Abstract

In this paper, we examine how the implementation of deposit insurance influences the impact of bank capital, excess lending, banking competition and monetary policy on liquidity creation of banks. Our examination uses China’s introduction of deposit insurance in 2015 as a natural experiment. We find that deposit insurance positively reinforces the effect of capital but weakens that of monetary policy on liquidity creation. We do not find that deposit insurance has a significant influence on the effects of excess lending and competition on the liquidity creation of banks. We also show that the implementation of deposit insurance has heterogenous effects on the liquidity creation of large and small banks.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The theory of financial intermediation postulates that liquidity creation is one of the major reasons why banks exist and is a fundamental service they provide to the economy (Diamond and Dybvig 1983; Bhattacharya and Thakor 1993). Banks create liquidity by borrowing short-term, often liquid, liabilities and then lending to projects that are often long term and illiquid. By transforming illiquid assets into liquid liabilities (i.e., liquidity transformation), banks improve the allocation of capital and accelerate economic growth (Bencivenga and Smith 1991). Among all the services that banks provide, liquidity creation has the most significant effect on economic growth (Berger and Sedunov 2017).

At the same time, that theory posits that banks are, by nature, opaque institutions with complex and risky business activities, especially related to lending. This opacity results in information asymmetries for depositors that dissuade them from depositing their savings with banks. Hence, in order to attract savers and increase public confidence in banks, as well as the financial system, many countries heavily regulate the banking sector and utilize a set of safety nets. One of the most widely implemented financial safety net is deposit insurance. This net has become common in the last 50 years with the number of countries with deposit-insured banking systems increasing from 12 in 1974 to 147 in 2023 (International Association of Deposit Insurers 2023) Deposit insurance has the aim of protecting depositors and providing stability to the financial system as it reduces the possibility of bank runs and contagion between banks (Diamond and Dybvig 1983).Footnote 1

Therefore, the overarching objective of this paper is to explore the possible link between deposit insurance and liquidity creation. To do so, we combine the two strands of the literature on the channels for liquidity creation by banks and the impact of deposit insurance. In particular, we aim to examine whether and how the presence of deposit insurance influences the channels through which banks create liquidity.

Studies have proposed a number of channels that that lead to the liquidity creation of banks such as their capital levels (Diamond and Rajan 2000, 2001), excess lending (Chen et al. 2015), and competition (Boyd and De Nicolo 2005) as well as monetary policy (Berger and Bouwman 2017). Recently, more empirical studies have tested these channels, especially after the seminal paper by Berger and Bouwman (2009), which develops various robust indicators to measure liquidity creation. On the link between bank capital and liquidity creation, Lei and Song (2013), Distinguin et al. (2013), Horvath et al. (2014), Fu et al. (2016) and Casu et al. (2019) report a negative relationship for US, Czech, Chinese and European banks, respectively.Footnote 2 However, some studies have found that the relationship between nonperforming loans, an indicator of excess lending, and liquidity creation is either non-existent (Umar and Sun 2016) or negative (Chen et al. 2015) in China. Horvath et al. (2016) and Jiang et al. (2019) show that competition reduces liquidity creation. While Berger and Bouwman (2017), Rauch et al. (2011), and Dang (2022) find that monetary policy has a positive impact on liquidity creation for US, German, and Vietnamese banks, respectively.

Two theoretical approaches are often used to explain the creation and expansion of deposit insurance: an economic approach grounded in potential efficiency gains (i.e., public-interest motivation) and political approach grounded in the rising power of special interest groups that favored deposit insurance (i.e., private-interest motivation) (Laeven 2004; Calomiris and Jaremski 2016). The empirical research on deposit insurance presents investigations into the economic drivers of the adoption of deposit insurance as well as its effects on the performance of banks and the risk and stability of the financial system (Kane 1987; Barth 1989; Demirguc-Kunt et al. 2008a, b; Calomiris and Chen 2016). This research commonly makes the argument that deposit insurance may have negative effects on the stability of the financial system if it is not supported by the regulation and supervision of banks, as this insurance could lead to excessive bank risk-taking due to moral hazard (Demirgüç-Kunt and Detragiache 2002). Literature has also provided overwhelming supporting evidence that, all things being equal, deposit insurance increases the risk-taking of banks, reduces the market discipline of insured depositors and benefit larger institutions more (see, e.g., Ely and Weaver 1991; Beltratti and Stulz 2012; Calomiris and Jaremski 2019; Dewenter et al. 2018; Hovakimian and Kane 2000; Ioannidou and Penas 2010; Nier and Baumann 2006; Wagster 2007).Footnote 3

The objective of our paper poses an important question as the implementation of deposit insurance could potentially modify these channels for liquidity creation. By the same token, the outcome expectations of policy interventions to increase liquidity creation in the financial system via the four identified channels may be dependent on the existence of deposit insurance in a country. Our paper is also relevant to countries that have already implemented deposit insurance. For example, albeit being a less likely scenario, governments’ consideration of removing deposit insurance may have indirect consequences on liquidity creation. Similarly, increasing or decreasing the coverage of deposit insurance may have indirect consequences on liquidity creation. For instance, after the Global Financial Crisis the European Union required its members to increase their protection of deposits to a minimum of €50,000 in 2009 and then to €100,000 in 2010 (European Commission 2014). Such policy changes to strengthen financial stability may have unanticipated positive or negative consequences on the liquidity created in the financial system. Hence, our paper has the potential to inform these decisions.

In particular, in this paper we use a natural experiment in China in which the government promulgated the regulations and set up the deposit insurance system in 2015.Footnote 4 We use a panel data set of 126 Chinese commercial banks covering a period from 2011 to 2017.

We adopt two identification strategies. First, we use the external shock provided by the introduction of deposit insurance to directly estimate the policy impact on the liquidity creation of banks from the modification of the channels of capital, excess lending, competition, and monetary policy. Second, we use a difference-in-differences (DID) approach that not only identifies the difference in liquidity before and after the policy implementation for each bank but also the heterogeneous effects of the policy on different types of banks. In this set-up, we assign the largest five banks (hereafter “big 5”), which are also state-controlledFootnote 5, as the control group. Our reasoning is that the deposits of these banks were already protected implicitly before the introduction of the system in 2015. Given that the big 5 had a market share of more than 50% of total assets, the public’s common belief was that they were too big to fail and that the government would bail them out in case of a crisis or a bank run. The treatment group is other banks. We postulate that the interaction of explicit deposit insurance in 2015 with the four major channels through which banks create liquidity may have different effects on the big 5 than other banks.

We find that the deposit insurance positively reinforces the effect of bank capital but weakens that of monetary policy on liquidity creation. We do not find a significant influence of deposit insurance on the effects of excess lending and competition on the liquidity creation of banks. We also show that implementation of deposit insurance has heterogenous effects on the liquidity creation of large and small banks. Our results are robust to alternative definitions of liquidity creation and when we separate the on- and off-balance sheet effects.

Our contribution to the literature is threefold. First, we extend the wide-ranging literature on deposit insurance and provide empirical evidence in relation to the possible effect of deposit insurance on liquidity creation. As mentioned above, the literature often examines the effects of deposit insurance on the lending of banks and the financial stability of the system, and it has shown that deposit insurance increases the insolvency risk of banks by encouraging reckless behavior that reduces the liquidity risk (or increases liquidity creation) of banks (Calomiris and Jaremski 2019; Demirgüç-Kunt and Detragiache 2002). In particular, we contribute to this literature by examining the interaction of deposit insurance with the main channels through which banks create liquidity.

