Abstract

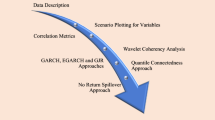

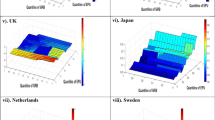

This paper discusses frequency and quantile-varying linkage between economic policy uncertainty (EPU) and green bond index (GBI) using wavelet multiscale decomposition and quantile-on-quantile regression approaches. We construct nine different time frequency combinations of short-term EPU and long-term GBI and find that dynamic coefficients exist for their relationship across different quantiles. For the same cases, the corresponding coefficients even change from positive to negative or conversely, further proving the unstable linkage related to different quantiles and frequencies. The major contribution of this study is that time frequencies and quantile-varying analysis are used simultaneously. In addition, China’s economic reform and complex external economic shocks make it a case worthy of study. Furthermore, this work indicates a nonlinear link, which adds to the theoretical foundation of EPU and GBI. Thus, authorities should stabilize their economic policy, avoid drastic policy changes and increase policy transparency, which can strengthen investors’ confidence in the green bond market.

Similar content being viewed by others

References

Adebayo TS, Acheampong AO (2022) Modelling the globalization-CO2 emission nexus in Australia: evidence from quantile-on-quantile approach. Environ Sci Pollut Res 29:9867–9882. https://doi.org/10.1007/s11356-021-16368-y

Adedoyin FF, Zakari A (2020) Energy consumption, economic expansion, and CO2 emission in the UK: the role of economic policy uncertainty. Sci Total Environ 738:140014. https://doi.org/10.1016/j.scitotenv.2020.140014

Arif M, Naeem MA, Farid S, Nepal R, Jamasb T (2022) Diversifier or more? Hedge and safe haven properties of green bonds during COVID-19. Energy Policy 168:113102. https://doi.org/10.1016/j.enpol.2022.113102

Baker SR, Bloom N, Davis SJ (2016) Measuring economic policy uncertainty. Q J Econ 131(4):1593–1636. https://doi.org/10.1093/qje/qjw024

Bakry W, Mallik G, Nghiem X, Sinha A, Vo XV (2023) Is green finance really “green”? Examining the long-run relationship between green finance, renewable energy and environmental performance in developing countries. Renew Energy 208:341–355. https://doi.org/10.1016/j.renene.2023.03.020

Bermpei T, Kalyvas AN, Neri L, Russo A (2022) Does economic policy uncertainty matter for financial reporting quality? Evidence from the United States. Rev Quant Financ Account 58:795–845. https://doi.org/10.2139/ssrn.3423646

Boutabba MA, Rannou Y (2022) Investor strategies in the green bond market: The influence of liquidity risks, economic factors and clientele effects. Int Rev Financ Anal 81:102071. https://doi.org/10.1016/j.irfa.2022.102071

Byrnes L, Brown C, Foster J, Wagner LD (2013) Australian renewable energy policy: barriers and challenges. Renew Energy 60:711–721. https://doi.org/10.1016/j.renene.2013.06.024

Chen J, Jiang F, Tong G (2017) Economic policy uncertainty in China and stock market expected returns. Account Finance 57(5):1265–1286. https://doi.org/10.1111/acfi.12338

Dai Z, Peng Y (2022) Economic policy uncertainty and stock market sector time-varying spillover effect: Evidence from China. N Am Econ Financ 62:101745. https://doi.org/10.1016/j.najef.2022.101745

Davis SJ, Liu D, Sheng XS (2019) Economic policy uncertainty in China since 1949: The view from mainland newspapers. Technical Report.

Desalegn TA, Zhu H (2021) Does economic policy uncertainty affect bank earnings opacity? Evidence from China. J Policy Model 43(5):1000–1015. https://doi.org/10.1016/j.irfa.2022.102069

Diza-Rainey I, Corfee-Morlot J, Volz U, Caldecott B (2023) Green finance in Asia: challenges, policies and avenues for research. Clim Policy 23:1–10. https://doi.org/10.1080/14693062.2023.2168359

Doğan B, Trabelsi N, Tiwari AK, Ghosh S (2023) Dynamic dependence and causality between crude oil, green bonds, commodities, geopolitical risks, and policy uncertainty. Q Rev Econ Financ 89:36–62. https://doi.org/10.1016/j.qref.2023.02.006

