Abstract

Using double auction market experiments with both human and agent traders, we demonstrate that agent traders prioritising low latency often generate, sometimes perversely so, diminished earnings in a variety of market structures and configurations. With respect to the benefit of low latency, we only find superior performance of fast-Zero Intelligence Plus (ZIP) buyers to human buyers in balanced markets with the same number of human and fast-ZIP buyers and sellers. However, in markets with a preponderance of agents on one side of the market and a noncompetitive market structure, such as monopolies and duopolies, fast-ZIP agents fall into a speed trap. In such speed traps, fast-ZIP agents capture minimal surplus and, in some cases, experience near first-degree price discrimination. In contrast, the trader performance of slow-ZIP agents is comparable to that of human counterparts, or even better in certain market conditions.

Similar content being viewed by others

1 Introduction

Automation and low-latency technology have fundamentally transformed trading in marketplaces. In financial markets, algorithmic trading accounts for more than 50% of all trades (Financial Times, 2018). One perceived advantage of an algorithmic trader (AT) is the speed with which it can act (cf. Baron et al., 2019). Flash crashes, which are becoming increasingly common, raise the question of whether fast trading is beneficial in every market situation. Thin (illiquid) and unbalanced markets, where ATs congregate on either the demand or supply side of the market, can experience perverse disruptions with ATs incurring significant losses. The first prominent flash crash of May 6th, 2 010 was triggered by a single large sell order executed by an AT. This resulted in a 6% drop in major equity indices (SEC, 2010).Footnote 1 Events like flash crashes suggest that traders acting with ultrafast speed can have detrimental effects in thin and unbalanced markets. In particular, the presence of low-latency ATs can contribute to the occurrence of flash crashes in markets, as experimentally demonstrated by Asparouhova et al. (2019).Footnote 2

We report on an exploratory study examining the effects of speed on allocative efficiency and trading performance in hybrid markets populated with human traders and ATs. One treatment variable is the speed at which the ATs act. In a hybrid session, the ATs are one of two implementations of Zero-Intelligence Plus (ZIP hereafter) agents, introduced by Cliff and Bruten (1997). All ATs are either slow-ZIP, which seeks to submit limit orders every five seconds on average, or fast-ZIP, which seeks to submit limit orders every second on average. A second treatment variable is market balance, the trader composition of the demand or supply sides of the market. We distinguish between balanced markets in which there is the same number of human and agent buyers and sellers and unbalanced markets in which one side of the market is populated by humans and the other side by a single type of AT. The third treatment variable is the market structure. We adopt three structures characterised by six sellers (Competitive), two sellers (Duopoly), and one seller (Monopoly) while maintaining a constant demand side of six buyers.

We find that the effects of speed on individual earnings and market performance are critically dependent on market structure and balance. Our first result is a partially successful replication of Das et al. (2001), who first demonstrated that fast-ZIP agents outperformed human traders in balanced competitive markets. We only find superior performance of fast-ZIP agents compared to human participants as buyers in a similar balanced competitive market setting.Footnote 3 In a second key result, in unbalanced monopoly and duopoly markets, we find that fast-ZIP sellers fail to exercise market power and generate perverse market outcomes in which prices resemble first-degree price discrimination against the agent traders, echoing flash crash incidences in financial markets. In contrast, as a third key result we find that slow-ZIP agents can outperform fast-ZIP agents, and in some cases even human traders under alternative market structures. Therefore, we provide evidence that slower speed/patience, even by mechanical design, can lead to better trading performance under certain market conditions.

To assess the robustness, and in an ad hoc attempt to identify the mechanisms driving our results, we assess human adaptation and the correlations between individual characteristics and documented treatment effects. It turns out that most of our results are robust to the inclusion of individual characteristics. In addition, as demonstrated by the original experimental market studies of Smith (1962), adaptation plays a vital role in the convergence toward competitive market equilibrium. We find that the inferior trading performance of fast-ZIP agents improves over time, although human traders over time still retain this superior trading performance under most market conditions and trader roles. We also find that slow-ZIP buyers initially outperform human buyers (in corresponding baseline treatments) in both unbalanced competitive and duopoly markets. However, estimated adaptation effects suggest these earning differentials fully dissipate by the end of the experimental sessions.

We contribute to the literature on trading heuristics in the continuous double auction (CDA). After the seminal studies by Smith (1962, 1981) which established that CDAs robustly generate competitive equilibrium outcomes even with small numbers of traders, subsequent efforts attempted to develop accurate models of trader behaviour in the CDA (e.g., Wilson, 1987, Friedman, 1991, Easley & Ledyard, 1993, and Gjerstad & Dickhaut, 1998). Gode and Sunder (1993) pivoted this literature with simulations demonstrating that Zero Intelligence (ZI) agents, who randomly make welfare-improving trade proposals, robustly realised social welfare maximizing allocations in a CDA.Footnote 4 Their study triggered the development of incrementally more sophisticated trading agents to establish the lower bounds of rationality, at which ATs could reproduce the trading patterns of humans or even outperform them. Cliff and Bruten (1997) developed a prominent type of ZIP agent by augmenting ZI agents with the ability to learn from market events. Gjerstad and Dickhaut (1998) developed a trading agent that determines its actions based on subjective belief functions of the probability of whether their bid or offer will be rejected; these functions are updated using observed market data. Both studies used computer simulations to demonstrate that their respective models are capable of generating price dynamics and allocative efficiency (the percentage of potential trade gains that are realised) similar to those generated in pure human experiments.

A subsequent wave of studies examined the interaction of human subjects and ATs in hybrid experiments and revealed asymmetries between the performance of humans and ATs. Das et al. (2001) first demonstrated that robot traders, following simple adaptive trading rules and reacting quickly, could outperform human traders while contemporaneously participating in a CDA. Gjerstad (2007) found that impatient versions of the Gjerstad and Dickhaut agents performed similarly to humans, and pace has an important influence on the performance of agents, with patient versions of these agents fairing the best. Our results extend those of Gjerstad by demonstrating that trading fast yields better results than trading slow primarily in balanced competitive markets, and it yields the opposite results in less competitive and unbalanced market structures.

