Abstract

By promoting diversity in equity ownership concentration, strengthening female representation on boards, aligning pay with sustainability goals, and implementing strong internal control processes, companies can integrate sustainable practices into their operations, improve their sustainability performance, and attain long-term environmental and societal health. Therefore, this study examined the relationship between ownership concentration and internal control through the sustainability lens, specifically focusing on the moderating effects of female directors and board compensation. Data from a sample of 1609 A-share listed businesses in Shanghai and Shenzhen between 2012 and 2021 were analyzed. The findings from the fixed effects model revealed the following: ownership concentration negatively affects internal control; the number of female directors positively influences internal control; female directors actively moderate the relationship between ownership concentration and internal control; and board compensation enhances the effectiveness of internal control. These insights provide valuable data for businesses to enhance their internal control systems, appoint key personnel, and advance their sustainability goals. This study suggests that linking board characteristics to corporate internal control can lead to strengthened sustainable objectives. It also incentivizes directors to prioritize and integrate sustainability concerns in their decision-making. Furthermore, by ensuring that compensation reflects sustainability performance, firms can cultivate a sustainability-based culture and drive effective internal controls that support sustainable practices, ultimately contributing to long-term environmental and social well-being.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Pervasive financial scandals, such as those involving Enron, WorldCom, and General Electric, have profoundly impacted the global economy and eroded investor trust (Griffiths, 2021). These events have not only weakened internal control in businesses but also triggered extensive analysis and reflection on internal control in both theoretical and practical circles. According to COSO (2013), internal control (hereafter IC) refers to the system of guidelines, practices, and procedures used by an organization to achieve its goals, protect its resources, and comply with legal requirements. It involves the steps taken to promote effectiveness, efficiency, and ethical behavior in the organization’s operations while reducing the possibility of errors, fraud, and resource misuse. As IC is an important indicator of company performance, international capital markets and regulatory organizations are now focusing on improving IC to enhance its effectiveness. China is no exception, as the continuous occurrence of IC failures due to corporate scandals serves as a stark reminder for Chinese corporations to strengthen their IC systems (Chen & Li, 2013). Considering that China’s securities investment funds are currently in a relatively formative stage and face unique challenges (Hao & Wang, 2018), enhancing the IC level of enterprises holds great significance for the survival and development of Chinese companies. Thus, this study conducted a series of investigations into IC in this context.

Equity ownership concentration (hereafter OC) reflects the extent to which shareholders hold a significant percentage of a company’s stock. These shareholders dominate the board of directors (BoD) and thus can limit the board’s independence and ability to effectively oversee management’s actions in areas like sustainability, financial reporting, and IC. Tibiletti et al. (2021) suggested that higher OC may have negative implications for sustainability, transparency, and accountability, as majority shareholders might give importance to short-term profits rather than long-term sustainability objectives (Al-Sartawi & Sanad, 2019; Gutiérrez, 2019; Larrain, 2015; Pucheta-Martínez, 2019). On the other hand, Oh et al. (2017) argued that concentrated equity ownership can facilitate sustainability, on the basis that majority shareholders with a long-term mindset may possess the capability and incentive to invest in sustainable practices, so as to benefit from improved performance and reputation over time. They may also have the power to influence management decisions and align them with sustainable goals (Sohail et al., 2021).

Striking a balance in ownership structure is crucial for companies to ensure effective governance and IC. In this regard, OC can affect IC by influencing the effectiveness of checks and balances and the accountability of decision-makers (Ang et al., 2022; Wu et al., 2021). Therefore, this study analyzed the impact of OC on corporate IC. Nonetheless, this impact can vary depending on other governance mechanisms and contextual factors (Hoang, 2023; Velte, 2023). Accordingly, to further strengthen IC in enterprises, we considered the role of female directors (hereafter FDs) and board compensation (hereafter BC). FDs may demonstrate a greater sense of responsibility than male directors, leading them to make more strategic decisions, promote financial performance, and evaluate and improve the company’s IC. Meanwhile, BoD composition can depend on the level of compensation (Dixon-Fowler et al., 2017), whereby higher compensation may attract more qualified and experienced board members who are better equipped to exercise effective control over management’s actions, including in financial reporting and ICs (Shafira et al., 2021). Hence, this study proposed that integrating FDs and BC are valuable tools that can help alleviate the adverse effects of OC on IC, especially during disruptive times.

The combined impacts of OC, FDs, and BC on IC mechanisms must be considered by organizations to optimize sustainability efforts. Efficient IC procedures can support a company’s sustainability initiatives and demonstrate commitment to ethical business conduct (Anselmi et al., 2023), particularly by enhancing its accountability and transparency in addressing environmental, social, and governance (ESG) risks. Therefore, promoting diverse ownership, increasing gender diversity on boards, aligning compensation with sustainability goals, and implementing robust IC processes can enable companies to integrate sustainable practices across their operations, improve overall sustainability performance, and safeguard environmental and social health in the long run (Ali et al., 2023; Anselmi et al., 2023; Cantele & Zardini, 2018; Hossain et al., 2022a, 2022b, 2022c, 2022d; Peng & Chandarasupsang, 2023).

Previous research has explored the connection of FDs with general sustainability (social and environmental) disclosures and accounting quality (Srinidhi et al., 2011; Garcia-Sanchez et al., 2017; Jizi, 2017; Ben-Amar et al., 2017; Wasiuzzaman & Mohammad, 2020; Buallay et al., 2022; Ali et al., 2023; D’Adamo, 2022). In contrast, our focus in this study was the impact of OC on IC via the moderating roles of FDs and BC from a sustainability perspective. As far as we know, the OC–IC relationship has been understudied, and no previous research has specifically examined FDs and BC as moderators of this relationship. Notably, this study was conducted in the context of China, where research on board diversity and compensation from a sustainability perspective is limited.

Hence, this study is unique and builds upon previous research in three key aspects. First, we reveal that high levels of OC can weaken IC, leading to negative implications for firm performance and value. Second, we identify two significant moderating variables that can mitigate the adverse effects of OC on IC: FDs and BC. Our empirical evidence suggests that including FDs and providing higher BC can enhance the effectiveness of IC systems, even in the presence of high OC. Third, we contribute to the understanding of how FDs and BC can directly improve IC, which can inform corporate governance practices and policy decisions. Specifically, the various viewpoints, unique skills, and experiences women bring to the boardroom enhances the effectiveness of IC. Similarly, higher compensation incentivizes directors to prioritize the best interests of the company and its shareholders, while also attracting and retaining skilled directors with the expertise to oversee IC systems effectively. Overall, our research adds valuable insights to the theory and practice on corporate governance and IC.

The following four sections are structured accordingly. Section 2 provides a comprehensive review of relevant theories and empirical literature before proposing the hypotheses. Section 3 outlines the methods employed, while Sect. 4 depicts a summary of the findings. Finally, Sect. 5 consolidates the findings, acknowledges limitations, and suggests avenues for future research.

2 Literature review and hypothesis development

2.1 Equity ownership concentration (OC) and corporate internal control (IC): modern principal–agent theory and rational person hypothesis

Power is a measure of influence, and for the management of an enterprise, the personality characteristics and decision-making of management can substantially impact the organization and individuals within it (Chen et al., 2021; Lin, 2011). The presence of executive power ensures proper board governance rights and reduces the likelihood of IC deficiencies (Bo & Driver, 2012; Jamadar et al., 2022).

This study draws on the modern principal–agent theory, which posits that in a business, managers who operate as their agents are granted the power to decide by owners (principals) (Sáenz González & Garca-Meca, 2014). Due to this separation of power, agents may prioritize their own interests, leading to conflicts of interest (Payne & Petrenko, 2019). When equity is focused and controlled by a few shareholders, this agency issues can be exacerbated. Majority shareholders may be influenced by a narrow range of perspectives and focus on maximizing their own short-term profits or personal gain, potentially neglecting corporate sustainability considerations in their decision-making (Ali et al., 2023; Anselmi et al., 2023; Hossain et al., 2022a, 2022b, 2022c, 2022d; Peng & Chandarasupsang, 2023). Meanwhile, minority shareholders may be less likely to monitor management’s actions in financial reporting and IC, leading to ineffective oversight (Almasria, 2022; Al-Twaijry et al., 2003; Anselmi et al., 2023). As a consequence, IC may weaken, as managers could be incentivized to take part in activities that are harmful to the company’s continuing interests, such as accounting fraud, excessive risk-taking, or self-dealing (Khan et al., 2023; Subramaniam et al., 2023).

