Abstract

The theoretical literature on bank runs has modeled depositors’ withdrawal decision as a one-off choice, made simultaneously by all depositors. Our game-theoretic framework gives depositors a heterogeneous, stochastic opportunity to change their minds about withdrawing their money. They can run out of (or run into) the crowd in front of the bank based on their observation of what others have done. Depositors’ opportunity to change their decision supports implicit coordination, which in some circumstances reduces the probability that self-fulfilling bank runs will occur.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Running is considered a healthy activity, the enjoyment of which often grows when performed with others.Footnote 1 These benefits however do not apply to running on a bank. On the contrary, the depositors’ dash to the bank to withdraw money on a large scale can be detrimental – not only to themselves and their bank but also to the health of the financial system as a whole.

Up until relatively recently, high-income countries with sophisticated financial markets were believed to be safe from bank runs. That notion started changing dramatically in 2007 with the runs on Countrywide Financial (the largest US mortgage lender the year before) and Northern Rock (the UK’s first bank run in 150 years). These episodes are often seen as important contributors to the Global Financial Crisis (GFC) (Shin 2009).

Many bank runs occurred during the GFC; even in advanced countries such as the United States (Bear Stearns, Washington Mutual, Wachovia), Canada (Home Capital Group), Iceland (Kaupthing, Landsbanki), the Netherlands (DSB Bank) and Spain (Bankia). Run-like phenomena have also been observed in other segments of the financial system, namely the repo market (Gorton and Metrick 2012), bank lending (Ivashina and Scharfstein 2010) and money market funds (Baba et al 2009). All these developments have rekindled interest by researchers and regulators, primarily because bank runs have the potential to evolve into major financial crises requiring costly policy interventions (Caprio and Klingebiel 1999; Laeven and Valencia 2013; Claessens et al 2014). The Covid-19 pandemic provided some run-like phenomena of its own, for example on toilet paper.

Late 2022 and early 2023 provided a reminder that the danger of bank runs has not gone away; if anything, it has intensified. We have observed runs in the cryptocurrency markets (see e.g. WSJ (2022) aptly titled “Crypto Has Reinvented Bank Runs”). More importantly, three U.S. banks experienced runs as the final version of the paper was prepared. In one of them, the depositors and investors of the Silicon Valley Bank withdrew around USD 42 billion in just one day. The fact that this was the second largest collapse in the history of the U.S. banking system and that it necessitated a complex policy response speaks volumes of the havoc that bank runs may create.

All these developments underscore the importance of shedding light on the psychological and strategic aspects of bank runs. While some researchers have considered bank runs driven by fundamentals (Gorton 1988; Calomiris and Mason 2003; Goldstein and Pauzner 2005), there is substantial empirical evidence that coordination problems may play a vital role (Davison and Ramirez 2014; De Graeve and Karas 2014). Bank runs may thus be self-fulfilling phenomena. The characterization of the recent Silicon Valley Bank collapse as "the first social media bank run" (YahooFinance 2023) is consistent with this conclusion.

The contribution of this paper is to provide insights about self-fulfilling bank runs, and to consider the effects of some policy recommendations about how to minimize these costly episodes. Our game-theoretic framework of Stochastic Leadership enriches the strategic interactions amongst depositors. It relaxes the widely-used (yet unrealistic) timing assumption that depositors only make a one-off withdrawal decision and are unable to change it. Mimicking the real world, our depositors are able to revise their initial decision with some (heterogeneous) probability, based on observing what others have done. In principle, they can run out of a bank run, or run into it, once they see whether other depositors have run on the bank.

To better understand the finer details of the Stochastic Leadership framework, let us frame it within the bank-run literature, initiated by Diamond and Dybvig (1983). Studies have used a wide range of approaches and models. Despite this, the strategic aspect of a bank-run situation has always been captured as a coordination game, namely Pure Coordination or Stag Hunt (Bryant 1994; Arifovic et al 2013; Peia and Vranceanu 2019; Shell and Zhang 2018). Each depositor has the option of leaving the money in the bank (action L) or withdrawing it before maturity (action W). The incentives and payoffs are such that each depositor would like to do what other depositors are doing. If others run on the bank, one wants to run as well to withdraw their money before the bank goes bankrupt. If others leave their money in the bank, each wants to do so too in order to collect interest on the deposit at maturity.

Given this structure, both the Pure Coordination and the Stag Hunt games feature two Pareto-ranked pure-strategy Nash equilibria. In the payoff-dominant equilibrium (denoted \(\mathcal {L}\)) all depositors leave their money in the bank so business as usual prevails. In contrast, in the payoff-inferior equilibrium (denoted \(\mathcal {W}\)) all depositors withdraw their money and a bank run occurs. In the commonly examined simultaneous-move game, standard tools cannot uniquely select between these pure-strategy equilibria \(\mathcal {L}\) and \(\mathcal {W}\).Footnote 2 The existence of inferior mixed-strategy equilibria further amplifies the equilibrium selection problem and the danger of a bank run occurring. In the Pure Coordination game, it is less of a threat because the Schelling (1960) focal argument selects the efficient equilibrium \(\mathcal {L}\). However, in the Stag Hunt game the bank-run equilibrium \(\mathcal {W}\) is risk dominant and thus commonly considered to be the most likely outcome (Cooper et al 1990, 1992; Harsanyi 1995).

Such equilibrium selection problems of the simultaneous move setup steered recent theoretic and experimental bank-run literature into an investigation of sequential environments (Kinateder and Kiss 2014; Kiss et al 2014; Davis and Reilly 2016).Footnote 3 Under the Stackelberg leadership timing, the depositors decide one after another upon observing the full history of previous decisions. In such a sequential setup, the payoff-dominant equilibrium \(\mathcal {L}\) is uniquely selected, and the threat of bank runs is eliminated. The outcomes of the Stackelberg and simultaneous-move setups are hence in stark contrast, and their conflicting predictions are one of the key reasons for our investigation of self-fulfilling bank runs within a more general framework.

Our Stochastic Leadership framework nests the conventional simultaneous and Stackelberg timing structures as two special cases, while also capturing everything in between them. The game starts with the conventional simultaneous move, but each depositor j has some ex-ante exogenous probability \(1-\theta _{j}\) of being able to change their initial action. Intuitively, depositors may change their minds about withdrawing their money during a banking frenzy, i.e. run out of a bank run, or run into it at a later stage. This revision probability is known to all depositors in advance. The focus on self-fulfilling runs is captured by the assumption that the depositors’ decision to change the initial action is based solely upon observing the behavior of others; the fundamentals of the bank are known to be solid and do not provide any reason for withdrawing money prematurely.

The complementary probability \(\theta _{j} \in \left[ 0, 1 \right] \) can be interpreted as depositor j’s degree of rigidity. This is analogous to the Calvo (1983) timing utilized in macroeconomics. However, in his influential setup the same revision probability applies to all agents, whereas in our framework it is heterogeneous (depositor-specific). It captures the fact that some depositors are rigid (have a high \(\theta _{j}\)) whereas others are flexible (have a low \(\theta _{j}\)).

There are a number of features of the world that can motivate probabilistic changes of mind and depositors’ rigidity in the bank-run context. First, the literature provides ample evidence that depositors gather information and react to it. The information linkages happen through social networks including families and neighborhoods (Kelly and O Grada 2000; Iyer and Puri 2012; Atmaca et al 2017), or through mere observation of the behaviour of strangers (Starr and Yilmaz 2007; Davison and Ramirez 2014). As an example, Starr and Yilmaz (2007) analyze a 2001 bank-run episode in Turkey that lasted for several months. The authors show that many depositors did not rush to the bank from the outset of the turmoil, only withdrawing their money upon seeing others do that. As another indication of the depositors’ change of mind, the authors document that many began redepositing their money after a period.

Second, heterogeneous rigidity \(\theta _{j}\) can capture important differences between term and demand deposits (Niinimäki 2002), whereby the former are more rigid. Term depositors face greater withdrawal constraints, making them less likely to be able to change their minds. Third, \(\theta _{j}\) can reflect heterogeneity across depositors in their education, financial sophistication or wealth. As Kiss (2018) shows, these personal characteristics can often explain whether depositors collect information on the bank’s fundamentals and therefore their behavior when a rumor spreads. Osili and Paulson (2014) and Fungáčová et al (2021) show how experience of banking crises shapes depositors’ trust towards banks (and potentially their rigidity).

