Abstract

I study publication of the European Union (EU) tax haven blacklist on December 5, 2017, to examine whether and how the use of recognized tax havens affects firm value. I find that the tax haven naming and shaming by the EU was associated with a negative stock price reaction of firms with tax haven subsidiaries. Overall, publication of the blacklist erased $56 billion in market capitalization among the implicated firms. The largest reaction was for those tax havens, for which it was not foreseeable that they would be included in the blacklist. Retail firms experienced a larger decrease in share price than firms in other industries, which is consistent with a potential consumer backlash. Also more tax-aggressive firms faced more negative returns, which suggests that investors expect firms might be audited or fined for past or overly aggressive tax avoidance. The negative reaction was less pronounced in countries with low levels of investor protection and weakly governed firms with substantial conflicts of interest between principals and shareholders. This is consistent with increased scrutiny and potential for countermeasures associated with the blacklist, which reduce opportunities for managerial wealth diversion.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

After months of screening of global tax policies, on December 5, 2017, the European Union (EU) finance ministers blacklisted 17 countries for refusing to cooperate with the EU’s decade-long crackdown on tax havens.Footnote 1 The EU referred to the blacklist as list of non-cooperative tax jurisdictions, since the listed countries failed to make sufficient commitments in response to the EU’s concerns. Large media sites, including the Financial Times, the Guardian, Thomson Reuters, among others, provided news coverage on the first-ever EU blacklist, naming and shaming tax havens. Before the blacklist was published, the public was unaware of the countries featuring in the list and the potential EU sanctions. On the blacklist publication day, it was revealed that, beyond being named, countries face few consequences for being blacklisted.Footnote 2 Since the blacklist does not have specific sanctions or financial penalties attached to it, it has been criticized as an insufficient response to the scale of tax evasion worldwide. Alex Cobham, the director of research at the Tax Justice Network (2017), commented that “tax avoiders and the countries that sponsor them will all be letting out a sigh of relief today.”

In this study, I examine the effect that publication of the EU tax haven blacklist had on share prices of firms with subsidiaries in the blacklisted countries. As there were no specific penalties associated with the blacklist, I expect that it worked mainly as a shaming mechanism, potentially inducing reputational costs for firms exposed to the blacklisted tax havens.Footnote 3 Investors of the exposed firms may be concerned with damage to firms’ brand value, losing customers to a boycott, diminished prospects for recruiting and retaining employees, and a weakened ability to raise capital. Hence, a negative market reaction towards the users of the exposed tax havens can be expected.

My contribution to the existing literature on effects of blacklisting and shaming of tax havens is twofold. First, this is the first paper to examine the publication of the first-ever EU tax haven blacklist, which was hotly anticipated by campaigners, lobbyists and politicians on both sides of the offshore debate. Second, the existing literature examines blacklisting effects on tax havens themselves, while I examine effects on firms that are users of the blacklisted tax havens. The analysis provides important policy implications on whether tax haven blacklisting and shaming affect firm value.

I find significantly negative abnormal stock price returns following publication of the EU tax haven blacklist for firms that are users of the recognized tax havens. Publication of the blacklist reduced value of firms with the blacklisted haven subsidiaries by 0.56% relative to other firms. In economic terms, blacklist reduced the overall market capitalization of the exposed firms by $56 billion. The negative reaction increases with the proportion of tax haven subsidiaries the firm has, and the largest reaction is for those tax havens, for which it was not foreseeable that they would be included in the blacklist. To investigate the partial relationship between firm characteristics and stock price reaction to tax shelter news, I examine cross-sectional variation in the market reaction. I consider corporate citizenship, tax aggressiveness and expropriation as the potential mechanisms that can explain the negative market response to publication of the blacklist.

First, the possibility of negative consumer reaction to indication of bad corporate citizenship makes firms relatively vulnerable to news of their tax avoidance strategies, especially so for firms operating in the retail sector. In line with this, I find that retail firms experienced a larger stock price decrease than firms in other industries.

Further, potential countermeasures should matter most for more tax-aggressive firms, since they have more to lose if the tax haven preferential treatment is limited as a consequence of the blacklist. Publication of the blacklist may result in regulatory fines and penalties for past actions or lead to lower tax avoidance in the future, both of which may decrease firm value. I measure tax avoidance as that part of the statutory tax rate less firm’s effective tax rate that is unexplained by firm, country and industry characteristics. I find that the more tax-aggressive firms have more negative returns around publication of the EU tax haven blacklist. This result shows that investors expect firms might be audited or fined for past or overly aggressive tax avoidance. The negative reaction might also reflect the potential future costs of restructuring the firms might incur in order to keep their corporate tax payments low. As maintaining such tax strategies has become costlier, firms might reduce their tax avoidance in response. When I use cash effective tax rates to measure firm’s tax aggressiveness, I find that the market reacts positively to evidence that a firm tries to reduce taxes (has a high proportion of tax haven subsidiaries), when its financial reports would lead one to believe the firm is not tax aggressive (has a high cash effective tax rate).

Finally, the underlying secrecy of tax havens can be used for expropriation purposes that destroy shareholder value. If investors suspect that managers who support tax avoidance activities might also be aggressive with reporting firm’s accounting earnings, then the market may grow suspicious of accuracy of the company’s financial statements.Footnote 4 Then, news on firm’s tax avoidance might be perceived as evidence not only about firm’s behaviour towards tax authorities, but also about insiders’ willingness to be aggressive with investors as well. Moreover, use of tax havens should be more costly to shareholders in countries that feature high expropriation risk.

I use firm-level and country-level evidence to study expropriation as the possible cost to shareholders of having tax haven subsidiaries. If the blacklist was a credible threat, blacklisting should contribute towards higher scrutiny and less shareholder expropriation in the future. Then, weakly governed firms and firms in countries with high expropriation risk should be less negatively affected by publication of the blacklist than strongly governed firms. The results conform to these expectations and show, for a range of governance variables, a smaller negative effect of the blacklist for weakly governed firms. This suggests that the potentially increased auditing, monitoring, scrutiny and transparency following publication of the blacklist reduce some of the expropriation cost associated with having tax haven subsidiaries. Another explanation for the finding is that public shaming matters less for firms that are already exposed to high expropriation risk, and they therefore react less to publication of the blacklist.

Moreover, investors react to the evolution of the blacklist and respond positively to countries being excluded from the blacklist. Overall, the results show that the EU was successful at shaming the users of tax havens, which resulted in negative market reaction towards the affected firms. The blacklist was considered as a credible threat to the retail firms and most tax-aggressive firms, despite the lack of specific sanctions or financial penalties. The blacklist was perceived as positive news in weakly governed firms and firms in countries with high expropriation risk. This is consistent with increased scrutiny by the EU and potential future countermeasures following publication of the blacklist, which should contribute towards less future expropriation of shareholders.

The setup of the paper will be as follows. Section 2 presents the literature review, and Sect. 3 discusses the institutional setting, data and methodology of the study. Section 4 presents the descriptive statistics, while Sect. 5 discusses the results. Section 6 explores the cross-sectional variation in market reactions, and Sect. 7 discusses the evolution of the blacklist. Section 8 concludes.

2 Related literature

Earlier literature has examined market price reaction to news regarding corporate fraud, including non-tax-related fraud against the government. For example, Bosch and Eckard (1991) study the idea that future fines and penalties constitute part of the market’s response. They argue that news of one type of aggressiveness could indicate to shareholders that the company’s management is aggressive with everyone. First, customers and suppliers might become suspicious of dealing with the firm, thereby increasing future transaction costs and perhaps causing customers and suppliers to deal with other companies instead (Klein and Leffler 1981). Second, it might signal that the firm could be engaging in other unknown aggressive activity that could lead to future prosecution and associated costs. In addition, it may signal that the dishonesty extends to financial accounting statements, and the management lies to the shareholders (Desai et al. 2007). In sum, earlier literature has generally found negative stock market responses to corporate misdeeds, but has not investigated market responses to tax haven shaming.

