Abstract

I analyse the link between money and credit for twelve industrialized countries in the time period from 1970 to 2016. The euro area and Commonwealth Countries have rather strong co-movements between money and credit at longer frequencies. Denmark and Switzerland show weak and episodic effects. Scandinavian countries and the US are somewhere in between. I find strong and significant longer run co-movements especially around booming house prices for all of the sample countries. The analysis suggests the expansionary policy that cleans up after the burst of a bubble may exacerbate the risk of a new house price boom. The interrelation is hidden in the short run, because the co-movements are then rarely statistically significant. According to the wavelet evidence, developments of money and credit since the Great Recession or their decoupling in Japan suggest that it is more appropriate to examine the two variables separately in some circumstances.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Gomis-Porqueras and Sanches (2013) point to an increasing role of fiat money and credit as means of payment in an environment of rising credit arrangements and credit instruments in the past two decades. Nevertheless, money and credit were largely neglected in monetary policy over the Great Moderation (Woodford 2008; Meyer 2001). The prevailing approach to model central banks behavior, were the interest rates and the Taylor-type rules. The Great Recession renewed interests in money and credit. The reason was that models without money or credit have neither predicted nor explained the crisis, while the role played by the financial sector in its propagation and origination is undisputed. Moreover, the unconventional responses of major central banks brought to the forefront the relevance of money and credit.

The main goal of the article is to analyze the relationship between money and credit growth, the prevailing direction of the link and to disentangle the short-, medium- and long-run co-movements and changes of the relation across time with a wavelet methodology. In particular, I aim to find out if strength and significance of the co-movements, and the lead-lag properties of money and credit changed in time during the period from the liberalization of the financial sectors in the 1970s and 1980s to the unconventional responses of major central banks to the Great Recession. The analysis is performed for Australia, Canada, Denmark, the euro area, Japan, New Zealand, Norway, Sweden, South Africa, Switzerland, the United Kingdom and the United States to find common/diversified patterns among them.

The existence, stability and causation of a relation between money and credit is relevant in its own right including the implications for policy (Goodhart et al. 2016). For example, real-time data on money growth are argued to contain information on the true level of current output gap (Scharnagl et al. 2010), on future inflationary pressures (Rua 2012), are historically associated with economic booms and busts (Gerdesmeier et al. 2010; Brunnermeier 2009; Adalid and Detken 2007; Bordo and Haubrich 2010; and Borio and Lowe 2004), while credit may amplify and propagate macroeconomic shocks in models with financial accelerators (Bernanke et al. 1999). However, and as noted by Schularick and Taylor (2012), the dynamics of money and credit have not been verified across a broad sample of countries over the long run, while the role of money and credit has changed apparently and substantially over time.

When the frequency content of money and credit changes over time, it is important to have a measure of correlation or coherence in the time-frequency plane. Wavelet analysis allows a simultaneous assessment of how variables relate at different frequencies and how such a relationship varies over time. Since wavelets are efficient in identifying damping in dynamic systems, our results could be potentially helpful for post-Great Recession models where money and credit coexist (Gu et al. 2016; Ferraris 2010; Telyukova and Wright 2008; Mills 2007). The need for models augmented with money and/or credit became apparent after the Great Recession.

The contribution of the article is twofold. First, we use a long-term dataset covering a period of almost half a century which enables the analysis of quite a long span and as such, this analysis can give us a more detailed picture of the historical interplay between money and credit. In particular, the existing literature falls short in analysing the dynamics between money and credit during the Great Recession of 2007–2009 and the 2010–2012 euro area debt crisis. Meanwhile, the unconventional scale of the intervention in response to the Great Recession and the importance of central banks that implemented quantitative easing (QE) comprise a natural background for the unresolved discussion on the relationship between money and credit.

Second, the analysis is significant because it allows us to analyse the short-run and long-run relationships so that economic forecasters with different operational horizons could adjust their decisions accordingly. The co-evolution of money and credit over time and over frequencies as well as similar processes are hard to estimate with pure time-domain and pure frequency-domain methods (Hkiri et al. 2018). Finally, the diversified groups of countries constitute an interesting setup to discover the general and country-specific patterns. In particular, the wavelet transform allows us to check if the link between money and credit growth differs during normal times, and real house price boom episodes at given frequencies.

The article is organized as follows. Section 2 contains the literature review of the few studies on the dynamics between money and credit. It discusses the diversified reasons for their decoupling after the 1970s. Section 3 presents the methodology applied and is followed by the description of the data in Sect. 4. The results of the continuous wavelet transform for the quarterly rates of M3 growth and bank credit growth are presented in Sect. 5.1. Section 5.2 concerns M3 and credit from all sectors. Section 5.3 briefly discusses a sensitivity analysis for M2 and robustness checks based on adjustments of M3 and M2 money growth rates for the real GDP rates of growth, and on the maximal overlap discrete wavelet transform.

2 The theoretical background of the decoupling of money and credit

Since 1970 the behaviour of money and credit aggregates has changed considerably. The complex reasons include new monetary policy regimes, which respond aggressively to inflationary pressure (Surico and Sargent 2011), deposit insurance and the expanded role of the Lender of Last Resort, greater role of activist macroeconomic policies, and a growing emphasis on bank (Schularick and Taylor 2012) and generally macroprudential supervision. In consequence, fisherian movements in interest rates and a drop in the opportunity cost of money have altered the money demand (Teles et al. 2016).

Besides better monetary policy, money and credit dynamics have changed as a result of deregulation, financial innovations including common access to ATM cards, the increasing role of money substitutes (Berentsen et al. 2015), and financial intermediation growing in complexity in a relatively stable macroeconomic environment characterized by low inflation. Before 1970, banks typically funded their loan growth through monetary liabilities (Schularick and Taylor 2012). Afterwards, nonmonetary sources of finance gained considerable importance for providing aggregate credit (Adrian and Shin 2008). Ultimately, broad money is nowadays determined by many concomitant interactions and factors which made money supply largely endogenousFootnote 1 and mainly driven by economic activity and bank lending. In consequence: (a) the link between money and credit is expected to be looser than in the past, (b) the new demand for money may be explained by the improved access to money markets (Berentsen et al. 2015).

