Abstract

The excessive use of non-renewable energy in 21st-century economic growth has continued to hurt the environment by accumulating carbon dioxide and other greenhouse gases. However, promoting environmental sustainability requires expanding clean energy utilisation. In this study, we examine the effects of clean energy expansion and natural resource extraction on load capacity factor (LCF) in China from 1970 to 2018. Using the dynamic autoregressive distributed lag simulations approach, we extend the standard load capacity curve (LCC) hypothesis by incorporating clean energy expansion and natural resource extraction as main determinants of the LCF. The empirical outcomes reveal that economic expansion is, although positively associated with the LCF, but its squared term degrades the LCF. This confirms that the LCC hypothesis is not valid for China. Moreover, while clean energy expansion has a positive effect on the LCF, the effect of natural resource extraction is negative. These effects are stronger and statistically significant only in the long run. Therefore, this study highlights the potentials for a sustainable decarbonized economy in China by investing not only in clean energy sources but also efficiently use the available natural resources in the country.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The rise in greenhouse gases has caused numerous negative consequences, including global warming and changes in the climate. As a result, maintaining a clean and healthy environment has become a crucial priority for communities and nations, while economic concerns remain important. A recent worldwide initiative aimed at addressing environmental challenges involves the annual gathering of the World leaders via the United Nations Climate Summits, commonly referred to as the Conference of the Parties (COP) to the United Nations Framework Convention on Climate Change (UNFCCC) (Leggett, 2020; Wang & Chang, 2014). This assembly of delegates from different nations worldwide aims to engage in discussions and negotiations pertaining to measures for climate change mitigation and adaptation. During the summits, participating nations would present their programs and strategies as well as their challenges towards reducing global temperatures by shifting away from fossil fuels and adopting alternative energy sources in their regions and continents (Chen et al., 2022; Sun et al., 2021; Zhang et al., 2019).

This study seeks to examine whether climate policies which promote clean energy expansion and natural resource extraction exert upward or downward pressure on environmental sustainability in China. China as a signatory to Paris agreement has been committed towards tackling environmental issues over the years. In recently, in its commitments to Paris agreement, China has introduced several climate policies, which include the “Dual Carbon Policy”. The main aim of the dual carbon policy is to peak carbon dioxide (CO2) in the country before 2030 and achieve carbon neutrality by 2060 (see Shao et al., 2022; Zhao et al., 2022; Wang & Yan, 2022).

While China is fast shifting towards clean energy sources, there is a rising level of natural resource extraction to meet the demand for twenty-first century growth, which is characterized by heavy production and consumption. Theoretically, as natural resources deplete, there is a tendency that such depletion may trigger environmental challenges as noted by Chang and Wang (2017). Moreover, given the tremendous growth of China over the years with its vast population of over 1.4 billion (i.e. 18.47% of the total global population), the country is one of the major emitter of CO2 as it accounted for more than 25% of the World’s GHG emissions in 2019. The per capita emissions of 9 metric tons of CO2 were not only higher than the 7% emissions in 27 EU nations but higher than the global average. According to Statista (2022), China was the largest World’s polluter in the year 2021, emitting about 11.47 billion metric tons of CO2. Even though most countries witnessed a decrease in total emissions due to the COVID-19 pandemic in 2020, China was one of a few countries that witnessed a rising level of emissions (see Statista, 2022; Özkan et al., 2023a&b).

Fundamentally, the environmental Kuznets curve (EKC) hypothesis, championed by Grossman and Krueger (1991), has been widely used to explain the nexus between economic growth, energy consumption, and environment sustainability. While some studies used CO2 emissions to measure the state of environmental pollution and sustainability (Ding et al., 2021; Khattak et al., 2022), several empirical studies used ecological footprint (EF) to assess the influence of human activities on sustainable environment (see Usman et al., 2020a&b; Fakher et al., 2023; Gimba et al., 2023). These commonly measures have received criticism for only being able to capture the demand side of the environmental equation. Therefore, our study contributes to the literature in three folds: Firstly, our study constructs the load capacity factor (LCF) variable, which apparently considers demand and supply factors. This variable comprehensively captures environmental sustainability than CO2 emissions or ecological footprint commonly used in the existing literature. Secondly, the load capacity curve (LCC) hypothesis is tested in China by controlling for the effects of clean energy expansion and natural resource extraction. This will provide policy insights into accelerating the pace of achieving net-zero emission targets in China by 2060. Thirdly, a dynamic autoregressive distributed lag (DARDL) simulation model is applied to capture the out-of-sample counterfactual shock effect in explanatory variables over time.

It is hoped that the findings of this study will help governments and policymakers to formulate and design appropriate environmental policies and programs that promote not only sustainable growth but also clean energy and efficient use of available natural resources to achieve long-term net-zero emission targets in China. The remaining sections of this study are adroitly structured based on the following: Sect. 2 reviews the related literature. Section 3 presents the dataset and empirical approaches employed. Section 4 presents the empirical results and a discussion of major findings. Lastly, Sect. 5 provides a summary of the study alongside the policy recommendation based on the findings.

2 Theoretical framework and literature review

The theoretical underpinning study is from two distinct environmental sustainability theories. The first theory is based on the LCC hypothesis advanced by Siche et al. (2010). This hypothesis is based on the assumption that LCF has a decreasing economic growth effect in the early stage of development. However, after certain technological advancement, an increase in LCF will be associated positively with economic growth. By this hypothesis, the relationship between economic growth and environmental sustainability is characterized by U-shape.

In recent times, several studies have attempted to test the validity of the LCC hypothesis. For example, Pata and Kartal (2023) displayed full support for the LCC and EKC hypotheses in South Korea with nuclear energy bolstering the level of environmental protection, while renewable energy has no significant environmental improvement in the long term. Pata et al. (2023a) also examined the vital role played by renewables and nuclear energy-related investment in R&D and income in achieving environmental sustainability in Germany. As documented, clean energy investment lowers environmental damage while investment in nuclear energy-related R&D is ineffective in reducing environmental degradation. Consequently, the LCC hypothesis is invalid, but the EKC is confirmed. Furthermore, in testing the LCC hypothesis using the non-renewable efficiency and REC, Alola et al. (2023) applied the dynamic ARDL simulations for India. While the results suggested that non-renewable energy efficiency and renewable energy promote the level of LCF, there is also evidence that the assumption of the LCC is invalid for India. On the contrary, Huang et al. (2023) examined the effect of technology in terms of eco-friendliness on the environment measured by LCF in the Indian economy. The results showed that the N-shaped LCC hypothesis is validated in India. The results further indicated that the eco-friendly-based technology reduces the LCF. This result invariably implies that an increase in eco-friendly technology harms environmental quality in India but an increase in energy consumption boosts environmental quality.

