Abstract

In this paper we analyze how stated choices for the amount of risk in pension assets of Dutch participants in DC pension products vary with their characteristics. We find strong evidence that this variation is in line with standard portfolio choice models. Heterogeneity in age, risk aversion, loss aversion, non-pension financial wealth, the relative importance of DC pension wealth and educational attainment leads to differences in product choice that are largely in line with standard theory. This applies to investment choices in the accumulation phase as well as in the retirement phase.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The Dutch pension industry has, in recent years, slowly but surely moved from Defined Benefit (DB) pension schemes toward Defined Contribution (DC) pension schemes. These individualized schemes offer individuals freedom of choice and the option to tailor their pension contract to their own preferences and characteristics. In this paper we analyze stated choices for the amount of risk in pension assets in DC pension schemes—the choice of an investment strategy—with standard life-cycle models of portfolio choice. We consider a wide variety of characteristics of the investors and analyze how product choice varies with these characteristics according to the predictions of standard models of portfolio choice. We then empirically test whether stated choices for an investment strategy are in line with the predictions, using a unique data set on stated choices by the customers of two Dutch pension providers. Dutch providers of DC contracts (these are called Flexible Pension Contracts in the new law that will soon be effective) have an important fiduciary role in nudging participants to engage in adequate asset allocations on the basis of observable characteristics such as age, income, non-financial wealth, risk aversion, gender and marital status. In this paper we summarize the choices made by relatively experienced participants with higher education and we show that the differences in product choice are roughly in line with standard theory which suggests that standard theory is a solid starting point to nudge the probably much larger group of individuals that will have to choose their asset allocation once the new Dutch pension law is effective in 2027. Note that the asset allocation in Dutch DC pension schemes is different from the decision in 401(k) plans in the US: In 401(k) pension plans the asset allocation decision typically consists of choosing between a number of investment funds, potentially including own company stock. In Dutch DC pension schemes the choice is limited to choosing a risk profile. This is why we focus on the choice of risk profile only.

The first part of this paper provides an overview of adjustments to the benchmark life cycle model (Merton 1969) for heterogeneous agents based on the existing literature. We analyze how the optimal asset allocation over the life cycles varies with the characteristics of the agent, for both the accumulation phase and the retirement phase. We address heterogeneity in financial characteristics, sociodemographic characteristics and individual preferences. Here we consider one characteristic at a time, keeping other characteristics constant. As a first example, we take into account housing wealth following Munk (2020). We show that Munk’s model predicts that for a homeowner, the optimal variable annuity in the decumulation phase has higher allocation toward stocks than for a renter with the same other characteristics. This is because real estate is a component of the homeowner’s wealth that has a low correlation to the stock market. As a second example, in line with Bodie et al. (1992), we argue that for a younger participant with (nearly) risk-free future labour income, theory predicts a higher asset allocation toward stocks than for older participants (assuming all else is constant). This is because young participants have much more human capital in the form of future labour income than older participants. A third example is risk aversion, which is the main focus of many studies (Andreoni and Sprenger 2012a, b; Barsky et al. 1997; Holt and Laury 2002; Alserda et al. 2019; Knoef et al. 2022). Merton (1969) argues that the optimal demand for stocks is a decreasing function of risk aversion for a given expected excess return and return volatility. We elicit risk aversion using an adjustment of the method of Andreoni and Sprenger (2012a; b) that specifically focuses on risk in the pension domain. Moreover, we control for other characteristics instead of considering risk aversion as the only relevant characteristic.

In the second part of our paper we analyze survey data collected among 8,123 participants in a Dutch DC pension scheme. In the survey, we asked for detailed information on many background characteristics, such as labour income, non-pension financial wealth, housing wealth, etc. In addition, we elicited stated product choices in the participant’s DC pension scheme, both before and after retirement. We compare the variation in the participants’ stated allocations into risky and risk-free assets during the accumulation phase and the retirement phase with the predictions derived in the first part of the paper.

Our first main finding is that the variation in product choice in the accumulation phase is largely in line with what standard models predict. This is related to variation with the following characteristics: age, risk aversion, loss aversion, relative importance DC, non-pension financial wealth, educational attainment and present bias. Second, product choices in the retirement phase also vary with characteristics as standard models predict. This relates to variation with the participant’s labour income, age, risk aversion, loss aversion, relative importance DC, non-pension financial wealth, educational attainment and present bias.

The current discussion in the Dutch pension sector about how to account for heterogeneity among pension plan participants mainly focuses on age profiles and measuring risk aversion. Our results suggest that pension providers could improve on this by offering more tailor-made investment choices to their participants, based on sound economic arguments and participant characteristics that are easy to measure.

The structure of this paper is as follows. In Sect. 2 we present a literature overview of heterogeneity in stated and revealed preferences regarding pension investment choices. In Sect. 3 we analyze how the optimal amount of investment risk in pension products varies with individual characteristics according to standard models of portfolio choice. In Sect. 4 we introduce our survey questions, discuss the dependent and independent variables used in the analysis, and present descriptive statistics. In Sect. 5 we analyze how the stated choices of our DC participants vary with their characteristics and compare these results with the predictions from the theoretical models of optimal asset allocation. In Sect. 6 we present our conclusions.

2 Literature Overview

In this section, we provide a concise overview of existing studies on heterogeneity in the selection of the amount of risk to be taken in pension product choices. Section 2.1 focuses on the theory, while Sect. 2.2 summarizes the empirical literature on this topic.

2.1 Theory

The basic model regarding life cycle investment is the one proposed by Merton (1969) and Samuelson (1969). They derive the optimal consumption pattern and the optimal asset allocation strategy (which we will refer to as product choice) over the life cycle. These papers show, under a number of simplifying assumptions, that the optimal fraction of total wealth allocated to stocks is constant over the life cycle. Under the assumption of risk-free human capital, Bodie et al. (1992) show that decreasing exposure to the risky asset in terms of financial wealth over time is optimal, as the remaining investment horizon decreases. Campbell and Viceira (2002, Chapter 7) find similar results, but also elaborate on, for example, optimal asset allocation in the presence of a subsistence level.

Many studies have discussed and generalized the stylized assumptions of the standard life cycle model and we present an overview of some well-known modifications that are relevant for our purposes. Cocco (2005) find a low correlation between labour income and stock market returns, which supports the assumption of bond-like human capital and the resulting age-dependent asset allocation. However, the magnitude of this correlation depends on the sector in which the agent is employed, leading to more conservative life cycles for those who work in a sector where the correlation is larger. Cocco (2005) also show that a young participant with a steeper expected career path prefers a riskier life cycle due to a higher implicit claim to the risk-free asset. Munk (2020) extends the life cycle model with a different asset class: endogenous housing wealth. He shows that in the presence of a borrowing constraint, the attractiveness of housing wealth crowds out stock market exposure. Olear et al. (2017) show that the optimal allocation to stocks in individualized pension schemes is a decreasing function of the assumed correlation between housing wealth and stocks. Their setting assumes that housing wealth is exogenous and they show that under the assumption of a low correlation with the stock market, the optimal amount of risk is larger for homeowners than for renters. This is because housing wealth is relatively risk-free, providing homeowners with a large amount of low risk wealth that is not available to renters. Bodie et al. (1992) argue that the presence of a partner implies larger labour supply flexibility at the household level, leading to a riskier optimal portfolio allocation over the life cycle. Campbell and Viceira (2002) find similar results.

Hubener et al. (2015) analyze portfolio choice in relation to flexible retirement, social security claiming, and acquiring life insurance in the US context, focusing on heterogeneity due to family composition. Using a calibrated optimal life cycle model, they find that couples should invest a larger share of their financial wealth in stocks than singles should, and couples with two children or more should invest less in stocks than couples without children (Hubener et al. 2015, Table 5).

van Bilsen et al. (2020) derive the optimal asset allocation for a loss-averse agent exhibiting a reference level based on the prospect theory of Tversky and Kahneman (1992). They show that the optimal allocation to stocks depends on past realized returns. Brennan and Xia (2002) solve the dynamic asset allocation problem for a long-term investor with finite horizon under interest rate and inflation risk. They conclude that the optimal stock–bond mix and bond maturity depend on the investment horizon and risk aversion of the participant. Campbell and Viceira (2002) use log-linearizations to derive the optimal asset allocation under time-varying stock returns and time-varying stock market risk. Under an alternative formulation of the financial market, life-cycle investing appears to be robust.