Moreover, the rational person hypothesis supports the idea that people are rational and self-interested, and tend to maximize their own benefits when making decisions (Pan et al., 2020). When few individuals own a substantial portion of a company’s stock (i.e., high OC), they may exert undue influence over management decisions (Wang, 2022). This can lead to managers prioritizing the interests of these selective stakeholders (Liang et al., 2023; Nur-Al-Ahad et al., 2022). Consequently, IC may deteriorate, as managers might be less inclined to implement effective IC systems if they believe it could negatively impact the interests of the major shareholders. Additionally, majority shareholders may engage in activities detrimental to the company’s IC, such as exerting undue influence on director appointments or participating in related-party transactions that favor themselves at the expense of other stakeholders.

Overall, the modern principal–agent theory and the rational person hypothesis provide a theoretical basis for understanding how OC negatively affects and hampers the IC of a corporation (Waheed & Malik, 2019; Yu, 2023). These theories highlight potential conflicts of interest and challenges in aligning the interests of significant shareholders with the long-term prosperity of the company, offering valuable insights into corporate governance practices and policy decisions aimed at fostering efficient IC systems (Aluchna et al., 2019).

Studying the impact of OC on IC is significant because IC plays a crucial role in ensuring that a company operates efficiently, effectively, and ethically (Goh, 2009; Wendry et al., 2023). Since weak IC can put a company at risk of financial mismanagement, fraud, and other misconduct, companies must be aware of this risk and take measures to mitigate it. To this end, examining OC’s influence on IC provides companies and researchers a better understanding of this complex issue and enables them to work towards meaningful solutions. Correspondingly, increasing amounts of study have been done to determine how OC affects organizations’ ICs. Tan and Mohan (2013) examined the effect of OC on corporate social responsibility (CSR) reporting in Pakistan, specifically exploring how IC mechanisms shape CSR activities within organizations. Smith et al. (2022) and Nguyen et al. (2021) observed that concentrated ownership can diminish the efficacy of IC systems because majority shareholders may prioritize their own interests and exert more influence over decision-making than other stakeholders. Similarly, Wendry et al. (2023) and Maury and Pajuste (2005) revealed how OC may possibly cause majority and minority shareholders to clash over conflicting interests, compromising the effectiveness of IC.

Conversely, Kao (2019) found that majority shareholders might be more interested in the company’s long-term performance and may monitor managerial behavior when there is high OC in the organization. However, this positive outcome is contingent on the presence of robust legal and institutional structures that safeguard the benefits of minority shareholders. Al-Sartawi and Sanad (2019) also found that OC improves IC, but this effect is contingent on institutional ownership levels and board independence. Hence, the body of literature on the OC–IC link holds divergent perspectives, with one group showing a positive effect and another showing a negative one. Notably, it appears that the effectiveness of IC based on OC depends on various factors, such as the institutional and legal environment, independent director and institutional investor proportions, and the level of board autonomy.

In the Chinese context, the influence of OC on the IC of companies has been a recent topic of interest. Martínez-Ferrero and Lozano (2021), Jiang and Bai (2022), and Ruan and Liu (2021) found that OC can have a negative impact on IC in Chinese companies. One possible reason could be due to the fact that majority shareholders in China exhibit self-interested behavior and often have a more controlling role in decision-making, leading to a lack of accountability and transparency. Alternatively, Li et al. (2018) established a positive influence of OC on IC in Chinese firms, as majority shareholders may have a stronger incentive to monitor management behavior. Meanwhile, Terjesen et al. (2016) found that the connection between OC and IC in China is complex and contingent on different elements, such as the degree of board independence, the presence of institutional investors, and the type of equity structure. Overall, the research consensus on the influence of OC on IC in Chinese enterprises is somewhat ambiguous, with the negative impact of OC on IC seemingly alleviated by select governance mechanisms. The discussion indicates that the negative impact of OC on IC can be mitigated by the presence of such mechanisms. However, the specific mechanisms and their effectiveness in alleviating this negative impact need further investigation and empirical validation.

In summary, IC helps organizations identify, assess, and mitigate environmental and social risks, as well as ensure compliance with governance standards. It promotes transparency, accountability, and ethical behavior, which are fundamental elements of ESG performance. However, when ownership is dominated by a small group of individuals or entities, it may lead to a lack of transparency and accountability that potentially impacts the effectiveness of ICs. Thus, we hypothesized that:

H1

OC has a negative effect on corporate IC.

2.2 The role of female directors (FDs): resource dependency theory, principal–agent theory, and intermediary theory

With an increasing emphasis on diversity and inclusion, businesses are recognizing the value of gender-balanced leadership in fostering ethical decision-making, minimizing risks, and ensuring sustainable growth. Consequently, the BoD of firms have seen a growth in the involvement of women on the board (Smith et al., 2022), which has brought several benefits. Specifically, women have higher requirements for risk controllability and tolerance, which means they can effectively control the scope and risk of financial decisions (Fasterling, 2017). Daminger (2019) found that women also tend to work harder to achieve better results, while Pan et al. (2020) reported that FDs increase corporate performance and are not easily influenced by the perceptions of their male counterparts. In fact, Tibiletti et al. (2021) discovered that FDs analyze comprehensive information and consider the interest of the whole in decision-making, which improves the company’s decision quality.

Listed companies with a significant number of FDs have been found to enhance their corporate governance structure, promote corporate information communication, and reduce corporate wrongdoing (Huang, 2020; Napitupulu, 2023). Additionally, FDs can significantly reduce group conflicts and disharmony within the board, thus improving BoD autonomy, corporate administration, and corporate value. In other words, increasing the number of FDs can elevate the firm’s management (Ayuso & Argandoa, 2009; Bannò et al., 2023). Apart from that, FDs are more empathetic, better understand consumer needs, and can create marketing strategies that satisfy consumers, ultimately improving company performance (Oradi, 2021).

According to the principal–agent theory, FDs’ extensive experience and tenure at the management level (Flabbi et al., 2017), coupled with their unique attributes, position them as effective agents who can align their actions with the interests of shareholders. This makes them invaluable in mitigating the agency problem. Furthermore, gender-diverse boards tend to have more independent members, which maintains a mutual restraint relationship between board members and reduces decisions made out of personal interest, ultimately enhancing sustainable corporate practices (Fernández-Temprano et al., 2020). The progression towards board diversity and independence thus reduces agency costs for corporations, while enhancing efficiency in corporate governance and overall corporate value (Zhou et al., 2021).

Importantly, the percentage of FDs on the board is shown to enhance the diversity of values and viewpoints at board meetings, which can strengthen firm sustainable goals by encouraging directors to prioritize and integrate more holistic and long-term sustainability approaches (Khan et al., 2023; Peng & Chandarasupsang, 2023). Consistent with this, Dhenge et al. (2022) found that women exhibit a more positive attitude toward environmental protection compared to men, due to their stronger environmental consciousness and awareness of the interconnectedness between human well-being and the environment. Women also tend to prioritize stakeholder interests, including environmental concerns, which can drive sustainable practices within organizations. Additionally, female board members may act as role models and catalysts for change, encouraging companies to adopt sustainable strategies and policies (Di Vaio et al., 2023a, 2023b). Accordingly, Dhenge et al. (2022) and Chen et al. (2016) indicated that firms with more women on their boards tend to have superior ESG performance. Overall, increasing gender diversity on corporate boards can aid better sustainability practices and outcomes (Wei et al., 2017). Emphasizing women representation on boards is imperative; however, women remain underrepresented in many organizations. This study thus explores how women’s voices are heard and valued in leadership and decision-making discussions in the China context.

Given their emphasis on sustainability, FDs play a crucial and influential role in organizations’ IC. As per Sanyaolu et al. (2022), gender diversity in the BoD leads to the representation of diverse viewpoints and interests in decision-making, thereby augmenting the IC of the company by identifying potential risks and opportunities that may have been overlooked otherwise. Their leadership and expertise also contribute to shaping and overseeing effective IC practices, wherein they promote responsible behavior and strengthen the overall IC culture within organizations. This, in turn, promotes transparency, accountability, gender equality, and social governance (D’Adamo, 2022; Di Vaio et al., 2023a; Leal Filho et al., 2022). Correspondingly, Yang et al. (2020) found that when facing risks, women in enterprises pay more attention to IC, while Oradi (2021) demonstrated that enterprises with more FDs have better IC systems. Additionally, Alkebsee et al. (2021) surveyed 1027 stocks in Shanghai and Shenzhen stock markets from 2007 to 2011 and proved that board diversity has a positive correlation with IC efficacy. Overall, it is widely believed that a greater representation of women in directorial positions leads to more effective IC within a company (Pan et al., 2020). Therefore, this study made the following assumption:

H2

FDs have a positive effect on corporate IC.

