Abstract

We present a scheme for analysing income tax perturbations, applied to a real Norwegian tax reform during 2016–2018. The framework decomposes the reform into a structural reform part and a tax level effect. The former consists of a distributional impact and a social efficiency effect measured as the behavioural-induced change in tax revenue. Considering the overall welfare effect conditional on inequality aversion, we back out the pivotal value of the decision makers’ inequality aversion, according to which unfavourable redistributional effects exactly cancel out a social efficiency enhancement.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

There are two major strands of research in the normative tax analysis of public economics. One approach is to characterise the optimal taxes starting with a clean sheet. This is known as the tax design problem. The other is the tax reform approach, highlighted in particular by Feldstein (1976), who argued that optimal tax reform must take as its starting point the existing tax system. According to Feldstein (op.cit., p.90), “in practice, tax reform is piecemeal and dynamic in contrast to the once-and-for-all character of tax design”. In the wake of Feldstein’s emphasis on tax reform analysis, a series of papers addressed in a theoretical framework the effects of small commodity tax reforms, often called tax perturbations (Diewert, 1978; Dixit, 1975; Guesnerie, 1977). Piecemeal income tax reforms have received attention only more recently, see Golosov et al. (2014), Saez (2001), Hendren (2016) and Bierbrauer et al. (2021). Most of the reforms that have been studied take the form of small perturbations of the initial tax function.

We present a framework for assessing income tax perturbations focusing on the distributional and social efficiency aspects of the reform. Distinguishing between tax level and tax structure has a long-standing tradition in public economics. We can think of the level as determined by the height at which the tax schedule is located, while the tax structure is determined by the shape of the tax function, i.e. the marginal taxes at various income levels. The shape of the tax function determines both the distribution of the tax burden across heterogeneous taxpayers and the extent to which taxes are distortionary and harm the social efficiency of the economy. The tax level determines the total burden imposed on the taxpayers as taxes suppress private consumption to make resources available for the public sector. Determining the tax structure and choosing the tax level are separate decisions. Politicians can have different views about either, and informing the discussion about either is important. This motivates efforts to disentangle the structural and the level part of a tax reform where it changes the tax policy in both respects.Footnote 1

Our contribution is to present a decomposition allowing us to study structural changes, leaving aside the choice of tax level. To separate out the structural aspect of a tax reform, we assume that any change of the aggregate burden on the taxpayers is offset by adjusting a hypothetical uniform cash transfer (or lump-sum tax) to keep the tax level unchanged. Then, we have a pure structural reform that influences the distribution of the tax burden and the economic behaviour of the taxpayers. We explore the redistributive and social efficiency effects of this reform. The advantage is to achieve a clear distinction between a pure (zero-sum) redistribution and a quantifiable enlargement (or contraction) of the amount available for distribution due to a more (or less) efficient allocation. We leave aside how the actual mechanical change in aggregate tax burden may (dis)benefit the taxpayers, which is a different type of policy question.

To make a welfare assessment of the distributional effects, we apply a particular class of welfare weights that reflect the inequality aversion of the distributional preferences. Departing from a tax-distorted initial allocation, efficiency effects are determined by the pre-existing tax wedges and the behavioural responses to the tax reform. The impact on social efficiency can then be measured by the behavioural-induced change of tax revenue. We shall elaborate on these aspects below.

Suppose the outcome is a more unequal distribution and a more efficient allocation or vice versa. Then, we need to place a value on the induced revenue change in order to compare it with the distributional effect and achieve an overall assessment of the structural reform. For this purpose, we assume that a behavioural-induced revenue gain is recycled as a lump-sum transfer (or a loss is covered by a lump-sum tax). Our approach implies that we consider (positive or negative) transfers to the taxpayers in two steps, first to offset the mechanical effect of the tax reform to keep the tax level unchanged (Step 1) and then to redistribute the additional tax revenue generated by enhanced efficiency (Step 2). Opting for this two-step procedure, rather than a single step, is motivated by our desire to specify the various factors that determine how the reform affects welfare.

Finally, we can describe how the overall welfare effect depends on the inequality aversion, which enables us to infer the range of distributional preferences that are implicit in political support for the reform. By exploring implicit preferences, assumed to be revealed by the tax reform, we add to the studies of implicit preferences previously based on the assumption that the actual policy is optimal, known as the inverse optimum problem (a term coined by Ahmad & Stern, 1984).

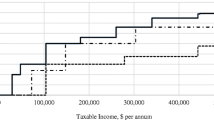

We apply our procedure to piecemeal income tax reforms implemented in Norway during the period 2016–2018, enabling us to achieve results with substantial empirical content. Figure 1 shows how the 2018-schedule compares to the schedule of 2015. The figure reveals that although there are some reductions at lower and medium income levels too, the largest reductions are seen at the top. As we shall demonstrate, this implies that the architects of this reform do not exhibit a large degree of inequality aversion.

The studies of income tax perturbations in the literature take somewhat different approaches to highlight various reforms and various reform effects, but the papers share a number of key features. In particular, they typically distinguish mechanical effects (abstracting from behavioural responses) and behavioural effects of tax reforms, adopting the terminology of Saez (2001).

The present study connects to other contributions of the literature. Golosov et al. (2014) establish a general and rich model to characterise the welfare effects of local tax reforms in a dynamic setting. The paper identifies the various mechanical and behavioural effects of tax perturbations. It addresses tax reforms that are departures from the existing tax system, such as introducing nonlinear capital taxes and introducing joint taxation of various forms of income in a life-cycle setting with age-dependent behaviour. In contrast, our paper presents a more detailed analysis of a more narrow set of tax perturbations.

Bierbrauer et al. (2021) are mainly concerned with the political feasibility of income tax reforms in the sense that a reform is in the self-interest of a majority of taxpayers. They consider a perturbation of the tax function, which may enhance or diminish the amount of tax revenue. The main assumption is that any additional tax revenue, whether mechanical or behavioural-induced, is recycled as a cash transfer (or a lump-sum tax makes up for a loss). To assess the reform, most of the analysis assumes that the induced revenue is transferred as a uniform lump sum to the taxpayers. Considering net effects of the tax and transfer changes, there may be losers and winners. The political feasibility will depend on the respective numbers of winners and losers, and the welfare effect will in general depend on the welfare weights assigned to the various agents.

With its emphasis on political feasibility, Bierbrauer et al. (2021) have a different focus than our paper. From a welfare-analytical perspective, the approaches show both similarities and differences. Bierbrauer et al. consider a revenue-neutral reform in the sense that any mechanical or behavioural-induced revenue change is offset by a lump-sum transfer. In this sense, their analysis could be perceived as addressing a structural reform where the benchmark is a fixed revenue rather than a fixed burden on the taxpayers, as in our structural reform analysis. We first ask how changing the profile of the tax schedule, while preserving the average burden on the taxpayers, impacts the distribution and affects social efficiency, where it is straightforward to measure the latter effect in terms of behavioural-induced change in tax revenue. In either study, a lump-sum transfer/tax is used as a level parameter.

Hendren (2016) expresses the reform-induced benefit to an agent as the change in net resources (lump-sum transfer minus gross tax liability) transferred from the government to the agent plus the impact of the agent’s change of behaviour on government revenue. For a revenue-neutral reform, the net resource transfers sum to zero and can be used as one way to express distributional effects of the total reform. In our analysis, we use the mechanical effects of the (structural) reform to express the distributional effects. Since the individual net resource transfers are determined both by mechanical and behavioural effects, the distributional effects in Hendren’s approach include efficiency effects that we would like to separate out.

Our paper focuses on taxation of labour income within a standard labour supply model. Hence, our framework is within the strong modelling tradition of optimal nonlinear and (piecewise) linear income taxation, see, for example, Mirrlees (1971), Sheshinski (1972), Dahlby (2008) and Apps and Rees (2009).

The current paper proceeds as follows. We describe our theoretical approach in Sect. 2. Section 3 presents the Norwegian tax perturbations used in the empirical analysis in Sect. 4. Section 5 concludes.