Despite such fundamental changes in the dynamics of money and credit in recent years and despite considerable importance of higher time-variation in the velocity of money and credit for the potentially larger instability in the transmission of monetary policy and for the amplification, propagation, and generation of shocks in normal times and during financial distress, the evidence on the relationship between money and credit is scarce.Footnote 2 It includes, for example, a study of Schularick and Taylor (2012), who using data for 12 developed countries show that money and credit began a recovery after the end of the World War II. The rapid upward trend has continued to the present, but since 1970 the authors have been evidencing the generalized decoupling of money and credit aggregates. This new global stylized, and not fully appreciated fact may be explained in their opinion foremostly due to the combination of increased leverage (i.e. banks may grant credit beyond their deposit base) and augmented funding via the nonmonetary liabilities of banks.

Goodhart and Hofmann (2008) and Kuzin and Schobert (2015) also investigated the relationship between money and credit. Goodhart and Hofmann (2008) found that after 1985 credit granger caused money growth in a panel VAR for 17 industrialized countries. Before 1985, money and credit were interdependent, although it was not clear whether money or credit was leading. Kuzin and Schobert (2015) found a different change in money-credit link. According to their results, domestic credit to non-banks used to determine money creation before the monetary union to a considerable extent in Germany. Afterwards, net foreign assets started to dominate the contribution to money creation in the euro area.

The reason for the limited evidence on the money and credit dynamics is twofold. The first explanation is related to the money multiplier approach, which became a popular misconception on how money is created. The second one is related to the fact that money and credit are jointly determined. When a bank makes a loan, at the same time it creates a matching deposit in the borrower’s bank account and thereby it creates new money. The opposite direction is also possible. Changes in the quantity of money may impact risk premia and more general credit conditions.Footnote 3 Nevertheless, in some circumstances it is more appropriate to examine bank or non-bank lending and broad money separately (Bank of England 2008).

Money and credit typically diverge during financial crises. Growth of credit may be weak if banks hoard liquidity despite credit’s low price. Flight-to-liquidity and risk aversion expand narrow money and may increase broad money. At the same time banks may attract funds in a capital market with increasing difficulty.Footnote 4

During a financial crisis, the decline of total bank assets and a fall in the size of banks’ loan portfolios are likely to encourage banks to limit the share of nonperforming loans. The amount of granted loans may be subdued by adverse selection and moral hazard problems as well. In order to decrease the exposure to the banking system or to contain the indebtedness ratios banks may be interested in internal sources of funding and market-based funding instead. Generally, non-deposit market funding constitutes an increasing share of the liability side of the banks’ balance sheet in recent years. It loosens the relationship between money and credit.

Finally, money and credit growth may vary as a result of the global liquidity conditions. Cross-border capital inflows and outflows can directly affect domestic credit beyond the volume that would result from domestic monetary conditions. Indeed, a meaningful credit build-up can appear without sizeable money overhang and vice versa as found by Liu and Kool (2018) for the euro area countries. The authors show that net foreign credit may create a wedge between money and bank credit especially if a current account deficit is present. Whereas the disparity between money and credit should be more pronounced in small and open economies, the wedge is expected to be subdued for the euro area as a whole. Carvalho (2018) shows in turn that the sectoral composition of international capital flows and the country’s FX regime have important implications for domestic credit and money holdings as well. While net debt flows of nonbanks seem to be more important in explaining broad money dynamics, the flows in the banking sector are correlated stronger with credit dynamics and with the excess growth of credit over money. In the floating FX regimes, the cross-border capital flows are more responsive to higher domestic money holdings than in the fixed FX regimes.

3 Methodology

The popular discrete short-time Fourier transform, which is applied to subsets of the time series via a moving window of constant length contains a considerable number of high frequency cycles, but the low frequency cycles are underrepresented. Whereas the base functions in the traditional Fourier methods are sine and cosine that are globally uniform in time and have infinite span, the generalized local base functions (wavelets) in a wavelet transform can be stretched and translated both in time and in frequency domains. Wavelets are, therefore, tempting alternatives to the Fourier-based cross spectrum and magnitude squared coherence (Whitcher et al. 2000).

Wavelets are packages of waves that are defined by a specific frequency. They degenerate towards their both ends (Kumar and Foufoula-Georgiou 2014). A wavelet is a function that integrates to zero and has a unit energy (Bruzda 2013) as well as limited period of fluctuations (Fan and Gençay 2010). Wavelets are scaled to have the most optimal resolution for both high and low frequency signals by using the least number of base functions (i.e. ‘the zoom-in’ property) (Lau and Weng 1995) to solve the problem of the so called ‘uncertainty principle’ (Chui 1992). I use functions and their modifications included in the ASToolbox (Aguiar-Conraria and Soares 2013) and the cross wavelet and wavelet coherence toolbox for MATLAB (Grinsted et al. 2004).

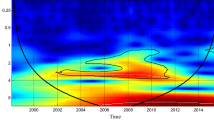

I analyse time-localized oscillations in money and credit signals separately for every country with a wavelet coherency. The wavelet coherency is the time-frequency domains correlation coefficient. It is similar to the conventional correlation coefficient and to the dynamic conditional correlation analysis. It takes values from zero to one. A value of zero stands for no co-movements. A value of one stands for the strongest possible co-movements between money and credit. The second power of the wavelet coherency can be interpreted as an R-squared coefficient in a regression of money on the present, past and future values of credit. To facilitate the interpretation, the wavelet coherency is marked with colours from blue (no or weak co-movements) to red (strong co-movements). The statistically significant estimates of the wavelet coherency are marked with black contours.

The plots of wavelet coherency between growth rates of money and credit are enriched by the wavelet phase spectrum. I use it to identify the relative lag between both time series. If arrows point to the right side: there is a positive instantaneous correlation between money and credit developments; if to the left—there is negative instantaneous correlation (analogous to negative covariance); if arrows are up—money growth leads credit growth by π/2; if arrows are down—credit growth leads money growth by π/2. As opposed to the conventional Granger causality test, the method does not assume a single, one-way link at each frequency and for the whole investigated time span (Grinsted et al. 2004).

