Abstract

The Belgian labor share, measured as the part of GDP going to labor, is declining. This fits into the global secular trend of decreasing labor shares. A novel strand in the literature focusses on its granular drivers. Recent research in the United States suggests that superstar firms, defined as large firms with a dominant market share, are increasing their market share and relate this to the fall of the labor share (Autor et al. in Q J Econ 135(2):645–709, 2020). Using a long time series of Belgian firm-level data from 1985 to 2014, we provide evidence for the link between the rise of market concentration and the decrease of the labor share in its two largest sectors: Manufacturing and Wholesale & Retail. These two sectors represent approximately half of the Belgian economy. We do not find evidence in other Belgian sectors.

Similar content being viewed by others

Notes

Bivens et al. (2014) document the disconnect between productivity and wages for production workers in the private sector in the United States. From 1948 to 1979, productivity and wages rose respectively by 108% and 93% in real terms, but between 1979 and 2013, productivity increased by 65% while wages increased only by 8%. .

For example, assume that firm A generates a value added of €100 and pays €60 in wage costs. Firm B has a value added of €400 and pays €140 in wage costs. The firm-specific labor shares are respectively 0.60 and 0.35 while the market shares equal respectively 0.20 and 0.80. The aggregate labor share is 0.40. This value is closer to firm B’s labor share due to its higher weight. The unweighted labor share is 0.475.

A country has multiple sectors like Manufacturing, Wholesale & Retail and so on. A sector consists out of various industries. For example, the Manufacturing sector combines various industries like Manufacture of Sugar, Manufacture of Beer, Printing of Newspapers and so on.

GlaxoSmithKline Biologicals increases its market share from 33% (1993) to 68% (2006) while its labor share stays approximately 29%. Electrabel is able to grow its market share from 65% (2007) to 92% (2014). In the same period, its labor share rises from 44% to 50%, which is below the Belgian aggregate labor share (approximately 59% in this period).

For example, assume that sector A has two industries. The four largest firms in the first industry create a value added of €80 relative to a total value added of €100. The four largest firms in the second industry create a value added of €120 relative to a total value added of €400. The market concentration will be .80 in the first industry and .30 in the second industry. Taking into account the weight of each industry, leads to an aggregate market concentration of .40 in this sector. .

The robustness section uses C10 and C20 as alternative market concentration measures in prediction 2 and 4.

The unweighted average firm weight is the market share of a firm when all firms are assumed to be equally large. For example, an industry with five firms has an unweighted average firm weight of 20%. The unweighted average labor share takes the average over all firm-specific labor share, without adjusting for the firm weight. .

NACE is the industry standard classification system used in the European Union. It is the acronym of the French translation of the Statistical Classification of Economic Activities in the European Community. The first four digits are common across all European countries. We refer to the NACE 1-digit and 4-digit level as respectively a sector and an industry.

We regress the aggregate Belgian labor share on year. The estimated coefficient equals -.00156 (se = 0.00031; p value < 0.01). .

Based on Eurostat data from 2014, Belgian GDP and its labor force equals respectively ± €400 billion and 4,497,200 employees. Dividing Belgian GDP by its labor force leads to an average value added per worker of €88,944. Multiplying this ratio by the regression coefficient of -0.00156 leads ceteris paribus to the estimated yearly loss of €139 per employee.

The Belgian economy seems to be in a similar point in the business cycle in 1985 in comparison to the economy in 2014. According to the World Bank, GDP grew by 1.7% and 1.3% in respectively 1985 and 2014 after having experienced a recession in earlier years. In particular, the Belgian economy decreased by 0.3% in 1981 while it fell by 2.3% in 2009.

Our data shows that value added per worker is more volatile than remuneration per worker. The standard deviation of the cyclical component from the Hodrick-Prescott filter is higher for value added per worker (0.025) than for remuneration per worker (0.012). Both variables move together as their correlation is 0.97. .

The Belgian labor share can be defined as \(LS = \frac{w*L}{VA} = \frac{w/p*L}{{VA_{.} /p}} = \frac{{(\bar{w}*L)}}{{\overline{VA} }}\) with w, L, p and VA denoting respectively nominal mean wage per worker, total employment, the CPI price index and nominal value added. Nominal variables are deflated by the CPI index so that we obtain real variables. Variables with a bar are denoted in real terms.

Decomposing the Belgian labor share further leads to \(LS = \frac{w*L}{VA} = \frac{w/p*L}{{VA_{.} /p}} = \frac{{\bar{w}}}{{\overline{VA} /L}}\). The nominator \(\bar{w}\) is the mean real wage per worker. The denominator \(\overline{VA} /L\) represents the average real value added per worker.