2 A scheme for assessing tax perturbations

2.1 Mechanical, efficiency and welfare effects

We consider a population of agents who choose labour supply for given wage rates and tax parameters. Denote the wage rate by w and labour supply by h. The tax function for labour earnings is given by \(T( y, \vec{\theta } )\), where y is income and \(\vec{\theta }\) is a vector of tax parameters (\(\vec{\theta }=(\theta _{1},\theta _{2}, \dots ,\theta _{j},\dots ))\), which may include tax rates and bracket limits of a piecewise linear tax system. Let the initial tax function be defined by the parameter vector \(\vec{\theta }^{\,1}\). We may simplify the notation by writing \(T_{1}\left( y\right) \equiv T( y,\vec{\theta } ^{\,1})\). A tax perturbation is then defined by a vector of increments, as \(d\vec{\theta }=(d\theta _{1},d\theta _{2},\dots ,d\theta _{j},\dots )\), generating a new tax function \(T_{2}(y) =T( y,\vec{\theta }^{\,2}) =T( y,\vec{\theta }^{\,1}+d\vec{\theta }^{\,1})\). Assume there is a distribution of agents with density function f(w). We normalise the size of the population to unity. The tax reform will have mechanical effects, behavioural effects and distributional effects. A mechanical effect is the effect on the tax liability for unchanged behaviour, i.e. fixed labour supply and consequently fixed income. For some initial income y, the mechanical effect is \(M\left( y\right) =T_{2}\left( y\right) -T_{1}\left( y\right)\). The immediate welfare effect on consumers is the sum of welfare-weighted real income effects of the tax reform. We note that real income losses are equal to the mechanical effects when, due to envelope properties, there are no first-order effects of behavioural changes. The behavioural effect on tax payment is the change due to behavioural changes, which in this case are labour supply and corresponding income responses. In formal terms, the behavioural effect is then \(B\left( w\right) =T_{1}^{\prime }\left( y( w,\vec{\theta }^{\,1}) \right) wdh\) \(=T_{1}^{\prime }\left( y( w,\vec{\theta }^{\,1}) \right) dy\) where dh is the change in labour supply and dy is the change in taxable income that the tax reform induces. As we shall discuss in the next section, there will be exceptions where the marginal disutility of labour is not equated to the after-tax wage rate.

Consider an agent with wage rate w reflecting his marginal product of labour. His marginal disutility of labour is s in monetary terms. Where the induced change in labour supply is dh, there is a social efficiency gain \(\left[ w-s\right] dh\), which is the increase in output beyond the cost of compensating the worker for the disutility of supplying the extra labour required. This is a behavioural effect. Where the tax function is differentiable, the marginal disutility of labour is equated to the after-tax marginal wage rate: \(w\left( 1-T^{\prime }\right)\), and the social efficiency gain is \(\left[ w-w\left( 1-T^{\prime }\right) \right] dh=wT^{\prime }dh=T^{\prime }dy\), where dy is the change in gross income.

Also paying attention to the extensive margin of labour supply, we may assume that there is a cost of working, k, and a distribution of k across the population is characterised by the density g(k). Assume that an agent pays the tax \(T_{0}\) when not working and obtains an income net of tax \(y-T\) if working. The net private gain from working is then \(y-k-\left( T-T_{0} \right)\), which is zero for a marginal worker, while the net social gain is \(y-k\). For a marginal worker induced to enter the labour force, the net social gain is \(y-k=T-T_{0}\), which is the change in tax revenue.

A tax reform will normally affect both the tax level, and the tax structure, defined by how the marginal tax rate varies across income, typically determined by number of tax brackets, bracket limits and marginal tax rate in each bracket. In this paper, we focus exclusively on the tax structure. We are not concerned with the overall resource allocation between the public and the private sector of the economy. In accordance with our focus, we shall single out structural changes for further scrutiny. We do this in the following way. We introduce a lump-sum element in the tax function allowing us to cleanse out the level effect. The new tax function is \(T_{3} (y)=T_{2}(y)-\alpha\), where we can interpret \(\alpha\) as a pure level parameter. This is a hypothetical tax schedule in the sense that it is not observed in practice. We shall set the change in \(\alpha\) (initially set equal to zero) equal to the average mechanical effect of a tax reform. This means that for a small tax perturbation, the change in tax level is measured by the average change in the burden on the taxpayers. By subtracting \(\alpha\) in the tax function, the taxpayers are on average compensated for the increased tax burden. A change in \(\alpha\) implies a vertical shift in the tax schedule. The advantage is to have a level effect which is unaffected by the reform changes in marginal tax rates. This would not be the case where the revenue effects induced by marginal tax rate changes are offset by a lump-sum tax/transfer.

Since mechanical effects reflect the income losses of the taxpayers (under the assumptions above), assuming no aggregate mechanical effect (after adjusting \(\alpha\)) implies that we are left with redistributive and efficiency effects. In two respects, these effects are not independent. First, the distributional profile of the tax schedule also affects how distortionary it is. Secondly, when there is a transfer from agent i to agent j, there will be income effects on behaviour that in turn will change the agents’ tax payments and tax revenue for the government. Whether there is a net effect depends on whether the agents have different marginal propensities to pay tax, where an agent’s marginal propensity to pay taxes is given by \(T^{\prime }wdh/d\alpha\), where \(dh/d\alpha\) is a pure income effect. As there are pre-existing distortions of labour supply, a behavioural-induced rise (fall) in tax revenue is beneficial (harmful), as discussed above. We can interpret this effect of a transfer as a social efficiency effect of redistribution.Footnote 2 In addition, the tax reform will obviously generate substitution effects. Our aggregate measure of the social efficiency impact will be the sum of these efficiency effects. It may also be of interest to observe which households and income groups contribute (positively or negatively) to the efficiency effect.

Now taking a formal approach, write the indirect utility function \(V( w^{i},\vec{\theta },\alpha )\), where i indicates agent. Simplifying the notation, we can write \(V^{i}( \vec{\theta },\alpha ) \equiv V( w^{i},\vec{\theta },\alpha )\). Taking \(\vec{\theta }^{\,1}\) as our point of departure, we consider the tax reform \(d\vec{\theta }=(d\theta _{1},d\theta _{2},\dots ,d\theta _{j} \dots )\), and \(d\alpha\) to cleanse out the level effect, as discussed above. Denote by \(\gamma ^{i}\) agent i’s marginal utility of income, and let \(g^{i}=\sum _{j}d\theta _{j}\frac{\partial V^{i}}{\partial \theta _{j}}/\gamma ^{i}+d\alpha\) be the gain in terms of income obtained by agent i due to the tax reform defined by the increments \(d\vec{\theta }\), \(d\alpha\). As discussed above, the private income gain (loss) for an agent is equal to the mechanical revenue loss (gain) for the government since both are defined absent behavioural changes.

Now, write total welfare \({\Lambda }\) as the welfare derived from private income plus the value of government revenue in terms of welfare:

where \(\mu\) is the shadow value of government revenue. The welfare effect of the structural tax reform under consideration can then be expressed asFootnote 3

We can now distinguish the various effects of the structural reform. By our definition of constant tax level, implemented by \(d\alpha\), it follows that \(\sum _{i}{g^{i}}=0\). However, each element in the sum may be strictly positive or negative, and there will be winners and losers. The social efficiency effect, measured in terms of government revenue, is given by \({\sum \nolimits _{j}} \frac{\partial R}{\partial \theta _{j}}d\theta _{j}+\mu \frac{\partial R}{\partial \alpha }d\alpha =dR_{b}\), which is the behavioural effect. The reason is that the mechanical effect included in the former term is offset by the latter term. The expression for the welfare effect of the structural reform is then reduced to \(d {\Lambda }=\sum \gamma ^{i}g^{i}+\mu dR_{b}\).

Now, assume that the revenue from enhanced efficiency, \(dR_{b}\), is redistributed as a lump-sum transfer denoted by \(d\alpha ^{*}\). In the absence of income effects, \(d\alpha ^{*}=\) \(dR_{b}\). Where there are income effects on behaviour, the final transfer will have to be calculated taking income effects into account and \(d\alpha ^{*}\) may deviate from \(dR_{b}\). We shall come back to this later. Where any additional tax revenue is recycled to the taxpayers, the total welfare effect of the structural reform can be rewritten as \(d {\Lambda }=\sum \gamma ^{i}\left( g^{i}+d\alpha ^{*}\right)\).

