Abstract

Energy use is an indicator of economic growth. However, high energy intensity has two main disadvantages. First, low energy efficiency increases a country’s dependence on other countries, especially when the country lacks energy sources. Second, if the country’s energy needs are met using traditional fossil fuels, this increases its CO2 emissions and reduces its air quality. Improving energy efficiency and reducing energy intensity are essential to reach the sustainability targets. This paper investigates the determinants of energy use in Turkiye for the period 1991–2019 by taking a dual approach. First, utilizing the Tapio decoupling factor, the decoupling factor analysis is not only being done for total energy use and real GDP, but also for industrial energy use and industrial income. Second, the factors determining the country’s total energy use are also examined, followed by an investigation of the indicators of energy use in the industry sector, which is highly energy intensive. For the industrial sector, two different decomposition analyses are performed and results are compared. The refined Laspeyres index method is adopted, and for each analysis, three main factors are considered. The empirical findings demonstrate that the income effect and population effect increased Turkiye’s total energy use, whereas the energy intensity effect decreased it. The first decomposition analysis for the industrial energy use reveals partly contrasting results with the previously published articles. For the industry sector, the second analysis show that productivity and employment increased Turkiye’s sectoral energy use; however, the sector’s energy intensity reduced it. Turkiye achieved some success in terms of reducing energy intensity at the sectoral and aggregate levels; however, as the findings of the present study demonstrate, further efforts are needed to lessen the country’s energy dependence and also to achieve future environmental sustainability targets. Trends relating to the determining factors in total and sectoral energy use are also compared in this paper, and some policy implications are presented.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

As countries became more industrialized, a significant increase in energy demand occurred. Many researchers have emphasized that energy use is the main driver of economic growth. However, depleting and unevenly distributed energy sources and environmental pressures have forced countries to seek alternative solutions (Mucuk & Uysal, 2009). One solution is to improve the energy efficiency, which will not only reduce the energy intensity of economic growth but also help to reduce the environmental pressures. To create a roadmap, one should firstly understand the dynamics of energy use. In addition to environmental sustainability pressures and depleting fuels, Turkiye is dependent on energy imports. Therefore, understanding the determinants of energy use is even more important for the country.

Overall global energy use increased substantially between 1991 and 2019. As IEA (2023) data revealed, it increased by 58.8% during this period. In 1991, global energy use was 263.9 million terajoules (TJ), whereas in 2019, this number reached 419 million TJ (IEA, 2023)Footnote 1. In Turkiye, the energy use increased faster than the world average. For example, in 1991, Turkiye’s energy use was 1.7 million TJ whereas it increased to 4.4 million TJ in 2019. The change in Turkiye’s total energy use was therefore 153.8%. Hence, Turkiye’s share of global energy use rose from 0.7 to 1% over the period 1991–2019. Regarding the industrial sector, the increase in energy use was faster than the increase in total energy use both globally and in Turkiye. Globally, the rise in industrial energy use was calculated as 60.9%, whereas it was computed as 171.6% for Turkiye. These numbers highlight that the industrial sector is highly energy intensive and requires particular focus from researchers, politicians, managers, and policy makers.

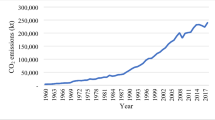

One outcome of the intensified energy use is the rising level of CO2emissions, since the energy demand has been met using fossil fuels. In the research period, global CO2emissions increased by 62.9%, from 20668.5 MT to 33667.9 MT. In Turkiye, CO2emissions increased more rapidly than the global levels, similar to the increases in energy use. Between 1991 and 2019, Turkiye’s CO2emissions rose by 178%, from 131.8 MT to 366.4 MT. In 2019, following electricity and heat production and the transport sector, industry was the third largest CO2emitting sector in Turkiye and worldwide. In the study period, global industrial CO2emissions rose by 61.1%, from 3880.1 MT to 6249.5 MT. Turkiye’s industrial CO2emissions rose from 34.6 MT to 67.1 MT over the period between 1991 and 2019. Hence, the rise in the emissions of Turkiye’s industrial sector was computed as 93.9%.

The increasing rate of CO2emissions and its negative impact have been the subject of the world agenda for more than four decades. In response to the climate crisis, 200 nations were invited to the COP28 (Conference of Parties) summit held in Dubai, United Arab Emirates from 30th November 2023 to 12th December 2023. As elucidated by Safi et al. (2024), the COP28 summit can be considered the starting point of the end of the fossil fuel era. Although it was criticized for using vague language and the lack of a clear timeline, for the first time in a climate summit agreement text, a consensus was reached on the need for a pivotal switch from fossil fuels to renewable energies. The countries agreed that the sustainable transition should be started immediately to achieve the net zero emission targets.

With regard to the literature, it is possible to state that the published studies addressed the problem in two different dimensions. In the first dimension, the scholars assigned the energy related variables as dependent proxies. However, in the second dimension, the explained variables are environment related.

Regarding the econometric analysis-based studies, it is possible to state that dozens of published papers have focused on the economic growth energy use dilemma. For instance, Işık (2010) uncovered the role of natural gas consumption (an energy source that is widely used in the country) on Turkiye’s economic growth by utilizing the ARDL model for the period between 1977 and 2008. The researcher concluded that the effect of natural gas consumption on economic growth was positive in the short term and negative in the long term.

In terms of the environmental analysis papers, one can see that the EKC hypothesis has been widely studied in the relevant literature. Assigning CO2emissions as a dependent proxy, Işık et al. (2019) tested the validity of the EKC hypothesis for 10 highly CO2emitting states in the US. The scholars utilized both renewable and non-renewable energy use together with two other independent variables, namely real GDP and population. In another study, Işık et al. (2023) included three independent variables, renewable energy consumption, economic freedom, and economic policy uncertainty, to investigate their impact on environmental degradation for the G7 and BRIC economies. China is the largest energy consumer and CO2emitter globally; therefore, it particularly grabs the attention of researchers. For example, Işık et al. (2024a) examined the effects of energy transition, natural resources, economic growth, and urbanization on China’s CO2emissions by using the augmented ARDL approach.

Researchers have followed several methods in order to calculate the impact of the determinants of Turkiye’s energy use. One method involves collecting household data and utilizing the multinomial logit model to analyze the economic and demographic determinants of energy use (Özcan et al., 2013). The second method consists of adopting econometric analyses to examine the relationship between energy use and economic growth (Öztürk et al., 2011). The third method is to conduct a decomposition analysis to identify the factors affecting energy use (Yılmaz et al., 2016).

In the scientific literature, decomposition analyses have mainly focused on the identifiers of CO2 emissions. When the research articles indexed in the Web of Science database were examined, it was observed that relatively few studies have examined the determinants of energy use or energy intensity. To the best of our knowledge, for the case of Turkiye, in 4 of 23 studies, the factors that affect energy use were decomposed, whereas in only one study, the aggregate energy intensity was analyzed. Four of these studies analyzed Turkiye as a single case study (Ediger & Huvaz, 2006; Yılmaz & Atak, 2010; Akyürek, 2020; Düzgün et al., 2022). On the other hand, Yang et al. (2022) examined the determinants of energy intensity of 44 world regions including Turkiye. Ediger and Huvaz (2006) examined the period from 1980 to 2000, whereas Yılmaz and Atak (2010) extended the study period until 2005. However, in the other three studies, the researchers analyzed the determinants of energy use or energy intensity for the period after 2000. Akyürek (2020) focused on the 2005–2014 period, whereas Yang et al. (2022) analyzed the period between 2000 and 2014, and Düzgün et al. (2022) examined the 2000–2018 period.

