Abstract

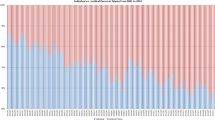

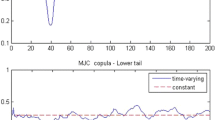

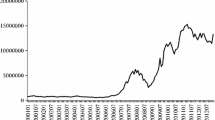

By analyzing not only an overnight return but also a midday-recess return, namely, a stock return during midday-recess, I analyze whether and why market closures affect cross-sectional stock returns. I find strong persistence in overnight and midday-recess returns, with both returns positively associated with each other. Moreover, these out-of-trading-hours returns are negatively associated with returns during trading hours. I analyze whether these associations are explained by a different investor clientele outside trading hours (the open of the trading session) compared to during trading hours (intraday and closing of the trading session). I find that institutional ownership increases more with returns during trading hours; the finding indicates that those returns are mainly determined by institutional investors, while midday-recess and overnight returns, that is, returns outside trading hours, are not. Overall, my results support the view that market closures do affect cross-sectional returns and the influence is attributable to differences in the investor clientele.

Similar content being viewed by others

Notes

Since the FactSet Ownership database does not provide the number of shares owned by individual investors, which are representative of the opening clientele, I mainly analyze a change in institutional ownership during each period. However, since institutional investors are strongly concerned with liquidity and are regarded as representative of the closing clientele, the analysis can provide robust insights with respect to how my findings are explained by the investor-clientele argument.

The Stock Exchange of Thailand closes midday. Due to a small sample size and limited historical data, samples from Thailand are less suitable for my analysis. Nevertheless, I analyze Thailand stock markets as a robustness check. Details are shown in Sect. 4.3.2.

Due to space constraint, Table 6 reports associations with as much as 2 lags. The result still holds for the association with more lags.

Due to limited availability of ownership data, I do not perform the analysis regarding investor clientele for the Thailand sample.

Table 8(a), (b) report associations with up to 4 lags, as statistical significance of the association with lags greater than 4 is limited. However, the result is available upon request.

Since the analysis on investor clientele is monthly, and the ownership data is only available from 2004, I divide the period into three sub-periods, while in the case of analyzing the return associations, I divide it into four periods.

References

Ang, A., Hodrick, R. J., Xing, Y., & Zhang, X. (2006). The cross- section of volatility and expected returns. Journal of Finance,61, 259–299.

Black, F. (1972). Capital market equilibrium with restricted borrowing. Journal of Business,45, 444–454.

Carhart, M. M. (1997). On persistence in mutual fund performance. Journal of Finance,52, 57–82.

Chang, R. P., McLeavey, D. W., & Rhee, S. G. (1995). Short-term abnormal returns of the contrarian strategy in the Japanese stock market. Journal of Business Finance and Accounting,22, 1035–1048.

Cliff, M., Cooper, M., & Gulen, H. (2008). Return differences between trading and non-trading hours: Like night and day. Virginia Tech working paper.

Corte, D., Kosowski, R., & Wang, T. (2015). Market closure and short-term reversal. Working Paper.

Daniel, K., & Titman, S. (2006). Market reactions to tangible and intangible information. Journal of Finance,61, 1605–1643.

Datar, V., Naik, N., & Radcliffe, R. (1998). Liquidity and asset returns: An alternative test. Journal of Financial Markets,1, 203–220.

Easlay, D., & O’Hara, M. (1992). Time and the process of security price adjustment. Journal of Finance,47, 576–605.

Fairfeld, P. M., Whisenant, S., & Yohn, T. L. (2003). Accrued earnings and growth: Implications for future profitability and market mispricing. Accounting Review,78, 353–371.

Fama, E. F., & French, K. R. (1992). The cross-section of expected stock returns. Journal of Finance,47, 427–465.

Fama, E. F., & French, K. R. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics,33, 3–56.

Fama, E. F., & French, K. R. (2015). A five-factor asset pricing model. Journal of Financial Economics,116, 1–22.

Fama, E. F., & MacBeth, J. D. (1973). Risk, return, and equilibrium: Empirical tests. Journal of Political Economy,81, 607–636.

Foster, F., & Viswanathan, S. (1990). A theory of intraday variation in volume, variance, and trading costs in securities markets. Review of Financial Studies,3, 593–624.

Glosten, L., & Milgrom, P. (1985). Bid, ask and transaction prices in a specialist market with heterogeneously informed traders. Journal of Financial Economics,14, 71–100.

Harris, L. (1986). A transaction data study of weekly and intradaily patterns in stock returns. Journal of Financial Economics,16, 99–118.

Haugan, R. A., & Baker, N. L. (1996). Commonality in the determinants of expected stock returns. Journal of Financial Economics,41, 401–439.

Hong, H., & Wang, J. (2000). Trading and returns under periodic market closures. Journal of Finance,55, 297–354.

Jegadeesh, N. (1990). Evidence of predictable behavior of security returns. Journal of Finance,45, 881–898.

Jegadeesh, N., & Titman, S. (1993). Returns to buying winners and selling losers: Implications for stock market efficiency. Journal of Finance,48, 65–91.

Kelly, M., & Clark, S. (2011). Returns in trading versus non-trading hours: The difference is day and night. Journal of Asset Management,12, 132–145.

Kyle, A. (1985). Continuous auctions and insider trading. Econometrica,53, 1315–1336.

Lee, C. M. C., & Swaminathan, B. (2000). Price momentum and trading volume. Journal of Finance,55, 2017–2069.

Lintner, J. (1965). The valuation of risk assets on the selection of risky investments in stock portfolios and capital budgets. Review of Economics and Statistics,47, 13–37.

Liu, C., & Lee, Y. (2001). Does the momentum strategy work universally? Evidence from the Japanese stock market. Asia Pacific Financial Markets,8, 321–339.

Lou, D., Polk, C., & Skouras, S. (2019). A tug of war: Overnight versus intraday expected returns. Journal of Financial Economics.

Polk, C., & Sapienza, P. (2009). The stock market and corporate investment: A test of catering theory. Review of Financial Studies,22, 187–217.

Sharpe, W. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. Journal of Finance,19, 425–442.

Sloan, R. (1996). Do stock prices fully reflect information in accruals and cash flows about future earnings? Accounting Review,71, 289–315.

Titman, S., Wei, K. C., & Xie, F. (2004). Capital investments and stock returns. Journal of Financial and Quantitative Analysis,39, 677–700.

Vuolteenaho, T. (2002). What drives firm-level stock returns? Journal of Finance,57, 233–264.

Wood, R., McInish, T., & Ord, J. (1985). An investigation of transactions data for NYSE stocks. Journal of Finance,40, 723–739.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Miwa, K. Market Closures and Cross-sectional Stock Returns. Asia-Pac Financ Markets 27, 1–33 (2020). https://doi.org/10.1007/s10690-019-09279-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10690-019-09279-z