Abstract

The authors have employed several techniques to account for model uncertainty in the inequality-growth model. However, the BMA technique is the most prominent approach that solves model uncertainty in the inequality-growth literature. This study applied a recent BMA analysis using panel data to examine the role of fiscal policy on income inequality in 37 OECD countries from 2000 to 2015. Fiscal policy (in terms of tax revenue increase) serves as a redistributive tool or instrument to transfer income from higher income earners to lower earners and is considered a mechanism for income equality. To the best of the author’s knowledge, only a few empirical growth studies have considered fiscal policy impact in their income inequality model setup. Our work contributes to very little research on the fiscal policy–income nexus using a novel BMA and MCMC regression as a robust methodology. Our empirical evidence on the role of fiscal policy on income inequality has found three variables, namely, economic growth, fiscal policy, and urban population, to impact income inequality significantly. We also found that the countries are conditionally neither converging nor diverging because of the probability of their coefficient being high at 100%. As expected, the coefficient of fiscal policy has a significant negative relationship with income inequality, indicating that fiscal policy reduces income inequality significantly by an average of 22% (with 100% certainty) for both BMA and Bayes models in OECD countries.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Inequality in income has emerged as a major socioeconomic issue in nations around the world, prompting policymakers to investigate a variety of solutions (Katic and Ingram 2018). Among the potential instruments at their disposal, fiscal policy plays an important role in determining income distribution within economies (Coady and Gupta 2012). Understanding the relationship between fiscal policy and income inequality becomes crucial as governments seek to create more equitable societies. This is not just to stimulate the economy but also to provide individuals and households with the best of welfare. Given the importance of fiscal policy on income distribution, this study intends to provide a comprehensive analysis of this relationship in 37 organizations for economic cooperation and development (OECD) countries.

The OECD is comprised of a diverse group of countries with varying degrees of economic development, social welfare systems, and fiscal policies (Arsu and Ayçin 2021). This degree of diversity can benefit from complementary strengths and specialization, fostering innovation, and economic growth. Conversely, significant disparities in economic development and productivity levels among diverse countries may create challenges for trade, investment, and regional integration as well as income inequality. Hence, this study seeks to cast light on the efficacy of fiscal policy measures in addressing income inequality by focusing on this extensive group of countries. This research seeks to identify patterns, trends, and potential policy implications by analyzing the fiscal policies implemented in these nations, including taxation, social expenditure, and redistribution measures.

Income inequality, as measured by the Gini coefficient, has been a subject of increasing concern in OECD countries. According to the OECD (2019) report on income inequality, the average Gini coefficient for OECD member countries stood at 0.32, indicating a relatively high level of income inequality. Furthermore, income disparities have been on the rise, with the average Gini coefficient increasing by 1.7 percentage points since the early 1990s. These statistics highlight the urgency of addressing income inequality through effective fiscal policy interventions. By extension, this shows the picture of the implication of continued income disparity in the region.

Fiscal policy encompasses various instruments, including taxation, social spending, and redistributive measures, which governments can employ to influence income distribution within their economies (Easterly and Rebelo 1993). For instance, progressive taxation systems can help reduce income disparities by imposing higher tax rates on higher income individuals, while social spending programs can provide targeted assistance to vulnerable populations (Richards-Melamdir 2021). However, the effectiveness of these fiscal policy measures in reducing income inequality can vary across countries and depend on factors such as the design of the policies, institutional arrangements, and political contexts (Christl et al. 2021).

This research will utilize an econometric approach, employing panel data analysis techniques to examine the relationship between fiscal policy and income inequality in the selected 37 OECD countries. The primary data sources will include official statistics from national income and wealth databases, the OECD Income Distribution Database. The study will span a significant period from 2000 to 2015, enabling the analysis of long-term trends, policy changes, and potential variations in the fiscal policy-income inequality relationship over time. The research objective is to investigate the association between various fiscal policy variables, such as taxation, social spending, and redistribution measures, and income inequality in the selected 37 OECD countries. The study finds evidence on the three variables namely, economic growth, fiscal policy, and urban population, to impact income inequality significantly. We also found that the countries are conditionally neither converging nor diverging because of the probability of their coefficient being high at 100%. As expected, the coefficient of fiscal policy has a significant negative relationship with income inequality, indicating that fiscal policy reduces income inequality significantly by an average of 22% (with 100% certainty) for both BMA and Bayes models in OECD countries.