Second, our paper contributes to the strand of the literature that focuses on the factors affecting liquidity creation (Berger and Bouwman 2017; Boyd and De Nicolo 2005; Chen et al. 2015; Diamond and Rajan 2000, 2001; Fungáčová et al. 2017). Closest study to our paper is the work by Fungáčová et al. (2017) in which they examine the effect of deposit insurance on the relationship between capital and liquidity creation in Russian banks. They find that the introduction of deposit insurance in Russia had different effects on the relationship between banks’ capital and liquidity creation across different types of banks. However, we extensively expand their work by adding excess lending, competition, and monetary policy to bank capital to examine the impact of deposit insurance on liquidity creation.

In addition, the exploration of China’s experience in implementing deposit insurance is important as its institutional setting differs from Russia. First, prior to the implementation of the deposit insurance in Russia, the government explicitly stated that it would only protect the deposits in state-owned banks (Chernykh and Cole 2011). In contrast, prior to the implementation of deposit insurance in China, the government has never publicly announced that it would only protect the deposits in state-owned banks. However, society expected that the government would rescue these banks first. Second, unlike Russia, China did not experience a large-scale banking crisis before the implementation of explicit deposit insurance. The incentive for Chinese financial authorities to introduce explicit deposit insurance was to improve the functioning of the banking sector to enhance financial system stability rather than in order to deal with a banking crisis, such as in the case of Russia. These nuances between the two countries highlight the relevance and importance of exploring the Chinese experience in the implementation of deposit insurance.

The liquidity creation in the Chinese banking system has received substantial attention recently due to the growth of the Chinese economy and its increasing importance on the world stage (Zhang et al. 2021). Hence, we also contribute to the limited literature that examines the liquidity creation of banks in China. For example, empirical studies find that banks’ diversification, and increased capital have the potential to reduce their liquidity creation (Hou et al. 2018; Lei and Song 2013), while excess lending does not influence liquidity creation (Chen et al. 2015). Zhang et al. (2021) show that excessive liquidity creation increases systemic risk. Therefore, as far as we are aware, our paper is the first to provide a comprehensive examination on the effect of the introduction of deposit insurance on liquidity creation in the banking sector of China. It is also important to understand the effects of safety nets, such as deposit insurance, regarding the opaque and large-scale interconnections of banks with other financial intermediaries (particularly the shadow banking sector) being a threat to the financial stability of China (Ehlers et al. 2018; IMF 2018; Nivorozhkin and Chondrogiannis 2022).

The paper is organized as follows. In the next section, we provide a brief review of the developments in the banking sector of China and the implementation of deposit insurance. Section 3 provides a review of the literature on the effect of deposit insurance on liquidity creation. In Sect. 4, we detail the research design and empirical models. Section 5 presents the data sources, definitions of the variables, and descriptive statistics. We discuss the empirical results in Sect. 6, followed by robustness tests in Sect. 7. Section 8 concludes.

2 Institutional Background

Prior to the series of reforms in the banking industry in China in 1978, the People’s Bank of China (PBOC) also operated as a commercial bank (Lin and Zhang 2009). The objective of the reforms was to transform the banking sector from being solely state-owned, monopolistic, and policy-driven to a multi-ownership, competitive, and profit-oriented system (Liang et al. 2013). At that time, China’s financial industry was immature; there was a very limited number of banks that provided simple services, were often government backed, and lacked the ability to operate independently (Zhou 2016). Therefore, China needed a banking system that could support its ambitious goals for economic development. As part of the reforms in 1978, the government created four state-owned commercial banks (Bank of China, the China Construction Bank, the Agricultural Bank of China, and the Industrial and Commercial Bank of China), and the PBOC passed on commercial banking duties to these banks, acting as a supervisor to the financial system. In addition, the government introduced a number of banks jointly owned by it and the public (joint-stock banks) in the mid-1980s (Liang et al. 2013). Due to these changes, the banking system became increasingly complicated, and risks were building up on banks’ balance sheets. At the same time, the government did not develop the capabilities of its regulators. Hence, due to losses and failures, it had to undertake large-scale bailouts in the late-1980s, which contributed to the increasing lack of market discipline (Zhou 2016).

Between 1993 and 2017, China’s banking sector had undergone a notable transformation (Williams 2018). In the early 1990s, the central government gave local governments the authority to establish regional banks, known as city commercial banks, by consolidating local rural and urban cooperatives. Today there are more than 450 city and rural commercial banks operating across the country. These banks have played an important role in China’s regional economic development (Zhang et al. 2016). External observers felt that China’s banking sector was technically insolvent as the newly established banks struggled to cope with the fast pace of economic growth (Liu 2009). At the end of the 1990s, it became apparent that the four big-state-owned banks, which each supported a particular sector in the economy, built up significant amounts of nonperforming loans, creating a serious threat to China’s financial market and the economy (Li and Zeng 2007). As a result, the government injected RMB 270 billion into the big four banks by issuing special Treasury bonds (Okazaki 2007).Footnote 6 Similarly, the nonperforming loans of city and rural commercial banks were estimated to be 50% of their total loans during the same period. The government eventually required them to merge with healthier financial institutions. Hence, Wu (2012) estimates that China spent RMB 5 trillion on financial bailouts during this time, which was around one-third of China’s GDP at the time. These reforms continued up to 2007 when China gave licenses to foreign banks to accept Chinese citizens’ deposits in local currency. Some studies have argued that such a rapid expansion of the banking sector required a more robust regulatory system and triggered the establishment of the China Banking Regulatory Commission (Zhang et al. 2016).Footnote 7

However, even though there were wide-ranging bailouts and mergers in the banking sector in China, there were significant differences in terms of the risks taken by the depositors of non-state-owned banks. For example, some Chinese bank failures showed that small-bank depositors faced a much higher risk of losing their deposits. Furthermore, the process for depositors to claim losses or receive compensation was costly as they had to wait for a significant number of years as the process for bankruptcies or mergers was very long. Given the inflation and opportunity costs, the loss for depositors investing in small banks was large. For instance, in 2001, the Shantou Commercial Bank became insolvent and was taken over by the authorities. The risk disposal process lasted 10 years until being completed in 2011.Footnote 8 Another example is related to the failure of Hainan Development Bank, which went bankrupt in 1998, that caused significant losses for depositors. Today, the liquidation process of Hainan Development Bank has taken more than 20 years and is still not fully completed; this process is reducing the compensation due to inflation.

In 2014, the PBOC issued the first draft bill as a sign of adoption of explicit deposit insurance. Zhou (2016) argues that the plan for the adoption of deposit insurance was part of a set of ongoing policies to modernize China’s financial market through reform and to better discipline China’s banking sector and enhance financial stability. Some example of these policies was the liberalization of interest rates and the designing of exit mechanisms for banks. The reform also coincided with a greater risk of banks encountering a liquidity crisis due to the slowing speed of economic development at the time. The growth of China’s shadow banking sector and the expansion of private lending also made adopting deposit insurance as a safety net as a priority to tackle the systemic risks building up in the financial sector. Before the introduction of explicit deposit insurance, China implemented a highly predictable implicit government guarantee against bank failures that left the Chinese people believing that they were highly protected (Yamori and Sun 2019). Zhou (2016) supports these arguments stating that China had been using implicit deposit insurance as the main mechanism to deal with failed banks. Accordingly, in the case of a bank run the PBOC intervened and implemented its “lender of last resort” mandate to pay for the deposits and debts of distressed banks. The introduction of deposit insurance made it clear that the government had abandoned the implicit protection of all deposits and started partial protections (Yamori and Sun 2019).