2.2 The piecewise linear income tax: a simple illustration

We shall consider a reform of a piecewise linear income tax, which is defined by three properties: number of tax brackets (steps), the bracket limits and the marginal tax rate in each bracket. To provide an illustration of our approach, we shall, as a first step, consider a simple two-bracket case. We assume that income below some level \(Y_{1}\) is taxed at a rate \(t_{1}\), where \(Y_{1}\) is the upper limit of the first tax bracket. The marginal tax rate is discontinuous at \(Y_{1},\) and income above \(Y_{1}\) is taxed at a marginal rate equal to \(t_{2}\). In practice, tax systems typically exhibit marginal tax progressivity in the sense that \(t_{2}>t_{1}\) so that the budget set is concave.Footnote 4 We let \(y\) denote taxable income. It is common to model the tax system as comprising a universal transfer, here denoted by \(a\).Footnote 5 People in the bracket \(\left[ 0,Y_{1} \right]\) pay a net tax \(t_{1}y-a\) and earn a disposable income \(c=y-t_{1}y+a\).Footnote 6 People with income above \(Y_{1}\) face a (net) tax liability \(t_{1}Y_{1}+t_{2} \left( y-Y_{2} \right) -a\) and earn a disposable income \(c=y-t_{1}Y_{1}-t_{2} \left( y-Y_{1} \right) +a.\)

We note that for taxpayers with income above \(Y_{1},\) the tax paid on the part of the income equal to \(Y_{1}\) is tantamount to a lump-sum tax. Increasing it raises the average tax rate while leaving the marginal tax rate unchanged.

We assume that people have the same preferences for consumption of market goods (disposable income) and labour (or leisure). For a person with a fixed wage rate, we can use gross income as a measure of labour supply and express utility as a function of disposable income, c, and gross income, y: \(u \left( c,y;w \right)\), which is maximised subject to the budget constraint. We assume that the cardinalisation of u is chosen such that the marginal utility \(u_{c}\) reflects the social welfare weight assigned to an extra unit of disposable income. Where inequality aversion prevails, \(u_{c}\) is a declining function of w. Marginal income is considered less socially valuable when accruing to a richer person. We let \(f \left( w \right)\) denote the density of the wage distribution, where \(f \left( w \right) =0\) for sufficiently low or high values of w.

At the income level \(Y_{1},\) the tax schedule and consequently the budget set will have a kink-point. At a kink-point, there will in general be bunching of agents with different wage rates all earning the same (gross and disposable) income given by the kink-point. We shall make the standard assumption that through any point in the y,c-diagram agents with higher wage rates have flatter indifference curves, i.e. a smaller marginal rate of substitution, \(S=-u_{y}/u_{c}\), than those with lower wage rates—an assumption usually referred to as agent monotonicity (see Mirrlees, 1971; Seade, 1982). This means that a person with a higher wage rate requires a smaller compensation in terms of disposable income for the efforts needed to increase the gross income.Footnote 7 We can express the required marginal compensation, S, as a function of w: \(S \left( w \right)\). Assuming there is a continuum of w-type agents, there will exist w-values \(\underline{w}\) and \(\overline{w}>\underline{w}\) for agents located at the kink-point such that \(S \left( \underline{w}\right) =1-t_{1}\) and \(S \left( \overline{w}\right) =1-t_{2}<S \left( \underline{w}\right)\). For \(w\)-values in between, \(S \left( \overline{w}\right) =1-t_{2}<S \left( w \right) <S \left( \underline{w}\right) =1-t_{1}\). These agents will choose the kink-point since they would be worse off moving to one of the segments on either side of the kink. Now, suppose that the bracket with marginal tax rate \(t_{1}\) is extended a bit beyond the initial value \(Y_{1}\). A person who is initially at the kink and who is characterised by \(S \left( w \right) <1-t_{1}\) will then benefit from choosing a slightly larger y, say increasing it by \(dy\). The agent will then achieve a gain equal to \(\left( 1-t_{1}-S \left( w \right) \right) dy\), which is the augmentation of disposable income minus the disutility of extra labour in monetary terms. In Appendix 2, we present a framework for obtaining empirical measures of these gains, given the changes of the reform under investigation here. The results confirm that the benefits due to bracket extensions are relatively small.

We express the social welfare function as

Taking account of the agents’ budget constraints, we can write

To find the social welfare effects of small changes in the parameters defining the tax structure, we differentiate with respect to \(t_{1},t_{2},Y_{1}\) and, invoking the Envelope Theorem,Footnote 8 we get

where \(u_c\) is the marginal utility of disposable income.

A lump-sum transfer that offsets the average loss of income due to the parameter increments \(dt_{1},dt_{2},dY_{1}\) is then given byFootnote 9

The net income change that an agent experiences is the change in income due to changes in all parameters of the tax-transfer system. For instance, a person in the lowest bracket will experience a net income change equal to \(da-ydt_{1}\). Now, denote the net income change of a person by \(g\), which is a function of w. We could make this explicit by writing \(g \left( w \right)\). By construction, the aggregate (or average) net income change is zero. These net income changes will then yield a change in social welfare equal to

Since taxpayers face offsetting income changes on average, we are left with a purely redistributive effect, which is negative (positive) where the richer persons experience a net gain (loss) and inequality aversion prevails.

Let us then consider the net tax revenue,

Before we proceed, we introduce m to denote the marginal propensity to pay tax, i.e. the additional tax that has to be paid due to the behavioural changes induced by an additional unit of income, \(ty_{a}\), where t is the marginal tax rate and \(y_{a}= \frac{\partial y}{\partial a}\). Where the income change is \(g\), the change in tax payment due to the income effect is \(ty_{a}g\). Making use of the Slutsky decomposition, we denote by \(s_{1-t_{1}}\) the compensated effect of \(1-t_{1}\) on earnings and \(s_{1-t_{2}}\) the compensated effect of \(1-t_{2}\) on earnings. As explained in Appendix 1, the net revenue effect after allowing for the transfer \(da\) is then

The change in tax revenue net of transfer is determined by a number of behavioural effects (as indicated by subscript b). Increasing marginal tax rates induces substitution from earning income to enjoying more leisure, with more harmful effects on social efficiency the larger the tax wedges and the stronger the responses, as shown by the first and second term on the right-hand side. The third integral, \(\int _{0}^{\infty }mgf \left( w \right) {\mathrm{d}}w\), can be interpreted as the efficiency effect of redistribution. With normal responses those who gain will lower their labour supply and earnings and face a lower tax liability, while those who incur a loss will increase their labour supply and earnings and face a larger tax liability. A positive covariance implies that the winners diminish their tax payments less than the losers increase their tax payments: the efficiency gains outweigh the efficiency losses. The term obviously vanishes where m is constant. The last term is the social efficiency effect which arises when taxpayers at the kink optimally respond to the extension of the lower tax bracket by increasing earnings. The social gain is simply the rise in income minus the monetary value of the disutility of further labour efforts. (The tax payment involved is a pure transfer with no net effect on society as a whole). We treat the gain as accruing to the government since it diminishes the transfer from the government needed to compensate the taxpayers on average.

In the main part of our empirical study, we shall circumvent the problems with assessing the last term of Eq. (3) by neglecting kinks, which means that the set of agents captured by this term is treated as an empty set. The effects to be estimated are then of the kinds illustrated by the remaining terms in Eq. (3). We shall, however, follow up our main analysis by addressing further the challenges posed by kinks. In Appendix 2, we demonstrate how to get empirical measures of the gains at the kinks, also providing estimates of the empirical significance given the kinks of the Norwegian tax schedule.

We can express aggregate social welfare as

where \(\mu\) expresses the social value of government revenue. The aggregate social welfare effect of the perturbations is then

where the terms are given by Eqs. (2) and (3), respectively.

2.3 Further specification issues

Even though we primarily study income tax perturbations, we also need to take into account effects related to indirect taxes. Behavioural responses to the reform will affect consumption, and consequently, commodity taxes will influence the revenue and efficiency effects of the reform. Firstly, a commodity tax drives a wedge between the marginal valuation of a commodity and the cost of producing it. Increased demand will then yield a social efficiency gain due to the pre-existing distortion. Analogous to what we found in the case of income taxation, a rise (fall) in indirect tax revenue, induced by behavioural changes, reflects a social efficiency gain (loss). The effective tax is made up of both the income tax and indirect taxes, as analysed in Edwards et al. (1994), and we need to allow for changes in both sources of revenue. This will be done in the empirical part, but for ease of exposition we shall confine attention to income taxes in the theoretical discussion.

Secondly, in order to take indirect taxes into account, one has to decide how to treat savings since in a particular period the indirect tax base will be smaller the larger is the savings rate. However, a single-period perspective would be too narrow since postponed consumption will be taxed in later periods. We therefore model consumption as if there are no savings. The empirical tax reform we shall consider does not directly impact savings and taxes on savings. The reason is that Norway has a dual income tax with separate taxation of capital income and labour earnings. Any savings effect will be indirect and channelled through the impact on disposable labour income.