The second theory for this study is based on the sustainable finance hypothesis advanced by the United Nations’ Environmental Protection Program (henceforth called UNEP) in 2014. The main thesis of this theory is that investment decisions are centred mainly on three main aspects, namely the environment, social, and governance (ESG). These aspects are linked to economic growth. For the purpose of this study, our interest is on the environment factor, which deals with climate actions to mitigate environmental degradation emanating from the accumulation of CO2 and other components of greenhouse gases. Based on the sustainable finance hypothesis, resources are expected to be used in such a way that it will promote not only a cleaner environment, but also economic growth and development. In such a situation, emphasis is placed on green activities by expanding renewable energy through innovations and technologies. The validity of this sustainable finance theory has been empirically tested in several recent studies. For example, Chang and Wang (2017) showed that the absence of a clear legal system for the marine renewable energy development affects the development of renewable energy the sector. Balcilar et al. (2023a) found evidence that the investment in renewable energy stimulates sustainable growth in OECD countries, while Usman (2023) supported the sustainable finance hypothesis by supporting the role of expenditure on renewable energy in mitigating environmental degradation in G7 countries.

With great evidence of devising clean energy sources and intensified clean transitional energy policies, if resources are efficiently utilized, environmental challenges might be reduced significantly in China. According to Fernández (2023), China's consumption of solar energy is significantly greater than that of other major countries, including the USA, Japan, and Germany. In addition, solar power generation has grown dramatically over time in China, with a total of 330 TWh generated in 2021. Meanwhile, wind power is the second most significant clean energy source in China. Also, Usman (2022) showed based on a dynamic ARDL model that a rise in the level of REC dampens environmental disasters in Nigeria through its negative effect on ecological footprint while Xu et al. (2022) examined how financial globalization affects the LCF in Brazil considering the role of REC and urban development. Their results find evidence that both REC and non-REC are attributing to a decline in the level of LCF. Furthermore, in a recent paper, Adikpo and Usman (2023) found that, in addition to the negative influence of a country’s reputation in lowering environmental externalities, REC evidently helps to promote environmental sustainability in D-8 economies. Nwani et al. (2023) applying the consumption-based Kaya identity metrics, showed that REC is negatively associated with CO2 emissions, while an inverted U-shaped is found between energy and carbon intensity for EU countries.

Furthermore, several studies have examined how natural resource explorations affect the environment. For example, Badeeb et al. (2020) utilized autoregressive distributed lag (ARDL) and structural break co-integration techniques to examine the impact of natural resources (NRs) on environmental quality within the EKC’s framework. Their research results demonstrated that a dependence on natural resources supports the link between economic growth and environmental quality. Another study conducted by Zafar et al. (2019) investigated the effect of NRs on the USA's Environmental Footprint (EFP) from 1970 to 2015 using ARDL and bounds testing methodologies. Their findings revealed that an abundance of natural resources is negatively correlated with EFP, leading to an improvement in environmental quality in the long run. Ahmed et al. (2020) investigated the role of NRs, human capita, and urban development on the level of ecological footprint in China. The findings showed that while an increase in both NRs and urban development escalate environmental disasters, human capital dampens ecological footprint. Also, Nathaniel et al. (2020) submit that economic growth and NRs have a positive and significant effect on ecological footprint, but the effect of renewable energy is negative and significant. These results imply that economic expansion with NRs cause environmental disasters, but REC improves the environment in terms of sustainability in BRICS countries.

Similarly, in a recent paper, Balcilar et al. (2023b) found that the negative effect of MNCs’ operational behaviours on the environment is perhaps moderated by natural resource endowments in Africa. There have been a few studies that have looked at the link between a sustainable environment and LCF. Pata (2021) investigated the influence of REC on LCF in the USA and Japan. Using the augmented-ARDL model, the study documented that REC enhanced LCF in the USA; however, the magnitude of REC was insignificant in Japan. Fareed et al. (2021) also documented that REC and export diversification bolster the LCF, which ultimately leads to improvement in the environment. Furthermore, the role of natural resources in explaining environmental disasters is evaluated by Naqvi et al. (2023). The results reveal that natural resources exacerbate the level of environmental degradation in 14 countries in Asia Pacific Economic Cooperation. Also, Luo et al. (2023) assess how the level of natural resources and economic expansion influence the environment in Asian countries. The results unfold that natural resources mitigate environmental disasters in oil exporting countries, while economic expansion stimulates disasters in the environment.

Given the foregoing literature review, it is clear that the need to investigate this specific issue is not only motivated by the paucity of literature on the natural resources–clean energy–LCF nexus but also to evaluate how natural resources and clean energy expansion mitigate environmental externalities using the procedure of the LCC hypothesis. It is hoped that our contribution could help provide a hint as to the effectiveness or otherwise of expanding clean energy and natural resources usage in promoting carbon neutrality targets in China.