In the U.S., the Bureau of Labor Statistics (BLS) documents that the real wage of goods-producing worker tracked the productivity increase from the late ‘40 s until the early ‘70 s. However, the real wage remained approximately the same between the early ‘70 s and the late ‘00 s while productivity more than doubled.

The dot-com bubble refers to the period from 1997 until 2000 in which the economy was growing rapidly. Many internet-based companies were founded during these years. Investors speculated heavily on the value of these companies. The BEL20 index rose from roughly 1800 points in’97 to 3600 points in’99. Afterwards, this turned out to be a speculative bubble which burst around ‘00. The index returned to 2500 points again.

We use market concentration measures in terms of value added. An alternative might be to define the concentration measures in terms of employment. We show the evolution of C4 (value added) and C4 (employment) in “Appendix” Figure 9. We find that market concentration tends to be lower in terms of employment suggesting that the largest firms are more productive than other firms. The secular trend goes in the same direction in all sectors but Manufacturing. In this sector, the superstar firms are able to capture more market share in terms of value added while decreasing their market share in terms of employment. Note that the four largest firms in terms of value added are not necessarily the same four firms which are largest in terms of employment. .

We regress the sectoral market concentration C4 on year and show the estimation results in “Appendix” Table 5. These linear trends are always significant, except for Professional, Scientific & Technic Activities. This is due to the fact that market concentration falls at first, after which it increases over time. These effects offset each other such that we do not identify a significant linear trend.

The between-firm component is 6.3, 1.1, 2.1 and 3.1 times as big as the within-firm component in respectively Manufacturing, Wholesale & Retail, Transportation & Storage and Financial & Insurance Activities.

Manufacturing and Wholesale & Retail account respectively for 33% and 20% of aggregate value added in Belgium between 1985 and 2014, as indicated in Table 2.

We choose 1998 as intermediate point because this year is in a comparable point in the business cycle as 1985 and 2014. According to the World Bank, GDP grows by 2.0% in 1998 after having experienced a recession (-1.0% in 1993) in earlier years. .

We refer to Bijnens and Konings (2018) for more detailed information on the filing requirements. Small firms are firms that exceed at least one of the following criteria: average number of employees above 50 FTE, €7.3 million for turnover and €3.65 for balance sheet total (2014 levels).

We thank Goutsmet et al. (2017) for providing us data on the domestic ultimate owner of Belgian firms. Firm A is the domestic ultimate owner of firm B if it owns at least 50% of the shares. A firm is its own domestic ultimate owner if nobody owns more than 50% of the shares.

References

Abadie, A., Athey, S., Imbens, G. W., & Wooldridge, J. (2017). When should you adjust standard errors for clustering? Cambridge (US): NBER Working Paper No. 24003.

Autor, D., Dorn, D., Katz, L. F., Patterson, C., & Van Reenen, J. (2020). The fall of the labor share and the rise of superstar firms. Quarterly Journal of Economics,135(2), 645–709.

Bivens, J., Gould, E., Mishel, L., & Shierholz, H. (2014). Raising America’s pay. Why it’s our central economic policy challenge. Washington (US): Economic Policy Institute Briefing Paper #378.

Bridgman, B. (2018). Is labor’s loss capital’s gain? Gross versus net labor shares. Macroeonomic Dynamics,22(8), 2070–2087.

Brooks, W. J., Kaboski, J. P., Li, Y. A., & Qian, W. (2019). Exploitation of labor? Classical monopsony power and labor’s share. Cambridge (US): NBER working paper no. 25660.

Dao, M., Das, M., Koczan, Z., & Lian, W. (2017). Why is labor receiving a smaller share of global income? Theory and empirical evidence. Washington (US): International Monetary Fund Working Paper No. 17/169.

De Loecker, J., Fuss, C., & Van Biesebroeck, J. (2018). Markup and price dynamics: linking micro to macro. Brussels (Belgium): NBB Working Paper No. 357.

De Mulder, J., & Druant, M. (2011). De Belgische arbeidsmarkt tijdens en na de crisis. Brussels (Belgium): NBB Economisch Tijdschrift.

Doan, H., & Wan, G. (2017). Globalization and the labor share in national income. Tokyo (Japan): ADB Institute Working Paper Series No. 639.

Elsby, M., Hobijn, B., & Sahin, A. (2013). The decline of the U.S. labor share. Brooking Papers on Economic Activity,2013, 1–42.

Fuss, C., & Theodorakopoulos, A. (2018). Compositional changes in aggregate productivty in an era of globalisation and financial crisis. Brussels (Belgium): NBB Working Paper No. 336.

