economic Review, 105(4), 1339–1370.

Nordhaus, W. (2017). Revisiting the social cost of carbon. Proceedings of the National Academy of Sciences, 114(7), 1518–1523.

Pindyck, R. S. (2011). Fat tails, thin tails, and climate change policy. Review of Environmental Economics and Policy, 5(2), 258–274.

Pizer, W. A., & Sexton, S. (2019). The distributional impacts of energy taxes. Review of Environmental Economics and Policy, 13(1), 104–123.

Poterba, J. (1991). Is the gasoline tax regressive? Tax Policy and the Economy, 5, 145–164.

Ramsey, F. (1928). A mathematical theory of savings. Economic Journal, 38(152), 543–559.

Rausch, S., & Schwarz, G. A. (2016). Household heterogeneity, aggregation and the distribution of environmental taxes. Journal of Public Economics, 138, 43–57.

Rausch, S., Metcalf, G. E., & Reilly, J. M. (2011). Distributional impacts of carbon pricing: A general equilibrium approach with micro-data for households. Energy Economics, 33(3), S20-33.

Rudik, I. (2020). Optimal climate policy when damages are unknown. American Economic Journal: Economic Policy, 12(2), 340–373.

Sinn, H. W. (2008). Public policies against global warming: A supply side approach? International Tax and Public Finance, 15(4), 360–394.

Smith, W. T. (1996a). Feasibility and transversality conditions for models of portfolio choice with non-expected utility in continuous time. Economics Letters, 53(2), 123–131.

Smith, W. T. (1996b). Taxes, uncertainty, and long-term growth. European Economic Review, 40(8), 1647–1664.

Stern, N. (2007). The economics of Climate Change: The Stern Review. Cambridge University Press.

Svensson, L. (1989). Portfolio choice with non-expected utility in continuous time. Economics Letters, 30, 313–317.

Vacisek, O. (1977). An equilibrium characterization of the term structure. Journal of Financial Economics, 5, 177–188.

van der Ploeg, F. (2016). Second-best carbon taxation in the global economy: The Green paradox and carbon leakage revisited. Journal of Environmental Economics and Management, 78, 85–105.

van der Ploeg, F. (2018). The safe carbon budget. Climatic Change, 147(1–2), 47–59.

van der Ploeg, F., & de Zeeuw, A. J. (2018). Climate tipping and economic growth: Precautionary capital and the social cost of carbon. Journal of the European Economic Association, 16(5), 1577–1617.

van der Ploeg, F., Rezai, A., & Tovar, M. (2020). Gathering support for green tax reform: Surprising evidence from German household surveys. Wirtschaftsuniversität Wien.

van Ploeg, F., & Rezai, A. (2020). Stranded assets in the transition to a carbon-free economy. Annual Review of Resource Economics, 12, 281–298.

Weil, P. (1990). Nonexpected utility in macroeconomics. Quarterly Journal of Economics, 105(1), 27–42.

Weitzman, M. L. (2001). Gamma discounting. American Economic Review, 91, 260–271.

Weitzman, M. L. (2007). Subjective expectations and asset-return puzzles. American Economic Review, 97, 1102–1130.

Weitzman, M. L. (2009). On modeling and interpreting the economics of climate change. Review of Economics and Statistics, 91, 1–19.

Weitzman, M. L. (2011). Fat-tailed uncertainty in the economics of catastrophic climate change. Review of Environmental Economics and Policy, 5(2), 275–292.

Weitzman. (1998). Why the far-distant discount rate should be discounted at its lowest possible rate. Journal of Environmental Economics and Management, 36, 201–208.

West, S. E., & Williams, R. C. (2004). Estimates from a consumer demand system: Implications for the incidence of environmental taxes. Journal of Environmental Economics and Management, 47(3), 535–558.

Williams, R. C., Gordon, H., Burtraw, D., Carbon, J., & Morgenstern, R. D. (2015). The initial incidence of a carbon tax across income groups. National Tax Journal, 68(1), 195–214.

Acknowledgements

This paper is a shortened version of the material covered in the keynote lecture of the 76th Congress of the International Institute for Public Finance, Reykjavik, Iceland, 19–21 August 2020. I am very grateful for the helpful comments and constructive suggestions of an anonymous referee and of Mireille Chiroleu-Assouline.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

van der Ploeg, F. Carbon pricing under uncertainty. Int Tax Public Finance 28, 1122–1142 (2021). https://doi.org/10.1007/s10797-021-09686-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-021-09686-x