These modifications make the life cycle model more realistic and show that heterogeneity in characteristics often leads to differences in the optimal life cycle investment strategy. All these studies find a decreasing optimal exposure to equities over the life cycle, but Benzoni et al. (2007) is an exception: they find a hump-shaped optimal risk exposure with age, under the assumption of cointegration between labour income and the stock market.

The literature referred to above is the foundation for life cycle investing in DC schemes. In individualized pension schemes, the pension provider is not restricted to a suboptimal ‘one size fits all’ asset allocation strategy for a heterogeneous population compared to a ‘one size fits all DB plan’. In theory an agent will, in the presence of freedom of choice, customize the asset allocation to individual characteristics such as risk attitudes, amount and risk characteristics of human capital, liquid and illiquid wealth other than pension assets, etc. Some options are currently available in Dutch DC pension schemes. In the accumulation phase, a participant can choose, roughly speaking, between a defensive, a neutral and an offensive life cycle investment strategy. In the retirement phase, the participant is mandated to annuitize his pension wealth, in contrast to many other countries, but for several years now, (s)he can choose between a guaranteed benefit level or limited equity exposure, implying a variable annuity depending on the stock market returns.

2.2 Empirical Studies

Gough and Niza (2011) review the empirical literature from 1988 to 2009 on retirement related choices such as decision to save, contribution rate, and asset allocation. They cite over 50 papers that relate agent characteristics to variation in asset allocation strategies. Comparing empirical results to the theory is not the main focus of these papers. Agnew et al. (2003) show that equity exposure in 401(k) plans increases with a participant’s labour income and falls with the participant’s age. They also show that married participants have higher equity exposure than single participants. Sunden and Surette’s (1998) empirical study focuses on gender and marital status in the allocation of assets in a retirement savings plan. They find that a married individual is less likely than a single individual to choose ‘mostly stocks’. Benartzi and Thaler (2001) conclude in an experimental setting that the menu of funds determines the allocation to stocks, since participants use the 1/n rule to allocate their contributions over the n funds. Accordingly, they conclude that in 401(k) plans that have more equity funds in their choice menu, participants end up with a higher allocation to stocks in their retirement accounts. Dulebohn (2002) concludes that in DC plans, the allocation to stocks is increasing in the risk tolerance of the individual. A higher risk tolerance, for example due to a higher income or participation in an additional plan, makes that participants have better ability to recover from a loss. The empirical study by Heaton and Lucas (1997) finds that households with variable income have less exposure to the stock market than similarly wealthy households with fixed income. For the more recent literature, we make a distinction between heterogeneity in stated preferences and revealed preferences.

2.2.1 Explaining Heterogeneity in Stated Preferences

Alserda et al. (2019) measure the risk preferences of participants in five differently organized pension plans with a collective investment strategy. They conclude that the collective asset allocation toward stocks is too low and not in line with the risk aversion of the average participant of the fund. Furthermore, sociodemographic factors such as age, gender, monthly income, having a partner and owning a house can explain the heterogeneity in risk preferences by as much of 5.6 \(\%\). Guiso and Paiella (2008) explain up to 13 \(\%\) of the variation in risk preferences, using data with very detailed information on individual characteristics. These authors have access to individual household data provided by the Bank of Italy, with more detail than is usually available to a pension provider.

Knoef et al. (2022) find that over 90 \(\%\) of participants prefer a fixed annuity over a variable annuity. In a contract with a variable annuity, the participant retains equity exposure after retirement, increasing the expected return and the expected annuity amount in the future. Based on elicited risk aversion, they conclude that almost all participants should prefer a variable annuity over a fixed annuity according to the standard theory. In addition, they conclude that for participants with a higher risk bearing capacity - such as those with a state pension income, with DB pension income, with large savings, or with housing wealth—a variable annuity with higher equity exposure is optimal. Finally, they take an emotional bias into account in the form of loss aversion and argue that this lowers the optimal stock allocation in a variable annuity. Our paper differs from their work in the sense that we directly link a wide variety of background characteristics to stated product choice in an empirical setting.

2.2.2 Explaining Heterogeneity in Revealed Preferences

Empirical research by Balter et al. (2018) in Denmark shows that demographic characteristics are important in explaining the probability that the participant would give up a guaranteed interest rate (in exchange for a pension plan with a higher expected return) in their DC pension. They conclude that a young man, living in Copenhagen, with a low guaranteed interest rate and low accumulated pension wealth is more likely to opt out of the guaranteed pension product than the average participant in these products. Bikker et al. (2012) find age-dependent asset allocations in the cross-section of Dutch pension funds. A one-year increase in the age of the active participant leads to a drop in the strategic asset allocation of 0.5 percentage points. Calvet et al. (2019) show that retail capital-protected investment with a guaranteed return increases the allocation to stocks for older people with low wealth. The increased allocation can be explained by emphasizing the guaranteed component designed to reduce loss aversion. Bütler and Teppa (2007) use data from ten Swiss pension funds where they observe the choice between an annuity and a lump sum. Their paper concludes that the annuity equivalent wealth is the most important factor in explaining the choice for an annuity versus a lump-sum.

Our paper contributes to the existing literature by providing an extensive theoretical overview of optimal asset allocation decisions for heterogeneous agents. The main contribution however is that we compare the expected empirical findings deduced from the theoretical models to empirical results using a unique, large sample of Dutch pension participants. To the best of our knowledge there is no paper that performs a similar analysis.

3 Modeling Product Choice for Heterogeneous Agents

Extending the standard life cycle model of Merton (1969), Bodie et al. (2009) concluded that it is optimal to customize the pension plan to the characteristics and preferences of the agent. Welfare losses of an asset allocation tuned to the median agent can be substantial (Bovenberg et al. 2007). In this section we analyze how according to standard theory, heterogeneity in characteristics and preferences of pension plan participants leads to different optimal asset allocations. We start from a standard life cycle model with constant relative risk aversion (CRRA) and consider one dimension of heterogeneity at the time, keeping other dimensions constant. Moreover, we only consider the optimal risk in the participant’s pension plan, which we refer to as ‘product choice’, taking other wealth components as given. In the institutional setting, product choice in the accumulation phase and product choice after retirement are separated, and in the empirical part we consider them separately. Most of the theory, however, applies to both stages of the life-cycle, which is why in this section we will treat them jointly. For each characteristic, we will formulate an expected empirical finding (EEF) based on the theoretical prediction.

In Sect. 3.1 we focus on the impact of different financial background characteristics: labour income, the relative importance of DC pension income compared to the (risk-free) state pension, and DB schemes or uncertain income from non-pension financial wealth or housing wealth. In Sect. 3.2 we consider the impact of different sociodemographic characteristics: age, education, and marital status. In Sect. 3.3 we investigate the role of the participant’s economic preferences: risk and loss aversion, time preference, and present bias.

3.1 Product Choice and Financial Background Characteristics

3.1.1 Labour Income Without Career Path

Agent i can invest her financial wealth \(F_{i,t}\) at time t in the stock market with uncertain return \(r_{s}\) or in the risk-free asset with return \(r_{f}\). The expected return on stocks is \(\mu _{s}\) and the volatility of stock returns is \(\sigma _{s}\). The agent has risk-free human capital \(H_{i,t}\) consisting of all future discounted labour income at time t. We do not consider the state pension as part of human capital as in Cocco (2005) and take it into account separately. The agent has risk aversion \(\gamma\). We present the optimal allocation to stocks \(\alpha _{s,i,t}\) for agent i at time t as a proportion of the total in a general form, where the first term overlaps with Merton (1969) and \(\phi _{i,t}\) defines the importance of total wealth relative to financial wealth for agent i at time t.

Bodie et al. (1992) extended Merton (1969) by taking into account risk-free human capital. We define \(\phi _{i,t}\) based on their equation (14) as follows.

