Abstract

Theoretically, a risk avers consumer takes a deductible if the premium rebate (far) exceeds his/her expected out-of-pocket expenditures. In the absence of risk equalization, insurers are able to offer high rebates because those who select into a deductible plan have below-average expenses. This paper shows that, for high deductibles, such rebates cannot be offered if risk equalization would “perfectly” adjust for the effect of self selection. Since the main goal of user charges is to reduce moral hazard, some effect of self selection on the premium rebate can be justified to increase the viability of voluntary deductibles.

Similar content being viewed by others

Explore related subjects

Find the latest articles, discoveries, and news in related topics.Avoid common mistakes on your manuscript.

Introduction

In a number of health insurance schemes the insured can opt for a voluntary deductible in return for a premium rebate. The main goal of these deductibles is to reduce moral hazard. The extent to which this goal will be achieved is greatly affected by the number of insured choosing a deductible. Obviously, this number is positively correlated with the rebate offered by insurers and negatively correlated with the rebate demanded by the insured.

In free, unregulated health insurance markets insurers can offer high rebates due to the effect of self selection. Self selection occurs because, within a premium-risk group, low-risk individuals have a greater incentive to opt for a deductible than high-risk individuals. However, in an increasing number of countries there is a system of risk equalization in which insurers receive a payment for the relatively high risks in their insurance pool and contribute a payment for the relatively low risks. To some extent, these equalization payments will adjust for differences in health status between the insured who choose a deductible and those who do not. The goal of this paper is to indicate whether the rebates offered in the absence of (perfect) risk equalization, can still be offered in the presence of “perfect” risk equalization. If the answer is negative then the viability of voluntary deductibles will be reduced, i.e. numbers of insured opting for a deductible will be lower. Consequently, moral hazard reductions will be smaller. In this context, “perfect” risk equalization refers to an equalization system fully adjusting for the effect of self selection. The rationale of this paper is that countries like Switzerland and the Netherlands tend to improve risk equalization and consider voluntary deductibles as an appropriate instrument to reduce moral hazard.

We analyzed panel data from Switzerland with information on expenditures and actual choice of deductible of 134,758 Swiss insured. Theoretically, risk avers insured take a deductible only if the premium rebate (far) exceeds their expected out-of-pocket expenditures, i.e. if they expect to obtain a financial gain. In the first step of the analysis we estimated the actual financial gain (i.e. premium rebate minus out-of-pocket expenditures) obtained by the group of insured with voluntary deductible d in 2003. In the second step we examined whether the rebate actually offered for d could have been offered in the presence of “perfect” risk equalization.

Prior to the empirical results, we theoretically consider (the composition of) both the demanded and offered premium rebate. Section “Demanded premium rebate” shows why risk avers consumers take a deductible only if they expect to obtain a financial gain. Section “Offered premium rebate” considers in more detail how this rebate will be reduced by improvements in the risk equalization system.

Demanded premium rebate

If an expected-income optimizing consumer with mandatory health insurance would be risk neutral and would face no transaction costs then he/she would take a deductible if the premium rebate exceeded the product of the possible losses z 1, z 2, … z h and the probabilities p 1, p 2, … p h of these losses to occur. The possible loss z h equals the costs of health intervention h that have to be paid out-of-pocket. The maximum value of \( \sum\limits_1^n {z_h } ph \) equals the deductible amount d, since the expenditures above this amount are reimbursed by the insurer.

In both economics and psychology it is widely argued that individuals consider more than (just) the expected value ∑z h p h in making choices under uncertainty. Arguing that a gain of 200 is not necessarily ‘worth’ twice as much as a gain of 100, Daniel Bernoulli and Gabriel Cramer hypothesized that an individual evaluates choices under uncertainty by the expected utility U = U(z h p h ) instead of the expected value (von Neumann & Morgernstern, 1944). In existing literature the von Neumann-Morgenstern expected utility model is widely used to model the demand for insurance. Since the demand for deductibles is in fact the opposite of the demand for insurance, the model can also be used to consider the choice whether to take a deductible, starting from full coverage. In the following two sections we assume the consumer to be risk avers. Notice that the context of this study is mandatory health insurance, in which individuals are obliged to insure. Theoretically, these insured are not necessarily risk averters; they could be risk lovers. Nonetheless, it is doubtful whether consumers are risk loving in the context of health insurance.

Similar to existing literature on the demand for health insurance, the expected-utility model used here does not take into account moral hazard.We further assume that individuals face no transaction costs in case of switching from a non-deductible to a deductible plan or the other way around. The role of transaction costs will be discussed in Section “Expected compensation”.

