Abstract

This study examines the link between economic complexity and environmental pollution by exploiting a massive and unprecedented decline of CO2 emissions and complexity in the former socialist transition countries after the fall of the iron curtain. We refer to the extended theories of the Environmental Kuznets Curve (EKC), stating that environmental pollution follows an inverted u-shaped course with respect to economic complexity. Using comprehensive data of 27 countries for the period 1995–2017, our results show that the EKC can be found for countries whose complexity rose over time. Additionally, since the results for production-based and consumption-based CO2 emissions are similar, we can discard emissions offshoring as a major explaining factor. Consequently, our findings suggest that more complex products have influenced the u-shaped course of the EKC. However, as the turning point is associated with high levels of pollution, our estimates imply that complexity may even exacerbate environmental issues in the short and middle run in less developed countries.

Similar content being viewed by others

1 Introduction

This decade will be marked by the so-called Green New Deal. The ecological transformation of the economy and the need to reduce environmental emissions are major issues of our time. To better understand the mechanisms of the interplay between economic transition and emissions, it is worth examining a past comprehensive transformation—that of the former socialist states.

The corresponding debates on the right way to tackle climate change are heavily polarized. While advocates of radical interventions are in favor of reducing resource and energy use with concepts of degrowth, proponents of market-based solutions rather demand industrial restructuring towards a greener and more sustainable growth path (e.g., Kallis et al. 2018; Hickel and Kallis 2020; Fernandes et al. 2021). The underlying question of these debates is whether and how we can overcome the trade-off between environmental pollution and economic prosperity. This trade-off is described by the Environmental Kuznets Curve (from here on, abbreviated as EKC), which, in its conventional variant, assumes a non-linear relationship between environmental pollution and GDP per capita in the form of an inverted U (Grossman and Krueger 1995; Dinda 2004).

In recent years, many papers have returned their attention to the EKC, presumably because climate change and global warming have become increasingly urgent issues. Parallelly, the so-called economic complexity approach by Hidalgo and Hausmann (2009) and subsequent work, such as Hausmann et al. (2014), has opened a fresh perspective on economic development. Hidalgo and Hausmann (2009) propose a product-based indicator that aims to relate the products an economy is exporting to its knowledge intensity or, framed differently, its innovation capabilities. Hidalgo and Hausmann (2009) refer to this knowledge or innovation intensity as complexity and frame their indicator as the Economic Complexity Index (from here on abbreviated as ECI). Thus, for economic complexity, the underlying question regarding the pollution-development nexus modifies as follows: Can we overcome the trade-off between environmental pollution and economic prosperity by developing more complex products? Since products with more environmental benefits are, on average, more complex than products without these benefits, a complexity-driven bending of the EKC would suggest that more complex products reduce environmental pollution from a certain threshold (Mealy and Teytelboym 2020).Footnote 1

Various papers have since analyzed the relationship between economic complexity and environmental pollution in order to verify the characteristic inverted u-shape of the EKC hypothesis (e.g., Neagu 2019; Chu 2021; Chu and Le 2022; Balsalobre-Lorente et al. 2022; Pata 2021; Swart and Brinkmann 2020). Chu (2021) examines the relationship with a sample of 118 countries and confirms the EKC. Neagu (2019) uses a sample of 25 countries that are members of the European Union and also finds an inverted U in favor of the EKC. In addition, Chu and Le (2022) and Balsalobre-Lorente et al. (2022) confirm the EKC by examining the pollution paths of G7 countries and the PIIGS countries (Portugal, Italy, Ireland, Greece, Spain), respectively. In contrast, Pata (2021) and Swart and Brinkmann (2020) use time-series data for the USA and Brazil, respectively, and provide mixed evidence: The EKC is found to hold for the USA but not for Brazil. A related strand of literature examines the EKC with GDP per capita and adds ECI as an explanatory variable. While Can and Gozgor (2017) and Leitão et al. (2021) report a negative relationship between CO2 emissions per capita and economic complexity, Boleti et al. (2021) and Nathaniel (2021) find that economic complexity increases CO2 emissions.

We supplement the literature in three ways. First, to our knowledge, we are the first to examine the link between environmental pollution and economic complexity for the former socialist transition countries. By doing that, we test the EKC hypothesis with a particularly well-suited sample since the former socialist transition countries experienced a major shock at a fixed point in time that impacted their future development. We exploit a massive and unprecedented decrease in CO2 emissions (minus 35%) and economic complexity (minus 11%) during the fall of the iron curtain, which credibly provides us with a sample of countries with comparable development starting points. We are aware, however, that despite the simultaneity of the shock, these countries already exhibited a decent degree of heterogeneity beforehand. The parallelly starting dynamics provide a useful ground for studying the EKC hypothesis, as it describes emission paths along the long-term economic development of countries which should ideally start at the beginning of the observation period. This distinguishes our approach from the previous literature, which, to our knowledge, did not yet consider a sample with a well-defined starting point. If country samples are heterogeneous and lack a joint starting point, it necessarily follows that differently developed countries are located on different parts of the curve during a given observation period. Consequently, there is no chance to observe the same parts of the curve for different countries. Therefore, a given (OLS) estimator will necessarily force a fit over the data that extrapolates the missing (and possibly large) parts of a country’s curve using data from other countries. Many papers (and so do we) circumvent the problem of heterogeneous countries by splitting the sample by income levels (see, e.g., Chu 2021; Doğan et al. 2019) or by choosing a fairly homogeneous group of countries (see, e.g., Nathaniel 2021; Alvadaro et al. 2021; Leitão et al. 2021; Balsalobre-Lorente et al. 2022; Zheng et al. 2021). However, the issue of the lack of a well-defined starting point has been largely neglected in the literature. In our view, analyses that identify the EKC by exploiting panel variation should, at best, conduct their analysis with fairly homogeneous country samples with similar starting points to be able to observe different countries at similar parts of the curve. We contribute to the literature by offering an analysis that addresses both of these issues, thereby putting the empirical literature on a more solid footing.

Second, we highlight the (conventionally neglected) three-dimensionality of the EKC and thereby problematize the usage of the Economic Complexity Index when studying the question at hand. In this respect, we argue that the theoretical foundation of the EKC hinges on the implicit assumption that economic development progresses over time, which must not necessarily be fulfilled when studying less developed countries. In addition, as the ECI is a relative measure that captures different aspects of development than, for instance, per capita GDP, this indicator often decreases over time. Guided by these considerations, we propose a sample split based on the dynamics and not on the levels of complexity. By doing that, we bring the empirics of the EKC closer to its conceptual foundation and raise awareness for the challenges the usage of the ECI evokes. In our view, this has not yet been extensively problematized so far. Why is the proposed sample split particularly sensible for our sample? After the fall of the iron curtain and the deindustrialization of the socialist economies, the countries underwent a structural transformation. Hence, our sample provides the unique possibility to explore how different dynamics of development are linked to the existence of the EKC. Countries that progressed towards stronger and more inclusive institutions and opened their increasingly liberalized markets gradually exhibited increased knowledge and productive capabilities. This improved their production processes and resulted in higher complexity of their manufactured products. On the other hand, countries that did not transform towards more inclusive institutions exhibited opposite economic complexity dynamics. With our sample, we can simultaneously observe the pollution and complexity trajectories of both groups of countries.

Third, we study the question at hand with both production-based and consumption-based CO2 emissions. We do that because one explanation for the existence of the EKC is that it is due to emissions offshoring, i.e., more developed countries offshore emission-intensive production to less developed countries, thereby reducing the emissions intensity of their domestic production without changing the emissions intensity of their consumption. In this study, we provide suggestive evidence on this strand of explanation. Overall, with our contributions to the literature, we aim to provide an empirical implementation of the EKC with respect to economic complexity that is more related to the theoretical foundations of this question.