China’s current deposit insurance is under the control of the PBOC. It was set up as a management agency with access to RMB 10 billion (around USD 1.4 billion at the time). Membership by deposit institutions was mandatory, including the state-controlled banks, joint-stock banks, and foreign banks. The agency does not protect the deposits of foreign banks and foreign branches of domestic banks. Coverage is a maximum of 500,000 RMB (around USD 80,000). The current system uses a flat-rate premium; however, China envisages that a combination of a benchmark premium rate and a risk-based one will be used in the near future.Footnote 9 The resources of the insurance funds of the agency mainly come from the premiums paid by insured institutions (set at between 0.01 and 0.02%), properties received under liquidation of insured institutions, and income from the management of the fund.Footnote 10

3 Review of the Literature on the Effect of Deposit Insurance on Liquidity Creation

In this section we explain the theoretical underpinnings and the empirical evidence regarding the four channels (i.e. bank capital, excessive lending behavior, banking market competition intensity and monetary policy) identified by the previous studies. For each of these channels’ literature provides competing theories and, sometimes, conflicting evidence. Our main objective is to examine how the introduction of deposit insurance may influence and moderate the relationship between the channels and liquidity creation and to provide evidence to support the competing theories.

3.1 Through the Channel of Bank Capital

Studies have proposed two competing hypotheses, risk absorption and financial fragility, to explain the nexus between bank capital and liquidity creation. The risk absorption hypothesis posits a positive relationship (Bhattacharya and Thakor 1993), while the financial fragility hypothesis proposes a negative one (Diamond and Rajan 2000, 2001). The Risk absorption hypothesis postulates that banks are more likely to create liquidity when they have higher levels of capital, as this position helps them to absorb more risk. In other words, all things being equal, higher capital leads to greater liquidity creation as the bank carries lower risk at a particular moment. Deposit insurance increases the confidence of depositors and other participants in the financial system in general but in particular in banks that reduces the likelihood of bank runs. Therefore, after the introduction of explicit deposit insurance, banking risks should decrease at the same rate as increased bank capital absorbs more risks. Banks, recognizing their less risky position due to deposit insurance and feeling safer, would choose to increase their liquidity creation. In other words, for a given level of bank capital, the introduction of deposit insurance would lead to more bank lending as it decreases the risk of deposit withdrawals.Footnote 11 In sum, the deposit insurance would positively reinforce the positive effect of bank capital on liquidity creation.

The financial fragility hypothesis postulates that liquidity creation decreases when banks have higher levels of capital. The reasoning is the bank’s ability to accumulate private information from depositors and borrowers over time. Depositors, concerned about possible abuse of their private information, become more vigilant about their deposits in the bank. As a consequence, banks may adopt a fragile financial structure in which they have a larger amount of liquid deposits to fulfill their commitment to depositors while buffering borrowers from depositors’ liquidity needs. In such circumstances, a higher level of capital increases the bargaining power of the bank and improves the credibility of its commitments. Having more capital, the bank does not need to maintain a fragile structure, or liquidity, in order to gain the trust of depositors. In other words, an increase in bank capital reduces financial fragility and, therefore, enhances liquidity creation. In this set-up, the availability of deposit insurance should reduce a bank’s need to maintain a fragile structure as depositors feel safer. Hence, the existence of explicit deposit insurance would mitigate the negative effect of capital on liquidity creation.

3.2 Through the Channel of Excess Lending

The lending business is the major income source for Chinese banks. Loan growth increases revenue as well as asset liquidity. However, greater lending (so-called “excess lending”) that exceeds the average lending of the bank’s peers could increase the level of credit risk and the amount of nonperforming loans over time. The liquidity spiral hypothesis, developed by Chen et al. (2015), posits that excess lending positively influences liquidity creation. It argues that excess lending is a consequence of underestimating the risks of projects that the bank is lending to and leads to loosening of lending standards. A bank with a large number of bad loans due to excess lending would decrease its cash inflow that would then aggravate the mismatch in liquidity maturities and then would increase liquidity creation.

Complementing this theory, we argue that in an environment where no deposit insurance exists the excess lending by a particular bank may lead to the withdrawal of deposits as some depositors may lose confidence in the bank. This withdrawal results in less liquidity creation as it alleviates the maturity mismatch and counterbalances the liquidity created by excess lending. The introduction of deposit insurance may have two moderating effects on the positive relationship between excess lending and liquidity creation. First, studies show that deposit insurance incentivizes banks to engage in the reckless behavior of more risky lending (Calomiris and Jaremski 2019; Demirgüç-Kunt and Detragiache 2002). Hence, the introduction of deposit insurance would stimulate excess lending and amplify its effect on liquidity creation. Second, having their deposits insured, depositors would be less likely to withdraw their funds even if they suspect risky behavior from banks.

Alternatively, the liquidity trade-off theory hypothesizes that the relationship between excess lending and the liquidity creation by banks is negative (Chen et al. 2015). It argues that the increased credit risk from excess lending pushes banks to reduce their liquidity creation in order to mitigate potential shocks. In such circumstances, deposit insurance could boost a bank’s confidence as the probability of runs is lower. Hence, ceteris paribus, having the protection of deposit insurance, a bank could increase its overall risk levels and could reduce its incentive to lower liquidity risk. In other words, the deposit insurance would mitigate the negative effect of excess lending on liquidity creation as posited by the liquidity trade-off theory.

3.3 Through the Channel of Bank Competition

The literature proposes opposing ideas regarding the relationship between bank competition and liquidity creation. The competition-stability argument hypothesizes that intensive bank competition increases the liquidity of banks (Boyd and De Nicolo 2005). Accordingly, in a competitive banking environment individual banks are less likely to have the monopolistic power to influence market rates. Hence, greater competition leads to lower lending rates and higher deposit rates, and such rates would boost the demand for deposits and loans in the economy, contributing to greater liquidity creation of banks. Introducing deposit insurance to a competitive banking market may favor larger banks in their possibly monopolistic positions. As in the case of China, implicit (i.e. too big to fail) and explicit deposit insurance may provide double protection for larger banks that cements their positions as dominant market players. It would be challenging for smaller banks to compete with larger banks given their wider branch networks. Overall, the presence of deposit insurance may give more advantage to larger banks, which then can control the lending and deposit rates that may reduce the positive effect of competition on liquidity creation.

In contrast, the competition-fragility hypothesis argues that bank competition reduces liquidity creation (Horvath et al. 2016) as intense competition could have a negative impact on the profitability of banks. Higher profits allow banks to absorb more risk. Hence, less profit would reduce banks’ capacity to absorb risk that in turn, would push them to reduce liquidity creation. The presence of deposit insurance in a banking system would also increase the chances of newcomers to the system as depositors would have more confidence in such banks. In a competitive market, smaller and newer banks would be more likely to have pricing power and the ability to take on risk, driving down the overall profitability of the banking market. As a result, less profitable banks would have a reduced capacity to create liquidity.

3.4 Through the Channel of Monetary Policy

Berger and Bouwman (2017) hypothesize that monetary policy has an influence on the liquidity creation by banks. They explain that loose monetary policy may increase deposits that expand the reserves of banks. An increase in bank deposits would then lead to an increase in loanable funds or decrease the cost of funds.Footnote 12 As a result, banks may respond by lending more that would lead to more liquidity creation. Assuming symmetry, the opposite effects can be predicted for tight monetary policy.

