Abstract

Our study presents a method to dissect bond excess returns into components influenced by credit spreads and credit losses. Analyzing data spanning 48 years, we find that companies with higher accrual quality experience greater shocks from credit spreads and lesser shocks from credit losses. Conversely, firms with lower accrual quality face reduced credit spread shocks but heightened credit loss shocks. This indicates that high accrual quality firms benefit more from credit spread shocks, while those with lower accrual quality profit more from credit loss shocks. Notably, excluding credit spread shocks, future realized returns have a negative correlation with accrual quality. These accrual quality premiums are significant both statistically and economically, especially when credit spread shocks are not considered. Additionally, accrual quality has improved over the past 48 years due to enhanced accounting standards. Our findings reveal the importance of a reliable accrual quality metric and underscore the need to factor in credit spread shocks in asset pricing evaluations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The accounting literature presents an ongoing debate about the effect of accounting information quality on a firm’s cost of debt. Most debates consider a risk proxy assessing the quality of accruals. Specifically, Sengupta (1998), Francis et al. (2005), and Le et al. (2021), among others, argue that accrual quality (AQ) affects cost of debt. They find a significant negative relation between the AQ factor returns and bond returns.Footnote 1 However, their studies do not document any evidence for predicting future realized bond returns. Moreover, since expected default and expected cost of debt are unobservable, previous studies often rely on the structural models of debt, i.e., Merton’s (1974) model, to decompose credit spreads. Du et al. (2019) believe that the structural models of debt have difficulties. First, the structural credit risk models underestimate credit spreads. Second, attempts to empirically implement the models on individual corporate bond prices have failed (Jones et al., 1984; Eom et al., 2004). Third, a few studies exist to empirically forecast future bond returns (i.e., Koijen et al., 2017; Bai et al., 2019; Borup et al., 2023; Kato and Nakamura 2024; Lim and Mali 2024). To address these shortages, we propose a unique method that decomposes bond returns into credit-spread and -loss shocksFootnote 2 without relying on the default model, which allows us to predict future bond returns.

We argue that poor relation between AQ and future realized bond returns stems from a negative relation between the AQ factorFootnote 3 and future credit losses, and a positive relation between the factor and credit spreads; that is, firms with lower AQ experience higher credit losses while firms with higher AQ experience lower credit losses in the future. Moreover, high (low) AQ firms experience high (low) credit spreads in the future. Thus, lower credit spread related to poor AQ firms are systematically compensated by higher expected returns, while higher credit spread related to good AQ firms are systematically compensated by lower expected returns. In contrast, lower credit losses related to good AQ firms are systematically compensated by lower expected returns, while higher credit losses related to poor AQ firms are systematically compensated by higher expected returns. These findings imply that, under a recession when firms do not have adequate information (or low AQ), uncertainty and discount rate increase and thereby market participants’ information (especially AQ) reduces, which causes a decrease in bond price. This causes default on bond contracts and thereby increase bond credit loss. On the other hand, the lack of information due to low AQ causes that market participants cannot screen bonds based on their credit ranks and thereby bond credit spread reduces significantly.

Numerous studies use the AQ factor, DD. This factor is the standard deviation of the residuals estimated from running the regression of working capital accruals on past, current, and future operating cash flows so that higher DD factor shows lower AQ. It is correlated with several characteristics that are likely to be related to credit shocks, as explained above. For instance, bonds with high DD measure (low AQ) are likely to possess higher bankruptcy risk due to high frequency of losses and has more volatile sales and earnings (Dechow and Dichev 2002). Each feature considers systematic future underperformance in the bond market, possibly due to credit shocks.

To obtain the AQ premium, we perform asset pricing tests by using a novel measure of expected returns that contains realized returns excluding credit-spread shocks. We use a price-response coefficient framework that estimates the credit-spread shock portion of realized returns. A credit-spread shock is a return arising from a revision in the expectation of the entire stream of future credit spreads, referred to as return on bond price surprise. We estimate credit-spread shocks as fitted values of realized bond returns’ regressions on bond price surprises. To estimate the shocks, we consider two assumptions: (i) a linear versus nonlinear relation between bond returns and bond price surprises, and (ii) the choice of two time-series and cross-sectional regressions. The firm-specific time-series (linear cross-sectional) return decomposition is expected to be the most (the least) powerful design for constructing our price surprise returns.

We conduct our empirical analyses for a sample of 148,378 “corporate bond”-year observations with returns from Jan. 1973 to Dec. 2023. We lag the DD measure by 1 year to avoid look-ahead bias in our asset pricing tests.Footnote 4 First, we find that the DD measure does not predict future bond returns at the portfolio and individual bond levels. Identically, corporate bonds with high AQ factor loadings and the AQ factor do not obtain significantly high returns at the portfolio level. Then, we decompose total realized returns into credit-spread shocks and returns excluding credit-spread shocks. This decomposition confirms that bonds with poor AQ (high DD measure) generate significantly less credit-spread shocks in the future. This result is robust to the choice of different nonlinearity assumptions and both time-series regressions and cross-sectional regressions. These results are robust to subsample periods, which implies that the results of our models are not stationary over time and accounting standards remain stationary. These standards have developed a core set of comprehensive accepted accounting pronouncements, high quality standards resulting in comparability, transparency, full disclosure, and rigorously interpreted and applied standards. All these standards have been improving AQ over the time.

Finally, we conduct asset pricing tests by using returns excluding credit-spread shocks. These tests examine both the AQ factor loadings (the AQ factor betas) and the DD measure at the individual and portfolio bond levels. The DD measure as a feature is, by itself, a significant predictor of future returns excluding credit-spread shocks. However, the DD measure premium (i.e., the regression coefficient on the portfolio rank of DD measure) reduces after controlling for the well-known benchmark characteristics of beta (the excess return on the CRSP value-weighted stock index), bond factor (the excess return on the U.S. aggregate bond index), DEF (the return spread between the high-yield bond index and the intermediate government bond index), and option factor (the return spread between the GNMA mortgage-backed security index and the intermediate government bond index). It remains statistically significant only in the test conducted on the firm-specific time-series return decomposition, which is the most powerful research design. The latter test premium is also economically significant, indicating a spread 17.28% in annualized returns between bonds in the highest and the lowest DD measure portfolios for the whole sample period 1973 to 2023 and spreads 29.16%, 16.20%, and 9.72% per annum for the subperiods 1973–1998, 1999–2006, 2007–2023, respectively.

The AQ factor premium (the AQ beta regression coefficient) is significant after controlling for the benchmark factor loadings when credit-spread shocks are excluded by both firm-specific time-series decomposition method and nonlinear cross-sectional return decomposition method. The significant estimates of AQ premium range from 1.56 to 4.56% per annum for the whole sample period. This premium ranges from 0.96 to 2.64%, 1.92 to 4.08%, and 3.00 to 5.76% per annum for the subperiods 1973 to 1998, 1999 to 2006, 2007 to 2023, respectively. Further, we present evidence that AQ is related to future realized returns after controlling for credit-spread shocks. These results are not sensitive to bond returns’ decomposition methods.

To reinforce our findings, we conduct two additional analyses. First, we directly estimate unconditional expected returns for each bond from the price surprise regressions of firm-specific time-series returns. When the resulting expected bond returns are used in asset pricing tests in place of returns excluding credit-spread shocks, the AQ premiums remain statistically and economically significant in all “characteristic”- and “factor loading”-based tests. Second, we address the suggested return decomposition’s inability to consider credit-loss shocks, i.e., the portion of bond returns due to changes in the expectation of future credit losses. If credit-spread shocks are negatively associated with AQ, they should show the correlated omitted variables that bias asset pricing tests toward finding the AQ premiums. In practice, additional tests represent that the relation between AQ and proxies for future credit-loss shocks is positive, implying that credit-loss shocks are unlikely to be responsible to significant positive AQ premiums.

Our findings contribute to the credit risk literature for several reasons. First, recent studies examine the relation between AQ and cost of debt (i.e., Sengupta, 1998; Francis et al., 2005; Le et al., 2021), while we are the first study to examine the relation between AQ and the components of cost of debt, which are the credit-spread and -loss shocks. Second, most accounting studies consider the bond yield spread as credit risk, while our study considers the bond price spread proposed by Nozawa (2017) as credit-spread risk. Third, credit-spread and -loss shocks are a hot issue in the credit risk literature. Fourth, it sheds light on the recent debate as to whether realized bond returns reflect the poor AQ risk premium (i.e., Sengupta, 1998; Francis et al., 2005). Finally, it underscores the importance of controlling for credit-spread shocks in asset pricing tests and develops a simple method for excluding credit-spread shocks from realized bond returns. Generally, this study advances the understanding of how AQ influences a firm's cost of debt by decomposing bond returns into credit-spread and -loss shocks. It addresses limitations of previous models and provides a novel method to predict future bond returns. This research enhances asset pricing models and informs financial risk management practices.

