Abstract

Empirical studies of ambiguity aversion mostly use artificial events such as Ellsberg urns to control for unknown probability beliefs. The present study measures ambiguity attitudes using real-world events in a large sample of investors. We elicit ambiguity aversion and perceived ambiguity for a familiar company stock, a local stock index, a foreign stock index, and Bitcoin. Measurement reliability is higher than for artificial sources in previous studies. Ambiguity aversion is highly correlated for different assets, while perceived ambiguity varies more between assets. Further, we show that ambiguity attitudes are related to actual investment choices.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Real-life decisions made under uncertainty nearly always involve ambiguity, as the probability distribution of future outcomes is not precisely known (Keynes, 1921; Knight, 1921). Most people are ambiguity averse, meaning that they prefer to make decisions with known probabilities (risk) rather than with unknown probabilities (ambiguity), a fact that the subjective expected utility model cannot explain (Ellsberg, 1961). Models that accommodate ambiguity aversion were first developed in the late 1980s by Gilboa and Schmeidler (1989), and extensive empirical studies on ambiguity have since been conducted (Trautmann & van de Kuilen 2015). These show that people’s choices not only reveal ambiguity aversion, common for likely gains, but also ambiguity seeking for unlikely gains and for losses, similar to the four-fold pattern of risk attitudes proposed by Tversky and Kahneman (1992).

One limitation of the available evidence on ambiguity attitudes is that these have mostly been measured with artificial events such as Ellsberg urns, rather than sources of ambiguity that decision makers face in real life. Artificial events are convenient because they can be designed to minimize the influence of people’s subjective beliefs.Footnote 1 Yet, as suggested by l’Haridon et al. (2018), the use of such artificial events may also make the experimental tasks less relevant for subjects and more difficult to understand. Recently, Baillon et al. (2018b) developed a novel method to measure ambiguity for naturally occurring sources that controls for unknown probability beliefs and risk preferences. This new method has been applied in laboratory experiments (Baillon et al., 2018b; Li et al., 2019), and in the field with high school students (Li, 2017).Footnote 2

Our paper’s contribution is to measure ambiguity attitudes for relevant real-world sources in a large set of real-world investors. In particular, households often confront financial decision problems such as saving, investment, and insurance, where the probability distribution of future outcomes is not precisely known. Our objective is to measure ambiguity attitudes toward return distributions that people typically face when making such investment choices. We field a purpose-built survey module to elicit ambiguity attitudes in a representative sample of about 300 Dutch investors who participated in the annual De Nederlandse Bank (DNB) Household Survey (DHS), using the method of Baillon et al. (2018b). At the individual level, we estimate both preferences toward ambiguity and perceived levels of ambiguity about four investments: a familiar individual stock, the local stock market index, a foreign stock market index, and the crypto-currency Bitcoin. We focus on investments, as there is a large theoretical literature in finance on the implications of ambiguity.

To assess the reliability of the ambiguity attitude measures for natural sources in the field, we first conduct an econometric analysis with panel models. Correlations between repeated measures of ambiguity aversion prove to be moderate to high, in the 0.6 to 0.8 range. Individual characteristics also display significant and plausible correlations with ambiguity attitudes, and these explain 23% of the variation in ambiguity aversion. This is an improvement over previous studies that used artificial urn experiments to measure ambiguity, where individual characteristics explained only up to 3% (see Dimmock et al., 2015; l’Haridon et al., 2018). Second, our research using real-world sources confirms that ambiguity aversion is not universal.Footnote 3 We show that about 60% of the investors, on average, are ambiguity averse toward the four investments, but a sizeable fraction (40%) is ambiguity seeking or neutral.

Previous studies have shown that ambiguity attitudes have an important second component called a-insensitivity, which refers to the tendency to treat all ambiguous events as if they are 50/50% (Abdellaoui et al., 2011; Fox et al., 1996; Tversky & Fox, 1995). For unlikely events, such as new ventures that offer a large payoff with a small unknown probability, a-insensitivity implies ambiguity seeking behavior. Our results confirm that the large majority of investors displays a-insensitivity toward real-world investments, at relatively high levels on average. In the multiple prior model of Chateauneuf et al. (2007), a-insensitivity can also be interpreted as a measure of the level of perceived ambiguity. Seen this way, our results suggest that most retail investors perceive relatively high ambiguity about the probabilities of future investment returns, most likely due to limited financial sophistication as documented in the household finance literature (Gomes et al., 2021). Nonetheless, a-insensitivity (perceived ambiguity) is lower for the familiar stock, and lower among investors with higher financial literacy and better education.

Our data also allow us to test whether ambiguity aversion and perceived ambiguity vary with the decision maker and the source of ambiguity. Popular theoretical formulations of ambiguity such as the smooth model (Klibanoff et al., 2005) and the alpha-MaxMin model (Ghirardato et al., 2004) assume that ambiguity aversion is subject-dependent but constant between sources, while perceived ambiguity is both source- and subject-dependent. These key assumptions in theoretical models have, thus far, not been based on empirical evidence. We show that ambiguity aversion toward the four investments we examine is strongly related and mostly driven by one underlying variable. This implies that, if an investor has relatively high ambiguity aversion toward one specific financial asset (e.g., a stock market index), he also tends to display high ambiguity aversion toward other investments. In contrast, we find that investors’ perceived levels of ambiguity differ substantially between assets and cannot be summarized by a single measure. Accordingly, the same investor may perceive low ambiguity about a familiar stock and high ambiguity about Bitcoin.

Finally, we test whether the new ambiguity attitude measures relate to the investors’ actual investment choices. We find that investors who perceive less ambiguity about a particular financial asset are more likely to invest in it. Further, investors with higher ambiguity aversion are less likely to invest in Bitcoin. Previous studies have measured ambiguity attitudes with Ellsberg urns to avoid issues with subjective beliefs and then related these measures to portfolio choices (Dimmock et al., 2016a, 2016b; Bianchi & Tallon, 2019; and Kostopoulos et al., 2019). Our paper is the first to confirm such a link using measures of non-artificial ambiguity directly relevant for the investments.

We contribute to the empirical literature on ambiguity by measuring ambiguity attitudes toward economically relevant sources in a large sample of investors.Footnote 4 We analyze the reliability of the new elicitation method of Baillon et al. (2018b) when it is used in a survey of the general population, and we validate the measures by testing the link with actual household investments. Compared to earlier large-sample ambiguity studies using artificial events (Dimmock et al., 2015; l’Haridon et al., 2018), we find that, when using real-world sources, measurement reliability is higher and individual characteristics explain a larger proportion of the heterogeneity in ambiguity aversion.

In addition, we add to the literature on natural sources of ambiguity.Footnote 5 Fox et al. (1996) already found that even professional option traders displayed high a-insensitivity toward familiar stock return distributions. Kilka and Weber (2001) showed that German students were more ambiguity averse and insensitive about a foreign stock compared to a domestic stock, displaying home bias. We can now confirm these results in a large field study of retail investors, using the latest methodology that controls for both unknown beliefs and risk preferences. In addition, our research adds to the literature on portfolio choice under ambiguity (e.g., Uppal & Wang, 2003; Boyle et al., 2012; and Peijnenburg, 2018), providing empirical evidence on how to model the ambiguity attitudes of households investing in financial markets.

2 Data and elicitation methods

2.1 Dutch household panel

We fielded a purpose-built module to measure ambiguity and risk attitudes in the CentERpanel, a representative household survey of about 2,000 respondents conducted by CentERdata at Tilburg University in the Netherlands. The survey is computer-based and subjects can participate from their homes. To limit selection bias, households lacking internet access at the recruiting stage were provided with a set-top box for their television sets (and with a TV if they had none). Each year, the DNB Household Survey (DHS) is fielded in the panel to obtain detailed information about the members’ income, assets, and liabilities.Footnote 6 We merged the DHS data with results from our survey module on ambiguity and risk attitudes. The CentERpanel is representative of the Dutch population and the DHS has previously been used to provide insight into household financial decisions (e.g., Guiso et al., 2008; van Rooij et al., 2011; and von Gaudecker, 2015).