3 Sources of data and methodological development

3.1 Data sources

In this study, a time series analytical approach is followed to achieve a specified study’s goal for China between the periods of 1970 to 2018. The data for GDP per capita and natural resources extraction (NR) are obtained from the World Development Indicators (WDI, 2022). The load capacity factor (LCF) and renewable/unpolluted energy (REC) are sourced from the Global Footprint Network and Our World Data, respectively (GFN, 2022; OWD, 2022). The variables, their unit of measurement, and sources are outlined in Table 1:

3.2 Empirical model

To examine the impact of the variables such as clean energy expansion and natural resources extraction on the level of LCF, we construct the general economic function in Eq. (1):

where \({\text{LCF}}\) is the load capacity factor, a measure of environmental quality. \({\text{GDP and GDP}}^{2}\) are the gross domestic product and its squared term. While \({\text{GDP}}\) measures the level of economic growth, the squared \({\text{GDP}}\) unfolds whether the LCC is characterized by a U-shape or an inverted U-shape.Footnote 1 Furthermore, \({\text{REC and NR}}\) present the clean energy expansion and natural resources extraction, which are included in the model as determinants of the LCF. Therefore, following Eq. (1), the econometric model in Eq. (2) expresses economic growth and its squared term, cleaned energy expansion, and natural resources as determinants of the LFC:

where, ln represents the logarithm forms of each of the variables. \(\theta_{0}\) indicates the intercept, \(\theta_{1}\) to \(\theta_{4}\) are the coefficients of the predictor's variables, \(\varepsilon_{t}\) signifies the stochastic variable. To eliminate the non-normality and heteroscedasticity issues in the study, Samreen and Majeed (2022), Ramezani et al. (2022), Pata et al. (2023b), recommended that all the variables in the model adopt log transformation. If the coefficient of \({\text{lnGDP}}\) is negative, (\(\theta_{1}\) < 0), and the coefficient of \({\text{lnGDP}}^{{2}}\) is positive (\(\theta_{2}\) > 0), then the LCC assumption is verified. If the reverse is the case, it implies that the LCC assumption cannot be verified or supported. The coefficient of \({\text{lnNR}}\) is expected to be negatively associated with the LCF (\(\theta_{3}\) < 0) because China is a nation that consumes large amounts of fossil fuels and other traditional energy sources. Particularly, China is the largest consumer of the coal in globe. \({\text{lnREC}}\) reduces carbon emissions in the atmosphere. This is because clean energy consumption helps to lower the atmospheric concentration of carbon dioxide and other components of greenhouse gases. Therefore, \({\text{lnREC}}\) is assumed to have a positive impact on the LCF (\(\theta_{4}\) > 0).

3.3 Dynamic ARDL simulations model

ARDL (autoregressive distributed lag) models are often used to estimate the long-run relationships between variables, particularly in the presence of non-stationarity. The application of an ARDL model can be challenging when the model is characterized by the complexity of lag lengths and differenced variables. This is because the effects of the regressors may be spread across different time periods, and it can be difficult to isolate the effects of specific regressors in the presence of other variables and their lags. Additionally, the length of the time series data and the choice of lag lengths can also impact the accuracy of the results. Therefore, careful analysis and interpretation of the results are necessary to accurately determine the effects of the regressors in the short term and long term. To simplify the process, Jordan and Philips (2018) introduced a simulated dynamic ARDL modeling approach to address the complexity of estimating the effects of independent variables on the dependent variable. As pointed out in the recent work of Ozkan et al. (2023) and Özkan et al. (2023a), the dynamic ARDL model can handle a complex issue of multiple lags of first difference variables and thus provide the estimated plot of out-of-sample counterfactual long- and short-term effect of exogenous shocks over time. To utilize the dynamic ARDL simulations model, two criteria need to be satisfied as noted by Sarkodie et al. (2019): firstly, the variables must have an integration order of not greater than I(1); secondly, the variables must be cointegrated. For the first criterion, the endogenous variable (LCF) needs to be stationary, i.e. I(1), while the exogenous variables can have an integration order of either I(0) or I(1). Therefore, Eq. (3) shows the expression of the Dynamic ARDL simulations model as follows:

From Eq. (3), \(\Delta\) represents the difference operator, \(\alpha_{0}\) denotes the intercept, \(\beta_{0}\) is the first lag of the endogenous variable. \(\theta_{i} , i = 1, \ldots ,4\) represent the short-run parameters while \(\omega_{j} , j = 1, \ldots ,4\) are the long-run parameters. The last term, i.e. \(\mu_{t}\) indicates the disturbance term, which is assumed to have a zero mean.

4 Empirical results and discussion

4.1 Preliminary check

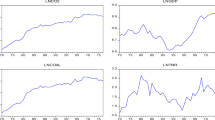

The initial step in the process of data analysis regarding time series involves preliminary checking, which involves a time plot visual of the variables explored in the study. This is necessary for determining whether trends, seasonality, drifts, and structural breaks exist in these variables as their presence may hamper the outcomes of the regression. As shown in Fig. 1, the time series plot representations reveal that the variables exhibit a trend. Therefore, it is necessary to perform further testing to determine whether the variables are stationary.

The descriptive statistical analysis for the aforementioned variables is understandably divulged in Table 2. All the variables are normally distributed with skewness close to 0 for all the variables and kurtosis having positive values for all the variables. Compared to the mean of the other variables, GDP has a high mean of 7.246. China has experienced rapid economic growth over the past few decades, and its GDP has played a crucial role in driving this growth. In the year 2019, the energy sector (including electricity, gas, and water supply) contributed about 5.5% to China's GDP. This suggests that the energy sector is a significant component of China's economy, but it is not the dominant sector (Morrison, 2019; Zheng & Walsh, 2019). It is worth noting that China has been investing heavily in clean energy and energy efficiency in recent years, in an effort to reduce its dependence on fossil fuels and mitigate the impacts of climate change. This shift in energy policy is likely to have a significant impact on the energy sector's contribution to China's GDP in the future. Natural resources, which represented 7.99% of economic growth in 2011 and 9.91% in 2008, substantially contributed to the gross domestic product of China (Pata & Isik, 2021). It was invariably divulged that China's environmental sustainability improved at a different rate than other countries. The LCF declined slightly from 0.64 in the year 1981 to 0.24 in the year 2017, indicating that China's resource utilization exceeds environmental sustainability. Chinese consume more ecological assets than available resources, causing environmental degradation (Meng et al., 2021; Xiong & Xu, 2021).

4.2 Unit root results

When analysing data from time series, it is essential to address where a series is stationary or non-stationary. A stationary stochastic process is one in which the statistical properties (such as mean, variance, and autocovariance) of the process do not change over time. Numerous studies used standard unit root tests by Dickey and Fuller (1979) and Phillips and Perron (1988) to investigate the order of integration of variables. Both tests are unsuitable for small sample data sets due to their poor size and power properties (Dejong et al., 1992). As a result, the Ng-Perron and DF-GLS unit root test is used in this study. Table 3 reveals the unit root test results of all the variables (LCF, GDP, REC, NR). As shown by the results, all the variables cannot reject the null hypothesis which perhaps shows no stationarity at levels but the results of their first differences submit that all the series are remarkably stationary at a 1% significance level for the two distinct tests for unit roots (i.e. Elliott et al., 1996 and Ng & Perron, 2001).

