Abstract

Recent studies have been analyzing and measuring the efficacy of the use of financial incentives to increase the Covid-19 vaccine uptake. To the best of our knowledge, this paper is the only study available in the literature that aims to measure the effect of financial incentives on vaccine rates among children. This paper explores the effects of a specific financial incentive on parents’ vaccination decisions for their children. Using data from a regional practice, where students aged 12 and older received $50 gift cards per Covid-19 vaccination dose, we use various methodologies (synthetic control, linear regression, and difference-in-differences) to approximate the effects of financial incentives on vaccine rates. Our analysis reveals that gift cards increase vaccination rates by 2.64–4.23 percentage points from a baseline rate of 38 percent, concluding that financial incentives, in conjunction with other incentives and policies, can be considered to increase the rate of vaccines for 12- to 17-year-olds.

Similar content being viewed by others

Introduction

“All the same, when you see the misery it brings,

you’d need to be a madman, or a coward,

or stone blind, to give in tamely to the plague.”

– Albert Camus, The Plague (1947)

As the world enters the third year of the Covid-19 pandemic, the global death toll impacted by Covid-19 nears 5.5 million. Even though the vaccines that are effective against the SARS-CoV-2 virus became publicly available in December 2020, as of October 11, 2021, 11% of American adults have chosen to not receive the vaccine. This percentage, which is commonly referred to as vaccine hesitancy, is higher for children. 18% of parents prefer not to have their 12–17-year-old children vaccined, (U.S. Census Bureau 2021).

A recent poll by the Kaiser Family Foundation conducted in November 2021, shows that 30% of parents state they will “definitely not” choose to vaccinate their 12- to17-year old children (Hamel et al., 2021). The poll also shows that 31% of parents of unvaccinated children are anxious about having to take time off work, and 17% of parents express challenges in access (travel) to vaccination centers. These percentages are far higher for the demographic categories of Black, Hispanic, and low-income parents.

Decision-makers have been seeking opportunities for incentives and interventions, such as nudges, financial incentives, and government mandates to overcome these challenges and increase vaccine uptake. In this paper, we focus on the impact of financial incentives, whose effect on decision-making has been well documented in the literature (Carpenter & Dolifka, 2017; Hammermann & Mohnen, 2014), regarding Covid-19 vaccine rates. Financial incentives were prevalent with the availability of the Covid-19 vaccine. Using a survey, Carpio et al. (2021) demonstrates that 14% of Americans are willing to get vaccinated if they receive payment. However, utilizing financial incentives as means to boost vaccination rates is a controversial topic.

Many researchers claim that they find financial incentives ethical and useful. Some researchers cite that incentives are utilized to compensate people as a means to overcome vaccine-related barriers such as transportation costs and finding childcare (Persad & Emanuel, 2021). Savulescu (2021) argues that incentives offset the risk people are taking for the broader public good, herd immunity. Wong et al., (2022) also argue that small financial incentives would benefit more people by offsetting their vaccination-related costs, such as transportation and daycare. Other researchers argue that vaccination is a public duty and thus incentives are “coercive” and a misuse of public resources, finding incentives morally suspect (Pennings & Symons, 2021; Largent & Miller, 2021). Having analyzed 31 recent studies, Khazanov et al., (2022) show that none of these 31 studies conclude that financial incentives negatively impact vaccine rates, and the majority of them demonstrate that financial incentives have a positive impact on vaccine rates. They also mention that the current range of financial incentives for Covid-19 vaccines is between $49 and $75 per person. The studies analyzing financial incentives can broadly be categorized into two groups: Randomized control trials (experiments) and quasi-experiments.

Randomized controlled trials (RCTs), which are the golden standard in causation studies, mostly conclude that financial incentives positively impact vaccine uptake. Using a sample of 1000 Americans in December 2020, Robertson, Scheitrum, et al. (2021) validate paying subjects $1000, $1500, or $2000 increases the vaccination uptake by 8 percentage points (p.p.). The incentive provided in this study is far higher than other studies. Another study conducted in Sweden, compares three nudges with financial incentives and concludes that a $24-equivalent payment increases vaccination rates by 4.2 p.p. at a 71.6% baseline (Campos-Mercade et al., 2021). Gupta et al., (2022) compare a non-incentivized 8-day practice with an incentivized 8-day practice in a local hospital in India and demonstrate that more vaccines were administered during the incentivized clinic period. Using survey-based data, Carpio et al., (2021) also demonstrate that $100 incentives increase the vaccination rates in companies by approximately 2%. Even though there is not an experiment demonstrating that financial incentives negatively impact vaccine rates, a few argue that the effect is null (see Jacobson et al., 2022).

