Abstract

Public investment is low and has declined in many EU countries since the global financial crisis. This paper estimates the effects of the various European Structural and Investment Funds (ESIF) on public investment in the EU countries. The analysis is run on annual data from 2000 to 2018 using dynamic panel data specifications. Funding from the Cohesion Fund, the EU’s facility for its less developed members, has had an almost one-to-one effect on public investment in the short term, and more in the longer term. Funding from the European Regional Development Fund may have had some effect, but it cannot be estimated precisely. Funding from other ESIF funds does not seem to have been related to public investment in the EU countries.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

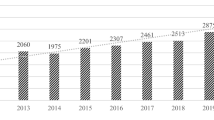

This paper investigates the relationship between funding from the European Structural and Investment Funds (ESIF) and public investment in the countries of the European Union. The choice of this topic is motivated by the observation that public investment in per cent of GDP has been low or declining in many EU countries, especially since the global financial crisis. Total public investment in the 28 countries that were in the EU in 2019 was 3.3 per cent of GDP in 1995, 3.4 per cent in 2007, and 3.0 per cent in 2019 (Ameco 2021, code: UIGG0). The decline in public investment has been even particularly pronounced in some of the countries that were most severely affected by the global financial crisis.

Public investment in infrastructure, buildings and equipment is commonly seen to be of key importance for economic development.Footnote 1 It may nevertheless be a tempting area for making budgetary cuts as their possible negative consequences are not noticed immediately (Novelli and Barcia 2021). The European Fiscal Board of the European Union has repeatedly argued that public spending should be directed much more towards investment in order to improve the longer-term growth prospects of the EU countries; see for instance European Fiscal Board (2020). These issues have only gained in importance since the Covid-19 pandemic started. The NGEU recovery fund will make additional resources available to the EU countries, and large parts of this new funding are being tied to public investment (Fuest 2021).

The ESIF funds are the main fiscal instrument which the European Union uses for achieving economic and social convergence across the union. The history of the funds harks back to formation of the European Economic Community, the predecessor of the European Union, in 1957, but the number of funds, their purposes and their names have changed recurrently since then. There have since 2014 been in total five ESIF funds with a range of focus areas. The European Regional Development Fund, the Cohesion Fund, and the European Social Funds are collectively known as the EU Cohesion Policy funds.Footnote 2 The European Agricultural Fund for Rural Development and the European Maritime and Fisheries Fund also aim to ensure economic and social convergence, but the funds have different focus areas, as indicated by their names. The funds will be discussed in some detail in Sect. 2.

Support from the ESIF funds is intended for a range of measures that seek to boost economic growth, competitiveness, employment, social inclusion, sustainability and rural development. In the period 2014–2020 more than one-third of the total EU budget went to the ESIF funds, meaning that all other activities, including the income and price support under the Common Agricultural Policy, must share the remainder. The European Commission argues that support from the ESIF funds is targeted at investment in the recipient countries, though the term may be used fairly loosely by the Commission (European Commission 2022).

The discussion above begs the question of how closely the support from the various ESIF funds is associated with higher public investment in the EU countries. This paper estimates fiscal reaction functions for public investment in the EU countries, using the funding received from various ESIF funds and various economic and political control variables as covariates. The annual panel data estimations cover the 28 countries that were members of the EU in 2019 and the time sample goes from 2000 to 2018. The endpoint is determined by the availability of adequate data on ESIF funding, but it conveniently excludes the period of the Covid-19 pandemic and the extraordinary policy measures taken in the slipstream of the pandemic.

The ESIF funds are intended to promote economic and social convergence, though the eligibility and allocation criteria vary from fund to fund. Some funds largely target projects that are counted as public investment in the national accounts, while other funds have broader scopes. It is in any case important to understand the role that the funds play at the macroeconomic level, including their role in public investment. As discussed below, these effects cannot be ascertained from the institutional and legal frameworks that are used to allocate the funding, but call rather for careful econometric investigation; see also Hagen and Mohl (2011).

There are several challenges involved in an analysis that seeks to ascertain the relationship between the provision of economic support and the eventual outcome of the support. Even if the support targets a specific objective, the outcome may be affected by behavioural changes in the recipient that may or may not be warranted by the principal. These behavioural changes are at the core of principal-agent theory and are of great practical importance (Bachtler and Ferry 2013; Aslett and Magistro 2021).Footnote 3 The principal may address possible principal-agent problems in various ways, such as requiring disclose of information, imposing strict monitoring, or demanding co-financing from the agent.

There are also principal-agent problems in the funding from the EU (Del Bo & Sirtori 2016; Notermans 2016). Support from the ESIF funds may substitute or crowd out national funding, so that the eventual effect, which is sometimes known as additionality, is smaller than would otherwise have been the case. The regulation of the ESIF funding espouses the principle of additionality, which is that “support from the Funds should not replace public or equivalent structural expenditure by Member States” (European Commission 2015, p. 58).Footnote 4 It should also be noted that the ESIF funding typically only covers a part of total spending, and the co-financing requirements from the recipients might amplify the effect of the support. The derived reactions of the recipients mean that the eventual effect of ESIF funding becomes an empirical question.

Given the substantial amounts involved, it is not surprising that numerous evaluations and assessments of the impact of ESIF funding have been carried out; see surveys by Hagen and Mohl (2011) and Notermans (2016). The studies typically focus on various economic and social objectives such as the income level, unemployment or poverty. It is helpful to distinguish between different levels of study. Studies at the micro level assess how recipients like firms and public organisations are affected and typically ignore the aggregate effects, while studies at the macro level assess how macroeconomic or social policy aggregates are affected at the national or regional level.

A key finding is that studies undertaken at the micro level typically find larger and more persistent effects than studies at the macroeconomic level do. This finding is occasionally called the micro–macro paradox, and it is particularly noticeable for studies that examine the effects of EU funding on productivity and income convergence (Bradley 2006; Alegre 2012; Notermans 2016). It is beyond the scope of this paper to account for the micro–macro paradox, but it may be useful to consider one important factor of economic growth at the macroeconomic level, specifically public investment.

This paper focuses on ESIF funding and public investment in the EU countries in the short and medium term. The research question is narrow in scope but it is relevant for policy-making at the national and EU levels. The paper complements a very small number of earlier studies that raise the same question.

Mohl (2016) revisits the analysis in Hagen and Mohl (2011) and considers the effect of total EU cohesion policy funding on public investment. Various dynamic panel data models are estimated using a range of estimation methods, but the conclusion is consistently that cohesion policy funding has no effect on public investment. The data end in 2006, which means that the funding rounds for 2007–2013 and 2014–2020 are not included in the sample and the data for the new members from Central and Eastern Europe only enter for a few years.

