Abstract

Central banks around the world are examining the possibility of introducing Central Bank Digital Currency (CBDC). The public’s preferences concerning the usage of CBDC for paying and saving are important determinants of the success of CBDC. However, little is known yet about consumers’ attitudes towards CBDC. Using data from a representative panel of Dutch consumers we find that roughly half of the public says it would open a CBDC current account. The same holds for a CBDC savings account. Thus, we find clear potential for CBDC in the Netherlands. This suggests that consumers perceive CBDC as distinct from current and savings accounts offered by traditional banks. Intended CBDC usage is positively related to respondents’ knowledge of CBDC and trust in the central bank. Price incentives matter as well. The amount respondents say they would want to deposit in the CBDC savings account depends on the interest rate offered. Furthermore, intended usage of the CBDC current account is highest among people who find privacy and security important and among consumers with low trust in banks in general. These results suggest that central banks can steer consumers’ adoption of CBDC via the interest rate, by a design of CBDC that takes into account the public’s need for security and privacy, and by clear communication about what CBDC entails.

Similar content being viewed by others

Data Availability

The data used in this study are available upon request.

Notes

According to, among others, Marchiori (2021), the relationship between the development of prices of (virtual) goods paid with virtual currencies and the supply of virtual currencies may be opposite to what is predicted by monetary theory when agents providing payments services are rewarded with newly issued virtual currency. A decline in the issuance of a virtual currency raises the prices of goods paid with it. However, Balvers and McDonald (2021) show that it is theoretically possible to design a global digital currency that mimics the ideal design and whose value reflects the price development of a tradeable goods basket.

See the CBDC Tracker from the Atlantic Council at www.atlanticcouncil.org/cbdctracker/.

Of the 771 panel members that did not fill in the survey, 727 people did not response and 44 people partly filled in the survey.

People who are selected for participation in the panel but who do not have a computer with Internet access receive the necessary equipment.

For more information on Centerpanel and DHS, see Teppa and Vis (2012).

The survey is available upon request.

The list of reasons is based on the discussion of preconditions, objectives and design choices for CBDC by Wierts and Boven (2020).

The question reads as follows “Are you familiar with the following terms? Cash, digital money, public money, private money, central bank money, commercial money, central bank digital currency (CBDC).” For each term the answer options are: “No, I have never heard of it”, “Yes, I have heard of it, but I don't know what is meant with it”, and “Yes, I know what is meant with it”.

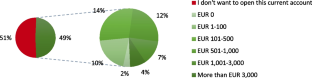

The response shares in Fig. 1 and the lower and upper bound of the balance categories above EUR 0 suggests that, on average, the Dutch would transfer between EUR 260 and EUR 700 to the CBDC current account. These amounts correspond with 10–25% of the average balance of EUR 2,800 that Dutch citizens had on their current account in 2019.

The impact is estimated as follows. People who find safeguarding their privacy very important have a two points higher score on the variable importance privacy CA than people with a neutral position. They have an 8 percentage points higher likelihood to intent to adopt a CBDC current account, as the marginal effect of a 1-point higher score on importance privacy CA amounts 4 percentage points.

People with very much trust in their own bank have a four points higher score on the variable narrow-scope trust in banks than people with very little trust, so we multiplied the marginal effect presented in the last column of Table 3 by four to estimate the impact (4 × 0.04 = 0.16).

The coefficient of the inverse Mills ratio (lambda) is positive and significant in the fourth model (Table 4, column 4). So, without correction, the coefficient estimates would have been upward-biased.

People who trust the central bank a lot have a three points higher score on the variable trust in the central bank than people with absolutely no trust, so we multiplied the marginal effects presented in Table 5 by three (-0.04*3 = -0.12 and 0.07*3 = 0.21).

References

Abramova S, Böhme R, Elsinger H, Stix H, Summer M (2022) What can CBDC designers learn from asking potential users? Results from a survey of Austrian residents. OENB Working Paper 241. Vienna: Österreichische Nationalbank

Adrian T, Mancini Griffoli T (2019) The rise of digital money. FinTech Notes No. 19/001. International Monetary Fund, Washington

Aghion P, Algan Y, Cahuc P, Shleifer A (2010) Regulation and distrust. Quart J Econ 125(3):1015–1049

Allen S, Čapkun S, Eyal I, Fanti G, Ford BA, Grimmelmann J, Juels A, Kostiainen K, Meiklejohn S, Miller A, Prasad E, Wüst K, Zhang F (2020) Design choices for Central Bank Digital Currency: policy and technical considerations, NBER Working Papers, no. 27634, Washington: NBER

Ampudia M, Palligkinis S (2018) Trust and the household-bank relationship. ECB Working Paper 2184. ECB, Frankfurt am Main

Andolfatto D (2021) Assessing the impact of central bank digital currencies on private banks. Econ J 131(634):525–540