While there are no previous analyses of stock market reaction to tax haven naming and shaming, there are several related studies. Desai and Dharmapala (2009) investigate how investors value managerial actions designed solely to minimize corporate tax obligations. They regress, over a cross section of companies, Tobin’s q (market value divided by replacement cost of assets) on a proxy for tax avoidance, measured as an estimate of the book-tax differences of the firm less an estimate of the portion of the book-tax differences arising from earnings management (total accruals of the firm). They find that their proxy for tax avoidance is positively related to firm value for well-governed firms, but unrelated to firm value for poorly governed firms. The authors interpret their evidence as consistent with agency costs mitigating the benefits to shareholders of corporate tax avoidance. In other words, managers’ tax-sheltering decisions are related to their ability to divert value, so that in poorly governed firms tax-sheltering signals a higher likelihood of managerial wealth diversion and on net adds no value. In comparison with my study, Desai and Dharmapala (2009) is not an event study. My paper examines additional cross-sectional determinants beyond governance and uses the publication of the EU tax haven blacklist and the firm’s exposure to the blacklisted tax havens to examine market’s perception of the firm’s behaviour. Nevertheless, findings of my paper correspond to those of Desai and Dharmapala (2009), since I find that poorly governed firms faced a less negative reaction to publication of the blacklist than better governed firms.

I contribute to the literature that has asserted that tax planning may occur in combination with managerial opportunism (Desai et al. 2007; Kim et al. 2011). Kim et al. (2011) use firm-level data to show that firms with higher tax-sheltering capabilities are more likely to experience future stock price crashes. The complex corporate structure arising from subsidiaries in many (secrecy) jurisdictions gives opportunistic managers the opportunity to stockpile negative news until a tipping point. In my setting, this translates to rational expectations of a decrease in stock price following publication of the EU tax haven blacklist, especially so if the firm has a large proportion of subsidiaries in the blacklisted tax haven countries.

Recent literature has also shown that managers seem to be sensitive about engaging in tax planning. Evidence by Graham et al. (2014) shows that 69% of surveyed executives do not engage in tax planning because they are concerned about the firm’s reputation. Akamah et al. (2018) discuss that such reputational concerns can cause managers to hide their haven subsidiaries in the guise of a more general geographic area (i.e. a subsidiary in Luxembourg would be reported as being in Europe). The authors find that there is indeed a reporting avoidance behaviour when tax and secrecy havens are implicated. Also my paper finds that the tax haven naming and shaming by the EU was associated with reputational concerns of investors and hence a decrease in firms’ value.

A strand of literature focuses on investor reaction to news on firms’ tax avoidance strategies. Hanlon and Slemrod (2009) study the stock price reaction to news about corporate tax aggressiveness and find that a company’s stock price declines when there is news about its involvement in tax shelters. Dyreng et al. (2016) find that public pressure from outside activist groups can exert a significant influence on the behaviour of large, publicly traded firms. Similarly, Johannesen and Larsen (2016) show that tax evasion creates considerable rents for firms in extractive industries and that disclosure rules have the potential to reduce these rents. These results correspond to my findings which show that public tax haven shaming by international organisations and news media does matter for investors.

Mixed evidence exists on the effects of tax haven blacklisting on tax havens themselves. Sharman (2009) argues that public blacklisting by international organizations can be an effective means of bringing about compliance, since it damages countries’ reputations among investors and produces pressure to comply. Even despite the absence of military and economic coercion, development of a blacklist is in and of itself a powerful economic weapon. Tax havens place a big importance on preserving their international reputations, since it is their main point of competition (Sharman 2006). This implies that inclusion in the blacklist should be an effective threat to tax havens themselves. On the contrary, Kudrle (2009) studies how blacklisting affects the volume of financial activity associated with tax havens and finds that there is no substantial or consistent impact of blacklisting on banking investment in and out of the tax havens. Findings of these studies suggest that tax havens might respond to their inclusion in the blacklist. If investors expect that tax havens might agree to limit the preferential treatment of multinational firms, which could lower firms’ future profits, investors are likely to react negatively to publication of the blacklist. This corresponds to findings in my paper.

3 Institutional setting, data and methodology

In this section, I discuss the institutional background of publication of the EU tax haven blacklist. I then explain my data sources and empirical methodology.

3.1 EU tax haven blacklist institutional setting

In January 2017, 92 countries received a screening letter from the EU. They included some of the world’s biggest countries, such as China, the USA and Japan; small European countries such as Monaco and Andorra; and tiny developing nations such as Niue in the Pacific. They were informed that they would be assessed against three broad criteria: tax transparency, fair taxation (not offering preferential measures or arrangements that enable companies to move profits to avoid taxes), and anti-profit-shifting measures (commitment to implement measures agreed by the Organisation for Economic Co-operation and Development (OECD) intended to stop countries stealing each others’ tax bases). In October, the commission wrote to 41 countries warning they had failed the test and were likely to be blacklisted, unless they promised to change their ways. Further, in a draft dated November 21, 36 countries were named, and the next draft on December 1 included about 20 jurisdictions.

On December 5, 2017, the news media started reporting about the first-ever EU tax haven blacklist, which named and shamed 17 countries in an attempt to suppress the billions of dollars lost to aggressive tax avoidance every year. Countries that had said they would make reforms were put on notice and added to a so-called grey list of 47 jurisdictions.Footnote 5

Some EU funding legislation includes reference to the blacklist with potential punitive measures related to foreign policy, economic relations and development cooperation. The guidelines provide information on how the EU’s partners should assess funding projects that involve entities in jurisdictions listed by the EU as non-cooperative for tax purposes. The assessment includes a series of checks designed to pinpoint the risk of tax avoidance. For example, before funding is channelled through an entity, it should be established that there are sound business reasons for the particular structuring of a project, which must not take advantage of the technicalities of a tax system or of mismatches between two or more tax systems for the purpose of reducing the tax bill (Lomas 2018). These guidelines should guarantee in particular that EU external development and investment funds cannot be channelled or transited through entities in countries on the EU’s list (European Commission 2018).

Moreover, as claimed by Luxembourg and Malta representatives in the EU finance ministers meeting in November 2017, any blacklisting sanctions would be unnecessary because investors would be deterred from putting money in the highlighted tax havens (Guarascio 2017). This is in line with previous literature which claims that public blacklisting by international organizations can be an effective means of bringing about compliance, since it damages countries’ reputations among investors and produces pressure to comply. Moreover, public pressure could result in backlash against the firm or its products from investors, politicians and customers (Graham et al. 2014; Sharman 2009). Investors of the exposed firms may be concerned with damage to firms’ brand value, losing customers to a boycott, diminished prospects for recruiting and retaining employees, and a weakened ability to raise capital (Baron 2003; Klein 2000; Sasser et al. 2006). Blacklists are known to provide basis for extra scrutiny, compliance costs and outright boycotts of certain jurisdictions by investors (Narci 2012).

Conforming to this, both tax havens and the countries exposed to the tax havens reacted to publication of the blacklist. As an example, South Korea’s foreign ministry was determined to persuade the European Union to exclude it from the blacklist immediately after its publication, since the inclusion could tarnish its national brand (The Korea Herald 2017). Also, before the blacklist was published, there were speculations about inclusion of specific countries in the blacklist, and Turkey was mentioned as one of the potential uncooperative jurisdictions. As claimed by Bloomberg (Chrysoloras and Dendrinou 2017), while EU countries were split over whether financial sanctions should be used against such uncooperative jurisdictions, inclusion in the blacklist would result in reputational damage to Turkey and raise pressure on EU companies to hold back investment. Several states, including France, supported punitive measures, such as exclusion from international funding. Germany was exercising its influence with international development institutions to restrict financing to Turkey from the state-owned KfW bank, the European Investment Bank and the European Bank for Reconstruction and Development. German commercial banks were also reviewing their exposure to Turkey days after chancellor Angela Merkel said that the EU may cut pre-accession funding to Turkey.