This research will add to the existing corpus of knowledge regarding the relationship between fiscal policy and income inequality, particularly in the context of OECD countries. This study has generated a valuable insight and inform policymakers on effective fiscal policy strategies to reduce income inequality by providing a comprehensive analysis encompassing a diverse set of nations. The ultimate objective of this study is that it contributes to the ongoing conversation about nurturing more equitable societies and promoting inclusive economic growth via fiscal policy instruments. Beyond that, this finding also adds to the body of knowledge on the relationship between fiscal policy and income inequality in across the globe. Policymakers should consider augmenting government grants with complementary measures such as targeted investments in education, job training, and affordable housing to amplify their effectiveness.

The remainder of the paper is organized as follows. The next section reviews the data, model, and empirical methodology for the association between income inequality and income inequality. The third section deals with empirical results. The fourth section presents robustness check and section five is conclusion of the study.

2 Literature review

The relationship between fiscal policy and income inequality has been the subject of substantial research and policy debate. Fiscal policy refers to government decisions regarding taxation, public expenditure, and redistribution, whereas income inequality describes the unequal distribution of income in a society. The role of fiscal policy on income distribution can take different forms such as taxation policies, social expenditure program and redistributive transfers, education, and human capital development expenditure, macroeconomic policies and economic development, or via political economy or institutional factors.

Taxation policies play a crucial role in determining the distribution of income. Progressive tax systems, in which individuals with higher incomes are subject to higher tax rates, are frequently viewed as an instrument for reducing income inequality. In general, empirical studies support the notion that progressive taxation is associated with decreased income inequality. Cevik and Correa-Caro (2020), Brown et al. (2023), for instance, discover that countries with higher top marginal tax rates tend to have lower income inequality. Aye and Odhiambo (2022), Gupta and Jalles (2022), Malla and Pathranarakul (2022), Wienk et al. (2022) found that progressive taxation is associated with lower income inequality, especially when combined with redistributive policies. Progressive taxation can help reduce income inequality by reducing the disposable income of high-income individuals, who tend to have a lower marginal propensity to consume. This means that they save a larger portion of their income, leading to lower demand for goods and services. Reducing income concentration through progressive taxation can help redistribute income and stimulate economic activity by increasing the purchasing power of lower income individuals (Muinelo-Gallo and Roca-Sagalés 2013; Carneiro 2023).

There is notion that is only income tax that abates income inequality while goods and service tax does not. The impact is observed only in the developing economies (Malla and Pathranarakul 2022). Nonetheless, there are controversies regarding the optimal progressivity of tax systems and the potential trade-offs between reducing inequality and encouraging economic growth (Dotti 2020, Muinelo‐Gallo and Miranda Lescano 2022). As tax rates become too high, they can potentially discourage work effort, investment, and entrepreneurship, thereby hindering economic growth and job creation (Carneiro et al. 2022). There is ongoing debate about the optimal level of progressivity that strikes a balance between reducing inequality and promoting economic efficiency.

Social expenditure programs and redistributive transfers can directly target income inequality by assisting low-income households. Welfare programs, unemployment benefits, and social assistance can aid in alleviating poverty and income disparities. The relationship between social spending and income equality has been demonstrated through research. For instance, Cimoli et al. (2017) discover that greater social spending is associated with lower income inequality in Latin American countries. Social spending can be more effective if the spending is directed to education as a component of social spending. This is the case in the 26 regions of Turkey (Celikay and Gumus 2017; Gründler and Scheuermeyer 2018). In addition, spending on income replacement programs such as unemployment insurance, sickness pay, occupational illness and disability also play a prominent role in income distribution (Moene and Wallerstein 2003, Gunasinghe et al. 2020). However, the effectiveness of social spending in reducing income inequality may vary depending on factors such as targeting precision, program design, and the overall fiscal sustainability of such measures.

Education and human capital development expenditures have been identified as significant income inequality determinants. Human capital accumulation, labor market outcomes, and income disparities can all be improved by fiscal policies that promote access to high-quality education and skill development. Moyo et al. (2022) demonstrate that disparities in education account for a substantial proportion of the variation in income distribution across nations. Providing equal access to education and addressing skill disparities is indispensable for reducing income inequality. Therefore, the relationship between education and income inequality can be positive and negative depending on the prevailing situations. Equitable public education will significantly close the widen income variation across the categories of individuals in the country (Artige and Cavenaile 2023).