The literature has also hypothesized a link between deposit insurance and the effectiveness of monetary policy (Andries and Billon 2010; Cecchetti and Krause, 2005). Cecchetti and Krause (2005) develop an equilibrium model and predict that countries with explicit deposit insurance and state-owned banks with a high degree of assets have less credit in the private sector. They argue that the bank loans extended to the private sector decrease in the presence deposit insurance as a consequence of less efficient financial intermediation that has higher costs. Andries and Billon (2010) also theoretically show that having national deposit insurance leads to a heterogeneous change in the monetary policy. Their arguments are based on the lending channel of monetary policy (Kashyap and Stein 1993) where a monetary contraction entails a decline in banks’ reserves that leads them to scale down their lending. However, in the presence of deposit insurance banks benefit from a more stable deposit base that enables them to insulate their loan portfolios against a restrictive monetary policy. Cecchetti and Krause (2005) and Opiela (2008) provide supporting evidence for the arguments that deposit guarantees weakened the effect of monetary policy interventions for Poland and a multinational sample of 49 countries, respectively.

3.5 The Heterogeneous Effect of Deposit Insurance on Liquidity Creation of Big 5 State-Owned Banks and Others

State-owned banks, i.e. big 5, constitute more than 36% of the assets in the banking system in China (Amstad et al. 2020). Moreover, big 5 are crucial in implementing government’s economic policy. Hence, we argue that in China big state-owned banks have always benefited from an implicit deposit insurance. This is similar to the case of Russia, where Fungáčová et al. (2017) argue that state-owned banks, given their vital role in the economy, were always protected through an implicit government guarantee. In China, deposit holders and all other market participants deem the big 5 state-owned banks are too big to fail. Their expectation is for Chinese government to step in to bailout big 5 banks in case of a bank run or a default. Hence, we postulate that depositors and market participants expectations of the state-owned big 5 state-owned banks in terms of their riskiness might have been less affected by the implementation of an explicit deposit insurance in comparison to other banks. In contrast, other banks’ business would be more impacted by the introduction of the implicit deposit insurance scheme. To this extent, they are more likely to engage in liquidity creation after the introduction of the scheme. Hence, we expect that the direction and intensity of the effect of deposit insurance on liquidity creation to differ between state-owned big 5 banks and other banks and look for evidence in our empirical model.

4 Empirical Models

We examine the impact of the implementation of deposit insurance in China on liquidity creation (LC) for bank i in year t as follows:

where \(post2015\) captures the policy effect and equals one for the years after 2015 and zero otherwise. \({X}_{it}\) represents the measures for bank capital, excess lending, bank competition, and monetary policy. The \({Z}_{it}^{K}\) is a vector of control variables for bank characteristics and macroeconomic variables. K is the number of the control variables. All variables are explained in the following section. \(\beta\) and \(\lambda\) are the estimated coefficients for the main and control variables, respectively.

Considering that implicit deposit insurance for the big 5 state-owned banks, we set the group of big 5 state-owned banks as the control group (treat = 0), and other banks as the treatment group (treat = 1). The following DID regression compares the different effects of the two groups before and after the implementation of explicit deposit insurance on liquidity creation (LC) for bank i in year t as follows:

where \(treat\) is the dummy variable for the treatment group. The main explanatory variables are denoted by C, N, COMP, and MP and represent bank capital, excess lending, bank competition, and monetary policy, respectively. The \({\gamma }_{4}\),\({ \delta }_{4}\),\({\theta }_{4}\) and \({\sigma }_{4}\) indicate how the implementation of deposit insurance heterogeneously affects the influence of the channels on the liquidity creation of state-owned big 5 and others. Focusing on the significance and directional signs of these four coefficients, we test the causal effect of deposit insurance on liquidity creation. K is the number of control variables. All variables are explained in the following section. The \(\lambda\) is the estimated coefficients for the control variables.

5 Data, Variables, and Descriptive Statistics

5.1 Sample and Data Sources

Our dataset consists of 126 Chinese commercial banks and covers the period from 2011 to 2017. We exclude the local branches of foreign banks as these are not covered by the insurance.Footnote 13 We also exclude three policy banksFootnote 14 that do not have a commercial motive and the Postal Savings Bank of China which was classified as “other financial institutions” by the regulatory authority during our sample period. The final sample accounts for more than 80% of the total assets of the Chinese banking industry. The sample comprises five large state-owned Banks (i.e., the Bank of China, China Construction Bank, Agricultural Bank of China, Industrial and Commercial Bank of China and the Bank of Communication), 12 joint-stock banks, 77 city commercial banks, and 32 rural commercial banks. We collect the data mainly from the BankFocus database that we complement with the CSMAR and Wind databases as well as banks’ annual reports. The macroeconomic variables are calculated based on the data released by the National Bureau of Statistics of China.

5.2 Definitions of Variables

5.2.1 Dependent Variables

We broadly follow Berger and Bouwman (2009) to construct the measures of liquidity creation. However, we argue that the classification of the accounting items capturing liquidity for US banks for on- and off-balance sheets is not fully replicable for Chinese banks. This is because the type of business in the Chinese banks and the consumption model of Chinese citizens are different from those in the US. Further, Berger and Bouwman (2009) use US bank call reports whose accounting items are different from the BankFocus database we use. There is no one-to-one match between the two databases. Therefore, we construct the measures of liquidity creation more in line with the characteristics of Chinese banks by following the three steps described in Sun et al. (2014).

In step 1, we classify the account items on- and off-balance sheet as liquid, semi-liquid, or illiquid based on the ease, cost, and time necessary for banks to turn their obligations into liquid funds and the ease, cost, and time customers need to withdraw liquid funds from banks. On the assets side, we classify the cash and transactive securities as liquid assets. We categorize residential real estate loans as illiquid assets in contrast to Berger and Bouwman (2009) who classify them as semi-illiquid. This is because mortgage-backed securitization is not widespread in China, and banks rarely securitized and sell mortgages for liquidity. In the same vein, we classify the items with high liquidation costs such as industrial and commercial loans, real estate investments, fixed assets, and intangible assets as illiquid assets. We classify consumer loans as semi-liquid assets due to their flexible structure and short maturity. We classify interbank loans as semi-liquid as they are large in size and have greater transparency, which makes converting them to cash easier than industrial and commercial loans.

On the liability side, we classify demand deposits and transactive liabilities as liquid. Time deposits are defined as semi-liquid liabilities due to the interest cost of withdrawing in advance. Similar to interbank loans, the interbank liabilities are classified as semi-liquid. Illiquid liabilities consist of the liabilities that are hard to withdraw and that are more expensive to cash out as well as subordinated debt, bank reserves, and other liabilities. Differing from Berger and Bouwman (2009), we classify savings deposits as semi-liquid liabilities instead of as liquid liabilities. This is because unlike US households, who have a weak attitude towards household saving and have a greater propensity to use income for current consumption, Chinese households are more inclined to save a larger proportion of their income to meet the future needs for big expenditures such as housing and education. This behavior reduces the liquidity of savings deposits in China. From the off-balance sheet items, we classify contingent liabilities (such as loan commitment and letters of credit) as illiquid as they are similar to industrial and commercial loans in terms of convertibility to cash. We categorize securitized assets and collaterals as semi-liquid as they are easily converted into cash despite the cost of liquidation. In general, our classifications of off-balance sheet items are consistent with those in Berger and Bouwman (2009); Table 1 displays them.

In step 2, we assign weights to all the categorized items. Illiquid assets, liquid liabilities, and illiquid off-balance items are assigned a weight of 0.5. The semi-liquid assets, semi-liquid liabilities, and semi-liquid off-balance sheet items are assigned a weight of 0. We assign the weight of -0.5 to liquid assets, illiquid liabilities, and liquid off-balance sheet items.