As the panel is nationally representative, it includes a large number of people who do not invest in financial markets: about 85% of the panel members as of December 2016. Ambiguity about all investments is likely to be high in this group, without much meaningful variation between sources. To better utilize resources, our questionnaire was targeted at the 15% of DHS respondents who invested in financial assets, defined to include mutual funds (about 68% of the investors), individual company stocks (45%), bonds (11%), or options (2.5%).Footnote 7 Our survey module was fielded from 27 April-14 May 2018, yielding 295 complete and valid responses.Footnote 8 Our survey was also given to a random sample of non-investors from the general population, with 230 complete responses. The non-investor sample allows us to compare the ambiguity attitudes of investors and non-investors, which we do in Sect. 5.4. For our main results, we focus only on investors, as our goal is to assess ambiguity attitudes of investors in financial markets and to validate our measures by confirming that ambiguity attitudes are associated with investment decisions.

Summary statistics on the investor sample appear in Appendix Table 1. Education is an ordinal variable ranging from 1 to 6, where 1 indicates primary education and 6 indicates a university degree. Household Income averages €3193 per month. Household Financial Wealth consists of the sum of all current accounts, savings accounts, term deposits, cash value of insurance policies, bonds, mutual funds, stocks, options, and other financial assets such as loans to friends or family, all reported as of 31 December 2017. Mean (median) wealth was €142,357 (€84,489). We also have measures for Age, Female, Single, Number of Children living at home, Employed, and Retired. Appendix Table 1 shows that the average Dutch investor in financial markets is relatively old, male, and well educated. We note that this is the profile of a typical Dutch individual investor, as the DHS data is representative, and it is also in line with other studies of investors in the Netherlands (e.g., Cox et al., 2020; von Gaudecker, 2015).

2.2 Elicitation of ambiguity attitudes

We elicit ambiguity attitudes toward real-world investments following the method of Baillon et al. (2018b). The first source of ambiguity we evaluate is the return on the Amsterdam Exchange Index (AEX) over a 1-month period.Footnote 9 The method divides the possible outcomes of the AEX into three mutually exclusive and exhaustive events, denoted as \({E}_{1}, {E}_{2}, {\text{and}} {E}_{3}\):

\({E}_{1}=(-\infty , -4\%]\): the AEX index decreases by 4% or more;

\({E}_{2}=(-4\%,+4\%)\): the AEX index decreases or increases by less than 4%;

\({E}_{3}=[+4\%, \infty )\): the AEX index increases by 4% or more.

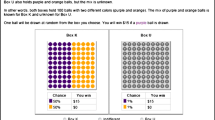

For each event \({E}_{i}\) separately, we elicit the respondent’s matching probability with a choice list, shown in Fig. 1 for event \({E}_{1}\) as an example. The matching probability \({m}_{i}\) is the known probability of winning p = \({m}_{i}\) at which the respondent is indifferent between Option A (winning €15 if Event \({E}_{1}\) happens) and Option B (winning €15 with known chance \(p\)).Footnote 10 We approximate the matching probability by taking the average of the probabilities p in the two rows that define the respondent’s switching point from Option A to B. For example, in Fig. 1 the matching probability is: \({m}_{1}=\frac{20\%+ 30\%}{2}=25\%\).

We also elicit a matching probability for the complement of each event:

\({E}_{23}=(-4\%, \infty )\): the AEX index does not decrease by 4% or more;

\({E}_{13}=\left(-\infty , -4\%\right] \cup [+4\%, \infty )\): the AEX index decreases or increases by 4% or more;

\({E}_{12}=(-\infty , +4\%)\): the AEX index does not increase by 4% or more.

The matching probability for the composite event \({E}_{ij}= {E}_{i}\cup {E}_{j}\) is denoted by \({m}_{ij}\), with \(i\ne j\). For example, Fig. 2 shows the choice list for the composite event \({E}_{23}\), with \({m}_{23}=55\%\).

A key insight of the method is that, for an ambiguity neutral decision maker, the matching probabilities of an event and its complement add up to 1 (\({m}_{1}+{m}_{23}=1)\), but under ambiguity aversion, the sum is less than 1 (\({m}_{1}+{m}_{23}<1\)). For example, the choices in Figs. 1 and 2 imply that \({1-m}_{1}-{m}_{23}=1-0.25-0.55=0.2\), indicating ambiguity aversion. Baillon et al. (2018b) define their ambiguity aversion index b, averaging over the three events, as follows:

with \(-1\le b\le 1.\) Here \({\overline{m} }_{s}=({m}_{1}+{m}_{2}+{m}_{3})/3\) denotes the average single-event matching probability, and \({\overline{m} }_{c}=({m}_{12}+{m}_{13}+{m}_{23})/3\) is the average composite-event matching probability. The decision-maker is ambiguity averse for \(b>0\), ambiguity seeking for \(b<0\), and ambiguity neutrality implies \(b=0\).

In practice, ambiguity attitudes have a second component apart from ambiguity aversion, namely a tendency to treat all uncertain events as though they had a 50–50% chance, which is called ambiguity-generated insensitivity or a-insensitivity (Abdellaoui et al., 2011; Tversky & Fox, 1995). For unlikely events, a-insensitivity leads to overweighting and more ambiguity-seeking choices. Empirical studies have shown that a-insensitivity is a typical feature of decision-making under ambiguity (Trautmann and van de Kuilen 2015; Dimmock et al., 2016a). Baillon et al. (2018b) define the following index to measure a-insensitivity:

with \(-2\le a\le 4.\) For ambiguity neutral decision-makers, \(a=0\), while \(a>0\) denotes a-insensitivity. Negative values, \(a<0\), indicate that the decision-maker is overly sensitive to changes in likelihood, implying underweighting of unlikely events.

In the neo-additive ambiguity model of Chateauneuf et al. (2007), index a is also a measure of the decision maker’s perceived level of ambiguity about a source, as long as \(0\le \alpha \le\) 1 (see Dimmock et al., 2015; Baillon et al., 2018a; and Online Appendix A). When \(a>1\) the respondent has violated monotonicity, as then the average matching probability of the single events exceeds the average for the composite events \(({\overline{m} }_{s}>{\overline{m} }_{c})\). We will later analyze how frequently such violations occur and how often index a falls within the boundaries \(0\le \alpha \le\) 1 where it can be interpreted as the level of perceived ambiguity.

The method of Baillon et al. (2018b) has two major advantages: first, risk preferences (both the utility and probability weighting function) cancel out in the comparison between Options A and B, so they do not need to be estimated to identify ambiguity attitudes (Dimmock et al., 2016a). Second, using events and their complements in the calculation of index b and a ensures that the unknown subjective probabilities drop out of the equation (Baillon et al., 2021). Accordingly, we can measure ambiguity aversion without knowing respondents’ subjective beliefs. This solves the important issue that, when observing a dislike of ambiguity, it is difficult to disentangle whether this is due to ambiguity aversion or pessimistic beliefs.

2.2.1 Implementation of the elicitation method in the CentERpanel

Our survey module for eliciting ambiguity attitudes started with one practice question in the same choice list format as Fig. 1, where the uncertain event for Option A was whether the temperature in Amsterdam at 3 p.m. one month from now would be more than 20 degrees Celsius. After the practice question, a set of questions followed for each investment asset: the AEX index, a familiar individual company stock, a foreign stock index (MSCI World), and a crypto-currency (Bitcoin). Six matching probabilities were measured for each investment separately, so that index b and a can be estimated. The order of the four sets of questions was randomized, as was the order of the six events. Our final ambiguity aversion measures are labelled b_aex, b_stock, b_msci, and b_bitcoin and our measures for a-insensitivity are labelled a_aex, a_stock, a_msci, and a_bitcoin. Furthermore, we define b_avg (a_avg) as the average of the four b-indexes (a-indexes).

Before beginning the questions about the individual stock, each respondent was first asked to name a familiar company stock; subsequently, that stock name was used in the six choice lists shown to the respondent. For those who indicated they did not know any familiar company stock, we used Philips, a well-known Dutch consumer electronics brand. For the well-diversified AEX Index and the MSCI World Index, the event \({E}_{1}\) (\({E}_{3}\)) represented a return of 4% (-4%) in one month. For the individual stock, the percentage change was set to 8% and forBitcoin to 30%, to reflect the higher historical volatility of these investments.Footnote 11

2.3 Elicitation of risk attitudes

The module also included four separate choice lists to measure risk attitudes (a screenshot is provided in Online Appendix B). The first risk attitude choice list elicited a certainty equivalent for a known 50% chance of winning €15 or €0 otherwise, based on a fair coin toss. The other three choice lists elicited a certainty equivalent for winning chances of €15 of 33%, 17%, and 83%, respectively, using a die throw. Respondents could win real money for the risk questions, and the order was randomized of the risk and ambiguity question sets in the survey.