Methodologically, we use the Fixed Effects estimator and include linear and squared terms of ECI to account for the assumed nonlinearity of the relationship of interest. Additionally, we verify the inverted u-shape relationship with the U-test proposed by Lind and Mehlum (2010). We estimate the parameters of the respective model for various indicators of environmental pollution, most importantly per capita carbon dioxide emissions (CO2).

The paper proceeds as follows. Section 2 overviews the related literature and presents our general framework. Section 3 introduces the data used in this study and presents descriptive evidence on emissions and complexity trajectories. Further, we describe the considered countries and introduce our sample split. Section 4 proposes our methodological approach and describes the control variables used in our estimations. Section 5 presents the results of our empirical exercises and studies the robustness of our findings. Section 6 concludes.

2 The link between economic complexity and environmental pollution

2.1 The environmental Kuznets curve

The relationship between economic growth and environmental pollution has become an important research topic in environmental economics over the last three decades. One of the addressed key questions is whether environmental pollution is (at least initially) a necessary trade-off for economic growth. Against this background, the so-called Environmental Kuznets Curve has emerged as a model for describing and explaining the route of environmental pollution in the course of the development of a country. The origin of the model stems from Simon Kuznets, who examined the relationship between income inequality and economic growth. His discovered inverted u-shaped curve was subsequently coined Kuznets Curve (Kuznets 1955). The environmental aspect was added after Grossman and Krueger (1995) found a similar inverted u-shaped pattern for the relationship between environmental pollution (dark matter, sulfur dioxide, and suspended particles) and economic growth (in the sense of GDP per capita). This early evidence was further corroborated by the analyses of Panayotou (1993, 1997). The basic premise of the model is that if a country’s income is low, emissions of certain pollutants would initially rise as income increases but would then decline again after a certain threshold, despite further increases in income.

Since then, there has been a vast number of empirical studies trying to prove the characteristic reversed u-shape for various countries individually but also for different country sets, using a variety of pollution indicators (an overview of the empirical results can be found in the work of Lieb (2003) and Shahbaz and Sinha (2019)). Besides that, many considerations have been put forward in the literature for the cause of this pattern. One of the most prominent arguments assumes that in countries with rising incomes, residents would shift their preferences to non-economic aspects, thus bringing issues such as environmental pollution to the fore (McConnell 1997; Roca 2003). Furthermore, it is argued that reductions in emissions may result from structural changes in production due to technological advances (De Bruyn et al. 1998). Another reasoning is based on the idea that, in the course of globalization, polluting industries would be shifted to less developed countries, thus explaining the decrease in emissions in developed countries and the increase in less developed countries (Suri and Chapman 1998; Kearsley and Riddel 2010). A further crucial aspect mentioned is the effect of innovations that enable wealthy countries to green their polluting production processes (Pasche 2002). However, despite all the studies and theoretical considerations, there is still no unambiguous scientific opinion on the existence of the EKC. On the contrary, a considerable body of criticism can be found in the literature, some of which strongly challenge both the basic theoretical concepts and the fundamental approach (Stern 2004).

2.2 Economic complexity

The Economic Complexity Index has been proposed by Hidalgo and Hausmann (2009) as a tool to measure a country’s productive structure. Building on global export data, this indicator assigns a metric complexity value to each economy, which can be interpreted as an indirect measure of the country's existing (innovative) capabilities. The general idea of the complexity measure is that the knowledge intensity of an economy is reflected in the sophistication of the products it is competitively exporting. This approach follows a growing body of literature suggesting that countries and regions do not arbitrarily diversify into new activities but rather that the existing set of local capabilities conditions which new activities they will develop in the future (Boschma et al. 2015; Essletzbichler 2015; Rigby 2015; Hartmann et al. 2017; Neffke et al. 2011). In this context, one of the crucial aspects is that the underlying local capabilities result from a long (sometimes historical) process and are, therefore, difficult to build and copy from other regions (Boschma 2017). This is due to their general form as a combination of different factors, such as the region's infrastructure, natural resources, institutions, and the tacit nature of the knowledge involved (Hausmann 2016; Maskell and Malmberg 1999).

In the context of the economic complexity approach, the authors emphasize that many (and especially the decisive) capabilities represent tacit knowledge, i.e., knowledge that is difficult to transmit and acquire and that often takes years to develop (Hausmann et al. 2014). As a consequence, economies develop along their existing capabilities, resulting in capability-specific development trajectories. Coined on the ECI approach, this is reflected in a capability-specific development of the export basket of an economy. In their work, Hidalgo and Hausmann (2009) and Hausmann et al. (2014) show that almost all products are, to a certain degree, related to each other and therefore share certain capabilities. They further argue that the capabilities needed to produce one good may or may not be useful in the production of other goods. For example, the capabilities for producing shirts would be useful for producing blouses since both products require similar capabilities, while they provide little support for producing engines. Following this logic, the export basket thus indicates which products an economy is capable of making, but also provides information about which products a country is currently not yet capable of making. A complex economy (reflected in a high index value) is therefore characterized as an economy with a diverse export basket as it combines a vast number of different capabilities to generate a diverse mix of products.

2.3 Economic complexity and the Environmental Kuznets Curve

In recent years, several studies have examined the link between economic complexity and environmental pollution. For this purpose, various authors have revisited the Environmental Kuznets Curve model, setting the complexity of a country, rather than income per capita, as the crucial variable. Following the reversed u-shape pattern of the EKC, they assume that with increasing economic complexity, pollution increases to a certain complexity level, after which pollution decreases despite further increasing complexity. The body of literature on this topic is rapidly growing, and the evidence is mixed so far. In time-series analyses, the characteristic inverse u-shaped curve has been validated for France (Can and Gozgor 2017) and the USA (Pata 2021), while it could not be documented for China (Yilanci and Pata 2020) and Brazil (Swart and Brinkmann 2020).

Many papers also use cross-country variation to investigate the EKC hypothesis. In terms of econometric specification (non-linear inclusion of the ECI) and regression technique, we most closely lean on the work of Neagu (2019), Chu (2021), Chu and Le (2022), and Balsalobre-Lorente et al. (2022). Neagu (2019) identifies the characteristic inverse u-shape for 25 states of the European Union for the period 1995–2017. Chu (2021) confirms the EKC hypothesis for CO2 using a broader data set that includes 118 countries from 2002 to 2014, while Chu and Le (2022) study pollution paths in G7 countries between 1997 and 2015 and find evidence in favor of the EKC. Balsalobre-Lorente et al. (2022) confirm the existence of the EKC with economic complexity for the PIIGS countries (Portugal, Italy, Ireland, Greece, Spain) for the period 1990–2019.

A growing number of studies assume a linear relationship between economic complexity and environmental pollution. For instance, Doğan et al. (2019) examine 55 countries over the period 1971 to 2014 and divided them into three distinct groups to reflect their income levels. Their results suggest that economic complexity affects CO2 emissions differently across development and income levels, increasing pollution in lower- and upper-middle-income countries and decreasing CO2 emissions in high-income countries. Similarly, Alvarado et al. (2021) use a sample of 17 Latin American economies and find heterogeneous effects of economic complexity on the ecological footprint. In addition, Boleti et al. (2021) use a sample of 88 developed and developing countries from 2002 to 2012. Based on fixed-effects instrumental variable estimations, they found that while an increasing complexity value is associated with improved environmental performance, it is also associated with poorer air quality (higher PM2.5 pollution, CO2, methane, and nitrous oxide emissions). The evidence of a positive link between economic complexity and CO2 emissions has been corroborated by the work of Neagu (2020) and Nathaniel (2021). In contrast, Zheng et al. (2021) and Leitão et al. (2021) report a negative link between economic complexity and CO2 emissions.