Our next objective is to study the welfare-weighted redistribution. In order to assess the distributional effects, we let the welfare weight be a function of disposable income, denoted by z. We choose the functional form

where \(\kappa >0\). The welfare weight is decreasing in z given that \(\beta >0\). This is a widely used function for generating welfare weights (see, for example, Ahmad & Stern, 1984; Evans, 2005; Layard et al., 2008).Footnote 10 We have that \(-\beta\) is the elasticity of the welfare weight with respect to disposable income: \(el_{z^{i}}\gamma ^{i}=-\beta ,\) and \(\frac{\gamma ^{i}}{\gamma ^{j}}=\left( \frac{z^{i}}{z^{j}}\right) ^{-\beta }\). We can interpret \(\beta\) as a measure of inequality aversion. When assigning welfare weights to different households, one may want to allow for differences in household size. The standard method to compare different households is to deflate the income of larger households by using an income equivalence scale, which implies dividing the household disposable income by a factor given by e(n) where n is the number of household members. Various equivalence scales can be employed. A common one is \(e(n)=\sqrt{n}\).Footnote 11 Where an equivalence scale is used, the z-variable will be disposable income adjusted for household size. The redistributional effect of the tax reform is welfare enhancing (diminishing) if \(\sum _{i}\gamma ^{i}g^{i}>0\) \(\left( <0\right)\), characterised as a distributional gain or loss. Deploying our weight function, we have that \(\sum _{i}\gamma ^{i}g^{i}=\sum _{i}\kappa \left( z^{i}\right) ^{-\beta }g^{i}.\) We note that the sign is independent of the value of \(\kappa >0.\)

Having identified both distributive and efficiency effects, a final question is whether the overall welfare effect is beneficial or harmful. We then need to assign a value to the social efficiency gain (or loss) in terms of behavioural-induced rise (decline) in tax revenue.

The social value of this gain in general depends on how the government spends the revenue. An interesting option is a cash transfer to the taxpayers. It is a natural benchmark in the sense that it implies no change of the public sector’s use of real resources. An alternative is to spend the revenue on publicly provided goods. In the event of political indifference between a cash transfer and real spending at the margin, it would obviously make no difference which alternative we consider, but where the policy makers place less value on real expenditure there would clearly be a stronger case for a cash transfer.Footnote 12 To get some information about the political comparison of alternatives, we could observe the tax level part of the tax reform. Where the reform involves a lowering of the tax level, it can be interpreted as evidence that less value is assigned to real government expenditure, which would establish a case for a cash transfer to redistribute any efficiency gain.

We shall now assume that government revenue could be recycled to the taxpayers through a lump-sum transfer. To pursue this approach, suppose that an amount r of government funds is available for transfers to N taxpayers and denote by L a uniform lump-sum transfer. Since a lump-sum transfer will affect tax revenue through income effects, we can write the behavioural effect of L on aggregate tax revenue as \(\varphi (L).\) Then, L must satisfy: \(L=\frac{1}{N}r+\frac{1}{N}\varphi \left( L\right)\). This means that \(\frac{dL}{dr}=\frac{1}{N}+\frac{1}{N}\varphi ^{\prime }\frac{dL}{dr},\) and \(\frac{dL}{dr}=\frac{1}{1-\frac{1}{N}\varphi ^{\prime }}\frac{1}{N}.\) When a lump-sum transfer discourages labour supply, we have \(\varphi ^{\prime }<0\) and \(N\frac{dL}{dr}<1\). Since an initial positive lump-sum transfer diminishes labour supply with a negative impact on tax revenue, the ultimate transfer that can be financed is less than the initial one. Thus, there is a revenue “leakage”. When one unit of income is equally distributed among the taxpayers as a lump-sum transfer, each taxpayer receives 1/N units. Denote by \(m^{i}\) the additional tax that agent i will pay when receiving a one unit transfer. We call this agent i’s marginal propensity to pay tax. The induced additional tax payments then amount to \({\sum _{i}}m^{i}\frac{1}{N}=\overline{m},\) and \(\varphi ^{\prime }=\overline{m},\) which is the average marginal propensity to pay tax. Substituting for \(\varphi ^{\prime }\), \(dL=\frac{1}{1-\frac{1}{N}\overline{m}}\frac{1}{N}dr\). We note that when a transfer to an agent has a negative impact on labour supply and shrinks the income tax base, the marginal propensity to pay tax is negative. Now, letting the efficiency gain of the perturbation in our model accrue to the taxpayers as a uniform lump-sum transfer, we set \(dr=dR_{b},\) and \(dL=\frac{1}{1-\frac{1}{N}\overline{m}}\frac{1}{N}dR_{b}\). The overall welfare effect is then

We can find the cut-off value of \(\beta\), denoted \(\beta ^{*}\), for which the perturbation is just welfare preserving, \(d{\Omega }=0\). To establish a link to the shadow value of government revenue, \(\mu\), introduced above, we see that \(\mu =\overline{\gamma }\frac{1}{1-\frac{1}{N}\overline{m}}\). It is determined both by the mean value of the welfare weights and the revenue leakage.

If we want to quantify the distributional gain (loss) or welfare effect of a perturbation for some value of \(\beta ,\) it is convenient to normalise the welfare measure by setting the average welfare weight equal to unity, \(\frac{1}{N}{\sum \nolimits _{i}}\gamma ^{i}=\overline{\gamma }=1\). We have \(\frac{1}{N}{\sum \nolimits _{i}}\gamma ^{i}=\frac{1}{N}\kappa {\sum \nolimits _{i}} \left( z^{i}\right) ^{-\beta }=1\), implying that \(\kappa =\frac{1}{\frac{1}{N}{\sum \nolimits _{i}}\left( z^{i}\right) ^{-\beta }}\). Then,

A marginal unit of income accruing to agent i is then valued as equal to \(\gamma ^{i}\) units of equally distributed income.

2.4 Further on the piecewise linear income tax

To elaborate on the piecewise linear income tax, we assume that there are J tax brackets. We denote by \(Y_{j}\) the upper limit of bracket j and let \(Y_{J}=\infty\). Denote by \(t_{j}\) the marginal tax rate in bracket j. Since a tax reform may introduce new tax brackets by splitting original ones, it is helpful to let J be the number of post-reform brackets. A bracket splitting may then be modelled by considering an original bracket as consisting of two parts with the same tax rate, say with \(t_{j-1}=t_{j}\) for some j. Part of the reform may then be to differentiate \(t_{j-1}\) and \(t_{j}\) so that in the post-reform situation, we have two proper tax brackets instead of one. In practice, tax systems exhibit marginal tax progressivity in the sense that \(t_{j-1}\le t_{j}\).

For a given number of (potential) tax brackets, a tax reform can change the properties of a bracket in two ways. It can change the bracket limits, and it can change the marginal tax rate \(t_{j}\) in bracket j. Suppose there is an increment \(dt_{j}.\) This will have three effects. It increases both the marginal and average tax rate on incomes in bracket j, and, furthermore, taxpayers in the brackets above will cet. par. face a lump-sum tax increase, \(\left( Y_{j}-Y_{j-1}\right) dt_{j}.\) The rise in the marginal tax rate in bracket j will discourage labour supply through the substitution effectFootnote 13, while the increase in the average tax rate and the lump-sum tax in the brackets beyond \(Y_{j}\) will, under standard assumptions, stimulate labour supply through the income effect.

It is common to model the tax schedule as comprising a universal transfer a. In practice, it is common to have a marginal tax rate equal to zero below some threshold implying that with a lump-sum transfer there would be a negative income tax for low income. This is of no importance where all active workers earn an income above the threshold. Where there is a tax rate t at the lowest income levels, the net tax liability at income y is \(ty-a\). This is zero for \(y=\underline{y}\) \(=\frac{a}{t}.\) a will then be a further tax parameter set by the government. In case all active workers have earnings above \(\underline{y}\), we can, however, model the tax schedule as having a zero marginal tax rate \(t_{1}\) for \(y<\underline{y}=Y_{1}\). Even if this is not strictly true, we may for simplicity confine attention to cases where we neglect workers with very low earnings and focus on the tax brackets 2, \(3,\ldots\), with endpoints \(Y_{2},\) \(Y_{3,}\ldots\) above \(\underline{y}\).