Fourth, the theory of rational inattention (Huang and Liu 2007; Sims 2010; Caplin and Dean 2015; Matějka and McKay 2015; Bartoš et al 2016) sheds light on why agents may not respond to various developments. Essentially, they attempt to avoid the costs of information acquisition and processing. The implication is that some depositors may simply find it optimal to wait and react to the observed decisions of other (informed) depositors rather than engage in a costly information search and processing themselves.Footnote 4 Fifth, the depositors’ rigidity may be driven by emotional and transactional switching costs (for formal modeling see Guin et al (2015)). Similarly, \(\theta _{j}\) may also capture the nature of the bank-depositor relationship, see e.g. Guin et al (2015), Iyer et al (2016). Stronger relationships can be viewed as a form of rigidity, because they reduce the probability of a deposit withdrawal.

Given these diverse influences from the real world on the rigidity of depositors, we postulate \(\theta _{j}\) as exogenous in this study. But it should be kept in mind that it can be endogenized in various ways, depending on which of the above features is considered the most relevant.

We first obtain some general results for our n-depositor bank-run game without Stochastic Leadership. We derive the classes of games that may arise under various parameter values (the bank’s reserve ratio and investment return on deposits). In addition to the Pure Coordination game and the Stag Hunt, a Deadlock game may also occur under some circumstances.

We then move from the normal-form game to the extensive-form game to explore the effect of Stochastic Leadership. Our analysis demonstrates that if there is sufficient heterogeneity in the revision opportunities across the depositors, occurrence of self-fulfilling bank runs is reduced or fully eliminated - even without a deposit insurance scheme. Under some circumstances (which we derive explicitly for the two-depositor and three-depositor cases) we obtain the No-run region. It is the set of parameters (namely payoffs and revision probabilities) under which the efficient \(\mathcal {L}\) is the unique equilibrium outcome. In the No-run region all depositors leave their money at the bank - both initially and in their revision, i.e. the risk-dominant as well as the mixed-strategy equilibria of the normal-form game are eliminated from the set of equilibria.Footnote 5

Intuitively, the rigid depositors (e.g. owners of term deposits) act as Stochastic leaders in the game. Conversely, flexible depositors (e.g., owners of demand deposits) act as Stochastic followers.Footnote 6 To avoid the bank run, members of each group need the other group to provide the right incentives to them. The mechanics behind this are analogous to Stackelberg leadership. Using backwards induction, if the Stochastic followers have a sufficiently low rigidity \(\theta _{j}\), they are flexible in running out of the run at the revision stage. This incentivizes the Stochastic leaders to leave their money in the bank (both initially and in their revision). Conversely, if the Stochastic leaders have a sufficiently high rigidity \(\theta _{j}\), they are inflexible in running into the run. This incentivizes the Stochastic followers to change their minds and run out of the bank run in their revision if they find out that the Stochastic leaders have not run initially. If these conditions are satisfied leaving the money in the bank becomes a strictly dominant strategy for the Stochastic leader(s). The Stochastic followers know this and select the same course of action. No depositor withdraws and the game ends up in the No-run region. Under Stackelberg leadership, the multiplicity of equilibria disappears and self-fulfilling bank runs are avoided.

An advantage of our framework is that it offers a novel way to assess the changes in the likelihood of bank runs based on strategic interactions and depositor/bank characteristics. It uses the combined size of the No-run regions. The larger that is, relative to the Possible-run region, the less likely the \(\mathcal {W}\) equilibrium is - implying a reduced threat of a bank run. We report below how the size of the No-run region(s) and the implied danger of a bank run depend on the bank’s reserve ratio, its investment return and depositors’ rigidity.

Our analysis emphasizes that in order for withdrawal rigidity to enhance implicit coordination between flexible and inflexible depositors, the proportions (implying aggregate revision probabilities) must be known to all depositors in advance. An essential attribute of our framework is therefore observability of the depositors’ heterogeneous characteristics and their past behavior. This is consistent with the above-cited studies on the importance of social networks and awareness of the decisions of others, and implies a key role for the banking regulator to play in disseminating information.

Section 2 presents our bank-run model, which is first examined within the conventional game-theoretic frameworks (Section 3) and then within our Stochastic Leadership framework (Sections. 4 and 5). For robustness purposes, we consider below two extensions, namely the effects of government deposit insurance (Section 6) and costs of withdrawing funds with a delay at the revision stage (Section 7). A brief discussion of larger numbers of depositors is also provided (Section 8). While some new insights emerge the analysis shows that our baseline findings are qualitatively unchanged. The final section of the paper spells out policy options that may reduce the occurrence of costly bank runs. As such, they may enhance social welfare by ensuring that running remains a healthy physical exercise rather than a threat to the banking system and people’s prosperity.

2 A simple bank run model

2.1 Main modifications of the conventional setup

To examine the effects of stochastic revisions in a parsimonious and intuitive way, we make three main modifications to the nature of the bank-run framework by Diamond and Dybvig (1983) and much of the subsequent literature. It must, however, be noted that these modeling assumptions alter neither the equilibria nor the intuition of the conventional bank-run game.

First, there are no depositor types according to liquidity needs, i.e. we do not postulate the common modeling shortcut via impatient depositors that always withdraw their money. This enables us to better focus on the strategic interactions between rational depositors in the presence of stochastic change-of-mind opportunities.Footnote 7

Second, depositors who run on the bank split the bank’s reserves (liquidation value) evenly. We do not use the standard assumption of random sequential ordering of the payouts in order to separate its effects from the effect of our Stochastic Leadership. Put differently, we focus on the asymmetry in the depositors’ revision flexibility (observed ex-ante) rather than the often-assumed randomly assigned queue order (only observable ex-post). Nonetheless, Section 7 incorporates two types of delayed-withdrawal costs \(\gamma \) and \(\Gamma \) that partly mimic this standard assumption, and as such introduces the first-come-first-served feature.

The third difference relates to the number of depositors. While we derive results for any (finite) number of depositors within the normal-form game (simultaneous move framework), within the extensive-form game featuring Stochastic Leadership we focus on the two- and three-depositor cases. This is to present its mechanics in the most accessible fashion, including the possibility of plotting the No-run and Possible-run equilibrium regions in 2D or 3D diagrams. The complexity of the strategic analysis under Stochastic Leadership grows substantially when the number of players grows. Each additional depositor with heterogeneous rigidity acting independently adds one dimension to the equilibrium space, i.e. in the n-depositor case the rigidity space is n-dimensional. Nevertheless, our insights about how probabilistic revision opportunities promote implicit coordination still apply under a greater number of players – not only in the banking context but more generally.

2.2 Players, actions and payoffs

There are n depositors. All are rational and have common knowledge of rationality. Each makes a unit deposit in the same bank, meaning that total deposits equal the number of depositors n.Footnote 8 Denoting \(r\in \left( 0,1\right] \) to be the bank’s reserve ratio, the amount \(r*n\) is kept by the bank as its total reserves. The rest of the money is invested and cannot be recouped by the bank before maturity. All of a sudden, a rumor spreads claiming that many depositors are considering withdrawing their money. There is no fundamental uncertainty about the bank functioning properly as in Diamond and Dybvig (1983) or Ennis and Keister (2009), but depositors may still choose to run on the bank if they are worried that others will do so. This would cause a self-fulfilling bank run.

The timing of moves in our Stochastic Leadership framework is as follows. All depositors first make the conventional simultaneous choice between action W, withdrawing their deposit before maturity, and action L, leaving their deposit at the bank. We denote \(n_{W}\) to be the number of depositors selecting W, hence \(n-n_{W}\) represents the number of depositors playing L. If the total amount of money to be withdrawn by all depositors choosing W does not exceed the total reserves, \(n_{W}\le r*n\), we observe business as usual. In such case the depositors playing W get their full deposit 1, and those playing L wait until maturity to receive their deposit with some investment return i, i.e. \(1+i\) in total. We narrow our attention to \(i>0\), i.e. the rate of return on the investment is positive.

If the amount of intended withdrawals exceeds the total reserves, \(n_{W}>r*n\), the bank experiences a run. We assume that in such case those playing W split the available amount of total reserves evenly, each receiving \(\frac{r*n}{n_{W}}\). Those playing L receive nothing.Footnote 9 For the purposes of the proofs let us define \(\bar{n}_{W}\left( r\right) \) as the maximum number of withdrawals that can be accommodated without triggering a bank run. Consequently, \(\bar{n}_{W}\left( r\right) +1\) is the minimum number of withdrawals that start a run. From these definitions it follows that \(\bar{n}_{W}\left( r\right) +1>n*r\ge \bar{n}_{W}\left( r\right) \).

