Abstract

The availability heuristic is a cognitive bias that affects various aspects of decision-making, including financial decisions. Based on a randomized controlled experiment, this study assesses the effectiveness of a debiasing treatment designed to prevent the effect of the availability heuristic in student loan decision-making. Experimental subjects were explained that there is a bias that may affect the decision of whether or not to pursue a master’s degree and take out a graduate loan to finance it, and they were recommended to base their decision on reliable and verified sources of information as well as expert advice. This specific debiasing strategy is tested empirically. Specifically, this study shows positive causal effects of the debiasing intervention on two indices of student loan decision-making, which were constructed as summary indicators of student loan debt attitude, the perception that significant referents approve the student loan indebtedness, financial self-efficacy in student loan decision-making, and graduate loan borrowing intention. The article highlights the need for higher education institutions seeking to make financial education effective to be concerned with reporting on (and raising awareness of) psychological factors that are present in making financial decisions as well.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Obtaining a graduate degree often requires significant financial investment, and many students opt for financial aid options such as educational loans to fund their education.Footnote 1 Understanding the dynamics of student loan borrowing is thus crucial for policymakers, lenders, and students themselves. This article presents the main results of a laboratory experiment designed to explore the decision-making process of college seniors about taking out a graduate loan. In order to test the effectiveness of the interventions to which the experimental subjects were exposed, the current study focuses on evaluating their impact on outcomes that precede borrowing behavior. Grounded on Ajzen (1991), debt attitude, subjective norm, perceived financial self-efficacy, and behavioral intention capture the motivational influences on borrowing behavior. However, the relevant research question (RQ) in this study is whether student loan financial education alone is sufficient or, in addition, students must be informed of the behavioral biases that are also present in financial decision-making. There is strong evidence that individuals frequently make biased decisions and that a variety of psychological factors can influence these choices (Hastie and Dawes 2010). When speaking of biases in the field of behavioral finance, reference is made to certain errors in the reasoning of individuals that affect their financial behavior (Baker and Nofsinger 2010). Cognitive biases (e.g., representativeness, anchoring, or framing) and emotional biases (e.g., overconfidence or lack of self-control) are also expected to be present in financial decision-making, and behavioral finance analysis attempts to understand individuals’ financial decisions influenced by cognitive and emotional factors (De Bondt and Thaler 1995).Footnote 2 The evidence on decision biases challenges the prescriptive validity of standard finance theory (Dittrich et al. 2001). Hence the importance of mechanisms for bias removal (e.g., Croskerry et al. 2013a, b). Nonetheless, effective debiasing requires the development of procedures that act in the “proper way” (Sandri 2009).

We ask whether similar cognitive biases are at play among student loan takers, although this is still an understudied area. The anchoring effect, for example, is the disproportionate influence on decision-makers to make biased judgments toward an initially presented value (Furnham and Boo 2011; Tversky and Kahneman 1974). Two studies have focused recently on amounts borrowed by students. On the one hand, based on a field experiment with a large U.S. community college, Marx and Turner (2020) tested the effect of informational emails on community college students’ borrowing decisions. Randomly assigned reminders that students could borrow less than the amount listed in the financial aid award letter did not affect borrowing decisions. However, when this information was combined with a reference to the average amount borrowed by past graduates (reference-point treatments), students were less likely to borrow at all—both reference-point treatments reduced the average amount borrowed by about $65 (within the control group, the mean amount borrowed was about $500). On the other hand, Porto et al. (2021) also explored the possibility of the anchor effect in student loan borrowing decisions by showing that survey participants were influenced by their own post-secondary experience (or lack thereof) in determining whether and how much young adults should take out student loans in a hypothetical scenario. Porto et al. (2021) used a sample of nearly 2000 American adults (18–64 years of age) to test the hypothesis that the loan amount experience matters on the amount recommended; data were collected through an online survey in 2014.

Other studies have investigated the role of the way loans are presented to students. This is a classic framing effect. Kahneman and Tversky (1979) already stated that people tend to make risk-averse decisions when choosing between options that appear to represent gains and risk-seeking decisions when choosing between options that appear to represent losses. The relevance of Kahneman and Tversky's concept of framing to student loan borrowing behavior was studied by Caetano et al. (2019). The authors conducted a survey in three Latin American countries (Chile, Colombia, and Mexico), and survey respondents were randomly assigned to the treatment or control group. They framed financially equivalent contracts for education as loans or as human capital contracts (HCCs) and asked respondents which one they would choose.Footnote 3 For the treatment group, each contract was clearly labeled as a loan or as an HCC, whereas for the control group, no label was attached to either contract. Caetano et al. (2019) showed that subjects were more favorably disposed to accepting student debts when the latter were labeled as HCCs—there was a perceived disutility based on the label of the debt at calling something a “loan” as opposed to a “human capital contract.”

The availability heuristic, which is the focus of this article, is also a cognitive bias in decision-making that is expected to play a significant role in influencing students' perceptions and judgments about student loan borrowing.Footnote 4 The availability heuristic refers to the tendency of individuals to rely on readily available information when making decisions (Tversky and Kahneman 1974). People tend to assess the relative importance of issues by the ease with which they are recalled from memory, and this is largely determined by the extent of media coverage (Kahneman 2011). If, by coincidence, two planes crashed recently and a person now prefers to take the train, it is nonsense because the risk has not really changed; it is an availability bias (Kahneman 2011). Likewise, it is expected that when the availability heuristic is in play, students tend to overestimate the prevalence or likelihood of negative events associated with student loan debt, such as unemployment or financial hardship. This overemphasis on negative outcomes can lead to increased anxiety and reluctance to take on student loans. Student loan borrowers surely rely heavily on the experiences and opinions of their peers, media exposure, or social influence rather than conducting objective research, resulting in suboptimal choices. For instance, media coverage depicting stories of graduates with excessive debt or negative experiences may lead potential borrowers to perceive taking out graduate loans as a risky or unfavorable decision. Let's think about an undergraduate student who is finishing a bachelor's degree and is thinking of getting a master's degree and financing it through a student loan. This individual may not make that decision if s/he saw recent bad news about someone who finished a master's degree but could not find a job and repay the loan, because s/he thinks that most likely it will happen to her/him too, even when the official statistics show high placement rates, high wages, and low student loan default rates. Heuristics are ultimately a mental shortcut individuals employ to make decisions more quickly than if they considered additional information—the costlier the information is to acquire, the more likely it becomes that a heuristic will be used.