The aspect that makes the complexity approach compelling for this analysis is that it is one of the strongest tools to explain the income variance of countries and forecast relatively accurately the growth trajectories of countries (Hausmann et al. 2014). This feature allows a novel perspective on the relationship between environmental pollution and economic development based on the corresponding complexity values of countries. Firstly, this is due to the underlying assumption that rising economic complexity values indicate an increasing knowledge and capability base in a society, which is arguably more consistent with the theoretical drivers of the relationship implied by the EKC. For instance, a growing knowledge base of a society could well translate into a preference shift towards demanding a more sustainable output or the development of more innovative and green products. Generally, knowledge (which should be reflected in the complexity value) about the adverse consequences of climate change and environmental pollution could induce societies to pursue a more rigorous sustainability pathway, which could then be reflected in falling CO2 emissions. Secondly, the economic complexity approach more conclusively deals with specific characteristics of countries, such as the natural resources intensity of their output, which are difficult to capture in the classical approach (Badeeb et al. 2020).Footnote 2

In addition, ECI can also be used to illustrate structural changes in production. This can be explained by the fact that the economic complexity of a country corresponds to the average complexity of its exported products. On this basis, it seems reasonable to examine the properties of the products in order to draw conclusions about structural changes and their environmental impact. Let us now consider the least complex products, such as raw nuts (rank 2848), sesame seeds (2845), and natural rubber (2840).Footnote 3 It is noticeable that these are often raw products or products that contain only a small number of production steps, mainly associated with manual labor and little mechanized activity, requiring a low level of capabilities (Observatory of Economic Complexity 2021). Therefore, it is plausible that countries specializing in these products (resulting in a low economic complexity value) have a relatively low environmental footprint. To enhance the complexity of a country, it would need to diversify its economy into new industries and products. Here various authors argue that industries do not diversify randomly; instead, they diversify into industries and products for which the region or country has the necessary capabilities (Hidalgo et al. 2007). For instance, a country would first develop from extracting non-complex raw materials (e.g., raw cotton) to processing those raw materials into a more complex product (e.g., cotton shirts). Let us now look at those more sophisticated products located in the middle of the complexity ranking, such as wrist-watches (1427), scissors (1449), and manicure or pedicure sets (1517). It becomes evident that these are primarily large-scale production items with the characteristics of energy-intensive manufacturing processes.

As a result, it is reasonable to believe that the negative impact on the environment would increase. This would be further strengthened by the possibility of transferring production processes from other countries to this country (offshoring) based on the capabilities of a society now in place. As countries move to the highest level of complexity, the associated products shift from economies of scale to economies of scope. Examples for these highly complex products include machining centers for working metal (4), machines and mechanical appliances (having individual functions) (6), and medical, surgical instruments and appliances (magnetic resonance imaging apparatus) (13). In contrast to the less complex products, the associated value creation is increasingly based on the knowledge component and less on the production factors characteristic for mass production. In addition, the highly complex products are often at the end of a global value chain, whereby the preceding energy-intensive processes can be outsourced to other countries. Moreover, the applied indicator must consider the determinants of pollution in a globalized set of actors ranging from individuals to international corporations, which in turn are subject to the influence of national and international institutions as well as technological development. This makes the use of a wide-ranging indicator particularly compelling in the context of our study.

Previous studies have already shown that ECI has implications for institutions (e.g. Hartmann et al. 2017) and a positive interaction has been found between economic complexity and human capital (Zhu and Li 2017), while ECI strongly correlates with traditional indicators of technological sophistication (Felipe et al. 2012). Furthermore, Mealy and Teytelboym (2020) showed that products with environmental benefits and renewable energy products are, on average, more complex (defined as products that require more capabilities) than typical products and therefore require more complex production capabilities. As a result, we argue that ECI is a supposedly better indicator of economic development in the context of the EKC than income (as measured by GDP per capita) as it captures a more tailored range of potential factors. We, therefore, hypothesize that the characteristic inverse u-shape curve also applies to the relationship between environmental pollution and economic complexity. Thus, in economies with low complexity, pollution would initially increase as complexity increases, and after a certain level of complexity, pollution would decrease despite further increasing complexity.

3 Data, sample (split) and descriptive statistics

3.1 Data

We use a comprehensive panel-data set that contains 27 former socialist transition countries throughout 1995–2017. To limit possible skewing and unintended effects of the collapse of the Soviet Union, the year 1995 was chosen as the starting point with the presumption that at least most of the associated (unintended) influences would have been subsided by then. The sample does not include the countries Serbia, Montenegro, and Kosovo, as no fully comprehensive data is available. In total, our sample contains 621 observations. For our explanatory variable of interest, the Economic Complexity Index (ECI), we use data from the Atlas of Economic Complexity Dataverse, provided by the Growth Lab at Harvard University (The Growth Lab at Harvard University 2019). More specifically, we use the “Growth Projections and Complexity Rankings” dataset, which provides economic and product complexity values based on two product classification systems, namely the Harmonized System (HS, 1992) and the Standard International Trade Classification (SITC, Revision 2). We rely our analyses on the latter; however, altering the classification system does not change our results significantly.

For the environmental indicators analyzed in this study, we use the CO2 and Greenhouse Gas Emissions Database provided by Our World in Data (Ritchie and Roser 2020). This dataset collects information from various data sources, namely the Global Carbon Project for CO2 emissions and the Climate Watch Portal for greenhouse gas emissions. Our main environmental variables are the annual production-based and consumption-based carbon dioxide emissions (CO2), measured in tonnes per person. For robustness analyses, we also examine total methane, greenhouse gas and nitrous oxide emissions (including land use change and forestry), measured in tonnes of carbon dioxide-equivalents per capita as well as annual production-based emissions of carbon dioxide (CO2), measured in kilograms per kilowatt-hour of primary energy consumption.Footnote 4 The control variables used in our estimations are extracted from the World Bank Development Indicators and cover various country characteristics (The World Bank 2021a). The additional variables for our robustness analyses are extracted from World Bank Open Data (The World Bank 2021b). An in-depth description of these variables follows in Sect. 4.2.

3.2 The transition shock

Since most of the existing studies describe a gradual and country-specific structural shift towards a more complex and knowledge-based economy, the problem for cross-country studies emerges that they catch countries on different development stages at the same point in time. Also, the lack of a well-defined starting point renders the modeling of the CO2-ECI nexus as an inverted u-shaped relationship at least questionable as it is unknown which point at the curve is hit by the chosen observation period. We, therefore, argue that related studies examine country groups without providing a credible explanation for why their specific time period should have captured the EKC (e.g., Chu 2021; Chu and Le 2022; Balsalobre-Lorente et al. 2022). For instance, Chu (2021) studies the relationship for the period 2002–2014. If the EKC describes a long-run structural shift, it needs to be clarified why it should have started in 2002 and what happened beforehand.