There is a complex relationship between macroeconomic policy, economic development, and income inequality. The income distribution may benefit from fiscal policies that support economic growth, such as infrastructure investment and research and development. However, the distributional impact of economic growth depends on variables such as institutions of the labor market, skill-biased technological change, and the inclusiveness of growth strategies. According to Rezk et al. (2022), the design of fiscal policies, particularly in terms of their impact on foreign direct investment, can substantially impact income inequality. The level of financial development also plays moderating in income distribution. That is, when a country reaches a financial development threshold foreign direct investment became weak in income distribution (Lee et al. 2022). This is also the case in Africa, Ofori et al. (2023), find that Chinese FDI plays weak role in income distributions.

Political economy and institutional factors influence the formulation and implementation of fiscal policies, thereby impacting their effect on income inequality. Variations in political systems, governance, and public administration can produce varying policy outcomes. Zuazu (2022) stresses the significance of inclusive political institutions for reducing income inequality via progressive fiscal policies. The presence of robust institutions, efficient tax administration, and openness can increase the redistributive effect of fiscal policy measures. Overall improvement in democratic institutions, alleviation of bureaucratic constraints, quality of judicial and regulatory system, control of corruption as well as quality of governance significantly contribute to reduction in income inequality (Kouadio and Gakpa 2022). Nevertheless, the political institution could also deter income distribution. Gu and Wang (2022) argued that political institution in form of political polarization can be harmful to the income distribution.

Literature on fiscal policy and income inequality emphasizes the significance of tax policies, social expenditures, human capital investments, macro fiscal policy, and institutional factors in determining the outcomes of income distribution. It has been demonstrated that progressive taxation, well-targeted social expenditures, and education investments have the potential to reduce income inequality. Nevertheless, there are ongoing discussions regarding the optimal design and trade-offs of fiscal policy measures. In addition, the efficacy of fiscal policies in reducing income inequality is contingent upon a variety of country-specific factors, such as political institutions, social norms, and labor market dynamics. Given this assertion, our study continues to investigate these intricate relationships and provides evidence-based insights to help policymakers design fiscal policy strategies that promote a more equitable distribution of income and inclusive growth.

3 Data, model, and methodology

3.1 Data set

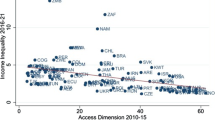

To empirically probe the discourse, the study utilities all the available data on proxy of income inequality from 1980 to 2018 sourced from OECD database (https://data.oecd.org/inequality/income-inequality.htm); real GDP growth and other determinants of income inequality from World Bank (2020). The dependent variable is The Gini coefficient (Gini) which is widely used in the literature as a proxy for income inequality (Atkinson and Brandolini 2001, JEL; Doerrenberg, and Peichl 2014, AE; Wildman 2021, EJHE). The Gini coefficient is the most used proxy for income inequality in literature—simply put, the higher the Gini coefficient represents a greater income inequality gap in a country's richest and vice versal. The explanatory variables are real GDP annual growth (GDPG) which is widely used in the literature as a proxy for economic growth (Jin and Jin 2014; Jiménez-Rodríguez and Sánchez 2005; Deme and Mahmoud 2020; Nonejad 2020, 2021). The Tax revenue, percent of GDP, is our proxy for fiscal policy (FP). It is expected that increase in the tax revenue (FP) will help to decrease income inequality (Muinelo-Gallo and Roca-Sagalés 2013; Cevik and Correa-Caro 2020; Agnello and Sousa, 2014). The control variables are trade openness, which is the exports plus imports as percent of GDP (OPENNESS) and urban population which is the Urban population (% of total population). It is expected that increase in both trade openness—urban population—income inequality nexus is mixed effect Reuveny and Li (2003) argue that openness decreases income inequality, and however, Spilimbergo et al. (1999) that increase in trade openness help to increase income inequality (Table 1).

3.2 Model specification

Using semi-elasticity specifications, this section presents the four models tailored to actualizing the study objectives. To address the first objective on analyzing the individual effect of economic growth and income inequality, fiscal policy (proxy by tax, government expenditure and government grant), urban population is expressed as a linear function of each fiscal indicator, economic growth, and a set of control variables. That is:

where the variables are as defined in Sect. 3.1; ln = natural logarithm; \({\mathrm{\alpha }}_{0}, {\mathrm{\vartheta }}_{0}\) = model intercept; \({\updelta }_{t}\)= year dummies; \({\mathrm{\alpha }}_{1-4}, {\mathrm{\vartheta }}_{1-4}\) = partial slope parameters; and \(e, v\) = error terms. This paper adopts the methodical approach of Adeleye et al. (2021).

