Abstract

In this paper, we focus on the effect of spillovers in monetary policy in the period 2004–2017. Firstly, we calculate shadow rates that measure the monetary stances for each country analysed. Then, by using the approach of spatial dynamic panel, we account for the presence of potential spillovers in the Eurozone, both in the long and short run, while controlling for the main channels regulating the monetary stances. Results confirm that monetary policy is largely affected by the presence of spillovers due to proximity in the business cycles and this effect should be considered to manage the effects of monetary policy in different European economies.

Similar content being viewed by others

Notes

We construct the yield curve for euro area with bond maturity of 3 months and 1, 5, 10, and 30 years.

The series are retrieved from Eurostat.

The number of simulations considered for the MCMC for direct, indirect, and total impacts is 500.

References

Acharya V, Eisert T, Eufinger C, Hirsch C (2016) Whatever it takes: the real effects of unconventional monetary policy. Safe working papers, p 152

Altavilla C, Giannone D, Lenza M (2014) The financial and macroeconomic effects of OMT announcements (No. 10025). CEPR discussion papers

Altavilla C, Canova F, Ciccarelli M (2016) Mending the broken link: heterogeneous bank lending and monetary policy pass-through (No. 11584). CEPR discussion papers

Altavilla C, Brugnolini L, Gürkaynak RS, Motto R, Ragusa G (2019) Measuring euro area monetary policy (No. 2281). European Central Bank

Anselin L (1988) Spatial econometrics: methods and models. Kluwer Academic Publishers, Dorddrecht

Arbia G (2006) Spatial econometrics: statistical foundations and applications to regional convergence. Springer, New York

Arbia G, Bramante R, Facchinetti S, Zappa D (2018) Modeling inter-country spatial financial interactions with Graphical Lasso: an application to sovereign co-risk evaluation. Reg Sci Urban Econ 70:72–79

Arellano M, Bond S (1991) Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Arnold M, Stahlberg S, Wied D (2013) Modeling different kinds of spatial dependence in stock returns. Empir Econ 44:1–14

Baumeister C, Benati L (2013) Unconventional monetary policy and the great recession: estimating the macroeconomic effects of a spread compression at the zero lower bound. Int J Central Bank 9(2):165–212

Beber A, Brandt MW, Kavajecz KA (2009) Flight-to-quality or flight-to-liquidity? Evidence from the euro-area bond market. Rev Financ Stud 22(3):925–957

Benedetti R, Palma D, Postiglione P (2019) Modeling the impact of technological innovation on environmental efficiency: a spatial panel data approach. Geogr Anal 52:231–253

Berben R-P, Locarno A, Morgan J, Vallés J (2004) Cross-country differences in monetary policy transmission. ECB working paper 0400

Bernanke BS, Blinder AS (1988) Credit, money, and aggregate demand. Am Econ Rev 78(2):435–439

Bernanke BS, Boivin J, Eliasz P (2005) Measuring the effects of monetary policy: a factor-augmented vectorautoregressive (FAVAR) approach. Q J Econ 120(1):387–422

Black F (1995) Interest rates as options. J Finance 50(5):1371–1376

Bletzinger T, von Thadden L (2018) Designing QE in a fiscally sound monetary union. In: A fiscally sound monetary union. ECB working paper, 2156

Bloom N (2009) The impact of uncertainty shocks. Econometrica 77(3):623–685

Bloom N (2014) Fluctuations in uncertainty. J Econ Perspect 28(2):153–176

Brady RR (2011) Measuring the diffusion of housing prices across space and over time. J Appl Econom 26(2):213–231

Burriel P, Galesi A (2018) Uncovering the heterogeneous effects of ECB unconventional monetary policies across euro area countries. Eur Econ Rev 101:210–229

Caballero RJ, Krishnamurthy A (2008) Collective risk management in a flight to quality episode. J Finance 63(5):2195–2230

Caballero RJ, Farhi E, Gourinchas PO (2017) The safe assets shortage conundrum. J Econ Perspect 31(3):29–46

Carriero A, Clark TE, Marcellino M (2018) Measuring uncertainty and its impact on the economy. Rev Econ Stat 100(5):799–815

Catania L, Billé AG (2017) Dynamic spatial autoregressive models with autoregressive and heteroskedastic disturbances. J Appl Econom 32(6):1178–1196

Christiano LJ, Eichenbaum M, Evans C (1996) The effects of monetary policy shocks: evidence from the flow of funds. Rev Econ Stat 78:16–34

Ciccarelli M, Maddaloni A, Peydró JL (2013) Heterogeneous transmission mechanism: monetary policy and financial fragility in the Eurozone. Econ Policy 28(75):459–512

Claus E, Claus I, Krippner L (2014) Asset markets and monetary policy shocks at the zero lower bound (No. DP2014/03). Reserve Bank of New Zealand

Damjanović M, Masten I (2016) Shadow short rate and monetary policy in the Euro area. Empirica 43(2):279–298

Debarsy N, Ertur C, LeSage JP (2012) Interpreting dynamic space–time panel data models. Stat Methodol 9(1–2):158–171

Dees S, Mauro FD, Pesaran M, Smith L (2007) Exploring the international linkages of the euro area: a global VAR analysis. J Appl Econom 22(1):1–38

Dell’Erba S, Baldacci E, Poghosyan T (2013) Spatial spillovers in emerging market spreads. Empir Econ 45(2):735–756

Di Berardino C, Mauro G, Quaglione D, Sarra A (2016) Industrial districts and socio-economic well-being: an investigation on the Italian provinces disparities. Soc Indic Res 129(1):337–363

Driscoll JC, Kraay AC (1998) Consistent covariance matrix estimation with spatially dependent panel data. Rev Econ Stat 80(4):549–560