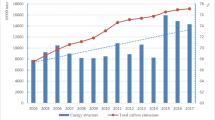

We mitigate this point of concern by choosing the former socialist transition countries as a study object. Our argument is that they started their transitional shift from a socialist planned economy to a market economy approximately parallelly with the end of the East Bloc. During the transition phase, the countries experienced a massive decline in per capita CO2 emissions (which has been noted by, for instance, York 2008) and economic complexity. The substantial shock that was triggered by the collapse of the Soviet Union is depicted in Fig. 1, where we show a long time series (from 1962) of per capita CO2 emissions and economic complexity. The gray-shaded area highlights the transition phase (which we set between 1989 and 1994). To show that the shock was specific to the countries in our sample, we display CO2 per capita and complexity trajectories for other European countries as a comparison group.Footnote 5 Between 1989 and 1994, the transition countries reduced their per capita CO2 emissions by, on average more than 35%, while they slightly increased by, on average, 6,5% in the other European countries. Simultaneously, the complexity of transition countries declined by 11% on average, while it barely changed in the other European countries (increase by 0.53%). Therefore, Fig. 1 reveals that our specific sample choice indeed provides us with a set of countries with a well-defined and joint starting point since beforehand, both variables of interest experienced a major (negative) shock.

3.3 Sample (split) and descriptive statistics

Despite existing similarities between the former socialist transition countries, the transformation towards a liberal market economy occurred differently from country to country (Gros and Steinherr 2012). As we show in this section, especially countries that were part of the Soviet Union, with longer history as socialist states, exhibit a negative development regarding economic complexity. This imposes a fundamental threat to the underlying EKC hypothesis since it relies on the implicit assumption that the economic prosperity of a country increases with time. Reporting an inverse u-shaped relationship between complexity and pollution for countries with decreasing complexity would imply that these countries started at the end of the curve and moved back along it. For greater clarity, the problem is depicted in Fig. 2. The left panel shows the stylized relationship in countries whose complexity decreased over time, and the right panel in countries that became more complex over time. For the underlying EKC hypothesis to make sense, in the left panel, we would have to observe that the development starts at the right end of the curve and then follows its course. Statistically, this is detectable, but from a theoretical point of view, this curve does not make sense as we would have to assume that the curve is entered at the “wrong” side of the curve.

Put differently, the EKC, in fact, describes a three-dimensional problem, with the three dimensions being environmental pollution, economic development, and time. Up to this point, the third dimension is largely neglected in the literature even though it is most relevant for studies that use economic complexity as an indicator. In contrast to GDP per capita, which on average reliably increases in the middle and long run, this is not necessarily the case for the Economic Complexity Index. This arises from the fact that ECI is a relative measure calculated based on the network of world trade flows. Additionally, ECI is standardized; hence, its values can change solely based on changes in its mean and standard deviation. Therefore, it is not unusual that the complexity of countries decreases over time.

To account for the different developments during and after the transformation phase and for the problem of decreasing ECI values, we divide our sample into two sub-groups. These groups are built by analyzing the evolution of economic complexity in each country. One group experienced an increase in their economic complexity over the observation period of 1995–2017; the other group experienced constant or decreasing complexities over time.Footnote 6

Table 1 presents the list of countries according to their respective groups. Belarus, Bosnia and Herzegovina, Bulgaria, Croatia, Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Romania, Slovakia, and Slovenia belong to the group of increasing ECI countries. The other group consists of Albania, Armenia, Azerbaijan, Georgia, Kazakhstan, Kyrgyzstan, Moldova, Mongolia, Northern Macedonia, Russia, Tajikistan, Turkmenistan, Ukraine, and Uzbekistan and is characterized by constant or decreasing complexities over time. Interestingly, the latter group predominantly consists of countries that formerly belonged to the Soviet Union and are rather located in Central Asia. In contrast, the former group predominantly consists of countries now members of the European Union.

This emphasizes that the former socialist transition countries are very heterogeneous, even though they share the experience of a joint transition phase. However, this does not imply that they have been a homogeneous group of countries during and shortly after the fall of the iron curtain. This can be seen in Fig. 3, where we plot the group-specific distributions of ECI in 1995 (first observation in our sample). Figure 3 reveals that already in the mid-1990s the countries of the two groups tremendously varied in terms of their economic complexity: While countries whose complexity increased after transition were comparably complex already in 1995, countries whose complexity decreased after the transition phase already lagged behind in 1995. These early heterogeneities do not challenge our approach since we make use of development dynamics that started at a fixed point in time. However, it shows that splitting the sample is particularly sensible with our specific country sample.

To study group-specific ECI dynamics, we show the complexity trajectories for every country in Fig. 4. Countries belonging to the increasing ECI group are displayed in the left panel, and those belonging to the decreasing or constant ECI group are displayed in the right panel. As can be seen, complexity in the increasing ECI countries evolved rather steadily while it fluctuated more in the other group. By construction, the heterogeneity between these two groups has increased until 2017.Footnote 7

How did these stark differences come about? In our case, the fact that the complexity of countries of the second group decreased over time could be explained with the partial deindustrialization of some of the former Soviet Union countries, moving to a more natural resources based economic structure (see, for instance, Oldfield 2000 for Russia and Batsaikhan and Dabrowski 2017 for Central Asia). Further, countries with a higher endowment in natural resources and more entrenchment of the ruling elite during the socialist period developed weaker institutions regarding voice and accountability, government effectiveness, rule of law, regulatory quality, absence of corruption, and political stability (Beck and Laeven 2006). Beck and Laeven (2006) further argue that the behavior of the ruling elite was crucial in the subsequent institution-building of countries. In countries with fewer natural resources and with shorter history under socialism, the elites rather fostered a transformation towards a market-based economy with strong institutions (e.g., regarding property rights or rule of law). In contrast, the elites in countries with a high endowment of natural resources and a longer history under socialism aimed to extract economic rents for themselves (by grabbing previously state-owned large enterprises) and gain political power. Empirically, institutional quality correlates negatively with natural resource reliance and years under socialism, while it correlates positively with economic growth (Beck and Laeven 2006).

How can these insights be connected to the evolution of economic complexity? The literature on innovation economics considers institutions as a central factor for the absorptive capacity that determines the innovativeness of a country in the context of regional and national innovation systems (Narula 2004; Perilla Jimenez 2019). There is also empirical evidence of a positive link between institutions and innovation (Rodríguez-Pose and Cataldo 2015). As the ECI measures the innovative capabilities of an economy, there exists a link between institutional quality and economic complexity. Therefore, it is reasonable to argue that the different institutional developments documented by Beck and Laeven (2006) were crucial in explaining the stark differences between the complexity trajectories of the two considered groups of our study.

The summary statistics presented in Table 2 further illustrate these heterogeneities. Table 2 shows summary statistics of the two variables of interest, namely the Economic Complexity Index (ECI) and the CO2 emissions per capita for both constructed country groups. In addition, information on GDP per capita is provided. Following Chu (2021), we rescaled ECI such that it is strictly positive, which makes the coefficients in the following estimations easier to interpret.Footnote 8 Also note that ECI itself is already standardized (Hausmann et al. 2014).

As can be seen, the group of countries with an increasing ECI is comparably complex, with an average of 2.95. In contrast, the constant and decreasing ECI countries exhibit an average complexity of 1.76. The difference between the two groups is also reflected in the per capita GDP values. On average, GDP per capita in the first group (increasing ECI) is nearly twice as high as in the second group (decreasing or constant ECI). A considerable difference between the two groups can also be found when comparing the per capita CO2 emissions. The first group emits an average of 6.76 tons of CO2 per capita, while the latter group’s emissions only amount to an average of 4.73 tons per capita. Hence, among the former socialist transition countries, the most complex countries are the heaviest polluters.

