Abstract

We employ an ARDL bounds testing approach to cointegration and Unrestricted Error Correction Models to estimate the relationship between income and CO2 emissions per capita in 21 Latin American Countries (LACs) over 1960–2017. Using time series, we estimate six different specifications of the model to take into account the independent effect on CO2 emissions per capita of different factors considered as drivers of different dynamics of CO2 emissions along the development path. This approach allows to address two concerns. First, the estimation of the model controlling for different variables serves to assess if the EKC hypothesis is supported by evidence in any of the LACs considered and to evaluate if this evidence is robust to different model specifications. Second, the inclusion of control variables accounting for the effect on CO2 emissions is directed at increasing our understanding of CO2 emissions drivers in different countries. The EKC hypothesis effectively describes the long-term income-emissions relationship only in a minority of LACs and, in many cases, the effect on CO2 emissions of different factors depends on the individual country experience and on the type and quantity of environmental policies adopted. Overall, these results call for increased environmental action in the region.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The relationship between economic growth and environment has been a matter of interest for many years and collected academic contributions that date back to the 1950s. While during the seventies, the prevailing view was that of growth having net adverse environmental impacts (Ehrlich & Holden, 1971; Meadows et al., 1972; Nordhaus, 1977), the stance during the eighties was more optimistic and was mainly based on the concept of sustainable development (Brundtland, 1987). The formulation of the Environmental Kuznets Curve (EKC) hypothesis in the early nineties marked a significant turning point in this debate and is currently one of its main focus. The growth-environment relationship ceased being considered a monotonic one—whether of positive or negative sign—and a number of authors began to argue that the impact of growth on the environment could change along the course of economic development. According to the EKC hypothesis, first stated by Grossman and Krueger (1991), in the early stages of economic growth environmental degradation and pollution increase, but beyond some level of income per capita, the trend reverses with additional income growth leading to environmental improvement. In analogy with the relationship between income and income inequality described by Kuznets (1955), the relationship between economic growth and environmental degradation could thus be described as an inverted U-shaped curve, hence the name. A number of elements related to the process of development—changes in the economic structure, technological progress, changes in preferences and increased environmental awareness, among others—would be at the basis of such a relationship.

Shafik and Bandyopadhyay (1992) provided a first empirical confirmation of the hypothesis and popularized the concept. Since then a large stream of empirical literature flourished using a variety of econometric techniques to test the hypothesis for different countries, environmental variables and time periods.

A review of the first stream of the EKC empirical literature can be found in Dinda (2004) and Stern (2004) who provide comprehensive and critical surveys of the first 15 years of testing for the EKC. Some of the critics, particularly to the econometric framework, have been incorporated in subsequent literature which has more accurately considered problematic issues such as the possible existence of unit root in the data, largely ignored by most of the early studies. A review of more recent empirical EKC literature, specifically focusing on developing countries, can be found in Purcel (2020). The EKC hypothesis has been tested for Latin American Countries (hereinafter LACs) by a relatively smaller number of studies than in other regions. A review of the studies analyzing the income-environment relationship in Latin America is provided in Table 1.

The majority of those studies employed a panel data approach, despite the superiority of time series techniques to investigate the existence of the EKC has been claimed for a long time (de Bruyn et al., 1998; Lindmark, 2002; Stern et al., 1996; Unruh & Moomaw, 1998; Vincent, 1997). Indeed, when panel data are used to analyse countries at different levels of development, the country data series will likely no overlap as the points at the extremes of the distribution come only from higher-income and lower-income countries (Panayotou et al., 2000). Moreover, as the heterogeneity of results from previous studies points out, not a common pattern exists in the evolution of \(CO_{2}\) emissions and income. For example, in a study for the EKC in 22 LACs, Pablo-Romero and De Jesús (2016) observe significant differencies among the countries of the region. Both processes are country-specific and a country-level analysis is crucial to understand their nature. Another deficiency in previous literature is related to the time period considered. Most studies do not take into account the period prior to the seventies or eighties. However, Latin America reached the culmination of its industrialization process in the mid-70s and ignoring the period previous to the manufacturing expansion prevents the analysis from capturing the eventual effect that structural change has on \(CO_{2}\) emissions (i.e., the composition effect).

Against this background, in this paper, we study the relationship between income and \(CO_{2}\) emissions per capita in twenty-one LACs over 1960–2017. We test the EKC hypothesis employing Autoregressive Distributed Lag (hereafter, ARDL) bounds testing approach to cointegration based on Unrestricted Error Correction Model (hereinafter, UECM). This approach allows us to contribute to the existing literature addressing the gaps highlighted. First, using a time series technique, we estimate the model separately in each of the 21 LACs in our sample, while still preserving a system view of the income-emissions pattern in the region through the consideration of many countries. Second, our study employs larger time series that encompass both the years of the industrialization boost and the subsequent (premature) de-industrialization in the countries considered, to account for the possible composition effect—i.e., the environmental impact of structural change.

The main research question this paper aims to answer is what is the long-run relationship between income growth and \(CO_{2}\) emissions in LACs and does the EKC effectively describe it? We estimate six different models for each country, controlling for different variables. In this way, we are able to address the robustness of the results across different model specifications and conclude if the EKC hypothesis is a robust description of the income-emission pattern in some country of the region. The control variables are chosen to account for the effect of elements discussed in the theoretical literature as possible causes to increases or reductions of \(CO_{2}\) emissions.

After estimating the basic model, in models two and three, we control for output structure and the exports of primary products to understand the environmental impact of structural change in LACs. Since industry, which is considered the most polluting sector, does not play a prominent role in LACs’ production structure, we would expect to find more evidence for \(CO_{2}\) emissions decline at higher levels of income, when the production structure is taken into account. However, LACs production and export matrix is dominated by commodities which are likely to have a negative environmental impact as shown by previous research (Jiménez y J. Mercado (2014)). We then address the role of trade and foreign direct investment (FDI) in model 4: how do trade and external relations impact on \(CO_{2}\) emissions’ trajectory in LACs? Following the Pollution Haven Hypothesis (PHH) reasoning, we might expect higher \(CO_{2}\) emissions to be associated to higher shares of imports and exports. Also, if abundance of natural resources and permissive environmental regulations are attracting foreign multinational enterprises in environmentally damaging sectors, we should expect a positive coefficient for FDI inflows. Finally, in models 5 and 6, we address the impact of energy consumption on \(CO_{2}\) emissions and their evolution. In line with previous research on these factors, we hypothesize that higher energy consumption increases \(CO_{2}\) emissions, but the energy mix plays an important role (Aspergis & Payne, 2009; Fuinhas et al., 2017; Jiménez and Mercado 2014; Onafowora & Owoye, 2014; Pao & Tsai, 2011, among others). We expect fossil fuel-related parameters to be positive, renewable energy parameters to be negative and the effect of electricity consumption to depend on the source of electricity generation and the extent to which it is a substitute to more environmentally damaging sources of energy. The multiple specifications allow us not only to address the robustness of the estimates but also to assess the effect of relevant factors on \(CO_{2}\) emissions dynamics. This provides a better understanding of the underlying causes of environmental damage and is a crucial step to the mitigation of the environmental impact of growth.

The reminder of the paper is structured as follows. Section 2 briefly reviews the theoretical foundations of the hypothesis and highlights some related criticisms. In Sect. 3, the econometric methodology, as well as the data employed in the analysis, is presented. In Sect. 4, we present and discuss the results of the models carried out. Section 5 concludes the paper and provides some insights for policy recommendations on the basis of our results.