As discussed in Sect. 2.1, the influence of OC on corporate IC has been extensively examined in scholarly literature. It is commonly held that high OC may result in inadequate IC mechanisms, thereby increasing the likelihood of fraudulent activities and other forms of financial impropriety. Concurrently, the United Nations’ 2030 Agenda for Sustainable Development posits that achieving social development, economic growth, and sustainable business performance is contingent upon the imperative of gender parity. The debate on FDs and IC is thus intensifying (Liu et al., 2019). Research suggests that gender diversity on boards can bring unique perspectives, skills, and values that enhance IC practices (Pan et al., 2020; Terjesen et al., 2016), which significantly contributes to the implementation of sustainable goals (Di Vaio et al., 2023a) and improved sustainability outcomes (Flabbi et al., 2017). FDs foster a more holistic consideration of sustainability factors, improve risk management, strengthen ethical standards, and enhance transparency and accountability (Di Vaio et al., 2023b). FDs also possess distinctive competencies, outlooks, and life encounters that can supplement the proficiency of their fellow board members and elevate the caliber of decision-making pertaining to IC. Thus, organizations that prioritize gender diversity on their boards are more likely to have robust IC mechanisms and benefit from the positive impact of autonomous FDs on IC quality (Chen et al., 2016).

With the increasing acknowledgment of gender diversity’s significance in corporate boards, it is vital to investigate the influence of OC on IC in light of the contribution of FDs to IC. This perspective posits that the inclusion of women on a firm’s BoD can ameliorate the adverse impacts of OC on IC and augment the overall efficacy of IC mechanisms. Accordingly, this study aimed to investigate if FDs serve as a moderating factor influencing the negative relationship between OC and IC.

The resource dependence theory explains that external resources (Hillman et al., 2009), such as capital, expertise, and information (Huang et al., 2020), are crucial. In this context, FDs can enrich a company’s resource base by bringing in new stakeholder perspectives, knowledge, and networks, ensuring that corporate’s IC systems are coherent with the interests of all stakeholders (Ronnegard & Smith, 2018). In line with this notion, the gender diversity of the directorate is a resource that ought to be fully utilized to enrich information resources, data integration, and corporate governance (Morck et al., 2005), as well as to minimize the imbalance of power caused by high OC. The intermediary theory further backs up the moderating role of FDs by suggesting that intermediaries, such as the BoD, are imperative in facilitating communication, coordination, and collaboration among different stakeholder groups (Hernández-Chea et al., 2021; Anselmi et al., 2023).

According to the stakeholder theory, firms should consider the interests of both internal and external stakeholders, which FDs are known to do (Smith et al., 2022). Stakeholders refer to various groups that can influence or be influenced by the management behavior of a company, such as suppliers, consumers, employees, shareholders, and local governments (KsiężaK, 2016). Stakeholders invest resources required for the long-term sustainability of an enterprise and obtain corresponding returns. They also participate in the construction of relevant IC mechanisms, as they are important beneficiaries of IC results and are subject to IC constraints (Masli, 2010). In this regard, FDs can ensure that diverse perspectives are represented and that different stakeholders communicate effectively with each other. This can help improve IC by promoting transparency, accountability, and collaboration. Therefore, FDs can reduce the centralization of power in the directorate.

Overall, resource dependence theory, stakeholder theory, and intermediary theory support the notion that FDs are important in weakening the connection between OC and IC by expanding the company’s resource base, promoting stakeholder engagement, and facilitating communication and coordination. This assumption provides a theoretical basis for the ability of FDs of Chinese-listed companies to preserve strong IC despite concentrated ownership. Following this line of inquiry, investigations have been conducted in China to study the potential effect of FDs on IC across different OC levels. According to Alkebsee et al. (2021), the inclusion of FDs in a firm’s board is linked to enhanced IC effectiveness, with the link being stronger in companies characterized by elevated levels of OC. The works of Zhang et al. (2023), Zhang (2021), and Gulzar (2011) also revealed that in high OC firms, there is a stronger positive correlation between the presence of FDs and various aspects of IC, including but not limited to financial reporting standards, risk management, and internal auditing. Collectively, the aforementioned studies indicate that the inclusion of women in a corporate BoD can yield favorable outcomes for internal governance, particularly in companies with greater levels of OC. This underscores the significance of advocating for gender diversity within corporate boards as a strategy for bolstering internal oversight and mitigating the hazards linked to OC in China. However, more investigations are needed to support whether a higher number of FDs can weaken the negative implications of OC on IC. It was thus hypothesized that:

H3

FDs moderate the relationship between OC and corporate IC.

2.3 The function of board compensation (BC): agency theory and stakeholder theory

BC refers to the payment and benefits provided to members of a company’s BoD (Goobey, 2005), which can take various forms including cash payments, equity awards, and additional benefits like insurance coverage, retirement plans, and travel expenses. The purpose of BC is to attract and retain qualified directors who can contribute to the company’s success and ensure effective governance (Merino et al., 2019). For BoD members, adequate compensation is essential for them to fulfill their responsibilities, such as attending board meetings, conducting research, and providing strategic guidance. Moreover, BC can influence directors’ behavior and decision-making processes (Deutsch et al., 2007). For instance, generous compensation may foster loyalty and commitment to the company, while inadequate compensation may lead to disengagement and reduced motivation.

Notably, BC plays a crucial role in establishing effective IC systems and directing organizations toward their objectives. Linking executive pay to sustainability-based goals and performance indicators creates a clear incentive for board members to consider ESG factors in their decision-making, champion sustainable practices, and integrate sustainability into strategic objectives (Di Vaio et al., 2023a, 2023b). Competitive compensation packages that emphasize sustainability also attract directors with expertise in sustainability and responsible business practices (Hossain et al., 2022a, 2022b, 2022c, 2022d). Their knowledge contributes to effective IC systems that address environmental risks, social impacts, and ethical considerations. Thus, properly structured compensation that aligns with sustainability goals motivates directors to prioritize such goals, fosters a culture of sustainability, and strengthens effective sustainability-driven IC mechanisms (Anselmi et al., 2023; Di Vaio et al., 2023a), ultimately leading to potential environmental and social benefits.

According to the agency theory, executives and directors may prioritize their own benefits over the interests of shareholders. The theory also states that the BoD plays a key role in overseeing managers’ conduct and making sure they serve the best interests of shareholders (Vitolla, 2020). Board members are typically independent from management and have a fiduciary duty to prioritize shareholders’ welfare. Thus, adequate compensation can attract qualified individuals to serve on the board and incentivize them to fulfill their duties effectively. Performance-based remuneration, such as stock options or bonuses, can be implemented to align directors’ and shareholders’ interests. Tying compensation to performance incentivizes directors to prioritize shareholders’ interests and work towards achieving the organization’s objectives. As a result, appropriate compensation structures enhance monitoring, attract competent directors, and mitigate risk-taking behavior, ultimately contributing to improved IC mechanisms within the organization (Jankensgard & Kapstad, 2021). Moreover, stakeholder theory suggests that firms have a responsibility to maximize shareholder value and consider the interests of all stakeholders (Ronnegard & Smith, 2018; Ali et al., 2023). To this end, adequate BC can help attract and retain board members who are committed to fulfilling this responsibility and ensuring that the company operates ethically and responsibly. In conclusion, the agency theory and stakeholder theory tenets support the idea that competitive BC can incentivize directors to act in the best interests of shareholders and other stakeholders, monitor the actions of management, and contribute to the effective functioning of IC mechanisms.

Empirical research has also provided evidence on the positive influence of BC on various corporate governance aspects. For example, Chen and Yuan (2020) found that directors who receive higher compensation are more motivated to prioritize IC initiatives, resulting in better IC quality and ultimately, better overall performance. Li and Xu (2019) and Tian et al. (2023) also confirmed the positive impact of BC on IC quality, while Ananzeh et al. (2022) revealed that higher BC improves a company’s CSR performance. Chen and Keefe (2020) provided evidence that BC improves firm performance, more so when the ownership structure is more dispersed.