Behavioral biases can also help us explain why some university students borrow more money than advised, overlooking factors such as job market conditions. For instance, students might tend to overestimate future earnings and underestimate the risks associated with borrowing a significant amount of money, possibly due to prominent stories of high-earning individuals who paid off their loans quickly. However, misleading information, often prevalent on social media and from unreliable sources, can fuel unrealistic salary expectations. In recent years, concerns have indeed emerged regarding students' expectations about their future salaries, suggesting that they tend to be overly optimistic (e.g., O'Shaughnessy 2023; Wiswall and Zafar 2015, 2021). Overborrowing behavior is risky because students may not earn enough to pay off their loans after graduation, or worse, they may not graduate, finding themselves with student loan debt but no degree.

To mitigate the influence of the availability heuristic, potential borrowers should strive to make decisions based on a more comprehensive analysis of relevant information rather than relying solely on easily accessible examples. This can be done by seeking out a variety of sources, considering long-term implications, and consulting with financial advisors or experts who can provide objective advice. Additionally, developing an awareness of cognitive biases such as the availability heuristic is crucial to making more informed and rational decisions regarding educational loans. Thus, one of the objectives of financial education aimed at university students should be to inform them about psychological factors that are present in student loan decision-making, with the ultimate goal of improving their future financial well-being.

However, debiasing interventions focused on student loan decision-making are practically nonexistent. Based on a randomized controlled experiment, the current study targets this gap in the literature. In particular, it aims to assess the effectiveness of a debiasing treatment designed to prevent the effect of the availability heuristic on the decision to apply for a loan to pursue a master's degree. The most effective way of helping university students improve their financial decision-making process is by educating them on what is wrong and what is not. In the current study, the experimental subjects were explained that there is a bias that may affect the decision of whether or not to pursue a master’s degree and take out a graduate loan to finance it, and they were recommended to base their decision on reliable and verified sources of information as well as expert advice. “Relying on practical experts” was precisely one of the debiasing methods proposed by Fischoff (1982). Our experimental evidence provides support for the impact of the independent variable (the training content provided in the experiment, i.e., the debiasing treatment) on dependent variables that precede (influence) the decision to request a loan to complete a master's degree.

Despite the growing number of university students who are taking out loans to finance their degrees, mainly in Anglo-Saxon countries,Footnote 5 in-depth research on the behavior of student loan recipients is limited. Nonetheless, this research is essential to look at deviations from the rational-agent paradigm in human capital investment decisions. It can help inform policy discussions about the design of financial aid packages for higher education students and student loan financial literacy programs. Our contribution to the financial education literature is novel because we focus on university students and the biases that affect financial decision-making. By incorporating debiasing training techniques, students can make more informed and rational choices regarding their student loan debt. Knowing whether financial education interventions work is also crucial in the context of the current study since refusing to take out a student loan to get the necessary funding to complete a program would require giving up postgraduate studies. Understanding the extent to which loan aversion is present across different populations is important if people are underinvesting in higher education because they are unwilling to borrow (Baum and Schwartz 2015; Boatman et al. 2016; Cunningham and Santiago 2008; De Gayardon et al. 2019). Underinvestment in graduate education has negative implications for individuals as advanced degrees lead to higher earnings on average, but it also has negative implications for society as highly qualified skills are correlated with productivity and economic growth and provide a greater tax base for government funding (Organisation for Economic Co-operation and Development [OECD] 2016).

2 Research design

Randomized controlled trials (RCTs) are a type of interventional study. These trials take a group of study participants and randomly divide them into separate groups (Thiese 2014). Experimental research undertaken in the last decade has shown that financial education improves both financial knowledge and financial behavior (Kaiser et al. 2022). However, financial education interventions aimed at university students are still rare. In order to fill this gap, a research team from the so-called FUNCAS project designed and ran an experiment in order to evaluate the impact of financial training on the financial decisions of university students.Footnote 6 In particular, the experiment aimed at college seniors in their decision to finance a graduate degree with a student loan. In the FUNCAS-controlled experiment design, a third of the participants (undergraduate students) would be exposed to a debiasing treatment (along with financial education) in the decision to take out a loan to finance a graduate degree, and this intervention would then be compared with another group (a control group) that had not been exposed and with a group that had a different intervention (only financial education).

2.1 Participants

At the beginning of the 2019–2020 academic year, final-year students from a business school at a public university in southern Spain participated in the experiment. The total sample consisted of 538 senior business undergraduate students or around 70% of the total number of college seniors enrolled at the business school. Although participation was voluntary, there were economic rewards assigned by lottery based on the correct answers to certain questions. The computer labs of the business school were used for the implementation of the experiment. Both the intervention and the data collection were carried out online using Qualtrics® software. Prior to the experiment, the researchers randomly loaded three distinct Qualtrics questionnaires onto the computers. The first questionnaire, designed for the control group, only contained a case study on which participants had to respond to several items on a seven-point Likert scale related to variables that precede the decision to apply for a graduate student loan, and they were also asked to report some sociodemographic variables. A second questionnaire, prepared for what we call experimental group 1, was the same as that of the control group, except that at the beginning of the questionnaire there was a web link to a short online course on graduate school financial education. Finally, the third questionnaire was designed for what we call experimental group 2, and was basically the same as that of experimental group 1, except that it also contained at the beginning of the questionnaire a web link to online information about the availability heuristic. The participants selected the computer at random as soon as they arrived. Experiment participants were informed that their participation was voluntary and that their responses would be used confidentially only for research purposes. Experimenters controlled the study at all times, ensuring, for example, that participants were not aware of the treatments given to peers and that there was no communication between them.

2.2 Balance testing

Balance tests, also referred to as randomization checks in the experimental design literature, check whether the means of pretreatment variables are approximately the same among treatment and control units. That is, we must ensure that the groups are comparable in terms of relevant characteristics to avoid confounding. Random assignment, while not guaranteeing to distribute any one characteristic perfectly among treatment groups, stochastically distributes all characteristics, known and unknown (Mutz et al. 2019). Table 1 shows the final number of experiment participants.Footnote 7 The so-called experimental group 1 includes the participants who received only one treatment (financial education), while the so-called experimental group 2 includes those who received two treatments (i.e., financial education along with information on the availability heuristic). Control group participants did not receive any treatment. Table 1 provides evidence that key predetermined student characteristics are balanced across treatment arms. Overall, the results suggest that the experimental design and randomization were appropriate.Footnote 8 It is important to note that randomly allocated groups do not need to be the same size for true baseline comparability; if the characteristics of the participants are comparable, any differences in group sizes do not bias the result (Elkins 2015).