Following Abdellaoui et al. (2011), we use index br for risk as a measure of Risk Aversion, and index ar for risk as a measure of Likelihood Insensitivity, which is the tendency to treat all known probabilities as 50–50% and thus overweight small-probability events. To estimate these measures, we assume a rank-dependent utility model with a neo-additive probability weighting function and a linear utility function. We do this for two reasons. First, these two risk attitude measures are conceptually related to index b for ambiguity aversion and index a for a-insensitivity (Abdellaoui et al., 2011). Second, utility curvature is often close to linear for small payoffs. We refer to Online Appendix C for more details about these measures, and for a robustness check using two non-parametric risk measures that do not rely on any model assumptions.

The Appendix Table 1 shows that on average investors were risk averse (mean > 0) but with strong heterogeneity, and about one third of the investors were risk seeking. Further, the Likelihood Insensitivity measure is positive for 85% of the investors, indicating a tendency to overweight small probabilities, in line with the findings of previous studies (see, e.g., Fehr-Duda & Epper, 2011 and Dimmock et al., 2021).

2.4 Real incentives

At the outset of the survey, each subject was told that one of his or her choices in the ambiguity and risk questions would be randomly selected and played for real money. Hence all respondents who completed the survey had a chance to win a prize based on their choices, and a total of €2,758 in real incentives was paid out. The incentives were determined and paid by CentERdata one month after the end of the survey, when the changes in the asset values were known. As panel members regularly receive payments for their participation, the involvement of CentERdata minimizes subjects’ potential concerns about the credibility of the incentives.

2.5 Financial literacy and asset ownership

Our survey module also collected data on financial literacy and asset ownership. Financial literacy is one of our key independent variables, as we aim to assess whether financial knowledge relates to ambiguity attitudes. To measure this, we use 12 questions from Lusardi and Mitchell (2007) and van Rooij et al. (2011), shown in Online Appendix C. Financial Literacy is the number of correct responses to the 12 questions (the average is 10.6; see Appendix Table 1).Footnote 12

We validate our ambiguity measures by examining whether they relate to the financial assets owned by the investors. Our survey module asked the panel members whether they currently invested in the familiar company stock they mentioned, in mutual funds tracking the MSCI World index, or any crypto-currencies such as Bitcoin. Invests in Familiar Stock is an indicator variable equal to one if the investor currently held the familiar company stock, which 30.2% did (see Appendix Table 1). Invests in Crypto-Currencies and Invests in MSCI World are equal to one if the investor held any crypto-currencies or funds tracking the MSCI World stock index, which was true for 2.4% and 1.4%, respectively. Finally, none of the investors in the sample owned funds tracking the domestic AEX stock index.

We note that even in the group of financial assets owners we label as “investors,” ownership of the four assets presented in our ambiguity survey is rather low, as most only own some mutual funds or bonds. Further, only half (55%) in the investor group could name a listed company stock with which they were familiar. All of this indicates that financial sophistication is not that high on average among Dutch retail investors, as is typically found in other household finance studies as well (see Gomes et al., 2021, for a review).

3 Results for ambiguity aversion

3.1 Descriptive statistics

Figure 3 shows the fraction of respondents who were ambiguity averse, neutral, and seeking, for the four sources of ambiguity: the familiar stock, the domestic stock market index (AEX), a foreign stock market index (MSCI World), and Bitcoin. To account for possible measurement error, we classify small values of index b that are not significantly different from zero as ambiguity neutral.Footnote 13 About 58% of the respondents were ambiguity averse, while 30% were ambiguity seeking, a pattern that is similar across the sources of financial ambiguity. Furthermore, ambiguity neutrality was less common (12%), implying that only few investors’ choices were consistent with the expected utility model. Our results confirm for real-world sources of uncertainty that ambiguity aversion is common, but not universal. These findings are comparable to earlier large-scale studies that used artificial sources, such as Dimmock et al. (2015), Dimmock et al., (2016a), and Kocher et al. (2018), showing that ambiguity seeking choices are not limited to Ellsberg urns.

Ambiguity Attitudes toward Financial Sources (Averse, Neutral and Seeking). This Figure shows the percent of investors who are ambiguity averse (b-index > 0, significant at 5%), ambiguity neutral (cannot reject b-index = 0), and ambiguity seeking (b-index < 0, significant at 5%) for the local stock market index (b_aex), a familiar company stock (b_stock), the MSCI World stock index (b_msci), and Bitcoin (b_bitcoin). The sample consists of n = 295 investors

Table 1 shows descriptive statistics for the b-indexes. Investors on average display higher ambiguity aversion toward the foreign stock index (0.21), compared to the domestic AEX index (0.17), the familiar individual stock (0.16), and Bitcoin (0.17), in line with the well-document home bias (French & Poterba, 1991). There was strong heterogeneity in ambiguity aversion between investors, as indicated by the high standard deviation of the b-indexes (about 0.5 on average). We use Hotelling’s T-squared statisticFootnote 14 to test the hypothesis that the mean b-index is equal for the four investments, which cannot be rejected at the 5% level (T2 = 7.65; p = 0.057). This implies that the mean level of ambiguity aversion does not depend strongly on the source of financial uncertainty. This is in line with Baillon and Bleichrodt (2015), who found that Dutch financial-economics students did not display source preference for the AEX over the Indian SENSEX index. Still, in our sample, ambiguity aversion for the familiar stock (0.16) is 34% lower compared to the MSCI World index (0.21; p = 0.009 for the mean difference), so investors on aggregate did display some source preference for the familiar stock over a foreign stock market index.

Figure 4 illustrates the relation between the ambiguity aversion measures for the four different investment sources at the subject level, shown with scatter plots. The correlations are all relatively strong, ranging between 0.62 and 0.74. This implies that if an investor had relatively high ambiguity aversion toward one specific financial source (e.g., the AEX index), he also tended to display high ambiguity aversion toward the other three investments. A factor analysis shows that the first factor explains 77% of the cross-sectional variation in the four ambiguity aversion measures, indicating that a single underlying variable is driving most of the variation.

Scatter Plots of Ambiguity Attitudes toward Different Financial Sources. This Figure shows scatter plots of the relationships between ambiguity aversion (the b-indexes) for different investments: the local stock market index (b_aex), a familiar company stock (b_stock), the MSCI World stock index (b_msci), and Bitcoin (b_bitcoin). The correlation (r) is shown above each scatter plot, with *, **, *** denoting significance at the 10%, 5% and 1%, respectively. The sample consists of n = 295 investors

3.2 Econometric model

Previous empirical studies by Borghans et al. (2009), Stahl (2014), and l’Haridon et al. (2018) found high levels of unexplained heterogeneity in ambiguity attitudes when measured with Ellsberg urns, which l’Haridon et al. (2018) interpreted as noise (e.g., errors or random responses). An open question is: to what extent does using real-world investments help to improve measurement reliability? In this section, we analyze the variation in ambiguity attitudes using econometric models, following the approach of Dimmock et al. (2015) and l’Haridon et al. (2018). We estimate a panel regression model, where the cross-sectional unit i is the individual respondent, and the “time dimension” s (or repeated measurement) comes from the four investments:

where \({b}_{i,s}\) is index b (ambiguity aversion) of respondent i toward source s, for the AEX index (s = 1), the familiar stock (s = 2), the MSCI World index (s = 3), and Bitcoin (s = 4).

The dummy variable \({d}_{s}\) is 1 for source s, and 0 otherwise. The constant \({\beta }_{1}\) represents ambiguity aversion for the AEX index, whereas the coefficients \({\beta }_{2}, {\beta }_{3}\) and \({\beta }_{4}\) for the familiar stock, MSCI World and Bitcoin represent differences in mean ambiguity aversion relative to the AEX index. A set of K observable individual characteristics \({X}_{i,k}\), such as age and gender, can also impact ambiguity aversion, with regression slope coefficients \({\gamma }_{k}^{b}\). The error term \({\varepsilon }_{i,s}^{b}\) is identically and independently distributed, with \(Var[{\varepsilon }_{i,s}^{b}]={({\sigma }_{\varepsilon }^{b})}^{2}\).

Random effect \({u}_{i}^{b}\) represents unobserved heterogeneity in ambiguity aversion, which is independent of the error term and uncorrelated between individuals, with \(Var[{u}_{i}^{b}]={({\sigma }_{u}^{b})}^{2}\). Further, random effect \({v}_{i,s}^{b}\) is known as a “random slope” (with \(Var[{v}_{i,s}^{b}]={({\sigma }_{v,s}^{b})}^{2}\)), as it changes the beta of the source dummy \({d}_{s}\). For example, \({v}_{i,2}^{b}\) captures individual heterogeneity in ambiguity aversion toward the familiar stock (s = 2), in addition to the heterogeneity in ambiguity aversion that affects all sources captured by the “random constant” \({u}_{i}^{b}\). Correlations between random effects (\({u}_{i}^{b}\),\({v}_{i,s}^{b}\)) are also estimated as part of the model.