The results of quasi-experiments, which do not follow randomized assignments, such as studies on lotteries, are mixed. Even though most of them conclude that financial incentives positively impact vaccine rates, few of them state that the effect is null, and one concludes a negative result. Ohio’s Vax-a-Million campaign is a heavily analyzed case among quasi-experiments. While Barber and West (2022) show that the Vax-a-Million lottery increased the vaccination share of the population by 1.5% (0.7 p.p.), Sehgal (2021) finds that the effect is 0.98%. Mallow et al., (2022) demonstrate that Ohio’s lottery was much more effective in increasing the vaccine uptake in low-income counties than in high-income ones. A nationwide analysis evaluating 12 statewide vaccination lotteries from a cost–benefit perspective finds that 10 of these lotteries result in an economically meaningful impact (Robertson, Schaefer, et al. 2021). A more comprehensive study analyzing 11 states implementing a vaccine lottery and 28 states not implementing a lottery, Acharya and Dhakal (2021), demonstrate that lotteries increase the vaccine rates by 2.1%.

Some quasi-experiment studies do not find convincing evidence that incentives increase vaccine uptake. Walkey et al., (2021) conclude that the evidence does not support an increase in the vaccination rate. In a more recent and comprehensive study, Thirumurthy et al., (2022) analyze national trends in vaccination rates (24 states with incentive programs and 26 states without incentive programs) and conclude that financial incentives, including lotteries, do not increase vaccination rates. The only negative effect among quasi-experiments is presented by Lang et al., (2022), who find a 1.3% decrease in the vaccination rate in Ohio after the lottery was implemented. This result is insignificant confirming that quasi-experiment research has not demonstrated a significant negative impact of financial incentives on vaccination rates.

Few studies analyze the effect of mandates on vaccine uptake. For example, reviewing data from four countries, Karaivanov et al., (2021) demonstrate that government-mandated proof of vaccination requirements increased the vaccination rates by 12.1 p.p. in Italy, 8 p.p. in France, 4.7 p.p. in Germany, and between 2.4 and 3 p.p. in different provinces of Canada. Oliu-Barton et al., (2022) also show that using data from France, Italy, and Germany, Covid certificates increased the vaccination rates by 13p.p. in France, 9.7 p.p in Italy, and 6.2 p.p. in Germany. Tevdovski et al., (2022) also argues that soft power is necessary to boost the vaccination process.

In this study, we focus on the effect of one financial incentive, gift cards, implemented in one of Illinois’ 102 counties, on vaccine rates of children. On August 13, 2021, the Rockford Public Schools (hereafter, RPS) in Winnebago County announced that students 12 and older would be paid $50 in gift cards for receiving the Covid-19 vaccine (Rockford Public Schools, 2021). Gift cards, which are prepaid stored-value money cards, and can be redeemed at any store, were distributed to children with their parents present. All students who attend RPS schools reside in Winnebago country, and they make up 61.2% of the county’s student population. Other neighboring counties surrounding Winnebago did not adopt a similar financial incentive policy. In this study, we are concerned with how much the $50 per dose impacted the vaccination rates among eligible children enrolled in K-12 schools. As of the gift card announcement date, 54.5% of Winnebago adults administered at least one dose of the Covid-19 vaccine, but only 38.1% of kids in the age bracket received at least one dose (see Table 1). It should be noted that the gift card distribution was provided by local education administration. The authors neither designed nor intervened in the gift-card process. The vaccination data used in this paper is retrieved from a publicly available database.

Our paper can be classified as a quasi-experiment project which is different from RCTs due to the following (Titiunik, 2021):

-

The mechanism of the assignment is neither designed nor implemented by us.

-

The mechanism is unknown and unknowable to us.

-

The allocation of the treatment unit (county) is ruled by the public authorities, not by us.

Even though there are advantages and disadvantages to conducting quasi-experiment research, the advantage is that they “do not interfere in the natural data generation process” (Ogilvie et al., 2020; Waddington et al., 2017).

To the best of our knowledge, our paper is the only study available in the literature that aims to measure the effect of financial incentives on vaccine rates among children. We use various methods to compare the vaccine uptake of a county (Winnebago) which used financial incentives to increase Covid-19 vaccine rates, to other counties that did not adopt a similar policy. Considering that financial incentives research focuses explicitly on adults, this paper contributes to the literature by demonstrating that financial incentives might increase vaccine among children. Also, considering the results of the meta-analysis of Jenkins et al., (1998), that the relationship between the financial incentives and performance changes depending on the setup, our results contribute to the economic literature by providing a comparison opportunity between a natural experiment and an RCT. Our results may serve as a benchmark for future vaccines, particularly for booster shot initiatives.

