Abstract

Due to the complex nature of some products and the different quality of returns, in closed-loop supply chains there might be different types of reverse processes and reverse flows, including repaired, refurbished, remanufactured, or recycled goods. These reprocessed goods return to different echelons of the supply chain according to their quality, and the volume of each type of reverse flow (i.e. the returns share) may significantly vary between different supply chains, affecting the dynamic behaviour of the entire system. The aim of this work is to explore the impact of the volume of returns among multiple reverse flows in a closed-loop supply chain where each member can have its own reverse flow. We analyse a four-echelon closed-loop supply chain, where a collector is in charge of collecting and inspecting the returns and sending them to the different echelons depending on their quality. An agent-based simulation model considering different return rates, coefficient of variations for the forward lead times, and returns share is developed and evaluated in terms of bullwhip effect. We observe that considerable volume and medium–low quality of the returns enable bullwhip effect reduction in systems where returns are shared among all the members of the supply chain. However, in single reverse flow closed-loop supply chains, moderate volume and high quality of the returns are preferable to gain improvements both in terms of order and inventory variability. From a managerial point of view, we provide useful recommendations for companies adopting closed-loop.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

1.1 Context and background

A widely researched topic in contemporary Supply Chains (SC) is the Bullwhip Effect (BWE), which refers to the amplification of orders through the echelons of a SC and it can be defined as that “tendency of replenishment orders to increase in variability as one moves up a SC” (Disney and Lambrecht 2008). The BWE negatively impacts SCs performance: it causes inefficiencies along the SC leading to overproduction and excessive orders, increased inventories, waste and raw material/energy consumption, poor customer service and inaccurate demand forecasting (see e.g. Trapero et al. 2012; Braz et al. 2018; Dolgui et al. 2020). All the above-mentioned consequences involve substantial costs, making the BWE one of the most detrimental phenomena for a SC.

In this fashion, since the seminal work of Forrester (1961), several studies have explored the causes, economic consequences, and remedies of this undesirable phenomenon, specifically in Forward SCs (FSCs), e.g. Chatfield et al. (2004), Costa et al. (2022). However, fewer studies have investigated the BWE in Closed-Loop SCs (CLSCs) (Braz et al. 2018). CLSCs refer to a combination of a FSC and a Reverse SC (RSC). In FSCs, the inputs are raw materials, and the outputs are products to satisfy market demand. On the contrary, in RSCs the inputs are the used products returned by the customers and the outputs are new material or reprocessed products to be re-inserted in the FSC. Used products that the customers return to be recovered are generally named returns and accounted by the return rate, i.e. percentage of used products that become returns. The advantages of CLSCs are considerable (Cannella et al. 2021), e.g. costs and emissions reduction (Braz et al. 2018; Hasanov et al. 2019) and several studies on this topic show that the existence of a reverse flow may positively affect the BWE (Tang and Naim 2004; Zhou & Disney 2006; Adenso-Díaz et al. 2012; Cannella et al. 2016; Zhou et al. 2017). In fact, nowadays more and more companies are moving from FSC structures to closed-loop variants to mitigate environmental impacts and exploit economic opportunities (Govindan et al. 2015).

However, the CLSC structure, by nature, is characterised by higher complexity, compared with the FSC, due to the time, quantity, and quality uncertainties of the returns. Specifically, the quality of the returns is a main source of uncertainty (Liao et al. 2019; Goltsos et al. 2019; Dominguez et al. 2020) and several scholars focus on it (Peng et al. 2020). Guan et al. 2021 carried out a comprehensive bibliometric analysis of two decades of research on CLSC and they discovered “quality” to had become a hot topic in the area of CLSCs, being an emergent word appearing in 2018–2020. Therefore, managing the uncertainty of the quality represents a significant problem for the design and analysis of CLSCs (Ponte et al. 2021). This problem is due to the several recovery processes that exist in real-life applications that are very much dependent on the nature of the industry (Masoudipour et al. 2017) and on the original product design (Abbey and Guide 2017), e.g. repairing, reusing, reconditioning, refurbishing, remanufacturing, repurposing/recontextualizing and recycling (King et al. 2006; Lüdeke-Freund et al. 2019; Farooque et al. 2019; Peng et al. 2020). All these processes have specific characteristics and different purposes, e.g. the identification of a new use for a product (reusing/ repurposing) or the recovery of the residual value of used products or their component through their total dismantling (remanufacturing/recycling). They take place at different levels and involve different actors across the SC (Batista et al. 2018). Therefore, returns can be shared among the members of the CLSC, according to their quality. The selection of the recovery process depends on the quality of the return; therefore, inspection is critical to determine the quality and the most suitable recovery strategy (Prahinski and Kocabasoglu 2006). Returns with high quality need less operations and can be more easily reused or repaired, which are initiatives typically involving the downstream echelons of a SC (Batista et al. 2018). Meanwhile, low-quality returns require more operations and are generally remanufactured or recycled. Thus, to hypothesize the same quality for all the returns, as most of previous works in the literature assume, result inconsistent with real-life situations (Goltsos et al. 2019). In conclusion, contrary to what is commonly assumed, CLSCs comprise different reverse processes based on different quality returns. Therefore, it is important to develop models that consider these possibilities, in order to understand their impact on the dynamics of CLSCs. Indeed, there is the need to expand the existing literature of the CLSCs field with different reverse options, where at each echelon it is possible to create loops. Currently, the most common assumption in the CLSC literature is to assume a single reverse flow (e.g. see Adenso-Díaz et al. 2012; Hosoda and Disney 2018) with hybrid manufacturing/remanufacturing systems (see e.g. Zhou and Disney 2006, Ponte et al. 2019 and Cannella et al. 2021 among others). Here, once returned products are available, they move to the remanufacturing process and then become available for the inventory of the SC echelon that is involved in the reverse operations, i.e. typically the retailer.

To the best of the authors’ knowledge, Zhou et al. (2017) and Dominguez et al. (2021) are the only works in the SC dynamics literature that study the BWE in a CLSC with separate reverse flows. Zhou et al. (2017) studied a three-echelon SC where each echelon had its own reverse logistics operations, in addition to its usual forward operations. In this setting, the authors addressed the impact on the BWE of the return rate, product consumption lead time, and remanufacturing lead time and found out that, when remanufacturing lead time increases, the CLSC overall performance is reduced, and vice versa. Dominguez et al. (2021) studied a divergent CLSC with several point-of-sales and reverse flows. They focused on the impact of two different remanufacturing configurations (i.e. centralised vs decentralised) on the BWE, revealing that centralized configurations can reduce the uncertainty in the reverse flows of remanufactured products and of the production orders, and they can improve inventory performance.

However, the impact of different volumes of returns among the members of the SC (i.e. the returns share) on the BWE has not been addressed in the aforementioned contributions. Zhou et al. (2017) presented two scenarios of returns share, but in the experiments, they focused on analysing the above-mentioned factors. While in Dominguez et al. (2021), although a more complex CLSCs structure is modelled, each reverse flow was connected only to a single member of the same echelon (i.e. the retailers).

Therefore, there is a lack of studies addressing the impact of the returns share among different echelons of a CLSC on the BWE, which may be a significant design factor to consider in this kind of SCs.

1.2 Objective

Motivated by the above-mentioned considerations, the objective of this work is to explore the impact of the returns share in CLSCs in terms of BWE. To do so, we model a four-echelon CLSC, i.e. factory, distributor, wholesaler, and retailer, with an external member in charge of collecting and inspecting the returns, i.e. the collector, where the reverse flow of returns could be sent to each member of the SC. In order to emulate real-life recovery processes, we assume that returns are characterized by different quality levels, i.e. they can be reprocessed in different manners (e.g. remanufacture and repair), and that the returns’ recovery duration depends on their quality (Zikopoulos 2017). Returns with high quality require less operations (e.g. repair) and less reverse lead time, i.e. the time needed to recover the returns, while returns with low quality require more operations (e.g. remanufacture) and more reverse lead time to be recovered. We assume that returns with high quality are sent to the downstream echelons, while returns with low quality are sent to the upstream ones.