A number of trade-offs will determine the optimal tax schedule.Footnote 14 A higher marginal tax rate in a bracket will increase the tax distortion but will shift more of the tax burden to those in tax brackets beyond the one we consider, and we have a standard equity-efficiency trade-off. Likewise, letting the higher tax rate kick in at a lower income level will raise the tax on agents beyond this point and will increase the marginal tax rate and associated distortion for some tax payers in the lower bracket. At the optimum, there must be indifference between alternative tax perturbations.

Within a standard optimal tax framework, welfare can obviously be enhanced by increasing the number of tax brackets, approaching a continuous tax schedule as the polar case. On the other hand, salience and avoiding complexity are often highlighted as a virtue of tax reforms.Footnote 15 In practice, there is a fairly small number of tax brackets. Numerical examples also indicate that there are diminishing returns to the number of tax brackets: the welfare gain from adding another bracket rather quickly becomes small (Andrienko et al., 2016).

In this paper, there is no assumption about optimality. Our interest is confined to the question whether a reform is efficiency or welfare enhancing. It may neither bring the schedule to its optimum nor be the most efficient step towards the optimum.

In our empirical analysis below, we shall employ a labour supply model with an extensive distribution of taxpayers. Where a large-scale empirical labour supply model is not available, one may have to resort to a simplified procedure to get results. Before we proceed to the empirical part, it may therefore be of interest to consider a simpler approach that would enable an analysis similar to ours in the absence of our type of empirical apparatus. Following Dahlby (2008, ch. 5.2), we can make the simplifying assumption that all taxpayers in a given tax bracket are identical with income equal to the average income in the bracket.Footnote 16 By assumption, there is nobody at the kinks in this simplified model.

We denote by \(y^{j}\) the (average) taxable income of taxpayers in bracket j and by \(n_{j}\) the number of agents in the bracket, where \(j=1,2,\dots ,J\). The tax liability of an agent in bracket 1 is then \(R^{1}=t_{1}\left( y^{1}-Y_{0}\right)\). For an agent in bracket 2, it is \(R^{2}=t_{1}\left( Y_{1}-Y_{0}\right) +t_{2}\left( y^{2}-Y_{1}\right)\). For \(j>2\),

The aggregate tax revenue is

where \(n_{i}\) denotes the number of taxpayers in bracket i. The mechanical effect of a tax perturbation is

This formula collects a number of effects. Where a tax rate in a bracket rises, this will increase the tax on the part of an agent’s income that falls within the bracket in question. Where a bracket limit is extended, a higher tax rate will kick in at a higher income than before to lower the tax charged at all income levels beyond the previous limit.Footnote 17 For a fixed wage rate, choosing labour supply is equivalent to choosing income. We can therefore write gross income as a function of \(1-t\) and income I: \(y(1-t,I)\). A tax reform will change both t and I, where the former will induce substitution and the latter generates an income effect. We denote the compensated elasticity of agent j by \(\xi _{c}^{j}=\left( \partial y^{j}/\partial \left( 1-t_{j}\right) \right) \left( 1-t_{j}\right) /y^{j}\) and the income elasticity by \(\xi _{I}^{j}=\left( \partial y^{j}/\partial I^{j}\right) I^{j}/y^{j}\). The income change induced by a tax perturbation is then

Denoting the average tax rate by \(\tau _{j}\), the agent will incur a real income loss equal to \(y^{j}d\tau _{j}\). Inserting this term in the expression above, we get

The change in tax liability is then

which replicates Dahlby (2008, formula 5.16). Also making use of the income elasticity, we can write \(R^{j}=y^{j}\left[ d\tau _{j}-\left( \xi _{c}^{j}t_{j}/\left( 1-t_{j}\right) \right) dt_{j}-t_{j}\left( \xi _{I}^{j}y^{j}/I^{j}\right) d\tau _{j}\right]\).

Using this simplified approach, one can calculate the various effects used in the analysis when one knows the average income and tax rates in the various tax brackets and has estimates of, or makes assumptions about, the elasticities at the relevant income levels. In that case, the income derivatives or elasticities above will vanish and a further simplification is obtained. Moreover, one may only have a notion of the net of tax elasticity for a representative individual and may apply this at all income levels. Also, neglecting income effects and setting \(\xi _{c}^{j}=\xi\) (with no distinction between uncompensated and compensated elasticities), we obtain the change in aggregate tax revenue \(dR={\sum {dR^{j}}=\sum {y^{j}d\tau _{j}}+\sum {y^{j}\left( \xi _{c}^{j}t_{j}/\left( 1-t_{j}\right) \right) dt_{j}}}\), where the former term on the right hand is the mechanical effect and the latter is the behavioural effect. How far one is willing to go in simplifying the analysis obviously depends on the extent to which one will accept crude results in the absence of detailed information. In this special case, formula (5) reduces to

where the former term on the right-hand side expresses the distributional effect and the latter is the efficiency effect.

The formulas above show the effects at the intensive margin. Taking account of changes at the extensive margin, one will have to add how the number of agents in a bracket responds to changes in the tax imposed on the bracket income as more or fewer agents are induced to work.Footnote 18 In Norway, high participation rates limit the scope for positive responses at the extensive margin.Footnote 19 Estimates of the so-called ETI (elasticity of taxable income) are obviously relevant here, see the review in Saez et al. (2012).Footnote 20 However, as we shall employ a labour supply model we account for effects both at the extensive and intensive margins in our empirical illustration, presented below.

3 The Norwegian tax reform 2016–2018

During recent decades, the Norwegian tax system has undergone a number of minor and major reforms. In the current paper, we single out for analysis a particular set of reforms that can be considered as income tax perturbations. Between 2016 and 2018, the tax schedule for labour earnings in Norway was subject to to a number of perturbations, see the comparison of the schedules of 2015 and 2018 in Fig. 1 in Introduction. Prior to 2016, the stepwise linear income tax on labour earnings had a small number of tax brackets, mainly characterised by a standard tax rate and two elevated tax rates referred to as “surtax” on high income. In 2016, the number of steps was increased.Footnote 21 The term “step-tax” was coined to reflect the larger number of steps distinguishing the new schedule from the previous one, and the term “surtax” was abandoned. The step-tax was then adjusted during the next couple of years. The introduction of the step-tax and the subsequent adjustments constitutes the tax perturbations we study from the perspectives of social efficiency and distribution as outlined above.

4 Empirical implementation

4.1 Model tools

Our theoretical framework offers a rather general model of a population of agents supplying labour, which might comprise both wage earners and self-employed. The application of the present study is restricted by available data and estimates and is confined to wage earners. We make use of tax simulation models developed for Norwegian policy-making, the so-called LOTTE model system, see Aasness et al. (2007).

We engage the labour supply module of the model system to simulate labour supply decisions in the benchmark and in the alternative schedule, the 2015- and the 2018-system, respectively. The labour supply model is based on a discrete choice random utility framework, related to the model presented in van Soest (1995). The labour supply model employed here is a version characterised as the “job choice model”, see Dagsvik et al. (2014) and Dagsvik and Jia (2016). Insofar as it gives fundamental importance to the notion of job choice, this approach differs from standard discrete choice models of labour supply, as the one in van Soest (1995). This model yields probabilities for the discrete labour supply options, both at the extensive and intensive margins.

The model is estimated by microdata from the Norwegian Labor Force Survey, deriving three separate submodules: a joint model for married couples and two separate models for single females and males. It is exploited that the labour supply module, LOTTE-Arbeid, interacts with the non-behavioural tax-benefit module, LOTTE-Skatt, which means that we have access to a detailed description of the Norwegian tax schedule. Although the theoretical framework departs from a continuous choice, we interpret the empirical model as a reasonable approximation to the theoretical one.Footnote 22

Moreover, we shall also account for the interaction between different tax bases by also controlling for the effect working through the indirect taxation. More precisely, when we calculate the efficiency effect of the perturbation, see Eq. (5), we use the module LOTTE-Konsum (Aasness et al., 2007) to calculate the indirect tax part of a change in disposable income, resulting from the labour supply effects. This raises the question of the marginal propensity to consume. Here, we simply assume that agents do not save, and thus, the MPC is 1.Footnote 23 Revenue effects of labour supply adjustments also account for payroll tax revenues being affected. Norway has a regionally differentiated payroll tax, which means that tax rates range from 0 to 14.1 (in 2018); we apply an average tax rate, at approximately 13.2%.

