Abstract

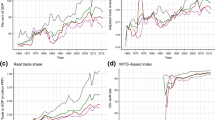

This paper investigates the impact of financial openness on financial sector development and income inequality. We use two approaches to capture financial openness for a panel dataset of 52 African countries from 1980–2019 and find that: (1) Principle-based financial openness policy negatively affects financial sector development and widens income inequality. In contrast, the outcome-based measures positively affect banking sector development and narrow income inequality. (2) Capital inflow to African countries is not merely pulled a vibrant macroeconomic fundamental. Only schooling and governance factors facilitate the impact of financial openness on financial sector development. (3) Adverse non-policy factors play an insignificant role in moderating the impact of financial openness. This implies that the impact of financial openness on financial sector development and income inequality is weak in countries experiencing a banking crisis or passing through a lengthy conflict. Our finding is consistent with the institutional quality theory, which claims robust institutions are needed. We underline that countries should take caution in implementing principle-based reforms. Particularly, there is an alternative policy path for African countries to optimize the benefit by pursuing outcome-based financial openness measures.

Similar content being viewed by others

Notes

Note.

(1) Principle based openness policy refers to the Chinn-Ito index which measures a country’s degree of capital account openness (Chinn and Ito 2006). These policies are implemented via capital account restrictions. We use de jure/Kaopen interchangeably to represent the principle-based financial openness measure.

(2) Outcome based openness policy is represented by de facto which is the sum of total assets and liabilities divided by GDP from (Lane and Milesi-Ferretti 2018).

(3) Throughout the paper the word finance and financial sector development are used interchangeably to represent the development in the banking and stock market.

(4) In the latter stage, the outcome-based openness measure is decomposed into foreign direct investment net inflow % of GDP (FDI net inflow) and de facto. While the former is interacted with the US adjusted real interest rate (FDI X Push), the latter interacted with extensive pull factors.

The French and English traditions in monetary theory and history have been different. The French tradition has stressed the passive nature of monetary policy and the importance of exchange stability with convertibility; stability has been achieved at the expense of institutional development and monetary experience. The British countries by opting for monetary independence have sacrificed stability, but gained monetary experience and better developed monetary institutions” (Mundell 1972).

References

Agnello L, Sousa RM (2012) How do banking crises impact on income inequality? Appl Econ Lett 19(15):1425–1429. https://doi.org/10.1080/13504851.2011.631885

Alessandria G, Qian J (2005) Endogenous financial intermediation and real effects of capital account liberalization. J Int Econ 67(1):97–128. https://doi.org/10.1016/j.jinteco.2004.10.003

Ang JB (2010) Finance and inequality: the case of India. South Econ J 76(3):738–761. https://doi.org/10.4284/sej.2010.76.3.738

Arestis P, Caner A (2004) Financial liberalization and poverty: channels of influence. Levy Econ Ins Working Pa. https://doi.org/10.1093/cjres/rsp012

Arestis P, Demetriades P (1999) Financial liberalization: the experience of developing countries. Eastern Econ J 25(4):441

Aryeetey E (2003) Recent developments in African financial markets: agenda for further research. J Afr Econ 12(SUPPL. 2):111–152. https://doi.org/10.1093/jae/12.suppl_2.ii111

Asongu SA (2014) Law, finance and investment: does legal origin matter in Africa? Rev Black Polit Econ 41(2):145–175. https://doi.org/10.1007/s12114-013-9173-7

Bandura WN (2021) Financial openness, trade openness and financial development: evidence from sub-Saharan Africa. Dev South Afr. https://doi.org/10.1080/0376835X.2021.1988517

Batuo ME, Asongu SA (2015) The impact of liberalization policies on income inequality in african countries. J Econ Stud. https://doi.org/10.1108/JES-05-2013-0065

Beck T, Demirgüç-Kunt A, Levine R (2003) Law and finance: why does legal origin matter? J Comp Econ 31(4):653–675. https://doi.org/10.1016/j.jce.2003.08.001

Berrill J, O’Hagan-Luff M, van Stel A (2018) The moderating role of education in the relationship between FDI and entrepreneurial activity. Small Bus Econ 54(4):1041–1059. https://doi.org/10.1007/s11187-018-0121-6

Botta A (2017) Financial and capital account liberalization, financial development and economic development: a review of some recent contributions. Forum Soc Econ 47(3–4):362–377. https://doi.org/10.1080/07360932.2017.1383286

Bumann S, Lensink R (2016) Capital account liberalization and income inequality. J Int Money Financ 61:143–162. https://doi.org/10.1016/j.jimonfin.2015.10.004

Calvo GA, Leonardo L, Reinhart CM (1993) Capital inflows and real exchange rate appreciation in latin America. IMF Staff Pap 40(1):108–151

Cerdeiro DA, Komaromi A (2019). Financial openness and capital inflows to emerging markets: In search of robust evidence. In: IMF Working Paper: Vol. WP/19/194. https://doi.org/10.1016/j.iref.2021.01.011