2 Theoretical basis of the EKC hypothesis and some related criticisms

The theory underlying the EKC hypothesis is based on the existence of a number of time-related effects occurring along the development process. Indeed, all other things remaining unchanged, greater economic activity would necessary imply a higher use of resources hence higher environmental impact. However, this effect, known as scale effect, can be mitigated and even offset, in the later stages of development, by the dynamic implications of growth.

A number of underlying factors to the EKC hypothesis have been identified and different authors have alternatively highlighted the relative importance of one or the other. Among the direct determinants of the EKC already identified by Grossman and Krueger (1991), the changes occurring in the economic structure at different levels of income per capita (i.e., structural change) could explain a growth-environment inverted U-shaped relationship. Indeed, as throughout the development process economic structures traditionally shift from low-polluting agriculture to energy-intensive industry to lighter manufacture and services, the impact of growth on environmental quality is expected to change at different levels of income. This factor has been considered as crucial in explaining the EKC relationship by many influential authors (Panayotou et al., 2000), for example) and its relevance has been recently reaffirmed as the “first and foremost” analytical base of the EKC (Savona and Ciarli (2019), p. 247). However, at least two criticisms can be directed to the environmentally beneficial impact of structural change. A first issue is related to the actual level of dematerialization brought about by a switch to a service economy. Indeed, the idea that the service sector uses a lesser amount of resources has been questioned (Fix, (2019). Moreover, when indirect emissions are accounted for, the overall decrease in environmental pressure related to structural change toward services is substantially reduced (Marin & Zoboli, (2017). A second issue related to the composition effect, particularly relevant when the EKC is applied to explain the income-emissions patterns in developing countries, is related to the type of structural change the EKC theory refers to. Indeed, the idea that economies switch from agriculture to industry and finally services is based on the transformations that occurred in the now developed countries during the nineteenth and twentieth centuries. However, in the face of a very different context and of the existence of many experiences of so-called premature de-industrialization (Palma, 2014); (Rodrik, 2016), it is possible to believe that those steps are not being followed by developing countries in current times, with the related implications in environmental terms.

Another element essential to the occurrence of environmental quality improvement as income rises is the technological progress that is generally associated with development. This factor, that refers both to general productivity improvements and emission-specific changes in process that lead to an improvement in energy efficiency, has been considered as crucial and become known as technique effect. It is worth mentioning that the results reached by most studies of decomposition analysis—another stream of literature that seeks to study the income-emissions relationship by decomposing emissions into their sources of changes (Stern (2017))—show that the within-sector technological change plays the most important role in explaining energy intensity changes. This conclusion is reached by both multiple (Voigt et al., 2014; Jimenez & Mercado, 2014, among others) and single-country (Sinton & Levine, 1994; Zhang, 2003; Ma & Stern, 2008; Ke et al., 2012) for China and Bhattacharya and Shyamal (2001) for India studies. However, while technological progress is so important in explaining environmental improvement, it is also very unlikely to occur automatically in developing countries (Zilio, 2012). This may be due to a number of constraints that range from import of obsolete technologies and poor own development of new technologies due to low incentives to firms’ eco-innovation and meagre public R&D expenditure.

Along with these more traditional elements explaining the EKC, a number of additional factors have been taken into account. Input mix changes and particularly the improvement in the energy mix, which has been found to occur with income growth [Semieniuk (2018), confirming the “energy ladder hypothesis”], could explain a reduced environmental impact of production at higher levels of per capita income. The role of education along with increasing environmental awareness and changes in consumer preferences have also been identified as underlying factors to the EKC, given that environmental quality has been considered a luxury goodFootnote 1. Finally, the role of the implementation of stricter environmental regulations in more developed countries has also been highlighted, even if some criticisms have been raised to this respect. In particular, it has been claimed that even if stricter environmental regulation could explain the reduction in environmental damage in some countries, it would hardly support the existence of an EKC at the global level. Indeed, once stricter regulations are enforced in one country, firms may relocate their more polluting activities to countries with laxer rules—typically developing countries—rather than invest in eco-innovation and reduce their total emissions. This effect, known as the “Pollution-Haven Hypothesis” (PHH), could be further magnified by trade liberalization which would reduce the costs of offshoring the “dirty” production. In fact, this assumption has been further developed through the “pollution offshoring hypothesis,” explicitly linking firms decisions to relocate highly polluting production to trade liberalization. These concerns triggered a stream of literature studying the effect of trade and international relocation of industries on the environment particularly in developing countries. However, mixed evidence has been found with respect to the PHH, possibly due to the employment of different empirical approaches.

3 Methodology and data

3.1 Methodology

A very large stream of empirical literature used different econometric techniques to test the EKC hypothesis in the last three decades. In particular, both methodological criticisms directed toward the early studies ignoring the possible existence of unit root in the data (Stern, 2004) and the long run nature of the relationship (Dinda, 2004), promoted the implementation of different univariate and multivariate techniques to test for long run cointegrating relationships. Among these, the (1) Engle and Granger (1987) residual-based approach to test for cointegrating relationships; (2) the full information maximum likelihood method developed by Johansen and Juselius (1990) and (3) the fully modified OLS procedure developed by Phillips and Hansen (1990) have been used. However, Narayan (2005) showed that these tests may be inappropriate when the sample size is relatively small.

Against this background, in this paper, we use Autoregressive Distributed Lag (hereafter, ARDL) bounds testing approach to cointegration based on Unrestricted Error Correction Model (hereinafter, UECM) to analyze the long run relationships. The error correction terms from the UECM are used to test for the direction of Granger-Causality and to conduct generalized variance decomposition analysis.

The ARDL bounds test procedure has been extensively used to test the EKC relationship. For example, using data panel, Fuinhas et al. (2017) used this procedure to test the impact of renewable energy policies on \(CO_{2}\) emissions in a panel of ten LACs and Apergis and Payne (2009) applied this methodology for Central American countries. Using time series data, this methodology has been used in Amri (2018) in a study for Tunisia, in Böl ük and Mert (2015) to test for the EKC relationship controlling for renewable energy in Turkey, in Onafowora and Owoye (2014) to test the EKC for several countries including Brazil and Mexico, in Zambrano-Monserrate et al. (2016) to explore the relationship between carbon dioxide emissions, economic growth, energy use and hydroelectric electricity production in Brazil and in Zambrano-Monserrate et al. (2018) testing the EKC hypothesis in Peru controlling for renewable electricity, petroleum and dry natural gas consumption. Rosado-Anastacio (2018) also uses ARDL bounds test to analyze the EKC hypothesis using \(CH_{4}\) emissions as pollutant, considering a sample from 1971 to 2012 for Argentina. He finds a long-run relationship between GDP and \(CH_{4}\) emissions controlling for electricity power consumption and agricultural land. However, he doesn’t find a short-run relationship between these variables. However, none of these studies has considered a large number of Latin American countries as we do in this paper. In Table 1, we collect the most recent studies of the EKC for LACs. As it can be seen, only few studies use ARDL bounds test to analyze this hypothesis. The main advantages of this time series method over panel data approach can be summarized in the following issues:

-

(1)

In our study, we perform a country specific analysis for 21 LACs in an individual basis. In panel approaches, the studies are multicountry so that conclusions are obtained at a multicountry level. In these analyses, the authors find an average turning point indicating the average level at which the \(CO_{2}\) emissions will begin to decrease. In a time series study, the turning point of the GDP refers to the level of GDP at which the specific country’s \(CO_{2}\) emissions will begin to decrease.