Based on this evidence, I expect that investors reacted negatively to publication of the blacklist. The blacklisted tax havens face public shaming and potential future countermeasures and might take commitments to change their tax laws and limit the preferential treatment of multinational firms in the future. Moreover, any funding projects involving entities in the blacklisted jurisdictions can be subject to auditing and assessment. This can jeopardize firms’ tax saving strategies or lead to future audits of the firm. Also firms’ reputation is negatively affected, since they face potential public pressure or backlash against the firm or its products for being a bad corporate citizen. Investors are likely to react negatively to such news since firms’ future reported earnings are likely to fall.

It is important to note that the EU refers to the blacklist as the list of non-cooperative tax jurisdictions, since the listed countries failed to meet agreed good tax governance standards. Most of the listed countries are small and might simply lack the administrative capabilities to deal with the EU’s requests. The EU has received criticism for omitting the most notorious tax havens from the blacklist, instead placing them on the grey list of countries which have committed to improve their transparency standards.Footnote 6 The EU’s response to this is that the list should raise the level of good tax governance globally and help prevent the large-scale tax abuse through tackling third countries that consistently refuse to play fair on tax matters. Therefore, even though many of the listed countries were not considered as tax havens previously, they were still shamed by the EU as being non-cooperative on tax matters and face potential sanctions. Since I am interested in the effect of EU shaming on firms with subsidiaries in these jurisdictions, I still expect a negative investor reaction towards the exposed firms.

Finally, information about compilation of the EU tax haven blacklist was available to investors prior to December 5, 2017. The announcement was hotly anticipated by campaigners, lobbyists and politicians on both sides of the offshore debate. However, there was a lot of uncertainty regarding the blacklist itself. First, a debate was on about inclusion of some devastated Caribbean islands, and the suggestion that no EU state will be included. Second, it was not yet clear what the penalty for failing to pass the test would be, with opinions varying on the severity of the necessary response. Finally, ministers could still decide to postpone the adoption of the list, as the listing was far from a sure thing in November 2017. According to event study assumptions, an event is anything that results in new relevant information (McWilliams and Siegel 1997). Therefore, when the blacklist was published on December 5, 2017, investors traded on the new information available to the market regarding the listed countries and potential penalties. Nevertheless, the public awareness of the blacklist compilation might weaken the power of my tests and cause an understatement (or more generally misstatement) of the economic impact that I find.

3.2 Data and variable construction

I obtain ownership and financial data of all listed firms in Bureau van Dijk’s Orbis database as of 2016. Market data is obtained from Datastream and Orbis. I additionally rely on data from BNY Mellon, KPMG, Property Rights Alliance, PRS Group, RepRisk, Transparency International and the World Bank, among others. I focus on the main variables of interest and provide a complete list with variable definitions in Table 13.

3.3 Sample selection

Table 1 presents a summary of the sample selection process. I obtain daily stock prices for all publicly listed active firms from Orbis and Datastream, listed on 111 stock exchanges worldwide.Footnote 7 I drop purely domestic firms (firms with no foreign subsidiaries) and firms with missing data for share prices during the event period and missing total assets. I also drop stocks not actively traded (no price changes between December 4, 2017, and December 8, 2017), penny stocks (prices below $0.10) and firms with assets below $5 million. I also drop firms operating within the financial services industries. I winsorize returns at the 1 and 99 percentiles to remove outliers. Besides using raw returns, I calculate one-factor alphas (abnormal returns or stock returns in excess of market returns after controlling for firms’ exposure to the market index). Alphas are obtained from a one-factor model estimated from November 6, 2016, to November 5, 2017 (the year ending 1 month before the event date). I require stocks to have at least 100 non-missing return observations during that period. Local market indices and risk-free rates are not available for 13 countries in the sample, out of 102 countries in total. I therefore obtain stock prices in US dollars and use the US market index (MSCI USA Value Weighted Index) and US T-bill as market index and risk-free rate for these countries.Footnote 8

3.4 Exposure to tax havens

My first key variable of interest, Tax haven exposure, indicates whether (1) or not (0) the firm has at least one subsidiary located in any of the blacklisted tax haven countries. I also consider the number of tax haven subsidiaries the firm has through the variable Log(1+Number of tax havens), and the proportion of tax havens, relative to all subsidiaries of the firm, through the variable Proportion of tax havens.Footnote 9 I only focus on those tax havens that are known to outside investors with access to commercially available databases. The exposure variables are constructed, based on publicly available information on firms’ corporate structures in Orbis Historical, provided by BvD. Companies disclose ownership data themselves, either when they disclose their shareholders or list their subsidiaries. Laws and regulations regarding disclosure of ownership data vary widely between countries. Also common company practices vary and often go beyond the legal requirements. BvD collects ownership information directly from the companies, from official bodies or from the associated information providers. The existence of unreported subsidiaries in other (haven) countries can potentially (downward) bias my estimates of tax haven exposure.Footnote 10

3.5 Measures of firm value

I measure the impact of publication of the tax haven blacklist on firm value using daily returns for [− 1; 3] event window around December 5, 2017, since markets often need time to digest new information. I include the day prior to the blacklist publication date to capture any effect of news available to the market before the event and 3 days after to provide time for the market to react and to take into account any lag and lead effects. Since the data sample consists of multiple countries, time zones and holidays can affect the dates on which information can be impounded in stock prices. Therefore, a multi-day period is particularly useful in this setting.Footnote 11

3.6 Other firm characteristics

Finally, I construct measures of firms’ corporate citizenship, tax aggressiveness and the potential for firm- and country-level expropriation.

I predict that firms which are more vulnerable to public perceptions of corporate citizenship could be more negatively affected after publication of the blacklist because consumers might react to the firm not being a good corporate citizen. Therefore, I predict that firms in the retail industry that deal directly with consumers will have a more negative reaction than other firms. Retail firms may be more susceptible to be publicly perceived and penalized for being unconscionable or unpatriotic, since consumers might decide to boycott firms’ products.Footnote 12 I set an indicator variable Retail equal to one if the firm operates within the retail sector.Footnote 13

Tax Aggressiveness (unadjusted) is the statutory tax rate at the country level less firm’s effective tax rate. The effective tax rate is defined as taxation over earnings before interest and tax (EBIT), observations with negative EBIT are denoted as missing, in line with O’Donovan et al. (2019).Footnote 14Tax Aggressiveness is the residual of a regression of firm’s Tax Aggressiveness (unadjusted) on return on assets, intangible assets divided by total assets and losses of the previous year (if any), scaled by assets, in line with O’Donovan et al. (2019). A variation of the measure additionally controls for industry and country fixed effects when constructing the residual and accounts for profitability and industry- and country-specific tax treatments. For all variables, the higher the value, the more tax aggressive the firm is.Footnote 15

As another proxy for tax aggressiveness, I use the Cash effective tax rate (ETR) from firms’ financial statements, which is calculated as cash taxes paid divided by pre-tax income. The variable directly measures the market’s ex-ante perceptions regarding firms’ tax aggressiveness. I expect that the higher the cash ETR, the less likely that the market would expect the firm to be sufficiently tax aggressive, and the more likely the market would react to a high firm’s exposure to blacklisted tax havens as a positive signal of optimal aggressiveness. I expect that the higher the firm’s cash ETR, the more positive (or less negative) the reaction upon publication of the blacklist.Footnote 16