Expected-utility theory and the demand for insurance

According to the expected-utility model, the utility function of a risk avers consumer is characterized by a diminishing marginal utility of income, as shown in Fig. 1. If the consumer is assumed to have income Io corresponding to utility U(Io), and if the probability to incur medical expenditures z equals p and the probability to have no medical expenditures equals 1 − p, then his/her expected income equals E(I), ceteris paribus.

Accordingly, the consumer’s expected utility in a situation without insurance equals E(U(I)), as shown in Fig. 1.

At a certain moment the consumer is offered an insurance police for an actuarially fair premium I 0 − E(I). This insurance policy takes away the uncertainty about whether and when there will be an income loss because of medical expenditures z. Consequently, the actual utility of income after paying the actuarially fair premium I 0 − E(I) is higher than the expected utility E(U(I)) in a situation without insurance. The utility gain of this insurance policy equals D-C, as shown in Fig. 2.

So, a rationally behaving risk avers consumer will always purchase insurance for an actuarially fair premium. Moreover, he/she will also buy insurance for a higher premium, as long as the loading fee does not exceed C-E. The maximum acceptable loading fee can be defined as the maximum amount that the insured is willing to pay for insurance, apart from the actuarially fair premium.

Expected-utility theory and the demand for voluntary deductibles

In case of voluntary deductibles in mandatory health insurance we must go the other way around to approach the minimum compensation C min demanded by an insured to be induced to take a deductible. Let us assume that U(I) in Fig. 3 is the utility curve of a risk avers consumer with a mandatory policy with full coverage and income Io (after the insurance premium). Notice that this starting point differs from that in the previous section.

At a certain moment, the consumer is offered the possibility to take a deductible d in return for an actuarially fair premium rebate PR that equals his/her expected out-of-pocket expenditures. We assume p to be the probability of medical expenditures to exceed d and assume 1 − p to be the probability of medical expenditures to be zero. For reasons of simplicity, the probability to incur medical expenditures in between is assumed to be zero. Accordingly, the actuarially fair premium rebate PR equals p*d. Consequently, having a deductible results in income Io + PR − d if medical expenditures exceed the deductible amount and results in income Io + PR if medical expenditures are zero, as shown in Fig. 3. The expected income E d (I) in case of a deductible with an actuarially fair premium rebate equals:

Expected utility E d (U(I)) is lower than U(Io) since the consumer is a risk averter and a deductible plan results in more uncertainty about the level of income than full insurance.

To induce the consumer to take a deductible, the insurer has to increase the premium rebate with compensation C such that E d (U(I)) equals or exceeds U(Io), as shown in Fig. 4. We define the minimum compensation C min , such that E d (U(I)) equals U(Io). So, the minimum compensation is in fact the opposite of the maximum loading fee discussed in Section “Expected-utility theory and the demand for insurance”. Whereas a risk avers consumer is willing to pay a loading fee for an insurance policy, he/she demands a compensation to be induced to take a deductible. As shown in Fig. 4, C increases both Io + PR − d and Io + PR, resulting in a higher expected income and a higher expected utility in case of a deductible.

In a study on the (hypothetical, survey-) choice whether to take a deductible among the Dutch privately insured, van de Ven and van Praag (1981) found that, for all deductible amounts included, the premium rebate was about 80% higher than the actuarially fair rebate. This implies that these insured would demand for a rebate nearly twice the expected out-of-pocket expenditures.

Expected compensation

Among others, Edwards (1955), Kahneman and Tversky (1979), Machina (1987), Fishburn (1983) argue that choices under uncertainty are not only influenced by risk aversion, but also by individual preferences and perceptions about both probabilities and prices. Burrows, Brown, and Gruskin (1993) report of inertia as being an important explanation for the fact that people are not switching in situations where this would benefit them in terms of (expected) utility. Kunreuther and Pauly (2004) argue that decisions are not always ‘optimal’ in terms of expected utility as a result of search and transaction costs, which occur as a consequence of searching for the best policy and switching from the current policy to a new one. Insured probably have greater inclination to switch between two policies in a situation where these costs are low than in a situation where these costs are high, ceteris paribus.

Following both this literature and the basic assumptions underlying the expected utility model, the demanded compensation is probably affected by a mixture of factors, such as the expected out-of-pocket expenditures, the deductible amount d, the level of risk aversion r (Pratt, 1964), the level of income I, the extent of transaction and search costs, and personal characteristics such as inertia. We do not explore these individual components in further detail, since the remainder of this paper is focused on the total demanded compensation regardless of its composition.

