Abstract

Coordination problems are ubiquitous in social and economic life. Political mass demonstrations, the decision whether to join a speculative currency attack, investment in a risky venture, and capital flight from a particular country are all characterized by coordination problems. Furthermore, all these events have a dynamic nature which has been largely omitted from previous experimental studies. Here I use a two-stage variant of a dynamic global game to study experimentally how the arrival of information in a dynamic setting affects the relative aggressiveness of speculators. In the first stage, subjects exhibit excess aggressiveness, which appears to be driven by beliefs about others’ actions rather than an intrinsic taste for attacking. However, following a failed first-stage attack, subjects learn to be less aggressive in the second stage. On the other hand, the arrival of new, more precise information after a failed attack leads to an increase in subjects’ aggressiveness. Beliefs, again, play a crucial role in explaining how the arrival of information affects attacking behavior.

Similar content being viewed by others

Notes

See IMF (2000) for examples from the Asian economic crisis of 1997–1998.

Relative aggressiveness is defined as the ability to coordinate on successful attacks.

Common-knowledge models of crises capture the first feature but abstract away from the second and the third features (Obstfeld 1996). Static global game models provide insight into the second feature but fail to incorporate the importance of learning and updating over time (Carlsson and van Damme 1993a, 1993b; Morris and Shin 1998).

Within the context of currency crises, the fundamental θ represents the strength of the currency peg or the ability of the central bank to defend the peg. The agents are the speculators deciding whether to attack the currency. The cost of attacking can be interpreted as the interest rate. This framework has been applied to several macroeconomic phenomena: see Goldstein and Pauzner (2004) and Rochet and Vives (2004) for bank runs; Corsetti et al. (2003) and Morris and Shin (2004) for debt crises; Atkeson (2000) for riots; Chamley (1999) for regime switches; and Edmond (2008) for political change.

Since belief formation is unobservable by nature, I refrain from making conjectures about the sources of these aggressive beliefs. This type of “Level 2 reasoning” has been documented in other settings. See Cornand and Heinemann (2010) for an example with public information in beauty contest games.

Since I do not develop new theory in this paper, we refer the readers to Angeletos et al. (2007) for detailed proofs of the propositions. For the sake of experimental tractability, I choose the simplest two-period variant of the multi-period model that can also be found in Angeletos et al. (2007). Online supplemental materials to this paper define several auxiliary objects and characterize the equilibrium/equilibria in more detail.

Note that z can be thought of as a public signal about θ that all agents receive.

Angeletos et al. (2007) assume a continuum of agents which enables them to produce closed-form solutions for the equilibrium. The conclusions in this paper are robust to using either the infinite N or the N=15 case for the theory predictions.

The information structure is parameterized by \(\beta _{t}=\sigma _{x,t}^{-2}\) and \(\alpha =\sigma _{z}^{-2}\), the precisions of private and public information, respectively, or equivalently by the standard deviations, σ x,t and σ z . Thus, α+β t is the overall precision of information. Subjects know the values of z, α, and β t .

The prior about θ, z, was chosen to be high enough that a new attack becomes possible with the arrival of new information in the second stage (see Sect. 5). At the same time, in order to get a reasonable number of random draws within the critical interval of [0,100], I kept z sufficiently high and α sufficiently low. The standard deviation, β 1, was chosen based on satisfying the criterion for stage-one uniqueness of equilibrium, namely \(\beta _{1}\geq \frac{\alpha ^{2}}{2\pi }\). The standard deviation, β 2 was chosen to be sufficiently high to produce an equilibrium with a new attack in stage 2 (see Sect. 5).

Copies of the consent forms, instructions, and questionnaire questions in German or English are available upon request.

Subjects were provided with several examples that familiarized them with the normal distribution to ensure their full understanding.

The belief variable takes on values 0–14. Belief elicitation was not incentivized. While belief accuracy is significantly higher when beliefs are incentivized (Gächter and Renner 2010; Wang 2011), incentivizing belief elicitation may allow risk-averse subjects to hedge with their stated beliefs against adverse outcomes of the other decisions (Blanco et al. 2010). Furthermore, in public goods experiments, incentivized beliefs tend to lead to further deviations from equilibrium play (higher contribution levels) than either non-incentivized beliefs or no beliefs at all (Gächter and Renner 2010). Since I find that in this experiment reported beliefs are highly correlated with actions, accuracy seems to be high even without incentives.