At the firm level, I use measures of firm governance to capture the degree to which monitoring affects conflicts of interest between principals and shareholders. I capture exposure to the US regulations and potential enforcement actions arising from having any US subsidiaries through Has US subsidiary dummy. Further, I use the RepRisk index score provided by RepRisk (2017) that dynamically captures and quantifies a company’s exposure to environmental, social and governance (ESG) and business conduct risks. The higher the index value, the higher the risk exposure. Since I am interested in the effect of governance, I calculate the reverse of RepRisk index score (1-score) and use that in the regression. I also use Foreign institutional ownership (direct or total) as another variable for firm-level governance, based on the idea that institutional investors monitor managerial performance more than individual owners, thus providing improved governance at the firm. This is in line with previous literature on corporate governance (Aggarwal et al. 2011; Desai and Dharmapala 2009; Rao 2018). I measure foreign institutional holdings using data from Orbis by computing the fraction of total shares outstanding that are held by foreign institutions (banks, insurance companies, mutual fund parent companies, pensions, endowments and professional investment advisors). Furthermore, I obtain cross-listings from BNY Mellon (2017), which subject firms to US regulations and potential enforcement actions (Coffee 2002; Doidge 2004; Doidge et al. 2004, 2010; Lel and Miller 2008; Stulz 1999). I split American depositary receipts (ADRs) into those that are unsponsored (Has unsponsored ADR) and subject to less stringent regulatory requirements and those that are sponsored (Has sponsored ADR) and subject to more stringent requirements. Finally, firms with subsidiaries in the most corrupt countries might use tax havens as offshore vehicles to bribe foreign government officials and win business. Since bribery is illegal, more scrutiny following the blacklist might reveal such activities, leading to regulatory fines. Moreover, since the detection probability has increased, the expected costs of violating anti-bribery regulations increase as well. In order to control for that, I construct Corruption exposure, a dummy variable that is equal to one if the firm is exposed to the most perceptively corrupt tercile of countries using the Corruption Perception Index by Transparency International (2016). Again, since I am interested in the effect of governance, I construct (1-corruption) exposure or lack of corruption and use that in the regression.

Shareholder expropriation can be facilitated by weak institutions and by lack of monitoring. At the country level, I measure this with commonly used indices, including protection of property rights (Property Rights Alliance 2017), country risk ratings (PRS Group 2017), the rule of law (La Porta et al. 1998), and protection of minority shareholders (The World Bank 2017). These measures capture the extent to which individuals are protected from expropriation by the government and insiders. For each index, I construct a dummy variable equal to one if a country ranks above the median (has low expropriation risk).Footnote 17

3.7 Event study methodology

According to the efficient market hypothesis, stock prices reflect all available information. Using this assumption, an event study can be used to calculate how an event changes stock prospects by quantifying its impact on the stock price. I use an event study methodology to test the market reaction to publication of the EU tax haven blacklist. I examine a 5-day window [− 1; 3] around December 5, 2017, (day 0) as the event period. I include the day prior to the blacklist publication to capture any effect of news available to the market before and 3 days after to provide time for the market to react. Daily returns for each stock are collected in two different periods. The first period is the event period, while the second period is the estimation period which is used to forecast the normal performance in the event window. The estimation window is the year ending 1 month before the blacklist publication date (November 6, 2016, to November 5, 2017).

For the baseline specifications, I implement the single factor market model to construct expected returns over the event window, according to MacKinlay (1997).Footnote 18 The parameters of the market model are estimated using ordinary least square (OLS) regression over the estimation period. This method is used to control for relation between stock returns and market returns and allows for variation in risk associated with the selected stock. The market model is based on the assumption of a constant and linear relation between individual asset returns and the return of the market index. The actual return of the stock is the return that the stock made in the event period and is calculated as follows:

where \(Price_{it}\) is the price of firm i at time t and \(Price_{it-1}\) is the price of the firm i on the previous trading day \(t-1\).

Then, the actual stock return is regressed on the market return in the estimation period to estimate market model parameters alpha (intercept) and beta (slope):

where \(ActualReturn_{it}\) is the daily return of firm i and \(MarketReturn_{mt}\) is the return of the local market index.Footnote 19

The expected return for the firm on any day during the event window is then calculated as the beta estimate from the regression (2) multiplied by the actual market return on the specific day:

Abnormal returns are calculated by deducting the returns that would have been realized if the analysed event would not have taken place (normal or expected returns) from the actual returns:

The cumulative abnormal return is then obtained by summing up the abnormal returns over the event period:

3.8 Identification strategy

I use the event study technique to examine the market response of firms connected to the blacklisted tax havens around the publication of the EU tax haven blacklist. For my baseline results, I run the following regression:

where \(CAR_{i}\) denotes the cumulative abnormal return of firm i around the publication of the tax haven blacklist, \(TaxHavenExposure_{i}\) indicates the proportion of firm’s subsidiaries that are located in the blacklisted tax haven countries, and \(\mathbf{X }_{i}\) contains controls, including country and industry fixed effects. \(\epsilon _{i}\) is the error term. The coefficient of interest, \(\beta\), captures whether exposure to the blacklisted tax havens impacts firm value. In parts of my analysis, I augment Eq. 6 with other tax haven variables, additional firm characteristics and their interaction with \(TaxHavenExposure_{i}\) to test whether certain types of activities are priced. Finally, I use two-way clustering and cluster the standard errors on country and industry. The event study methodology follows that used in O’Donovan et al. (2019) and Zhang (2007).

To alleviate concerns that event day clustering may bias the coefficient estimates, I implement the calendar time portfolio and Fama–MacBeth approaches, following O’Donovan et al. (2019) and Schipper and Thompson (1983). For the portfolio approach, I construct daily abnormal returns of portfolios of firms that have tax haven subsidiaries and that do not. The returns are constructed for 60 days around publication of the blacklist (30 days before and 30 days after December 5, 2017). I then regress these portfolio returns on event day dummy interacted with tax haven exposure dummy, day fixed effects and tax haven exposure dummy. For the Fama–MacBeth approach, I regress daily abnormal returns on tax haven exposure for each date during the 60 days. I then regress the resultant tax haven exposure coefficients on event day dummy interacted with tax haven exposure dummy to establish whether the tax haven exposure coefficient is statistically different on the relevant event dates, as compared to non-event dates.

4 Descriptive statistics

Table 14 provides summary statistics for firms with and without exposure to the blacklisted tax havens, providing a breakdown by country, with countries ranked in declining order by fraction of implicated firms. I find that 2031 firms or 15.45% of the 13,149 sample firms have subsidiaries in the blacklisted tax haven countries. As discussed previously, this estimate is likely conservative. There is a substantial cross-country variation in the fraction of firms that have exposure to tax havens. At the top are firms located in Kuwait, Switzerland, South Korea, the Netherlands, Bermuda and United Kingdom with at least one in four firms being tax haven users.

The use of blacklisted tax havens extends across all industries, shown in Table 15, and only a minority of industries have no firms with exposure to tax havens.

Furthermore, Table 16 shows which tax havens are more frequently used, as a proportion of all tax haven subsidiaries in the data. Approximately 40% of tax haven subsidiaries are located in South Korea, and approximately 19% of tax haven subsidiaries are located in the United Arab Emirates, followed by Marshall Islands and Panama.

Next, I compare characteristics of firms with and without exposure to the blacklisted tax havens in Table 2. Firms that have tax haven subsidiaries are substantially larger, have more subsidiaries, and are more exposed to foreign countries. These firms are more tax aggressive and pay relatively lower effective corporate tax rates than firms without tax haven subsidiaries. The exposed firms seem to be better governed at both country- and firm-level, except for their RepRisk index score and corruption exposure. They are located in countries with higher GDP per capita or higher productivity and standard of living.