The heterogeneity of our sample is also visible in Fig. 5 where the per capita CO2 emissions are plotted against economic complexity for both groups. In the interest of greater clarity, we show the yearly averages of these two variables. As can be seen, the relationship of interest tremendously varies by the group of countries considered. While for the countries whose complexity decreased or barely changed over time, a negative relationship can be documented, Fig. 5 reveals a relationship that resembles an inverse u-shaped form for the countries whose complexity rose over time. This is a first hint that the EKC describes the CO2-ECI path of the increasing ECI countries decently, while it seems that it is not a useful model for the second group of countries. Hence, there are two layers of nonlinearity to deal with in our study. The first layer is implied by the EKC and the proposed inverse u-shaped relationship. The second layer comes through the heterogeneity of the countries considered. In our view, it is essential to consider both layers to gain a more accurate picture of the underlying relationship.

4 Empirical analysis

In the empirical analysis, we aim to examine the relationship between economic complexity and environmental pollution, measured by carbon dioxide (CO2) emissions per capita. More precisely, the inverse u-shaped relationship between these two variables, as proposed by the Environmental Kuznets Curve hypothesis, is under investigation. Therefore, we include the Economic Complexity Index (ECI) and its square as the main explanatory variables in our regressions. In Sect. 2, we described three different strands of explanation for the prevalence of the EKC: the preference shift towards more environmental awareness, the development of green innovations, and the offshoring of emission-intensive industries to less developed countries. In our empirical analysis, we, therefore, differentiate between production-based and consumption-based CO2 emissions to examine the offshoring hypothesis more directly. If offshoring was the dominating factor, we should see that in the production-based emissions but not necessarily in the consumption-based emissions.

4.1 Methodological approach

As the underlying relationship between economic complexity and environmental pollution describes country-specific economic developments, we propose a fixed-effects model to examine the EKC hypothesis. By that means, we can exploit within-country variation and account for different levels of the curves. As seen in Figs. 3–5, the CO2 and complexity levels vary substantially between countries in our sample. Therefore, we think it is sensible to absorb country-specific effects. We aim to identify the EKC by including a linear and a squared term of the Economic Complexity Index as explanatory variables. The coefficient of the linear term of ECI in the regression should be positive and significant, which corresponds to the upward-sloping part of the curve, while the coefficient of the square of ECI should be negative and significant, which indicates a declining slope of the curve or, put differently, a concave course of the EKC. Generally, we most closely follow the estimation strategy of Chu (2021) and Chu and Le (2022) and rely on standard panel techniques with fixed effects. As Chu (2021), we additionally test for joint significance of ECI and ECI2 and apply the U-test, proposed by Lind and Mehlum (2010), to identify an inverse u-shaped course of the EKC. The U-test calculates the maximum (since we assume an inverse U) of the function y = f(x), where y represents per capita CO2 emissions, and x represents economic complexity. It also provides confidence intervals for the extremum point and checks whether it lies within the data range. Finally, we scrutinize the plausibility of these extremum points and the course of the curves resulting from our estimates. To this end, we also show linear predictions of the CO2 emissions along the distribution of ECI for the estimated parameters of our models.

The equation describing the model to identify the curve takes the following form:

In this model, Xi,t represents a matrix of control variables, γi represents country fixed effects, ωt captures time fixed effects, and ɛi,t is a random error term. We regress the CO2 emissions per capita, as measured in metric tons, on ECI and its square and GDP per capita to study the effect of economic complexity, conditional on income. This is important since we want to disentangle economic complexity from factors that can increase the income of an economy (such as natural resources) but do not reflect economic complexity. Therefore, we are not considering ECI as a proxy for income but as a source of additional information, specifically capturing the capabilities of a society. We also include a one-period lag of the dependent variable to capture the dynamic nature of the underlying process. In addition, we include various control variables, which are described in more detail in the next section. We also include time dummies in every specification to account for general year-specific shocks.

4.2 Control variables

In our estimations, we control for a battery of country-specific variables related to CO2 emissions and economic complexity to isolate the effect of innovative capabilities of an economy on its environmental pollution. In the choice of the control variables, we closely follow the previous literature and mainly rely on the work of Boleti et al. (2021) and Chu (2021). We include agriculture and industry value added proportionally to total GDP to control for the sector composition of an economy (Boleti et al. 2021). We also control for the proportion of exports and imports in total GDP to capture the impact of trade openness on environmental pollution. A large body of literature has examined this relationship (e.g., Antweiler et al. 2001; Frankel and Rose 2005; Kasman and Duman 2015). These studies rather suggest that trade openness of countries does not have large detrimental effects on environmental quality. In addition, natural resources rents as a percentage of GDP are included to control for the natural resources’ intensity of the outputs of the considered countries as these presumably have a large impact on CO2 emissions (Alvadaro et al. 2021).

Moreover, we include two spatial variables, namely population density and the share of the urban population. Both variables can influence CO2 emissions since the demand of urban areas might exacerbate environmental issues (Balsalobre-Lorente et al. 2022). On the other hand, more urbanized countries might have developed more efficient solutions for environmental problems or established more environmental awareness (Boleti et al. 2021). As in Chu (2021), we also consider an institutional variable that captures the conditions under which a society can develop innovative and knowledge-intensive products. Therefore, we include the Civil Liberties Index from the Freedom House Indicator. It might be the case that a freer society increases CO2 emissions by exploiting the extended set of (business) opportunities; however, it is also possible that more civil liberties support the process of developing less CO2-intensive products.

5 Empirical results

5.1 The link between CO2 emissions and economic complexity

In this section, we present the results concerning our main outcome variables of interest, namely the production-based and consumption-based carbon dioxide (CO2) emissions per capita. We start by taking the production-based emissions as a dependent variable and later extend the analysis by examining consumption-based CO2 emissions. At first, the results for the full sample of all 27 former socialist transition countries will be depicted. After that, we take a finer look at the data by splitting the sample and re-run the analysis with the chosen sub-sample.

In Table 3, the results for the full sample are presented. We start by estimating the parameters of the model without control variables in column (1) and extend this model with the set of control variables described above. In column (2), we include the control variables that capture the output composition of the countries. In column (3), we include the spatial controls, and in column (4), we also consider our institutional variable. The model depicted in column (4) is our preferred one with the full set of control variables. As can be seen, the parameters of interest, namely ECI and ECI2, show the expected signs in columns (2) to (4).

However, the coefficients are not statistically significant at any conventional significance level. The same applies to the joint significance of ECI and ECI2 and the U-test. Therefore, we cannot find evidence for an inverse u-shaped relationship between economic complexity and CO2 emissions for the full sample of all 27 former socialist transition countries. These results are consistent with our descriptive findings in Fig. 5 and our considerations regarding the three-dimensionality of the underlying relationship, expressed in the Environmental Kuznets Curve.

To address this challenge, we have split the country sample according to the country-specific evolutions of ECI over time, as outlined in the previous sections. In Table 4, we present the results for the countries with increasing complexity as these are of main interest, given our theoretical considerations. We include the same set of control variables as before and extend every specification with one additional group of control variables. As can be seen, the coefficient of ECI is positive, and the coefficient of ECI2 is negative in every depicted specification. Moreover, both linear and squared terms of ECI are highly significant throughout all four specifications.Footnote 9

The same holds for the joint significance of both linear and squared terms of ECI and the U-test, applied in every specification. Therefore, the results presented in Table 4 suggest that the CO2 emissions in the group of countries that became more complex over time indeed follow an inverse u-shaped pattern with respect to economic complexity. Hence, the results for these countries are consistent with the findings from the literature. Closest to our study is the work of Chu (2021), Chu and Le (2022), Neagu (2019), and Balsalobre-Lorente et al. (2022) since they apply similar econometric specifications and regression techniques. All of these papers document an inverted u-shaped pattern between environmental pollution and economic complexity and therefore confirm the existence of the EKC. However, we only find this relationship for a group of countries and not the full sample of the former socialist transition countries. The results for the countries with decreasing or constant complexity can be found in the appendix (Table 11). The coefficients of both linear and squared terms of ECI are insignificant and small throughout all specifications and therefore do not confirm the EKC for these countries. Accordingly, we conclude that the EKC is not a useful model to describe the CO2-ECI path of this group of transition countries and focus on the first group (increasing ECI) from here on.