2.3 Reserve ratio intervals

For any number of depositors, the parameter space of the reserve ratio r needs to be conceptually split into n parts; based on how many withdrawals can occur before a bank run is triggered. This will be relevant in the proof of our results. For example, in the simplest two-depositor case \(\left( n=2\right) \) featuring depositors A (female) and B (male) we need to distinguish the cases of low (L) and high (H) reserves: \(r_{L}<\frac{1}{2}\) and \(r_{H}\ge \frac{1}{2}\). In the latter case, the bank’s reserves are sufficient for one withdrawal to be made, unlike in the former case.

In the three-depositor case \(\left( n=3\right) \), player C (female) is added so there exist three reserve ratio regions. Under a low reserve ratio \(r_{L}\in \left( 0,\frac{1}{3}\right) \) the reserves are insufficient to cover a single withdrawal. Under a medium level of reserves \(r_{M}\in \left[ \frac{1}{3},\frac{2}{3}\right) \) one withdrawal can be covered but not two. Under a high reserve ratio \(r_{H}\in \left[ \frac{2}{3},1\right] \) reserves are able to cover two withdrawals.

2.4 Payoff matrices for the two-depositor game

Using the above assumptions, we can derive the depositors’ payoffs. For illustration, let us offer them here for the two-depositor case (Appendix B offers them for the three-depositor case). The following payoff matrices are for \(r_{L}<\frac{1}{2}\) and \(r_{H}\ge \frac{1}{2}\) respectively, whereby the pure-strategy Nash equilibria are indicated in bold.

It is useful to provide a numerical example. It depicts the value \(i=0.1\), but it is shown below that the same three classes of games apply for any reasonable investment return value, namely any \(i\in \left( 0,\frac{2}{9}\right) \). The following matrices report the payoffs under three distinct levels of the reserve ratio: \(r\in \left\{ 0.2,0.4,0.6\right\} \).Footnote 10

It is apparent that for any number of depositors n the high reserve-ratio case \(r_{H}\in [\frac{n-1}{n},1]\) differs from other r values. This is because the strategic considerations disappear; the depositors are unaffected by the other depositors’ decisions. Like under \(100\%\) reserve banking, each depositor can single-handedly avert a bank run by leaving their money in the bank. As such, playing W is a strictly dominated strategy for all depositors.Footnote 11 The resulting game under \(r_{H}\) is commonly called the Deadlock (or dominance-solvable), with the \(\mathcal {L}\) outcome being the unique equilibrium by strict dominance. In the next section, we prove that for all reserve ratios other than \(r_{H}\) the bank-run game manifests itself as either a Pure Coordination game or a Stag Hunt.

3 Results under the conventional simultaneous move

3.1 Classes of games

Following the Diamond and Dybvig (1983) literature, there are two opposite incentive forces at play. Each depositor would like to keep their money in the bank to get the return i, but only as long as the others do so. If s/he expects the others to withdraw their deposits, it is best to run and withdraw too. We can summarize the outcomes of this coordination game as follows.

Proposition 1

Consider the normal-form bank-run game. For any number of depositors \(n\in \mathbb {N}\), and for any reserve ratio except high values \(r_{H}\in [\frac{n-1}{n},1]\), the game has no dominated strategies and features two Pareto-ranked pure-strategy Nash equilibria. It is generically a Pure Coordination game or a Stag Hunt, depending on the values of i and r. In the payoff-dominant equilibrium \(\mathcal {L}\) all depositors leave their money in the bank. In the payoff-inferior equilibrium \(\mathcal {W}\) (which is risk-dominant in the Stag Hunt) all depositors run and withdraw.

Proof

See Appendix C.\(\square \)

Let us offer some intuition here. The Pure Coordination and Stag Hunt games differ in that the \(\mathcal {W}\) equilibrium is risk-dominant in the latter game, but not in the former. To identify risk dominance, one needs to weigh evenly the payoffs from all possible outcomes when choosing W and L respectively. The proof in Appendix C shows that \(\mathcal {W}\) is risk dominant (and the game is a Stag Hunt) if and only if

where \(\mathcal {C}\left( n-1,n_{W}\right) \) denotes the number of \(n_{w}\)-combinations from a set of \(n-1\) elements. For illustration, in the two-depositor case featured in Eq. 1 under \(r_{L}<\frac{1}{2}\) the expected payoffs from W and L (given the other depositor plays them with equal probability) are \(\frac{3r}{2}\) and \(\frac{1+i}{2}\) respectively. This implies the following conditions for the three possible classes of games:

As an example using the above value \(i=0.1\), we obtain a threshold \(\overline{r}_{L}(i)=\frac{11}{30}\). Hence, the Pure Coordination game obtains for all \(r\in (0,\frac{11}{30}]\), whereas the Stag Hunt obtains for all \(r\in (\frac{11}{30},\frac{1}{2})\).

The three classes of games in the two-depositor case are summarized graphically in Fig. 1, and for comparison Fig. 2 offers an analogous picture for the three-depositor game. The two figures make it apparent that the nature of the two-depositor case findings carries over to the game with a greater number of players.

The bank-run literature has not paid much attention to the distinction between the Stag Hunt and the Pure Coordination game. However, this is potentially a serious omission as the game-theoretic literature suggests a major difference between these two classes of games in the likelihood of the Pareto-dominant equilibrium \(\mathcal {L}\) being played, and thus the chances of a bank run. While the multiplicity of equilibria in both games does not allow any definite conclusions, the Pareto-inferior equilibrium \(\mathcal {W}\) is considered less likely in the Pure Coordination game than in the Stag hunt. In particular, in the former game the payoff-dominant \(\mathcal {L}\) can be selected by the Schelling (1960) focal point argument (Myerson 1991; Kim 1996; Colman 1997; Colman and Bacharach 1997). In contrast, in the Stag Hunt \(\mathcal {W}\) is commonly seen as the likely outcome based on risk considerations (see e.g. Van Huyck et al (1990) and Harsanyi (1995)).Footnote 12

3.2 Effects of i and r in the normal-form game

The proof of Proposition 1 provides some further insights about the impact of investment returns and reserve ratios on the set of equilibria and likelihood of bank runs. They can be summarized as follows.

Remark 1

Consider the normal-form bank-run game featuring any number of depositors \(n\in \mathbb {N} \), and any reserve ratio except high values \(r_{H}\in [\frac{n-1}{n},1]\).

-

(i)

The investment return has a monotone effect on the likelihood of bank runs. A higher i may make them less likely by altering the game from Stag hunt to Pure Coordination.

-

(ii)

The reserve ratio has a non-monotone effect on the likelihood of bank runs. A higher r may make bank runs less likely by accommodating more withdrawals, and thus possibly altering the game from Stag Hunt to Pure coordination. Nevertheless, a higher r may also make bank runs more likely by increasing the amount available for each prematurely withdrawing depositor, and thus possibly altering the game from Pure Coordination to Stag Hunt.

Intuitively, the differences between the effect of i and r on the occurrence of bank runs arise because investment returns only impact the depositors’ payoff through one channel, whereas the reserve ratio works through two distinct channels. In terms of claim (i), a higher i increases the incentive to leave the money in the bank until maturity. As such, it reduces the likelihood of a bank run.Footnote 13 The proof of Proposition 1 implied that for all reserve ratios except \(r_{H}\) an increase in i reduces the parameter space over which the bank-run Nash equilibrium is risk dominant. Therefore, it converts part of the parameter space from the Stag Hunt into the Pure coordination game. This is apparent in Eq. 4) for the two-depositor case, whereby a higher i increases the threshold \(\overline{r}_{L}(i)=\frac{1+i}{3}\). It is also shown graphically in Figs. 1 and 2. The bottom panel of each figure further indicates that if i is sufficiently high, then the Stag Hunt game no longer occurs, and the likelihood of bank runs is thus lower.

In terms of claim (ii), a higher r enlarges the stock of available reserves, which has two effects. First, the bank can service a greater number of premature withdrawals, which tends to make bank runs less likely. This is the logic commonly discussed. The second effect, usually overlooked due to the existence of deposit insurance, is that a greater stock of reserves increases the amount available for each prematurely withdrawing depositor. This strengthens the incentive to run when a rumor spreads, and tends to make bank runs more likely. The relative magnitude of these two opposing effects and their impact on the class of game underlies the non-monotonic relationship between r and the likelihood of runs.