Elsayed AH, Gozgor G, Lau CKM (2022) Risk transmissions between bitcoin and traditional financial assets during the COVID-19 era: the role of global uncertainties. Int Rev Financ Anal 81:102069. https://doi.org/10.1016/j.irfa.2022.102069

Ge T, Cai X, Song X (2022) How does renewable energy technology innovation affect the upgrading of industrial structure? The moderating effect of green finance. Renew Energy 197:1106–1114. https://doi.org/10.1016/j.renene.2022.08.046

Ghirelli C, Gil M, Perez JJ, Urtasun A (2021) Measuring economic and economic policy uncertainty and their macroeconomic effects: the case of Spain. Empir Econ 60:869–892. https://doi.org/10.1007/s00181-019-01772-8

Gianfrate G, Peri M (2019) The green advantage: exploring the convenience of issuing green bonds. J Clean Prod 219:127–135. https://doi.org/10.1016/j.jclepro.2019.02.022

Haq IU, Chupradit S, Huo C (2021) Do green bonds act as a hedge or a safe haven against economic policy uncertainty? Evidence from the USA and China. Int J Financ Stud 9(3):40. https://doi.org/10.3390/ijfs9030040

He L, Liu R, Zhong Z, Wang D, Xia Y (2019) Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renew Energy 143:974–984. https://doi.org/10.1016/j.renene.2019.05.059

Hu Y, Jiang H, Zhong Z (2020) Impact of green credit on industrial structure in China: theoretical mechanism and empirical analysis. Environ Sci Pollut Res 27(10):10506–10519. https://doi.org/10.1007/s11356-020-07717-4

Huang J, Jin Y, Duan Y, She Y (2023) Do Chinese firms speculate during high economic policy uncertainty? Evidence from wealth management products. Int Rev Financ Anal 87:102639. https://doi.org/10.1016/j.irfa.2023.102639

Hung NT (2023) Green investment, financial development, digitalization and economic sustainability in Vietnam: Evidence from a quantile-on-quantile regression and wavelet coherence. Technol Forecast Soc Change 186:122185. https://doi.org/10.1016/j.techfore.2022.122185

Hyun S, Park D, Tian S (2022) The price of frequent issuance: the value of information in the green bond market. Econ Chang Restruct. https://doi.org/10.1007/s10644-022-09417-0

Iqbal U, Gan C, Nadeem M (2022) Economic policy uncertainty and firm performance. Appl Econ Lett 27:756–770. https://doi.org/10.1080/13504851.2019.1645272

Jankovic I, Vasic V, Kovacevic V (2022) Does transparency matter? Evidence from panel analysis of the EU government green bonds. Energy Econ 114:106325. https://doi.org/10.1016/j.eneco.2022.106325

Kido Y (2018) The transmission of US economic policy uncertainty shocks to Asian and global financial markets. N Am Econ Financ 46:222–231. https://doi.org/10.1016/j.najef.2018.04.008

Lee C, Lee C (2022) How does green finance affect green total factor productivity? Evidence from China Energy. Econ 107:105863. https://doi.org/10.1016/j.eneco.2022.105863

Lee C, Wang F, Chang Y (2023) Towards net-zero emissions: Can green bond policy promote green innovation and green space? Energy Econ 121:106675. https://doi.org/10.1016/j.eneco.2023.106675

Lei W, Liu L, Hafeez M, Sohail S (2022) Do economic policy uncertainty and financial development influence the renewable energy consumption levels in China? Environ Sci Pollut Res 29:7907–7916. https://doi.org/10.1007/s11356-021-16194-2

Li H, Usman N, Coulibay MH, Phiri R, Tang X (2022a) Does the resources curse hypothesis exist in China? What is the dynamic role of fiscal decentralization, economic policy uncertainty, and technology innovation for sustainable financial development? Resour Policy 79:103002. https://doi.org/10.1016/j.resourpol.2022.103002

Li X, Chen L, Lin J (2023) Borrowing-firm environmental impact on insurer green finance assessment: Green loan subsidy, regulatory cap, and green technology. Environ Impact Assess Rev 99:107007. https://doi.org/10.1016/j.eiar.2022.107007