Alegre (2012) considers the effects of measures of total ESIF funding on public investment using annual data over the years 1993–2005 for the first 15 EU countries from Western Europe. The key finding is that an increase in cohesion policy funding of one euro is associated with an increase in total public investment of around 0.6 euro in the long term. An analogous exercise using data from Spanish regions instead of the EU countries provides comparable results. The estimated models of public investment in Alegre (2012) contain few control variables for the budgetary position of the country or region. Moreover, the data end in 2005 and the study only uses data from the first 15 EU countries, so the estimation results do not account for the developments in the Central and Eastern European EU countries, which typically have much lower per capita incomes than other EU countries.

Cantos-Cantos et al. (2020) examine the effect of a specific ESIF fund, the European Regional Development Fund (ERDF), on public investment in the Spanish regions using data from 1994 to 2014. Various panel data methods are used, including some that take possible co-integration into account, but the conclusion is generally that there is no discernible link between ERDF funding and public investment in the regions in Spain.

The differences between the results in the small number of studies that analyse how EU funding affects public investment are striking and suggest that a fresh look using updated data may provide valuable insights. This paper contributes to the literature in at least three ways. First, it considers all of the various ESIF funds at the same time, an investigation that provides deeper insights into the effects of the various funds on public investment. Second, it uses data for the period 2000–2018, which means that the member countries from Central and Eastern Europe are represented in most of the time sample. Finally, it carries out various sample splits that make it easier to interpret the results and help uncover possible heterogeneity within the sample.

The rest of the paper is organised as follows. Section 2 provides an overview of purposes and allocation criteria of the European Structural and Investment Funds. Section 3 documents the data used in the analyses. Section 4 discusses the model specification and estimation methodology. Section 5 presents the results of the baseline estimation. Section 6 shows the results of various robustness analyses and sample splits. Finally, Sect. 7 offers some concluding comments.

2 The European structural and investment funds

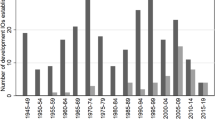

The EU operates with Multiannual Financial Frameworks, or budget periods, that each run for seven years. This means that our sample covers the three budget periods 2000–2006, 2007–2013 and 2014–2020, but data on the payments from the funds for 2019–2020 were not available at the time of writing. Changes from budget period to budget period have occasionally caused some changes in how the funds are named and in the ways that the support is allocated. We have chosen the names used for the funds in the last budget period considered, which was in 2014–2020.

Five different ESIF funds were operating in the budget period 2014–2020. The five funds have various objectives, eligibility conditions and allocation criteria, but they complement each other in how they support economic and social cohesion across the EU countries and across the regions of the EU countries. Table 1 presents the key features of the five ESIF funds.

The main ESIF instrument is the European Regional Development Fund (ERDF). This fund is intended to strengthen economic and social cohesion in the European Union and to reduce regional disparities across the EU by promoting both public and private investment. To achieve this goal, the main task of the ERDF has since 2000 and throughout the following budgetary periods been to contribute to investment in sustainable growth and sustainable job creation.

The ERDF focuses on investment in research, innovation and infrastructure, but digitalisation was added as a priority from the 2014–2020 budgetary period. Supporting small and medium sized enterprises (SMEs), by simplifying access to funding for example, hold an important place in the investment priorities. Since 2007, ERDF investments have also prioritised environmental protection and the transition to a low-carbon economy. The investment priorities of the ERDF mean that not only public investment projects but also private projects can receive support from the ERDF fund.

The requirements to allocate the ERDF funds between various projects and the share of national own-financing both depend on the relative income level of the given NUTS2 region. The maximum financing rates from the ERDF range from 50 to 85 per cent of project costs, and since June 2013 up to 95 per cent, depending on the relative income level of the region.

The Cohesion Fund was set up in 1994 to contribute funding for projects focused on the environmental and trans-European transport network for the less well-off countries in the EU. The projects that fall under these two thematic aims are in large part public investment projects. While funding from the ERDF is available for all member countries, funding from the Cohesion Fund (CF) is only available for members whose gross national income per capita is less than 90 per cent of the EU average. The territorial funding level for the Cohesion Fund is not the NUTS2 region, but the whole country. For the countries that receive CF funding, the amount allocated is found from data on GDP per capita, GNI per capita, and the unemployment rate. Fifteen EU countries were eligible to receive funding from the CF in the 2014–2020 budgetary period. The financing from the Cohesion Fund for projects can cover up to 85 per cent of total costs.

The European Social Fund (ESF) is the oldest ESIF fund. It was set up in 1957 under the Treaty of Rome to improve employment opportunities and promote the mobility of workers. The ESF also finances initiatives that promote education and life-long learning, equal opportunities for men and women, sustainable development, and economic and social cohesion. This means that ESF funding largely goes to non-investment spending, including spending on human capital. ESF funding is always accompanied by public or private co-financing and so, like the ERDF, the ESF can fund both public and private sector projects. The financing from the ESF covers between 50 and 85 per cent of total project costs, but it can be as much as 95 per cent in exceptional cases, and the actual rate depends on the relative income level of the region.

The European Agricultural Fund for Rural Development (EAFRD) is the second pillar of the European Union’s Common Agricultural Policy and it was created under this name in 2014. Both EAFRD and, before 2014, the Guidance Section of the European Agricultural Guidance and Guarantee Fund (EAGGF) focus on supporting the competitiveness of agriculture, strengthening the balanced development of rural economies, modernising agricultural facilities and preserving European landscapes. The spending may consequently be either for investment or non-investment and it can go to the public sector or the private sector. The EU countries execute EAFRD funding through rural development programmes.

The financing from the EAFRD usually covers between 53 and 85 per cent of the total cost, while the rest must be financed from national budget sources. It is important to note that the EAFRD fund supports social development and sustainability in the countryside, and is separate from the income and price support given to farmers through the first pillar of the Common Agricultural Policy. The share of project costs financed by EAFRD depends on the relative income level of the NUTS 2 region.

The support from the European Maritime and Fisheries Fund (EMFF) is small and disbursements under this name only started in 2014. The EMFF supports the Common Fisheries Policy and the level of support from this fund does not depend on the income level of member country receiving it. The allocation decisions are based on various sector-specific criteria such as the size and economic relevance of the fisheries and aquaculture sector in each region.

At the heart of the ESIF policy lies the principle of additionality, i.e. the idea that resources received from the EU funds should not substitute public expenditure. The funds covered by the additionality principle and the reference points used to determine additionality have, however, changed between budgetary periods.

Until the budgetary period that started in 2014, only the ERDF and ESF funds were covered by the principle of additionality. Since 2014, the Cohesion Fund has been covered too (European Commission 2013a). The definition of the reference level used to assess additionality, which is the public or equivalent structural expenditure, has also changed over the years. Before 2014, the public or equivalent structural expenditure was somewhat broader than public investment or gross fixed capital formation (European Commission 2009). Since 2014, however, it has explicitly meant the gross fixed capital formation of the general government (European Commission 2013a). Before the start of a new budgetary period, member states and the Commission decide and agree on an average public or equivalent structural expenditure that the member state will need to maintain in the new budgetary period.