The transitions between the Stag Hunt and the Pure Coordination game, as a consequence of changes in r, can also be seen graphically in Figs. 1-2. In particular, focus on the two-depositor case and consider the effect of an increase in the reserve ratio, starting from some low level in the interval \(r\in \left( 0,\overline{r}_{L}(i)\right] \). There are three possible cases depending on the extent to which r is increased; corresponding to the three regions in the top panel of Fig. 1. First, if the increase in the reserve ratio is sufficiently small the new r value remains within the interval \(r\in \left( 0,\overline{r}_{L}(i)\right] \). In such case we still have a Pure Coordination game and the likelihood of bank runs does not change significantly. Second, if the increased r value is in the interval \(r\in \left( \overline{r}_{L}(i),\frac{1}{2}\right) \) the game is altered from Pure Coordination to Stag Hunt, and the likelihood of bank runs rises. Finally, if the increased r value is in the interval \(r_{H}\in \left[ \frac{1}{2},1\right] \) we have the Deadlock game, so the likelihood of bank runs decreases (to zero).

4 Stackelberg and stochastic leadership frameworks

4.1 Stackelberg leadership

Before we postulate the Stochastic Leadership framework, let us briefly discuss conventional Stackelberg leadership. Within the latter setting the equilibrium selection problem present in the Pure Coordination game, and even more strongly in the Stag Hunt, is resolved under all circumstances. The \(\mathcal {L}\) equilibrium surely arises for all i and r values, which is arguably unrealistic.

The two-depositor case is depicted in the top panel of Fig. 3. Depositor A moves first and observing her decision depositor B moves second (or the other way round). In the three-depositor case, we add depositor C who moves last, observing A’s and B’s sequential decisions.

The timing of a two-depositor bank-run game under Stackelberg leadership (top panels), simultaneous moves (bottom left panel) and Stochastic Leadership (bottom right panel). The solid and dotted squares indicate certain and probabilistic moves respectively. Only a move to the left of another move can be observed

The Stackelberg game is solved by backwards induction, with the payoff-dominant outcome \(\mathcal {L}\) uniquely obtaining in equilibrium. Intuitively, each depositor knows that by playing L they can incentivize each subsequent depositor to do the same, and thus surely avoid the bank run.

The Stackelberg timing is not in line with many real-world situations because it features a combination of four strong assumptions. 1) The Stackelberg leader’s initial move can be observed when the follower makes a move. 2) The follower’s move takes place immediately after the leader’s. 3) The follower’s move occurs with certainty. 4) The leader can make a revision of the initial action with zero probability. When applied together, these four Stackelberg assumptions ensure that mis-coordination cannot occur in the Stag Hunt and other coordination games (such as the Battle of the sexes). This is because the Stackelberg leader faces no cost of inducing the follower to cooperate. The rest of this paper explores a more general, and arguably more realistic, type of leadership timing.

4.2 Stochastic leadership

We study the effect of allowing for a probabilistic change of mind, i.e. altering the timing of the depositors’ decisions and their information sets. We ask whether/how this may alleviate self-fulfilling bank runs, ensuring equilibrium uniqueness and efficiency in the Stag Hunt and Pure Coordination games. In doing so, we relax Stackelberg assumptions 3) and 4), but keep 1) and 2) for comparability with the conventional frameworks.

The game starts at \(t=0\) with a simultaneous decision of all depositors j between W and L. We assume that upon observing all other depositors’ initial choices, each depositor j can make an immediate revision with some exogenous probability \(1-\theta _{j}\). This probability is known to all players prior to the game. Their degree of rigidity \(\theta _{j}\) is therefore in the spirit of Calvo (1983)’s price setting decisions.Footnote 14

For reasons explained above we assume that the depositors cannot observe the move of Nature, i.e. the revision opportunities are simultaneous. In other words, at the time of revision the depositors do not know whether the others are also given a revision opportunity. The payoffs are determined purely by the post-revision action. If a depositor changes her/his mind, their initial action becomes payoff-irrelevant (unless a switching cost is introduced, see Section 7).

For illustration, the timeline of the Stochastic Leadership framework in the two-depositor case is summarized in Fig. 3, and contrasted with the conventional simultaneous moves and Stackelberg leadership frameworks. The extensive-form game under Stochastic Leadership is then presented in Fig. 4, again for the two-depositor case. Only one of the four subgames starting with the move of Nature is fully plotted to maintain clarity; the graphical representation of the other three subgames in Fig. 4 would be identical. It is clear that the extensive-form is analogous for the cases with a greater number of players n, featuring \(2^{n}\) such subgames.

The extensive-form of the two-depositor bank-run game under Stochastic Leadership, featuring rigidities \(\theta _{A}\) and \(\theta _{B}\). Only the first of the four subgames starting with the move of Nature is fully drawn. The three types of conditions required for A’s No-run region are indicated. The Running-out condition ensures the Stochastic follower has a sufficient incentive to leave the crowd, whereas the Not-running-initially and Not-running-later conditions ensure that the Stochastic leader will not join the crowd

As in Fig. 4, we will throughout the paper denote the players’ initial action by 1 and their final action by 2 in the subscript. The latter will apply even if the player did not end up having a revision opportunity. Further, we will indicate the selected choice in the superscript, i.e. \(\left( B_{1}^{L},B_{2}^{W}\right) \) expresses that depositor B decided to leave his money in the bank initially, but then changed her/his mind and withdrew at the revision stage.

For comparison with the conventional frameworks, Fig. 5 below presents the rigidity space of the two- and three-depositor cases. It makes clear how our Stochastic Leadership framework nests the standard simultaneous-move and Stackelberg leadership cases as the vertices of the plotted square and cube.

The rigidity space in the two-depositor case (top panel) and three-depositor case (bottom panel). The conventional frameworks of simultaneous moves and Stackelberg leadership are indicated by dots and diamonds respectively, with their labels appearing in the bubbles. Our framework considers everything in between them

4.3 Modeling extensions

As indicated in the Introduction, we check the robustness of our findings by incorporating a government deposit insurance. The scheme naturally reduces incentives to withdraw money during a banking panic, and thus lowers the likelihood of a bank run: for theoretical contributions see Bryant (1980), Diamond and Dybvig (1983), Cooper and Ross (2002), for experimental evidence see Madies (2006), Schotter and Yorulmazer (2009), Kiss et al (2012). However, the deposit insurance scheme tends to lead to a moral hazard problem (see, for instance Wheelock (1992); Wheelock and Wilson (1995); Cooper and Ross (2002); Demirgüç-Kunt and Detragiache (2002)).

Section 7 explores another extension, namely two types of delay costs. One is incurred if depositors decide to withdraw their money at the revision stage rather than initially; their payoff is reduced by a fixed amount \(\gamma >0\). The other cost \(\Gamma >0\) is broader. It applies for a change of mind in any direction, i.e. when depositors revise their action from L to W or from W to L. Both types of costs capture the first-come-first-serve feature. They partly convert the crowd in front of the bank into a queue, placing the initial withdrawers ahead of the revision withdrawers. The conclusion of this extended analysis is that the \( \gamma \) and \(\Gamma \) costs do not qualitatively alter our key findings.

5 Results under stochastic leadership

5.1 No-run regions

In regards to the likelihood of bank runs within the Stag Hunt and Pure coordination games, our analysis implies that the predictions of the simultaneous game may be too pessimistic, and the predictions of Stackelberg leadership may be too optimistic. This is because these standard frameworks are polar – and not necessarily representative – cases. Let us formulate our first result regarding the scope for a bank run under Stochastic Leadership. While the results will be formulated for the two- and three-depositor cases, it will be apparent that the intuition of Stochastic leadership applies more broadly for games with a greater number of depositors.

Proposition 2

Consider the two- and three-depositor versions of the bank-run game, namely the Pure Coordination and Stag Hunt (i.e. all reserve ratios except \(r_{H}\)).

-

(i)

Under the simultaneous move, no parameter values surely avoid a bank run.

-

(ii)

Under Stackelberg leadership, all parameter values surely avoid a bank run.

-

(iii)

Under Stochastic Leadership, only some parameter values surely avoid a bank run. In particular, a No-run region obtains if and only if the degree of rigidity is sufficiently high for the Stochastic leader(s), and sufficiently low for the Stochastic follower(s).

Proof

Proving the first two claims is straightforward. The one-shot simultaneous move game of claim (i) occurs in our framework if all depositors are fully rigid, e.g. in the two-depositor game, it happens under \(\theta _{A}=\theta _{B}=1\). In such case the equilibrium multiplicity of the normal-form game still applies, similarly to Diamond and Dybvig (1983). Solving backwards, the same is true under the two-shot simultaneous move game, which occurs if all depositors are fully flexible, \(\theta _{A}=\theta _{B}=0\). It is apparent that any finitely repeated simultaneous move game will generate multiple equilibria in the Pure Coordination and Stag Hunt games, for any number of depositors \(n\in \mathbb {N}\), because the bank-run equilibrium \(\mathcal {W}\) cannot be eliminated with certainty. The Stackelberg leadership in claim (ii) is the opposite polar case, featuring a unique subgame perfect equilibrium \(\mathcal {L}\) as discussed in the previous section.