-

(2)

In time series approaches, considering only a country in each analysis, problems of heterogeneity are avoided. This kind of problems is usually found in panel approaches and different techniques must be used in order to consider this heterogeneity.

-

(3)

Controlling for different variables as pointed out in the introduction allows us to control for omitted variables bias as well as to test the robustness of the results and investigate the determinants of \(CO _{2 }\) emissions.

-

(4)

Our study does not focus exclusively on an unidirectional relationship. It also considers bi-directional relationships between \(CO_{2}\) emissions and GDP per capita, and we also analyze short and long run relationships, implying that we can test the EKC in the short-run and long-run.

The ARDL method, developed by Pesaran et al. (2001), has some advantages:

-

(1)

The ARDL procedure can be applied to any time series, irrespective of the order of integration of the variables. That is, the time series can be I(0) or I(1), so that the uncertainty associated with pretesting the order of integration is eliminated.

-

(2)

This procedure is valid for small samples, avoiding the problem of asymptotic distributions.

-

(3)

The technique can distinguish between dependent and independent variables and generates estimates for the long run and the short run simultaneously, eliminating the problem generally associated with omitted variables and autocorrelation.

The ARDL model can be written as follows:

The lags included in each term of the right hand size are selected using any Information Criteria. In this expression, the \(\beta _{j}\) represent the short run error correction dynamics, while the terms \(\delta _{j}\) \((j=1,2,...,p_{j})\) correspond to the long run relationship.

We test for cointegration relationship between the variables in the system using the bounds test developed by Pesaran and Shin (1999), Pesaran et al. (2001). We use an F-statistic to determine whether the variables are cointegrated by testing the joint significance of the lagged level coefficients; that is:

In the presence of cointegration, one should fail to accept the null hypothesis.

Narayan (2005) and Narayan and Narayan (2010) derived exact critical values for the bounds test developed in Pesaran et al. (2001). They show that there can be three possible situations. They derived a lower and an upper bound so that if the F-statitistic is lower than the lower bound, there is not a cointegration relationship. If the F-statistic lies between the lower and the upper bound, the result of the test is inconclusive and we should use other techniques to analyze the cointegration. Finally, if the F-statistic is higher than the upper bound, then we cannot reject that a cointegration relationship exists.

We use Schwarz information criteria to identify the optimal order of the ARDL components, that is the logs of the differenced variables (short run dynamics). Once the optimal lag length is selected and the long run relationship is confirmed, then the UECM can be estimated:

where \(\varphi\) is the speed of adjustment parameter and \(EC_{t-1}\) is the one period lagged error correction term. This coefficient indicates the speed of adjustment back to equilibrium after a shock in the system and it should have statistically significant negative sign.

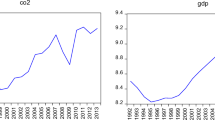

3.2 Data

We used data obtained from the World Bank, CEPALSTAT and Latin American Energy Organization. The \(CO_{2}\) emissions per capita, GDP per capita and population density data are obtained from the World Bank Development Indicators. The data on agriculture, industry and services value added to GDP are also obtained from the World Bank Development Indicators, and the data on the share of primary products exports are obtained from CEPALSTAT. GDP per capita, agriculture, industry and services data are expressed in constant 2010 US dollars. The share of primary exports refers to the share of total exports of a number of commodities including food, live animals, mineral fuels, lubricants and related materials. We consider annual data series for 21 LACsFootnote 2 over the period 1960-2017Footnote 3. Other variables included in the analysis are related to the external relationships of the LACs through trade—measured by exports and imports of goods and services—and foreign direct investment (FDI). We also consider variables related with the extension of the agricultural sector in the region (agricultural land and percentage of rural population) and variables related with energy consumption (electricity, gasoline, diesel, fuel consumption and renewable consumption). A description of the variables, including the related source and sample, is provided in Table 2.

4 Results

4.1 Estimation of the basic EKC relationship

In this first model, we estimate the basic relationship between income and \(CO_{2}\) emissions per capita, including the level and the square of the income term to test for the EKC using the ARDL specification and the bound tests. The results of these estimations are shown in Table 3. The main findings are as follows:

-

Only in five out of the twenty-one LACs considered, cointegration between the variables is found;

-

Of these five countries, only three cases (Costa Rica, Ecuador and Mexico) show inverted U-shaped relationships supporting the EKC—that is, positive parameter of the income in level and negative parameter related to the squared income term. In two countries (Argentina and Peru), the income parameters are non-significant at the 5% level;

-

Only in the case of Haiti, the results of the bound test are inconclusive.

A first conclusion to be drawn is that only in three out of the twenty-one countries considered, we found results supportive of the EKC. In these cases, the turning points are located inside the sample. Also, the speed of adjustment parameter is negative and significant, being around 0.50 in absolute value. This is an evidence in favor of a cointegration relationship among the variables (\(e_{t}\) and \(y_{t},y_{t}^{2}\) ). The speed of adjustment represents the proportion by which the long run disequilibrium in the dependent variable is corrected in each short time period. For the other countries showing a cointegrating relationship, the estimated coefficients are not significant, so the EKC relationship is not supported by the data. Finally, for most of the countries, no cointegration is found in this estimation. We can conclude that these estimations do not yield very much support to the EKC hypothesis. However, some econometric problems, such as those outlined in Müller-Fürstenberger and Wagner (2007), may be present in these estimations influencing the results. For example, we might be missing relevant variables that explain \(CO_{2}\) emissions independently from income per capita, hence suffering a misspecification error. In order to address this concern and establish if the relationships found are robust across different specifications, we estimate again the relationships including additional variables in the following ARDL models .

4.2 Estimation of the EKC relationship controlling for production structure

As we have seen, the composition effect, that is the shift of production structures from agriculture to industry and finally to the service sector along the development path, has been considered among the most important causes to the EKC hypothesis. In fact, a greater importance of the agriculture and services sectors in an economy are expected to be grounds for less \(CO_{2}\) emissions with respect to the industrial sector, typically considered the most polluting economic activity. However, we also highlighted some criticisms that have been raised challenging the composition effect as causing the EKC. On the one hand, the actual extent to which a greater service sector implies a lesser amount of resources used by the economy has been questioned (Fix, 2019; Marin and Zoboli, 2017). On the other, criticisms with respect to the occurrence of similar structural change processes in developed countries then and developing countries now have also been raised. In this respect, it should be considered that Latin American economies—that never reached high industrialization levelsFootnote 4—experienced a generalized de-industrialization process since about the mid-1970s and that since then the service sector has been increasingly important. Given that industry is the most polluting sector and that it does not play a central role in LACs’ production structure, we might expect a stronger evidence for the EKC in these countries once output structure is taken into account. Therefore, in this second model, we include agriculture, industry and services value added to GDP as additional explanatory variables. We prefer these variables as proxy for the output structure and its changes over time against the sectoral contributions to GDP to minimize eventual collinearity problems among the covariates. The results of these second estimates are displayed in Table 4.