The total variance of ambiguity attitudes can now be decomposed as follows:Footnote 15

with the four right-hand-side components representing variance explained by observed variables, unobserved individual heterogeneity in ambiguity attitudes that is common to all sources (\({u}_{i}^{b}\)), unobserved source-specific individual heterogeneity (\({v}_{i,s}^{b})\), and random errors (\({\varepsilon }_{i,s}^{b})\).

Our estimation approach is as follows: first, we estimate a model with only a random constant, and then random slopes are added to the model one at a time, followed by a test for their significance (a likelihood-ratio test).Footnote 16 Suppose \({v}_{i,2}^{b}\) (familiar stock) and \({v}_{i,4}^{b}\) (Bitcoin) are significant individually: then a model with both random slopes is estimated and tested as well. Finally, if an estimated random slope model turns out to have insignificant variance (\({\sigma }_{v,s}^{b}=0\)), or perfect correlation with the random constant (\(Cor({u}_{i}^{b},{v}_{i,s}^{b})\) = 1 or -1), then it is considered invalid and not used.

3.3 Analysis of heterogeneity in ambiguity aversion

The estimation results for index b, ambiguity aversion, appear in Table 2. The sample consists of all 295 investors. All values of index \({b}_{i,s}\) are included, even if the respondent violated monotonicity or made other errors, to show the impact of noise in the data. Model 1 in Table 2 includes only a random effect capturing individual heterogeneity in ambiguity aversion that is common to the four investments, which explains 69% of the variation. The constant in the model is 0.177 (p < 0.001), implying that investors on average are ambiguity averse toward the investments. Table 2 also reports the interclass correlation coefficient (ICC), which in our dataset captures the correlation of ambiguity aversion toward the four sources.Footnote 17 The ICC is 0.69, indicating that the correlation in ambiguity aversion for the four investments is high.

Model 2 adds dummies to allow for differences in the mean level of ambiguity aversion toward the four investments. The dummy for the MSCI World index is positive (p = 0.042), implying investors are more ambiguity averse toward foreign stocks. Random slopes for source-specific ambiguity aversion are added next, and a chi-square test (reported in Online Appendix E.1) shows that only adding a random slope for Bitcoin leads to an improvement of model fit (p < 0.001). Heterogeneity in ambiguity aversion toward Bitcoin (the random slope) explains 5% of the variation in Model 3, on top of the 70% captured by ambiguity aversion toward all four sources (random constant). Overall, the results imply that ambiguity aversion toward investments is driven mainly by one underlying factor, with high correlation between measurements for different sources.

3.4 Variation in ambiguity attitudes explained by individual characteristics

Model 4 in Table 2 adds observed individual socio-demographic variables such as age, gender, education, employment, income, and financial assets, which together account for about 6% of the variation. Ambiguity aversion toward investments is lower for younger investors (p = 0.008) and singles (p = 0.044). In Model 5, proxies for financial literacy and risk attitudes are added, which account for an additional 17% of the variation. Specifically, ambiguity aversion toward investments and risk aversion are positively related (p < 0.001). Ambiguity aversion is not related to financial literacy and also not lower for the familiar stock, suggesting limited competence effects (Heath & Tversky, 1991) in ambiguity aversion for investments.

All observed variables together explain 23% of the variation in ambiguity aversion in Model 4, while 52% is driven by unobserved heterogeneity (of which 5% specific to the Bitcoin source), and the remaining 25% is error. The relatively low percentage attributed to error suggests that measurement reliability is relatively high for ambiguity aversion toward investments.

4 Results for a-insensitivity and perceived ambiguity

4.1 Descriptive statistics

Panel B of Table 1 summarizes the a-index values. On average, a-insensitivity is high (0.79), implying that investors do not much discriminate between single and composite events, suggesting they perceive high ambiguity about their probabilities.Footnote 18 Further tests show that the mean of index a is significantly lower for the familiar stock (0.69).

Overall, the large majority of investors is insensitive to the likelihood of ambiguous events (a > 0) for the four investment sources, as shown in Panel A of Table 3. Hence, a-insensitivity is common, in line with earlier results for stocks in Fox et al. (1996) and Kilka and Weber (2001), but we can now confirm this in a large field study of investors, using measurements that control for beliefs and risk preferences. These findings are also in line with results for Ellsberg urns in Dimmock et al. (2015) and Dimmock et al., (2016a).

Panel A of Table 3 shows about two thirds of the a-index values fell in the range 0 to 1, such that they can be interpreted as the perceived level of ambiguity. About 25% of the respondents had a > 1 and thus violated monotonicity when looking at each investment separately, and 20% after averaging over the four investments (a_avg > 1). Earlier studies such as Li et al. (2018) and Dimmock et al., (2016a) found similar rates of monotonicity violations, as summarized in Sect. 5.4.2.

As we aim to interpret index a as a proxy for perceived ambiguity, from now on we exclude monotonicity violations (a > 1) and negative values of a, using pairwise deletion.Footnote 19 Panel B of Table 3 shows descriptive statistics for perceived ambiguity. On average, investors perceived less ambiguity about the familiar individual stock (0.64) than toward the foreign index (0.72), the domestic stock index (0.74), and Bitcoin (0.75).Footnote 20 We note that perceived ambiguity about investments is relatively high, at 0.71 on average. For comparison, in Dimmock et al., (2016a), perceived ambiguity toward Ellsberg urns was 0.35 on average.

There are several reasons why perceived ambiguity about investment can be expected to be high in our field study. First, the household finance literature shows that typical retail investors are not sophisticated, lack financial knowledge, and suffer from a host of biases (see Gomes et al., 2021 for a review). In line with this, even in the group of financial asset owners that we labelled as investors, only 55% could mention a familiar stock name, and less than half owned individual stocks. Second, the probabilities of the one-month investment return events are hard to estimate, as both the mean and standard deviation are time-varying (Lettau & Ludvigson, 2010), requiring quite a high level of financial sophistication. Finally, our choice lists do not reveal any information about the event probabilities; a respondent who always selects the middle row due to lack of knowledge or attention will end up with an a-index equal to one (100%).Footnote 21

Figure 5 shows scatter plots of the relations between perceived ambiguity toward the four financial sources. The correlations between the a-indexes are positive, ranging from 0.35 to 0.55, but lower than correlations between the b-indexes. A factor analysis indicates that the first component accounts for about 60% of the cross-sectional variation in the four measures. This implies that, for a given respondent, the perceived ambiguity toward different investments is related, but not strongly. Hence, the same investor may perceive relatively low ambiguity about a familiar stock, while concurrently perceiving high ambiguity about another investment.Footnote 22

Scatter Plots of Perceived Ambiguity about Different Financial Sources. This Figure shows scatter plots of the relation between perceived ambiguity (the a-indexes) for different investments: the local AEX stock market index (a_aex), a familiar company stock (a_stock), the MSCI World stock index (a_msci), and Bitcoin (a_bitcoin). The correlation (r) is shown above each scatter plot, with *, **, *** denoting significance at the 10%, 5% and 1%, respectively. The original sample consists of n = 295 investors, but values of index a that are negative or larger than 1 are excluded pairwise

4.2 Analysis of heterogeneity in perceived ambiguity

We now analyze the variance in perceived ambiguity, using a similar panel model as above:

where \({a}_{i,s}\) is index a (perceived ambiguity) of respondent i toward source s, with \(0{\le a}_{i,s}\le 1\). The constant \({\lambda }_{1}\) represents perceived ambiguity for the AEX index, whereas the coefficients \({\lambda }_{2}, {\lambda }_{3}\) and \({\lambda }_{4}\) for the familiar stock, MSCI World and Bitcoin represent differences in the mean relative to the AEX. The random effect and the error term are denoted by \({u}_{i}^{a}\) and \({\varepsilon }_{i,s}^{a}\), respectively, whereas \({v}_{i,s}^{a}\) represents random slopes (added if significant based on a likelihood ratio test).