Overall, BC can serve as a motivator for board members to actively monitor and oversee the company’s operations and financial reporting. This, in turn, can lead to better IC and lower the risk of financial misstatements or fraudulent activities. Moreover, when board members are appropriately compensated, they have less incentive to engage in conflicts of interest or other unethical behavior, which can further contribute to better IC. Based on this, it was hypothesized that:

H4

BC has a positive impact on corporate IC.

As discussed earlier, OC can deteriorate IC within a company, as a dominant shareholder or group may wield significant control over decision-making and prioritize their interests over other shareholders. When a specific individual or small group holds significant ownership of company shares (Jahnke, 2019), the interests of the concentrated owners may not coincide with those of dispersed shareholders. In this context, agency theory recommends that BC can weaken the negative link between OC and corporate IC. BC plays a pivotal role in shaping IC mechanisms and driving sustainable goals. Properly designed compensation structures can incentivize directors to prioritize stakeholder interests and sustainability objectives, thereby ensuring that ICs align with sustainable practices (Chen & Yuan, 2020; D’Adamo, 2022).

Despite limited research on the interaction between BC and OC in affecting IC, some studies have explored related topics. For example, Tian et al. (2023) deduced that the relationship between BC and IC quality is strengthened when ownership is more concentrated, indicating the vital role of ownership structure in enhancing the effect of BC on IC. Alqatan et al. (2019) also observed positive effects of board size and independent director percentage on IC. Additionally, Gutiérrez (2019), Larrain and Urzúa (2015), and Pucheta-Martínez (2019) examined the linkage between OC and corporate governance in Latin America, revealing that higher levels of OC may lead to weaker governance and lower firm value. Although not focusing on BC, these studies imply that OC can negatively impact corporate governance and IC, which are crucial for a firm’s performance. Understanding the moderating role of BC between OC and IC enables firms to design compensation structures that not only foster accountability and transparency but also alleviate the potential negative consequences of concentrated ownership. This knowledge is essential for promoting effective corporate governance and IC mechanisms. Considering the arguments above, we hypothesized that:

H5

BC moderates the relationship between OC and corporate IC.

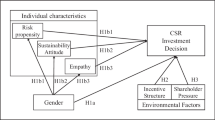

The conceptual framework in Fig. 1 depicts the relationships among OC, IC, and the moderating factors such as FDs and BC. The research aimed to examine the impact of OC on IC, exploring how concentrated ownership may affect the effectiveness of IC mechanisms. Additionally, the study investigated the moderating roles of FDs and BC in the relationship between OC and IC.

3 Data source and methods

3.1 Data and sample selection

Data were obtained from A-share-listed organizations in the Shanghai and Shenzhen stock markets of China, covering the period from 2012 to 2021. This time frame was chosen because it coincides with significant corporate governance reforms in China aimed at improving transparency, accountability, and shareholder protection. Notably, from 2015 to 2021, there was an increase in the appointment of FDs in China’s corporate sector, partly influenced by the impact of the one-child policy that was in effect from 1979 to 2015. A comprehensive filtering process was conducted to ensure data quality and relevance. Firstly, financial and insurance firms were excluded from the study. Secondly, listed companies that had been subjected to special treatment (ST) or *ST during the sample selection period were eliminated. Finally, sample companies with incomplete disclosure of enterprise research and development investment, financial data, and corporate governance information were excluded. The data utilized in the study were sourced from two main databases. The information related to BC was obtained from the WIND database, whereas data on FDs and other relevant information were extracted from the CSMAR database.

3.2 Variable measurement

3.2.1 Internal control (IC)

The dependent variable of this study was IC. To assess the quality of corporate IC, we utilized the Shenzhen Dibo Enterprise Risk Management Database, specifically the 2012–2021 Enterprise IC Comprehensive Index. Shenzhen Dibo Enterprise is recognized as a pioneer in conducting comprehensive research on IC and risk management in China. To develop a robust IC evaluation system, we drew upon extensive literature (Ruan & Liu, 2021; Smith et al., 2022) from both domestic and international scholars. By digitizing IC indicators and learning from prior works, an evaluation system was designed to more accurately reflect the actual conditions of the companies under study. For this purpose, we followed the approach used in Li’s (2019) research and standardized the IC index of the DiBo database by dividing it by 100. This standardized measure served as the indicator of IC quality, where a higher score indicates higher-quality IC within the companies.

3.2.2 Equity ownership concentration (OC)

In this study, OC was the independent variable. OC reflects the shareholder structure of a company, indicating whether shareholders are concentrated or dispersed. It also plays a crucial role in representing the distribution of control rights within a company (Jahnke, 2019; Waheed & Malik, 2019). The calculation method of OC is as follows:

OC = (shareholding ratio of a shareholder/total equity) * 100%

3.2.3 Female directors (FDs)

This study considered FDs’ proportion on the board as a moderator. Following Peng and Chandarasupsang (2023) as well as Oradi and E-Vahdati (2021), we calculated FDs as follows:

FDs = Total number of female board members/Total number of board members.

3.2.4 Board compensation (BC)

BC was the other moderator of this study. The compensation committee within the board mainly provides proposals for the compensation policy and structure of the company’s senior management (Chen & Yuan, 2020). These data were obtained from the WIND database.

3.2.5 Control variables

Through a review of relevant literature (Al-Sartawi & Sanad, 2019; Gutiérrez, 2019; Larrain, 2015; Pucheta-Martínez, 2019; Peng & Chandarasupsang, 2023; Oradi & E-Vahdati, 2021), we also considered the potential impact of enterprise size, asset-liability ratio, fixed asset ratio, and asset turnover ratio on enterprise IC. Additionally, we controlled for industry and time effects. The variables included in this study are listed in Table 1, and the profile of the sample companies is provided in Table 2.

3.3 Model building

where \({\mathrm{IC}}_{i.t}\) is the IC of enterprise i at year t, \({\mathrm{OC}}_{i,t}\) is OC, \({\mathrm{FD}}_{i,t}\) is FDs, \({\mathrm{BC}}_{i,t}\) is BC, \(\mathrm{OC}*{\mathrm{FD}}_{i,t}\) is the interaction between OC and FDs, \(\mathrm{OC}*{\mathrm{BC}}_{i,t}\) is the interaction between OC and BC, \({Z}_{i,t}\) represents the control variables of enterprise i at year t, \({\mu }_{i,t}\) is the error term, and \({\alpha }_{n}\) is the constant term. The models above were developed upon referring to Sohail et al. (2021) and Peng and Chandarasupsang (2023).

4 Data analysis and results

Table 3 presents descriptive statistics related to the sampled firms’ IC, OC, FDs, BC, and control variables. The table includes average and standard deviation values, as well as the Pearson correlation test results. Most variables showed positive and significant correlations with each other.

Table 4 reports the fixed effects model and general mixed model results on the effects of OC, FDs, and BC on IC, as well as the moderating roles of FDs and BC between OC and IC. In Model 1, we observed a significant negative relationship between OC and IC, supporting H1. This study confirms the unfavorable impact of OC on the corporate governance mechanism of publicly traded firms in China. In Model 2, the results indicated a significant positive effect of FDs on IC, which supported H2. We then assessed the interaction (Model 3) between OC and FDs in affecting corporate IC. The significant interaction term (FDs) implies that the relationship between OC and IC is not the same across different levels of FDs. This means the impact of OC on IC is moderated by FD. The results supported the moderating role of FDs in minimizing the effect of OC on IC, thus validating H4. In Model 4, the results indicated a significant positive influence of BC on IC and supported H3.

Similarly, in Model 5, H5 was supported as the interaction between BC and OC was significant in affecting IC. It was suggested that BC exerts a moderating effect on the association between OC and IC. Apart from supporting H5, this finding highlights the importance of designing effective BC structures to influence how OC affects IC. Based on the results, FDs and BC exert significant moderating effects on the link between OC and company IC.

4.1 Robustness test results

We also conducted a robustness test to confirm the obtained results. For this test, a new general least squares method was adopted to re-analyze the data, the results of which are presented in Table 5. In Model 1, a significant negative relationship between OC and IC was observed. In Model 2, a significant positive effect of FDs on IC was evident. Model 3 explored the interaction between OC and FDs. In Model 4, a significant positive effect of BC on IC was noted, while Model 5 investigated the interaction between OC and BC. Both moderating factors were found to be significant. Therefore, the robustness test’s results aligned with the prior findings, confirming their validity and reliability.