Grossklags and Schmidt (2003, 2006) conducted hybrid experiments in a more complex environment with agents following an arbitrage strategy. However, they found that the interaction between the trading agents and human participants decreased efficiency. Cartlidge et al. (2012) and Angerer et al. (2023) conducted human-agent experiments in which they varied the speed of the agents. The former found that agents that act too quickly have negative effects on market efficiency, while the latter found that faster agents are more effective at harvesting arbitrage opportunities in fragmented asset markets, resulting in stronger adherence to a law of one price.

We proceed to the next section, laying out our experimental design. In section three, we present extensive data analysis which establishes our main results. We discuss the limitations of our study and potential drivers of our treatment effects in the penultimate section. Section five concludes.

2 Experimental design

2.1 Market environment and treatments

Our experimental design focusses on the participation in a CDA with a commonly induced market supply and demand pair (Smith, 1976) in all treatments, as depicted in Fig. 1. The market supply (demand) schedule consists of the private costs (values) of individual units for sellers (buyers). We choose an asymmetric pair of supply and demand schedules. In the competitive equilibrium of this configuration, buyers derive their profits fairly evenly across their traded units, while sellers derive a greater proportion of their profits from early traded units. Therefore speed, balance, and competitive factors can all impact buyers and sellers differently in this configuration.Footnote 5

In addition to a competitive market structure, we also employ “non-competitive” market structures, monopoly, and duopoly, to explore the effects of speed in market conditions with different levels of market power. The equilibrium characteristics of these three market structures are summarised in Table 1. The competitive equilibrium yields a lower equilibrium price compared to a monopoly and duopoly structure when market power is concentrated on the seller side. We choose a configuration in which the alternative solutions yield the same quantity traded as the competitive equilibrium. This allows us to focus on the agents’ ability to capture surplus through effective price negotiation rather than their ability to withhold units from the market.

Our experimental treatment design is presented in Fig. 2. There are 17 different treatments in total. The first part of the treatment label denotes the number (1, 2, or 6) and type (H–Human, FZ–Fast ZIP, SZ–Slow ZIP) of sellers, the second part denotes the number and type of buyers in the market. We establish baselines of pure human interactions for the market structures considered: competitive (6H-6H), duopoly (2H-6H), and monopoly (1H-6H). The balanced treatments (Balanced-FZ, Balanced-SZ) consist of 3 human buyers and sellers and 3 ZIP buyers and sellers. In these balanced treatments, each human trader has an agent 'clone' with the same schedule of reservation values/unit costs. For unbalanced markets, human traders and ZIP agents populate only one side of the market, either the supply or demand side. For unbalanced competitive markets, slow/fast-ZIP agents are either buyers (6H-6SZ, 6H-6FZ) or sellers (6SZ-6H, 6FZ-6H). Similarly, for unbalanced duopoly markets, slow/fast-ZIP agents represent either duopolists (2SZ-6H, 2FZ-6H) or buyers (2H-6SZ, 2H-6FZ), and for unbalanced monopoly markets, they represent either monopolists (1SZ-6H, 1FZ-6H) or buyers (1H-6SZ, 1H-6FZ). We conducted 8 sessions for each treatment, except for treatment 2H-6SZ, for which we conducted 9 sessions. In all treatments, the instructions state that there may be computer agents present in the market.

Experimental treatment design. This figure provides an overview of the treatments in the experiment. The first part of the acronym denotes the number of sellers and their type (H–Human, FZ–Fast ZIP, SZ–Slow ZIP), the second part denotes the number of buyers and their type (H–Human, FZ–Fast ZIP, SZ–Slow ZIP). In baseline treatments (6H-6H, 2H-6H, 1H-6H), traders consist of only human participants. In balanced competitive markets, traders consist of three human buyers and sellers, and either three fast-ZIP buyers and sellers (Balanced-FZ) or slow-ZIP buyers and sellers (Balanced-SZ). For unbalanced markets, humans and ZIP agents are either on the demand or supply side of the market

2.2 Trading agents

Cliff and Bruten (1997) developed ZIP agents which augment ZI traders with adaptive price expectations based on previously accepted or rejected bids and offers. In particular, agents start with an initial expectation of the transaction price pi based on their value or cost λi and a latent surplus demand (or profit margin) \(\mu :p_{i} (t) = \lambda_{i} (1 + \mu (t))\).

Price expectations are adjusted every time a bid or offer is submitted to the market and either accepted (resulting in a trade) or rejected (resulting in an addition to the order book). If a trade occurs at a price q that is higher than the expected price pi for unit i of a seller (buyer), the seller (buyer) increases (decreases) his profit margin μ. Otherwise, if q is less than pi, the seller (buyer) decreases (increases) his profit margin μ. The algorithm constrains the profit margin to be nonnegative. The size of the adjustment of the profit margin is proportional to a learning rate parameter β. We provide the complete specification of the ZIP algorithm in “Online Appendix B”.

As the ZIP algorithm uses reservation values in the formulation of bids or offers, we note that this generally leads to a bias, positive or negative depending upon the market supply and demand schedules, in the initial prices of any market period. Consequently, our analysis does not compare the relative performance of buyers versus sellers. Rather, we analyse paired individual differences between human participants and trading agents in balanced markets (differences are calculated for each human-agent pair with the same role and private values). For unbalanced markets, we fix the role and market setting to compare differences between human participants in the same role, trading against different types of ZIP agents or other human participants.

Our experimental treatments study two ZIP types defined by differential speed, i.e., fast-ZIP and slow-ZIP, related to their specific sleep–wake cycles. Agents are only allowed to submit or update their orders after a specific time interval. Fast-ZIP agents have a sleep/wake cycle that is a random variable with a uniform probability distribution for 0.75 to 1.25 s; slow-ZIP agents’ sleep/wake cycle is a random variable with a uniform probability distribution for 3.75 to 6.25 s. Following the implementation of fast- and slow-ZIP agents by Das et al. (2001), fast- and slow-ZIP agents operate on slightly different information sets; slow-ZIP agents do not react to rejected bids or offers, whereas fast-ZIPs do.