Arango-Arango C, Bouhdaoui Y, Bounie D, Eschelbach M, Hernandez L (2018) Cash remains top-of-wallet! International evidence from payment diaries. Econ Model 62:38–48

Arauz A, Garratt R, Ramos F. DF (2021) Dinero Electrónico: the rise and fall of Ecuador’s central bank digital currency. Latin Am J Cent Bank 2(2):100030

Bagnall J, Bounie D, Huynh KP, Kosse A, Schmidt T, Schuh S, Stix H (2016) Consumer cash usage: a cross-country comparison with payment diary survey data. Int J Cent Bank 12(4):1–61

Balloch A, Nicolae A, Philip D (2015) Stock market literacy, trust, and participation. Rev Finance 19:1925–1963

Balvers RJ, McDonald B (2021) Designing a global digital currency. J Int Money Financ 111:102317

Bank of Canada, ECB, Bank of Japan, Sveriges Riksbank, Swiss National Bank, Bank of England, Board of Governors of the Federal Reserve and BIS (2020) Central bank digital currencies: foundational principles and core features. Report no 1

Bank of England (2020) Central Bank Digital Currency: opportunities, challenges and design. Discussion paper. Bank of England, London

Bijlsma M, Jonker N, van der Cruijsen C (2023) Consumer willingness to share payments data: trust for sale? Journal of Financial Services Research 64:41–80

Bolt W, Jonker N, van Renselaar C (2010) Incentives at the counter: an empirical analysis of surcharging card payments and payment behaviour in the Netherlands. J Bank Finance 34:1738–1744

Brunnermeier MK, Niepelt D (2019) On the equivalence of public and private money. J Monet Econ 106:27–41

Centraal Bureau voor de Statistiek (2021) Vermogen van huishoudens; huishoudenskenmerken; vermogensbestanddelen 2021. Retrieved from: https://www.cbs.nl/nl-nl/cijfers/detail/83834NE. Accessed 6 Nov 2023

Chakravarty S, Feinberg R, Rhee EY (2004) Relationships and individuals’ bank switching behavior. J Econ Psychol 25(4):507–527

Chiu J, Davoodalhosseini M, Jiang J, Zhu Y (2022) Bank market power and central bank digital currency: theory and quantitative assessment. J Polit Econ 131(5):1213–1248

ECB (2020) Report on a digital euro. ECB report. ECB, Frankfurt am Main

ECB (2021) Eurosystem report on the public consultation on a digital euro. ECB report. ECB, Frankfurt am Main

European Commission (2006) Interim report II. Current accounts and related services. Sector inquiry under article 17 regulation 1/2003 on retail banking. European Commission, Brussels

Fernández-Villaverde J, Sanches D, Schilling L, Uhlig H (2021) Central bank digital currency: central banking for all? Rev Econ Dyn 41:225–242

Garratt R, van Oordt M (2021) Privacy as a public good: a case for electronic cash. J Polit Econ 129(7):2157–2180

Gerritsen D, Bikker J (2020) Bank switching and interest rates: examining annual transfers between savings accounts. J Financ Serv Res 57:29–49

Gronwald M (2019) Is Bitcoin a commodity? On price jumps, demand shocks, and certainty of supply. J Int Money Financ 97:86–92

Hauff JC (2019) Reasons to switch: empowered vs less powerful bank customers. Int J Bank Market 37(6):1441–1461

Henry CS, Huynh KP, Nichols G, Nicholson MW (2019) 2018 Bitcoin Omnibus Survey: awareness and usage. Staff Discussion Paper 2019–10. Bank of Canada, Ottawa

Hernandez L, Jonker N, Kosse A (2017) Cash versus debit card: the role of budget control. J Consum Aff 51(1):91–112

Jiang D, Lim SS (2018) Trust and household debt. Rev Finance 22(2):783–812

Jonker N (2007) Payment instruments as perceived by consumers: results from a household survey. De Economist 155(3):271–303

Jonker N, van der Cruijsen C, Bijlsma M, Bolt W (2022) Pandemic payment patterns. J Bank Finance 143:106593

Kantar Public (2022) Study on New Digital Payment Methods. Kantar Public, commissioned by the ECB. Retrieved from: https://www.ecb.europa.eu/paym/digital_euro/investigation/profuse/shared/files/dedocs/ecb.dedocs220330_report.en.pdf. Accessed 16 Nov 2023

Keister T, Sanches D (2022) Should central banks issue digital currency? Rev Econ Stud 90(1):404–431

Kiff J, Alwazir J, Davidovic S, Farias A, Khan A, Khiaonarong T, Malaika M, Monroe HK, Sugimoto N, Tourpe H, Zhou P (2020) A survey of research on retail Central Bank Digital Currency. IMF Working Paper No. 20/104. IMF, Washington

Kosse A, Mattei I (2023) Making headway – Results of the 2022 BIS survey on central bank digital currencies and crypto. BIS Papers No. 136. BIS, Basel