In the last step, we calculate the measures of liquidity creation based on the following Eq. (3). Following Berger and Bouwman (2009), we regard the liquidity creation per unit of assets as the main dependent variables. The main measures are total liquidity creation (lc_ta), liquidity creation on balance sheet (lc1_ta), and liquidity creation off-balance sheet (lc2_ta).Footnote 15

5.2.2 Explanatory Variables

To measure the capital levels of banks, we use capital adequacy ratio (car), Tier 1 capital adequacy ratio (ccar), and equity ratio (ea) as variables (Lei and Song 2013). The capital adequacy ratio is the sum of Tier 1 and 2 capital divided by the total risk weighted asset. The Tier 1 capital adequacy ratio is the Tier 1 capital divided by the total risk weighted assets. The equity ratio equals the total equity divided by total assets.

We use excess loan growth rate (elgr1 and elgr2) and relative loan (relative_loan) (Chen et al. 2015). The first measure for excess loan growth, elgr1, is the difference between the growth rate of a bank’s loans in a given year and in the last year. The second measure, elgr2, is the difference between the growth rate of a bank’s loans in a given year and the mean growth rate in the last two years. Relative loan is defined as the loans to total assets ratio of each bank minus the average loans to total assets ratio of all banks.

To measure bank competition, we use 5-bank concentration ratio (cr5), Herfindahl-Hirschman Index (HHI), and size ratio. Measure cr5 is the size proportion of the big 5 in the full sample, which illustrates the degree of monopoly and market competitiveness. We calculate this variable for assets (cr5_assets), deposits (cr5_deposits), and loans (cr5_loans). HHI is the sum of the squared market share of each bank. We calculate the HHI based on assets (hhi_assets), deposits (hhi_deposits), and loans (hhi_loans). Size ratio is the market share of each bank divided by the size of the total market. We use total assets (sl_assets), total deposits (sl_deposits), and total loans (sl_loans) to calculate the market share.

As an indicator of monetary policy, we use deposit rate (depositr) that is the 1-year benchmark deposit rate, loan rate (lendr) that is the 1-year benchmark loan rate, and deposit reserve ratio (rmbdrr). Definitions of all explanatory variables are presented in Table 2.

5.2.3 Control Variables

Control variables are mainly composed of bank characteristics and macroeconomic indicators. Bank size (size) is measured by the natural logarithm of the bank’s total assets. Following Fungáčová et al. (2017), we use risk asset ratio, volatility, and ZSCORE as proxies for bank risk. The risk asset ratio is the risk weighted assets divided by total assets. Volatility is the standard deviation of ROAs for each bank for the whole sample period (Laeven and Levine 2009). ZSCORE is the sum of ROA and equity to total assets ratio divided by the standard deviation of the annual return on assets. We use the natural logarithm of the ZSCORE value. Bank profitability is represented by ROA (roaa) and ROE (roae). Bank governance variables consist of the ratio of deposits to asset (bankgovernance1), net loans to total assets (bankgovernance2), and growth rate of gross loans (bankgovernance3) (Lei and Song 2013). We also use the dummy variable IPO (ipo) to capture whether a bank is listed on the stock market. The bank type (banktype) variable is a categorial variable that equals one for the big 5, two for joint-stock banks, three for city commercial banks, and four for rural commercial banks. The macroeconomic variables are annual GDP (gdp) and CPI (cpi) growth. All definitions are presented in Table 2.

5.3 Descriptive Statistics

We present the descriptive statistics for all variables in Table 3. We observe that Chinese banks’ average liquidity creation per dollar of assets is 0.160 USD of which 0.095 and 0.065 came from on- and off-balance sheet items, respectively. The big 5 are the major contributors to the liquidity creation in the Chinese banking industry with an average of 0.313 USD per dollar of assets. For the overall sample, the average capital adequacy ratio is 12.87% with the average Tier 1 capital ratio being 10.75%. The average excess loan growth is -1.10% (elgr1) for one year and − 1.60% (elgr2) for two years.

All of the bank concentration ratios, whether measured by assets, deposits, or loans, show that the monopolistic power of the big 5 weakened from 2011 to 2017. The big 5 concentration ratios are the highest around the year of 2011 (about 75.1%), and the lowest in 2017 (about 55.0%). Similar trends occur when the concentration is measured with HHI. The distribution of size ratio indicates that big and small banks have significantly large differences in their relative market shares. The average profitability of Chinese banks is 14.40% (roae) and 1.00% (roaa). In terms of risk measures, the average risk weighted asset and ZSCORE are 65.02% and 3.90, respectively. On the liabilities side, the average deposit ratio of Chinese banks is 68.82%. Finally, we observe that 35.82% of the banks are listed on the stock market.

6 Results

6.1 Main Results

We present the results for the impact of deposit insurance through the channel of bank capital in Table 4. We find that the coefficients for the interaction terms car×post2015 (interaction of deposit insurance period with capital adequacy ratio) and ccar×post2015 (interaction of deposit insurance period with Tier 1 capital adequacy ratio) are positive and statistically significant. These results show that the presence of deposit insurance positively reinforces the effect of bank capital on liquidity creation. This finding is plausible as bank risks decrease after the introduction of deposit insurance as the same level of bank capital absorbs more risks. Furthermore, the deposit insurance increases depositors’ confidence that reduces the banks’ need to have a highly liquid financial structure in order to maintain that confidence and establish a reputation. We do not find a significant coefficient for ea×post2015. This finding may not be surprising as ea is not a ratio that could capture the true capital levels of a bank as capital adequacy is directly related to the risk that the bank is taking. In other words, the effect of deposit insurance on the relationship between capital and liquidity creation can only be observed through variables that are risk adjusted, such as car and ccar. In sum, our evidence shows that the introduction of deposit insurance can reinforce the positive effect of bank capital on liquidity creation and mitigate the negative effect of capital on liquidity creation. Moreover, we find the coefficients for car, ccar, and ea are negative (but not statistically significant) that is in line with Lei and Song (2013) and the predictions of the financial fragility hypothesis.

We present the results for the impact of deposit insurance through the channel of excess lending in Table 5. We do not find significant coefficients for any of the interaction terms of elgr1×post2015, elgr2×post2015, or relative_loan×post2015. Hence, we do not find any evidence on the effect of deposit insurance on the influence of excess lending on the liquidity creation by banks. We find positive coefficients for relative loan, elgr1, and elgr2; however, only the first one is statistically significant that partly supports Chen et al. (2015) who finds that excess lending positively influences liquidity creation.

We present the results for the impact of deposit insurance through the channel of bank competition in Table 6. We find that none of the interaction terms (cr5_assets×post2015, hhi_assets×post2015, and sl_assets×post2015) are significant. Therefore, deposit insurance does not influence the liquidity creation through the channel of bank competition.Footnote 16 At the same time we find that the coefficients for cr5_assets and hhi_assets are positive and statistically significant. These findings are in line with the competition-stability argument of Boyd and De Nicolo (2005) that intense bank competition increases liquidity creation. On the other hand, sl_assets is negative and significant that supports the competition-fragility hypothesis of Horvath et al. (2016) that bank competition reduces the liquidity creation by banks.Footnote 17

We present the results for the impact of deposit insurance on liquidity creation through the monetary policy channel in Table 7. We find that the coefficients for two (depositr×post2015 and lendr×post2015) out of the three interaction terms are negative and statistically significant. The results show that deposit insurance reduces the positive impact of monetary policy on liquidity creation. These findings are in line with the literature arguing that deposit insurance reduces the effectiveness of monetary policy (Cecchetti and Krause 2005; Lin 2015; Opiela 2008). We also find that the coefficients for depositr, lendr, and rmbdrr are all positive and in some cases (Column 1 and 3) are statistically significant. These results confirm the arguments of Berger and Bouwman (2017) that loose (tight) monetary policy leads to more (less) liquidity creation.