Compared with the previous model, once output structure is taken into account, we find only three cases of not cointegrating relationships. Both the number of countries with inconclusive situations and cointegrating relationships increase. In some of these cases, however, the income parameters are non-significant, so we cannot draw conclusions on the existence of support for the EKC for these countriesFootnote 5 Among the cointegrating relationships for which the income parameters are significant, we find Colombia, Costa Rica, Jamaica and Mexico. In those countries, the signs of the parameters support the EKC hypothesis. It seems important to note that for Costa Rica and Mexico, we find similar results as in the first estimation, meaning that those results are likely to be robust, hence describing the real income-emissions relationship in those countries. The income parameters are also significant in Venezuela, but the estimated signs point to a U-shaped relationship in this case in line with results from Robalino-López et al. (2015) for this country.

4.3 Estimating the EKC controlling for output structure through the share of primary products exports: investigating the environmental impact of commodity dependence

Commodity dependence is a long-time feature of Latin American economies. With different nuancesFootnote 6, all LACs’ output and export structures are strongly concentrated in primary products and mostly due to the well-known boom of commodity prices, this pattern was even exacerbated in recent yearsFootnote 7. Surely, commodity dependence has a number of different implications and its analysis goes far beyond the objectives of this paper. However, given the great importance of this pattern in the region, it may have an impact on LACs’ emissions dynamics and their relation with income that is worth considering.

Therefore, we estimate again the model controlling for the export share of primary products. We choose this variable against the product share of these goods to minimize the risk of collinearity among the covariates. In this estimation, we also control for population density, which many have considered as a potential underlying factor to \(CO_{2}\) emissions dynamics. However, there is not complete agreement over the expected impact of this factor. Some deem increasing population density to reduce, ceteris paribus, a country’s emissions, due to the reduction in transportation and electric networking costs that it would imply (Panayotou et al., 2000). In contrast, others have believed that increasing population density increases emissions given that “more dense populations will burn more fuel.” (Poudel et al. 2009, p. 19).

Results in Table 5 show the bounds tests and long run estimates of the cointegrating relationships controlling for population density and exports of primary goods. In this estimation, the number of countries for which we find cointegration increases again, but only in some of them (Colombia, Costa Rica, Ecuador, El Salvador, Mexico, Paraguay), we find significant income parameters. In all these six cases, the income parameter signs provide support to the EKC hypothesis.

With respect to the control variables included in this model, we find that the share of commodity exports parameter, when significant (in Jamaica, Mexico, Paraguay and Peru) always shows positive sign. This implies that a higher share of commodity exports is related to a higher environmental impact as measured by \(CO_{2}\) emissions per capita. This result is in line with the neo-extractivism literature denouncing the high environmental pressure caused by commodity dependent economies (Lander, 2014; Svampa, 2019). Also, it confirms Jiménez and Mercado (2014) results on the environmental effect of natural resources. In the light of these results and the fact that a large part of the environmental impact of this economic model is not captured by \(CO_{2}\) emissions dynamics, the analysis in environmental economics perspective of this production model is an interesting field to be explored by future research.

Turning to the effect of population density on \(CO_{2}\) emissions per capita our estimations yield mixed results supporting both postures expressed by the literature, depending on the country. In most of the cases for which the population density parameter is significant (Cuba, El Salvador, Haiti, Mexico, Paraguay, Peru), it has positive sign, implying that a higher density of population—which is also likely to be associated to higher urbanization—increases carbon dioxide emissions per capita. However, in some cases, for example in Mexico, the estimated sign is negative. In this country, the large extension of the territory may be explaining this result. Given its geographical characteristics indeed, it is likely that the benefits in terms of transportation and networking savings overwhelm the negative environmental effects of increasing population density.

4.4 Estimating the EKC controlling for external relationships and agricultural land

As already mentioned, the effect of trade on environmental quality has been extensively discussed, and the idea that trade has a negative impact on the environment in developing countries has been formulated in the PHH hypothesis. In order to control for the eventual influence of trade and other external relationships of LACs, in this model, we include FDI inflows, as well as exports and imports as a share of GDP. Moreover, in this estimation, we also control for the share of agricultural land area, since we suppose that this variable, reflecting important characteristics of each country, might be influencing the way their external relations are shaped.

In this model, the number of cointegrating relationships increases with respect to the first model. Indeed, we find cointegration for fourteen countries in the sample, being only three and four, respectively, the cases for which either no cointegration or inconclusive results are found. However, of the countries for which we found cointegration, only eight (Brazil, Ecuador, El Salvador, Honduras, Jamaica, Mexico, Nicaragua, Panama) show significant income parameters, and six an inverted U-shaped relationship (all but Honduras and Nicaragua for which the signs are indicating a U-shaped relationship). In all the cases where the EKC is supported, the speed of adjustment in the short run relationship is negative and clearly statistically significant. All of these results are shown in Table 6.

Turning to the analysis of the control variables of this model, we find that the FDI related parameter is significant in four (Argentina, El Salvador, Jamaica and Venezuela) out of the fourteen countries for which we find cointegration. In all these countries except in Jamaica, the sign of the parameter is positive which might be indicating that FDI are mainly directed toward polluting sectors, at least in these countries. Indeed, pollution-intensive sectors attract a large share of total FDI inflows in the region (Blanco et al., 2013) and many studies investigating the environmental impact of FDI found that, in most cases, environmental damage and pollution are linked to or caused by increasing FDI inflows (Hoffmann et al., 2005; Merican et al., 2007; Acharyya, 2009; Lee, 2009).

In relation to the variables related to trade, we find that the export parameter is significant in only four countries (Honduras, Jamaica, Mexico, Nicaragua), in most cases showing a negative sign. It seems that a greater share of exports has a positive environmental effect, if any. With respect to imports, the parameter is significant in only five countries (Brazil, El salvador, Jamaica, Mexico, Nicaragua) and shows mixed signs. Overall, we don’t find clear evidence of an univocal environmental impact of trade and our findings do not support the PHH in the region. Rather, it seems that the environmental impact of trade is different in each country and it is likely to depend on a variety of issues, ranging from inherent characteristics of the country to specific regulations implemented. This result is consistent with the findings of previous literature looking for the impact of trade in the region and particularly with the conclusions reached by Jenkins (2003). Analyzing the environmental effect of the openness to trade after the liberalization process of mid-80s/early 90s in Argentina, Brazil and Mexico, he found that not a unique effect could be found. In Argentina and Brazil, opening to trade resulted in an exacerbation of their existing specialization in polluting industries. Conversely in Mexico—which was the only country among these to implement environmental regulations together with commercial liberalization—increasing trade had beneficial environmental effects. That is, these and our results suggest that it is likely that the environmental impact of greater commercial activity is determined by the context within which trade is increased rather than by trade itself.

Finally, with respect to the parameter related to agricultural land, it is significant in seven countries (Argentina, El Salvador, Honduras, Jamaica, Mexico, Nicaragua and Venezuela), having positive sign in all of them, except for Honduras and Mexico. The fact that a greater share of agricultural land seems to lead to greater emissions can be related to different factors. It can be related to the fact that greater agricultural activity is environmentally damaging, differently from what could be expected and this might be due to the type of agricultural practices carried out. This is likely to be case of Argentina, for example, in which the agricultural activity is very much related to an environmentally impacting agro-industry.