2.3 Factor manipulated in the experiment

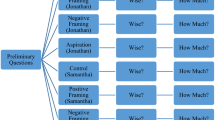

In experimental research, one or more independent variables are typically altered, and the effects of this change on another dependent variable(s) are examined. This change or experimental manipulation is usually referred to as the treatment (Rogers and Révész 2020). In the FUNCAS randomized controlled experiment, the independent variable (or experimental factor) was the training content for graduate school decision-making. At the beginning of the experiment, the treatment groups were exposed to several stimuli, while the control group didn’t receive any intervention.Footnote 9 Specifically, experimental manipulation consisted of providing subjects in experimental group 1 with a short online course on the cost–benefit analysis methodology when deciding whether or not to pursue a graduate degree and the suitability of taking out a student loan to fund a graduate degree program (Modules 1 and 2 in Fig. 1). In particular, the first module explains how to make the decision to invest in a master's degree by estimating its economic viability using the net present value (NPV) criterion. Through an applied example, students are told that they must take all relevant costs and benefits into account when making a decision. First, they are taught to estimate the direct and opportunity costs of completing a master's degree. Then, they are shown how to weigh expected earnings based on the probabilities of finding employment as undergraduates and graduates. Finally, they learn how to calculate the benefits of the master's degree—the difference in expected income throughout working life—and how to discount these amounts to take into account the different values of money over time. In the second module, the decision to finance a master's degree through a graduate loan is analyzed, which is presented as an example, and certain financial concepts are discussed, such as the debt capacity, the calculation of the cost of the loan, the repayment period, and especially the importance of preparing a cash budget. Subjects in experimental group 2 received the same financial education treatment (i.e., Module 1 and Module 2) along with information on the so-called availability heuristic (or availability bias) that can affect decisions about graduate studies (Module 3 in Fig. 1). In particular, the third module introduces the topic of cognitive biases in decision-making, that is, how decision-makers not only involve logical and rational considerations but also psychological aspects. Then it focuses on the availability heuristic, which consists of people evaluating the probability that events occur because of the ease with which relevant examples come to mind. Based on examples, both general and specific regarding decisions to invest in and finance a master's degree, it is recommended to rely on reliable and proven sources of information as well as expert advice. “Appendix” Fig. 2 shows the actual script of the debiasing treatment.

2.4 Outcome measures

Researchers typically draw upon experimental research designs to determine whether there is a causal relationship between the treatment and the outcomes (Rogers and Révész 2020). After the intervention, the FUNCAS randomized controlled experiment focused on variables that precede (influence) the decision to request a loan to complete a master's degree, that is, variables that precede debt behavior. According to the literature, applying for a loan can be considered a planned decision, constituting the theory of planned behavior (TPB) as an appropriate conceptual framework for the study of borrowing decisions by university students (e.g., Chudry et al. 2011). The TPB, proposed by Ajzen (1985, 1991) and updated on its website in 2019 (Ajzen 2019), indicates that there is a set of key variables that precede behavior, such as attitude, subjective norm, perceived control over the behavior, and the intention to carry out that behavior.

In the experiment, the dependent variables (or outcome measures) were those corresponding to the TPB, applied to the specific behavior under analysis, which was the decision to request a loan to pursue a master's degree after graduating from college. First, the attitude toward student loan borrowing tries to evaluate the degree to which an individual has a more favorable or more adverse personal judgment toward student loan indebtedness for graduate education. Second, the subjective norm evaluates whether significant referents approve or disapprove of the debt behavior. Third, the perceived financial self-efficacy (the perceived control over behavior) reflects the individual's beliefs about the ease or difficulty of requesting a loan to finance a master's degree. Finally, the intention to take out a graduate loan assesses if the student plans, will make an effort, or intends to request a student loan to get a master's degree (behavioral intention).

Experimenters had to decide how to collect data on those dependent variable outcomes. The variables of attitude, subjective norm, perceived behavioral control, and behavioral intention were measured using an online questionnaire designed expressly for this experiment by the researchers. Based on a case study, participants were asked to rate on a seven-point Likert-type scale several items related to the variables that precede (influence) borrowing behavior (Table 2). The guidelines recommended on Ajzen's website (2019) on how to construct TPB questionnaires were followed in the experiment questionnaire design, as well as articles with specific recommendations for measuring young people's attitudes toward debt (e.g., Callender and Jackson 2008; Gamble et al. 2019; Harrison et al. 2015; Haultain et al. 2010) and other related scales used in the literature (e.g., Chudry et al. 2011; Koropp et al. 2014; Kraft et al. 2005).

2.4.1 Experimental scenario setup

The responses to the questionnaire items on the variables that precede the borrowing behavior to finance a graduate education were based on a case study that was presented to the experimental subjects after the intervention and to the control group right at the beginning of the experiment. An experimental, scenario-based research approach was chosen based on the fact that hypothetical decisions, as they are made by participants in experiments, are expected to be “as useful as real ones for finding out how people think about certain types of problems” (Baron 2007, p. 40).

In particular, all participants were instructed to imagine that after completing their undergraduate degree, they were interested in pursuing a master's degree (12 months) from a recognized business school. In relation to the viability of the program, they were told that the master's degree was viable from an economic point of view (net present value greater than zero), but for its financing, they only had funds equivalent to 50% of its total cost. The total cost was €30,000—the direct costs of tuition and books of €12,000 plus the cost of living for the year of completion of the master's degree of €18,000 (“Appendix” Fig. 4). Nonetheless, they could finance their educational expenses through a graduate loan according to the bank's financing conditions, which were shown to all participants in the experiment (“Appendix” Fig. 5).

Although the literature on earnings beliefs shows that students often think too optimistic about future earnings and employment (e.g., Betts 1996; Wiswall and Zafar 2015, 2021), nevertheless, experiment participants were provided with objective labor market information on expected wages and employability rates during their working lives as college graduates and MBA grads (“Appendix” Fig. 4). The experimental scenario setup also controlled for the possibility that the borrowing decision was not influenced by the probability of dropping out of the program due to poor academic performance. Participants were instructed to assume that they would devote themselves full-time to the program and that they would be expected to maintain their high academic performance from college.