The rest of the paper is organised as follows. Section 2 reviews the literature. Section 3 presents the proposed methodology of bond returns’ decomposition. Section 4 describes the data. Section 5 reports the empirical results, Sect. 6 presents the robustness checks, Sect. 7 illustrates the methodology limitations, and Sect. 8 presents our conclusions.

2 Motivation

2.1 Theoretical Literature

The prior studies document theoretical basis for the relation between AQ and cost of debt by using the market microstructure and risk management literatures. Following the risk management literature, Klein and Bawa (1976), Barry and Brown (1985), Coles et al. (1995), Kilic and Shaliastovich (2018), Roy Trivedi (2024), and Ghani and Ghani (2024) show that assets with low information about past returns earn high expected returns. Lambert et al. (2007) and Ball and Nikolaev (2022) find that a firm with more information about future cash flows has lower conditional beta and thereby lower expected returns. Generally, the literature documents that a firm with higher information quality has lower forward-looking beta and hence lower cost of debt. Following the market microstructure literature, Sengupta (1998), Francis et al. (2005), and Le et al. (2021) find that higher information quality decreases a firm’s cost of debt. Although analytical models propose various mechanisms through which information quality affects cost of debt, they show the same empirical predictions about the relation between AQ and cost of debt. If low AQ increases information asymmetry, low AQ bonds will obtain high returns.

While these studies provide valuable insights, they do not fully address how AQ impacts returns resulting from credit-spread shocks and credit-loss shocks. Our study aims to fill this gap by examining the relationship between AQ and returns specifically in the context of these shocks. We find that bonds with high DD measures (indicating low AQ) experience fewer credit-spread shocks. The return differences between the extremes of the AQ portfolio are statistically significant. After accounting for credit-spread shocks, bonds with low AQ yield higher returns, thereby supporting our hypothesis.

2.2 Empirical Literature

Incomplete accounting information plays a critical role in corporate credit risk (Duffie and Lando 2001). The effects of this information on credit risk have been studied from the perspective of disclosure ranking (Yu 2005), information asymmetry (Lu et al., 2010; Fosu et al., 2023), and analyst forecasts (Guntay and Hackbarth 2010). These studies use corporate disclosure ranking assessed by these three perspectives between uninformed and informed traders to describe the variation of bond yield spreads. Duffie and Lando (2001) believe that the level of incomplete accounting information has a significant impact on credit risk. Bharath et al. (2008) show that poorer accounting-quality firms face significantly higher yield spreads. Qi et al. (2010) find that high AQ reduces information asymmetry and thereby lowers cost of debt. Alam et al. (2020) examine the relationship between accounting information risk, measured with AQ, and credit spreads, measured with credit default swap (CDS) spreads. They find a negative relationship between AQ and CDS spreads whereby better AQ is related to lower CDS spreads. However, these studies do not thoroughly investigate the information risks arising from credit-spread shocks and credit-loss shocks in corporate bonds and their relationship with the cost of debt.

Nozawa (2017) introduces two risk factors of credit-spread shock (bond price spread) and credit-loss shock (both the incidence of default and the loss given default). He believes that credit spread is higher when bond issuer takes a higher default risk and when discount rate of bond cash flows increases. Lambert et al. (2007) find that better quality accounting information decreases the assessed variance of a firm’s asset value and hence its credit risk. This finding is consistent with Duffie and Lando (2001) who found the effect of uncertainty in the firms’ incomplete accounting information on their credit risk. Chen et al. (2015) examine the effects of accounting information uncertainty on corporate credit risk and find that the volatilities of earnings management activities positively affect bond yield spreads. Generally, the relation between AQ and credit- and loss-spread shocks can be explained as follow. In a bond market with low AQ firms, bondholders cannot screen bonds based on their credit rankings due to inadequate information. This means that the bondholders cannot determine bonds’ credit spread and therefore bond credit spread (cost of debt) decreases (increases). Additionally, in a bond market with low AQ firms, uncertainty and discount rate increases remarkably and hence the rate of default on the bond contracts rises. This causes an increase in credit loss of bonds in the market. In this paper, our credit risk model is consistent with Nozawa (2017) for removing issues of the existing literature. First, the structural credit risk models underestimate credit spreads, while our credit risk model does not. Second, attempts to empirically implement the models on individual corporate bond prices have failed. To address these shortages, we propose a unique method consistent with Nozawa (2017) that decomposes bond returns into credit-spread and -loss shocks without relying on the default model.

Another aspect of the empirical studies uses the Dechow and Dichev (2002) DD measure to examine the relation between AQ and cost of capital. A higher DD measure exhibits lower AQ. These studies document higher cost of debt for low AQ firms by using alternative measures of cost of debt, including (i) implied cost of debt (Francis et al., 2005; Liu and Wysocki 2017); (ii) CAPM beta (Francis et al., 2005; Liu and Wysocki 2017); and (iii) industry adjusted earnings-to-price ratio (Francis et al., 2005; Liu and Wysocki 2017). In contrast, evidence about the relation between AQ and cost of debt is mixed. Karjalainen (2011) finds that low AQ firms have a high cost of debt. He finds that the debt-pricing effect of AQ implies that information risk, as proxied by AQ, is a separate risk factor along with credit risk, which is priced in the debt contracts. This implies that poor AQ estimates less precise credit risk, thereby increasing the information risk of a firm’s lenders. Further, Francis et al. (2005) find positive AQ factor loadings and conclude that AQ is a priced risk factor. They show that bonds with higher AQ loadings earn higher average realized returns by using standard two-stage asset-pricing tests of Fama and MacBeth (1973). They find that DD measure does not predict future monthly realized returns. Resolving the debate on the presence of a priced AQ factor is critical due to recent implicitly (or explicitly) studies that use the AQ loadings to proxy for accounting quality (Ecker al., 2006; Chen et al., 2007; Krishnan et al., 2008; Chang et al., 2009; Kravet and Shevlin 2010; Kim and Venkatachalam 2011; Dichev and Owens 2024). To address shortages in this part of literature, we propose a unique method that decomposes bond returns into credit-spread and -loss shocks without relying on the default model, which allows us to predict future bond returns.

Another important aspect of the prior studies focuses on predictability of bond returns. For example, Koijen et al. (2017) predict future bond excess returns by using the Cochrane and Piazzesi (2005) CP factor. Gilchrist and Zakrajsek (2012) show that credit spread, especially a component of the bond risk premium, forecasts economic activity. A related literature examines predictability of macro-economic factors for future bond returns. Cooper and Priestley (2008) show that trend deviations in industrial production forecast future bond returns. Joslin et al. (2014) incorporate this finding in an affine term structure model. Ludvigson and Ng (2009) show that a principal component extracted from macroeconomic series forecasts future bond returns. Bai et al. (2019) find that downside risk is the strongest predictor of future bond returns and propose common risk factors based on the prevalent risk features of corporate bonds, such as downside risk, credit risk, and liquidity risk. They find that these bond factors have economically and statistically significant risk premiums that cannot be explained by the well-known bond market factors.

Overall, while prior literature demonstrates significant relationships among AQ, credit- and loss-spread shocks, and the cost of debt, there is a lack of studies explicitly examining these relationships. This study addresses this gap by introducing a new credit-spread shock to predict future bond returns, thereby providing a comprehensive understanding of the interplay between AQ and bond return predictability.

3 Proposed Methodology

3.1 The DD Measure and Credit-Spread Shocks

Asset pricing tests commonly use the average realized returns on bonds to estimate a firm's cost of debt. However, Elton (1999) suggested that this method might be inaccurate due to the impact of information shocks. While these tests typically equate average realized returns with expected returns, this may not be accurate for limited data samples. Elton (1999) noted that over longer periods, realized returns could correlate with expected returns. Therefore, if firms with varying levels of AQ experience different magnitudes of credit-spread shocks, using average realized returns as a proxy for expected returns could cause bias in asset pricing tests, suggesting a link between AQ and the cost of debt. This potential bias is present regardless of whether the analysis is conducted at an individual bond or portfolio level, or whether it is based on factor loadings or characteristics. The extent of this bias hinges on the relationship between AQ and future credit-spread shocks; a significant association could lead to a negligible risk premium.

