Abstract

This paper analysed the effect of freshwater withdrawals and management on agricultural and industrial sectors productivity in the emerging market economies. The auto-regressive distributed lag model and the panel analyses were employed in our estimations. Our result revealed that Brazil had better water use efficiency in agricultural production with annual withdrawals which contribute significantly and positively to the increase in crop and livestock index. In contrast, annual withdrawals for agriculture were considered to be least efficient in Russia, followed by China and India, although, in South Africa, the result suggested an insignificant positive effect in the incremental index. Furthermore, our analysis revealed that freshwater withdrawals have a significant positive impact on industrial outputs in South Africa. Similarly, water withdrawals were positively related to industrial sector productivity in China and Russia. Brazil and India appear to be the least efficient countries where withdrawals impacted negatively (and significantly for Brazil) on industrial sector outputs. Our panel analyses showed that freshwater withdrawals were positively associated with crop and livestock production index and industrial outputs in the BRICS economies. However, the magnitude of the impacts was only significant for the industrial sector. Moreover, investments and private participation in water and sanitation projects impacted significantly and positively in productivity in both sectors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Freshwater (water without significant salt content) accounts for about 6% of the world's water supply but is essential for human uses such as agriculture, manufacturing, drinking and sanitation (Sauer et al., 2008). Freshwater withdrawals are the measures of the number of water resources diverted from surface and groundwater sources mainly for agricultural, industrial and domestic (or municipal) usages. Generally, water resources are an essential economic driver because they facilitate food production, energy generation and various activities in other economic sectors (Sauer et al., 2008). Water is widely acknowledged as the core of sustainable development. Water resources together with the variety of services they provide play a major role in achieving economic growth, environmental sustainability and poverty reduction. Water is proven to be vital for food, energy and security to human; environmental health; facilitates improvements in social well-being; public health and inclusive growth which ultimately affect the livelihoods of teaming world population (United Nations World Water Assessment Programme [WWAP], 2015; Lebdi, 2016; Boberg, 2005; Doczi et al., 2014; Rosegrant & Ringler, 1999; Hess et al., 2013; High-Level Panel on Water [HLPW], 2017).

Water management, agriculture and industrial productions are interrelated (Haq & Shafique, 2015). Agricultural water use is mostly for irrigation (Liu et al., 2017). Alexandratos and Bruinsma (2012) assert that water usage for irrigation accounts for 70% of global annual freshwater withdrawals. As a result, much of the future food production in developing countries are more likely to come from irrigated land. For instance, about 20% of total arable cropland is under irrigation, producing about 40% of the global harvest (Sauer et al., 2008). Most people who rely on rain-fed agriculture are extremely vulnerable to both short-term dry conditions and long-term drought, as a result, are disinclined to invest in agricultural inputs that could boost yields. In developing countries, advances in productivity improvements, as well as area expansion, have been much slower in rain-fed agriculture than in irrigated agriculture (Molden et al., 2007).

Industrial water withdrawals are a significant component of urban and rural water demand. Benson and Huffaker (2012) argue that the full difference between withdrawal and consumptive water use in crop production goes to recharge the water system. Hence, an industrial sector employs capital and water remaining from food production (under the implicit conjecture that agriculture has priority rights to water) to produce industrial output (Benson & Huffaker, 2012). Essentially, water is used non-consumptively in the production of industrial output (e.g. hydropower production, generating steam power, processing, cooling, microchip processing, cleaning, transportation chemical industry, ferrous and non-ferrous metallurgy, mechanical engineering, the textile industry as well as the wood, pulp and paper industry, etc.) (Teli et al., 2014; Peterson & Klepper, 2007; Boberg, 2005; Benson & Huffaker, 2012; HLPW, 2017). An aggregate industrial sector production reveals constant marginal returns to capital (the source of continued economic growth) and decreasing marginal returns to water.

Agricultural and industrial water management contributed significantly to global food production, manufacturing output and rural and urban incomes over the past decades (Fraiture et al., 2013). While water is not evenly distributed across landmasses, much of it is mostly far from population centres. About three-quarters of annual rainfall takes place in areas where not more than the one-third population of the world dwells. Since precipitation is also temporally uneven, it is difficult for people in many regions to make use of the preponderance of the hydrologically available freshwater supply (Boberg, 2005). The actual amount of water available to any economy for a particular use is determined not only by physical availability but also on both management and infrastructure that are critical in capturing runoff and groundwater. In other words, the improved efficiency of agricultural and industrial water use would ultimately improve the economic productivity of water (HLPW, 2017).

It must be emphasized that there already exist difficulties in fairly allocating the world’s freshwater resources among and within countries. These conflicts are intensifying among agricultural, industrial, domestic and urban sectors with implications on livelihoods and economic development. Against this backdrop, we analysed the responsiveness of the agricultural and the industrial sectors productivity to freshwater withdrawals and management in the context of the emerging market economies and the BRICS countries (Brazil, Russia, India, China and South Africa).

2 Literature review

Water is a local variable resource (Cisneros et al., 2014), and its scarcity is acknowledged as a major risk in many parts of the world, and water crises have been consistently cited as one of the top global risks (Scheierling & Tréguer, 2018). Shiklomanov and Rodda (2003) argue that the estimated 1.4 × 1018 m3(cubic metre) of water resources on Earth, more than 97% is held in the oceans whereas approximately 35 × 1015 m3 of Earth’s water is freshwater—0.3% of which is held in rivers, lakes and reservoirs. Freshwater resources are water—that theoretically can be used for drinking, agriculture, hygiene and industry. However, not all of this water can be accessed because seasonal flooding makes the water extremely difficult to capture before it flows into remote rivers (Food and Agricultural Organisation (FAO), 2017). This explains that only about 9000–14,000 cubic km are economically available for human use (FAO, 2018). The remainder of the freshwater is stored in groundwater aquifers, glaciers and permanent snow. Natural freshwater ecosystems play a central role in determining water quality as well as quantity and the sustainability of water resources. They offer a range of critical, life-supporting functions such as cleaning and the recycling of water itself (Boberg, 2005). A lack of available water for agricultural production, industrial production, energy projects, ecological use and other forms of anthropogenic water consumption is already a global issue and is expected to be more severe with rapid population growth, higher food demands, global production and trade pattern, technological development, increasing temperatures and shifting precipitation patterns (Elliott et al., 2014; Ercin & Hoekstra., 2012).

From an economic standpoint, an indicator of water's economic productivity could practically be refined to reflect a broader spectrum of economic considerations as well as the consumptive use by sector (Colby, 2016). It has, thereby, become pertinent that data and information on water resources and their use are coupled with indicators of growth in key economic sectors to evaluate its role and influence on economic development (WWAP, 2015). Proper water management is expected to enhance water use and the efficient allocation of resources which indirectly impact the growth of output. FAO (2018) asserts that between now and 2030, the world’s population is estimated to grow by 2 billion people. Consequently, feeding this growing population and reducing extreme hunger can only be achieved if agricultural yields can be increased significantly and sustainably.

