Abstract

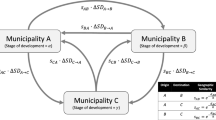

The Japanese government provides information on local fiscal performance through the Fiscal Index Tables for Similar Municipalities (FITS-M). The FITS-M categorize municipalities into groups of “similar localities” and provide them with the fiscal indices of their group members, enabling municipalities to use the tables to identify their “neighbors” (i.e., those in the same FITS-M group) and refer to their fiscal information as a “yardstick” for fiscal planning. We take advantage of this system to estimate municipal spending function. In particular, we examine whether the FITS-M help identify a defensible spatial weights matrix that properly describes municipal spending interactions. Our analysis shows that they do. In particular, geographical proximity is significant only between a pair of municipalities within a given FITS-M group, and it does not affect competition between pairs belonging to different groups even if they are located close to each other. This would suggest that the FITS-M work as intended, indicating that spending interaction among Japanese municipalities originates from yardstick competition and not from other types of fiscal competition.

Similar content being viewed by others

Notes

This is in contrast to the case where g is spending on a pure public good, where \(\beta = \beta _{j} \forall j \ne i\), which reduces \(\sum _{j\ne i}\beta _{j}\hbox {g}_{j}\) to \(\beta \left( \sum _{j\ne i}g_{j}\right) \) (see Sandler 1992).

With panel data, we may identify \(\beta _{j} \forall j \ne i\) by imposing restrictions on a spatial weights matrix. Such restrictions include symmetry, where \(w_{ij}=w_{ji}\) (Bhattacharjee and Jensen-Butler 2013), and sparsity, where each unit is affected by a limited number of other units only (Ahrens and Bhattacharjee 2015; Bailey et al. 2015). Meanwhile, Bhattacharjee and Holly (2013) consider a specific case that allows us to utilize moment conditions to identify spatial interaction. However, we cannot always justify the use of these restrictions or identifying assumptions (we are plausibly unable to do this for the current case too).

The i-th row of W therefore constitutes a set of spatial weights for the i-th local government.

For this argument, we discuss movements of existing entities across borders and exclude cases where, say, new firms are born in a given location.

Indeed, the choice over such factors is arbitrary in the empirical literature. Case et al. (1993) propose constructing W with \(W_{ij} = 1/{\vert }Q_{i}-Q_{j}{\vert }\), where Q is a relevant socioeconomic variable. Typically, studies utilize the following variables for Q: (i) per capita income (Case et al. 1993; Boarnet and Glazer 2002; Finney and Yoon 2003; Baicker 2005; Caldeira 2012), (ii) population (Case et al. 1993; Rincke 2010), (iii) racial composition (Case et al. 1993; Boarnet and Glazer 2002), (iv) migration and commuting (Figlio et al. 1999; Baicker 2005; Rincke 2010), and (v) partisan affiliation (Foucault et al. 2008).

The expenditure functions assigned to municipalities are identical except that towns and villages do not implement some of the social programs provided by cities and there are some variations among the five types of cities. Prefectures devolve parts of their expenditure functions to the first three types of cities, with the largest degree of devolution to designated cities, followed by core and then special cities. The functions assigned to the special wards are more or less similar to those of ordinary cities, although the Tokyo Metropolitan Government handles a few of the standard municipal functions (firefighting, water supply, and sewage disposal) for the special wards. Populations of designated cities are the largest among municipalities (3.7 to 0.71 million) followed, with some overlap of population ranges, by core cities (0.62 to 0.27 million) and special cities (0.57 to 0.19 million). Populations of the special wards in Tokyo metropolitan area range from 41.8 to 0.04 million.

