Abstract

Thin capitalization rules limit firms’ ability to deduct internal interest payments from taxable income, thereby restricting debt shifting activities of multinational firms. Since multinational firms can limit their tax liability in several ways, regulation of debt shifting may have an impact on other profit shifting methods. We therefore provide a model in which a multinational firm can shift profits out of a host country by issuing internal debt from an entity located in a tax haven and by manipulating transfer prices on internal goods and services. The focus of this paper is the analysis of regulatory incentives, \((i)\) if a multinational firm treats debt shifting and transfer pricing as substitutes or \((ii)\) if the methods are not directly connected. The results provide a new aspect for why hybrid thin capitalization rules are used. Our discussion in this paper explains why hybrid rules can result in improvements in welfare if multinational firms treat methods of profit shifting as substitutes.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The loss of tax revenue caused by earnings stripping is a prominent subject of both public debate and academic literature. Earnings stripping is a practice in which a multinational corporation (MNC) finances a production facility with loans issued by an entity in a tax haven and can thus reduce its taxable income. The MNC thereby exploits corporate income tax rate differentials and the fact that interest payments on intercompany loans are at least partially tax deductible in many countries. This provides MNCs with an opportunity to lower their tax bills. The resulting profit shifts from high tax to low tax jurisdictions take place in, and therefore are relevant for, many developed countries. The OECD addresses this topic in its Action Plan on Base Erosion and Profit Shifting (OECD, 2013) and, in its final report, suggests best practice actions to reduce the prevalence of misuse of internal loans (OECD, 2015). To alleviate the issue, almost all affected countries have introduced thin capitalization rules which limit the deductibility of internal interest payments from taxable income and hence restrict debt shifting activities of multinational firms. The design of the thin capitalization rules varies across countries. Rules can either take the form of a safe harbor rule, which limits the tax-deductible amount of internal debt compared to equity, or an earnings stripping rule, which regulates the ratio of debt interest to pre-tax earnings. Interestingly, we note that countries exist that only use one of the two regulatory rules, while other countries have implemented instruments that simultaneously employ both types of rule (e.g., Denmark, Czech Republic, Lithuania, Latvia and Japan).

There is no doubt that thin capitalization rules, regardless of type, restrict the misuse of internal loans (Büttner et al., 2012; Wamser, 2014). However, there is a wider discussion taking place among economists and policymakers on which rule to use under certain circumstances. Indeed, recent policy changes have been witnessed in Belgium (2019), the Netherlands (2019), Sweden (2019), Lithuania (2019) and Japan (2019) to name just a few examples. Of course, the European Union’s Anti-Tax Avoidance Directive (2016) will have given rise to some of these changes. Article 4 of the Directive stipulates that all countries in the European Union must implement an earnings stripping rule by January 2020 or if an equally effective interest limitation rule is already in place which can continue to be used in the meantime, by January 2024.

The frequent policy changes highlight that countries are concerned about MNCs’ debt shifting activities and combat them with adjustments of tax rates and a mix of measures to fight profit shifting. Not all afore-mentioned countries changed their regulatory system to one which solely employs the earnings stripping rule.

In this paper we will therefore focus in particular on the choice of regulation when both types of rule are available. We analyze thin capitalization rules in a general equilibrium model in which a MNC can shift profits via debt shifting and transfer pricing. The transfer pricing channel serves as a role model for other potential profit shifting methods and was chosen due to its current relevance for MNCs’ profit shifting activities. MNCs could also switch between shifting methods to avoid restrictions which apply to only one of their profit shifting strategies. Regulatory changes focused on one profit shifting channel will influence MNCs’ strategy as a whole. We believe that changes in effective costs of one method will lead to changes in effective costs of other methods, too. To consider this, the different profit shifting methods are modeled in the form of cost substitutes. The empirical literature on MNCs dealing with substitution across different methods of profit shifting is rather limited. Just a few papers, like those of Saunders-Scott (2015) and Nicolay et al. (2017), found evidence for the existence of a substitutional effect. Nevertheless, there might be other potential reasons for countries to implement a hybrid thin capitalization rule than the substitution of profit shifting channels. Møen et al. (2019) show that MNCs use both internal and external debt to shift profits. The possibility of shifting profits by external debt could offer an incentive for MNCs to evade regulation that is based on internal debt only. In turn, this could cause countries to tackle different types of debt with different rules and create incentives for the use of hybrid rules. See Møen et al. (2019) for a general discussion on using internal and/or external debt to shift profits and Blouin et al. (2014) for a discussion of the effects that thin capitalization rules have on the internal and external debt-to-asset ratios of MNCs. Another argument for the use of hybrid thin capitalization rules could arise due to firm heterogeneity. If countries could choose which rule to use for a specific sector, this could be beneficial in the context of the fact that heterogeneous firms may have different debt-to-asset ratios for reasons other than earnings stripping. For a general discussion of firm heterogeneity and profit shifting, see Krautheim and Schmidt-Eisenlohr (2011). However, we believe that the substitution of profit shifting channels is one of the strongest motives for the implementation of a hybrid thin capitalization rule, albeit one that has not yet been entirely analyzed.

To the best of our knowledge, we are the first to analyze a general equilibrium model which incorporates the simultaneous application of both safe harbor rules and earnings stripping rules in an environment where a multinational firm treats different channels of profit shifting as substitutes. The most closely related approaches to ours are those described in the papers of Schindler and Schjelderup (2016), Mardan (2017) and Gresik et al. (2017). Schindler and Schjelderup (2016) analyzed thin capitalization rules under cost complementarity and cost substitution. A main result is that stricter regulation of debt shifting can foster profit shifting activities. However, their results are either based on sole application of a safe harbor rule or, conversely, sole application of an earnings stripping rule. In contrast, our paper addresses the simultaneous use of safe harbor rules and earnings stripping rules. Our results indicate that the earnings stripping rule cannot completely replicate the consequences of the safe harbor rule; thus, the choice to employ both rules may lead to a welfare improvement. This result complements the results in the existing literature. Gresik et al. (2017) employ a general equilibrium analysis to show in which situations MNCs may carry out debt shifting and transfer pricing and that the safe harbor rule is inferior to the earnings stripping rule. Their main argument for the superiority of the earnings stripping rule is that this rule imposes restrictions on the misuse of debt financing as well as transfer pricing activities. They find that the safe harbor rule affects only the debt shifting strategy of MNCs. Mardan (2017) on the other hand found no clear preference for one rule over another when he investigated a model which focuses on the presence of financial frictions. The results show that the superiority of one rule over another depends on the extent to which MNCs can use other profit shifting channels besides debt shifting activities. In contrast to our approach, neither Mardan (2017) nor Gresik et al. (2017) use a setting in which a multinational firm treats different profit shifting channels as substitutes. Gresik et al. (2017) rule out a part of the substitutional effect by definition of the concealment cost function, as an increase in effective debt shifting costs does not lead to an increased use of transfer pricing in their model. Thus, they find that the safe harbor rule is inferior to the earnings stripping rule and the implication that follows is that hybrid rules should not be the policy of choice for countries. In contrast, our results suggest that the substitution of profit shifting methods alters the choice of the MNC in a specific way and also alters the effective tax rates and, as a consequence, the cost of capital.