Liu et al. (2017) argue that pursuing sustainable irrigation would likely impede other development and environmental goals attributable to higher food prices and the expansion of cropland. Groundwater has become one of the most fragile of natural resources. The rapid development of groundwater use for irrigation has resulted in significant agricultural growth in the Maghreb, but in many regions, such development has become unsustainable due to overexploitation of aquifer or as a result of water and soil salinization (Ordu et al., 2011). Benson and Huffaker (2012) contend that an agricultural sector withdraws water for crops irrigation, and the difference between water withdrawals and the volume consumed by crops (otherwise called return flow) recharges water supplies applied for industrial production.

Thus, industrial freshwater usage is the second-largest consumer of water in the world (Plessis, 2017). Industrial water use tends to rise rapidly as a country industrializes and then declines as nations move towards more service-based industries. Accordingly, the stage of a nation’s development is the key determinant of future industrial water use (Strzepek & Boehlert, 2010). The industrial water consumers include economic entities such as oil refineries, mines, plants and manufacturing plants, as well as energy installations using water for the cooling of power plants. Water demand by the industrial sector of a country is generally proportional to the average income level of its people (Plessis, 2017). Industrial water withdrawals constitute 5% in low-income countries as opposed to more than 40% in some high-income countries (Plessis, 2017). Given the increasing sectorial water demands, there is a need to ensure that the risk of the water crisis is reduced through investment in water, improve human capacity to meet the growing demand and enhance water use efficiency (or water productivity)—doing more with less water (Giordano, 2015).

Admittedly, investments in water infrastructure are essential to unlocking the full potential of economic growth in the early phases of a country's economic development. As soon as the marginal benefits of further development decline, emphasis shifts towards building institutional and human capabilities to enhance water resource efficiency and sustainability, and secure social development and economic gains (World Water Development Report [WWDR], 2015). Efficient water infrastructure can reduce the risk of water scarcity and also help manage water-related disasters. This, in effect, makes the development efforts of a country more sustainable by reducing the vulnerability (or increasing the resilience) of economies to extreme events (WWDR, 2015). To avoid solving one problem by worsening another, it is essential to understand how different spectrums of the economy are connected through water (WWAP, 2012).

From an empirical standpoint, Benson and Huffaker (2012) assessed the impact of the Agricultural Water Conservation Policy on Economic growth. The findings show that the rate of return of water in industrial productions outweighs the rate of return of water withdrawn to agricultural production. The result further highlighted that the inequality associating the elasticity of agricultural production with regards to irrigation withdrawals and irrigation efficiency holds but in a particular direction. Sauer (2008) used a global agricultural and forest sector model to explore the interdependencies between development, water scarcity, land and food supply. The simulations reveal that agricultural sector responses to income and population growth are associated with considerable increases in irrigated area as well as agricultural water use (see also Pimentel et al., 2004a, 2004b; Peterson & Klepper, 2007; Colby, 2016; Grovermann et al., 2019).

Haq and Shafique (2015) analysed the impact of water management on agricultural production in Pakistan. The empirical findings show that capital stock and labour force in the agriculture sector have significant influence on output growth. Liu et al., (2017) utilized the global partial equilibrium grid-resolving model and the global water balance model to assess the impact of sustainable irrigation water withdrawals on food security and land use. The results reveal that pursuing sustainable irrigation seems to erode other development and environmental goals due to higher food prices and cropland expansion. Fraiture et al., (2013) explored the role of agricultural water management in ensuring sustainable food production. The paper contends that looking at water withdrawals for food production in isolation would not capture the important developments outside the water sector that influence the sustainability of agricultural water management. The results show that integrated approaches to food production bring about the higher economic value of benefits per unit of water.

3 Materials and methods

Data for this study were obtained from the World Development Indicators at various sample periods for Brazil, Russia, India, China and South Africa. While the base year for our dynamic model estimations varied across each economy, which is occasioned by the year data was available for all the variables of interest, The ending year for all the sample periods is 2017. However, for the panel estimation, we set a common base year of 1990 and bring the individuals and the series under a panel set-up. Missing data (particularly for freshwater withdrawals and water productivity) were mapped using the cubic spline function. This approach is a common numerical curve fitting strategy that essentially fits a smooth curve to the known series using cross-validation between each set of adjacent points to establish the degree of smoothing and estimate the missing observation by the value of the spline (Fung, 2006).

In this study, the predictive procedures are operated and generated by the STATA econometric software. The cubic spline is continuous and fits each point and has a continuous slope as well as curvature. This approach has continued to enjoy wider acceptance in the recent empirical literature (see, e.g. Zhu et al., 2019; Jiang et al., 2019; Lorenčič, 2016; Kim et al., 2019; Noor et al., 2014). Interpolation procedures have vastly been employed in time series and cross-sectional data sets (Honaker & King, 2010; Lepot et al., 2017; Wongsai et al., 2017), and predominantly in groundwater resource data mappings due to challenges of data limitations associated with empirical analysis in this subject area. For instance, Filho et al. (2016) employed variance of the technique to analyse the spatial distribution of water table levels in unconfined aquifers of key geological formations in Brazil (see, e.g. Kang et al., 2009; Kazemi et al., 2017).

The composite index for crop and livestock production is derived using the crop production index and the livestock production index. Since data for annual freshwater withdrawals for agricultural use is jointly and specifically for crop and livestock productions, it becomes necessary that a single index is derived using the two variables since their underlying values were calculated using common bases and parameters. We estimated our composite index using the principal component analysis (PCA). This measures multi-dimensional concepts which cannot be captured by a single indicator. Theoretically, a composite indicator should be based on a framework, which allows individual variables to be selected, combined and weighted so that the composite indicator reflects the structure or dimensions of the phenomena being measured (Dharmawardena & Samita, 2015; Singh, 2014). A composite index is, therefore, formed when individual variables are combined into a single index, based on an underlying model of the multi-dimensional concept that is being measured (Greco et al., 2018).

A lack of correlation (or orthogonality) in the principal components is an essential property and shows that the principal components are measuring different “statistical dimensions” in the data (Organisation for Economic Co-operation and Development [OECD], 2008). For further details on PCA refer to, e.g. Muema et al. (2018), Berni et al., (2011), Mazziotta and Pareto (2015), Chao and Wu (2017). Previous related literature has widely applied this approach in deriving agricultural outputs composite indexes (see Dong et al., 2015; Dharmawardena & Samita, 2015; Atay, 2015).

3.1 Empirical framework

This study is arguably timely especially at a time when freshwater resources have come under rising pressure to satisfy the economic, social and environmental needs of a growing world population. To our knowledge, empirical assessment of the subject vis-à-vis economic productivity using historical data is new to literature. Although a lot of works have looked at the range of issues concerning water scarcity, efficiency and management (mainly confined to case-studies, exploratory and experimental designs), there is fewness of empirical analysis based on ex-post facto design that specifically sought to determine how the agricultural and the industrial sectors productivity have responded to freshwater withdrawals particularly in the emerging market economies christened as the BRICS countries—Brazil, Russia, India, China and South Africa. Our justification for selecting these countries is that they are among the fastest-growing economies in the world. Literature, however, seems to have a consensus that water resources is an input in the engine of production and is recognized as a factor of production (Colby, 2016; Giordano, 2015; Liu et al., 2017; Plessis, 2017; Strzepek & Boehlert, 2010). Hence, Agricultural and industrial growth is linked with the availability of water resources which, according to WWDR (2015), underpin economic growth.