As for claim (iii) regarding Stochastic Leadership, the most straightforward way to prove it is using continuity arguments. We will however proceed in a more illustrative way and derive the exact circumstances (necessary and sufficient conditions) for the No-run and Possible-run region – in terms of the depositors’ rigidities and payoffs.

As indicated graphically in Fig. 4, three types of conditions need to hold to avoid a bank run with certainty. The same conditions apply for the Stag Hunt and Pure Coordination game. For the Stochastic followers it is the Running-out condition, whereas for the Stochastic leaders it is the Not-running-initially and the Not-running-later conditions. If they all hold we achieve the No-run equilibrium region; otherwise we obtain the Possible-run region.

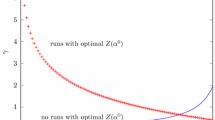

Before offering the formal details of the proof, it is worthwhile to discuss the intuition of claim (iii) using a graphical exposition. Figures 6 and 7 plot the equilibrium regions for the two-depositor and three-depositor games respectively (for all values except \(r_{H}\), i.e. under \(r<\frac{1}{2}\) and \(r<\frac{2}{3}\) respectively).

Each figure consists of three panels, going from a high level of investment return (the top panel) to a medium and low level (the bottom panels). The colored areas in both figures show the Possible-run regions, in which the \(\mathcal {W}\) outcome can occur in equilibrium. This is not the case in the white No-run regions, in which \(\mathcal {L}\) is the unique subgame-perfect equilibrium outcome and a bank run is surely avoided.Footnote 15

Eyeballing Figs. 6 and 7 makes apparent that the findings of the two- and three-depositor cases are analogous. This is because the intuition regarding the forces at play carries over to the games with a greater number of depositors. Because of this, we will only report the proof of Proposition 2 for the two-depositor case in the main text, and relegate the proof of the three-depositor case to Appendix D.

Let us focus on the scenario in which depositor A (female) is the Stochastic leader and B (male) is the Stochastic follower, i.e. \(\theta _{A}>\theta _{B}\) (the opposite case can be derived by symmetry). Solving by backwards induction, B’s Running-out condition requires the Stochastic leader A to be sufficiently rigid. This is in order for her absence in the withdrawal-seeking crowd to incentivize the Stochastic follower B to leave the crowd. In other words, A’s revision probability must be sufficiently low for B to run out of the bank run if he does not see A in the crowd.

Furthermore, for equilibrium uniqueness the opposite is also required. The Stochastic follower B must be sufficiently flexible in leaving the crowd in his revision, i.e. he must have a high enough probability of being able to change her/his mind. This is to incentivize the Stochastic leader A to leave the money in the bank in both her revision (A’s Not-running-later condition) and in her initial move (A’s Not-running-initially condition).

Specifically, consider the revision stage after the initial play of \(\left( A_{1}^{L},B_{1}^{W}\right) \), which is the worst case scenario for A. The Stochastic follower B has run but finds out that the Stochastic leader A has not, i.e. A is not a part of the crowd in front of the bank. What will be B’s optimal play in his revision? For \(\mathcal {L}\) to be the unique subgame-perfect equilibrium, it is required that B finds it optimal to leave the crowd, i.e. play the static best response to A’s observed initial action \(A_{1}^{L}\) rather than to A’s anticipated revision (which could potentially be \(A_{2}^{W}\)). For this to be the case, it must hold that B’s minimum expected payoff from \(B_{2}^{L}\) must exceed his maximum expected payoff from \(B_{2}^{W}\) for any possible revision play of A. Only then will B surely choose to leave the crowd when given a revision opportunity. This narrative implies that B’s Running-out condition is:

Intuitively, the left-hand side (LHS) of Eq. 5 reports B’s minimum expected payoff from leaving the crowd (switching to \(B_{2}^{L}\)). The right-hand side (RHS) reports his maximum expected payoff from staying in the crowd and withdrawing his money, i.e. \(B_{2}^{W}\). This inequality can be rearranged into

The condition shows that the Stochastic leader A must be sufficiently rigid for B’s Running-out condition to be satisfied. Let us now turn to A’s revision decision and derive her Not-running-later condition. Assuming Eq. 6 is satisfied, it is required that upon playing \(A_{1}^{L}\) she still leaves her money in the bank in her revision, \(A_{2}^{L}\). This must be true even in the worse case in which A observes B opening with \(B_{1}^{W}\), i.e. A finds out that B initially joined the crowd in front of the bank. A’s Not-running-later condition is hence as follows

where the LHS reports A’s minimum expected payoff from \(A_{2}^{L}\), and the RHS reports her maximum expected payoff from \(A_{2}^{W}\). Rearranging Eq. 7 implies

In the final step, assume that both Eqs. 6 and 8 hold and move backwards to A’s initial decision. The Not-running-initially condition for A to surely open with \(A_{1}^{L}\) implies that her minimum expected payoff must be greater than her maximum expected payoff from opening with \(A_{1}^{W}\). This condition happens to be the same as her Not-running-later condition Eq. 8 in this case.

In summary, if Eqs. 6 and 8 are satisfied then \(\left( A_{1}^{L},A_{2}^{L}\right) \) becomes strictly dominant for A. As B knows this, both A and B open with L and never revise. A bank run cannot occur; \(\mathcal {L}\) becomes the unique subgame-perfect equilibrium. Graphically, we obtain the white No-run equilibrium region in the bottom right-hand corner of the three panels of Fig. 6.

By symmetry, the conditions for B to surely play \(\left( B_{1}^{L},B_{2}^{L}\right) \) and guarantee \(\mathcal {L}\) as the unique subgame-perfect equilibrium are

These are the white No-run regions in the top left-hand corner of the three panels of Fig. 6, which completes the proof for the two-depositor case. The claims for the three-depositor case are proven in Appendix D.\(\square \)

As discussed above, a greater size of the No-run region, relative to the Possible-run region, implies a reduction in the likelihood of bank runs. This is because the inferior \(\mathcal {W}\) equilibrium can only occur in the latter type of region, not the former. Figures 6 and 7 indicate that the sizes of the regions are functions of the level of the investment return and reserve ratio, which is explored in the next section.

5.2 Effects of i and r under stochastic leadership

We have seen above that under Stochastic Leadership the exact values of i and r affect the rigidity thresholds, and thus the likelihood of bank runs. This is in contrast to Stackelberg leadership, where their exact values do not affect the set of equilibria within a certain class of game. The impact is similar to the normal-form game, and can be summarized as follows.

Proposition 3

Consider the two- and three-depositor versions of the bank-run game, namely the Pure Coordination and Stag Hunt (i.e. all r except \(r_{H}\)). Under Stochastic Leadership:

-

(i)

A higher return on investment i increases the relative size of the No-run region, making bank runs less likely.

-

(ii)

A higher reserve ratio r has a non-monotone effect on the relative size of the No-run region and the likelihood of bank runs.

Proof

The results are apparent in Figs. 6 and 7. In terms of claim (i), the conditions in Eqs. 6 and 8 show that the thresholds \(\overline{\theta _{A}}\) and \(\overline{\theta _{B}}\) in the two-depositor case are decreasing in i, whereas the thresholds \(\underline{\theta _{A}}\) and \( \underline{\theta _{B}}\) are increasing in i. Similarly, in the three-depositor case presented in Appendix D the conditions in Eqs. 27 and 29 imply that \(\frac{\partial \overline{\theta _{A}} }{\partial i}<0\) and \(\frac{\partial \underline{\theta _{B}(\theta _{C})}}{\partial i}>0\) under all parameter values. All these relationships imply that a higher i increases the combined size of the No-run regions and shrinks the Possible-run region(s).

In terms of claim (ii), the thresholds \(\left\{ \overline{\theta _{A}}, \overline{\theta _{B}},\underline{\theta _{A}},\underline{\theta _{B}}\right\} \) in Eqs. 6 and 8 that apply in the two-depositor case are increasing in r for some parameter values, and decreasing in r for others. This means that the impact of r on the sizes of the No-run and Possible-run regions, and hence on the likelihood of bank runs, is non-monotone. The same can be shown for the three-depositor case reported in Appendix D, and is apparent in Fig. 7.\(\square \)

It should be noted that the effects of i and r in the extensive-form game are analogous to those in the normal-form game from Section 3.2. Higher i is again beneficial for reducing the probability of bank runs, whereas higher r may sometimes have the opposite effect. Nonetheless, under simultaneous moves the channel was only a shift between the Stag Hunt and Pure Coordination games. In contrast, under Stochastic Leadership there is an additional channel, namely changes in the equilibrium regions within each class of game.