Conclusion

According to the previous consideration we assume insured i to take a voluntary deductible d if the offered premium rebate OPR exceeds his/her demanded premium rebate DPR.

with DPR i,d as the sum of the expected out-of-pocket expenditures E(OOPE) i,d and the minimum compensation C min,i,d.

Offered premium rebate

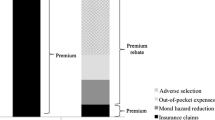

In a free, unregulated health insurance market the offered premium rebate OPR for a certain deductible can be based on out-of-pocket expenditures, reductions in moral hazard, reductions in administration costs, and the effect of self selection, due to that deductible (Bakker, van Vliet, & van de Ven, 2000).

Out-of-pocket expenditures and cost reductions

The insured with a deductible pay the expenditures up to the deductible amount out of their own pocket, resulting in a shift of costs from the insurer to the insured. In a competitive health insurance market, insurers will be forced to reflect these out-of-pocket expenditures in the premium rebate.

A second component is the reduction in moral hazard. Moral hazard can be defined as the increase in (more expensive) medical consumption because of insurance. Based on the RAND-experiment, Keeler, Buchanon, Rolph, Hanley, and Reboussin (1988) conclude that full insurance coverage leads to about 70% higher medical expenditures than no insurance coverage. So, compared to full coverage, deductibles are expected to reduce total expenditures. In the RAND experiment a 95% coinsurance plan with a stop-loss of $ 1,000 resulted in 31% lower medical expenditures than a full-coverage plan (Manning, 1987). The average medical expenditures of those not having a deductible in the RAND-experiment were $ 749 (in 1984 US-dollars). A more recent study by van Vliet (2004) shows that in the Dutch private health insurance market of 1996 a deductible of Dfl. 1,750 led to a reduction in medical expenditures of about 14%. The average expected medical expenditures of the insured having that deductible were Dfl. 2,548 (in 1996 Dutch guilders).

In a reimbursement scheme, a third component could be a reduction in administration costs. Part of the insured will not send their bills to the insurer before the total amount exceeds the deductible. Consequently, the insurer does not have to handle the bills of those whose expenditures remain below the deductible amount in the accounting period. However, many health insurance schemes are characterized by arrangements between insurers and providers of care. Due to these arrangements a reduction in administration costs is expected to be negligible since (a part of) the bills are sent directly from the provider to the insurer, with the insured being notified afterwards. Hence, we assume a reduction in administration costs to be absent.

Self selection

In a competitive health insurance market without risk equalization, the premium rebate is not just a reflection of out-of-pocket expenditures and the cost reductions mentioned above, but also comprises the effect of self selection. Self selection occurs because high risks have a greater incentive to buy (more) insurance coverage than low risks within the same premiumrisk group. Many studies found evidence of self selection in health insurance (e.g. Beck, 2004; Browne, 1992; Gardiol, Geoffard, & Grandchamp, 2005). In the context of the present study, self selection occurs because the healthy insured have a greater incentive to opt for a voluntary deductible than the unhealthy insured (given a certain premium rebate). In a heterogeneous risk pool self selection results in market segmentation such that those who choose the deductible on average are healthier and have lower expenditures than those who do not choose a deductible, ceteris paribus. Competition will force the insurer to increase the premium for full coverage and decrease the premium (i.e. increase the premium rebate) for the deductible plan. Consequently, the premium rebate for a certain deductible is not only based on out-of-pocket expenditures plus the reduction in moral hazard due to that deductible, but also on differences in ex-ante health status between those whose choose a deductible and those who do not. The more heterogeneous premium-risk groups are the larger will be this effect of self selection.

In the presence of risk equalization among insurers, the effect of self selection on the premium rebate will be smaller. If the equalization payments do “perfectly” adjust for expenditure differences due to differences in ex-ante health status between the healthy and the unhealthy then the effect of self selection on the premium rebate is zero (although there might be substantial self selection). For instance, this scenario occurs if the level of deductible is included as a risk factor in the risk equalization system.

Conclusion

If the equalization payments fully adjust for the effect of self selection then the offered premium rebate can be based exclusively on the expected out-of-pocket expenditures E(OOPE d ), and expenditure reductions M R d due to reduced moral hazard.

Data

To estimate the actual financial gains obtained in the Swiss basic health insurance and to examine whether the premium rebates actually offered could have been offered in the presence of perfect risk equalization, we analyzed 2003-data from a Swiss sickness fund.

Swiss sickness fund insurance

Since the Revised Health Insurance Law came into force in January 1996, all Swiss residents must have basic health insurance.

