Abstract

The devastating effects of the financial and economic recessions within the last two decades have led researchers to question whether there is a connection between the public and private financial sectors that contributes to the rapid propagation of crisis. We analyze the fractional cointegrating structure between the private and public debt-to-GDP ratios for 17 European countries to examine the relevance of this relationship as an amplification channel of shocks. On the one hand, the univariate fractional integration approach reveals that shocks have permanent effects on financial variables in all the countries considered. On the other hand, we find that the number of countries for which private and public debt are cointegrated increase after the Great Recession.

Similar content being viewed by others

References

Aliyu RM, Usman UA (2013) An econometric study of the impact of external debt, public debt and debt servicing on national savings in Nigeria: a cointegration approach. Int J Manag Soc Sci Res 2(2):73–83

Andrade JS, Syssoyeva-Masson I (2016) Investigating the presence of long memory in debt series and its relation with growth. Economic modelling, 9627

Andrés J, Arce O, Thaler D, Thomas C (2020) When fiscal consolidation meets private deleveraging. Rev Econ Dyn 37:214–233

Antonini M, Lee K, Pires J (2013) Public sector debt dynamics: the persistence and sources of shocks to debt in 10 EU countries. J Money Credit Bank 45(2–3):277–298

Arteta C, Hale G (2008) Sovereign debt crises and credit to the private sector. J Int Econ 74(1):53–69

Baillie R (1996) Long memory processes and fractional integration in econometrics. J Econom 73(1):5–59

Bank of International Settlements (2021a) BIS credit-to-GDP gap statistics. BIS statistics warehouse

Bank of International Settlements (2021b) BIS long series on total credit. BIS statistics warehouse

Batini N, Melina G, Villa S (2019) Fiscal buffers, private debt, and recession: the good, the bad and the ugly. J Macroecon 62:103044

Bernardini M, Forni L (2020) Private and public debt interlinkages in bad times. J Int Money Finance 109:102239

Bhargava A (1986) On the theory of testing for unit roots in observed time series. Rev Econ Stud 53(3):369–384

Bohn H (2007) Are stationarity and cointegration restrictions really necessary for the intertemporal budget constraint? J Monet Econ 54(7):1837–1847

Caporale GM, Gil-Alana LA (2014) Fractional integration and cointegration in US financial time series data. Empir Econ 47:1389–1410

Caporale GM, Carcel H, Gil-Alana LA (2018) The EMBI in Latin America: fractional integration, non-linearities and breaks. Finance Res Lett 24:34–41

Caporale GM, Gil-Alana LA, Martin-Valmayor M (2021a) Persistence in the market risk premium: evidence across countries. J Econ Finance 45:413–427. https://doi.org/10.1007/s12197-020-09519-3

Caporale GM, Gil-Alana LA, Malmierca M (2021b) Persistence in the private debt-to-GDP ratio: evidence from 43 OECD countries. Appl Econ 53(43):5018–5027. https://doi.org/10.1080/00036846.2021.1912700

Cholifihani M (2008) A cointegration analysis of public debt service and GDP in Indonesia. IBT J Bus Stud 4(2):68–81

Corsetti G, Kuester K, Meier A, Müller G (2013) Sovereign risk, fiscal policy, and macroeconomic stability. Econ J 123(566):F99–F132. https://doi.org/10.1111/ecoj.12013

Cuestas JC, Gil-Alana LA, Regis PJ (2015) The sustainability of European external debt: What have we learned? Rev Int Econ 23(3):445–468

Cuestas JC, Gil-Alana L, Malmierca M (2023) Credit-to-GDP ratios-non-linear trends and persistence: evidence from 44 OECD economies. J Econ Stud 50(3):448–463

De Blas B, Malmierca M (2020) Financial frictions and stabilization policies. Econ Model 89:166–188

Drudi F, Giordano R (2000) Default risk and optimal debt management. J Bank Finance 24(6):861–891

Engle R, Granger CWJ (1987) Cointegration and error correction: represent estimation and testing. Econometrica 55:251–276

Gil-Alana LA (2003) Testing of fractional cointegration in macroeconomic time series. Oxford Bull Econ Stat 65(4):517–529

Gil-Alana LA, Moreno A (2012) Uncovering the U.S. term premium: an alternative route. J Bank Finance 36:1184–1193

Gil-Alana LA, Robinson PM (1997) Testing of unit roots and other nonstationary hypothesis in macroeconomic time series. J Econom 80(2):241–268