2.4.2 Descriptive analysis of the dependent variables

Table 2 shows the descriptive statistics of the variables that precede (influence) the decision to request a loan to complete the master's degree. In Table 2, average scores below the midpoint for the debt attitude, self-efficacy, and intention items would indicate more perceived financial strain, greater perceived difficulty in making the debt decision, and debt aversion (also called loan aversion). On the contrary, average scores above the midpoint for the subjective norm would indicate more positive behaviors toward student loan debt. Our goal now is to test whether these financial outcomes are statistically different between treated and untreated subjects. We specifically want to examine whether educating university students about certain heuristics, such as availability, is needed. We hypothesize that the financial decision-making process can be enhanced by means of debiasing; this intervention can relieve stress, encourage social acceptance, enhance self-efficacy, and boost intentions in the decision to apply for a graduate loan.

3 Estimating treatment effects

The ultimate aim of experimental studies is to assess the effects of interventions. “An impact evaluation is a systematic and empirical investigation of the effects of an intervention; it assesses to what extent the outcomes experienced by affected individuals were caused by the intervention in question” (Clarke et al. 2019, p. 1). However, there is still little empirical evidence of the positive causal effects of financial education programs (Hastings et al. 2012). Kaiser et al. (2022) recently ran a meta-analysis of studies conducted in the last decade that experimentally evaluated financial education programs, showing that financial education improves both financial knowledge and financial behavior. Nonetheless, studies examining experimentally the underlying mechanisms by which prospective graduate students make decisions about debt-financed graduate education are very limited. The present study has thus sought to contribute to the emerging literature interested in studying the implications of behavioral biases in financial decision-making in general (e.g., Loerwald and Stemmann 2016) and among university students in particular (e.g., Cox et al. 2020).

In the current study, the students have not yet carried out any financial behavior. However, as we have already mentioned, attitude, subjective norm, perceived control, and behavioral intention capture the motivational influences on behavior (Ajzen 1985, 1991). We want to check if the variables that precede (influence) the decision to request a student loan to complete a master's degree (i.e., dependent or outcome variables) are statistically different between treated and untreated subjects. More specifically, we want to test whether the treated developed a pro-student loan debt attitude, improved the perception that significant referents approve of the decision to take out a loan, felt more secure about making a student loan decision, and had a greater intention of taking out a student loan. We pay special attention to testing the effect on the borrowing behavior antecedent variables of including in the training information about the presence of the availability heuristic in decision-making. Knowing whether financial education interventions work is crucial in the context of the current study since refusing to take out a student loan to get the required 50% of funding would require giving up postgraduate studies.Footnote 10

3.1 Methodology

In order to assess the causal impact of interventions (Fig. 1) on outcomes (Table 2), the current study suggests summarizing the information displayed in Table 2 into “an index of student loan decision-making.” The construction of composite indices for assessing multidimensional phenomena is, in fact, a central issue in data analysis, particularly in economics and sociology. In this study, following the methodology proposed by Krishnan (2010), two methods will be used to formulate a single index: z-score and factor analysis. As a previous step, we calculate Cronbach’s alpha coefficient, which is a measure of internal consistency, that is, how closely related a set of survey items are as a group. It is considered to be a measure of scale reliability. The alpha coefficient for the five items in Table 2 is 0.7011, suggesting that the items have relatively high internal consistency. Analysts frequently use 0.7 as a benchmark value for Cronbach’s alpha (Hair et al. 2013).

3.1.1 Building an index of student loan decision-making

Standardization is generally acknowledged as a necessary step before proceeding to the aggregation process. A z-score is computed as:

We standardize each variable shown in Table 2 separately to z-scores (standardization to mean = 0 and SD = 1). As a further analysis, we combine all five answers into an average of z-scores following Kling et al. (2007), a standardization that weighs all variables equally. This final standardized index of student loan decision-making will be the dependent variable Y of a standard OLS regression:

In Eq. (1), we regress the index of student loan decision-making on the treatment dummy variables: \(x_{1}\) for the financial education treatment, and \(x_{2}\) for the financial education along with debiasing treatment. The parameters of the regression equation are estimated with the primary focus on the coefficients for the treatment indicators (Imbens and Rubin 2015). In Eq. (1), β1 and β2 are the parameters of interest and measure the causal effect of being randomized into the financial education or financial education plus debiasing treatment arm, respectively, relative to the control arm. The β1 and β2 coefficients capture the differences between the outcomes of each treatment group and the control group (the reference category). The estimated coefficients allow us to evaluate the effectiveness of each intervention since the individuals were randomly assigned to the different groups. In Eq. (1), we also consider pretreatment covariates: \(x_{3}\) = gender; \(x_{4}\) = business majors; \(x_{5}\) = academic ability; \(x_{6}\) = student loan experience; and \(x_{7}\) = mother’s education. Majors and mother’s education will be introduced into the econometric estimation as a set of dummy variables. Adding covariates to the regression typically improves the precision of the estimates (Imbens and Wooldridge 2009). It is important to highlight that it is appropriate to control only for pretreatment predictors when estimating causal effects in experiments (Gelman and Hill 2006).

A second way of generating a summary indicator of student loan decision-making is by extracting a first-factor using principal component analysis (PCA). PCA is a multivariate statistical technique used to reduce the number of variables in a data set into a smaller number of dimensions (Vyas and Kumaranayake 2006). The PCA has a number of excellent mathematical properties (Kendall and Stuart 1968). The most important property is that the index obtained from the first principal component explains the largest portion of the variance of the individual indicators. A PCA-based indicator of student loan decision-making is derived from variables shown in Table 2. This index will also be the dependent variable in Eq. (1).

Table 3 shows the descriptive statistics for both indices of student loan decision-making. Higher (positive) values would indicate a less worrying or stressful debt decision, greater acceptance from significant referents about requesting a student loan, feeling more secure in making a student loan decision, and a greater intention of taking out a student loan.