General

In 2002, there were 93 insurance companies operating under the health insurance law, which defines the scope of the benefits package as well as the conditions under which insurers and providers of care are operating. Among others, the package includes inpatient and outpatient care, physician’s services, physiotherapy, laboratory analyses, health care at home, nursing home care, technical aid, medicaments from pharmacy and physicians, and alternative and complementary benefits. Insurers are obliged to accept all applicants, thereby avoiding explicit preferred-risk selection in principle. The insured may change insurer twice per year. To equal out different starting positions of the competing insurers when open enrollment started in 1996 and to avoid preferred-risk selection, government created a solidarity fund responsible for risk equalization (Beck, Spycher, Holly, & Gardiol, 2003). Every canton has its own risk equalization system, which takes into account age and gender and equalizes the actual net expenditures, i.e. the expenditures reimbursed by the insurer.

Individual deductibles

There are user charges in the form of individual deductibles starting from a mandatory minimum. The insured can reduce their premium by opting for a higher deductible. In order to protect solidarity, premium rebate limits are set by the federal government. In addition to these deductibles there is a coinsurance of 10% up to a maximum of CHF 600 per person per year for all medical expenditures above the deductible. During inpatient care those from single-occupant households must pay hotel-type expenses of CHF 10 per day. During the years in our data the mandatory deductible was CHF 230 and the voluntary deductibles on top of the mandatory deductible were CHF 170, 370, 970 and 1,270 per person per year. A voluntary deductible of CHF 170 (€ 110, 2006) resulted in a premium rebate of up to 8%. For voluntary deductibles of CHF 370, 970 and 1,270 (€ 235, € 610 and € 800 respectively, 2006) the rebates were at most 15, 30 and 40% of the community-rated premium per insurer per canton, respectively. Children are exempted frommandatory deductibles and their voluntary deductible options are all lower then the options for adults and seldom chosen.

Data

The data are taken from administrative sources and contain background information and medical expenditures for insured from four Swiss cantons who were enrolled in the sickness fund in 1998. These insured, all older than 26 years, were followed during the period 1998–2003, starting with n = 197,120 and ending up with n = 134,758. The main reasons for drop-out were leaving to another region or leaving the country, switching to another insurance company and deaths. The data set includes information on age, gender, medical expenditures, insurance premium, deductible level, premium rebate, region and years of enrollment. Medical expenditures are divided into 11 categories of medical care, i.e. physician care, medicaments from physicians, medicaments from pharmacies, physiotherapy, laboratory analyses, stationary and ambulatory hospital care, health care at home, nursing home care, technical aid, and other. Apart from nursing home care, this benefit package is comparable to that in other health insurance schemes. To generalize the results and conclusions, expenditures for nursing home care were not taken into account in the empirical analysis.

The first line of Table 1 shows the gross expenditures, i.e. the expenditures registered by the insurer, per deductible amount. These expenditures are probably incomplete because of unfiled claims. The reason is that some of the insured will send their bills to their insurer only if the total amount exceeds the deductible, i.e. if they expect to get any reimbursement. The amount of unfiled claims is expected to increase with a higher deductible.

To get a better indication of the expenditure differences among insured with different deductible amounts, Table 1 also shows the average expenditures above CHF 1,500 and the proportion of insured with expenditures exceeding CHF 1,500. These expenditures are not affected by unfiled claims, since all insured with expenditures exceeding CHF 1,500, in principle, send all bills to the insurer in order to get (some) reimbursement. For these insured the gross expenditures registered by the insurance company reflect to their actual expenditures.

At first glance, Table 1 reveals that there is a high correlation between the level of deductible and expenditures>CHF 1,500. This can be the result of both a reduction in moral hazard and the effect of self selection. Self selection is evident in the correlation between the level of deductible and age.

Method

In the first part of the empirical analysis we quantified the actual financial gain obtained for voluntary deductible d in 2003. In the second part we examined whether the premium rebate offered for deductible d could have been offered in the presence of “perfect” risk equalization.

The actual financial gain

For insured i we calculated the actual financial gain C i,d from having a voluntary deductible d as the offered premium rebate for this deductible, OPR d , minus his/her out-of-pocket expenditures OOPE i,d due to this deductible. Obviously, C i,d can also be a financial loss instead of a financial gain.

The data set contains information on the actual rebates for different deductible plans, but lacks some information on expenditures for the insured whose expenditures did not exceed the deductible amount, asmentioned in Section “Data”. To correct for unfiled claims we used the following three-step procedure:

-

(A)

estimate an expenditure model on the group of insured without a voluntary deductible;

-

(B)

predict the expenditures of the insured with a voluntary deductible by combining their characteristics with the coefficients obtained in A;

-

(C)

calculate the expected out-of-pocket expenditures using the results of B.