Thus substitution across profit shifting methods offers two opposing arguments for how an MNC can react to hybrid regulation. Either hybrid regulation could raise the effective cost of capital, the MNC thus reacting by decreasing the amount of capital it holds, or stricter regulation could force the MNC to increase the amount of capital it holds in order to mitigate the constraints. Hybrid rules may thus improve welfare if the reaction of the MNC coincides with the characteristics of a country’s welfare function.

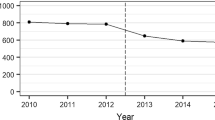

As a starting point, we are able to replicate the results of Gresik et al. (2017) in our framework as a literature benchmark, when we do not apply the afore-mentioned substitution. We then argue that countries either choose to employ the earnings stripping rule, the safe harbor rule or the hybrid model, depending on their unique country characteristics. It is therefore possible that one country chooses one type of rule, while another chooses a different type. All afore-mentioned European countries have enforced the same type of regulation. The safe harbor rule allows deductible interest expenses up to a 4:1 debt to equity ratio with a safe harbor limit of approximately €3 m. The earnings stripping rule allows a company to make tax deductions of 30% of its earnings before interest, taxes, depreciation and amortization (EBITDA). Japan imposes a debt to equity ratio of 3:1 and allows net interest payments of up to 50% of adjusted taxable income, except for net interest payments up to JPY10m. This paper aims to provide an explanation for the observed variation of fiscal rules. We will show that the decision of fiscal rules depends on country-specific factors like tax rates and capital investment. For example, all afore-mentioned European countries levy combined corporate income tax rates equal to or lower than the European average of 22% in 2020, e.g., 22% in Denmark, 20% in Latvia, 19% in Czech Republic and 15% in Lithuania. Japan levies a combined corporate income tax rate of 29.7%.Footnote 1 A similar picture can be drawn for effective average tax rates. In 2019, Japan had the highest effective average tax rate (27.2%) followed by the Czech Republic (21.2%), Denmark (19.6%), Latvia (17%) and Lithuania (13.4%). All countries decreased their combined and effective average corporate income tax rates in the last decades, possibly as a consequence of competition for foreign investment. The amount of inward and outward investments varies across those countries. The Czech Republic has the highest amount of inward foreign direct investment measured in percentage of GDP (68%) followed by Latvia (52%), Lithuania (38%), Denmark (35%) and Japan (4%). This ordering of countries is inverted in the case of outward investments as Denmark (63%) and Japan (35%) have the highest amount of outward foreign direct investment measured in percentage of GDP followed by the Czech Republic (18%), Lithuania (9%) and Latvia (6%). To summarize, these observations suggest that there exist a partition of countries which can be characterized by a low ratio of inward to outward investments and another partition of countries with a high ratio of inward to outward investments. We argue that these country-specific differences have an effect on the fiscal rules that the countries apply.

Our prediction is that countries with a high ratio of inward to outward foreign direct investment can have an interest in protecting the tax revenues paid by MNCs through an additional safe harbor rule. In contrast, countries with a low ratio of inward to outward foreign direct investment are more interested in domestic tax revenues and wages and only implement an additional safe harbor rule if the MNC increases the amount of capital it holds. In many countries the reaction of the MNC will not coincide with their welfare characteristics, and therefore, these countries should only implement an earnings stripping rule. We will show that the results of our model substantiate this prediction. Accordingly, MNCs treating profit shifting methods as substitutes could be an important aspect explaining the policy choice of fiscal authorities in Denmark, Lithuania and Japan and other countries. We think that our results provide a new aspect to the explanation for why hybrid thin capitalization rules are used.

The remainder of the paper is organized as follows: In Sect. 2 we present a general equilibrium model with debt shifting and transfer pricing. Section 2.1 focuses on the impact of thin capitalization rules and cost substitution on an MNC’s production decision. In Sect. 2.2 we discuss the effect on welfare maximization, and finally, in Sect. 3, we offer concluding remarks.

2 The model

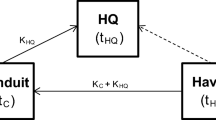

Our model covers a two-country setting in which a MNC has subsidiaries in both countries. The countries differ in that one is a tax haven which levies a corporate income tax (CIT) with a zero tax rate, while the other is the home of the MNC’s production facility with a positive CIT rate \(t\). We will refer to the latter as the home country from now on. Production in the home country is financed by the tax haven subsidiary, which endows the home country subsidiary with capital \(k\) in the form of either internal debt \(b\) and/or equity \(e\). The MNC faces capital costs \(r\), which are given exogenously, as well as capture market and firm-specific risks. We assume, for simplicity, that the tax haven subsidiary is entirely financed with equity by the parent company located outside these countries. The financing structure is inspired by Gresik et al. (2017), as we are only interested in internal debt shifting. A more complex financing structure would raise questions on how to deal with issues like regulation on total debt or external debt shifting which we have discussed in introduction.