4.3 Cointegration outcomes

Further, once the integration order of the variables has been determined, the next step is to assess whether there is a long-run relationship between the variables. This is done using the Pesaran, Shin, and Smith (PSS, 2001) bounds testing approach in Table 4. At a significance level of 1%, the estimated F-statistic of 12.082 and t-statistic of − 5.552 are both greater than the corresponding upper bounds (critical values) of 7.30 and − 4.10, respectively. This suggests a rejection of the null hypothesis, which invariably indicates that there is strong evidence of a statistically significant long-run relationship between the variables being analysed. Consequently, the results of both the PSS bounds testing utilizing the Narayan (2005) critical values and the approximate values provide evidence of a cointegrating relationship among the series. This implies that LCF, GDP, GDP2, REC, and NR have a stable and long-lasting relationship.

4.4 Long-run and short-run dynamic ARDL coefficients

After verifying the likely cointegration, the next step is to check for the dynamic short-run and long-run estimated effects simultaneously using the ARDL method. The results of this estimation process are presented in Table 5. The results of the ARDL analysis indicate that GDP has an upward (positive) impact on the LCF in both the short run and the long run. Specifically, the result suggests that a 1% increase in GDP leads to a 0.328% increase in the LCF in the long run, while holding other variables constant. In the short run, GDP increases LCF, but the effect is not statistically significant. These suggest that the positive effect of GDP on environmental sustainability is only significant in the long run. The results further reveal that the squared term of GDP has a negative and significant relationship with the LCF. This result shows that a 1% increase in the squared term of GDP (GDPSq) would cause the LCF to significantly decline by 0.038%, holding other variables constant. Given these results, the LCC hypothesis is not valid for the case of China.

Also, the results show that clean energy consumption exhibits a positive impact on the LCF only in the long run. This implies that a 1% increase in clean energy stimulates the LCF by 0.103% in the long term. Furthermore, an increase in natural resource usage is adjudged to have exhibited a negative effect on the LCF. Particularly, a 1% increase in the use of natural resources translates to a 0.027% decline in the LCF in the long run.

The dynamic ARDL method relies on model diagnostics for accuracy and reliability. The diagnostic tests conducted on the dynamic ARDL models are presented in Table 6. According to the results, the models exhibit no issues related to heteroscedasticity, serial correlation, misspecification, or non-normality. This, therefore, indicates that the model is well-specified and can be relied upon for accuracy in their predictions (Eweade et al., 2022; Zhang et al., 2021).

Furthermore, the stability of the model is demonstrated in Fig. 2 through the presentation of CUSUM and CUSUMSQ plots that fall within the 5% significance level. This indicates that the model is stable and that its predictions can be relied upon. Additionally, all diagnostic tests conducted on the dynamic ARDL model show that the estimates are reliable and robust, which makes them suitable for policy decisions.

Once the short- and long-run effects of the LCF have been predicted, the next step is to examine the response of the LCF to a counterfactual change in a single fundamental variable. This analysis involves holding all other explanatory variables constant at a specific point in time and observing how the LCF reacts to changes in the selected fundamental variable. This step provides important insights into the sensitivity of the LCF to changes in individual explanatory factors, which can be useful for making policy decisions. Therefore, the plots in question illustrate how the LCF changes in response to a shock of ± 1% in the independent variable. Figures 3, 4, 5, and 6 reveal the dynamic ARDL simulation plots. The y-axis shows the predicted mean values of the LCF with ± 1% change in each of the fundamental variables. According to Figs. 3 and 4, a 1% positive shock to GDP (GDPSq.) leads to a rise (fall) in the LCF, while a − 1% change in GDP (GDPSq.) increases (decrease) in the LCF. This suggests that there is a positive relationship between GDP and environmental quality, which is likely due to the composition and technique effects. As production levels increase in China, environmental degradation tends to decrease. By this finding, it negates the tenant of the LCC hypothesis which is characterized by the U-shape relationship between income level and the LCF. Figures 4 and 5 demonstrate that while a 1% positive shock in clean energy consumption stimulates the LCF significantly, a 1% positive shock to natural resources leads to a decrease in the level of LCF. The predicted value of the LCF following a negative shock is the reverse of the positive trend observed. This supports the positive relationship between clean energy and LCF. Similarly, the negative effect of a change in natural resources supports the results of the dynamic ARDL long-run and short-run coefficients already discussed.

4.5 Discussion of findings

The results for this study provide valuable insights into how the fundamentals influence the LCF, both in the short run and in the long run. Particularly, the coefficients of our models are useful in predicting the response of environmental quality to changes in the various exogenous factors considered in the analysis. As shown in the results, the effect of GDP on the LCF is positive but only statistically significant in the long run. These findings have important implications for policymaking, as they simply suggest that policies aimed at promoting economic expansion may also have long-run decreasing effects on environment disasters. These findings also suggest that China has achieved appreciable income level high enough that can stimulate environmental sustainability. Therefore, policymakers can prevent scale effects by promoting economic growth through enhancing knowledge-based and technological-based productivities. These findings are consistent with Caglar and Askin (2023) and Kartal et al. (2023) who also found positive effect of economic growth on the level of LCF.

It is important to note, therefore, that the relationship between GDP and environmental sustainability is complex and may depend on a range of other factors, such as the composition of the economy, the level of clean energy utilization, and the level of natural resources available for use (see Balcilar et al., 2023b; Adebayo & Samour, 2023). The fact that the positive impact of GDP on the level of LCF is stronger and only significant in the long run compared to the short run suggests that the benefits of economic expansion in terms of a sustainable environment may take time to materialize fully. This may be due to a range of factors, such as the time needed for environmental policies and technologies to take effect, or the time needed for changes in economic structure to occur as noted by Rehman et al., (2023). It is also possible that environmental degradation in a country is stronger in the long run than in the short run, depending on the specific circumstances. This might be caused by factors hindering the positive effects of economic growth on the LCF, such as ineffective environmental regulations or inefficient production processes. This result concurs with Chang and Wang (2010) and Akhayere et al. (2023). The variations in the output might be due to the techniques utilized, observations adopted, and the response variable analysed. Based on the coefficients obtained through the ARDL method, it can be concluded that the LCC hypothesis is not applicable to China. This means that the relationship between economic growth and environmental quality does not follow the U-shaped curve predicted by the LCC hypothesis. These results correspond with the results of Alola et al. (2023) and Pata et al. (2023a) but are contradictory to the findings of Dogan and Pata (2022), Huang et al. (2023), and Pata and Kartal (2023).