Methodology and data

We retrieve daily Covid-19 vaccination data from the web page of the Centers for Disease Control and Prevention COVID-19 Vaccine Tracker.Footnote 1 We removed the individuals aged 18+ who received at least one vaccine dose from the individuals aged 12+ who received one or more vaccine doses, to determine the number of 12- to 17-year-olds who received at least one vaccine dose and calculated the percentage of 12- to 17-year-olds who received at least one dose of the vaccine. This data, identified as the vaccination rate, will be our primary interest.

Winnebago County is in northwest Illinois of the US, with two neighboring counties in Wisconsin and four in Illinois. Considering the varying political and social arenas as well as different medical approaches between Illinois and Wisconsin, we only focus on the four counties in Illinois as the set control units: Boone, DeKalb, Ogle, and Stephenson. Following a convention by Brehm et al., (2022), our analysis covers 10 weeks: 5 weeks before and 5 weeks after the reward announcement. Thus, our main dataset covers July 13 to September 20, 2021. Table 1 summarizes demographic data and vaccination rates of all five counties. The demographic data reveals that Winnebago County is the largest county by population, and also has the lowest median household income ($54,971). Considering the demographic determinants of Covid-19 vaccine acceptance cited by Malik et al., (2020), we should also note that Winnebago county has the second-lowest high school graduation rate (87.8%), the second-highest unemployment rate (6%), and the highest rate of racial diversity (66.9% white).

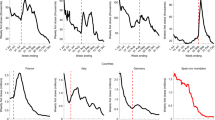

As Table 1 shows, the vaccination rate in Winnebago county, which was 38.06% before the gift card announcement (7th row), increased from 4th rank among five counties to the 3rd one (44.28%) after the announcement (see 8th row). Figure 1 also displays how vaccination rates in Winnebago County changed over time with respect to its neighboring counties. A quick look at Fig. 1 reveals that there is a small shift in Winnebago County’s vaccination trend six days after August 13, 2021.

We compare Winnebago’s vaccination rates with those of its four neighbors using three methodologies. The main methodology we follow is the synthetic control method. Linear regression and difference-in-differences methods will be used for robustness checking. All the analyses in this paper were performed on Python.

Synthetic control method

The synthetic control method (SCM), which is developed by Abadie and Gardeazabal (2003) and implemented by several researchers in different settings (Abadie et al., 2010), including vaccine incentives (see (Sehgal, 2021) as an example), is useful in analyzing the causal effect of a treatment where one unit, such as a county or state, receives a treatment, whereas other units with similar characteristics do not (donor pool). In this methodology, a synthetic version can be constructed (a counterfactual) of the treated unit by combining the pretreatment data the donor pool. As Sehgal (2021) argues, the synthetic control method “combines elements of both matching and differences-in-differences techniques.” SCM has been favorably used in social science settings, especially in ones with policy change. Abadie et al., (2015) and Athey and Imbens (2017) refer to SCM as “arguably the most important innovation in the policy evaluation literature in the last 15 years.”

In our setup, Winnebago County will be considered a treated county, whereas the neighboring four counties are referred to members of the donor pool. This synthetic control for Winnebago County will be a weighted average of its neighboring counties, whose weights are estimated by using a minimum distance approach, are nonnegative numbers, and add up to 1. We will then compare how the counterfactual Winnebago rates behave after the treatment day, August 13, 2021.

Let Y, a 70 × 1 matrix, stand for the vaccination rates in Winnebago county, and X, a 70 × 4 matrix, stand for the vaccination rates in four counties, each column representing one county. We divide both matrices, Y and X, into two: before and after the treatment. \({Y}^{pre}\), a 39 × 1 matrix, will represent the vaccination rates in Winnebago before the treatment date and \({X}^{pre}\), a 39 × 4 matrix, will represent the vaccination rates in Boone, DeKalb, Ogle, and Stephenson counties before the treatment. We then will estimate the weight matrix, W, of the model.

which minimizes the following objective function with no intercept:

such that

where \({w}_{j}\) is the \({j}^{th}\) entry in the vector W. Thus, the counterfactual estimation of Winnebago County, \({\widehat{Y}}_{S},\) using synthetic control method, would be

where \(\widehat{W}\) is the estimation of W.

The estimated weights of the model are given in the third column of Table 2 and the evolution of counterfactual estimation in time, are depicted in Fig. 2, which shows that the pretreatment estimation curve track the observed Winnebago rates quite well. The average gap between Y, observed vaccination rates, and counterfactual vaccination rates, \({\widehat{Y}}_{S}\), for the post-treatment period is 1.65 p.p. (equality of means test yields p = 0.00).