The subsidiary in the home country produces output with the help of capital \(k\) as well as labor inputs \({l}_{M}\) and uses production technology \(f(k, {l}_{M})\) with the usual properties \(f_{k}^{\prime } ,f_{{l_{M} }}^{\prime } > ~0\) and \(f_{{kk}}^{{\prime \prime }} ,f_{{{\text{ll}}}}^{{\prime \prime }} < 0\). Besides the subsidiary, a domestic firm also operates in the home country. The domestic firm only uses labor inputs \({l}_{D}\) to produce output with production technology \(g({l}_{D})\). The technology has the usual properties \({g}_{{l}_{D}}^{^{\prime}}>0\) and \(g_{{ll}}^{{\prime \prime }} < {\text{0}}\). Staff are employed at a wage rate \(w\), which is the same for both firms. Furthermore, both firms sell their produced units in a competitive market with a purchasing price normalized to one. Moreover, workers in the home country inelastically supply one unit of labor and the wage rate clears the labor market such that \({l}_{M}+{l}_{D}=1\). The modeling of the domestic firm is important for establishing the market-clearing wage, and it plays an important role in the welfare analysis. The welfare in the home country is affected by national and public income. National income is composed of workers’ income, which corresponds to their wage and entrepreneurial income, which itself corresponds to the after-tax profits of the domestic firm. Public expenditure is entirely financed by tax revenues from both the domestic and the multinational firm. Section 2.2 analyzes welfare maximization in detail. Additionally, the MNC is able to shift profits from the home country to the tax haven via debt shifting and transfer pricing. This setting is based on Gresik et al. (2017) and is a generalization of the model created by Hong and Smart (2010).

Our model differs in some aspects from that presented by Gresik et al. (2017) because we are primarily interested in the interplay between profit shifting methods and their impact on thin capitalization regulation. In the first step, our model incorporates transfer pricing and allows for the mispricing of internal goods and services instead of an abusive internal interest surcharge. The motivation behind this approach is that internal goods and services have an impact on EBITDA and can thus help explain empirical findings like those found by Saunders-Scott (2015). The aim is to not only investigate the well-known effects on the use of internal debt and overall investments, but also see to what extent thin capitalization regulation could have an additional effect on EBITDA through the transfer pricing channel. Both types of modeling lead to the shift of a lump-sum of profits between the affiliates and are expected to affect thin capitalization rules in a similar manner. The total profits shifted via transfer pricing are tax deductible, denoted by \(q\) and defined as the deviation from the internal price \({p}_{I}\) from the arm’s length price \(p\) on all internal goods and services \(I\), i.e., \(q=\left({p}_{I}-p\right)I\). The MNC naturally operates with an efficient combination of price deviation and amount of internal goods and services to minimize the costs of its transfer pricing activities. We therefore let all costs for the use of the transfer pricing method depend only on the amount of profits shifted via transfer pricing and cover them via a concealment cost function. Secondly, we assume that the amount of internal debt affects concealment costs which arise if the MNC shifts profits via the transfer pricing channel. A substitutional or even complementary concealment cost effect on the different types of profit shifting is therefore also included in the model. Thus, concealment costs \(c(q,rb)\) depend on the profits shifted via transfer pricing \(q\) and the amount of debt interest \(rb\). The cost function has the usual first- and second-order properties \({c}_{q}^{^{\prime}}, {c}_{b}^{^{\prime}}>0\) and \(c_{{qq}}^{{\prime \prime }} ,c_{{{\text{bb}}}}^{{\prime \prime }} > {\text{0}}\). As the above-mentioned empirical literature suggests, the substitutability of profit shifting methods is more suitable than complementarity. This paper therefore focuses on the effects of concealment cost substitutability. In line with Saunders-Scott (2015), as well as Schindler and Schjelderup (2016), we define cost substitutability as an increased use of one profit shifting method based on an increase in costs of another method. As a result, the cross-derivatives of the concealment cost function are assumed to be positive, i.e., \(c_{{qb}}^{{\prime \prime }} > ~{\text{0}}\) and \(c_{{bq}}^{{\prime \prime }} > {\text{0}}\).

Additionally, we assume positive stand-alone costs for profit shifting via the transfer pricing channel, i.e., \(c\left(q,0\right)\ge 0\). There are no stand-alone costs for internal debt, however, i.e., \(c\left(0,rb\right)=0\). The argument for the former is that transfer pricing usually requires concealment costs that can mirror possible risk and auditing costs, including fines (Kant, 1988) or costs to conceal the true deviation from the arm's length principle (Haufler & Schjelderup, 2000). In the case of the latter, there are two different literature branches which treat the topic of related costs of internal debt, both of which we would like to discuss in this paper. On the one hand, internal debt should not generate costs itself, providing no laws were breached by the MNC. This point of view is supported by Stonehill and Stitzel (1969) who argue that internal debt is nothing more than tax-favored equity. Furthermore, Gresik et al. (2017) argue that MNCs are not able to exploit loopholes to conceal excessive debt. Both arguments imply zero internal debt costs and thus \(b=k\). However, no empirical support exists for this type of modeling (Büttner et al., 2012). On the other hand, there could be agency costs associated with the use of lawyers or accountants. In our opinion, no direct internal debt costs should be incurred if the MNC abides by the law and the debt level should be less than 100%. Our setting incorporates these opposing ideas due to the fact that an indirect cost effect arises through cost substitution. This ensures that higher internal debt levels lead to higher total concealment costs and that the efficient debt level is below the maximum.

2.1 Firm behavior and thin capitalization rules

The domestic firm operates only in the home country, does not have a relationship with the tax haven and thus has no profit shifting opportunities. The domestic firm’s after-tax profits can be written as

where \({\pi }_{D}\) denotes the domestic pre-tax profits. Profit maximization leads to the first-order condition

where marginal labor productivity equals the wage rate. Equation (2) and the labor market-clearing condition \({l}_{M}+{l}_{D}=1\) explain the relationship between the domestic and the multinational firm and their impact on workers’ national income. The higher the number of workers employed by the multinational firm, the higher the competition between those firms in the labor market. This has a positive effect on wages. In contrast, the MNC benefits from foreign direct investment in addition to its labor inputs and shifts profits by means of transfer pricing and debt shifting. Thus, the MNC’s after-tax profits read

In the absence of regulation, the efficient transfer price, as well as the amount of internal debt, is determined at the point where the tax rate equals the respective marginal costs. It can thus be said that marginal costs are equal across the different profit shifting methods, i.e., \({c}_{q}^{^{\prime}}={c}_{b}^{^{\prime}}\). Additionally, the home country subsidiary employs staff at its marginal cost, i.e., \({f}_{{l}_{M}}^{^{\prime}}=w\), which implies that marginal labor productivity is equal across firms. Finally, the level of investment depends on taxes because an increase in tax rate results in higher marginal capital productivity, as \({f}_{k}^{^{\prime}}=\frac{r}{1-t}\). Under these conditions, an unconstrained multinational firm usually shifts some of its profits via transfer pricing and some via debt financing, even when substitutability across profit shifting methods is assumed. It may be imaginable that the MNC finances its investment entirely via debt in the most extreme cases and therefore operates without transfer pricing. Either way, internal debt will play a key role in the MNC’s investment strategy.