Also, our study unfolds that clean energy expansion has a positive relationship with LCF only in the long run. This means that expansion of renewable energy consumption enhances environmental sustainability only after some times, i.e. long run. The plausible explanation for this result may be traceable to the fact that China, over the years, has introduced several development plans to transit renewable energy paths. These plans are anchored on stimulating renewable energy sources, including hydropower, solar, and wind to make their consumption not only available but affordable for all. At present, renewable energy accounts for about 14.95% of the total primary energy consumption mix in China as of 2021. Therefore, this result is consistent with Usman (2022, 2023) who found that an increase in clean energy is positively associated with environmental quality. This result is contrary to Pata and Kartal (2023) who observed an insignificant effect of clean energy in the long term in South Korea.

Furthermore, the results that natural resource use has a negative effect on LCF is only significant in the long run. This, therefore, implies that in the short run, the extraction of natural resources leading to natural resource depletion may not have effect on environmental degradation. However, the environmental effect of natural resource extraction is only noticeable in the long run through a decrease in the level of LCF of power plants and other energy facilities. Therefore, this result is consistent with Li et al. (2022) where it is discovered that increasing the use of natural resources triggers environmental damage in the Southeast Asian Economies. This is also echoed in the work of Wang et al. (2019) and Badeeb et al. (2020) that natural resource extraction bolsters environmental damage. On the contrary, our finding is inconsistent with Adebayo and Samour (2023) who show that natural resource rent promotes environmental quality.

The summary of the results is presented in Fig. 7. Accordingly, GDP has a positive relationship with LCF while its squared term has a negative effect. This shows that the LCC hypothesis is invalid in the case of China. The effect of clean energy is positive while that of natural resources is negative.

5 Conclusion and policy recommendations

The high levels of environmental degradation arising from the accumulation of CO2 and other greenhouse gases have posed a serious challenge in China over the past three decades. The use of energy from fossil fuels is the major cause of this problem. Essentially, every nation requires energy to foster economic growth, hence reducing energy consumption can have adverse effects on economic expansion. In this research, we explore not just the transition towards adopting clean energy but also the influence of natural resources on the environment in China within the framework of the LCC hypothesis. Employing the dynamic ARDL simulations as our analytical tool, our results reveal that economic expansion is although positively associated with the LCF, but its squared term degrades the LCF. This confirms that the LCC hypothesis is not valid for China. The implication of this result is that economic expansion is environmentally conscious and friendly, hence China is at the path of environmental sustainability. The results furthermore reveal that clean energy expansion promotes environmental sustainability by stimulating the level of LCF. However, an increase in natural resource extraction lowers the level of environmental sustainability by decreasing the amount of LCF. The impacts of economic expansion, clean energy expansion, and natural resources are stronger and only significant in the long run. This suggests that the environmental benefits of economic expansion and clean energy expansion may take time to be witnessed in China. Similarly, the deteriorating effect of natural resource extraction may also take a long time to materialize.

Based on these findings, a couple of policy recommendations for mitigating environmental problems confronting China could be drawn:

Given that the expansion of clean energy has a long-run beneficial effect on the environment through an increase in LCF, we therefore recommend that China should invest tremendously in green energy-related technologies without necessarily ditching economic growth to put the country in the path of environmental sustainability. In other words, expanding clean energy, may not necessarily require slowing economic growth to achieve environmental sustainability; instead, China should pursue both economic growth and environmental sustainability concurrently––capitalizing on the positive association between economic growth expansion and the LCF. This approach aligns with the idea that a growing economy can coexist with eco-friendly practices––fostering more harmonious balance between economic prosperity and environmental protection as emphasized by Balcilar et al. (2023b). Therefore, as a way to attract tremendous investments in green energy, government and policymakers should set clear targets and deploy necessary incentive mechanisms such as encouraging public–private partnerships in green energy investment, tax credits and tax holidays for investment in green energy, subsidies, etc. All these will help expedite actions towards achieving the targeted level of green energy investments over time.

While attracting investments in clean energy, it is also our recommendation that special consideration should be given to clean energy sources such as hydropower, wind, and solar because of their availability in China. The 14th Five-Year Development Plan launched in 2021 by Chinese government is a step towards attracting green energy as it liberalizes the economy by shifting it towards consumption-driven growth and providing conducive environment for market forces to play a vital role in resource allocations. Basically, if emphasis is placed on stimulating clean energy sources commonly available in the country, it will help lowering not only the costs of such energy but also making it accessible and sustainable.

Also, the long-run positive impact of GDP on LCF in China is an indication that income growth could possibly promote environmental sustainability in China in the long run possibly due to shifting of policy directives towards knowledge and technology-based innovations. Thus, policymakers in China should formulate a comprehensive policy framework that promotes economic growth and at the same time protect the environment. In such a scenario, government and policymakers should increase expenditures on renewable energy technologies, implement more stringent environmental regulations, and promoting sustainable patterns of consumption and production. All these can be achieved by strengthening carbon pricing policy which compels polluters to pay for every ton of carbon and other greenhouse gases coughed into the atmosphere.

Furthermore, the fact that natural resource extraction poses a deteriorating effect on the LCF suggests that the use of natural resources lowers the quality of the environment. For this reason, we recommend the need to avoid overuse of the available natural resources and ensure that natural resources are efficiently used in China. To do this, the government and its managers should draw policies to reduce the rapid growth of population. Also, the extraction of natural resources such as coal and other pollution-based resources should be reduced in China. For example, the coal-fired power plants in China emit over 40% of their carbon dioxide, sulphur dioxide, nitrogen oxides, and particulate matter, which have serious environmental and health consequences. If coal and other non-renewable natural resources are required to meet the demand for raw materials needed for production and consumption, such natural resources should be efficiently used in order to reduce environmental consequences. To this extent, we further suggest that renewable energy education should be incorporated into educational programs that prepare citizens for a greater future.