3.3 Empirical approach estimation techniques

To examine the role of fiscal policy on income inequality in OECD from 2000 to 2015, we employed Bayesian Model Average. Nowadays, the application of Bayesian models has increased in the recent literature due to its diverse benefits for different research areas. For instance, the Bayesian model average (BMA) in particular, it eliminates the nuisance factor to produce best and most reliable parameter estimates (See, Durlauf and Temple, 2005). Following Kaplan and Lee (2018), the regression model is presented as follows:

The vector of income inequality and \(X\) represents the drivers of income inequality including controls trade openness and urban population. Since Bayesian methodology is a likelihood, if we have a k possible dependent variable, it will result \({2}^{k}\) possible combination of regressors, i.e., \({2}^{k}\) for different models which is indexed by \({M}_{j}\) for \(=1, \dots .,..\) \({2}^{k}\), and \({M}_{j}\) depends on the parameters \({\theta }^{j}\). The posterior Mean (PM) of \(n\) distribution is as follows:

Note: Y is all observation data used for the purpose the analysis, \(while f\left(Y|{H}_{j}\right)\) represent the marginal likelihood of the \({H}_{j}\) which is given by

where \(\theta\) represents the unknown coefficients of model \({H}_{j}, p \left(\theta \right),\) and \(f\left(Y|{H}_{j}\right)\) is the likelihood of the model.

4 Empirical results

The BMA analysis for the selected model is presented in Tables 2 and 3 below. In both Tables, the posterior Mean (PM) is the same and comparing both BMA and Bayes regression, the parameters for all the independent variables have the same signs. Although the economic significance of BMA is proportionate greater than that of Bayes Regression.

Regarding the economic growth–income inequality nexus, economic growth has a high posterior probability of inclusion (100%) and a positive significant relationship with income inequality. The positive coefficient of economic growth indicates that income inequality rises with an increase in economic growth in OECD countries. This result is in line with the view of Acemoglu et al., 2011; Galor and Moav, 2004, Scholl and Klasen, 2019 that economic growth contributes to increase in income inequality.

As expected, both BMA and Bayes confirm a negative association between fiscal policy and income inequality and a high posterior probability of inclusion (100%). The negative coefficient of fiscal policy (i.e., taxes revenue) indicates that taxes revenue helps to reduce income inequality. This result is consistent with Muinelo-Gallo and Roca-Sagalés (2013) find that government revenue increases in relation to the increase in tax revenue percentage of national income, leading to reduction in income inequality in the society. Increase in fiscal policy should be encouraged through increase in tax revenue to reduce income inequality in OECD countries.

Finally, increase in urban population and trade openness have a significant positive effect on income inequality with a high posterior probability of inclusion (100%) for urban population, and a low posterior probability of inclusion (6.4%) for trade openness, the probability that urban population has a negative impact on income inequality is 100%, while that of trade openness is just 6%. So, we are not sure of this positive relationship between trade openness between income inequality. However, 100 percent posterior probability for urban population, confirms the trade openness has a positive and significant effect on income inequality. The indication of the positive effect shows that trade openness increases income inequality in the sample.

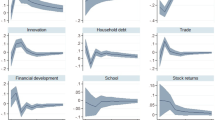

5 Robustness

In addition to the basic BMA analysis, we carry out a MMMC as a robust estimation to check the outcomes BMA on the role of fiscal policy on income inequality in OECD countries. We can conclude that MCMC is robust to BMA since all four regressors have the same sign as in BMA techniques. The results show that one of the regressors that was earlier found significant with our main BMA analysis, both economic growth, urban population, and trade openness increase income inequality in OECD countries. Similarly, our MCMC results for all lower quantile (2.5 and 25%), middle quantile (50%) and higher quantiles (75 and 97.50%) in Table 4 confirm a significant positive relationship between economic growth and income inequality; a significant positive relationship between urban population and income inequality; a positive relationship between trade openness and income inequality and a significant negative relationship between fiscal policy and income inequality.