Previous empirical studies have associated firms with higher DD scores (indicating lower AQ) with a reduced likelihood of future credit-spread shocks. Characteristics of the DD measure have also been linked to abnormal bond returns, possibly influenced by credit-spread shocks. Dechow and Dichev (2002) found that companies with higher DD scores often face more significant losses due to financial distress. Dichev (1998) observed that distressed firms tend to generate lower returns, likely because of future credit-spread shocks. Additionally, there might be a direct link between the DD measure and fundamental indicators predicting future returns, which the bond market may not fully recognize, as suggested by Francis et al. (2005).

In summary, previous research indicates that structural debt models like Merton's (1974) model are not very effective in academic contexts because they often underestimate credit spreads, and practical applications to corporate bond pricing have been challenging (Jones et al., 1984; Eom et al., 2004). Moreover, only a few studies have successfully predicted future bond returns (Koijen et al., 2017; Bai et al., 2019). Given the unobservable nature of expected default and debt cost, assessing credit spreads becomes more complex. To overcome these challenges, our study introduces a novel method that separates bond returns into credit spread and loss surprises. This approach does not depend on a specific default model and offers a more accurate prediction of future bond returns.

3.2 Constructing Credit-Spread and -Loss Shocks

Our study introduces a framework that employs price response coefficients (PRCs)Footnote 5 to differentiate expected bond returns from the impacts of credit-spread and loss shocks. This approach analyzes bond returns without relying on a default model. Credit-spread shock, as defined by Nozawa (2017), refers to the variation in the bond price spread (the price difference between a corporate bond and a Treasury bond before default). This variation is associated with the yield spread, where a shift may reflect a change in bond price in terms of yield multiplied by duration.

We present an innovative method to decompose these two types of shocks, which is based on the concept of bond price spread. A credit-spread shock occurs when the bond price spread reacts to changes in expectations of future bond price spreads. For example, a positive shift in bond price will result in a positive credit spread, whereas a negative shift will lead to a negative credit spread. Considering that the total credit spreads of a corporate bond issuer over its lifetime should equal the cumulative bond price spreads, we can evaluate a credit-spread shock as the return on unexpected changes in bond price spreads.

In our analysis, we break down realized bond returns into three key components: the expected return, the return due to changes in expectations of future price spreads (i.e., return on credit-spread shocks), and the unexpected return not related to surprises in the bond price spread. This decomposition method effectively accounts for the different elements that contribute to the overall return of a bond.

Equation (1) explains how to calculate the expected return of a bond at a future time \(t+1\). The expected bond return, denoted as \(E\left({R}_{j,t+1}\right)\), is based on the formula \({R}_{j,t+1}=\frac{{P}_{j,t+1}+{C}_{j,t+1}}{{P}_{j,t}}\), where \({P}_{j,t+1}\) represents the bond's price per dollar of face value at time \(t+1\), including accrued interest, and \({C}_{j,t+1}\) is the bond's coupon rate. The term \({R}_{j,t+1}^{s}\) refers to the portion of the return at time \(t+1\) that results from credit-spread shocks. Additionally, \({\varepsilon }_{j,t+1}^{*}\) is the part of the return that is unexpectedly not related to fluctuations in the bond price spread. The bond price spread surprise, \(U{(P}_{t+1}-{P}_{f,t+1})\), is the difference between the bond's price and a comparable Treasury bond's price. The change in expected bond price spreads between times t and \(t+1\), denoted as \(\Delta E\left({(P}_{t+1+s}-{P}_{f,t+1+s})|U{(P}_{t+1}-{P}_{f,t+1})\right)\), is due to the bond price spread surprise. Lastly, β is a discount factor, calculated as \(\frac{1}{1+{R}_{f,t+1}}\), where \({R}_{f,t+1}\) is the interest rate for discounting future cash flows. This rate is derived from \({R}_{f,t+1}=\frac{{P}_{f,t+1}-{C}_{f,t+1}}{{P}_{f,t}}\), with \({P}_{f,t+1}\) and \({C}_{f,t+1}\) being the price and coupon rate of a matching Treasury bond at time \(t+1\), respectively.

We demonstrate that depending on various assumptions about how bond price spreads evolve over time, the credit-spread shock can be understood simply because of the current period's price surprise.

where \(\varnothing \) represents a Price Response Coefficient (PRC) that has a positive (or negative) correlation with the ongoing impact (or the discount rate) of the bond price spread surprise.

Inserting Eq. (2) into Eq. (1) suggests a method for breaking down returns as indicated by the PRC framework.

We build bond price spread surprises using a time-series model. The surprise in bond price spread, named SURP, is calculated as the actual price spread minus the expected price spread. This is represented by the formula (\(({P}_{j,t+1}-{P}_{f,t+1})-{E}_{t}({P}_{j,t+1}-{P}_{f,t+1})\). Expected prices are predicted using a straightforward statistical model, which posits that annual prices adhere to a first-order autoregressive process (AR1).

where \({P}_{j,t+1}\) represents the price of firm j before any extraordinary items in the fiscal year t, adjusted in proportion to the book value of the firm's debt at the start of the following fiscal year, t + 1.

The process of estimating expected prices is carried out in two steps: (i) firstly, the prediction coefficients, \({\widehat{\beta }}_{0}\) and \({\widehat{\beta }}_{1}\), are obtained by cross-sectional estimation of the model using data from the previous year; (ii) secondly, the predicted price is calculated by applying these estimated coefficients to the values of relevant variables as follows:

At the beginning of the year, the market value of a company's debt is measured using the yearly SURP. For instance, to determine the anticipated prices for 2008 at the end of 2007, we use predictor variable values from the fiscal year 2007 and coefficients derived from the prices of the fiscal year 2006. These expected prices are then adjusted to reflect absolute values by multiplying them with the book value of the debt.

From Eq. (3), we can calculate the credit-spread shock component, \({R}_{j,t+1}^{s}\), as the fitted value from the cross-sectional regression of realized returns against bond price surprises, \(U(P_{t + 1} - P_{f,t + 1} )\)Footnote 6. To estimate \({R}_{j,t+1}^{s}\), we first use a simple statistical model for price prediction to calculate the SURP. This model assumes that annual prices follow an AR(1) process and is estimated using cross-sectional data for a one-year period. We then construct predicted prices for the next year by comparing current-year prices with those from the previous year, using the resulting coefficients to determine SURP.

Next, we apply Eq. (3) to break down realized bond returns into the credit-spread shock portion, using both time series and cross-sectional returns decomposition. This cross-sectional approach helps us measure the monthly correlations between excess bond returns and simultaneous price surprises. In this decomposition, we assume that the size of the PRCs is consistent across all firms in the cross-section. We conduct cross-sectional regressions of excess bond returns on price surprise variables within 5% intervals across the price surprise distribution, accounting for potential nonlinearity in the return-price relationship. This nonlinear credit response model allows PRCs to vary based on the magnitude of price surprises, leading to more accurate estimates of credit-spread shocks.

The firm-specific credit response model, as per Lipe et al. (1998), involves estimating regressions of excess bond returns on price surprises using at least 72 monthly returns over a sample period. This model is more precise in estimating credit-spread shocks than nonlinear cross-sectional returns regressions of earnings surprise. Our focus will be on the results from the firm-specific decomposition, as it offers more accurate outcomes. We will also present results from all three decompositions.

The returns \({R}_{j,t+1}^{s}\) from the time-series and cross-sectional decompositions provided by Eq. (3) are the fitted values, while the residuals plus the intercept represent returns excluding credit-spread shocks, known as \({R}_{j,t+1}^{ns}\). The component not explained by bond price surprises, estimated by Eq. (3) and referred to as the linear credit response model, is termed the credit-loss shock \({R}_{j,t+1}^{l}\). Our proposed decomposition method is further discussed in Appendix A.