2.3 Trading process

Each participant participates in a single treatment and session, consisting of one market setting. Each market setting is run for 8 consecutive trading periods, each lasting 2.5 min. A participant is privately informed of the redemption value for buyers (or costs for sellers) vi for unit i, i = 1, …, 5 (i = 1, …, 15 for duopoly scenario, and i = 1, …, 30 for monopoly scenario), which is drawn from the specified supply and demand functions. The information about the private values/costs of the units is given to the trader at the beginning of each period. Each limit order and each transaction are valid for a single unit, and a crossing of bid and ask prices leads to a transaction price equal to the earlier submitted of the two. See “Online Appendix A” for the full set of instructions and screen captures of the software interfaces.

2.4 Experimental procedures and individual assessments

The experiment was conducted in the laboratory of the Centre for Behavioural and Experimental Research at Wuhan University and in accordance with its ethics guidelines. Participants were recruited using the Ancademy System (https://www.yanzhonglab.com/). A total of 746 students (mean age = 20.2; Gender: 436 females; 309 males, this data is missing for one subject) participated in 24 sessions. The participants were almost exclusively students from Wuhan University and enrolled in a broad cross-section of majors. An experimental session lasted no more than 120 min. The minimum payoff was a show-up fee of 20 Chinese Yuan. Depending on their trading behaviour in the experiment, the average payoff per participant was 82.7 Chinese Yuan (Min = 35.3, Max = 137.2).

To assess their individual characteristics, participants completed three tasks at the beginning of the experiment. The purpose of each respective task is to measure theory of mind, cognitive reflection, and reaction speed. Details of the tasks are provided in “Online Appendix C”. After completing the tasks, we provide participants with a hard copy of the instructions for market participation, which are also conveyed verbally by playing an audio recording to ensure consistency between sessions. The translated instructions can be found in “Online Appendix A”. We also conduct a trial period before the actual experiment to acquaint participants with the trading interface. We implemented the above-described market design using a market platform on the Ancademy System. The trading interface is depicted in Fig. A.4 in “Online Appendix A”. At the end of the experiment, the participants complete a questionnaire with general questions about their age, sex, and background. In addition, they are asked to provide their assessments of the market with respect to the number of active computer agents and the number of buyers and sellers. The questionnaire is not compulsory for subjects and can be found in “Online Appendix C”.

3 Results

In this section, we highlight the differential effects of speed in both balanced competitive markets and unbalanced markets. In balanced competitive markets, speed leads to superior performance of fast-ZIP buyers. In unbalanced markets, speed is detrimental to trading performance, as fast-ZIP agents are trapped in perverse market outcomes. Fast-ZIP agents make price concessions too quickly, and thus realise lower profits compared to other trader types.

3.1 Balanced competitive markets

3.1.1 Data visualisations for representative trading sessions

We start by presenting the trade and price dynamics for a representative session of the competitive baseline treatment and each of the two balanced competitive treatments. In Fig. 3a, the 6H-6H session exhibits variable trade prices at the beginning of the session and then converges towards the equilibrium price. In the Balanced-FZ session, Fig. 3b, market periods begin almost exclusively with ZIP-ZIP (ZZ) trades, followed by human–human (HH) and human-ZIP agent (HZ/ZH) trades. Like the 6H-6H session, prices become less variable during the session, but the convergence to the equilibrium price takes more periods. In Fig. 3c, the Balanced-SZ session shows different dynamics. HH trades are the most prevalent type at the beginning of each period, and their transaction prices are noticeably lower than the equilibrium price. Furthermore, trades between humans and agents in the Balanced-SZ session are more evenly distributed throughout the trading period compared to the Balanced-FZ session, implying that human traders and slow-ZIPs trade at a comparable speed. In contrast, the clustering of ZZ trades implies that fast-ZIPs operate at a comparably faster speed. This observation is in line with the “robot phase transition” phenomenon found by Cartlidge and Cliff (2013).

Example trading sessions for balanced competitive treatments. This array of figures presents trade prices across the 8 trading periods for three representative trading sessions of the baseline and the balanced competitive sessions. There is a representative subfigure for each of the three treatments: Humans only (6H-6H, a), Balanced-FZ (b), and Balanced-SZ (c). Triangles denote trades between two human traders (HH), dots denote trades between two ZIP agents (ZZ), and crosses denote trades between a human trader and a ZIP agent (HZ or ZH, with the first character denoting the type of seller and the second the type of buyer). Seller-initiated trades, i.e., a limit ask is accepted, are further indicated by a black open circle. a Trade prices of a representative 6H-6H trading session. b Trade prices of a representative Balanced-FZ trading session. c Trade prices of a representative Balanced-SZ trading session

Within a period, early prices in the Balanced-SZ and Balanced-FZ sessions are typically lower than the equilibrium price. The transaction prices then increase over the period. Closer inspection reveals that these early low prices are largely initiated by underpriced sell orders. These asks are more likely initiated by faster sellers; whose earnings inevitably suffer.

3.1.2 Trade prices, market efficiency, and earnings shares

Table 2 shows by treatment the average prices, average market efficiency (the ratio of total realised trader earnings and total earnings in equilibrium), and the realised earnings shares of each trader type: Human Sellers, Human Buyers, ZIP Sellers, and ZIP Buyers. Table 3 shows the results of the Wilcoxon signed rank test that compares the differences in the human and agent counterpart earnings at the session level. In all three treatments, market efficiency exceeds 98% on average, with nearly all potential gains from trade being realised. However, the distribution of earnings among trader types varies significantly between treatments. Human sellers achieve 24.15% of total earnings in the Balanced-FZ treatment, while only 18.99% in the Balanced-SZ treatment. In contrast, human buyers achieve a 7.24% earnings share in the Balanced-SZ treatment compared to the Balanced-FZ.

To compare the differences in human and their ZIP counterpart earnings at the session level, we present the results of nonparametric Wilcoxon signed rank tests in Table 3.Footnote 6 We find that fast-ZIP buyers perform better than human buyers (p value = 0.012), but fast-ZIP sellers perform worse than human sellers (p value = 0.012). Human buyers perform better than their slow-ZIP counterparts (p value = 0.025), while there is no significant difference between human sellers and slow-ZIP sellers (p value = 0.161).