Although the notion of additionality is easy to understand, it is actually quite complicated to apply, and several shortcomings have undermined the verification of additionality principle over the years. These have included problems with defining the relevant eligible expenditure, difficulties in verifying the reliability of data, and shortcomings in data comparability over programming periods (European Commission 2009). Overall, there were several challenges with the ex-post verification of additionality for the 2007–2013 budgetary period, and this led to a considerable change in the methodology for the 2014–2020 period (European Commission 2017).

3 Data

We use annual data for 28 EU countries for 2000–2018, as these are the years for which suitable data on ESIF funding to the individual EU member countries are available at the time of writing in November 2021. The sample includes the UK, which was a member of the EU until 2020, and the new EU members from Central and Eastern Europe that joined in 2004, 2007 or 2013 and so were not members of the EU throughout the full sample period. Eight countries, Czechia, Estonia, Latvia, Lithuania, Hungary, Poland, Slovenia and Slovakia, joined the EU in May 2004; Romania and Bulgaria joined in January 2007; and Croatia did so in July 2013.

3.1 Data and data sources

We construct a dataset with data for the payments from the European Structural and Investment Funds, a large number of fiscal and macroeconomic variables, and two political variables.

We discussed the ESIF funds and their eligibility and allocation criteria in Sect. 2. Data on the payments from each of the ESIF funds to each EU country are publicly available from the European Commission’s data catalogue “Historic EU payments - regionalised and modelled” (European Commission 2021). These data are in the first place cash-based and record the flows only as the payments are disbursed. The national accounts however are accrual-based and record the flows when the underlying transaction occurs, so the ESIF reimbursement data and the national account variables are not directly comparable. However, the dataset also contains series for the ESIF funds provided under the label “modelled annual expenditure” (European Commission 2018, 2020), and these modelled ESIF series are meant to track the expenditures as they are incurred and so to mimic the accrual-based data.Footnote 5 The modelled ESIF data series are generally used in this study to ensure consistency with the data from the accrual-based national accounts.

The econometric analysis uses the modelled ESIF amounts in per cent of the GDP of the country receiving the support.Footnote 6 The data on nominal GDP are sourced from Ameco, the macroeconomic database of the European Commission (Ameco 2021, code: UVGD).Footnote 7 For convenience the abbreviations of the various ESIF are also used as names for the modelled funding in per cent of GDP. The variable ERDF is thus the modelled funding from the European Regional Development Fund in per cent of GDP, the variable CF is the modelled funding from the Cohesion Fund in per cent of GDP, the variable ESF is the modelled support from the European Social Fund in per cent of GDP, and the variable RURAL is the sum of the modelled support from the European Agricultural Fund for Rural Development Fund and the European Maritime and Fisheries Fund in per cent of GDP.Footnote 8

The fiscal and macroeconomic variables are all sourced from Ameco (2021). The main fiscal variable is IG, which denotes general government gross fixed capital formation or, for simplicity, public investment in per cent of GDP (Ameco, UIGG0). This variable is the dependent variable in all of the estimations of the paper. The variable DEBT is the public debt in per cent of GDP (Ameco, UDGG). The variable BALCYC denotes the cyclically adjusted public balance in per cent of GDP, where the cyclical adjustment follows the rules in the Excessive Deficit Procedure of the European Union (Ameco, UBLGAP).

The macroeconomic variables capture the broader macroeconomic situation of the EU28 countries. The variable YPPP denotes GDP per capita in purchasing power parity terms, expressed as an index with the original EU15 = 100 (Ameco, HVGDPR). The variable YGAP is the output gap computed by the European Commission and expressed as the gap between actual GDP and potential GDP in per cent of potential GDP (Ameco, AVGDGP).

A number of variables are used for robustness checks. The variable INTG denotes the interest payments on public debt in per cent of GDP (Ameco, UYIG). The variable GSIZE denotes total public spending in per cent of GDP and so is a measure of the size of the public sector (Ameco, UUTG). The variable IP is private investment in per cent of GDP (Ameco, UIGP).

We also include two political variables in some robustness checks as politics could also affect public investment decisions. The variables are sourced from Armingeon et al. (2021). The dummy variable ELECTION takes the value 1 for years in which there was a general election and 0 otherwise. The variable SCHMIDT is the Schmidt Index. Relying on Schmidt (1992), the Schmidt Index captures the political orientation of the cabinet in power measured by the share of leftist and non-leftist parties in the government. Based on the share of leftist parties in the government, each cabinet is assigned a value from 1 to 5, where the minimum value 1 depicts a cabinet dominated by right-leaning parties, while the maximum 5 depicts a cabinet dominated by left-leaning parties.

3.2 Data description

This subsection presents the dataset. The full sample of 28 countries is labelled EU28, and this is the sample of countries considered in most of the empirical analysis in Sects. 5 and 6. We will however also consider three different groups that divide countries by their economic history and whether or not they have received support from the Cohesion Fund. The group WE–CF contains the 11 Western European EU countries that have never received support from the Cohesion Fund. The group WE+CF consists of the Western European EU counties that have received support from the Cohesion Fund during at least one budget period during the sample years 2000–2018, these being Cyprus, Greece, Ireland, Malta, Portugal and Spain. The third group, CEE, contains the 11 post-transition countries from Central and Eastern Europe, all of which have received support from the Cohesion Fund.

Table 2 shows summary statistics for all of the variables defined in Subsect. 3.1. The table reports the means for the EU28 group and for the three groups WE–CF, WE+CF and CEE. The amount of ESIF funding varies substantially across the country groups. The aggregate ESIF funding, TOTAL, is around 0.1 per cent of GDP in the WE–CF countries, 1.0 per cent in the WE+CF countries, and 1.9 per cent in the CEE countries. This pattern is consistent with the ESIF funds being a way of facilitating structural change and investment in order to promote economic and social convergence across the EU. We will return to the dynamics of the ESIF variables later in this subsection.

The average public investment across the 28 EU countries is 3.7 per cent of GDP; the EU countries from Western Europe that have not received support from the Cohesion Fund invest on average 3.3 per cent of GDP and the other countries from Western Europe invest 3.5 per cent, which is less than the 4.4 per cent invested by the EU countries from Central and Eastern Europe. It is however instructive to consider the dynamics of public investment over the sample period 2000–2018.

Table 2 provides averages of several fiscal variables and they generally exhibit substantial differences across the three groups of EU countries. One example is the average public debt stock, which is very high in the WE+CF countries, somewhat lower in the WE–CF countries, and much lower in the CEE countries. Not surprisingly, the relative income YPPP also exhibits substantial variation across the groups of EU countries. The averages of the election dummy correspond to a general election almost every four years. There seems to be very little difference in the ideological outlook of the cabinets in the three subgroups of EU countries.