Expected expenditures

Expenditures of the insured without a voluntary deductible were assumed to be recorded in full. This seems to be reasonable since only 18% of these insured had expenditures below the mandatory deductible of CHF 230 and only 12% had no expenditures recorded at all. To estimate the total expenditures E(Y) i we used the two-part model defined in Eq. (9).

We estimated p(Y i > 0) by a logistic regression. For the estimation of the second part of Eq. (9), we considered two options. The first, described by Duan, Manning, Morris, and Newhouse (1983), is applying OLS to the logarithm of positive medical expenditures. An important disadvantage of this option with regard to our analysis is that the predictions need to be retransformed to monetary units. The second option is GLM with a log-link and a choice of distributions. We chose to use this option since the predictions do not need to be retransformed and a distribution can be chosen that fits the data in a proper way (Manning & Mullahy, 2001). The distribution chosen in our analysis reflects how the variance is related to the mean. As will be described below, E(Y) i and its variance were finally used to estimate the out-of-pocket expenditures that concentrate in the left-tail of the distribution. Testing a normal, log-normal, Poisson and Gamma distribution revealed that Gamma is the best in estimating the out-of-pocket expenditures in our data. The fit will be illustrated later on. For the estimation of both the first and the second part of Eq. (9) the following information was used to create the explanatory variables: age, gender, region and gross expenditures in three previous years. Dummy variables were created to represent 14 age/gender groups, and nine different regions, and continuous variables were created for the log(gross expenditures + 1) in years t − 1, t − 2 and t − 3 separately for the 10 categories of medical care mentioned in Section “Data”.

As a next step, the coefficients obtained were used to predict the expenditures of the insured with a voluntary deductible. For these insured the predicted expenditures were—a fraction F(d)0—higher than the gross expenditures recorded in the data. Theoretically, this discrepancy can be the effect of moral hazard, unfiled claims, and unobserved differences in health status. However, unobserved differences in health status are expected to be insignificant, since differences in health and risk are sufficiently captured by including prior expenditures of three preceding years in our model, differentiated as well into 10 types of expenditures. In the remainder of the analysis unobserved differences in health status are assumed to be absent. Accordingly, the expected expenditures can be seen as the expenditures that these insured would have had in a situation without a voluntary deductible.

During the years in our data, the deductible levels did not change. So, given F(d)0, the gross expenditures in years t −1, t −2 and t −3 were probably affected by moral hazard and unfiled claims as well. This could have biased the prediction of expected expenditures in year t, since prior expenditures were included in our model and most of the insured with voluntary deductible d in year t had the same level of deductible in previous years. We corrected for this by multiplying the gross expenditures in prior years by 1 + F(d)0. This further increased the relative difference in predicted and gross expenditures in year t, because, obviously, expenditures in t − 1, t − 2 and t − 3 have a positive impact on (predicted) expenditures in year t. As a result, the predicted expenditures for insured with deductible d were on average—a fraction F(d)1—higher than the gross expenditures. Accordingly, we multiplied the (original) gross expenditures in prior years (as recorded in the data) by 1 + F(d)1, and so on. This iterative process converged after eight steps, i.e.: F(d) s did not change anymore (for s ≥ 8).

Expected out-of-pocket expenditures

As a next step we wanted to predict the out-of-pocket expenditures due to the voluntary deductible. Since all the insured in the data had a mandatory deductible of CHF 230, the total deductible x equaled voluntary deductible d + CHF 230. The out-of-pocket expenditures of an individual i due to his/her total deductible x were estimated according to Eq. (10).

with

and with Γ(.) the cumulative density function of the gamma distribution with parameters c and k (van Vliet, 1995). Equation (10) can be seen as the weighted sum of the expected out-of-pocket expenditures if medical expenditures are below \( x\left( { = E(Y)_i^* \Gamma (c_i ,k + 1)/\Gamma (c_i ,k)} \right) \) and the out-of-pocket expenditures if medical expenditures exceed x(= x). Respectively, the weighting factors are Γ(c i , k) and 1 − Γ(c i , k), i.e. the probability that Y < x and the probability that Y > x (van Vliet, 1995, 2004).

The final step in estimating the out-of-pocket expenditures E(OOPE) i,d due to a voluntary deductible d was to subtract the expected out-of-pocket expenditures due to the mandatory deductible of CHF 230 from the expected out-of-pocket expenditures due to the total deductible x. We estimated the out-of-pocket expenditures due to the mandatory deductible the same way as the total out-of-pocket expenditures, with x in (10) and (11) being replaced with 230. Table 2 shows the average results per deductible.

