Abstract

With application of Diebold and Yilmaz’s (Int J Forecast 28(1):57–66, 2012) spillover approach, we examine shock spillover in international sovereign bond yields over short, medium, and long term maturities for major eight economies. By scrutinizing the data from 1st January 2013 to 12th November 2020, we explored that irrespective of pre-covid-19 or covid-19 period, shock spillover in bond yields across markets are much stronger over long and medium maturities relative to short-term maturity. Moreover, shock spillover of bond yields has amplified manifold during Covid-19, irrespective of their maturities compared to pre-Covid-19 period. The magnitude of shock spillovers remains low with short-term maturity. Assessing the relationship between international sovereign bond markets (SBMs) contributes to our understanding and is also crucial to the investors (both domestic and foreign) in investing in SBMs.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The world economy witnessed tremendous cross-country financial market shock spillovers that affected macroeconomic performance and its recovery worldwide during the Global Financial Crisis (2008). Similarly, the Covid-19 pandemic forced the world to experience an unprecedented health crisis that led to economic and financial catastrophes across the markets (Umar et al., 2021). The impact of pandemics varies across markets. Various preventive measures; lockdown, shutdown, declaration of micro containment zones and social distancing undertaken by different governments to control the spread of virus imperilled the economic activities. However, to counteract the pandemic effects and stimulate economic activities, the government of various countries simultaneously undertook different stimulus packages. In this context, advanced sovereign bond markets (SBMs) supported immensely in funding these stimulus packages.

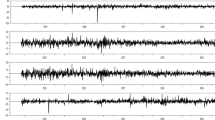

The SBMs are beneficial for project financing and helpful to finance fiscal packages of different governments. Hordahl and Shim (2020)Footnote 1 maintained that sovereign bonds play a vital role in local financial requirement and act as a more robust indicator reflecting investors' confidence. The sovereign bond yields of different maturitiesFootnote 2 in advanced and emerging markets fluctuated dramatically during this pandemic (See Fig. 1). This volatility adversely affected financing the corporate and public sector investments, and fiscal stimulus supportive measures. This affects balance sheet of public and private sectors in the short-run. Arellano et al. (2020)Footnote 3 illustrated that the economic cost of covid-19 is tremendously high and can generate a prolonged debt crisis for nations. The significance of portfolio management intensified during the pandemic. Comprehending the optimal risk-return trade-offs involves dynamic correlation and connectivity in investment portfolios (Elsayed et al., 2022). Investors want to diversify their portfolios globally, and policymakers attempt to sustain financial stability. Therefore, shock spillover between international bond markets is vital for asset and risk management (Sensoy et al., 2017).

Source Author’s own plotting based on data drawn from Investing.com (https://www.investing.com/rates-bonds/world-government-bonds). (Undoubtedly, bond rates fell dramatically during covid-19 across various maturities and continued due to the exponential growth of covid-19 infection across countries in the first half of 2020. After reaching a minimum, the bond rates started to rise slightly and gradually in the second half of 2020 in some countries (viz. the US, Japan, China, Brazil and Russia) as a result of the different stance of fiscal policies adopted by various national and sub-national governments around the world to revive their economic activities. In contrast, bond rates continued at their minimum levels in some markets such as Germany, India, and Indonesia in the second half of 2020 (see Fig. 1)). Figure 1 demonstrates the trend pattern of 1-year bond rates (denoted as S), 5-years bond rates(denoted as M), and 10-years bond rates (denoted as L) across 8 countries with different economic progress covering pre-pandemic and during pandemic periods. Each of the panel figures in Fig. 1 represents short maturity, medium maturity, and long-term maturity bond rates of eight large countries such as the US, Japan, Germany, China, India, Russia, Indonesia, and Brazil, respectively for the period 1st January 2013 to 12th November 2020

Pattern of S, M, and L of Selected Advanced and Emerging Economies.

A comprehensive understanding of international bond market spillover can advance several important policy implications. For instance, it can help investors to diversify their risks by advancing a portion of their capital in the fixed-income asset of various maturities or bonds issued by foreign countries (Ahmad et al., 2018). International investors adjust their bond portfolios when economic circumstances change globally (Claeys & Vasicek, 2012).

Given the significance of the issue, the present paper examines the sovereign bond market shock spillovers among 8 major economies (‘in terms of purchasing power adjusted GDP, measured by IMF in 2020’), namely, the US, Japan, Germany, Russia, Brazil, China, India, and Indonesia. Out of 8 economies considered in the study, three economies belong to the advanced nations (the US, Japan, Germany) and five are from the emerging economies (China, India, Russia, Indonesia, and Brazil).

We selected a combination of advanced and emerging economies for the following reasons. First, a high integration between advanced economies' financial markets leads to a negligible benefit of diversification and thus, investors look for alternative markets. With technological advancement, globalization, and emerging economies' strong economic conditions, investors who want to diversify their portfolios move to the emerging markets. The sovereign bond is the primary instrument of funding in emerging markets. The increasing financing infrastructure and fiscal packages through the issuance of bonds increased manifold in emerging markets (Hördahl & Shim, 2020). Hence, it is an attractive asset class for investors presently. Moreover, the sufficiently available liquidity in the developed markets leads to nominal short-term rates being close to zero or negative, whereas longer-dated assets offers minimal returns. Alternatively, many investors look for fixed incomes like sovereign bonds in emerging markets (Sensoy et al., 2017). Second, the covid-19 hit the vulnerable emerging markets hard, reflecting unexpected and substantial outflow of capital from them (Beirne et al., 2020; Hofmann et al., 2020; Benigno et al., 2020), leading to more considerable volatility in bond prices in both advanced and emerging markets (see Fig. 1). Third, the advanced economies have not been able to escape from the shock effects of pandemic, the small economies being incapable of establishing efficient bond markets have failed to welcome MNCs as well as foreign investors significantly. With this settings in mind, that motivated us to select our sample from both the advanced and emerguing economies to realize the deep international bond market interactions in this current milieu.

The concomitant works on bond markets majorly focused on determinants of bond markets (Ilmanen, 1995; Sutton, 2000; Bernoth et al., 2004; Bernanke, 2007; Bellas et al., 2010; Bae & Kim, 2011; Bhattacharyay, 2011; Bernoth & Erdogan, 2010; Comelli, 2012; Bai et al., 2012; Matei & Cheptea, 2012; Bhattacharyay, 2013; Csonto & Ivaschenko, 2013; Gade et al., 2013; Georgoutsos & Migiakis, 2013; Pelizzon et al., 2013; Dewachter et al., 2015; Afonso et al., 2015; Blatt et al., 2015; Feld et al., 2017). They described how financial, structural, macroeconomic, and institutional factors explain the variations of sovereign bond yields/spread.

Some other group of literature emphasized investigating how credit rating, political and economic news affect sovereign bond yield/spread (Goldberg & Leonard, 2003; Christopher et al., 2012; Claeys & Vasicek, 2012; Beetsma et al., 2013; Mohl & Sondermann, 2013). During the ongoing pandemic, several works, for instance, Albulescu (2020), Akhtaruzzaman et al. (2020), Azimli (2020), Bai et al. (2020), Beirne et al. (2020), Cepoi (2020), El-Khatib and Samet (2020), Goodell and Huynh (2020b), Ji et al. (2020), Okorie and Lin (2020), Shehzad et al. (2020), Topcu and Gulal (2020), Zhang et al. (2020), Zaremba et al. (2020), Gubareva and Umar (2020), Zaremba et al. (2021), Pang et al. (2021), and Zaremba et al. (2022) focused on how Covid-19 affected stock markets. At the same time, another strand of studies investigated the sensitivity of crypto-currencies and commodity markets during the pandemic (Conlon & McGee, 2020; Corbet et al., 2020; Goodell & Goutte, 2020a; Mensi et al., 2020; Mnif et al., 2020; Sharif et al., 2020; Yarovaya et al., 2020). However, studies, for instance, by Andries et al. (2020), Arellano et al. (2020), Cakmakli et al. (2020), Christensen et al. (2020), Daehler et al. (2020), Delatte and Guillaaume (2020), Gubareva (2020), Hartley and Rebucci (2020), Hofmann et al. (2020), Jinjarak et al. (2020), Pang et al. (2020), and Zaremba et al. (2020) have analyzed how Covid-19 influenced the sovereign bond markets or bond yields. These studies have also studied how the policy responses to Covid-19 affect the bond markets.