3.2 Results

Table 4 shows the results of the econometric estimation (descriptive statistics are shown in “Appendix” Table 5). The most notable result is that, in both econometric estimates (Model I and Model II), the coefficients associated with the financial education treatment (experimental group 1) are not statistically significant. There is only statistical significance when, in addition to financial education, the subjects are exposed to a debiasing treatment (experimental group 2). More specifically, the estimated coefficients associated with experimental group 2 are positive and statistically significant (Model I and Model II), which indicates that being exposed to the treatment combination of financial education and debiasing information positively affects student loan decision-making. In particular, this intervention positively impacted the variables that precede the decision to request a loan to complete a master's degree by developing a pro-student loan debt attitude, enhancing students’ perception that significant referents approve of the debt behavior, increasing the students' perceived financial self-efficacy, and favoring their intention to finance graduate studies through student loans. Our results highlight the fact that financial education alone may not be enough to change students’ behaviors but must be accompanied by information on heuristics, such as availability, that affect financial decision-making as well. For example, do not be influenced by negative news about student loan defaults and check the information with reliable sources, which was the specific debiasing strategy in the experiment.

In relation to pretreatment covariates, gender showed statistical significance in both models (Table 4); in particular, we get negative estimated coefficients. In fact, borrowing money to get a master's degree was perceived by women as stressful/worrying. Ratcliffe and McKernan (2013) already found that more than half of Americans who had student loan debt were worried that they would be unable to repay their debt; those who were women were more likely to have student loan stress. Self-efficacy (perceived behavioral control) in graduate loan decision-making was also lower for women than for men. This result corroborates others shown by the literature, namely, that women feel more insecure about money matters than men (e.g., Fünfgeld and Wang 2009). Regarding majors, college seniors majoring in Finance and Accounting were more likely to report higher levels of perceived financial self-efficacy in comparison with those majoring in Business. This result is sensible given the curriculum of this student profile, which has a special emphasis on financial operations, financial and banking products, financial instruments and markets, etc. However, the possibility of taking out a student loan to get a master's degree after completing the undergraduate degree was perceived by those majoring in Tourism as something stressful/worrying and they also perceived that they had lower financial self-efficacy in comparison with those majoring in Business. It is also worth noting that past behavior (prior student loan experience) is positively associated with the index of student loan decision-making. The influence of past behavior on future behavior has attracted, in fact, considerable attention in the literature on the theory of planned behaviour—see Eagly and Chaiken (1993) for a review. Prior negative experiences in the credit markets by students and their families could deter potential borrowers from taking on student debt (Boatman et al. 2016).Footnote 11

4 Discussion

Obtaining a post-college credential is almost always worth it, as evidenced by higher earnings over a lifetime (e.g., Carnevale et al. 2021). A standard cost–benefit analysis would suggest that a rational student should pursue a master’s degree if the benefits outweigh the costs—flows of benefits and costs properly discounted at the present moment. In a certain sense, this rational choice analysis is an optimization-based approach. In the experimental setting, participants were told that the master's program was viable from an economic point of view (NPV > 0). However, the basic question put forward by behavioral finance theorists is: “Are investors always rational?” The rational choice would be to take out a student loan to be able to concentrate on grad school. In the experiment, a case study was designed to have 50% of the focal loan share. The possibility of borrowing €15,000 was reasonable for the master's degree contemplated in the experiment. In the United States, for instance, master’s degree borrowers took out an average of $19,400 in loans during the 2017–2018 academic year (NCES 2022). However, not all individuals are willing to invest in an economically viable master's degree if that investment requires student debt. In the current study, we wanted to verify if the financial education interventions influenced the antecedent variables predicting borrowing behavior. This article makes an original contribution by highlighting that student loan financial education alone may not be enough to change financial attitudes, financial self-efficacy, or borrowing intentions. The present study underscores the significance of educating university students about specific heuristics or mental shortcuts, such as availability, as it mitigates stress associated with the decision to borrow funds for graduate school and enhances their self-perception of their capacity to make such a decision. Experimental subjects who received only financial education are not statistically different from those in the control group.

In terms of policy implications, this study can inform and improve current approaches to financial education. So far, financial education programs aimed at university students have been offered by educational institutions and financial entities, but an impact evaluation of their effectiveness is scarce. Impact evaluation collects information on whether the program is making a difference in previously identified and desired outcome measures. To avoid self-selection bias, the causal effects of financial education programs aimed at improving student loan financial literacy should be assessed in experimental settings. This study also emphasizes the necessity for higher education institutions to be concerned with informing and raising awareness about the psychological factors that are present in student loan financial decision-making. In the current study, the intervention focused on the availability heuristic. It's a rule of thumb or mental shortcut that causes people to estimate the probability of an outcome based on how prevalent or familiar that outcome is in their lives. For example, bad news on social media about someone who completed a master's degree but can't find a job and pay off the student loan because they are personally and emotionally overwhelmed may influence the decision not to apply for a graduate loan, although official statistics indicate that most students who take out a graduate loan have no difficulty repaying it. Hence the need to inform students that they should base their decisions on reliable and verified sources of information, as well as expert advice.

4.1 Limitations and future research

This article has presented innovative results derived from experimental research. Nonetheless, we are aware of its limitations, especially regarding external validity given that the experiment was conducted with a group of undergraduate students in a business school. External validity refers to the extent to which the results of an experiment can be generalized to a larger population or real-world settings. It assesses whether the results obtained from a study are applicable beyond the specific context and sample used in the experiment. In fact, a common critique of experiments is that because they often take place in the laboratory, it is debatable the extent to which the results can be generalized and applied to the broader world (Grant and Wall 2009).

External validity results primarily from the replication of particular experiments across diverse populations (McDermott 2011). Replication, which is the intentional repetition of previous research to confirm the previous results, serves as a de facto reliability check on previous research (Plucker and Makel 2021). The generalizability of our experimental results requires extending the study to other university students from other fields of study. This is a task that the project researchers are already working on.Footnote 12 But we should also emphasize that if a researcher discovers a significant difference between the treatment and control conditions, the experiment is deemed internally valid (Campbell 1957). Internal validity is thus the degree to which a study establishes the cause-and-effect relationship between the treatment and the observed outcome (Slack and Draugalis 2001), and it has been verified in the present study. Therefore, it is expected that a replication of the experiment with other university students (humanities, STEM degrees, health sciences, etc.) will yield similar conclusions. Although field experiments also attempt to define treated and untreated groups in college financial aid research (e.g., Burland et al. 2023; Dynarski et al. 2021), a replication of the current study will nevertheless have to remain laboratory-based since there are no public loans for (under)graduate education in Spain. Future research should also explore the long-term effectiveness of interventions in the context of student loan debt. The current study only examined short-term changes in financial outcomes.