Chinn MD, Ito H (2006) What matters for financial development? Capital controls, institutions, and interactions. J Dev Econ 81(1):163–192. https://doi.org/10.1016/j.jdeveco.2005.05.010

Chinn MD, Ito H (2008) A new measure of financial openness. J Comp Policy Anal Res Pract 10(3):309–322. https://doi.org/10.1080/13876980802231123

Clarke GRG, Xu LC, Zou H (2006) Finance and income inequality: what do the data tell us? South Econ J 72(3):578–596. https://doi.org/10.2307/20111834

Daumont R, Gall F Le, Leroux F (2004) Banking in Sub-Saharan Africa: What Went Wrong? In: IMF Working Papers, WP/04/55 (Vol. 04, Issue 55). https://doi.org/10.5089/9781451847659.001

Demirgüç-Kunt A, Detragiache E (1998) The Determinants of Banking Crises: Evidence From Developing and Developed Countries. In: IMF Working Papers, 45(1), pp 81–109. https://doi.org/10.5089/9781451947175.001

Eichengreen B, Gullapalli R, Panizza U (2011) Capital account liberalization, financial development and industry growth: a synthetic view. J Int Money Financ 30(6):1090–1106. https://doi.org/10.1016/j.jimonfin.2011.06.007

Elkhuizen L, Hermes N, Jacobs J, Meesters A (2018) Financial development, financial liberalization and social capital. Appl Econ 50(11):1268–1288. https://doi.org/10.1080/00036846.2017.1358446

Erauskin I, Turnovsky SJ (2019) International financial integration and income inequality in a stochastically growing economy. J Int Econ 119:55–74. https://doi.org/10.1016/j.jinteco.2019.04.003

Fernandez-Arias E (1996) The new wave of private capital inflows: push or pull? J Dev Econ 48(2):389–418. https://doi.org/10.1016/0304-3878(95)00041-0

Furceri D, Loungani P, Ostry J, Pizzuto P (2020) Financial globalization, fiscal policies and the distribution of income. Comp Econ Stud 62(2):185–199. https://doi.org/10.1057/s41294-020-00113-4

Gleditsch NP, Wallensteen P, Eriksson M, Sollenberg M, Strand H (2002) Armed conflict 1946–2001: a new dataset. J Peace Res 39(5):615–637

Gourinchas PO, Jeanne O (2006a) Capital flows to developing countries: The allocation puzzle. In: IMF Working Paper (Vol. 80, Issue 4). https://doi.org/10.1093/restud/rdt004

Gourinchas PO, Jeanne O (2006b) The elusive gains from international financial integration. Rev Econ Stud 73(3):715–741. https://doi.org/10.1111/j.1467-937X.2006.00393.x

Greenwood J, Jovanovic B (1990) Financial development, growth, and the distribution of income. J Political Econ 98(5 part 1):1076–1107. https://doi.org/10.1086/261720

Haan J, Pleninger R, Sturm JE (2018) Does the impact of financial liberalization on income inequality depend on financial development? Some new evidence. Appl Econ Lett 25(5):313–316. https://doi.org/10.1080/13504851.2017.1319554

Hall RE, Jones CI (1999) Why do some countries produce so much more output per worker than others? Q J Econ. 114(1):83–116

Harrison A, McLaren J, McMillan M (2011) Recent perspectives on trade and inequality. Ann Rev Econ 3:261–289. https://doi.org/10.1146/annurev.economics.102308.124451

Hasan I, Horvath R, Mares J (2020) Finance and wealth inequality. J Int Money Financ 108:102161. https://doi.org/10.1016/j.jimonfin.2020.102161

Hermes N, Meesters A (2015) Financial liberalization, financial regulation and bank efficiency: a multi-country analysis. Appl Econ 47(21):2154–2172. https://doi.org/10.1080/00036846.2015.1005815

Iamsiraroj S, Doucouliagos H (2015) Does growth attract FDI? Economics. https://doi.org/10.5018/economics-ejournal.ja.2015-19

Johnston RB, SundararajanV (1999) Sequencing Financial Sector Reforms; Country Experience and Issues. In: International Monetary Fund, Washington, D.C. (R. Barry J). International Monetary Fund. https://doi.org/10.5089/9781557757791.071

Kaufmann D, Kraay A, Mastruzzi M (2010) The Worldwide governance indicators methodology and analytical issues. Hague J Rule Law. 5430:220

Kim DH, Hsieh J, Lin SC (2019) Financial liberalization, political institutions, and income inequality. In: Empirical economics (Issue 0123456789). Springer, Berlin. https://doi.org/10.1007/s00181-019-01808-z

Kose MA, Prasad E, Rogoff K, Wei SJ (2009) Financial globalization: a reappraisal. IMF Staff Pap 56(1):8–62. https://doi.org/10.1057/imfsp.2008.36

Koudalo YMA, Wu J (2022) Does financial liberalization reduce income inequality? Evidence from Africa. Emerg Mark Rev. https://doi.org/10.1016/j.ememar.2022.100945