Apart from these studies, there are also a few extant literatures that rest on analyzing cross-border sovereign bond markets spillover/connectivity (Ahmad et al., 2018; Cronin & Dunne, 2019; Claeys & Vasicek, 2012, 2019; Fernandez-Rodriguez et al., 2016; Antonakakis & Vergos, 2013; Tule et al., 2017; Sowmya et al., 2016; Yang & Hamori, 2015; Sensoy et al., 2017; Asutay & Hakim, 2018; Chen et al., 2020; Gao et al., 2021; Umar et al., 2021; Karkowska & Urjasz, 2021; Balli et al., 2022). However, many of these studies dealt with sovereign bond market spillover/connectivity, particularly among the erstwhile advanced countries of Europe. A few analyses have focused either on emerging economies, or both developed and emerging markets during the pre-pandemic period. Zaremba et al. (2022) and Gubareva and Umar (2020) stated that studies on equities, commodities, and cryptocurrencies had been meticulously examined, whereas sovereign bond markets need significant attention. Although there are some attempts to address this issue, little is known about how shocks are transmitted across sovereign bond markets during the pre-Covid-19 period and during Covid-19 crisis period. Hence, the present analysis attempts to fill this cavity in the literature and can serve as a guide to the investors to make better asset allocation decisions in the present as well as in the future.

For analysis, we have considered three sovereign bond yield rates based on maturity patterns such as short-maturity, medium-maturity and long-maturity, and denoted them as S, M, and L, respectively.Footnote 4 However, bond yields over various maturities reveal the expectation of market participants involving future changes in prices/interest rates and identify the present state of the economy. The short maturity bond yield rate is generally treated as a reference for the policy rates. A well-integrated short-maturity bond market reflects sound-harmonized monetary policies across economies, whereas medium and long-maturity bond yields demonstrate future economic prospects driven by investors' risk attitude and expectation (Yang & Hamori, 2015). Therefore, it is crucial to analyze the shock spillover of international bond markets with varying maturities.

The regularity of such advancement has promoted a renewed interest in analyzing the international bond yield shock spillovers during covid-19 and pre-covid-19 periods of different maturities. Therefore, this analysis communicates the following unexamined questions considering the advanced and emerging economies: how does Covid-19 affect international bond market shock spillovers? Do the bond market spillovers during the pre-covid-19 period differ from the covid-19 period? Are there any variations in shock spillovers from different bond yields of varying maturities between both the periods?

This analysis complements the concomitant literature in three ways. First, the studies on equities, commodities, or cryptocurrencies have been sufficiently studied, whereas sovereign bond markets are ineadequately studied (Zaremba et al., 2022; Gubareva & Umar, 2020). So, this analysis adds significant value to the extant literature. Second, we investigate shock spillover between international sovereign bond markets (including advanced and emerging markets) in the pre-covid-19 period and during the covid-19 period. Third, we examine both static and dynamic shock spillovers across sovereign bond markets using Diebold and Yilmaz’s (2012) approach. This approach allows the researchers to simultaneously discover static and dynamic shock spillovers across the markets. Section 3 represents the detailed discussion about Diebold and Yilmaz's method and the motivation behind its use in this analysis.

Our result reveals that no matter whether Covid-19 or pre-Covid-19 period, bond market spillover is higher with long and medium maturities yields than in short maturity bond yields. The shock spillover increased manifold during Covid-19 relative to the pre-Covid-19 period across maturities. However, the spillover is much lesser with short maturity. Our analysis suggests that investors must focus on short-maturity bond assets rather than any specific region for diversification and risk management of their portfolios, at least in the short run. The remaining part of this analysis is organized as follows. Section 2 debates concomitant papers, whereas Sect. 3 provides detailed methods of empirical analysis. We explain data, its sources and summary statistics in Sect. 4. Section 5 explains the results. Section 6 contains a robustness check. Section 7 concludes.

2 Literature Survey

Obstfeld (1996) and Masson (1999) explain that fear of cross-country financial uncertainty spillover may grow many equilibria which characterise with mixed market results as well as self-fulfilling features. During uncertainty, macroeconomic fundamentals are neither so bold as to avoid a speculative attack in a market nor so frail as to make it inevitable. Therefore, uncovering a country’s distressed debt situation may cause an abrupt loss of investors’ confidence. It ultimately tends to self-fulfilling waves of cross-country portfolios, readjusting with corresponding position of market rates. Hence, market sentiment in a particular country changes due to the crisis generated in another market. According to Daehler et al. (2020), the country-specific factors such as growth dynamic, fiscal space, and the political system may affect the lenders’ perception of riskiness of potential borrowers and borrowing cost, while global factors may influence the borrowing cost of a particular sovereign borrower. However, several financial literature rest on capital markets, while attention on debt markets is limited. High trading volume in the capital market caused numerous analyses, whereas the sovereign bond market is an underdeveloped and recent phenomenon in emerging markets that contributed to scanty research on it (Zunino et al., 2012).Footnote 5

Claeys and Vasicek (2012), Antonakakis and Vergos (2013), Fernandez-Rodriguez et al. (2016) and Cronin and Dunne (2019) analyzed the strength and direction of spillover between EU countries. They maintained that the presence of high and significant spillover with heterogeneity between bond markets of the EU has been nurtured by both global financial market conditions and idiosyncratic risk components. However, the European sovereign bond market is a multifaceted network structure; which can serve as an essential reference for the market agents (Chen et al., 2020). The financial crisis leads to a more significant decrease in the magnitude of spillovers within peripheral than within major countries in the EU. Karkowska and Urjasz (2021) stated that Central and Eastern Europe (CEE) countries’ sovereign bond markets are more intertwined than global markets. Recently, employing sovereign bond yield data from 17 European countries, Pang et al. (2021) pointed out that mean correlation decreased during the pandemic.

Some other important studies rest on emerging countries or a mix of emerging and advanced countries. Tule et al. (2017)Footnote 6 examined volatility spillover in the Nigerian Sovereign bond market arising from oil price shocks. They demonstrated that a significant cross-market volatility spillover occurs between oil and bond markets. Ahmad et al. (2018) examined the financial linkages through return and volatility spillover between BRICS and the USA, EMU, and Japan. They found Russia and South Africa transmit shocks higher than they receive within BRICS. Thus, they are net transmitters of shocks. At the same time, China and India exhibit weak connectedness. Sensoy et al. (2017) showed that the correlations between cross emerging country bond returns has meaningfully amplified after the global financial crisis. Chowdhury et al. (2019) examined the varying integration of Asian financial markets within the global financial structure. They disclosed that the Asian market connections are deepening with the rest of the world. Gao et al. (2021) examined the dynamic return and volatility spillovers between China’s green bond as well as financial markets. They found substantial two-way risk spillovers between the two markets. Balli et al. (2022) found that Sukuk markets significantly interact with Islamic equity markets. Two factors such as profitability and liquidity, stimulate Islamic financial market spillovers meaningfully.

Some investigations are based on different maturities (Yang & Hamori, 2015; Sowmya et al., 2016Footnote 7 and ). They stated that the transmission of shocks is higher in long-term rates relative to short and medium terms maturities. The long-maturity bond rate is driven by global investors, preferences, and level of savings, whereas economic fundamentals and domestic monetary policies drive the short-maturity bond yield.

Barring such limited bond market spillover analysis, several studies are based on what determines the sovereign bond market yield. Bernoth et al. (2004) attempted to examine whether default or liquidity risk determines sovereign bond yield differential across EU countries.

Bellas et al. (2010) investigated the short and long-run impacts of macroeconomic and financial market factors on emerging markets’ sovereign bond yield spread. They pointed out that macroeconomic factors are the central antecedent of bond yield spread in the long run. Conversely, financial volatility is an essential determinant of bond yield spread in the short run across emerging markets.

Comelli (2012) and Csonto and Ivaschenko (2013) also concluded that both the country-specific as well as global parameters are crucial determinants of bond yield spread, and the impacts vary across time and space. Specifically, Csonto and Ivaschenko pointed out that both factors play a significant role in the long run, while the global factors that determine the bond spread in the short run. Bhattacharyay (2011, 2013) tried to detect the critical antecedents of Asian economies’ bond market development with a response to crucial financial and economic factors. He identified that economic size, economic growth, globalization, exchange rate fluctuation, banking system and size, and variations in interest rates are the major factors that help develop bond markets in Asia.

Bernoth and Erdogan (2010) maintained that sovereign bond spread may not only be influenced by alteration of macroeconomic fundamentals but by the shift in pricing of sovereign risks. Similarly, Dewachter et al. (2015) examined the determinants of bond yield differential, stressing both economic and non-fundamental factors in the Eurozone. Bai et al. (2012) studied how liquidity and credit risk drive the sovereign bond spread in the Eurozone. They concluded that liquidity risk explains the variation in the bond spread during the initial stage of the Euro Area sovereign debt crisis, whereas credit risk mostly drives the variation in bond spread after late 2009. Matei and Cheptea (2012) showed that high fiscal deficit and public debt, and political risk injected substantial upward pressure on the bond spread in advanced European economies.