Since the excessive use of internal debt reduces the taxable corporate income for the home country, there is a justified interest in limiting this option. The home country can use thin capitalization rules to restrict the share of tax-deductible internal debt. A safe harbor rule, which limits the tax-deductible amount of internal debt compared to overall capital used, or an earnings stripping rule, which regulates the ratio of debt interest to pre-tax earnings, can be implemented. Establishment of a safe harbor rule allows internal debt to be deducted as long as

The share of internal debt to capital is denoted by \({z}_{sh}\), with \(0\le {z}_{sh}\le 1\). On the one hand, this type of rule restricts the amount of tax-favored internal debt. This is synonymous with an increase of the effective costs. On the other hand, there is no direct effect on the effective costs of transfer pricing activities. Nevertheless the substitutability of profit shifting methods leads to an indirect cost effect if the amount of internal debt changes. In contrast, an earnings stripping rule can be characterized as

It becomes apparent that transfer pricing lowers pre-tax earnings before interest expenses and thus places greater emphasis on the earnings stripping rule. The ratio of internal debt interest to EBITDA is denoted by \({z}_{es}\), with \(0\le {z}_{es}\le 1\). A lower \({z}_{es}\) implies a more stringent rule and thus lower deductible interest expenses.

Equations (3), (4) and (5) set up the profit maximization problem of the MNC in the case of the home country employing a safe harbor rule, an earnings stripping rule or a combination of the two, respectively. The resulting first-order conditionsFootnote 2 are

where \({\lambda }_{sh}\) and \({\lambda }_{es}\) are the respective Lagrange multipliers. We will therefore first take a look at the unconstrained case, i.e., \({\lambda }_{sh}=0\) and \({\lambda }_{es}=0\). If we compare the substitutability of profit shifting methods with the case, where the methods are not connected to each other, the following statement applies.

Proposition 1

If a substitution effect between debt shifting and transfer pricing exists, then a multinational firm operates with the same capital inputs, has a lower amount of internal debt and shifts fewer profits via transfer pricing than when profit shifting methods are not connected to each other.Footnote 3

First, Eqs. (8) and (9) show that profit shifting costs are not related to the choice of production inputs in the unconstrained case. Thus, the MNC operates with the same amount of capital inputs regardless of how it decides to optimize its profit shifting activities. Of course, the composition of capital may change due to changes in the use of internal debt. Equation (7) shows that the amount of internal debt decreases if cost substitutability is assumed. In the absence of substitutability, it is most efficient to use internal debt only, i.e., \(k=b\). Substitutability implies an increase in marginal costs of internal debt and thus leads to a shift in use from internal debt to equity. The varying amounts of internal debt further affect transfer pricing strategy. A decreasing proportion of internal debt under substitutability leads to lower marginal costs of transfer pricing. This is due to the assumption that cross-derivatives of the concealment cost function are positive. As a result, the MNC will increase the amount of profits shifted via transfer pricing. However, stand-alone costs of transfer pricing are always lower than the costs associated with the same amount of profits being shifted under substitutability, i.e., \(c\left(\overline{q },0\right)<c\left(\overline{q },b\right)\), because the first-order derivatives of the concealment cost function are positive. Consequently, the overall profits shifted, as well as the amount of internal debt and transfer pricing, are lower under substitutability. The amount of internal debt decreases because substitutability raises the costs of profit shifting in Eq. (7). The amount of transfer pricing decreases because under substitutability a positive cost effect arises due to the use of internal debt in Eq. (6). The MNC can only react by decreasing the amount of profits shifted via transfer pricing.

The most notable message of these findings is that an underestimation of transfer pricing costs (if cost substitutability is not expected) results in exceptionally high forecasts for the prevalence of profit shifting methods. This effect will certainly have an impact on the choice and effectiveness of regulatory instrument. Hence, the main purpose of this section is to assess how the substitutability of profit shifting costs affects the safe harbor and earnings stripping rules.

Next, we consider the case of a binding safe harbor rule, i.e., \({\lambda }_{sh}>0\) and \({\lambda }_{es}=0\). Firstly, it was found, as Eq. (6) shows, that the introduction of a safe harbor rule has no direct impact on transfer pricing activities. Nevertheless, marginal costs of transfer pricing and the amount of profits shifted through it are of course affected by the level of internal debt. Secondly, it was found that, if the safe harbor rule does not bind, the same case applies as discussed before. Based on this, it can be said that a binding safe harbor rule limits the use of either internal debt or transfer pricing and consequently other methods are more likely to be used. Intuitively, one might expect that this results in limited debt shifting and instead more transfer pricing activities. This is a possible outcome of course, but the opposite may also be true. Either way, the MNC tries to soften the safe harbor limitation for internal debt by using higher amounts of capital. This can be explained by Eq. (8) in which the effective cost of capital decreases if a binding rule is in place. The increased use of capital allows the MNC to use more internal debt, too, as seen in the unconstrained case. Furthermore, it can thereby limit transfer pricing activities. Which of the options the MNC chooses depends on the marginal costs associated with the profit shifting methods.

Additionally, different levels of use of capital inputs affect the labor use by the MNC. Equation (9) shows that labor is used at its marginal productivity level. As the use of capital inputs increases, so does marginal labor productivity and hence labor inputs are affected, i.e., the amount of labor input increases. Consequently, there is more competition in the labor market between the domestic and the multinational firm. This results in a lower number of domestic staff employed and higher wages. Overall, despite the adaptations in production inputs and profit shifting activities, the distortions brought about by the safe harbor regulation reduce the MNC’s total profit.

The effects of an earnings stripping rule, i.e., \({\lambda }_{sh}>0\) and \({\lambda }_{es}=0\), are similar to those of a safe harbor rule. A binding earnings stripping rule decreases the effective cost of capital, and thus, the MNC operates with high levels of capital inputs, as outlined by Eq. (8). As mentioned before, this leads to more staff being employed by the MNC, fewer being employed by the domestic firm and higher wages. The main difference between safe harbor and earnings stripping regulation arises as a result of the direct effect shown in Eq. (6). Even if the MNC operates without the use of internal debt, earnings stripping regulation raises effective transfer pricing costs and therefore limits the ability to shift profit in this manner. This effect can lead to a situation in which the MNC reduces both internal debt use and transfer pricing activities in line with regulation. Nevertheless, the MNC substitutes one method in favor of the other. This effect still takes place but is not directly visible if the use of both methods decreases. The points regarding the introduction of a thin capitalization rule, which have been presented above, are summarized in Proposition 2.Footnote 4

Proposition 2

In the case of cost substitution, the introduction of a thin capitalization rule, regardless of safe harbor or earnings stripping rule, leads to lower total MNC profits, increased capital and labor inputs for the MNC and a lower amount of overall shifted profits. Additionally, the safe harbor rule implies a limited use of one profit shifting method in favor of the other; however, the effect is ambiguous under the earnings stripping rule.