Goutsmet, D., Lecocq, C., & Volckaert, A. (2017). Methodologie voor het beschrijven van speerpuntclusters in Vlaanderen. Leuven: Steunpunt Economie & Ondernemen.

Hyytinen, A., Ilmakunnas, P., & Maliranta, M. (2016). Olley-Pakes productivity decomposition: Computation and inference. Journal of the Royal Statistical Society,179(3), 749–761.

ILO & OECD. (2015). The labour share in G20 economics. ILO and OECD.

Karabarbounis, L., & Neiman, B. (2013). The global decline of the labor share. The Quarterly Journal of Economics,129(1), 61–103.

Kehrig, M., & Vincent, N. (2018). The micro-level anatomy of the labor share decline. Cambridge (US): NBER Working Paper No. 25275.

Koh, D., Santaeulàlia-Llopis, R., & Zheng, Y. (2018). Labor share decline and intellectual property products capital. London (UK): Queen Mary University of London, School of Economics and Finance. Working Paper Series No. 927.

Melitz, M., & Polanec, S. (2015). Dynamic Olley-Pakes productivity decomposition with entry and exit. The Rand Journal of Economics,46(2), 362–375.

Olley, S., & Pakes, A. (1996). The dynamics of productivity in the telecommunications industry. Econometrica, 64(6), 1263–1298.

Rios-Rull, J.-V., & Santaeulalia-Llopis, R. (2010). Redistributive shocks and and productivity shocks. Journal of Monetary Economics,57(8), 931–948.

Rognlie, M. (2015). Deciphering the fall and rise in the net capital share: Accumulation or scarcity? Brookings Papers on Economic Activity, 1–69.

Smith, M., Yagan, D., Zidar, O., & Zwick, E. (2019). Capitalists in the twenty-first century. Quarterly Journal of Economics,134(4), 1675–1745.

Acknowledgements

We thank the participants at the VIVES informal seminar (February 02, 2018—University of Leuven) and at the Spring Meeting for Young Economists (April 13, 2019—Brussels) for comments and suggestions. Special thanks are extended to Joep Konings, Cathy Lecocq, Jakob Vanschoonbeek, Angelos Theodorakopoulos, Marno Verbeek and two anonymous referees for their remarks and suggestions.

Funding

We are grateful for the financial support from Methusalem that made this study possible.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Data Appendix

Our empirical analysis uses Belgian firm-level data obtained from the National Bank of Belgium (1985–2014). The data set includes all firms which have to file an annual income statement. ‘Small firms’ do not have to file this although they can voluntarily choose to do so.Footnote 24 Further, self-employed people are not included. We make use of the following balance-sheet variables: remuneration, value added and employment. Remuneration (62) is defined as the total amount of the wage bill. This includes salaries, wages, social security payments and pension payments. Value added (9800) is defined as operating revenue (70/74) minus trade goods, raw materials and excipients (60) and services and diverse goods (61). Employment is defined as full-time equivalents (9087) from 1996 onwards. It is defined as the number of jobs (9086) before 1996. The numbers between parentheses refer to the codes in the Belgian financial statement.

The data is distributed over 485 industries in Manufacturing (234), Construction (23), Wholesale & Retail (99), Transportation & Storage (23), Information & Communication (27), Financial & Insurance Activities (22), Professional, Scientific & Technic Activities (21) and Administrative & Support services (36) sector.

Next, our unconsolidated firm-level data structure does not take into account that firms might belong to a parent company. Each firm has its own legal VAT number but multiple firms can belong to the same parent company. We use an example to illustrate how this might impact our analysis. Assume an industry with ten supermarkets. The four largest firms produce a value added of €50, €40, €30 and €20. Suppose that the six other supermarkets produce a value added of €10 each. Our concentration measure C4 would be 0.70 (= 140/200). However, if the six other supermarkets belong to the same parent company, then this group of firms produces a total value added of €60. The parent company combines the market shares of each of its subsidiaries and will suddenly become the largest ‘firm’ in the industry. This alters the concentration ratio. This firm will have more market power than each of its subsidiaries separately. We follow Goutsmet et al. (2017) in order to match firms with their corresponding parent company. Firms are linked to a parent company by exploiting information about the domestic ultimate owner, as defined by Bel-first.Footnote 25 We aggregate subsidiaries belonging to the same parent company up until the level of an industry, thereby following Autor et al. (2020).