Substituting (2) in (1), we see that the optimal fraction of financial wealth allocated to risky assets is equal across the income distribution if higher labour income and human capital imply proportionally higher financial wealth. This is plausible if financial wealth is mainly (DC) pension wealth and accumulated pension wealth increases proportionally with earnings. This property is lost however, if there is heterogeneity in career paths. Therefore we conclude that each income category allocates the same fraction of accumulated financial wealth to the risky asset if human capital is risk-free and all wage profiles are similar.

3.1.2 Labour Income with Subsistence Level

We assume a utility function where agents derive utility of consumption in excess of a subsistence level, as in Rubinstein (1976). We consider the case in which the subsistence level \(subs_{i,t}\) can be heterogeneous across agents i. It includes all types of expenditures, such as food, clothing, energy, housing, etc., and will vary with household composition but also, for example, be different for renters and homeowners. Solving the life cycle optimization problem with such a utility function is discussed in Exercise 6.4 in Munk (2017). The solution is a guaranteed benefit level to finance the subsistence level plus CRRA upside. The remaining wealth \(W_{i,t}-subs_{i,t}\) is to be invested in the same way as it would be invested by an investor without subsistence level.

In this setting we define the relative importance of financial wealth \(\phi _{i,t}\) as follows:

Substituting in (1) now gives the optimal allocation to stocks in terms of financial wealth.

Scholz et al. (2006) show that heterogeneous individuals aim to achieve different replacement rates. De Bresser et al. (2015, 2017) also show that the required minimum level of consumption is heterogeneous across participants. Based on (3) combined with (1), we can formulate the following EEF:

EEF 1

Standard models predict that a participant with a low minimum consumption level invests more in stocks than a participant with a high minimum consumption level (ceteris paribus).

We see that a higher subsistence level lowers the optimal allocation to risky assets. To analyze this empirically, we need a good measure of the minimum subsistence level. We try to develop such a measure using a separate survey question, see Appendix A, question 7. Equation 3 also implies that the subsistence level in absolute terms is more important for individuals with lower financial wealth, which will typically also be the individuals with lower labour income if financial wealth is mainly pension wealth. We formulate the EEF as follows:

EEF 2

Standard models predict that a participant with higher labour income and therefore higher pension wealth invests more in stocks than a participant with low labour income (ceteris paribus).

3.1.3 Relative Importance DC Extended by the State Pension and DB Pension Schemes

Like many other countries, the Netherlands grants pension benefits to their citizens regardless of payments into this unfunded system during the citizens’ working lives. These state pensions safeguard basic needs and ensure a living standard above the poverty line after retirement. Clearly, a generous state pension reduces the part of the subsistence level that needs to be financed by an occupational pension. We abstain from political risk and assume a model in which the state pension is guaranteed for all generations. The value of the state pension \(gov_{i,t}\) will be added as guaranteed income. Moreover, we extend the setting by taking into account accumulated pension wealth in a DB pension scheme \(db_{i,t}\). Assuming that DB pensions are risk-free, we define the relative importance of financial wealth \(\phi _{i,t}\) in this extended setting:

Combining this with (1) gives the optimal asset allocation:

The exact implications for the optimal asset allocation in occupational pension schemes depend on the value of the state pension income compared to the subsistence level. If the value of the subsistence level always equals the value of the state pension \(subs_{i,t}=gov_{i,t}\) there is no heterogeneity in the optimal asset allocation in the absence of a career path in line with (2) substituted in (1). If the value of the subsistence level exceeds the value of the state pension \(subs_{i,t}>gov_{i,t}\), we expect to find what is stated in EEF 2. Taking into account guaranteed DB pension income has a similar effect of the state pension. We formulate the EEF as follows:

EEF 3

Standard models predict that a participant with a small relative importance of DC pension invests more in stocks than a participant with a high relative importance of DC pension (ceteris paribus).

Potter van Loon and Grooters (2018) consider the optimal asset allocation at the retirement age and define the relative importance of DC pension income with respect to the state pension and DB pension schemes, ignoring a subsistence level in the optimal asset allocation. In their model, DC participants can take a significant risk because they set \(subs_{i,t}\) in (4) to zero. In the definition of Knoef et al. (2022) the parameter \(\phi _{i,t}\) is even lower, since housing wealth and saving deposits are taken into account as risk-free assets as well. We will take these assets into account as uncertain in the next subsection. Due to data limitations, we cannot take explicit account of the partner’s pension. Thus in the empirical analysis, the importance of DC should be interpreted at the individual level.

3.1.4 Non-pension Financial Wealth

Assume that participant i has a certain amount of non-pension financial wealth, such as savings deposits, stocks or bonds that we denote by \(\tilde{F}_{i,t}\). This is another component of total wealth in addition to the financial wealth accumulated with the pension fund and human capital. We define \(\tilde{F}_{i,t}^{s}\) and \(\tilde{F}_{i,t}^{r_{f}}\) as the amounts of non-pension financial wealth allocated to stocks and bonds respectively. We assume that the pension fund and the individual invest in the same assets so that the returns on their portfolios are perfectly correlated. The relative importance of financial wealth \(\phi _{i,t}\) is defined as follows for an agent with non-pension financial wealth, adjusting for the riskiness of other wealth components:

We get the optimal asset allocation by substituting (5) in (1) where we ignore the fact that non-pension financial wealth is not insured against longevity risk. Assuming that the asset allocation of non-pension financial wealth is given and does not change, the optimal asset allocation of accumulated financial wealth with the pension fund depends on the given asset allocation of non-pension financial wealth. This leads to the following EEF:

EEF 4

Standard models predict that a participant with non-pension financial wealth with a high (low) risk profile invests less (more) in stocks than a participant without non-pension financial wealth (ceteris paribus).

3.1.5 Housing Wealth

In Olear et al. (2017) the agent can also invest in housing wealth HW with uncertain return \(r_{t+1}^{hw}\). In their setting the housing investment position is exogenously given and there is no constraint on borrowing. Let \(\sigma _{s,hw}\) be the covariance between stock market and housing wealth. Then \(\phi _{i,t}\) in (1) is given by:

The first two terms in (6) determine the optimal asset allocation for a renter. For a homeowner, the effect of housing wealth on the optimal allocation toward stocks depends on the sign of the last term in (6). NBIM (2015) conclude that the correlation between private real estate and the stock market is low, although it changes over time (Sing and Tan 2013). Cocco (2005) and Munk (2020) solve the life cycle optimization problem under the assumptions of a borrowing constraint and an endogenous housing investment position. These papers conclude that housing wealth crowds out the allocation to stocks due to the attractiveness of housing wealth as an investment option. In particular this applies to younger people with low financial net worth. Their setting abstracts from optimal decisions on asset allocations as considered in Olear et al. (2017). Under the assumption of a low correlation between private real estate and the stock market, we obtain the following EEF:

EEF 5

Standard models predict that a homeowner invests more in stocks than a renter (ceteris paribus).

3.2 Product Choice and Sociodemographic Characteristics

3.2.1 Age

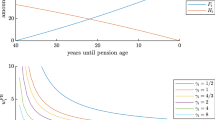

Merton (1969) and Samuelson (1969) show that under the assumption of constant relative risk aversion it is optimal to have a constant allocation to stocks as a fraction of total wealth over the life cycle. Bodie et al. (1992) expand Merton (1969) by introducing risk-free human capital. They derive the conventional wisdom of decreasing equity exposure in terms of financial wealth as the remaining investment horizon decreases. Intuitively, this optimal asset allocation in (2) is obtained because the ratio of human wealth over financial wealth decreases as the participant gets older. The reason is that human wealth depletes while financial wealth accumulates over the life cycle. Jagannathan and Kocherlakota (1996), Campbell and Viceira (2002) and Cocco (2005) also find such age-dependent asset allocation.

van Bilsen et al. (2020) extend the life cycle model by assuming a loss-averse participant with an endogenous reference level. They show that a participant exhibiting these preferences reduces equity exposure with age even in a setting without human capital. This implies that even after retirement, the optimal share in stocks is expected to fall with age of the retiree. We formulate the EEF as follows:

EEF 6

Standard models predict that a younger participant invests more in stocks than an older participant (ceteris paribus).