The top panel of Fig. 6 shows a situation worth highlighting, namely a Double No-run region obtaining when both i and r are sufficiently high. In such a situation the No-run regions of both players overlap, i.e. both players have a strictly dominant strategy of playing L throughout. As such, in a real-world or experimental setting the claim that a bank run will be avoided can arguably be made with an even greater amount of confidence than for the single No-run region. Let us highlight an implication, namely that heterogeneity in depositors’ rigidity is not a necessary condition to uniquely achieve the \(\mathcal {L}\) outcome and avoid bank runs. In the Double No-run region A’s and B’s rigidities may be similar or even the same. Intuitively, if the investment return is sufficiently high, there is less of a need for heterogeneity in the depositors’ rigidity to facilitate coordination. Notwithstanding that, such heterogeneity is still beneficial; it is just no longer a necessary condition due to the pro-coordination effect of high i levels. Put differently, a high investment return is a partial substitute for heterogeneous rigidity in alleviating bank runs.

The next section considers our first extension: government deposit insurance, a scheme widely adopted in the real world in an effort to avoid banking crises. It has been used extensively since 2007, most recently during the March 2023 bank runs.

6 Incorporating deposit insurance

Over a hundred countries have an explicit deposit insurance scheme,Footnote 16 more than half of whom are members of the International Association of Deposit Insurers. In our framework, the scheme will consist of the government’s guarantee of a minimum payout ratio, \(I\in [0,1]\). This is the portion of the deposit that depositors receive in the case of a bank run – from the bank and the government combined. If a bank run occurs the government simply tops up the amount a depositor receives from the bank to the I level.

6.1 Deposit insurance in the normal-form game

Let us again focus on the two-depositor case, and specifically \(r_{L}<\frac{1}{2}\) as the \(r_{H}\) case has been shown above to always avoid bank runs even without deposit insurance. Four different cases can be distinguished based on the I value. First, if \(I\in (0,r]\) the payout ratio is no more than the minimum amount depositors get from withdrawing (playing W) during a bank run. Therefore, the government’s scheme only pays out money to those who played L and got nothing from their bank. Second, if \(I\in (r,2r)\) the government also tops up the payment from the bank to depositors in the case both of them run. Third, if \(I\in [2r,1)\) the government pays some top-up money to both depositors, since I is greater than the maximum amount that can be obtained in a bank run. The fourth case \(I=1\) represents a 100% payout ratio, i.e. all depositors receive their deposits in full. All these four cases are summarized in the following payoff matrix

For illustration, let us use the same values as in the middle payoff matrix of Eq. 2, namely \(r=0.4\) and \(i=0.1\), and consider three different payout levels: \(I\in \left\{ 0.3,0.6,0.9\right\} \). For example, in the intermediate case featuring a \(60\%\) payout ratio, a depositor playing W in a two-depositor run receives 0.4 from her bank, and a top up of 0.2 from the government’s insurance scheme. The following matrices offer the corresponding normalized payoffs.

Without deposit insurance, under the chosen values of \(r=0.4\) and \(i=0.1\) we obtain the Stag Hunt game. In the presence of deposit insurance this is no longer the case. The equilibrium outcomes under deposit insurance can be summarized as follows.

Proposition 4

Consider the bank-run game featuring deposit insurance. For any number of depositors \(n\in \mathbb {N}\), any reserve ratio except high values \(r_{H}\in [\frac{n-1}{n},1]\) and any payout ratio \(I\in (0,1]\), deposit insurance reduces the likelihood of a bank run. The normal-form game still has two Pareto-ranked pure-strategy Nash equilibria, \(\mathcal {L}\) and \(\mathcal {W}\), but there exists no circumstances under which \(\mathcal {W}\) is risk-dominant (i.e. the game is never Stag Hunt). In particular, under \(I\in \left( 0,r\right) \) the normal-form game is one of Pure Coordination, whereas under \(I\in (r,1)\) it is a Deadlock, in which \(\mathcal {W}\) can be eliminated by weak-dominance.

Proof

It is apparent from the payoffs in Eqs. 9-10 that under a low payout ratio, \(I\in \left( 0,r\right) \), we still obtain a Pure coordination game – as was the case without deposit insurance. However, if the insurance payout ratio is at least r, then L starts to weakly dominate W and depositors no longer have an incentive to run. This is because they know that the total amount they will receive from their bank and government if they play L is no less than that from W.\(\square \)

In summary, there are three differences introduced by deposit insurance. First, the Stag Hunt game no longer occurs. Second, there is an expansion of the parameter space of the Deadlock game to \(I\in (r,1)\). Third, the Deadlock game under deposit insurance and \(r<r_{H}\in [\frac{n-1}{n},1]\) is slightly different from the above case of \(r_{H}\) without deposit insurance. It is only solvable by weak-dominance, not strict-dominance, so \(\mathcal {W}\) is still a Nash equilibrium therein.

6.2 Deposit insurance under stochastic leadership

Let us now move from the normal-form game to the extensive-form game under probabilistic revisions of the depositors’ actions.

Proposition 5

Consider the two- and three-depositor versions of the bank-run game featuring deposit insurance. Under Stochastic Leadership and any reserve ratio except \(r_{H}\in [\frac{n-1}{n},1]\), the deposit insurance scheme enlarges the relative size of the No-run region(s) for any payout ratio \(I\in (0,1]\). The effects of i and r on the size of the No-run region(s) are qualitatively the same as in the absence of deposit insurance.

Proof

Let us focus again on the two-depositor case; we have demonstrated earlier that the proof of the three-depositor case is analogous. The steps in deriving the No-run region(s) follow those in the proof of Proposition 2, i.e. the incentive compatibility conditions (rigidity thresholds) are only altered quantitatively, not qualitatively. Under \(I\in (0,r]\), the Running-out condition of depositor B becomes

which, upon rearranging, implies

It is apparent that this is weaker than in the condition in Eq. 6, derived in the absence of deposit insurance. The threshold \(\overline{\theta _{A}}\) is decreasing in I for all considered payout ratios \(I\in (0,1]\), because the insurance scheme decreases depositor B’s running-out cost in the case of a bank run. Moving backwards, the Not-running-later and Not-running-initially conditions of the Stochastic leader A both have the form

which can be rearranged into

Comparing Eqs. 14 to 8 makes clear that deposit insurance increases the threshold \(\underline{\theta _{B}}\); even if the payout is low, \(I\in \left( 0,r\right) \). Intuitively, this is because A’s not-running cost (in the case of a bank run) is reduced. Combining this effect with the change of the Running-out condition implies that the size of the No-run region increases unambiguously upon the introduction of the government’s insurance scheme.\(\square \)

In summary, Proposition 4 shows the potential benefits of deposit insurance in alleviating bank runs, and the fact that it is a partial substitute to Stochastic Leadership.Footnote 17 However, it should be noted that the above benefits of the insurance scheme are somewhat short-term, i.e. relating to what happens when a banking panic occurs.

There exists a large literature on the possible long-term adverse effects, highlighting a likely moral hazard the deposit insurance scheme creates: see e.g. (see, for instance Wheelock (1992); Wheelock and Wilson (1995); Cooper and Ross (2002); Demirgüç-Kunt and Detragiache (2002)). In a nutshell, banks are incentivized to invest in riskier assets and depositors have less of an incentive to monitor their bank properly. As a consequence, the insurance scheme may actually increase the likelihood/frequency of banking panics over the longer term. Because of that, enhancing implicit coordination of depositors through alternative avenues such as observable heterogeneous withdrawal rigidity may be desirable.

7 Incorporating costs of delay

This section considers two types of delay costs in the bank-run game and shows that the qualitative nature of our benchmark results is robust to these extensions. We will limit our attention to the two-depositor game to best present the intuition, but the three-depositor case is analogous and available upon request.

7.1 Cost of delayed running

Let us postulate a cost \(\gamma >0\) of changing one’s action from L to W at the revision stage. This modification introduces a queue type (first-come-first-serve) feature whereby the "latecomers" receive a lower payoff than if they had withdrawn their deposit in the initial move. Note that while in the conventional setting the queue order is random, in our framework delay costs partly endogenize it. Existence of the cost \(\gamma \) thus provides an additional incentive for depositors to play W from the start, i.e. run on the bank as soon as the rumor spreads.