5 Conclusion

Master’s degrees likely offer greater lifetime earning potential and other non-monetary benefits associated with degree attainment. Investments in advanced degrees are also beneficial to the economy and society. Nonetheless, the fact of having to finance a graduate degree with a student loan can curb investments in human capital because of fear of debt (anti-debt attitudes) or insecurity in making student loan decisions (low perceived financial self-efficacy). Can financial education programs help in this regard?

This article experimentally investigates this topic by designing online training that teaches experimental subjects in the first treatment arm how to calculate the net present value (NPV) of the investment in a master's degree and informs them about the convenience of requesting a student loan to finance the completion of the degree. In particular, the importance of maintaining an adequate debt ratio, the amount of money to borrow based on expected income after graduation, the relevance of the annual percentage rate (APR) when applying for a student loan, and loan repayment options. Nonetheless, since few studies have examined student loan borrowing behavior through the lens of experimental and behavioral finance, the current study also includes information about possible cognitive biases that could affect financial decision-making. More specifically, experimental subjects in a financial education plus debiasing treatment arm are explained that heuristics are shortcuts to simplify the assessment of probabilities in a decision-making process and that the availability heuristic is a mental shortcut people use to make decisions about the likelihood of an event based on how immediately an example or case comes to mind. This bias may also affect the decision of whether or not to pursue a master’s degree and take out a loan to finance it. It is recommended that they base their decisions on reliable and verified sources of information as well as expert advice.

To evaluate the impact of interventions on the dependent variables (outcomes), this study uses the theory of planned behavior (TPB) as a framework of reference. Specifically, two indices of student loan decision-making are constructed as summary indicators of student loan debt attitude, the perception that significant referents approve the student loan indebtedness, financial self-efficacy in student loan decision-making, and graduate loan borrowing intention. An important lesson from the results of this study is that financial education programs aimed at potential graduate students can help in the graduate school decision-making process. However, financial education alone is not enough. Financial education programs, in addition to informing students about the formal (technical) aspects of investment in an advanced degree and indebtedness through a graduate loan, should also inform students about some heuristics that are present in the decision-making process. Heuristics often arise in the context of insufficient information. So, while determining whether financial education can influence financial attitudes, financial self-efficacy, and borrowing intentions is an important question for policymakers and counselors alike, removing or at least mitigating cognitive biases appears to be an important goal as well.

Notes

A graduate degree may still be a good investment, even if it means borrowing money to do so. For example, a U.S. worker with a bachelor’s degree will earn $2.8 million over his or her lifetime (median lifetime earnings); the figure is $3.2 million for a master’s degree holder (Carnevale et al. 2021).

The basic classification between cognitive and emotional biases is obtained from Pompian (2012).

An HCC is basically a loan that is repaid as a percentage of income (up to a monthly cap).

After an intensive search, we were unable to find any academic documents that studied the availability bias in financial decisions related to student loans.

For example, during the 2017–2018 academic year, 39% (41%) of U.S. undergraduate (graduate) students took out student loans (National Center for Education Statistics [NCES] 2022).

FUNCAS is an acronym that stands for Fundación de las Cajas de Ahorros (Foundation of Savings Banks). It was the institution that financed the project, hence the name. The study was framed within the training needs contemplated in the Financial Education Plan (2018–2021) of the Bank of Spain, aimed at helping individuals learn to make informed financial decisions.

After eliminating individuals due to inconsistent response patterns observed or difficulty with the Spanish language, the final sample consisted of 525 participants (53.1% were women and 46.9% were men).

One of the assumptions of ANOVA is that the variances are the same across groups. Before running a one-way ANOVA, we used Levene’s test to check the assumption of equal variances. Levene’s test confirmed that this assumption was not violated.

The full training given in the experiment is available on request.

In principle, given the assumption of full-time dedication to the program, there would be no room for the possibility of working while studying.

The estat ovtest command in Stata performs the Ramsey RESET test (REgression Specification-Error Test). The RESET omitted variables test is shown at the bottom of Table 4. Using a significance p value of 0.05, the RESET test is not significant, indicating there are no omitted variables in the model.

There are various barriers that exist to being able to launch experiments of this type, from the request for funding to authorization by the institutions to undertake the study, without forgetting the entire complex process of recruiting participants.

If intervals do not overlap, the corresponding means are significantly different.

To test the hypothesis that all group means are equal, we used a one-way ANOVA. The F-value of 236.15 (p < 0.001) told us that at least one of the group means differs from another. A Tukey pairwise comparison (95% confidence) confirmed that the means of experimental group 1 and the control group were not significantly different, but those means were statistically different from the mean of experimental group 2. Before performing a one-way ANOVA, we used Levene’s test to verify the assumption of equal variances. The analysis of this appendix was performed using Stata® 18 along with Minitab® 21 statistical software.

References

Ajzen I (1985) From intentions to actions: a theory of planned behavior. In: Kuhl J, Beckman J (eds) Action-control: from cognition to behavior. Springer, Berlin, pp 11–39

Ajzen I (1991) The theory of planned behavior. Organ Behav Hum Decis Process 50(2):179–211

Ajzen I (2019) Constructing a theory of planned behavior questionnaire. www.people.umass.edu/aizen/pdf/tpb.measurement.pdf

Baker HK, Nofsinger JR (eds) (2010) Behavioral finance: investors, corporations, and markets. Wiley, London

Baron J (2007) Thinking and deciding, 4th edn. Cambridge University Press, Cambridge

Baum S, Schwartz S (2015) Student aid, student behavior, and educational attainment. In: Castleman BL, Schwartz S, Baum S (eds) Decision making for student success. Routledge, London, pp 50–74. https://doi.org/10.4324/9781315767932

Betts JR (1996) What do students know about wages? Evidence from a survey of undergraduates. J Hum Resour 30(1):27–56

Boatman A, Evans B, Soliz A (2016) Understanding loan aversion in education: evidence from high school seniors, community college students, and adults (CEPA working paper no. 16–15). Stanford Center for Education Policy Analysis. http://cepa.stanford.edu/wp16-15

Burland E, Dynarski S, Michelmore K, Owen S, Raghuraman S (2023) The power of certainty: experimental evidence on the effective design of free tuition programs. Am Econ Rev Insights 5(3):293–310

Caetano G, Palacios M, Patrinos HA (2019) Measuring aversion to debt: an experiment among student loan candidates. J Fam Econ Issues 40(1):117–131

Callender C, Jackson J (2008) Does the fear of debt constrain choice of university and subject of study? Stud High Educ 33(4):405–429