Linear regression

To cross-check the validity of our results, we run the following linear regression

We estimate counterfactual vaccination rates, using regression method as \({\widehat{Y}}_{R}=X\widehat{\beta }\), where \(\widehat{\beta }\), is the estimated slope coefficient of Eq. 2\({Y}^{pre}={X}^{pre}\beta +\varepsilon\) (Eq. 2). The coefficients of the regression, \(\widehat{\beta }\), are given in the second column of Table 2 and the estimated time series curve for Winnebago vaccination rates, \({\widehat{Y}}_{R}\), is given in Fig. 2. As can be seen from Table 2, the highest coefficient belongs to DeKalb County and the lowest coefficient belongs to Stephenson County, being negative. The average gap between the observed vaccination rates in Winnebago county (Y) and the counterfactual vaccination rates in Winnebago county (\({\widehat{Y}}_{R})\), is 1.62 p.p. (equality of means test yields p = 0.00). It is worth noting that the average gap estimations of linear regression and synthetic control methods are very close.

The evolution of both counterfactuals (synthetic control, and the linear regression) is depicted in Fig. 2, which shows both pretreatment estimation curves track the observed Winnebago rates quite well. Similarly, both models show that there is a gap after the treatment day between the observed vaccination rates in Winnebago County and the counterfactuals.

Difference-in-differences (DiD)

Another method which is commonly used in evaluating policy adoptions, is a difference-in-differences method (DiD). DiD method is used to explore the effect of an intervention by comparing the changes over time between treated unit and control unit(s). One assumption, which is crucial in this method, is that treatment and control groups must have parallel trends before the intervention. This can be seen in Fig. 1.

To adopt this method, we will be using two units for the analysis. i = 1, will be representing the treated unit, Winnebago county, and i = 2 will be representing the average of the neighbouring counties, i.e., the data presented in Fig. 1. The variable vaccination rate, \({V}_{1,t}\), will be the vaccination rate in Winnebago, and \({V}_{2,t}\) will be the average vaccination rate of 4 neighbouring counties. We also added an explanatory variable, Tests, which shows the daily testing numbers in the corresponding unit. Following (Robertson, Schaefer, et al. 2021), and (Acharya & Dhakal, 2021), we estimate the following model:

where dependent variable \({V}_{i,t}\) is the vaccination rate in unit i, which takes values 1 or 2, at time t, which takes values 0, 1, 2, …, 70 to represent 70 days in the data set. \({Treat}_{i}\) is a dummy variable, showing the treatment status of the unit. \({Post}_{t}\) is also a dummy variable of the postintervention period, which distinguishes between treatment and control dates as follows:

Our main interest is the significance of the coefficient of the interaction term (Post × Treat), \({\beta }_{3},\) which measures the rate of change in vaccine uptake associated with the financial incentive implementation. The regression results reveal that the coefficient of the interaction term in (Eq. 2), \({\beta }_{3}\), is − 2.59, with an insignificant p value (0.00).

Results revisited

Note that not all of the students in Winnebago are offered the incentive, i.e., RPS consists of only 61.2 percent of Winnebago County. This leads us to make a no-show adjustment to our results. Following (Bloom, 1984), we calculate the Local Average Treatment Effect (LATE) by dividing the intent to treat (ITT) estimate, i.e., calculated percentage point increase, to compliance rate (C), 61.2%.

Thus, we conclude that the incentive of a $50 gift card per shot increased the vaccination rates in Winnebago County by between 2.64 p.p. and 4.23 p.p.

Our correspondence with RPS authorities revealed that, as of December 12, 2022, more than a year after the implementation of the gift card distribution policy, 12,943 gift cards were distributed in total. Considering the number of students aged between 12 and 17 is 22,908, the cost per student of this policy is $28.25, which is far lower than the range for adults, which is shown to be between $49 and $75 by Khazanov et al., (2022).

Inference, robustness, and placebo checks

Considering that SCM is a fairly new and developing tool in social sciences, inference in different settings is yet to be discovered. Li (2017) posits that “there is no inference theory” regarding the SCM. Even though there are a couple of methodologies proposed, they mostly work in large datasets. Abadie et al., (2010) for example, proposes a method to permute counties to the treatment and calculate a p-value. However, the lowest p-value, in that case, is 1/n, which works if n is big but does not if n is small (n = 5 in our case). Thus, the inference is especially a challenging problem in small samples. As (Bonander et al. 2021) suggest, “there are currently no best practice recommendations” for inferential analyses in SCM settings. Therefore, current works mostly rely on placebo tests or comparing the size of the permuted prediction errors, which we will perform here. In this section, we will focus on synthetic analysis and provide evidence for its robustness. We will run two main checks.