Li J (2023) Predicting the demand for central bank digital currency: a structural analysis with survey data. J Monet Econ 134:73–85

Lusardi A, Mitchell OS (2014) The economic importance of financial literacy: theory and evidence. Journal of Economic Literature 52(1):5–44

Marchiori L (2021) Monetary theory reversed: virtual currency issuance and the inflation tax. J Int Money Financ 117:102441

Martenson R (1985) Consumer choice criteria in retail bank selection. Int J Bank Mark 3(2):64–75

Oliveira T, Thomas M, Baptista G, Campos F (2016) Mobile payment: understanding the determinants of customer adoption and intention to recommend the technology. Comput Hum Behav 61:404–414

Paulhus DL (1991) Measurement and control of response bias. In: Robinson JP, Shaver P, Wrightsman LS (eds) Measures of Personality and social psychological attitudes. Academic Press, San Diego, pp 17–59

Schnabel I (2020) The importance of trust for the ECB’s monetary policy. Speech as part of the seminar series “Havarie Europa. Zur Pathogenese europäischer Gegenwarten” at the Hamburg Institute for Social Research, 16 December. Retrieved from: https://www.ecb.europa.eu/press/key/date/2020/html/ecb.sp201216_1~9caf7588cd.en.html. Accessed 16 Nov 2023

Schuh S, Stavins J (2010) Why are (some) consumers (finally) writing fewer checks? The role of payment characteristics. J Bank Finance 34(8):1745–1758

Simon J, Smith K, West T (2010) Price incentives and consumer payment behaviour. J Bank Finance 34:1759–1772

Stavins J (2018) Consumer preferences for payment methods: role of discounts and surcharges. J Bank Finance 94:35–53

Sveriges Riksbank (2020) Second special issue on the e-krona. Sveriges Riksbank Economic Review. Sveriges Riksbank, Stockholm

Teppa F, Vis C (2012) The CentERpanel and the DNB Household Survey: methodological aspects. DNB Occasional Study 10(4). DNB, Amsterdam

Van der Cruijsen C, Diepstraten M (2017) Banking products: you can take them with you, so why don’t you? J Financ Serv Res 52(1–2):123–154

Van der Cruijsen C, Plooij M (2018) Drivers of payment patterns at the point of sale: stable or not? Contemp Econ Policy 36(2):363–380

Van der Cruijsen C, de Haan J, Roerink R (2021) Financial knowledge and trust in financial institutions. J Consum Aff 55(2):680–714

Van der Cruijsen C, de Haan J, Roerink R (2023) Trust in financial institutions: a survey. J Econ Surv 37(4):1214–1254

Van Rooij MCJ, Lusardi A, Alessie RJM (2012) Financial literacy, retirement planning and household wealth. Econ J 122(560):449–478

Whited TM, Wu Y, Xiao K (2022) Will Central Bank Digital Currency disintermediate banks? https://doi.org/10.2139/ssrn.4112644

Wierts P, Boven H (2020) Central Bank Digital Currency - Objectives, preconditions and design choices. DNB Occasional Study No. 1(2020). DNB, Amsterdam

Acknowledgements

We would like to thank colleagues at DNB for helpful comments on earlier versions of this paper and the questionnaire. We also received insightful comments from members of the European Central Bank High Level Taskforce on CBDC. One anonymous referee provided many helpful suggestions. We are grateful to Miquelle Marchand and Josette Janssen of Centerdata for collecting the data and for their help with the questionnaire. The views expressed in this paper are our own and do not necessarily reflect those of DNB, the ESCB or SEO Amsterdam Economics. All remaining errors are the authors’.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Declarations of interest

None.

Conflicts of interests/Competing interests

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1. Introductory text CBDC

Currently, you have access to:

-

1:

cash: coins and banknotes issued by the central bank (public money/central bank money) and

-

2:

digital money: the money you hold on your current and savings accounts at commercial banks, like ING, Rabobank, ASN bank and ABN AMRO (private money /commercial bank money).

Policymakers are considering whether citizens, like commercial banks, should be able to have an account with the central bank. There is no such possibility yet.

Money on such an account is known as ‘digital central bank money’. This is a new form of public money. We call it here a digital banknote. You will be able to pay with it in different ways, just like with the digital money you are currently holding at the current account of your bank. For example, you will be able to pay directly with digital banknotes for your purchases at physical shops using your debit card or smartphone.

It will also be possible to use digital banknotes to transfer money from your current account to a digital wallet on your smartphone, which you can subsequently use to pay your purchases with. When you run out of digital banknotes in this digital wallet, you can refill it.

Appendix 2. Description of variables

Table 8

Appendix 3. Detailed tables

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Bijlsma, M., van der Cruijsen, C., Jonker, N. et al. What Triggers Consumer Adoption of Central Bank Digital Currency?. J Financ Serv Res 65, 1–40 (2024). https://doi.org/10.1007/s10693-023-00420-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10693-023-00420-8