Afonso et al. (2015) too analyzed the primary determinants of long-term sovereign spread of the Euro Area. Georgoutsos and Migiakis (2013) attempted to find the most important determinants of bond spread. Although they observed heterogeneity in the determinants of spread across Euro Area economies, economic and market sentiments were the most significant determinants of the spread. Further, Gade et al. (2013) investigated the impact of political communication on the sovereign bond spread in the Euro Area and strongly argued that positive political communication produces compression of bond spread, whereas negative political communication causes a widening of the bond spread. Others such as Pelizzon et al. (2013), Feld et al. (2017), Bae and Kim (2011), Bernanke (2007), Ilmanen (1995), and Diebold et al. (2008) also attempted to analyze the determinants of bond spread.

Another strand of literature focused on how economic-related news or credit ratings impact sovereign bond yield spread. Beetsma et al. (2013) looked into how macroeconomic and financial news affect European sovereign bond markets and stated that more news on average drive up the domestic bond spread and other countries’ bond spread. Christopher et al. (2012) scrutinized the permanent and temporary effects of sovereign credit ratings on emerging countries’ interdependency of bond and stock markets in the short and long run. Their findings revealed that the association between assets is more linked to the credit rating and outlook in the long run than in the short run. Engsted and Tanggaard (2007) and Goldberg and Leonard (2003) examined which news (policy announcement, inflation, interest rate, and bond return) accounts for a high degree of comovement between the US and German bond market yields. Engsted and Tanggaard reported that inflation news is the primary force that explains yield comovement, whereas Goldberg and Leonard stated that the US announcement on labour market condition, real GDP growth, and consumer sentiments drive up the yields. Mohl and Sondermann (2013) examined how disorderly political communication of Euro Area politicians affected sovereign bond yields of periphery countries and confirmed that political statement influences the development of bond spread.

In one of the recent studies carried out during Covid-19, Sene et al. (2020) illustrated the overshooting of Eurobonds yields issued by emerging and developing nations. They revealed that daily reporting of covid-19 cases caused surge in yields and declaration of international creditor support to developing and emerging economies and pleased the investors’ concerns. Arellano et al. (2020) stated that lockdown measures are worthy of alleviating health adversity but carry substantial economic costs and may prolong the debt crisis. Beirne et al. (2020) also examined the impact of covid-19 on bond yield and reported that covid-19 imposed a significant dampening impact on bond yields across developed and emerging economies. Pang et al. (2020) explained the pandemic effects on sovereign bond yield in European economies. Christensen et al. (2020) and Hofmann et al. (2020) analyzed the trend and pattern of sovereign bond markets during Covid-19.

Hordahl and Shim (2020) examined the association between bond portfolio outflow and long-term rates across emerging markets (EM) during covid-19. They revealed some heterogeneity in the connection between portfolio flows and long-term interest rates across EMs. Andries et al. (2020) and Zaremba et al. (2020) assessed the pandemic effects on bond spread in advanced and emerging countries. They pointed out that a higher number of infected cases and deaths significantly increase uncertainty among investors in the bond markets. Recently, Gubareva and Umar (2020) used wavelet analyses to examine the pandemic impact on the performance of emerging market bonds, considering investment grade and high yield ranges of creditworthiness. Zaremba et al. (2022) discovered the pandemic impact on the term structure of interest rates in the advanced as well as emerging economies. They demonstrated that expansion of pandemic significantly affects sovereign bond markets.

Further, Jinjarak et al. (2020) and Zaremba et al. (2020) assessed whether effective government policies reduce uncertainty in sovereign bond markets during Covid-19 pandemic in developed and emerging economies. They illustrated that government interventions dramatically reduce uncertainty in domestic sovereign bond markets. Hartley and Rebucci (2020) examined the impact of Quantitive Easing (QE) intervention on sovereign bond yield. They found that the average QE announcements across both advanced and emerging economies have − 0.23% single-day impact and − 0.29% and − 0.31% cumulative impacts on the country’s 10-year bond yield over the following two and three days, respectively. Daehler et al. (2020) showed country-specific factors specifically drive CDS spread during the pandemic. Gubareva (2020) studied the liquidity of EM bonds during the pandemic. Delatte and Guillaaume (2020) illustrated the determinants of bond spread in the Euro Area during Covid-19 and observed that Central Bank speeches are the main drivers of spread, whereas the contribution of securities purchase programs is limited in its impacts. Umar et al. (2021) studied the bond market shock spillovers between emerging and the US economies during the pandemic. They displayed a substantial rise in the dynamic connectedness between media coverage, emerging market bonds, and US bonds during the pandemic. Elsayed et al. (2022) observed the linkage between green bonds and financial markets. They observed the highest linkage in the first quarter of 2020 as a result of the Covid-19 pandemic. However, Zaremba et al. (2021) maintained that government involvements considerably lessen local sovereign bond volatility.

Since the associated literature advocate that international investors and fund managers use the sovereign bond to avoid risk, an empirical investigation of international sovereign bond market shock spillovers before and during the Covid-19 is the need of the hour. Therefore, this paper contributes to the literature by examining static and dynamic shock spillovers between international sovereign bond markets in the pre-Covid-19 and during the Covid-19.

3 Methodology

We apply Diebold and Yilmaz’s (2012) model for our empirical investigation. Diebold and Yilmaz’s (hereafter, DY) approach rests on forecast error variance decomposition. The motivation behind the implementation of DY approach comes from the following reasons. First, the popularity of this method is far reaching because of its widespread empirical applications, most especially in analyzing financial assets markets (Antonakakis & Vergos, 2013; Balli et al., 2022; Chevallier & Ielpo, 2013; Cronin, 2014; Diebold & Yilmaz, 2012; Gao et al., 2021; Karkowska & Urjasz, 2021; Klößner & Sekkel, 2014; Klößner & Wagner, 2014; Kumar, 2013; Lin & Chen, 2021; Rout, 2020; Rout & Mallick, 2020a, 2020b, 2021). Second, the DY approach provides many motivating components; for instance, it can measure dependency between asset portfolios. It also can quantify the dependency between asset markets across countries. Third, the method is variable order insensitive and provides unbiased results. Fourth, this approach can capture both static and dynamic shock spillovers between international sovereign bond markets, which is crucial for the present analysis. Given these interesting characteristics and widespread applications, the DY approach seems to be an appropriate econometric framework for the present analysis.

The DYFootnote 8 approach begins with a covariance stationary variable VAR(p) as follows:

\(Z_{t}\) in Eq. (1) refers to n variables and \(\varepsilon_{t} \sim\) (0, Σ) a vector of independently and identically distributed error term in Eq. (1). This VAR framework in Eq. (1) can be expressed in its moving average form:

Here, regularity conditions on \(A_{i}\) matrices apply. The moving average coefficients in Eq. (2) are central to establishing the dynamic of the VAR framework. It allows measuring the fraction of h-step ahead error variance for forecasting \(Z_{i}\), which is due to \(Z_{j,}\) \(\forall\) \(j \ne i\) for each \(i\). To provide a conclusive result, DY employed the generalized VAR model of Koop et al. (1996) and Pesaran and Shin (1998) which is insensitive to variable order.

The decomposition of forecast error variance of one of the bond yield prices can be represented as follow. The own variance share indicates a fraction of h-step ahead error variance in forecasting \(Z_{j }\) due to shocks in \(Z_{j }\), for \(j\) = 1, 2, …… N and cross variance share represents the fraction of h-step ahead error variances in forecasting \(Z_{j }\) due to shocks in \(Z_{i }\), for \(i,j = 1, 2, \ldots \ldots N\) where \(i \ne j\). In Table 1, the N \(\times\) N block is known as variance decomposition matrix denoted as \(\left[ {T_{ij}^{h} } \right]\). The bottom row (‘To Others’) elements represent the column sums except own in that column. The rightmost column (From Others) represents row sum, except for its own element in that row and a bottom right element represents the total spillover. This spillover measure includes its own shocks and shocks from others, the former is based on diagonal elements and the later is based on off-diagonal elements in the variance decomposition matrix.

However, marking the KPPS (Koop, Potter, Pesaran & Shin) h-step ahead forecast error variance decomposition by \(\Theta_{ji}^{g}\) (h), for h = 1, 2, ……Footnote 9

In Eq. (3), Σ is a variance matrix for error vector ‘\(\varepsilon\)’, \(\sigma_{jj}\) is a standard deviation of error term for \(j{\text{th}}\) equation, \(e_{j}\) is the selection vector with one as \(j{\text{th}}\) element and zero otherwise. It can be given as \(\mathop \sum \nolimits_{i = 1}^{N} \Theta_{ji}^{g} \left( h \right)\) \(\ne 1\), means a sum of the elements of each row of variance decomposition table is not equal to 1, because of non-zero covariance between original shocks. Now, we can normalize \(\Theta_{ji}^{g}\) (h) by dividing it by row sum and reducing as:

By construction \(\mathop \sum \nolimits_{i = 1}^{N} \hat{\Theta } _{ji}^{g} \left( h \right)\) = 1 and \(\mathop \sum \nolimits_{ji = 1}^{N} \hat{\Theta } _{ji}^{g} \left( h \right)\) = N.