In other to observe the empirical effects of freshwater withdrawals on productivity, a model is fashioned in line with the law of production. A specific production function widely applied in economic analysis is the Cobb–Douglas production function with a constant return to scale. The application of the production function approach for the measurement of potential output growth takes into account diverse sources of an economy's productive capacity including total factor productivity as well as allocative efficiency.

We follow Giorno et al. (1995) and model the potential output using the neo-classical two factor Cobb–Douglas production function thus:

where Y, L, K and A are real GDP, labour input, capital input and the total factor productivity level, respectively. To account for dynamics associated with the main input of interest in this study, we modify the water resource model in Benson and Huffaker (2012) which recognized that economies are endowed with renewable freshwater resources that evolve in the following form:

where t denotes time (i.e. the year in our context), W(t) = the volume of water (in m3/year), Wk = the river system’s capacity to store water in different forms of impoundments (in m3); and Va(t) and Vi(t) represent the volume of water withdrawn by producers for irrigated farming (in m3/year) and for industrial production (in m3/year), respectively. The term \(\varphi\)[Wk − W(t)] represents accumulated water each year, at a rate proportional to remaining storage capacity, and \(\varphi\) (in units of 1/t) is set at unity so that the term is in flow units. The term \(\varepsilon\) measures the volume of consumptively used freshwater by the agricultural and industrial sectors each year.

3.2 Model specification

We specify the agricultural and industrial production functions for the BRICS economies in the following linear expressions:

where

CLPI is the crop and livestock production index. The crop production index shows agricultural production (including all crops except fodder crops) for each year relative to the base period 2004–2006. The livestock production index includes meat and milk from all sources, dairy products such as cheese, eggs, honey, raw silk, wool, and hides and skins. FAO's production indexes are calculated from the underlying values in international dollars, normalized to the base period 2004–2006.

INDVA is industrial value-added. This comprises a total of industrial sector output as a share of gross domestic product (GDP). It comprises value-added in mining, manufacturing, construction, electricity, water and gas. Value-added is the net output of a sector after adding up all outputs and subtracting intermediate inputs.

FWWA is total freshwater withdrawals for agriculture use. This comprises total withdrawals for irrigation (crop farm) and livestock production relative to total freshwater withdrawals.

FWWI is total freshwater withdrawals for direct industrial use (including withdrawals for cooling thermoelectric plants) relative to total freshwater withdrawals.

FERT is fertilizer consumption (% of fertilizer production). This measures the quantity of plant nutrients used per unit of arable land. Fertilizer products cover nitrogenous, potash and phosphate fertilizers (including ground rock phosphate).

INVWS is the natural logarithm of investment in water and sanitation with private participation (measured in current US$).

IRGL is agricultural irrigated land (% of total agricultural land). Agricultural irrigated land refers to agricultural areas purposely provided with water, including land irrigated by controlled flooding.

LPR is the labour force participation rate (% of total population ages 15+). Labour force participation rate is the proportion of the population ages 15 and older that is economically active: all people who supply labour for the production of goods and services during a specified period.

We take the variables to the model to estimate both the direction and magnitude of response of agricultural and industrial sectors productivity to freshwater withdrawals across the countries of our interest. For the respective economies, we subjected the variables to stationarity (using the ADF unit root approach) test where the series has a mix of I(0) and I(1) and none, however, is I(2). We are guided to argue that our series are not cointegrated, and as such, the auto-regressive distributed lag (ARDL) model appears more appropriate to estimate our model while the ARDL bound testing methodology is applied to test for the cointegrating relationship among the series. In addition to the time series estimates, we bring the data set for the individual countries under a panel set-up to analyse how the response variables are jointly affected by freshwater withdrawals in the selected emerging market economies popularly referred to as the BRICS countries. More formally, we highlight how our model is justified in the light of Markov model. By the application of lags, following the Akaike information criterion (AIC), and the extended causality analysis, the specified dynamic model does not follow the Markov model which assumes that when predicting the future, the past does not matter, only the present. However, in line with the hidden Markov model, the analysis examines observed events as well as unobserved events that could be a causal factor in the modelled functions.

Our long-run and short-run models are patterned after Loayza and Ranciere (2005) which estimated with the variants of the following dynamic regression:

where y represents the per capita GDP growth rate, X is a set of growth determinants including financial depth and control variables, γ and δ are the short-run coefficients related to growth and its determinants, β are the long-run coefficients, φ is the speed of adjustment to the long-run relationship, ε is a time-varying disturbance, and the subscripts i and t represent country and time, respectively.

The ARDL specifications are fashioned after the above model but modified to take into account our selected indicators under a time series procedure. The dynamic models are therefore represented thus:

where Eqs. (6) and (7) model the agricultural and the industrial production functions, respectively. t denotes period (time), and CPLI = crop and livestock production index, INNVA = industrial sector outputs (% of GDP), FWWA = annual freshwater withdrawals for agricultural use (% of total freshwater withdrawal), FWWI = annual freshwater withdrawals for industrial use (% of total freshwater withdrawal), FERT = fertilizer consumption (% of fertilizer production), IRGL = agricultural irrigated land (% of total agricultural land, LPR = labour force participation rate (% of total population ages 15 +), INVWS = natural logarithm of Investment in water and sanitation with private participation (originally reported in current USD), hence, taking its log form would stabilize the variance of the time series and bring it to the same base with other variables). ε = error term. λ and δj represent the short-run parameters of lagged dependent and independent variables, respectively, and ∆ are the differencing operator. β1 – β3 are the long-run coefficients, and β0 is the intercept. φ is the coefficient of the speed of adjustment towards the long-run equilibrium. p = lags of explanatory variables. q = lags of dependent series.

4 Discussion

The dynamic effects of freshwater withdrawals on agricultural and industrial sectors productivity were estimated and are presented in Tables 1 and 2, respectively. The results reveal how the crop and livestock production index and industrial value-added have responded to the explanatory variables across the sample economies in the long run and short run. Our main findings will be based on the long-run coefficients while also taking into account the respective speed of adjustments towards the long-run equilibrium relationship. Also, Tables 1 and 2 present the relationships among the variables in a panel analysis thereby allowing us to estimate the joint effect in the BRICS as a unit.

Results in Table 1 show that the one-period lag of CLPI has a long-run significant influence on the current CLPI for all the BRICS economies. In the case of Brazil, FWWA and FERT were positively and significantly associated with CLPI both in the short run and long run, while INVWS and IRGL were negatively and significantly related to CLPI in the long run. It can also be observed that a 1% change in FWWA and FERT led to about 25% and 12% increases in CPLI, respectively, in the long run. One-unit change in INVWS and IRGL brought about 34% and 10% decline in a decrease in the CLPI in the long run, respectively. The outcome for Brazil recorded a substantial improvement in the parameters from the short run to the long run. In contrast, Table 2 shows that freshwater withdrawal was negatively and significantly associated with Brazil's industrial output in the long run and the short run. Whereas LPR had a significant positive influence on INDVA in the long run, INVWS had a negative and significant effect on the response variable. The results provided important information about the error correction process and indicate that deviations from long-run equilibrium adjusted at the speed of 67% and 51% for the agricultural output and industrial output, respectively, on annual basis.