Comparing this setting to the benchmark game makes apparent that the cost does not affect the Running-out condition; the relevant condition is still Eq. 6. But the Not-running-later condition is modified and features the cost of delay, namely

It is straightforward to see that this condition is weaker than Eq. 7) because A’s incentive to run (switch to W) is lower. Finally, the Not-running-initially condition is not affected by \(\gamma \) and it is stricter than Eq. 15. Therefore, the necessary and sufficient conditions for the No-run region are still Eqs. 6 and 8 of the benchmark case. This can be summarized as follows.

Proposition 6

Consider the two-depositor version of the bank-run game, featuring a cost \(\gamma >0\) of changing one’s action from L to W at the revision stage. Such a delayed-running cost does not have any effect on the size of the No-run region(s).

Intuitively, having to pay \(\gamma \) for joining the queue at the revision stage does not change the incentive of the Stochastic follower(s) to leave the queue when they do not see the Stochastic leader(s) in the crowd. Furthermore, the conditions for B to surely stick with \(B_{1}^{L}\), i.e. not to join the queue even if he has a chance to revise, do not depend on \(\gamma \). This is because joining the queue at the revision stage does not occur on the equilibrium path in Eqs. 6 and 8. As a consequence, the parameter regions in which a bank run is surely avoided (i.e. thresholds of the No-run region) remain the same.

However, it should be noted that the cost \(\gamma \) may still affect the occurrence of bank runs within the Possible-run region(s). As it reduces the payoff from withdrawing the deposit at the revision stage compared to doing so initially, existence of the cost may provide a slightly greater incentive to run.

7.2 Cost of changing one’s mind

The broader cost \(\Gamma >0\) occurs for any revision of actions. It applies when depositors revise their action from L to W, as well as from W to L. The Running-out condition Eq. 5 is modified into:

which can be rearranged into:

It is easy to check that Eq. 16 is stronger than the Running-out condition Eq. 6 in the benchmark setup. This is because B now has to pay a cost \(\Gamma \) when leaving the crowd, hence there is less of an incentive for him to follow A and run out. Next, the Not-running-later condition is modified into:

which is weaker than the corresponding condition of the benchmark case in Eq. 7. Finally, it is apparent that the Not-running-initially condition is unaltered and stricter than Eq. 17. This implies that the conditions for A to surely open with L, and for the other player to follow, are Eqs. 8 and 16. The results can be summarized as follows.

Proposition 7

Consider the two-depositor version of the bank-run game, featuring a cost \(\Gamma >0\) of changing one’s action in any direction at the revision stage. Such change-of-mind cost makes it harder for the Stochastic leader to induce the Stochastic follower to run out of the run, and thus reduces the size of the No-run region – making bank runs more likely.

Intuitively, by increasing the relative size of the Possible-run region, the cost \(\Gamma \) makes the \(\mathcal {W}\) equilibrium – and bank runs – occur with a higher probability. In order to ensure the No-run region the anti-coordination effect of the cost \(\Gamma \) has to be offset by a greater degree of rigidity of the Stochastic leader. Nevertheless, let us note that this effect is only quantitative; the qualitative results under Stochastic Leadership still apply.

8 Increasing the number of depositors

This intuition obtained under the two- and three-depositor cases largely carries over to the cases featuring a greater number of depositors. Heterogeneity in revision opportunities (Stochastic Leadership) is still beneficial for the depositors’ implicit coordination during a banking frenzy. The low revision probability of the Stochastic leaders and the high revision probability of the Stochastic followers combine to provide the right incentives for the other type of depositors. Nevertheless, with an increasing number of depositors each Stochastic leader acting independently will be more hesitant to leave the money in the bank as s/he cannot rely with certainty on other high-rigidity depositors to open with L. Therefore, while the nature of our conditions will be similar, each will apply for more depositors. This implies that it gets increasingly harder to avoid self-fulfilling bank runs with each additional independently-acting depositor. As a consequence, for a No-run region to still occur one of two things is required. Either there is a stronger Stochastic Leadership (a greater degree in heterogeneity in depositors’ rigidity), or there is a higher investment return.

One can modify the analysis in two main ways to ensure the No-run region even under a large number of depositors. First, some partial form of sequential observability assumed under Stackelberg leadership (and investigated experimentally e.g. in Kinateder et al (2020)) can be introduced for a proportion of depositors. This seems realistic; real-world depositors can generally monitor the evolving situation including the number of others withdrawing their money, and respond accordingly. Second, one can consider the Stochastic leaders and followers acting (at least partly) as groups rather than each depositor acting fully independently. Third, depositors within each group can be assumed to follow symmetric strategies (perhaps achieved through some coordination device as in Diamond and Dybvig (1983)) and act in unison.Footnote 18 This would mimic the existence of large institutional investors that can better explicitly coordinate their actions. Empirical evidence supports such avenue, e.g. Starr and Yilmaz (2007) report differences between large, medium-sized and small depositors’ reactions to withdrawals by members of each group.

9 Summary and conclusions

Nine-time Olympic champion swimmer Mark Spitz argued that ‘If you fail to prepare, you’re prepared to fail.’ This statement is arguably true not only in the sports context, but also in relation to financial regulation. There is an ever-present danger of a banking panic. In recent years it was intensified by the 2020-2022 boom-bust financial cycle, the problems induced by the Covid-19 pandemic and excessively high inflation. The March 2023 collapses of several banking institutions in the U.S. provide a further demonstration that the required policy intervention can be costly and magnify the moral hazard problem and systemic risk down the road. As such, financial institutions and public policymakers need to better understand the mechanics of bank runs as well as the solutions available. This paper contributes on both fronts.

The existing bank-run literature in the tradition of Diamond and Dybvig (1983) generally assumes that withdrawal is a one-off decision that depositors cannot alter. This may be a plausible simplification in some contexts, but it may be too restrictive in others. Furthermore, the two polar cases commonly examined in the literature have very different predictions. In most papers depositors decide simultaneously, i.e. they are unable to observe what others have done. This leads to multiple equilibria and the possibility of bank runs. On the other hand, Kinateder and Kiss (2014) and others examine sequential timing in which each depositor can observe moves that occurred previously. In such Stackelberg settings the likelihood of bank runs in equilibrium is greatly diminished or fully eliminated.

Our Stochastic Leadership framework nests the simultaneous and Stackelberg frameworks as special cases. It allows depositors to change their minds about withdrawing money from the bank. Each depositor has some ex-ante probability of being able to reconsider her initial decision based on observing what others have done.Footnote 19

Our analysis demonstrates how the Stochastic leaders (rigid depositors) and Stochastic followers (flexible depositors) are more likely to achieve an outcome with higher welfare if their actions are implicitly coordinated. Their heterogeneity may help them to avoid self-fulfilling bank runs. This reduces the need for deposit insurance, and can thus help to alleviate its various undesirable incentive effects (see Demirgüç-Kunt and Detragiache (2002); Hoggarth et al (2005); Wang (2013)).

In regards to policy recommendations, our analysis implies that availability of a wide range of banking products (including a good mix of current and term deposits) may be beneficial by ensuring a wide range of depositor rigidities. For example, in the case of the recent failure of Silicon Valley Bank, more diversity among depositors, rather than the high concentration of large tech-firm deposits, may have slowed or eliminated the very fast run that led to its failure. However, heterogeneity must be combined with collection and dissemination of information by the government or regulator to facilitate implicit coordination of flexible and rigid depositors.

Our results suggest that the existence of a large depositor/investor with a credible long-term commitment, acting as a Stackelberg or Stochastic leader, may in principle help to prevent bank runs. There are some related historical examples, e.g. the leadership role of J.P. Morgan during the financial panic of 2007.

More research is required to assess how observable heterogeneous characteristics such as withdrawal rigidity may affect the depositors’ behavior in various institutional settings, and to fully understand the policy implications for optimal regulation of banking services. Nonetheless, let us emphasize that our ‘change-of-mind’ framework may be potentially useful in modeling strategic behavior in many different areas. Examples include macroeconomic policy (e.g. interactions between the central bank, government and the prudential authority), management/business areas (e.g. the interactions between oligopolists), as well as political science (e.g. interactions between political parties or climate-deal negotiating governments).

Notes

For example, in the two years prior to Covid-19 the New York City Marathon had around 53 thousand participants and barely made the Wikipedia list of the 20 biggest all-time running events.