3.2.2 Education

Cocco (2005) extend the life cycle model of Merton (1969) for agents with heterogeneity in their career path. Agents with higher education levels have a steeper career path than agents with lower education levels (Campbell et al. 2001). Assuming that earnings are uncorrelated with stock returns, a young participant with a steeper career path holds higher implicit claims to the risk-free asset. As a consequence, for participants with a steeper career path the optimal equity exposure is higher (Cocco 2005). We formulate the EEF as follows.

EEF 7

Standard models predict that a participant with higher education (and a steeper career path) invests more in stocks than a participant with lower education (ceteris paribus).

3.2.3 Marital Status

Bodie et al. (1992) solve the life cycle model under the labour-leisure trade off. They conclude that higher equity exposure is optimal for individuals with greater labour flexibility. They show that it is possible to present the optimal asset allocation in (1) by multiplying the ratio of human capital wealth over financial wealth in (2) by a factor less than or equal to one reflecting labour flexibility. The authors argue that we can use the marital status of the household as a proxy for labour flexibility since two partners can more easily adjust a household’s total labor supply than a single individual can. Campbell and Viceira (2002) use a similar line of reasoning and Hubener et al. (2015) also find that the optimal investment in stocks is larger for couples than in singles. On the other hand, one can also argue that there is a lack of flexibility in the hours worked by the partner combined with the responsibility to guarantee a decent standard of living for the partner as well. This line of reasoning predicts the opposite effect of marital status on equity exposure. Therefore, we formulate the EEF as followsFootnote 1:

EEF 8

The effect of marital status on optimal asset allocation is ambiguous.

3.2.4 Gender

Finally, theoretical models do not say anything about gender differences (ceteris paribus). We will test ex-post whether significant gender differences are present. The literature typically finds that men are willing to take more risks than women (Agnew et al. 2013), but this should already be reflected in their risk aversion (and perhaps loss aversion) parameters. Controlling for risk preferences (so ‘ceteris paribus’), there is no reason why gender should still matter.

3.3 Product Choice and the Economic Preferences of the Individual

3.3.1 Risk Aversion

Methodologies have been developed in recent years to elicit the risk attitudes of pension plan participants. Alserda et al. (2019) elicit risk aversion using lottery questions, framed in a pension context, based on Holt and Laury (2002). van der Meeren et al. (2019) measure risk aversion using the choice sequence (CS) method, in which the participant chooses between two risky pension products, based on Barsky et al. (1997). The framing of the questions in these methods, using a constant relative risk aversion framework, matters for the outcome (Binswanger and Schunk 2008). The pension builder, based on Dellaert et al. (2016), derives risk preferences from the stated choice of distribution of pension income at retirement age, avoiding assumptions about the utility function. Knoef et al. (2022) elicit risk aversion in an integrated framework with time preferences, present bias and probability weighting using the convex time budget (CTB) method proposed by Andreoni and Sprenger (2012a, b). In our survey, we used a specification of the CS method (see Appendix A, question 8). Irrespective of the method used, the implication of heterogeneity in risk aversion for the optimal asset allocation in (1) is unambiguous.

EEF 9

Standard models predict that a less risk-averse participant invests more in stocks than a more risk-averse participant (ceteris paribus).

3.3.2 Loss Aversion

Tversky and Kahneman (1992) challenge standard expected utility theory and argue that individuals value gains and losses compared to some reference level. They argue that individuals are loss-averse implying that the optimal asset allocation is no longer given by (1). The reference level of the standard of living differs from the subsistence level, since consumption can be lower than the reference level. Several papers solve the life cycle optimization problem using the framework of Tversky and Kahneman (1992). A recent example is van Bilsen et al. (2020) who show that the optimal asset allocation for a loss-averse participant with a constant reference level depends on the state of the economy, particularly on the annualized realized stock returns. In ‘bad’ and ‘normal’ times a loss-averse agent has a lower optimal equity share than in ‘good times’. Berkelaar et al. (2004) find that stronger loss aversion implies lower equity exposure in most states of the world, though not always. We formulate the EEF in line with Knoef et al. (2022) as follows:

EEF 10

Standard models predict that a loss-neutral participant usually invests more in stocks than a loss-averse participant (ceteris paribus).

3.3.3 Time Preferences

Merton’s (1969) life cycle model, without a borrowing constraint and stochastic pension contributions, shows that a participant with a higher time preference parameter prefers higher consumption in early years. We argue that the time preference parameter has an indirect effect on the optimal asset allocation via consumption. A higher time preference parameter leads to a lower accumulation of financial wealth, while the depletion of human capital wealth is independent of the time preference parameter. For most scenarios this leads to an increase in human capital over financial wealth in (2). We conclude that a higher time preference parameter typically leads to a higher equity exposure for (2) in (1), ceteris paribus.

In a pension system with a fixed contribution rate such as the Dutch and standard utility function there is no link between the time preference parameter and the optimal asset allocation via the accumulation of financial wealth. However, in a more advanced financial model with time-varying equity risk premium, such as in Koijen et al. (2010), time preferences could lead to equity hedge demands as well. Therefore, we formulate the EEF as follows:

EEF 11

The effect of time preferences is ambiguous.

3.3.4 Present Bias

Present bias is the tendency to grab immediate smaller rewards rather than to wait for larger future rewards (O’Donoghue and Rabin 1999). Goossens and Werker (2020) show that, under financial market conditions as those described in Brennan and Xia (2002), present bias does not change the optimal asset allocation toward stocks in terms of total wealth.

EEF 12

Standard models predict that the present bias parameter does not influence the asset allocation toward stocks (ceteris paribus).

Table 1 provides an overview of the characteristics we consider and the EEFs concerning their relation to equity exposure (EQ), keeping the other characteristics constant.

4 Data and Descriptive Statistics

We have access to survey data from active and inactive participants in the DC pension plans of two Dutch pension providers. The data was collected between May and August 2021. The survey was sent to 341,033 respondents who had not yet retired. In total, 20,204 respondents opened the link to the survey in the e-mail. 3,282 of these did not start the survey, 1,399 did not accept the privacy statement and 6,349 respondents started but did not finish the survey. The remaining 9,174 respondents completed the questionnaire. We excluded 1,051 respondents due to quality concerns about their data (see Appendix B). This leads to a final sample of 8,123 respondents. We have detailed data on all characteristics discussed in the previous section and the respondents’ elicited choice regarding the preferred life cycle. The relevant survey questions are presented in Appendix A. In principle the questions are answered for the individual. This also applies to the income related variables Q2 labour income and Q5 relative importance DC. Some variables can only be defined at the household level, however, particularly variables related to housing (Q3 and Q4) and non-pension financial wealth (Q6).

4.1 Financial Background Characteristics and Sociodemographic Characteristics

We present summary statistics of background characteristics in Table 2. The sample design implies that the sample is not representative of the complete Dutch population. The majority of our sample is male (77 \(\%\)), corresponding to the overrepresentation of males among the clients of the two pension providers. The median age is 52 years and 77.2 \(\%\) of the respondents have a partner. Educational attainment peaks at higher professional education at 38.9 \(\%\). The most common individual income category (after tax per month) is ‘€3,500 or more’. More than 75 \(\%\) own their home financed with a mortgage and more than 40 \(\%\) of the sample owns a house worth more than €350,000. Ideally we would work with the variable net housing wealth (i.e., housing wealth net of mortgage), but the information on mortgages in the data is incomplete. The imperfect measure of housing wealth may lead to underestimation of the magnitude of the effect of housing wealth, due to attenuation bias.

The DC pension at the company that sent out the survey is, in addition to the basic state pension, the only pension provision for 22.9\(\%\) of the sample, while for 31.5\(\%\), it represents only a minor part of their total expected retirement income. A majority of the sample also have private (non-pension) financial wealth, and for most of them this is close to risk-free. The median minimal consumption level (i.e., the minimum amount a household needs for expenses during retirement, see question 7 in Appendix A) for the household during retirement is €2,200 per month.