4 Sample and Data

4.1 Constructing DD Measure

Our dataset comprises 148,378 business years spanning from 1973 to 2023 and contains all necessary information to construct the DD measure. This includes the extra return on the CRSP Value Weighted Stock Index (\({R}^{STK}\)), the additional return on the US Aggregate Bond Index (\({R}^{BOND}\)), the differential return between the High-Yield Bond Index and the Intermediate Government Bond Index (\({R}^{DEF}\)), and the return discrepancy between the GNMA Mortgage-Backed Security Index and the Intermediate Government Bond Index (\({R}^{OPTION}\)). To avoid overstating the returns from trading strategies linked to accrual-related factors (as per Beaver et al., 2007), all pricing tests incorporate the delisting returns for companies removed from trading during the estimation period. In cases where the delisting return is not available in the CRSP database, we substitute it with the average delisting return from studies by Shumway (1997) and Shumway and Warther (1999).

We apply the Dechow and Dichev (2002) AQ measureFootnote 7 to each corporate bond, using the accounting data of the respective companies. Following the methodology of Francis et al. (2005), we conduct a cross-sectional regression for each bond that has at least 20 observations annually.

In Eq. (6), we calculate the total current accruals (\({TCA}_{j,t}\)) of a firm j for a specific year t. This is done by taking the annual change in current assets (\(\Delta {ACT}_{j,t}\)), subtracting the yearly change in current liabilities (\(\Delta {CL}_{j,t}\)), subtracting the yearly change in cash holdings (\(\Delta {CH}_{j,t}\)), and then adding the annual change in short-term debt (\(\Delta {DL}_{j,t}\)). The firm's operational cash flow for the year (\({CF}_{j,t}\)) is calculated by taking the net income before extraordinary items (\({NI}_{j,t}\)) and subtracting total accruals (\({TA}_{j,t}\)). The total accruals are computed by deducting depreciation and amortization expenses (\({D}_{j,t}\)) from the total current accruals (\({TCA}_{j,t}\)). Additionally, we consider the annual change in sales \(\Delta {S}_{j,t}\)) and the value of gross equipment, property, and plant assets (\({GEPP}_{j,t}\)) for each year.

To assess AQ for each firm j and year t, we use the standard deviation of residuals from a specific regression model (Eq. 6) applied over a five-year period (from \(t-5\) to \(t-1\)). We standardize these variables using the average total assets from the year before t to ensure comparability. To avoid any forward-looking bias in our AQ measurement, we lag it by one additional year since it incorporates projected cash flows for the next year. The necessary accounting data for this analysis is sourced from the CRSP and Compustat databases.

4.2 Corporate Bond Data

Our study derives corporate bond prices using data from four main sources: Lehman Brothers Fixed Income, TRACE, Mergent FISD/NAIC, and DataStream, in that specific order. A detailed description of these data sources is provided in Appendix B. Additionally, we've conducted robustness checks by altering the order of these sources.

To calculate excess returns and credit spreads for corporate bonds, we use synthetic Treasury bonds that are aligned with the characteristics of the corporate bonds. These synthetic bonds are based on the constant-maturity yield data provided by the Federal Reserve. For data accuracy, we apply two specific filters. The first filter discards any bond price returns that are higher than the price of the corresponding Treasury bond. The second filter eliminates any bond price data that is less than one cent per dollar. These filters help in ensuring the reliability of our data by removing any incorrect data points.

5 Empirical Analyses and Results

5.1 AQ Characteristic and Future Bond Returns

The study by Francis et al. (2005) uncovered a strong negative correlation between AQ and bond returns. However, they found no evidence linking the AQ characteristic, specifically the DD measure, with the level of AQ risk (AQ factor loading) and its impact on future bond returns. Thus, our research is pioneering in investigating the predictability of AQ over the study period.

Table 1, Panel A, presents findings from a literature review that focuses on characteristic-based analysis of monthly returns on individual bonds. This part of the study involves a regression analysis based on the following cross-sectional characteristics:

where \({R}_{j,t+1}\) is the bond \(j\)’s return in moth \(t+1\), \({R}_{f,t+1}\) is the one-month T-bill rate in month \(t+1\), \({Lev}_{j,t}\) is the firm j’s ratio of interest-bearing debt to total assets in month t,\({SDD}_{j,t}\) is the portfolio rank of DD measure, \({Size}_{j,t}\) is the logarithm of firm j’s total assets in month t, \({ROA}_{j,t}\) is the firm’s return on assets in month t, \({IntCov}_{j,t}\) is the firm’s ratio of operating income to interest expense in month t, \({\sigma (NIBE)}_{j,t}\) is the standard deviation of firm j’s net income before extraordinary items (NIBE), scaled by average assets, over the rolling prior 10-year period. We need at least five observations of NIBE to compute standard deviation.

In our study, we analyze the results of Fama and MacBeth (1973) monthly cross-sectional regression coefficients, including their average and associated t-statistic p-values.

In Table 1 Panel A, we present outcomes from our specified model (7). The coefficients and t-statistics for control variables are in columns 3 to 8. Notably, ROA and IntCov, indicators of earnings volatility, show a small positive (and significantly negative) relationship with future bond returns. Moreover, factors like size and leverage are linked to future bond returns with a small (and significantly) negative correlation. The SDD, a rank measure of DD, displays a slightly positive correlation, which becomes slightly negative when other variables like leverage, size, ROA, IntCov, and (NIBE) are included in the regression. These findings align with those of Francis et al. (2005), who observed similar relationships between bond returns and control variables, although they did not focus on future bond returns.

Our results indicate that the DD measure does not effectively predict future bond returns in portfolios, echoing the findings of Francis et al. (2005) in their study of a factor-mimicking portfolio (AQ Factor). This portfolio was constructed by taking short positions in bonds ranking lowest and long positions in those ranking highest in the DD measure at the beginning of each month.

Table 1 Panel B provides descriptive statistics for the AQ element along with benchmark factors such as market premium (STK), bond, DEF, and OPTION. The monthly return of the AQ element, at 0.14%, was not statistically significant.

Table 1 Panel C shows that 59.22% of the variation in the AQ factor is explained by benchmark factors. The regression intercept, at -0.045% per month, is insignificant, indicating no abnormal returns on the AQ factor. This suggests that the DD measure does not support the notion that lower AQ is associated with higher bond returns.

5.2 AQ Factor Loadings and Future Bond Returns

Our study found no concrete evidence that the DD measure can forecast future bond yields. Nonetheless, the DD measure might serve as a general indicator of the systematic aspect of accrual risk, as indicated by its relationship with the AQ factor. To evaluate whether the market effectively prices this correlation, we employed the two-stage regression method recommended by Francis et al. (2005). This method assesses whether beta loadings on a risk factor can account for the differences in expected returns across various bonds. In simpler terms, it checks if bonds with higher beta values typically yield higher returns, aligning with the Fama and MacBeth (1973) model. To perform this regression, we calculated factor betas for each bond portfolio by correlating the portfolio’s returns with the factor returns over the entire study period.

where \({R}_{j,t}\) represents the return on portfolio j in month t, and \({R}_{f,t}\) is the rate for a one-month Treasury bill. \({R}^{STK}\) refers to the excess return on the CRSP value-weighted stock index, while \({R}^{BOND}\) indicates the excess return on the U.S. aggregate bond index. \({R}^{DEF}\) is the difference in returns between the high-yield bond index and the intermediate government bond index. \({R}^{OPTION}\) compares returns between the GNMA mortgage-backed security index and the intermediate government bond index. Additionally, \({R}^{AQ}\) represents the equal-weighted return on a portfolio that takes a short position in the two lowest quintiles and a long position in the two highest quintiles of the DD measure.

In the second phase of our analysis, we perform a cross-sectional regression to examine how actual bond returns correlate with the risk factor loadings that were determined in the first stage of the study.

where \({\overline{R} }_{j}\) denotes the average return on portfolio \(j\), \({\overline{R} }_{f}\) denotes the one-month T-bill rate, and \({\widehat{b}}_{j}^{AQ}\), \({\widehat{b}}_{j}^{STK}\), \({\widehat{b}}_{j}^{BOND}\), \({\widehat{b}}_{j}^{DEF}\), and \({\widehat{b}}_{j}^{OPTION}\) are the factor betas estimated in the first stage.

Panel D of Table 1 presents the outcomes of the Fama and MacBeth (FMB) regression applied to all corporate bonds. The statistical significance of the coefficients and t-statistics has been adjusted based on Shanken's (1992) correction method. To calculate the magnitude of the premiums, we used the average monthly portfolio returns, which are determined by the equal-weighted average of individual bond returns. We evaluated three types of factor models: (i) a standard model incorporating only the benchmark factors; (ii) a model including solely the AQ factor; and (iii) a comprehensive model containing both the benchmark factors and the AQ factor. Our results align with those of Francis et al. (2005), where the AQ factor premium (represented by the \({b}_{j}^{AQ}\) regression coefficient) was not statistically significant in any of the models.