In the article, wavelet gain coefficient represents the change of amplitudes of credit growth signal to a change in amplitudes of money growth signal. The estimates of the coefficients are reported for the typical business cycle (2–8 years cycle) and for the longer run cycle of 8–16 years. The coefficient equals unity if 1% money growth translates into a 1% increase of credit growth.

The black curved lines drawn at every wavelet coherency plot mark the interpretable area (i.e. the cone of influence). Areas outside or overlapping these lines should be interpreted with caution. The reason is that they may be distorted by zero padding (Mallat 2009).

Mathematically, the continuous wavelet transform (CWT) of a square-integrable signal g is defined as:

where \(a > 0\) is the scale parameter, \(b\) is the translation parameter and \(\psi\) is the analysing wavelet. For a base (mother) wavelet I choose the most typical complex Morlet wavelet (Grossmann and Morlet 1984) (2). The wavelet allows the optimal time-frequency resolution with respect to the Heisenberg inequality. The amplitude and local phase can be examined with the below formula:

where t is a non-dimensional ‘time’ parameter. Moreover, both \(\sigma > 0\) and the non-dimensional frequency \(k_{0}\) are constants. The constant \(k_{0}\) determines the amount of oscillations within the Gaussian envelope. Higher (lower) \(k_{0}\) translates into better (poorer) frequency localization but poorer (better) time localization. I set \(\sigma = 1\) and \(k_{0} = 6\) as suggested by Torrence and Compo (1998) to satisfy the admissibility condition and to obtain a satisfactory balance between time and frequency localization. As a result, a direct relationship between the wavelet scale and the Fourier frequency is created (Aguiar-Conraria and Soares 2013), because for \(k_{0} = 6\), the wavelet scale is almost equal to the Fourier period. The wavelet coherency is defined as follows:

where S denotes a smoothing operator in time and scale. I use the Hanning window with the size parameter set to two and zero padding on the boundaries. In turn, x and y are two signals: \(x,y \in L^{2} \left( R \right)\) and \(XWT_{xy} \left( {a,b} \right) = CWT_{x} \left( {a,b} \right)\overline{{CWT_{y} \left( {a,b} \right)}}\), where XWT stands for the cross wavelet transform. The wavelet phase difference or the wavelet phase spectrum is defined as:

where \(\phi_{xy} \left( {a,b} \right) \in \left( { - \pi ,\pi } \right.\), ℜ and ℑ are the real and imaginary parts of a complex number, respectively, and the function ‘atan’ is treated as the (2-argument) four-quadrant inverse tangent. The gain coefficient is defined as follows:

In the tests of significance I assume constant AR(2) background spectra.

I use logarithmic growth rates of seasonally adjusted money and credit growth series with the detection and correction for outliers with X-13 ARIMA.

I compare the relationship between money and credit growth for periods of macroeconomic stability and for periods around real house price booms. I define a real house price boom as a consecutive period when real house prices exceed the Hodrick–Prescott trend (smoothing parameter = 100,000) by at least 5% for at least 12 quarters after Goodhart and Hofmann (2008). Next, I classify the identified boom episodes into high and low-cost booms following Adalid and Detken (2007). If the annual average real GDP growth in the 3 years following the boom compared to the annual average growth during the boom is greater by at least 2.4 p.p., the boom is classified as a high cost one. Otherwise it is classified as a low cost one.

Finally, I apply the maximal overlap discrete wavelet transform (MODWT) and examine how correlations between money and credit growth change across time and specific frequency scales. Following Kapounek and Kučerová (2018), I introduce the discrete wavelet transform (DWT), where the scale parameter is discretized to integer powers of 2j, j = 1,2,3,… And the wavelet is defined as follows:

where n stands for the length of a signal and m equals to the number of scales. The interrelation between the MODWT and the previously described continuous wavelets analysis is that MODWT is a non-decimated variation of the orthonormal DWT, whereas a DWT is a discretized version of the CWT.

I use the Daubechies wavelet for the orthogonal filter in the MODWT decomposition. For the scale \({{\uplambda }}_{\text{j}}\) and lag \(\tau\), the MODWT estimator of the wavelet cross correlation is given by the equation (Whitcher et al. 2000):

where \({\tilde{{\upsigma }}}_{\text{x}} \left( {{{\uplambda }}_{\text{j}} } \right)\) and \({\tilde{{\upsigma }}}_{\text{y}} \left( {{{\uplambda }}_{\text{j}} } \right)\) are the squared root of the two time series wavelet variances. For \(\tau = 0\) we have the estimator of the wavelet correlation between the two time series. The MODWT estimator of the cross covariance \({\tilde{{\upgamma }}}_{{{{\uptau }},{\text{xy}}}} \left( {{{\uplambda }}_{\text{j}} } \right)\) is expressed by the equation (Whitcher et al. 2000):

I consider two subsamples: 1Q 1970–4Q 1983 and 1Q 1984–4Q 2016. The first subsample represents the period before the Great Moderation. The beginning of the Great Moderation was chosen after McConnell and Perez-Quiros (2000) who found a structural break in the volatility of real U.S. GDP growth.

4 Data

M3 and M2 monetary data come from the International Monetary Fund (IMF, International Financial Statistics database) and the Federal Reserve Bank of St. Louis (FRED). Credit data are from the new Bank for International Settlements (BIS) database. These are: (a) credit to private non-financial sector (PNFS) from banks and (b) credit to PNFS from all sectors. The credit series were obtained by adjusting levels through standard statistical techniques described in Dembiermont et al. (2013). House prices are nominal residential property price indices from the BIS Residential Property Price database. They are adjusted for the deseasonalized consumer price inflation based on OECD data. The real and nominal GDP in national currency (expenditure approach) comes from OECD. All of the time series are quarterly and range from 1Q 1970 to 4Q 2016 with a few exceptions. The exceptions mostly concern shorter M2 series in some countries and shorter series for the euro area. More data details are given in explanatory notes to the presented Figures.