Since firms implicated by publication of the EU tax haven blacklist are substantially larger, both by assets and number of (foreign) subsidiaries, I match firms by headquarter country and number of foreign subsidiaries (nearest neighbour matching).Footnote 20 For the matched sample, shown in the last column of Table 2, firms with exposure to tax havens are no longer substantially different from firms with no exposure to blacklisted tax havens. The only remaining differences stem from their statutory corporate tax rate, corruption exposure, whether the firm has a US subsidiary and the country’s GDP per capita. To alleviate concerns that my results might be explained by firm size, I control for size (number of foreign subsidiaries) throughout my analysis and ensure that my results are robust for matched samples (matching on either firms’ total assets or number of foreign subsidiaries). I also examine whether firms’ tax aggressiveness, corruption exposure, exposure to US regulations and country’s GDP matter in my analysis in the cross-sectional tests.

5 Market response to publication of the EU tax haven blacklist

In this section, I begin by documenting the baseline effect of publication of the blacklist on firm value, using cumulative raw and abnormal returns, and provide some robustness tests.

5.1 Main result

Table 3 shows the main result of the analysis of market reaction to publication of the EU tax haven blacklist. The table presents the results of a univariate split by firms with tax haven subsidiaries and without tax haven subsidiaries. Firms without tax haven subsidiaries face negative cumulative returns; however, they are insignificant for all models, except the cumulative raw returns. Firms with tax haven subsidiaries face statistically significant negative cumulative returns during the event period, according to different expected return models. The cumulative returns of firms with tax haven subsidiaries are significantly more negative than the returns of firms without tax haven subsidiaries in both full sample and matched sample. According to the baseline model (market model), firms with tax haven subsidiaries face negative cumulative abnormal returns during the event window that are 0.56% lower than those of firms that do not have any tax haven subsidiaries. Matching by country and closest neighbour by number of foreign subsidiaries reduces this differential to 0.34%. I obtain the overall market impact of the blacklist publication by multiplying each firm’s market capitalization at the end of 2017 by its cumulative abnormal return. In economic terms, blacklist reduced the overall market capitalization of the exposed firms by $56 billion. Further, the regressions in Tables 18 and 4 introduce additional controls—firm size and country and industry fixed effects.

The dependent variable in Table 18 is Cumulative raw return around the event date. The control variables of interest are Tax haven exposure that indicates whether (1) or not (0) a firm is connected to the EU blacklisted tax havens, Proportion of tax havens that indicates the proportion of tax haven subsidiaries a firm has, and Log(1+Number of tax havens) that indicates the natural logarithm of the number of tax haven subsidiaries a firm has. All specifications include country and industry [49 Fama-French industries (French 2018)] fixed effects. Also, specifications 2, 4 and 6 control for firm size (number of firm’s foreign subsidiaries).Footnote 21

The results show that firms connected to the EU blacklisted tax havens face negative cumulative raw returns during the event window, as compared to firms without any tax haven subsidiaries. In column 2 the raw returns are 0.57% lower for such firms than for same-country, same-industry firms without an exposure to tax havens, after controlling for firm size. Moreover, for a one percentage point increase in the percentage of tax havens a firm has, its raw returns decrease by 0.63%, as seen in column 4. Similarly, for a 1% increase in the number of tax havens the firm has, its raw returns decrease by 0.23%, as seen in column 6.

When I use Cumulative abnormal returns (alphas), calculated according to the market model, as the dependent variable in Table 4, results are largely unchanged, and firms that have tax haven subsidiaries are still significantly negatively affected.Footnote 22 I treat the column 4, − 0.72%, as my baseline estimate.

Overall, firms connected to tax havens are adversely affected by publication of the tax haven blacklist. First, there are reputational effects of EU shaming of the blacklisted tax havens. Firms with a substantial share of the blacklisted tax haven subsidiaries face potential public pressure or backlash against the firm or its products (Graham et al. 2014). Investors react negatively, since it can harm firms’ future profits. Moreover, firms can be audited and their transactions with subsidiaries in tax havens are likely to be excessively monitored, inducing costs for the firm itself. Finally, tax havens face potential future countermeasures by the EU. As the blacklisted tax havens might not be eligible for funds from the bloc except where to aid development and might face further sanctions, the tax haven countries might decide to take commitments to change their tax laws (Sharman 2009). This can jeopardise firms’ tax saving strategies. The adverse market reaction to publication of the blacklist suggests that tax havens help firms with saving taxes and generate firm value on average.

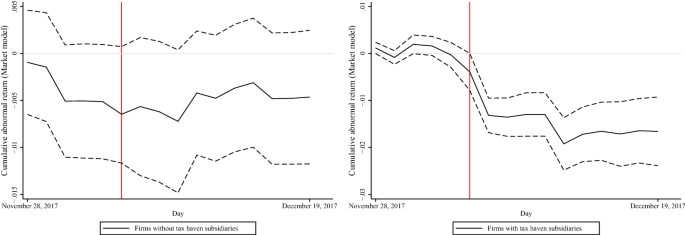

Finally, Fig. 1 shows the cumulative abnormal returns, calculated according to the market model, around publication of the EU tax haven blacklist for firms with and without tax haven subsidiaries. Publication of the EU tax haven blacklist does not affect firms without any blacklisted tax haven subsidiaries, so their cumulative abnormal returns are small and insignificant both before and after blacklist publication. Market reaction is significantly negative for firms with blacklisted tax haven subsidiaries, whose cumulative abnormal returns become negative and statistically significant right after December 5, 2017. The cumulative effect is approximately 1.3% reduction in firm’s stock price 3 days after publication of the blacklist, and the cumulative effect over 10 days averages at approximately 1.7% reduction in firm’s stock price. These observations support the regression results that the market reacted negatively to publication of the EU tax haven blacklist for the firms with blacklisted tax haven subsidiaries.

Market reaction to publication of the EU tax haven blacklist: cumulative abnormal returns (Market model) Notes The graphs show the cumulative abnormal returns, calculated according to the market model, around publication of the EU tax haven blacklist (December 5, 2017) for firms with and without tax haven subsidiaries. The dashed lines represent the 95% confidence intervals for significance limits

5.2 Robustness

Since all firms with tax haven subsidiaries have the same event date, significance levels in the main analysis can be influenced by event date clustering. Therefore, I repeat the analysis using two approaches that alleviate these concerns—portfolio approach and Fama–MacBeth approach. Results of these specifications are depicted in Table 5 and show that firms with tax haven subsidiaries earn statistically significant negative cumulative abnormal returns after publication of the blacklist. The economic magnitude of the two approaches can be calculated by multiplying the main coefficients by five (the number of days in the event window). For the portfolio approach, the economic magnitude is − 1.16%, while it is − 0.97% for the Fama–MacBeth approach. These are larger than the baseline effect, since they do not control for either country or industry fixed effects, or firm size.

Table 6 shows additional robustness tests of the main specification (Table 4, column 4). Column 1 shows the results of the main specification for the ease of comparison. Further, as shown in column 2 the coefficient of interest is larger than in the main specification when I repeat the analysis using a matched sample, matching by country and closest neighbour by number of foreign subsidiaries. Similarly, the coefficient is larger than in the main specification when I match firms by total assets in column 3. Moreover, the coefficient is larger than in the main specification when I exclude the size control and any fixed effects, as in column 4. This shows the importance of having both the size control and country and industry fixed effects in the regressions.

