Abstract

This study analyzes the optimal antitrust enforcement rule and, in doing so, presents a model that illuminates two important issues. First, it compares the per se legal and illegal judicial standards to the rule of reason judicial standard in terms of information costs and general social welfare. Second, it seeks to derive the optimal judicial standard that minimizes the problems of under- and over-deterrence. These two issues are closely related because the benefit of additional information can only be measured by its deterrent effects. In this respect, this work synthesizes economic models from decision theory and the public enforcement of law. Lastly, in addition to discussing the optimal information level, we derive the optimal permissiveness of the judicial standard, the optimal burden of proof, and the optimal punishment level. We also analyze how these policy variables are interrelated .

Similar content being viewed by others

Notes

If \(|\alpha |>1\), then the overall social welfare will increase, despite consumers being harmed, because the increase in the firm’s profit is larger than the consumer welfare loss. This welfare trade-off problem has been analyzed by Williamson (1968).

The types of firms do not represent the natural order of the firms. An H-type firm may be able to design a transaction in a procompetitive way in a different situation. The type just represents the hidden information of the firm’s ability in the situation under investigation.

For the sake of simplicity, we assume that \(q\) is independent of \(x\).

Leegin Creative Leather Products, Inc. v. PSKS, Inc., 551 U.S. 877, 882 (2007) and Dr. Miles Medical Co. v. John D. Park and Sons, 220 U.S. 373 (1911).

It is true that information enables a better evaluation of the social welfare impact, \(x\), as well as a better characterization of the conduct. However, no matter which conduct is under investigation, the process of initial characterization at the beginning of the trial may not differ. Since the focus of this study is on the second stage, we assume that only the second stage of the trial requires the collection of information.

The \(B\)-type firms can counterbalance the anticompetitive effect of the conduct by enhancing efficiency. Thus, they will try to increase efficiency as much as possible, and in turn, will maximize both the social welfare and profit of the firm.

Jefferson Parish Hospital Dist. No. 2. v. Hyde, 466 U.S. 2, 15 n25 (1984).

Broadcast Music, Inc. v. CBS, Inc., 441 U. S. 1, 8–10 (1979).

Continental T.V., Inc. v. GTE Sylvania Inc., 433 U.S. 36, 50 (1977).

We also assume that different judicial standards have different levels of permissiveness (different liability standards).

References

Baker, J. (1988). Private information and the deterrent effect of antitrust damage remedies. Journal of Law, Economics and Organization, 4, 385–408.

Becker, G. (1968). Crime and punishment: An economic approach. The Journal of Political Economy, 76, 169–217.

Beckner, F., & Salop, S. (1999). Decision theory and antitrust rules. Antitrust Law Journal, 67, 41–76.

Besanko, D., & Spulber, D. (1989). Antitrust enforcement under asymmetric information. Economic Journal, 99, 408–425.

Block, M., Nold, F., & Sidak, J. (1981). The deterrent effect of antitrust enforcement. Journal of Political Economy, 89, 429–445.

Brunet, E. (2009). Antitrust summary judgment and the quick look approach. Lewis & Clark law school legal studies research paper no. 2009-6.

Christiansen, A., & Kerber, W. (2006). Competition policy with optimally differentiated rules instead of per se rules vs rule of reason. Journal of Competition Law and Economics, 2, 215–244.

Cyrenne, P. (1999). On antitrust enforcement and the deterrence of collusive behaviour. Review of Industrial Organization, 14, 257–272.

Ehrlich, I., & Posner, R. (1974). An economic analysis of legal rulemaking. Journal of Legal Studies, 3, 257–286.

Garner, B. (Ed.). (2009). Black’s Law Dictionary. Saint Paul, MN: Thomson West.

Kaplow, L. (1994). The value of accuracy in adjudication: An economic analysis. Journal of Legal Studies, 23, 307–401.

Kaplow, L. (1995). A model of the optimal complexity of legal rules. Journal of Law, Economics and Organization, 12, 150–163.

Kaplow, L. (2011). On the optimal burden of proof. Journal of Political Economy, 119, 1104–1140.

Kaplow, L., & Shavell, S. (1994). Accuracy in the determination of liability. Journal of Law and Economics, 37, 1–15.

Katsoulacos, Y., & Ulph, D. (2009). On optimal legal standards for competition policy: A general welfare-based analysis. The Journal of Industrial Economics, 57, 410–437.

Schinkel, M., & Tuinstra, J. (2006). Imperfect competition law enforcement. International Journal of Industrial Organization, 24, 1267–1297.

Schwartz, W. (1980). An overview of the economics of antitrust enforcement. Georgetown Law Journal, 69, 1075–1102.

U.S. Department of Justice and Federal Trade Commission. (2010). Horizontal merger guidelines. Washington, DC: U.S. Government Printing Office.

Williamson, O. (1968). Economics as an antitrust defense: The welfare trade-offs. The American Economic Review, 58, 18–36.

Author information

Authors and Affiliations

Corresponding author

Appendix: Proof of Lemma 1

Appendix: Proof of Lemma 1

We derive the solution by breaking down the range of \(L+\sigma\).

-

1.