5 Discussion

Today, China is undergoing an economic transformation, but faces challenges such as insufficient information disclosure by listed companies, low capital market efficiency, and regulatory issues (Zhao et al., 2018). These issues can be resolved by enhancing IC, which involves a series of activities in which senior management makes decisions, involves all employees, and controls important processes within an enterprise (Sumaryati et al., 2020). Higher levels of OC can worsen these governance issues and lower firm value, as per Gutiérrez (2019), Larrain (2015), and Pucheta-Martínez (2019), When a minority of shareholders holds a considerable large percentage of a company’s equity, they gain considerable influence over decision-making, leading to potential misaligned incentives and conflicts of interest that can undermine IC (Pucheta-Martínez, 2019). This implies that a high degree of OC may have a detrimental impact on both corporate governance and IC. Hence, it is essential for publicly traded companies, especially in China, to focus on mitigating potential IC failure caused by OC. To this end, this study investigated the influence of OC on IC in Chinese companies. Moreover, unlike previous studies that solely looked at FDs (Reig-Aleixandre et al., 2023), this study examined the combined roles of both FDs and BC in moderating the relationship between OC and IC. By considering the broader context of corporate governance and the interaction of multiple factors, this study offers a comprehensive analysis and deeper understanding of these phenomena.

As predicted, the findings illustrated an adverse effect of OC on companies’ IC. This finding is supported by the modern principal–agent theory and the rational person hypothesis. According to agency theory, OC may result in a conflict of interests between majority and minority shareholders, with the majority tending to dominate the company’s assets and weaken IC (Bergh, 1995; Shleifer & Vishny, 1986; Hastori et al., 2015). Previous studies have also established a negative correlation between OC and IC, implying that higher levels of OC can lead to weaker governance (Al-Sartawi & Sanad, 2019; Gutiérrez, 2019; Larrain, 2015; Pucheta-Martínez, 2019). Likewise, Goh (2009) and Hao, Qi and Wang (2018) explored various aspects of corporate governance and IC, both indicating an adverse impact of OC on IC.

The BoD, as a critical decision-making body, demonstrates a crucial role in corporate governance and IC oversight (Aydiner et al., 2019). Independent directors, acting in the principal–agent relationship, pay close attention to the company’s daily operations and internal management, which promotes effective BoD supervision and corporate governance (Capezio et al., 2011). In this regard, this study reached a significant conclusion that a higher number of FDs promote IC, consistent with numerous earlier studies (Peng & Chandarasupsang, 2023; Buallay et al., 2022; Terjesen et al., 2016; Chen et al., 2016; Abbott et al., 2012; Mitra & Singh, 2009). For instance, Adams and Ferreira (2009) revealed that firms with more female members on their boards are less prone to financial statement corrections due to errors or omissions. This phenomenon was attributed to the tendency of women to ask critical questions and confront management, resulting in improved IC. Similarly, Chang’s (2020) study found that companies with FDs demonstrated superior IC practices, possibly because of women’s greater risk aversion and proclivity to question assumptions. Furthermore, the presence of FDs within an organization can serve as role models and a source of inspiration for other female employees, fostering a corporate culture that values ethical conduct and robust internal oversight. Indeed, studies by Abbott et al. (2012), Ben-Amar et al. (2017), Wasiuzzaman and Wan Mohammad (2020), and Srinidhi et al. (2011) suggest that the inclusion of FDs on boards is linked to a decreased probability of financial statement fraud. Scholars have also demonstrated that when the representation of women on BoDs increases, business philanthropy, community participation, and employee compensation all improve significantly (Chen et al., 2016; Dhenge et al., 2022; Tibiletti et al., 2021; Wei et al., 2017). The findings further support the idea that FDs exhibit better moral character compared to men (Wang, 1994) and tend to be more attentive to their position and role, dedicating more time and energy to their work.

This positive association between FDs and IC is consistent with agency theory, indicating that FDs are better equipped to handle conflicts of interest between shareholders and company executives. FDs are more empathetic to stakeholder concerns and more committed to sustainability, thereby reducing agency problems. Additionally, the resource dependency theory supports the idea that FDs bring distinctive resources that contribute to improved IC within organizations. One of the main ways in which FDs impact IC is through the diversity of perspectives and expertise they bring to the board, leading to a stronger focus on stakeholder interests and a more inclusive decision-making process (Chen et al., 2016). Their presence contributes to more robust and effective oversight, improving corporate governance and decision-making processes. Overall, promoting gender diversity and encouraging the inclusion of FDs in corporate boards can enhance IC, foster sustainable practices, improve decision-making, and promote gender equality. This highlights the importance of promoting gender diversity within corporate boards to enhance IC, corporate governance, and overall corporate performance.

This study has also established that FDs have a moderating impact on the relationship between OC and IC. This aligns with earlier findings that show women are more responsible than men (Reig-Aleixandre et al., 2023) and more risk-aware (Costa-Font et al., 2022), allowing them to mitigate the negative impact of concentrated ownership on IC. Based on agency theory, women directors may bring more objective perspectives to resolving complicated issues, which can reduce informational biases and assist in solving governance problems like high OC (Flabbi et al., 2017; Peng & Chandarasupsang, 2023). By ensuring women have representation in decision-making positions, organizations can challenge gender biases and create more inclusive workplaces that are not biased toward the demands of majority shareholders. Moreover, FDs inspire aspiring women leaders and encourage them to pursue careers in traditionally male-dominated industries. Increased gender diversity in boardrooms sends a powerful message that talent and expertise are not limited by gender, breaking down barriers and promoting equal opportunities for all.

This positive relationship between BC and IC aligns with agency theory, claiming that a well-paid board fosters more powerful IC. Linking remuneration to performance inspires directors to put foremost shareholders’ interests while working toward the organization’s goals. In accordance with the agency theory, executives and directors may put their own interests ahead of those of shareholders. Suitable compensation structures reduce agency-related issues and enhance monitoring, attract competent directors, and mitigate risk-taking behavior, ultimately contributing to improved IC mechanisms within the organization (Jankensgard & Kapstad, 2021). The current study took a step further by examining the moderating effect of BC between OC and IC. Adequate BC is vital in attracting and retaining board members who are dedicated to fulfilling their responsibilities and ensuring ethical and responsible company operations.

Our findings suggest that BC has a crucial moderating influence in the link between OC and IC, underscoring the significant impact that BC structures have on how OC influences IC (Ali et al., 2023). Similar findings were observed in a study by Balagobei (2018). This aligns with stakeholder theory, which posits that BC can incentivize board members to actively oversee company operations such as IC and financial reporting, thereby maximizing shareholder value and interests. BC can ameliorate the relationship between OC and IC, which highlights the significance of designing compensation structures that promote accountability, transparency, and sustained value creation to alleviate the negative effects of OC on IC.

In conclusion, this study emphasizes the importance of collectively considering OC, FDs, and BC when designing corporate governance structures that effectively promote IC mechanisms and optimize sustainability efforts. By fostering a diverse ownership structure, promoting gender diversity within boards, aligning compensation packages with sustainability objectives, and implementing strong IC processes, companies can enhance their sustainability performance, embed sustainable practices across their operations, and make lasting contributions to environmental and social well-being in the long run.

5.1 Theoretical implications

This research adds to the existing body of literature in five ways. First, it examines how OC, a key corporate governance construct, impacts the corporate IC of China’s listed corporations. Second, the study emphasizes the significance of corporate governance structures by indicating the significant impacts of FDs and BC on IC. Third, it addresses the underexplored association between OC and IC by introducing both FDs and BC as moderating variables. Fourth, this research extends the principal–agent theory by highlighting the crucial role of FDs in China’s corporate landscape. It showcases their substantial contribution to IC and how their involvement as agents at the management level effectively addresses the agency problem through sustainable practices that align with stakeholder interests. Lastly, by linking BC to OC, the study offers numerous advantages for organizations seeking to enhance IC mechanisms. This alignment of interests between board members and shareholders fosters improved governance, accountability, and risk management practices.

5.2 Managerial implications

The findings obtained from this study have valuable practical implications for managers in forming effective boards and enhancing IC mechanisms. The empirical evidence provided for listed companies can be utilized to enhance economic sustainability by improving the quality of IC and establishing a reasonable OC. The presence of FDs can further contribute to diversity in management and decision-making dynamics (El-Chaarani et al., 2022). As such, firms are encouraged to recognize the significance of FDs’ involvement as a distinctive feature of the Chinese governance structure and invest in robust IC mechanisms. Moreover, when it comes to IC, BC structures should support a long-term perspective. Owners with concentrated stakes often have a vested interest in the sustained success of the organization. Aligning BC with OC can reinforce this long-term perspective. Managers should design compensation packages that incentivize board members to prioritize and maintain IC systems focused on long-term sustainability and value creation, rather than pursuing short-term gains. Therefore, by implementing effective OC and appropriate BC, management can reduce the agency problem and strengthen the firm’s sustainable development capabilities.