Robustness

Here, we run a robustness check for the synthetic control method, as proposed by Abadie et al., (2015), to see the sensitivity of our results to changes in county weights. In this check, we leave one county out at every step and conduct the synthetic analysis with the remaining counties until we are left with one county only. Thus, we will have synthetic control estimations with the number of counties, n = 4 (the original one), 3, 2, 1. Table 3 displays the weights of these estimations whereas Fig. 3 depicts the estimated curves. Note that the second column of Table 3 presents our original results given in Table 2.

Overall, all four estimations in Fig. 3 provide quite accurate and similar goodness of fits. Exclusion of a county from the county pool did not have a large effect on results. In other words, the decline in the goodness of fit is very small as the number of donor pools decreases. The case of n = 1, where the synthetic Winnebago is Ogle, produces a worse fit than other n > 1 cases. As the number of control counties increases, the counterfactual curve approaches the observed Winnebago curve.

Placebo trials

To ensure that the gift card announcement in Winnebago County affected the vaccination rates, we perform two falsification/placebo analyses. In the first, we follow (Abadie et al., 2010, 2015) and artificially change the treatment county to each of four neighboring counties and estimate the difference between their synthetic control vectors and their observed values. Fig. 4 summarizes the results of this analysis. The upper panel displays the synthetic control estimation of four different placebo counties and compares them with that of Winnebago’s. The gap in Winnebago County in the figure always stands as the lowest among all placebo county analyses, which provides further evidence for the effectiveness of gift cards. The bottom panel presents the ratio of post-treatment root mean square prediction error (RMSPE) to pre-treatment RMSPE to estimate the effect of the treatment, as proposed by Abadie et al., (2015):

where t = 1 represents July 13, 2021, where the data starts, T0 stands for treatment day, August 13, 2021, and T is the final day of the sample set, September 20, 2021. \({Y}_{j,t}\) represents the vaccination rates in county j at time t and is the jth column in the matrix Y. Lastly, \(\widehat{{Y}_{j,t}}\) is the synthetic control estimation of \({Y}_{j,t}.\)

The bottom panel of Fig. 4, which depicts the RMSPE Ratios of all placebo analyses, shows that the treatment analysis performed with Winnebago County results is the highest among all. However, considering that the number of donor counties is small, we will perform another placebo analysis with date falsification.

In the second placebo analysis, we shift the whole data so that it covers the nine weeks of data prior to our analysis, i.e. May 4-July 12, 2021. Thus, June 4 will be the placebo announcement date and we will perform a synthetic control analysis with this placebo date (Winnebago County stays as the treatment county). We do not expect to observe a big gap between the synthetic control data and the observed data. Moreover, we also do not expect to see as high RMSPE Ratios as we observed in Fig. 5.

The upper panel shows the vaccination rate differences in Winnebago (bold line) and placebo differences in four neighboring counties, assuming a placebo announcement date: July 13, 2021. The lower panel displays the root mean square prediction errors of the estimations in the upper panel. (Data: CDC and authors’ calculations)

The upper panel Fig. 5 displays the gap between synthetic and observed vaccination rates in Winnebago as well as in the other four counties, whereas the bottom panel shows the RMSPE Ratios. None of the counties has as high RMSPE Ratios as Winnebago had in Fig. 4. Moreover, the upper panel shows that the gap of Winnebago County vaccination rates is not negative anymore.

In sum, in this section, we provide evidence that neither a permutation of counties as treated counties nor a placebo date change provided counterevidence against our hypothesis that the gift card announcement in Winnebago County on August 13, 2021, increased the vaccination rates.

Conclusion and discussion

Mass vaccination becomes the biggest concern of the countries and states, when a new pandemic hits the world. However, it is not always easy to reach the masses because of various reasons related to vaccine hesitancy. Covid-19 is no different. Thus, health experts and leaders are seeking ways to overcome the barriers and concerns of the unvaccinated. This is of special concern for children as their rate of vaccination is lower than those of adults. In this paper, we measure the effectiveness of a financial incentives on vaccine uptake of children. Specifically, in August 2021, Rockford Public Schools (RPS), which is located in one of Illinois’s northern counties, Winnebago, announced that students 12 and older would be paid $50 in gift cards for receiving the Covid-19 vaccine (Rockford Public Schools, 2021). In this study, we explore how this policy affected the vaccination rates of K-12 children in Winnebago County. Using three different methodologies, we show that the financial incentives increased the vaccination rate of children by between 2.64 and 4.23 percentage points from a baseline rate of 38 percent. In other words, the current vaccination rates would be somewhere between 2.64 and 4.23 p.p. lower, had there been no gift cards. Studies analyzing the vaccine uptake of the population as a whole (not just children), conclude similar but lower increases. Barber and West (2022) show that Ohio’s “Vax-a Million” Lottery increased vaccine uptake by 0.7 p.p., Acharya and Dhakal (2021), conclude that, after analyzing 39 states that lotteries increased the vaccine uptake by 2.1%. Our results are a little bit higher. Our correspondence with RPS authorities revealed that the per-student cost of this policy is approximately $28.25, which is less costly compared to other incentives (Khazanov et al., (2022) shows that the current range of financial incentives for Covid-19 vaccine uptake stays between $49 and $75 per person). Thus, we conclude that smaller financial incentives, compared to those of adults, produce better results for vaccine uptake of children.