Table 4 shows the estimation results. Model 1 includes only a random effect, capturing individual heterogeneity in perceived ambiguity that is common to the four sources, which explains 44% of the variation. Model 2 shows that investors perceive less ambiguity about the familiar stock, \({\lambda }_{2}\) = -0.091 (p < 0.001), relative to \({\lambda }_{1}\) = 0.718 for the other investments on average. The ICC is 0.45, implying that levels of perceived ambiguity toward the four different investments have a moderate positive correlation.

Next, including random slopes for the familiar stock and Bitcoin in Model 3 leads to a significant improvement of model fit (see Online Appendix E.2). Individual variation in perceived ambiguity toward the familiar stock explains 5% of the total variation, versus 4% for Bitcoin, on top of the 43% captured by general perceived ambiguity about all investments (random constant). Hence, whereas ambiguity aversion is mostly driven by one underlying preference variable, perceived levels of ambiguity tend to differ more depending on the specific source considered.

4.3 Variation in perceived ambiguity explained by individual characteristics

Model 4 adds observed individual socio-demographic variables to the model, which account for 8% of the variation (= 10–2%) in perceived ambiguity. Older investors perceive more ambiguity about investments (p = 0.005), whereas investors with higher education (p < 0.001) and more income (p = 0.026) perceive less ambiguity. Model 5 adds proxies for financial literacy and risk attitudes, which explain an additional 4%. Specifically, investors with better financial literacy perceive less ambiguity (p = 0.011). Further, perceived ambiguity is positively related to index ar for risk (p = 0.005), a proxy for likelihood insensitivity. All variables together explain 14% of the variation, whereas 38% is driven by unobserved heterogeneity, and 47% is error. Together, the results indicate that measurement reliability for perceived ambiguity is reasonable, although clearly lower than for ambiguity aversion. The likely reason is that index a is measured using differences in matching probabilities for composite events and single events (see Eq. (2)), and therefore more sensitive to errors and violations of monotonicity.

In Online Appendix F we repeat the analyses above using all values of index a, without screening out monotonicity violations and negative values: in that case the ICC is just 0.16 and measurement error accounts for 75% of the variation. The high level of noise implies that unfiltered a-insensitivity is strongly influenced by errors such as violations of monotonicity (a > 1). Further, screening out such violations leads to substantially better reliability for index a.

5 Validity of the measures

5.1 Relation with risk preferences, education and financial literacy

We assess the validity of the ambiguity measures by testing whether they relate to other variables in expected ways. For example, a priori we expect that ambiguity aversion is positively related to risk aversion, as that is the most common finding in previous studies summarized by Trautmann and van de Kuilen (2015) and Baillon et al. (2018c). Similarly, we expect that likelihood insensitivity (overweighting of small probabilities) is positively related to a-insensitivity (overweighting of unlikely events), and thus to perceived ambiguity. The results in Tables 2 and 4 confirm these relations (p < 0.01).Footnote 23

A priori, we also expect that investors with better financial knowledge and higher education perceive less ambiguity about the distribution of investment returns. Table 4 confirms both of these relations (p < 0.05), suggesting that more knowledge reduces the level of perceived ambiguity.Footnote 24 As an additional test, we also included a dummy for investors who named a specific stock they are familiar with (see Online Appendix G). As expected, investors naming a familiar stock perceive lower ambiguity about it (− 0.182; p < 0.001), compared to those answering questions about Philips.

The competence hypothesis of Heath and Tversky (1991) predicts that ambiguity aversion is stronger when the decision maker feels less competent or less knowledgeable about the source, suggesting a negative relation between financial literacy and ambiguity aversion. The coefficient in Table 2 is negative as expected, but the effect is too small to be statistically significant.Footnote 25 Further, investors who named a specific familiar stock also did not display significantly lower ambiguity aversion to it (see Online Appendix G). Still, investors were significantly more ambiguity averse toward the foreign MSCI stock index in Table 2 compared to the domestic AEX index, displaying home bias (French & Poterba, 1991). In addition, the difference in ambiguity aversion for the familiar stock (b = 0.156) and the MSCI index (b = 0.210) is 34% in relative terms, a sizeable difference (p = 0.009). All in all, we find that there are strong competence effects in perceived ambiguity (a-insensitivity), but less so in ambiguity aversion.

5.2 The relation to investments

Next, we evaluate whether ambiguity attitudes correlate with actual investment choices. Based on theory, we expect that investments in risky assets are negatively affected by ambiguity aversion (Dow & Werlang 1992) and by the level of perceived ambiguity (Boyle et al., 2012; Uppal & Wang, 2003). One caveat is that these relations also depend on how much ambiguity the investor perceives about all other available investment opportunities considered, for which we lack complete information. Further, many other unknown parameters also affect these relations, such as the investor’s subjective expectations about the return distribution of all available assets (mean, risk, skewness, and cross-correlations) and risk preferences. Although the exact signs are hard to predict, negative relations of index b and a with investments are what we expect to find on aggregate, based on earlier work by Dimmock et al., (2016a).

We estimate a pooled probit model for asset ownership, \({DI}_{i,s}\), a dummy variable indicating ownership of the familiar stock (s = 2), the MSCI World index (s = 3), and Bitcoin (s = 4):

where indexes \({b}_{i,s}\) and \({a}_{i,s}\) have slope coefficients \({\theta }_{1}\) and \({\theta }_{2}\). The constant \({\mu }_{2}\) represents average ownership of the familiar stock, whereas \({\mu }_{3}\) and \({\mu }_{4}\) indicate differences in ownership rates for MSCI World and Bitcoin. Investment in the AEX index (s = 1) is excluded, as noone in our sample invested in a fund tracking the AEX. The model includes K observable individual characteristics \({X}_{i,k}\) as control variables, with slope coefficients \({\theta }_{k+2}\), for \(k=\text{1, 2,}\dots , K\).

The results in Model 1 of Table 5 show that index a has a negative relation with investing in an asset (p = 0.005). The coefficient of index b is also negative, as expected, but only marginally significant (p = 0.060). As more controls are added in Models 2 and 3, we note that the effect of index \(a\) becomes smaller, probably because it is related to financial literacy and education.

To reduce the impact of measurement error, Models 4 to 6 of Table 5 use as independent variables the predicted values \({\widehat{b}}_{i,s}\) and \({\widehat{a}}_{i,s}\) of ambiguity aversion and perceived ambiguity from the estimated panel models in Tables 2 and 4 (Model 3).Footnote 26 Using the predicted values, we effectively remove the error terms \({\widehat{\varepsilon }}_{i,s}^{b}\) and \({\widehat{\varepsilon }}_{i,s}^{a}\) from index b and a. The sample in Models 4 to 6 is smaller, as it includes only observations with \(0\le {a}_{i,s}\le 1\), similar to Table 4. The results in Model 4 confirm that investors who perceive more ambiguity about an asset are less likely to invest in it, while ambiguity aversion is not significant.

Online Appendix E.3 shows results for several model specification tests. First, adding a random effect to the panel probit model (6) does not add value, because ownership of different investments is not very correlated. Second, allowing ambiguity aversion and perceived ambiguity to have a different effect on each investment does not improve the model fit either. Online Appendix H.5 also reports estimates using a probit model for each investment separately, as a robustness check. The results show that higher perceived ambiguity is negatively related to investing in MSCI World and Bitcoin, but it is not significant for the familiar stock. Further, investors with higher ambiguity aversion (index b) are less likely to invest in Bitcoin. Overall, these results show that the ambiguity attitude measures have significant correlations with actual investment choices.

5.3 Robustness tests

We performed several additional robustness checks for our main results, reported in Online Appendix H. First, we repeated the main analysis after screening out investors who make mistakes on the ambiguity choice lists, by preferring Option A or B on every row. The main effect is that the mean level of index b drops, as the most common error is selecting the unambiguous Option B on every row of the choice list; this results in high values of index b.Footnote 27 Apart from that, the measurement reliability (ICC), the percentage of variance explained by observable variables, and the correlates of ambiguity attitudes are similar to the full-sample results.

Second, we repeated the main analysis after excluding values of b and a from subjects with many violations of set-inclusion monotonicity. Third, we excluded 30 respondents who spent less than 10 minutes on the ambiguity survey module, to screen out subjects who devoted insufficient attention to the questions. The results in Online Appendix H are similar to the main findings in Tables 2 and 4. Overall, the three robustness checks show that the main results are not driven by respondents who made many mistakes, or who spent little time on the ambiguity questions.