Finally, like any other study, this research is faced with some limitations. One of such limitations is the fact that our study is focused on only China, which is a large emerging market economy. Because of the peculiar problems of different economies, future studies should employ panel data and categorize countries into clusters based on their incomes. By so doing, will provide more insights that will help policymakers achieve environmental policy targets. Moreover, the dynamic ARDL simulations approach employed in this study uses only the mid-point observations in the distribution. To capture the effect of clean energy expansion and natural resource extractions on the entire distribution of the LCF, future studies should consider methodologies that help assess how these variables affect the LCF on the tails of the distribution. This will provide a better understanding of the subject matter.

Data availability

The datasets generated during and/or analysed during the current study are available on reasonable request.

Notes

The LCC is U-shaped if GDP is negatively associated with the LCF, and square of GDP is positively associated with the LCF. Conversely, the LCC is an inverted U-shape if GDP is positively associated with the LCF, and square of GDP is negatively associated with the LCF.

References

Adebayo, T. S., & Samour, A. (2023). Renewable energy, fiscal policy and load capacity factor in BRICS countries: novel findings from panel nonlinear ARDL model. Environment, Development and Sustainability. https://doi.org/10.1007/s10668-022-02888-1

Adikpo, J. A., & Usman, O. (2023). Moving towards the path of environmental sustainability in Developing-8 countries: Investigating the role of country’s reputation in mitigating environmental externalities. Environmental Science and Pollution Research. https://doi.org/10.1007/s11356-023-29883-x

Ahmed, Z., Asghar, M. M., Malik, M. N., & Nawaz, K. (2020). Moving towards a sustainable environment: The dynamic linkage between natural resources, human capital, urbanization, economic growth, and ecological footprint in China. Resources Policy, 67, 101677.

Akhayere, E., Kartal, M. T., Adebayo, T. S., & Kavaz, D. (2023). Role of energy consumption and trade openness towards environmental sustainability in Turkey. Environmental Science and Pollution Research, 30(8), 21156–21168.

Alola, A. A., Özkan, O., & Usman, O. (2023). Role of non-renewable energy efficiency and renewable energy in driving environmental sustainability in India: Evidence from the load capacity factor hypothesis. Energies, 16(6), 2847.

Badeeb, R. A., Lean, H. H., & Shahbaz, M. (2020). Are too many natural resources to blame for the shape of the environmental Kuznets curve in resource-based economies? Resources Policy, 68, 101694.

Balcilar, M., Usman, O., & Ike, G. N. (2023a). Investing green for sustainable development without ditching economic growth. Sustainable Development, 31(2), 728–743.

Balcilar, M., Usman, O., & Ike, G. N. (2023b). Operational behaviours of multinational corporations, renewable energy transition, and environmental sustainability in Africa: Does the level of natural resource rents matter? Resources Policy, 81, 103344.

Baloch, M. A., Mahmood, N., & Zhang, J. W. (2019). Effect of natural resources, renewable energy and economic development on CO2 emissions in BRICS countries. Science of the Total Environment, 678, 632–638.

Caglar, A. E., & Askin, B. E. (2023). A path towards green revolution: How do competitive industrial performance and renewable energy consumption influence environmental quality indicators? Renewable Energy, 205, 273–280.

Chang, Y. C., & Wang, N. (2010). Environmental regulations and emissions trading in China. Energy Policy, 38(7), 3356–3364.

Chang, Y. C., & Wang, N. (2017). Legal system for the development of marine renewable energy in China. Renewable and Sustainable Energy Reviews, 75, 192–196.

Chen, L., Msigwa, G., Yang, M., Osman, A. I., Fawzy, S., Rooney, D. W., & Yap, P. S. (2022). Strategies to achieve a carbon neutral society: A review. Environmental Chemistry Letters, 20(4), 2277–2310.

da Silva, P. P., Cerqueira, P. A., & Ogbe, W. (2018). Determinants of renewable energy growth in Sub-Saharan Africa: Evidence from panel ARDL. Energy, 156, 45–54.

DeJong, D. N., Nankervis, J. C., Savin, N. E., & Whiteman, C. H. (1992). The power problems of unit root test in time series with autoregressive errors. Journal of Econometrics, 53(1–3), 323–343.

Dickey, D. A., & Fuller, W. A. (1979). Distribution of the estimators for autoregressive time series with a unit root. Journal of the American Statistical Association, 74(366a), 427–431.

Ding, Q., Khattak, S. I., & Ahmad, M. (2021). Towards sustainable production and consumption: Assessing the impact of energy productivity and eco-innovation on consumption-based carbon dioxide emissions (CCO2) in G-7 nations. Sustainable Production and Consumption, 27, 254–268.

Dogan, A., & Pata, U. K. (2022). The role of ICT, R&D spending and renewable energy consumption on environmental quality: Testing the LCC hypothesis for G7 countries. Journal of Cleaner Production, 380, 135038.

Elliott, G., Rothenberg, T. J., & Stock, J. H. (1996). Efficient tests for an autoregressive unit root. Econometrica, 64(4), 813–836.

Eweade, B. S., Uzuner, G., Akadiri, A. C., & Lasisi, T. T. (2022). Japan energy mix and economic growth nexus: Focus on natural gas consumption. Energy and Environment. https://doi.org/10.1177/0958305X221130460

Fakher, H. A., Ahmed, Z., Acheampong, A. O., & Nathaniel, S. P. (2023). Renewable energy, nonrenewable energy, and environmental quality nexus: An investigation of the N-shaped environmental Kuznets curve based on six environmental indicators. Energy, 263, 125660.

Fareed, Z., Salem, S., Adebayo, T. S., Pata, U. K., & Shahzad, F. (2021). Role of export diversification and renewable energy on the load capacity factor in Indonesia: A Fourier quantile causality approach. Frontiers in Environmental Science, 434.

Fernández, L. (2023). Topic: Renewable energy china. Statista. Retrieved Feb 17, 2023, from https://www.statista.com/topics/5100/renewable-energy-china/#topicOverview.