The spillover index is the cross-variance shares marked as in Eq. (5):

Like Cholesky factor-based measure of KPSS used in Diebold and Yilmaz (2012). Equation (5) shows the total spillover index which is the total forecast error variance due to mutual interaction among variables. DY estimate the size of spillover received by market \(j\) from all other markets \(i\) expressed as in Eq. (6):

Similarly, the size of spillover from market \(j\) to all other markets \(i\) expressed as in Eq. (7):

Note that spillover size provides a decomposition of total spillover into those coming from (or to) a particular source. The estimation procedure of net spillover from market \(j\) to all other markets \(i\) as

The net spillover is the difference between gross spillover “To” (provided by Eq. 7) and gross spillover received “from” all other markets (provided by Eq. 6). Note all the variables in the model are endogenous. Flowchart 1 shows the detailed methodological steps that is adopted in the present analysis.

4 Data and Summary Statistics

We have used daily sovereign bond yields with different maturities from Monday to Friday for the period Jan.01, 2013, to Nov.12, 2020. For many countries, data on Saturdays and Sundays, including other local public holidays, are not available mainly due to the absence of trading. Hence, we consider daily data from Monday to Friday to avoid any missing value in our data series. If there is still any missing value between Monday to Friday, then we have filled them with their respective preceding values. For analysis of our base model, we have used 1-year bond prices, 5-years bond prices, and 10-years bond prices as proxies for short maturity (S), medium maturity (M), and long-maturity (L) bond prices, respectively.

Further, to check the robustness of our findings, we have built up a country-level composite time series index over different maturities for the US, Japan, Germany, China, India, Russia, Indonesia, and Brazil. For each sample country, we construct three composite indices such as short-term maturity (S), medium-term maturity (M), and long-term maturity (L) bond prices. The detailed variables used for the robustness check of our empirical results are presented in Table 6 in the Appendix. All the data series are drawn from Investing.comFootnote 10 with daily frequency.

For the construction of composite indices, we run PCA over 1-month, 6-months, and 1-year bond prices to construct our short-maturity bond price index(S) for the US (indicated as 1-month, 6-months, and 1-year ⇒ run PCA ⇒ S in Table 6 in the Appendix). After running PCA, we have derived the first principal component score. The score is treated as S. Similarly, we computed our other indices to obtain S, M, and L for each country. For a comprehensive and comparative analysis, we divide our sample data into two sub-periods: the pre-Covid-19 period (from January 1, 2013, to December 31, 2019) and the Covid-19 period (from January 1, 2020, to November 12 2020).

Table 2 summarises the S, M, and L series statistics for eight countries. Based on mean and median values, bond prices are higher in emerging countries (Brazil, Russia, India, Indonesia, and China) compared to the advanced countries (the US, Japan, and Germany) across all maturities. The higher standard deviation demonstrates more considerable volatility in emerging countries’ bond prices compared to advanced economies. They confront more considerable volatilities, which could be attributed to their weak macroeconomic fundamentals, political instability and lack of robust, vibrant or active financial markets. Russia and Brazil report maximum daily bond prices among both advanced and emerging economies, but Germany and Japan report minimum daily bond yields. Jarque–Bera test statistics confirm that the distribution of bond yioeld is not normal. We have also checked the unit root problem in all the individual series with Augmented Dickey and Fuller (ADF) statistical test. The ADF test suggests that all the sovereign bond yield series are subject to unit root problems in their levels, but there is no unit root problem in their first differences. Thus, we have used first difference series, while modelling the mutual responses of bond yield movements across 8 economies.

5 Result and Discussion

5.1 Static Spillover Analysis

Since we investigate the interactions of bond yields across 8 major emerging and advanced economies, we modelled through the application of the vector autoregressive (VAR) time series model. While modelling through the VAR, we have checked for the stability of those VAR models to ensure the parameters estimated are stable. The analysis rests on 18 empirically estimated models, including the models estimated to check the robustness of our empirical findings. Figures 7 and 8 in the appendix indicates that no root lies outside the unit circle for all the estimated models reflecting that all the specified models satisfy the stability condition. Table 3 provides a full-sample analysis of shocks spillover across the bond markets with three different maturities: S, M, and L. Table 3 reports the outcomes of three estimated models with an optimum lag of 2 selected by Akaike Information Criteria (AIC) and 12 horizons.

The diagonal elements reflect the contributions of idiosyncratic shocks (own shocks) of bond yeilds with different maturities. The idiosyncratic shocks are relatively higher with S than the M and L across all the bond markets. This finding is also in line with the studies of Zunino et al. (2012) and Sowmya et al. (2016). Interestingly, such a phenomenon reflects an insignificant contribution of external factors in explaining the variations over S. Since S is commonly treated as a reference for setting monetary policy rates (Yang & Hamori, 2015), the variation in S is, therefore, mainly driven by domestic macroeconomic performance rather than caused due to any global factors. In case of Japan, China, India, Russia, Indonesia, and Brazil, idiosyncratic shocks are much more robust, and external shocks contribute insignificantly across bonds of all maturities. It shows that the sovereign bond markets in Japan, China, India, Russia, Indonesia, and Brazil are not well connected with the world markets like the US. These bond markets play a crucial role in financing their government’s projects or financing their fiscal packages. Most big corporates continue to depend on the commercial banking system to finance their capital expenditures and other business projects. Thus, idiosyncratic shocks largely dominate in these markets.

The US and Germany need to consider external factors as bond prices in both the markets receive a reasonable size of external shocks over M and L, although they receive an insignificant magnitude of shocks in S from external markets. The US largely dominates the global sovereign bond markets, and thus, it is well-integrated with the global economies. They sell their sovereign bonds in the international markets where emerging economies like China subscribe to a significant portion of it including other advanced economies. Hence, there exists a high magnitude of shocks spillover from the US’s bond markets to many other economies. Similarly, Germany’s bond market is one of the leading sovereign bond markets in the Euro area, integrated well with the global markets. According to Yang and Hamori (2015), Germany represents the EU, as it is the largest market in Eurozone with the most liquid sovereign securities. Therefore, in the US and Germany, the global and domestics factors account for considerable variations in forecast error variance of sovereign bond prices. It is also evident in a recent study by Karkowska and Urjasz (2021), who maintained that advanced countries like the US and Germany’s government bond markets turn out to be the most connected and, thus, can be described as the most powerful transmitter of shocks. The US financial market is the primary source of spillover (Lin & Chen, 2021).

Commonly, the total forecast error variance that each market exports to all other bond markets (marked as “To Others” in rows and corresponds to Eq. 7) and the fraction of variance of forecast error each market imports from all other markets (marked as “From Others” in columns and corresponds to Eq. 6). In this context, all the bond markets transmit a relatively higher magnitude of shocks to all other bond markets through L and M than via S. The bond prices over long and medium maturities of individual markets are interdependent to a greater extent than the short-maturity bonds. The long and medium maturity bonds are driven by international risk appetite, global investors’ preferences to diversify their portfolios and global saving trends. Conversely, the short maturity bond prices are mainly driven by economic fundamentals and domestic monetary policies. This findings of ours align with studies such as Zunino et al. (2012) and Sowmya et al. (2016).

The above result shows that the US and Germany are not only propagating major shock spillovers but also at the same time are receiving a higher magnitude of shocks over the L and M; while shocks via S are insignificant. It demonstrates the predominant influence of these advanced countries in the international bond markets. Such empirical results may indicate a caveat for conservative financial market policy while allowing more excellent cross-border investment activities. The bottom-most row (marked as Net) shows the difference between “To Others” and “From Others” bond market shocks spillover over S, M, and L. It reveals that the US propagates a higher magnitude of shocks to others, followed by Brazil, than what they receive from others. Conversely, followed by Japan, Indonesia receives larger shocks from others than what they transmit to others. It indicates that Indonesia and Japan are prone to more significant external shocks than other countries. Apart from these, all other bond markets receive shocks as much as they transmit. Thus, net shocks spillover is closer to zero. Ultimately, the bottom right entries (marked in blue colour) represent the total spillover index over three different maturities such as S, M, and L, respectively. For the full sample period, the bond market shocks spillover indices of S, M, and L are 1.5%, 8.6%, and 10.6%, respectively. This implies that the shocks spillover occurs relatively higher with L and it is followed by M, which is strongly claimed by Sowmya et al. (2016) as well. In contrast, shocks spillover in the short maturity is marginal across sovereign bond markets. Commonly, around 9% to 11% of total forecast error variances in the bond market occur in L and M, and around 2% of total forecast error variance occurs in S for eight financial markets. Therefore 90% in both L and M and 98% in S of these variances are explained by their idiosyncratic market-specific shocks.