We adopt a full-factorial experiment design varying the following factors: return rate, coefficient of variation for the forward lead times, and returns share. We consider two different scenarios: (1) multiple reverse flows CLSC, i.e. CLSCs with multiple reverse flows where collected returns are sent to all echelons of the SC depending on their quality, and (2) single reverse flow CLSC, i.e. CLSCs with a single reverse flow where collected returns are sent to one echelon as they are characterized by the same level of quality. In these scenarios, we analyse seven possible configurations. In the former scenario, we analyse (I) equal returns share for each echelon of the chain, emulating the case in which each echelon receives the same amount of returns, (II) increasing returns share from downstream echelons to upstream ones, that emulates the case in which the factory receives more return and, thus, the majority of the returns are characterized by low quality, and (III) decreasing returns share from downstream echelons to upstream ones, that emulates the case in which the retailer receives more returns and, thus, the majority of the returns are characterized by high quality. In the latter scenario, we analyse the cases where all the returns are sent either to the (IV) retailer or to the (V) wholesaler, and the case where they are sent either to the (VI) distributor or to the (VII) factory.

We decided to simulate all these different loops or returns share configurations, as depending on the final product, there are some SC that are more likely to implement one configuration, or another. In real-life, a decreasing returns share configuration can be associated to those SC where practises like reusing and repairing are more common than recycling, i.e. the majority of returned products are characterized by a good level of quality (EMF 2013; Zhang et al. 2021). For instance, in the textile industry, practises like reusing (e.g. second-hand clothes) are quite common, as well as for electronics (EMF 2018). As well as in the automotive sector, for example Volkswagen achieved 70% of cost savings by reusing car engines and parts (Wang and Wu 2021). In addition, electric vehicle batteries (EVB) can be remanufactured, repurposed, reused, and recycled (Alamerew and Brissaud 2020). However, there exists a ratio of returned product that does not meet the quality standards to go through those reverse processes. For this reason, the decreasing returns share represents this kind of real SC situations when a significant percentage of returned products reaches a high-quality level, but there is a percentage that has lower quality. Differently, for those SCs that, for instance, produce packaging, glass bottles, or cans, it is almost impossible to reuse or repair them when returned, even if they can be recycled repeatedly without losing their original quality (Wang and Wu 2021). Thus, these SCs are more likely to recycle materials, i.e. they are more likely to meet the increasing returns share configuration or the boundary scenarios of single reverse flows CLSC where the returns are entirely sent to upstream echelons.

To emulate these CLSC scenarios, we adopt the agent-based modelling simulation technique, among the most commonly used techniques to study the impact of different factors on the performance of a RSC or CLSCs (Dev et al. 2017). We adopt the order variance ratio to evaluate the performance of the SC, which is by far the most widely used measure to detect the BWE (Cannella et al. 2013) and the inventory variance ratio, to evaluate inventory dynamics.

Our findings contribute to the knowledge on CLSC dynamics and can help facing design problems as different possible closed-loop solutions are compared. In general, we observe that every CLSC configuration outperforms the FSC in terms of order variability. In line with prior works, we find that the higher the return rate (i.e. the returns volume), the more CLSC echelons can benefit from order variability reduction. In addition, we demonstrate the importance of managing both quantity and quality of the returns to balance the effect of reverse operations from both the orders and inventory perspective. Indeed, depending on the specific CLSC scenario (i.e. single or multiple reverse flows), their combination (i.e. high quality and low quantity or low quality and high quality) can result more beneficial in terms of BWE reduction.

The rest of this paper is structured as follows. Section 2 provides the literature review of CLSCs dynamics. Section 3 describes the CLSC model under study. Section 4 defines the experimental design. Section 5 shows and discusses the numerical results. Section 6 summarises the main findings and provides some managerial implications. Finally, Sect. 7 presents the conclusions and directions for future research.

2 Literature review

In this section, we provide a summary about the state-of-the-art of BWE in FSC, and then a literature review on the BWE in CLSCs is provided.

The importance of studying and minimising the BWE in FSC is due to the fact that it occurs in about two-thirds of firms, and it may impact their profitability by 10–30% (Moritz et al. 2022). In the well-established literature on this detrimental phenomenon consisting of studying the order variability amplification along the SC, it is considered that the major causes of the BWE in the FSC are demand forecasting, price variation, lead time, and the structure of the SC (Yu and Yan 2021). Lead-time reduction and information transparency have been identified as potential areas for reducing/removing the propagation of the BWE across FSCs to avoid the negative impact that it can have on inventory cost and extra cost, customer service level, logistics and transportation efficiency (Framinan 2022).

Recently, more and more companies are leaving the FSC configuration and are switching to CLSCs, a fact that has led academics to investigating the BWE on CLSCs during the last two decades. Indeed, since the first work on this topic by Tang and Naim (2004) affirmed that CLSCs face less order variability as compared to FSCs, more than the 80% of the subsequent studies on this field agree with the conclusion that the BWE can be decreased or mitigated in CLSCs (Braz et al. 2018). Among them, Adenso-Díaz et al. (2012) analyse the various significant factors on the CLSC dynamics, i.e. return rates, such as those of the FSC, e.g. lead times and proportional controllers. Using simulation, they showed that the BWE highly depends on the percentage of returns. Turrisi et al. (2013) propose a new replenishment policy to better coordinate the reverse flow of material with the forward one. After an analysis in terms of inventory variance, they showed that it increases with the reverse flow variability. Cannella et al. (2021) investigate the value of proportional order-up-to policies (POUT) policies and the adjustment of their inventory controllers in a CLSCs that face a twofold uncertainty of the demand and of the returns. They find that, considering both the cost structure and the average return rate, a large operational BWE-related cost savings can be reached by appropriately tuning the inventory controllers in CLSCs. Lin et al. (2022) developed a stylized model of the hybrid manufacturing/remanufacturing system to evaluate the order variance in relation to product demand frequency, product return rate, and product return delay under push and pull policy scenarios. They find that the product return rate is the key factor influencing the policy selection.

However, due to the different modelling assumptions (Cannella et al. 2016) and the additional sources of uncertainties that characterize CLCSs (Goltsos et al. 2019), different researchers found that CLSCs are more likely to experience higher BWE than FSC. Among them, Hosoda et al. (2015) observed through a mathematical model and a numerical study that increasing the return rate may have a negative impact on the system. Moreover, they stated that sharing information may reduce inventory variance, but at the expense of increased production variance. Dominguez et al. (2021) analysed different return rates, information transparency levels, and number of nodes in the SC using a simulation model. They observe that high return rates may have a negative impact on the dynamic performance of the CLSCs members due to the uncertainty added in the inventory management system by the returns. Recently, Papanagnou (2021) stated that Internet of Things can reduce costs associated with inventory fluctuations and eliminate the BWE in CLSC. Tombido et al. (2020) conducted a comparison of series and divergent CLSCs. They showed that it is more beneficial to have one reliable collector than more than one collector with uncertainties in the quantity of products returned. In general, most of the contributions have focused on the impact of the volume of the returns, the duration of the reverse logistics operations, the transparency of information on the remanufacturing process, and the ordering policy (Dominguez et al. 2020), which are the main factors studied in the CLSCs dynamics field.