We also simultaneously estimate some of the selected indicators, and the results are presented in Table 8. We find that the coefficients for the interaction terms for bank capital and monetary policy channels are similar with the results reported above and are statistically significant. In general, the simultaneous inclusion of variables for all channels provides the same results.

6.2 State-Owned Big 5 Versus Other Banks

We present the results of the DID analysis in Table 9 in which we test whether the indirect impact of deposit insurance differs for state-owned big 5 that already had protection through an implicit deposit insurance before 2015. We use different combinations of the selected explanatory variables in the estimated regressions. The first set (Columns 1 and 2) comprises car, relative_loan, sl_assets, and depositr. In Column 2, where we run fixed-effects regressions and find that the coefficients for all interaction terms (car×treat×post2015, relative_loan×treat×post2015, sl_assets×treat×post2015 and depositr×treat×post2015) are statistically significant. In the second set (Columns 3 and 4), the variables are car, relative_loan, sl_assets, and lendr. Similar to the first set of results, we report that all the interaction terms (car×treat×post2015, relative_loan×treat×post2015, sl_assets×treat×post2015, and lendr×treat×post2015) are significant in the random and fixed effects models. The third set of regressions (Columns 5 and 6) comprises ccar, relative_loan, sl_assets, and depositr. Here we report similar findings except that sl_assets×treat×post2015 loses its statistical significance in Column 6 in the fixed effect regressions. Overall, our results indicate that the influence of deposit insurance on the selected measures’ impact on liquidity creation is statistically different for the two groups (i.e., state-owned big 5 versus the others).

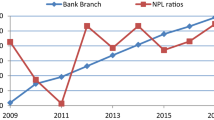

To justify our methodological choice, we also provide evidence for the implicit parallel trend assumption required for the DID set-up. In our context the control group and treatment group should share common trends before the introduction of deposit insurance in 2015. Accordingly, we use an event study to address the effects of the time trend presented in Fig. 1. We observe that for all variables the coefficients of interactions before 2015 (left section of each graphic) are not significant. However, after 2015 these coefficients become significant that provides support for the underlying assumptions of the DID strategy.Footnote 18

Testing parallel trend assumptions. Note: The points in the graphs show the coefficients for the interaction variables (Variable*Treat*Year) and the vertical dashed line represents the confidence interval at the 95% level. We observe that for all variables, the coefficient for the interactions before 2015 (left section of each graphic) are not significant. However, after 2015 these coefficients become significant. Note that we cannot present data for the bottom right graph due to multicollinearity issues

Overall, these results show that deposit insurance more positively enlarges the effect of bank capital on liquidity creation in the other banks in comparison to state-owned big 5 banks. This is probably a consequence of the implicit deposit insurance that big 5 benefited from prior to 2015. In contrast, other banks were exposed to more systematic risk before 2015. Hence, they were influenced more by the implementation of the explicit deposit insurance. Regarding the excess lending (measured by relative_loan), we find that the introduction of the deposit insurance more negatively affected the influence of excess lending on the liquidity creation by other banks in comparison to the big 5. Thus, an explicit deposit insurance reduces certain risks that creates more incentives for the big 5 to increase lending and liquidity creation. We also find some evidence that the negative effect of explicit deposit insurance on the influence of bank competition and monetary policy on liquidity creation is larger for other banks in comparison to state-owned big 5.

7 Robustness Checks

7.1 The Liquidity Creation on and Off-Balance Sheet

Earlier, we examined liquidity creation both on- and off-balance sheet. However, there may be differences between the two on how the variables of interest affect liquidity creation. In this section, we divide the total liquidity creation into those from on-balance sheet items (lc1_ta) and those from off-balance sheet items (lc2_ta). We present the benchmark results for the first three channels in Table 10. We find that the results for car× post2015 and ccar × post2015 are similar to our original results. This similarity shows that the deposit insurance positively reinforces the effect of bank capital on liquidity creation both on-balance sheet and off-balance sheet. Additionally, this similarity is more pronounced for the balance sheet items. The coefficient for relative_loan × post2015 is only significant and positive for the on-balance sheet liquidity. This coefficient provides some evidence about the effect of deposit insurance on the influence of excess lending on on-balance sheet liquidity creation. The results for the monetary policy channel are presented in Table 11. We find that different variables for monetary policy have heterogeneous effects on both on- and off-balance sheet liquidity creation. The deposit insurance only mitigates the effect of the 1-year benchmark deposit rate (depositr) and deposit reserve ratio (rmbdrr) on the off-balance sheet liquidity creation. On the other hand, the 1-year benchmark loan rate (lendr) has a negative influence on the impact of monetary policy on both on- and off-balance sheet liquidity creation.

Finally, we simultaneously include all channels in the models. The results, presented in Table 12, show that the deposit insurance positively enhances the effects of bank capital and excess lending on both on- and off-balance sheet liquidity creation. On the other hand, excess lending’s effect is only observed for on-balance sheet liquidity creation. The deposit insurance has no effect on the influence of bank competition on both on- and off-balance liquidity creation. Finally, in terms of the impact of monetary policy on liquidity creation, the deposit insurance reduced its effect both on- and off-balance sheet.

7.2 Using Savings Deposits as an Alternative Measure for Liquidity Creation

In this subsection, we use an alternative measure for liquidity creation. As mentioned in subsection 4.2.1, we use Sun et al.’s (2014) rather than Berger and Bouwman’s (2009) definition of liquidity creation that is more suitable in the Chinese banking context. However, it may be a strong assumption that savings deposits are classified as semi-liquid rather than as liquid liabilities. Hence, for robustness checks, we also categorize this variable as in Berger and Bouwman (2009) and re-run our analysis. The results for the DID analysis are presented in Table 13. We find that all the signs and significances of the coefficients, with minor changes in their magnitude, are similar to the findings reported in Table 9. Overall, our results are robust to the change in the liquidity classification of savings deposits.

7.3 The Potential Impact of Other Regulatory Changes on the Results

We also check the robustness of our results regarding the potential impact of other regulatory changes introduced at the same time in China. In particular, the PBOC made changes in 2015 to reform the interest rate market. The banks raised the deposit rate ceiling to 120% of the 1-year benchmark deposit rate from the previous 110%, giving banks more room to price the deposit rates. To address the potential confounding effects of these two regulatory changes on our setting, we re-run the DID estimations by using the loan to deposit ratio (ldr) for the first regulatory change and the net interest margin (nim) for the second regulatory change. We report the results in Tables 14 and 15, respectively. We do not find any significant effect of these changes on liquidity creation. We conclude that these other regulatory changes do not impact the robustness of our results.

8 Conclusions

We examine how the implementation of deposit insurance indirectly influences the liquidity creation by banks through the four channels identified by the literature. We exploit China’s introduction of deposit insurance as a natural experiment that uses the panel data of 126 Chinese banks. We also investigate the heterogeneous effects for different types of banks (i.e., the largest five state-owned banks versus other banks).

We find that the deposit insurance positively influences the effect of bank capital on liquidity creation. Our results also show that deposit insurance weakens the effect of monetary policy on liquidity creation. Regarding the excess lending and bank competition channels, our empirical evidence does not capture any effect of deposit insurance. Examining the possible different effects on the state-owned five largest banks and other banks, we find that the deposit insurance has heterogeneous effects on liquidity creation.