For a comprehensive understanding of bond market shocks before the global pandemic and during the pandemic, we divided the entire sample into pre-Covid-19 period (1st January 2013 to 31st December 2019) and Covid-19 period (1st January 2020 to 12th November 2020). The Covid-19 virus generated a global health crisis that significantly affected the sovereign bond prices of countries worldwide. It can be seen from Fig. 1 that there is more significant variability or disruption in bond markets, reflecting a greater level of investment risk. Investors pay attention when there is movement in the bond market. Therefore, the pattern of bond yilds itself justifies a comparative analysis between the normal and covid-19 period and afterwards. Therefore, the estimated result for the pre-Covid-19 period is presented in Table 4. While for the Covid-19 period, it is reported in Table 5. Comparing between the two, our result demonstrates that bond market shock spillover has increased dramatically during Covid-19 period across maturities compared to pre-Covid-19 period. In the context of the financial market, Yousfi et al. (2021) and Elsayed et al. (2022) demonstrated that the shocks spillover had reached the highest level during the pandemic compared to the pre-pandemic period.

During the pre-pandemic period, the total shock spillover, as shown in Table 4, remained almost similar to the magnitude of spillover that occurred during the whole sample period. The total spillovers through L and M are around 10%, respectively. Through S, it is around 2% of total forecast error variance for eight bond markets, reflecting the dramatic contributions of idiosyncratic market-specific shocks rather than external market shocks in the pre-Covid-19 period.

The idiosyncratic shocks lost their ground during the pandemic and shaded their strength in terms of their influence. The total spillover through L and M has increased around three times, while the spillover over S has increased around eight times during the pandemic compared to the pre-pandemic period. Nevertheless, the shock spillover is minimal for S.

The spillover index involving S, M, and L for the pandemic period are 16.8%, 27.0%, and 29.8%, respectively. It maintains the consistency that spillover is higher in L and M, including in the pandemic period compared to S. It observed that during the pandemic, the total forecast error variance in bond yields, which ranges from 27 to 30% in L and M, is explained by the spillover of shocks across the markets (by their mutual or external shocks). However, its ranges from 9 to 11% over the same maturity during the pre-pandemic period. It, of course, reveals the devasting consequences of Covid-19 on sovereign bond markets around the world. Several recent studies, for example, Gubareva and Umar (2020), Zaremba et al. (2021), Yousfi et al. (2021) and Elsayed et al. (2022), strongly argue that the Covid-19 pandemic affected financial markets severely.

Overall, the financial markets worldwide have severely been affected and suffered a massive loss of investment along with a plunge in employment and economic output in other sectors due to the current ongoing pandemic. Countries with prominent foreign participants in the bond markets have suffered much more than those with low foreign participants (Hordahl & Shim, 2020),Footnote 11 particularly in emerging markets. The waves of pessimism in financial markets during Covid-19 have triggered an outflow of capital to safer markets known as the “flight to safety phenomenon”. Therefore, sovereign bond market shock spillover has increased many folds during the pandemic.

In the context of transmission of shocks to others and receiving shocks from others, all the bond markets export and import a relatively much higher magnitude of shocks during the pandemic than the pre-pandemic period across all three maturities. However, China has been receiving a marginally larger size of shocks during the pandemic relative to the pre-pandemic period but receives the least size of shocks than any other economy. Brazil and the US, followed by Russia and China, propagate a higher magnitude of shocks than what they receive from others. In contrast, Indonesia receives a higher magnitude of shocks from others, followed by Japan, India, and Germany, compared to their propagation of shocks to others (see Table 3).

5.2 Rolling Analysis

Section 5.2 discusses the time-varying sovereign bond price shock spillover in S, M, and L across eight bond markets. The preceding Fig. 1 indicates, there exists a high degree of uncertainty throughout our sample period, most commonly in terms of variations in the pre-Covid-19 and Covid-19 periods. Therefore, it may be highly questionable regarding the appropriateness of the fixed-parameter framework whether it should apply for the full sample. Thus, this study analyses bond market shocks spillover using a rolling window of 200 days starting on 1st January 2013. Figure 2 shows the time-varying bond markets’ total shock spillover index of S, M, and L for the period 1st January 2013 to 12th November 2020.

Total Shock Spillover through S, M, and L. Total shocks spillover indices of sovereign S, M, and L maturities bond rates which we estimate using Diebold and Yilmaz (2012) frameworks with a 200-days rolling window

There is a significant time variation of total shocks spillover across maturities. As we move with our analysis in terms of journey from normal period to crisis period, total spillover varies simultaneously. The shock spillover is marked by the Covid-19 crisis period because there is a sudden spike in the magnitude of shock spillover. In March 2020, the spillover size attained its peak and reached around 45% of the total variance forecast error. Elsayed et al. (2022) investigated the shocks spillover between green bonds and financial markets employing Diebold and Yilmaz’s (2012) approach. Their findings match our empirical results. They strongly presented that the highest connectedness is observed in the first quarter of 2020 due to the pandemic.

Since the last week of February, the number of Covid-19 cases worldwide grew exponentially; therefore, the WHO alerted the world on 11th March 2020 by announcing that Covid-19 is a global pandemic. It might have caused psychological worries to investors about the cataclysmic impact of coronavirus on the world economy. Hence, shocks spillover increased substantially by March 2020. Not surprisingly, the magnitude of shock spillover began to recede gradually since April as national and subnational governments worldwide have tried to tackle Covid-19 pandemic with a blend of public health safety measures, fiscal measures, macro-prudential, monetary or market-related measures simultaneously (Andries et al., 2020). However, irrespective of the maturities of bonds, our analysis of spillover demonstrates that shock transmission has drastically increased during the pandemic, thus potentially exhibiting greater risk of investment for investors as the shocks spillover and risks are positively correlated.

Considering bond market shock spillover underlying various maturities, spillover is much higher for long and medium maturities than short-maturity bonds throughout the sample period, reflecting the primary contribution of idiosyncratic factors. Figure 3 visualized the contribution of idiosyncratic factors that majorly explain total variance forecast errors. The idiosyncratic factors make short maturity variation more significant than long and medium maturities reflecting relative dominance of the former.

Idiosyncratic bond price shocks in explaining the movement of S, M, and L. Own shocks of short, medium, and long maturities bond rates which we estimate using Diebold and Yilmaz (2012) frameworks with a 200-days rolling window

The variation in total shock spillover during the sample period across eight bond markets is marked with various disruptions that include both economic and financial uncertainties. For instance, some markets struggled to finance their public debt and were confronted with a severe sovereign debt crisis in 2013, although the financial problem in the Euro Area had eased in the second part of 2012 (Kose et al., 2020). It kept the shock spillover afloat slightly higher in 2013. Following the European debt crisis and other financial disruptions, the financial market fragility got erupted in China in 2015–2016, along with the beginning of a verbal trade war between the US and China in 2016. These disruptions led to a considerable shock spillover over M and L between 2015 and 2017.

The shocks spillover after reaching its minimum level in mid of 2018 began to increase afterwards. Since mid-2018, total shocks spillover has been increasing as a result of the world economy experiencing a slowdown primarily driven by tremendous sluggishness in international trade and manufacturing investment amid rising trade tension between countries and policy uncertainties afflicting the world economy (Kose et al., 2020).

Figure 4 shows that each bond market receives total shocks from all other bond markets (as per Eq. 6), and Fig. 5 shows each bond market transmits total shocks to all other bond markets (as per Eq. 7) over S, M, and L. There is heterogeneity or asymmetry in receiving and propagating shocks across the bond markets. The transmission and reception of shocks over S are less than M and L during the pre-Covid-19 and Covid-19 periods. The US, Germany, and Japan are receiving a higher magnitude of shocks, followed by India and China, while Russia, Indonesia, and Brazil receive minimal magnitude of shocks from all other markets. This provides an important signal for investors about their pattern of portfolio diversification. Conversely, the US and Germany dominate the transmission of shocks to all other markets over L and M. However, they propagate shocks less through S relative to L and M. Both the countries are followed by China and India in exporting shocks from their bond markets, whereas Brazil, Russia, Indonesia, and Japan transmit a lesser magnitude of shocks. During the pandemic, transmission and reception in the size of shocks have increased in almost all bond markets, although Brazil and Russia receive less and they also transmit less shocks, including Indonesia and Japan.