In all of these studies, the researchers decomposed the energy use or energy intensity at the sectoral level. Edigar and Huvaz (2006) performed their analysis on the agricultural, industrial and services sectors, whereas Yılmaz and Atak (2010) also included the transportation sector in their study. Akyürek (2020) and Düzgün et al. (2022) conducted their decomposition analyses for only one sector, namely manufacturing and residential sectors, respectively. On the other hand, Yang et al. (2022) decomposed the aggregate energy intensity for eight different sectors. In four of these studies, the researchers utilized the well-established Logarithmic Mean Divisia Index (LMDI) method (Ediger & Huvaz, 2006; Akyürek, 2020; Yang et al., 2022; Düzgün et al., 2022). Together with this, Yılmaz and Atak (2010) used Se-Hark Park’s alternative decomposition method. In four studies, the researchers reported the impact of three factors on energy use, namely economic activity, economic structure and energy intensity (Ediger & Huvaz, 2006; Yılmaz & Atak, 2010; Akyürek, 2020; Düzgün et al., 2022). However, Yang et al. (2022) examined the effect of two factors on aggregate energy intensity, namely sectoral aggregate energy intensity and sectoral structure.

The contributions of our study to the extant literature are as follows:

-

1)

The present study utilizes the Tapio decoupling factor to examine the existence of possible decoupling between real economic output and energy use for the first time for Turkiye. In the literature, researchers have used the Tapio decoupling factor for the analysis of the potential decoupling between Turkiye’s CO2 emissions and real economic output (Song et al., 2018; Karakaya et al., 2019; Dong et al., 2021). Thus, our study will contribute to the literature by conducting the decoupling factor analysis for energy use of Turkiye, rather than the CO2 emissions.

-

2)

After decoupling factor analysis, a decomposition analysis will be performed to examine the impact of various factors on energy use. Together with this, rather than the LMDI method, the researcher will utilize the refined Laspeyres index (RLI) method for the decomposition analysis. The RLI method is a relatively less used approach compared to the LMDI method. However, it also gives perfect decomposition analysis results, parallel to the LMDI. In the literature, some researchers have adopted the RLI method for the decomposition of CO2 emissions (Kumbaroğlu, 2011; Rüstemoğlu and Andres, 2016; Büke and Köne, 2016). Hence, this study will be the first one in the literature that analyzes the energy use of Turkiye using the RLI method.

-

3)

As mentioned in the literature discussion paragraphs, published studies have examined Turkiye’s energy use at the sectoral level. This study, however, not only provides decomposition analysis at the sectoral level but also at the aggregated level. Regarding the aggregated decomposition of energy use, the researcher will examine the impact of three factors, namely per capita real income, energy intensity and population.

-

4)

For the sector level analysis, the researcher will focus on the industrial sector, since it has the largest share in Turkiye’s energy use. In the published papers, highlighted determinants are total economic output, sectoral energy intensity, and sectoral structure effects. In the present study, we will run the decomposition analysis twice. In the first analysis, the aforementioned three factors (total economic output, sectoral energy intensity, and sectoral structure effects) will be considered. Additionally, in the second analysis, the impacts of not only the sectoral energy intensity but also sectoral productivity and sectoral employment will be considered. Briefly, in the second analysis, total economic output and sectoral structure will be replaced by sectoral productivity and sectoral employment factors, respectively. By doing so, the researcher aims to provide a comparison between the two models regarding the sector level decomposition analysis.

This paper firstly aims to examine the possible decoupling between Turkiye’s total energy use and real GDP. By utilizing the Tapio decoupling factor, the analysis will not only be done for total energy use and real GDP, but also for industrial energy use and industrial income. Afterwards, the RLI method will be used for the decomposition of aggregated and sector level (for industry sector) energy use. The aggregated decomposition analysis will focus on the impacts of three determinants, namely real income per capita, energy intensity and population. For the decomposition of industrial energy use, the RLI method is used twice. In the first model, the effects of sectoral energy intensity, sectoral structure effect, and total output effect in industrial energy use are computed. However, in the second model, the productivity effect and employment effect respectively replace the sectoral structure effect and total output. The results of the decoupling factor and decomposition analyses are compared for both aggregated and sector level.

The rest of this paper is organized as follows: in the second section, the theoretical framework is explained. In the third section, Turkiye’s energy market is briefly presented. In the fourth section, the decoupling factor and decomposition techniques used in the analyses are reviewed. The results of the study are reported and compared in Sect. 5. Finally, Sect. 6 concludes the paper.

2 Theoretical framework

As emphasized by Örgün and Pala (2017), four different hypotheses for the economic growth and energy use nexus are proposed in the scientific literature, the first of which is the neutrality hypothesis. This hypothesis highlights that there is no casual relationship between energy use and economic growth. Scientific evidence was provided supporting this hypothesis by Yıldırım and Aslan (2012). In their study, the authors investigated the link between energy use, economic growth, employment and gross-capital formation for 17 OECD countries. They reported that the neutrality hypothesis was valid for all research countries, except Turkiye. The second category involves the growth hypothesis, which suggests that there is a unidirectional causality from energy use to economic growth. Therefore, if energy use is restricted, this limitation will reduce economic growth. Soytaş and Sarı (2003) justified this hypothesis for the case of Turkiye. The third hypothesis is the conservation hypothesis, which emphasizes that there is a unidirectional causality from economic growth to energy use. Thus, it can be concluded that efficient policies that reduce energy use will not hamper the economic growth performance of countries. Zachariadis (2007) supported this hypothesis based on a a case study involving Canada and the UK. The last category comprises the feedback hypothesis. Based on this hypothesis, there is a bidirectional causality between energy use and economic growth. Lee et al. (2008) verified that the feedback hypothesis held for the nexus between economic growth and energy use for 22 OECD nations.

In this analysis, we predict that the third hypothesis (conservation hypothesis) is valid for the relationship between energy use and economic growth in the case of Turkiye. Therefore, several sub-hypotheses have been developed to justify the results.

For the decomposition of total energy use, the following hypotheses will be tested:

-

H0: Energy intensity decreases energy use.

-

H1: Population increases energy use.

-

H2: The per capita income effect increases energy use.

Regarding the decomposition analysis of the industrial sector, two different analyses are provided.

For the first decomposition model, the following hypotheses will be tested:

-

H0: Sectoral energy intensity reduces energy use.

-

H1: The sectoral structure effect raises energy use.

-

H2: The total output effect raises energy use.

For the second decomposition model, the following hypotheses will be tested:

-

H0: Sectoral energy intensity curbs energy use.

-

H1: The productivity effect raises energy use.

-

H2: The employment effect increases energy use.

3 Overview of the energy market in Turkiye

In 1991, renewable energy use in the global energy matrix was at the early stages. The share of fossil fuels (oil, coal, and natural gas) in total energy use was 77.5% in, whereas the share of traditional renewables (hydro and traditional biomass) was 16.5%, nuclear was 5.5%, and modern renewables (solar, wind, modern biofuels, and other renewables) was only 0.5%Footnote 2. At the end of the study period, the share of conventional fossil fuels increased slightly to 78.1%, whereas the share of traditional renewables decreased to 12.8%. Together with this, the share of modern renewables increased to 5.0% (a substantial increase) and the share of nuclear decreased to 4.1% (a remarkable decline) in 2019Footnote 3.

In Turkiye, the share of fossil fuels was even larger than the global average. The total share of the fossil fuels was 88.2% in Turkiye’s energy use. However, the share of hydro in Turkiye’s energy mix was higher than the global average in 1991. The share of hydro sources in Turkiye’s energy use was 11.7%, whereas the share of modern renewables (solar, wind, and other renewables) was equal to 0.1%Footnote 4.

At the end of the study period, a decrease in the share of fossil fuels in Turkiye’s energy use was observed. The share of fossil fuels in Turkiye’s energy mix, declined to 80.7%, in 2019Footnote 5. Furthermore, the shares of hydro and modern renewables increased to 12.8% and 6.5%, respectively, in that yearFootnote 6.

3.1 Oil

Turkiye’s oil imports increased in the study period, since its economy expanded and its population increased. In 1991, the total imports of crude oil were 738.2 thousand TJ, however it increased to 1.3 million TJ by 2019Footnote 7. Therefore, the increase in Turkiye’s oil imports equates to 76.2%. As described in the IEA energy report (2021), Turkiye was able to produce only 9% of its oil demand in 2019, and as a consequence, the country imported 91% of its oil demandFootnote 8.

Turkiye mainly imports crude oil from Iraq, Iran, and Saudi Arabia. Turkiye’s oil imports from the Russian Federation declined considerably between 2008 and 2018. Moreover, the oil imports from Iran entirely halted in 2019 because of the US sanctions. Thus, in 2019, Turkiye increased its oil imports from the Russian Federation once again. In addition to the Russian Federation and Iraq, other suppliers of oil to Turkiye include Kazakhstan, Libya, and Nigeria.