Our work has some policy implications. First, our findings indicate that countries that may consider introducing deposit insurance (or perhaps consider the less likely scenario of removing the existing deposit insurance) should consider the externalities caused by such a move on liquidity creation in the financial system. Second, the regulatory authorities may need to closely monitor the indicators for bank capital in order to evaluate the overall effect of deposit insurance on financial stability before introducing it. Moreover, they may need to closely monitor smaller banks as they are more likely to show excessive risk-taking after the introduction of deposit insurance that may have an impact on financial stability. Third, the monetary authority should be aware of the negative influence of deposit insurance on the impact of monetary policy on liquidity creation, and possibly adjust their policy instruments accordingly.

Notes

In contrast, Down (2000) theoretically demonstrates that deposit insurance is unnecessary and incapable of achieving a superior outcome when a financial intermediary has adequate capital.

Similar result are reported by Berger and Bouwman (2009) for small US banks, but not for medium and large ones.

The main purpose of the system is to protect depositors’ legal benefits, prevent and resolve the financial risks, and maintain financial stability. The regulation (5th) stipulates that the highest reimbursement amount is RMB 500,000. Among Chinese depositors, 99.7% are below this threshold (The People’s Bank of China 2013).

These banks are the Industrial & Commercial Bank of China, the China Construction Bank, the Bank of China, the Bank of Communications, and the Agricultural Bank of China. The government and government-controlled entities are the majority shareholders who control more than 50% of shares in these banks. We followed the classification outlined by the China Banking and Insurance Regulatory Commission to identify the stated-owned banks. We classify the banks which are held or controlled by the government and state-funded financial firms. We exclude the policy banks in our sample as these banks are non-profit organizations.

For example, one of the first cases of bank closure was the Hainan Development Bank in 1998. The central government took over its all its debt, which was around USD 2 billion (Yan and Huang 2008).

The main role of this institution is to regulate the banking institutions through formulating supervisory rules and regulations, authorizing the establishment of banking institutions, examining and enforcing rules, encouraging better/proper governance, collecting information and finding resolutions.

In September 2011, the Banking Regulatory Commission announced that the bank had been restructured and renamed the Guangdong Huaxing Bank.

Pennacchi (1999) provides a detailed discussion on the relative merits of a targeting policy and a flat-rate insurance policy.

Zhou (2016) provides a detailed description of the duties of the agency and regulations governing the deposit insurance fund.

Our interpretation of the direction of the influence that the deposit insurance has on the relationship between bank capital and liquidity creation differs from Fungáčová et al. (2017). They argue, with respect to risk absorption, that deposit insurance can reduce liquidity creation because it reduces incentives for banks to prevent runs by owning more capital, therefore, reducing their ability to create liquidity.

Bergen and Bouwman (2017) explain that retail deposits are a cheaper source of funding in comparison to Federal Reserve funds or large corporate deposits.

The second clause of Chinese deposit insurance regulation stipulates that “All financial institutions absorbing deposits such as commercial banks, rural cooperative banks and rural credit cooperatives etc. should insure their deposits in accordance with the regulation. This regulation is not applicable to the branches of insured institutions established outside the People’s Republic of China (PRC) and branches of foreign banks established inside of PRC.”

These are the China development bank, the Export-Import Bank of China, and the Agriculture Development Bank.

The lc_ta and lc1_ta are equivalent to “cat fat” and “cat nonfat” in Berger and Bouwman (2009), respectively. We do not calculate the liquidity creation based on maturity as this data are not available in the sources we used.

In unreported results, we also calculate competition by using the size of deposits or loan size. The results do not change. These results are not reported for brevity and are available on request.

It is important to note here that sl_assets has a negative coefficient in comparison to cr5_assets and hhi_assets which have positive coefficients. This difference may be due to the fact the former is an indicator that captures a broader measure of banking competition as it is calculated for the whole sample period per bank. In contrast, the latter two variables are calculated per bank per year. Given that competition in the banking sector and banks’ positions in the system are medium to long-term phenomena, our view is that the findings for China are more supportive of the competition-fragility hypothesis.

We also test whether changes in post-crisis Basel (Basel 2.5) requirements for the largest banks in China may have affected our results as larger banks may behave differently. If large banks have responded to the new Basel requirements over the period of our analysis but small banks have not, then our DID strategy may not suffice as there could be some pre-existing trends already. To remedy this concern, we run mean comparison t-tests to examine whether there were differences between the responses of the large and small groups of banks to Basel 2.5 during the introduction of the deposit insurance. Due to the lack of accounting information disclosed by banks, we use the liquidity coverage ratio (LCR) that was introduced by new Basel requirements in 2014. We find that there is a high percentage of reporting by both groups (80% for large banks and 90% for all banks) in which banks started to release their LCR information after 2015. The results of the mean comparison t-tests, not reported for brevity, show that there is no statistically significant difference between the two groups.

References

Amstad M, Sun G, Xiong W (2020) The handbook of China’s financial system. Princeton University Press

Andries N, Billon S (2010) The effect of bank ownership and deposit insurance on monetary policy transmission. J Bank Finance 34(12):3050–3054

Barth JR (1989) Thrift deregulation and federal deposit insurance. J Financ Serv Res 2(3):231–259

Beltratti A, Stulz RM (2012) The credit crisis around the globe: why did some banks perform better? J Financ Econ 105(1):1–17

Bencivenga VR, Smith BD (1991) Financial intermediation and endogenous growth. Rev Econ Stud 58:195–209

Berger AN, Bouwman CH (2009) Bank liquidity creation. Rev Financ Stud 22(9):3779–3837

Berger AN, Bouwman CH (2017) Bank liquidity creation, monetary policy, and financial crises. J Financ Stab 30:139–155

Berger AN, Sedunov J (2017) Bank liquidity creation and real economic output. J Bank Finance 81:1–19

Bhattacharya S, Thakor AV (1993) Contemporary banking theory. J Financ Intermed 3:2–50

Boyd JH, De Nicolo G (2005) The theory of bank risk taking and competition revisited. J Finance 60(3):1329–1343

Calomiris CW, Chen S (2016) The spread of deposit insurance and the global rise in bank leverage since the 1970s. Working Paper Columbia Business School, Columbia University

Calomiris CW, Jaremski M (2016) Deposit insurance: theories and facts. Annual Rev Financ Econ 8:97–120

Calomiris CW, Jaremski M (2019) Stealing deposits: Deposit insurance, risk-taking, and the removal of market discipline in early 20th -century banks. J Finance 74(2):711–754

Casu B, di Pietro F, Trujillo-Ponce A (2019) Liquidity creation and bank capital. J Financ Serv Res 56:307–340

Cecchetti SG, Krause S (2005) Deposit insurance and external finance. Econ Inq 43(3):531–541

Chen TH, Chou HH, Chang Y, Fang H (2015) The effect of excess lending on bank liquidity: evidence from China. Inter Rev Econ Finance 36:54–68

Chernykh L, Cole RA (2011) Does deposit insurance improve financial intermediation? Evidence from the Russian experiment. J Bank Fin 35(2):388–402

Dang VD (2022) Bank funding, market power, and the bank liquidity creation channel of monetary policy. Res Inter Bus Finance 59:101531

Demirguc-Kunt A, Detragiache E (2002) Does deposit insurance increase banking system stability? An empirical investigation. J Monet Econ 49:1373–1406

Demirguc-Kunt A, Kane EJ, Laeven L (eds) (2008a) Deposit insurance around the world: issues of design and implementation. MIT Press, Cambridge MA

Demirguc-Kunt A, Kane EJ, Laeven L (2008b) Determinants of deposit-insurance adoption and design. J Financ Intermed 17(3):407–438