5.3 Policy implications

This study’s policy implications underscore the importance of comprehensive approaches that integrate OC, FDs, BC, and IC to enhance sustainability efforts. Specifically, implementing policies that promote diverse ownership structures, encourage gender diversity on boards, align compensation packages with sustainability objectives, and strengthen IC processes can drive sustainable practices and enhance the welfare of the society and environment. These policy interventions create a supportive environment for organizations to incorporate sustainability into the heart of their operations, leading to lasting positive effects on the planet and society. By adopting such holistic policies, companies can be key players in advancing sustainability goals and making meaningful contributions to a more sustainable future. However, it is vital to note that the implementation of these policy suggestions may vary depending on the legal and regulatory frameworks in different jurisdictions. Additionally, a comprehensive analysis of the specific context and circumstances of each company is essential to tailor the policies and interventions to their unique needs and challenges.

6 Conclusion

This study employed a multi-theory method to propose and test the relationships of OC, FDs, and BC with corporate IC, all viewed through the sustainability lens. In today’s modern enterprises, the concepts of “power” and “authority” still hold significant importance (Li, 2016). However, the overemphasis on these aspects can negatively impact the overall functioning of a company. To promote sustainable practices and strong ESG performance, organizations must ensure that their IC mechanisms are robust and independent from any undue influence. This can be achieved by implementing governance structures that encourage diversity and inclusivity on boards like FDs, actively engaging with stakeholders, and aligning executive compensation with ESG goals. By doing so, companies can strengthen their IC systems, effectively address ESG challenges, and foster long-term sustainability and value creation. This holistic strategy enhances the organization’s bottom line while also having a good influence on society and the environment, which is in accordance with sustainable business principles.

6.1 Recommendations and future prospects

Based on this study’s findings, several suggestions are put forward. First, governments can regulate OC to prevent it from negatively impacting IC. This can be achieved through measures such as enforcing antitrust laws, setting limits on ownership stakes, and imposing restrictions on insider trading. Second, companies can enhance transparency and accountability in their IC systems by regularly reporting on their IC practices and their effectiveness. With this, investors and other stakeholders would be more convinced and IC act as a deterrent to potential wrongdoers. Third, there is a need to encourage academic research, industry collaborations, and knowledge sharing on the relationship between OC, IC, and gender diversity. This can lead to a deeper understanding and identification of innovative approaches to address the challenges associated with these factors. Fourth, companies should consider establishing independent board committees or special committees dedicated to overseeing IC. These committees should be empowered with authority and resources to monitor and evaluate the effectiveness of IC mechanisms, irrespective of OC. Lastly, companies can provide training and education to their directors, executives, and employees on IC best practices. This can help ensure that everyone is aware of their responsibilities and can contribute to improving IC within the organization.

In addition, this study has limitations that offer future study directions. First, our findings are specific to the particular context in which the research was conducted (i.e., listed companies in China) and may not be easily generalized to other countries or industries. Second, the data available to the researchers were limited, potentially leading to incomplete or biased results. Third, the study’s sample size may have been insufficient, which could affect statistical power and the ability to draw strong conclusions. Fourth, the study’s measurements of OC, IC, FDs, BC, and the control variables could have shortcomings, and alternative operationalizations may produce different results. Lastly, the study’s cross-sectional timeframe could be a limitation, as IC and corporate governance practices are constantly evolving, and results may vary over time. It is essential to acknowledge these potential limitations when interpreting the study’s findings and to exercise caution when applying them to other contexts or making broad generalizations.

Future studies can overcome these limitations by conducting comparative studies between financial and non-financial companies or exploring the post-pandemic context (Paoloni & Lombardi, 2023). Additionally, research could be extended to different regions and industries, such as manufacturing or financial firms, to enhance the generalizability of the findings. Upcoming studies can replicate or extend this study by focusing on changes in governance mechanisms and performance resulting from IC, BC, and FDs. Moreover, future research might consider incorporating other moderating variables such as supervisory boards, audit committees, shareholder activism, and financial expertise to gain more diverse perspectives and a holistic insight into corporate governance and performance.

Availability of data and materials

Data used to support the findings of this study are available from the corresponding author upon request.

References

Abbott, L. J., Parker, S., & Presley, T. J. (2012). Female board presence and the likelihood of financial restatement. Accounting Horizons, 26(4), 607–629. https://doi.org/10.2308/acch-50249

Adams, R. B., & Ferreira, D. (2009). Women in the boardroom and their impact on governance and performance. Journal of Financial Economics, 94(2), 291–309. https://doi.org/10.1016/j.jfineco.2008.10.007

Ali, S. M., Appolloni, A., Cavallaro, F., D’Adamo, I., Di Vaio, A., Ferella, F., Gastaldi, M., Ikram, M., Kumar, N. M., Martin, M. A., Nizami, A.-S., Ozturk, I., Riccardi, M. P., Rosa, P., Gonzalez, E. S., Sassanelli, C., Settembre-Blundo, D., Singh, R. K., Smol, M., … Zorpas, A. A. (2023). Development goals towards sustainability. Sustainability, 15(12), 9443. https://doi.org/10.3390/su15129443

Alkebsee, R. H., Tian, G. L., Usman, M., Siddique, M. A., & Alhebry, A. A. (2021). Gender diversity in audit committees and audit fees: Evidence from China. Managerial Auditing Journal. https://doi.org/10.1108/MAJ-06-2019-2326

Almasria, N. A. (2022). Corporate governance and the quality of audit process: An exploratory analysis considering internal audit, audit committee and board of directors. European Journal of Business and Management Research, 7(1), 78–99. https://doi.org/10.24018/ejbmr.2022.7.1.1210

Alqatan, D., Albitar, K., & Huang, W. (2019). The role of board characteristics on the relationship between international financial reporting standards (IFRS) adoption and earnings management: Evidence from China. Journal of Accounting and Taxation, 11(9), 145–154. https://doi.org/10.5897/JAT2019.0357

Al-Sartawi, A. M. M., & Sanad, Z. (2019). Institutional ownership and corporate governance: Evidence from Bahrain. Afro-Asian Journal of Finance and Accounting, 9(1), 101–115. https://doi.org/10.1504/AAJFA.2019.096916

Al-Twaijry, A. A., Brierley, J. A., & Gwilliam, D. R. (2003). The development of internal audit in Saudi Arabia: An institutional theory perspective. Critical Perspectives on Accounting, 14(5), 507–531. https://doi.org/10.1016/S1045-2354(02)00158-2

Aluchna, M., Berent, T., & Kamiński, B. (2019). Dividend payouts and shareholder structure: Evidence from the Warsaw stock exchange. Eastern European Economics, 57(3), 227–250. https://doi.org/10.1080/00128775.2019.1568196

Ananzeh, H., Al Amosh, H., & Albitar, K. (2022). The effect of corporate governance quality and its mechanisms on firm philanthropic donations: Evidence from the UK. International Journal of Accounting & Information Management. https://doi.org/10.1108/IJAIM-12-2021-0248

Ang, R., Shao, Z., Liu, C., Yang, C., & Zheng, Q. (2022). The relationship between CSR and financial performance and the moderating effect of ownership structure: Evidence from Chinese heavily polluting listed enterprises. Sustainable Production and Consumption, 30, 117–129.

Anselmi, D., D’Adamo, I., Gastaldi, M., & Lombardi, G. V. (2023). A comparison of economic, environmental and social performance of European countries: A sustainable development goal index. Environment, Development and Sustainability. https://doi.org/10.1007/s10668-023-03496-3

Aydiner, A. S., Tatoglu, E., Bayraktar, E., & Zaim, S. (2019). Information system capabilities and firm performance: Opening the black box through decision-making performance and business-process performance. International Journal of Information Management, 47, 168–182. https://doi.org/10.1016/j.ijinfomgt.2018.12.015

Ayuso, S., & Argandoña, A. (2009). Responsible corporate governance: Towards a stakeholder board of directors?. IESE Business school working paper no. 701, available at SSRN: https://ssrn.com/abstract=1349090 or https://doi.org/10.2139/ssrn.1349090.