Except for trade (% of GDP) and natural resources rents (% of GDP), all coefficients of the control variables are insignificant and, in most cases, very small. With regards to the trade variable, the negative coefficient is consistent with the findings of, for instance, Antweiler et al. (2001). Hence, higher trade openness is associated with slightly lower environmental pollution for the countries considered. Throughout all specifications, natural resources rents as a percentage of total GDP have positive, highly significant, and comparably large coefficients, which suggests that the exploitation of natural resources exerts large detrimental effects on environmental pollution. Not surprisingly, there is a strong positive association between CO2 emissions and its lag from the previous period.

To better grasp the relationship of interest, Fig. 6 depicts the link between ECI and CO2 per capita, resulting from the estimates of specification (4) in Table 4. The chosen range on the x-axis is given by the minimum and maximum of ECI in the respective subsample. The other complexity values on the x-axis represent the 10th, 25th, 50th, 68th, 75th, and 90th percentile of the group-specific distribution of ECI.Footnote 10 The inverse U that the EKC implies is visible, as well as the turning point at an economic complexity of approximately 2.85, highlighted by the dashed vertical line in Fig. 6. The turning point roughly coincides with the median of the distribution and is associated with CO2 emissions of around 7 tons per capita. However, the 95% confidence intervals are very wide at the distribution tails and largely overlap. This is not surprising, given our small sample with just 286 observations. Nonetheless, for this sample, the inverse u-shape can be documented.

To evaluate the magnitude and economic significance of our results, we further analyze the marginal effects of ECI on CO2 for different values of ECI. Therefore, Table 5 presents the marginal effects at different points of the distribution of ECI for the group of countries with increasing complexity. Additionally, we calculate how, on average, a country’s per capita CO2 emissions would change when its economic complexity moves forward along the distribution.

For instance, increasing complexity from the minimum (2.16) to the 25th percentile (2.61) is, on average and ceteris paribus, associated with an increase of CO2 emissions of approximately 350 kg per capita. In contrast, increasing complexity from the median (2.87) to the 75th percentile (3.35) is, on average and ceteris paribus, associated with a decrease of CO2 emissions of around 212 kg per capita. Going further to a complexity value of 3.57, representing the 90th percentile of the distribution, additional CO2 savings of 220 kg per capita can be realized. Thus, from the turning point to the 90th percentile, the overall CO2 savings associated with the higher complexity amount to 432 kg per capita.

Our findings hitherto suggest that the EKC is a valid model to describe the CO2-ECI nexus for our sub-sample of former socialist transition countries whose complexity increased over time. Hence, at first, an increase in complexity is associated with higher CO2 emissions. However, there exists a threshold, after which the CO2 emissions decrease with increasing complexity. This threshold is the extremum point of the CO2-ECI function, which the U-test calculates. We can make use of this extremum point and ponder it against the data to check for the plausibility of our estimation results. In specification (4), the sign of ECI switches from positive to negative after a complexity value of approximately 2.85. Comparing this to Fig. 5 shows that this threshold is quite plausible as it also lies within the range of the visual extremum point.

To better assess the complexity value after which the CO2 emissions start to decrease, we show the distribution of the Economic Complexity Index for our full sample in Fig. 7. The vertical dashed line indicates the extremum point of approximately 2.85, which corresponds to the specification in column (4). Figure 7 reveals that the complexity value of 2.85 is comparably large as it is located on the right side of the histogram. Hence, countries must reach relatively high levels of complexity to reduce CO2 emissions again. This has important implications for policymakers in poorly complex countries if they want to reduce CO2 emissions by making their products more complex. They would have to accept substantially rising CO2 emissions as they climb up the complexity ladder before a positive effect of complexity on environmental pollution can be realized.

Up to now, these results are consistent with the explanation that countries achieved to decrease their CO2 emissions by developing more complex products. As outlined in Sect. 2, one alternative explanation for the observed pattern could be that some countries might have tried to reduce CO2 emissions by offshoring CO2-intensive production. Especially richer countries could have both incentive and scope to do so. Therefore, we explicitly examine the per capita consumption-based CO2 emissions in the following. If the economies did outsource their CO2-intensive production at high stages of complexity but did not alter their actual environmental footprint, we would not expect to see an inverted u-shaped pattern concerning consumption-based CO2 emissions. However, inspection of Table 6 suggests that this does not seem to be the case.

The results are very similar to those obtained from the previous estimations where we analyzed production-based CO2 emissions. Table 6 reveals a positive and significant coefficient of the linear term of ECI and a negative and significant squared term of ECI, as well as an indication for joint significance and an inverse u-shaped relationship.

Hence, the inverse u-shaped course of CO2 emissions with respect to economic complexity can be found, both when analyzing production and consumption-based emissions. Our results, therefore, suggest that more complex and presumably greener products played a role in shaping the EKC. This is consistent with the recent work of Neagu et al. (2022), who found that in Central and Eastern European countries, economic complexity is positively associated with an indicator capturing the green openness of economies (see Can et al. 2022 for a description of the index). However, with our data, we cannot further discriminate between the two remaining strands of explanations, namely the preference shift versus the technological development of greener products.

5.2 Robustness analysis

In this section, we examine the robustness of our findings. We focus on the estimations we conducted with the sample of countries with increasing complexity. First, we investigate if considering suitable alternative or additional control variables changes our results. Second, we consider other indicators of environmental pollution or progress, such as methane emissions per capita, nitrous oxide emissions per capita, greenhouse gas emissions per capita, and energy use per unit CO2. Third, we alter the functional form of the underlying relationship by applying regression splines instead of including linear and squared terms of ECI. Note that including a broader set of control variables or applying alternative environmental measures will partly result in fewer observations. To ensure comparability, we replicated all our estimations from the previous section with the reduced sample sizes and found no significant impact on the results.

We start by analyzing changes in our results by altering the set of control variables and presenting the respective estimation results in Table 7. In column (1), additional control variables are considered that aim to additionally reflect foreign investment activities and the energy composition and intensity of an economy. We, therefore, include net FDI inflows (% of GDP), alternative and nuclear energy use (% of total energy use), and electric power consumption (kWh per capita). In column (2), we replicate our estimations with alternative variables and substitute the Human Development Index for GDP per capita, the share of exports for the share of total trade, and three Governance Indices from the World Bank (Political Stability, Government Effectiveness, and Control of Corruption) for the Civil liberties indicator. Inspection of Table 7 shows that in both specifications, the coefficient of ECI is positive, and the coefficient of ECI2 is negative. Additionally, linear and squared terms of ECI are jointly significant, and the U-test identifies an extremum point to the underlying CO2-ECI function. The specification with the alternative controls also exhibits a turning point of around 2.85, which is consistent with our previous findings.