Dewenter KL, Hess A, Brogaard J (2018) Institutions and deposit insurance: empirical evidence. J Financ Serv Res 54(3):269–292

Diamond DW, Dybvig PH (1983) Bank runs, deposit insurance, and liquidity. J Polit Econo 91:401–419

Diamond DW, Rajan RG (2000) A theory of bank capital. J Finance 55(6):2431–2465

Diamond DW, Rajan RG (2001) Liquidity risk, liquidity creation, and financial fragility: a theory of banking. J Polit Econo 109(2):287–327

Distinguin I, Roulet C, Tarazi A (2013) Bank regulatory capital and liquidity: evidence from US and European publicly traded banks. J Bank Finance 37:3295–3317

Dowd K (2000) Bank capital adequacy versus deposit insurance. J Financ Serv Res 17:7–15

Ehlers T, Kong S, Zhu F (2018) Mapping shadow banking in China: Structure and dynamics. BIS Working Paper

Ely DP, Weaver RR (1991) The shifting value of federal deposit insurance: implications for reform. J Financ Serv Res 5:111–130

European Commission (2014) Directive 2014/49/EU of the European Parliament and of the Council of 16 April 2014 on deposit guarantee schemes. https://eur-lex.europa.eu/eli/dir/2014/49/oj

Fu XM, Lin YR, Molyneux P (2016) Bank capital and liquidity creation in Asia Pacific. Econ Inq 54:966–993

Fueda I, Konishi M (2007) Depositors’ response to deposit insurance reforms: evidence from Japan, 1990–2005. J Financ Serv Res 31:101–122

Fungáčová Z, Weill L, Zhou M (2017) Bank capital, liquidity creation and deposit insurance. J Financ Serv Res 51(1):97–123

Hall MJB (1999) Deposit insurance reform in Japan: better late than never? J Financ Serv Res 15:211–242

Horvath R, Seidler J, Weill L (2014) Bank capital and liquidity creation: Granger-causality evidence. J Financ Serv Res 45:341–361

Horvath R, Seidler J, Weill L (2016) How bank competition influences liquidity creation. Econ Modelling 52:155–161

Hou X, Li S, Li W, Wang Q (2018) Bank diversification and liquidity creation: Panel Granger-causality evidence from China. Econ Modelling 71:87–98

Hovakimian A, Kane EJ (2000) Effectiveness of capital regulation at US commercial banks, 1985 to 1994. J Finance 55(1):451–468

IMF (2018) Global Financial Stability Report April 2018: a bumpy Road ahead. International Monetary Fund

International Association of Deposit Insurers (2023) Deposit Insurance Systems Worldwide, https://www.iadi.org/en/about-iadi/deposit-insurance-systems/dis-worldwide/

Ioannidou VP, Penas MF (2010) Deposit insurance and bank risk-taking: evidence from internal loan ratings. J Financ Intermed 19(1):95–115

Jiang LL, Levine R, Lin C (2019) Competition and bank liquidity creation. J Financ Quant Anal 54(2):513–538

Kane EJ (1987) No room for weak links in the chain of deposit-insurance reform. J Financ Serv Res 1(1):77–111

Kashyap AK, Stein JC (1993) Monetary policy and bank lending. NBER Working Paper 4317, Cambridge MA

Laeven L (2004) The political economy of deposit insurance. J Financ Serv Res 26:201–224

Laeven L, Levine R (2009) Bank governance, regulation and risk taking. J Financ Econ 93(2):259–275

Lei ACH, Song Z (2013) Liquidity creation and bank capital structure in China. Global Finance J 24(3):188–202

Li L, Zeng R (2007) 1979–2006: China’s Big Financial changes. Shanghai renmin chubanshe, Shanghai. (in Chinese)

Liang Q, Xu P, Jiraporn P (2013) Board characteristics and Chinese bank performance. J Bank Finance 37(8):2953–2968

Lin XC, Zhang Y (2009) Bank ownership reform and bank performance in China. J Bank Finance 58:131–143

Liu M (2009) Basic Rules Helped China Sidestep Bank Crisis What the West Could Learn from China’s Firewalls, Financial Times, 29 June 2009, Asia Ed1 edition

Nier E, Baumann U (2006) Market discipline, disclosure and moral hazard in banking. J Financ Intermed 15(3):332–361

Nivorozhkin E, Chondrogiannis I (2022) Shifting balances of systemic risk in the Chinese banking sector: determinants and trends. J Intern Financ Mark Instit Money 76:101465

Okazaki K (2007) Banking system reform in China: the challenges of moving toward a market-oriented economy. Rand

Opiela TP (2008) Differential deposit guarantees and the effect of monetary policy on bank lending. Econ Inq 46(4):610–623

Pennacchi GG (1999) The effects of setting deposit insurance premiums to target insurance fund reserves. J Financ Serv Res 16:153–180

People’s Bank of China (2013) Circular of the State Council on Approving and Transmitting the Opinions of the Development and Reform Commission on the Key Work of Deepening the Reform of the Economic System in 2013 Guo Fa, No. 20, http://www.gov.cn/zwgk/2013-05/24/content_2410444.htm

Pozdena RJ (1992) Danish banking: lessons for deposit insurance reform. J Financ Serv Res 5:289–298

Rauch C, Steffen S, Hackethal A, Tyrell M (2011) Determinants of bank liquidity creation. Working Paper, European School of Management and Technology

Sun S, Li MH, Liu LY (2014) The research on the relationship between commercial bank liquidity creation and capital adequacy ratio: evidence from the Chinese banking industry. J Finance Econ 40(7):65–76 (in Chinese)

Umar M, Sun G (2016) Nonperforming loans, liquidity creation, and moral hazard: case of Chinese banks. China Finance Econ Rev 4(10):1–23

Wagster JD (2007) Wealth and risk effects of adopting deposit insurance in Canada: evidence of risk shifting by banks and trust companies. J Money Credit Bank 39(7):1651–1681

Williams G (2018) The evolution of China’s banking system. 1993–2017, 1st edn. Routledge

Wu W (2012) Study on State Aid Legal systems of Market Exit mechanisms of Financial Institutions 101. China University of Political Science and Law. [in Chinese]

Yamori N, Sun J (2019) How did the introduction of deposit insurance affect Chinese banks? An investigation of its wealth effects. Emerg Mark Financ Tr 55(9):2022–2038

Zhang D, Jing C, Dickinson DG, Kutan AM (2016) Nonperforming loans, moral hazard and regulation of the Chinese commercial banking system. J Bank Finance 63:48–60

Zhang X, Fu Q, Lu L, Wang Q, Zhang S (2021) Bank liquidity creation, network contagion and systemic risk: evidence from Chinese listed banks. J Financ Stab 53:100844

Zhou Y (2016) Establishing a Deposit Insurance System in China: a long-awaited move toward deepening Financial Reform. Chi -Kent J Int’l Comp L 16:46

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest or competing interests.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

*The authors thank, in particular, Yusen Kwoh and Weihong Zeng for helpful comments and discussions. Our thanks also to participants at seminars held at the University of Leicester and University of Huddersfield. Xiangyi Zhou acknowledges financial support from the Chinese Fundamental Research Funds for the Central Universities (SK2020053). We remain responsible for all errors and omissions.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Zhou, X., Li, X., Zhou, Y. et al. Deposit Insurance and Bank Liquidity Creation: Evidence from a Natural Experiment in China*. J Financ Serv Res (2024). https://doi.org/10.1007/s10693-024-00431-z

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10693-024-00431-z