5 Empirical results

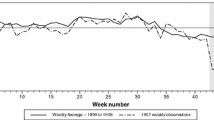

At first, it is convenient to look at the time series in time-domain in Fig. 1. We split countries into the following three groups—countries which adopted QE, the Commonwealth Countries—except for the UK, and others. The ‘eyeball metric’ suggests that the quarterly rates of money and credit growth follow similar patterns. In the first group of countries, money and credit behaviour is relatively stable. Money and credit rates of growth fall from the 1970s to at least the 1990s, later they reach a plateau of roughly similar values until the Great Recession. The Great Recession is marked by their fall and the subsequent trials to restore their growth in the following years. In the second group of countries, the variance of the rates of money and credit growth is larger, although money and credit rates of growth also seem to follow a downward trend from the 1970s on. Next, we can distinguish the build-up of money and credit levels ahead of the Great Recession. Afterwards, rates of money and credit growth reach smaller values with their variance decreased. The linkage of money and credit growth rates seems to be the weakest in the third group of countries, where the variance of money growth rate is considerably larger than that of the credit growth rates.

To provide a detailed analysis of co-movements in the time-frequency domain (including the impact of the diversified patterns in the velocity of money and credit, Fig. 9), we decompose the time series using CWT. In the following Sections, we point to significant longer run co-movements of money and credit around times of financial distress for all of the sample countries and typically for the euro area and the Commonwealth Countries also during normal times.

5.1 M3 and bank credit

The reader sees an interesting clustering in the coherency graphs (Fig. 2). The euro area and Commonwealth Countries, except for Canada, have rather strong co-movements between money and credit at longer frequencies, whereas Denmark and Switzerland, both small and open economies, show rather weak and episodic effects. Scandinavian countries and the US are somewhere in between. The typical co-movements are positive.

Wavelet coherency between M3 and bank credit from 1Q 1984 to 4Q 2016. Notes: Frequency unit is a year (left hand-side of all of the plots). The number of bootstrap samples: 500. The plot for the euro area starts from 3Q 1997. Shaded areas represent the episodes of real house price booms according to Table 1.

We find strong co-movements especially around the episodes of real house price booms (Table 1),Footnote 5 which pose a potential threat for monetary policy after the burst of a house price bubble. In case the policy would lead to large money (credit) growth, it may eventually translate into credit (money) growth of a similar size with a lag of between 2 and 16 years. The reason for this are high and positive coherencies between money and credit (Fig. 2) and the estimates of the gain coefficients often close to or above unity,Footnote 6 both for the typical business cycle frequency range (2–8 year cycles, Fig. 3b) and especially for the longer run developments (Fig. 3a). In turn, money and credit-based indicators are in many empirical studies evidenced as a reliable early warning signal of a new asset price boom (for example, Fujiki et al. 2016). In the short run, however, the link may be hidden because the co-movements of money and credit are then rarely statistically significant.

Estimates of the wavelet gain coefficients for bank credit with respect to M3 and their constancy tests from 1970 to 2016. Notes: The number of bootstrap samples: 1000. The plots for the euro area start from 3Q 1997, while for Japan and Switzerland from 4Q 1971. Shaded areas represent the episodes of real house price booms according to Table 1.

Moreover, wavelets allowed us to discover strikingly diversified patterns near the episodes of QE in the US, EA, JP and the UK. In the US, the relationship between money and bank credit seems to disappear since the outbreak of the Great Recession. The decoupling of M3 and credit is also visible for the aggregated data (Fig. 4a), which is typical during financial crises in OECD economies (ECB 2012).Footnote 7

For the EA and the UK in Fig. 2, we can see a significant and strong relationship between money and credit generally over the whole available time span, including the period commencing from the outbreak of the Great Recession. However, a more detailed investigation suggests alternative reasons for the discovered post-Great Recession’s coherencies. In the UK, the aggregates of money and credit were relatively close to each other and maintained the upward trend (Fig. 4c) whereas ECB’s nonstandard measures have not managed to continue the earlier growth rates (Fig. 4b). In EA, both variables reached a plateau from 2007 on. In consequence, the significant co-movements between money and credit seem to result from their joint and largely subdued growth. Only from around 2014 on EA money growth accelerated, but credit stagnated. Their decoupling period is, however, too short to find a wavelet interpretation in Fig. 2.

The case-study of JP proves in turn that money and credit growth may remain subdued and decouple for a prolonged period of time. A reader can clearly see a considerable divergence of money and credit during the ‘lost decade’ after the collapse in stock and land prices in 1990 and 1991.Footnote 8 The weak economic growth, miserable credit growth and persistent deflation led the Bank of Japan to be the first central bank to introduce QE in 2001. Nevertheless, the upward trend of broad money and credit did not appear until the end of the initial round of QE in 2006 (Fig. 4d).Footnote 9

Interestingly, the diversified and thought-provoking patterns in the co-movements between money and credit and in their aggregated values during QE seem to coincide with macroeconomic performance, which may have relevant implications for monetary policy or its evaluation. In the US and in the UK, the upward trend of money was generally maintainedFootnote 10—which was not the case in the EA and JP. Accordingly, Fed’s and BoE’s macroeconomic outcomes are more favourable than in the EAFootnote 11 and JP. The evidence suggests that asset purchases had significant effects on GDP and inflation both in the UK (Weale and Wieladek 2016) and in the US.Footnote 12 Meanwhile in Japan, where the decoupling of money was largest and prolonged, QE’s effects on output till the most recent ‘Abenomics’ era were poor (Michaelis and Watzka 2017). In line with that, Fig. 2 reveals no significant co-movements.Footnote 13 Only the comprehensive economic policy package unveiled by the Japanese Prime Minister Shinzo Abe in early 2013 may be possibly reflected by significant in-phase co-movements of money and credit growth for the cycle shorter than three years (Fig. 2). The result gives us hope that the monetary stimulus could finally let the credit in JP to rise.

Interestingly, in the EA, credit growth leads money growth at the typical business cycle frequency range but money growth leads credit growth for the 8 + years cycle. Moreover, the estimates of the M3 growth—bank credit growth gain coefficients are close to unity (especially for the 8–16 years cycle), suggesting a one-to-one long run relationship. The evidence implies that M3 provides useful information about longer run bank credit developments. It can be interpreted as a fresh justification for a separate ECB’s monetary pillar.