We discuss in more detail some of the most important variables in the dataset. Figure 1 shows IG, public investment in per cent of GDP, in each of the EU28 countries for the full sample 2000–2018. The figure confirms that there is substantial variation across the countries. Many Western European countries, including Germany, Austria and the UK, have relatively low rates of public investment throughout the sample period. The highest investment rates are typically found in the CEE countries, but investment rates have also been high in countries such as Greece and Luxembourg.

Another striking observation from Fig. 1 is the considerable variation over time in public investment in per cent of GDP, as changes of more than 1 percentage point from year to year are not uncommon. The declines after the global financial crisis are particularly striking and generally occurred in the countries that were affected most severely by the crisis. This confirms that the post-crisis adjustments have often seen reductions in public investment in per cent of GDP.

Figure 2 in "Appendix A" shows the dynamics of the four ESIF variables for each of the 28 EU countries. The figure reveals how the various ESIF funds are very different in size over time and across the EU countries. The combined ESIF support is very small for the countries in the WE–CF group, larger for some of the countries in the WE+CF group and even larger at 2–4 per cent of GDP in the CEE countries. This pattern is not surprising given the relative income levels of the countries. The various ESIF variables generally exhibit substantial time variation.

The allocation criteria vary somewhat across the various ESIF funds, but the EU countries with the lowest per capita income are the main recipients. This means that the ESIF variables are likely to be correlated. Table 3 shows the Variance Inflation Factor (VIF) and its square root for the four ESIF variables when they are treated as the only covariates.Footnote 9 The VIF is above 5 but below 10 for the ERDF variable, just below 5 for the CF and ESF variables, and well below 5 for the RURAL variable. These results suggest that multicollinearity may reduce the precision of the coefficient estimates, especially for ERDF and perhaps also for CF and ESF. We will therefore examine the stability of the results when we present the baseline estimation in Sect. 5.

We have run a number of panel unit root tests on the variables in Table 2. Most, but not all, of the variables are panel stationary in the sample consisting of 28 EU countries over the sample period 2000–2018 (not shown). The ESIF variables we use in most specifications have been modelled to mimic accrual accounting are borderline stationary depending on the specific test of panel unit roots used. The cash-based ESIF data are however consistently panel stationary, which suggests that the modelling creates a degree of persistence in the data series. Given that we always include the lagged dependent variable in the estimations, the borderline stationarity results are unlikely to affect the results unduly. The variables DEBT, YPPP and INTG exhibit trends for many countries, so it is not surprising that it is not possible to reject a panel unit root in these variables irrespective of the test used. The variables DEBT and YPPP are included as control variables in the baseline specification, so we run robustness checks to ascertain the possible consequences of the variables exhibiting panel unit roots.

4 Methodology

Empirical specifications for fiscal reaction functions, such as those for public investment, are typically relatively parsimonious. The dynamic panel data model in this study regresses the public investment in per cent of GDP on its lagged value, all or a subset of the four ESIF variables defined in Sect. 3, and various control variables. The control variables always include country fixed effects and typically also three dummy variables taking the value 1 for each of the three budget periods covered by the sample. Other control variables include fiscal variables such as the debt stock and the budget balance, and macroeconomic variables such as the relative income level and the cyclical position.Footnote 10 The specification of the reaction function for public investment, including the choice of control variables, follows other studies of public investment (Mehrotra and Välila 2006; Heinemann 2006, Picarelli et al. 2019). However, we include the ESIF variables as covariates in line with other studies that consider the effects of ESIF funding; see Alegre (2012), Mohl (2016), and Cantos-Cantos et al. (2020).

The estimation of the public investment models is complicated by the inclusion in the models of the lagged dependent variable, as this can give rise to the Nickell bias in the estimated coefficients when the models are estimated with fixed effects least squares (Nickell 1981). Various GMM estimators are available that may address this problem, but these estimators become consistent with a large number of cross sections. Moreover, it is difficult in many cases to find suitable instruments. The Nickell bias declines as the number of time periods rises. Judson and Owen (1999) and Bun and Kiviet (2001) run numerous Monte Carlo simulations and show that the Nickell bias is modest when the number of time periods is around 20 or more. Given these complications we estimate the public investment reaction functions using fixed effects least squares, but as a robustness check we also estimate the baseline public investment reaction functions using the bias-corrected LSDV dynamic panel estimator. The estimator is described in Bruno (2005), which extended the bias-corrected LSDV estimator derived by Kiviet (1995, 1999) to accommodate unbalanced panels as well.

The model of public investment is estimated using fixed effects least squares, which means that the coefficients are determined entirely from the dynamics over time. The allocation of support from each of the ESIF funds is decided for each seven-year budget period in the year before the start of the budget period. The amounts allocated are based on a number of economic and social criteria, and the final decision is made in the Council of Ministers after extensive negotiation. The upshot of this institutional setup is that the total allocation for the seven-year budget period is largely predetermined and independent of any measures taken in the individual EU member countries. The allocations of funding within the budget period and the following three years are, however, influenced by the policies within each EU country, as funding is typically conditional on the specific plans for a project being approved and the project subsequently being realised. This administrative practice means that the ESIF funding variables will in practice never be fully exogenous, and so it is difficult or virtually impossible to establish causal effects. The same limitation is found in other studies of EU funding and public investment; see Mohl (2016) and Alegre (2012).Footnote 11

5 Baseline results

We start the empirical investigation with the sample of all 28 EU members and the time period 2000–2018. Table 4 shows the results when the dynamic panels of public investment are estimated using fixed effects least squares. Note that the specifications include dummies for the three budget periods, but the coefficients for these dummies are not reported.

Column (4.1) provides the findings for the baseline model. The coefficient of the lagged dependent variable is 0.48 and it is precisely estimated. Public investment in the panel of EU countries exhibits substantial persistence, a result that has also been found in other studies of public investment in the EU countries (Hagen and Mohl 2011; Mohl 2016, Picarelli et al. 2019).

The coefficient of the lagged debt stock DEBT(-1) is −0.015 and it is statistically significant at the 1 per cent level. An increase in the debt stock of 10 percentage points is associated with public investment being 0.15 percentage point lower in the following year and with a somewhat larger decline in the longer term. Comparable results have been found in other studies of public investment in Europe (Heinemann 2006, Bacchiocchi et al. 2011, Picarelli et al. 2019, Kostarakos 2021). The cyclically adjusted budget balance lagged one year, BALCYC(-1), has no discernible effect on public investment.

The macroeconomic control variables appear to be of some importance. The coefficient of YPPP(-1) is negative, suggesting that a higher relative income level is associated with lower public investment in per cent of GDP. Finally, the coefficient of YGAP(-1) is positive, so a favourable position of the business cycle appears to be followed by higher public investment in the following year. Novelli and Barcia (2021) similarly find that public investment is pro-cyclical.