4.2 Empirical estimates

As announced in the foregoing, we carry out the major part of our empirical analysis assuming away the presumably minor effects of kinks in the budget set; an issue we shall come back to in a sequel to the main presentation. Recall that we apply a stepwise procedure to identify the welfare effects of the reform, distinguishing between the mechanical effect, the behavioural effect and effects on overall welfare. The first effect, the mechanical effect is the change in tax burden when behavioural effects are neglected by the envelope theorem. We therefore obtain estimates of the mechanical effect by keeping labour supply behaviour fixed, as given by the tax rules of 2015, and derive individual tax burden differences caused by the reform by applying the tax rules of 2015 and 2018 on the same fixed income.Footnote 24 As the 2018-schedule diminishes the tax burden compared to the 2015-schedule, we control for the tax level effect by imposing a hypothetical lump-sum tax that would offset the average tax cut.Footnote 25 Each household would then be charged approximately NOK 6000 lump sum.Footnote 26 We are then left with purely redistributive effects, where those given a tax relief above NOK 6000 by the actual reform are winners, and others are losers due to the structural reform. Whereas the (net) changes in tax burdens are measured in actual values, note that \(z^{i}\) of Eq. (4) is measured in terms of equalised income, where we have used the square root of the number of household members as the equivalence scale.Footnote 27

Figure 2 presents the distribution of the net gain, defined by the difference in tax burden between the two schedules minus the lump-sum tax, when households are ranked by pre-reform equivalised disposable income. The actual reform involves tax cuts in all parts of the piecewise linear schedule, see Fig. 1, but the substantial reductions occur at the high end of the distribution. The diagrams of Fig. 2 reflect this: taxpayers with negative or small positive overall effect are predominantly found at the low end of the income distribution, whereas large gains are mostly found at the top end.

By definition, pure redistribution means that the sum of gains equals aggregate losses. We refer to the welfare effect of pure redistribution as the (total) distributional effect. Obviously, this effect is zero if all (positive and negative) income changes are given equal weight in the welfare assessment. It is trivial that this would happen only if there is no inequality aversion, i.e. the value of \(\beta\) is zero. We denote this threshold value by \(\overline{\beta }.\) For other values of \(\beta\), there will be a strictly positive or negative distributional effect. The \(\beta\)-function shows the distributional effect of the reform for larger or smaller inequality aversion.Footnote 28 We shall soon return to what this \(\beta\)-function may look like (in Fig. 4).

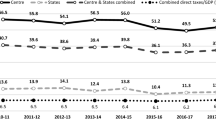

As discussed in the theoretical part, the efficiency effects of the structural reform are determined by the labour supply effects. As above, we cleanse out the level effect to obtain estimates of the behavioural responses to structural changes. The average labour supply effects, measured in annual working hours, are presented in Table 1.

In total, these effects imply that the tax revenue (from the personal income tax, the payroll tax and indirect taxation) increases by approximately NOK 2 billion. This is the behavioural-induced change in tax revenue, which is our measure of the social efficiency gain.

Furthermore, in Fig. 3 we show how the gains in NOK due to labour supply responses distribute on working hours in the three different subgroups. We see that most individuals do not alter their choice of working hours. All three diagrams display modest gains.Footnote 29 In Appendix 3, we also consider how efficiency gains vary across levels of education. We find that the effect of the reform is somewhat larger for the highly educated taxpayers, as shown in Fig. 6.

Finally, by using Eq. (5) \(d{\Omega }={\sum \nolimits _{i}} \gamma ^{i}g^{i}+N\overline{\gamma }dL\), we combine the mechanical effect and the efficiency effect to find the cut-off value of \(\beta\), denoted \(\beta ^{*},\) for which the perturbation is just welfare preserving, \(d{\Omega }=0\). Now, the revenue from the efficiency effect of the reform is given back to the agents in terms of lump-sum transfers. In this transformation, we also control for the labour supply effects working through the income effect on recipients of lump-sum transfers. Figure 4 describes how an estimate of \(\beta ^{*}\) is obtained, where we also display the “distributional change curve”.Footnote 30 Including the efficiency part implies that we obtain a new curve for the welfare change with the same shape as the distributional change curve, but moved upward by the same vertical increment all along the scale. Since the tax reform enhances social efficiency, there is a positive effect counteracting the negative effect of redistribution according to inequality-averse preferences. The allocative efficiency gain will be the overriding effect even for strictly positive inequality aversion (\(\beta >0\)) as long as it falls short of a cut-off value where the welfare loss due to unfavourable redistribution and the social efficiency gain just cancel out. This “no-effect-of-the-reform” benchmark occurs for the inequality aversion \(\beta ^{*}=1.2\).Footnote 31

To put our result in perspective, it is of interest to note that the literature on the inequality aversion parameter has taken a number of approaches, ranging from presentation of purely illustrative examples to estimations and discussion of what may be “appropriate” values. Various strands of the literature conceive of the \(\beta\)-parameter (in our notation) as either directly reflecting political preferences or originating from various more or less related sources, which can be pure political preferences or measures of individual utility, possibly adopted by political decision makers. In either case, \(\beta\) is usually interpreted as the elasticity of people’s marginal (social) utility of income. Going a long way back, Dalton (1939) argued that \(\beta\) was greater than 1. A study of the British income taxation, reported in Stern (1977), suggested that a value around 2 seemed to give tax rates not too dissimilar to those existing in the UK. Taking an inverse optimum (or implicit preference) approach, Christiansen and Jansen (1978) found a value close to 0.9 in their preferred version. Evans (2005) provides a survey of previous estimates and itself offers an estimate of 1.4. Based on a number of surveys, Layard et al. (2008) arrived at a preferred estimate equal to 1.26. Applications in cost–benefit analyses have used many different values. The guidance of the UK Treasury has a preference for using 1, but one can find cases where analysts have used values up to 2 or 2.5. With these findings in mind, we may conclude that a value of around 1.2 finds its place towards the lower end of the range of values appearing in the literature but without deviating substantially from numbers that are quite common. It follows that the considered tax reform is welfare enhancing only for a moderate inequality aversion.

We interpret the cut-off value \(\beta ^{*}=1.2\) as conveying information about the politicians’ implicit distributional preferences, where approval of the reform is taken as evidence that the decision-makers have a lower inequality aversion, and dismissal of the reform indicates a higher inequality aversion. This reform approach to reveal implicit preferences bears close resemblance to the inverse optimum approach referred to above, which is used to infer the preferences that are consistent with the actual policy, assuming that the latter is optimal given the preferences. The inference from reform analysis is less accurate since it does not yield a single estimate,Footnote 32 but only conveys information about a range of preferences, such as the implicit inequality aversion being less than \(\beta ^{*}\). In either case, a number of assumptions must be satisfied for the inference to be meaningful: the underlying model and the estimates of behavioural responses derived by the analyst must be sufficiently reliable and shared by the politicians, who must also not be governed by other concerns.

Finally, we should pay attention to the caveat that our analysis has assumed away the effects of kinks in the tax schedule. We first note that the error committed is potentially larger where there is bunching, in the sense of excessive mass of agents, at the kinks. In Appendix 2, Fig. 5 and Table 2, we consider the distribution of taxpayers around the kinks where the respective surtax rates kicked in according to the tax rules of 2015. Figure 5 shows indications of bunching at the first kink, whereas the density function looks smooth around the two other kinks. Also taking into consideration that there are taxpayers who fail to hit the exact kink-point, as discussed by Chetty (2012), we see from Table 2 that the fraction of taxpayers around each of the thresholds is tiny given that there are approximately 2.6 million individuals with wage income above NOK 50,000 (approximately 5600 euros or 6200 US dollars). Further, in Appendix 2, we discuss how to obtain empirical estimates of the private economic gains for taxpayers located at the kink. Moreover, we provide empirical measures for these gains given the reform under consideration here.

We have previously considered the private benefits accruing to the agents as the disposable income effects occurring when keeping gross incomes fixed (mechanical effects). This is justified by the envelope theorem: Behavioural changes do not make a (first order) difference. When we take into account that there are kinks, private benefits arise also due to responses to bracket extensions, and we acknowledge that we had underestimated the benefits. Taking kinks into account also implies that we have to enhance our estimate of the social efficiency gain, which previously only captured tax revenue effects of behavioural changes. In formal terms, the additional effects due to kinks are captured by expressions of the kind represented by the last term of equation (3). As explained in further detail in the appendix, our empirical findings are the following. The gross private benefits (prior to any offsetting lump-sum tax) are tiny and mainly accrue to agents higher up in the income distribution where the pre-reform surtaxes on “high incomes” used to kick in. The fractions of affected agents at the respective kinks are also tiny, less than 0.5 per cent. The extra social efficiency gain that can be attributed to the bracket extensions is estimated to be around NOK 7 per person in the entire population of wage earners. Even if the adjustments of estimates, warranted by the kinks, are of interest in principle, the upshot is that, at least in our case, they make only a negligible quantitative difference.