Further, we encounter the issue of a broken book year for remuneration, value added and employment. In order to do analyses with yearly data, the reported book year should match the corresponding calendar year. A book year should start on 01/01 and end on 31/12. However, this is only the case in 78% of our observations. How do we solve this issue? If a book year spans n calendar years in our data set, then we duplicate that row n − 1 times. We allocate the part of the original observation to the corresponding calendar year based on the number of months. Assume a firm produces €100 during a book year going from 01/04/2004 till 31/03/2005. We then separate this row into a row for 2004 with €75 (9 out of 12 months) and a row for 2005 with €25 (3 out of 12 months). If the firm produces €200 during the book year going from 01/04/2005 to 31/03/2006, we separate this row again in a row with €150 for 2005 and €50 for 2006. Next, we sum the information within the same year. We get a value of €175 for 2005. We can only do this if that year has information for 12 months. For example, the year 2004 has only 9 months of information. We extrapolate this and get a value of €100 for 2004. The same approach applies for 2006. Note that our method shifts some data to 1984 (if the book year in 1985 spans more than one book year). We drop this information as it is not representative for the Belgian economy. We keep only data from 1985 till 2014 after adjusting for the broken book year issue. The calendar and adjusted book year now match in 100% of the cases.

Lastly, the definition of the labor share causes two technical issues. First, the labor share is negative if value added or remuneration is lower than zero. We drop observations with a negative value added or a negative remuneration. We also drop observations with a value of zero for value added or remuneration. Second, if value added of a firm approaches zero, then the labor share goes to infinity. This is not a problem when we weigh our calculations by value added but it leads to a distorted Melitz and Polanec (2015) decomposition. We solve this by limiting the labor share at a value of two (Tables 3, 4, 5, 6; Figs. 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19).

Sectoral market share in total value added. Notes: The market share evolution is plotted from 1985 to 2014 for each sector. Each sector is represented by its section code as used in NACE Rev. 2. The horizontal line represents the cut-off value of five percentage market share. The market share is calculated within a year. The eight largest sectors are Manufacturing (C), Wholesale & Retail (G), Transportation & Storage (H), Construction (F), Information & Communication (J), Professional, Scientific and Technic Activities (M), Administrative & Support services (N) and Financial & Insurance Activities (K)

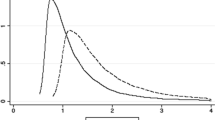

The link between market concentration (C4) and the labor share: Yearly. Notes: This figure plots the yearly coefficient from Eq. (2) by sector. Robust standard errors are used to calculate the 95% confidence interval and shown around the point estimate in the figure

The link between market concentration (C4) and the between-firm component: Yearly. Notes: This figure plots the yearly coefficient from Eq. (6) by sector. Robust standard errors are used to calculate the 95% confidence interval and shown around the point estimate in the figure

The link between market concentration (C4) and the labor share and between-firm component: 1985–1998. Notes: This figure plots the regression coefficients from Eqs. (2) and (6) for the period 1985–1998. Each coefficient follows from a separate regression. Robust standard errors are used to calculate the 95% confidence interval and shown around the point estimate in the figure

The link between market concentration (C4) and the labor share and between-firm component: 1998–2014. Notes: This figure plots the regression coefficients from Eqs. (2) and (6) for the period 1998–2014. Each coefficient follows from a separate regression. Robust standard errors are used to calculate the 95% confidence interval and shown around the point estimate in the figure

Melitz-Polanec decomposition of the change in the labor share (1985–1998). Notes: Each bar shows the cumulated sum between 1985 and 1998 for each labor share component of the Melitz-Polanec decomposition. Results are ranked from the largest between-firm component to the lowest between-firm component

Melitz-Polanec decomposition of the change in the labor share (1998–2014). Notes: Each bar shows the cumulated sum between 1998 and 2014 for each labor share component of the Melitz-Polanec decomposition. Results are ranked from the largest between-firm component to the lowest between-firm component

The link between market concentration (C10) and the labor share. Notes This figure plots the regression coefficients from Eqs. (2) and (6). Each coefficient follows from a separate regression. Robust standard errors are used to calculate the 95% confidence interval and shown around the point estimate in the figure

The link between market concentration (C20) and the labor share. Notes: This figure plots the regression coefficients from Eqs. (2) and (6). Each coefficient follows from a separate regression. Robust standard errors are used to calculate the 95% confidence interval and shown around the point estimate in the figure

Rights and permissions

About this article

Cite this article

Abraham, F., Bormans, Y. The Impact of Superstar Firms on the Labor Share: Evidence from Belgium. De Economist 168, 369–402 (2020). https://doi.org/10.1007/s10645-020-09365-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10645-020-09365-y