3.1.3 Trading volume

Competitive equilibrium predicts that 50% of all trades will be between human and ZIP agents (HZ/ZH), and the remainder is evenly split between HH trades (trades between human traders) and ZZ trades (trades between ZIP agents). Table 4 provides detailed statistics on the percentage of trades between different types of traders.

In the Balanced-FZ treatment, approximately 35% of the trades are ZZ ones, likewise for HZ/ZH trades, and approximately 29% of the trades are HH ones. This leads us to reject the hypothesis that for a given trade the probability that both the buyer and the seller are human is 50% and that these probabilities are independent (Chi-square = 54.8, p value = 0.000). This bias towards HH and ZZ trades in the market is similar to the results of Cartlidge and Cliff (2013). In contrast, in the Balanced-SZ treatment HZ/ZH trades represent 48% of the conducted trades, and HH and ZZ trades represent around 26%. In fact, we cannot reject the hypothesis that for a given trade the probability that both the buyer and the seller are human is 50% and that these probabilities are independent (Chi-square = 0.7, p value = 0.715).

3.1.4 Individual trader performance

To allow further control for other determinants of earning performance, we analyse individual period earnings using regression analysis. The dependent variable is the paired difference between the earnings of a human participant (EarningsH) and his ZIP agent clone in the same role with the same private values (EarningsZ). By regressing the earnings difference on a specific role (Buyer or Seller) in a specific treatment (Fast or Slow ZIP), we are comparing the performance of human participants and ZIP agents in the same role. We use two sets of regressors:

-

1.

Treatment effects: the role and treatment of the paired human-agent difference, i.e. {Fast-Buyer, Slow-Buyer, Fast-Seller, Slow-Seller};

-

2.

Adaptation effects: The interaction effects of Period number and role in treatment variables.

The dependent variable (EarningsH – EarningsZ) is regressed on the treatment variables in Model (1), and additionally on adaptation factors in Model (2). We control for individual characteristics in Model (3) to account for a variety of skills relevant to the tasks in the experiment, in particular speed of reaction, cognitive reflection, and theory of mind. The results are presented in Table 5.

The regression results, reported in Table 5, establish the statistical significance of the differential trader-type performance while controlling for other potential confounding factors.Footnote 7 Human buyers perform worse by 35.8 (p value = 0.000) ECU compared to fast-ZIP buyers, while human sellers perform better than their fast-ZIP seller counterparts by 29.2 (p value = 0.012) ECU. In contrast, human traders generally outperform slow-ZIP agents in the role of both buyer and seller, by 18.4 (p value = 0.026) ECU and 7.8 (p value = 0.188) ECU, respectively. Taking individual characteristics and adaptation effects into account, we can see that the superior performance compared to slow-ZIP agents can be partially explained by the adaptation abilities of human traders. In contrast, the inferior performance of human buyers compared to fast-ZIP buyers remains significant after adjusting for adaptation effects and individual characteristics.

3.2 Unbalanced markets

3.2.1 Trade prices

In this section, we report the results for unbalanced markets organised by different levels of market structure: competitive, duopoly, and monopoly.

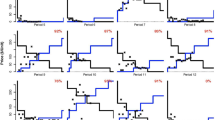

Figure 4 consists of a \(5\times 3\) array of time series figures depicting the intraperiod price dynamics by various treatments. The columns indicate market structure (competitive, duopoly, monopoly) and the rows indicate the trader population (human seller and fast/slow-ZIP buyers, all human traders, human buyers, and slow/fast-ZIP sellers). Each figure presents the time series of the average price dynamics for a treatment. The time series report the average price of the nth transaction in a period. This average is taken across all periods, markets, and sessions of the specified treatment. The number of transactions can vary between individual periods. Therefore, the latter elements in these average time series may include fewer observations, resulting in possibly less precise estimates of true mean prices. To convey this, we use two different marks in these plots. A dot marks the average price if the nth transaction occurs in 95–100% of all periods, and a cross marks the average price if that nth transaction occurs in 80–95% of all periods.

Average trade prices by treatment. This figure presents the average trade prices for unbalanced market treatments and treatments with humans only as benchmarks (see Table 1). The time series in the figures plot the average price of the nth transaction of a period, averaged across all periods, markets, and sessions. The dots (●) represent the average prices for transactions that occur in at least 95% of all periods, while the crosses (×) represent the average prices for the transactions that occur in 80–95% of all periods

The first column in Fig. 4 shows the average trade price dynamics in unbalanced competitive market treatments. The human baseline, the 6H-6H treatment, shows strong price convergence towards the competitive equilibrium price. The price dynamics in the slow-ZIP buyer 6H-6SZ treatment and slow-ZIP seller 6SZ-6H treatment are both similar to the 6H-6H treatment, albeit initial trade prices are lower for 6H-6SZ and higher for 6SZ-6H. In contrast, the 6H-6FZ treatment illustrates that fast-ZIP buyers perform worse than slow-ZIP buyers in the 6H-6SZ treatment, as they lose more surplus to human sellers who achieve prices close to the monopoly equilibrium price. Similarly, fast-ZIP sellers in the 6FZ-6H treatment perform worse than their slow-ZIP counterparts, as human buyers are able to achieve prices approaching first-degree price discrimination.

The second column in Fig. 4 shows the average trade price dynamics in unbalanced duopoly market treatments. When comparing human-only 2H-6H treatment with slow-ZIP buyer treatment 2H-6SZ, the price convergence towards the equilibrium price in the 2H-6SZ treatment is not as pronounced as in the 2H-6H treatment, with prices remaining above the competitive equilibrium. Slow-ZIP duopolists, in the 2SZ-6H treatment, generate a price dynamic similar to that of human duopolists in the 2H-6H treatment.

In contrast, the fast-ZIP seller treatment 2FZ-6H shows that fast-ZIP duopolists realise prices well below the competitive equilibrium. Fast-ZIP duopolists are not able to exert their market power like slow-ZIP agents. Similarly, human sellers achieve approximately first-degree price discrimination when trading with fast-ZIP buyers, capturing most of the potential market gains from exchange in the 2H-6FZ treatment.