In the Russian case, results in Table 1 revealed that FWWA exerted a significant negative influence on CLPI. The weak effect of FWWA could be attributed to Russia's poor freshwater allocation for agricultural production which averaged 19.93% between 1994 and 2017. This is the least among the selected economies and about three times lower than the joint annual average of water allocation within the BRICS community (see Fig. 1). However, FERT was found to be significantly and positively related to the dependent variable, accounting for about 12% increase in CLPI. Although INVWS impacted significantly and positively on the response variable in the long run, the observed short-run influence was insignificant. Relatively, the freshwater allocation for industrial use (FWWI) in Russia was not significant but positively associated with INDVA while INVWS and LPR had a negative influence on the dependent variable. This outcome appears to suggest inefficiency in water allocation to the sector because water allocation for industrial production in Russia is approximately three times greater than the BRICS annual average. Based on the short-run dynamics in Tables 1 and 2 for Russia, CLPI and INDVA adjusted towards long-run equilibrium at the speed of 82% and 75% annually, respectively.

Source: World Bank's World Development Indicators for various years. Note: FWWA = Freshwater withdrawal for agricultural use. FWWD = Freshwater withdrawal for domestic use. FWWI = Freshwater withdrawal for industrial use

Average annual freshwater allocation for agriculture, industry and domestic users, and average annual water productivity.

The Indian case provided evidence of the poor contribution of freshwater withdrawals to both agricultural and industrial production. FWWA and FWWI were both negatively related to CLPI and INDVA, respectively, in the short run and long run. When FWWA changed by 1%, CPLI decreased by 19% in the long run. FERT, however, had a significant positive impact on CLPI which was an impressive improvement from the short-run parameter estimate. Remarkably, India had the highest average annual freshwater allocation to agriculture (at 91.90%), and the lowest allocation to industrial consumers (at 2.26%)—more than 10 times lower than the BRICS average (see Fig. 1). Relative to the estimated outcome, a one-unit change in FWWI led to 10% (or 1.10 unit) decrease in INDVA. The cointegrating coefficients in Tables 1 and 2 revealed that convergence towards long-run equilibrium was at the speed of 76% and 62% for CLPI and INDVA, respectively.

Further insights are revealed in Tables 1 and 2 which showed that China ranked second to India in average annual FWWA and second to Russia in average annual FWWI. Table 1 shows that FWWA and INVWS had a negative and significant effect on CPLI both in the short and long run. When FWWA changed by 1%, CLPI decreased by 6% in the long run. FERT, on the other hand, was found to be positively and significantly related to CLPI in the long term. Comparatively, Table 2 reveals that FWWI contributed positively and significantly to industrial sector outputs in China in the short run as well as the long run. When FWWI increased by 1%, INDVA increased by 3% in the short run and 12% in the long run. Similarly, INVWS and LPR have also had a significant influence on the dependent variable. The error correction term in both models was negative and had the right sign; being an indication that deviations from long-run equilibrium were corrected at the speed of 51% and 49% for CLPI and INDVA, respectively.

Relatively, close to Brazil, South Africa seemed to have made most of the freshwater withdrawals for agricultural use compared to other economies. We observed an impressive transition from a significant negative influence of FWWA on CLPI in the short run to a significant positive impact in the long run—1% change in FWWA led to about a 21% decline in the response variable in the short run. The result, however, changed in the long run where a change in the explanatory variable brought about a 13% increase in CLPI. This could be attributed to efficiency in water use, especially for irrigation, and where IRGL was found to have exerted a strong positive influence on CLPI both in the long and short run. Notably, South Africa ranked third behind India and China in the volume of water allocation for agriculture with more than 2% higher than the BRICS annual average of 61.27% but yet outperformed the two economies. Estimation of the industrial production function in Table 2 indicated that FWWI and INVWS were positively and significantly associated with industrial outputs in South Africa. Conversely, LPR had a long-run significant negative influence on industrial outputs. From the short-run dynamic estimations in Tables 1 and 2, convergence towards long-run equilibrium was 62% and 54% for CLPI and INDVA, respectively.

In addition to the country-specific results, a panel analysis of the BRICS economies (as a unit) in Tables 1 and 2, showed that FWWA had a positive but insignificant influence on crop and livestock production index—1% change in FWWA led to 9% increase in CLPI. Moreover, FERT, INVWS and IRGL were positively and significantly associated with CLPI. The industrial function coefficient in Table 2 revealed that FWWI and INVWS exerted a positive and significant effect on INDVA whereas LPR had a significant negative effect on INDVA. Table 3 presents a resampled coefficient estimation of the panel series based on the Bootstrap approach. Based on 10,000 resamples estimation, the results for the two functions did not differ in magnitude and direction but varied in the values of their parameter estimates. The variance inflation factor (VIF) in Table 4 explains how much of the variance of a coefficient estimate of the explanatory variables have been inflated due to collinearity with the other predictors. VIFs above 10 suggest evidence of multicollinearity. From the results, the series have VIF's values less than 10 thus indicating that our predictors do not have multicollinearity problems.

4.1 Dumitrescu–Hurlin panel causality test

To find the causal relationship among our response variables and the regressors, the study utilizes Dumitrescu–Hurlin (DH) panel causality test. Unlike the traditional pairwise (stack) Granger causality test, the DH panel causality procedure is the latest version of the Granger causality test for panel data which accounts for heterogeneity among cross sections. Moreover, this approach consists of two different statistics namely, Wbar-statistics and Zbar-statistics. Wbar-statistics takes average statistics of the test, whereas Zbar-statistics indicates a standard normal distribution.

The regression model does not estimate causal relationships among underlying variables. Essentially, our panel regression estimates observe the heterogeneity among the cross sections and provided us with the direction and magnitude of the impact of the explanatory variables on the response variables. However, the estimates create a missing link relevant for policy by not analysing the causal association among the variables of interest. This is essential because causality analysis provides direction about the relationship which helps in policy direction. For this purpose, we use the DH causality approach robust to the issue of cross-sectional dependence in the data. The result of DH causality analysis is presented in Table 5. From the first panel, the results reveal that a bidirectional causal relationship exists between freshwater withdrawals for agricultural use (FWWA) and crop and livestock index (CLPI), and between FWWA and fertilizer consumption (FERT). This entails that past information in FWWA is critical in forecasting CLPI and FERT and vice versa. The key findings suggest that FWWA is not the only factor influencing CLPI but FERT.

In the second panel, we find that there is bidirectional causality between freshwater withdrawals for industrial use (FWWI) and industrial value-added (INDVA). In other words, FWWI is a major determinant of INDVA, and past information in FWWI is significant in forecasting INDVA with a possible feedback effect. Moreover, we find a unidirectional causal relationship between INDVA and labour force productivity rate (LPR) and FWWI, with causality running from LPR to INDVA without a feedback effect. This entails that past information on LPR is a key factor in forecasting INDVA, but not vice versa.