5.4 Cross-sample comparisons

5.4.1 Comparison with the sample of non-investors

Table 7 in Appendix Table 2 shows summary statistics for index b and a in the group of 230 non-investors who owned no financial assets. In the columns “Mean” and “Median,”stars indicate whether the estimate for non-investors is significantly different from the value for investors in Table 1. Non-investors display significantly higher a-insensitivity to the investment sources on average (a_avg) compared to investors, as expected. By contrast, their average ambiguity aversion (b_avg) is not different from investors. This is in line with our earlier conclusion that competence effects are most pronounced in a-insensitivity, the cognitive component of ambiguity attitudes.

Online Appendix D provides more detailed analyses of the non-investor group, using the econometric model. In the non-investor group, heterogeneity in ambiguity aversion is driven by a single underlying factor, while random slopes for Bitcoin and other sources are not significant. Further, perceived ambiguity toward different investment is also largely driven by one underlying factor, explaining 48% of the variation. The means of ambiguity aversion and perceived ambiguity are also not different between sources. Hence, non-investors make less distinction in ambiguity between investments, most likely due to high unfamiliarity with all types of investments.

5.4.2 Comparisons with related ambiguity studies using Ellsberg urns

In this section we compare our results to Dimmock et al. (2016a, henceforth DKW), who measured index b and a with Ellsberg urns in a large sample of the Dutch population (the LISS panel). We restricted their original sample of 666 subjects to 126 investors owning some financial assets, using the same criteria for defining investors as in our own sample. Hence, both samples are representative for Dutch investors, but they differ in the sources of ambiguity: our study used investments, while DKW used Ellsberg urns.

First, we compare monotonicity violations. About 25% in our sample of investors violated monotonicity when looking at each investment separately, while in the DKW study with Ellsberg urns, 25.4% violated monotonicity. Similar rates are reported by Li et al. (2018), ranging from 14 to 28%, in a study using both artificial and natural sources. Thus, the rates of monotonicity violations we found are similar to those in previous ambiguity studies.Footnote 28

Regarding ambiguity aversion, the average of index b for Ellsberg urns in DKW is 0.14, similar to the average value of 0.18 that we find for investments. This suggests that the mean level of ambiguity aversion is not that source-dependent, also between artificial and real-world sources. However, perceived ambiguity toward the Ellsberg urn on average was 0.35 in DKW, considerably lower than the range of 0.64 to 0.75 for investments in Table 3. This reinforces our conclusion that perceived ambiguity is source-dependent, also between artificial and real-world sources.

The percentage of variation in ambiguity aversion explained by respondent characteristics in DKW was 2%, but the methodology used was different. A more direct comparison can be made to l’Haridon et al. (2018) and Dimmock et al. (2015), who also measured ambiguity attitudes with Ellsberg urns in large samples and applied panel regression models. In those studies, observed individual characteristics like gender and age explained at most 3% of the variation and correlations between repeated measurements of ambiguity aversion were rather low (ICC: 0.15–0.30). l’Haridon et al. (2018) argue that when most variation in ambiguity attitudes remains unexplained, it is likely driven by noise (mistakes, random responses, etc.). By contrast, in the present study using real-world sources, the ICC is 0.69 and up to 23% of the variation in ambiguity aversion is explained. This suggests that ambiguity aversion for natural sources measured with the Baillon et al. (2018b) method has higher reliability compared to traditional measures based on Ellsberg urns.Footnote 29

6 Conclusions

This paper measures ambiguity attitudes for relevant real-world sources of ambiguity in a large representative sample of investors, while controlling for unknown probability beliefs and risk preferences. One concern raised in the literature is that ambiguity measurements for artificial events such as Ellsberg urns are often noisy, and not related to individual characteristics and economic outcomes (see, e.g., Sutter et al., 2013; Stahl, 2014; and l’Haridon et al., 2018). Focusing on investments, our results show that the reliability of ambiguity aversion for natural sources is high, measured using the new method of Baillon et al. (2018b), as correlations between repeated measures of ambiguity aversion are in the 0.6 to 0.8 range. Individual characteristics also are significantly correlated with ambiguity attitudes: thus, demographics, income, wealth, financial literacy, and risk aversion explain 23% of the variation in ambiguity aversion and 14% of perceived ambiguity. Perceived ambiguity is lower among investors with better financial literacy and higher education, while ambiguity aversion is positively related to risk aversion. We also confirm that investors who perceive higher ambiguity about a particular asset are less likely to invest in it, and investors with higher ambiguity aversion are less likely to invest in Bitcoin, showing that the new measures of ambiguity attitudes are correlated with actual investment choices.

Our results further indicate that ambiguity aversion toward different investments is largely driven by one underlying subject-dependent preference variable, while perceived ambiguity tends to differ more depending on the specific source considered. Our results support theoretical models that treat ambiguity aversion as subject-dependent, and perceived ambiguity as both subject- and source-dependent (Ghirardato et al., 2004; Hurwicz, 1951; Klibanoff et al., 2005). Furthermore, we confirm for relevant real-world sources that ambiguity aversion is common but not universal (Kocher et al., 2018). A sizeable fraction of investors is ambiguity neutral or seeking, while for unlikely events, ambiguity seeking prevails.

Our evidence also confirms insensitivity to the likelihood of ambiguous events as a second component of ambiguity attitudes, displayed by the large majority of investors. Early studies on natural ambiguity by Fox et al. (1996) and Kilka & Weber (2001) already reported a-insensitivity for stocks that was source-dependent; we can now confirm this in a large field study, using the latest methodology that controls for both unknown beliefs and risk preferences.

In addition, our research contributes to the literature on portfolio choice under ambiguity, by providing insight on how to model ambiguity attitudes.Footnote 30 Our findings support theoretical work that has modelled ambiguity attitudes with a single ambiguity preference parameter, but with different levels of perceived ambiguity depending on the investment source (e.g., Uppal & Wang, 2003; Boyle et al., 2012; and Peijnenburg, 2018). Further, the result on heterogeneity in ambiguity aversion for investments can have asset pricing implications, as demonstrated by Bossaerts et al. (2010), and Dimmock et al. (2016b). In asset pricing models, ambiguity averse investors may drop out of the markets for highly ambiguous investments, leaving only ambiguity seeking and neutral investors to drive prices.

Our results suggest that ambiguity aversion is a source-independent trait, like a preference, and not much dependent on financial knowledge or education. As ambiguity aversion or seeking leads to sub-optimal decision making (people would be better off being ambiguity neutral), a relevant question is how can the negative influence of this trait can be reduced? A possible avenue is to provide decision makers more information to reduce the amount of uncertainty that they perceive about a source. The reason is that the impact of ambiguity aversion (or seeking) on decisions is lower when people perceive less ambiguity about a source. For example, in the best case, when people perceive no ambiguity, they maximize utility without being influenced by ambiguity aversion. As expected, we find that perceived ambiguity is lower among investors with higher financial literacy and better education, and perceived ambiguity is also lower for the familiar stock.

In sum, our results tentatively suggest that policies aimed at reducing perceived ambiguity appear to be more promising for stimulating equity market participation than are policies targeting ambiguity aversion (as find we competence effects for perceived ambiguity, but not for aversion). To confirm these conjectures, an interesting avenue for future research would be to reduce perceived ambiguity through an experimental intervention such as financial literacy training (see Nieddu & Pandolfi, 2021), and then to measure the subsequent impact on actual investments.

Notes

For example, consider a person who prefers to win $15 with a known chance of 50%, rather than receiving $15 if the Dow Jones index goes up next month. This choice could be the result of ambiguity aversion, but it might also be due to pessimistic beliefs about the chance of the Dow Jones index increasing.

Baillon et al. (2018b) measure ambiguity attitudes about a stock market index in a laboratory setting with students. Li (2017) measures ambiguity attitudes toward phrases in foreign languages among Chinese high school students. Li et al. (2019) measure ambiguity aversion about the actions of other subjects in a trust game.

In previous studies with Ellsberg urns, ambiguity aversion is typically the modal finding, but with strong heterogeneity between subjects and a sizeable fraction of ambiguity seeking responses. See van de Kuilen and Wakker (2011), Trautmann and van de Kuilen (2015), Dimmock et al. (2015), Dimmock, Kouwenberg & Wakker (2016a), Cubitt et al. (2018), and Kocher et al. (2018).

Additional information on the DHS is available at https://www.centerdata.nl/en/databank/dhs-data-access.

Asset ownership figures as of 31 December 2016 based on the October 2017 DHS survey of wealth and assets.

Out of 391 panel members who indicated that they invested in financial assets in the DHS as of December 2016 or December 2015, 308 completed the survey questions, for a response rate of 79%. Then we excluded 13 respondents who gave invalid responses when asked to name a familiar stock, leaving 295 valid responses.