Regarding the methodological approach, there are several methods that have been used in the literature such as difference equation modelling (e.g. Cannella et al. 2016) and control theory (e.g. (Zhou et al. 2017, Ponte et al. 2021), among others. In particular, thanks to the natural correspondence between SC members and agents, the agent-based modelling simulation (ABMS) is more and more used in the SC dynamics literature (see e.g. Adenso-Díaz et al. 2012, Ponte et al. 2017, Dominguez et al. 2018, Naghavi et al. 2020).

3 Model description and methodological approach

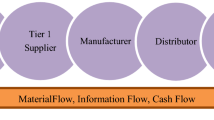

In this paper, we model a multi-echelon CLSC where each member of the SC may have its own reverse flow of returns. The SC structure (Fig. 1) consists of a four-echelon FSC composed of a factory, a distributor, a wholesaler and a retailer (i = 1,2,3,4), based on the well-established work of Chatfield et al. (2004). Lower echelons place orders to the next upper echelon that fills them. The factory places orders with an external supplier and the retailer sells the products to an external customer. At the end of the life-cycle of the product (i.e. consumption lead times), the customer returns a fraction of the used products to one collector, i.e. centralized CLSC configuration that according to Dominguez et al. (2021), as mentioned in Sect. 1, and Tombido et al. (2020) is more beneficial in terms of CLSC dynamic performance than the decentralized one. To reflect real industrial cases, as explained in the previous section, we assume that each member of the SC can receive returns and reprocess them. Thus, we assume that the collector, after collecting and inspecting the returns, sends them to the different members of the FSC, depending on their quality. Once all members receive the returns, the recovery process starts.

3.1 Modelling Assumptions

The SC model relies on widely accepted assumptions in SC dynamics: the ones concerning the FSC are based on Chatfield et al. (2004), while the ones concerning the RSC have been defined according to Cannella et al. (2016), extended to our specific configuration.

-

Single-product serial SC. We assume a single-product SC where each echelon interacts only with the previous one, the following one, and, depending on the scenario, with the collector.

-

Customer demand. A demand D is observed by the customer, following a normal distribution with mean \({\mu }_{D}\), estimated by \(\overline{D }\), and variance \({\sigma }_{D}^{2}\) estimated by \({s}_{D}^{2}\). Demand is truncated to non-negative values.

-

Forward lead time. The forward lead time L of the echelon i is assumed to be stochastic and gamma distributed. Forward lead times are assumed to be stationary, independent, and identically distributed with mean \({\upmu }_{{L}_{i}}\) estimated by \({\overline{L} }_{i}\), and variance \({\sigma }_{{L}_{i}}^{2}\) estimated by \({s}_{{L}_{i}}^{2}\), where LT c.v. = \({\sigma }_{{L}_{i}}\)/\({\upmu }_{Li}\) is the coefficient of variation.

-

No negative orders. Products delivered cannot be returned back. This assumption has been chosen because it has been widely demonstrated in the literature that their allowance produces an overestimation of the BWE (Chatfield and Pritchard 2013; Dominguez et al. 2015; Wang and Disney 2016).

-

p-period moving averages (MA(p)) and moving variances (MV(p)) as the forecast technique for incoming orders.

-

All-data approach for forecasting lead times. To evaluate the estimated lead times, i.e. mean and standard deviations, each echelons uses the entire historical data that are available.

-

The factory places orders to an external supplier with unlimited capacity.

-

Backlogs and partial shipments are allowed.

-

Inventory policy and forecasting. Each echelon in the SC uses the periodic-review Order-Up-To (S,R) replenishment rule (Disney and Lambrecht 2008), which is a largely used periodic review policy in the literature and in practical applications (e.g. Liu and Wang 2007; Corsini et al. 2022). The Order-Up-To (OUT) level, \({S}_{i}^{t}\), is the base stock that allows the system to meet the demand during the time period \({L}_{i}+R\) that represent the protection period. At the beginning of every period t, the echelon i places an order to raise the inventory position to \({S}_{i}^{t}\). To compute \({S}_{i}^{t}\), echelon i can access the demand data from previous periods (which are used to forecast \({D}_{i}^{t}\), the expected average demand at time t, \({\overline{D} }_{i}^{t}\), and its variance,\({s}_{{D}_{i}^{t}}^{2}\)), and the lead time data from previous periods, and uses this information to generate forecasts for the average lead-time demand mean \({\overline{X} }_{i}^{t}\) and variance \({s}_{{X}_{i}^{t}}^{2}\).

$${S}_{i}^{t}={\overline{X} }_{i}^{t}+z{s}_{{X}_{i}^{t}}$$(1)

where:

-

Orders \({O}_{i}^{t}\) are placed by each echelon at each time unit to raise their current inventory position to the target OUT level \({S}_{i}^{t}\), as described by Eq. (4). Where \({WIP}_{i}^{t}\) represents the work in progress (i.e. the inventory on order but not yet arrived),\({B}_{i}^{t}\) the backlogs and \({I}_{i}^{t}\) the current inventory.

$${O}_{i}^{t}={\mathrm{S}}_{i}^{t}-{\mathrm{I}}_{i}^{t}-{WIP}_{i}^{t} +{B}_{i}^{t}$$(4)

Moreover, we assume that there is information transparency for the reverse process, i.e. the SC echelon involved in the reverse process updates its work in progress taking into account the amount of the returns that will receive after the reverse lead time. Thus, \({WIP}_{i}^{t}\) can be expressed as in Eq. (5), i.e. the sum of the inventory on order but not yet arrived related to the forward process, \({({WIP}_{F})}_{i}^{t}\) and that related to the reverse process \({({WIP}_{R})}_{i}^{t}\).

-

A push policy is assumed to operate at the collector: once returns are collected, they are directly sent to the FSC. This is the preferred modelling decision in the field of CLSC dynamics (Goltsos et al. 2019), see e.g. Ponte et al. (2020) and Dominguez et al. (2019).

-

Only a percentage α \((0\le \alpha \le 1\)), named return rate, of market sales can be returned from the customer to the collector. The remaining quantity, i.e. 1-α, is hypothesized to be unusable or disposed to a landfill.

-

Before used products become available for the collector, they are held by the customers for a time known as consumption lead time that represents the products life duration. It quantifies the time lag between the sale of the products and their collection. The consumption lead time \({L}_{c}\) has been modelled as normally distributed with mean \({\mu }_{{L}_{c}}\) and variance \({\sigma }_{{L}_{c}}^{2}\).

-

Reverse lead times. One of the defining characteristics of real-life CLSCs is the variability of reverse lead times due to the uncertain quality of returns (Dominguez et al. 2020). Once the returns are available for every echelon, the time required to reprocess them can vary according to their quality. To reflect this condition as much as possible, we assume that such recovery operations require different reverse lead times depending on their quality. Specifically, we assume deterministic reverse lead times \({L}_{{r}_{i}}\) with mean \({\mu }_{{L}_{{r}_{i}}}\) that are inversely proportional to the returns’ quality. For the sake of simplicity, we assume that reverse lead times include the time required for inspection and transportation, performed by the collector, as well as the time required for the recovery processes, performed by the involved SC member. We assume that the retailer will receive returns with a a high level of quality, i.e. those that need less reverse lead time to be reprocessed. In contrast, the factory will receive returns with low level of quality, i.e. that need more reverse lead time to be reprocessed. To represent this hypothesis, we assume that the reverse lead time of the factory, i.e. \({\mu }_{{{L}_{r}}_{1}}\), is equal to the forward lead time, according to the findings of prior works, such as e.g. Hosoda and Disney (2018), while the other reverse lead times decrease downstream.

-

Once the returns are reprocessed, it can be assumed that they are as-good-as new products from the forward process (Braz et al. 2018). After the reverse operations, the quality of products coming from the reverse flow, i.e. reprocessed returns, is the same as those coming from the forward flow.