Balagobei, S. (2018). Corporate governance and firm performance: Empirical evidence from emerging market. Asian Economic and Financial Review, 8(12), 1415–1421. https://doi.org/10.18488/journal.aefr.2018.812.1415.1421

Bannò, M., Filippi, E., & Trento, S. (2023). Women in top echelon positions and their effects on sustainability: A review, synthesis and future research agenda. Journal of Management and Governance, 27(1), 181–251. https://doi.org/10.1007/s10997-021-09604-7

Ben-Amar, W., Chang, M., & McIlkenny, P. (2017). Board gender diversity and corporate response to sustainability initiatives: Evidence from the carbon disclosure project. Journal of Business Ethics, 142(2), 369–383. https://doi.org/10.1007/s10551-015-2759-1

Bergh, D. D. (1995). Size and relatedness of units sold: An agency theory and resource-based perspective. Strategic Management Journal, 16(3), 221–239. https://doi.org/10.1002/smj.4250160306

Bo, H., & Driver, C. (2012). Agency theory, corporate governance and finance. Edward Elgar Publishing. https://doi.org/10.4337/9781781002407.00019

Buallay, A., Hamdan, R., Barone, E., & Hamdan, A. (2022). Increasing female participation on boards: Effects on sustainability reporting. International Journal of Finance & Economics, 27(1), 111–124. https://doi.org/10.1002/ijfe.2141

Cantele, S., & Zardini, A. (2018). Is sustainability a competitive advantage for small businesses? An empirical analysis of possible mediators in the sustainability–financial performance relationship. Journal of Cleaner Production, 182, 166–176. https://doi.org/10.1016/j.jclepro.2018.02.016

Capezio, A., Shields, J., & O’Donnell, M. (2011). Too good to be true: Board structural independence as a moderator of CEO pay-for-firm-performance. Journal of Management Studies, 48(3), 487–513. https://doi.org/10.1111/j.1467-6486.2009.00895.x

Chang, H. Y., Hu, W. Y., Liu, H. H., & Sue, H. C. (2020). Does women on board affect the socially responsible firms’ effectiveness of internal control? Applied Economics, 52(56), 6162–6170. https://doi.org/10.1080/00036846.2020.1784836

Chen, Z., & Keefe, M. O. C. (2020). Rookie directors and firm performance: Evidence from China. Journal of Corporate Finance, 60, 101511. https://doi.org/10.1016/j.jcorpfin.2019.101511

Chen, H., & Li, F. (2013). Analysis the impact of XBRL in China’s capital market using methods of empirical research. Research Journal of Applied Sciences, Engineering and Technology, 5(5), 1521–1527. https://doi.org/10.19026/rjaset.5.4898

Chen, H., & Yuan, W. (2020). Board compensation and firm internal control quality: Evidence from China. Corporate Governance: an International Review, 28(1), 33–47. https://doi.org/10.1111/corg.12294

Chen, Y., Eshleman, J. D., & Soileau, J. S. (2016). Board gender diversity and internal control weaknesses. Advances in Accounting, 33, 11–19. https://doi.org/10.1016/j.adiac.2016.04.005

Chen, D. Q., Zhang, Y., Xiao, J., & Xie, K. (2021). Making digital innovation happen: a chief information officer issue selling perspective. Information Systems Research, 32(3), 987–1008. https://doi.org/10.1287/isre.2021.1008

COSO. (2013). Internal control - integrated framework. Committee of sponsoring organizations of the Treadway commission.

Costa-Font, J., & Vilaplana-Prieto, C. (2022). Risky restrictions? Mobility restriction effects on risk awareness and anxiety. Health Policy, 126(11), 1090–1102. https://doi.org/10.1016/j.healthpol.2022.08.009

D’Adamo, I. (2022). The analytic hierarchy process as an innovative way to enable stakeholder engagement for sustainability reporting in the food industry. Environment, Development and Sustainability. https://doi.org/10.1007/s10668-022-02700-0

Daminger, A. (2019). The cognitive dimension of household labor. American Sociological Review, 84(4), 609–633. https://doi.org/10.1177/0003122419859007

Deutsch, Y., Keil, T., & Laamanen, T. (2007). Decision making in acquisitions: The effect of outside directors’ compensation on acquisition patterns. Journal of Management, 33(1), 30–56. https://doi.org/10.1177/0149206306296576

Dhenge, S. A., Ghadge, S. N., Ahire, M. C., Gorantiwar, S. D., & Shinde, M. G. (2022). Gender attitude towards environmental protection: A comparative survey during COVID-19 lockdown situation. Environment, Development and Sustainability. https://doi.org/10.1007/s10668-021-02015-6

Di Vaio, A., Hassan, R., & Palladino, R. (2023a). Blockchain technology and gender equality: A systematic literature review. International Journal of Information Management, 68, 102517. https://doi.org/10.1016/j.ijinfomgt.2022.102517

Di Vaio, A., Zaffar, A., Balsalobre-Lorente, D., & Garofalo, A. (2023b). Decarbonization technology responsibility to gender equality in the shipping industry: A systematic literature review and new avenues ahead. Journal of Shipping and Trade, 8(1), 1–20. https://doi.org/10.1186/s41072-023-00140-1

Dixon-Fowler, H. R., Ellstrand, A. E., & Johnson, J. L. (2017). The role of board environmental committees in corporate environmental performance. Journal of Business Ethics, 140, 423–438. https://doi.org/10.1007/s10551-015-2664-7

El-Chaarani, H., Paoloni, P., & El-Abiad, Z. (2022). Impact of legal protection and board characteristics on CEO compensation. International Journal of Management and Decision Making, 21(3), 305–338. https://doi.org/10.1504/IJMDM.2022.124410

Fasterling, B. (2017). Human rights due diligence as risk management: Social risk versus human rights risk. Business and Human Rights Journal, 2(2), 225–247. https://doi.org/10.1017/bhj.2016.26

Fernández-Temprano, M. A., & Tejerina-Gaite, F. (2020). Types of director, board diversity and firm performance. Corporate Governance: the International Journal of Business in Society. https://doi.org/10.1108/CG-03-2019-0096

Flabbi, L., Piras, C., & Abrahams, S. (2017). Female corporate leadership in Latin America and the Caribbean region: Representation and firm-level outcomes. International Journal of Manpower. https://doi.org/10.1108/ijm-10-2015-0180

Garcia-Sanchez, I. M., Martínez-Ferrero, J., & García-Meca, E. (2017). Gender diversity, financial expertise and its effects on accounting quality. Management Decision, 55(2), 347–382.

Goh, B. W. (2009). Audit committees, boards of directors, and remediation of material weaknesses in internal control. Contemporary Accounting Research, Forthcoming. https://doi.org/10.1506/car.26.2.9

Goobey, A. R. (2005). Developments in remuneration policy. Journal of Applied Corporate Finance, 17(4), 36–40. https://doi.org/10.1111/j.1745-6622.2005.00058.x

Griffiths, P. D. R. (2021). Conceptual framework: Corporate responsibility governance business ethics culture and the knowledge economy. In P. D. R. Griffiths (Ed.), Corporate governance in the knowledge economy lessons from case studies in the finance sector. Springer. https://doi.org/10.1007/978-3-030-78873-5_2

Gulzar, M. A. (2011). Corporate governance characteristics and earnings management: Empirical evidence from Chinese listed firms. International Journal of Accounting and Financial Reporting, 1(1), 133. https://doi.org/10.5296/ijafr.v1i1.854

Gutiérrez, L. H., Pombo, C., & Pinto, E. (2019). Ownership concentration and corporate governance in Latin America. Journal of Economics, Finance and Administrative Science, 24(47), 112–126. https://doi.org/10.1108/JEFAS-01-2017-0001

Hao, D. Y., Qi, G. Y., & Wang, J. (2018). Corporate social responsibility, internal controls, and stock price crash risk: The Chinese stock market. Sustainability, 10(5), 1675. https://doi.org/10.3390/su10051675

Hastori, H., Siregar, H., Sembel, R., & Maulana, A. (2015). Agency costs, corporate governance and ownership concentration: The case of agro-industrial companies in Indonesia. Asian Social Science, 11(18), 311–319. https://doi.org/10.5539/ass.v11n18p311

Hernández-Chea, R., Mahdad, M., Minh, T. T., & Hjortsø, C. N. (2021). Moving beyond intermediation: How intermediary organizations shape collaboration dynamics in entrepreneurial ecosystems. Technovation, 108, 102332. https://doi.org/10.1016/j.technovation.2021.102332

Hillman, A. J., Withers, M. C., & Collins, B. J. (2009). Resource dependence theory: A review. Journal of Management, 35(6), 1404–1427. https://doi.org/10.1177/0149206309343469

Hoang, H. V. (2023). Environmental, social, and governance disclosure in response to climate policy uncertainty: Evidence from US firms. Environment, Development and Sustainability. https://doi.org/10.1007/s10668-022-02884-5

Hossain, M. I., Ong, T. S., Tabash, M. I., & Teh, B. H. (2022a). The panorama of corporate environmental sustainability and green values: Evidence of Bangladesh. Environment, Development and Sustainability. https://doi.org/10.1007/s10668-022-02748-y

Hossain, M. I., Ong, T. S., Tabash, M. I., Siow, M. L., & Said, R. M. (2022b). Systematic literature review and future research directions: Drivers of environmental sustainability practices in small and medium-sized enterprises. International Journal of Sustainable Economy, 14(3), 269–293.