An interesting pattern emerges when the results for the ESIF variables are considered. The coefficient of the Cohesion Fund variable CF is around 1 and statistically significant at the 5 per cent level, while the coefficients of the other ESIF variables are small in numerical terms and estimated very imprecisely. Taken at face value, these results would suggest that there is close to a one-to-one association in the short-term between support from the Cohesion Fund and public investment, and twice that effect in the longer term, given that the estimated coefficient of the lagged dependent variable is around 0.5. Meanwhile, the other three ESIF funds, ERDF, ESF and RURAL, appear not to be associated with public investment in the sample of EU countries.

Table 7 in Appendix B shows the results when the baseline estimation is altered in various ways. Column (B1.1) repeats for convenience the baseline specification; Columns (B1.2)–(B1.5) show the results when the funding dummies are removed, when year fixed effects are included instead of the funding dummies, when the crisis years 2009–2010 are excluded, and when the two variables with trending dynamics, the public debt stock DEBT and the relative income level YPPP, are excluded. The finding is in all cases that the overall conclusions from the baseline estimation in Column (4.1) do not change.

As discussed in Sect. 3.2, the four ESIF variables exhibit some collinearity, which may inflate standard errors and complicate statistical inference. We begin the investigation by replacing the four individual ESIF funds in the baseline estimation with the aggregate ESIF investment TOTAL. Column (4.2) in Table 4 shows the results. The results for the lagged dependent variable and the independent control variables are close to those in Column (4.1). The coefficient of TOTAL, the aggregate ESIF funding, is 0.28.Footnote 12 That the coefficient is relatively small is consistent with the findings in the baseline specification when all four ESIF variables are included.Footnote 13 The total effect appears to be driven by the effect of the Cohesion Fund, so it is reasonable to presume that the effects of the three other ESIF variables are very small or non-existent.

We may analyse further the consequences of the ESIF variables being correlated. If each of the four variables is included individually in the specifications, the coefficient of each variable attains statistical significance even though the point estimates of ERDF, ESF and RURAL vary noticeably across the different specifications (not shown). This result is unsurprising given the substantial correlation between the ESIF variables. It is informative to run estimations where CF is included with each of the three other ESIF variables one by one. Columns (4.3)-(4.5) show the results. The coefficient of CF is around 1 in each of the three pair-wise competitions, while the coefficients of the other ESIF variables are small and statistically insignificant in all cases. This provides further evidence that CF is important for public investment, while the other ESIF variables are of limited or no importance.

Finally, we consider the WE–CF group alone, this being the group of Western European EU countries that has never received support from the Cohesion Fund, so CF = 0 for all years for these 11 countries, and it is thus not correlated with the three other ESIF variables for this group. Column (4.6) shows the results when ERDF, ESF and RURAL are included simultaneously, and the sample comprises only the countries in the WE–CF group. The coefficient of ERDF is 0.44 but is very imprecisely estimated, the coefficient of ESF is negative and statistically insignificant, and the coefficient of RURAL is close to 0 and statistically insignificant. The upshot from the analysis of the WE–CF group of the richest Western European countries is that it cannot be ruled out that ERDF may have a minor positive effect on public investment, but nor can it be pinned down with any precision.

We conclude from the estimations in Table 4 that the effects of the ESIF funds on public investment differ markedly across the four funds. Support from the Cohesion Fund has a one-to-one effect on public investment in the short term and up to twice that effect in the longer term. Support from the European Regional Development Fund could have a positive effect on public investment, but the effect is small and statistically insignificant. Support from the European Social Fund and from the rural development and fisheries ESIF funds seems unimportant for public investment. In the light of these findings, we run the estimations in Table 4 with CF as the only ESIF variable included. The estimated coefficient of CF is, as expected, around 1 in all five of the specifications; see Table 8 in "Appendix C".

It is useful to compare the results for the ESIF variables in Tables 4, 5, 6 with those in the literature. When all of the ESIF variables are included simultaneously, the coefficient of CF attains economic and statistical significance, but this is not the case for the coefficient of ERDF. This result is consistent with the study by Cantos-Cantos et al. (2020), who conclude that the effect of ERDF on public investment is virtually nil. The results when only total ESIF funding enters the specification are also consistent with earlier findings. The estimated coefficient of TOTAL is 0.28, but the long-term effect is twice as large and close to the long-term estimate of around 0.6 in Alegre (2012).

The results in Tables 4 do not align closely with those in Mohl (2011), who found that total cohesion policy funding had no effect on public investment. It should be recalled however that the sample in that study ends in 2006, which means that there is relatively little overlap between the sample used in Mohl (2011) and the one in our study. Moreover, the Central and Eastern European countries are hardly represented in the sample in Mohl (2011). In Sect. 6 we run the baseline estimation independently for the three groups of countries in the sample, and the results are generally clearer for the CEE countries than for the WE+CF countries.

6 Robustness and heterogeneity

This section discusses a number of additional estimations, partly to assess the robustness of the results and partly to widen the scope of the analysis.

Including the lagged dependent variable in the panel means the results may be affected by the Nickell bias, so we have also estimated Table 4 using the bias-corrected LSDV dynamic panel estimator, where the bias correction is initialised using the Arellano-Bond GMM estimator (Arellano and Bond 1991). Bruno (2005) finds that the choice of the initial estimator should have only a marginal impact on the performance of the bias-corrected LSDV estimator. The estimation results are shown in Table 9 in "Appendix D". As expected, the coefficients of the lagged dependent variable are larger than when the models are estimated with least squares fixed effects, but the differences are generally small. Moreover, the estimated coefficients of the four ESIF variables shown in Table 9 are very close to those in Table 4. The small differences between the results obtained with the two estimators may be due to the relatively large number of time periods in the dataset (Judson & Owen 1999; Bun & Kiviet 2001).

We next replace the modelled ESIF series, which mimic accrual data, with the original cash-based ESIF data, which follow the time at which the reimbursement of the project spending takes place. Table 10 in Appendix E shows the results when the cash-based data are used instead of the modelled data. The cash-based ESIF variables are marked by the postscript _P. The results are qualitatively in line with those for the modelled variables in Table 4. The main difference is that the coefficients of CF and of TOTAL are a little smaller for the cash-based variables than for the modelled variables. The finding that the coefficients of CF and TOTAL are a little smaller is reasonable given that the cash-based funding variables are by construction less closely linked to the accrual-based public investment. The upshot is that whereas using the modelled ESIF variables is consistent with the use of accrual data from the national accounts, the results are qualitatively unchanged if the original cash-based data are used.