The AEX is a stock market index composed of the shares of 25 companies traded on the Amsterdam stock market.

If the respondent clicks on B in a particular row, all answers in previous rows are set to A, and answers in all subsequent rows to B (i.e., multiple switching between A and B was disallowed). Assuming the event Ei has some positive probability between 0 and 1, choosing B in the first row of the list is a dominated choice, as is preferring Option A in the last row. Both choices (all A, or all B) were allowed, to check for respondent errors.

The percentage change was set based on the approximate volatility of the asset (15% for the AEX index and the MSCI World index, 40% for a typical individual stock, and 100% for Bitcoin in February 2018), to ensure that the events E1,E2 and E3 had non-negligible probabilities of occurring.

The average financial literacy score is relatively high because our sample consists of investors. In the subsample of 230 non-investors in the sample, the average score is only 8.6 out of 12 (see Online Appendix D).

We label b = 0 as ambiguity neutral in our paper, following the standard terminology in the literature that typically only measures the ambiguity aversion/seeking component. While less conventional, in models with a-insensitivity it might be better to reserve the term ambiguity neutral for the special case b = 0 and a = 0, which includes the subjective expected utility model.

Hotelling's T-squared statistic (T2) is a generalization of the paired samples t-test used in a multivariate setting with more than two related measurements.

For ease of exposition, the correlations between \({u}_{i}^{b}\) and \({v}_{i,s}^{b}\) are assumed to be zero in Eq. (4). In the estimated variance decompositions, any covariance between \({u}_{i}^{b}\) and \({v}_{i,s}^{b}\) is assigned 50–50% to the random constant and slope.

A model with a full set of 3 random slopes plus a random constant is too complex to estimate, given that there are only 4 repeated measurements and such an approach would give infeasible coefficients. For this reason, we add random slopes one at a time, and then test for their significance.

The interclass correlation coefficient is typically measured in a model without independent variables and defined as: ICC = \(Var\left[{u}_{i}^{a}\right]/(Var[{u}_{i}^{a}]+Var\left[{\varepsilon}_{i,s}^{a} \right],\) or the proportion of variance explained by the individual-level random effect.

In a lab experiment of Baillon et al. (2018b), the mean of index a for the AEX index was much lower (0.15–0.34) than in our sample (0.83). Their events were based on returns in the next 25 min, whereas we use a time period of one month to define the events. A reviewer pointed out that a lot more can happen in a month than in 25 min.

As a robustness check, in Online Appendix H we also report model estimation using all values of index a.

Hotelling’s T-squared test rejects the null hypothesis of equal means (p = 0.003). A follow-up analysis shows that the mean level of perceived ambiguity for the familiar stock is significantly lower than for the other three investments.

By contrast, Baillon et al. (2018a) used different choice lists such that switching on the middle row gave a matching probability of 35% for single events but 70% for composite events, resulting in an a-index of 0. The choice list design may also have provided some information about the objective event probabilities, reducing ambiguity.

Further, the correlations between index b and a are low, ranging from 0.11 to 0.32, indicating that ambiguity aversion and perceived ambiguity are two separate aspects of ambiguity attitudes (in line with evidence in Abdellaoui et al., 2011; Dimmock et al., (2015, 2016b); and Baillon et al., 2018b). The neo-additive model in Sect. 2.2.1 implies that the absolute value of b increases linearly as a function of index a. In the data, the average correlation between abs(b) and a is 0.47 (when 0 ≤ a ≤ 1).

Unfortunately, no direct measurement of cognitive ability is available in the DHS and in other CentERpanel surveys.

Conversely, Soo Hong et al. (2018) report that only high comprehension subjects display ambiguity aversion when the elicitation method presents ambiguity in a relatively complex way, whereas low comprehension subjects choose randomly and are close to ambiguity neutral. In Table 2, education does not have a significant relation with ambiguity aversion, suggesting that our choice lists are not too complex for the subjects.

Predicted values are based on fitted values of the random effects (\({\widehat{u}}_{i}^{b}\), \({\widehat{u}}_{i}^{a})\) and random slopes (\({\widehat{v}}_{4,s}^{b}\),\({\widehat{v}}_{2,s}^{a}\),\({\widehat{v}}_{4,s}^{a}\)) for each investor, as well as differences in means of index b and a between sources (\({\widehat{\beta }}_{s}\), \({\lambda }_{s}\)), from Model 3 in Tables 2 and 4.

Always selecting option B may also reflect extreme ambiguity aversion (MaxMin) and an extreme prior ([0,1]).

An exception is the study by Baillon et al. (2018a), who report low monotonicity violations rates ranging from 4 to 10%. The choice lists design in Baillon et al. (2018a) was slightly different from ours, such that subjects who switch in the middle of the list get a matching probability 35% for single events, but 70% for composite events. Always switching near the middle of the list without thinking gives an a-index close to 0 and no violations of monotonicity. Further, it may have also signaled that the composite event was more likely, possibly further reducing monotonicity violations.

The higher measurement reliability can also stem from the fact that the index b measure is an average over three events, reducing the impact of errors. Additional analyses in Online Appendix I show that averaging has limited impact on reliability, so the effect is mostly due to using real-world sources instead of artificial events.

References

Abdellaoui, M., Baillon, A., Placido, L., & Wakker, P. P. (2011). The rich domain of uncertainty: Source functions and their experimental implementation. American Economic Review, 101(2), 695–723.

Baillon, A., & Bleichrodt, H. (2015). Testing ambiguity models through the measurement of probabilities for gains and losses. American Economic Journal: Microeconomics, 7(2), 77–100.

Baillon, A., Bleichrodt, H., Keskin, U., & I’HaridonLi, O. C. (2018a). The effect of learning on ambiguity attitudes. Management Science, 64(5), 2181–2198.

Baillon, A., Bleichrodt, H., Li, C., & Wakker, P. P. (2021). Belief hedges: Measuring ambiguity for all events and all models. Journal of Economic Theory, 198, 105353.

Baillon, A., Huang, Z., Selim, A., & Wakker, P. P. (2018b). Measuring ambiguity attitudes for all (natural) events. Econometrica, 86(5), 1839–1858.

Baillon, A., Schlesinger, H., & van de Kuilen, G. (2018c). Measuring higher order ambiguity preferences. Experimental Economics, 21(2), 233–256.

Bianchi, M., & Tallon, J. M. (2019). Ambiguity preferences and portfolio choices: Evidence from the field. Management Science, 65(4), 1486–1501.

Borghans, L., Heckman, J. J., Golsteyn, B. H., & Meijers, H. (2009). Gender differences in risk aversion and ambiguity aversion. Journal of the European Economic Association, 7(2–3), 649–658.

Bossaerts, P., Ghirardato, P., Guarnaschelli, S., & Zame, W. R. (2010). Ambiguity in asset markets: Theory and experiment. Review of Financial Studies, 23(4), 1325–1359.

Boyle, P., Garlappi, L., Uppal, R., & Wang, T. (2012). Keynes meets Markowitz: The trade-off between familiarity and diversification. Management Science, 58(2), 253–272.

Cao, H., Wang, T., & Zhang, H. (2005). Model uncertainty, limited market participation, and asset prices. Review of Financial Studies, 18(4), 1219–1251.

Chateauneuf, A., Eichberger, J., & Grant, S. (2007). Choice under uncertainty with the best and worst in mind: Neo-additive capacities. Journal of Economic Theory, 137(1), 538–567.

Cox, R., Kamolsareeratana, A., & Kouwenberg, R. (2020). Compulsive gambling in the financial markets: Evidence from two investor surveys. Journal of Banking and Finance, 111, 105709.

Cubitt, R., van de Kuilen, G., & Mukerji, S. (2018). The strength of sensitivity to ambiguity. Theory and Decision, 85(3–4), 275–302.

Dimmock, S. G., Kouwenberg, R., Mitchell, O. S., & Peijnenburg, K. (2015). Estimating ambiguity preferences and perceptions in multiple prior models: Evidence from the field. Journal of Risk and Uncertainty, 51(3), 219–244.

Dimmock, S. G., Kouwenberg, R., Mitchell, O. S., & Peijnenburg, K. (2016b). Ambiguity aversion and household portfolio choice puzzles: Empirical evidence. Journal of Financial Economics, 119(3), 559–577.

Dimmock, S. G., Kouwenberg, R., Mitchell, O. S., & Peijnenburg, K. (2021). Household portfolio underdiversification and probability weighting: Evidence from the field. Review of Financial Studies, 34(9), 4524–4563.