The third column in Fig. 4 shows the average trade price dynamics in unbalanced monopoly markets. Human monopolists achieve the monopoly price for the first traded units on average when trading against human buyers, as shown in the figure for the 1H-6H treatment. We also observe some convergence towards the competitive equilibrium price for units traded later in the period. In treatment 1H-6SZ, human monopolists generate lower prices for units traded early against slow-ZIP buyers but are more successful in negotiating higher trade prices for units traded later. In treatment 1SZ-6H, patient slow-ZIP monopolists are more successful at maintaining higher prices compared to their human counterparts. Human monopolists generate prices that essentially reflect first-order price discrimination when trading against fast-ZIP buyers. Perhaps because of the absence of competition from another seller, fast-ZIP monopolists perform better than fast-ZIP duopolists. However, trade prices are still below the competitive equilibrium price and well below the monopoly price.

3.2.2 Surplus shares

In the following analysis, we examine how the noted price dynamics in varying unbalanced market structures result in performance differences, as measured by surplus shares. Our operational definition of a surplus share is the percentage of total potential gains from exchange captured. Table 6 shows the average trade prices, market efficiency, and the average buyer and seller surplus shares in the unbalanced treatments by market structure. The differences in surplus shares between fast-ZIP agents and the other two types are quite large and statistically robust, as we will report in Table 7, while the differences in surplus between human traders and slow-ZIP agents are statistically insignificant.

In the unbalanced competitive markets shown in Panel A, slow-ZIP sellers realise a smaller surplus share (43.47%) than human sellers (48.73%), while fast-ZIP sellers only realise a surplus share of 14.31%. In comparison, slow-ZIP buyers realise a larger surplus share (53.36%) than human buyers (50.22%), while fast-ZIP buyers only realise a surplus share of 17.47%, performing consistently worse compared to slow-ZIP agents in both the buyer and seller roles.

In the unbalanced duopoly markets shown in Panel B, the surplus share of slow-ZIP sellers (62.28%) is only slightly larger than human sellers (61.22%). The same holds for slow-ZIP buyers (41.48%) who also perform slightly better than human buyers (37.14%). Similar to the unbalanced competitive market environment, both fast-ZIP buyers and sellers realise smaller surplus shares relative to slow-ZIP and human participants.

In unbalanced monopoly markets shown in Panel C, slow-ZIP monopolists achieve a larger surplus share (86.00%) than human monopolists (76.21%), whereas slow-ZIP buyers achieve only a slightly smaller surplus share (17.41%) than their human counterparts (18.25%). Fast-ZIP buyers (1.95%) lose most of the surplus to the human monopolist (96.96%).

Similar to Table 3, we compare the earnings differences between human traders and their ZIP counterparts at the session level using nonparametric Wilcoxon rank sum tests for unbalanced markets in Table 7. We show that both in the buyer and seller roles, both human traders and slow-ZIP agents significantly outperform fast-ZIP agents at the 1% level. The differences between human and slow-ZIP agents are all statistically insignificant, and the sign varies by the market structure.

3.2.3 Individual trader performance

To provide a more nuanced look at the factors behind performance differences, we further analyse individual period earnings in unbalanced markets using regression analysis. We partition the unbalanced market data by trader role (Buyers, Sellers) and type of trader (human, slow-ZIP, fast-ZIP). We focus on a comparative analysis of human trader performance across treatments, with the treatment effects denoting the opponent type. We regress the aggregate period earnings of human sellers (buyers), in other words, realised producer (consumer) surplus, in a session on the treatment variables slow-ZIP and fast-ZIP (Model (1) and (4)) and adaptation effects (Model (2) and (5)) and further include individual characteristics in Model (3) and (6). Analysing human buyers and sellers separately across different treatments allows us to illustrate the differential treatment effects for buyers and sellers. The intercept reflects the baseline 6H-6H treatment.

Table 8 presents these regression results for unbalanced competitive markets. In the exclusively human subject, baseline aggregate seller (buyer) earnings are slightly less (more) than theoretical competitive equilibrium benchmarks. See the estimated values of the intercept for Models (1), (2), (4), and (5). When slow-ZIP sellers interact with human buyers, estimated Models (4)–(6) show no statistically significant differences in their respective average aggregate earnings. However, when slow-ZIP buyers interact with human sellers, the slow-ZIP buyers’ average earnings are marginally significantly higher, − 264.8 ECU per period, than their corresponding human buyers according to Model (2). However, the estimated time adjustment (slow-ZIP*Period) shows a significant decay in this advantage of 53.7 ECU per period.

The results are more definitive and negative for fast-ZIP buyers. Focussing on Model (2), human sellers aggregately initially earn 1804.6 ECU per period when interacting exclusively with fast-ZIP buyers. Recall that the total potential gain for the total market is 2110 ECU of which the sellers earn 1060 ECU in the competitive equilibrium. There is a significant decay of this human seller (fast-ZIP*Period) advantage of -50.4 ECU per period. Still, at the end of an eight-period experimental session, only a fraction of the excess human seller earnings has dissipated. In the treatment that reverses the roles, 6FZ-6H, Model (5) shows that these estimated effects still hold. Human buyers’ initial average period earnings are 1955.5 ECU—essentially first-degree price discrimination levels of earning—with an estimated decay rate of − 41.8 ECU per period.

Turning our attention to the noncompetitive market treatments, we start with Table 9 which presents the regression results for aggregate human trader earnings in duopoly markets. Model (1) establishes the statistical significance that the earnings of human duopolists are higher when trading against fast-ZIP buyers versus human buyers (p value = 0.000), and weakly lower when trading against slow-ZIP buyers (p value = 0.534). Models (2) and (3) reveal that, in pure human interactions, there is a breakdown in successful duopoly coordination as earnings erode across periods. However, the estimated coefficient on the interaction of the Period*fast-ZIP factor is essentially the negative of the estimated Period coefficient. This indicates that excess human seller earnings do not dissipate when interacting with fast-ZIP buyers. In contrast, when trading against slow-ZIP agents, human earnings increase (reflected in a positive value of Period + slow-ZIP*Period coefficient estimate), suggesting an adaptation effect by human traders leading to higher prices over time.