Furthermore, I examine whether investors reacted to the grey list of tax havens, which was published on the same day as the blacklist. Since the grey-listed countries committed to addressing deficiencies in their tax systems, according to the EU, I expect that there would be no significant shaming effect of firms with many subsidiaries in the grey-listed countries. Contrarily, as the EU said in a press release, “The EU listing process had a very positive impact as most jurisdictions engaged constructively with the EU during the listing process. Many made concrete, high-level commitments to improve their standards as a result of the EU screening exercise” (Commission 2017). Since the EU was not shaming the grey-listed tax havens, and they do not face sanctions or penalties for being included in the grey list, I expect the investors to be indifferent regarding firms’ exposure to the grey-listed tax havens. In order to control for firms’ exposure to grey-listed tax havens, I create a variable Proportion of grey tax havens, equal to the proportion of grey-listed tax haven subsidiaries the firm has, as a proportion of all firm’s subsidiaries. As column 5 shows, controlling for firms’ exposure to grey-listed tax havens does not affect the main coefficient of interest significantly. There seems to be a small positive effect of having subsidiaries in the grey-listed countries, which corresponds to my intuition that these countries do not face any EU shaming or penalties.

Finally, most countries in the blacklist are countries with a relatively small GDP or overseas territory islands, with a notable exception of South Korea. South Korea had never been blacklisted before, but was included in the EU tax haven blacklist since it did not comply with transparency requirements. Almost every third South Korean firm owns a tax haven in my sample, and more than 40% of tax haven subsidiaries in the sample are located in South Korea. Therefore, I examine to what extent the baseline results are driven by South Korea being included in the EU tax haven blacklist in Table 7. Column 1 shows the results of the main specification (Table 4, column 4) for the ease of comparison. In specification 2, I interact the Proportion of tax havens variable with a dummy variable for whether the parent firm is located in South Korea. The interaction term shows a large negative reaction of South Korean firms, as compared to firms located in other countries. Similarly, in specification 3 I control for the proportion of tax haven subsidiaries a firm has, without considering South Korea as one of the 17 blacklisted countries. The estimated coefficient is smaller and less significant than the baseline coefficient. In specification 4 I control for the proportion of South Korean subsidiaries a firm has, and find a large and statistically significant negative effect of firms with a large proportion of subsidiaries located in South Korea. This suggests that the baseline results are to a substantial extent affected by South Korea’s inclusion in the blacklist. This is confirmed in specification 5 as well. However, since the main result holds also when excluding South Korea from the blacklisted tax haven list, the results are not entirely driven by South Korea. With these robustness tests in mind, I continue to use the specification in Table 4, column 4 as my main specification.

5.3 Interaction with previous tax haven lists

As discussed in the media, the EU tax haven blacklist is not exclusive, and the sources agree that it omits several major offshore hubs, such as Bermuda, British Virgin Islands and the Cayman Islands, as well as important European countries, such as Ireland, Luxembourg and the Netherlands that have been recognized as tax havens in other tax haven lists. As new research shows, Ireland is the biggest tax haven for multinationals (Tørsløv et al. 2018). Moreover, the EU tax haven blacklist has been said to merely include non-cooperative jurisdictions, which are small and lack administrative capabilities to deal with the EU’s request. Table 19 in the Appendix section shows the different tax haven lists that have been used in the previous literature, while Tables 20 and 21 compare countries represented in the previous lists with countries in the EU tax haven blacklist. The EU tax haven blacklist features Panama, which has appeared in all previous lists, and it also includes countries that have not appeared in any previous tax haven lists, such as Mongolia, Namibia and South Korea. Nevertheless, the EU blacklist does not include Cayman Islands and Isle of Man, which have been included in all previous tax haven lists. I expect that investor reaction to inclusion of particular countries in the blacklist could differ, based on whether these countries were previously known to be tax havens or not.

To examine whether investors reacted differently to different types of blacklisted tax havens, I split all tax havens into groups, based on how foreseeable they were to be included in the blacklist. If the tax haven was included in at least half of the previous tax haven lists (e.g. 3 lists), it is likely that it could be included in the EU blacklist as well. Similarly, if the haven was included in only 2 of the previous lists, it is less foreseeable it would be included in the EU tax haven blacklist. Based on this, I create 3 groups of countries—Likely to be on EU list and was on EU list, Likely to be on EU list and was not on EU list and Not likely to be on EU list and was on EU list. Similarly, I create another 3 groups of countries—Was on all previous lists and was on EU list, Was on all previous lists and was not on EU list and Was on no previous lists and was on EU list. Finally, I create another 2 groups of countries—Was on at least one list and was on EU list and Was on at least one list and was not on EU list.Footnote 23 I then calculate each firm’s exposure to the specific group through the proportion of subsidiaries the firm has in these countries. Finally, I regress the stock returns on the proportion of subsidiaries the firms have in the different groups.

The results are displayed in Table 8 and show that the larger the firm’s exposure to the tax havens that were unlikely to be on the EU blacklist but were actually included, the worse the investor reaction. Similar results can be observed for firms with a large exposure to the tax havens that had never been on a blacklist before, but were included in the EU list. Since it was not foreseeable that these countries would be included in the blacklist and might face potential sanctions and countermeasures, investors reacted negatively to the new information, which was immediately priced in the firm value. Interestingly, there is a small positive market reaction of the firms exposed to those countries that were on at least one previous tax haven blacklist, but not on the EU list.Footnote 24 These are the countries that are considered as tax havens by the market, but escaped inclusion in the blacklist, such as Bahamas, Bermuda, Cayman Islands, Ireland, Isle of Man, Jersey, Luxembourg and others. They were not shamed by the EU and do not face any future sanctions. Since these countries are often used for firms’ tax saving strategies, and they managed to escape the blacklisting, these are positive news for the investors.

6 Cross-sectional variation in market reactions

To further examine the partial relationship between firm characteristics and investor reaction to publication of the blacklist, I investigate the cross-sectional relation between firm characteristics and the event window returns. Results of the different specifications are displayed in Tables 9, 10 and 11. Column 1 shows the results of the main specification for the ease of comparison (Table 4, column 4).

6.1 Corporate citizenship

Specification 2 of Table 9 examines corporate citizenship as an explanation for the negative market response to publication of the blacklist. The possibility of a negative consumer reaction to indication of bad corporate citizenship makes retail firms relatively more vulnerable to news of their tax avoidance strategies. The results show that investors of firms operating within the retail sector reacted more negatively, compared to firms in other industries. This is consistent with the potential consumer backlash, which can harm firms’ future profits.Footnote 25

I recognize that interpretation of the results is subject to the concern that engagement in tax shelters is endogenous. It is possible that retail firms are less likely to have subsidiaries in tax shelters but, if they do so, the expected benefit would be higher than otherwise in order to offset the higher expected costs. It is also possible that the type of shelters that retail firms engage in is systematically different than the type of shelters that are important in other sectors. The results should be interpreted with these caveats in mind.

6.2 Tax aggressiveness

Specifications 3–6 of Table 9 test whether tax-aggressive firms were affected differently around publication of the EU tax haven blacklist than less tax-aggressive firms. In column 3, I control for tax aggressiveness using an unadjusted measure, which subtracts the firm’s effective tax rate from the country’s statutory corporate tax rate. In column 4, I use a measure which is obtained by regressing the unadjusted tax aggressiveness on firm’s return on assets, intangible assets divided by total assets and losses of the previous year (if any), scaled by assets. The measure in column 5 additionally adds industry and country fixed effects. All specifications show that the more tax-aggressive firms have more negative returns around publication of the EU tax haven blacklist.

The results are consistent with investors expecting that firms might be audited or fined for past tax evasion or overly aggressive tax avoidance. Even though the blacklist does not incorporate any specific sanctions or penalties, it was effective at shaming and increasing public scrutiny on the more tax-aggressive firms to a larger extent than less tax-aggressive firms. As tax saving strategies through the use of tax havens are most relevant for relatively tax-aggressive firms, they would be more negatively affected if tax havens had to limit their preferential treatment. The negative reaction might also reflect the potential future costs of restructuring the firms might incur in order to keep their corporate tax payments low. Investors react negatively to such information since firms’ future after-tax profits are likely to fall.