Li X, Li Z, Su C, Umar M, Shao X (2022b) Exploring the asymmetric impact of economic policy uncertainty on China’s carbon emissions trading market price: Do different types of uncertainty matter? Technol Forecast Soc Change 178:121601. https://doi.org/10.1016/j.techfore.2022.121601

Li Z, Zhong J (2020) Impact of economic policy uncertainty shocks on China’s financial conditions. Financ Res Lett 35:101303. https://doi.org/10.1016/j.frl.2019.101303

Lin B, Su T (2022) Uncertainties and green bond markets: Evidence from tail dependence. Int J Financ Econ. https://doi.org/10.1002/ijfe.2659

Liu D, Sun WH, Xu L, Zhang X (2023a) Time-frequency relationship between economic policy uncertainty and financial cycle in China: Evidence from wavelet analysis. Pac Basin Financ J 77:101915. https://doi.org/10.1016/j.pacfin.2022.101915

Liu J, Mao W, Qiao X (2023b) Dynamic and asymmetric effects between carbon emission trading, financial uncertainties, and Chinese industry stocks: evidence from quantile-on-quantile and causality-in-quantiles analysis. N Am Econ Financ 65:101883. https://doi.org/10.1016/j.najef.2023.101883

Liu M (2022) The driving forces of green bond market volatility and the response of the market to the COVID-19 pandemic. Econ Anal Policy 75:288–309. https://doi.org/10.1016/j.eap.2022.05.012

Liu R, He L, Liang X, Yang X, Xia Y (2020) Is there any difference in the impact of economic policy uncertainty on the investment of traditional and renewable energy enterprises?—A comparative study based on regulatory effects. J Clean Prod 255:120102. https://doi.org/10.1016/j.jclepro.2020.120102

Liu S, Qi H, Wan Y (2022) Driving factors behind the development of China’s green bond market. J Clean Prod 354:131715. https://doi.org/10.1016/j.jclepro.2022.131705

Long S, Tian H, Li Z (2022) Dynamic spillovers between uncertainties and green bond markets in the US, Europe, and China: evidence from the quantile VAR framework. Int Rev Financ Anal 84:102416. https://doi.org/10.1016/j.irfa.2022.102416

Lyu Y, Yi H, Hu Y, Yang M (2021) Economic uncertainty shocks and China’s commodity futures returns: a time-varying perspective. Resour Policy 70:101979. https://doi.org/10.1016/j.resourpol.2020.101979

Mamman SO, Wang Z, Iliyasu J (2023) Commonality in BRICS stock markets’ reaction to global economic policy uncertainty: evidence from a panel GARCH model with cross sectional dependence. Financ Res Lett 55:103877. https://doi.org/10.1016/j.frl.2023.103877

Matkovskyy R, Jalan A, Dowling M (2020) Effects of economic policy uncertainty shocks on the interdependence between Bitcoin and traditional financial markets. Q Rev Econ Financ 77:150–155. https://doi.org/10.1016/j.qref.2020.02.004

Meo MS, Karim MZA (2022) The role of green finance in reducing CO2 emissions: an empirical analysis. Borsa Istanb Rev 22:169–178. https://doi.org/10.1016/j.bir.2021.03.002

Mo B, Li Z, Meng J (2022) The dynamics of carbon on green energy equity investment: quantile-on-quantile and quantile coherency approaches. Environ Sci Pollut Res 29(4):5912–5922. https://doi.org/10.1007/s11356-021-15647-y

Moghaddam MB (2023) The relationship between oil price changes and economic growth in Canadian provinces: Evidence from a quantile-on-quantile approach. Energy Econ 125:106789. https://doi.org/10.1016/j.eneco.2023.106789

Mokni K (2021) When, where, and how economic policy uncertainty predicts Bitcoin returns and volatility? A quantiles-based analysis. Q Rev Econ Financ 80:65–73. https://doi.org/10.1016/j.qref.2021.01.017

Nartea, G. V., Bai, H., Wu, J. (2020). Investor sentiment and the economic policy uncertainty premium. Pac.-Basin Financ J 64: 101438. doihttps://doi.org/10.1016/j.pacfin.2020.101438