Receiving Shock from All Other Bond Markets Via S, M, And L. Each bond market receives total shocks from all other bond markets through the sovereign short, medium, and long maturities bond rates, which we have estimated using Diebold and Yilmaz’s (2012) frameworks with a 200-days rolling window

Transmission of Shocks to All Other Bond Markets Via S, M, And L. Each bond market transmits total shocks to all other bond markets through the sovereign short, medium, and long maturities bond rates estimated using Diebold and Yilmaz's (2012) framework with a 200-days rolling window

6 Robustness Check

The variables used for the robustness check of our empirical findings are mentioned in Sect. 4 and Table 6 in the Appendix. We have used composite index of short (S), medium (M), and long (L) maturities’ bond yields, which are constructed by using the principal component analysis (PCA). We run PCA over the bond yields of varying maturities and obtained the first component score, which we have further used for the estimation of our shock spillover model. Table 7 in Appendix is the outcome of three estimated models with an optimum lag of 2 in each model selected based on Akaike Information Criteria (AIC) and 12 horizons for the entire sample. We follow the same procedure and criteria for deriving the estimates reported in Tables 8 and 9 in Appendix for pre-Covid-19 and Covid-19 periods, respectively.

Using the composite index of S, M, and L, our result confirms that the bond market shock spillover index for the full sample period is 2.0% (S), 9.2% (M), and 10.2 (L)%, respectively. It implied that the shock spillover is relatively higher with L and followed by M. In contrast, the shock spillover over short maturity(S) is marginal across sovereign bond markets. These estimates derived from our alternative models are closesly similar to our baseline models. Comparing the shock spillover estimates over two periods (Covid-19 and pre-Covid-19 period) shows that bond markets shock spillover has increased dramatically for all types of bonds with varying maturities during the Covid-19 than pre-Covid-19 crisis period. We observed this interpretation from our estimates reported in Tables 8 and 9. During the pre-pandemic period, the magnitude of shock spillover remains almost similar to that of the magnitude of shock spillover derived over the entire sample period.

The spillover indices for S, M, and L during the pandemic period, which are 19.9%, 27.3%, and 27.8%, respectively, are almost closer to the estimated figures as we had obtained from our baseline models. Our effort to carry out a dynamic analysis under a rolling window of 200 days corroborates our findings that sovereign bond yield shock spillover across eight countries are higher over L and M maturities than over S maturity. It also confirms that idiosyncratic shocks mainly drive short-maturity bond yields substantially. In contrast, there is a greater presence of external factors exhibiting shock spillover in L and M. Further, it ensures that shock spillovers are much higher during Covid-19 crisis period compared to the pre-Covid-19 period irrespective of maturity of sovereign bonds across all the markets with our rolling window analyses (see Figs. 8, 9, 10, 11 in the Appendix).

7 Conclusion

The Covid-19 health pandemic hit the world hard, causing tremendous economic and financial losses for the advanced and emerging economies. Some pertinent questions have guided our analysis: how does Covid-19 affect the international bond markets? What is the extent of shock spillover in bond yield rates across markets? Does bond market shock spillover during the pre-Covid-19 period differ from the Covid-19 period? Are there any variations in shock spillovers in different sovereign bond prices based on their maturity patterns during the Covid-19 and pre-Covid-19 periods? Aiming to answer these important questions, the paper examined the sovereign bond market shock spillover in short (S), medium (M), and long (L) maturities among 8 economies such as the US, Japan, Germany, China, India, Russia, Indonesia, and Brazil for the period from 1st January 2013 to 12th November 2020 (daily data) by utilising the Diebold and Yilmaz’s (2012) static and dynamic frameworks.

We observed that Covid-19 affected the financial markets, including bond markets, across countries severely. The bond yields have witnessed a constant fall and rise during Covid-19. Our result reveals that no matter whether Covid-19 or pre-Covid-19 period, shock spillovers in bond yields are higher with long (L) and medium (M) maturities than the shorter (S)-maturity. More importantly, the shock spillovers have increased manifold during Covid-19 relative to pre-Covid-19 period across varying maturities, although the spillover is much less with the short maturity. Thus, we conclude that since countries are subject to heterogeneous asset classes based on their varying maturity patterns, investors should look for short-maturity assets (bonds) as part of their better risk management strategies. Based on our evidence, it suggests that the external shocks minimally influence the short maturity bond yields.

The drawback of this present study is that this analysis is limited to considering few countries from both the developed and emerging economies, and it is also silent on the determinants of total shock spillover across sovereign bond markets during the Covid-19 crisis. Nevertheless, this partial analysis provides some valuable insights to the international investors and macro policy-making of economies about how individual markets react in response to other international markets during the pandemic and lead to changing the course of their strategies for various assets/instruments with varying maturities.

Data Availability

We have provided enough number of graphs and tables and summery statistics. However, if raw data is required at any stage, the same can be secured upon a request to the corresponding author.

Code Availability

Yes, we can be able to provide the code upon a request.

Notes

Hordahl and Shim (2020) in a recent study investigated the relationship between long-term rates and bond portfolio outflow across emerging markets economies (EME) during covid-19 period.

Bond pricing can vary depending on short-maturity or long-term maturity.

Arellano et al. (2020) analysed impact of default risk on debt markets during covid-19 and strongly argued that default risk made lockdowns more costly as it limits the fiscal capacity of government to support consumption.

We have resorted to designating these three different maturity patterns of bond prices with single alphabet because of space constraint in the tables and figures and more importantly to maintain the coherence of using the same acronym throughout the analysis for the convenience of the readers without confronting difficulties.

See Zunino et al. (2012) paper on “On the efficiency of sovereign bond markets.”

See Tule et al. (2017) on “Oil price shocks and volatility spillovers in the Nigerian sovereign bond market”.

See Sowmya et al. (2016) on “Linkages in the term structure of interest rates across sovereign bond markets”.

See the paper of Hördahl and Shim (2020) who investigated EME bond portfolio flows and long-term interest rates during the Covid-19 pandemic.

References

Afonso, A., Arghyrou, M. G., & Kontonikas, A. (2015). The determinants of sovereign bond yield spreads in the EMU. ECB Working Paper, No. 1781, ISBN 978-92-899-1594-6, European Central Bank (ECB).

Ahmad, W., Mishra, A. V., & Daly, K. J. (2018). Financial connectedness of BRICS and global sovereign bond markets. Emerging Markets Review, 37, 1–16.

Akhtaruzzaman, M., Boubaker, S., & Sensoy, A. (2020). Financial contagion during COVID–19 crisis. Finance Research Letters, 38, 101604.

Albulescu, C. T. (2020). COVID-19 and the United States financial markets’ volatility. Finance Research Letters, 38, 101699. https://doi.org/10.1016/j.frl.2020.101699

Andries, A. M., Ongena, S., & Sprincean, N. (2020). The COVID-19 Pandemic and Sovereign Bond Risk. Swiss Finance Institute Research Paper (20–42).

Antonakakis, N., & Vergos, K. (2013). Sovereign bond yield spillovers in the Eurozone during the financial and debt crisis. Journal of International Financial Markets, Institutions, and Money, 26, 258–272. https://doi.org/10.1016/j.intfin.2013.06.004

Arellano, C., Bai, Y., & Mihalache, G. P. (2020). Deadly Debt Crises: COVID-19 in Emerging Markets. (No. w27275). National Bureau of Economic Research Working Paper.

Asutay, M., & Hakim, A. (2018). Exploring international economic integration through sukuk market connectivity: A network perspective. Research in International Business and Finance, 46, 77–94.

Azimli, A. (2020). The impact of COVID-19 on the degree of dependence and structure of risk-return relationship: A quantile regression approach. Finance Research Letters, 36, 101648.

Bae, B. Y., & Kim, D. H. (2011). Global and regional yield curve dynamics and interactions: The case of some Asian countries. International Economic Journal, 25(4), 717–738.

Bai, J., Julliard, C., & Yuan, K. (2012). Eurozone sovereign bond crisis: Liquidity or fundamental contagion. Federal Reserve Bank of New York Working Paper.

Bai, L., Wei, Y., Wei, G., Li, X., & Zhang, S. (2020). Infectious disease pandemic and permanent volatility of international stock markets: A long-term perspective. Finance Research Letters. https://doi.org/10.1016/j.frl.2020.101709

Balli, F., Billah, M., Balli, H. O., & De Bruin, A. (2022). Spillovers between Sukuks and Shariah-compliant equity markets. Pacific-Basin Finance Journal, 101725.

Beetsma, R., Giuliodori, M., De Jong, F., & Widijanto, D. (2013). Spread the news: The impact of news on the European sovereign bond markets during the crisis. Journal of International Money and Finance, 34, 83–101.

Beirne, J., Renzhi, N., Sugandi, E., & Volz, U. (2020). Financial Market and Capital flow dynamics during the COVID-19 pandemic. ADBI Working Paper Series, No. 1158, ADB Institute.