A way of tackling multiple equilibria is to use sunspots as coordination devices, both in theory (Shell 1989; Cass and Shell 1983) and in the lab (Fehr et al 2019; Siebert and Yang 2021). Specifically in the bank-run literature, Diamond and Dybvig (1983) rely on sunspots in their canonical model, while Arifovic and Jiang (2019) use sunspots in the lab.

In Green and Lin (2003), depositors decide sequentially, but they do not observe the actions of other depositors. The authors propose a natural mechanism that implements the efficient allocation in the Diamond-Dybvig environment. Gu (2011) proposed a herding bank-run model that also features sequential decision-making. However, the paper focuses on the signal-extraction problem and assumes away the coordination issue that we are interested in.

Chari and Jagannathan (1988) and others explicitly model the existence of informed vs. uninformed depositors. Rational inattention can be seen as a microfoundation for some depositors choosing to remain uninformed. Relatedly, Masiliūnas (2017) shows how the cost of information disclosure affects coordination failures.

If the conditions are not satisfied we obtain a ‘Possible-run region’ - the set of parameters generating multiple equilibria including the inefficient \(\mathcal {W}\).

It will be apparent that in the three-depositor case there can be either one Stochastic leader and two Stochastic followers, or two Stochastic leaders and one Stochastic follower.

Experimental papers on bank runs have often disregarded liquidity types, see Garratt and Keister (2009), Schotter and Yorulmazer (2009), Arifovic et al (2013). Note that in the setup by Diamond and Dybvig (1983) assuming away impatient depositors leads to an easy solution that maximizes depositors’ utility: the bank would simply forbid early withdrawals. Adding liquidity types to our model would make it very complex as we would need to also specify the joint distribution of liquidity and rigidity types. Nonetheless, such extension could certainly be explored in future work on the topic.

The fact that banks issue current deposits can be motivated in many ways, e.g. in Diamond and Dybvig (1983) they serve as the bank’s liquidity insurance to risk-averse depositors. In their model the assumption that depositors are sufficiently risk-averse is important as their solution of the optimization problem equates the marginal utilities of patient and impatient depositors (leading to a specific set of payoffs creating a coordination problem). As we do not (need to) incorporate impatient depositors for our game-theoretic extensions of the literature there is no obvious optimization exercise in our framework. In line with other (mainly experimental) studies such as Madies (2006), Schotter and Yorulmazer (2009) and Arifovic et al (2013), we focus on the coordination game between depositors by adopting the simplest assumptions that yield the required game-theoretic classes of games. As such, our framework is applicable for any underlying utility functions of the depositors that generate a coordination problem between the depositors.

The latter assumption disregards own capital and external financing options for parsimony, but this has no qualitative effect on any of our findings. Appendix A sketches how we can think of the liquidation value and justify this assumption formally. Our baseline setup also assumes that there is no deposit insurance scheme, which will be added in Section 6.

Since the worst possible outcome from L generates a higher payoff than the the best outcome from W, leaving the deposit in the bank is an “obviously dominant strategy” in the sense of Li (2017).

In the experimental studies by Colman (1997), Colman and Stirk (1998), Chuah et al (2016), Belloc et al (2019) the payoff-dominant outcome \(\mathcal {L}\) in the Stag Hunt is achieved between 27% and 62% of the time. Relatedly, Capraro et al (2020) provide experimental evidence that cooperation in the Stag Hunt game is driven by efficiency motives. In terms of the Pure Coordination game, experiments imply a higher probability of the payoff-dominant outcome \(\mathcal {L}\), namely between 72% and 84% (Mehta et al 1994; Isoni et al 2014; Sitzia and Zheng 2019).

In macroeconomic studies Calvo-style rigidity is however commonly restricted to be the same across all agents, whereas in our setting it can be heterogeneous.

In the two-depositor game one can unambiguously relate the three panels presented in Fig. 6 to the classes of games derived above. Proposition 1 implies that for a low interest return (captured in the bottom-right-hand panel of Fig. 6) we have the Stag Hunt game. If the investment reaches some threshold (namely \(i\ge 3r-1\)) we obtain the Pure Coordination game featured in the other two panels. The matching of the classes of games for the three-depositor case presented in Fig. 7 is more complex, depending on the exact combination of the i and r levels. In principle, all three panels can be a Stag as well as a Pure Coordination game. But the higher the i, the greater the range of r values that yield the Pure Coordination game as opposed to the Stag Hunt game in each panel.

Such substitution effect in relation to the conventional Stackelberg leadership has been experimentally documented by Kiss et al (2012).

We are grateful to an anonymous reviewer for pointing out this interpretation.

Shakina and Angerer (2018) propose an experimental environment in which depositors may change their minds and redeposit their funds after having withdrawn them from the bank. The authors however focus on the role of communication, they do not touch upon the issue of rigidity.

In the \(r_{L}\in \left( 0,\frac{1}{3}\right) \ \)case the condition would be stronger as both B and C would have to play L in their revision to avoid a run.

Differentiating both sides of Eq. 32 with respect to \(\theta _{j}\), we can see that both increase monotonically with \(\theta _{j}\):

$$\begin{aligned} \frac{\partial LHS}{\partial \theta _{j}}=\theta _{C}\left( 1+i\right)>0, \frac{\partial RHS}{\partial \theta _{j}}=\theta _{C}\frac{r}{2}+\left( 1-\theta _{C}\right) \left( 1-\frac{3r}{2}\right) >0. \end{aligned}$$At \(\theta _{j}=0\), Eq. 32 is the same as Eq. 33 and at \(\theta _{j}=1\), Eq. 32 becomes

$$\begin{aligned} \left( 1+i\right) >\theta _{C}\frac{3r}{2}+\left( 1-\theta _{C}\right) , \end{aligned}$$which is always satisfied. Therefore, if Eq. 33 holds, the LHS of Eq. 32 is greater than its RHS for all possible values of \(\theta _{j}\in \left[ 0,1\right] \), implying that the Not-running-later condition is always satisfied.

References

Arifovic J, Jiang JH (2019) Strategic uncertainty and the power of extrinsic signals-evidence from an experimental study of bank runs. Journal of Economic Behavior & Organization 167:1–17

Arifovic J, Jiang JH, Xu Y (2013) Experimental evidence of bank runs as pure coordination failures. Journal of Economic Dynamics and Control 37(12):2446–2465

Atmaca S, Schoors K, Verschelde M (2017) Bank loyalty, social networks and crisis. Journal of Banking & Finance

Baba N, McCauley R, Ramaswamy S (2009) Us dollar money market funds and Non-US banks. BIS Quarterly Review

Bartoš V, Bauer M, Chytilová J, Matějka F (2016) Attention Discrimination: Theory and Field Experiments with Monitoring Information Acquisition. American Economic Review 106(6):1437–75

Belloc M, Bilancini E, Boncinelli L, D’Alessandro S (2019) Intuition and deliberation in the stag hunt game. Scientific Reports 9(1):1–7

Bryant J (1980) A model of reserves, bank runs, and deposit insurance. Journal of Banking & Finance 4(4):335–344

Bryant J (1994) Coordination theory, the stag hunt and macroeconomics. In: Problems of coordination in economic activity, Springer, pp 207–225

Calomiris CW, Mason JR (2003) Fundamentals, panics, and bank distress during the depression. American Economic Review 93(5):1615–1647

Calvo GA (1983) Staggered prices in a utility-maximizing framework. Journal of Monetary Economics 12(3):383–398

Caplin A, Dean M (2015) Revealed preference, rational inattention, and costly information acquisition. American Economic Review 105(7):2183–2203

Capraro V, Rodriguez-Lara I, Ruiz-Martos MJ (2020) Preferences for efficiency, rather than preferences for morality, drive cooperation in the one-shot stag-hunt game. Journal of Behavioral and Experimental Economics 86:101535

Caprio G, Klingebiel D (1999) Bank Insolvencies: Cross-country Experience. The World Bank

Cass D, Shell K (1983) Do sunspots matter? Journal of Political Economy 91(2):193–227

Chari VV, Jagannathan R (1988) Banking Panics, Information, and Rational Expectations Equilibrium. The Journal of Finance 43(3):749–761

Chuah S-H, Hoffmann R, Larner J (2016) Perceived intentionality in 2\(\times \) 2 experimental games. Bulletin of Economic Research 68(S1):78–84

Claessens S, Kose MMA, Laeven ML, Valencia F (2014) Financial Crises: Causes, Consequences, and Policy Responses. International Monetary Fund

Colman AM (1997) Salience and Focusing in Pure Coordination Games. Journal of Economic Methodology 4(1):61–81

Colman AM, Bacharach M (1997) Payoff dominance and the stackelberg heuristic. Theory and Decision 43(1):1–19