3.2 Coal

Coal has the second largest share in Turkiye’s energy use mix. Although the country has significant coal reserves, the imports continued to increase in the examined period. In 1991, Turkiye’s coal imports totalled 181.3 thousand TJ and it increased to 1.02 million TJ in 2019. Coal imports increased significantly by around 461.3%. Turkiye also exported coal in the study period, although its exports were minimal compared to the imports. The exports rose from 749 TJ to 6715 TJ during the examined period. Turkiye’s coal production accounted for 42% of the total demand; therefore, it imported the remaining 58% of its coal demand. The country aims to increase its coal production further to reduce the import dependence, but among the fossil fuels, coal is the dirtiest one and increasing the coal share will result in an increase in CO2 emissions and air pollution. Turkiye mainly imports coal from Colombia (accounts for almost half of coal imports) and the Russian Federation. Relatively small amounts of coal are imported from Australia and the United States.

3.3 Natural gas

Among the fossil fuels, natural gas exhibited the highest increase in Turkiye’s energy use mix. Turkiye’s natural gas consumption increased from 46 thousand TJ to 1.08 million TJ between 1991 and 2019. The huge rise in the country’s natural gas consumption equates to 2247.3% for the review period. For that reason, the ratio of natural gas imports was higher than the country’s oil and coal imports. Turkiye’s natural gas imports increased from 154.5 thousand TJ-gross to 1.73 million TJ-gross over 1991–2019. The huge increase in Turkiye’s natural gas imports equates to 1020.5%. The country mainly imports natural gas from Russia, Azerbaijan, Iran, and Algeria respectively. Natural gas is mostly used for electricity and heat generation purposes. Industrial and residential sectors follow electricity and heat generation, in this respect. Turkiye aims to increase its domestic natural gas production by exploration and reduce the reliance on imports.

3.4 Renewables

The share of renewables in Turkiye’s total energy use showed some remarkable changes in the studied period. For instance, biofuel consumption decreased from 300.8 thousand TJ to 106.3 thousand TJ from 1991 to 2019. The decline in Turkiye’s biofuels use equates to − 64.7%. Meanwhile, the utilization of modern renewables such as wind and solar showed a substantial increase in the same period. In 1991, wind and solar usage in Turkiye’s energy use was only 17 thousand TJ, but by 2019, it increased to 116.4 thousand TJ. The considerable increase in Turkiye’s modern renewable energy use was around 584.4%. The country has an ambitious renewable energy policy and because of the favourable resource endowment and supportive government policies, the use of modern renewables increased, particularly in electricity generation.

3.5 Electricity

Turkiye’s electricity consumption increased rapidly between 1991 and 2019 due to the rapid population growth and industrialization. Total electricity consumption was 52.9 terawatt hours (TWh) in 1991, and this number reached 272 TWh in 2019Footnote 9. The country produces its electricity from various sources. In 1991, there were mainly 5 different sources in Turkiye’s electricity generation matrix, namely hydro, coal, natural gas, oil, and geothermalFootnote 10. However, in 2019, the electricity generation matrix was more diverse as compared to 1991. At the end of the study period, the country’s electricity generation resources were coal, hydro, natural gas, wind, solar, geothermal, biofuels, other sources, oil, and wasteFootnote 11. In the electricity generation mix of Turkiye, the increased share of renewables (including modern renewables) was remarkable. Total share of renewables (hydro, solar, wind, geothermal) in Turkiye’s electricity generation was around 44% in 2019, which exceed the country’s target of 38.8% stated in the Eleventh Development Plan.

3.6 Turkiye’s sectoral energy use

Turkiye’s sector level energy use from 1991 to 2019, is presented in Fig. 1. A careful examination of the figure allows one to conclude that some significant changes occurred in Turkiye’s sectoral energy use over the three decades. In 1991, the residential sector had the highest energy use, followed by the industrial and transportation sectors in this respect. Due to the industrialization of country, the energy use in the industrial sector increased more rapidly than the residential sector. At the end of 2019, the industrial sector ranked 1st in energy use. As a result of significant population growth and the increased number of vehicles, the transportation sector also exceeded the residential sector in terms of energy use. Another rapid increase in energy use was observed in the commercial and public services in Turkiye. Starting from 1990s, the service sector has become overwhelmingly important in the country. The sectors including education, health care, tourism and hospitality, finance, and food and beverages have all gained importance in the nation’s economy. Therefore, the energy demand of the services sector increased substantially. Finally, the increases in the energy use of the agricultural and forestry sectors were minimal, whereas the fishing sector energy use was largely stable over 1991–2019.

Turkiye’s sector level energy use over 1991–2019 (IEA, 2023)

4 Materials and methods

4.1 Data collection

The real income, population, sectoral real income, employment and sectoral employment were collected from the World Bank, World Development Indicators. The data period covers the years from 1991 to 2019 and is sufficiently large for a decoupling factor analysis and a decomposition analysis. The present data are also consistent with international standards.

4.2 Decoupling factor analysis

The concept of decoupling was derived from physics. As stated by Han et al. (2018), decoupling means that the relationship between two or more physical quantities is either decreased or does not exist anymore. Recently, the decoupling approach has been utilized to characterize the link between economic growth and the quality of the environment. OECD (2002) classified decoupling into two parts as either absolute decoupling or relative decoupling. Afterwards, some researchers provided a more detailed classification. For example, Tapio (2005) provided a new decoupling concept including eight different cases, namely expansive negative decoupling, strong negative decoupling, weak negative decoupling, strong decoupling, weak decoupling, recessive decoupling, expansive coupling, and recessive coupling. In most of the published studies, researchers have utilized the Tapio decoupling factor to examine the link between CO2 emissions and real income. However, in this study, CO2 emissions will be replaced by energy use. The relation between Turkiye’s total and sector level energy use and total and sector level real income will be analyzed. The mathematical formula of the decoupling value is presented as:

The detailed classification for the decoupling value is represented in Table 1.

Among all eight potential cases of the decoupling factor analysis, the strong decoupling and weak decoupling are the first and second desirable outcomes that the researchers seek to observe. The remaining six cases are considered as unwanted outcomes.

4.3 Decomposition analysis

In this study, the RLI method has been employed for the decomposition analysis of energy use. The RLI method is based on the Kaya Identity which has the following form:

In this study, the aim is to find the decomposition results of energy use; therefore, the modified version of the Kaya Identity has been used. The modified Kaya Identity is represented as:

Regarding total energy use, the effects of three factors including energy intensity, per capita real income, and population were evaluated. Here, \(\left(\frac{\text{E}\text{U}}{\text{G}\text{D}\text{P}}\right)\),\(\left(\frac{\text{G}\text{D}\text{P}}{\text{P}\text{O}\text{P}}\right)\) and \(\text{P}\text{O}\text{P}\)denote energy intensity, per capita real income, and population, respectively. The detailed calculations of each factor using the RLI method are presented as:

where Eq. (4) represents the energy intensity. In that equation, PINC denotes per capita real income. Energy intensity is calculated by dividing total energy use by total economic output. Per capita real income is calculated by dividing total economic output by population.

Equation (5) represents the per capita real income. In that equation, EI represents the energy intensity.

Equation (6) represents the population effect.

Per capita real income is expected to cause an increase in energy use in the country. Similarly, a rise in the population is expected to raise the energy use. However, lower population growth is preferred because it results in comparatively less energy use. The third factor is the energy intensity and it is expected to reduce energy use as the technology advances and the country develops.

For the sectoral energy use, the RLI decomposition analysis was employed twice. Thus, the Kaya Identity was also modified twice.

In the equation above, \(\text{E}\text{i}\) represents the energy use in the industrial sector, whereas \(\text{G}\text{D}\text{P}\text{i}\)denotes the output of the same sector. In addition, GDP is the total output in Turkiye. Hence, \(\left(\frac{\text{E}\text{i}}{\text{G}\text{D}\text{P}\text{i}}\right)\) is the sectoral energy intensity, \(\left(\frac{\text{G}\text{D}\text{P}\text{i}}{\text{G}\text{D}\text{P}}\right)\) is the sectoral structure effect, and \(\text{G}\text{D}\text{P}\) is the total output effect. Detailed calculations of the factors using the RLI method are as follows:

Equation (8) denotes the sectoral energy intensity. In that equation, SSi denotes the sectoral structure effect.