In summary, our findings support the conclusions of Francis et al. (2005), indicating that a high exposure to AQ risk, as indicated by the AQ factor loading, does not correlate with higher bond returns.

5.3 The DD Measure and Future Bond Returns: Controlling for Credit-Spread Shocks

In our study, we focus on analyzing data derived from the breakdown of bond returns. To qualify for inclusion in our sample, each bond is required to have a minimum of 72 months of available bond returns and valid price surprise data. This criterion resulted in a final dataset comprising 77,242 observations for analysis.

5.3.1 Descriptive Statistics

Table 2, Panels A and C, present the descriptive statistics for bond excess returns, credit-spread shocks (\({R}_{j,t+1}^{s}\)), returns excluding credit-spread shocks (\({R}_{j,t+1}^{ns}\)), and credit-loss shocks (\({R}_{j,t+1}^{l}\)). Typically, credit-spread shocks show a positive trend in Panel C's firm-specific decomposition and range from slightly negative to positive in the linear or nonlinear return decompositions in Panel A.

The returns excluding credit-spread shocks differ from anticipated returns, such as the cost of debt, for two main reasons. First, these returns surpass risk-free returns, attributable to the breakdown of excessive bond yields. Second, they correspond to credit-loss shocks and the intercepts in Eq. (3). To demonstrate that credit-loss shocks are unrelated to the DD measure and don't impact Sect. 6's findings, it's shown that potential biases from these shocks don't affect the lack of a positive correlation between the DD measure and other factors.

5.3.2 Univariate Analysis

In Sect. 2, we explored the idea that bonds with high DD (Debt Default) measures (indicating lower Accounting Quality or AQ) are subjected to smaller credit-spread shocks. This led us to examine whether bonds with lower AQ indeed face smaller price surprises. According to the data in Table 2 (Panels B and D), there's a notable negative relationship between the average price-surprise proxies and DD measure portfolios in both cross-sectional and time-series returns samples. The differences in price surprises between the highest and lowest AQ portfolios (Portfolio 10 and Portfolio 1) are significantly negative.

Our analysis also focused on whether the smaller price surprises associated with negative AQ shocks lead to a noticeable decrease in credit-spread shocks. Table 2 examines if lower prices due to poor AQ shocks significantly reduce credit-spread shocks. Panels B and D of Table 2 detail the total realized excess returns divided into credit-spread shocks (\({R}_{j,t+1}^{s}\)), returns unrelated to credit-spread shocks (\({R}_{j,t+1}^{ns}\)), and credit-loss shocks (\({R}_{j,t+1}^{l}\)) for the DD measure portfolios. These panels display results from both cross-sectional and time-series decomposition methods. The excess returns and return components' differences between the highest and lowest AQ portfolios (row 10–1) are statistically significant, supporting the findings of Francis et al.’s (2005) study on their bond samples.

The additional columns in Panel B (and D) show \({R}_{j,t+1}^{s}\), \({R}_{j,t+1}^{ns}\), and \({R}_{j,t+1}^{l}\) for different credit response models. In all models, credit-spreads are lower (and credit-losses higher) for bonds in the highest DD measure portfolio, with significant differences in the 10–1 spread. Conversely, \({R}_{j,t+1}^{ns}\) is consistently higher for the lowest AQ portfolios, with significant spreads indicated in row 10–1.

This study suggests that lower AQ affects market participants' ability to evaluate bonds based on credit ranking due to insufficient information, leading to an inability to adjust credit spreads and debt costs accordingly. Conversely, higher AQ facilitates better creditworthiness assessment and lowers default risk. In markets with predominantly low AQ firms, increased uncertainty and discount rates result in higher default rates, elevating credit losses and bond costs.

In summary, our findings support the hypothesis that bonds with high DD measures (low AQ) experience fewer credit-spread shocks. The return differences between the extremes of the AQ portfolio are statistically significant in both analyses. After accounting for credit-spread shocks, it's observed that bonds with low AQ yield higher returns.

5.3.3 AQ Feature and Future Bond Returns Excluding Credit-Spread Shocks

Our study examines the relationship between the DD measure and realized bond returns, specifically excluding the impact of credit-spread shocks. Table 3 presents firm-level regressions of future returns based on the sorted DD measure (SDD), while excluding the impact of credit-loss shocks due to their minimal economic and statistical significance. Panel A (and B) displays results from cross-sectional (and time-series) return analysis. These sections highlight the total excess returns and the excess returns excluding credit-spread shocks (\({R}_{j,t+1}^{ns}\)).

When considering the full excess returns, the SDD-related premiums appear insignificant, both before and after adjustments for various risk factors such as Leverage, Size, ROA, IntCov, and σ(NIBE). This finding supports the conclusions drawn by Francis et al. (2005) for similar samples. However, when examining the excess returns excluding credit-spread shocks and without accounting for other risk factors, the SDD premiums are significant and positive at 5% and 10% levels. These premiums, ranging from 0.05 to 0.19% monthly, translate into an annual difference of 5.40% (0.05%\(\times 9\times 12\)) to 20.52% (0.19%\(\times 9\times 12\)) between the portfolios with the highest and lowest DD measures.

When additional risk characteristics are considered, the magnitude of SDD premiums decreases. Panel A, which employs a cross-sectional return decomposition approach to exclude credit-spread shocks, finds these premiums to be insignificant. In contrast, Panel B, utilizing a more sophisticated firm-specific return decomposition method, still indicates discernible premiums. These premiums are economically meaningful, with an estimated annual difference of approximately 17.28%Footnote 8 (0.16%\(\times 9\times 12\)) in returns between the highest and lowest AQ portfolios after excluding credit-spread shocks.

Overall, the study suggests that when accounting for credit-spread shocks, there is a notable negative correlation between the AQ measure and future realized bond returns, particularly when analyzing firm-specific time-series data.

5.3.4 AQ Factor Loadings and Future Bond Returns Excluding Credit-Spread Shocks

Table 4 in our study presents how various risk factors influence actual bond returns, as shown through Fama–MacBeth (FMB) second-stage regressions. The findings are categorized into cross-sectional (Panel A) and time-series (Panel B) decompositions, focusing on the impact of the AQ factor loadings, especially in the context of credit-spread shocks.

In both panels, the initial row of each section reports outcomes from asset pricing models using total excess returns. These tests reveal that neither the AQ premiums nor the AQ factor beta coefficients are significant. In the second row of Panel A, where credit-spread shocks are excluded using a linear credit response model, the AQ factor premium appears positive and statistically significant at a 5% level, implying its relevance in explaining the AQ premium. This section also shows that when credit-spread shocks are excluded using a nonlinear credit response model, the AQ factor premium is significant, amounting to 0.38% monthly, which annually translates to a range between 1.56% (\(0.13\%\times 12\)) to 4.56%Footnote 9 (\(0.38\%\times 12\)).

In Panel B's second section, the results reflect returns after excluding credit-spread shocks through a firm-specific credit response model. Here, the AQ factor premium is positively significant at a monthly rate of 0.36%, equating to an annual premium ranging from 3.12% (\(0.26\%\times 12\)) to 4.32% (\(0.36\%\times 12\)).

Overall, these findings, when controlling for standard risk factors and removing the effects of credit-spread shocks, show a strong and positive link between AQ factor loadings and future bond returns. The study utilized two advanced return decomposition models, considering nonlinearity in the return-price surprise relationship, and allowing the price response coefficient to vary across different firms, to ensure robust and comprehensive analysis of the data.

6 Additional Robustness Checks

6.1 Subsamples

In this section, we divided our analysis into three distinct time frames: 1973–1998, 1999–2006, and 2007–2023. To identify any significant changes during these periods, we utilized the Ahmed et al. (2017) sup-MZ test, which tests for the most significant value of the Maasoumi et al. (2010) MZ tests across a range of potential break years (detailed in Appendix C). These subperiods were chosen for two main reasons. First, there have been substantial changes in accounting regulations since 1973, significantly impacting AQ. Second, our model results varied over time, reflecting changes in accounting standards. Over the last 50 years, a set of core accounting standards has been established, promoting uniformity, transparency, and precise interpretation. Notably, since 1999, accounting standards have shifted to recognize both realized and unrealized gains and losses, primarily due to the widespread use of financial derivatives. This change has implications for the importance of traditional accruals and gives management more flexibility in earnings management.