The performance differentials of alternative trader types in the role of duopolists selling to human buyers are found in Models (4)–(6) of Table 9. Human and slow-ZIP duopolists earn statistically the same amounts, between the Duopoly and Competitive predicted levels, when trading with human buyers. Furthermore, Model (5) reports that these profits slowly decay at similar rates across periods. Perhaps the most salient result is the exploitation of the fast-ZIP duopolists by human buyers. As seen in Models (4) and (5), human buyers are earning more than 1500 of the 2110 potential gains from exchange when trading against fast-ZIP sellers. The predicted market power of the Duopoly fails perversely, the buyers’ predicted earnings are 240. As Models (5) and (6) show, there is a minor—but significant—recovery of earnings over the periods by the fast-ZIP duopolists.

Table 10 presents the regression results on the determinants of human trading performance in monopoly markets. Model (1) shows that human monopolists on average earn 1608 ECU when trading with human buyers, less than the predicted monopoly earnings of 1870 ECU. However, human monopolists on average earn 2046 ECU when trading with fast-ZIP buyers, which is nearly 97% of the 2110 ECU potential gains from exchange. When trading against slow-ZIP buyers, human monopolists earn 108.2 ECU more earnings on average than against human buyers. Models (2) and (3) incorporate potential adaptation factors of which the significant effect is for the human monopolists to increase their earnings across periods when trading with both fast-ZIP and slow-ZIP buyers.

Models (4)–(6) of Table 10 explore the earnings of human buyers when trading with different types of monopolist traders. Model (4) shows that when trading with a human monopolist, human buyers earn 385 ECU on average versus the theoretical benchmark of 240 ECU. However, when trading with a slow-ZIP monopolist, the human buyers’ earnings are lower and essentially at the theoretical benchmark levels. The human buyers, in stark contrast, are much more effective when trading with a fast-ZIP monopolist earning essentially 1,380 ECU on average. When allowing for adaptation effects in Models (5) and (6), we find this ranking of human buyer earnings is robust. We further find a moderate upward trend in earnings for human buyers when trading with either a human or a slow-ZIP monopolist, and a slight—but significant—downward trend when trading with a fast-ZIP monopolist.

4 Discussion

In this section, we speculate on the underlying mechanisms driving our observed treatment effects and provide clarity on whether some treatment effects are driven by the asymmetry in the market demand and supply schedules or by market power differentials arising from the noncompetitive environment resulting from duopoly/monopoly rather than duopsony/monopsony settings.

We propose two possible channels for the observed treatment effects. The first channel is the latency differences between slow- and fast-ZIP agents. Our results demonstrate that speed benefits ZIP agents in balanced competitive markets but is detrimental in unbalanced markets and rather disastrous in unbalanced and non-competitive markets. Das et al. (2001) found speed gave fast-ZIP agents an advantage in two ways, executing on outlier limit orders and more often holding a limit order that partially defined the bid-ask spread when an outlier market order is placed. In unbalanced markets, the latter tendency to generate new outstanding bids or asks leads to quicker build-up on the side of the order book dominated by fast-ZIP agents. Bossaerts and Plott (2008) refer to the pair limit order counts in the two order queues as the “jaws” of the market and note that prices adjust against the side of the market with the longer jaw. When the market is also non-competitive, the lack of sophistication and strategic behaviour further exasperates this dynamic.

A second potential channel is the variation within the group of human traders with respect to skill, sophistication, and strategic thinking. There has been ample evidence of differences in human trading behaviour against computerised agents compared to other human traders. We found that participants in our experiment have differential reaction times in our reaction time task, and faster reaction times are positively correlated with performance in non-competitive and unbalanced competitive markets. In particular, quick reaction times benefit human buyers in duopoly and monopoly markets. Previous studies, e.g., Bruguier et al. (2010) and Corgnet et al. (2018), have found that eye test scores for theory of mind are positively correlated with individual earnings in experimental asset markets. We observed mostly opposite results, high eye test scores are negatively correlated with earnings for those in competitive situations, except for the unbalanced competitive treatments. Theory of mind, which the eye tests attempt to measure, appears to work against humans, except when there is an opportunity to gain through tacit cooperation. Finally, we surprisingly found that CRT scores do not correlate with the market earnings of human participants, in contrast to the previously documented positive correlation in asset markets (e.g., Bosch-Rosa et al., 2018; Corgnet et al., 2015; Noussair et al., 2016). However, we do observe that CRT scores are positively correlated with the ability to detect when a ZIP agent is participating in the market. How this multi-dimension human trader variation modulates outcomes in hybrid markets is a question whose answer is just beginning to be explored. We believe an inductive theory can be developed from experiments that systematically sort for these characteristics, inherent in the one human versus populations of algorithmic traders experiments of Tai et al. (2018).

Next, we provide an assessment of whether our asymmetric results for the buyer and seller roles arise from the generalised distribution of market power or inherent role differences. To assess this attribution, we further assess the robustness of our results by conducting simulation studies using alternative supply–demand schedules and market power distributions.Footnote 8 We run these simulations using the same protocols and software as the original experiment but replacing human traders with ZIP agents. In every scenario and every market structure, we conduct three different simulation treatments: a treatment exclusively with fast-ZIP traders, a treatment with fast-ZIP sellers and slow-ZIP buyers, and a treatment with slow-ZIP sellers and fast-ZIP buyers. We conduct simulations for two scenarios: In Scenario (1), we horizontally flip the market supply and demand schedules around the competitive equilibrium price whilst retaining relative market power between buyers and sellers. In Scenario (2), in addition to flipping the supply–demand curves, we also reallocate market power from the supply to the demand supply side by holding the number of sellers constant at six and restricting the number of buyers to two (in an effective duopsony setting) and one (in a monopsony setting), respectively.

For Scenario (1), the simulations demonstrate that our results are robust if the market power remains with the sellers, and we only change the supply/demand schedules. For Scenario (1), with the flipped supply and demand schedules, slow buyers consistently outperform their faster counterparts in all three market structures (Competitive: 88.66% vs. 53.65%; Duopoly: 73.86% vs. 27.25%; Monopoly: 49.97% vs. 14.67%), with differences significant at the 1% level. Similarly, slow sellers achieve near first-degree price discrimination when trading against fast buyers and outperform their faster counterparts in the competitive (69.77% vs. 44.83%) and duopoly market structure (88.78% vs. 72.59%), with both differences statistically significant at the 1% level.