GFN (2022). Global footprint network. https://www.footprintnetwork.org (Accessed on 22 Dec 2022).

Gimba, O. J., Alhassan, A., Ozdeser, H., Ghardallou, W., Seraj, M., & Usman, O. (2023). Towards low carbon and sustainable environment: Does income inequality mitigate ecological footprints in Sub-Saharan Africa? Environment, Development and Sustainability, 25, 10425–10445.

Grossman, G. M. & Krueger, A. B. (1991). Environmental impacts of a North American free trade agreement. NBER working paper 3914, Nov. 1991.

Huang, Y., Villanthenkodath, M. A., & Haseeb, M. (2023). The nexus between eco-friendly technology and environmental degradation in India: Does the N or inverted N-shape load capacity curve (LCC) hypothesis hold? Natural Resources Forum, 47(2), 276–297.

Jordan, S., & Philips, A. Q. (2018). Cointegration testing and dynamic simulations of autoregressive distributed lag models. The Stata Journal, 18(4), 902–923.

Kartal, M. T., Samour, A., Adebayo, T. S., & Depren, S. K. (2023). Do nuclear energy and renewable energy surge environmental quality in the United States? New insights from novel bootstrap Fourier Granger causality in quantiles approach. Progress in Nuclear Energy, 155, 104509.

Khattak, S. I., Ahmad, M., Ul Haq, Z., Shaofu, G., & Hang, J. (2022). On the goals of sustainable production and the conditions of environmental sustainability: Does cyclical innovation in green and sustainable technologies determine carbon dioxide emissions in G-7 economies. Sustainable Production and Consumption, 1(29), 406–420.

Leggett, J. A. (2020). The united nations framework convention on climate change, the Kyoto protocol, and the Paris agreement: a summary. Congressional research service, R46204, UNFCC, New York, 2. https://sgp.fas.org/crs/misc/R46204.pdf.

Li, Y., Alharthi, M., Ahmad, I., Hanif, I., & Hassan, M. U. (2022). Nexus between renewable energy, natural resources and carbon emissions under the shadow of transboundary trade relationship from South East Asian economies. Energy Strategy Reviews, 41, 100855.

Luo, J., Ali, S. A., Aziz, B., Aljarba, A., Akeel, H., & Hanif, I. (2023). Impact of natural resource rents and economic growth on environmental degradation in the context of COP-26: Evidence from low-income, middle-income, and high-income Asian countries. Resources Policy, 80, 103269.

Meng, F., Guo, J., Guo, Z., Lee, J. C., Liu, G., & Wang, N. (2021). Urban ecological transition: The practice of ecological civilization construction in China. Science of the Total Environment, 755, 142633.

Morrison, W. M. (2019). China’s economic rise: History, trends, challenges, and implications for the United States. Current Politics and Economics of Northern and Western Asia, 28(2/3), 189–242.

Naqvi, S. A. A., Hussain, B., & Ali, S. (2023). Evaluating the influence of biofuel and waste energy production on environmental degradation in APEC: Role of natural resources and financial development. Journal of Cleaner Production, 386, 135790.

Narayan, P. K. (2005). The saving and investment nexus for China: Evidence from cointegration tests. Applied Economics, 37(17), 1979–1990.

Nathaniel, S. P., & Bekun, F. V. (2020). Environmental management amidst energy use, urbanization, trade openness, and deforestation: The Nigerian experience. Journal of Public Affairs, 20(2), e2037.

Nathaniel, S. P. (2021). Environmental degradation in ASEAN: Assessing the criticality of natural resources abundance, economic growth and human capital. Environmental Science and Pollution Research, 28(17), 21766–21778.

Nathaniel, S. P., Yalçiner, K., & Bekun, F. V. (2021). Assessing the environmental sustainability corridor: Linking natural resources, renewable energy, human capital, and ecological footprint in BRICS. Resources Policy, 70, 101924.

Ng, S., & Perron, P. (2001). Lag length selection and the construction of unit root tests with good size and power. Econometrica, 69(6), 1519–1554.

Nguyen, K. H., & Kakinaka, M. (2019). Renewable energy consumption, carbon emissions, and development stages: Some evidence from panel cointegration analysis. Renewable Energy, 132, 1049–1057.

Nwani, C., Usman, O., Okere, K. I., & Bekun, F. V. (2023). Technological pathways to decarbonisation and the role of renewable energy: A study of European countries using consumption-based metrics. Resources Policy, 83, 103738.

OWD (2022). Our world in data. https://ourworldindata.org (Accessed on 22 Dec 2022).

Özkan, O., Coban, M. N., Iortile, I. B., & Usman, O. (2023a). Reconsidering the environmental Kuznets curve, pollution haven, and pollution halo hypotheses with carbon efficiency in China: A dynamic ARDL simulations approach. Environmental Science and Pollution Research, 30(26), 68163–68176.

Özkan, O., Haruna, R. A., Alola, A. A., Ghardallou, W., & Usman, O. (2023b). Investigating the nexus between economic complexity and energy-related environmental risks in the USA: Empirical evidence from a novel multivariate quantile-on-quantile regression. Structural Change and Economic Dynamics, 65, 382–392.

Ozkan, O., Sharif, A., Mey, L. S., & Tiwari, S. (2023). The dynamic role of green technological innovation, financial development and trade openness on urban environmental degradation in China: Fresh insights from carbon efficiency. Urban Climate, 52, 101679.

Pata, U. K. (2021). Do renewable energy and health expenditures improve load capacity factor in the USA and Japan? A new approach to environmental issues. The European Journal of Health Economics, 22(9), 1427–1439.

Pata, U. K., & Isik, C. (2021). Determinants of the load capacity factor in China: A novel dynamic ARDL approach for ecological footprint accounting. Resources Policy, 74, 102313.

Pata, U. K., & Kartal, M. T. (2023). Impact of nuclear and renewable energy sources on environment quality: Testing the EKC and LCC hypotheses for South Korea. Nuclear Engineering and Technology, 55(2), 587–594.

Pata, U. K., Kartal, M. T., Erdogan, S., & Sarkodie, S. A. (2023a). The role of renewable and nuclear energy R&D expenditures and income on environmental quality in Germany: Scrutinizing the EKC and LCC hypotheses with smooth structural changes. Applied Energy, 342, 121138.