Bellas, D., Papaioannou, M. G., & Petrova, I. (2010). Determinants of emerging market sovereign bond spreads: Fundamentals vs financial stress. IMF Working Paper. № 10/281. International Monetary Fund.

Benigno, P., Canofari, P., Di Bartolomeo, G., & Messori, M. (2020). Uncertainty and the pandemic shocks. Monetary Dialogue Papers, European Parliament. https://iris.luiss.it/retrieve/handle/11385/200497/108086/Covid-Uncertainty.pdf

Bernanke, B. S.(2007). Global imbalances: recent developments and prospects. Bundesbank Lecture speech, September 11, 2007.

Bernoth, K. & Erdogan, B. (2010). Sovereign bond yield spreads: A time-varying coefficient approach. DIW Discussion Papers, No. 1078, Deutsches Institut für Wirtschaftsforschung (DIW).

Bernoth, K., von Hagen, J., & Schuknecht, L. (2004). Sovereign risk premia in the European government bond market. ZEI Working Paper, No. B 26–2003, Rheinische Friedrich-Wilhelms-Universität Bonn, Zentrum für Europäische Integrationsforschung (ZEI).

Bhattacharyay, B. N. (2011). Bond market development in Asia: An empirical analysis of major determinants. ADBI Working Paper, No. 300, Asian Development Bank Institute (ADBI),.

Bhattacharyay, B. N. (2013). Determinants of bond market development in Asia. Journal of Asian Economics, 24, 124–137.

Blatt, D., Candelon, B., & Manner, H. (2015). Detecting contagion in a multivariate time series system: An application to sovereign bond markets in Europe. Journal of Banking & Finance, 59, 1–13.

Cakmakli, C., Demiralp, S., Kalemli-Ozcan, S., Yesiltas, S., & Yildirim, M. A. (2020). COVID-19 and emerging markets: an epidemiological model with international production networks and capital flows. NBER Working Paper No. 27191.

Cepoi, C. O. (2020). Asymmetric dependence between stock market returns and news during COVID19 financial turmoil. Finance Research Letters, 36, 101658. https://doi.org/10.1016/j.frl.2020.101658

Chen, W., Ho, K. C., & Yang, L. (2020). Network structures and idiosyncratic contagion in the European sovereign credit default swap market. International Review of Financial Analysis, 72, 101594.

Chevallier, J., & Ielpo, F. (2013). Volatility spillovers in commodity markets. Applied Economics Letters, 20(13), 1211–1227.

Chowdhury, B., Dungey, M., Kangogo, M., Sayeed, M. A., & Volkov, V. (2019). The changing network of financial market linkages: The Asian experience. International Review of Financial Analysis, 64, 71–92.

Christensen, J. H., Fischer, E., & Shultz, P. (2020). Emerging Bond Markets and COVID-19: Evidence from Mexico. FRBSF Economic Letter, 23, 1–05.

Christopher, R., Kim, S. J., & Wu, E. (2012). Do sovereign credit ratings influence regional stock and bond market interdependencies in emerging countries? Journal of International Financial Markets, Institutions, and Money, 22(4), 1070–1089.

Claeys, P., & Vašíček, B. (2012). Measuring sovereign bond spillover in Europe and the impact of rating news. Czech National Bank Working Paper, No. 7.

Claeys, P., & Vašíček, B. (2019). Transmission of uncertainty shocks: Learning from heterogeneous responses on a panel of EU countries. International Review of Economics & Finance, 64, 62–83.

Comelli, F. (2012). Emerging market sovereign bond spreads: Estimation and back-testing. Emerging Markets Review, 13(4), 598–625.

Conlon, T., & McGee, R. (2020). Safe haven or risky hazard? Bitcoin during the COVID-19 bear market. Finance Research Letters, 35, 101607. https://doi.org/10.1016/j.frl.2020.101607

Corbet, S., Larkin, C., & Lucey, B. (2020). The contagion effects of the covid-19 pandemic: Evidence from gold and cryptocurrencies. Finance Research Letters, 35, 101554. https://doi.org/10.1016/j.frl.2020.101554

Cronin, D. (2014). The interaction between money and asset markets: A spillover index approach. Journal of Macroeconomics, 39, 185–202. https://doi.org/10.1016/j.frl.2020.101554

Cronin, D., & Dunne, P. (2019). Have sovereign bond market relationships changed in the euro area? Evidence from Italy. Intereconomics, 54(4), 250–258.

Csonto, B. Ivaschenko, l. (2013). Determinants of sovereign bond spreads in emerging markets: Local fundamentals and global factors vs. ever-changing misalignments, IMF Working Paper No. 13/164, 1–42.

Daehler, T., Aizenman, J., & Jinjarak, Y. (2020). Emerging markets sovereign spreads and country-specific fundamentals during COVID-19, National Bureau of Economic Research. Working paper No. w27903.

Delatte, A. L., & Guillaume, A. (2020). Covid 19: A new challenge for the EMU, CEPII Working Paper No. 2020-08–July 2020.

Dewachter, H., Iania, L., Lyrio, M., & de Sola Perea, M. (2015). A macro-financial analysis of the euro area sovereign bond market. Journal of Banking & Finance, 50, 308–325.

Diebold, F. X., Li, C., & Yue, V. Z. (2008). Global yield curve dynamics and interactions: A dynamic Nelson-Siegel approach. Journal of Econometrics, 146(2), 351–363.

Diebold, F. X., & Yilmaz, K. (2009). Measuring financial asset return and volatility spillovers, with application to global equity markets. Economic Journal, 119(534), 158–171.

Diebold, F. X., & Yilmaz, K. (2012). Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting, 28(1), 57–66. https://doi.org/10.1016/j.ijforecast.2011.02.006

El-Khatib, R., & Samet, A. (2020). Impact of COVID-19 on emerging markets. Available at SSRN 3685013.

Elsayed, A. H., Naifar, N., Nasreen, S., & Tiwari, A. K. (2022). Dependence structure and dynamic connectedness between green bonds and financial markets: Fresh insights from time-frequency analysis before and during COVID-19 pandemic. Energy Economics, 105842.

Engsted, T., & Tanggaard, C. (2007). The comovement of US and German bond markets. International Review of Financial Analysis, 16(2), 172–182.

Feld, L. P., Kalb, A., Moessinger, M. D., & Osterloh, S. (2017). Sovereign bond market reactions to no-bailout clauses and fiscal rules–The Swiss experience. Journal of International Money and Finance, 70, 319–343.

Fernández-Rodríguez, F., Gómez-Puig, M., & Sosvilla-Rivero, S. (2016). Using connectedness analysis to assess financial stress transmission in EMU sovereign bond market volatility. Journal of International Financial Markets, Institutions, and Money, 43, 126–145.

Gade, T., Salines, M., Glöckler, G., & Strodthoff, S. (2013). “Loose lips sinking markets?: The impact of political communication on sovereign bond spreads. ECB Occasional Paper, No. 150, European Central Bank (ECB).

Gao, Y., Li, Y., & Wang, Y. (2021). Risk spillover and network connectedness analysis of China’s green bond and financial markets: Evidence from financial events of 2015–2020. The North American Journal of Economics and Finance, 57, 101386.

Georgoutsos, D. A., & Migiakis, P. M. (2013). Heterogeneity of the determinants of euro-area sovereign bond spreads; what does it tell us about financial stability? Journal of Banking & Finance, 37(11), 4650–4664.

Goldberg, L. S., & Leonard, D. (2003). What moves sovereign bond markets? The effects of economic news on US and German Yields. Federal Reserve Bank of New York Current Issues in Economics and Finance, 9(9), 1–7.

Goodell, J. W., & Goutte, S. (2020a). Co-movement of COVID-19 and Bitcoin: Evidence from wavelet coherence analysis. Finance Research Letters, 38, 101625.

Goodell, J. W., & Huynh, T. L. D. (2020b). Did Congress trade ahead? Considering the reaction of US industries to COVID-19. Finance Research Letters, 36, 101578. https://doi.org/10.1016/j.frl.2020.101578

Gubareva, M. (2020). The impact of Covid-19 on liquidity of emerging market bonds. Finance Research Letters, 41(10), 101826. https://doi.org/10.1016/j.frl.2020.101826

Gubareva, M., & Umar, Z. (2020). Emerging market debt and the COVID-19 pandemic: A time-frequency analysis of spreads and total returns dynamics. International Journal of Finance & Economics.

Hartley, J. S., & Rebucci, A. (2020). An event study of COVID-19 central bank quantitative easing in advanced and emerging economies, National Bureau of Economic Research working paper No. w27339.

Hofmann, B., Shim, I., & Shin, H. S. (2020). Emerging market economy exchange rates and local currency bond markets amid the Covid-19 pandemic, Bank for International Settlements Bulletin No. 5.