Equation (9) denotes the sectoral structure effect. Sectoral energy intensity is calculated by dividing industrial energy use by industrial real income. The sectoral structure effect is computed by dividing industrial real income by total real income.

Equation (10) denotes the total output effect.

The sectoral energy intensity effect is expected to decrease energy use as technological advances are made in the industrial sector and more energy efficient capital is used. The sectoral structure effect is expected to increase the energy use in the country as the share of the industrial sector in the total real income increases. The total output effect is naturally expected to increase energy use.

Regarding the second analysis for sectoral level decomposition, the modified Kaya Identity is as follows:

In Eq. (11), \({\text{E}}_{\text{i}}\) represents the energy use of the industrial sector and \(\frac{\text{E}\text{i}}{\text{G}\text{D}\text{P}\text{i}}\) is the sectoral energy intensity. However, \(\text{E}\text{M}\text{P}\text{i}\)is the sectoral employment in Turkiye. Hence, \(\frac{\text{G}\text{D}\text{P}\text{i}}{\text{E}\text{M}\text{P}\text{i}}\) is the productivity of the industrial sector, whereas \(\text{E}\text{M}\text{P}\text{i}\) is the employment effect. Detailed computations of these factors are shown below:

Equation (12) denotes the energy intensity and \(\text{P}\text{R}\text{O}\text{D}\text{i}\) represents the productivity of the industrial sector.

Equation (13) denotes the productivity effect.

Finally, Eq. (14) denotes the employment effect. The sectoral employment effect is expected to raise the energy use in the country, whereas sectoral energy intensity is expected to reduce it. The productivity effect is also expected to increase the energy use as more economic output will be produced as the country develops.

The RLI method has some advantages, such as:

-

1.

As Sun (1998) described, it can provide a complete decomposition for the target variable.

-

2.

As Ang and Zhang (2000) highlighted, it can pass the necessary tests including time-reversal, factor-reversal and zero value robustness.

-

3.

For up to Four variables, the decomposition analysis is simple and robust

The method also has some drawbacks, most notably that RLI does not solve the nested decomposition issue (Song et al., 2019).

Even though the RLI method was first proposed in Sun’s 1998 study, it remains a valid and strong decomposition technique due to the strengths that we listed above. Recently, Wang et al. (2021) performed a decomposition analysis for China’s residential sector related to CO2emissions for the period between 2005 and 2015 by using the RLI approach. This method has not only been used for the decomposition of CO2emissions in the literature. For instance, by using the RLI method, Song et al. (2021) conducted a decomposition analysis for China’s PM2.5 emissions (which cause severe air pollution and serious health issues). Moreover, as part of their study, Zuo et al. (2021) provided a decomposition and decoupling factor analysis for the water consumption dynamics of the Xinjiang Uygur Autonomous Region of China, again by adopting the RLI approach. Overall, one can conclude that the RLI method will likely be used by researchers in future studies.

5 Empirical findings

5.1 Decoupling factor analysis’ results

In this section, the decoupling factor results of Turkiye’s total and industrial sector energy use are initially presented. After that, the RLI decomposition analysis results for the total and sector level energy use of the country are shown and discussed. The results of the decoupling factor analysis for total energy use and real income in Turkiye are presented in Table 2.

In 11 of 28 periods, decoupling was observed between energy use and real income in Turkiye at some desirable level. The decoupling was a strong one in 4 periods, whereas the decoupling was weak in the remaining 7 periods. Strong decoupling was established in the periods 1997-98, 2007-08, 2012-13, and 2017-18. Strong decoupling occurs when the energy or environment related variable decreases while real income increases. Therefore, the decoupling value for the strong decoupling is negative. Strong decoupling is highly desirable in our case study, since it indicate that Turkiye was more economically productive with less energy use. Weak decoupling was present in the periods 1991-92, 1996-97, 2003-04, 2004-05, 2009-10, 2010-11, and 2013-14, respectively. Weak decoupling exists when the energy or environment related variable increases at a slower growth rate compared to real income. Hence, the decoupling value is between 0 and 0.8 for this case. Weak decoupling is the second-best alternative for the sustainability scenario, because it also indicates some efficiency in energy use.

Expansive coupling is close to weak decoupling in terms of decoupling value; however, it is not a desirable outcome. Expansive coupling occurs when both energy use and real income increase but the decoupling value is between 0.8 and 1.2. Expansive coupling was observed in the periods 1992-93, 1995-96, 2002-03, 2006-07, 2011-12, and 2016-17. The respective expansive coupling values were computed as 1.02, 1.11, 1.05, 1.08, 0.97, and 0.98. One of the worst outcomes is expansive negative decoupling. In this case, the energy or environment related variable increases significantly faster than real income. The decoupling value is therefore greater than 1.2. Expansive negative decoupling was observed in Turkiye, in 7 of 28 periods. These periods were 1994-95, 1999–2000, 2001-02, 2005-06, 2014-15, 2015-16, and 2018-19. The corresponding decoupling values were computed as 1.37, 1.65, 1.52, 1.61, 1.45, 1.37, 1.47. When one examines the periods carefully, it is possible to conclude that these correspond with the financial, economic, or political crisis periods of Turkiye.

In two periods, recessive coupling was observed between Turkiye’s energy use and real income. The existence of recessive coupling is due to the simultaneous decline of energy use and real income. In this case, the decoupling value is between 0.8 and 1.2. In the present research, the recessive coupling occurred in the periods 1993–1994 and 1998–1999. The corresponding decoupling values were 1.08 and 1.02. Strong negative decoupling is the case when energy use increases and real income decreases. The decoupling value is computed as negative in this scenario. Regarding Turkiye, strong negative decoupling between energy use and real income was only detected in one period (2008-09) and the corresponding decoupling value was computed as -0.16. The global financial crisis was also very destructive for Turkiye’s economy; thus, strong negative decoupling among the abovementioned variables was an expected result. Recessive decoupling would exist if both real income and energy use decrease and the decoupling value is greater than 1.2. In Turkiye, recessive decoupling was observed in only 1 of 28 periods. The decoupling value was calculated as 1.72 for that period. The main reason for the declining GDP and energy use was the crisis that emerged in the Turkish banking sector in the early 2000s. Finally, the weak negative decoupling is the scenario where both real income and energy use are falling and the decoupling value is between 0 and 0.8. This case was not observed in the study period for Turkiye.

Over the period 1991–2019, Turkiye’s total energy use increased by an average of 3.5% annually. In the same period, however, the country’s real income expanded by 4.6% on an annual average basis. Turkiye’s real income and energy use nexus was characterized by weak and strong cases of decoupling in 11 of 28 periods. While the country’s economy grew, the energy use increased at a slower rate. As revealed by the data calculations and application of the Tapio model in the present study, energy conservation policies did not hamper Turkiye’s economic growth. Hence, it can be concluded that the results of the decoupling factor analysis are in line with the third hypothesis (i.e., the conservation hypothesis).

The results of the sector level decoupling factor are demonstrated in Table 3. The industrial sector is relatively energy intensive; therefore, its decoupling potential is generally weaker than the aggregated level. Parallel to the aggregated level, there was found to be 11 desirable decoupling periods for the industrial sector. However, there were 2 strong decoupling periods and this result is less than the number of strong decoupling periods found in the aggregated level of analysis. On the other hand, the results revealed that industry sector’s energy use and real income exhibited weak decoupling in 9 periods and this number was higher than the decoupling results of the aggregated level. Strong decoupling was detected in the periods of 2004-05 and 2012-13. The respective decoupling values were computed as -0.11 and − 0.65. Weak decoupling was found in the periods 1991-92, 1992-93, 1997-98, 2003-04, 2006-07, 2010-11, 2011-12, 2014-15, and 2015-16. The related decoupling values were computed as 0.02, 0.47, 0.57, 0.07, 0.10, 0.55, 0.74, 0.70, and 0.27, respectively. One of the undesirable outcomes of the Tapio decoupling factor analysis is the expansive negative decoupling. It was observed in 8 periods based on the research findings. Recessive decoupling, expansive coupling, and strong negative decoupling followed expansive negative decoupling. Respectively, each of them occurred in 5, 3, and 1 periods. Based on the decoupling factor calculations, weak negative decoupling and recessive coupling cases were not found for Turkiye’s industrial energy use and real income.