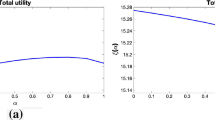

4.2 Preference Parameters

We present summary statistics of the preference parameters in Table 3. Risk aversion and loss aversion parameters are elicited using the choice sequence (CS) method and the method of Knoef et al. (2022), see Questions 8 and 9 in Appendix A. When irrational choices are made (see question 8 in Appendix A), the CS method cannot be used to compute the risk aversion parameter. This is the case for 20.5 \(\%\) of the sample (similar to van der Meeren et al. 2019, who also used the CS method). The median respondent has a risk aversion level of 1.84, similar to the average risk-aversion parameter of 1.79 found in van der Meeren et al. (2019). We categorize risk aversion into five categories (see Appendix A for the motivation): ‘very low’ (\(\gamma \in (-\infty , 0.72)\)), ‘low’ (\(\gamma \in (0.72, 1.20)\)), ‘medium’ (\(\gamma \in (1.20, 2.14)\)), ‘high’ (\(\gamma \in (2.14, 10.73)\)) or ‘very high’ (\(\gamma \in (10.73, + \infty )\)).

For loss aversion, we use similar categories: ‘low’ (\(\lambda \in (-\infty , 1)\)), ‘medium’ (\(\lambda \in (1, 2.22)\)), ‘high’ (\(\lambda \in (2.22, 5)\)) and ‘very high’ (\(\lambda \in (5, +\infty )\)). We cannot calculate the loss aversion parameter for 29.9 \(\%\) of the sample due to irrational answers (see question 9 in Appendix A). The distributions of both the risk-aversion and the loss-aversion parameters are similar to what Knoef et al. (2022) found.

We use the method developed by Wang et al. (2016) to measure time preference and present bias (see questions 10 and 11 in Appendix A). The median present bias and time preference parameters are 0.94 and 0.98, respectively. This is consistent with values typically found in the literature, such as Ericson and Laibson (2019). Both are smaller than one, indicating a preference for immediate and earlier rewards. We see that the standard deviation of the present bias parameter is large, which might be due to the noisy answers of participants who do not understand the questions.

4.3 Product Choice

Stated product choice is elicited with two questions on how much risk individuals want to take with their pension wealth during the accumulation and the retirement phase. Possible answers are on a five-point scale from ‘as little as possible’/‘none’ to ‘as much as possible’ (Questions 11 and 12 in Appendix A). We present the choices made in Fig. 1.

We see that 45.5 % prefer a product with average investment risk in the accumulation phase. In the retirement phase, 43.1 % prefer a product with a small amount of investment risk. More than half the participants prefer a variable annuity, much more than in Knoef et al. (2022) who find that over 90 % of participants prefer a fixed annuity. Van der Cruijsen and Jonker (2019) also find a strong preference for a fixed annuity, albeit in a somewhat different context. One possible explanation for this difference could be ‘extremeness’ aversion (Benartzi and Thaler 2002) and the fact that our survey questions use five different categories. Another explanation could be that our survey explicitly emphasizes the trade-off between the risk and return of a variable annuity.

Table 4 reveals plausible correlations between different variables related to risk and loss aversion. The qualitative measures of risk for the accumulation and retirement phases are strongly positively correlated. We also see a strong and negative correlation between risk aversion and risk taken in stated product choices. Similarly, we find significant and substantial negative correlations between the measure of loss aversion and risk-taking in stated product choices.

5 Empirical Model and Estimation Results

The two dependent variables, product choice in the accumulation phase and after retirement, are both discrete with five answers that are clearly ordered, from low to high investment risk. This makes it natural to model them with an ordered logit model. To formulate this model, we use a latent continuous variable \(y_{i}^{*}\) for individual i that can be interpreted as an indicator of the desired amount of risk (either before or after retirement) on a continuous scale. The ordered logit model is given by:

Here \(x_{i}\) is a vector of independent variables (the characteristics of the investor), \(\beta\) is a vector of regression coefficients (one for the accumulation phase and another one for after retirement), and \(\epsilon _{i}\) is an error term, which is assumed to follow a logistic distribution, independent of \(x_{i}\). The parameters \(\kappa _j\) are the cut-off points for the observed categorical outcome \(y_{i}\), with \(\kappa _0 = -\infty , \kappa _1=0, \kappa _5=\infty\) and \(\kappa _2, \kappa _3\) and \(\kappa _4\) parameters to be estimated (again, separately for the accumulation phase and the decumulation phase).

With this model, the probabilities of the five outcomes, given x, are given by:

where \(\Lambda (.)\) is the logistic distribution function \(\Lambda (z)=\frac{\text {exp}(z)}{1+\text {exp}(z)}\).

The model is estimated using maximum likelihood. The sign of the \(\beta\) parameters can be interpreted directly—a positive \(\beta _{k}\) means that the chances to choose one of the riskier investment options increases if \(x_{i,k}\) increases and the other \(x_{i,j}\) do not change. Interpreting the magnitude is harder. A popular method is to look at odds ratios \(\frac{Pr(y_{i} \ge j|x_{i})}{Pr(y_{i} < j|x_{i})}\). If \(x_{i,k}\) increases by 1 and the other \(x_{i,j}\) do not change, the odds ratio changes by a factor \(\text {exp}(\beta _{k})\).

5.1 Empirical Results: How Does Product Choice Vary with Investor Characteristics?

Detailed results are presented in Tables 5 (accumulation phase) and 6 (retirement phase). These tables contain the estimates of the odds ratios \(\text {exp}(\beta _{k})\) and the p-values indicating whether each odds ratio is significantly different from one. Since the results in Tables 5 and 6 are largely similar, we discuss both tables jointly.

The only case where the empirical finding is at odds with the theoretical prediction concerns subsistence level in the accumulation phase: a higher reported subsistence level is associated with a significantly higher tendency to take risk, whereas EEF 1 predicts a negative effect. One potential explanation is that participants have interpreted the subsistence level as a preferred consumption standard instead of a minimum. This would also explain why there is so much heterogeneity in reported subsistence levels (cf. Table 2, Panel B). Keeping other variables constant, a higher labour income significantly and monotonically increases the tendency to take investment risk after retirement, in line with the theory (EEF 2). There is no significant effect of labour income in the accumulation phase, however. In line with EEF 3 (left column table 5), we find that participants whose DC pension wealth is a smaller fraction of total pension wealth prefer more equity exposure. In line with EEF 4, a higher level of non-pension financial wealth is also associated with more equity exposure, ceteris paribus. To interpret the size of this effect, in the retirement phase: suppose someone in the highest wealth category has a predicted probability 0.5 to take at least a given amount of investment risk, then the prediction of the same probability for an otherwise identical person with no financial wealth would be only 0.337 (= 0.509/(1+0.509). We find a significant result for housing wealth in line with EEF 5 in the sense that participants with more housing wealth prefer more investment risk. However, we find no significant difference in product choice between renters and participants with the highest value of the house in the accumulation phase.

In line with EEF 6 we find clear evidence that during the accumulation phase, younger participants prefer much more equity exposure than older participants. The age effect is very large, with an estimated odds ratio of 7.462 for the youngest compared to the oldest group. The effect of current age for desired risk taking in the retirement phase is much smaller. This is in line with standard human capital theory, since at that stage of the life cycle, human capital is completely depleted (cf., e.g., van Bilsen et al. 2020). Since it is current age and not actual age in the retirement phase that we include in the regression, the fact that the age effect is still significantly negative is surprising. It may point at an effect of social norms since older cohorts will be more used to a pension income that is completely certain.

The ceteris paribus relationship between preferred equity exposure and education level is positive both in the accumulation and in the retirement phase, in line with the theory prediction (EEF 7). Participants without a partner prefer more equity exposure than participants with a partner, ceteris paribus. Although EEF 8 was ambiguous, this seems to be in line with the argument that a partner increases the responsibility to guarantee a decent standard of living for the household.

Confirming EEF 9, we find the significant result that a more risk-seeking participant prefers more equity exposure. The odds ratio of choosing a category with high as opposed to low equity exposure in the accumulation phase is 0.102 for participants with ‘very high risk aversion compared to participants with ‘very low risk aversion’; it is 0.151 in the retirement phase. The preference for more risk decreases monotonically with risk aversion, but the main difference is between the risk aversion categories “very low” and “low,” rendering the effect nonlinear.