Before 1984, the co-movements between growth rates of money and bank credit were strong and significant over the majority of the interpretable time span at the typical business cycle frequency range (except for Canada) (Fig. 5). Money growth was leading credit growth most frequently. Otherwise, the two financial variables exhibited a positive instantaneous correlation.

Wavelet coherency between M3 and bank credit from 1Q 1970 to 4Q 1983. Notes: See notes to Fig. 1. The plots for Japan and Switzerland start from 4Q 1971.

5.2 M3 and credit from all sectors

Figure 8 shows that Commonwealth Countries have rather strong co-movements between money and credit at longer frequencies. In the remaining countries, significant co-movements are generally less frequent than in the case of bank credit. In particular, it concerns the US, where the linkage between M3 growth and credit growth is significant only periodically and mainly during booming house prices. Similarly, significant co-movements in the EA appeared closely to the outbreak of a real house price boom of 2005–2009. In JP, high coherencies between developments of M3 and credit concern the period from the beginning of the Great Moderation to 2003, but they are largely absent in the period when QE was adapted.

The remaining results are largely similar to the results found in the previous chapter for bank credit. The typical co-movements are positive. House price booms are still associated with significant and strong co-movements between money growth and credit growth. Estimates of the wavelet gain coefficients are often close to or above unity (not reported). Credit growth from all sectors lags money growth in almost half of the countries examined (JP, UK, SE, NO, NZFootnote 14) after 1984. In the EA, broad money has lost its leading properties—money growth merely lags developments in credit from all sectors.

5.3 Robustness checks

The general results remain unchanged—providing M3 is substituted by M2. In particular: (a) real house price booms are still associated with significant co-movements between money growth and credit growth (b) the co-movements are mostly often positive, although it is not always possible to detect if money growth or credit growth was leading (Figs. 6, 7), (c) for the 8–16 years cycle, the estimates of wavelet gain coefficients for credit with respect to M2 were predominantly close to unity (not reported). The difference is that significant co-movements of M2 and credit measures are less frequent than for M3—at least for the three major economies: JP, the UK and the EA. In the US, they stay roughly the same.

Wavelet coherency between M2 and bank credit from 1Q 1984 to 4Q 2016. Notes: The plot concerns credit to private non-financial sector from banks at market value. Frequency unit is a year (left hand-side of all the plots). The number of bootstrap samples: 500. Shaded areas represent the episodes of real house price booms according to Table 1. Data for Sweden available since 1Q 1998. Data for New Zealand available since 1Q 1994. Data for Denmark available since 1Q 1991. Data for Switzerland available since 1Q 1984. Data for the euro area available since 3Q 1997. M2 data for Norway were not available (plot for M3 is used instead).

Wavelet coherency between M2 and credit from all sectors from 1Q 1984 to 4Q 2016. Notes: The plot concerns credit to the private non-financial sector from All sectors at a market value. Frequency unit is a year (left hand-side of all the plots). The number of bootstrap samples: 500. Shaded areas represent the episodes of real house price booms according to Table 1. Data for Sweden available since 1Q 1998. Data for New Zealand available since 1Q 1994. Data for Denmark available since 1Q 1991. Data for Switzerland available since 1Q 1984. Data for the euro area available since 1Q 1999. M2 data for Norway were not available (plot for M3 is used instead).

Adjustment for the real GDP growth of M2 and M3 rates of growth has altered neither the general conclusions (not reported) nor country-specific major results. The two opposing exceptions were the US and JP. In the US, the real GDP adjustment revealed significant co-movements between growth rate of M2 and M3 on the one hand, and the growth rates of both measures of credit on the other hand over the whole interpretable time span. In JP, the real GDP adjustment deteriorated the link between monetary growths and credit changes. Except for very short frequencies up to 2 years, the co-movements were statistically insignificant. The result for the US may suggest that despite the abandonment of M3 monitoring by Fed in 2005, broad money may convey information about credit dynamics also during normal times, while the results for JP may suggest that the effects of Japan’s unconventional monetary policy may have not succeeded in creating favourable conditions for money and credit to co-move.

Next, to check the robustness of our previous findings we implement the MODWT method. We show that co-movements between broad money and bank credit change at different frequencies and through specific time periods starting from the beginning of the Great Moderation (Tables 2, 3). The robustness analysis largely confirms our previous results on significant co-movements in the EA and the Commonwealth Countries at lower frequencies (except for New Zealand), lack of significant, positive correlation in Denmark and Switzerland, lack of significant correlation in the US (CWT showed only temporary correlation) and in JP—where money and credit largely decoupled. The findings of the multiscale correlation based on the MODWT and the CWT taken together, suggest that the correlations rise during episodes of booming house prices, although they may be insignificant over the normal times. The results of the MODWT method for M2 and both credit definitions, before and after 1984 have not changed the general conclusions. In particular, for M3 and credit from all sectors, we confirmed that it is generally more difficult to find significant coherencies over the whole investigated time span than in case of the bank credit (Table 4), similarly like in the CWT analysis.

Finally, the hypothesis of homogenous versus heterogeneous correlations horizons within each 5-year subperiod is tested using the ANOVA-F test in Table 3. The frequency scales are defined identically to Table 2. We show that the variability of correlation between money and credit rates of growth is significantly affected by variability in frequency scales, while the correlations change in time. Thus, the robustness analysis largely supports the need to consider different operational horizons when assessing the relationship between money and credit growth. This conclusion seems to be especially important during crises associated with the asset price busts. Indeed, when we specified the 5-year subperiod from 2007 to 2011 associated with the Great Recession, the F statistic is relatively large (4.27 and 5.98 for M3 versus bank credit and for M3 vs. credit from all sectors, respectively).

6 Conclusions

The main goal of the article was to analyze the co-movements and lead lag patterns between money and credit dynamics across time and frequency for 12 developed countries from 1970 to 2016. Despite money and credit are jointly determined, we provide a wavelet evidence that in some circumstances it is more appropriate to examine lending and money separately.