There are four ranges of n for the ordinary cities \((n< 50{,}000; 50{,}000 \le n< 100{,}000; 100{,}000 \le n < 150{,}000; 150{,}000 \le n)\) and five for towns and villages \((n< 5000; 5000 \le n< 10{,}000; 10{,}000 \le n< 15{,}000; 15{,}000 \le n < 20{,}000; 20{,}000 \le n)\). Meanwhile, the classification with \(s_{2}\) and \(s_{3}\) comprises four categories for the ordinary cities \((s_{2}+s_{3} < 0.95\) and \(s_{3}< 0.55; s_{2}+s_{3} < 0.95\) and \(0.55 \le s_{3}; 0.95 \le s_{2}+s_{3}\) and \(s_{3} < 0.65; 0.95 \le s_{2}+s_{3}\) and \(0.65 \le s_{3})\) and three categories for towns and villages \((s_{2}+s_{3} < 0.80; 0.80 \le s_{2}+s_{3}\) and \(s_{3} < 0.55; 0.80 \le s_{2}+s_{3}\) and \(0.55 \le s_{3})\). The combination of these ranges and categories yields 16 \((4 \times 4)\) groups of ordinary cities and 15 \((5 \times 3)\) groups of towns and villages.

Such information includes within-group per capita averages and their annual changes of revenues by sources (e.g., taxes, transfers, and local bonds), expenses by type (e.g., personnel, personal transfers, and debt services), expenses by objective (e.g., social protection, public health, and public works), and capital expenses by funding sources (e.g., categorical grants, local bonds, and general revenues). The FITS-M also show the shares of these items, some of which can be used as indices for fiscal rigidity (the share of obligatory expenses), fiscal capacity, or self-sufficiency (the share of own revenues). Additional tables offer debt-related indices (e.g., several versions of debt ratio) and employment-related indices (e.g., wage level for municipal employees and per capita municipal employments).

Unlike the spatial Durbin model, Eq. (8) excludes as regressors weighted values of other municipalities’ control variables \(\left( \sum _{j\ne i}w_{ij}x_{k,jt} \forall k\right) \). This exclusion is due to the Nash assumption in the theoretical models of fiscal competition on which we base our arguments. The model assumes that the local government decides its fiscal variable \(g_{i}\) as an optimal response to a given value of \({{\varvec{g}}}_{-i}\) chosen by other governments and not to their controls \((x_{k,j} \forall k\) and \(j \ne i)\) that partially condition \({{\varvec{g}}}_{-i}\).

We do not delineate the exact form of the ML function on which we perform optimization. Readers may easily refer to Yu et al. (2008) and Lee and Yu (2010a, (2010b) to obtain appropriate guidance and explanation in this regard. We base our inference on what Lee and Yu call the “transformation approach.” To actually obtain the estimates, we use XSMLE, a Stata module for spatial panel data model estimation introduced by Belotti et al. (2013). Since XSMLE produces the estimates based on the “direct approach,” we adjust their values so that our inferences can be based on the transformation approach.

All figures are those for FY2010.

At the end of FY2010, there were 1750 municipalities. However, during FY2008 to FY2010, there were 96 instances of municipal mergers. We exclude municipalities that vanished on account of these mergers from the sample. Other than the four largest main islands (Hokkaido, Honshu, Shikoku, and Kyushu) and the Okinawa Islands, we also exclude 51 “island municipalities,” which have no geographical neighbors as they consist of only small islands. Furthermore, we exclude 10 municipalities that were hit by the Great Eastern Japan Earthquake in late FY2010 (i.e., March 2011) and 6 cities that changed their city classification type. These exclusions reduce the size of our sample to 1637.

A number of studies use the contiguity matrix as a baseline spatial matrix (Case et al. 1993; Boarnet and Glazer 2002; Hanes 2002; Revelli 2003, 2006; Geys 2006; Lundberg 2006; Revelli and Tovmo 2007; Werck et al. 2008; Nogare and Galizzi 2011; Bartolini and Santolini 2012; Caldeira 2012; Gebremariam et al. 2012; Costa et al. 2015).

The general form of the ID is the “distance decay” function specified as \(W_{ij} = 1/d_{ij}^{\delta }\), where \(\delta \) is some positive parameter. Evidently, our ID assumes that \(\delta = 1\). (Murdoch et al. 1993; Finney and Yoon 2003; Baicker 2005; Foucault et al. 2008; Caldeira 2012; Akai and Suhara 2013; Costa et al. 2015). Variations of distance decay include distance decay with threshold D, where \(W_{ij} = 1/d_{ij}^{\delta }\) if \(d_{ij} < D\), and zero otherwise (Hanes 2002; Baicker 2005; Solé-Ollé 2006; Gebremariam et al. 2012; Costa et al. 2015).

