Abstract

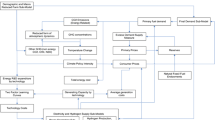

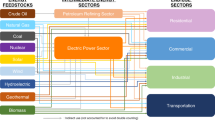

In energy-economy modeling, new hybrid models attempt to combine the technological explicitness of bottom-up models with the macroeconomic feedbacks and statistically estimated behavioral parameters of top-down models. However, statistical estimation of behavioral parameters (portraying firm and household technology choices) with such models is challenged by the number of uncertain variables and the lack of historical data on technologies in terms of capital costs, operating costs, and market shares. Multiple combinations of parameter values might equally explain past technology choices. This paper reports on the application of a Bayesian statistical simulation approach for estimating the most likely values for these key behavioral parameters in order to best explain past technology choices and then simulate policies to influence future technology choices. The method included (1) data collection of key technology market shares, capital costs, and operating costs over the past; (2) backcasting a hybrid energy-economy model over a historical time period; and (3) the application of Markov chain Monte Carlo statistical simulation using the Metropolis–Hastings algorithm as a tool for estimating distributions for key parameters in the model. The results provide a means of indicating the uncertainty bounds around key behavioral parameters when generating forecasts of the effect of certain policies. However, the results also indicate that this approach may have limited applicability, given that future available technologies may differ substantially from past technologies and that it is difficult to separate the effects of parameter uncertainty from model structure uncertainty.

Similar content being viewed by others

Notes

CIMS also tracks stock turnover, modeling retirement of existing stock and demand for new stock. Furthermore, the macroeconomic component of the model, inspired by top-down models, ensures equilibrium between the energy sector and the rest of the economy. Again, however, the focus of this study is on improving the model’s performance in terms of behavioral realism.

Multiple solutions might exist to the calibration inverse problem not only due to the parameterization of the market share function but also because the multiple years of data available in a historical time trend provide essentially only one observation: each year of data is correlated with the previous. This limited number of observations suggests that this inverse problem is under-constrained (there are more parameters than informative data points) and that multiple (perhaps an infinite) number of solutions to the problem will exist. Applying calibration approaches has not shown this to be the case; supplemental analysis indicated the historical data matrix was indeed informative for parameter values. Nevertheless, we include this hypothesis here for completeness.

Unscaled indicated that the integral of the posterior density over the full range of values does not sum to 1. Scaled posterior probability densities could be calculated by normalizing the unscaled densities by this integral.

This step replaces the more conventional steps of first calculating a likelihood and then combining the likelihood and a prior probability distribution to calculate the posterior. However, selecting a likelihood function also introduces additional parameters (in the case of a normal distribution, the variance) that must also be estimated in a formal parameter analysis. To avoid the complexity of additional dimensionality in the parameter estimation, Walters and Ludwig [27] replace the posterior with an expression that is independent of these “nuisance parameters,” representing a marginal probability integrated over the variance. This is the approach we apply here.

Removing burn-in iterations refers to the practice of not including the initial set of MCMC iterations in parameter estimations in order to remove effects of autocorrelation (time correlation between subsequent points in the random walk) as it “climbs” toward the mode of the posterior distribution. For the furnace calibration, 6,000 burn-in iterations were removed.

Prior probability distributions, or priors, represent previous knowledge of parameter values. Because large standard deviations were applied to the prior probability distributions, the priors do not dominate the posterior. Historical data have the strongest effect on calibration.

In this alternative prior distribution, the mean value of the v parameter was set to 12 rather than 10, representing increased heterogeneity of consumer choices. Values of both 10 and 12 have been used in recent configurations of the CIMS forecasting model.

A group of major utilities sponsored the “Golden Carrot” program in 1993: they provided a US $30 million prize for a fridge that was CFC-free and 25% more efficient. The winning design by Whirlpool became commercially available in 1995. Other manufacturers soon followed suit [6].

A node is a technology competition for a single service (e.g., heating, vehicle-kilometers traveled, etc.).

A carbon tax starting at US $15/tonne CO2e rising to US $300/tonne CO2e by 2050 was used based on a separate analysis suggesting this price trajectory could allow Canada to reach stated emissions reductions targets of 20% below 2006 levels by 2020 and 65% below 2006 levels by 2050.

For this study, we used an exogenous forecast for the price of energy as determined by reviewing forecasts from Natural Resources Canada and the US Department of Energy.

Baseboard heaters are competed separately in the full CIMS model based on floor space and were excluded here to avoid the interactions between space heater choices and insulation technology choices. In our modified furnace model, baseboard heaters were accounted for by subtracting a fixed percentage of the total forecasted households in Ontario.

References

Axsen, J., Mountain, D., & Jaccard, M. (2009). Combining stated and revealed choice research to simulate preference dynamics: The case of hybrid-electric vehicles. Resource and Energy Economics, 31(3), 221–238.