We find that in the euro area, broad money growth leads bank credit growth for the 8 + years cycle, while our analysis suggests an almost one-to-one relationship. The evidence implies that M3 provides useful information about longer run bank credit developments. It can be interpreted as a justification for the ECB’s monetary pillar. Thus, we contribute to the unresolved discussion on the validity of the ECB’s monetary policy strategy. The result for the US may suggest that the abandonment of M3 monitoring by Fed in 2005 could have been premature as broad money adjusted for the real GDP growth and credit exhibit significant co-movements also during normal times, while the results for Japan generally suggest that the unconventional stimulus has not succeeded in creating conditions for money and credit to co-move with only tentative and mixed results for the ‘Abenomics’ era. Therefore, our results shed new light on the importance of monitoring money and credit, which may have relevant implications for monetary policy or for its evaluation. Indeed, the diversified patterns in the co-movements between money and credit and in their aggregated values during quantitative easing seem to coincide with macroeconomic performance in the Unites States, the United Kingdom, the euro area and Japan.

The contribution of the article is twofold. First, we assess the linkage between money and credit using a long-term dataset when compared with similar studies. Our findings suggest that the correlations rise during episodes of booming house prices, whereas they may be not significant over the normal times. High coherencies pose a potential threat for the monetary policy after the burst of a house price bubble. In case the policy would lead to a large money (credit) growth around the booming episode, it may eventually translate into credit (money) growth of a similar size with a lag of between 2 and 16 years. In this context, we contribute to the plea for the right timing of the exit strategies from quantitative easing. Second, a set of 12 developed countries enables a detailed analysis of regional differences in the short-run and long-run. The hard to detect high frequency co-movements may suggest that the mutual connectedness of money and credit provides no useful information or that money is irrelevant. Instead, we find that the euro area and the Commonwealth Countries have rather strong interdependencies between money and credit at longer frequencies. Denmark and Switzerland show weak and episodic effects. Scandinavian countries and the US are somewhere in between. Finally, the co-movements happen to be strong and significant especially around house price booms in the longer run. Thus, the wavelet analysis largely supports the need to consider different operational horizons when assessing the linkage between money and credit.

Notes

Money endogeneity simply means that the act of lending creates deposits, while the quantity of loans and deposits in the modern economy are mostly created by commercial banks themselves (McLeay et al. 2014).

For example, the applications of wavelets in economics receive recently a growing attention (Bruzda 2017), but the joint interdependencies between money and credit have not been investigated with wavelets to our knowledge. The non-wavelet evidence on the linkage between money and credit is discussed in the following part of Sect. 2.

The joint determination of money and credit holds not only during normal times but during crises and QE as well. QE should increase the amount of money and make credit more accessible. On the other hand, a more accessible credit (lower risk premia and policy rates) should translate into more credit and more money (McLeay et al. 2014).

Notwithstanding this, behaviour of money and credit is likely to depend on the condition of a banking system, on the role of the financial sector in propagating the crisis or on possible causes and channels of the slump.

Money growth was leading credit growth during the booms in the euro area (1Q 2005–1Q 2009 for the 8 + year cycles), New Zealand (1Q 2004–2Q 2008), Japan (3Q 1989–1Q 1993), and the United Kingdom (4Q 2002–3Q 2008). Credit growth was leading money growth during the booms in the United States (3Q 1987–3Q 1990; 2Q 2003–1Q 2008), Sweden (3Q 1988–2Q 1992) and the euro area (1Q 2005–1Q 2009 for the 2–8 year cycles). In Sweden during the low cost boom of 3Q 1988–2Q 1992 the correlation was negative.

The exceptions with prolonged estimates of the gain coefficients substantially smaller than one, were Canada for the 8–16 years cycle over the entire 1970–2016 time span, the United Kingdom since the 1990s for both 2–8 and 8–16 years cycle, Sweden and Switzerland since the late 1990 s for both 2–8 and 8–16 years cycle, and New Zealand since 90 s for the 2–8 years cycle.

The deterioration could possibly reflect creation of new money by Fed during QE and a contraction in outstanding loans and fiduciary media until late 2009. While credit growth was contained, risk aversion expanded narrow money and to some extent broader aggregates. The decoupling of money and credit was further increased by inflows of dollars held abroad (and their subsequent outflows) into the US banking system. The reason was the uncertainty associated with the euro area debt crisis and the Federal Deposit Insurance Corporation’s unlimited guarantee’s introduction in 2008 followed by its withdrawal before QE3.

The decoupling of money and credit in Japan was explained in literature by nonperforming loans, slow regulatory response in regulated sectors, little incentives for banks to clean up their balance sheets, fiscal policy mistakes (Ito and Mishkin 2006), ‘zombie lending’ (Caballero et al. 2008), procrastination with regard to the cleaning-up of problems of bank loans (Nagahata and Sekine 2005), negative effect of 1997 prudential reforms on banks’ capital buffers (Watanabe 2007) and a liquidity trap that rendered conventional monetary policy impotent (Krugman 1998) in an environment of positive real interest rates during deflation. In consequence, the moderate growth of broader aggregates coincided with the strong expansion of narrow money. Credit, in turn, contracted for almost two decades.

However, we had subdued credit growth in both countries, which may be reflected in the disappearance of significant co-movements in the US or in ‘shrinking’ of the area of significant co-movements in the UK in Fig. 3.

For example, Beckworth (2017) argues that ECB tightened the monetary policy in 2008 and again in 2010–2011, which caused the EA recessions and sparked the sovereign debt crisis. Similarly, Ahmad and Brown (2016) agree that the ECB prioritised its price-stability mandate over concerns related to the sovereign debt crisis. It explains why some authors evidence that the effects of ECB’s QE concerned primarily interest rates and not lending (Creel et al. 2016) or that QE was insufficient and too late to avoid a recession (Rodríguez and Carrasco 2016; Lenza et al. 2010). Others argue, however, that in the absence of ECB’s liquidity injections, the bond yield spreads of EA countries (Jäger and Grigoriadis 2017) and interbank spreads would be higher while investments would be lower (Quint and Tristani 2018).

Significant co-movements concern longer run developments (12 + year cycles), but the interpretable area is limited only to the period of 1993–2005. Significant linkage appears for very high frequencies, but only periodically.

In NZ for the majority of the time span, it was not very clear whether money developments were leading the credit growth rate or conversely. M3 growth rate has started to lead developments of credit from all sectors roughly since the real house price boom of 2004–2008 for the 8 years cycle.