The most important point stated in Proposition 2 is the fact that even if a thin capitalization rule’s main goal is to target the misuse of internal debt, such regulation also affects other profit shifting channels. It is even questionable, whether thin capitalization rules lead to a limited use of internal debt or whether cost advantages can change the direction of the targeted effect. The introduction of a safe harbor rule for example affects concealment costs and raises the effective costs of profit shifting. This effect can be seen when the right-hand side of Eq. (7) increases. Consequently, the MNC is incentivized to lower marginal debt shifting costs. Under the assumption of substitutability, this can be done either by reducing the amount of internal debt or by reducing the amount of profits shifted via transfer pricing. Based on Eq. (6) marginal transfer pricing costs remain constant, meaning a reduction of internal debt leads to more generous transfer pricing and vice versa. The decision on which type of profit shifting to reduce depends on the structure of the concealment cost function and the adaptations made with respect to Eqs. (6) and (7). In general, it is therefore possible that the introduction of a safe harbor rule will lead to increased debt shifting activities by the MNC. However, regulation will target at least one profit shifting channel and, in case of cost substitution, has a positive effect on the use of the other methods. This means that a safe harbor rule will cause the MNC to do less of one type of profit shifting, but more of the other, while an earnings stripping rule can cause the MNC to do less of both. This finding is in line with those by Schindler and Schjelderup (2016), who analyzed the interplay of debt shifting and abusive internal interest surcharges. A further important point is that the effects of both types of thin capitalization rule are not too dissimilar under cost substitution. This is due to the indirect effect that the safe harbor rule has on transfer pricing activities. If transfer pricing activities are considered separately, the safe harbor rule, in contrast to the earnings stripping rule, has no impact on transfer pricing because the rule itself is not connected to the amount of profits shifted in this way. This difference cannot be observed under cost substitutability. Nevertheless, the strength of the effects is a crucial factor when deciding which rule to implement.

2.2 Welfare

In general, the home country’s government has the opportunity to maximize welfare by introducing a safe harbor rule, an earnings stripping rule or a combination of the two. To answer the question which rule should be used, Gresik et al. (2017) created a model which included debt shifting and transfer pricing via abusive internal interest surcharges and which showed that the safe harbor rule is inferior to the earnings stripping rule under certain conditions. They showed that in an environment where both rules bind, implementation of a safe harbor rule reduces welfare and thus one should not use it in conjunction with an earnings stripping rule. In this section, we will show that this result holds true for cost substitution across profit shifting methods, as well as for transfer pricing via mispricing of internal goods and services. This is the case if certain conditions are kept constant. Additionally, we will analyze how cost substitution affects the combined use of the safe harbor and earnings stripping rules if we relax these conditions.

The welfare in the home country is affected by national income \(x\), which is used for consumption, and public income \(G\), which is used to finance public goods or other necessary government spending. National income is composed of workers’ income, which corresponds to their wage \(w\), on the one hand and, on the other hand, entrepreneurial income, which corresponds to the after-tax profits of the domestic firm \(\left(1-t\right){\pi }_{D}\). Thus, national income is \(x=w+\left(1-t\right){\pi }_{D}\). Public expenditure is entirely financed by tax revenues from the domestic and the multinational firm, i.e., \(G=t{\pi }_{D}+t{\pi }_{M}\). Hence, home country welfare can be written as

We assume that the welfare function has the usual properties, i.e., \({W}_{x}^{^{\prime}}, {W}_{G}^{^{\prime}}>0\) and \(W_{{xx}}^{{\prime \prime }} ,{\text{W}}_{{{\text{GG}}}}^{{\prime \prime }} < ~{\text{0}}\). In the following, welfare is denoted by \({W}^{es/sh}\) if both rules bind. Differentiating \({W}^{es/sh}\) with respect to \({z}_{sh}\) yields

where the former term in the brackets is \(\frac{dx}{d{z}_{sh}}\) and the latter is \(\frac{dG}{d{z}_{sh}}\). We are especially interested in changes of the safe harbor regulation when both rules bind for two reasons. Firstly, the previous literature recommends the use of a sole earnings stripping rule. Thus, the effects of a safe harbor regulation in combination with an existing earnings stripping rule are highly relevant. Secondly, to use a similar approach is the easiest way to compare our results with those of Gresik et al. (2017). Therefore, this section focuses on the analysis of changes in the safe harbor regulation when both rules bind and the earnings stripping rule is kept constant. In any equilibrium where both rules bind, Eqs. (1–9) and \({l}_{M}+{l}_{D}=1\) hold with equality. Totally differentiating these equations and inserting the results in Eq. (11) leads to

Equation (12) shows the effect of a tightening of the safe harbor rule on welfare. Whenever Eq. (12) is strictly positive, a tightening of the rule leads to lower welfare in the home country since a higher \({z}_{sh}\) implies weaker regulation. For \(\frac{dk}{d{z}_{sh}}>0\), a weakening of the safe harbor rule has a strictly positive effect on national income; however, the effect on public income is ambiguous. The ambiguity is caused by the different effects on the tax base of the domestic and the multinational firm. As we know from the derivation of Eq. (12), a weakening of the safe harbor rule reduces the profit of the domestic firm on the one hand and increases the MNC’s taxable profits in the home country on the other hand. For national income, the positive effect on wages overcompensates for the loss in entrepreneurial income. As a result of these findings the following statement applies.

Proposition 3

For \({W}_{x}^{^{\prime}}={W}_{G}^{^{\prime}}\;and\) \(\frac{dk}{d{z}_{sh}}>0\) , one should not use the safe harbor rule in conjunction with the earnings stripping rule if both rules bind in equilibrium because a tightening of safe harbor regulation decreases the home country’s welfare.