4.2 Diagnostic tests

We presented the results of coefficient diagnostic tests for Eqs. (6) and (7) in Tables 6 and 7. Results in Table 6 revealed that crop and livestock production index has a long-run relationship with the independent variables. It can be observed that the F-statistic for each of the economies is greater than critical values both in the upper and lower bounds at a 5% level of significance. This is indicative that the dependent variable and the regressors move together in the long run. However, Table 6 shows that industrial value-added had a long-run association with the determinants particularly in Russia, China and South Africa. There is no strong evidence supporting the existence of a long-run association between the variables in the case of Brazil and India.

In addition to ascertaining the country-specific long-run relationships, we presented in Table 8 the result of panel cointegrating relationships among our variables of interest. The Pedroni panel cointegration test estimated the joint long-run association for the BRICS economies as a unit. The results provide evidence of a long-run relationship between FWWA and CLPI. This is an indication that the two variables move together in the long run. However, such co-movement was not established between FWWI and INDVA in the BRICS economies. The null hypothesis of no cointegration cannot be rejected for all the test-statistics, both panel (within-dimension) and group (between-dimension). The significance of this finding is that freshwater withdrawals for agriculture does not only strongly influence agricultural production but is fundamental to driving the sector in the long term. This outcome is confirmed for all the BRICS countries as reported in Table 6. However, while it appears that freshwater withdrawal for industrial use is a factor that influences industrial outputs, it is not clear if freshwater withdrawal is central to driving the sector in the long run. This again raises questions about freshwater management and use efficiency especially as it affects the industrial sector. This same concern is strongly observed in the case of Brazil and India where a cointegrating relationship could not be established between FWWI and INDVA.

The results of the correlation analysis are presented in Table 9, where FWWA, INVW and FERT and IRGL are positively correlated with CLPI. While INVWS is a significant positive correlation with FWWA, FERT is significantly but negatively correlated with FWWA. The second panel reveals that FWWI and LPR have a positive correlation with INDVA, whereas INVWS is negatively correlated with INDVA.

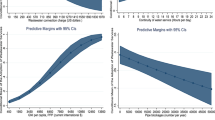

Tables 10 and 11 present the results of residual diagnostic tests namely, serial correlation test, heteroscedasticity test and the Ramsey RESET test for Eqs. (6) and (7), respectively. Results of these tests were decided at a 5% probability value. Results in both models suggested that we cannot reject the null hypothesis that there is no autocorrelation in our model estimations. This confirmed the Durbin Watson (DW) stats in Tables 1 and 2 where the statistical values were approximately 2 and indicate that our model has no autocorrelation problems. Similarly, we cannot reject the null hypothesis of homoscedasticity (or constant variance) and heteroscedasticity cannot, therefore, be assumed. The Ramsey Regression Equation Specification Error Test (RESET) results in both models indicate that the null hypothesis which states that the functional forms are correctly specified cannot be rejected. This is an indication that our models were correctly specified. Stability diagnostics were also conducted for the respective time series dynamic estimations for each of our sample economies. We specifically conducted the recursive estimations based on the cumulative sum (CUSUM) test which strongly confirmed the stability of our coefficients (see Fig. 2).

5 Policy and managerial implications

Our findings show implications on the amount of freshwater withdrawn from both groundwater and surface water by human activities. A very significant amount of usable freshwater supplies are acknowledged to be limited to a certain degree, and most countries, with special reference to the BRICS economies, are already approaching or may have reached a water-stressed state. Where freshwater demand exceeds supply, a conflict between withdrawal needs and ecological interests may arise. More so, freshwater extraction or withdrawal occurring faster than its natural rate of recharge could result in the loss of capacity to meet both present and future needs. From our analyses, this possibility was observed to be less severe for the agricultural sector but portends dire trends for the industrial sector.

Practically, there is strong evidence that freshwater withdrawals for agriculture exert a positive influence on agricultural production with further confirmation that both are positively correlated and have a long-run relationship. From the foregoing, we cannot ignore the empirical findings and the attendant suggestions, particularly on the analysis of past information on freshwater withdrawals for agriculture, as a vital policy consideration when forecasting for an increase in crop and livestock productions. Likewise, in policy measures designed to improve the efficiency of withdrawals for agriculture, past information on crop and livestock productions should be taken into account. In the same vein, practical and policy implications of the above findings seem to apply to industrial value-added vis-à-vis freshwater withdrawals for industrial use, especially where it is evident that the latter is an important factor that positively influences the former. More importantly, when it is further substantiated by the positive correlation between the two variables as well as the two-way causality strongly established.

Furthermore, our results highlighted the importance of private sector participation in investment in water and sanitation projects. Although the indicator has a significant impact on both agricultural and industrial outputs. There are indications that it has to be further strengthened with more relevance for industrial output where the correlation is negative and appears not to have had much influence compared to the agricultural sector. Thus, private participation is critical in supplementing ground and surface water for industrial production. Generally, our findings imply that agricultural and industrial sectors are the largest users of freshwater and major drivers of economic growth and, by extension, poverty reduction and employment generation not only in the BRICS countries but globally.

In line with the findings, we argue that a starting point for improved water use efficiency in industry and agriculture is an understanding of current and predicted future surface water as well as groundwater supply and demand. Hence, a systematic and transparent approach is imperative in order to reliably establish a water balance in a region and, possibly, manage the linkage between agricultural and industrial water demands and supply at any given point in the production cycle. Such assessment can then bring to the fore the justification and the need for further investment in sustainable measures to augment water resource supply (which may include water reuse or recycling) and the application of economic instruments as well as other measures to influence water demand (HLPW, 2017). Finally, in line with the position of Grovermann et al. (2019), we suggest that efficient water management should go hand-in-hand with eco-efficiency as well as agricultural and industrial innovation systems if the water challenges are to be mitigated and water resource outcomes significantly improved.

6 Conclusion

Globally, freshwater plays a major role in fostering economic growth and development by sustaining adequate food supply and industrial outputs. Hence, the economic prosperity of world economies largely depends on adequate freshwater supply and its efficient use. As human populations and economies grow, global freshwater demand also continues to increase rapidly. In most parts of the world, the demand for water for diverse uses exceeds supply thereby giving a sign of a global water crisis which may threaten the growth and productivity of critical sectors that rely on water. The pending crisis may not necessarily be as a result of water shortage but due to mismanagement of water resources—whereas there is the possibility that, with good management, the symptoms of water scarcity can be properly treated, it is also possible that, with bad management, water problems in areas of no water scarcity might be created (Molden et al., 2007) and consequently undermine economic prosperity and productive environment. Against this backdrop, we analysed the effect of freshwater withdrawals and management on agricultural and industrial sectors productivity in the emerging market economies in the BRICS countries. Our findings revealed relative effects (both in direction and magnitude) of water withdrawals across the sample economies.