References

Adalid R, Detken C (2007) Liquidity shocks and asset price boom/bust cycles. ECB working paper, no. 732

Adrian T, Shin HS (2008) Liquidity and financial cycles. SSRN Electron J 10:15–20. https://doi.org/10.2139/ssrn.1165583

Aguiar-Conraria L, Soares MJ (2013) The continuous wavelet transform: moving beyond uni- and bivariate analysis. J Econ Surv 28(2):344–375. https://doi.org/10.1111/joes.12012

Ahmad AH, Brown S (2016) Re-examining the ECB’s two-pillar monetary policy strategy: are there any deviations during and the pre-financial crisis periods? Empirica 44(3):585–607. https://doi.org/10.1007/s10663-016-9339-1

Bank of England (2008) Money and credit: banking and the macroeconomy. Bank Engl Q Bull 48(1):96–106

Beckworth D (2017) The monetary policy origins of the eurozone crisis. Int Finance 20(2):114–134. https://doi.org/10.1111/infi.12110

Berentsen A, Huber S, Marchesiani A (2015) Financial innovations, money demand, and the welfare cost of inflation. J Money Credit Bank 47(S2):223–261. https://doi.org/10.1111/jmcb.12219

Bernanke BS, Gertler M, Gilchrist S (1999) Chapter 21 the financial accelerator in a quantitative business cycle framework. Handb Macroecon 1:1341–1393. https://doi.org/10.1016/s1574-0048(99)10034-x

Bordo MD, Haubrich JG (2010) Credit crises, money and contractions: an historical view. J Monet Econ 57(1):1–18. https://doi.org/10.1016/j.jmoneco.2009.10.015

Borio C, Lowe P (2004) Securing sustainable price stability: should credit come back from the wilderness? BIS working paper no. 157

Brunnermeier MK (2009) Deciphering the liquidity and credit crunch 2007–2008. J Econ Perspect 23(1):77–100. https://doi.org/10.1257/jep.23.1.77

Bruzda J (2013) Wavelet analysis in economics applications. Nicolaus Copernicus University Press, Torun

Bruzda J (2017) Real and complex wavelets in asset classification: an application to the US stock market. Finance Res Lett 21:115–125. https://doi.org/10.1016/j.frl.2017.02.004

Caballero RJ, Hoshi T, Kashyap AK (2008) Zombie lending and depressed restructuring in Japan. Am Econ Rev 98(5):1943–1977. https://doi.org/10.1257/aer.98.5.1943

Carvalho D (2018) Financial integration and the Great Leveraging. Int J Finance Econ 24:54–79. https://doi.org/10.1002/ijfe.1649

Chen H, Cúrdia V, Ferrero A (2012) The macroeconomic effects of large-scale asset purchase programmes*. Econ J 122(564):F289–F315. https://doi.org/10.1111/j.1468-0297.2012.02549.x

Chui CK (1992) An Introduction to wavelets. Academic Press Inc., Harcourt Brace Jovanovich, San Diego

Chung H, Laforte J-P, Reifschneider D, Williams JC (2012) Have we underestimated the likelihood and severity of zero lower bound events? J Money Credit Bank 44:47–82. https://doi.org/10.1111/j.1538-4616.2011.00478.x

Creel J, Hubert P, Viennot M (2016) The effect of ECB monetary policies on interest rates and volumes. Appl Econ 48(47):4477–4501. https://doi.org/10.1080/00036846.2016.1158923

Dembiermont C, Drehmann M, Muksakunratana S (2013) How much does the private sector really borrow? A new database for total credit to the private nonfinancial sector. BIS Q Rev 10:65–81. https://doi.org/10.1006/juec.1995.1024

ECB (2012) Money and credit growth after economic and financial crises—a historical global perspective. Monthly Bulletin, European Central Bank, February

Fan Y, Gençay R (2010) Unit root tests with wavelets. Econom Theory 26(05):1305–1331. https://doi.org/10.1017/s0266466609990594

Ferraris L (2010) On the complementarity of money and credit. Eur Econ Rev 54(5):733–741. https://doi.org/10.1016/j.euroecorev.2009.12.003

Fujiki H, Kaihatsu S, Kurebayashi T, Kurozumi T (2016) Monetary policy and asset price booms: a step towards a synthesis. Int Finance 19(1):23–41. https://doi.org/10.1111/infi.12081

Gerdesmeier D, Reimers H, Roffia B (2010) Asset price misalignments and the role of money and credit. Int Finance 13(3):377–407. https://doi.org/10.1111/j.1468-2362.2010.01272.x

Gomis-Porqueras P, Sanches D (2013) Optimal monetary policy in a model of money and credit. J Money Credit Bank 45(4):701–730. https://doi.org/10.1111/jmcb.12021

Goodhart C, Hofmann B (2008) House prices, money, credit, and the macroeconomy. Oxf Rev Econ Policy 24(1):180–205. https://doi.org/10.1093/oxrep/grn009

Goodhart C, Bartsch E, Ashworth J (2016) Central banks and credit creation: the transmission channel via the banks matters. Sver Riksbank Econ Rev 3:55–68

Grinsted AJ, Moore C, Jevrejeva S (2004) Application of the cross wavelet transform and wavelet coherence to geophysical time series. Nonlinear Process Geophys 11:561–566. https://doi.org/10.5194/npg-11-561-2004

Grossmann A, Morlet J (1984) Decomposition of hardy functions into square integrable wavelets of constant shape. SIAM J Math Anal 15(4):723–736. https://doi.org/10.1137/0515056

Gu C, Mattesini F, Wright R (2016) Money and credit redux. Econometrica 84(1):1–32. https://doi.org/10.3982/ecta12798

Hkiri B, Hammoudeh S, Aloui C, Shahbaz M (2018) The interconnections between U.S. financial CDS spreads and control variables: new evidence using partial and multivariate wavelet coherences. Int Rev Econ Finance 57:237–257. https://doi.org/10.1016/j.iref.2018.01.011

Ito T, Mishkin FS (2006) Two decades of japanese monetary policy and the deflation problem. In Monetary policy with very low inflation in the pacific rim, NBER-EASE, vol 15. University of Chicago Press, pp 131–202