Campbell DT (1957) Factors relevant to the validity of experiments in social settings. Psychol Bull 54(4):297–312

Carnevale AP, Cheah B, Wenzinger E (2021) The college payoff. Georgetown University Center on Education and the Workforce

Chudry F, Foxall G, Pallister J (2011) Exploring attitudes and predicting intentions: profiling student debtors using an extended theory of planned behavior. J Appl Soc Psychol 41(1):119–149

Clarke GM, Conti S, Wolters AT, Steventon A (2019) Evaluating the impact of healthcare interventions using routine data. BMJ 365:l2239. https://doi.org/10.1136/bmj.l2239

Cox JC, Kreisman D, Dynarski S (2020) Designed to fail: effects of the default option and information complexity on student loan repayment. J Public Econ 192:104298

Croskerry P, Singhal G, Mamede S (2013a) Cognitive debiasing 1: origins of bias and theory of debiasing. BMJ Qual Saf 22(Suppl 2):ii58–ii64

Croskerry P, Singhal G, Mamede S (2013b) Cognitive debiasing 2: impediments to and strategies for change. BMJ Qual Saf 22(Suppl 2):ii65–ii72

Cunningham AF, Santiago DA (2008) Student aversion to borrowing: who borrows and who doesn't. Institute for Higher Education Policy and Excelencia in Education. https://eric.ed.gov/?id=ED503684

De Bondt WFM, Thaler RH (1995) Financial decision making in markets and firms: a behavioral perspective. Handb Oper Res Manag Sci 9(13):385–410

De Gayardon A, Callender C, Green F (2019) The determinants of student loan take-up in England. High Educ 78(6):965–983

Dittrich D, Güth W, Maciejovsky B (2001) Overconfidence in investment decisions: an experimental approach (CESifo working paper no. 626). Center for Economic Studies and ifo Institute (CESifo)

Dynarski S, Libassi CJ, Michelmore K, Owen S (2021) Closing the gap: the effect of reducing complexity and uncertainty in college pricing on the choices of low-income students. Am Econ Rev 111(6):1721–1756

Eagly AH, Chaiken S (1993) The psychology of attitudes. Harcourt Brace Jovanovich College Publishers, Orlando

Elkins MR (2015) Assessing baseline comparability in randomised trials. J Physiother 61(4):228–230

Fischoff B (1982) Debiasing. In: Kahneman D, Slovic P, Tversky A (eds) Judgment under uncertainty: heuristics and biases. Cambridge University Press, Cambridge, pp 422–444

Fünfgeld B, Wang M (2009) Attitudes and behaviour in everyday finance: evidence from Switzerland. Int J Bank Mark 27(2):108–128

Furnham A, Boo HC (2011) A literature review of the anchoring effect. J Socio-Econ 40(1):35–42

Gamble A, Gärling T, Michaelsen P (2019) Young adults’ attitudes toward borrowing. In: Hauff JC, Gärling T, Lindblom T (eds) Indebtedness in early adulthood: causes and remedies. Palgrave Macmillan, New York, pp 65–87

Gelman A, Hill J (2006) Causal inference using regression on the treatment variable. In: Data analysis using regression and multilevel/hierarchical models. Cambridge University Press, pp 167–198. https://doi.org/10.1017/CBO9780511790942.012

Grant AM, Wall TD (2009) The neglected science and art of quasi-experimentation: why-to, when-to, and how-to advice for organizational researchers. Organ Res Methods 12(4):653–686

Hair JF, Black WC, Babin BJ, Anderson RE (2013) Multivariate data analysis, international edn. Pearson, London

Harrison N, Agnew S, Serido J (2015) Attitudes to debt among indebted undergraduates: a cross-national exploratory factor analysis. J Econ Psychol 46:62–73

Hastie R, Dawes RM (2010) Rational choice in an uncertain world: the psychology of judgment and decision making, 2nd edn. Sage Publications, London

Hastings JS, Madrian BC, Skimmyhorn WL (2012) Financial literacy, financial education and economic growth (NBER working paper series Nº 18412). National Bureau of Economic Research

Haultain S, Kemp S, Chernyshenko OS (2010) The structure of attitudes to student debt. J Econ Psychol 31(3):322–330

Imbens GW, Rubin DB (2015) Regression methods for completely randomized experiments. In: Causal inference for statistics, social, and biomedical sciences: an Introduction. Cambridge University Press, pp 113–140. https://doi.org/10.1017/CBO9781139025751.008

Imbens GW, Wooldridge JM (2009) Recent developments in the econometrics of program evaluation. J Econ Lit 47(1):5–86

Kahneman D (2011) Thinking, fast and slow. Macmillan, New York

Kahneman D, Tversky A (1979) Prospect theory: an analysis of decision under risk. Econometrica 47(2):263–291

Kaiser T, Lusardi A, Menkhoff L, Urban C (2022) Financial education affects financial knowledge and downstream behaviors. J Financ Econ 145(2):255–272

Kendall MG, Stuart A (1968) The advanced theory of statistics, vol 3. Charles Griffin & Co., London

Kling JR, Liebman JB, Katz LF (2007) Experimental analysis of neighborhood effects. Econometrica 75(1):83–119

Koropp C, Kellermanns FW, Grichnik D, Stanley L (2014) Financial decision making in family firms: an adaptation of the theory of planned behavior. Fam Bus Rev 27(4):307–327

Kraft P, Rise J, Sutton S, Røysamb E (2005) Perceived difficulty in the theory of planned behaviour: perceived behavioural control or affective attitude? Br J Soc Psychol 44(3):479–496

Krishnan V (2010) Constructing an area-based socioeconomic index: a principal components analysis approach. Early Child Development Mapping Project, Edmonton

Loerwald D, Stemmann A (2016) Behavioral finance and financial literacy: educational implications of biases in financial decision making. In: Aprea C, Wuttke E, Breuer K, Keng Koh N, Davies P, Greimel-Fuhrmann B, Lopus JS (eds) International handbook of financial literacy. Springer, Berlin, pp 25–38

Marx BM, Turner LJ (2020) Paralysis by analysis? Effects of information on student loan take-up. Econ Educ Rev 77:102010

McDermott R (2011) Internal and external validity. In: Druckman JN, Green DP, Kuklinski JH, Lupia A (eds) Cambridge handbook of experimental political science. Cambridge University Press, Cambridge, pp 27–40