5 Conclusion

We have analysed a real tax reform in Norway based on a scheme for assessing an income tax perturbation. In practice, a tax reform will consist of both a change of tax level and a change of tax structure, i.e. slope and progressivity of the tax schedule. We cleanse out the level effect by adjusting a hypothetical lump-sum tax to isolate the structural change. We conceive of the impact of the structural change as consisting of distributional effects and social efficiency effects, which taken together yield an overall welfare effect. These effects are closely related to the tax perturbation effects that are referred to as mechanical effects, behavioural effects and welfare effects. Mechanical effects are effects on tax payments and tax revenue in the absence of any change in labour supply and commodity demand. Invoking envelope properties, behavioural changes have no direct first order effects on utility, and the real income effects experienced by the taxpayers are identical to the mechanical effects. These effects will therefore reflect the distributional gains and losses of various taxpayers. A caveat is that further effects arise when taking into account the kinks inherent in the piecewise linear income tax. These effects are discussed, but shown to be of minor empirical magnitude and are largely suppressed in our presentation. To find the ensuing welfare impact, one would have to assign welfare weights to the respective gains and losses.

Since there are pre-existing tax distortions, behavioural effects will affect social efficiency. Both direct and indirect taxes cause under-consumption of all commodities apart from leisure. Where a tax reform enhances labour supply and consumption of taxed commodities, a more efficient allocation is achieved. The increase in tax revenue due to behavioural changes is a measure of the allocative efficiency gain, while revenue foregone would reflect a loss. The overall welfare effect, capturing both allocative efficiency and welfare effects of redistribution, depends on the value of the use of additional tax revenue. An option is to recycle the extra tax revenue through a uniform lump-sum transfer. We can then find the gains and losses of various taxpayers due to the combined distributional and efficiency effects, and we can find the welfare weights that yield a positive or negative overall welfare impact.

We have applied the theoretical approach outlined above to the actual tax perturbations implemented in Norway in the period 2016–2018. We use households as units. Household welfare is assumed to depend on disposable income per consumer unit, where the number of units is determined by an equivalence scale. The welfare weights assigned to marginal income are then determined by equivalent income. We subscribe to the widely held view that additional income is more highly valued if accruing to a larger household than if given to a smaller household with the same income. We can interpret the key parameter that determines the welfare weight corresponding to each (equivalent) income level as a measure of inequality aversion.

The structural reform in Norway redistributes income in favour of better-off households. This means that there is an equity loss according to distributional preferences exhibiting inequality aversion. On the other hand, the tax reform induces behavioural changes that increase tax revenue and enhance allocative efficiency. In this sense, we face the frequently highlighted trade-off between equity and efficiency. The combination of a distributional loss and an allocative efficiency gain obviously yields an overall welfare gain only if a sufficiently moderate inequality aversion prevails. Our empirical finding is that the overall welfare gain created by the reform is positive if the value of the inequality parameter is less than 1.2 (to some extent dependent on the choice of equivalence scale), which is considered as an inequality aversion in the medium range. One finds both lower and higher values in various contexts in the literature. Assuming that a tax reform is implemented only if it is considered beneficial according to the prevailing political preferences, we can infer, from a revealed preference perspective, that the inequality aversion underlying the political reform decision is less than the threshold value of 1.2.

Notes

A similar distinction between level and structure of tax rates is mentioned in Andrienko et al. (2016).

It is common in tax analysis to make use of Diamond’s (1975) marginal social valuation of income for an agent, which is the sum of the direct effect on the agent and the marginal propensity to pay taxes affecting government revenue. The two effects are rarely distinguished. In our presentation, we separate the two effects.

We assume from the outset that the cardinalisation (in particular the concavity) of the indirect utility function is chosen such that it reflects the inequality aversion of the government.

See also footnote 15 and the further discussion in Andrienko et al. (2016).

In practice, people with zero or very low earnings typically receive transfers that vary according to the circumstances facing the respective taxpayers. There are unemployment benefits, disability benefits, sickness benefits, welfare benefits, etc.

For low income, we then have a negative income tax. In practice, it is common that there is a zero tax rate below a certain income threshold, beyond which there is a positive net tax liability. This would be consistent with our example if every work-active agent earned a high enough income to face a gross tax liability exceeding the transfer.

For a given income, a person with a higher wage rate enjoys more leisure and needs to forego less leisure in order to increase income. Both circumstances tend to diminish the compensation required for working the extra time needed to earn an additional unit of income.

This is equivalent to establishing an indirect utility function before differentiating.

One could conceive of this change in lump-sum income as the increment that would yield \({d\Omega }=0\) where \(u_{c}=1\) for all w.

A more general weighting scheme is discussed by Saez and Stantcheva (2016).

The use of equivalence scales to measure relative well-being across households is controversial for several reasons, for example, because differences in working hours of household members are not normally accounted for. Given the high participation rates of Norwegian females, we expect that results here are less sensitive to this assumption than for what would be the case for many other countries. Moreover, we have verified that results are robust with respect to the choice of equivalence scale within the scale-category employed.

A third option would exist where the tax reform is considered as a partial reform enabling some other tax change, for example, using labour income taxes to cut business taxes. Comparison with a cash transfer would again be an issue.

An exception applies to agents located at kinks, i.e. at bracket limits where the tax rate is discontinuous.

Computing the actual payments that are due is hardly a concern with modern computer technology. Hence, it may seem paradoxical that more tax brackets were used at the time when this may have been a concern.

This simplification neglects both dispersion of within-bracket income and agents selecting a kink-point. A further, but less precise, simplification would be to assign to everybody in a given bracket an income equal to the mid-point of the bracket.

We assume tax rates are increasing in income.

Cf. Dahlby (2008, formula 5.27)

However, since participation is exclusive of persons on disability pensions, etc., the scope may be underestimated to the extent that the latter category is not entirely exogenous.

We may note that this reform direction reversed the long-term and internationally wide-spread trend towards fewer steps in the income tax.

Alternatively, one might argue that choices are indeed discrete, and it is the theoretical model that should be perceived as an approximation to reality.

See Thoresen et al. (2010) for further discussion on this.

The 2018 tax rule is deflated to the 2015-level by using a wage growth index.

The tax relief on earnings was actually a net tax cut and therefore entails lower current or future public spending (at least neglecting the higher future tax option) than would otherwise be the case. This change relative to the counterfactual should not be confounded with changes in public expenditures over time due to other circumstances, such as the return on the petroleum-based sovereign fund in Norway.

This was equivalent to approximately 750 US dollars or 670 euros at the average exchange rates in 2015.

We have also derived empirical estimates based on a framework founded on individual income, thus no income accumulation across household members and therefore no need for equivalences scales. Of course, this gives other estimates of the inequality aversion in the benchmark case (no effects of the reform on distribution and welfare)—estimates that we soon will return to.

By including negative values of \(\beta\), we also show for completeness the less plausible cases where there is equality aversion.

However, we see that there is substantial heterogeneity in the behavioural responses, in particular for married couples. The modelling approach generates such patterns by (for instance) allowing for taste-modifying characteristics in the empirical approach, such as letting responses vary with respect to education, number of children, etc.

Here, \(\beta ^{*}\) is backed out with the use of a discrete choice labour supply model, but it could also have been obtained by employing a reduced form estimate of response, such as one represented by the elasticity of taxable income. However, as the elasticity of taxable income (usually) only captures intensive margin responses (Saez et al., 2012), one has to employ other evidence or make assumptions with respect to the extensive margin responses.

This estimate is little influenced by the choice of equivalence scale. Table 4 in Appendix 3 reports estimates of \(\beta ^{*}\) for other assumptions about equivalence scale.

Of course, also a single estimate is “inaccurate” in the sense that it has a confidence interval.

References

Aasness, J., Dagsvik, J. K., & Thoresen, T. O. (2007). The Norwegian tax-benefit model system LOTTE. In A. Gupta & A. Harding (Eds.), Modelling our future: Population ageing, health and aged care, international symposia in economic theory and econometrics (pp. 513–518). Amsterdam: Elsevier Science.