Jäger J, Grigoriadis T (2017) The effectiveness of the ECB’s unconventional monetary policy: comparative evidence from crisis and non-crisis Euro-area countries. J Int Money Finance 78:21–43. https://doi.org/10.1016/j.jimonfin.2017.07.021

Kapounek S, Kučerová Z (2018) Historical decoupling in the EU: evidence from time-frequency analysis. Int Rev Econ Finance 60:265–280. https://doi.org/10.1016/j.iref.2018.10.018

Krugman P (1998) It’s baaack: japan’s slump and the return of the liquidity trap. Brook Pap Econ Act 29(2):137–206. https://doi.org/10.2307/2534694

Kumar P, Foufoula-Georgiou E (2014) Wavelet analysis in geophysics: an introduction. In: Foufoula-Georgiou E, Kumar P (eds) Wavelets in geophysics, vol 4. Elsevier, Amsterdam, pp 8–12

Kuzin V, Schobert F (2015) Why does bank credit not drive money in Germany (any more)? Econ Model 48:41–51. https://doi.org/10.1016/j.econmod.2014.10.013

Lau KM, Weng H (1995) Climate signal detection using wavelet transform: how to make a time series sing. Bull Am Meteorol Soc 76(12):2391–2402. https://doi.org/10.1175/1520-0477(1995)076%3c2391:csduwt%3e2.0.co;2

Lenza M, Pill H, Reichlin L (2010) Monetary policy in exceptional times. Econ Policy 25(62):295–339. https://doi.org/10.1111/j.1468-0327.2010.00240.x

Liu J, Kool CJM (2018) Money and credit overhang in the euro area. Econ Model 68:622–633. https://doi.org/10.1016/j.econmod.2017.05.003

Mallat S (2009) A wavelet tour of signal processing. Academic Press, London

McConnell M, Perez-Quiros G (2000) Output fluctuations in the United States; what has changed since the early 1980s? Am Econ Rev 90(5):1464–1476. https://doi.org/10.1257/aer.90.5.1464

McLeay M, Radia A, Thomas R (2014) Money creation in the modern economy. Bank Engl Q Bull 54(1):14–27

Meyer LH (2001) Does money matter? The 2001 Homer Jones Memorial Lecture, Washington University, St Louis, Missouri, 28 March 2001

Michaelis H, Watzka S (2017) Are there differences in the effectiveness of quantitative easing at the zero-lower-bound in Japan over time? J Int Money Finance 70:204–233. https://doi.org/10.1016/j.jimonfin.2016.08.008

Mills D (2007) A model in which outside and inside money are essential. Macroecon Dyn 11:219–236

Nagahata T, Sekine T (2005) Firm investment, monetary transmission and balance-sheet problems in Japan: an investigation using micro data. Jpn World Econ 17(3):345–369. https://doi.org/10.1016/j.japwor.2004.03.004

Quint D, Tristani O (2018) Liquidity provision as a monetary policy tool: the ECB’s non-standard measures after the financial crisis. J Int Money Finance 80:15–34. https://doi.org/10.1016/j.jimonfin.2017.09.009

Rodríguez C, Carrasco C (2016) ECB policy responses between 2007 and 2014: a chronological analysis and an assessment of their effects. Panoeconomicus 63(4):455–473. https://doi.org/10.2298/pan1604455r

Rua A (2012) Money growth and inflation in the Euro area: a time-frequency view. Oxf Bull Econ Stat 74(6):875–885. https://doi.org/10.1111/j.1468-0084.2011.00680.x

Scharnagl M, Gerberding C, Seitz F (2010) Should monetary policy respond to money growth? New results for the Euro area. Int Finance 13(3):409–441. https://doi.org/10.1111/j.1468-2362.2010.01267.x

Schularick M, Taylor AM (2012) Credit booms gone bust: monetary policy, leverage cycles, and financial crises, 1870–2008. Am Econ Rev 102(2):1029–1061. https://doi.org/10.1257/aer.102.2.1029

Surico T, Sargent P (2011) Two illustrations of the quantity theory of money: breakdowns and revivals. Am Econ Rev 101:113–132

Teles P, Uhlig H, Azevedo JV (2016) Is quantity theory still alive? Econ J 126(591):442–464. https://doi.org/10.1111/ecoj.12336

Telyukova IA, Wright R (2008) A model of money and credit, with application to the credit card debt puzzle. Rev Econ Stud 75(2):629–647. https://doi.org/10.1111/j.1467-937x.2008.00487.x

Torrence C, Compo GP (1998) A practical guide to wavelet analysis. Bull Am Meteorol Soc 79(1):61–78. https://doi.org/10.1175/1520-0477(1998)079%3c0061:APGTWA%3e2.0.CO;2

Watanabe W (2007) Prudential regulation and the “Credit Crunch”: evidence from Japan. J Money Credit Bank 39(2–3):639–665. https://doi.org/10.1111/j.0022-2879.2007.00039.x

Weale M, Wieladek T (2016) What are the macroeconomic effects of asset purchases? J Monetary Econ 79:81–93. https://doi.org/10.1016/j.jmoneco.2016.03.010

Whitcher B, Guttorp P, Percival DB (2000) Wavelet analysis of covariance with application to atmospheric time series. J Geophys Res Atmosp 105(D11):14941–14962. https://doi.org/10.1029/2000jd900110

Woodford M (2008) How important is money in the conduct of monetary policy? J Money Credit Bank 40:1561–1598

Acknowledgments

The research under the project no. 2017/26/D/HS4/00116 titled: ‘Money, Credit and House Prices from the Wavelet Perspective’ was funded by National Science Centre, Poland. The author thanks professor Joanna Bruzda from Nicolaus Copernicus University in Toruń (Poland) for the helpful comments and remarks.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

See Figs. 6, 7, 8, 9, 10 and Table 4.

Wavelet coherency between M3 and credit from all sectors from 1Q 1984 to 4Q 2016. Notes: See notes to Fig. 1. The plot for the euro area starts from 3Q 1997.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Ryczkowski, M. Money and credit during normal times and house price booms: evidence from time-frequency analysis. Empirica 47, 835–861 (2020). https://doi.org/10.1007/s10663-019-09457-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-019-09457-2