4.5 Estimating the EKC controlling for renewable energy production, population density and rural population

Among the many factors that determine the possibility of different environmental impacts of growth, the energy mix plays an important role. In particular, when energy is obtained from renewable and clean sources, the impact on the environment is reduced. Fuinhas et al. (2017) studied the effect of renewable energy policies on \(CO_{2}\) emissions in ten Latin American countries and found that while higher levels of primary energy consumption per capita lead to higher emissions levels, those can be reduced in the long run by the implementation of renewable energy policies. Also, a decomposition analysis by Sheinbaum et al. (2011) showed that, despite energy intensity reductions in Colombia and Mexico—and to a lesser extent in Argentina and Brazil—the increasing dependence on fossil fuels for energy generation in these countries has hindered a reduction in \(CO_{2}\) emissions to occur.

Against this background, we include renewable energy production in the model that estimates the relationship between income and carbon dioxide emissions per capita to control for the effect of renewable sources of energy on the environmental impact of growth. In this estimation, we also control for the independent effect on \(CO_{2}\) emissions of population density and the share of rural population.

The results are displayed in Table 7.

First of all, we note that, as observed for other models, when more control variables are included the number of countries for which a cointegrating relationship is found to increase. Of the seventeen countries for which we find cointegration in this estimation, only eleven show significant income parameters and six (Ecuador, El Salvador, Jamaica, Mexico, Paraguay and Peru) have signs supporting the EKC hypothesis.

With respect to the control variables included, we observe that the parameter related to renewable energy production is significant and negative in most of countries for which cointegration is found. This result is not surprising considering that renewable energy production generates a lesser amount of emissions than energy obtained from fossil fuels. However, it is interesting to note that in Paraguay, where hydroelectric energy generation is particularly important, the parameter related to renewable energy production has positive sign, implying that this energy production is increasing \(CO_{2}\) emissions in this country. This issue should be further investigated.

The population density parameter is significant in twelve countries in this estimation, with mixed signs. Again, our results support the idea that higher population density tends to increase emissions in small countries—for example, Cuba, Dominican Republic El Salvador and Jamaica for which the parameter has positive sign—whereas it might have a beneficial impact on emissions in countries like Chile where more dense populations can significantly reduce transportation costs and emissions.

Finally, we observe that the share of rural population also seems to have an impact on emissions per capita. Not surprisingly, a higher share of rural population is generally leading to lower levels of \(CO_{2}\) emissions per capita—in most countries in our sample, the parameter is significant and negative.

4.6 Estimating the EKC relationship controlling for energy consumption

The importance of energy consumption and the different sources of energy generation has already been discussed. In this model, we use the bound tests and ARDL specification to estimate the long run relationships testing the EKC hypothesis controlling for electricity, gasoline, diesel and fuel consumption. The results of these estimations are found in Table 8.

We found cointegration in fourteen out of twenty-one countries in the sample, and significant income parameters in eight of these countries. However, according to the signs of the parameters, we only find support for the EKC in Costa Rica, Cuba, El Salvador and Mexico.

With respect to the variables included to control for energy consumption, we find that they are significant in most countries. Overall, the signs are as expected. Indeed, the parameters related to diesel, gasoline and fuel consumption are significant and positive in the vast majority of cases: not at all surprisingly fossil fuel consumption increases \(CO_{2}\) emissions per capita. Conversely, mixed results are found for the electricity consumption parameter that is positive or negative depending on the country. This is likely to depend on the source of electricity generation in each country as well as on the extent to which electricity is substituting energy consumption from other more or less environmentally damaging sources.

4.7 Discussion of the results

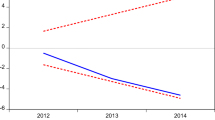

The results of the estimates performed point out to mixed results. We find that the number of countries for which we find cointegration in the different model specifications varies depending on the variables we control for. When the model includes more control variables, we observe an increase in the number of countries that show cointegrating relationships. In the cases in which we find cointegration, not always the income parameters are significant for all countries. As a consequence, in some cases, it is not possible to define which pattern carbon dioxide emissions follow as income grows. Moreover, even when the income parameters are significant, not always they have the signs predicted by the EKC hypothesis. Overall, our results do not support the EKC hypothesis for most countries in the region, implying that we cannot expect an automatic reduction of \(CO_{2}\) emissions per capita with income growth, not even in the long term. However, there is a minority of countries for which we find fairly consistent results supporting the EKC hypothesis. In the case of Mexico, we find support for the EKC in all the six models performed and the estimated turning points are also stable, ranging from a minimum of 8993 US$ in model 4 to a maximum of 11312.9 US$ in model 6. The turning point estimated is located inside the sample in models shown in Tables 3, 4, 6 and 7. Similar results are obtained for Costa Rica and El Salvador. In these cases, we find support for the EKC in four out of the six models performed and the values estimated for the income parameters also are quite robust resulting in pretty stable turning point estimates—at about 9000 US$ and 2800 US$ in Costa Rica and El Salvador, respectively. In Ecuador, the EKC hypothesis is confirmed in four out of six cases as well, but the estimates for the turning points are less robust, ranging from 4498 to 9059 US$. In the case of Costa Rica, the turning points are inside the sample in models shown in Tables 5 and 8. The same happens in the case of El Salvador for models shown in Tables 5 to 8. Conversely in the case of Ecuador, the turning points are inside the sample in models shown in Tables 5 and 7. In other countries, we also observe results confirming the EKC hypothesis, but those results are not robust across different model specifications. Overall, we can conclude that in most of the countries of the region, the EKC is not supported by evidence. However, there are some countries—namely Mexico, Costa Rica, El Salvador and Ecuador—for which the relationship between \(CO_{2}\) emissions and income per capita seems to be described by an inverted U-shaped curve in the long term.

With respect to the control variables included in the different models, we observe that these are in general significant meaning that not considering them might create problems of omitted variables bias. Even if not all control variables are significant in all the countries considered and even if in some cases the results are mixed, the signs of the parameters are as expected in most cases. This allows us to draw some conclusions about the environmental impact of some elements related to the process of development that have been considered as either causing environmental damage or allowing environmental improvement, independently from income growth.

With respect to the investigation of the composition effect in LACs, our results do not provide evidence of a unique effect of the environmental impact of the industrial and service sectors. However, we find that the primarization of LACs’ economies tends to have a negative impact on the environment, as measured by \(CO_{2}\) emissions. This conclusion is supported by the observation that both the share of commodity exports and the share of agricultural land tend to increase \(CO_{2}\) emissions per capita. Considering that a higher share of rural population is found to reduce \(CO_{2}\) emissions per capita, we consider this result as related to the commodities production model in the region rather than to the sector itself. In this sense, the primary sector that could be modestly impactful on the environment, ends up exerting high environmental damage due to the way it is deployed in the region—in the form of mining activities or agroindustry.

Among the factors that are also found to be relevant in determining the environmental impact of growth, we find the energy mix to play an important role. Indeed, if on the one hand a higher consumption of fossil fuel produced energy tends to increase \(CO_{2}\) emissions, they are reduced if a higher share of renewable energy is produced. As a consequence, the environmental effect of economic growth is not only determined by the level of such growth, but the way the additional income is produced is also extremely important.

With respect to other elements considered in our analysis, we find more mixed results. Indeed, the environmental effect of both population density and external relationships seems to highly depend on the individual country considered. As a general consideration, we might say that population density tends to reduce \(CO_{2}\) emissions only in those countries that have a geographical configuration that makes the benefits of more dense population—in terms of networking and reduction in transportation costs—particularly important. Moreover, with respect to the effect of FDI inflows and trade related variables, we observed that not a common pattern exists. Our results provide some evidence that FDI inflows tend to increase \(CO_{2}\) emissions in most countries of the region, but no clear support for the PHH is provided by our results.