Table 5 presents the results when additional control variables are added to the baseline specification in Column (4.1) in Table 4. The models are, as before, estimated with fixed effect least squares. Column (5.1) shows the results when two additional fiscal control variables are included in the specification. The coefficient of public interest payments INTG is negative, so higher interest payments are associated with lower public investment. The magnitude of the effect is substantial, but it should be noted that the coefficient of the lagged public debt variable DEBT(-1) is now lower than in the baseline estimation in Column (4.1). The size of the public sector is positively associated with the public investment, but the positive association arises partly by construction as public investment is part of public spending. Despite the statistical and economic significance of the coefficients of the added control variables, the coefficient of CF is still around 1 and it is the only coefficient of the ESIF variables that is statistically significant.

Alegre (2012) argues that private and public investment may be mutually dependent as complements or substitutes. Column (5.2) shows the result when private investment in per cent of GDP is included contemporaneously in the model of public investment. The estimated coefficient is positive, but it is relatively small and not statistically significant. Alegre (2012) reports that private investment has a negative and statistically significant effect on public investment. The results for the ESIF variables are unchanged.

Column (5.3) shows the results when the two political variables are added to the baseline specification. The variable ELECTION is a dummy value taking the value 1 in years in which there are general elections, while the variable SCHMIDT is an index that depicts the political stance of the cabinet and takes the highest values for cabinets with a left-leaning orientation. The political variables are of little or no importance, and the coefficients of the ESIF variables are essentially unchanged from those in the baseline specification in Column (4.1).

Column (5.4) presents the results when the five additional control variables are included simultaneously. The coefficient of private investment is now statistically significant at the 10 per cent level, but the coefficient of CF is nevertheless still statistically significant and only a little below 1, while the coefficients of the other ESIF variables remain statistically insignificant. The upshot is that inclusion of a number of additional fiscal, macroeconomic and political variables have very little impact on the results for the ESIF variables.

Finally, we examine possible cross-sectional heterogeneity in the panel. To this end, we run the baseline estimation from Column (4.1) for each of the three country groups WE–CF, WE+CF and CEE. The aim is to ascertain possible differences across the three groups, but it should be kept in mind that the sample sizes are generally relatively small, which may limit the inferences that can be made since the coefficients will generally be estimated less precisely. Columns (5.1) to (5.3) in Table 6 show the results for each of the three country groups. The results for the WE–CF group are identical to those in Column (4.6) in Table 4.

The coefficient of the lagged dependent variable varies somewhat across the country groups; public investment exhibits more persistence in the WE–CF countries than in the WE+CF and CEE countries. This finding is unsurprising given the different dynamics of public investment shown in Fig. 1. Other studies have found corresponding differences in the persistence of various other fiscal variables between the EU countries in Western Europe and those in Central and Eastern Europe (Staehr 2008).

Besides the difference in persistence between the country groups, it is noticeable that the coefficients of all of the control variables attain the same signs across the three country groups, except in the case of BALCYC(−1). The coefficients are not statistically significant in all three groups at the same time, except the coefficient of the lagged debt stock. As before, the coefficients of ERDF, ESF and RURAL are not statistically significant. The coefficient of CF is positive but small and statistically insignificant for the WE+CF group, while it is around 1 and statistically significant at the 10 per cent level for the CEE group.

The CEE countries only joined the EU starting in 2004, so the time samples are somewhat different across the three country groups. We have therefore repeated the estimations for the period 2004–2018 so that possible differences across the three groups cannot easily be related to the time sample. The results are shown in Columns (6.4) to (6.6), where the results in Column (6.6) are by construction identical to those in Column (5.3). The coefficient of CF for the WE+CF group is now 0.61, but it is still very imprecisely estimated. We conclude that the large and statistically significant effect of support from the Cohesion Fund in large part is driven by the CEE countries.

7 Concluding comments

Public investment has been low and declining in many EU countries since the global financial crisis, and this may harm economic growth and development in the longer term. The European Structural and Investment Funds (ESIF) are the main fiscal instrument of the European Union for the objective of economic and social convergence across the regions of the union. This paper assesses whether there are relationships at the macroeconomic level between support from the ESIF funds and public investment in the EU countries.

The analysis uses an annual panel dataset for 28 EU countries from 2000 to 2018. Data for the ESIF variables are amended using statistical modelling in order to mimic accrual-based data. The econometric analysis is carried out using dynamic panel data specifications. Public investment is regressed on the lagged dependent variable, the support from the ESIF funds, and a large number of fiscal and macroeconomic control variables. All the estimations use country fixed effects, so the estimated effects are derived from the within-country time variation. A key challenge is to separate the effects of each of the ESIF funds given that there is substantial correlation between the dynamics of the four variables.

The analysis shows that the various ESIF funds affect public investment in the EU countries in very different ways. The Cohesion Fund provides support to the less developed EU countries, which are largely in Southern Europe and Central and Eastern Europe. Support from the Cohesion Fund had a close to one-to-one effect on public investment in the short term and more in the longer term. Funding from the European Regional Development Fund, the largest ESIF fund, might have some effect on public investment, but the effect is probably small and it cannot be established with reasonable precision. Payments from the European Social Fund and payments from the funds supporting agriculture, fishing and rural development do not appear to be associated with public investment in the EU countries.

The results are robust to various specification changes including the exclusion of the years of the global financial crisis, changes in the estimation methodology and the inclusion of additional control variables. They are also robust to a division of the sample into various country groups, though there are some differences in the persistence of public investment across the groups.

The results seem to align reasonably well with the eligibility and allocation criteria for the various ESIF funds discussed in Sect. 2. The Cohesion Fund mainly provides funding for environmental projects and trans-European networks, which may in large part be counted as public investment. The almost one-to-one effect in the short term and the larger effect in the longer term suggest that crowding out of national funding is limited.

The European Regional and Development Fund provides funding to projects for a broad set of objectives and the lack of a clear relationship between ERDF funding and public investment may be seen in this context. This paper focuses on public investment or gross capital formation in the public sector, so funding that goes to non-investment projects is not included. If climate-related funds are spent on improving networks for instance, it is likely to be public investment, but if the funds are spent on training courses for public sector employees, it is likely to be public consumption.

The European Social Fund, the European Agricultural Fund for Rural Development, and the European Maritime and Fisheries Fund meanwhile are funds that like ERDF support a range of projects, so the finding that they have no effect on public investment may not be inconsistent with their prescribed objectives.

The results in the paper may be of some importance for the debate on public investment in the European Union and the perceived need to increase this type of investment in some EU countries; see Sect. 1. Public investment is closely related to funding from the Cohesion Fund, but this is likely not the case for the European Regional and Development Fund, the European Social Fund and other ESIF funds. The evidence provides some support for the argument that the Cohesion Fund can contribute to increased public investment, while the evidence is less strong for the ERDF, the ESF and the rural funds.