For loss aversion, we find qualitatively similar results (EEF 10). Moreover, individuals with irrational answers to the risk and loss aversion questions prefer less investment risk that the most risk seeking individuals. We find that, keeping other variables constant, more impatient individuals (individuals with a stronger time preference; cf. EEF 11) prefer less equity exposure. The sign we find for the time preference parameters is in line with the prediction of a more advanced financial model with a time-varying equity risk premium, such as the model used by Koijen et al. (2010), where time preferences could lead to equity hedge demands. The coefficients on present bias are all insignificant. Here we did not have an unambiguous theoretical prediction (EEF 12).

Finally, in our regressions we also controlled for gender, which was not considered in the discussion of the theory. We find that men are willing to take more risks than women. This is in line with the empirical literature, e.g. Agnew et al. (2003), but note that this result involves keeping other variables constant, including risk and loss aversion.

To summarize, we find that a young man with a high education, high non-pension financial wealth, small relative importance of DC pension wealth, low risk aversion and low loss aversion has the strongest preference for equity risk exposure in the accumulation phase. Preferences for equity exposure after retirement are related to the same factors, but in addition, higher labour income increases the desired equity exposure of pension wealth after retirement.

5.2 Retirement Phase: Fixed or Variable Annuity?

Before participants decide on how much equity risk they are willing to take in the retirement phase, they choose between a fixed and a variable annuity. For this reason, we also perform a logit regression that models the choice between a fixed and variable annuity. We define the answer category of stated product choice \(\le\) 1 as a fixed annuity and the answer category of stated product choice > 1 as a variable annuity. Observe that ‘1’ refers to ‘none’ investment risk in Fig. 1b. We present the results in Table 7. These results show that variables such as labour income, non-pension financial wealth, risk aversion, loss aversion and gender are important drivers of the choice between a fixed and variable annuity. To summarize, a man with a high labour income, high non-pension financial wealth, low risk aversion and low loss aversion prefers a variable annuity over a fixed annuity.

We perform some robustness checks in Appendix C. We find that our results are robust to a linear and a logit regression specification for stated product choice in the retirement phase.

6 Summary and Conclusion

In Table 8, we provide a qualitative overview of the empirical results for stated product choice in the accumulation phase and the retirement phase, comparing the empirical findings with the expectations based on the standard theory (expected empirical findings (EEF) 2–12). We write a ‘0’ if there is no significant effect, we write a ‘-’/‘+’ if we find at least one of the categories with a negative/positive significant effect and a ‘\(- -\) ’/‘++’ if we find for all categories a negative/positive monotonic significant effect. If the result is inconclusive, we also write a ‘0’. Although in the theory section we did not differentiate between the accumulation and retirement phase, we do make this distinction now since these are separate decisions in practice and we have used separate stated product choice questions for both of them. The main message from Table 8 is that in most cases, the signs and significance levels confirm the EEFs. In nine cases, we have a clear prediction of the sign. In seven and eight cases out of these nine for the accumulation and retirement phase respectively, the estimated coefficient is significant with this expected sign. In two of the eighteen cases, the estimate is insignificant and in one of eighteen cases the estimate is significant, but of the wrong sign compared to what we predicted in Sect. 3.

Our paper has a few limitations. We use self-reported data for individual characteristics, which is typically noisy. Also, the method used to elicit product choice at the pension providers is more complex than we have presented here. The sample we have used is not a random sample of the Dutch adult population and can be selective in several respects. First of all, the sample is drawn for individuals holding a DC pension product and it thus over-represents individuals in occupations and sectors where such pensions are more common. If DC products become more common in the future, the composition of the population of interest may change, making our current sample less representative. Moreover, this type of voluntary survey typically has low response rates and this is not much better in our case. We cannot rule out the possibility that our survey participants are not representative of the complete population of DC pension holders, although we also do not have specific reasons to expect serious selection bias.

Although we have more explanatory variables than in most papers, there are certainly other relevant factors that we did not measure. An example is the individuals’ perceived distribution of stock returns, i.e., the expectation and volatility of these returns. If such perceptions are correlated with the included regressors, such as the measures for risk and loss aversion, then they might lead to an omitted variable bias. We have no strong reason to expect such a bias but also cannot rule it out. In future work subjective probabilities concerning stock returns (cf., e.g., Hurd et al. 2011) could be elicited and used to account for such a potential bias.

We show in this paper that risk aversion plays an important role in explaining product choice, but the industry should not limit itself to this variable only. We see that economic variables measuring risk capacity are important as well. We propose that future research considers eliciting economic preference parameters, such as risk aversion and loss aversion, for participants with irrational answers.

Notes

In the empirical analysis, we do not take the effect of other characteristics of the household into account. For example, Hubener et al. (2015) analyze a model which also includes the number of children and find, for the US context where the costs of children’s education play a larger role, that more children lead to a smaller optimal share of stocks over most of the life cycle.

We have defined replacement rates in an optimistic scenario and in a pessimistic scenario respectively as follows {0.65, 0.68,..,0.89, 0.92 } and {0.65, 0.63,..., 0.49, 0.47.} such that we get equal steps in \(\frac{1}{\gamma }\), which is directly related to the optimal asset allocation. Furthermore, note that we will not consider negative coefficients for \(\gamma\) as in van der Meeren et al. (2019).

For risk aversion we define the following choices as irrational: A-A-A-B-B, A-A-B-B, A-B-B-B-B, A-B-A-A-A, A-B-B-B-A, B-B-B-A-A, B-B-A-A, B-A-A-A-A, B-A-B-B-B, B-A-A-A-B. These answers imply \(\gamma <x\) and \(\gamma >x\) which is a contradiction.

For loss aversion we define the following choices as rational: A-A-A-A-A, B-A-A-A-A, B-B-A-A-A, B-B-B-A-A, B-B-B-B-A, B-B-B-B-B, (A=B)-A-A-A-A, B-(A=B)-A-A-A, B-B-(A=B)-A-A, B-B-B-(A=B)-A, B-B-B-B-(A=B). The participant can only switch once from B to A.

References

Agnew, J., Balduzzi, P., & Sunden, A. (2003). Portfolio choice and trading in a large 401 (k) plan. American Economic Review, 93(1), 193–215.

Alserda, G., Dellaert, B., Swinkels, L., & van der Lecq, F. (2019). Individual pension risk preference elicitation and collective asset allocation with heterogeneity. Journal of Banking & Finance, 101, 206–225.

Andreoni, J., & Sprenger, C. (2012). Estimating the preferences from convex budgets. American Economic Review, 102(7), 3333–56.

Andreoni, J., & Sprenger, C. (2012). Risk preferences are not time preferences. American Economic Review, 102(7), 3357–3376.

Balter, A., Kallestrup-Lamb, M., & Rangvid, J. (2018). The move towards riskier pension products in the world’s best pension systems. Netspar Design Paper 105.

Barsky, R. B., Juster, F. T., Kimball, M. S., & Shapiro, M. D. (1997). Preference parameters and behavioral heterogeneity: An experimental approach in the health and retirement study. The Quarterly Journal of Economics, 112(2), 537–579.

Benartzi, S., & Thaler, R. H. (2001). Naive diversification strategies in defined contribution saving plans. American Economic Review, 91(1), 79–98.

Benartzi, S., & Thaler, R. H. (2002). How much is investor autonomy worth? Journal of Finance, 57, 1593–1616.

Benzoni, L., Collin-Dufresne, P., & Goldstein, R. S. (2007). Portfolio choice over the life-cycle when the stock and labor markets are cointegrated. The Journal of Finance, 62(5), 2123–2167.

Berkelaar, A. B., Kouwenberg, R., & Post, T. (2004). Optimal portfolio choice under loss aversion. Review of Economics and Statistics, 86(4), 973–987.

Bikker, J. A., Broeders, D. W., Hollanders, D. A., & Ponds, E. H. (2012). Pension funds’ asset allocation and participant age: A test of the life-cycle model. Journal of Risk and Insurance, 79(3), 595–618.