-

When the collector receives the returns from the customer, they will be sent to a specific echelon according to their quality. The ratio of the return rate that goes to echelon i is named returns share and is identified by \({\vartheta }_{i}\), thus each echelon receives \({\vartheta }_{i}*\alpha\) returns. It follows that \(\sum_{i=1}^{4}{\vartheta }_{i}=1\).

3.2 Dynamics of the supply chain

At the beginning of each time unit, the first event that occurs is the demand generation. The customer generates a random demand. Then the collector receives the returns and, after collecting and inspecting the returns, sends them to the SC echelons that will reprocess them depending on their quality. Finally, all the other members perform the following sequence of actions, starting from the retailer:

-

1.

Update the OUT level \({S}_{i}^{t}\) based on the forecast calculated in the previous time unit.

-

2.

Place an order \({O}_{i}^{t}\) to bring the inventory position to the new value of \({S}_{i}^{t}\).

-

3.

Receive the products from the echelon upstream and returns from the collector, so update inventory and work-in-progress accordingly.

-

4.

Receive new orders from the downstream echelon, satisfy the demand fully or partially, and then update inventory and backlog accordingly.

-

5.

Update the forecast that will be used in the following time unit, i.e. the forecasting frequency is one time unit.

3.3 Methodology

Managers in the decision-making process because it can help them understand complexities, dynamics and interactions that characterize SCs (Oliveira et al. 2016). As well as a decision-making tool for SC optimization (Long and Zhang 2014). Specifically, researchers have used the ABMS technique due to the link between agents and SC members (Cannella et al. 2019). ABMS refers to a category of computational models invoking the dynamic actions, reactions, and intercommunication protocols among the agents in a sharing environment to evaluate their performance (Abar et al. 2017). An agent-based approach to SC simulation has several advantages, such as the possibility to develop and implement simulation models with multiple layers and achieve a resilient and flexible system (Abar et al. 2017). Furthermore, ABMS is fully consistent with SC realities (Long and Zhang 2014). Therefore, to manage the complexity of the CLSC that we choose to analyse in this work, we selected ABMS as simulation methodology using AnyLogic as simulation software (see e.g. Ivanov and Rozhkov 2020).

The validation of a simulation model is an important step to ensure that it concerns what already exists in literature and to prove the reliability of the tools that are used. In this regard, our simulation model has been validated using the results obtained by Chatfield et al. (2004) and Dominguez et al. (2015) as shown in Appendix A.

4 Metrics and experimental design

The performance of CLSCs might depend on how firms deal with the BWE as it is one of the main sources of inefficiencies in current SCs (Braz et al. 2018). The BWE in SCs increases costs such as overproduction and useless waste, and thus, it is a valid key performance indicator for both economic and sustainable performance. The “Order Variance Ratio” OrVrR is by far the most widely used measure to detect the BWE (Cannella et al. 2013). It measures the total amplification of orders, and it is defined as the ratio of the variance of orders placed by a generic echelon i to the variance of the demand placed by the final customer.

Furthermore, to have a clear vision on the dynamic of our SC, we included the “Inventory Variance Ratio” InvVrR, which is the ratio of the variance in the inventory of a generic echelon i to that of the demand of the final customer. This metric relates to the service level (Ponte et al. 2022), i.e. the higher the variance of the inventory, the higher the safety stock required to reach a specific service level, thus, it measures the potential undesired extra costs that the SC echelon may face.

To investigate the impact of different volumes of returns among the members of the CLSC on the BWE, we adopted a Design of Experiments (DoE) approach. To set the numerical values for the experiments, we employ values taken from the related literature. More specifically, lead times, forecasting, and demand are from Chatfield et al. (2004), while return rates are from Cannella et al. (2016). Concerning the returns share, we adapted and extended those of Zhou et al. (2017), i.e. equal return yield and convex decreasing return yield. In the first case, each member of the SC receives the same percentage of returns, while the second one refers to the case of high-quality returns, i.e. when returns have a much higher chance of being reprocessed in the downstream echelons. In our work, we analyse the two main scenarios of (1) multiple reverse flows CLSC, i.e. where every echelon receives a certain volume of returns, and (2) single reverse flow CLSC, i.e. where collected returns are sent to one echelon.

Specifically, we analyse seven returns share configurations. (I) Equal returns share for each echelon of the chain ϑi = [0.25,0.25,0.25,0.25], that emulates the case in which each echelon receives the same amount of returns, e.g. when α = 0.4 each echelon receives 0.4*0.25 = 0.1 of the returns. (II) Increasing returns share from downstream echelons to upstream ones ϑi = [0.4,0.3,0.2,0.1], that emulates the case in which the factory receives more returns and, thus, the majority of the returns are characterized by low quality. (III) Decreasing returns share from downstream echelons to upstream ones ϑi = [0.1,0.2,0.3,0.4], that emulates the case in which the retailer receives more returns and, thus, the majority of the returns are characterized by high quality. Finally, when the total amount of the returns are sent to the (IV) retailer ϑi = [0,0,0,1], or to the (V) wholesaler ϑi = [0,0,1,0], or to the (VI) distributor ϑi = [0,1,0,0] or to the (VII) factory ϑi = [1,0,0,0].

We studied the impact of different volumes of returns among the members of the SC in several scenarios varying the values of the return rate, the coefficient of variation for the forward lead and the returns share (see Table 1). We run a factorial experiment with these factors resulting in 42 (3 return rates × 2 lead time c.v.’s × 7 returns share) scenarios, that have been reduced to 30 scenarios due to the absence of returns when α = 0. The scenario with α = 0 has been included as a benchmark. Numerical experiments are performed using the settings described in Table 2. Simulation runs consisted of 20 replications of 3,500 periods each, with the first 1,500 periods of each replication removed as a warm-up.

5 Numerical results and discussion

In this section we present the numerical results obtained; first, we focus on the OrVrR, and then on the InvVrR.

5.1 Analysis of the order variance ratio

Table 3 shows the results for OrVrR (averages and 95%-confidence intervals) for each scenario, and Δ, which is the percentage difference between the closed-loop scenario and the forward one (α = 0.0) with the same coefficient of variation for the forward lead times. Looking at the results, we note that the confidence intervals do not overlap among the different scenarios.

To start, we focus on the multiple reverse flows CLSC, i.e. where every member of the SC receives a certain percentage of the returns, referring to Fig. 2a. Thus, equal, increasing and decreasing returns share. Results show that, in each scenario, in terms of the OrVrR indicator, the CLSC outperforms the FSC. Differences are smaller at downstream echelons (< 5%), and up to more than 60% at upstream echelons. For α = 0.4 there are no relevant differences between the three scenarios, since the differences in the resulting amount of returns that go to each echelon are insignificant, for example, the wholesaler receives 10%, 12% and 8% of the returns, respectively, for equal, increasing and decreasing returns share. By increasing the return rate, i.e. α = 0.7, we observe a significant OrVrR reduction. Moreover, the distributor and the wholesaler take advantage when the returns share decreases from the retailer to the factory, i.e. when the majority of the returns have high quality, even if this advantage marginal compared to the impact of α. This result suggests that multiple reverse flows CLSCs are more sensitive to the return rate than to the returns share.