We repeated our analysis from Table 1 for these three subperiods. Table 5, Panel A, shows that the SDD measure generally had an insignificant correlation with future returns across all subperiods. The coefficient of SDD slightly decreased from the first to the third subperiod. Adding control variables like leverage, size, ROA, and others didn't significantly affect this correlation. This aligns with Francis et al. (2005), who found a similar pattern but not for future bond returns, suggesting that the DD measure isn't a reliable predictor of future bond returns at a portfolio level.

In Panel B of Table 5, the AQ factor showed no substantial returns, with monthly values of 0.28%, 0.19%, and 0.13% for each respective subperiod. Panel C indicates that benchmark factors explained a significant portion of the AQ factor's variation, and the regression intercepts were statistically insignificant, indicating no significant gains from the AQ factor.

Furthermore, Panel D of Table 5 shows the second-stage estimation results based on individual bond returns for each period, confirming that the AQ factor premium is not significant in any subperiod and that higher AQ risk does not correlate with higher bond returns.

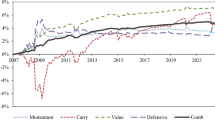

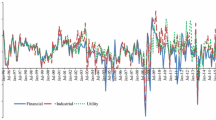

Finally, we analyzed bond return decomposition data. For each bond, we required at least 72 months of non-missing bond returns and price surprises, limiting our subsample sizes for the three subperiods. Panels A and C of Table 6 present descriptive statistics for bond excess returns, credit-spread shocks, returns excluding credit-spread shocks, and credit-loss shocks for each subperiod. The results indicate a decrease in all types of shocks from the first to the third subperiod, as accounting standards improved. For instance, credit-spread shocks, as estimated by the Linear Credit Response Model in Panel A, decreased from 1.30% in the first subperiod to 0.56% in the third subperiod.

Table 6, in both Panels B and D, demonstrates a significant negative correlation between the magnitude of price surprises (SURP) and the DD measure. Specifically, the average differences in price surprises between the worst performing (Portfolio 10) and the best performing (Portfolio 1) in terms of AQ are notably negative and statistically significant, with a p-value of 0.00 for each subperiod. The study further examines if lower price surprises, a result of poor AQ, lead to substantially smaller credit-spread shocks. Panels B and D detail the realized excess returns categorized into credit-spread shock (\({R}_{j,t+1}^{s}\)), returns excluding non-credit-spread shock (\({R}_{j,t+1}^{ns}\)), and credit-loss shock (\({R}_{j,t+1}^{l}\)) across different DD measure portfolios.

The data in these panels, particularly in Row 10–1, highlight the contrasts in average excess returns and their components between the least and most successful AQ shock portfolios. There is a consistent pattern across all subperiods, where credit-spread shocks are lower and credit-loss shocks are higher in bonds within the highest DD measure portfolios. The spread in returns between the extreme DD measure portfolios is statistically significant, validating the findings of Francis et al. (2005) for their bond samples. Specifically, the spread ranges from -0.27% to -0.37% for credit-spread shocks and 0.051% to 0.183% for credit-loss shocks in the first subperiod, with similar patterns observed in subsequent subperiods.

Moreover, returns excluding credit-spread shocks (\({R}_{j,t+1}^{ns}\)) are consistently higher for the worst AQ shock portfolios (Portfolio 10) across all subperiods. For instance, the spread in \({R}^{ns}\) ranged from 1.23 to 1.30% in the first subperiod, indicating a significant impact.

Overall, the univariate analysis suggests that bonds with a high DD measure (indicating lower AQ) experience fewer credit-spread shocks compared to those with a low DD measure (indicating higher AQ). Furthermore, the returns of low AQ bonds are higher when credit-spread shocks are excluded. Across all the subperiods, the magnitude of shocks for all bonds decreases due to the advancements in accounting standards.

This research evaluates whether the DD measure is associated with bond returns, excluding the impact of credit-spread shocks. Table 7 presents the results of firm-level regression analyses, forecasting future returns based on the sorted DD measure (SDD). Part A and Part B detail the outcomes from cross-sectional and time-series return decompositions, respectively, excluding the effects of credit-loss shocks due to their limited economic and statistical significance.

The panels in both parts of the table outline total excess returns and those excess returns that exclude credit-spread shocks (\({R}^{ns}\)) for each examined subperiod. A trend is observed where the SDD premiums diminish across subperiods, attributable to advancements in accounting standards. When excess returns, excluding credit-spread shocks, are analyzed against the SDD without considering other risk factors, the findings reveal that SDD premiums are positively significant across all decomposition methods. For the first subperiod, monthly SDD premiums vary from 0.15 to 0.32%, for the second subperiod from 0.09 to 0.23%, and for the third subperiod from 0.04 to 0.13%. These premiums are substantial, translating to annual differences between the highest and lowest DD measure portfolios of 16.20% (0.15%\(\times 9\times 12\)), 9.72% (0.09%\(\times 9\times 12\)), and 4.32% (0.04%\(\times 9\times 12\)) respectively, with the highest annual difference reaching 34.56% (0.32%\(\times 9\times 12\)), 24.84% (0.23%\(\times 9\times 12\)), and 14.04% (0.13%\(\times 9\times 12\)) for each subperiod.

Upon factoring in additional risks, the magnitude of the SDD premiums is reduced. In Panel A, where credit-spread shocks are removed using cross-sectional return decomposition, the premiums appear less significant. However, they remain notable in Panel B, where the more precise firm-specific return decomposition is used to exclude credit-spread shocks. In this panel, the premiums are economically impactful, with the differential in returns excluding credit-spread shocks between the highest and lowest AQ portfolios approximating 29.16% (0.27%\(\times 9\times 12\)) annually for the first subperiod, 16.20% (0.15%\(\times 9\times 12\)) for the second, and 9.72% (0.09%\(\times 9\times 12\)) for the third.

Overall, the study demonstrates a significant negative relationship between AQ and future bond returns, especially when credit-spread shocks are accounted for using a sophisticated firm-specific time-series model. The research also highlights a notable reduction in the magnitude of these shocks across the subperiods, underscoring the effectiveness of improved accounting standards over the years.

Table 8 showcases the results from the Fama–MacBeth (FMB) second-stage regressions, analyzing the real bond returns against the risk factor loadings. This table includes results from both cross-sectional (Panel A) and time-series (Panel B) methods. The AQ factor loadings used here are adjusted for credit-spread shocks.

In both Panel A and B, the first row under each section reports the outcomes using total excess returns. In these results, neither the AQ premiums nor the beta coefficients associated with the AQ factor were insignificant. The second row of Panel A employs the linear credit response model to exclude credit-spread shocks, revealing a significant positive AQ factor premium at the 5% level. This highlights the model's effectiveness in accounting for the AQ premium. The third row in Panel A presents results using the nonlinear credit response model, excluding credit-spread shocks. Here, the AQ factor premium is substantial, with monthly values of 0.22%, 0.34%, and 0.48% for the subperiods 1973–1998, 1999–2006, and 2007–2023, respectively. These premiums are noteworthy, varying from 0.96 (\(0.08\%\times 12\)) to 2.64% (\(0.22\%\times 12\)) annually for the first subperiod, 1.92% (\(016\%\times 12\)) to 4.08% (\(0.34\%\times 12\)) for the second, and 3.00% (\(0.25\%\times 12\)) to 5.76% (\(0.48\%\times 12\)) for the third.

Panel B's second section details the returns excluding credit-spread shocks through a firm-specific credit response model. The AQ factor premiums are positively significant, with monthly rates of 0.20%, 0.34%, and 0.45% for the respective subperiods. The corresponding annualized premiums range from 0.48% (\(0.04\%\times 12\)) to 2.40% (\(0.20\%\times 12\)) for the first subperiod, 1.32% (\(0.11\%\times 12\)) to 4.08% (\(0.34\%\times 12\)) for the second, and 2.28% (\(0.19\%\times 12\)) to 5.40% (\(0.45\%\times 12\)) for the third.