5 Conclusions

Based on the influential Environmental Kuznets Curve hypothesis, in this paper, we employed an ARDL bounds testing approach to cointegration and Unrestricted Error Correction Models to estimate the relationship between income and \(CO_{2}\) emissions per capita in twenty-one Latin American Countries over 1960-2017. Following a time series approach, we performed a separate estimation for each one of the countries in our sample. We estimated six different specifications of the model for each country, to take into account the independent effect on \(CO_{2}\) emissions per capita of different factors other than income. We find that there is not a unique pattern that describes the income-emission relationship in all countries of the region. In most countries in our sample, \(CO_{2}\) emissions do not decrease at higher levels of income. However, in a minority of countries—Mexico, Costa Rica, El Salvador and Ecuador—we find that the EKC hypothesis is supported by robust evidence and describes the long-term relationship between income and \(CO_{2}\) emissions per capita. The finding that different patterns for the dynamics of \(CO_{2}\) emissions at different levels of income per capita apply to different countries in the region enhances the importance of analyzing this relationship at the country level. With respect to the underlying drivers of \(CO_{2}\) emissions, our results confirm our hypothesis on the environmental impact of commodity and primary products dependence. The parameter related to the share of commodity exports, when significant, always has positive sign. Therefore, a higher share of commodity exports increases \(CO_{2}\) emissions per capita and diversifying away from this sector would bring environmental—as well as macroeconomic—benefits to the region. Moreover, the parameter of agricultural land is also significant and positive. In some LACs, agricultural activity has negative environmental impacts, which is likely to be associated to the typology of agro-industry practice. On the other hand, not a unique effect of the more general pattern of structural change is found. In relation to the role of trade and FDI to national emissions, we find that FDI are positively related to \(CO_{2}\) emissions. This result confirms that of Sapkota and Bastola (2017) and provides support to the PHH. FDI are likely to be mainly directed toward polluting sectors in Latin America—such as mining—driven by both abundance of natural resources and often permissive environmental regulations. On the other hand, mixed results are found for the parameters related to trade. Finally, we observe that renewable energy production leads to lower emissions while fossil fuel consumption increases \(CO_{2}\) emissions per capita, as expected. The electricity consumption parameter yields mixed results that likely depend on the alternative energy sources and the modes of electricity generation in each country.

In conclusion, both the observation that the EKC hypothesis describes the income-emissions pattern only in a minority of countries in the region and the importance of some specific elements in determining a lesser environmental impact of growth, call for environmental policy in the region. These policies, in the form of promotion of renewable energy production, fostering of greener sectors of economic activity or environmental standards to be implemented in conjunction to increased international openness, can strongly influence the impact of growth on \(CO_{2}\) emissions in these countries allowing them to capture the economic benefits of it without exerting ever increasing environmental damage.

Notes

The role of these “behavioral factors” in reducing the environmental impact of production in later stages of development, strongly emphasized by the early EKC literature, has been criticized. Panayotou et al. (2000) argue that, since their contribution requires a perception of the negative impact of increased pollution, they would be inconsistent with empirical findings of an inverted U-shaped relationship between growth and global pollutants such as CO2. However, as Stern points out, these would be ”underlying causes [. . . ] which can only have an effect via the proximate variables” (Stern, 2004, p. 1421). Still, criticisms remain given that high income inequality and highly nonlinear preferences for environmentally-friendly goods considerably constrain these products mass diffusion hence consumer preferences significant impact on the relationship (Magnani, 2000; Vona and Patriarca 2011).

The LACs considered are: Argentina (ARG), Bolivia (BOL), Brazil (BRA), Chile (CHI), Colombia (COL), Costa Rica (COS), Cuba (CUBA); Dominican Republic (R.DOM), Ecuador (ECU), El Salvador (EL SAL), Guatemala (GUA), Haiti (HAI), Honduras (HON), Jamaica (JAM), Mexico (MEX), Nicaragua (NIC), Panama (PAN), Paraguay (PAR), Peru (PERU), Uruguay (URU) and Venezuela (VEN).

In some of the estimations, the sample period starts in 1970 due to data availability.

Argentina and Peru, for which this result is the same as in the previous model; Ecuador, for which in the first estimation we found support for the EKC and Cuba, Haiti and Honduras.

Andean economies, which include countries from Venezuela to Chile are mostly specialized in oil, gas and minerals whereas the rest of South America is agriculture-based (Ocampo, 2017).

In 2017, primary products exports accounted on average for 65.1% of total exports in the region, according to CEPALSTAT data. We should also note that, among the LACs in our sample, only Mexico and El Salvador have partially diversified their export structure away from agriculture over the study period of 1963-2017. In 2017, the exports of primary products accounted for 17.9 and 23.9 percent of total exports in these two countries, respectively.

References

Acharyya, J. (2009). FDI, growth and the environment: Evidence from India on \(CO_{2}\) emission during the last two decades. Journal of Economic Development, 34(1), 43–58.

Al-Mulali, U., Tang, C. F., & Ozturk, I. (2015). Estimating the environment Kuznets curve hypothesis: Evidence from Latin America and the Caribbean countries. Renewable and Sustainable Energy Reviews, 50, 918–924.

Amri, F. (2018). Carbon dioxide emissions, total factor productivity, ICT, trade, financial development, and energy consumption: Testing environmental Kuznets curve hypothesis for Tunisia. Environmental Science and Pollution Research, 25, 33691–33701.

Aspergis, N., Payne, J.E. (2009). CO2 emissions, energy usage and output in Central America. Energy Policy, 37, 3282–3286.

Aspergis, N., & Payne, J. E. (2010). Renewable energy consumption and economic growth: Evidence from a panel of OECD countries. Energy Policy, 38(1), 656–660.

Bhattacharya, R., & Shyamal, P. (2001). Sectoral changes in consumption and intensity energy in India. Indian Economic Review, 36(2), 381–392.

Bidi, F., & Jamil, M. (2021). Testing environmental Kuznets curve (EKC) hypothesis in different regions. Environmental Science and Pollution Research, 28, 13581–13594.

Blanco, L., Gonzalez, F., & Ruiz, I. (2013). The impact of FDI on \(CO_{2}\) emissions in Latin America. Oxford Development Studies, 41(1), 104–121.

Bölük, G., & Mert, M. (2015). The renewable energy, growth and environmental Kuznets curve in-Tukey: An ARDL approach. Renewable and Sustainable Energy Reviews, 52, 587–595.

Brundtland, G. (1987). Report of the World Commission on Environment and Development: Our common future. United Nations General Assembly document A/42/427.

de Bruyn, S.M., van den Bergh, J.C.J.M., Opschoor, J.B. (1998). Economic growth and emissions: Reconsidering empirical basis of environmental Kuznets curves. Ecological Economics, 25(2), 161–175.

Chang, C.-C., & Carballo, C. (2011). Energy conservation and sustainable economic growth: The case of Latin America and the Caribbean. Energy Policy, 39, 4215–4221.

Dinda, S. (2004). Environmental Kuznets curve hypothesis: A survey. Ecological economics, 49(4), 431–455.

Ehrlich, P., & Holden, J. (1971). Impact of population growth. Science, 171, 1212–1217.

Engle, R. F., & Granger, C. W. J. (1987). Co-integration and error correction: Representation, estimation and testing. Econometrica, 55(2), 251–276.