Hördahl, P., & Shim, I. (2020). EME bond portfolio flows and long-term interest rates during the Covid-19 pandemic, Bank for International Settlements Bulletin (No. 18, pp. 1–9).

Ilmanen, A. (1995). Time-varying expected returns in international bond markets. The Journal of Finance, 50(2), 481–506.

Ji, Q., Zhang, D., & Zhao, Y. (2020). Searching for safe-haven assets during the COVID-19 pandemic. International Review of Financial Analysis, 71, 101526. https://doi.org/10.1016/j.irfa.2020.101526

Jinjarak, Y., Ahmed, R., Nair-Desai, S., Xin, W., & Aizenman, J. (2020). Pandemic shocks and fiscal-monetary policies in the Eurozone: COVID-19 dominance during January–June 2020, National Bureau of Economic Research Working Paper, W27451. http://www.nber.org/papers/w27451.

Karkowska, R., & Urjasz, S. (2021). Connectedness structures of sovereign bond markets in Central and Eastern Europe. International Review of Financial Analysis, 74, 101644.

Klößner, S., & Sekkel, R. (2014). ‘International spillovers of policy uncertainty. Economics Letters, 124(3), 508–512.

Klößner, S., & Wagner, S. (2014). Exploring all VAR orderings for calculating spillovers? Yes, we can!—a note on Diebold and Yilmaz (2009). Journal of Applied Econometrics, 29(1), 172–179. https://doi.org/10.1002/jae.2366

Koop, G., Pesaran, M. H., & Potter, S. M. (1996). Impulse response analysis in nonlinear multivariate models. Journal of Econometrics, 74(1), 119–147. https://doi.org/10.1016/0304-4076(95)01753-4

Kose, M. Ayhan; Sugawara, Naotaka; Terrones, Marco E. (2020). Global Recession., Policy Research Working Paper; No. 9172. World Bank.

Kumar, M. (2013). Returns and volatility spillover between stock prices and exchange rates: Empirical evidence from IBSA countries. International Journal of Emerging Markets, 8(2), 108–128. https://doi.org/10.1108/17468801311306984

Lin, S., & Chen, S. (2021). Dynamic connectedness of major financial markets in China and America. International Review of Economics & Finance, 75, 646–656.

Masson, P. (1999). Contagion: Macroeconomic models with multiple equilibria. Journal of International Money and Finance, 18(4), 587–602.

Matei, I., & Cheptea, A. (2012). Sovereign bond spread drivers in the EU market in the aftermath of the global financial crisis. In Essays in Honor of Jerry Hausman. Emerald Group Publishing Limited.

Mensi, W., Sensoy, A., Vo, X. V., & Kang, S. H. (2020). Impact of COVID-19 outbreak on asymmetric multifractality of gold and oil prices. Resources Policy, 69, 101829.

Mnif, E., Jarboui, A., & Mouakhar, K. (2020). How the cryptocurrency market has performed during COVID 19? A Multifractal Analysis. Finance Research Letters, 36, 101647.

Mohl, P., & Sondermann, D. (2013). Has political communication during the crisis impacted sovereign bond spreads in the euro area? Applied Economics Letters, 20(1), 48–61.

Obstfeld, M. (1996). Models of currency crises with self-fulfilling features. European Economic Review, 40(3–5), 1037–1047.

Okorie, D. I., & Lin, B. (2020). Stock Markets and the COVID-19 fractal contagion effects. Finance Research Letters, 38, 101640. https://doi.org/10.1016/j.frl.2020.101640

Pang, R. K. K., Granados, O., Chhajer, H., & Legara, E. F. (2020). An analysis of network filtering methods to sovereign bond yields during COVID-19. arXiv preprint arXiv:abs/2009.13390.

Pang, R. K. K., Granados, O. M., Chhajer, H., & Legara, E. F. T. (2021). An analysis of network filtering methods to sovereign bond yields during COVID-19. Physica a: Statistical Mechanics and Its Applications, 574, 125995.

Pelizzon, L., Subrahmanyam, M. G., Tomio, D., & Uno, J. (2013). The microstructure of the European sovereign bond market: A study of the Euro-zone crisis. Unpublished working paper. New York University.

Pesaran, H. H., & Shin, Y. (1998). Generalized impulse response analysis in linear multivariate models. Economics Letters, 58(1), 17–29. https://doi.org/10.1016/s0165-1765(97)00214-0

Rout, S. K. (2020). Spillover of financial innovations during Covid-19: A cross-country analysis. Asian Development Policy Review, 8(4), 298–318.

Rout, S. K., & Mallick, H. (2020a). International spillovers of interest rate shocks: An empirical analysis. Asian Journal of Empirical Research, 10(10), 215–222.

Rout, S. K., & Mallick, H. (2020b). Transmission of international financial shocks: A cross country analysis. Asian Development Policy Review, 8(4), 236–259.

Rout, S. K., & Mallick, H. (2021). International interdependency of macroeconomic activities: A multivariate empirical analysis. International Economics and Economic Policy, 18(2), 425–450.

Sène, B., Mbengue, M. L., & Allaya, M. M. (2020). Overshooting of sovereign emerging Eurobond yields in the context of COVID-19. Finance Research Letters, 38, 101746. https://doi.org/10.1016/j.frl.2020.101746

Sensoy, A., Ozturk, K., Hacihasanoglu, E., & Tabak, B. M. (2017). Not all emerging markets are the same: A classification approach with correlation based networks. Journal of Financial Stability, 33, 163–186.

Sharif, A., Aloui, C., & Yarovaya, L. (2020). COVID-19 pandemic, oil prices, stock market, geopolitical risk, and policy uncertainty nexus in the US economy: Fresh evidence from the wavelet-based approach. International Review of Financial Analysis, 70, 101496. https://doi.org/10.1016/j.irfa.2020.101496

Shehzad, K., Xiaoxing, L., & Kazouz, H. (2020). COVID-19’s disasters are perilous than Global Financial Crisis: A rumour or fact? Finance Research Letters, 36, 101669. https://doi.org/10.1016/j.frl.2020.101669

Sowmya, S., Prasanna, K., & Bhaduri, S. (2016). Linkages in the term structure of interest rates across sovereign bond markets. Emerging Markets Review, 27, 118–139.

Sutton, G. D. (2000). Is there excess comovement of bond yields between countries? Journal of International Money and Finance, 19(3), 363–376.

Topcu, M., & Gulal, O. S. (2020). The impact of COVID-19 on emerging stock markets. Finance Research Letters, 36, 101691. https://doi.org/10.1016/j.frl.2020.101691

Tule, M. K., Ndako, U. B., & Onipede, S. F. (2017). Oil price shocks and volatility spillovers in the Nigerian sovereign bond market. Review of Financial Economics, 35, 57–65.

Umar, Z., Manel, Y., Riaz, Y., & Gubareva, M. (2021). Return and volatility transmission between emerging markets and US debt throughout the pandemic crisis. Pacific-Basin Finance Journal, 67, 101563.

Yang, L., & Hamori, S. (2015). Interdependence between the bond markets of CEEC-3 and Germany: A wavelet coherence analysis. The North American Journal of Economics and Finance, 32, 124–138.

Yarovaya, L., Matkovskyy, R., & Jalan, A. (2020). The Effects of a 'Black Swan’Event (COVID-19) on Herding Behavior in Cryptocurrency Markets: Evidence from Cryptocurrency USD, EUR, JPY, and KRW Markets: EUR, JPY, and KRW Markets. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3586511

Yousfi, M., Dhaoui, A., & Bouzgarrou, H. (2021). Risk spillover during the COVID-19 global pandemic and portfolio management. Journal of Risk and Financial Management, 14(5), 222.

Zaremba, A., Kizys, R., & Aharon, D. Y. (2021). Volatility in international sovereign bond markets: The role of government policy responses to the COVID-19 pandemic. Finance Research Letters, 43, 102011.

Zaremba, A., Kizys, R., Aharon, D. Y., & Demir, E. (2020). Infected markets: Novel coronavirus, government interventions, and stock return volatility around the globe. Finance Research Letters, 35, 101597. https://doi.org/10.1016/j.frl.2020.101597

Zaremba, A., Kizys, R., Aharon, D. Y., & Umar, Z. (2022). Term spreads and the COVID-19 pandemic: Evidence from international sovereign bond markets. Finance Research Letters, 44, 102042.

Zhang, D., Hu, M., & Ji, Q. (2020). Financial markets under the global pandemic of COVID-19. Finance Research Letters, 36, 101528. https://doi.org/10.1016/j.frl.2020.101528

Zunino, L., Bariviera, A. F., Guercio, M. B., Martinez, L. B., & Rosso, O. A. (2012). On the efficiency of sovereign bond markets. Physica a: Statistical Mechanics and Its Applications, 391(18), 4342–4349.

Acknowledgements