Nelson T, Nelson J, Ariyaratnam J, Camroux S (2013) An analysis of Australia’s large scale renewable energy target: Restoring market confidence. Energy Policy 62:386–400. https://doi.org/10.1016/j.enpol.2013.07.096

Nenavath S, Mishra S (2023) Impact of green finance and fintech on sustainable economic growth: Empirical evidence from India. Heliyon 9:e165301. https://doi.org/10.1016/j.heliyon.2023.e16301

Pham L, Cepni O (2022) Extreme directional spillovers between investor attention and green bond markets. Int Rev Econ Financ 80:186–210. https://doi.org/10.1016/j.iref.2022.02.069

Pham L, Nguyen CP (2022) How do stock, oil, and economic policy uncertainty influence the green bond market? Financ Res Lett 45:102128. https://doi.org/10.1016/j.frl.2021.102128

Ren X, Li Y, Yan C, Wen F, Lu Z (2022) The interrelationship between the carbon market and the green bonds market: evidence from wavelet quantile-on-quantile method. Technol Forecast Soc Change 179:121611. https://doi.org/10.1016/j.techfore.2022.121611

Schoenmaker D (2017) From risk to opportunity: a framework for sustainable finance. RSM series on positive change, 2

Sim N, Zhou H (2015) Oil prices, US stock return, and the dependence between their quantiles. J Bank Financ 55:1–8. https://doi.org/10.1016/j.jbankfin.2015.01.013

Sun C (2023) How are green finance, carbon emissions, and energy resources related in Asian sub-regions? Resour Policy 83:103648. https://doi.org/10.1016/j.resourpol.2023.103648

Sun G, Li G, Dilanchiev A, Kazimova A (2023a) Promotion of green financing: Role of renewable energy and energy transition in China. Renew Energy 210:769–755. https://doi.org/10.1016/j.renene.2023.04.044

Sun Y, Gao P, Raza SA, Shah N, Sharif A (2023b) The asymmetric effects of oil price shocks on the world food prices: Fresh evidence from quantile-on-quantile regression approach. Energy 270:126812. https://doi.org/10.1016/j.energy.2023.126812

Sun Y, Lu Z, Bao Q, Li Y, Li H (2022) The Belt & Road Initiative and the public and private debts of participating countries: The role of China’s economic policy uncertainty. Struct Change and Econ Dyn 60:179–193. https://doi.org/10.1016/j.strueco.2021.11.014

Syed AA, Ahmed F, Kamal MA, Ullah A, Ramos-Requena JP (2022) Is there an asymmetric relationship between economic policy uncertainty, cryptocurrencies, and global green bonds? Evidence from the United States of America. Mathematics 10(5):720

Taghizadeh-Hesary F, Yoshino N, Phoumin H (2021) Analyzing the characteristics of green bond markets to facilitate green finance in the post-COVID-19 world. Sustainability 13:5719. https://doi.org/10.3390/su13105719

Tam PS (2018) Global trade flows and economic policy uncertainty. Appl Econ 50(34–35):3718–3734. https://doi.org/10.1080/00036846.2018.1436151

Tang L, Wan XY (2022) Economic policy uncertainty and stock price informativeness. Pac Basin Financ J 75:101856. https://doi.org/10.1016/j.pacfin.2022.101856

Tang YM, Chen XH, Sarker PK, Baroudi S (2023) Asymmetric effects of geopolitical risks and uncertainties on green bond markets. Technol Forecast Soc Change 189:122348. https://doi.org/10.1016/j.techfore.2023.122348

Tariq A, Hassan A (2023) Role of green finance, environmental regulations, and economic development in the transition towards a sustainable environment. J Clean Prod 413:137425. https://doi.org/10.1016/j.jclepro.2023.137425

Ullah A, Zhao X, Amin A, Syed AA, Riaz A (2023) Impact of COVID-19 and economic policy uncertainty on China’s stock market returns: evidence from quantile-on-quantile and causality-in-quantiles approaches. Environ Sci Pollut Res 30(5):12596–12607. https://doi.org/10.1007/s11356-022-22680-y

Vo H, Nguyen T, Truong H (2023) Economic policy uncertainty and corporate investment: an empirical comparison of Korean chaebol and non-chaebol firms. Financ Res Lett 54:103810. https://doi.org/10.1016/j.frl.2023.103810