One exception applies for fast-ZIP and slow-ZIP monopolist sellers (1FZ-6FZ vs. 1SZ-6FZ) as the fast-ZIP monopolist captures on average more surplus (85.33%) than the slow-ZIP monopolist (82.45%), which is statistically significant at the 5% level. When comparing prices from the two treatments, the slow-ZIP monopolist seller achieves higher prices (345) on average than his fast-ZIP counterpart (307). The 1SZ-6FZ subgraph in Fig. D.2 illustrates that the slow-ZIP monopolist uses his market power effectively. However, the trading volume is lower in the 1SZ-6FZ treatment compared to the 1FZ-6SZ treatment, leading to slow-ZIP monopolists performing worse than fast-ZIP monopolists, due to their average failure to trade all tradable units. Therefore, we generally conclude that our results on the superior performance of slow-ZIPs compared to fast-ZIPs under unbalanced market structures hold for alternative supply–demand schedules in Scenario (1).

In Scenario (2), the market power shifts from sellers to buyers in an equivalent duopsony/monopsony scenario and the price dynamics are flipped, resulting in lower trade prices compared to the competitive equilibrium in most market structures. Slow-ZIP sellers consistently realise greater surplus than fast-ZIP sellers for all three market structures (Competitive: 69.77% vs. 44.83%; Duopsony: 63.84% vs. 15.89%; Monopsony: 42.11% vs. 6.98%), with all differences statistically significant at the 1% level. Similarly, slow buyers outperform their faster counterparts in the competitive (88.66% vs. 55.65%) and duopsony market structure (97.32% vs. 83.75%), with both differences statistically significant at the 1% level. One exception is again the monopsony setting, where the fast-ZIP monopolist buyer captures more surplus (85.29%) than the slow-ZIP monopolist buyer (93.02%), (6FZ-1FZ vs. 6FZ-1SZ), which is statistically significant at the 1% level. This is again due to the low trading volume in the 6FZ-1SZ treatment, similar to the exception in Scenario 1. Therefore, we illustrate that speed traps are not a particular phenomenon specific to buyers or sellers, but that speed can be detrimental to traders with greater market power. However, the simulation analysis revealed one caveat of our results that the lower trading volume of slow-ZIPs can still lead to inferior performance compared to fast-ZIPs, despite more favourable transaction prices.

5 Concluding remarks

In this work, we conducted laboratory experiments to demonstrate potential high-speed pitfalls for trading performance. While previous research has focused on the benefits of speed, we challenge the notion that speed is always good for trader performance and present alternative market structures in which speed can be disadvantageous. In particular, we show that speed can be beneficial in balanced markets and can lead to superior performance, depending on the role of the fast traders, but it can be detrimental in unbalanced and noncompetitive market conditions. Our results provide insight into the role of speed in different market conditions and demonstrate the pitfalls of speed for trader roles with more market power.

How might these insights apply in current markets? In a high-frequency world where speed is crucial for trading performance and co-location services and optic fibre connections are commonly used to shave microseconds off latency, this result is particularly relevant to highlight the pitfalls of speed in certain market conditions. Our study highlights the risks of speed and presents example market conditions in which speed can trap traders into perverse market outcomes. These extreme market conditions can be found during crashes, such as the Flash Crash on May 6, 2010, when a sell order executed by an algorithmic trader triggered a large sell pressure, leading to a 9% plunge in the Dow Jones Industrial Index (cf. Kirilenko et al., 2017). During these market conditions, high-speed algorithmic traders can be especially vulnerable as they may be incapable of adapting to non-standard market conditions. These considerations also highlight the importance of appropriate risk management for AT systems.

Notes

More recent prominent examples of flash crashes include the Japanese Yen in foreign exchange markets (Bloomberg, 2019; Reuters, 2019) where liquidity droughts around Japanese holidays and positional skews of retail traders can lead to thin (illiquid) and unbalanced markets and ideal conditions for flash crashes to occur.

Unlike Asparouhova et al. (2019), we do not address the important phenomenon of the endogenous decisions to adopt robot traders and on which side of the market to operate, rather we study the conditional impacts of such decisions.

Our findings thus suggest that the results of Das et al. (2001) are knife-edge and crucially rely upon factors such as market balance and structure, as well as potentially upon human trader characteristics.

In these ZI simulations, while the allocation of units generally coincides with the competitive equilibrium one, prices only approached equilibrium ones during the latter stages of trading activity within trading periods as a result from the probabilistic Marshallian order of trades induced by the ZI strategies.

We provide evidence that our results hold for an alternative supply–demand configuration in the simulation results in “Online Appendix D”.

Using the session as the unit of observation is a cautious approach to rule out possible dependencies of within session observations.

The reported p-values are calculated from hypothesis tests of zero effect applying the Wild cluster bootstrap-t procedures proposed by Cameron et al. (2008). This approach has been shown to obtain more accurate cluster-robust inferences when there are few (five to thirty) clusters.

We thank a reviewer for suggesting this exercise. We report greater detail on this exercise in “Online Appendix D” and provide the simulation results and codes in the replication materials: https://osf.io/a8zem/.

References

Angerer, M., Neugebauer, T., & Shachat, J. (2023). Arbitrage bots in experimental asset markets. Journal of Economic Behavior and Organization, 206, 262–278.

Asparouhova, E. N., Bossaerts, P. L., Rotaru, K., Wang, T., Yadav, N., & Yang, W. (2019). Humans in charge of trading robots: The first experiment. In Working Paper.

Baron, M., Brogaard, J., Hagströmer, B., & Kirilenko, A. (2019). Risk and return in high-frequency trading. Journal of Financial and Quantitative Analysis, 54(3), 993–1024.