Now, we focus on single reverse flow CLSC referring to Fig. 2b. Results show that there is OrVrR reduction from the echelon that receives the returns to the upstream ones, as compared to the α = 0 scenario. For instance, when ϑi = [0,0,0,1], from the retailer to the factory, every member shows an OrVrR reduction compared to the FSC scenario. Contrarily, when ϑi = [1,0,0,0] the retailer, the wholesaler and the distributor show the same trend of the FSC and the factory is the only member that takes advantage of the reverse flow. In general, the retailer is the less influenced members by different returns share. Indeed, in most of the scenarios, it shows small values of Δ in Table 3, except when ϑi = [0,0,0,1] and α = 0.7, where Δ = 40%, i.e. on receiving the entire volume of returns. While the factory is the only member that, no matter the scenario, always benefits from the reverse process. In fact, its Δ is always higher than 25%, i.e. no matter the returns share the factory always benefits from a significant OrVrR reduction. On the other hand, the wholesaler and the distributor explore the larger range of Δ, from less than 5% up to more than 50% depending on the return rate and the returns share combination.

In general, by by looking at the performance of each echelon individually, they benefit from the greatest reduction in BWE when they receive the total amount of returns. Indeed, for instance, the factory reaches Δ = 71% when ϑi = [1,0,0,0], i.e. see Table 3. However, looking at the SC overall performance, results suggest to concentrate the returns in the downstream echelons, especially for high return rates, to let every echelon benefit from a lower BWE. For instance, in Fig. 2b, both ϑi = [0,0,0,1] and ϑi = [0,0,1,0] scenarios show significant improvements in the BWE of every SC echelon.

An interesting observation is that the OrVrR indicator does not always increase from one echelon to the next, and that, under some conditions, it may decrease. Particularly, it happens for high return rates, when the majority, or the entire amount, of the returns, goes to downstream echelons. When the SC is closed at the factory (or at the distributor), the observed OrVrR in this echelon is lower than that in the previous echelon.

Now we move to the analysis of different coefficients of variation for the forward lead times referring to Fig. 3,i.e. LT c.v. = 0 on the left column and LT c.v. = 0.5 on the right column. Comparing the results, we observe that, as in FSCs, when the LT c.v. grows, OrVrR grows too, but returns can dampen its growth. When α = 0 and the lead time coefficient of variation increases from 0.0 to 0.5, the increase in the OrVrR indicator is 32%, 39%, 34% and 21% for the factory, the distributor, the wholesaler and the retailer, respectively. For instance, for α = 0.4 and ϑi = [0.25,0.25,0.25,0.25] the increase in OrVrR drops to 23%, 30%, 26% and 14% for the factory, the distributor, the wholesaler and the retailer, respectively. Each CLSC scenario shows a smaller difference between LT c.v. = 0 and LT c.v. = 0.5 than the α = 0 scenario. With the exception, for the echelons placed lower than the reverse flow, of the single reverse flow CLSC scenarios, e.g. when ϑi = [0,1,0,0] the retailer and the wholesaler, are not affected by BWE reduction and neither by this dampening effect. Consequently, to take advantage of this dampening effect in the OrVrR, once again, results suggest that it is better to concentrate returns in the downstream echelons.

5.2 Analysis of the inventory variance ratio

In order to have an overall view of the dynamic behaviour of the CLSC in terms of BWE, it is important to manage both the orders and the inventory perspective. In this regard, here we discuss the InvVrR. From the discussion on the OrVrR it emerges that the impact of the coefficient of variation for the forward lead time is in line with prior work of the SC dynamics field (i.e. its increase implies BWE increase); moreover, its impact is marginal compared to the other selected experimental factors. Thus, for the sake of brevity, in this subsection we omitted it, and we focus on the returns share and the return rate.

Starting from the analysis of the impact of the return rate when there are multiple reverse flows, i.e. as shown in Fig. 4 for the entire SC and in Fig. 5 for each SC echelon, results reveal that its increase makes the InvVrR increase too. Specifically, for equal returns share, i.e. ϑi = [0.25, 0.25, 0.25, 0.25], each echelon experiences an InvVrR increase that overpass the FSC scenario for both α = 0.4 and α = 0.7. Which is true even for the decreasing returns share configuration, i.e. ϑi = [0.1, 0.2, 0.3, 0.4]. The only exception is the factory, which for α = 0.4 still shows a lower InvVrR compared to α = 0.0 scenario. Regarding the increasing returns share configuration, i.e. ϑi = [0.4,0.3,0.2,0.1], the InvVrR values are always lower than for the FSC scenarios.

Now, concerning the single reverse flow CLSCs, we observe (see Table 4) the opposite behaviour than for OrVrR. When a SC echelon receives the reverse flow, it shows the highest inventory variability, which seems intuitive due to the push policy assumption. However, interestingly, we observe that, when the return rate is moderate (i.e. α = 0.4), SC echelons placed either upstream or downstream experience a reduction of the InvVrR indicator. This reduction holds even when the return rate increases, i.e. α = 0.7, except for the factory. Here, indeed, once again, the factory is the most affected member by the presence of reverse flows and by the returns volume. In terms of InvVrR, its value increases as compared to the FSC, i.e. α = 0, when α increase, as well as for equal returns share and specifically for decreasing returns share, see Table 4.

To conclude, it should be noted that the decrease in the BWE, when moving upstream the SC that was observed for the OrVrR does not occur for the InvVrR, suggesting that this kind of CLSCs may be more sensitive in terms of order variability.

6 Summary of findings and managerial implications

The results reveal several important findings to help managing the CLSC. We contribute to the current scientific debate on what the effects of the returns flow of materials on the dynamics of the SC are. More specifically, we have analysed different returns share scenarios to extend the knowledge on how they impact the SC in terms of BWE and found out that the quality and quantity of the returns are key factors to improve CLSCs dynamic performance.

In this section, we summarize the main contributions of our work and present some managerial implications for companies operating in a CLSC setting.

-

In multiple reverse flows CLSCs, the concentration of returns in the upstream echelons allows for a BWE reduction at any echelon of the CLSC both in terms of order and inventory variability.

In multiple reverse flows CLSC, i.e. where every echelon of the SC receives returns, each echelon can benefit from BWE reduction compared to the FSC. Specifically, we compare three different possibilities that are equal, increasing and decreasing returns share, i.e. the case in which each echelon receives the same amount of returns, the case in which the majority of the returns are characterized by low quality and the case in which the majority of the returns are characterized by high quality. Our results reveal that multiple reverse flows CLSC always outperform FSC in terms of order variability. Moreover, in line with prior work, there is a significant reduction in the BWE with the increase of the return rate. On the other hand, from the inventory variability analysis, results for multiple reverse flows CLSCs reveal that the increasing returns share configuration is the most beneficial in terms of BWE reduction. It follows that concentrating the returns upstream in the SC makes it possible to obtain a decrease of both order and inventory variability.

-

In single reverse flow CLSCs, the echelon that receives the returns and the upstream echelons always experience a BWE reduction.

In the scenarios with a single reverse flow, our results reveal that the echelon that receives the returns shows the highest BWE reduction as compared to the FSC. In addition, all the upstream echelons show a significant BWE reduction. We also note that the single reverse flow CLSC in which returns are reprocessed at downstream echelons allows a BWE reduction along the CLSC (that is, for every member) compared to the FSC. Since we assume that the returns’ quality is related with returns share, i.e. returns with high quality are sent to downstream echelons while those with low quality are sent upstream, this finding suggests that single reverse flow CLCSs perform better when the returns’ quality is high as compared to the case when the returns’ quality is low. Therefore, configurations that can take advantage of high returns’ quality show a better performance in terms of order variability reduction. In other words, each echelon benefits from a BWE reduction if at least itself or one of the lower echelons receives returns. From the inventory variability perspective, we observed an interesting behaviour: although the SC echelon that receives the returns shows a slightly higher inventory variability as compared to the FSC scenario, the echelons upstream and downstream face reduced inventory variability.

-

In a CLSC, high return rates alleviate the detrimental effect of lead times variability.