Looking at agricultural productivity, on one hand, as related with crop and livestock production index (CLPI), our result suggested that Brazil had better water use efficiency with annual withdrawals contributing positively and significantly to CLPI both in the short and long run; even though Brazil trailed behind India, China and South Africa in average annual freshwater allocation for Agriculture. In contrast, annual withdrawals for agriculture are considered to be least efficient in Russia, followed by China and India. For these economies, annual freshwater withdrawals are found to be negatively associated with CLPI in the long run—the observed negative influence is significant for Russia and China but insignificant for India. The result revealed a significant long-run positive effect in the case of South Africa. Moreover, the perceived inefficiency in the Russian context may be contested (or may not be concluded from the parameter estimate) because its water allocation for agriculture is lowest among the BRICS and more than three times less than the annual BRICS average. And with India having far greater allocation agricultural production and more than 150% of the BRICS annual average, the outcome does not reflect or justify such huge water allocation, hence, may be attributed to inefficiency. Besides the country-specific perspective, our panel estimation revealed that freshwater withdrawals are positively but not significantly related to agricultural sector productivity in the BRICS economies.

On the other hand, industrial production, by estimates, functions to produce an interesting result where efficiency is arguably, the core of performance. For instance, based on our analysis, freshwater withdrawals have significantly impacted positively and added value to industrial production in South Africa. But, considering freshwater as a factor input, only 9.24% was allocated for industrial use which is more than twice less than the BRICS average. Similarly, Water withdrawals were significantly and positively related to industrial sector productivity in China, both in the short and long run. Russia also had an impressive outcome even though the positive influence recorded was not significant but only 1% difference compared to the extent of impact recorded in China in the long run. Although Russia saw a positive influence on the response variable, the fact that its water allocation was thrice more than that of China, six times more than that of South Africa and about twice greater than the BRICS average. This raises the question of efficiency where economies with lower water allocation appear to do better. Furthermore, Brazil and India seem to be the least efficient in performance as withdrawals impact negatively (and significantly for Brazil) on industrial sector output.

The opposing results for Brazil based on the two estimated production functions appear to suggest that Brazil sacrificed the industrial sector (in water allocation and priority) for agricultural production, probably, for a better comparative advantage. A joint analysis of the BRICS economies under a panel set-up, however, showed that freshwater withdrawals exerted a significant and positive influence on industrial output during the sample period. We can conclude from the joint evaluations of our models that freshwater withdrawals were positively related to an increase in crop and livestock production index and industrial value-added in the BRICS economies. However, the magnitude of the impacts was significant for the industrial sector compared to the agricultural sector. Moreover, investments and private participation in water and sanitation projects impacted significantly and positively to productivity in both sectors.

References

Alexandratos, N., & Bruinsma, J. (2012), World Agriculture Towards 2030/2050. ESA Working Paper No. 12-03. Food and Agriculture Organization of the United Nations. https://www.fao.org/3/ap106e/ap106e.pdf

Atay, M. U. (2015). The impact of climate change on agricultural production in Mediterranean countries. PhD thesis, Middle East Technical University (pp. 1–99).

Benson, A., & Huffaker, R. (2012). The impact of agricultural water conservation policy on economic growth. The Open Hydrology Journal, 6, 112–117.

Berni, A., Giuliani, A., Tartaglia, F., Tromba, L., Sgueglia, M., Blasi, S., & Russo, G. (2011). Effect of vascular risk factors on the increase in carotid and femoral intima-media thickness. Identification of a Risk Scale. Atherosclerosis, 216(1), 109–114. https://doi.org/10.1016/j.atherosclerosis.2011.01.034

Boberg, J. (2005). How demographic changes and water management policies affect freshwater resources. The RAND Corporation, (2005/010743) (pp. 1–154).

Chao, Y., & Wu, C. (2017). Principal component-based weighted indices and a framework to evaluate indices: Results from the Medical Expenditure Panel Survey 1996 to 2011. PLoS ONE, 12(9), 1–20.

Cisneros, J. B. E., Oki, T., Arnell, N. W., Benito, G., Cogley, J. G., Doll, P., Jiang, T., & Mwakalila, S. S. (2014). Freshwater resources. In C. B. Field & V. R. Barros (Eds.), Climate Change 2014: Impacts, Adaptation, and Vulnerability. Part A: Global and Sectoral Aspects. Contribution of Working Group II to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change, Conference: IPCC AR5 (Chapter 3, pp. 229–269). Cambridge University Press, Cambridge, United Kingdom and New York, NY, USA.

Colby, B. B. G. (2016). Water linkages beyond the farm gate: Implications for agriculture. Economic Review, (Special Issue), 47–74.

Dharmawardena, J. S. N. P., Thattil, R. O., & Samita, S. (2015). Adjusting variables in constructing composite indices by using principal component analysis: Illustrated by Colombo district data. Tropical Agricultural Research, 27(1), 95–102.

Doczi, J., Calow, R., & D’Alançon, V. (2014). Growing more with less China’s progress in agricultural water management and reallocation. Overseas Development Institute (ODI), (September), 1–48.

Dong, F., Mitchell, P. D., Knuteson, D., Wyman, J., Bussan, A. J., & Conley, S. (2015). Assessing sustainability and improvements in US Midwestern soybean production systems using a PCA–DEA approach. Renewable Agriculture and Food Systems, 31(6), 524–539. https://doi.org/10.1017/S1742170515000460

du Plessis, A. (2017). Freshwater challenges of South Africa and its Upper Vaal River (pp. 1–13). Springer.

Elliott, J., Deryng, D., Müller, C., Frieler, K., Konzmann, M., & Gerten, D. (2014). Constraints and potentials of future irrigation water availability on agricultural production under climate change. PNAS, 111(9), 3239–3244. https://doi.org/10.1073/pnas.1222474110

Ercin, A. E., & Hoekstra, A. Y. (2012). Water footprint scenarios for 2050: A global analysis and case study for Europe. Value of Water Research Report Series, 59, 1–70.

Filho, O. A., Soares, W., & Fernandéz, C. I. (2016). Mapping of the water table levels of unconfined aquifers using two interpolation methods. Journal of Geographic Information System, 8, 480–494.

Food and Agricultural Organisation (FAO). (2017). Water for sustainable food and agriculture. A Report Produced for the G20 Presidency of Germany, 1–33.

Food and Agricultural Organisation (FAO). (2018). The future of food and agriculture: Trends and challenges. Rome.

Fraiture, A. C. De, Faryap, A., Unver, O., & Ragab, R. (2013). Integrated water management approaches for sustainable food production. Background Paper for World Irrigation Forum, 28 Sept‐5 Oct 2013, Mardin (Turkey) (pp. 1–17).

Fung, D. S. (2006). Methods for the estimation of missing values in time series. Masters Thesis, Edith Cowan University (pp. 1–205).

Giordano, M. (2015). Water use efficiency across sectors (pp. 1–19). Sustainable Withdrawal and Scarcity. International Water Management Institute.