For Turkiye’s industrial sector, the annual average GDP growth was found to be 5.3% over the studied period. On the other hand, the country’s industrial energy use rose by 4.4%, between 1991 and 2019 on an annual average basis. Therefore, it is possible to conclude although the industrial energy use growth rate was slower than the industrial real income, this did not affect the sector’s economic growth performance negatively. As a result, we can state that the Tapio decoupling factor results for Turkiye’s industrial energy use support the conservation hypothesis.

5.2 RLI decomposition analysis results

5.2.1 Total energy use

Year by year decomposition analysis results of Turkiye’s total energy use are depicted in Fig. 2.

The results of the RLI decomposition analysis demonstrated that the main reason for the change in total energy use during the study period was the per capita real income. The increase in Turkiye’s real income per capita was calculated as 125.5%. The annual average growth rate of real income per capita was computed as 3% in the review period. The findings of the RLI decomposition analysis indicated that the per capita income effect raised the energy use of Turkiye in 22 of 28 periods. During the periods in which the Turkish economy expanded, the energy use tended to increase, and during the recessionary phases, the decline in per capita real income reduced it. Turkiye’s per capita real income decreased the energy use in the periods 1993–1994 (devaluation crisis), 1998–1999 (devastating earthquake in Marmara region), 2000-01 (economic crisis), 2007-08 (stagnation), 2008-09 (global financial crises), and 2018-19 (stagnation). In these periods, per capita real income in Turkiye shrank by 6.2%, 4.8%, 7.1%, 0.4%, 6%, and 0.4%, respectively. Using the RLI approach, the cumulative impact of per capita real income in total energy use was calculated as 2424148 TJ, which is equivalent to 91.5%. The results also reveal that the increasing impact of per capita real income on energy use is in line with the extant literature.

Among other factors, population appeared to be the second one that affected energy use. Turkiye’s population increased from 54.8 million to 83.4 million over the period 1991–2019. Hence, the population growth rate was calculated as 52.1% and annual average population growth computed as 1.51%. Since 2011, Turkiye has accepted refugees, especially from Syria because of the civil war in that country. As a result, the country’s annual population growth rate increased substantially.Footnote 12 In 2019, the cumulative impact of population in Turkiye’s energy use was calculated as 1212124 TJ and its share was 45.8%.

Energy intensity was the only factor that lowered total energy use in Turkiye. Turkiye’s energy intensity declined by 26% from \(5.92*10\)-6 to \(4.38*10\)-6 during the study period. Overall, in 16 of 28 periods, Turkiye’s energy intensity reduced the energy use and this was a desirable outcome. In the remaining 12 periods, however, the energy intensity effect increased the energy use of the country. These periods are 1992-93, 1994-95, 1995-96, 1999-2000 (devastating earthquake), 2001-02, 2002-03, 2005-06, 2006-07, 2008-09 (financial crises), 2014-15, 2015-16, and 2018-19 (stagnation). In only 3 of 12 periods, the increases in energy intensity could be explained by economic or financial crises; however, in the remaining 9 of 12 periods, energy intensity raised the energy use in times of economic expansion. The results showed that Turkiye’s energy efficiency improvement is relatively weak and better management of energy use is required. Using the RLI approach the cumulative impact of energy intensity factor on energy use was found to be -987572 TJ and its share was -37.3% in 2019. The findings revealed that the energy intensity factor was close to compensating for the increasing impact of population in total energy use in Turkiye; however, the outcome had yet to reach a desirable level. The cumulative decomposition analysis results of Turkiye’s total energy use are depicted in Fig. 3.

Turkiye’s economic growth was calculated to be 243% for the period from 1991 to 2019, whereas the total energy use in the country increased by 153.8%. The decomposition analysis results revealed that the energy intensity factor reduced the energy use in the country in 16 of 28 periods, but the real income only declined in 3 of these 16 periods. Thus, it is possible to state that energy conservation policies that reduced energy intensity did not interrupt the economic growth. Hence, it is evident that the results of the RLI decomposition analysis for Turkiye’s total energy use are consistent with the conservation hypothesis.

5.2.2 Decomposition analysis results of the sector-level energy use

For industrial energy use, two different decomposition analyses were conducted. In the first one, the effects of three factors including sectoral energy intensity, sectoral structure, and total economic output were investigated. In the second analysis, however, sectoral structure effect was replaced by sectoral productivity and total output effect was replaced by sectoral employment.

5.2.3 Results of the first approach

Annual decomposition analysis results of the industrial energy use based on the first approach are depicted in Fig. 4.

The major determining factor of Turkiye’s industrial energy use was the output effect. Turkiye’s total real income increased by 243% from 290.8 billion dollars (in 1991) to 997.4 billion dollars (in 2019). Thus, the output effect increased Turkiye’s industrial energy use in 24 of 28 periods. The output effect reduced the energy use in only the 1993-94, 1998-99, 2000-01, and 2008-09 periods (i.e. in the periods of economic or financial crises). The cumulative impact of the output effect on Turkiye’s industrial energy use was calculated as 1099802 TJ and its share was 134.4% in 2019. The result regarding the dominant output effect in energy use is consistent with the findings of Ediger and Huvaz (2006) and Yılmaz and Atak (2010).

Following the output effect, energy intensity was the second largest determinant of industrial energy use over 1991–2019. In 19 of 28 periods, it lowered the energy use and this was a desirable outcome regarding the energy efficiency of Turkiye’s industrial sector. These results are partly contrasting with the findings of earlier energy use decomposition studies in the literature. For instance, the findings of the study of Ediger and Huvaz (2006) revealed that the impact of energy intensity was generally minimal in the period 1980–2000. In addition, their findings also showed that the energy intensity factor raised energy use in the sector between 1995 and 2000. The findings are also partly contrasting with the study of Yılmaz and Atak (2010), who proved that the energy intensity increased Turkiye’s sector level energy use in the 2000–2005 period. The empirical results of the present study demonstrated that the cumulative impact of energy intensity on industrial energy use was continuously negative since the period of 2004–2005. One can conclude that energy intensity became a major factor of industrial energy use in Turkiye. Using the RLI approach, the cumulative impact of energy intensity was calculated as -419691 TJ and its share was − 51.3%.

The structure effect had a minor increasing impact on Turkiye’s industrial energy use in the research period. The findings of the current study show that the structure effect increased the energy use of the sector in 18 of 28 periods. The share of the industrial sector in the total economy was around 22.9% in 1991 and it gradually increased to 26.9% until 2019. It is possible to conclude that Turkiye became more industrialized in the research period; however, the structure effect was not a dominant determinant of industrial energy use. The increase in industrial real income was calculated as 303.6%, and this value was higher than Turkiye’s overall real income increase (243%). The findings contrast with the extant literature once again. For example, Ediger and Huvaz (2006) demonstrated in their study that the structure effect played a more significant role in industrial energy use. Their study covered the period between 1980 and 2000, and in that period, Turkiye’s industrialization process was relatively quicker than in the post 2000 period. After 2000, the services sector became overwhelmingly important in the Turkish economy; thus, the structure effect was no longer a major determinant of industrial energy use. The RLI analysis results demonstrated that the cumulative impact of the structure effect was 138149.7 TJ in 2019. Its share was computed as 16.9% in industrial energy use. The cumulative decomposition analysis results for Turkiye’s industrial energy use based on the first approach are shown in Fig. 5.

5.2.4 Results of the second approach

Findings of the second approach for the decomposition of Turkiye’s annual industrial energy use are shown in Fig. 6.