The first row of Table 2 shows what the expenditures of the five subgroups would have been in a situation without a voluntary deductible. The difference with the first row of Table 1 captures both moral hazard and unfiled claims.

The necessary expenditure reduction due to less moral hazard

As a final step we wanted to examine whether the premium rebates actually offered in 2003, could have been offered in the presence of perfect risk equalization. With perfect risk equalization, the premium rebate for a deductible can be based only on out-of-pocket expenditures and a reduction in moral hazard, as argued in Section “Out-of-pocket expenditures and cost reductions”. In such a situation the actual rebates found in our data could have been offered only if the expenditure reduction due to less moral hazard equals or exceeds the actual financial gain found, as follows from Eq. (7) and (8). Accordingly, we calculated the (relative) necessary expenditure reduction m according to Eq. (12).

with \( \bar C_d \) the actual average financial gain found for the group of insured with voluntary deductible d and \( \overline {E(Y)} _d \) the average expected total expenditures.

Results

General statistics

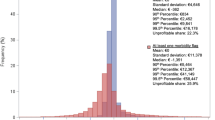

To quantify the actual financial gain for the insured with a deductible, we first estimated the total expenditures and the out-of-pocket expenditures, as described in Section “Method”. Table 3 indicates the validity of the procedure used to estimate the out-of-pocket expenditures. For the insured without a voluntary deductible, it shows the actual values of expenditures between CHF 230 (mandatory deductible level) and CHF 400, 600, 1200 and 1500 (total deductible levels) and the predicted expenditures in these intervals. Notice that for these insured the gross expenditures on top of the mandatory deductible of CHF 230 in year t are not affected by unfiled claims or reductions in moral hazard. The predicted expenditures of these insured might be slightly affected by the corrections described in Section “Expected expenditures”. However, the effect is negligible since these corrections were only applied to the gross expenditures of those with a voluntary deductible in one of the previous years; less than 3% of the insured without a deductible in year t had a voluntary deductible in t − 1, t − 2 and/or t − 3. From Table 3 it can be concluded that the predicted expenditures closely agree with the actual expenditures in these intervals. The distribution test mentioned in Section “Expected expenditures” revealed that for the normal, log-normal and Poisson distribution the correspondence between the actual and predicted expenditures in these intervals was substantially poorer.

Potential gain for insured without a voluntary deductible

It could easily be calculated how large the average financial gain of those without a voluntary deductible would have been if they had collectively chosen a voluntary deductible. This quantity, which we define as the potential gain, is shown in Table 4. It is calculated as the average premium rebate that these insured would have received for voluntary deductible d minus their average expected out-of-pocket expenditures due to d. This calculation ignores a possible reduction in moral hazard. If this would be taken into account as well then the potential gain would be even higher since a larger reduction in moral hazard might result in lower out-of-pocket expenditures.

From Table 4 it can be concluded that on average a voluntary deductible would have been beneficial for these insured. Table 4 also shows the proportion of insured that would have had a (positive) financial gain. Of course, part of these insured knew for sure that their out-of-pocket expenditures would exceed the deductible amount due to a chronic disease, for instance. They were not likely to choose a deductible as long as the premium rebate did not (far) exceed the deductible amount. Nonetheless, Table 4 reveals that this was definitely not the case for all the insured who did not choose a deductible. For 23% of these insured a voluntary deductible of CHF 170 would have been beneficial. This figure is 27% for a voluntary deductible of CHF 370, 38% for a voluntary deductible of CHF 970 and 43% for a voluntary deductible of CHF 1,270. Apparently, these (ex-post) potential gains were not large enough to induce these insured to take a deductible.

Actual financial gain in practice

After predicting the total expenditures for insured with voluntary deductible d we estimated their out-of-pocket expenditures according to Eq. (10) and (11). The average actual financial gain could be calculated by subtracting the estimated out-of-pocket expenditures from the premium rebate for voluntary deductible d. Table 5 shows the average actual gain per deductible in 2003.

We may not directly conclude that the actual financial gain exactly equals the minimum compensation considered in Section “Demanded premium rebate”. The reason is that some of the insured with deductible d would possibly also have chosen d in return for a lower rebate. However, we expect that the minimum compensation will not be far from the actual financial gain since the previous section revealed that a substantial number of insured did not choose a deductible while it would have yielded them a considerable financial advantage.

