Abstract

Recent projections on sea level rise (SLR) show that approximately 32% and 22.62% of Lagos City will be inundated by 2100 and 2050, respectively. There are also few empirical estimates of the impact of such forecasts on the current price of residential real estates that are highly exposed to the SLR. In that regard, this study investigates the effects of proximity to the oceanfront and exposure to SLR on the current price of residential real estate in Lagos, a coastal city in Nigeria. The study employs a hedonic pricing model (HPM), and the results reveal three key findings. First, the results show that beachfront residential real estate sells at a 5.2% premium for every kilometre closer to the coastline. Second, the estimates show that residential real estate highly exposed to SLR sells at a 0.5% discount relative to a comparable unexposed property. Third, analysis indicates that Nigeria’s real estate market expects a 37-year window before a 1 km2 is completely underwater, rendering affected residential real estate worthless. Overall, these findings were interpreted as evidence that environmental amenities and climate risks are priced in Nigeria’s real estate market. Therefore, this study concludes that both climate change and proximity to the coast influence the current price of residential real estate in the coastal city of Lagos, Nigeria.

Source: author’s computation

Source: author’s computation

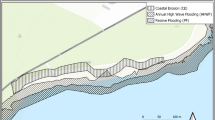

Source 1: Adelekan [26]

Source: www.Earth.org (2021)

Source: author’s computation

Source: author’s computation

Source: author’s computation

Similar content being viewed by others

Availability of Data and Materials

The data used in this study is secondary data, all obtained from open source. However, this can be made available upon request.

Notes

See Benoit [27] for interpreting coefficients in logarithmically models with logarithmic transformations: Log-linear model.

In addition, column (C) demonstrates a similar negative relationship between house price and distance to the oceanfront.

References

Lagos-CRA. (2021). Lagos state climate risk assessment (CRA) comprehensive report (Final). Lagos State Ministry of Environment & Water Resources.

Filippova, O., Nguyen, C., Noy, I. & Rehm, M. (2019). Who cares? Future sea-level-rise and house prices. CESifo Working Paper No No. 7595, Category 10: Energy and Climate Economics, www.CESifo-group.org/wp

Parris, A., Bromirski, P., Burkett, V., Cayan, D., Culver, M., Hall, J., & Weiss, J. (2012). Global sea level rise scenarios for the US national climate assessment. National oceanic and atmospheric administration (NOAA) technical report OAR CPO-1.

Beck, J. & Lin, M. (2020). Impacts of sea level rise on real estate prices in coastal Georgia. The Review of Regional Studies, 49(2020), 43{52.

Jin, D., Hoagland, P., Au, D. K., & Qiu, J. (2015). Shoreline change, seawalls, and coastal property values. Ocean & Coastal Management, 114(2015), 185–193. https://doi.org/10.1016/j.ocecoaman.2015.06.025

Bernstein, A., Gustafson, M. T., & Lewis, R. (2019). Disaster on the horizon: The price effect of sea level rise. Journal of Financial Economics, 134(2019), 253–272.

Fu, X., & Nijman, J. (2020). Sea level rise, homeownership, and residential real estate markets in South Florida. The Professional Geographer. https://doi.org/10.1080/00330124.2020.1818586

McAlpine, S. A., & Porter, J. R. (2018). Estimating recent local impacts of sea level rise on current real-estate losses: A housing market case study in Miami-Dade. Florida. Population Research and Policy Review, 37(2018), 871–895. https://doi.org/10.1007/s11113-018-9473-5

Warren-Myersa, G., Aschwanden, G. D., Fuerst, F. & Krause, A. (2018). Are we underestimating the sea level rise risk for property? The 24th pacific rim real estate society conference “Property research for our changing world” 21 – 24 January 2018. Auckland, New Zealand.

Murfin, J., & Spiegel, M. (2020). Is the risk of sea level rise capitalised in? The Review of financial studies, 33(3), 1217–1255.

Montero, J.-M. & Fernandez-Aviles, G. (2014). Hedonic price model. (C. M. A, Ed.) Encyclopedia of quality of life and well-being research. https://doi.org/10.1007/978-94-007-0753-5

Gopalakrishnan, S., Smith, M. D., Slott, J. M., & Murray, A. (2010). The value of disappearing beaches: A hedonic pricing model with endogenous beach width. Journal of Environmental Economics and Management, 61(2011), 297–310.