The lead time variability is a problem that affects most real-life SCs. Ignoring it implies a BWE underestimation, as it is an important component in demand variance amplification (Chatfield and Pritchard 2013). In this study, we have explored how multiple reverse flows CLSCs and single reverse flow CLSCs perform under the lead time variability. We observe that, similarly to the FSC, the BWE increases with the variability of the lead times. For scenarios with forward lead time variability, the BWE is higher than for the scenarios without forward lead time variability. However, results reveal smaller differences in terms of order variability for scenarios without lead time variability and for scenarios with lead time variability as the return rate increases, i.e. the bullwhip indicator tends to be the same for both scenarios. Therefore, for high return rates, the CLSC can dampen the demand amplification phenomenon.

-

• In single reverse flows CLSCs with high return rates and low-quality returns, the BWE does not always increase when moving upstream the SC.

When the SC is closed at the factory and the distributor, i.e. when the quality of the return is low, and the return rate is high, the OrVrR indicator does not always increase from one echelon to the next, as in FSCs. For instance, when the returns are solely received by the factory, its OrVrR is lower than the OrVrR of the distributor. We believe that it is related to the fact that, as the return rate increases, the factory faces unmanageable inventories. Indeed, we have observed high inventory variability for high return rates. This behaviour suggests that merely increasing the return rate can create an undesired effect at upstream echelons. Recall that, in line with prior works, we have assumed a push policy for the reverse flows. However, this aspect should be revised to remedy these undesired effects on inventory variability, and we believe that a proper strategy to achieve it would be to adopt a pull policy for the reverse flows. In any case, this result reasserts the importance of appropriately managing the returns focusing not only on the return rate, but also on the returns share.

As a summary of the findings, we can conclude that the returns share in CLSCs plays a significant role in terms of order and inventory variability. Our work is the first one in the CLSCs field that explicitly studies the impact of different returns share configurations on the BWE, and highlights the importance of tuning the returns share in both multiple reverse flows CLSCs and single reverse flow CLSCs. In order to have balanced improvements when implementing closed-loop solutions both in terms of order and inventory variability as compared to the FSC, we have identified two efficient combinations of return rate and returns share:

-

(1)

High volume, medium–low quality returns (i.e., high return rates and decreasing returns share) for multiple reverse flows CLSCs. This combination would lead to an improvement in terms of reduced order variability without undesired increased inventory variability.

-

(2)

Low-to-moderate volume, high quality returns (i.e., moderate return rates and reverse flows inserted downstream) for single reverse flow CLSC. This combination would lead to reduced order and inventory variability for the entire SC, with a marginal increase in terms of inventory variability limited to the echelon that receives the reverse flow.

In other words, when the volume of returned product is high, i.e. high return rate, it is better to share it among all the SC members, i.e. multiple reverse flows CLSC. Particularly, we show that in this case the high quality of the returns is not relevant. Instead, when the volume of the return is smaller, it is better to direct it to just one SC echelon. Specifically, we show that in the case of limited quantity, the high quality of the returns is the key to obtain BWE reduction.

From a managerial point of view, a significant implication for designing CLSCs has been captured. Tuning both the quality and the quantity of the returns can be an opportunity to improve SC’s operational performance. Specifically, the return flows, if well managed and understood, can help to increase the stability of the orders at each echelon of the SC, making the CLSC a suitable configuration to improve the operational efficiency. For these reasons, managers could develop, for example, incentives or recall strategies to ensure the quality of higher possible returns, enabling processes like reusing and repairing, if they belong to a single reverse flow CLSC. On the contrary, if they are involved in a multiple reverse flow CLSCs, they should focus on increasing the returns volume rather than the quality.

A final remark about the presence of reverse flows at the factory that results in a reduction in raw material consumption. It makes closing the loop to become a solution for the materials scarcity problem and a suitable strategy for companies that want to adopt the sustainable goal of reducing new virgin material waste. Thus, to avoid inefficiency and to increase new raw material saving, managers should implement ad-hoc solutions to best exploit the benefits of return flows.

7 Conclusions and future research

This work analyses the impact of the returns share on the dynamic performance of a CLSC where each member of the SC may have its own reverse flow of returns. We consider a four-echelon CLSC with an external member in charge of collecting and inspecting the returns. Returns are shared depending on their quality, i.e. returns with high quality are sent to downstream echelons, while those with low quality to upstream ones. We focus on seven possible scenarios where every echelon of the SC receives returns, i.e. multiple reverse flows CLSC, and where one echelon at a time receives the returns, i.e. single reverse flow CLSC. We simulate several scenarios adopting a full-factorial experimental design varying the following factors: return rate, coefficient of variation for the forward lead times, and returns share. We adopt ABMS as a methodological approach and measure the dynamic performance of the SC through a widely-used BWE metric named order variance ratio. In line with previous studies, our results reveal that BWE is generally reduced in CLSCs. This holds for whatever returns share in multiple reverse flows CLSC. For single reverse flow CLSC, the echelons that show BWE reduction are those placed upstream than the one where the SC is closed. Furthermore, based on our findings, we can affirm that CLSCs that can take advantage of high return can achieve balanced improvements in terms of inventory and order variability reduction as compared to FSCs when the returns are shared among all the SC echelons, i.e. multiple reverse flows CLSCs. Here a high quality of the returns is not required, particularly if the majority of the returns have medium–low quality. On the contrary, single reverse flow CLSCs perform better when the return rate is moderate, and the returns’ quality is high. Thus, we suggest managers to adopt strategies to tune not only the volume of used products from the customers (i.e. the return rate), but also their quality depending on the CLSCs structure they are involved in.

To conclude, this work not only have provided new knowledge regarding CLSC dynamics, but also aims to suggest some future research lines. Indeed, a limitation related to the selected BWE indicator opens new avenues for the CLSC field. This indicator captures changes in the variance of orders, but does not capture changes in the average of orders. However, the average of the orders placed by each echelon of the chain decreases when additional reverse flows are inserted in the system. Therefore, it can be interesting for future studies the adoption of performance indicators that evaluate both the variance and the average of orders to better understand the complexity of CLSCs. Moreover, as it is rarely feasible to reuse/recycle all unwanted items within the same SC (Farooque et al. 2019), new studies could analyse how closed loops and symbiotic relations involving the use of waste as a resource for another can affect the dynamic behaviour and operational performance of SCs. Therefore, a possible research stream is to study the upgrade of CLSC into Circular Supply Chain (Farooque et al. 2019; Batista et al. 2018) or Symbiotic Supply Chain (Turken and Geda 2020) to efficiently manage the substantial amounts of waste that CLSC still generates.