Considering that previous studies focus on the elderly, making use of RCTs or lotteries, our research contributes to the literature in two ways. First, this study is focused explicitly on students aged 12 and older and demonstrates that financial incentives have a greater impact on the vaccine rate for children. To the best of our knowledge, there is no research performed on the effectiveness of the financial incentives on Covid-19 vaccination rates, among children aged 12–17). Second, this research is a quasi-experiment, not from an RCT, which would provide a different perspective to the ongoing discussions.

Even though the practice we analyze here is a regional one, it carries vital lessons both for the U.S. and for the rest of the world, as the new virus variants, such as delta and omicron, have been appearing constantly. Children in the U.S. have missed more classes than most children in advanced economies (The Economist 2022). Thus, American authorities have been proposing various financial incentives to boost Covid-19 vaccination rates. For example, President Joe Biden made an open call on July 29, 2021, for states and territories to pay $100 (Rappeport, 2021). Some other countries offer similar incentives to boost vaccination too. Serbia announced that they will pay the equivalent of $30 (3000 dinars) to those who are vaccinated (Euronews, 2021). Russia held lotteries distributing cars and more (Thomson Reuters Foundation, 2021). Each of these policies has its benefits and costs. This paper offers insight into the benefits of giving gift cards, providing a comparison opportunity for the states. We showed that gift cards proved effective in increasing vaccination rates.

There are limitations to this study. The data we used is of the K-12 children from Winnebago county, IL, USA. Studies on different states and countries might yield different results, as demographics and income rates may vary. Further studies on different demographic groups, such as age, race, ethnicity, and income, would enhance our understanding of the effects of financial incentive on vaccine uptake.

References

Abadie, A., Diamond, A., & Hainmueller, A. J. (2010). Synthetic Control Methods for Comparative Case Studies: Estimating the Effect of California’s Tobacco Control Program. Journal of the American Statistical Association, 105(490), 493–505. https://doi.org/10.1198/jasa.2009.ap08746

Abadie, A., Diamond, A., & Hainmueller, J. (2015). Comparative politics and the synthetic control method. American Journal of Political Science, 59(2), 495–510. https://doi.org/10.1111/ajps.12116

Abadie, A., & Gardeazabal, J. (2003). The economic costs of conflict: A case study of the Basque Country. American Economic Review. https://doi.org/10.1257/000282803321455188

Acharya, B., & Dhakal, C. (2021). Implementation of state vaccine incentive lottery programs and uptake of COVID-19 vaccinations in the United States. JAMA Network Open, 4(12), e2138238. https://doi.org/10.1001/jamanetworkopen.2021.38238

Athey, S., & Imbens, G. W. (2017). The state of applied econometrics: Causality and policy evaluation. Journal of Economic Perspectives, 31, 3–32. https://doi.org/10.1257/jep.31.2.3

Barber, A., & West, J. (2022). Conditional cash lotteries increase COVID-19 vaccination rates. Journal of Health Economics, 81, 102578. https://doi.org/10.1016/J.JHEALECO.2021.102578

Bloom, H. S. (1984). Accounting for no-shows in experimental evaluation designs. Evaluation Review, 8(2), 225–246.

Bonander, C., Humphreys, D., & Esposti, M. D. (2021). Synthetic control methods for the evaluation of single-unit interventions in epidemiology: A tutorial. American Journal of Epidemiology. https://doi.org/10.1093/aje/kwab211

Brehm, M. E., Brehm, P. A., & Saavedra, M. (2022). The Ohio vaccine lottery and starting vaccination rates. American Journal of Health Economics, 8(3), 387–411. https://doi.org/10.1086/718512

Campos-Mercade, P., Meier, A. N., Schneider, F. H., Meier, S., Pope, D., & Wengström, E. (2021). Monetary incentives increase COVID-19 vaccinations. Science. https://doi.org/10.1126/science.abm0475

Carpenter, J., & Dolifka, D. (2017). Exploitation aversion: When financial incentives fail to motivate agents. Journal of Economic Psychology, 61, 213–224. https://doi.org/10.1016/j.joep.2017.04.006

Carpio, C. E., Coman, I. A., Sarasty, O., & García, M. (2021). COVID-19 vaccine demand and financial incentives. Applied Health Economics and Health Policy, 19(6), 871–883. https://doi.org/10.1007/s40258-021-00687-9

Euronews. (2021). Serbia in “world first” as citizens offered €25 to have COVID vaccine. https://www.euronews.com/2021/05/05/serbia-in-world-first-as-citizens-offered-25-to-have-covid-vaccine. Accessed January 14, 2022.