Jinwon, K., Sukjoon, Y., Eunjung, Y., & Brijesh, T. (2020). Valuing recreational beaches: A spatial hedonic pricing approach. Coastal Management, 48(2), 118–141. https://doi.org/10.1080/08920753.2020.1732799

Fuerst, F., & Warren-Myers, G. (2021). Pricing climate risk: Are flooding and sea level rise risk capitalised in Australian residential property? Climate Risk Management, 34(2021), 100361.

Walsh, P., Griffiths, C., Guignet, D., & Klemick, H. (2019). Adaptation, sea level rise, and property prices in the Chesapeake Bay Watershed. Land Economics, 95(1), 19–34.

Adelekan, I. O. (2010). Vulnerability of poor urban coastal communities to flooding in Lagos Nigeria. Environment & Urbanisation, 22(2), 433–450. https://doi.org/10.1177/0956247810380141

Owen, M. (2020, July 30). Sea Level Rise Projection Map - Lagos. https://earth.org/data_visualization/sea-level-rise-by-2100-lagos/

Danladi, I. B., Kore, B. M. & GÜL, M. (2017). Vulnerability of the Nigerian coast: An insight into sea level rise owing to climate change and anthropogenic activities. Journal of African Earth Sciences (2017). https://doi.org/10.1016/j.jafrearsci.2017.07.019

Ikuemonisan, F. E., & Ozebo, V. C. (2020). Characterisation and mapping of land subsidence based on geodetic observations in Lagos. Nigeria. Geodesy and Geodynamics, 11(2020), 151–162. https://doi.org/10.1016/j.geog.2019.12.006

Onenai, J., & Ayodele, D. (2014). The vulnerability of Eti-Osa and Ibeju-Lekki coastal communities in Lagos State Nigeria to climate change hazards. Research on Humanities and Social Sciences, 4(27), 132–142.

Baldauf, M., Garlappi, L., & Yannelis, C. (2020). Does climate change affect real estate prices? Only if you believe in it. The Review of Financial Studies, 33(3), 1256–1295.

Giglio, S., Maggiori, M., Rao, K., Stroebel, J., & Weber, A. (2021). Climate change and long-run discount rates: Evidence from real estate. The Review of Financial Studies, 00(2021), 1–45.

Ikuemonisan, F. E., Ozebo, V. C., & Olatinsu, O. B. (2020). Geostatistical evaluation of spatial variability of land subsidence rates in Lagos. Nigeria. Geodesy and Geodynamics, 11(2020), 316–327.

Monson, M. (2009). Valuation using hedonic pricing models.

Giglio, S., Maggiori, M., Stroebel, J. & Weber, A. (2015). Climate change and long-run discount rates: NBER working paper no. 21767. http://www.nber.org/papers/w21767

Adelekan, I. O. (2015). Flood risk management in the coastal city of Lagos. Nigeria. Journal of Flood Risk Management, 9(2016), 255–264. https://doi.org/10.1111/jfr3.12179

Benoit, K. (2011). Linear regression models with logarithmic transformations. Methodology Institute, London School of Economics.

Acknowledgements

The research funding from the Ministry of Science and Higher Education of the Russian Federation (Ural Federal University project within the Priority-2030 Program) is gratefully acknowledged.

Author information

Authors and Affiliations

Contributions

All authors have significantly contributed to the development of the study conception and design. Conceptualisation and introduction were done by Aliyu Rafindadi Sanusi; methodology and analysis were done by Jamilu Iliyasu; literature review and discussion were done by Suleiman Onimisi Mamman; and literature review and conclusion were done by Yakubu Abubakar. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethical Approval

This study does not require ethics approval. This is because the study does not involve the use of animals, as the data used was mainly secondary data.

Consent to Participate

Not applicable.

Consent for Publication

We agree to the publication of identifiable details within the manuscript in your journal if it is deemed appropriate.

Competing Interests

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Iliyasu, J., Sanusi, A.R., Mamman, S.O. et al. Pricing Environmental Amenities and Climate Change Risks in Real Estate Market. Environ Model Assess 28, 999–1010 (2023). https://doi.org/10.1007/s10666-023-09919-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10666-023-09919-9