If we assume that the government puts equal weighting on national and public income, i.e., \({W}_{x}^{^{\prime}}={W}_{G}^{^{\prime}}\), then Eq. (12) can be reduced to

which is strictly positive as long as a weakening of the safe harbor rule has a positive effect on the MNC’s capital inputs, i.e., \(\frac{dk}{d{z}_{sh}}>0\). Thus, Eq. (13) proves Proposition 3 and supports the primary findings by Gresik et al. (2017). This result is driven by two main assumptions. The first assumption is that both an increase in national and public income has the same effect on welfare. The results from Eq. (12) may change if we ease this condition and assume that the welfare weightings of national and public income differ. Proposition 3 still holds true for \({W}_{x}^{^{\prime}}\ne {W}_{G}^{^{\prime}}\) as long as

Thus, Eq. (14) characterizes the range of welfare functions for which the result holds true, even if welfare weightings are not equal. It is significant that countries with a high welfare weight on national income will probably lie in the range of Eq. (14), whereas countries with a high welfare weight on public income will probably lie outside the range. In the following, we assume that implementation of a stricter safe harbor rule in conjunction with an earnings stripping rule creates incentives for the MNC to reduce its capital inputs. The argument for this assumption is that stricter hybrid regulation could raise the effective cost of capital and the MNC will thus react by decreasing the amount of capital it holds. In contrast, it could be argued that stricter regulation forces the MNC to increase the amount of capital it holds in order to mitigate the constraints. We will take a closer look at how regulation affects capital inputs and shed light on these opposing arguments. Totally differentiating Eq. (8) given Eqs. (6–9) and the results of Appendix 4 lead to

with \(\omega =\frac{1}{1-{c}_{q}^{^{\prime}}}\left[\left(t-{c}_{b}^{^{\prime}}\right){z}_{sh}+\frac{{z}_{sh}}{{z}_{es}}\left(1-t\right)-1\right]\). Equations (6) and (7) determine the Lagrangian multipliers and Eq. (9), as well as Appendix 4, specify changes in the labor market. As we are interested in changes in safe harbor regulation assuming a fixed earnings stripping ratio, there are no changes in \({z}_{es}\) and thus \(d{z}_{es}=0\). As a result of these specifications, Eq. (8) simply depends on production inputs, marginal concealment costs, the safe harbor ratio and some factors which are exogenous to this setting, such as interest rate, earnings stripping ratio and tax rate.

The sign of Eq. (15) is ambiguous and is determined by the underlying cost function and the characteristics of the respective domestic firm. If we remember Proposition 2 and the partially opposing effects stated in it, it is impossible to determine the sign of the effect an increase in capital inputs has on marginal debt shifting and marginal transfer pricing costs. The first argument that comes to mind is that higher capital inputs mitigate the constraints imposed by the safe harbor rule and earnings stripping rule which allows for higher internal debt use. As we know, such higher internal debt use can lead to adverse effects on transfer pricing activities. For this reason it is therefore only the structure of the concealment cost function that determines the direction of the effect. Additionally, the effect size can vary from country to country, since the home country’s domestic economy affects the MNC’s capital use. Consequently, this has an impact on the extent to which the constraints are mitigated. In summary, countries with different characteristics will trigger different MNC capital input reactions due to a tightening of thin capitalization rules. Up until now, two things have been established about thin capitalization regulation in this section. Firstly, an economic environment can exist under which both rules bind and a weakening of the safe harbor regulation will not increase welfare. Secondly, due to unique country characteristics, it is possible that some countries prefer one type of thin capitalization rule over another and others again may wish to use hybrid rules. The results are summarized in Proposition 4.

Proposition 4

For \(\frac{dk}{d{z}_{sh}}<0\) , it is possible to use a safe harbor rule in conjunction with an earnings stripping rule, as long as a country’s welfare function lies within the range defined by Eq. ( 14 ). For \(\frac{dk}{d{z}_{sh}}>0\) , it is possible to use a safe harbor rule in conjunction with an earnings stripping rule, as long as a country’s welfare function lies outside the range defined by Eq. ( 14 ). If this is not the case, a combination of the two rules should not be used.

Proposition 4 does not imply that we expect a high number of countries to use hybrid rules or even that a single country may benefit from such a combination of rules. It merely serves as an important aspect of the explanation for the observed policy choice of some countries.

One main driver behind this finding is cost substitution across profit shifting methods. Without cost substitution, Eq. (15) can be reduced to

Since Eq. (16) is always positive, hybrid regulation can only improve welfare under cost substitutability for all countries lying in the range of Eq. (14). Consequently, multinational firms either treat their profit shifting methods as substitutes, which could explain why countries use such hybrid rules nowadays, or these countries should modify their regulatory instruments and decide on one rule or the other. In contrast, there can be countries that lie outside the range of Eq. (14) but which increase their welfare by implementing a hybrid instrument if the MNC reacts by decreasing the capital inputs it holds (\(\frac{dk}{d{z}_{sh}}>0\)). These countries use the safe harbor rule as an additional protection of their public income, since the implementation of that rule decreases the amount of shifted profits. The results coincide with the characteristics of countries that use hybrid rules nowadays. The Czech Republic, Latvia and Lithuania can be characterized by a high ratio of inward to outward investments and thus have an interest in protecting their public income through an additional safe harbor rule. In contrast, Denmark and Japan with a low ratio of inward to outward foreign direct investment are more interested in domestic tax revenues and wages and only implement an additional safe harbor rule if the MNC increases the amount of capital it holds.