References

Abar S, Theodoropoulos GK, Lemarinier P, O’Hare GMP (2017) Agent based modelling and simulation tools: a review of the state-of-art software. Comput Sci Rev. https://doi.org/10.1016/j.cosrev.2017.03.001

Abbey JD, Guide VDR (2017) Closed-loop supply chains: a strategic overview. Sustain Supply Chains Res-Based Textbook Oper Strategy 74:375–393. https://doi.org/10.1007/978-3-319-29791-0_17

Adenso-Díaz B, Moreno P, Gutiérrez E, Lozano S (2012) An analysis of the main factors affecting bullwhip in reverse supply chains. Int J Prod Econ 135:917–928. https://doi.org/10.1016/j.ijpe.2011.11.007

Alamerew YA, Brissaud D (2020) Modelling reverse supply chain through system dynamics for realizing the transition towards the circular economy: a case study on electric vehicle batteries. J Clean Prod 254:120025. https://doi.org/10.1016/j.jclepro.2020.120025

Batista L, Bourlakis M, Smart P, Maull R (2018) In search of a circular supply chain archetype–a content-analysis-based literature review. Prod Plan Control 29:438–451. https://doi.org/10.1080/09537287.2017.1343502

Braz AC, De Mello AM, de Vasconcelos Gomes LA, de Souza Nascimento PT (2018) The bullwhip effect in closed-loop supply chains: a systematic literature review. J Clean Prod 202:376–389. https://doi.org/10.1016/j.jclepro.2018.08.042

Cannella S, Barbosa-Póvoa AP, Framinan JM, Relvas S (2013) Metrics for bullwhip effect analysis. J Oper Res Soc 64:1–16. https://doi.org/10.1057/jors.2011.139

Cannella S, Bruccoleri M, Framinan JM (2016) Closed-loop supply chains: what reverse logistics factors influence performance? Int J Prod Econ 175:35–49. https://doi.org/10.1016/j.ijpe.2016.01.012

Cannella S, Di Mauro C, Dominguez R, Ancarani A, Schupp F (2019) An exploratory study of risk aversion in supply chain dynamics via human experiment and agent-based simulation. Int J Prod Res 57:985–999. https://doi.org/10.1080/00207543.2018.1497817

Cannella S, Ponte B, Dominguez R, Framinan JM (2021) Proportional order-up-to policies for closed-loop supply chains: the dynamic effects of inventory controllers. Int J Prod Res 59:3323–3337. https://doi.org/10.1080/00207543.2020.1867924

Chatfield DC, Pritchard AM (2013) Returns and the bullwhip effect. Transp Res Part E Logist Transp Rev 49:159–175. https://doi.org/10.1016/j.tre.2012.08.004

Chatfield DC, Kim JG, Harrison TP, Hayya JC (2004) The bullwhip effect-impact of stochastic lead time information quality, and information sharing: a simulation study. Prod Oper Manag 13(340):353

Corsini RR, Costa A, Cannella S, Framinan JM (2022) Analysing the impact of production control policies on the dynamics of a two-product supply chain with capacity constraints. Int J Prod Res. https://doi.org/10.1080/00207543.2022.2053224

Costa A, Cannella S, Corsini RR, Framinan JM, Fichera S (2022) Exploring a two-product unreliable manufacturing system as a capacity constraint for a two-echelon supply chain dynamic problem. Int J Prod Res 60:1105–1133. https://doi.org/10.1080/00207543.2020.1852480

Dev NK, Shankar R, Choudhary A (2017) Strategic design for inventory and production planning in closed-loop hybrid systems. Int J Prod Econ 183:345–353. https://doi.org/10.1016/j.ijpe.2016.06.017

Disney SM, Lambrecht MR, 2008. On replenishment rules, forecasting and the bullwhip effect in supply chains

Dolgui A, Ivanov D, Rozhkov M (2020) Does the ripple effect influence the bullwhip effect? An integrated analysis of structural and operational dynamics in the supply chain†. Int J Prod Res 58:1285–1301. https://doi.org/10.1080/00207543.2019.1627438

Dominguez R, Cannella S, Framinan JM (2015) On returns and network configuration in supply chain dynamics. Transp Res Part E Logist Transp Rev 73:152–167. https://doi.org/10.1016/j.tre.2014.11.008

Dominguez R, Cannella S, Barbosa-Póvoa AP, Framinan JM (2018) Information sharing in supply chains with heterogeneous retailers. Omega (United Kingdom) 79:116–132. https://doi.org/10.1016/j.omega.2017.08.005

Dominguez R, Ponte B, Cannella S, Framinan JM (2019) On the dynamics of closed-loop supply chains with capacity constraints. Comput Ind Eng 128:91–103. https://doi.org/10.1016/j.cie.2018.12.003

Dominguez R, Cannella S, Ponte B, Framinan JM (2020) On the dynamics of closed-loop supply chains under remanufacturing lead time variability. Omega (united Kingdom). https://doi.org/10.1016/j.omega.2019.102106

Dominguez R, Cannella S, Framinan JM (2021) Remanufacturing configuration in complex supply chains. Omega (united Kingdom). https://doi.org/10.1016/j.omega.2020.102268

Ellen MacArthur Foundation (2013) Towards the circular economy. J Ind Ecol 2(1):23–44

Ellen MacArthur Foundation, 2018. Circular consumer electronics: an initial exploration. Ellen MacArthur Found. pp. 1–17

Farooque M, Zhang A, Thürer M, Qu T, Huisingh D (2019) Circular supply chain management: a definition and structured literature review. J Clean Prod. https://doi.org/10.1016/j.jclepro.2019.04.303

Forrester JW (1961) Industrial dynamics. J Oper Res Soc 48:1037–1041. https://doi.org/10.1057/palgrave.jors.2600946

Framinan JM (2022) Modelling supply chain dynamics. Model Supply Chain Dyn. https://doi.org/10.1007/978-3-030-79189-6

Goltsos TE, Ponte B, Wang S, Liu Y, Naim MM, Syntetos AA (2019) The boomerang returns? Accounting for the impact of uncertainties on the dynamics of remanufacturing systems. Int J Prod Res 57:7361–7394. https://doi.org/10.1080/00207543.2018.1510191

Govindan K, Soleimani H, Kannan D (2015) Reverse logistics and closed-loop supply chain: a comprehensive review to explore the future. Eur J Oper Res. https://doi.org/10.1016/j.ejor.2014.07.012

Guan G, Jiang Z, Gong Y, Huang Z, Jamalnia A (2021) A bibliometric review of two decades’ research on closed-loop supply chain: 2001–2020. IEEE Access. https://doi.org/10.1109/ACCESS.2020.3047434

Hasanov P, Jaber MY, Tahirov N (2019) Four-level closed loop supply chain with remanufacturing. Appl Math Model 66:141–155. https://doi.org/10.1016/j.apm.2018.08.036

Hosoda T, Disney SM (2018) A unified theory of the dynamics of closed-loop supply chains. Eur J Oper Res 269:313–326. https://doi.org/10.1016/j.ejor.2017.07.020

Hosoda T, Disney SM, Gavirneni S (2015) The impact of information sharing, random yield, correlation, and lead times in closed loop supply chains. Eur J Oper Res 246:827–836. https://doi.org/10.1016/j.ejor.2015.05.036

Ivanov D, Rozhkov M (2020) Coordination of production and ordering policies under capacity disruption and product write-off risk: an analytical study with real-data based simulations of a fast moving consumer goods company. Ann Oper Res 291:387–407. https://doi.org/10.1007/s10479-017-2643-8

King AM, Burgess SC, Ijomah W, McMahon CA (2006) Reducing waste: repair, recondition, remanufacture or recycle? Sustain Dev 14:257–267. https://doi.org/10.1002/sd.271

Liao H, Deng Q, Shen N (2019) Optimal remanufacture-up-to strategy with uncertainties in acquisition quality, quantity, and market demand. J Clean Prod 206:987–1003. https://doi.org/10.1016/j.jclepro.2018.09.167

Lin J, Zhou L, Spiegler VLM, Naim MM, Syntetos A (2022) Push or pull? The impact of ordering policy choice on the dynamics of a hybrid closed-loop supply chain. Eur J Oper Res 300:282–295. https://doi.org/10.1016/j.ejor.2021.10.031

Liu H, Wang P (2007) Bullwhip effect analysis in supply chain for demand forecasting technology. Xitong Gongcheng Lilun yu Shijian/System Eng. Theory Pract 27:26–33. https://doi.org/10.1016/s1874-8651(08)60044-7

Long Q, Zhang W (2014) An integrated framework for agent based inventory-production-transportation modeling and distributed simulation of supply chains. Inf Sci (ny) 277:567–581. https://doi.org/10.1016/j.ins.2014.02.147