See the classic discussion by Anselin (1988).

See Case et al. (1993, p. 298) for the benefit spillover model and Brueckner (2003, pp. 180–181) for the resource flow model. Using a specific form of benefit spillover, some studies associate the negative sign of \(\rho \) with free-riding behavior of local governments (Murdoch et al. 1993; Finney and Yoon 2003; Akai and Suhara 2013). However, in the presence of a general form of benefit spillover, we cannot generally determine the sign of the slope of the reaction function.

See Case et al. (1993), Bivand and Szymanski (2000), Boarnet and Glazer (2002), Revelli (2003), Baicker (2005), Dahlberg and Edmark (2008), Foucault et al. (2008), Werck et al. (2008), Ermini and Santolini (2010), Rincke (2010), Nogare and Galizzi (2011), Bartolini and Santolini (2012), and Costa et al. (2015). In addition, a number of empirical studies on tax competition provide analogous results. However, Chirinko and Wilson (2008/2013) show that, after controlling for spatiotemporal aggregate shocks and delayed responses, the reaction function indeed slopes down in tax competition.

The following argument is analogous to the issue of choosing between logarithm and level forms of a dependent variable without estimating the Box–Cox form that nests the former two forms with additional parameters. For a textbook explanation, see Davidson and MacKinnon (1993).

Since q = 11 in our case, the critical values of \(\chi ^{2}\)(11) are 17.3, 19.7, and 24.7 for the 0.10, 0.05, and 0.01 levels of significance, respectively.

In this respect, when models to be evaluated are not nested, we can interpret a model selection with the likelihood dominance criterion (LDC) as a ranking of multiple hypotheses through nonnested hypothesis testing that rules out the possibilities of either rejecting or accepting all models.

Several studies in the literature have indeed employed hybrid weights matrices. In particular, they use the matrices to differentiate the effects of interaction between a pair of localities whose geographical proximity is identical (contiguous). For example, Rincke (2010) adjusts the contiguity matrix with an index of commuting patterns between a pair of localities. Other studies adjust the contiguity index with some form of population-related index (Werck et al. 2008; Nogare and Galizzi 2011; Akai and Suhara 2013; Costa et al. 2015). These weights capture the effect of the adjusting factor (commuting patterns or population characteristics) after allowing for the influence of geographical proximity (contiguity).

Obviously, the standard time effect [\(\tau _{t}\) in Eq. (6)] cannot allow for these temporal effects. We also thought of including the interactions of time and cross-sectional dummies in the model, but this was infeasible since the number of such interactions amounts to the sample size \((N \times T)\).

When K refers to the number of parameters to be estimated in the original (linear) model, the augmented model has \(K +N \times (K + 1)\) parameters to be estimated. Given our sample with \(N = 1637\) and \(T = 3\), this method is simply infeasible since \(K +N \times (K + 1) > N \times T\). Chirinko and Wilson (2008/2013) also suggest a way to reduce the number of the augmented regressors by restricting parameters in the augmented model. However, this still requires \(K +N\) parameters to be estimated. Since we only have \(T = 3\), this may still be too large a number of parameters. Furthermore, as Chirinko and Wilson (2008/2013) report, this restriction necessitates a nonlinear estimation, which may have difficulty converging. Indeed, we did have difficulty in converging with the models that have as augmented regressors the interactions of prefectural and time dummies.

Bailey et al. (2015) note, “Almost all spatial econometric models estimated in the literature assume that the spatial parameters do not vary across the units. ... Such parameter homogeneity is not avoidable when T is very small, but need not be imposed in the case of large panels where T is sufficiently large.”

Given the interactions between time and regional dummies, we now have \(q = 25\). The critical values of \(\chi ^{2}\)(25) are then 34.4, 37.7, and 44.3 for the 0.10, 0.05, and 0.01 levels of significance, respectively.

A recent study by Leduc and Wilson (2015) nicely summarizes recent evidence on the flypaper effect and discusses methodological issues in estimating the effect of central grants.

References

Ahrens, A., & Bhattacharjee, A. (2015). Two-step Lasso estimation of the spatial weights matrix. Econometrics, 3(1), 128–155.