In the second approach, the first component (sectoral energy intensity) is the same as the one used in the previous approach (one can compare Eqs. 7 and 11). However, the second and third components are different, namely the sectoral productivity effect and sectoral employment effect. Industrial real income increased by 303.6% in Turkiye over the period 1991–2019, whereas the sector’s energy use increased by 171.6%. Furthermore, sectoral energy intensity decreased from \({7.17*10}^{-6}\) to \(4.83*{10}^{-6 }\)in the studied period. Therefore, the sectoral energy intensity factor reduced the energy use of the industrial sector. The decomposition analysis results revealed that the cumulative share of sectoral energy intensity was \(-51.3\%\) in 2019. As previously mentioned, the negative energy intensity is a desirable result regarding the energy improvements of the sector.

The leading determinant of Turkiye’s industrial energy use appeared to be the productivity effect based on the second approach. Turkiye’s productivity (real income per worker) in the industrial sector rose substantially by 202.4% from 12186.6 dollars to 36846.2 dollars over the examined period. In 21 of 28 periods, industrial energy use was raised by the productivity effect based on the RLI findings. In periods such as 1993–1994, 1998–1999, 2000-01, 2007-08, 2008-09, 2013-14, and 2017-18, the productivity effect reduced energy use in the sector. These were the periods that were mainly characterized by economic or financial instabilities, natural disasters (such as the devastating earthquake in 1999), and stagnations. The cumulative share of the productivity effect in energy use was found to be 116.3% in 2019.

It was observed that the second factor that increased industrial energy use was the sectoral employment effect. It increased the energy use in 19 of 28 periods. Periods such as 1992-93, 1996-97, 1998-99, 1999–2000, 2000-01, 2001-02, 2002-03, 2008-09, and 2018-19 were the ones in which energy use was decreased by the sectoral employment effect. Although the share of industry workers declined gradually from 29.7 to 25.3% in total employment between 1991 and 2019, employment in the sector increased from 5.5 million to 7.3 million and this led to an increase in energy use. The cumulative impact of the employment effect in the sector’s energy use was computed as 286666.2 TJ, whereas its share was 35% at the end of the study period. In Fig. 7, the cumulative results of the second approach for the energy use of the Turkish industrial sector are presented.

Turkiye’s industrial energy use was 2.7 times higher in 2019 compared to the 1991 level, whereas this ratio was equivalent to 4 for the industrial sector’s real income for the same years. The empirical results of the RLI decomposition analysis demonstrated that the industrial energy intensity factor reduced sectoral energy use in 19 of 28 periods. However, Turkiye’s industrial real GDP declined in only 5 of these mentioned 19 periods. Thus, we can conclude that the declining energy use for industrial activities did not reduce the sector’s economic growth potential. Overall, similar to the results of other analyses performed in the present study, the sectoral decomposition analysis results support the conservation hypothesis.

5.3 Comparison of the models’ results

Since two different approaches have been studied for industrial energy use, it will be beneficial to compare their results. In the first model, sectoral energy intensity, sectoral structure effect, and total output effect were employed, whereas in the second model, only sectoral energy intensity remained the same as the first model. In the second model, the sectoral productivity effect and sectoral employment effect were adopted. If one compares these two approaches, it is possible to conclude that the second model is a better fit for the decomposition of industrial energy use. We reached this conclusion by carefully evaluating two conditions that appeared just after the computations. First, it can be observed from the graphical representations (especially Figs. 5 and 7) that fluctuations in the second model are comparatively less than in the first model. Since the decomposition analysis considers only three components, less scattered results possibly show that the variables are more closely related to the decomposed variable. Second, the variables used to calculate the indexes were compared. In the first model, sectoral energy use, sectoral real income, and total real income were used, while in the second model, sectoral energy use, sectoral real income, and sectoral employment were utilized. In the first model, in addition to the sectoral energy intensity effect, sectoral structure and total output effects are employed. However, in the second model, the sectoral energy intensity effect was used together with the sectoral employment and sectoral productivity effects. The second model was more realistic because the components were more sector-related. Thus, it was concluded that to decompose the industrial sector’s energy use, the proposed second model is more appropriate. Cumulative results of the RLI decomposition analysis for both aggregated and sectoral level are summarized in Table 4.

The results of the decomposition analysis of industrial energy use could be compared with a recent article published by Ataman (2024). The decomposition analysis conducted by the author was similar to the first decomposition analysis done for the industrial sector. The scholar concluded that the economic activity effect is the largest factor that caused the rise in energy use in the sector. This result is parallel with the results of the present study, since we found that the economic output effect is the main accelerator of energy use. However, our results contradict those of Ataman (2024) since the author concluded that the structure effect was a major factor that reduced energy use and the intensity effect caused a minor increase in energy use. We reported that the structure effect caused a minor increase and the intensity effect caused a major decrease in industrial energy use. The present article covers a longer time horizon (from 1991 to 2019); therefore, the trends in the determining factors could be observed in a more detailed way.

6 Conclusion

In this study, decoupling factor analysis and decomposition analysis were conducted for the energy use of Turkiye over the period of 1991–2019. The first part of the study examined the potential decoupling between real income and energy use at the aggregated and sector (industrial) levels. In the second part of the study, a decomposition analysis was performed for the total and industrial energy use of the country. For the sectoral level, two different models were analyzed and the results compared. Regarding the decoupling factor analysis, Tapio’s approach was utilized, whereas the RLI method was adopted for the decomposition analysis. While focusing on the decomposition analysis we examined the impacts of per capita real income, population, and energy intensity on energy use. For industrial energy use, the researcher focused on the impacts of the total output effect, sectoral structure effect, and sectoral energy intensity in the first model. However, the researcher analyzed the impacts of sectoral energy intensity, sectoral productivity, and sectoral employment in the second model. The first model is partly in line with the extant literature, whereas the second model is proposed by the researcher in this study.

The general findings of the decoupling factor analysis showed that the decoupling between Turkiye’s total energy use and real income was stronger than the decoupling between industrial energy use and industrial real income. For both cases, in 17 of 28 periods the unwanted decoupling cases occurred. The results of the aggregated decomposition analysis are generally consistent with the extant literature. The per capita real income effect was the main driver of total energy use. The energy intensity reduced the total energy use; however, the results revealed that Turkiye has more to do in terms of energy efficiency. The population effect was the second determining factor of the analysis and it increased energy use continuously. Turkiye’s population growth rate was still high in the examined period, because the country continued to accept refugees from neighbouring countries. As Rüstemoğlu (2022) suggested for Australia, Turkiye should also re-evaluate its migration policies.

For sectoral energy use, the decomposition analysis results of the first model partly contrasted with the earlier literature. The output effect was consistent in general; however, the impacts of two factors, structure effect and intensity effect, were found to be less and more dominant in the industrial sector’s energy use compared to previously published articles. In the second model, the researcher replaced the output effect and sectoral structure effect with the sectoral employment and sectoral productivity effects. The results of the second model were more balanced since the selected variables and calculated indexes were more sector oriented. Therefore, for future studies, researchers could use the second model for sectoral analysis to obtain more accurate results.

As discussed in the second section of the present research, there are four different hypotheses regarding the nexus between energy use and economic growth, namely the neutrality hypothesis, growth hypothesis, conservation hypothesis and feedback hypothesis. Based on the Tapio decoupling model, RLI decomposition analysis findings, and the sub-hypotheses that were developed for this research, the link between energy use and economic growth in the case of Turkiye is in line with the conservation hypothesis.