Recall that the net payoff from attacking is positive if the status quo is abandoned and negative otherwise, which is the reason I choose to use the language of “successful” attacks.

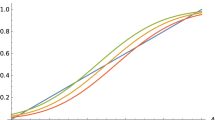

Bootstrapping with 1000 randomly generated attack sizes based on each draw of θ and the corresponding actual size of the attack produces confidence intervals that make it possible to draw inference about the significance of cost at the aggregate level. I fail to reject the null that the attack sizes are the same when comparing the C20 and C50 and when comparing the C50 and C60 treatments even at the 90 percent confidence level. However, compaing the C20 with the C60 treatments does lead to the conclusion that the attack size is significantly smaller in the C60 treatment than in the C20 treatment for most realizations of θ (see Fig. 7 in Appendix).

By contrast, Heinemann et al. (2004) find support in favor of the effectiveness of the cost of attacking as a means to reduce the probability of a speculative attack. It is possible that the relatively low impact of cost changes here may also reflect the feature of the design that keeps the costs at a given level for the duration of 20 periods. For example, Heinemann et al. (2009) find that global games may overestimate the effect of the hurdle compared to responses to opportunity costs in some settings. One can address this issue using sessions that vary the costs each round, keeping the fundamentals constant. However, the large discontinuous change in the cost of attacking should draw more attention than small changes from round to round. (Subjects are made well aware of the change in the cost from treatment to treatment.) Therefore, finding much larger cost effects in this setting with repeated cost changes seems to be unlikely.

The predicted size of the attack is calculated numerically for the N=15 case using a Monte Carlo simulation to sample from the posterior distribution over θ and then calculate a threshold x ∗ such that subject i should attack if and only if x i <x ∗. Given this threshold, the size of the attack equals \(\Pr (x_{i}<x^{\ast }|\theta )=\varPhi (\sqrt{\beta _{1}}(x^{\ast }-\theta ))\). The x ∗ for the N=15 case is quantitatively very similar to the x ∗ for the infinite agent case of Angeletos et al. (2007).

The logistic specification is appropriate given the binary nature of the dependent variable. In order to obtain consistent estimates, conditional logit is used due to the panel structure of the data (Chamberlain 1980).

Note that θ can be greater than 1, in which case an attack always fails.

Note that θ can be less than 1, in which case an attack always succeeds given that at least one subject attacks.

The results therefore also relate to the literature on the role of persistent deviations from equilibrium play in environments characterized by strategic complementarity (Haltiwanger and Waldman 1985, 1989; Fehr and Tyran 2005, 2008). This literature emphasizes the fact that under strategic complementarity the rational agents have an incentive to partially mimic the irrational agents which reinforces deviations from equilibrium play at the aggregate level. In this setting the mere belief that other players are deviating from the equilibrium frequency of attacking the status quo induces players to increase the probability of attacking, which partially reinforces the initial beliefs. This reinforcement may make it difficult to converge to the equilibrium. See also Izmalkov and Yildiz (2010) for a general class of models where agents’ sentiments are believed to play an important role. Arifovic and Maschek (2012) build and simulate a model of a currency crisis where agents’ beliefs are the source of volatility that can lead to a devaluation.

The theoretical share of successful attacks for the N=15 case was calculated using a Monte Carlo simulation for each realization of θ to predict the number of attackers given the theoretical threshold x ∗ (see footnote 18).

In Angeletos et al. (2007), this effect guarantees the existence of a unique equilibrium where no agent is willing to attack in the second stage (see Lemma 2 in Angeletos et al. (2007) for proof). The robust prediction of the model is that the observation that the status quo has survived a first-period attack creates a large drop in the size of the attack in the second period.

See Fig. 3 for the success rates in stage one by cost treatment.

Confidence intervals were obtained by bootstrapping with 1000 randomly generated expected attack sizes based on each draw of x and the corresponding actual belief about the size of the attack.

Note that the number of rounds that continue into the second stage may simply be insufficient for subjects to achieve full convergence.