The results may also be viewed through the prism of the principle of additionality. As discussed in Sect. 2, the definition and evaluation of additionality have changed over time, so the results obtained using a sample from 2000 to 2018 cannot be construed as an ex-post evaluation of the principle of additionality. However, if we consider the rules for the principle of additionality that were in place from the start of the funding period 2014–2020, then the analysis might provide some insights. Funding from the CF fund appears to be associated with increased public investment, but this may not be the case for the other ESIF funds. This suggests that the principle of additionality is not fully satisfied ex-post for the ERDF, the ESF and the rural funds. These findings should of course be interpreted in the light of the estimations covering the period from 2000 to 2018, which were carried out using fixed effects as discussed in Sect. 5.

The policies meant to foster regional convergence have been under debate almost from the inception of the forerunners to the European Union, and this also applies to the contents and governance of the European Structural and Investment Funds. The debates have focused on the priorities of funding and of the burdens of administration and evaluation, but the importance of public investment in regional convergence is also among the topics of debate (Bubbico et al. 2016). The results in this paper suggest that the relation between public investment and the current ESIF funds varies markedly across the various funds.

This study of the effects of ESIF funding on public investment in the EU countries leaves several issues open for further investigation. One avenue would seek to obtain a clearer identification of the causal effect of ESIF funding, similar to the effects found in Becker et al. (2010, 2013). This would require substantial exogenous variation across a large number of observations and this will be challenging to obtain using country-level data. Another avenue of investigation could focus on specific categories of public investment, such as investment in buildings and structures, infrastructure, or research and development in order to establish whether ESIF funding affects different categories of public investment in different ways. Finally, it would be beneficial to identify the institutional and economic conditions under which support from the various ESIF funds has the greatest effect on public investment. We leave these issues for future studies.

Notes

The European Globalisation Adjustment Fund for Displaced Workers which was set up in 2006 is not considered an ESIF fund as it targets distinct cases of hardship in EU countries affected by a crisis.

Principal-agent issues are at the centre of the literature on governance in federal or multilevel systems; see for example Knight (2002) and Volden (2007). They are also key for the effectiveness of foreign aid to developing countries; see for example Pack & Pack (1993) and Chatterjee & Turnovsky (2005).

The scope of the principle of additionality has changed somewhat over time and it only applies to all ESIF funds from the beginning of the 2014–2020 funding period.

In some cases gross national income (GNI) may be a more informative measure of value creation than GDP. We have tried to run the estimations where government investment and various other macroeconomic variables were expressed in per cent of GNI. Although GDP and GNI differ to an extent for some countries, the estimation results were very similar, and we therefore show only the results when the variables are scaled using GDP.

The data were downloaded on 1 November 2021. The data were used in the Autumn Forecast 2021 of the European Commission.

The funding from the European Maritime and Fisheries Fund is added to the funding from the European Agricultural Fund for Rural Development, since the payments from the fisheries fund are small and only started in 2014. The results would change very little if the European Maritime and Fisheries Fund were not included in the RURAL variable.

The computed Variance Inflation Factors for the ESIF variables are slightly higher when additional covariates are included, but the results are qualitatively unchanged.

The relative income level in the countries is a key control variable since funding from the ESIF funds depends in large part on the income level.

Becker et al. (2010, 2013) identify the causal effects of EU funding using a regression discontinuity approach, where the effects on income and employment growth in regions that are a little too well-off to receive funding are compared with the effects in regions that are less well-off and so receive funding. This methodology is not available in this case given that we consider public investment at the country level.

Table 8 in Appendix C shows the results in the model where TOTAL is included in various specifications; the results are in all cases close to the result in Column (4.2).

The average of the coefficient estimates of the four ESIF variables in Column (4.1) is around 0.25, which is very close to the coefficient estimate of 0.28 of TOTAL in Column (4.2).

References

Afonso A, St. Aubyn M, (2019) Economic growth, public, and private investment returns in 17 OECD economies. Port Econ J 18(1):47–65

Ameco (2021) Macro-economic database AMECO, European Commission, https://ec.europa.eu/economy_finance/ameco/.

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Armingeon K, Virginia, Wenger FW, Isler C, Knöpfel L, Weisstanner D, Engler S (2021) Comparative political data set, Zurich: Institute of Political Science, University of Zurich, https://www.cpds-data.org/index.php

Aslett K, Magistro B (2021) Principal agent problems in EU funds: a case study of patronage in Hungary, forthcoming in Europe-Asia Studies

Bacchiocchi E, Borghi E, Missale A (2011) Public investment under fiscal constraints. Fisc Stud 32(1):11–42

Bachtler JF, Ferry M (2013) Conditionalities and the performance of European structural funds: a principal-agent analysis of control mechanisms in European Union cohesion policy. Reg Stud 49(8):1–16

Becker SO, Egger PH, von Ehrlich M (2010) Going NUTS: the effect of EU structural funds on regional performance. J Public Econ 94(9–10):578–590

Becker SO, Egger PH, von Ehrlich M (2013) Absorptive capacity and the growth and investment effects of regional transfers: a regression discontinuity design with heterogeneous treatment effects. Am Econ J Econ Pol 5(4):29–77

Bom PRD, Ligthart JE (2014) What have we learned from three decades of research on the productivity of public capital? J Econ Surv 28(5):889–916

Bradley J (2006) Evaluating the impact of European Union cohesion policy in less-developed countries and regions. Reg Stud 40(2):189–200

Bruno GSF (2005) Approximating the bias of the LSDV estimator for dynamic unbalanced panel data models. Econ Lett 87(3):361–366

Bubbico RL, Rubianes AC, Ottersten EK, Sioliou MK (2016) Cohesion policy, EU economic governance and the role of the European Investment Bank, ch. 12 in Piattoni S, Polverari L (eds.) Handbook on Cohesion Policy in the EU, Edward Elgar, Cheltenham, pp. 186–202

Bun M, Kiviet J (2001) The accuracy of inference in small samples of dynamic panel data models. Tinbergen Institute Discussion Paper, no. 01-006/4

Cantos-Cantos JM, Balsalobre-Lorente D, García-Nicolás C (2020) Why the financial aid of the EU’s regional policy does not impact on the public investment level? The case of the Spanish regions. J Public Affairs. https://doi.org/10.1002/pa.2295

Chatterjee S, Turnovsky SJ (2005) Foreign aid, taxes and public investment: a further comment. J Dev Econ 45(1):155–163

Del Bo CF, Sirtori E (2016) Additionality and regional public finance—Evidence from Italy. Environ Plan C Politics Space 34(5):855

European Commission (2009) Report on ex-ante verification of additionality in the regions eligible under the Convergence objective for the period 2007–13, European Commission, DG Regional Policy, Brussels