These findings are in line with literature on corporate tax abuse (Blank 2009; Madhavan 2002). Hedge funds and private equity funds own significant stakes in multinational firms, and fund managers spend considerable time searching for information about corporate managers’ tax planning behaviour. Many funds seek to maximize the economic return on their investment within a relatively short period of time. They may enjoy a firm’s claimed tax benefits today; however, when they get to know that the tax authorities might audit or reject the firm’s tax position, they would sell the stock.

As another test, in column 6 I look at cash effective tax rates as a measure of tax aggressiveness. The larger the cash effective tax rate, the less tax aggressive the firm is. The results show that the market reaction is less negative for firms that are viewed to be generally less tax aggressive, controlling for the proportion of tax haven subsidiaries. This is consistent with market reacting positively to evidence that a firm tries to reduce taxes (has a high proportion of tax haven subsidiaries), when its financial reports would lead one to believe the firm is not tax aggressive (has high cash effective tax rate). The results also correspond to the previous literature (Hanlon and Slemrod 2009), which claims that in order to maximize the value of the firm, shareholders would like to minimize corporate tax payments net of the private costs of doing so—they want the company to be optimally aggressive. Investors could consider this behaviour to be an attractive attribute of a corporation because it could increase the economic return on their investments in the corporation’s stock. Exposure to the blacklisted subsidiaries could signal that the corporation’s tax director was willing to claim risky tax positions that could generate substantial benefits for investors in the future. Investors often comment that they do not seek to invest in corporations whose tax directors break the tax law, but rather that claim tax positions that “push the envelope” (Blank 2009). When a tax director pushes the envelope, he claims tax positions that technically appear to comply with the tax rules. Investors may respect this type of tax director for pursuing aggressive tax positions that yield economic returns on their investments, but refrain from violating explicit tax rules.

6.3 Firm-level governance

In Table 10, I use measures of firm-level governance to capture the degree to which monitoring efforts reduce conflicts of interest between principals and shareholders. In poorly governed firms, managers may find it easier to extract resources for their own gain. If tax havens are used to expropriate shareholders, I expect the publication of the blacklist and the resulting increased scrutiny to reduce such activities, particularly in weakly governed firms. Thus, I expect weakly governed firms to be less negatively affected by publication of the blacklist. For all my firm-level governance measures, higher values indicate stronger governance. Specification 1 shows the results of the main specification for the ease of comparison.

Specifications 2 and 3 consider foreign institutional ownership or the firm-level fraction of foreign total or direct investment, as firm-level governance measures. The larger the foreign institutional ownership (the better governed the firm), the worse the investor reaction.

Further, in specification 4 I interact the Proportion of tax havens with the reverse of RepRisk index score as firm-level governance measure. The index gives a score that dynamically captures and quantifies a company’s exposure to environmental, social and governance (ESG) and business conduct risks.Footnote 26 Again, I observe evidence that worse governance is associated with less negative returns for firms that are exposed to the blacklisted tax havens.

Specifications 5 and 6 examine the effect of having unsponsored or sponsored American Depositary Receipts (ADRs) and hence being subject to stringent US regulations, as firm-level governance measures. The results show that firms with ADRs faced more negative investor reaction that worse governed firms.

Further, specification 7 examines exposure to the United States legislation and regulations as an explanation for the market response. After the matching analysis conducted in Table 2, having a US subsidiary was one of the variables that were still different between the two groups. To examine whether firms with subsidiaries in the USA reacted differently to the blacklist, I interact the tax haven exposure variable with the US subsidiary dummy. The coefficient on the interaction term is insignificant, so the results suggest that having a subsidiary in the USA does not affect investor reaction to publication of the blacklist.

Finally, specification 8 of Table 10 examines the reverse of corruption as an explanation for the stock price reaction to publication of the blacklist. Firms with subsidiaries in corrupt countries might use tax havens as offshore vehicles to bribe foreign government officials. Moreover, after the matching analysis conducted in Table 2, corruption exposure was one of the variables that were still significantly different between the two groups. To examine whether investors of more corrupt firms reacted differently to the blacklist, I interact the tax haven exposure variable with the (1-corruption) exposure or lack of corruption. As the results show, having subsidiaries in perceptively corrupt countries is not associated with more negative abnormal returns. Based on this, it seems that investors of relatively more corrupt firms did not react differently than those of less corrupt firms, and public shaming does not seem to matter more or less for firms more exposed to corruption.

Taken together, the results of this section are consistent with the view that weakly governed firms may benefit from publication of the tax haven blacklist, since it potentially reduces expropriation. The results suggest that shareholders benefit from the potentially additional auditing, monitoring, scrutiny and transparency following publication of the blacklist, especially so in weakly governed firms. Another explanation for the results is that when the market learns of tax shelter activity for firms with good governance, it reacts negatively because this confirms the suspicion of poor governance that was previously thought not to be value-decreasing. On the other hand, the market price for firms with bad governance already reflects a reduction in value related to poor governance provisions, so investors do not react negatively (Hanlon and Slemrod 2009). Finally, investors of firms with worse firm-level governance might simply react less to EU shaming than investors of well-governed firms.

6.4 Country-level governance

To support my interpretation of the firm-level governance results, I next turn to country-level evidence in Table 11. I expect that the use of tax havens comes at a particularly high cost in countries where investors face high expropriation risk and low levels of investor protection. Publication of the blacklist should make expropriation harder to maintain in the future and therefore benefit outside shareholders, more so in countries with high expropriation risk. I test this by augmenting the main specification by several country-level measures associated with expropriation risk and investor protection. This setup allows me to compare firms affected by publication of the blacklist to other firms headquartered in the same country. For all my country-level governance measures, higher values indicate stronger governance.

The results suggest that the negative investor reaction is more pronounced for firms headquartered in countries with low expropriation risk and high investor protection. Specifically, firms both exposed to tax havens and high country-level governance are more adversely affected. The results correspond to my intuition in the firm-level governance analysis—the weakly governed firms are likely to benefit from publication of the blacklist, while for the well-governed firms, the exposure to blacklisted tax havens confirms the suspicion of poor governance, which is then priced in firm’s value.

Importantly, this effect is distinct from any effects of firms’ headquarters country development. I do not find a differential effect on firm value for firms in countries with higher economic development, when looking at the interaction between tax haven exposure and the natural logarithm of country’s GDP per capita. This suggests that my measures of expropriation risk and investor protection do not merely reflect economic development.

In sum, the results suggest that, due to their opaqueness, tax havens might be used for expropriation of corporate resources, at the cost of shareholders. Publication of the blacklist and the potential future countermeasures reduce some of that cost. Another explanation for the finding is that investors of firms with worse governance seem to react less to EU shaming than investors of well-governed firms.

7 Evolution of the EU tax haven blacklist

On December 5, 2017, the EU Council adopted the first common EU tax haven blacklist after assessment of countries against distinctive criteria. Pursuing the assessment process, the Council continuously updated the list on the basis of commitments received, while also reviewing countries that had not yet been assessed. First, on January 23, 2018, 8 jurisdictions were moved from the blacklist to the grey list, since several jurisdictions sent new commitments. Countries that were moved to the grey list were Barbados, South Korea, Grenada, Macau, Mongolia, Panama, Tunisia and United Arab Emirates. Further, on March 13, 2018, Bahrain, Marshall Islands and Saint Lucia were moved from the blacklist to the grey list, while Bahamas, Saint Kitts and Nevis and US Virgin Islands were added to the blacklist. Further, on May 25, 2018, Bahamas and Saint Kitts and Nevis were moved to the grey list, on October 2, 2018, Palau was moved to the grey list and on November 6, 2018, Namibia was moved to the grey list. I examine whether the evolution of the blacklist had an impact on firm value for firms with subsidiaries in the countries that were either added or removed from the blacklist. I calculate each firm’s exposure to the removed countries or the added countries through the number of firm’s subsidiaries in these countries, as a proportion of firm’s total subsidiaries. I then calculate the firm’s cumulative abnormal returns over 5 days window around the blacklist evolution dates and use the cumulative abnormal returns as the dependent variable in the regressions. The results are depicted in Table 12, where column 1 shows the baseline specification of the blacklist publication date on December 5, 2017.