Fix, B. (2019). Dematerialization through services: Evaluating the evidence. BioPhysical Economics and Resource Quality, 4(2), 6.

Fuinhas, J. A., Cardoso Marques, A., & Koenghan, M. (2017). Are renewable energy policies upsetting carbon dioxide emissions? The case of Latin America countries. Environmental Science and Pollution Research, 24, 15044–15054.

Grossman, G.M., & Krueger, A.B. (1991). Environmental impacts of the North American Free Trade Agreement. NBER. Working paper 3914.

Hausmann, R., Pritchett, L., & Rodrik, D. (2005). Growth accelerations. Journal of Economic Growth, 10(4), 303–329.

Hoffmann, R., Lee, C. G., Ramasamy, B., & Yeung, M. (2005). FDI and pollution: A Granger causality test using panel data. Journal of International Development, 17(3), 311–317.

Jardón, A., Kuik, O., & Tol, R. (2017). Economic growth and carbon dioxide emissions: An analysis of Latin America and the Caribbean. Atm ósfera., 30, 87–100.

Jenkins, R. O. (2003). La apertura comercial ha creado para ísos de contaminadores en América Latina?. Revista de la CEPAL.

Jespersen, J. (1999). Reconciling environment and employment by switching from goods to services? A review of Danish experience. European Environment, 9(1), 17–23.

Jimenez, R., & Mercado, J. (2014). Energy intensity: a decomposition and counterfactual exercise for Latin American countries. Energy Economics, 42, 161–171.

Johansen, S. (1988). Statistical analysis of co-integrating vectors. Journal of Economic Dynamics and Control, 12, 231–254.

Johansen, S., & Juselius, K. (1990). Maximum likelihood estimation and inference on co-integration with application to the demand for money. Oxford Bulletin of Economics and Statistics, 52, 169–221.

Ke, J., Price, L., Ohshita, S., Fridley, D., Zheng, N., Zhou, N., & Levine, M. (2012). China‘s industrial energy consumption trends and impacts of the top-1000 enterprises energy-saving program and the ten key energy-saving projects. Energy Policy, 50, 562–569.

Kong, Y. S., & Khan , R.(2019) To examine environmental pollution by economic growth and their impact in an environmental Kuznets curve (EKC) among developed and developing countries, PLoS One, 14(3).

Kuznets, S. (1955). Economic growth and income inequality. American Economic Review, 49, 1–28.

Lander, E. (2014). El Neoextractivismo como modelo de desarrollo en Amé rica Latina y sus contradicciones. Berlin: Heirinch Boll Stiftung.

Lee, C. G. (2009). Foreign direct investment, pollution and economic growth: Evidence from Malaysia. Applied Economics, 41(13), 1709–1716.

Lindmark, M. (2002). An EKC-pattern in historical perspective: carbon dioxide emissions, technology, fuel prices and growth in Sweden 1870–1997. Ecological Economics, 42(1–2), 333–347.

Ma, C., & Stern, D. I. (2008). China‘s changing energy intensity trend: A decomposition analysis. Energy Economics, 30, 1037–1053.

Magnani, E. (2000). The environmental Kuznets curve, environmental protection policy and income distribution. Ecological Economics, 32, 431–443.

Marin, G., & Zoboli, R. (2017). The economic and environmental footprint of The EU Economy: Global effects of a transition to services. Rivista Internazionale di Scienze Sociali, 136(2), 195–228.

Martinez-Zarzoso, I., & Bengochea-Morancho, A. (2003). Testing for an environmental Kuznets curve in Latin-American countries. Revista de Aná lisis Económico, 18(1), 3–26.

Meadows, D. H., Meadows, D. L., Randers, J., & Behrens, W. H. (1972). The limits to growth; A Report to the Club of Rome‘s project on the predicament of mankind. New York: Universe Books.

Merican, Y., Zulkronian, Y., Zaleha, M., & Hook, L. S. (2007). Foreign direct investment and the pollution in five ASEAN nations. International Journal of Economics and Management, 1(2), 245–261.

Moomaw, W.R., & Unruh, G.C. (1997). Are environmental Kuznets curves misleading us? The case of \(CO_{2}\) emissions. Environment and Development Economics, 2(4), 451–463.

Moomaw, W.R., & Unruh, G.C., (1998). An Alternative Analysis of apparent EKC-type Transitions. Ecological Economics, 25(2), 221–229.

Müller-Fürstenberger, G., & Wagnar, M. (2007). Exploring the environmental Kuznets hypothesis: Theoretical and econometric problems. Ecological Economics, 62, 648–660.

Narayan, P. K. (2005). The saving and investmemt nexus for China: Evidence from cointegration tests. Applied Econometrics, 37, 1979–1990.

Narayan, P. K., & Narayan, S. (2010). Carbon dioxide emissions and economic growth: Panel data evidence from developing countries. Energy Policy, 38(1), 661–666.

Narayan, P. K., & Smyth, R. (2008). Energy consumption and real GDP in G7 countries: New evidence from panel cointegration with structural breaks. Energy Economics, 30, 2331–2341.

Nordhaus, W. D. (1977). Economic growth and climate: The carbon dioxide problem. American Economic Review, 67(1), 341–346.

Ocampo, J. A. (2017). Commodity-Led Development in Latin America. International Development Policy, Revue internationale de politique de dé veloppement, 9(1), 51–76.

Onafowora, O. A., & Owoye, O. (2014). Bounds testing approach to analysis of the environmental Kuznets. Energy Economics, 44, 47–62.

Pablo-Romero, M. P., & De Jesús, J. (2016). Economic growth and energy consumption: The energy-environmental Kuznets curve for Latin America and the Caribbean. Renewable and Sustainable Energy Reviews, 60, 1343–1350.

Palma, J. G. (2014). De-industrialisation, ‘premature‘ de-industrialisation and the dutch-disease. Revista NECAT, 5(1), 7–23.

Panayotou, T., Peterson, A., & Sachs, J.D. (2000). Is the Environmental Kuznets Curve Driven by Structural Change? What Extended Time Series May Imply for Developing Countries. CAER II Discussion Paper No. 80, August 2000.

Pao, H.-T., & Tsai, C.-M. (2011). Modeling and Forecasting the \(CO_{2}\) Emissions, Energy Consumption and Economic Growth in Brazil. Fuel and Energy Abstracts., 36, 2450–2458.

Patiño, L. I., Alcantara, V., & Padilla, E. (2021). Driving forces of \(\text{CO}_{2}\) emissions and energy intensity in Colombia. Energy Policy, 151, 112130.

Pesaran, M.H., & Shin, Y. (1999). An autoregressive distributed lag modelling approach to cointegration analysis. Chapter 11 in Econometrics and Economic Theroy in the 20th century: The Ragnar Fritch Centenial Symposium. Stoom S. (ed). Cambridge University Press. Cambridge.

Pesaran, M. H., Shin, Y., & Smyth, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16, 289–326.

Phillips, P. C. B., & Hansen, B. E. (1990). Statistical inference in instrumental variables regression with I(1) processes. Review of Economic Studies, 57, 99–125.

Piaggio, M., Padilla, E., & Román, C. (2017). The long-term relationship between \(CO_{2}\) emissions and economic activity in a small open economy: Uruguay 1882–2010. Energy Economics, 65(C), 271–282.

Poudel, B.N., Paudel, K.P., & Bhattarai, K. (2009). Searching for an Environmental Kuznets Curve in Carbon Dioxide Pollutant in Latin American Countries. Journal of Agricultural and Applied Economics 41(1), 13–27.

