Abstract

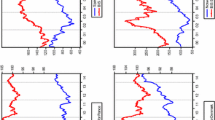

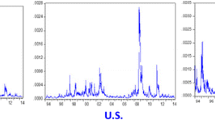

This study examines first the effects of financial market turmoil in the fall of 2008 on the conditional correlations between three exchange rate returns (USD/EUR, JPY/USD, USD/GBP), and then the effects of quantitative easing programs and Greek debt crisis on the entire distribution of estimated correlations. The dynamic correlations have sharply increased during the period that followed the collapse of Lehman Brothers, indicating a financial contagion across currency markets. The quantitative easing programs of the Federal Reserve and the Bank of England have affected the conditional correlations between the currency pairs. Finally, the Greek debt crisis has emerged as the most significant covariate of the quantile regressions.

Similar content being viewed by others

Notes

The Federal Reserve sells short-term treasuries and uses the funds to buy up long-term securities. This type of operation, which does not affect the monetary base, is expected to increase short-term interest rates and reduce long-term interest rates, thus twisting the yield curve. A similar policy has been also pursued by the Bank of England, as the HM Treasury sold short-term gilds to finance purchases of private sector assets.

Neely (2011) provides an excellent review of the research that studies foreign exchange volatility reaction to macroeconomic announcements.

Bauwens et al. (2006) review the research on multivariate GARCH models.

Caporin and McAleer (2013) discuss DCC models and their limitations in more detail.

In the other two cases, the plots of the significant coefficients which are available upon request, suggest that the quantile estimates still cross the OLS estimate, but the evidence against OLS is less compelling compared with the case of Table 4, as the 95 % confidence bands of the respective estimates overlap at all the quantiles examined.

References

Bauer M, Neely CJ (2012) “International channels of the Fed’s unconventional monetary policy”, Federal Reserve Bank of St. Louis, Working paper 2012-028B

Bauwens L, Laurent S, Rombouts JVK (2006) Multivariate GARCH models: a survey. J Appl Econom 21:79–109

Bullard J (2010) “Three lessons for monetary policy from the panic of 2008”, Federal Reserve Bank of St. Louis. Review 92(3):155–163

Caporin M, McAleer M (2013) Ten things you should know about DCC, No EI 2013-13, Econometric Institute Research Papers, Erasmus University Rotterdam, Erasmus School of Economics (ESE), Econometric Institute

Cappiello L, Engle RF, Sheppard KK (2006) Asymmetric dynamics in the correlations of global equity and bond returns. J Financ Econom 4:537–572

Engle R (2002) Dynamic conditional correlation: a simple class of multivariate generalized autoregressive conditional heteroskedasticity models. J Bus Econ Stat 20:339–350

Fawley BW, Neely CJ (2013) Four stories of quantitative easing. Review, pp 51–88

Gagnon J, Raskin M, Remarche J, Sack B (2010) “Large-scale asset purchases by the Federal Reserve: did they work?” Federal Reserve Bank of New York Staff Reports, No. 441

Glick R, Leduc S (2013) “Unconventional monetary policy and the dollar”, Federal Reserve Bank of San Francisco Economic Letter, April 1–5

Joyce M, Lasaosa A, Stevens I Tong M (2010) “The financial market impact of quantitative easing”, Bank of England, Working Paper Series, No. 393

Koenker R (2005) Quantile regression. Cambridge University Press, Cambridge

Koenker R, Bassett G (1978) Regression quantiles. Econometrica 46:33–50

Koenker R, Hallock KF (2001) Quantile regression. J Econ Perspect 15(4):143–156

Neely CJ (2010) “The large-scale asset purchases had large international effects”, Federal Reserve Bank of St. Louis, Working Paper 2010-018D

Neely CJ (2011) A survey of announcement effects on foreign exchange volatility and jumps, Federal Reserve Bank of St Louis. Review 93(5):361–407

Nelson DB (1991) Conditional heteroskedasticity in asset returns: a new approach. Econometrica 59(2):347–370

Rosa C (2012) “How “unconventional are large-scale asset purchases? The impact of monetary policy on asset prices”, Federal Reserve Bank of New York Staff Reports No. 560

Spiegel MM (2006) Did quantitative easing by the Bank of Japan work? FRBSF Econ Lett 28:1–3

Swanson ET (2011) Let’s twist again: a high-frequency event-study analysis of operation twist and its implications for QE2. Brook Pap Econ Act 42:151–207

Tamakoshi G, Hamori S (2013) An asymmetric dynamic conditional correlation analysis of linkages of European financial institutions during the Greek sovereign debt crisis. Eur J Financ 19:939–950

Tamakoshi G, Hamori S (2014) Co-movements among major European exchange rates: a multivariate time-varying asymmetric approach. Int Rev Econ Financ 31:105–113

Tamakoshi G, Toyoshima Y, Hamori S (2012) A dynamic conditional correlation analysis of European stock markets from the perspective of the Greek sovereign debt crisis. Econ Bull 32:437–448

Ugai H (2007) “Effects of the quantitative easing policy: a survey of empirical analyses”, Monetary and Economic Studies, March, pp 1–47

Yang SY (2005) A DCC analysis of international stock market correlations: the role of Japan on the Asian Four Tigers. Appl Financ Econ Lett 1:89–93

Acknowledgments

We would like to thank George Mavropoulos for research assistance and two anonymous referees for their useful comments. This paper was presented at the Statistics and Econometrics Seminar of Aix-Marseille School of Economics-Greqam. We thank seminar participants for their comments, especially Professor Eric Girardin. An earlier version of this paper was presented at the 13th Annual Conference of European and Finance Society in Thessaloniki 2014. We thank session participants for their comments. The views expressed are the authors’.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Karfakis, C., Panagiotidis, T. The effects of global monetary policy and Greek debt crisis on the dynamic conditional correlations of currency markets. Empirica 42, 795–811 (2015). https://doi.org/10.1007/s10663-014-9277-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-014-9277-8