The results in Table 12 show that firms with subsidiaries in countries that are removed from the EU tax haven blacklist are positively affected. The market reaction is significant for the first time when countries were removed from the blacklist on January 23, 2018, as in column 2. Eight jurisdictions were removed from the blacklist on January 23, including relatively large GDP countries, such as South Korea and United Arab Emirates, and also well-known tax havens, such as Grenada, Macau and Panama. The reaction is also significant on May 25, 2018, when well-known tax havens Bahamas and Saint Kitts and Nevis were removed from the blacklist, as in column 4. For the countries that were unlikely to be listed, removal from the blacklist gave evidence to investors that these countries should not be considered as tax havens and maybe should not have been blacklisted in the first place. For the countries that were likely to be listed and were de-listed, removal from the blacklist signalled investors that these countries are willing to address their shortfalls and commit to reforms to increase tax transparency. Since the grey-listed countries do not face sanctions or financial penalties, investors can be less concerned when investing in firms with subsidiaries in these countries.

8 Conclusion

Consistent with the notion that firms use tax havens to create shareholder value, I find that publication of the EU tax haven blacklist on December 5, 2017, led to negative abnormal returns of firms with the blacklisted tax haven subsidiaries. In economic terms, blacklist reduced the overall market capitalization of these firms by $56 billion. The reaction was driven by the EU shaming of tax havens and by the potential future countermeasures and financial penalties associated with the blacklist. The largest reaction was for those tax havens, for which it was not foreseeable that they would be blacklisted. Investors reacted negatively to the new information, which was immediately priced in the firm value. Further, I observe no share price impact of having subsidiaries in the grey-listed tax havens, since the EU was not shaming these countries and they do not face sanctions or penalties of being included in the grey list.

Firms operating within the retail sector faced particularly large share price decrease since consumers might react negatively to an indication of bad corporate citizenship. This is consistent with the potential consumer backlash, which can harm firms’ future profits. Also more tax-aggressive firms faced more negative returns, which shows that investors expect that firms might be audited or fined for past or overly aggressive tax avoidance. The negative reaction might also reflect the potential future costs of restructuring the firms might incur in order to keep their corporate tax payments low. Firms with relatively high cash effective tax rates had a less negative reaction, consistent with the market reacting positively to evidence that these firms were not as tax-passive as previously believed. The negative reaction was also less pronounced in countries with low levels of investor protection and weakly governed firms with substantial conflicts of interest between principals and shareholders. The finding suggests that tax-sheltering signals a higher likelihood of managerial wealth diversion, at the cost of shareholders. The increased transparency following publication of the blacklist, as well as the potential for countermeasures, reduce some of that cost.

Moreover, investors react to evolution of the blacklist and respond positively to countries being excluded from the blacklist. The findings of my paper show that public tax haven shaming by international organisations and news media matters for investors, which is the main policy implication of my study. Even despite the lack of specific sanctions or penalties, the exposed firms faced negative returns after publication of the blacklist. The potential for negative investor reaction might deter firms’ managers from engaging in tax avoidance activities or at least increase costs associated with tax avoidance. What should matter most is whether these spotlights are followed by improvements in firms’ corporate tax strategies and contribute towards less tax avoidance in the future.

Notes

The blacklisted countries were American Samoa, Bahrain, Barbados, Grenada, Guam, South Korea, Macau, the Marshall Islands, Mongolia, Namibia, Palau, Panama, St Lucia, Samoa, Trinidad and Tobago, Tunisia and the United Arab Emirates.

The Guardian (2017) claims that the blacklist could be linked to EU legislation so that jurisdictions implicated would not be eligible for funds from the bloc except where to aid development. According to Cable News Network (2017), the potential punitive measures are related to foreign policy, economic relations and development cooperation. The penalties could include special documentation requirements and withholding tax measures. EU states have also been told to conduct audits and monitor transactions with the blacklisted countries.

I say that a firm is exposed to tax havens or a user of tax havens if it has at least one subsidiary in a blacklisted tax haven country.

Enron’s chief financial officer used a sophisticated offshore web to tunnel $42 million out of the firm. Similarly, Parmalat’s founder used offshore entities to expropriate $620 million from the firm.

The grey-listed countries were Albania, Andorra, Armenia, Aruba, Belize, Bermuda, Bosnia and Herzegovina, Botswana, Cabo Verde, Cayman Islands, Cook Islands, Curaçao, Faroe Islands, Fiji, Greenland, Guernsey, Hong Kong, Jamaica, Jersey, Jordan, Lichtenstein, Labuan Island, Former Yugoslav Republic of Macedonia, Malaysia, Maldives, Isle of Man, Morocco, Mauritius, Montenegro, Nauru, Niue, New Caledonia, Oman, Peru, Qatar, Saint Vincent and the Grenadines, San Marino, Serbia, Seychelles, Switzerland, Swaziland, Taiwan, Thailand, Turkey, Uruguay, Vanuatu and Vietnam.

Sources agree that the blacklist omits several major offshore hubs, such as Bermuda, British Virgin Islands and the Cayman Islands, as well as important European countries, such as Ireland, Luxembourg and the Netherlands.

Table 17 lists the stock exchanges represented in the study.

The countries for which market indices and risk-free rates are not available are Burkina Faso, Ghana, Gibraltar, Liberia, Malta, Nepal, Palestine, Sudan, Slovakia, Senegal, Ukraine, Uzbekistan and Zambia. For robustness, I try excluding firms located in these countries from the main sample (325 firms). The results do not change substantially.

Domestic subsidiaries in the country of origin are also considered, when calculating tax haven exposure variables. Results hold also when I disregard domestic subsidiaries and only consider foreign tax haven subsidiaries for the exposure variables.

See, for example, Dyreng et al. (2018) for an analysis of subsidiary disclosure in the United States.

Researchers using event study methods commonly examine multi-day windows to account for potential imprecision in dating the event or the availability of information about it to market participants, or for uncertainty about the speed of the event’s effects on security prices. The event window of 3 days has been used by Hanlon and Slemrod (2009), while the event window of 5 days has been used by O’Donovan et al. (2019). Previous event studies use various event windows, so I ensure that my results are also robust to using a different event period length.

In 2012, it was revealed that Starbucks had not paid corporate tax since its entry in the United Kingdom (UK). The firm was implicated in funnelling its revenues offshore, to a Dutch subsidiary. These revelations resulted in a consumer boycott, which led to lower revenues for Starbucks in 2012 and 2013.

I also use an indicator variable Brand value equal to one if the firm was listed as having one of the top 100 brand names as ranked in Business Week magazine in 2017 (Interbrand 2017). Business Week obtains the rankings from Interbrand, which ranks brands based upon the estimated amount the brand is likely to earn the firm in the future. The findings are similar if I use this corporate citizenship measure, instead of the Retail dummy.

Taxation measure includes all taxes related to the accounting period (paid, accrued or deferred). The findings are virtually unchanged if, instead of EBIT, I use EBITDA in the denominator to define the effective tax rate.

In order to limit the influence of measurement error due to outliers, I reset any values of cash ETR greater than 0.5 to 0.5, and any values less than zero to zero.

The results are robust if I use continuous governance measures, instead of medians.