In general terms, these results indicate that the insurer had to offer a substantial premium rebate (relative to the out-of-pocket expenditures) to induce almost 50% of the insured to take a deductible. As described in Section “Offered premium rebate”, this is no problem in a health insurance market without perfect risk equalization like the Swiss basic health insurance. Premium rebates in these insurance markets can be very high because of the effect of self selection, despite the legal restrictions on premium rebates.

Necessary reduction in moral hazard

If we assume risk equalization to adjust perfectly for differences in health status between the insured with and the insured without a voluntary deductible, the premium rebate can be based only on cost sharing plus the reduction in moral hazard, as argued in Section “Out-of-expenditures and cost reductions”. The bottom row of Table 5 shows how large the expenditure reduction due to less moral hazard had to be to offer the actual premium rebates (found in the data) in the presence of perfect risk equalization. The reduction is presented as a percentage of the average expected expenditures of the insured with d.

To offer the actual rebate found for a voluntary deductible of CHF 170, the expenditure reduction had to be 1.3% relative to the expected expenditures of these insured, ceteris paribus. For the groups of insured having a voluntary deductible of CHF 370, 970 or 1,270 the reductions had to be 4.5, 20 and 48.8%, respectively.

To examine whether these reductions are likely to occur, these results can be compared with the results discussed in Section “Out-of-pocket expenditures and cost reductions”. In the RAND-experiment an expenditure reduction of 31% was found for a 95%-coinsurance plan with a maximum on out-of-pocket expenditures of $1,000. This plan can be seen as a high-deductible plan with the deductible amount being 134% (= $1,000/$ 749) of the average expenditures that insured were expected to have in case of full-coverage (Manning et al., 1987). van Vliet (2004) found that in the Dutch private health insurance of 1996 a deductible of Dfl. 1,750 led to an expenditure reduction of 14%. This deductible amount was about 69% (=Dfl. 1,750/Dfl. 2,548) of the average expenditures that insured were expected to have in case of full-coverage.

From Table 2 it can be calculated that in our data a voluntary deductible of CHF 170 is about 5% (=CHF 170/CHF 3,351) of the average expenditures that the insured with this deductible were expected to have in a situation without a voluntary deductible. For voluntary deductibles of CHF 370, 970 and 1,270 these figures are 13% (=CHF 370/CHF 2,929), 45% (=CHF 970/CHF 2,136) and 92% (= CHF 1,270/CHF 1,373), respectively. Comparing the necessary reduction with the results of Manning et al. (1987) and van Vliet (2004), we conclude that the actual rebate offered for a deductible of CHF 1,270 could definitely not have been offered in the presence of “perfect” risk equalization. We should be careful with a conclusion regarding the deductible of CHF 970 because of the low number of insured having that deductible in our data. Regarding the deductibles of CHF 170 and CHF 370 we conclude that the premium rebates actually offered could probably also have been offered in the presence of perfect risk equalization.

With respect to the lower deductibles, i.e. CHF 170 and CHF 370, one should notice that these results do not imply that a reduction of 1% will always be large enough to offer an attractive premium rebate. If the voluntary deductible of CHF 170 would have been the highest deductible available then the insured with voluntary deductibles of CHF 370, 970 and 1,270 in our dataset would presumably have taken the voluntary deductible of CHF 170. Since these insured are on average healthier, the average medical expenditures and average out-of-pocket expenditures in the group of insured with a voluntary deductible of CHF 170 would have been lower. Consequently, the necessary expenditure reduction would have been larger, according to Eq. (12).

Conclusion and policy implications

Theoretically, a risk avers consumer takes a voluntary deductible only if the premium rebate exceeds his/her expected out-of-pocket expenditures, i.e. if he/she expects to obtain a financial gain. In our 2003-data from Switzerland we found that the actual rebates for voluntary deductible d (far) exceeded the average out-of-pocket expenditures for insured with d. Moreover, our results reveal that a substantial number of insured did not choose a deductible although it would have yielded them a considerable financial advantage. This indicates that consumers demand a large financial compensation in order to be induced to take a (high) deductible.

In the absence of (perfect) risk equalization insurers can offer high premium rebates due to the effect of self selection. We conclude that, for high deductibles, such premium rebates cannot be offered in the presence of “perfect” risk equalization. In such a situation numbers of insured opting for a high deductible will be lower and the total reduction in moral hazard will be smaller than in the absence of (perfect) risk equalization.