Akai, N., & Suhara, M. (2013). Strategic interaction among local governments in Japan: An application to cultural expenditure. Japanese Economic Review, 64(2), 232–247.

Anselin, L. (1984). Specification tests on the structure of interaction in spatial econometric models. Papers of the Regional Science Association, 54(1), 165–182.

Anselin, L. (1986). Non-nested tests on the weight structure in spatial autoregressive models: Some Monte-Carlo results. Journal of Regional Science, 26(2), 267–284.

Anselin, L. (1988). Spatial econometrics: Methods and models. Dordrecht: Kluwer.

Anselin, L., & Bera, A. K. (1998). Spatial dependence in linear regression models with an introduction to spatial econometrics. In A. Ullah & D. E. Giles (Eds.), Handbook of applied economic statistics (pp. 237–290). New York: Marcel Dekker.

Baicker, K. (2005). The spillover effects of state spending. Journal of Public Economics, 89(2/3), 529–544.

Bailey, S. J., & Connolly, S. (1998). The flypaper effect: Identifying areas for further research. Public Choice, 95(3/4), 335–361.

Bailey, N., Holly, S., & Pesaran, M. H. (2015). A two-stage approach to spatiotemporal analysis with strong and weak cross-sectional dependence. Journal of Applied Econometrics. doi:10.1002/jae.2468.

Bartolini, D., & Santolini, R. (2012). Political yardstick competition among Italian municipalities on spending decisions. Annals of Regional Science, 49(1), 213–235.

Beenstock, M., & Felsenstein, D. (2012). Nonparametric estimation of the spatial connectivity matrix using spatial panel data. Geographical Analysis, 44(4), 386–397.

Belotti, F., Hughes, G., & Mortari, A. P. (2013). XSMLE: Stata module for spatial panel data models estimation. Statistical Software Components S457610, Boston College Department of Economics, Revised March 15, 2014.

Bergstrom, T. C., & Goodman, R. P. (1973). Private demands for public goods. American Economic Review, 63(3), 280–296.

Besley, T., & Case, A. (1995). Incumbent behavior: Vote seeking, tax setting and yardstick competition. American Economic Review, 85(1), 25–45.

Bhattacharjee, A., & Holly, S. (2013). Understanding interactions in social networks and committees. Spatial Economic Analysis, 8(1), 23–53.

Bhattacharjee, A., & Jensen-Butler, C. (2013). Estimation of the spatial weights matrix under structural constraints. Regional Science and Urban Economics, 43(4), 617–634.

Bhattacharjee, A., Castro, E., Maiti, T., & Marques, J. (2015). Endogenous spatial structure and delineation of submarkets: A new framework with application to housing markets. Journal of Applied Econometrics. doi:10.1002/jae.2478.

Bivand, R., & Szymanski, S. (1997). Spatial dependence through local yardstick competition: Theory and testing. Economics Letters, 55(2), 257–265.

Bivand, R., & Szymanski, S. (2000). Modeling the spatial impact of the introduction of Compulsory Competitive Tendering. Regional Science and Urban Economics, 30(2), 203–219.

Boadway, R. (1983). On the method of taxation and the provision of local public goods: Comment. American Economic Review, 72(4), 846–851.

Boarnet, M., & Glazer, A. (2002). Federal grants and yardstick competition. Journal of Urban Economics, 52(1), 53–64.

Boarnet, M., Cemiglia, F., & Revelli, F. (2004). Yardstick competition in intergovernmental relationships: Theory and empirical predictions. Economics Letters, 83(3), 325–333.

Brueckner, J. K. (1998). Testing for strategic interaction among local governments: The case of growth controls. Journal of Urban Economics, 44(3), 438–467.

Brueckner, J. K. (2003). Strategic interaction among governments: An overview of empirical studies. International Regional Science Review, 26(2), 175–188.

Brueckner, J. K., & Saavedra, L. A. (2001). Do local governments engage in strategic property-tax competition? National Tax Journal, 54(3), 203–230.

Burridge, P. (2012). Improving the J test in the SARAR model by likelihood-based estimation. Spatial Economic Analysis, 7(1), 75–107.

Burridge, P., & Fingleton, B. (2010). Bootstrap inference in spatial econometrics: The J-test. Spatial Economic Analysis, 5(1), 93–119.