Mutz DC, Pemantle R, Pham P (2019) The perils of balance testing in experimental design: Messy analyses of clean data. Am Stat 73(1):32–42

National Center for Education Statistics (2022) 2017–18 national postsecondary student aid study, administrative collection (NPSAS:18-AC): first look at student financial aid estimates for 2017–18. U.S. Department of Education

Organisation for Economic Co-operation and Development (2016) Skills matter: Further results from the Survey of Adult Skills. https://doi.org/10.1787/9789264258051-en

O'Shaughnessy T (2023) Reality check: exploring unrealistic undergraduate salary expectations. Clever. https://listwithclever.com/research/college-student-salary-expectations-study/

Park HM (2009) Comparing group means: T-tests and one-way ANOVA using STATA, SAS, R, and SPSS (The University Information Technology Services (UITS) Center for Statistical and Mathematical Computing Working Paper). Indiana University. https://scholarworks.iu.edu/dspace/handle/2022/19735

Plucker JA, Makel MC (2021) Replication is important for educational psychology: Recent developments and key issues. Educational Psychologist 56(2):90–100

Pompian MM (2012) Behavioral finance and wealth management: how to build investment strategies that account for investor biases, 2nd edn. Wiley, London

Porto N, Cho SH, Gutter M (2021) Student loan decision making: experience as an anchor. J Fam Econ Issues 42(4):773–784

Ratcliffe C, McKernan SM (2013) Forever in your debt: who has student loan debt, and who’s worried? The Urban Institute. https://www.urban.org/sites/default/files/publication/23736/412849-Forever-in-Your-Debt-Who-Has-Student-Loan-Debt-and-Who-s-Worried-.PDF

Rogers J, Révész A (2020) Experimental and quasi-experimental designs. In: McKinley J, Rose H (eds) The Routledge handbook of research methods in applied linguistics. Routledge, London, pp 133–143

Sandri S (2009) Reflexivity in economics: an experimental examination on the self-referentiality of economic theories. Springer, Berlin

Slack MK, Draugalis JR (2001) Establishing the internal and external validity of experimental studies. Am J Health Syst Pharm 58(22):2173–2181

Thiese MS (2014) Observational and interventional study design types: an overview. Biochem Med 24(2):199–210

Tversky A, Kahneman D (1974) Judgment under uncertainty: heuristics and biases. Science 185(4157):1124–1131

Vyas S, Kumaranayake L (2006) Constructing socio-economic status indices: how to use principal components analysis. Health Policy Plan 21(6):459–468

Wiswall M, Zafar B (2015) Determinants of college major choice: identification using an information experiment. Rev Econ Stud 82(2):791–824

Wiswall M, Zafar B (2021) Human capital investments and expectations about career and family. J Political Econ 129(5):1361–1424

Funding

Funding for open access publishing: Universidad de Granada/CBUA. Funding was provided by FUNCAS Foundation through the FUNCASEDUCA Program of financial education research grants (Ref. EF021/2018). Funding for open access charge: Universidad de Granada / CBUA.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares that he has no conflict of interest.

Additional information

Responsible Editor: Gerlinde Fellner-Röhling.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1 Debiasing the availability heuristic

Tversky and Kahneman (1974) proposed several heuristics, or rules of thumb, that are prevalent and persistent in human judgment and decision-making. Heuristics are simplified procedures for assessing probabilities. The availability heuristic is a mental shortcut people use to make decisions about the likelihood of an event based on how immediately an example or case comes to mind. Our brains tend to rely on what is most easily accessible in our memory when formulating judgments or choices. For example, one may think that the probability of having a fatal accident while riding a bicycle is much higher than walking down the street, perhaps because the media usually echoes the first fatality more than the last. Nonetheless, walking down the street is 7 times more likely to result in death than riding a bicycle (https://injuryfacts.nsc.org). When judging the probability of an event—the likelihood of having a fatal accident, say—people often search their memories for relevant information. While this is a perfectly sensible procedure, it can produce biased estimates because not all memories are equally retrievable or “available,” in the language of Tversky and Kahneman (1974). More recent and more prominent events will weigh more and distort the estimate. This example was incorporated into the information provided to the participants (experimental group 2). It was explained to them that the so-called availability heuristic is a bias that may affect the decision of whether or not to pursue a master’s degree and take out a loan to finance it. Based on the literature (e.g., Fischoff 1982), they were recommended to base their decision on reliable and verified sources of information (e.g., official statistics) as well as expert advice. Figure 2 reproduces the debiasing treatment in the FUNCAS experiment (an English translation of the actual Spanish script).

It is relevant now to check the experimentally manipulated factor related to availability bias since this factor implies the inclusion of information prepared ad hoc, and it is necessary to know if this has been perceived correctly. The experiment questionnaire included a final question in which all participants were asked to rate what they considered most likely in relation to having a fatal accident, from 1, having an accident walking on the street, to 7, having an accident while riding a bike. If the information was perceived correctly, individuals in the condition that included the availability bias should score significantly lower than those who did not receive such treatment.

The results obtained are in line with the above. Figure 3 shows that the means do not differ from the statistical point of view when comparing the control group and the experimental group that did not receive the information regarding availability bias (e.g., experimental group 1), and that the means of these two groups are significantly different from the average scores given by the individuals who received information related to availability bias (i.e., experimental group 2).Footnote 13 The mean of this last group was lower, which means a greater probability of a fatal accident occurring on the street, which was the correct answer.Footnote 14

Appendix 2 Data about the program and the labor market

Experiment participants were presented with what recent undergraduates and graduates earn in their first few years after leaving university. The information on average salaries in the Spanish labor market was obtained from the National Institute of Statistics (https://ine.es/) (Fig. 4).

Appendix 3 Graduate student loan banking brochure

The most common way to finance a master’s degree program is by taking out student loans to cover the cost of tuition, fees, books, and sometimes also living costs or various expenses. Figure 5 reproduces the graduate student loan banking brochure that was shown to all participants in the experiment. The information was based on advertising brochures that some Spanish private banks are offering to graduate students.

Appendix 4

See Table 5.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Salas-Velasco, M. Debiasing the availability heuristic in student loan decision-making. Empirica 51, 501–528 (2024). https://doi.org/10.1007/s10663-024-09609-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-024-09609-z

Keywords

- Debiasing treatment

- Experimental finance

- Financial education intervention

- Student loan borrower behavior