The Swiss and the Dutch 2006-equalization schemes are “imperfect”, implying that part of the expenditure differences between the insured with and without voluntary deductible d can be reflected in the premium rebate for d. As a result, the level of cross-subsidization between the healthy and the unhealthy insured is lower than in a situation with perfect risk equalization. One way to increase cross-subsidization would be to include the level of deductible as a risk factor in the equalization model. Risk equalization would then “perfectly” adjust for differences in health status between those who choose a deductible and those who do not. As shown in this paper, this would also lead to a smaller number of insured choosing a deductible and a smaller reduction in moral hazard. Since the main goal of user charges is to reduce moral hazard, some effect of self selection on the premium rebate can be justified to increase the viability of voluntary deductibles.

References

Bakker F.M., van Vliet R.C.J.A., van de Ven W.P.M.M. (2000) Deductibles in health insurance: Can the actuarially fair premium rebate exceed the deductible?. Health Policy 53:123–141

K. Beck (2004) Risiko Krankenversicherung — Risikomanagement in einem regulierten Krankenversicherungsmarkt (Health insurance — risk management in a regulated health insurance market). Bern: Haupt Verlag.

Beck K., Spycher S., Holly A., Gardiol L. (2003) Risk adjustment in Switzerland. Health Policy 65: 63–75

Browne M.J. (1992) Evidence of adverse selection in the individual health insurance market. The Journal of Risk and Insurance 59: 13–34

Burrows C., Brown K., Gruskin A. (1993) Who buys health insurance: A survey of two large organizations?. Australian Journal of Social Issues 28: 106–123

Duan N., Manning W.G., Morris C.N., Newhouse J.P. (1983) A comparison of alternative models for the demand for medical care. Journal of Business and Economic Statistics 1:115–126

Edwards W. (1955) The prediction of decisions among bets. Journal of Experimental Psychology 50: 201–214

Fishburn P.C. (1983) Transitive measurable utility. Journal of Economic Theory 31: 293–317

Gardiol, L., Geoffard, P.-Y., & Grandchamp, C. (2005). Separating selection and incentive effects: An econometric study of Swiss health insurance claims data. Working Paper, Institute for Health Economics and Management, University of Lausanne.

Kahneman D., Tversky A. (1979) Prospect theory: An analyses of decision under risk. Econometrica 47:263–291

Keeler, E. B., Buchanon, J. A., Rolph, J. E., Hanley, J. M., & Reboussin, D. M. (1988). The demand for episodes of medical treatment in the Health Insurance Experiment. RAND Report R-3454-HHS, Santa Monica: CA.

Kunreuther H., Pauly M. (2004) Neglecting disaster: Why don’t people insure against large losses?. Journal of Risk and Uncertainty 28:5–21

Machina M.J. (1987) Choice under uncertainty: Problems solved and unsolved. Economic Perspectives 1:121–154

Manning W.G., Mullahy J. (2001) Estimating log models: To transform or not to transform?. Journal of Health Economics 20:461–494

Manning W.G., Newhouse J.P., Duan N., Keeler E.B., Leibowitz A., Marquis M.S. (1987) Health insurance and the demand for medical care: Evidence from a randomized experiment. American Economic Review 77:251–277

von Neumann J., Morgernstern O. (1944) Theory of games and economic behaviour. Princeton, Princeton University Press

Pratt J.W. (1964) Risk aversion in the small and the large. Econometrica 32: 122–136

van de Ven W.P.M.M., van Praag B.M.S. (1981) The demand for deductibles in private health insurance: A probit model with sample selection. Journal of Econometrics 17: 229–252

van Vliet R.C.J.A. (1995) Financiële consequenties van eigen bijdragen in de gezondheidszorg: een modelmatige benadering. (Financial consequences of co-payments in health care: an approach through modeling). Het Verzekerings-Archief 72: 66–74

van Vliet R.C.J.A. (2004). Deductibles and health care expenditures: Empirical estimates of price sensitivity based on administrative data. International Journal of Health Care Finance and Economics 4:283–305

Acknowledgement

The authors gratefully acknowledge the valuable comments of three anonymous reviewers. They thank CSS for the provision of data and Urs Käser-Meier for excellent preparation of the data set.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This is an open access article distributed under the terms of the Creative Commons Attribution Noncommercial License ( https://creativecommons.org/licenses/by-nc/2.0 ), which permits any noncommercial use, distribution, and reproduction in any medium, provided the original author(s) and source are credited.

About this article

Cite this article

van Kleef, R.C., Beck, K., van de Ven, W.P.M.M. et al. Does risk equalization reduce the viability of voluntary deductibles?. Int J Health Care Finance Econ 7, 43–58 (2007). https://doi.org/10.1007/s10754-007-9011-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10754-007-9011-1