Lüdeke-Freund F, Gold S, Bocken NMP (2019) A review and typology of circular economy business model patterns. J Ind Ecol. https://doi.org/10.1111/jiec.12763

Masoudipour E, Amirian H, Sahraeian R (2017) A novel closed-loop supply chain based on the quality of returned products. J Clean Prod 151:344–355. https://doi.org/10.1016/j.jclepro.2017.03.067

Moritz BB, Narayanan A, Parker C (2022) Unraveling behavioral ordering: relative costs and the bullwhip effect. Manuf Serv Oper Manag 24:1733–1750. https://doi.org/10.1287/msom.2021.1030

Naghavi S, Karbasi A, Kakhki MD (2020) Agent based modelling of milk and its productions supply chain and bullwhip effect phenomena (Case Study: Kerman). Int J Supply Oper Manag 7:279–294. https://doi.org/10.22034/IJSOM.2020.3.6

Oliveira JB, Lima RS, Montevechi JAB (2016) Perspectives and relationships in supply chain simulation: a systematic literature review. Simul Model Pract Theory 62:166–191. https://doi.org/10.1016/j.simpat.2016.02.001

Papanagnou CI (2021) Measuring and eliminating the bullwhip in closed loop supply chains using control theory and Internet of Things. Ann Oper Res. https://doi.org/10.1007/s10479-021-04136-7

Peng H, Shen N, Liao H, Xue H, Wang Q (2020) Uncertainty factors, methods, and solutions of closed-loop supply chain — A review for current situation and future prospects. J Clean Prod. https://doi.org/10.1016/j.jclepro.2020.120032

Ponte B, Sierra E, de la Fuente D, Lozano J (2017) Exploring the interaction of inventory policies across the supply chain: an agent-based approach. Comput Oper Res 78:335–348. https://doi.org/10.1016/j.cor.2016.09.020

Ponte B, Naim MM, Syntetos AA (2019) The value of regulating returns for enhancing the dynamic behaviour of hybrid manufacturing-remanufacturing systems. Eur J Oper Res 278:629–645. https://doi.org/10.1016/j.ejor.2019.04.019

Ponte B, Framinan JM, Cannella S, Dominguez R (2020) Quantifying the bullwhip effect in closed-loop supply chains: the interplay of information transparencies, return rates, and lead times. Int J Prod Econ. https://doi.org/10.1016/j.ijpe.2020.107798

Ponte B, Cannella S, Dominguez R, Naim MM, Syntetos AA (2021) Quality grading of returns and the dynamics of remanufacturing. Int J Prod Econ. https://doi.org/10.1016/j.ijpe.2021.108129

Ponte B, Dominguez R, Cannella S, Framinan JM (2022) The implications of batching in the bullwhip effect and customer service of closed-loop supply chains. Int J Prod Econ 244:108379. https://doi.org/10.1016/j.ijpe.2021.108379

Prahinski C, Kocabasoglu C (2006) Empirical research opportunities in reverse supply chains. Omega 34:519–532. https://doi.org/10.1016/j.omega.2005.01.003

Tang O, Naim MM (2004) The impact of information transparency on the dynamic behaviour of a hybrid manufacturing/remanufacturing system. Int J Prod Res 42:4135–4152. https://doi.org/10.1080/00207540410001716499

Tombido L, Louw L, van Eeden J (2020) The bullwhip effect in closed-loop supply chains: a comparison of series and divergent networks. J Remanufacturing 10:207–238. https://doi.org/10.1007/s13243-020-00085-9

Trapero JR, Kourentzes N, Fildes R (2012) Impact of information exchange on supplier forecasting performance. Omega 40:738–747. https://doi.org/10.1016/j.omega.2011.08.009

Turken N, Geda A (2020) Supply chain implications of industrial symbiosis: a review and avenues for future research. Resour Conserv Recycl 161:104974. https://doi.org/10.1016/j.resconrec.2020.104974

Turrisi M, Bruccoleri M, Cannella S (2013) Impact of reverse logistics on supply chain performance. Int J Phys Distrib Logist Manag 43:564–585. https://doi.org/10.1108/IJPDLM-04-2012-0132

Wang X, Disney SM (2016) The bullwhip effect: progress, trends and directions. Eur J Oper Res. https://doi.org/10.1016/j.ejor.2015.07.022

Wang Z, Wu Q (2021) Carbon emission reduction and product collection decisions in the closed-loop supply chain with cap-and-trade regulation. Int J Prod Res 59:4359–4383. https://doi.org/10.1080/00207543.2020.1762943

Yu D, Yan Z (2021) Knowledge diffusion of supply chain bullwhip effect: main path analysis and science mapping analysis. Scientometrics 126:8491–8515. https://doi.org/10.1007/s11192-021-04105-8

Zhang A, Wang JX, Farooque M, Wang Y, Choi TM (2021) Multi-dimensional circular supply chain management: a comparative review of the state-of-the-art practices and research. Transp Res Part E Logist Transp Rev 155:102509. https://doi.org/10.1016/j.tre.2021.102509

Zhou L, Disney SM (2006) Bullwhip and inventory variance in a closed loop supply chain. Or Spectr 28:127–149. https://doi.org/10.1007/s00291-005-0009-0

Zhou L, Naim MM, Disney SM (2017) The impact of product returns and remanufacturing uncertainties on the dynamic performance of a multi-echelon closed-loop supply chain. Int J Prod Econ 183:487–502. https://doi.org/10.1016/j.ijpe.2016.07.021

Zikopoulos C (2017) Remanufacturing lotsizing with stochastic lead-time resulting from stochastic quality of returns. Int J Prod Res 55:1565–1587. https://doi.org/10.1080/00207543.2016.1150616

Acknowledgements

This research was supported by the University of Seville (V PPIT-US), by the Junta de Andalucía through the projects EFECTOS (ref. US-1264511) and DEMAND (ref. P18-FR-1149), by the Spanish Ministry of Science and Innovation, under the project ASSORT (ref. PID2019-108756RB-I00), and by the University of Catania, through the Piano della Ricerca programme, under the project GOSPEL.

Funding

Funding for open access publishing: Universidad de Sevilla/CBUA.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no relevant financial or non-financial interests to disclose. Jose M. Framinan, co-author of this article, declares to be a member of the Editorial Board of Flexible Services and Manufacturing journal. He has no further competing interests to declare that are relevant to the content of this article. Rebecca Fussone, Roberto Dominguez and Salvatore Cannella, have no competing interests to declare that are relevant to the content of this article.

Ethical approval

The authors declare compliance with the Ethical Standards required by this journal.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A

Appendix A

For the model validation, we have simulated a four echelon FSC, i.e. factory, distributor, wholesaler and retailer, based on the modelling assumptions of Chatfield et al. (2004), specifically the scenario that they define: information quality level 2 and no information sharing. The simulation for the validation was run for 20 replications of 5,200 time periods (with 200 as warm-up) and the value shown in the graphs is an average value over the replicates. Figure

Validation with Chatfield et al. (2004)

6 shows the comparison of our results obtained with AnyLogic (on the right) with those of Chatfield et al. (2004) with the simulator SISCO (on the left) in terms of the standard deviation of orders. Figure

Validation with Dominguez et al. (2015)

7 shows the comparison of our results obtained with AnyLogic (on the right) with those of Dominguez et al. (2015) with the simulator SCOPE (on the left) in terms of total variance amplification.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Fussone, R., Dominguez, R., Cannella, S. et al. Bullwhip effect in closed-loop supply chains with multiple reverse flows: a simulation study. Flex Serv Manuf J 36, 250–278 (2024). https://doi.org/10.1007/s10696-023-09486-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10696-023-09486-x