Giorno, C., Richardson, P., Roseveare, D., & van den Noord, P. (2015). Potential output, output gaps and structural budget balances. OECD Economic Studies, 24(24), 1–22. https://doi.org/10.1787/533876774515

Greco, S., Ishizaka, A., Tasiou, M., & Torrisi, G. (2018). On the methodological framework of composite indices : A review of the issues of weighting, aggregation, and robustness. Social Indicators Research, 141(1), 61–94. https://doi.org/10.1007/s11205-017-1832-9

Grovermann, C., Wossen, T., Muller, A., & Nichterlein, K. (2019). Eco-efficiency and agricultural innovation systems in developing countries: Evidence from macro-level analysis. PLoS ONE, 14(4), 1–16.

Haq, R., & Shafique, S. (2015). Impact of water management on agricultural production. Asian Journal of Agriculture and Development, 6(2), 85–94.

Hess, T., Aldaya, M., Fawell, J., Franceschini, H., Ober, E., Schaub, R., & Schulze-aurich, J. (2013). Understanding the impact of crop and food production on the water environment: using sugar as a model. Journal of the Science of Food and Agriculture, 94, 2–8. https://doi.org/10.1002/jsfa.6369

High Level Panel on Water (HLWP). (2017). Water use efficiency for resilient economies and societies: Roadmap. HLWP Report, (June), 1–22.

Honaker, J., & King, G. (2010). What to do about missing values in time-series cross-section data. American Journal of Political Science, 54(2), 561–581.

Jiang, L., Zhou, S., Li, K., Wang, F., & Yang, J. (2019). A New Nonparametric Estimate of the Risk-Neutral Density with Applications to Variance Swaps, (2002), 1–19. Retrieved from https://arxiv.org

Kang, B., He, D., Perrett, L., Wang, H., Hu, W., Deng, W., & Wu, Y. (2009). Fish and fisheries in the Upper Mekong: Current assessment of the fish community, threats and conservation. Reviews in Fish Biology and Fisheries, 19(4), 465–480.

Kazemi, E., Karyab, H., & Emamjome, M. (2017). Optimization of interpolation method for nitrate pollution in groundwater and assessing vulnerability with IPNOA and IPNOC method in Qazvin plain. Journal of Environmental Health Science & Engineering, 15(23), 1–10. https://doi.org/10.1186/s40201-017-0287-x

Kim, T., Ko, W., & Kim, J. (2019). Analysis and impact evaluation of missing data imputation in day-ahead PV generation forecasting. Applied Sciences, 9(204), 1–18. https://doi.org/10.3390/app9010204

Lebdi, F. (2016). Irrigation for Agricultural Transformation. African Centre for Economic Transformation, Background Paper FOR African Transformation Report 2016: Transforming Africa’s Agriculture, (February), 1–41.

Lepot, M., Aubin, J.-B., & Clemens, F. H. L. R. (2017). Interpolation in time series: An introductive overview of existing methods, their performance criteria and uncertainty assessment. Water Review, 9(796), 1–20. https://doi.org/10.3390/w9100796

Liu, J., Hertel, T. W., Lammers, R. B., Prusevich, A., Baldos, U. L. C., Grogan, D. S., & Frolking, S. (2017). Achieving sustainable irrigation water withdrawals: Global impacts on food security and land use. Environmental Research Letters, 12(104009), 1–12.

Loayza, N., & Ranciere, R. (2005). Financial development, financial fragility, and growth. In IMF Working Papers 2005/170, International Monetary Fund. https://openknowledge.worldbank.org/handle/10986/14233.

Lorenčič, E. (2016). Testing the performance of cubic splines and nelson-Siegel model for estimating the zero-coupon yield curve. Naše Gospodarstvo/our Economy, 62(2), 42–50. https://doi.org/10.1515/ngoe-2016-0011

Mazziotta, M., & Pareto, A. (2015). Composite Index Construction by PCA ? No, thanks. Conference Paper, (May), 1–9.

Molden, D., Frenken, K., Barker, R., Fraiture, C. De, Mati, B., Svendsen, M., Finlayson, C. M. (2007). Trends in water and agricultural development. International Water Management Institute (IWMI), 57–89.

Muema, F. M., Home, P. G., & Raude, J. M. (2018). Application of benchmarking and principal component analysis in measuring performance of public irrigation schemes in Kenya. Agriculture, 8(162), 1–20. https://doi.org/10.3390/agriculture8100162

Noor, M., Yahaya, A., Ramli, N., & Bakri, A. M. M. A. (2014). Filling missing data using interpolation methods: Study on the effect of fitting distribution. Key Engineering Materials, 594–595, 889–895. https://doi.org/10.4028/www.scientific.net/KEM.594-595.889

Ordu, A. U., Kolster, J., & Matondo-Fundani, N. (2011). Agricultural use of groundwater and management initiatives in the Maghreb: Challenges and opportunities for sustainable aquifer exploitation. African Development Bank (AFDB), 1–24.

Organisation for Economic Co-operation and Development (OECD). (2008). Handbook on Constructing Composite Indicators: Methodology and user guide. Organisation for Economic Co-Operation and Development (OECD) Publications (pp. 1–162).

Peterson, S., & Klepper, G. (2007). Potential impacts of water scarcity on the world economy. Potential Impacts of Water Scarcity on the World Economy. In J. L. Lozán, H. Grassl, P. Hupfer, L. Menzel, & C.-D. Schönwiese (Eds.), Global change: Enough water for all? (pp. 263–267). Wissenschaftliche Auswertungen.

Pimentel, B. D., Berger, B., Newton, M., Wolfe, B., Karabinakis, E., Clark, S., Nandagopal, S. (2004a). Water Resources, Agriculture and the Environment. Report 04–1, College of Agriculture and Life Sciences, Cornell University, Ithaca, NY, USA, (July) (pp. 1–47).

Pimentel, D., Berger, B., Filiberto, D., Newton, M., Wolfe, B., Clark, S., & Nandagopal, S. (2004b). Water resources: Agricultural and environmental issues. BioScience, 54(10), 909–918.

Rosegrant, M. W., & Ringler, C. (1999). Impact on food security and rural development of reallocating water from agriculture. EPTD Discussion Paper, 47, 1–48.

Sauer, T., Havlík, P., Schneider, U. A., Kindermann, G., & Obersteiner, M. (2008). Agriculture, population, land and water scarcity in a changing world: The role of irrigation. 12th Congress of the European Association of Agricultural Economists—EAAE 2008 (pp. 1–9).

Scheierling, S. M., & Tréguer, D. O. (2018). Beyond crop per drop assessing agricultural water productivity: Assessing agricultural water productivity and efficiency in a maturing water economy. International Bank for Reconstruction and Development /The World Bank (pp. 1–99).

Shiklomanov, I. A., & Rodda, J. C. (2003). World Water Resources at the Beginning of the Twenty-First Century. Cambridge: Cambridge University Press.

Singh, S. (2014). Introduction to principal component analysis in applied research. New Man International Journal of Multidisciplinary Studies, 1(12), 67–75.

Strzepek, K., & Boehlert, B. (2010). Competition for water for the food system. Phil. Trans. R. Soc., 365, 2927–2940. https://doi.org/10.1098/rstb.2010.0152

Teli, M. N., Teli, M. N., Kuchhay, N. A., Rather, M. A., Ahmad, U. F., Malla, M. A., & Dada, M. A. (2014). Spatial interpolation technique for groundwater quality assessment of district Anantnag J&K. International Journal of Engineering Research and Development, 10(3), 55–66.

