Abstract

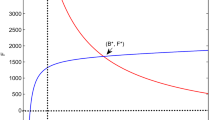

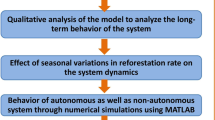

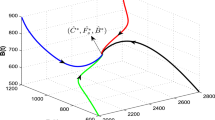

Carbon tax serves as a tool to discourage carbon dioxide (\(\text {CO}_2\)) emissions, which are a root cause of climate change. A well-designed tax policy could reduce the risk of climate change, promote innovation in carbon-reducing technologies, and increase public revenue. In this research work, the model formulation is based on dynamic interactions among variables, namely the atmospheric concentration of \(\text {CO}_2\), human population, forestry biomass, and the levied carbon tax. We assume that the collected revenue is used to control anthropogenic emissions of \(\text {CO}_2\) and fund reforestation/afforestation programs. We have derived sufficient conditions under which the considered dynamical variables settle to their equilibrium levels. The model analysis reveals that the atmospheric level of \(\text {CO}_2\) decreases as the levied tax rate increases, indicating that the atmospheric \(\text {CO}_2\) level can be reversed from its present state through the imposition of a carbon tax. Additionally, the formulated system undergoes Hopf-bifurcation concerning the growth of the levied tax and deforestation rate. Furthermore, through simulations, we have demonstrated that utilizing tax revenues for technologies that limit human-induced \(\text {CO}_2\) emissions and reforestation/afforestation programs is a promising strategy for mitigating the increased levels of \(\text {CO}_2\).

Similar content being viewed by others

Data availability

All data used during this study are included in the article.

References

IPCC (2018) Global warming of 1.5\(^\circ \)C. An IPCC special report on the impacts of global warming of 1.5\(^\circ \)C above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change, sustainable development, and efforts to eradicate poverty. https://www.ipcc.ch/site/assets/uploads/sites/2/2019/06/SR15_Full_Report_High_Res.pdf Accessed 18 Feb 2022

European Environment Agency (1996) Environmental taxes, implementation and environmental effectiveness. European Environment Agency, Copenhagen

Wanstall CT, Hadji L (2018) A step function density profile model for the convective stability of CO\(_2\) geological sequestration. J Eng Math 108:53–71

Capozza I, Samson R (2019) Towards green growth in emerging market economies: evidence from environmental performance reviews. OECD, Paris

Shahzad U (2020) Environmental taxes, energy consumption, and environmental quality: theoretical survey with policy implications. Environ Sci Pollut Res 27(20):24848–24862

Kosonen K (2012) Regressivity of environmental taxation: myth or reality? In: Handbook of research on environmental taxation. Edward Elgar Publishing, Cheltenham, pp 161–174

World Bank (2023) Carbon pricing dashboard. World Bank 2020. https://carbonpricingdashboard.worldbank.org/map_data. Accessed 26 Mar 2023

Sundar S, Mishra AK, Naresh R (2016) Effect of environmental tax on carbon dioxide emission: a mathematical model. Am J Appl Math Stat 4(1):16–23

Devi S, Gupta N (2019) Effects of inclusion of delay in the imposition of environmental tax on the emission of greenhouse gases. Chaos Solitons Fractals 125:41–53

Fan X, Li X, Yin J (2019) Impact of environmental tax on green development: a nonlinear dynamical system analysis. PLoS ONE 14(9):e0221264

Misra AK, Jha A (2021) Modeling the effect of population pressure on the dynamics of carbon dioxide gas. J Appl Math Comput 67:623–640

Misra AK, Jha A (2022) Modeling the effect of budget allocation on the abatement of atmospheric carbon dioxide. Comput Appl Math 41(5):1–30

IPCC (2014) Environmental taxation principles-fiscal instruments and environmental policy-making. In: Working Group I Contribution to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change. https://doi.org/10.1017/CBO9781107415324.004

Marron DB, Toder EJ (2014) Tax policy issues in designing a carbon tax. Am Econ Rev Pap Proc 104(5):563–568

Dubey B, Patra A (2013) Optimal management of a renewable resource utilized by a population with taxation as a control variable. Nonlinear Anal Model Control 18(1):37–52

Devi S, Gupta N (2019) Dynamics of carbon dioxide gas (CO\(_2\)): effects of varying capability of plants to absorb CO\(_2\). Nat Resour Model 32(1):e12174

Grobusch LC, Grobusch MP (2022) A hot topic at the environment-health nexus: investigating the impact of climate change on infectious diseases. Int J Infect Dis 116:7–9

Misra AK, Verma M (2013) A mathematical model to study the dynamics of carbon dioxide gas in the atmosphere. Appl Math Comput 219(16):8595–8609

Shukla JB, Sharma S, Dubey B, Sinha P (2009) Modeling the survival of a resource-dependent population: effects of toxicants (pollutants) emitted from external sources as well as formed by its precursors. Nonlinear Anal Real World Appl 10(1):54–70

Dubey B, Sharma S, Sinha P, Shukla JB (2009) Modelling the depletion of forestry resources by population and population pressure augmented industrialization. Appl Math Model 33:3002–3014

Verma M, Misra AK (2018) Optimal control of anthropogenic carbon dioxide emissions through technological options: a modeling study. Comput Appl Math 37(1):605–626

Ladde GS (1976) Competitive processes and comparison differential systems. Trans Am Math Soc 221(2):391–402

Hale JK (1969) Ordinary differential equations. Wiley-Interscience, New York

Freedman HI, So JH (1985) Global stability and persistence of simple food chains. Math Biosci 76(1):69–86

Misra AK, Jha A (2023) How to combat atmospheric carbon dioxide along with development activities? A mathematical model. Physica D Nonlinear Phenom 454:133861

Castillo-Chavez C, Song B (2004) Dynamical models of tuberculosis and their applications. Math Biosci Eng 1(2):361

Misra AK, Goyal K, Maurya J (2022) Impact of social media advertisements on the dynamics of online shopping: a modeling study. Differ Equ Dyn Syst 3:651–671

Acknowledgements

Authors are thankful to the handling editor and reviewer for their useful suggestions, which have improved the first draft of this paper. Anjali Jha is thankful to Innovation in Science Pursuit for Inspired Research (INSPIRE), Department of Science & Technology, Government of India for providing financial support in the form of senior research fellowship (No: DST/INSPIRE Fellowship/2018/IF180791).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no conflicts to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Jha, A., Misra, A.K. A robust role of carbon taxes towards alleviating carbon dioxide: a modeling study. J Eng Math 144, 20 (2024). https://doi.org/10.1007/s10665-023-10327-x

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10665-023-10327-x