Bloomberg. (2019). Flash-crash risks are back as Japan shutters for six-day holiday. Retrieved December 11, 2020, from https://www.bloomberg.com/news/articles/2019-12-30/flash-crash-risks-are-back-as-japan-shutters-for-six-day-holiday

Bosch-Rosa, C., Meissner, T., & Bosch-Domènech, A. (2018). Cognitive bubbles. Experimental Economics, 21, 132–153.

Bossaerts, P., & Plott, C. R. (2008). From market jaws to the Newton method: The geometry of how a market can solve systems of equations. Handbook of Experimental Economics Results, 1, 22–24.

Bruguier, A. J., Quartz, S. R., & Bossaerts, P. (2010). Exploring the nature of ‘trader intuition.’ Journal of Finance, 65, 1703–1723.

Cameron, A. C., Gelbach, J. B., & Miller, D. L. (2008). Bootstrap-based improvements for inference with clustered errors. The Review of Economics and Statistics, 90(3), 414–427.

Cartlidge, J., & Cliff, D. (2013). Evidencing the ‘robot phase transition’ in human-agent experimental financial markets. In Proceedings of the international conference on agents and artificial intelligence.

Cartlidge, J., Szostek, C., Luca, M. De & Cliff, D. (2012). Too fast too furious: Faster financial market trading agents can give less efficient markets. In Proceedings of the international conference on agents and artificial intelligence.

Cliff, D., & Bruten, J. (1997). Zero is not enough: on the lower limit of agent intelligence for continuous double auction markets. HP Laboratories Technical Report HPL Vol. 28.

Corgnet, B., Desantis, M., & Porter, D. (2018). What makes a good trader? On the role of intuition and reflection on trader performance. Journal of Finance, 73(3), 1113–1137.

Corgnet, B., Hernán-González, R., Kujal, P., & Porter, D. (2015). The effect of earned versus house money on price bubble formation in experimental asset markets. Review of Finance, 19(4), 1455–1488.

Das, R., Hanson, J. E., Kephart, J. O., & Tesauro, G. (2001). Agent-human interactions in the continuous double auction. In Proceedings of the international joint conferences on artificial intelligence (IJCAI) vol. 2 (pp. 1169–176).

Easley, D., & Ledyard, J. O. (1993). Theories of price formation and exchange in oral double auctions. The Double Auction Market: Institutions, Theories and Evidence, Santa Fe Institute Studies in the Sciences of Complexity (pp. 63–97).

Financial Times. (2018). How high-frequency trading hit a speed bump. Retrieved January 25, 2021, from https://www.ft.com/content/d81f96ea-d43c-11e7-a303-9060cb1e5f44

Friedman, D. (1991). A simple testable model of double auction markets. Journal of Economic Behavior and Organization, 15, 47–70.

Gjerstad, S. (2007). The competitive market paradox. Journal of Economic Dynamics and Control, 31, 1753–1780.

Gjerstad, S., & Dickhaut, J. (1998). Price formation in double auctions. Games and Economic Behavior, 22, 1–29.

Gode, D. K., & Sunder, S. (1993). Allocative efficiency of markets with zero-intelligence traders: Market as a partial substitute for individual rationality. Journal of Political Economy, 101, 119–137.

Grossklags, J., & Schmidt, C. (2003). Artificial software agents on thin double auction markets: a human trader experiment. In Proceedings of the IEEE/WIC international conference on intelligent agent technology (IAT) 400–407 (IEEE Comput. Soc, 2003).

Grossklags, J., & Schmidt, C. (2006). Software agents and market (in) efficiency: A human trader experiment. IEEE Transactions on Systems, Man, and Cybernetics Part C (applications and Reviews), 36, 56–67.

Kirilenko, A., Kyle, A. S., Samadi, M., & Tuzun, T. (2017). The flash crash: High-frequency trading in an electronic market. Journal of Finance, 72, 967–998.

Noussair, C. N., Tucker, S., & Xu, Y. (2016). Futures markets, cognitive ability, and mispricing in experimental asset markets. Journal of Economic Behavior & Organization, 130, 166–179.

Reuters. (2019). To avoid a 'flash crash', FX traders drop yen shorts and run bare. Retrieved December 11, 2020, from https://www.reuters.com/article/us-asia-markets-flashcrash-idUSKCN1S00YY

Securities and Exchange Commission (SEC). (2010). Findings regarding the market events of May 6, 2010. Accessed September 7, 2021.

Smith, V. L. (1962). An experimental study of competitive market behavior. Journal of Political Economy, 70, 111–137.

Smith, V. L. (1976). Experimental economics: Induced value theory. American Economic Review, 66, 274–279.

Smith, V. L. (1981). An empirical study of decentralized institutions of monopoly restraint. In J. Quirk & G. Horwich (Eds.), Essays in contemporary fields of economics in Honor of E.T. Weiler (1914–1979) (pp. 83–106). Purdue University Press.

Tai, C. C., Chen, S. H., & Yang, L. X. (2018). Cognitive ability and earnings performance: Evidence from double auction market experiments. Journal of Economic Dynamics and Control, 91, 409–440.

Wilson, R. B. (1987). On equilibria of bid-ask markets. In G. R. Feiwel (Ed.), Arrow and the ascent of modern economic theory (pp. 375–414). New York University Press.

Acknowledgements

We would like to thank the Editors (Roberto Weber, Arno Riedl), two anonymous reviewers, David Cliff, Steven Gjerstad, Christoph Siemroth, Yilong Xu (discussant) and participants at the North American Regional Experimental Finance Conference 2020 and the Durham Workshop for Algorithmic Trading for useful suggestions and comments. Financial support from the Economic and Social Research Council (Grant No. ES/P011829/1) and the National Natural Science Foundation of China (Grant No. 72173093) is gratefully acknowledged. The replication material for the study is available at https://osf.io/a8zem/. Those who wish to replicate the experimental findings may contact the co-author and director of the Center for Behavioral and Experimental Research (CBER) at Wuhan University, Lijia Wei, who will coordinate access to the custom software used for the experiment. The authors are listed in alphabetical order.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Peng, Y., Shachat, J., Wei, L. et al. Speed traps: algorithmic trader performance under alternative market balances and structures. Exp Econ (2023). https://doi.org/10.1007/s10683-023-09816-8

Received:

Revised:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10683-023-09816-8