The United Nations World Water Development Report [WWDR]. (2015). The United Nations World Water Development Report 2015: Water for a Sustainable World. UNESCO, 1.139.

Wongsai, N., Wongsai, S., & Huete, A. R. (2017). Annual seasonality extraction using the cubic spline function and decadal trend in temporal daytime MODIS LST data. Remote Sensing, 9(1254), 1–17. https://doi.org/10.3390/rs9121254

Zhu, Y., Jian, Z., Du, Y., Chen, W., & Fang, J. (2019). A New GM(1,1) model based on cubic monotonicity-preserving interpolation spline. Symmetry, 11(420), 1–12. https://doi.org/10.3390/sym11030420

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1: Unit root test for Brazil

ADF | PP | |||

|---|---|---|---|---|

Levels: I(0) | First differencing: I(1) | Levels: I(0) | First differencing: I(1) | |

Variable | t-stat | t-stat | ||

CLPI | − 5.535*** | − 1.470 | − 5.454*** | − 1.415 |

INDV | 10.286*** | − 1.820 | 10.112*** | − 1.622 |

FWWA | − 0.931 | − 15.255*** | − 0.903 | − 15.154*** |

FWWI | − 1.880 | − 13.124*** | − 1.825 | − 13.071*** |

FERT | − 14.544*** | − 1.703 | − 14.372*** | − 1.620 |

INVWS | − 0.330 | − 12.950*** | − 2.268 | − 16.140*** |

IRGL | − 15.030*** | − 1.755 | − 14.921*** | − 1.673 |

LPR | − 1.510 | − 15.172*** | − 1.448 | − 14.301*** |

Appendix 2: Unit root test for Russia

ADF | PP | |||

|---|---|---|---|---|

Levels: I(0) | First differencing: I(1) | Levels: I(0) | First differencing: I(1) | |

Variable | t-stat | t-stat | ||

CLPI | − 7.053*** | − 1.611 | − 7.132*** | − 1.483 |

INDV | 6.110*** | − 1.384 | 6.183*** | − 1.222 |

FWWA | − 1.773 | − 12.192*** | − 1.641 | − 12.071*** |

FWWI | − 1.531 | − 10.815*** | − 1.487 | − 10.885*** |

FERT | − 11.242*** | − 1.453 | − 11.130*** | − 1.301 |

INVWS | − 1.123 | − 9.225*** | − 1.021 | − 9.143*** |

IRGL | − 13.653*** | − 1.571 | − 13.104*** | − 1.241 |

LPR | − 1.835 | − 11.134*** | − 1.661 | − 11.043*** |

Appendix 3: Unit root test for India

ADF | PP | |||

|---|---|---|---|---|

Levels: I(0) | First differencing: I(1) | Levels: I(0) | First differencing: I(1) | |

Variable | t-stat | t-stat | ||

CLPI | − 13.225*** | − 1.463 | − 13.042*** | − 1.375 |

INDV | 9.511*** | − 1.861 | 9.425*** | − 1.691 |

FWWA | − 1.634 | − 7.341*** | − 1.552 | − 7.123*** |

FWWI | − 1.774 | − 12.455*** | − 1.624 | − 12.361*** |

FERT | − 15.142*** | − 1.822 | − 15.013*** | − 1.752 |

INVWS | − 1.435 | − 11.664*** | − 1.313 | − 11.512*** |

IRGL | − 8.091*** | − 1.235 | − 8.165*** | − 1.115 |

LPR | − 1.723 | − 10.441*** | − 1.523 | − 10.231*** |

Appendix 4: Unit root test for China

ADF | PP | |||

|---|---|---|---|---|

Levels: I(0) | First differencing: I(1) | Levels: I(0) | First differencing: I(1) | |

Variable | t-stat | t-stat | ||

CLPI | − 10.543*** | − 1.3513 | − 10.413*** | − 1.280 |

INDV | 12.225*** | − 1.922 | 12.154*** | − 1.710 |

FWWA | − 1.421 | − 9.341*** | − 1.312 | − 9.234*** |

FWWI | − 1.632 | − 14.114*** | − 1.585 | − 14.243*** |

FERT | − 7.484*** | − 0.511 | − 6.961*** | − 0.342 |

INVWS | − 1.755 | − 15.103*** | − 1.694 | − 15.224*** |

IRGL | − 13.151*** | − 1.732 | − 13.021*** | − 1.501 |

LPR | − 0.843 | − 6.235*** | − 0.621 | − 6.190*** |

Appendix 5: Unit root test for South Africa

ADF | PP | |||

|---|---|---|---|---|

Levels: I(0) | First differencing: I(1) | Levels: I(0) | First differencing: I(1) | |

Variable | t-stat | t-stat | ||

CLPI | − 7.331*** | − 1.143 | − 7.712*** | − 1.184 |

INDV | 10.353*** | − 1.612 | 10.273*** | − 1.541 |

FWWA | − 1.741 | − 10.225*** | − 1.532 | − 10.883*** |

FWWI | − 1.215 | − 8.425*** | − 1.365 | − 8.755*** |

FERT | − 15.351*** | − 1.641 | − 15.112*** | − 1.462 |

INVWS | − 1.630 | − 9.553*** | − 1.781 | − 10.091*** |

IRGL | − 11.274*** | − 1.773 | − 11.353*** | − 1.846 |

LPR | − 1.141 | − 5.345*** | − 1.195 | − 5.522*** |

Appendix 6: Panel unit root test for the BRICS countries

Methods & statistic | Order of integration | |||||

|---|---|---|---|---|---|---|

Variable | aLevin, Lin & Chu t | aBreitung t-stat | bIm, Pesaran and Shin W-stat | bADF—Fisher Chi-square | bPP—Fisher Chi-square | |

CLPI | − 4.488*** | − 2.987*** | − 4.865*** | 142.654*** | 255.654*** | I(0) |

INDV | − 1.787 | − 3.785*** | − 3.654*** | 111.763*** | 279.960*** | I(0) |

FWWA | − 6.567*** | − 7.544*** | − 11.544*** | 239.364*** | 794.481*** | I(0) |

FWWI | − 8.765*** | − 1.223 | − 1.547 | 72.556*** | 114.432*** | I(0) |

FERT | − 3.840*** | − 0.592 | − 2.654** | 76.554* | 88.764*** | I(0) |

INVWS | − 9.675*** | − 5.875*** | − 11.601*** | 861.221*** | 11.7654*** | I(0) |

IRGL | − 1.888** | − 3.992*** | − 2.654** | 91.544** | 117.487*** | I(0) |

LPR | − 7.674*** | − 5.841*** | − 8.905*** | 225.418*** | 613.702*** | I(0) |

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Egbo, O.P., Ezeaku, H.C., Okolo, V.O. et al. Enhancing agricultural and industrial productivity through freshwater withdrawals and management: implications for the BRICS countries. Environ Dev Sustain 25, 3771–3799 (2023). https://doi.org/10.1007/s10668-022-02202-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10668-022-02202-z