Purcel, A. A. (2020). New insights into the environmental Kuznets curve hypothesis in developing and transition economies: A literature survey. Environmental Economics and Policy Studies, pp. 1–47.

Rehermann, F., & Pablo-Romero, M. (2018). Economic growth and transport energy consumption in the Latin Americanand Caribbean countries. Energy Policy, 122, 515–527.

Robalino López, A., García Ramos, J. E., Golpe Moya, A. A., & Mena Nieto, Á. I. (2014). System dynamics modelling and the environmental Kuznets Curve in ecuador (1980–2025). Energy Policy, 67, 923–931.

Robalino-López, A., Mena-Nieto, Á., García-Ramos, J-E., & Golpe, A. (2015). Studying the relationship between economic growth, \(CO_{2}\) emissions, and the environmental Kuznets curve in Venezuela (1980–2025). Renewable and Sustainable Energy Reviews, 41(C), 602–614.

Rodrik, D. (2016). Premature deindustrialization. Journal of Economic Growth, 21(1), 1–33.

Rosado-Anastacio, J. A. (2018). The environmental Kuznets curve hypothesis for CH4 emissions: Evidence from ARDL bounds testing approach in Argentina, Latin American. Journal of Management for Sustainable Development, 4(1), 1–23.

Rosado, J. E., & Alvarado Sánchez, M. I. (2017). The influence of economic growth and electric consumption on pollution in South America Countries. International Journal of Energy Economics and Policy, 7(3), 121–126.

Sánchez, L., & Caballero, K. (2019). La curva de Kuznets ambiental y su relación con el cambio climático en América Latina y el Caribe: un análisis de cointegración con panel, 1980–2015. Revista de econom ía del Rosario, 22(1), 101–142.

Sapkota, P., & Bastola, U. (2017). Foreign direct investment, income, and environmental pollution in developing countries: Panel data analysis of Latin America. Energy Economics, 64, 206–212.

Savona, M., & Ciarli, T. (2019). Structural Changes and Sustainability. A Selected Review of the Empirical Evidence. Ecological Economics 159, 244–260.

Semieniuk, G. (2018). Energy in Economic Growth: Is Faster Growth Greener? In: SOAS Department of Economics Working Papers 208. School of Oriental and African Studies. University of London, London.

Shafik, N. (1994). Economic development and environmental quality: An econometric analysis. Oxford Economic Papers, 46, 757–773.

Shafik, N., & Bandyopadhyay, S. (1992). Economic growth and environmental quality: Time series and cross-country evidence. Background paper for the world development report 1992. The World Bank, Washington DC.

Sheinbaum, C., Ruiz, B. J., & Ozawa, L. (2011). Energy consumption and related \(CO_{2}\) emissions in five Latin American countries: Changes from 1990 to 2006 and perspectives. Energy, 36, 3629–3638.

Sinton, J. E., & Levine, M. D. (1994). Changing energy intensity in Chinese industry:The relatively importance of structural shift and intensity change. Energy Policy, 22(3), 239–255.

Stern, D. I. (2004). The rise and fall of the environmental Kuznets curve. World Development, 32(8), 1419–1439.

Stern, D.I., Common, M.S., & Barbier, E.B. (1996). Economic Growth and Environmental Degradation: the Environmental Kuznets Curve and Sustainable Development. World Development 24 (7), 1151–1160.

Stern, D. I., & Enflo, K. (2013). Causality between energy and output in the long-run. Energy Economics, 39, 135–146.

Svampa, M. (2019). Las fronteras del neoextractivismo en América Latina: conflictos socioambientales, giro ecoterritorial y nuevas dependencias. CALAS - Maria Sibylla Merian Center: Transcript Verlag.

Tateishi, H., R.; da Silva, P. F. B.; Aguiar, D. R. D. Bragagnolo, C. (2017), The relationship between economic growth energy consumption, and pollution: evidence from Brazil. International Journal of Energy, Environment and Economics 25(2), 169–175.

Unruh, G. C., & Moomaw, W. R. (1998). An alternative analysis of apparent EKC-type transitions. Ecological Economics, 25(2), 221–229.

Valencia-Herrera, H., Santillán-Salgado, R. J., & Venegas-MArt ínez, F. (2020). On the interaction among economic growth, energy electricity consumption, \(\text{ CO}_{2}\) emissions and urbanization in Latin America. Revista Mexicana de Economía y Finanzas, Nueva é poca, 15(11), 745–767.

Vincent, J. (1997). Testing for environmental Kuznets curves within a developing country. Environment and Development Economics 2(4), 417–431.

Voigt, S., De Cian, E., Schymura, M., & Verdolini, E. (2014). Energy intensity developments in 40 major economies: Structural change or technology improvement? Energy Economics 41, 47–62.

Vona, F., & Patriarca, F. (2011). Income inequality and the development of environmental technologies. Ecological Economics 70 (11), 2201–2213.

Yilanci, V., Bozoklu, S., & Gorus, M. S. (2020). Are BRICS countries pollution havens? Evidence from a bootstrap ARDL bounds testing approach with a Fourier function. Sustainable Cities and Society, 55, 10235.

Zambrano-Monserrate, M. A., Valverde-Bajaña, I., Aguilar-Bohorquez, J., & Mendoza-Jiménez, M. (2016). Relationship between economic growth and environmental degradation: Is there an environmental evidence of Kuznets curve for Brazil? International Journal of Energy Economics and Policy, 6(2), 208–216.

Zambrano-Monserrate, M. A., Silva-Zambrano, C., Davalos-Peñafiel, J. L., Zambrano-Monserrate, A., & Ruano, M. A. (2018). Testing environmental Kuznets curve hypothesis in Perú: The role of renewable electricity, petroleum and dry natural gas. Renewable and Sustainable Energy Reviews., 82, 4170–4179.

Zhang, Z. X. (2003). Why did the energy intensity fall in China‘s industrial sector in the 1990s? The relative importance of structural change and intensity change. Energy Economics, 25(6), 625–638.

Zilio, M. I. (2012). Curva de Kuznets ambiental: La validez de sus fundamentos en países en desarrollo. Cuadernos de economía, 35(97), 43–54.

Zilio, M., & Caraballo, M. (2014). El final de la curva de Kuznets de carbono? Un análisis semiparamétrico para la Amé rica Latina y el Caribe. El trimestre económico, 81(321), 241–270.

Zilio, M., & Recalde, M. (2011). GDP and environment pressure: The role of energy in Latin America and the Caribbean. Energy Policy, 39, 7941–7949.

Acknowledgements

The first author acknowledges financial support from Erasmus+/KA1 Grant number 2019/109282 and the second author acknowledges financial support from the Spanish Ministry of Science and Technology Grant ECO2015-70331-C2-1-R, and Spanish Government Project PID2019-108079GBC22.

Funding

Open Access funding provided thanks to the CRUE-CSIC agreement with Springer Nature.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Seri, C., de Juan Fernández, A. CO2 emissions and income growth in Latin America: long-term patterns and determinants. Environ Dev Sustain 25, 4491–4524 (2023). https://doi.org/10.1007/s10668-022-02211-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10668-022-02211-y

Keywords

- Environmental Kuznets curve

- Inverted-U-shaped curve

- Linear relationship

- CO2 per capita

- GDP per capita

- Latin American countries

- ARDL bounds testing

- Time series analysis