Kuznets S (1955) Economic growth and income inequality. Am Econ Rev 45(1):1–28

Lane PR, Milesi-Ferretti GM (2006) The External wealth of nations mark II revised and extended estimates of foreign assets and liabilities, 1970–2004. IMF Publications, Washington

Lane PR, Milesi-Ferretti GM (2018) The external wealth of nations revisited: international financial integration in the aftermath of the global financial crisis. IMF Econ Rev 66(1):189–222. https://doi.org/10.1057/s41308-017-0048-y

Law SH, Azman-Saini WNW (2012) Institutional quality, governance, and financial development. Econ Gov 13:217–236. https://doi.org/10.1007/s10101-012-0112-z

Monnin P (2014) Inflation and income inequality in developed and developing countries. In: CEP Working Paper, Vol 1. https://doi.org/10.1108/JES-02-2018-0045

Mukherjee P, Roy Chowdhury S, Bhattacharya P (2021) Does financial liberalization lead to financial development? Evidence from emerging economies. J Int Trade Econ Dev. https://doi.org/10.1080/09638199.2021.1948589

Njikam O (2017) Financial liberalization and growth in African economies: the role of policy complementarities. Rev Dev Financ 7(1):73–83. https://doi.org/10.1016/j.rdf.2017.02.001

O’Toole CM (2014) Does financial liberalisation improve access to investment finance in developing countries? J Glob Dev 5(1):41–74. https://doi.org/10.1515/jgd-2013-0028

Ozdemir O (2019) Autoregressive distributed lag approach to the income inequality and financial liberalization nexus: empirical evidence from Turkey. Int J Econ Financ Issues 9(6):1–15. https://doi.org/10.32479/ijefi.8626

Ozkok Z (2015) Financial openness and financial development: an analysis using indices. Int Rev Appl Econ 29(5):620–649. https://doi.org/10.1080/02692171.2015.1054366

Palik J, Rustad SA, Peace FM (2020) Conflict Trends in Africa 1989–2019. In: PRIO Paper. https://reliefweb.int/sites/reliefweb.int/files/resources/Palik%2C Rustad%2C Methi - Conflict Trends in Africa%2C 1989–2019%2C PRIO Paper 2020.pdf

Porta RL, Lopez-de-Silanes F, Shleifer A (1998) Law and finance. J Polit Econ 106(6):1113–1155

Prasad E, Wei SJ (2005) The Chinese approach to capital inflow: patterns and possible explanations

Quinn DP, Toyoda AM (2008) Does capital account liberalization lead to growth? Rev Financ Stud. https://doi.org/10.1093/rfs/hhn034

Quinn D, Schindler M, Toyoda AM (2011) Assessing measures of financial openness and integration. IMF Econ Rev 59(3):488–522. https://doi.org/10.1057/imfer.2011.18

McKinnon MI (1973) Money and capital in economic development. Washington, Brookings

Saadi Sedik T, Sun T (2012) Effects of capital flow liberalization: what is the evidence from recent experiences of emerging market economies?, In: IMF Working Papers (Vol. 12, Issue 275). https://doi.org/10.5089/9781589068032.001

Schindler M (2009) Measuring financial integration: A new data set. IMF Staff Pap 56(1):222–238. https://doi.org/10.1057/imfsp.2008.28

Shaw ES (1973) Financial deepening in economic development. Oxford Univerity Press, New York

Solow RM (1956) A contribution to the theory of economic growth. Q J Econ 70(1):65–94

Solt F (2019) The standardized world income inequality database. Harvard Dataverse. https://doi.org/10.7910/DVN/LM4OWF

Stiglitz JE (2000) Capital market liberalization, economic growth, and instability. World Dev 28(6):1075–1086. https://doi.org/10.1016/S0305-750X(00)00006-1

Van Velthoven A, De Haan J, Sturm JE (2018) Finance, income inequality and income redistribution. Appl Econ Lett 26(14):1202–1209. https://doi.org/10.1080/13504851.2018.1542483

Wang R, Luo H (2019) Does financial liberalization affect bank risk-taking in China? SAGE Open. https://doi.org/10.1177/2158244019887948

Wang M, Wong MCS (2011) FDI, education, and economic growth: quality matters. Atl Econ J 39(2):103–115. https://doi.org/10.1007/s11293-011-9268-0

Author information

Authors and Affiliations

Contributions

Both authors participated in the conception, design, analysis, write-up, and final approval for publication.

Corresponding author

Ethics declarations

Conflict of interest

This manuscript has not been submitted to, nor is it under review at another journal or other publishing venue. We have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Ethics approval and consent to participate

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ashenafi, B.B., Dong, Y. Decomposing the impact of financial openness on finance and income inequality: principle vs. outcome-based approaches from Africa. Econ Change Restruct 57, 35 (2024). https://doi.org/10.1007/s10644-024-09638-5

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10644-024-09638-5