Ahmad, E., & Stern, N. (1984). The theory of tax reform and the Indian indirect taxes. Journal of Public Economics, 25(3), 259–298.

Andrienko, Y., Apps, P., & Rees, R. (2016). Optimal taxation and top incomes. International Tax and Public Finance, 23(6), 981–1003.

Apps, P., & Rees, R. (2009). Public economics and the household. Cambridge: Cambridge University Press.

Apps, P., Long, N. V., & Rees, R. (2014). Optimal piecewise linear income taxation. Journal of Public Economic Theory, 16(4), 523–545.

Bierbrauer, F. J., Boyer, P. C., & Peichl, A. (2021). Politically feasible reforms of non-linear tax systems. American Economic Review, 111(1), 153–191.

Chetty, R. (2012). Bounds on elasticities with optimization frictions: A synthesis of micro and macro evidence on labour supply. Econometrica, 80(3), 969–1018.

Christiansen, V., & Jansen, E. S. (1978). Implicit social preferences in the Norwegian system of indirect taxation. Journal of Public Economics, 10(2), 217–245.

Dagsvik, J. K., & Jia, Z. (2016). Labor supply as a choice among latent jobs: Unobserved heterogeneity and identification. Journal of Applied Econometrics, 31(3), 487–506.

Dagsvik, J. K., Jia, Z., Kornstad, T., & Thoresen, T. O. (2014). Theoretical and practical arguments for modeling labor supply as a choice among latent jobs. Journal of Economic Surveys, 28(1), 134–151.

Dahlby, B. (2008). The marginal cost of public funds: Theory and applications. Cambridge: MIT Press.

Dalton, H. (1939). Principles of public finance. London: George Routledge & Sons.

Diamond, P. (1975). A many-person Ramsey tax rule. Journal of Public Economics, 4(4), 227–244.

Diewert, W. E. (1978). Optimal tax perturbations. Journal of Public Economics, 10(2), 139–177.

Dixit, A. (1975). Welfare effects of tax and price changes. Journal of Public Economics, 4(2), 103–123.

Edwards, J., Keen, M., & Tuomala, M. (1994). Income tax, commodity taxes and public good provision: A brief guide. FinanzArchiv, 51(4), 472–487.

Evans, D. J. (2005). The elasticity of the marginal utility of consumption for 20 OECD countries. Fiscal Studies, 26(2), 197–224.

Feldstein, M. (1976). On the theory of tax reform. Journal of Public Economics, 6(1–2), 77–104.

Golosov, M., Tsyvinski, A., & Werquin, N. (2014). A variational approach to the analysis of tax systems. NBER Working Paper no. 20780, National Bureau of Economic Research, Cambridge, MA.

Gruber, J., & Saez, E. (2002). The elasticity of taxable income: Evidence and implications. Journal of Public Economics, 84(1), 1–32.

Guesnerie, R. (1977). On the direction of tax reform. Journal of Public Economics, 7(2), 179–202.

Hendren, N. (2016). The policy elasticity. Tax Policy and the Economy, 30(1), 51–89.

Layard, R., Mayraz, G., & Nickell, S. (2008). The marginal utility of income. Journal of Public Economics, 92(8–9), 1846–1857.

Mirrlees, J. A. (1971). An exploration in the theory of optimal income taxation. Review of Economic Studies, 38(2), 297–302.

Saez, E. (2001). Using elasticities to derive optimal income tax rates. Review of Economic Studies, 68(1), 205–229.

Saez, E., Slemrod, J., & Giertz, S. H. (2012). The elasticity of taxable income with respect to marginal tax rates: A critical review. Journal of Economic Literature, 50(1), 3–50.

Saez, E., & Stantcheva, S. (2016). Generalized social marginal welfare weights for optimal tax theory. American Economic Review, 106(1), 24–45.

Seade, J. (1982). On the sign of the optimum marginal income tax. Review of Economic Studies, 49(4), 637–643.

Sheshinski, E. (1972). The optimal linear income tax. Review of Economic Studies, 39, 205–229.

Stern, N. H. (1977). Welfare weights and the elasticity of the marginal utility of income. In M. J. Artis & A. R. Nobay (Eds.), Studies in modern economic analysis: The proceedings of the AUTE conference in Edinburgh 1976. Oxford: Blackwell.

Thoresen, T. O., Aasness, J., & Jia, Z. (2010). The short-term ratio of self-financing of tax cuts: An estimate for Norway’s 2006 tax reform. National Tax Journal, 63(1), 93–120.

Thoresen, T. O., & Vattø, T. E. (2015). Validation of the discrete choice labor supply model by methods of the new tax responsiveness literature. Labour Economics, 37, 38–53.

van Soest, A. (1995). Structural models of family labor supply: A discrete choice approach. Journal of Human Resources, 30(1), 63–88.

Acknowledgements

This paper is part of the research of Oslo Fiscal Studies supported by the Research Council of Norway. Earlier versions of the paper have been presented in the special session on the occasion of Matti Tuomala’s retirement at the 74th Annual Congress of the International Institute of Public Finance (Tampere August 2018) and a seminar at the Norwegian Ministry of Finance (October 2018). We are grateful for comments received on both occasions. Also, comments from Ray Rees, Jukka Pirttilä, Kristoffer Berg, Stephen Smith and Erling Holmøy are gratefully acknowledged.

Funding

Open access funding provided by University of Oslo (incl Oslo University Hospital).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: The net revenue in a piecewise linear income tax

Consider the tax revenue function:

and the effects of perturbing the tax schedule. We denote partial derivatives by subscripts,

We also make use of the Slutsky decomposition denoting by \(s_{1-t_{1}}\) the compensated effect of \(1-t_{1}\) on earnings and by \(s_{1-t_{2}}\) the compensated effect of \(1-t_{2}\) on earnings.

We may note that a higher \(t_{1}\) will affect those with high income by increasing the tax on the part of their income equal to \(Y_{1}\), which in turn has an income effect on the taxable income that is subject to the high marginal tax.

By extending the upper bracket limit by one unit the tax due on that unit is lowered from \(t_{2}\) to \(t_{1}\), which is a tax cut for all taxpayers in the second bracket and prompts an income effect on the labour earnings that will shrink the tax base of the high rate.

For the increments \(dt_{1}\), \(dt_{2}\), \(dY_{1}\), \(da\), where \(da\) is the compensating transfer discussed in Sect. 2.2, we get

Deleting offsetting terms, we get

We introduce m to denote the marginal propensity to pay tax, as defined in the main text. The net revenue effect after allowing for the transfer \(da\) is then

Appendix 2: Extensions of tax brackets

We have simplified our main analysis by neglecting the distinctive effects of the kinks in the tax function, based on the presumption that allowing for these effects would not make a significant difference. We shall now delve a bit further into the implications of kink-points to see how they may affect our results. As shown in Figs. 1 and 5, there are three main kink-points in the 2015 tax rules at NOK 210,000, NOK 560,000 and NOK 890,000, respectively. Table 2 shows the number of agents within close proximity of the kinks.

As discussed in Sect. 2.2 agents, optimally located at a kink-point where the marginal tax rate discontinuously rises from \(\underline{t}\) to \(\overline{t}\), all have a marginal disutility of labour in monetary terms, S, lying between \(1-\underline{t}\) and \(1-\overline{t}\). Taking a somewhat crude approach, we now let these agents be represented by a single agent, referred to as the representative agent. We set the representative agent’s marginal disutility of labour at the kink equal to the mean value \(\overline{S}=(1-\underline{t}+1-\overline{t})/2\). (This would be the average for the bunching agents in the case of a uniform distribution.) Denoting gross income at the kink-point by \(\overline{Y}\), we can express a marginal extension of the tax bracket ending at the kink-point by a small increment \(d\overline{Y}\). The representative agent then obtains a gain measured by disposable income net of disutility of labour equal to \((1-\underline{t}-\overline{S})d\overline{Y}\). To get the aggregate impact, we multiply this effect by the number of agents at the kink. We note that we easily find this value empirically by observing the tax rates, the reform perturbation and the observed number of agents.

Our approach is based on the perception that the tax policy changes we consider are “small”, referred to as perturbations. Considering closely the Norwegian tax reform under survey, we have concluded that the first and third changes (the ones at NOK 210,000 and 890,000) constitute exceptions to the marginal increments, implying that agents initially at the kink will respond to the extensions by moving to an interior point in the income segment beyond the kink (not all the way to the new kink). The question is how to handle this case.