Abstract

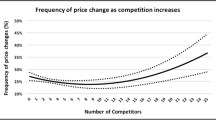

This paper explores nominal rigidities by investigating price-setting behavior of Austrian firms based on survey evidence. Distinguishing between two stages of price setting—first the price reviewing phase and second the price changing phase—our results suggest that the main obstacles to price flexibility lie on the second stage. Our main result is that firms postpone price adjustments, because they are afraid to antagonize customers with frequent price changes. Thus, customer relationships - especially those with consumers—are a major source of price stickiness in the Austrian economy.

Similar content being viewed by others

Notes

For similar studies focusing on other countries see Amirault et al. (2004) for Canada, Apel et al. (2005) for Sweden, Aucremanne and Druant (2005) for Belgium, Fabiani et al. (2004) for Italy, Hall et al. (1997) for the U.K., Hoeberichts and Stokman (2005) for the Netherlands, Loupias and Ricart (2004) for France, Luennemann and Mathae (2006) for Luxembourg, Martins (2005) for Portugal, Nakagawa et al. (2000) for Japan and Stahl (2005) as well as Wied-Nebbeling (1985) for Germany.

A detailed description of the survey is provided in Kwapil et al. (2005).

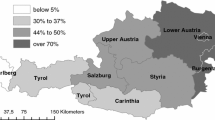

The Austrian market is regarded as their main market, if they earn more than 60% of their turnover there.

The alternative answers were that the parent company, the main client or a regulatory authority determine prices.

The remaining 30% review their prices on specific occasions, e.g. when costs change considerably.

Kashyap (1995) rejects this hypothesis. He observes differing reviewing behavior also with regard to products having similar cost and demand characteristics. However, if products are alike, then the arrival of the necessary information should be correlated as well.

The results shown in Table 2 refer to a sample of firms that answered the question on price reviews as well as the question on price changes.

For a detailed description of these theories see Blinder et al. (1998).

We asked the same question in relation to price decreases. However, as the results are very similar in both cases, we just report the results on price increases.

There is just one exception, namely menu cost would rank sixth under this criterion and information cost would rank seventh.

As a robustness check, we estimate the model a second time including the market share as a proxy for the firms’ market structure. However, this does not change the results qualitatively.

As already mentioned above, we asked the question of which theory comes close to the actual way of price setting twice. Once in relation to price increases and once in relation to price decreases. However, the concept of implicit contracts was formulated in only one question, as it refers to price increases and decreases at the same time. Consequently, Table 5 does not distinguish between upward and downward price adjustments.

Moreover, we observe that firms with a high share of consumers are less likely to have explicit contracts. Here we observe a negative relationship which is significant only at the 10% level. Taking a closer look at our sample, we find that firms with a high share of consumers mainly sell durable consumer goods and services, which are not purchased on a regular basis (e.g. carpenter). Therefore, explicit contracts would need to promise constant prices for very long periods and might thus, not be a viable option.

References

Amirault D, Kwan C, Wilkinson G (2004) A survey of the price-setting behaviour of Canadian companies. Bank of Canada Review Winter 2004–2005, Bank of Canada

Apel M, Friberg R, Hallsten K (2005) Microfoundations of macroeconomic price adjustment: Survey evidence from Swedish firms. J Money Credit Bank 37(2):313–338

Aucremanne L, Druant M (2005) Price-setting behaviour in Belgium: What can be learned from an ad hoc survey? Working paper 448, European Central Bank

Ball L, Mankiw GN (1994) A sticky-price manifesto. Carnegie-Rochester Conference Series on Public Policy (41):127–151

Blinder AS (1991) Why are prices sticky? Preliminary results from an interview study. Am Econ Rev 81(2):89–100

Blinder AS, Canetti ERD, Lebow DE, Rudd JB (1998) Asking about prices. Russell Sage Foundation, New York

Clarida R, Galí J, Gertler M (1999) The science of monetary policy: A new Keynesian perspective. J Econ Lit 37(4):1661–1707

Fabiani S, Druant M, Hernando I, Kwapil C, Landau B, Loupias C, Martins F, Mathae T, Sabbatini R, Stahl H, Stokman A (2005) The pricing behaviour of firms in the euro area: New survey evidence. Working paper 535, European Central Bank

Fabiani S, Gattulli A, Sabbatini R (2004) The pricing behaviour of Italian firms: New survey evidence on price stickiness. Working paper 333, European Central Bank

Galí J, Gertler M, Lopéz-Salido JD (2001) European inflation dynamics. Eur Econ Rev 45(7):1237–1270

Hall S, Walsh M, Yates A (1997) How do UK companies set prices? Working paper 67, Bank of England

Hoeberichts M, Stokman A (2005) Price setting behaviour in the Netherlands: Results of a survey. Working paper 73, De Nederlandsche Bank

Issing O (2004) Inflation persistence in the euro area. Contribution to the ECB conference ‘Inflation Persistence in the euro area’, Dec. 10, 2004 Frankfurt am Main, mimeo. http://www.ecb.int/press/key/date/2004/html/sp041210_1.en.html

Kashyap AK (1995) Sticky prices: New evidence from retail catalogs. Q J Econ 110(1):245–274

Kwapil C, Baumgartner J, Scharler J (2005) The pricing-setting behavior of Austrian firms: Some survey evidence. Working paper 464, European Central Bank

Loupias C, Ricart R (2004) Price setting in France: New evidence from survey data. Working paper 423, European Central Bank

Luennemann P, Mathae T (2006) New survey evidence on the pricing behaviour of Luxembourg firms. Working paper 617, European Central Bank

Martins F (2005) The price setting behaviour of Portuguese firms evidence from survey data. Working paper 562, European Central Bank

Nakagawa S, Hattori R, Takagawa I (2000) Price-setting behavior of Japanese companies. Bank of Japan, Mimeo

Okun A (1981) Prices and quantities: A macroeconomic analysis. Basil Blackwell, Oxford

Rotemberg J (2004) Fair pricing. NBER Working paper 10915, National Bureau of Economic Research

Rotemberg J (2005) Customer anger at price increases, changes in the frequency of price adjustment and monetary policy. J Monetary Econ 52(4):829–852

Stahl H (2005) Price setting in German manufacturing: New evidence from new survey data. Working paper 561, European Central Bank

Wied-Nebbeling S (1985) Das Preisverhalten in der Industrie. Schriftenreihe Band 43, Institut fuer Angewandte Wirtschaftsforschung Tuebingen

Zbaracki M, Riston M, Levy D, Dutta S, Bergen M (2004) Managerial and customer costs of price adjustment: Direct evidence from industrial markets. Rev Econ Stat 86(2):514–533

Author information

Authors and Affiliations

Corresponding author

Additional information

The views expressed in this paper are those of the authors and do not necessarily represent the position of the Oesterreichische Nationalbank. We are grateful to the participants of the Inflation Persistence Network of the Eurosystem as well as to the participants of the OeNB’s Workshop on ‘Price Setting and Inflation Persistence in Austria’ for their useful comments and suggestions. All remaining errors and shortcomings are the responsibility of the authors alone.

Rights and permissions

About this article

Cite this article

Kwapil, C., Scharler, J. & Baumgartner, J. Price-setting behavior of Austrian firms. Empirica 34, 491–505 (2007). https://doi.org/10.1007/s10663-007-9046-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-007-9046-z