\(L+\sigma >1+ \sqrt{\frac{4\sigma }{k}}\) If \(L+\sigma >1+\sqrt{\frac{4\sigma }{k} }\), then \(\alpha ^{B} =1\) and

$$\begin{aligned} W_{R} =\frac{1-\rho }{m} \int _{-m}^{-k\frac{L+\sigma }{\sigma } } L+\sigma +\frac{2\alpha }{k} \sigma \mathrm{d}\alpha -\frac{A}{\sigma } . \end{aligned}$$Note that \(W_{R} \le 0\) and the equality hold if \(L\rightarrow \infty\) and \(\sigma \rightarrow \infty\). Therefore, the optimal judicial standard includes \(L^{*} \rightarrow \infty\) and \(\sigma ^{*} \rightarrow \infty\).

-

2.

\(L+\sigma \le 1+\sqrt{\frac{4\sigma }{k}}\)

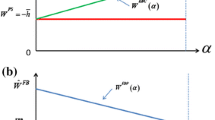

First, we show that the optimal judicial standard is in the range \(1\le L+\sigma \le \frac{m}{k} \sigma\). Suppose a judicial standard that is so restrictive that it will eliminate the under-deterrence problem: no \(H\)-type firm will engage in any transaction, \(\alpha ^{H} =-m\), and \(L+\sigma =\frac{m}{k} \sigma\). Once the judicial standard reaches this level of restriction, there is no marginal benefit to making the judicial standard more restrictive, because it will only aggravate the over-deterrence problem without reducing the under-deterrence problem. Therefore, the optimal judicial standard should satisfy \(L+\sigma \le \frac{m}{k} \sigma\). However, there can be a judicial standard so permissive that it will allow all \(B\)-type firms to make their transactions, thereby eliminating the over-deterrence problem. In such a case, both \(\alpha ^{B}\) and the amount of social loss caused by the over-deterrence problem will be reduced to 0. To accomplish this level of permissiveness, the judicial standard should satisfy \(L+\sigma =1\). This judicial standard does not need to become any more permissive, because this would only aggravate the under-deterrence problem without reducing the over-deterrence problem. Therefore, the optimal judicial standard should satisfy \(1\le L+\sigma\). Note that these results also imply that the optimal judicial standard satisfies \(1\le \frac{m}{k} \sigma\).

Lemma 3

The optimal judicial standard should satisfy \(1\le L+\sigma \le \frac{m}{k} \sigma\).

Since the optimal judicial standard should satisfy \(1\le L+\sigma \le \frac{m}{k} \sigma\), the court now has to solve the following maximization problem:

The unconstrained solution for this maximization problem is

It is readily verifiable that the first constraint, \(L+\sigma \ge 1\), is not binding. Therefore, we only need to consider the second constraint, \(L+\sigma \le \frac{m}{k} \sigma\). The second constraint is binding when \(1+\frac{2m}{k} \frac{(1-\rho )}{\rho } \sigma ^{0} \ge \frac{m}{k} \sigma\), which can be reduced to

Then, the optimal solution is

Lastly, we show the uniqueness of \(\rho =\frac{2\sigma ^{0} }{2\sigma ^{0} +m\sigma ^{0} -k}\).

Lemma 4

There exists a unique \(\rho\) that satisfies \(\rho =\frac{2\sigma ^{0} }{2\sigma ^{0} +m\sigma ^{0} -k}\), where \(\sigma ^{0} =\sqrt{\frac{Ak\rho }{(1-\rho )(\rho (1+m)-1)} }\).

Proof

Let \(f(\rho )=\frac{2\sigma ^{0} }{2\sigma ^{0} +m\sigma ^{0} -k}\); it is easily verifiable that \(f\left( \frac{1}{1+m} \right) =f(1)=2/(2+m)\) and that \(f\) is a concave function (\(f''<0\)) that is maximized at \(\rho =1/\sqrt{1+m}\). The proof is equivalent to showing that \(f(\rho )-\rho =0\) at a single point of \(\rho\).

Since \(f''<0\), there exists a unique \(\rho\) such that \(f'(\rho )=1\), and at that value of \(\rho\), \(f(\rho )-\rho\) is maximized. Let this point of \(\rho\) be \(\rho ^{0}\). If \(\rho ^{0} \le \frac{1}{1+m}\), \(f(\rho )-\rho\) is a decreasing function in \(\left( \frac{1}{1+m} ,1\right)\), \(f\left( \frac{1}{1+m}\right) -\frac{1}{1+m} >0\), and \(f(1)-1<0\). Therefore, there exists a single point, \(\rho\), that satisfies \(f(\rho )-\rho =0\). Since \(f\left( \frac{1}{1+m}\right) -\frac{1}{1+m} >0\) and \(f(1)-1<0\), if \(\rho ^{0} >\frac{1}{1+m}\), then \(\rho ^{0} <1\). Note that, for \(\rho \in \left( \frac{1}{1+m} ,\rho ^{0} \right]\), \(f\) is an increasing function and \(f\left( \frac{1}{1+m} \right) >\frac{1}{1+m}\). Therefore, there exists no \(\rho\) such that \(f(\rho )-\rho =0\). Since \(f(\rho )-\rho\) is a decreasing function in \((\rho ^{0} ,1)\), and \(f(\rho ^{0} )-\rho ^{0} >0\) and \(f(1)-1<0\), there exists a unique \(\rho \in (\rho ^{0} ,1)\) that satisfies \(f(\rho )=\rho\).

Lastly, because \(1>f>\frac{2}{2+m}\), the unique solution \(\rho _{0}\) can be found in the range \(\left( \frac{2}{2+m} ,1\right)\).

Rights and permissions

About this article

Cite this article

Kwak, J. Optimal antitrust enforcement: information cost and deterrent effect. Eur J Law Econ 41, 371–391 (2016). https://doi.org/10.1007/s10657-014-9466-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10657-014-9466-8