Dimmock, S. G., Kouwenberg, R., & Wakker, P. P. (2016a). Ambiguity attitudes in a large representative sample. Management Science, 62(5), 1363–1380.

Dow, J., & da Costa Werlang, S. R. (1992). Uncertainty aversion, risk aversion, and the optimal choice of portfolio. Econometrica, 60(1), 197–204.

Easley, D., & O’Hara, M. (2009). Ambiguity and nonparticipation: The role of regulation. Review of Financial Studies, 22(5), 1817–1843.

Ellsberg, D. (1961). Risk, ambiguity, and the Savage axioms. Quarterly Journal of Economics, 75, 643–669.

Epstein, L. G., & Schneider, M. (2010). Ambiguity and asset markets. Annual Review of Financial Economics, 2(1), 315–346.

Fehr-Duda, H., & Epper, T. (2011). Probability and risk: Foundations and economic implications of probability-dependent risk preferences. Annual Review of Economics, 4(1), 567–593.

Fox, C. R., Rogers, B. A., & Tversky, A. (1996). Options traders exhibit subadditive decision weights. Journal of Risk and Uncertainty, 13(1), 5–17.

French, K. R., & Poterba, J. M. (1991). Investor diversification and international equity markets. American Economic Review, 81(2), 222–226.

Garlappi, L., Uppal, R., & Wang, T. (2007). Portfolio selection with parameter and model uncertainty: A multi-prior approach. Review of Financial Studies, 20(1), 41–81.

Ghirardato, P., Maccheroni, F., & Marinacci, M. (2004). Differentiating ambiguity and ambiguity attitude. Journal of Economic Theory, 118(2), 133–173.

Gilboa, I., & Schmeidler, D. (1989). Maxmin expected utility with non-unique prior. Journal of Mathematical Economics, 18(2), 141–153.

Gollier, C. (2011). Portfolio choices and asset prices: The comparative statics of ambiguity aversion. Review of Economic Studies, 78(4), 1329–1344.

Gomes, F., Haliassos, M., & Ramadorai, T. (2021). Household finance. Journal of Economic Literature, 59(3), 919–1000.

Guiso, L., Sapienza, P., & Zingales, L. (2008). Trusting the stock market. Journal of Finance, 63(6), 2557–2600.

Heath, C., & Tversky, A. (1991). Preference and belief: Ambiguity and competence in choice under uncertainty. Journal of Risk and Uncertainty, 4(1), 5–28.

Hurwicz, L. (1951). Some specification problems and applications to econometric models. Econometrica, 19(3), 343–344.

Keynes, J. M. (1921). A treatise on probability. Macmillan.

Kilka, M., & Weber, M. (2001). What determines the shape of the probability weighting function under uncertainty? Management Science, 47(12), 1712–1726.

Klibanoff, P., Marinacci, M., & Mukerji, S. (2005). A smooth model of decision making under ambiguity. Econometrica, 73(6), 1849–1892.

Knight, F. H. (1921). Risk, uncertainty and profit. Houghton Mifflin.

Kocher, M. G., Lahno, A. M., & Trautmann, S. T. (2018). Ambiguity aversion is not universal. European Economic Review, 101(1), 268–283.

Kostopoulos, D., Meyer, S., & Uhr, C. (2019). Ambiguity and investor behavior. SAFE Working Paper No. 297, available at SSRN: https://doi.org/10.2139/ssrn.3340851

I’Haridon, O., Vieider, F. M., Aycinena, D., Bandur, A., Belianin, A., Cingl, L., Kothiyal, A., & Martinsson, P. (2018). Off the charts: Massive unexplained heterogeneity in a global study of ambiguity attitudes. Review of Economics and Statistics, 100(4), 664–677.

Lettau, M., & Ludvigson, S. C. (2010). Measuring and modeling variation in the risk-return trade-off. In Y. Ait-Sahalia & L. P. Hansen (Eds.), Handbook of Financial Econometrics (Vol. 1, pp. 617–690). Elsevier Science.

Li, C. (2017). Are the poor worse at dealing with ambiguity? Journal of Risk and Uncertainty, 54(3), 239–268.

Li, C., Turmunkh, U., & Wakker, P. P. (2019). Trust as a decision under ambiguity. Experimental Economics, 22(1), 51–75.

Li, Z., Müller, J., Wakker, P. P., & Wang, T. V. (2018). The rich domain of ambiguity explored. Management Science, 64(7), 3227–3240.

Lusardi, A., & Mitchell, O. S. (2007). Baby Boomers’ retirement security: The role of planning, financial literacy and housing wealth. Journal of Monetary Economics, 54(1), 205–224.

Mukerji, S., & Tallon, J. M. (2001). Ambiguity aversion and incompleteness of financial markets. Review of Economic Studies, 68(4), 883–904.

Nieddu, M., & Pandolfi, L. (2021). Cutting through the fog: Financial literacy and financial investment choices. Journal of the European Economic Association, 19(1), 237–274.

Peijnenburg, K. (2018). Life-cycle asset allocation with ambiguity aversion and learning. Journal of Financial and Quantitative Analysis, 53(5), 1963–1994.

Potamites, E., & Zhang, B. (2012). Heterogeneous ambiguity attitudes: A field experiment among small-scale stock investors in China. Review of Economic Design, 16(2), 193–213.

Schmeidler, D. (1989). Subjective probability and expected utility without additivity. Econometrica, 57(3), 571–587.

Soo Hong, C., Ratchford, M., & Sagi, J. S. (2018). You need to recognise ambiguity to avoid it. Economic Journal, 128(614), 2480–2506.

Stahl, D. O. (2014). Heterogeneity of ambiguity preferences. Review of Economics and Statistics, 96(4), 609–617.

Sutter, M., Kocher, M. G., Glätzle-Rützler, D., & Trautmann, S. T. (2013). Impatience and uncertainty: Experimental decisions predict adolescents’ field behavior. American Economic Review, 103(1), 510–531.

Trautmann, S. T., & van de Kuilen, G. (2015). Ambiguity attitudes. In G. Keren & G. Wu (Eds.), The Wiley Blackwell Handbook of Judgment and Decision Making (pp. 89–116). Wiley-Blackwell.

Tversky, A., & Fox, C. R. (1995). Weighing risk and uncertainty. Psychological Review, 102(2), 269–283.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty, 5(4), 297–323.

Uppal, R., & Wang, T. (2003). Model misspecification and underdiversification. Journal of Finance, 58(6), 2465–2486.

van de Kuilen, G., & Wakker, P. P. (2011). The midweight method to measure attitudes toward risk and ambiguity. Management Science, 57(3), 582–598.

van Rooij, M., Lusardi, A., & Alessie, R. (2011). Financial literacy and stock market participation. Journal of Financial Economics, 101(2), 449–472.

von Gaudecker, H. M. (2015). How does household portfolio diversification vary with financial literacy and financial advice? Journal of Finance, 70(2), 489–507.

Acknowledgements

This project received funding from NETSPAR, Wharton School’s Pension Research Council/Boettner Center, and Labex Ecodex. For comments, the authors thank Stephen Dimmock, Peter Wakker, and seminar and conference participants at DIW Berlin, the Experimental Finance conference, the EEA meeting, and the PIER Research Workshop. This paper is part of the NBER’s Research Program on the Economics of Aging and the Working Group on Household Portfolios. The content is solely the responsibility of the authors and does not represent the official views of the institutions named above. In this article use is made of data of the DNB Household Survey administered by Centerdata (Tilburg University, The Netherlands). The replication material for the study is available at Harvard Dataverse, at https://doi.org/10.7910/DVN/PTGPYT.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendices

Appendix 1: Dataset

Appendix 2: Ambiguity attitudes of non-investors

Our survey was also given to a random sample of 304 non-investors, with 230 complete and valid responses (76%). Table 7 below displays summary statistics of the ambiguity attitudes of non-investors, index b and a. In the columns “Mean” and “Median”, stars (***, **, *) indicate whether the mean or median of the index is significantly different from the sample of investors in Table 1, at a significance level 10%, 5%, or 1%. More summary statistics of the non-investor sample and econometric analyses of their ambiguity attitudes are available in Online Appendix D.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Anantanasuwong, K., Kouwenberg, R., Mitchell, O.S. et al. Ambiguity attitudes for real-world sources: field evidence from a large sample of investors. Exp Econ (2024). https://doi.org/10.1007/s10683-024-09825-1

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10683-024-09825-1