Elhorst JP (2012) Dynamic spatial panels: models, methods, and inferences. J Geogr Syst 14(1):5–28

Elhorst JP (2014) Spatial panel data models. In: Spatial econometrics. Springer, Berlin, Heidelberg, pp 37–93

Elhorst JP, Lacombe DJ, Piras G (2012) On model specification and parameter space definitions in higher order spatial econometric models. Reg Sci Urban Econ 42(1–2):211–220

Ertur C, Koch W (2007) Growth, technological interdependence and spatial externalities: theory and evidence. J Appl Econ 22(6):1033–1062

Falagiarda M, McQuade P, Tirpák M (2015) Spillovers from the ECB’s non-standard monetary policies on non-euro area EU countries: evidence from an event-study analysis (No. 1869). ECB working paper

Fingleton B, Garretsen H, Martin R (2015) Shocking aspects of monetary union: the vulnerability of regions in Euroland. J Econ Geogr 15(5):907–934

Fiorelli C, Meliciani V (2019) Economic growth in the era of unconventional monetary instruments: a FAVAR approach. J Macroecon 62

Fratzscher M, Duca ML, Straub R (2016) ECB unconventional monetary policy: market impact and international spillovers. IMF Econ Rev 64(1):36–74

Gagnon JE, Bayoumi T, Londono JM, Saborowski C, Sapriza H (2017) Direct and spillover effects of unconventional monetary and exchange rate policies. Open Econ Rev 28(2):191–232

Gambacorta L, Hofmann B, Peersman G (2014) The effectiveness of unconventional monetary policy at the zero lower bound: a cross-country analysis. J Money Credit Bank 46(4):615–642

Georgiadis G (2015) Examining asymmetries in the transmission of monetary policy in the euro area: evidence from a mixed cross-section global VAR model. Europ Econ Rev 75:195–215

Havranek T, Rusnák M (2012) Transmission lags of monetary policy: a meta-analysis (No. wp1038). William Davidson Institute at the University of Michigan, Ann Arbor

Hjortsoe I, Weale M, Wieladek T (2016) Monetary policy and the current account: theory and evidence (No. 11204). CEPR discussion papers

Islam N (1995) Growth empirics: a panel data approach. Q J Econ 110(4):1127–1170

Kang YQ, Zhao T, Yang YY (2016) Environmental Kuznets curve for CO2 emissions in China: a spatial panel data approach. Ecol Ind 63:231–239

Kelejian H, Piras G (2017) Spatial econometrics. Academic Press, Cambridge

Kim S (2003) Monetary policy rules and business cycles. Scand J Econ 105(2):221–245

Korinek A (2016) Currency wars or efficient spillovers? A general theory of international policy cooperation (No. w23004). National Bureau of Economic Research, Cambridge

Kremer M (2016) Macroeconomic effects of financial stress and the role of monetary policy: a VAR analysis for the euro area. IEEP 13(1):105–138

Krippner L (2013) A tractable framework for zero lower bound Gaussian term structure models (No. DP2013/02). Reserve Bank of New Zealand, Wellington

Krippner L (2015) Zero lower bound term structure modeling: a practitioner’s guide. Springer, Berlin

Lenza M, Pill H, Reichlin L (2010) Monetary policy in exceptional times. Econ Policy 25(62):295–339

LeSage JP (2014) What regional scientists need to know about spatial econometrics. Rev Reg Stud 44(1):13–32

LeSage JP, Pace RK (2009) Introduction to spatial econometrics. CRC Press, Boca Raton

Lombardi M, Zhu F (2014) A shadow policy rate to calibrate US monetary policy at the zero lower bound (No. 452). Bank for International Settlements, Basel

Milcheva S, Zhu B (2016) Bank integration and co-movements across housing markets. J Bank Finance 72(S):S148–S171

Mutl J, Pfaffermayr M (2011) The Hausman test in a Cliff and Ord panel model. Econom J 14(1):48–76

Parent O, LeSage JP (2010) A spatial dynamic panel model with random effects applied to commuting times. Transp Res Part B Methodol 44(5):633–645

Parent O, LeSage JP (2011) A space–time filter for panel data models containing random effects. Comput Stat Data Anal 55(1):475–490

Pattipeilohy C, Bräuning C, van den End JW, Maas R (2017) Assessing the effective stance of monetary policy: a factor-based approach (No. 575). Netherlands Central Bank, Research Department

Peersman G (2011) Macroeconomic effects of unconventional monetary policy in the Euro Area (No. 8348). CEPR discussion papers

Rey H (2016) International channels of transmission of monetary policy and the Mundellian trilemma. IMF Econ Rev 64(1):6–35

Rogers JH, Scotti C, Wright JH (2014) Evaluating asset-market effects of unconventional monetary policy: a multi-country review. Econ Policy 29(80):749–799

Shambaugh JC (2012) The Euro’s three crises. Brook Pap Econ Act 2012(1):157–231

Wu JC, Xia FD (2016) Measuring the macroeconomic impact of monetary policy at the zero lower bound. J Money Credit Bank 48(2–3):253–291

Yu J, De Jong R, Lee LF (2008) Quasi-maximum likelihood estimators for spatial dynamic panel data with fixed effects when both n and T are large. J Econ 146(1):118–134

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

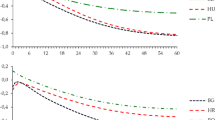

See Tables 5, 6 and 7 and Fig. 6.

Rights and permissions

About this article

Cite this article

Fiorelli, C., Cartone, A. & Foglia, M. Shadow rates and spillovers across the Eurozone: a spatial dynamic panel model. Empirica 48, 223–245 (2021). https://doi.org/10.1007/s10663-020-09483-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-020-09483-5