Binswanger, J., & Schunk, D. (2008). What is an adequate standard of living during retirement? Journal of Pension Economics and Finance, 11(2), 203–222.

Bodie, Z., Merton, R. C., & Samuelson, W. F. (1992). Labor supply flexibility and portfolio choice in a life cycle model. Journal of Economic Dynamics and Control, 16(3), 427–449.

Bodie, Z., Detemple, J., & Rindisbacher, M. (2009). Life-cycle finance and the design of pension plans. Annual Review of Financial Economics, 1(1), 249–286.

Bovenberg, L., Koijen, R., Nijman, T., & Teulings, C. (2007). Saving and investing over the life cycle and the role of collective pension funds. De Economist, 155(4), 347–415.

Brennan, M. J., & Xia, Y. (2002). Dynamic asset allocation under inflation. The Journal of Finance, 57(3), 1201–1238.

Bütler, M., & Teppa, F. (2007). The choice between an annuity and a lump sum: Results from Swiss pension funds. Journal of Public Economics, 91(10), 1944–1966.

Calvet, L., Celerier, C., Sodini, P. & Vallee, B. (2019). Can financial innovation solve household reluctance to take risk? Working paper. Retrieved from https://www.bwl.uni-mannheim.de/media/Lehrstuehle/bwl/Area_Finance/Finance_Area_Seminar/FSS_2019/Calvet_Paper.pdf

Campbell J. Y, & Viceira, L. M. (2002). Strategic asset allocation. Portfolio choice for long-term investors. Oxford University Press.

Campbell, J. Y., Cocco, J. F., Gomes, F. J., & Maenhout, P. J. (2001). Investing retirement wealth: A life-cycle model. In Risk aspects of investment-based Social Security reform (pp. 439–482). University of Chicago Press.

Cocco, J. F. (2005). Portfolio choice in the presence of housing. The Review of Financial Studies, 18(2), 535–567.

De Bresser, J., Knoef, M., & Kools, L. (2017). Pensioenwensen voor en na de crisis. In Netspar Design Paper 85.

De Bresser, J., & Knoef, M. (2015). Can the Dutch meet their own retirement expenditure goals? Labour Economics, 34, 100–117.

Dellaert, B., Donkers, B., Turlings, M., Steenkamp, T., & Vermeulen, E. (2016). Naar een nieuwe aanpak voor risicoprofielmeting voor deelnemers in een pensioenregeling. In Netspar Design Paper 49.

Dulebohn, J. H. (2002). An investigation of the determinants of investment risk behavior in employer-sponsored retirement plans. Journal of Management, 28(1), 3–26.

Ericson, K., & Laibson, D. (2019). Intertemporal choice. In D. Bernheim, D. Laibson, S. DellaVigna (Eds.), Handbook of behavioral economics - foundations and applications 2. (pp. 2–67) Elsevier.

Goossens, J., Werker, B. (2020). Present bias, asset allocation and the yield curve. In Working paper. Retrieved from https://www.netspar.nl/assets/uploads/P20201005_DP026_Goossens.pdf

Gough, O., & Niza, C. (2011). Retirement saving choices: Review of the literature and policy implications. Journal of Population Ageing, 4(1–2), 97.

Guiso, L., & Paiella, M. (2008). Risk aversion, wealth, and background risk. Journal of the European Economic Association, 6(6), 1109–1150.

Heaton, J., & Lucas, D. (1997). Market frictions, savings behavior, and portfolio choice. Macroeconomic Dynamics, 1(1), 76–101.

Holt, C. A., & Laury, S. K. (2002). Risk aversion and incentive effects. American Economic Review, 92(5), 1644–1655.

Hubener, A., Maurer, R., & Mitchell, O. (2015). How family status and social security claiming options shape optimal life-cycle portfolios. Review of Financial Studies, 29, 937–978.

Hurd, M., van Rooij, M., & Winter, J. (2011). Stock market expectations of Dutch households. Journal of Applied Econometrics, 26, 416–436.

Jagannathan, R., & Kocherlakota, N. R. (1996). Why should older people invest less in stocks than younger people. Federal Reserve Bank of Minneapolis Quarterly Review, 20, 11–20.

Knoef, M., Potter van Loon, R., Turlings, M., van Toorn, M., Weehuizen, F., Dees, B. & Goossens J. (2022). Matchmaking in pensioenland: welk pensioen past bij welke deelnemer?. In Netspar design paper 202.

Koijen, R., Nijman, T., & Werker, B. (2010). When can life cycle investors benefit from time-varying bond risk premia? Review of Financial Studies, 23(2), 741–780.

Merton, R. C. (1969). Lifetime portfolio selection under uncertainty: The continuous-time case. The Review of Economics and Statistics, 247–257.

Munk, C. (2017). Reader dynamic asset allocation. Retrieved from https://www.dropbox.com/s/4curig2hl5l4ef0/DAA20170502.pdf?dl=0

Munk, C. (2020). A mean-variance benchmark for household portfolios over the life cycle. Journal of Banking and Finance, 116, 105883.

NBIM. (2015). The diversification potential of real estate. Norges Bank Investment Management: Discussion Note.

O’Donoghue, T., & Rabin, M. (1999). Doing it now or later. American Economic Review, 89(1), 103–124.

Olear, G., de Jong, F., & Minderhoud, I. (2017). Individualized life-cycle investing. In Netspar Design Paper 83.

Potter van Loon, R., & Grooters, D. (2018). Vast of variabel? Een persoonlijke keuze. Tijdschrift voor Pensioenvraagstukken, 2018(1), 31–37.

Rubinstein, M. (1976). The strong case for the generalized logarithmic utility model as the premier model of financial markets. Journal of Finance, 31(2), 551–571.

Samuelson, P. A. (1969). Lifetime portfolio selection by dynamic stochastic programming. Review of Economics and Statistics, 5(3), 239–46.

Scholz, J. K., Seshadri, A., & Khitatrakun, S. (2006). Are Americans saving “optimally’’ for retirement? Journal of Political Economy, 114(4), 607–643.

Sing, T. F., & Tan, Z. Y. (2013). Time-varying correlations between stock and direct real estate returns. Journal of Property Investment & Finance, 31(2), 179–196.

Sunden, A. E., & Surette, B. J. (1998). Gender differences in the allocation of assets in retirement savings plans. The American Economic Review, 88(2), 207–211.

Tversky, A., & Kahneman, D. (1992). Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and uncertainty, 5(4), 297–323.

van Bilsen, S., Laeven, R. J., & Nijman, T. E. (2020). Consumption and portfolio choice under loss aversion and endogenous updating of the reference level. Management Science,66(9), 3927–3955.

Van der Cruijsen, C., & Jonker, N. (2019). Pension profile preferences: The influence of trust and expected expenses. Applied Economics,51, 1212–1231.

van der Meeren, G., de Cloe-Vos, H., & van Geen, A. (2019). Meet risicobereidheid met een kwantitatieve methode. ESB, 104(4773), 222–225.

Wang, M., Rieger, M. O., & Hens, T. (2016). How time preferences differ: Evidence from 53 countries. Journal of Economic Psychology, 52, 115–135.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no relevant financial or non-financial interests to disclose.

Additional information

We thank Marcus Haveman, Martin Rougoor, Frank de Jong, Nikolaus Schweizer, Jennifer Alonso-Garcia, Anne Balter, Jorgo Goossens, Lieske Coumans, Daniel Kárpáti, Gijsbert Zwart, and an anonymous referee for their useful input and feedback on this study.

Appendix

Appendix

We present the survey questions in Appendix A. In Appendix B, we explain our sample selection criteria. Appendix C presents some robustness checks.

1.1 A. Survey Questions

The survey questions are mainly based on questions in the LISS panel (https://www.centerdata.nl/liss-panel). We framed questions for stated product choices on the product menu of the DC providers. Here we only present selected questions needed to construct the dependent and independent variables in the analysis. Survey questions were asked in Dutch, but here we present the translations.

-

1.

What is your highest level of education (for which you obtained a diploma)?