Turkiye is highly dependent on energy imports and therefore promotes the utilization of domestic energy sources such as coal and renewables. Coal is the dirtiest fossil fuel; thus, increasing its use rises the air pollution and health issues. On the other hand, Turkiye’s ambitious renewable energy policies largely have a positive impact on electricity generation and this is highly beneficial for environmental sustainability. Turkiye is currently building a nuclear power plant in its Mediterranean coastal province Mersin to reduce the energy dependency. However, as Aktaş (2021) highlighted, 78% of the citizens consider this project to be risky. Moreover, 84% of them think that the nuclear project is the wrong decision. Although nuclear energy could be a good solution for decreasing energy imports, the general tendency in the world is to close such nuclear power plants. Past experiences (such as Ukraine − 1986 and Japan − 2011) regarding nuclear energy have increased the concerns among global citizens about this risky subject. Therefore, this paper suggests the utilization of modern renewables including solar, wind, and geothermal for Turkiye in its energy production. Diversification of the energy use matrix could also stimulate employment in the related sectors (Wada & Tuna, 2017). Turkiye’s target for electricity generation from renewable energy sources and energy efficiency measures will also contribute to the country’s economic stability achievements. In order to accomplish these goals, incentives, investment opportunities, green projects, research and development on renewable energy sources, and tax reductions on sustainability projects should be supported. Turkiye’s strategic energy plans, which involve the extensive use of wind and solar energy sources for electricity generation, will also have a positive impact on the environmental quality of the country due to the reduction of CO2emissions. Other policy recommendations for Turkiye’s total and industrial energy use reduction can be listed as follows:

First, sub-sector policy derivations should be scheduled for the industrial sector. For example, regarding the manufacturing of basic metals, new public and private sector investments should be initiated. Such investments would reduce the country’s energy import dependence. Second, as recommended by Önder (2021), energy demand in the electricity, gas, steam, and air conditioning supply sectors should be met using the abundant renewable energy sources of Turkiye (including hydro, biomass, solar, geothermal, and wind). Third, for the production of paper and paper products, recycling projects should be implemented in order to reduce the waste and energy use. Fourth, as emphasized by Karaaslan & Çamkaya (2022), investors in the industrial sector who are willing to utilize renewable energy in their production facilities should be financially supported. Fifth, it is notable that the transport sector was the second leading consumer of energy in Turkiye, following the industrial sector. In order to decrease the total energy use in the country, the transport sector requires special attention. To decrease the energy use of this sector, public transportation should be promoted. The railway network should be further expanded and train travel should be supported. Sixth, the utilization of solar panels for houses as well as small and medium-sized enterprises should be supported with the help of subsidies. Seventh, education should be used an important tool to raise the awareness about energy conservation, carbon footprint and climate change. Younger generations should be educated about concepts such as energy conservation, energy dependence and climate crises. Last but not least, the increasing utilization of modern renewables will raise the competitiveness in the energy sector and this will lower the energy prices.

Various recommendations can be made for future research studies on energy and environment related topics. For example, Turkiye’s transport, residential buildings, commercial and public services sectors are highly energy intensive sectors; thus. decomposition analysis studies could also be conducted for these sectors. Recent environment and energy related studies have utilized the load capacity factor and ecological footprint as explained variables (Pata & Işık, 2021; Işık et al., 2021). These studies utilized the econometric regression techniques as methods; however, decomposition analyses could be also performed by identifying the load capacity factor and ecological footprint as dependent variables. On the other hand, some more recent environment and energy related studies have highlighted the importance of international trade by assigning exports as the explanatory variable in econometric regressions (Işık et al., 2024b). Exports could also be included in energy and environment related studies that will use index decomposition analysis. Rüstemoğlu (2023) compared Turkiye’s CO2emission dynamics with six other developing nations by using migration as an independent variable. These types of studies could be repeated using energy use as the dependent proxy rather than CO2, in the decomposition analysis.

The datasets generated during and/or analyzed during the current study are available from the corresponding author on reasonable request.

Notes

All the data related to CO2 emissions, total and industrial energy use in this study were sourced from the International Energy Agency (IEA) database. Energy use data based on the energy source were gathered from the database of Our World in Data.

In 1991, the shares of oil, coal, and natural gas were equal to 35%, 23.9% and 18.6% of global energy use, respectively. The share of hydro was 6.1% and traditional biomass was 10.4%. Furthermore, the shares of wind, solar, modern biofuels, and other renewables were 0.01%, 0.001%, 0.1%, and 0.4% in the same year.

In 2019, the shares of oil, coal, and natural gas were equal to 30.7%, 25%, and 22.4% in global energy use, respectively. In the same year, the share of hydro was 6.4%, and traditional biomass was 6.4%. On the other hand, the shares of solar, wind, modern biofuels, and other renewables were equal to 1.1%, 2.1%, 0.6% and 1.2% in global energy use, respectively.

In 1991, the shares of oil, coal, and natural gas were equal to 46.6%, 34.7%, and 6.9% in Turkiye’s energy use, respectively. However, solar or wind sources were not included in Turkiye’s energy use mix.

In 2019, the shares of oil, coal, and natural gas were equal to 30.4%, 26.6%, and 23.7%, in Turkiye’s energy use, respectively. Compared to 1991, one can conclude that natural gas partly replaced oil and coal in the energy matrix.

In 2019, the shares of solar, wind, modern biofuels and other renewables were 1.3%, 3.1%, 0.1%, and 2% in Turkiye’s overall energy use. It is possible to conclude that modern renewables considerably increased in Turkiye’s energy matrix. The country’s reliance on hydro sources also continued in the study period.

Energy exports/imports data of the country are extracted from the IEA database.

All energy trade information for Turkiye’s energy market is summarized from the IEA energy report.

The electricity generation data of Turkiye were gathered from the IEA database.

In 1991, the amount of electricity generation from hydro, coal, natural gas, oil, and geothermal sources in Turkiye was 22.7 thousand GWh, 21.6 thousand GWh, 12.6 thousand GWh, 3.3 thousand GWh, and 81 GWh, respectively.

In 2019, the amount of electricity generation from coal, hydro, natural gas, wind, solar, geothermal, biofuels, other sources, oil, and waste in Turkiye was 112.9 thousand GWh, 88.8 thousand GWh, 57.3 thousand GWh, 21.7 thousand GWh, 9.3 thousand GWh, 9 thousand GWh, 3.5 thousand GWh, 1.1 thousand GWh, 336 GWh, and 34 GWh, respectively.

Based on the World Bank (2023) data, Turkiye’s annual population growth rate was 1.2% in 2007. However, it increased because of the Syrian civil war and reached its peak (1.7%) in 2014. Thereafter, the population growth rate started to decline again and it was 1.3% in 2019.

References

Aktaş, E. (2021). Mersin Halkının Akkuyu Nükleer Santral Projesi ve Sektörel Etkileri Hakkındaki Görüşleri (the opinion of people about the nuclear power plants who live Turkey’s Mersin Province). Journal of Applied and Theoretical Social Sciences, 3(2), 109–124.

Akyürek, Z. (2020). LMDI decomposition analysis of energy consumption of Turkish manufacturing industry: 2005–2014. Energy Efficiency, 13, 649–663.

Ang, B. W., & Zhang, F. Q. (2000). A survey of index decomposition analysis in energy and environmental studies. Energy, 25, 1149–1176.

Ataman, A. Y. (2024). Analysis of the energy consumption on manufacturing industry in Turkiye (2003–2014). Ekonomi (Tek), 13(1), 1–48.

Dong, J., Li, C., & Wang, Q. (2021). Decomposition of carbon emission and its decoupling analysis and prediction with economic development: A case study of industrial sectors in Henan Province. Journal of Cleaner Production, 321, 129019.

Düzgün, B., Köksal, M. A., & Bayındır, R. (2022). Assessing drivers of residential energy consumption in Turkey: 2000–2018. Energy for Sustainable Development, 70, 371–386.

Ediger, V. Ş., & Huvaz, O. (2006). Examining the sectoral energy use in Turkish economy (1980–2000) with the help of decomposition analysis. Energy Conversion and Management, 47(6), 732–745.

Han, X., Xu, Y., Kumar, A., & Lu, X. (2018). Decoupling Analysis of Transportation Carbon Emissions and Economic Growth in China. Environmental Progress and Sustainable Energy, 37(5), 1696–1704.

IEA (2021). International Energy Agency. Energy policy review, country report. https://www.iea.org/reports/turkey-2021 accessed: March, 2023.

IEA (2023). International Energy Agency. https://www.iea.org/, accessed: May, 2022.

Işık, C. (2010). Natural gas consumption and economic growth in Turkey: A bound test approach. Energy Systems, 1, 441–456.

Işık, C., Ahmad, M., Ongan, S., Ozdemir, D., & Muhammad, I., Alvarado R (2021). Convergence analysis of the ecological footprint: Theory and empirical evidence from the USMCA countries. Environmental Science and Pollution Research, 28, 32648–32659.