For more on multiple equilibria in this environment, see Shurchkov (2008).

Only a very small number of rounds survive into the second stage in the lower signal range which widens the confidence intervals for those realizations of x.

References

Angeletos, G.-M., Hellwig, C., & Pavan, A. (2007). Dynamic global games of regime change: learning, multiplicity, and timing of attacks. Econometrica, 75(3), 711–756.

Arifovic, J., & Maschek, M. (2012). Currency crisis: evolution of beliefs, real world data and policy experiments. Journal of Economic Behavior & Organization, 82, 131–150.

Atkeson, A. (2000). Discussion of Morris and Shin’s ‘Rethinking multiple equilibria in macroeconomic modelling’. NBER Macroeconomics Annual.

Blanco, M., Engelmann, D., Koch, A. K., & Normann, H.-T. (2010). Belief elicitation in experiments: is there a hedging problem? Experimental Economics, 13(4), 412–438.

Brunnermeier, M. K., & Morgan, J. (2010). Clock games: theory and experiments. Games and Economic Behavior, 68(2), 532–550.

Cabrales, A., Nagel, R., & Armenter, R. (2007). Equilibrium selection though incomplete information in coordination games: an experimental study. Experimental Economics, 10(3), 221–234.

Carlsson, H., & van Damme, E. (1993a). Global games and equilibrium selection. Econometrica, 61(5), 989–1018.

Carlsson, H., & van Damme, E. (1993b). Equilibrium selection in stag hunt games. In K. Binmore, A. Kirman, & P. Tani (Eds.), Frontiers of game theory (pp. 237–253). Cambridge: MIT Press.

Chamberlain, G. (1980). Analysis of covariance with qualitative data. Review of Economic Studies, 47, 225–238.

Chamley, C. (1999). Coordinating regime switches. Quarterly Journal of Economics, 114(3), 869–905.

Chen, Q., Goldstein, I., & Jiang, W. (2010). Payoff complementarities and financial fragility: evidence from mutual fund outflows. Journal of Financial Economics, 97(2), 239–262.

Cheung, Y.-W., & Friedman, D. (2009). Speculative attacks: a laboratory study in continuous time. Journal of International Money and Finance, 28(6), 1064–1082.

Cooper, R. W., DeJong, D. V., Forsythe, R., & Ross, T. W. (1990). Selection criteria in coordination games: some experimental results. American Economic Review, 80(1), 218–233.

Cooper, R. W., DeJong, D. V., Forsythe, R., & Ross, T. W. (1992). Communication in coordination games. Quarterly Journal of Economics, 107(2), 739–771.

Cornand, C., & Heinemann, F. (2010). Measuring agents’ reaction to private and public information in games with strategic complementarities. CESifo Working Paper Series 2947.

Corsetti, G., Guimaraes, B., & Roubini, N. (2003). International lending of last resort and moral hazard: a model of IMF’s catalytic finance. NBER Working Paper 10125.

Costain, J. S., Heinemann, F., & Ockenfels, P. (2007). Multiple outcomes of speculative behavior in theory and in the laboratory. Bank of Spain working paper.

Costa-Gomes, M., & Weizsäcker, G. (2008). Stated beliefs and play in normal form games. Review of Economic Studies, 75, 729–762.

Danielsson, J., & Peñaranda, F. (2011). On the impact of fundamentals, liquidity and coordination on market stability. International Economic Review, 52(3), 621–638.

Edmond, C. (2008). Information revolutions and the overthrow of autocratic regimes. Mimeo, New York University.

Fehr, E., & Tyran, J.-R. (2005). Individual irrationality and aggregate outcomes. Journal of Economic Perspectives, 19(4), 43–66.

Fehr, E., & Tyran, J.-R. (2008). Limited rationality and strategic interaction—the impact of the strategic environment on nominal inertia. Econometrica, 76(2), 353–394.

Fischbacher, U. (2007). z-Tree: zurich toolbox for ready-made economic experiments. Experimental Economics, 10(2), 171–178.

Gächter, S., & Renner, E. (2010). The effects of (incentivized) belief elicitation in public goods experiments. Discussion Papers 2010-12, The Centre for Decision Research and Experimental Economics, University of Nottingham.