Pata, U. K., Olasehinde-Williams, G., & Ozkan, O. (2023b). Carbon efficiency in China: Should we be concerned about the shadow economy and urbanization? Geological Journal, 58(10), 3646–3658.

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289–326.

Phillips, P. C., & Perron, P. (1988). Testing for a unit root in time series regression. Biometrika, 75(2), 335–346.

Ramezani, M., Abolhassani, L., Shahnoushi Foroushani, N., Burgess, D., & Aminizadeh, M. (2022). Ecological footprint and its determinants in MENA countries: A spatial econometric approach. Sustainability, 14(18), 11708.

Rehman, S. U., Elrehail, H., Alshwayat, D., Ibrahim, B., & Alami, R. (2023). Linking hotel environmental management initiatives and sustainable hotel performance through employees’ eco-friendly behaviour and environmental strategies: A moderated-mediated model. European Business Review, 35(2), 184–201.

Sadorsky, P. (2009). Renewable energy consumption and income in emerging economies. Energy Policy, 37(10), 4021–4028.

Samreen, I., & Majeed, M. T. (2022). Economic development, social–political factors and ecological footprint: A global panel data analysis. SN Business & Economics, 2(9), 132.

Sarkodie, S. A., Strezov, V., Weldekidan, H., Asamoah, E. F., Owusu, P. A., & Doyi, I. N. Y. (2019). Environmental sustainability assessment using dynamic autoregressive-distributed lag simulations—nexus between greenhouse gas emissions, biomass energy, food and economic growth. Science of the Total Environment, 668, 318–332.

Shahbaz, M., Raghutla, C., Chittedi, K. R., Jiao, Z., & Vo, X. V. (2020). The effect of renewable energy consumption on economic growth: Evidence from the renewable energy country attractive index. Energy, 207, 118162.

Shao, W., Yu, X., & Chen, Z. (2022). Does the carbon emission trading policy promote foreign direct investment?: A quasi-experiment from China. Frontiers in Environmental Science, 9, 798438.

Siche, R., Pereira, L., Agostinho, F., & Ortega, E. (2010). Convergence of ecological footprint and emergy analysis as a sustainability indicator of countries: Peru as case study. Communications in Nonlinear Science and Numerical Simulation, 15(10), 3182–3192.

Sun, Y., Li, M., Zhang, M., Khan, H. S. U. D., Li, J., Li, Z., & Anaba, O. A. (2021). A study on China’s economic growth, green energy technology, and carbon emissions based on the Kuznets curve (EKC). Environmental Science and Pollution Research, 28, 7200–7211.

Usman, O. (2022). Modelling the economic and social issues related to environmental quality in Nigeria: The role of economic growth and internal conflict. Environmental Science and Pollution Research, 29(26), 39209–39227.

Usman, O. (2023). Renewable energy and CO2 emissions in G7 countries: Does the level of expenditure on green energy technologies matter? Environmental Science and Pollution Research, 30(10), 26050–26062.

Usman, O., Akadiri, S. S., & Adeshola, I. (2020b). Role of renewable energy and globalization on ecological footprint in the USA: Implications for environmental sustainability. Environmental Science and Pollution Research, 27(24), 30681–30693.

Usman, O., Alola, A. A., & Sarkodie, S. A. (2020a). Assessment of the role of renewable energy consumption and trade policy on environmental degradation using innovation accounting: Evidence from the US. Renewable Energy, 150, 266–277.

Wang, H., Schandl, H., Wang, G., Ma, L., & Wang, Y. (2019). Regional material flow accounts for China: Examining China’s natural resource use at the provincial and national level. Journal of Industrial Ecology, 23(6), 1425–1438.

Wang, N., & Chang, Y. C. (2014). The development of policy instruments in supporting low-carbon governance in China. Renewable and Sustainable Energy Reviews, 35, 126–135.

Wang, X., & Yan, L. (2022). Measuring the integrated risk of China’s carbon financial market based on the copula model. Environmental Science and Pollution Research, 29(36), 54108–54121.

WDI (2022). World development indicators of the World Bank. https://databank.worldbank.org/source/world-development-indicators (Accessed on 22 Dec 2022).

Xiong, J., & Xu, D. (2021). Relationship between energy consumption, economic growth and environmental pollution in China. Environmental Research, 194, 110718.

Xu, D., Salem, S., Awosusi, A. A., Abdurakhmanova, G., Altuntaş, M., Oluwajana, D., Kirikkaleli, D., & Ojekemi, O. (2022). Load capacity factor and financial globalization in Brazil: The role of renewable energy and urbanization. Frontiers in Environmental Science, 9, 823185.

Zafar, M. W., Zaidi, S. A. H., Khan, N. R., Mirza, F. M., Hou, F., & Kirmani, S. A. A. (2019). The impact of natural resources, human capital, and foreign direct investment on the ecological footprint: The case of the United States. Resources Policy, 63, 101428.

Zhang, L., Godil, D. I., Bibi, M., Khan, M. K., Sarwat, S., & Anser, M. K. (2021). Caring for the environment: How human capital, natural resources, and economic growth interact with environmental degradation in Pakistan? A dynamic ARDL approach. Science of the Total Environment, 774, 145553.

Zhang, L., Pang, J., Chen, X., & Lu, Z. (2019). Carbon emissions, energy consumption and economic growth: Evidence from the agricultural sector of China’s main grain-producing areas. Science of the Total Environment, 665, 1017–1025.

Zhao, X., Ma, X., Chen, B., Shang, Y., & Song, M. (2022). Challenges toward carbon neutrality in China: Strategies and countermeasures. Resources, Conservation and Recycling, 176, 105959.

Zheng, W., & Walsh, P. P. (2019). Economic growth, urbanization and energy consumption—A provincial level analysis of China. Energy Economics, 80, 153–162.

Funding

Open access funding provided by the Scientific and Technological Research Council of Türkiye (TÜBİTAK).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Usman, O., Ozkan, O., Adeshola, I. et al. Analysing the nexus between clean energy expansion, natural resource extraction, and load capacity factor in China: a step towards achieving COP27 targets. Environ Dev Sustain (2024). https://doi.org/10.1007/s10668-023-04399-z

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10668-023-04399-z