Gogas P, Plakandaras V, Papadimitriou T (2014) Public debt and private consumption in OECD countries. J Econ Asymmetries 11:1–7

Granger CWJ (1980) Long memory relationships and the aggregation of dynamic models. J Econom 14:227–238

Granger CWJ (1981) Some properties of time series data and their use in econometric model specification. J Econom 16:121–131

Granger CWJ, Joyeux R (1980) An introduction to long-memory time series models and fractional differencing. J Time Ser Anal 1:15–29

Guerini M, Moneta A, Napoletano M, Roventini A (2018) The Janus-faced nature of debt: results from a data-driven cointegrated SVAR approach. Macroecon Dyn 24(1):24–54

Hassler U, Rodrigues PMM, Rubia A (2014) Persistence in the banking industry: fractional integration and breaks in memory. J Empir Finance 29:95–112

Hosking JRM (1981) Fractional differencing. Biometrika 68:165–176

İlgün MF (2016) Financial development and domestic public debt in emerging economies: a panel cointegration analysis. J Appl Econom Bus Res 6(4):284–296

Johansen S, Nielsen MO (2010) Likelihood inference for a nonstationary fractional autoregressive model. J Econom 158:51–66

Johansen S, Nielsen MO (2012) Likelihood inference for a fractionally cointegrated vector autoregressive model. Econometrica 80:2667–2732

Johansyah MD, Supriatna AK, Rusyama E, Saputra J (2021) Application of fractional differential equation in economic growth model: a systematic review approach. AIMS Math 6(9):10266–10280

Jordà O, Schularick M, Taylor AM (2014) Private credit and public debt in financial crises. FRBSF economic letter. Federal Reserve Bank of San Francisco

Marinucci D, Robinson PM (2001) Semiparametric fractional cointegration analysis. J Econom 105:225–247

Robinson PM (1994) Efficient tests of nonstationary hypotheses. J Am Stat Assoc 89:1420–1437

Robinson PM, Hualde J (2003) Cointegration in fractional systems with unknown integration orders. Econometrica 71(6):1727–1766

Robinson PM, Hualde J (2007) Root-n-consistent estimation of weak fractional cointegration. J Econom 140:450–488

Saad W (2011) Assessing sustainability of lebanese public debt: a cointegration analysis approach. Int Res J Financ Econ 62:143–156

Schmidt P, Phillips PCB (1992) LM tests for a unit root in the presence of deterministic trends. Oxford Bull Econ Stat 54(3):57–287

Sowell F (1992) Modelling long run behaviour with the fractional ARIMA model. J Monet Econ 29(2):277–302

Tarasov VE, Tarasova VV (2016) Long and short memory in economics: fractional order difference and differentiation. Int J Manag Soc Sci 5(2):327–334

Vides JC, Golpe AA, Iglesias J (2018) How did the Sovereign debt crisis affect the Euro financial integration? A fractional cointegration approach. Empirica 45(4):685–706. https://doi.org/10.1007/s10663-017-9386-2

Vides JC, Golpe AA, Iglesias J (2020) U.S. budget deficit sustainability revisited: long run, persistence, and common trend. FinanzArchiv: Public Finance Anal 76(4):370–395

Acknowledgements

Luis A. Gil-Alana gratefully acknowledges financial support from the MINEIC-AEI-FEDER PID2020-113691RB-I00 project from ‘Ministerio de Economía, Industria y Competitividad’ (MINEIC), ‘Agencia Estatal de Investigación’ (AEI) Spain and ‘Fondo Europeo de Desarrollo Regional’ (FEDER). An internal Project from the Universidad Francisco de Vitoria is also acknowledged. Comments from the Editor and two anonymous reviewers are gratefully acknowledged.

Funding

No funding was received.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Responsible Editor: Jesus Crespo Cuaresma.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

See Table 6.

Appendix 2: Main statistics and graphical trends of the data

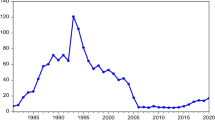

See Tables 7 and 8, Figs. 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18 and 19.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Malmierca-Ordoqui, M., Gil-Alana, L.A. & Bermejo, L. Private and public debt convergence: a fractional cointegration approach. Empirica 51, 161–183 (2024). https://doi.org/10.1007/s10663-023-09594-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-023-09594-9