Balakrishnan, S., Roy, A., Ierapetritou, M., Flach, G., & Georgopoulos, P. (2003). Uncertainty reduction and characterization of complex environmental fate and transport models: An empirical Bayesian framework incorporating the stochastic response surface method. Water Resources Research, 39, 12.

Bataille, C., Jaccard, M., Nyboer, J., Rivers, N. (2006). Towards general equilibrium in a technology-rich model with empirically estimated behavioral parameters. The Energy Journal, Special Issue on Hybrid Energy-Economy Modeling, pp. 93–112

Bosetti, V., & Tavoni, M. (2009). Uncertain R&D, backstop technology and GHGs stabilization. Energy Economics, 31, S18–S26.

Canada. (2005). Energy consumption of major household appliances shipped in Canada: Trends for 1990–2001. Ottawa: Natural Resources Canada, Office of Energy Efficiency.

Consumer Reports. (1995). The new refrigerators: How much energy do they save? Consumer Reports, 60(5), 310.

Denison, D. G. T., Holmes, C. C., Mallick, B. K., & Smith, A. F. M. (2002). Bayesian methods for nonlinear classification and regression. Chichester: Wiley.

Dowlatabadi, H., & Oravetz, M. A. (2006). US long term energy intensity: Backcast and projection. Energy Policy, 34, 3245–3256.

Gelman, A., Carlin, J. B., Stern, H. A., & Rubin, D. B. (2004). Bayesian data analysis (2nd ed.). Boca Raton: Chapman & Hall.

Gerlagh, R., & van der Zwaan, B. C. C. (2004). A sensitivity analysis of timing and costs of greenhouse gas emission reductions under learning effects and niche markets. Climatic Change, 65, 39–71.

Horne, M., Jaccard, M., & Tiedemann, K. (2005). Improving behavioral realism in hybrid energy-economy models using discrete choice studies of personal transportation decisions. Energy Economics, 27, 59–77.

Hourcade, J-C., Jaccard, M., Bataille, C. & Ghersi, F. (2006). Hybrid modeling: New answers to old challenges. The Energy Journal, Introduction to the Special Issue on Hybrid Energy-Economy Modeling, pp. 1–12.

Jaccard, M. (2005). Hybrid energy-economy models and endogenous technological change. In R. Loulou, J. Waaub, & G. Zaccour (Eds.), Energy and environment (pp. 1–29). New York: Springer.

Jaccard, M., Nyboer, J., Bataille, C., & Sadownik, B. (2003). Modeling the cost of climate policy: Distinguishing between alternative cost definitions and long-run cost dynamics. The Energy Journal, 24(1), 49–73.

Jaccard, M., & Rivers, N. (2007). Estimating the effect of the Canadian Government’s 2006–2007 greenhouse gas policies. Toronto: CD Howe Institute.

Louviere, J., Hensher, D., & Swait, J. (2000). Stated choice methods: Analysis and applications. Cambridge: Cambridge University Press.

Mau, P., Eyzaguirre, J., Jaccard, M., Collins-Dodd, C., & Tiedemann, K. (2008). The neighbor effect: Simulating dynamics in consumer preferences for new vehicle technologies. Ecological Economics, 68, 504–516.

Morgan, M. G., & Henrion, M. (1990). Uncertainty: A guide to dealing with uncertainty in quantitative risk and policy analysis. Cambridge: Cambridge University Press.

Rivers, N., & Jaccard, M. (2005). Combining top-down and bottom-up approaches to energy-economy modeling using discrete choice methods. The Energy Journal, 26(1), 83–106.

Smith, L. A. (2003). Predictability past, predictability present. Proceedings of ECMWF Seminar on Predictability, Reading, UK: ECMWF, pp. 291–242.

Tanner, M. (1996). Tools for statistical inference: Methods for the exploration of posterior distributions and likelihood functions (3rd ed.). New York: Springer.

Tarantola, A. (2005). Inverse problem theory and methods for model parameter estimation. Philadelphia: SIAM.

Train, K. (2002). Discrete choice methods with simulation. Cambridge: Cambridge University Press.

Train, K. (1985). Disount rates in consumers’ energy-related discussions: A review of the literature. Energy, 10(12), 1243–1253.

Tschang, F. T., & Dowlatabadi, H. (1995). A Bayesian technique for refining the uncertainty in global energy model forecasts. International Journal of Forecasting, 11, 43–61.

Urban, G., Weinberg, B., & Hauser, J. (1996). Premarket forecasting of really-new products. Journal of Marketing, 60, 47–60.

Walters, C., & Ludwig, D. (1994). Calculation of Bayes’ posterior probability distributions for key population parameters. Canadian Journal of Aquatic Sciences, 51, 713–722.

Author information

Authors and Affiliations

Corresponding authors

Rights and permissions

About this article

Cite this article

Beugin, D., Jaccard, M. Statistical Simulation to Estimate Uncertain Behavioral Parameters of Hybrid Energy-Economy Models. Environ Model Assess 17, 77–90 (2012). https://doi.org/10.1007/s10666-011-9276-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10666-011-9276-0