Wang J, Tian J, Kang Y, Guo K (2023) Can green finance development abate carbon emissions: evidence from China. Int Rev Econ Financ 88:73–91. https://doi.org/10.1016/j.iref.2023.06.011

Wang K, Liu L, Zhong Y, Lobonţ O (2022a) Economic policy uncertainty and carbon emission trading market: a China’s perspective. Energy Econ 115:106342. https://doi.org/10.1016/j.eneco.2022.106342

Wang K, Su C, Umar M, Lobont OR (2022b) Oil price shocks, economic policy uncertainty, and green finance: a case of China. Technol Econ Dev Econ 29(2):500–517. https://doi.org/10.3846/tede.2022.17999

Wang X, Li J, Ren X (2022c) Asymmetric causality of economic policy uncertainty and oil volatility index on time-varying nexus of the clean energy, carbon and green bond. Int Rev Financ Anal 83:102306. https://doi.org/10.1016/j.irfa.2022.102306

Wang X, Li J, Ren X, Lu Z (2022d) Exploring the bidirectional causality between green markets and economic policy: evidence from the time-varying Granger test. Environ Sci Pollut Res 29:88131–88146. https://doi.org/10.1007/s11356-022-21685-x

Wang X, Luo Y, Wang Z, Xu Y, Wu C (2021a) The impact of economic policy uncertainty on volatility of China’s financial stocks: an empirical analysis. Financ Res Lett 39:101650. https://doi.org/10.1016/j.frl.2020.101650

Wang X, Zhao H, Bi K (2021b) The measurement of green finance index and the development forecast of green finance in China. Environ Ecol Stat 28:263–285. https://doi.org/10.1007/s10651-021-00483-7

Wang XQ, Su C, Lobonţ OR, Li H, Nicoleta-Claudia M (2022e) Is China’s carbon trading market efficient? Evidence from emissions trading scheme pilots. Energy 245:123240. https://doi.org/10.1016/j.energy.2022.123240

Wang Y, Wang L, Pan C, Hong S (2022f) Economic policy uncertainty and price pass-through effect of exchange rate in China. Pac Basin Financ J 75:101844. https://doi.org/10.1016/j.pacfin.2022.101844

Wei P, Qi Y, Ren X, Duan K (2022) Does economic policy uncertainty affect green bond markets? Evidence from wavelet-based quantile analysis. Emerg Mark Financ Trade 58(15):4375–4388. https://doi.org/10.1080/1540496X.2022.2069487

Wei W, Hu H, Chang CP (2021) Economic policy uncertainty and energy production in China. Environ Sci Pollut Res 28:53544–53567. https://doi.org/10.1007/s11356-021-14413-4

Wen F, Shui A, Cheng Y, Gong X (2022) Monetary policy uncertainty and stock returns in G7 and BRICS countries: a quantile-on-quantile approach. Int Rev Econ Financ 78:457–482. https://doi.org/10.1016/j.iref.2021.12.015

Wu H, Zhu H, Huang F, Mao W (2023) How does economic policy uncertainty drive time–frequency connectedness across commodity and financial markets? N Am Econ Financ 64:101865. https://doi.org/10.1016/j.najef.2022.101865

Xia Y, Shi Z, Du X, Niu M, Cai R (2023) Can green assets hedge against economic policy uncertainty? Evidence from China with portfolio implications. Financ Res Lett 55:103874. https://doi.org/10.1016/j.frl.2023.103874

Xie Q, Tang G (2022) Do market conditions interfere with the transmission of uncertainty from oil market to stock market? Evidence from a modified quantile-on-quantile approach. Energy Econ 114:106250. https://doi.org/10.1016/j.eneco.2022.106250

Xiong X, Liu J, Liu Z (2022) Can economic policy uncertainty predict financial stress? A MIDAS approach. Appl Econ Lett 29:22–29. https://doi.org/10.1080/13504851.2020.1854664

Yang J, Yang C (2021) Economic policy uncertainty, COVID-19 lockdown, and firm-level volatility: evidence from China. Pac Basin Financ J 68:101597. https://doi.org/10.1016/j.pacfin.2021.101597