Hossain, M. I., Teh, B. H., Chong, L. L., Ong, T. S., & Islam, M. T. (2022c). Green human resource management, top management commitment, green culture, and green performance of Malaysian palm oil companies. International Journal of Technology, 13(5), 1106–1114.

Hossain, M. I., Teh, B. H., Tabash, M. I., Alam, M. N., & San Ong, T. (2022d). Paradoxes on sustainable performance in Dhaka’s enterprising community: A moderated-mediation evidence from textile manufacturing SMEs. Journal of Enterprising Communities: People and Places in the Global Economy, (ahead-of-print).

Huang, S., Chen, C. P., & Wong, T. C. (2020). Application of machine learning in auditing teaching: a case study of predicting the audit report type of China ST listed companies. International Journal of Computer Auditing. https://doi.org/10.53106/256299802020120201003

Jahnke, P. (2019). Ownership concentration and institutional investors’ governance through voice and exit. Business and Politics, 21(3), 327–350. https://doi.org/10.1017/bap.2019.2

Jamadar, Y., Ong, T. S., Kamarudin, F., & Abdullah, A. A. (2022). Future firm performance, corporate governance, information asymmetry and insider trading—A systematic literature review using PRISMA. International Journal of Sustainable Economy, 14(3), 309–329. https://doi.org/10.1504/IJSE.2022.123878

Jankensgard, H., & Kapstad, P. (2021). Empowered enterprise risk management: Theory and practice. John Wiley & Sons. https://doi.org/10.1111/j.1745-6622.2006.00106.x

Jiang, L., & Bai, Y. (2022). Strategic or substantive innovation? The impact of institutional investors’ site visits on green innovation evidence from China. Technology in Society, 68, 101904. https://doi.org/10.1016/j.techsoc.2022.101904

Jizi, M. (2017). The influence of board composition on sustainable development disclosure. Business Strategy and the Environment, 26(5), 640–655.

Kao, L. (2019). Institutional ownership and internal control quality: Evidence from corporate governance reforms. Journal of Business Research, 101, 784–795. https://doi.org/10.1016/j.jbusres.2018.07.035

Khan, G. F., Hassan, S., & Qadeer, N. (2023). Impact of firm performance and CEO compensation with moderating role of board characteristics and audit quality. Annals of Social Sciences and Perspective, 4(1), 209–230.

KsiężaK, P. (2016). The benefits from CSR for a company and society. Journal of Corporate Responsibility and Leadership, 3(4), 53–65. https://doi.org/10.12775/JCRL.2016.023

Larrain, B., & Urzúa, F. (2015). Concentrated ownership and corporate governance in Latin America. Journal of Business Research, 68(6), 1311–1320. https://doi.org/10.1016/j.jbusres.2014.10.006

Leal Filho, W., Kovaleva, M., Tsani, S., Țîrcă, D. M., Shiel, C., Dinis, M. A. P., & Tripathi, S. (2022). Promoting gender equality across the sustainable development goals. Environment, Development and Sustainability. https://doi.org/10.1007/s10668-022-02656-1

Li Youmei. (2016). “White collar” in social structure and its social functions. Group Studies I.: Proceedings of the “Outstanding Achievement Award in Sociology” of the Lu Xueyi Sociology Development Foundation (1st-2nd), 1, 129. https://doi.org/10.1023/A:1015219218896.

Li, D., & Xu, N. (2019). Board compensation, agency problems and internal control quality: Evidence from China. International Journal of Accounting and Information Management, 27(4), 423–437. https://doi.org/10.1108/IJAIM-07-2019-0119

Li, X., Zheng, C., Liu, G., & Sial, M. S. (2018). The effectiveness of internal control and corporate social responsibility: Evidence from Chinese capital market. Sustainability, 10(11), 4006. https://doi.org/10.3390/su10114006

Liang, G., Liu, C., & Ma, K. (2023). The restriction and supervision of the power of university presidents. US-China Education Review, 13(1), 40–53. https://doi.org/10.17265/2161-623X/2023.01.006

Lin, S., Pizzini, M., Vargus, M., & Bardhan, I. R. (2011). The role of the internal audit function in the disclosure of material weaknesses. The Accounting Review, 86(1), 287–323. https://doi.org/10.2139/ssrn.1592593

Liu, S., Yang, D., Liu, N., & Liu, X. (2019). The effects of air pollution on firms’ internal control quality: Evidence from China. Sustainability, 11(18), 5068. https://doi.org/10.3390/su11185068

Martínez-Ferrero, J., & Lozano, M. B. (2021). The nonlinear relation between institutional ownership and environmental, social and governance performance in emerging countries. Sustainability, 13(3), 1586. https://doi.org/10.3390/su13031586

Masli, A., Peters, G. F., Richardson, V. J., & Sanchez, J. M. (2010). Examining the potential benefits of internal control monitoring technology. The Accounting Review, 85(3), 1001–1034. https://doi.org/10.2308/accr.2010.85.3.1001

Maury, B., & Pajuste, A. (2005). Multiple large shareholders and firm value. Journal of Banking & Finance, 29(7), 1813–1834. https://doi.org/10.1016/j.jbankfin.2004.07.009

Merino, E., Manzaneque-Lizano, M., & Sanchez-Araque, J. (2019). Sustainability and corporate governance: Transparency and excessive directors’ remuneration in listed companies during the global financial crisis. Sustainability, 12(1), 158. https://doi.org/10.3390/su12010158

Mitra, S. K., & Singh, V. B. (2009). When rebels become stakeholders: Democracy, agency and social change in India. Sage Publications India.

Morck, R., Wolfenzon, D., & Yeung, B. (2005). Corporate governance, economic entrenchment, and growth. Journal of Economic Literature, 43(3), 655–720. https://doi.org/10.1257/002205105774431252

Napitupulu, I. H. (2023). Internal control, manager’s competency, management accounting information systems and good corporate governance: Evidence from rural banks in Indonesia. Global Business Review, 24(3), 563–585. https://doi.org/10.1177/0972150920919845

Nguyen, H. A., Le Lien, Q., & Anh Vu, T. K. (2021). Ownership structure and earnings management: Empirical evidence from Vietnam. Cogent Business & Management, 8(1), 1908006. https://doi.org/10.1080/23311975.2021.1908006

Nur-Al-Ahad, M., Jamadar, Y., Latiff, A. R. A., Tabash, M. I., & Zaman, A. (2022). Effect of Islamic and conventional bonds on firm’s performance: Evidence from Malaysia. In 2022 International conference on sustainable Islamic business and finance (SIBF) (pp. 108–116). IEEE. https://doi.org/10.1109/SIBF56821.2022.9939670.

Oh, W. Y., Cha, J., & Chang, Y. K. (2017). Does ownership structure matter? The effects of insider and institutional ownership on corporate social responsibility. Journal of Business Ethics, 146, 111–124. https://doi.org/10.1007/s10551-015-2914-8

Oradi, J., & E-Vahdati, S. (2021). Female directors on audit committees, the gender of financial experts, and internal control weaknesses: Evidence from Iran. Accounting Forum, 45(3), 273–306. https://doi.org/10.1080/01559982.2021.1920127

Pan, A. (2020). Study on the decision-making behavior of evacuation for coastal residents under typhoon storm surge disaster. International Journal of Disaster Risk Reduction, 45, 101522. https://doi.org/10.1016/j.ijdrr.2020.101522