Işık, C., Azka, A., Yusoff, N., Peng, S., Ullah, A., & Akbar, M. (2024a). The influence of energy transition, and natural resources on carbon emissions in China: An augmented ARDL application. Environment Development and Sustainability. https://doi.org/10.1007/s10668-023-04398-0.

Işık, C., Ongan, S., & Özdemir, D. (2019). Testing the EKC hypothesis for ten US states: An application of heterogeneous panel estimation method. Environmental Science and Pollution Research, 26, 10846–10853.

Işık, C., Ongan, S., Özdemir, D., Jabeen, G., Sharif, A., Alvarado, R., Amin, A., & Rehman, A. (2024b). Renewable energy, climate policy uncertainty, industrial production, domestic exports/re-exports, and CO2 emissions in the USA: A SVAR approach. Gondwana Research, 127, 156–164.

Işık, C., & Pata, U. K. (2021). Determinants of the load capacity factor in China: A novel dynamic ARDL approach for ecological footprint accounting. Resources Policy, 74, 102313.

Işık, C., Simionescu, M., Ongan, S., Radulescu, M., Yousaf, Z., Rehman, A., Alvarado, R., & Ahmad, M. (2023). Renewable energy, economic freedom and economic policy uncertainty: New evidence from a dynamic panel threshold analysis for the G-7 and BRIC countries. Stochastic Environmental Research and Risk Assessment, 37, 3367–3382.

Karaaslan, A., & Çamkaya, S. (2022). The relationship between CO2 emissions, economic growth, health expenditure, and renewable and non-renewable energy consumption: Empirical evidence from Turkey. Renewable Energy, 190, 457–466.

Karakaya, E., Bostan, A., & Özçağ, M. (2019). Decomposition and decoupling analysis of energy-related carbon emissions in Turkey. Environmental Science and Pollution Research, 26, 32080–32091.

Köne, A. Ç., & Büke, T. (2016). The impact of changing energy mix of Turkey on CO. Emission Intensities Environment Protection Engineering, 42(3), 85–93.

Kumbaroğlu, G. (2011). A sectoral decomposition analysis of Turkish CO. Emissions over 1990–2007 Energy, 36(5), 2419–2433.

Lee, C-C., Chang, C-P., & Chen, P-F. (2008). Energy-income causality in OECD countries revisited: The key role of capital stock. Energy Economics, 30, pp2359–2373.

Mucuk, M., & Uysal, D. (2009). Turkey’s energy demand. Current Research Journal of Social Sciences, 1(3), 123–128.

Önder, H. G. (2021). Renewable energy consumption policy in Turkey: An energy extended input-output analysis. Renewable Energy, 175, 783–796.

OECD – Organization for Economic Co-operation and Development (2002). OECD – Organization for Economic Co-operation and Development. Indicators to Measure Decoupling of Environmental Pressure from Economic Growth. Sustainable Development. SG/SD (2002) 1/ Final (2002). Website: http://www.olis.oecd.org/olis/2002doc.nsf/LinkTo/sg-sd(2002)1-fnal accessed: May, 2022.

Our World in Data (2023). Energy. https://ourworldindata.org/energy#country-profiles, accessed: March 2023.

Özcan, K. M., Gülay, E., & Üçdoğruk, Ş. (2013). Economic and demographic determinants of household energy use in Turkey. Energy Policy, 60, 550–557.

Öztürk, İ., Kaplan, M., & Kalyoncu, H. (2011). Energy consumption and economic growth in Turkey: cointegratıon and causality analysis. Romanian Journal of Economic Forecasting, 2, 31–41.

Örgün, B. O., & Pala, A. (2017). Enerji Tüketimi, Dışa Açıklık ve Ekonomik Büyüme İlişkisi: 28 Avrupa Birliği Ülkesi için Panel Granger Nedensellik Analizi (the relationship between Energy Consumption, Trade openness and economic growth: Panel Granger Causality Analysis for EU-28 Countries). Finans Politik ve Ekonomik Yorumlar, 54(623), 9–20.

Rüstemoğlu, H. (2022). Analysis of the drivers of CO. Emissions and Ecological Footprint Growth in Australia Energy Efficiency, 15(1), 1–22.

Rüstemoğlu, H. (2023). Growth with environmental pollution?A comprehensive and comparative environmental analysis for the BRICS, Mexico, Indonesia and Turkiye for the period between 1992–2020. Energy Efficiency, 16(96). https://doi.org/10.1007/s12053-023-10175-9.

Rüstemoğlu, H., & Andres, A. R. (2016). Determinants of CO. Emissions in Brazil and Russia between 1992 and 2011: A Decomposition Analysis Environmental Science & Policy, 58, 95–106.

Safi, A., Gao, S., Zhu, Y., & Kchouri, M. (2024). B., Financial inclusion empowering sustainable technologies: Insights into the E-7 economies from COP28 perspectives. Technological Forecasting & Social Change, (201):123177.

Song, M., Cheng, S., Wu, Y., Chen, H., Chen, J., & Hou, W. (2019). Determinants of changes in electricity generation intensity among different power sectors. Energy Policy, 130, 389.

Song, M., Chen, J., Gao, M., Li, D., Li, L., & Xie, Q. (2021). Changes in PM2.5 emissions in China: An extended chain and nested refined Laspeyres index decomposition analysis. Journal of Cleaner Production, 294, 126248.

Song, M., Chen, J., Wang, P., Cui, L., & Huang, S. (2018). Decomposition and decoupling analysis of CO2 emissions in OECD. Applied Energy, 231, 937–950.

Soytaş, U., & Sarı, R. (2003). Energy consumption and GDP: Causality relationship in G-7 countries and emerging markets. Energy Economics, 25(1), 33–37.

Sun, J. W. (1998). Changes in energy consumption and energy intensity: A complete decomposition model. Energy Economics, 20, 85–100.

Tapio, P. (2005). Towards a theory of decoupling: Degrees of decoupling in the EU and the case of road traffic in Finland between 1970 and 2001. Transport Policy, 12, 137–151.

Wada, I., & Tuna, G. (2017). Crude oil price volatility and energy mix in Saudi Arabia. Energy Sources Part B: Economics Planning and Policy, 12(6), 526–532.

Wang, F., Meng, F., Chen, S., Cheng, S., Chen, B., Li, Z., & Liu, G. Analysis of subnational CO2 mitigation policy pressure in the residential sector in China. Journal of Cleaner Production, 293: 126203.

World Bank (2023). World Bank, World Development Indicators. https://databank.worldbank.org/ accessed: May, 2022.

Yang, X., Xu, H., & Su, B. (2022). Factor decomposition for global and national aggregate energy intensity change during 2000–2014. Energy, 254, 124347.

Yıldırım, E., & Aslan, A. (2012). Energy consumption and economic growth nexus for 17 highly developed OECD countries: Further evidence based on bootstrap-corrected causality tests. Energy Policy, 51, 985–993.

Yılmaz, M., & Atak, M. (2010). Decomposition Analysis of Sectoral Energy Consumption in Turkey. Energy Sources, Part B: Economics, Planning and Policy, 5, 224–231.

Yılmaz, M., Ürüt Kelleci, S., & Bostan, A. (2016). Türkiye İmalat Sanayiinde Enerji Tüketiminin İncelenmesi: Ayrıştırma Analizi (Analysis of energy consumption in Turkish manufacturing industry: decomposition analysis). Uşak Üniversitesi Sosyal Bilimler Dergisi (Uşak University, Social Sciences Journal), 9 (1): 205–224.

Zachariadis, T. (2007). Exploring the relationship between energy consumption and economic growth with bivariate models: New evidence from G-7 countries. Energy Economics, 29, 1233–1253.

Zuo, Q., Wu, Q., Ma, J., Zhang, Z., & Jiang, L. (2021). Evolution analysis of water consumption and economic growth based on decomposition-decoupling two-stage method: A case study of Xinjiang Uygur Autonomous Region, China. Sustainable Cities and Society, 75, 103337.

Funding

Open access funding provided by the Scientific and Technological Research Council of Türkiye (TÜBİTAK).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The findings of this study were presented at the 6th International Conference on Economics Research and Financial Markets held in May 2022 in Konya, Turkiye.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.