However, it is striking that the turning point resulting from the model with the additional controls in column (1) is substantially lower than in every other specification. As a result, the EKC implied by the first specification in Table 7 exhibits a slightly different course. To better assess the differences, we plot the EKCs from all estimations we conducted with production-based CO2 emissions per capita. The results are presented in Fig. 8. For greater clarity, we only depict the point estimates and do not report confidence intervals here. Note, however, that the confidence intervals largely overlap between the different curves. As can be seen, five of the six estimated curves look very alike and hardly deviate from the curve depicted in Fig. 6. The inverse u-shaped course is clearly visible. In contrast, the curve associated with the additional controls specification in Table 7 looks quite different. It rather reveals a concave decreasing course and not an inverse U, even though a slightly upward-sloping part is visible. Thus, we cannot conclude that our results are robust to the specific choice of the control variables. However, we think that even the curve associated with the additional control specification exhibits strong similarities to the other curves, particularly in its nonlinearity and downward-sloping part.

Next, we alter the dependent variable in our analysis. Up to now, only CO2 emissions have been used as an indicator of environmental pollution. Now we use data on methane emissions per capita, nitrous oxide emission per capita, greenhouse gas emissions per capita, and CO2 per unit energy and return to our preferred set of control variables. Table 8 presents the results of this exercise. To save space, we do not report the coefficients of the control variables here. As can be seen, the coefficients of the linear and squared terms of ECI have the expected signs and are jointly significant for all considered pollution indicators. Moreover, the U-test rejects a monotone or u-shaped course and identifies a plausible extreme point to the pollution-complexity function in the case of methane emissions per capita, nitrous oxide emissions per capita, and CO2 emissions per unit energy. However, for greenhouse gas emissions per capita, we can only find weak evidence in favor of the EKC as linear and squared terms of ECI are insignificant and the U-test does not identify a significant inverse U. In addition, the turning point is substantially lower than in the other specifications, hinting towards an asymmetric curve with weakly increasing emissions at low complexity values. Nevertheless, our findings are quite robust to altering the indicator for environmental pollution.

For the following robustness test, we study how our results change when we alter the functional form of our specified models. Until now, we identified the EKC by including linear and squared terms of ECI and studied their joint significance and the extremum point to the CO2-ECI function. Here, we apply regression splines to identify the underlying relationship. Therefore, we make use of the extremum points, given by the U-test, of our preferred specifications (i.e., those with the full set of control variables) for all dependent variables we have considered up to now. Following Chu (2021), we construct a dummy variable to split the CO2-ECI function into the two segments that are predicted by the EKC: an upward-sloping and a downward-sloping part. Hence, in the case of CO2 emissions per capita, our dummy variable equals one if ECI takes values above the extremum point of 2.85 (from Table 4) and zero if ECI takes values beneath the extremum point of 2.85. The extremum points referring to the other dependent variables can be found in Tables 6 and 8. Finally, we include the interaction of ECI and this dummy variable to study the relationship depending on ECI being below or above the extremum point.

The results for all considered indicators of environmental pollution are presented in Table 9. The results confirm our previous findings for our main variable of interest, the production-based CO2 emissions per capita. The coefficient of ECI, which represents the partial effect for all ECI values below the turning point, is positive and significant. This indicates that higher complexity is associated with higher CO2 emissions below the turning point, as implied by the EKC. In contrast, the interaction term between ECI and the threshold dummy is negative and, in absolute terms, higher than the value of the coefficient of ECI, which suggests that the partial effect for all ECI values above the turning point is negative. This, in turn, indicates that after the turning point, a higher value of economic complexity is associated with lower per capita CO2 emissions, as implied by the EKC. This is consistent with our previous results and shows that our findings for production-based CO2 emissions per capita do not hinge on the choice of the underlying functional form.

The results for the other applied indicators are less clear. The interaction term is negative and, in absolute terms, higher than the coefficient of ECI throughout all specifications, but it is not always statistically significant. Additionally, the coefficient of ECI is not precisely estimated in specifications (2)-(7). Therefore, we can only find weak evidence for an inverse u-shaped relationship between complexity and various environmental pollution indicators when applying regressions splines. However, it should be noted that the results presented in Table 9 do not stand in stark contrast to our findings from previous estimations. Moreover, it is interesting to see that when applying regression splines, the upward-sloping part of the curve is harder to detect. This is in line with the results of the model with additional control variables. If anything, there is a tendency towards a weak upward-sloping part and a strong downward-sloping part of the curve.

In this section, we showed that our findings are quite robust to substituting the set of control variables, the main dependent variable, and the underlying functional form of the model, even though some specifications rather point towards a rather weakly upward-sloping part of the curve. We additionally checked for the sensitivity of the relationship by restricting the observation period to 2004–2017 to evaluate if the bending of the curve was primarily due to the accession to the EU. If it were the case that the countries were on a positive ECI-CO2 path, which has been only reversed by the entry into the EU, then we would not expect to see an inverse U over the observation period 2004–2017. However, we still find an inverse U with an upward-sloping part below the turning point. Additionally, we experimented with the classification into the two sub-groups and found no large impact of single countries classified as increasing ECI or decreasing/constant ECI on our results. We also conducted the analysis based on a sample split into three groups (increasing vs. constant vs. decreasing ECI) and found robust evidence in favor of the EKC. For the sake of brevity, we do not report these estimations, but they are available upon request.

6 Conclusion

Following a recently emerging research strand, we have examined the nexus between environmental pollution and economic complexity for the former socialist transition countries. To this end, we have extended the previous conceptual foundations of this approach by proposing a sample selection and split that is more suitable for studying the question at hand than previous approaches. Based on the EKC hypothesis, we should expect an inverse u-shaped relationship between environmental pollution and economic development as an economy progresses and becomes more complex.

Our empirical results suggest that the characteristic u-shape can be found for specific subsamples of the considered countries and not for the full sample. We document a significant inverse u-shaped relationship between CO2 emissions and economic complexity for countries whose complexity increased over time. In those countries, the CO2 emissions have been increasing with growing complexity until they reached a certain threshold, after which they started to decrease. We think that our estimates represent credible evidence in favor of the EKC, even though some robustness tests point in the direction of a rather negative concave course of the curve. To the least, throughout all our estimations, we credibly showed that the relationship between environmental pollution and economic complexity is non-linear and turns negative for higher complexity values.

Overall, our results align with previous research on the EKC with economic complexity. As Chu (2021), Chu and Le (2022), Neagu (2019), and Balsalobre-Lorente et al. (2022), we can document the inverted u-shaped pattern. However, the difference in the curves between our two groups of countries suggests that the link between economic complexity and environmental pollution differs, depending on the complexity or income levels of the countries considered. Broadly in line with our results, Doğan et al. (2019) show that higher economic complexity is associated with better environmental outcomes in highly developed countries, whereas it exerts rather adverse effects in lower income countries. Similarly, Chu (2021) documents a negative association between economic complexity and CO2 emissions in high income countries and a positive association in middle income countries. These results are not directly comparable with our findings since they include ECI linearly in their respective specifications. However, they point in a similar direction.

Additionally, our results imply that economic complexity exacerbates environmental pollution up to a certain threshold. Evidence on the (linear) effect of complexity on environmental pollution is mixed in the literature: Boleti et al. (2021) provide inconclusive results, Nathaniel (2021) and Neagu (2020) report a positive link, while Leitão et al. (2021) and Zheng et al. (2021) reveal a negative association. However, these papers operationalize the ECI as a linear term and therefore do not take nonlinearity and the possibility of a turning point into account. Our robust evidence on the nonlinear relationship between economic complexity and CO2 emissions challenges the assumed linearity in their approaches.