European Commission (2013a) Regulation (EU) No 1303/2013a of the European Parliament and of the Council of 17 December 2013a laying down common provisions on the European Regional Development Fund, the European Social Fund, the Cohesion Fund, the European Agricultural Fund for Rural Development and the European Maritime and Fisheries Fund and laying down general provisions on the European Regional Development Fund, the European Social Fund, the Cohesion Fund and the European Maritime and Fisheries Fund and repealing Council Regulation (EC) No 1083/2006”, Official J Eur Union, L347, pp. 320–347, https://eur-lex.europa.eu/eli/reg/2013a/1303/oj

European Commission (2013b) Regulation (EU) No 1300/2013b of the European Parliament and of the Council of 17 December 2013b on the Cohesion Fund and repealing Council Regulation (EC) No 1084/2006, Official J Eur Union, L347, pp. 281–288, https://eur-lex.europa.eu/eli/reg/2013b/1300/oj

European Commission (2013c) Regulation (EU) No 1301/2013c of the European Parliament and of the Council of 17 December 2013c on the European Regional Development Fund and on specific provisions concerning the Investment for growth and jobs goal and repealing Regulation (EC) No 1080/2006, Official J Eur Union, L347, pp. 289–302, https://eur-lex.europa.eu/eli/reg/2013c/1301/oj

European Commission (2013d) Regulation (EU) No 1304/2013d of the European Parliament and of the Council of 17 December 2013d on the European Social Fund and repealing Council Regulation (EC) No 1081/2006, Official J Eur Union, L347, pp. 470–486, https://eur-lex.europa.eu/eli/reg/2013d/1304/oj

European Commission (2013e) Regulation (EU) No 1305/2013e of the European Parliament and of the Council of 17 December 2013e on support for rural development by the European Agricultural Fund for Rural Development (EAFRD) and repealing Council Regulation (EC) No 1698/2005, Official J Eur Union, L347, pp. 487–548, https://eur-lex.europa.eu/eli/reg/2013e/1305/oj

European Commission (2015) European Structural and Investment Funds 2014–2020: Official texts and commentaries, European Commission, Belgium

European Commission (2017) Ex-post verification of additionality 2007–2013, Communication from the Commission, COM (2017) 138 final, Brussels

European Commission (2018) Regionalisation of ESIF payments 1989–2015, Directorate-General for Regional and Urban Policy, https://data.europa.eu/doi/https://doi.org/10.2776/445389

European Commission (2020) Test and update of regionalised ESIF payments 1989–2018. Final report, Directorate-General for Regional and Urban Policy, https://data.europa.eu/doi/https://doi.org/10.2776/569313

European Commission (2021) Historic EU payments—regionalised and modelled, https://cohesiondata.ec.europa.eu/Other/Historic-EU-payments-regionalised-and-modelled/tc55-7ysv

European Commission (2022) European Structural and Investment Funds, https://ec.europa.eu/info/funding-tenders/funding-opportunities/funding-programmes/overview-funding-programmes/european-structural-and-investment-funds_en

European Fiscal Board (2020) Assessment of the fiscal stance appropriate for the euro area in 2021, European Commission, https://ec.europa.eu/info/sites/info/files/2020_06_25_efb_assessment_of_euro_area_fiscal_stance_en.pdf

Forte-Campos V, Rojas J (2021) Historical development of the European Structural and Investment Funds, Econ Bull, no. 3/2021, Banco de España

Fuest C (2021) The NGEU economic recovery fund. Cesifo Forum 22(1):3–8

González Alegre J (2012) An evaluation of EU regional policy. Do structural actions crowd out public spending? Public Choice 151(1):1–21

Hagen T, Mohl P (2011) Econometric evaluation of EU Cohesion Policy: a survey, ch. 16 in Jovanović MN & Sidjanski D (ed.) International Handbook of Economic Integration, Edward Elgar, Cheltenham, pp. 343–370

Heinemann F (2006) Factor mobility, government debt and the decline in public investment. IEEP 3(1):11–26

Judson R, Owen A (1999) Estimating dynamic panel data models: a guide for macroeconomists. Econ Lett 65(1):9–15

Kiviet JF (1995) On bias, inconsistency, and efficiency of various estimators in dynamic panel data models. J Econ 68(1):53–78

Kiviet JF (1999) Expectations of expansions for estimators in a dynamic panel data model: some results for weakly exogenous regressors, ch. 8 in Hsiao C, Pesaran, Lahiri K & Lee LF (eds.) Analysis of Panels and Limited Dependent Variable Models, Cambridge University Press, Cambridge, pp. 199–225

Kostarakos I (2021) Public debt and aggregate investment in the EU, Appl Econ Lett, forthcoming

Mehrotra A, Välila T (2006) Public investment in Europe: evolution and determinants in perspective. Fisc Stud 27(4):443–471

Milbourne R, Otto G, Voss GM (2003) Public investment and economic growth. Appl Econ 35(5):527–540

Mohl P (2016) Does EU cohesion policy really increase public investment?, Ch. 10 in Empirical Evidence on the Macroeconomic Effects of EU Cohesion Policy, Springer, Wiesbaden, pp. 137–153

Nickell S (1981) Biases in dynamic models with fixed effects. Econometrica 49(2):1417–1426

Notermans T (2016) Does Cohesion policy lead to economic convergence?, Ch. 29 in Piattoni S, Polverari L (eds.) Handbook on Cohesion Policy in the EU, Edward Elgar, Cheltenham, pp. 461–474

Novelli AC, Barcia G (2021) Sovereign risk, public investment and the fiscal policy stance, J Macroecon, vol. 67, Article no. 103263

Pack H, Pack JR (1993) Foreign aid and the question of fungibility. Rev Econ Stat 75(2):258–265

Picarelli M, Vanlaer W, Marneffe W (2019) Does public debt produce a crowding out effect for public investment in the EU?, European Stability Mechanism Working Paper, no. 36

Romp W, de Haan J (2007) Public capital and economic growth: a critical survey. Perspekt Wirtsch 8(S1):6–52

Schmidt MG (1992) Regierungen: Parteipolitische Zusammensetzung [Governments: party political composition], in Schmidt MG (ed.) Lexikon der Politik [Encyclopedia of Politics], vol. 3: Die westlichen Länder [the Western countries], Munich: C. H. Beck, pp. 393–400

Staehr K (2008) Fiscal policies and business cycles in an enlarged euro area. Econ Syst 32(1):46–69

Volden C (2007) Intergovernmental grants: a formal model of interrelated national and subnational political decisions. Publius J Fed 37(2):209–243

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible Editor: Harald Oberhofer.

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

See Fig. 2.

Appendix B

See Table

7.

Appendix C

See Table

8.

Appendix D

See Table

9.

Appendix E

See Table

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Staehr, K., Urke, K. The European structural and investment funds and public investment in the EU countries. Empirica 49, 1031–1062 (2022). https://doi.org/10.1007/s10663-022-09549-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-022-09549-6