Yasmeen R, Hao G, Ullah A, Shah WUH, Long Y (2022) The impact of COVID-19 on the US renewable and non-renewable energy consumption: a sectoral analysis based on quantile on quantile regression approach. Environ Sci Pollut Res 29:90419–90434. https://doi.org/10.1007/s11356-022-22054-4

Yin H, Chang L, Wang S (2023) The impact of China’s economic uncertainty on commodity and financial markets. Resour Policy 84:103799. https://doi.org/10.1016/j.resourpol.2023.103779

You W, Guo Y, Zhu H, Tang Y (2017) Oil price shocks, economic policy uncertainty and industry stock returns in China: Asymmetric effects with quantile regression. Energy Econ 68:1–18. https://doi.org/10.1016/j.eneco.2017.09.007

Yu H, Lv W, Liu H, Wang J (2022) Economic policy uncertainty and corporate bank credits: evidence from China. Emerg Mark Financ Trade 58(11):3023–3033. https://doi.org/10.1080/1540496X.2021.2021179

Yuan D, Li S, Li R, Zhang F (2022a) Economic policy uncertainty, oil and stock markets in BRIC: evidence from quantiles analysis. Energy Econ 110:105972. https://doi.org/10.1016/j.eneco.2022.105972

Yuan M, Zhang L, Lian Y (2022b) Economic policy uncertainty and stock price crash risk of commercial banks: Evidence from China. Econ Anal Policy 74:587–605. https://doi.org/10.1016/j.eap.2022.03.018

Zakari A, Oryani B, Alvarado R, Mumini K (2023) Assessing the impact of green energy and finance on environmental performance in China and Japan. Econ Chang Restruct 56:1185–1199. https://doi.org/10.1007/s10644-022-09469-2

Zhang D (2023) Does green finance really inhibit extreme hypocritical ESG risk? A greenwashing perspective exploration. Energy Econ 121:106688. https://doi.org/10.1016/j.eneco.2023.106688

Zhang Y, Yan X (2020) The impact of US economic policy uncertainty on WTI crude oil returns in different time and frequency domains. Int Rev Econ Financ 69:750–768. https://doi.org/10.1016/j.iref.2020.04.001

Zhang D (2021) Green credit regulation, induced R&D and green productivity: revisiting the Porter Hypothesis. Int Rev Financ Anal 75:101723. https://doi.org/10.1016/j.irfa.2021.101723

Zhao S, He X, Faxritdinovna KU (2023) Does industrial structure changes matter in renewable energy development? Mediating role of green finance development. Renew Energy 214:350–358. https://doi.org/10.1016/j.renene.2023.05.088

Zhao Y, Su K (2022) Economic policy uncertainty and corporate financialization: Evidence from China. Int Rev Financ Anal 82:102182. https://doi.org/10.1016/j.irfa.2022.102182

Zheng J, Jiang Y, Cui Y, Shen Y (2023) Green bond issuance and corporate ESG performance: steps toward green and low-carbon development. Res Int Bus Financ 66:102007. https://doi.org/10.1016/j.ribaf.2023.102007

Zhu H, Wu H, Ren Y, Yu D (2023) Time-frequency effect of investor sentiment, economic policy uncertainty, and crude oil on international stock markets: evidence from wavelet quantile analysis. Appl Econ 54:6116–6146. https://doi.org/10.1080/00036846.2022.2057912

Acknowledgements

This work was supported by a grant from the Romanian Ministry of Research, Innovation and Digitalization, the project with the title „Economics and Policy Options for Climate Change Risk and Global Environmental Governance” (CF 193/28.11.2022, Funding Contract no. 760078/23.05.2023), within Romania's National Recovery and Resilience Plan (PNRR)—Pillar III, Component C9, Investment I8 (PNRR/2022/C9/MCID/I8)—Development of a program to attract highly specialized human resources from abroad in research, development and innovation activities.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

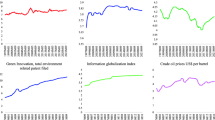

Appendix

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Wang, K. Economic policy uncertainty and green finance: evidence from frequency and quantile aspects. Econ Change Restruct 57, 1 (2024). https://doi.org/10.1007/s10644-024-09579-z

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10644-024-09579-z

Keywords

- Economic policy uncertainty

- Green bond index

- Wavelet multiscale decomposition

- Quantile-on-quantile regression