-

O Primary education

-

O Secondary/lower vocational education

-

O Pre-academic education

-

O Secondary vocational education

-

O Higher professional education

-

O Academic education

-

O Other

-

O None

-

-

2.

Status is active: What is your monthly labour income after tax? Status is inactive: When you accumulated pension wealth in a defined contribution scheme with <XX>, what was your monthly labour income after tax during that period?

-

O No labour income

-

O Less than €500

-

O €500 to €1,000

-

O €1,000 to €1,500

-

O €1,500 to €2,000

-

O €2,000 to €2,500

-

O €2,500 to €3,000

-

O €3,000 to €3,500

-

O €3,500 to €4,000

-

O €4,000 to €4,500

-

O €4,500 to €5,000

-

O €5,000 to €7,500

-

O €7,500 or more

-

-

3.

What is your domestic situation?

-

O I rent a house

-

O I own a house with a mortgage

-

O I own a house without a mortgage

-

O Otherwise, namely:.......

-

-

4.

Participant owns a house: What is the value of the house?

-

O Less than €150,000

-

O €150,000 to €250,000

-

O €250,000 to €350,000

-

O €350,000 to €500,000

-

O €500,000 or more

-

-

5.

Status is active: When you retire, do you still have income from other pension schemes, in addition to the defined contribution scheme with <XX>? Status is inactive: When you retire, do you still have income from other pension schemes, in addition to the pension income you accrued through your (former) employer with <XX>? For inactive people replace ‘my defined contribution scheme’ in the answers with ‘the defined contribution scheme you accrued through your (former) employer’.

-

O My defined contribution scheme with <XX> is the most important part of my income during retirement in addition to the state pension income.

-

O My defined contribution scheme with <XX> is the most important part of my income during retirement, but I also have pension income from other schemes that are less important, in addition to the state pension income.

-

O My defined contribution scheme with <XX> is an important part of my income during retirement, but I also have pension income from other schemes that are about as important, in addition to the state pension income.

-

O My defined contribution scheme with <XX> is a minor part of my income in retirement, but I also have pension income from other schemes that are more important, in addition to the state pension income.

-

-

6.

(Do you / Does your household) have non-pension financial wealth (you may deduct your debts)? Think of saving deposits, stocks or a second home.

-

O I do not have non-pension financial wealth

-

O My non-pension financial wealth is less than €5,000

-

O My non-pension financial wealth is between €5,000 to €25,000

-

O My non-pension financial wealth is between €25,000 to €50,000

-

O My non-pension financial wealth is between €50,000 to €100,000

-

O My non-pension financial wealth is between €100,000 to €250,000

-

O My non-pension financial wealth is €250,000 or more

-

-

7.

What is the minimum amount that (your partner and) you need per month for expenses during retirement?

-

Think of all your expenses: food and drink, clothing, housing, insurance, etc. €...

-

-

8.

The more risk you take with your pension wealth, the higher your pension income can be. And the more disappointing your pension income can be. How much risk do you prefer in order to have a chance of a higher pension income? Several times we let you choose between two future pension incomes: A and B. For both pension incomes you can see how high your total pension income can become if returns are optimistic (green, left bar) and how low it can become if returns are pessimistic (orange, right bar). The optimistic scenario and pessimistic scenario have equal probability. The pension incomes you see represent your income after tax from your pension plan, any other pensions and your state pension income. We have based these amounts among others on your current labour income, but the pension income is an estimate. The actual amount you receive may differ. We always ask you which of the two pension incomes you prefer. Which pension income do you prefer?.Footnote 2

-

O Pension A

-

O Pension BFootnote 3

-

-

9.

Suppose you have no partner and you are retired. You receive a monthly state pension income of €1,100 after tax. In addition to this you receive a monthly pension of €800 after tax. You can choose between two risk profiles for your total pension income: A and B. These risk profiles determine how much higher or lower your monthly pension income can become. Both profiles have a 50 \(\%\) chance of a lower pension income and a 50 \(\%\) of a higher pension income (just like heads and tails when tossing a coin). Indicate for each scenario whether risk profile A suits you better or risk profile B. Or risk profiles A and B are equally good.

Risk profile A

Risk profile B

a.

− €22 + €30

− €2 + €10

b.

− €16 + €30

− €2 + €10

c.

− €11 + €30

− €2 + €10

d.

− €8 + €30

− €2 + €10

e.

− €6 + €30

− €2 + €10

With risk profile A there is a 50 \(\%\) chance that you will receive €<X> less and a 50 \(\%\) chance that you will receive €30 more per month. With risk profile B there is a 50 \(\%\) chance that you will receive €2 less and a 50 \(\%\) chance that you will receive €10 more per month.

-

Please enter at X the specific amounts that belong to the five options (only in the question, do not show separately above)

-

O Risk profile A

-

O Risk profile B

-

O Risk profiles A and B are equally goodFootnote 4

-

-

10.

Suppose you can get €10,000 today or a higher amount in one year. What amount is just as attractive in one year as €10,000 today? Assume that prices in one year will be the same as today’s prices (no inflation).

-

(A) Receive €10.000 today

-

(B) Receive €X in one year

X = €...

-

-

11.

Suppose you can get €10,000 today or a higher amount in five years. What amount is just as attractive in five years as €10,000 today? Assume that prices in five years will be the same as today’s prices (no inflation).

-

(A) Receive €10.000 today

-

(B) Receive €X in five years

X = €...

-

-

12.

For a good pension income it is necessary to invest a considerable proportion of pension wealth. If <XX> takes more investment risk, your expected pension income will be higher. The more investment risk, the higher your pension income is when investment returns are good. But your pension income is lower in the event of poor investment returns. The other way around: the less investment risk you take, the lower your expected pension income will be and the uncertainty in pension income is smaller. How much risk do you prefer in the accumulation phase?

-

O As little as possible investment risk

-

O A little bit of investment risk

-

O Average investment risk

-

O Considerable investment risk

-

O As much as possible investment risk

-

-

13.

It is possible to take investment risks with your pension wealth during retirement. You can continue to benefit from good investment results. Do you choose this? Then your pension income can go up or down every year. The less investment risk you take, the smaller the fluctuations in your pension income will be. Your pension income decreases less in the event of poor investment returns. However, your pension income increases less in the event of good investment returns. If you take less investment risk, your expected pension income will be lower. How much risk do you prefer in the retirement phase?

-

O I want no investment risk with my pension income.

-

O I want to take a little bit of investment risk with my pension income. As a result, my pension income may be slightly higher. I understand that investment results can also be disappointing.

-

O I want to take quite some investment risk with my pension income. As a result, my pension income may be higher. I understand that investment results can also be more disappointing.

-

O I want to take a lot of investment risk with my pension income. As a result, my pension income may be higher. I understand that investment results can also be quite disappointing.

-

O I want to take as much as possible investment risk with my pension income. As a result, my pension income may be a lot higher. I understand that investment results can also be quite disappointing.

-

1.2 B. Sample Exclusion Criteria

We start with 9,174 participants and define a number of criteria on the basis of which we exclude participants from the study. Below we show these criteria and, in parentheses, how many participants do not meet each of them. It is possible that participants are excluded on multiple criteria.

1. No labour income (50): It is not possible for a participant in a pension scheme to have no labour income (for inactive participants: at the time of pension accumulation). Therefore we exclude these participants.

2. Time < 10 min (217): We think that at least ten minutes are needed to answer all survey questions properly.

3. Age < 20 or Age > 67 (40).

4. Income category incompatible with hours worked, giving an implausible hourly wage (77).

5. Routing error in numbers shown (17) + (46) + (33) + (192) + (3): If there is an error in the numbers that the participants have seen, we exclude them.

6. No variation in answers (71) + (2).

7. Minimum consumption level > €6,500 (85).

8. Implausible answers to other questions (437).

After these exclusion criteria, we have 8,123 participants left and have therefore excluded 1051 participants.

1.3 C. Robustness Checks

We do a robustness check for the retirement phase, since a ‘scale’ interpretation of the dependent variable is valid due to a constant equity exposure in the retirement phase. We perform a logit regression and an ordinary least squares (OLS) regression.

1.3.1 Logit Model