Caldeira, E. (2012). Yardstick competition in a federation: Theory and evidence from China. China Economic Review, 23(4), 878–897.

Case, A. C., Rosen, H. S., & Hines, J. R, Jr. (1993). Budget spillovers and fiscal policy interdependence. Journal of Public Economics, 52(3), 285–307.

Chirinko, R. S., & Wilson, D. J. (2008/2013). Tax competition among U.S. states: Racing to the bottom or riding on a seesaw? Federal Reserve Bank of San Francisco working paper series 2008-03.

Costa, H., Veiga, L. G., & Portela, M. (2015). Interactions in local governments’ spending decisions: Evidence from Portugal. Regional Studies, 49(9), 1441–1456.

Dahlberg, M., & Edmark, K. (2008). Is there a “race-to-the-bottom” in the setting of welfare benefit levels? Evidence from a policy intervention. Journal of Public Economics, 92(5), 1193–1209.

Davidson, R., & MacKinnon, J. G. (1981). Several tests for model specification in the presence of alternative hypotheses. Econometrica, 49(3), 781–793.

Davidson, R., & MacKinnon, J. G. (1993). Estimation and inferences in econometrics. Oxford: Oxford University Press.

Ermini, B., & Santolini, R. (2010). Local expenditure interaction in Italian municipalities: Do local council partnerships make a difference? Local Government Studies, 36(5), 655–677.

ESRI Japan. (2011). The national database on municipal borders [Zenkoku shi-cho-son kai data], Version 7.1. http://www.esrij.com/products/japan-shp/. Accessed November 12, 2014.

Facchini, F. (2014). The determinants of public spending: A survey in a methodological perspective. MPRA paper no. 53006, Munich Personal RePEc Archive.

Figlio, D. N., Kolpin, V. W., & Reid, W. E. (1999). Do states play welfare games? Journal of Urban Economics, 46(3), 437–454.

Finney, M. M., & Yoon, M. J. (2003). Asymmetric interdependence in the provision of a local public good: An empirical examination. Public Finance Review, 31(6), 648–668.

Folmer, H., & Oud, J. (2008). How to get rid of W: A latent variables approach to modelling spatially lagged variables. Environment and Planning A, 40(10), 2526–2538.

Foucault, M., Madies, T., & Paty, S. (2008). Public spending interactions and local politics: Empirical evidence from French municipalities. Public Choice, 137(1), 57–80.

Gebremariam, G. H., Gebremariam, T. G., & Schaeffer, P. V. (2012). County-level determinants of local public services in Appalachia: A multivariate spatial autoregressive model approach. Annals of Regional Science, 49(1), 175–190.

Geospatial Information Authority of Japan. (2014). Latitude and longitude of prefectural and municipal office locations [To-do-fu-ken Shi-cho-son no To-zai-nan-boku Ten no Keido Ido]. http://www.gsi.go.jp/KOKUJYOHO/center.htm. Accessed November 12, 2014.

Getis, A., & Aldstadt, J. (2004). Constructing the spatial weights matrix using a local statistic. Geographical Analysis, 36(2), 90–104.

Geys, B. (2006). Looking across borders: A test of spatial policy interdependence using local government efficiency ratings. Journal of Urban Economics, 60(3), 443–462.

Granger, C. W. J., King, M. L., & White, H. (1995). Comments on testing economic theories and the use of model selection criteria. Journal of Econometrics, 67(1), 173–187.

Griffith, A. D., & Lagona, R. (1998). On the quality of likelihood-based estimators in spatial autoregressive models when the data dependence structure is misspecified. Journal of Statistical Planning and Inference, 69(1), 153–174.

Hanes, N. (2002). Spatial spillover effects in the Swedish local rescue services. Regional Studies, 36(5), 531–539.

Harris, R., Moffat, J., & Kravtsova, V. (2011). In search of “W”. Spatial Economic Analysis, 6(3), 249–270.

Hines, J. R., & Thaler, R. H. (1995). Anomalies: The flypaper effect. Journal of Economic Perspectives, 9(4), 217–226.