Gupta, M., Gupta, V. K., Kaur, N., Singla, P., & Singla, M. (2022). Effect of non incentivised and incentivised free COVID-19 vaccination camps in Augmentation of State’s Efforts in Achieving Vaccination Targets Necessary for Herd Immunity. Journal of Clinical and Diagnostic Research. https://doi.org/10.7860/JCDR/2022/52333.15929

Hamel, L., Lopes, L., Kearney, A., Stokes, M., Kirzinger, A., Sparks, G., & Brodie, M. (2021). KFF COVID-19 vaccine monitor: Winter 2021 update on parents’ Views of vaccines for kids | KFF. https://www.kff.org/coronavirus-covid-19/poll-finding/kff-covid-19-vaccine-monitor-winter-2021-update-on-parents-views-of-vaccines/. Accessed December 8, 2021

Hammermann, A., & Mohnen, A. (2014). The pric(z)e of hard work. Journal of Economic Psychology, 43, 1–15. https://doi.org/10.1016/j.joep.2014.04.003

Jacobson, M., Chang, T. Y., Shah, M., Pramanik, R., & Shah, S. B. (2022). Can financial incentives and other nudges increase COVID-19 vaccinations among the vaccine hesitant? A randomized trial. Vaccine. https://doi.org/10.1016/j.vaccine.2022.08.060

Jenkins, G. D., Jr., Mitra, A., Gupta, N., & Shaw, J. D. (1998). Are financial incentives related to performance? A meta-analytic review of empirical research. Journal of Applied Psychology, 83(5), 777–787. https://doi.org/10.1037/0021-9010.83.5.777

Karaivanov, A., Kim, D., Lu, E., Shigeoka, H., & Lu, S. E. (2021). COVID-19 Vaccination mandates and vaccine uptake. NBER Working Paper Series, 29563. https://www.nber.org/papers/w29563. Accessed 30 March 2022

Khazanov, G., Stewart, R., Pieri, M., Huang, C., Robertson, C. T., Schaefer, K. A., et al. (2022). The effectiveness of financial incentives for COVID-19 vaccination: A systematic review. https://psyarxiv.com/ctzn9/. Accessed December 11, 2022.

Lang, D., Esbenshade, L., & Willer, R. (2022). Did Ohio’s vaccine lottery increase vaccination rates? A pre-registered, synthetic control study. Journal of Experimental Political Science. https://doi.org/10.1017/XPS.2021.32

Largent, E. A., & Miller, F. G. (2021). Problems with paying people to be vaccinated against COVID-19. JAMA: Journal of the American Medical Association. https://doi.org/10.1001/jama.2020.27121

Li, K. T. (2017). Statistical inference for average treatment effects estimated by synthetic control methods. https://faculty.wharton.upenn.edu/wp-content/uploads/2017/06/Li_JMP_Statistical-Inference-SCM.pdf. Accessed March 30, 2022

Malik, A. A., McFadden, S. M., Elharake, J., & Omer, S. B. (2020). Determinants of COVID-19 vaccine acceptance in the US. EClinicalMedicine, 26, 100495. https://doi.org/10.1016/j.eclinm.2020.100495

Mallow, P. J., Enis, A., Wackler, M., & Hooker, E. A. (2022). COVID-19 financial lottery effect on vaccine hesitant areas: Results from Ohio’s Vax-a-million program. The American Journal of Emergency Medicine, 56, 316–317. https://doi.org/10.1016/j.ajem.2021.08.053

Ogilvie, D., Adams, J., Bauman, A., Gregg, E. W., Panter, J., Siegel, K. R., et al. (2020). Using natural experimental studies to guide public health action: Turning the evidence-based medicine paradigm on its head. Journal of Epidemiology and Community Health, 74(2), 203–208. https://doi.org/10.1136/jech-2019-213085

Oliu-Barton, M., Bsr Pradelski, B., Guetta-Jeanrenaud, L., From Philippe Aghion, G., Artus, P., Fontanet, A., et al. (2022). The effect of Covid certificates on vaccine uptake. Health Outcomes and the Economy. https://doi.org/10.21203/rs.3.rs-1242919/v1

Pennings, S., & Symons, X. (2021). Persuasion, not coercion or incentivisation, is the best means of promoting COVID-19 vaccination. Journal of Medical Ethics, 47(10), 709–711. https://doi.org/10.1136/medethics-2020-107076

Persad, G., & Emanuel, E. J. (2021). Ethical considerations of offering benefits to COVID-19 vaccine recipients. JAMA, 326(3), 221. https://doi.org/10.1001/jama.2021.11045

Rappeport, A. (2021). The Biden administration wants states and cities to pay people $100 to get vaccinated. The New York Times. https://www.nytimes.com/2021/07/29/us/politics/100-dollars-covid-vaccine-biden.html. Accessed November 13, 2021.