Overall, the results from these asset pricing tests across 50 years suggest that the AQ factor has been increasingly factored into corporate bond returns, even after adjusting for popular benchmark risk factors. The AQ factor loadings (betas) display a significant positive correlation with future bond returns, unaffected by credit-spread shocks. This analysis is supported by two sophisticated return decomposition models that account for nonlinearity in the return-price surprise relationship and allow variation in price surprise coefficients across firms. The findings also indicate that the effectiveness of these models has evolved over time.

6.2 Alternative Bond Return Decomposition

Subsection (3.2) introduces an alternative method to break down bond returns into two components: \({R}^{s}\) for credit-spread shocks, and \({R}^{ns}\) for returns unrelated to credit-spread shocks. This approach relies on a firm-specific credit response model.

Equation (3) suggests that the constant intercepts from company-specific regressions of excess bond returns against price shocks can act as proxies for \({R}^{ER}\), representing constant and unvarying expected returns. The fitted values represent the credit-spread shocks (\({R}^{s}\)), and the residuals (\({R}^{l}\)) include credit-loss shocks and deviations from anticipated bond returns, which are the unfixed month-specific expected returns.

Table 9, Panel A provides descriptive statistics for these return components. Typically, the average residual returns are around zero. The expected excess returns (\({R}^{ER}\)) have an average of 0.92% and a median of 0.78% monthly. 13% of these implied raw expected returns are negative, indicating that the intercepts absorb negative post-hoc credit-loss shocks for corporate bonds during the analysis period. The next subsection will explore potential biases arising from cross-sectional variations in credit-loss shocks. Panel B of Table 9 presents the results of the return decomposition for different DD measure portfolios. Bonds in the highest DD measure portfolio show a higher average expected return of 1.13% monthly compared to those in the lowest DD measure portfolio, leading to an annual difference of 13.56% (1.13 × 12). This disparity is statistically and economically meaningful.

Table 9 also details the tests for unconditional expected returns in Panels C and D. Due to each bond in our sample having only one expected return estimate, conventional asset pricing tests were not feasible. Thus, pooled regressions of returns and factor loadings with fixed time effects were conducted, with double-clustered standard errors by firm and year.

The results in Panels C and D of Table 9 indicate that the premiums on excess returns, not adjusted for credit-spread shocks, are not significant in either characteristic- or factor-loading-based tests. However, when risk factors are considered, the analysis of unconditional expected returns reveals a statistically positive AQ premium. Panel C's SDD coefficient is 0.10, translating to a 10.80% (\(0.1\%\times 9\times 12\)) annual spread of returns between the highest and lowest DD measure portfolios. Panel D's AQ factor premium estimates vary from 0.29% to 0.36% monthly (3.48% to 4.32% annually). In summary, the return decomposition aligns with the conclusion that AQ is a priced risk factor in the market.

6.3 Alternative Benchmark Model

This section explores whether an alternative benchmark model, specifically the two-stage regression approach by Bhojraj and Swaminathan (2009), can effectively estimate the co-variation in asset returns. This is in contrast to the two-stage regression method used by Francis et al. (2005) in our study. The Bhojraj and Swaminathan method is often employed to determine if loadings on a risk factor can account for variances in expected returns, suggesting that bonds with higher betas typically yield higher returns. Detailed information on Bhojraj and Swaminathan's (2009) two-stage model and its applications can be found in Appendix D.

In Table 13, the first row of Partitions A and B shows the results from asset pricing models using total excess returns. In these tests, both AQ premiums and AQ factor beta coefficients are significant. The second row of Partition A analyzes returns after removing credit-spread shocks, using a linear credit response model. Here, the AQ factor premium is positively significant at the 5% level, demonstrating its effectiveness in explaining AQ premium. The third row in Panel A shows results excluding credit-spread shocks through a nonlinear credit response model, revealing AQ factor premiums with significant annual rates between 2.52% (0.21% × 12) and 5.76% (0.48% × 12).

In Panel B, the second division of Table 13 presents results for returns excluding credit-spread shocks, based on a firm-specific credit response model. The AQ factor premium is positively significant with monthly values of 0.55%, translating to annualized premiums ranging from 3.84% (0.32% × 12) to 6.60% (0.55% × 12) per annum.

The asset pricing tests in this subsection indicate that the AQ factor is indeed priced in corporate bond returns when an alternative benchmark model is used. The AQ factor's betas or loadings show a strong positive correlation with future returns, even when credit-spread shocks are excluded. These findings align with those in Table 4 but demonstrate greater statistical and economic significance.

6.4 Price Surprise Based on Analysts’ Forecast

Our approach to analyzing bond returns involved a simple time-series model based on single-period price changes. To verify our initial results, we extended our analysis to include price surprises based on analysts' multi-year forecasts. Using Easton and Monahan's (2005) method, we examined errors in current-year predictions and adjustments in forecasts for the next one to two years, assessing their impact on price shocks. We employed a nonlinear credit response model to analyze how monthly excess bond returns are affected by these forecast revisions, aligning with forecast-revision portfolios. This approach deviates from the commonly used yield spread method, focusing instead on bond prices as indicators of credit spread.

We utilized three variables derived from analysts' forecasts to assess bond credit disturbances for the fiscal year t + 1. The first variable is the forecast error for estimates made at the end of fiscal year t, reflecting adjustments in expectations for the next year's credit shocks based on the actual shocks realized that year. The subsequent variables are revisions in forecasts for the one- and two-year-ahead credit shocks (denoted as \({CS}_{j,t+1}\) and \({CS}_{j,t+2}\)), calculated by comparing consensus forecasts for future yields against those made previously as follow:

Monthly bond prices are then adjusted based on these forecast changes and errors. Our findings, which are not detailed in the tables, align with those presented in Tables 3 and 4. They show that the AQ factor has a monthly premium of 0.10% (0.13%) when employing nonlinear (linear) return decomposition, not considering the debt market value. However, this premium becomes statistically insignificant when debt market value is accounted for. Using both the portfolio partitioning and return decomposition models, the AQ factor premium appears significant, ranging from 0.36% to 1.08% per month when incorporating known risk factors for corporate bonds.

6.5 Other Robustness Checks

Our research in Sect. 5 revisits the analysis conducted by Francis et al. (2005), but with a key difference: we use a "one year" delayed measurement of the DD metric, similar to theirs. Our results remain robust, even when we employ immediate, non-delayed DD measurements. In all test scenarios we explored, the DD metric and the associated AQ factor compensations consistently show statistical and economic significance.

As per Francis et al. (2005), the results in Table 3 highlight the effectiveness of ranking portfolios based on the DD measure. This approach enhances the reliability of tests that are based on financial characteristics by minimizing errors in the DD measure calculation. The robustness of these findings is noteworthy, particularly given that they hold true even when using the raw, unadjusted DD measure. This suggests a more stringent and potentially less powerful analysis. Our additional findings, not detailed in Table 3, align with these observations. The DD measure only shows notable premiums in tests where the firm-specific credit response model excludes credit-loss disturbances and other risk characteristics are considered.

In their 2005 study, Francis et al., conducted two-stage regressions using individual bond returns and their factor loadings. We replicated these tests using a minimum of 30 months of continuous returns data. Our untabulated findings indicate that the individual AQ factor beta premium is not statistically significant when using returns that are not adjusted for credit-spread shocks, aligning with the observations of Francis et al. (2005). However, when we exclude credit-spread shocks using both the cross-sectional nonlinear and linear credit response models, the AQ factor premium is found to be 0.42 (0.27) with a p-value of 0.05 (0.12). When we employed a firm-specific model for assessing credit-spread shocks, the premium sizes were comparable but lacked statistical significance. The limited interpretative power of the "individual bond factor loading" tests, due to their inherently reduced statistical power, complicates our understanding of these results.

In summary, our analyses affirm the reliability of our findings when considering the portfolio rank of accruals in tests based on financial characteristics. This demonstrates a divergence from Sloan’s (1996) findings related to the accrual anomaly.

7 Methodology Limitations

Our proposed method for decomposing returns is subject to three key limitations. First, according to the Price Response Coefficient (PRC) framework we employ, there's an assumption that the relationship between actual returns and credit-spread shocks is linear, assuming constant credit losses. However, this is not always the case in reality, as returns and credit-spread shocks may not always exhibit a linear relationship. Future studies could benefit from exploring the inclusion of random shocks within the PRC framework, to better understand and account for this non-linearity.