Based on the extensive literature, we introduced three different strands of explanation for the existence of the EKC and differentiated between a preference shift towards more environmental awareness, a shift towards greener and more complex production technologies, and the offshoring of emission-intensive industries to less developed countries. To examine the possible role of emissions offshoring, we analyzed the evolution of consumption-based CO2 emissions with respect to economic complexity. It turns out that the inverse u-shaped relationship can also be documented for the CO2 emissions that arise from domestic consumption patterns, leading to the conclusion that emissions offshoring does not play a major role. Therefore, our results point towards more complex and greener products indeed being the drivers of the inverse u-shaped course implied by the EKC. With our data at hand, we cannot assess whether or to what extent this is a demand-driven process where a preference shift towards more environmental awareness induced a more rapid and rigorous production of greener goods or if it reflects supply-side technology shocks that facilitated the development of more sustainable products. In our view, disentangling these strands of explanation is an attractive avenue for further research.

It should be noted that this analysis faces some drawbacks. With respect to the broader context of the ECI/CO2 nexus, the results could be due to specific particularities of the chosen sample. Also, it is possible that the effects of the transition were not absorbed as early as 1995, as had been assumed in this paper. Accordingly, other unintended effects might have influenced the results. Furthermore, the sample of the countries with increasing complexities mainly consists of member states of the European Union. Therefore, other institutional factors might have influenced the emissions path of these countries. Moreover, our sample size is comparably small, reducing our estimates' statistical power on which we base our conclusions.

An additional important, albeit not surprising finding of our analysis is that the turning point after which the emissions start to decrease is associated with very high levels of pollution. This can be documented throughout all our estimations. Hence, for the EKC to unfold its positive effects on environmental pollution and climate change, it is necessary to accept substantial adverse effects in the form of higher pollution levels beforehand. If we were to extrapolate these findings to the development and emissions path of currently underdeveloped countries, we would either have to accept that emissions would further rise as these countries develop or somehow prohibit them from developing to reduce CO2 emissions. It should therefore be kept in mind that this dilemma can potentially be an obstacle to joint actions to fight climate change.

Hence it remains challenging for policymakers to choose the right path in fighting climate change and simultaneously enhancing the standards of living. Relying solely on the power of the EKC may not be sufficient as the implied rise of CO2 emissions might be too high and socially and environmentally unacceptable. Our findings nonetheless suggest that a society can profit from developing more complex and innovative products as these are, on aggregate, associated with lower per capita emissions after the turning point. From a policy perspective, it might be sensible to pursue green innovation and industrial policies more resolutely to actively dissolve the trade-off between economic development and environmental pollution.

Notes

The authors provide a synthesized dataset on all products with environmental benefits, as classified by various sources, such as the WTO, the OECD, and the Asia-Pacific Economic Cooperation (APEC). These data are not linked to actual CO2 emissions relating to those products. Nonetheless, in this study, we refer to these products as green products and presume they are associated with lower CO2 emissions. Since our analysis is based on the country level, we do not refer to individual products or goods that are produced in certain “green” industries.

This is rooted in the structure of the complexity indicator, which penalizes a product’s complexity if it is exported by predominantly non-complex countries since—in the logic of the complexity measure—this indicates a low complexity of the product. Often natural-resources-intensive products are exported by rather non-complex countries. In contrast, these natural-resources-intensive products are part of the GDP just as any other product and thus can increase per capita GDP without capturing that these products have arguably little to do with productivity or innovation.

The ranking of those products is based on the 2019 complexity values provided by the Observatory of Economic Complexity, which ranks export products based on their HS96 (1998–2018) classification according to their complexity values. The ranking covers 2848 products at a 6-digit depth in 2019. In the interest of readability, we have truncated the designation of the products to the essentials.

More information on the data is provided here: https://github.com/owid/CO2-data/blob/master/owid-CO2-codebook.csv.

These countries are Andorra, Belgium, Denmark, Germany, Finland, France, Greece, Ireland, Iceland, Italy, Liechtenstein, Luxembourg, Malta, Netherlands, Norway, Austria, Portugal, Sweden, Switzerland, Cyprus, Spain, Turkey, and United Kingdom.

We performed this classification by regressing ECI on the year and considered a significant positive coefficient as an indicator of increasing complexity and an insignificant or negative coefficient as an indicator of constant or decreasing complexity. Alterations of this classification procedure (e.g., with regard to the standard errors) did not change the results significantly.

In the appendix we provide information on the distribution of the complexity of products, according to the Product Complexity Index (PCI), depending on the respective groups. Figure 9 shows the group-specific distributions of PCI for the whole observation period, while Figs. 10 and 11 show the group-specific distributions of PCI at the beginning (1995) and the end (2017) of the observation period. Additionally, we provide information on the most extensively exported products for both groups between 1995 and 2017. Table 12 shows a list of the top ten exported products. Overall, the heterogeneity that is reflected in the ECI can also be documented when analyzing product-level data.

More precisely, we added + 2 to the raw ECI values to ensure that no value falls beneath zero. We played around with the exact rescaling procedure and found no meaningful impact on our results.

We replicated these estimations with the natural logarithms of CO2 per capita and GDP per capita and found no differences in the results. The results are shown in the appendix (Table 10).

For better clarity, the 68th percentile is shown in Fig. 6 since its corresponding ECI value lies between the the 50th and the 75th percentile values.

References

Alvarado R, Tillaguango B, Dagar V, Ahmad M, Işık C, Méndez P, Toledo E (2021) Ecological footprint, economic complexity and natural resources rents in Latin America: empirical evidence using quantile regressions. J Clean Prod 318:128585. https://doi.org/10.1016/j.jclepro.2021.128585

Antweiler W, Copeland BR, Taylor MS (2001) Is free trade good for the environment? Am Econ Rev 91(4):877–908. https://doi.org/10.3386/w6707

Badeeb RA, Lean HH, Shahbaz M (2020) Are too many natural resources to blame for the shape of the environmental Kuznets curve in resource-based economies? Resour Policy 68:101694. https://doi.org/10.1016/j.resourpol.2020.101694

Balsalobre-Lorente D, Ibáñez-Luzón L, Usman M, Shahbaz M (2022) The environmental Kuznets curve, based on the economic complexity, and the pollution haven hypothesis in PIIGS countries. Renew Energ 185:1441–1455. https://doi.org/10.1016/j.renene.2021.10.059

Batsaikhan U, Dabrowski M (2017) Central Asia—twenty-five years after the breakup of the USSR. Russ J Econ 3(3):296–320. https://doi.org/10.1016/j.ruje.2017.09.005

Beck T, Laeven L (2006) Institution building and growth in transition economies. J Econ Growth 11(2):157–186. https://doi.org/10.1007/s10887-006-9000-0

Boleti E, Garas A, Kyriakou A, Lapatinas A (2021) Economic complexity and environmental performance: evidence from a world sample. Environ Model Asses 26(3):251–270. https://doi.org/10.1007/s10666-021-09750-0

Boschma R (2017) Relatedness as driver of regional diversification: a research agenda. Reg Stud 51(3):351–364. https://doi.org/10.1080/00343404.2016.1254767

Boschma R, Balland PA, Kogler DF (2015) Relatedness and technological change in cities: the rise and fall of technological knowledge in US metropolitan areas from 1981 to 2010. Ind Corp Change 24(1):223–250. https://doi.org/10.1093/icc/dtu012

Can M, Ben Jebli M, Brusselaers J (2022) Can green trade save the environment? Introducing the Green (Trade) Openness Index. Environmental Science and Pollution Research, 1–12

Can M, Gozgor G (2017) The impact of economic complexity on carbon emissions: evidence from France. Environ Sci Pollut R 24(19):16364–16370. https://doi.org/10.1007/s11356-017-9219-7