Goldstein, I., & Pauzner, A. (2004). Contagion of self-fulfilling financial crises due to diversification of investment portfolios. Journal of Economic Theory, 119(1), 151–183.

Haltiwanger, J. C., & Waldman, M. (1985). Rational expectations and the limits of rationality: an analysis of heterogeneity. American Economic Review, 75(3), 326–340.

Haltiwanger, J. C., & Waldman, M. (1989). Limited rationality and strategic complements: the implications for macroeconomics. Quarterly Journal of Economics, 104(3), 463–483.

Heinemann, F., Nagel, R., & Ockenfels, P. (2004). The theory of global games on test: experimental analysis of coordination games with public and private information. Econometrica, 72(5), 1583–1599.

Heinemann, F., Nagel, R., & Ockenfels, P. (2009). Measuring strategic uncertainty in coordination games. Review of Economic Studies, 76, 181–221.

IMF (2000). Recovery from the Asian crisis and the role of the IMF.

Izmalkov, S., & Yildiz, M. (2010). Investor sentiments. American Economic Journal: Microeconomics, 2(1), 21–38.

Morris, S., & Shin, H. S. (1998). Unique equilibrium in a model of self-fulfilling currency attacks. American Economic Review, 88(3), 587–597.

Morris, S., & Shin, H. S. (2004). Coordination risk and the price of debt. European Economic Review, 48, 133–153.

Obstfeld, M. (1996). Models of currency crises with self-fulfilling features. European Economic Review, 40(3–5), 1037–1047.

Prati, A., & Sbracia, M. (2002). Currency crisis and uncertainty about fundamentals. Economic working papers, 446, Bank of Italy.

Rochet, J., & Vives, X. (2004). Coordination failures and the lender of last resort: was Bagehot right after all? Journal of the European Economic Association, 2(6), 1116–1147.

Schotter, A., & Yorulmazer, T. (2009). On the dynamics and severity of bank runs: an experimental study. Journal of Financial Intermediation, 18(2), 217–241.

Schmidt, D., Shupp, R., Walker, J. M., & Ostrom, E. (2003). Playing safe in coordination games: the roles of risk dominance, payoff dominance, and history of play. Games and Economic Behavior, 42, 281–299.

Shurchkov, O. (2008). Effects of one-sided communication on coordination and equilibrium selection in dynamic global games: experimental evidence. Mimeo, MIT.

Van Huyck, J. B., Battalio, R. C., & Beil, R. O. (1990). Tacit coordination games, strategic uncertainty, and coordination failure. American Economic Review, 80(1), 234–248.

Wang, S. W. (2011). Incentive effects: the case of belief elicitation from individuals in groups. Economics Letters, 111, 30–33.

Author information

Authors and Affiliations

Corresponding author

Additional information

I am especially grateful to George-Marios Angeletos and Ernst Fehr for their invaluable insights and support throughout this project. Casey Rothschild has offered a tremendous level of guidance in the analysis and application of the theory. In addition, I would like to thank Ernst Fehr and the University of Zurich for providing the resources and the financial support without which this study would not be possible. I would also like to thank Daron Acemoglu, Miriam Bruhn, James Costain, Florian Ederer, Muhamet Yildiz, Akila Weerapana, and the seminar participants and organizers of the MIT macroeconomics workshop, Wellesley College Calderwood seminar, the IESE Conference on Complementarities and Information, the 2007 SAET conference, the conference of the French Economic Association on Behavioral Economics and Experiments, the ESA World Meeting 2007, and the 22nd World Congress of the EEA for valuable comments and discussion. All remaining errors are my own.

Appendix

Appendix

Locally weighted regressions of the average size of the attack for different realizations of θ in the C20 and C60 treatments. Confidence intervals are obtained by the method of bootstrapping with 1000 randomly generated attack sizes based on each draw of theta and the corresponding actual size of the attack

Rights and permissions

About this article

Cite this article

Shurchkov, O. Coordination and learning in dynamic global games: experimental evidence. Exp Econ 16, 313–334 (2013). https://doi.org/10.1007/s10683-012-9339-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10683-012-9339-3