3 Conclusion

In this paper, we analyzed thin capitalization rules when multinational firms can shift profits via debt shifting and transfer pricing and treat these methods as cost substitutes. With this paper, we aim to add a new explanation for the use of hybrid thin capitalization rules to the existing literature. We focused on hybrid rules, i.e., the simultaneous application of the safe harbor rule and the earnings stripping rule, which is the policy of choice of countries like Denmark and Japan. Our results suggest that hybrid rules can be welfare improving under the assumption of cost substitution. The main driver for this result is the MNC’s reaction on capital inputs due to stricter regulation. The argument for decreasing capital inputs is that stricter hybrid regulation could raise the effective cost of capital. In contrast, one could argue that stricter regulation forces the MNC to increase its capital use to mitigate the constraints. Without substitutability and for a defined range of welfare functions the former effect is greater than the latter and we derive the well-known result that safe harbor rules are inferior to earnings stripping rules and that the two rules should not be used in conjunction. If cost substitution applies, the result can change depending on the underlying concealment cost function. The prediction was that countries with a high ratio of inward to outward foreign direct investment can have an interest in protecting the tax revenues paid by MNCs through an additional safe harbor rule. In contrast, countries with a low ratio of inward to outward foreign direct investment are more interested in domestic tax revenues and wages and only implement an additional safe harbor rule if the MNC increases the amount of capital it holds. In many countries the reaction of the MNC will not coincide with their welfare characteristics, and therefore, these countries should only implement an earnings stripping rule. As the welfare analysis has shown, hybrid instruments can be welfare improving either when a positive capital input reaction coincides with a high interest in national income or when a negative capital input reaction coincides with a high interest in public income. Thus, the implication for policy making is not that all countries should use hybrid policies, but that cost substitution across methods of profit shifting and the countries’ welfare characteristics can be an important aspect explaining the policy choice of the countries that have chosen such an instrument. Our results are, of course, based on stylized model characteristics. Nevertheless, we believe that the results provide important insights for the explanation of the observed choice of policy of several countries.

Notes

See the OECD Tax Database for the data used.

The maximization problem and the corresponding first-order conditions can be found in Appendix 1.

The proof of Proposition 1 and the arguments provided below is shown in Appendix 2.

The proof of Proposition 2 and the arguments provided above is shown in Appendix 3.

The derivation of equation (12) can be found in Appendix 9.

References

Blouin, J.L., Huizinga, H., Laeven, L., and Nicodeme, G., 2014. Thin capitalization rules and multinational firm capital structure. CESifo working paper No. 4695.

Büttner, T., Overesch, M., Schreiber, U., & Wamser, G. (2012). The impact of thin-capitalization rules on the capital structure of multinational firms. Journal of Public Economics, 96, 930–938.

Gresik, T. A., Schindler, D., & Schjelderup, G. (2017). Immobilizing corporate income shifting: Should it be safe to strip in the harbor. Journal of Public Economics, 152, 68–78.

Haufler, A., & Schjelderup, G. (2000). Corporate tax systems and cross country profit shifting. Oxford Economic Papers, 52, 306–325.

Hong, Q., & Smart, M. (2010). In praise of tax havens: International tax planning and foreign direct investment. European Economic Review, 54(1), 82–95.

Kant, C. (1988). Endogenous transfer pricing and the effects of uncertain regulation. Journal of International Economics, 24, 147–157.

Krautheim, S., & Schmidt-Eisenlohr, T. (2011). Heterogeneous firms, ‘profit shifting’ FDI and international tax competition. Journal of Public Economics, 95, 122–133.

Mardan, M. (2017). Why countries differ in thin capitalization rules: The role of financial development. European Economic Review, 91, 1–14.

Møen, J., Schindler, D., Schjelderup, G., & Bakke, J. (2019). International debt shifting: The value-maximizing mix of internal and external debt. International Journal of the Economics of Business, 26, 431–465.

Nicolay, K., Nusser, H., Pfeiffer, O., (2017). On the interdependency of profit shifting channels and the effectiveness of anti-avoidance legislation. ZEW discussion paper 17.

OECD. (2013). Addressing base erosion and profit shifting. OECD Publishing.

OECD. (2015). Limiting base erosion involving interest deductions and other financial payments. Final Report. OECD Publishing.

Saunders-Scott, M. J. (2015). Substitution across methods of profit shifting. National Tax Journal, 68(4), 1099–1120.

Schindler, D., & Schjelderup, G. (2016). Multinationals and income shifting by debt. International Journal of the Economics of Business, 23, 263–286.

Stonehill, A., & Stitzel, T. (1969). Financial structure and multinational corporations. California Management Review, 12, 91–96.

Wamser, G. (2014). The impact of thin capitalization rules on external debt usage - a propensity score matching approach. Oxford Bulletin of Economics and Statistics, 76, 764–781.

Acknowledgements

We thank the editor of this journal Ronald B. Davies and two anonymous referees for constructive comments. Earlier revisions of this paper have been presented at the WEAI 2019 in San Francisco, and we wish to thank all participants for the helpful discussion in the early stage.

Funding

Open Access funding enabled and organized by Projekt DEAL. The authors did not receive support from any organization for the submitted work. The authors have no relevant financial or non-financial interests to disclose.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

Equations (3), (4) and (5) set up the profit maximization problem of the MNC,

Solving the maximization problem requires a Lagrangian function that can be defined as

The resulting first-order conditions are

Rearranging terms in Eqs. (19–22) leads to the first-order conditions of Eqs. (6–9).

Appendix 2

Proof of Proposition 1

In the unconstrained case, marginal labor productivity reads \({f}_{{l}_{M}}^{^{\prime}}=w\) and marginal capital productivity reads \({f}_{k}^{^{\prime}}=\frac{r}{1-t}\), regardless of whether cost substitutability is assumed or not. Thus, totally differentiating yields \(\frac{dk}{dq}, \frac{dk}{db},\frac{d{l}_{M}}{dq},\frac{d{l}_{M}}{db}=0\), which proves the first part of Proposition 1. Without substitutability, the first-order condition, \({{\Pi }^{*}}_{b}^{^{\prime}}=rt>0\), shows that the MNC chooses \({b}^{*}=k\) in equilibrium. Equation (9), together with \({{\Pi }^{*}}_{b}^{^{\prime}}\), shows that the effective gains of internal debt decrease under cost substitutability, because \({\Pi }_{b}^{^{\prime}}-{{\Pi }^{*}}_{b}^{^{\prime}}=-r{c}_{b}^{^{\prime}}<0\), which implies \(b<{b}^{*}\). Additionally, Eq. (6) is the same in both cases, i.e., \(t={c}_{q}^{^{\prime}}\). Combined with \(c\left(q,0\right)<c(q, rb)\) and \(c_{{qq}}^{{\prime \prime }} > ~{\text{0}}\) we get \(q<{q}^{*}\) for any positive value of \(rb\).