Holly, S., Pesaran, M. H., & Yamagata, T. (2010). A spatio-temporal model of house prices in the USA. Journal of Econometrics, 158(1), 160–173.

Kelejian, H. H. (2008). A spatial J-test for model specification against a single or set of non-nested alternatives. Letters in Spatial and Resource Sciences, 1(1), 3–11.

Kelejian, H. H., & Piras, G. (2011). An extension of Kelejian’s J-test for non-nested spatial models. Regional Science and Urban Economics, 41(3), 281–292.

Kelejian, H. H., & Piras, G. (2014). Estimation of spatial models with endogenous weighting matrices and an application to a demand model for cigarettes. Regional Science and Urban Economics, 46(C), 140–149.

Kelejian, H. H., & Piras, G. (2015). An extension of the J-test to a spatial panel data framework. Journal of Applied Econometrics. doi:10.1002/jae.2425.

Leamer, E. E. (1983). Let’s take the con out of econometrics. American Economic Review, 73(1), 31–43.

Lee, L. F., & Yu, J. (2010a). Estimation of spatial autoregressive panel data models with fixed effects. Journal of Econometrics, 154(2), 165–185.

Lee, L. F., & Yu, J. (2010b). Some recent developments in spatial panel data models. Regional Science and Urban Economics, 40(5), 255–271.

Leenders, R. T. A. J. (2002). Modelling social influence through network autocorrelation: Constructing the weight matrix. Social Networks, 24(1), 21–47.

Lu, X., & White, H. (2014). Robustness checks and robustness tests in applied economics. Journal of Econometrics, 178(P1), 194–206.

Leduc, S., Wilson, D. (2015). Are state governments roadblocks to federal stimulus? Evidence on the flypaper effect of highway grants in the 2009 Recovery Act. Federal Reserve Bank of San Francisco working paper series, 2013-16.

Lundberg, J. (2006). Spatial interaction model of spillovers from locally provided public services. Regional Studies, 40(6), 631–644.

Lundberg, J. (2014). On the definition of W in empirical models of yardstick competition. Annals of Regional Science, 52(2), 597–610.

MacKinnon, J. G. (1983). Model specification tests against non-nested alternatives. Econometric Reviews, 2(1), 85–110.

MacKinnon, J. G. (1992). Model specification tests and artificial regressions. Journal of Economic Literature, 30(1), 102–146.

Matsuki, S. (2010). The twelve months of municipal budgeting [Jichitai zaimu no 12- kagetsu]. Tokyo: Gakuyo Shobo. (in Japanese).

Ministry of Internal Affairs and Communications. (2014a). Annual report on municipal finances [Shi-Cho-Son betsu Kessan Joukyo Shirabe]. http://www.soumu.go.jp/iken/kessan_jokyo_2.html. Accessed September 16, 2014) (in Japanese).

Ministry of Internal Affairs and Communications. (2014b). The fiscal indices tables for similar municipalities [Ruiji Dantai Betsu Shichoson Zaisei Shisu Hyo]. http://www.soumu.go.jp/iken/ruiji/. Accessed September 16, 2014 (in Japanese).

Murdoch, J. C., Rahmatian, M., & Thayer, M. A. (1993). A spatially autoregressive median voter model of recreational expenditures. Public Finance Quarterly, 21(3), 334–350.

Negishi, M. (2007). The role of modern fiscal analysis: On the historical processes leading to the establishment of the Fiscal Index Tables of Similar Municipalities [Gendai no chihozaisei bunseki no yakuwari: Ruijidantaibestu Shichoson Zaisei Shisuhyo no seiritsu katei no bunseki wo chushin to shite]. Local Public Finance [Chiho Zaisei], 46(9), 273–293. (in Japanese).

Nikkei Digital Media. (2014). Regional information files. Nikkei Economic Electronic Databank System. http://www.nikkei.co.jp/needs/. Accessed September 16, 2014.

Nishihama, S. (2007). Fiscal analysis of expenditure structures among similar municipalities [Saishutsu Kozo kara Mita Ruiji Dantai no Zaisei Bunseki]. Jichi Osaka, 57(12), 31–38. (in Japanese).

Nogare, C. D., & Galizzi, M. M. (2011). The political economy of cultural spending: Evidence from Italian cities. Journal of Cultural Economics, 35(3), 203–231.