Secondly, the non-linear relationship between one-period price surprises and returns, as highlighted by Antle et al. (1994), poses a significant challenge. This relationship falls outside the scope of traditional accounting methods, presenting a complex issue that requires further investigation. Therefore, any critique or evaluation of our methodology should consider the impact of external factors, those not captured by standard accounting practices.

8 Conclusion

In our study, we applied a simple method based on the credit-response coefficient framework to determine the portion of observed bond returns attributable to credit-spread shocks. When evaluating bond returns minus credit-spread shocks—calculated using advanced return decomposition methods—we observed that bonds with lower AQ (indicated by higher AQ factor betas) yield significantly higher expected returns compared to bonds with higher AQ (indicated by lower AQ factor betas). Our analysis over the past 50 years demonstrates that firms with lower AQ (those with high DD measures) tend to experience smaller credit-spread shocks than firms with higher AQ (those with low DD measures).

The AQ measure, developed by Dechow and Dichev in 2002, has become crucial in bond market pricing due to its robust theoretical underpinnings and widespread use in accounting research. This model has garnered significant interest in asset pricing studies because it factors in a critical aspect of AQ: the potential reversibility of errors in accrual estimates. The accuracy of accounting information, particularly regarding its influence on capital costs, is a key focus in theoretical research on the relationship between information quality and cost of capital, as emphasized by Lambert et al., 2007.

Our findings also reveal that accounting standards have evolved considerably over the past 50 years, with AQ showing an upward trend for the last three decades. This indicates that our results are not constant over time, highlighting the importance of excluding credit-spread shocks to avoid skewed estimations of risk premiums. The insights from this research offer valuable information to bond market participants, including issuers and investors, by demonstrating how firms with lower AQ can reduce bond credit-spread and credit-loss shocks, thereby providing predictive insights into future bond returns. These findings also play a role in bond valuation, as credit-spread (credit-loss) shocks negatively (positively) impact the cost of debt, consequently decreasing (increasing) the value of bonds.

The managerial and practical implications of this paper are significant. For managerial implications, managers can use the insights from this study to better assess and manage the firm's credit risk by understanding the impact of AQ on credit-spread and -loss shocks. The findings provide managers with a framework to anticipate how variations in AQ can influence future bond returns, allowing for more informed strategic financial decisions. Additionally, firms can develop internal policies and procedures to improve their AQ, thereby potentially lowering their cost of debt and enhancing their overall financial stability.

For practical implications, investors and financial analysts can apply the novel decomposition method to predict future bond returns more accurately, aiding in the selection of bonds with favorable risk-return profiles. Credit rating agencies and financial institutions can incorporate the study's methodology to refine their credit risk models, leading to more precise assessments of bond issuers' creditworthiness. Moreover, the ability to separate credit-spread shocks from realized returns can improve market participants' ability to price bonds accurately, contributing to more efficient financial markets.

Notes

Francis et al. (2005) use the proxies of AQ factor, leverage, firm size, asset returns, interest coverage, and earnings volatility to estimate cost of debt. These proxies show that low AQ compensates high cost of debt.

Our focus on credit spreads is motivated by the theory of frictionless financial markets proposed by Modigliani and Miller (1958) and the theory of the relation between quality of borrowers’ balance sheets and their access to external finance. Shocks on credit spreads may also reflect shifts in the effective supply of funds offered by financial intermediaries, which, in the presence of financial market frictions, have important implications for the usefulness of credit spreads as predictors of future bond returns. Our focus on credit loss is motived by the approach that an increase in discount rate causes a decrease in investment, which imposes an increase in cost of debt and a subsequent decrease in expenditure and production.

This factor, referred to as DD, is the Dechow and Dichev (2002) residual accrual volatility factor.

The look-ahead bias is used because we use one-year-ahead cash flow for constructing the DD measure. The tests are robust to use a non-lagged DD measure, as illustrated in Sect. 5.

Accounting research has extensively used VAR regression to segment asset returns, drawing on the idea of earnings response coefficients. Various studies, including those by Ogneva (2012), Nallareddy and Ogneva (2017), and Tavakoli Baghdadabad and Mallik (2018a; 2018b) have categorized unexpected returns into two parts: shocks related to cash flows and those unrelated to cash flows. Campello et al. (2008) implemented this approach to forecast expected returns using asset returns. However, their method has certain limitations, such as limiting the analysis to companies that have publicly traded debt. An alternative approach has been suggested by Nozawa (2017), which offers a different solution to this issue.

The 17.28% spread mentioned in our research is significant due to its impact on the market value of debt. In a basic bond valuation model, assuming calculations are made once per period, a 1% decrease in the cost of capital can lead to an approximate 0.4% increase in bond price, which in turn raises the firm's value. According to Panel D of Table 2, the average annualized return on bonds, excluding credit-spread shocks, within the lowest AQ decile is 21.24% (1.77%\(\times 12)\).

By shifting from the lowest to the highest AQ decile, a reduction of 17.28% in expected returns translates to a 2.03% (17.28/(21.24 × 0.4)) decrease in the cost of capital. Consequently, this reduction in the cost of capital corresponds to a 2.03% increase in the market value of the firm's debt. This significant change underscores the importance of AQ in influencing bond pricing and the overall financial health of a firm.

The Fama–MacBeth (FMB) test premiums are expected to align with the average returns of various factors. However, the significant premiums identified in this subsection seem inconsistent with the Accounting Quality (AQ) factor's abnormal returns presented in Table 1. This discrepancy is mainly due to distortions in factor returns caused by credit-spread shocks. By recalibrating the AQ factor to exclude these shocks, we find that the AQ factor's abnormal returns are in harmony with the premiums observed in this subsection.

Moreover, our two-stage analysis was conducted using equal-weighted portfolio returns. This approach is particularly suitable for evaluating the impact of AQ, as it tends to be more significant for smaller firms that often have less access to information. Unreported results from our study confirm that the disparity between total returns and returns excluding credit-spread shocks is more pronounced in smaller firms compared to larger ones, especially when comparing firms with high and low AQ. This finding underlines the greater sensitivity of smaller firms to AQ variations.

To observe this, we rewrite (A.1) as:

$${DR}_{t}={k}_{1}{P}_{t-1}-{P}_{f,t-1}+{a}_{0}{U(P}_{t}-{P}_{f,t})+{UDR}_{t}$$(A.1)where \({DR}_{t}={R}_{t}.{(P}_{t-1}-{P}_{f,t-1})\) is the dollar return, \({UDR}_{t}={UR}_{t}.{(P}_{t-1}-{P}_{f,t-1})\) is the dollar-return residual, and \({U(P}_{t}-{P}_{f,t})\) is the innovation in dollar price spread. Both (A.1) and (A.1) will yield consistent estimates \({a}_{0}\). The choice of specification turns on whether the heteroscedasticity \({UR}_{t}\) is lower than \({UDR}_{t}\).

Zero expected net investment implies that the present value of a future investment, which needs to achieve future operating cash flows, equals the present value of future depreciation.

From (A.7), revisions in future expected price spread induced by \({U(P}_{t}-{P}_{f,t})\) are given by.

$$\Delta E\left(\theta \left(L\right){U(P}_{t+s}-{P}_{f,t+s})|{U(P}_{t}-{P}_{f,t})\right)=\sum_{j=0}^{\infty }{\theta }_{j}\Delta E\left({U(P}_{t+s-j}-{P}_{f,t+s-j})|{U(P}_{t}-{P}_{f,t})\right)={\theta }_{s}{U(P}_{t}-{P}_{f,t})$$The first equality holds because both \(\theta (L)\) and expectations operators are linear. The second equality holds for two reasons. First, since \({U(P}_{t}-{P}_{f,t})\) does not generate information about either expectation of future innovations or realization of past innovations,

\(\Delta E\left({U(P}_{t+s-j}-{P}_{f,t+s-j})|{U(P}_{t}-{P}_{f,t})\right)=0\) for all \(j\ne s\)

Second, since \(E\left({U(P}_{t}-{P}_{f,t}) \right)=0\) prior to knowing \({U(P}_{t}-{P}_{f,t})\) and \(\left({U(P}_{t}-{P}_{f,t}) |{U(P}_{t}-{P}_{f,t}) \right)={U(P}_{t}-{P}_{f,t})\), then \(\Delta E\left({U(P}_{t+s-j}-{P}_{f,t+s-j})|{U(P}_{t}-{P}_{f,t})\right)={U(P}_{t}-{P}_{f,t})\) for all\(j=s\).