Appendix 3

Proof of Proposition 2

In case of a safe harbor regulation marginal capital productivity is given by \({f}_{k}^{^{\prime}}=\frac{r-{\lambda }_{sh}{z}_{sh}}{1-t}\). Since we know that \({\lambda }_{sh}{z}_{sh}\) is always positive, an introduction of a safe harbor rule leads to decreasing marginal capital productivity, i.e., \(\frac{d{f}_{k}^{^{\prime}}}{d{\lambda }_{sh}{z}_{sh}}=-\frac{1}{1-t}<0\), which implies an increasing \(k\). Totally differentiating \({l}_{M}+{l}_{D}=1\) implies \(d{l}_{M}=-d{l}_{D}\). Equations (2 and 9) imply \({f}_{l}^{^{\prime}}-{g}_{l}^{^{\prime}}=0\). Totally differentiating yields \(\frac{{dl_{M} }}{{dk}} = - \frac{{f_{{lk}}^{{\prime \prime }} }}{{f_{{{\text{ll}}}}^{{\prime \prime }} {\text{ + g}}_{{{\text{ll}}}}^{{\prime \prime }} }} > {\text{0}}\), which proves that higher capital use results in higher labor demand by the MNC. Marginal debt shifting costs under substitutability are given by \({c}_{b}^{^{\prime}}=t-\frac{{\lambda }_{sh}}{r}\), and these decrease for positive values of \({\lambda }_{sh}\). Due to \(c_{{bb}}^{{\prime \prime }} ,c_{{qq}}^{{\prime \prime }} ,c_{{bq}}^{{\prime \prime }} ,c_{{qb}}^{{\prime \prime }} > ~{\text{0}}\) either a decreasing \(q\) or \(b\) is implied. Additionally, marginal transfer pricing costs are not directly affected by regulation, i.e., \(t={c}_{q}^{^{\prime}}\), which implies that a decrease in \(q\) results in an increase in \(b\) and vice versa. Overall shifted profits have to decrease, as the MNC would choose a combination of \(q\) and \(b\) with lower marginal costs, as well as more, or the same, overall shifted profits itself, if possible. The same argument applies for total MNC profits. Regulation decreases those profits. If there could be gains achieved through strategic changes, the MNC would adapt its strategy without the need for regulatory incentives.

In case of earnings stripping regulation, marginal capital productivity is given by \({f}_{k}^{^{\prime}}=\frac{r}{1-t+{\lambda }_{es}{z}_{es}}\). Since we know that \({\lambda }_{es}{z}_{es}\) is always positive, introduction of a safe harbor rule leads to decreasing marginal capital productivity, i.e., \(\frac{d{f}_{k}^{^{\prime}}}{d{\lambda }_{es}{z}_{es}}=-\frac{r}{{\left(1-t+{\lambda }_{es}{z}_{es}\right)}^{2}}<0\), which in turn implies an increasing \(k\). Marginal debt shifting costs under substitutability are given by \({c}_{b}^{^{\prime}}=t-{\lambda }_{es}\), which decrease for positive values of \({\lambda }_{es}\). Due to \(c_{{bb}}^{{\prime \prime }} ,c_{{qq}}^{{\prime \prime }} ,c_{{bq}}^{{\prime \prime }} ,c_{{qb}}^{{\prime \prime }} > ~{\text{0}}\), this implies either a decreasing \(q\) or \(b\). Additionally, marginal transfer pricing costs are directly affected by regulation, i.e., \(t={c}_{q}^{^{\prime}}+{\lambda }_{es}{z}_{es}\). Thus, the decreasing q or b has a negative impact on \({c}_{q}^{^{\prime}}\). Combined with the positive effect of \({\lambda }_{es}{z}_{es}\), the reaction of the other profit shifting channel can be either positive or negative. The arguments for overall shifted profits are the same as for the safe harbor rule.

Appendix 4

Derivation of Eq. (12)

In any equilibrium where both rules are binding, Eqs. (1–9) and (i) \({l}_{M}+{l}_{D}=1\) hold with equality. We know from Appendix C that \(\frac{{dl_{M} }}{{dk}} = - \frac{{f_{{lk}}^{{\prime \prime }} }}{{f_{{ll}}^{{\prime \prime }} + g_{{ll}}^{{\prime \prime }} }}\) and \(d{l}_{M}=-d{l}_{D}\), which implies \(\frac{{dl_{D} }}{{dk}} = \frac{{f_{{lk}}^{{\prime \prime }} }}{{f_{{ll}}^{{\prime \prime }} + g_{{ll}}^{{\prime \prime }} }}\). Totally differentiating Eq. (2) results in \(\frac{{dw}}{{dl_{D} }} = g_{{ll}}^{{\prime \prime }}\). Combining these conditions results in (ii) \(\frac{{dw}}{{dk}} = \frac{{f_{{lk}}^{{\prime \prime }} g_{{{\text{ll}}}}^{{\prime \prime }} }}{{f_{{ll}}^{{\prime \prime }} + g_{{{\text{ll}}}}^{{\prime \prime }} }}\). Furthermore, differentiating Eq. (1) combined with \(\frac{dw}{dk}\) leads to (iii) \(\frac{{d\pi _{D} }}{{dz_{{sh}} }} = - l_{D} \frac{{f_{{lk}}^{{\prime \prime }} g_{{ll}}^{{\prime \prime }} }}{{f_{{ll}}^{{\prime \prime }} + g_{{ll}}^{{\prime \prime }} }}\frac{{{\text{dk}}}}{{{\text{dz}}_{{{\text{sh}}}} }}\). Combining Eqs. (4, 5) as well as (9) and totally differentiating yields \(\frac{{dq}}{{dk}} = f_{k}^{\prime } - \frac{{f_{{lk}}^{{\prime \prime }} g_{{ll}}^{{\prime \prime }} }}{{f_{{ll}}^{{\prime \prime }} + g_{{ll}}^{{\prime \prime }} }}{\text{l}}_{{\text{M}}} {\text{ - }}\frac{{{\text{rz}}_{{{\text{sh}}}} }}{{{\text{z}}_{{{\text{es}}}} }}\). Based on this, differentiating \({\pi }_{M}=f\left(k, {l}_{M}\right)-w{l}_{M}-q-rb\) with respect to \({z}_{sh}\), using the fact that Eq. (5) binds and rearranging the terms, leads to (iv) \(\frac{d{\pi }_{M}}{d{z}_{sh}}=(1-{z}_{es})\frac{r{z}_{sh}}{{z}_{es}}\frac{dk}{d{z}_{sh}}\). Using (ii), (iii) and (iv) in Eq. (11) and rearranging gives Eq. (12).

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Goerdt, G., Eggert, W. Substitution across profit shifting methods and the impact on thin capitalization rules. Int Tax Public Finance 29, 581–599 (2022). https://doi.org/10.1007/s10797-021-09674-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-021-09674-1