Pesaran, M. H. (2006). Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica, 74(4), 967–1012.

Pesaran, M. H., & Weeks, M. (2003). Non-nested hypothesis testing: An overview. In B. H. Baltagi (Ed.), A companion to theoretical econometrics (Chapter 13). College Station, TX: Blackwell.

Pollak, R. A., & Wales, T. J. (1991). The likelihood dominance criterion: A new approach to model selection. Journal of Econometrics, 47(2–3), 227–242.

Qu, X., & Lee, L. F. (2015). Estimating a spatial autoregressive model with an endogenous spatial weight matrix. Journal of Econometrics, 184(2), 209–232.

Revelli, F. (2001). Spatial patterns in local taxation: Tax mimicking or error mimicking? Applied Economics, 33(9), 1101–1107.

Revelli, F. (2003). Reaction or interaction? Spatial process identification in multi-tiered government structures. Journal of Urban Economics, 53(1), 29–53.

Revelli, F. (2006). Performance rating and yardstick competition in social service provision. Journal of Public Economics, 90(3), 459–475.

Revelli, F., & Tovmo, P. (2007). Revealed yardstick competition: Local government efficiency patterns in Norway. Journal of Urban Economics, 90(3), 459–475.

Rincke, J. (2010). A commuting-based refinement of the contiguity matrix for spatial models, and an application to local police expenditures. Regional Science and Urban Economics, 40(5), 324–330.

Saha, A., Shumway, R., Talpaz, H. (1994). Performance of likelihood dominance and other nonnested model selection criteria: Some Monte Carlo results. Department of Agricultural Economics working paper. College Station: Texas A&M University.

Salmon, P. (1987). Decentralization as an incentive scheme. Oxford Review of Economic Policy, 3(2), 97–117.

Sandler, T. (1992). Collective action: Theory and applications. Ann Arbor: University of Michigan Press.

Shleifer, A. (1985). A theory of yardstick competition. RAND Journal of Economics, 16(3), 319–327.

Smith, T. (2009). Estimation bias in spatial models with strongly connected weight matrices. Geographical Analysis, 41(3), 307–332.

Solé-Ollé, A. (2006). Expenditure spillovers and fiscal interactions: Empirical evidence from local governments in Spain. Journal of Urban Economics, 59(1), 32–53.

Stakhovych, S., & Bijmolt, T. H. A. (2008). Specification of spatial models: A simulation study on weights matrices. Papers in Regional Science, 88(2), 389–408.

Stetzer, F. (1982). Specifying weights in spatial forecasting models: The results of some experiments. Environment and Planning A, 14(5), 571–584.

Werck, K., Heydels, B., & Geys, B. (2008). The impact of “central places” on spatial spending patterns: Evidence from Flemish local government. Journal of Cultural Economics, 32(1), 35–58.

Wildasin, D. E. (1988). Nash equilibria in models of fiscal competition. Journal of Public Economics, 35(2), 229–240.

Williams, A. (1966). The optimal provision of public goods in a system of local government. Journal of Political Economy, 74(1), 18–33.

Wrede, M. (2001). Yardstick competition to tame the Leviathan. European Journal of Political Economy, 17(4), 705–721.

Yu, J., de Jong, R., & Lee, L. F. (2008). Quasi-maximum likelihood estimators for spatial dynamic panel data with fixed effects when both \(n\) and \(T\) are large. Journal of Econometrics, 146(1), 118–134.

Acknowledgments

We are grateful to Robert Chirinko, Editor-in-Chief, and two anonymous reviewers for their helpful observations and constructive suggestions, which substantively improved the paper. We also thank Mutsumi Matsumoto for his valuable comments. Hayashi acknowledges financial support from the Japan Finance Organization for Municipalities and the Grant-in-Aid for Scientific Research (15H03359) of the Japan Society for the Promotion of Science.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Hayashi, M., Yamamoto, W. Information sharing, neighborhood demarcation, and yardstick competition: an empirical analysis of intergovernmental expenditure interaction in Japan. Int Tax Public Finance 24, 134–163 (2017). https://doi.org/10.1007/s10797-016-9413-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-016-9413-4