Robertson, C., Schaefer, K. A., & Scheitrum, D. (2021a). Are vaccine lotteries worth the money? Economics Letters, 209, 110097. https://doi.org/10.1016/J.ECONLET.2021.110097

Robertson, C., Scheitrum, D., Schaefer, A., Malone, T., McFadden, B. R., Messer, K. D., & Ferraro, P. J. (2021b). Paying Americans to take the vaccine—would it help or backfire? Journal of Law and the Biosciences, 8(2). https://doi.org/10.1093/jlb/lsab027

Rockford Public Schools. (2021). RPS 205 Launches Vaccine Incentive Program. https://www.rps205.com/205vibe/205-vibe-news/defult-post-page-clone-clone-clone/~board/news/post/rps-205-launches-vaccine-incentive-program. Accessed December 29, 2021.

Savulescu, J. (2021). Good reasons to vaccinate: Mandatory or payment for risk? Journal of Medical Ethics, 47(2), 78–85. https://doi.org/10.1136/medethics-2020-106821

Sehgal, N. K. R. (2021). Impact of Vax-a-million lottery on COVID-19 vaccination rates in Ohio. The American Journal of Medicine, 134(11), 1424–1426. https://doi.org/10.1016/j.amjmed.2021.06.032

Tevdovski, D., Jolakoski, P., & Stojkoski, V. (2022). The impact of state capacity on the cross-country variations in COVID-19 vaccination rates. International Journal of Health Economics and Management, 22(3), 237–255. https://doi.org/10.1007/s10754-021-09319-0

The Economist. (2022). America has failed to learn from the safe opening of classrooms abroad. The Economist. https://www.economist.com/leaders/2022/01/13/america-has-failed-to-learn-from-the-safe-opening-of-classrooms-abroad. Accessed January 15, 2022.

Thirumurthy, H., Milkman, K. L., Volpp, K. G., Buttenheim, A. M., & Pope, D. G. (2022). Association between statewide financial incentive programs and COVID-19 vaccination rates. PLoS ONE, 17(3), e0263425. https://doi.org/10.1371/journal.pone.0263425

Thomson Reuters Foundation. (2021). Carrot or stick? How countries are tackling COVID-19 vaccine hesitancy. Thomson Reuters Foundation. https://news.trust.org/item/20210601155421-gr1fs/. Accessed December 30, 2021.

Titiunik, R. (2021). Natural Experiments. In J. Druckman & D. P. Green (Eds.), Advances in experimental political science. Cambridge University Press. https://doi.org/10.1017/9781108777919

U.S. Census Bureau. (2021). Week 39 Household Pulse Survey: September 29 – October 11. https://www.census.gov/data/tables/2021/demo/hhp/hhp39.html. Accessed December 21, 2021.

Waddington, H., Aloe, A. M., Becker, B. J., Djimeu, E. W., Hombrados, J. G., Tugwell, P., et al. (2017). Quasi-experimental study designs series—Paper 6: Risk of bias assessment. Journal of Clinical Epidemiology, 89, 43–52. https://doi.org/10.1016/j.jclinepi.2017.02.015

Walkey, A. J., Law, A., & Bosch, N. A. (2021). Lottery-based incentive in Ohio and COVID-19 vaccination rates. JAMA: Journal of the American Medical Association. https://doi.org/10.1001/jama.2021.11048

Wong, C. A., Pilkington, W., Doherty, I. A., Zhu, Z., Gawande, H., Kumar, D., & Brewer, N. T. (2022). Guaranteed financial incentives for COVID-19 vaccination. JAMA Internal Medicine, 182(1), 78. https://doi.org/10.1001/jamainternmed.2021.6170

Acknowledgements

This research is partially funded by the Mary Ashby Cheek grant from Rockford University. We would like to thank attendees of the Midwest Economic Association 2022 Conference’s Health Care Demand Session, especially Tyler Boese from the University of Minnesota, and Çağrı Akkkoyun for their valuable feedback.

Orhan Erdem and Sukran Erdem received $200 for having their children vaccinated.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Erdem, O., Erdem, S. & Monson, K. Children, vaccines, and financial incentives. Int J Health Econ Manag. 23, 537–552 (2023). https://doi.org/10.1007/s10754-023-09343-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10754-023-09343-2