5.1 Further robustness test

6 Conclusion

The authors have employed several techniques to account for model uncertainty in the inequality-growth model. However, BMA technique is the most prominent approach that solves model uncertainty in the inequality-growth literature. This study applied a recent BMA analysis using the available panel data from 1980 to 2018 to examine the role of fiscal policy (tax revenue, public spending and public revenue and grants) on income inequality in 37 OECD countries. Fiscal policy serves as a redistributive tool or instrument to transfer income from higher income earners to lower earners and considered as a mechanism for income equality. To the best of the knowledge of the author, only a few empirical growth studies have considered fiscal policy impact in their income inequality model setup. By introducing tax revenue to Bértola and Williamson (2017), our work contributes to very few research on fiscal policy–income nexus using a novel BMA and MCMC regression as a robust methodology.

Our empirical evidence on the role of fiscal policy on income inequality has found three variables namely, economic growth, fiscal policy (tax revenue and public spending), and urban population to have a significant impact on income inequality. However, public revenue and grants were found to reduce income inequality but not significant. We also found that the countries are conditionally neither converging nor diverging because the probability of their coefficient high at 100% (i.e., P! = 0 is the posterior probability for each IV. So, all are 100% significant except trade openness). As expected, the coefficient of fiscal policy has a significant negative relationship with income inequality, indicating that fiscal policy measured by tax reduces income inequality significantly by average 22% (with 100% certainty) for both BMA and Bayes models in OECD countries.

Also, government expenditure is found to significantly reduce inequality, and however, government does not have significant effect on inequality. The findings revealing that distributive expenditures and direct taxes can lead to significant reductions in net income inequality offer promising policy implications for promoting a more equitable society. These fiscal measures have demonstrated their potential to effectively address income disparities and enhance social welfare. However, the observed limited impact of government grants on income inequality suggests that further refinements to this policy instrument may be necessary to achieve more substantial outcomes. Policy aims at increasing the growth rate of tax revenue and government expenditure as potent instrument to combat inequality, create a more inclusive society, and foster sustainable economic growth.

In addition, policymakers should consider augmenting government grants with complementary measures such as targeted investments in education, job training, and affordable housing to amplify their effectiveness. Additionally, conducting in-depth assessments to identify the barriers hindering the full potential of government grants in reducing income inequality can help inform evidence-based policy adjustments. By adopting a comprehensive approach that combines different fiscal tools, governments can better optimize the distribution of resources and work towards a fairer and more just society where economic opportunities are accessible to all. However, one limitation of this study is that we did not account for moderation effect of fiscal policy through economic growth on income inequality. We leave this subject matter for future research.

Data availability

The data that support the findings of this study are available from the corresponding author, [Abdulrasheed Zakari], upon reasonable request.

References

Adeleye BN et al (2021) Investigating growth-energy-emissions trilemma in South Asia. Int J Energy Econ Policy 11(5):112–120

Arsu T, Ayçin E (2021) Evaluation of Oecd countries with multicriteria decision-making methods in terms of economic, social and environmental aspects

Artige L, Cavenaile L (2023) Public education expenditures, growth and income inequality. J Econ Theory 209:105622

Aye GC, Odhiambo NM (2022) Dynamic effect of fiscal policy on wealth inequality: evidence from middle-income countries. Cogent Econ Financ 10(1):2119705

Brown TAK et al (2023) Tax and income inequality: evidence from Sub-Saharan Africa. Int J Dev Issues 22(3):345–360

Carneiro FM et al (2022) Economic growth and inequality tradeoffs under progressive taxation. J Econ Dyn Control 143:104513

Carneiro FM (2023) Essays in macroeconomics: public debt reform, progressive taxation and distributional effects of fiscal policy

Celikay F, Gumus E (2017) The effect of social spending on reducing poverty. Int J Soc Econ 44(5):620–632

Cevik S, Correa-Caro C (2020) Growing (un) equal: fiscal policy and income inequality in China and BRIC+. J Asia Pac Econ 25(4):634–653

Christl M, et al. (2021) The cushioning effect of fiscal policy in the EU during the COVID-19 pandemic. JRC (Joint Research Centre) Technical Report 2: 2021.

Cimoli M et al (2017) Productivity, social expenditure and income distribution in Latin America. Braz J Polit Econ 37:660–679

Coady MD, Gupta MS (2012) Income inequality and fiscal policy. International Monetary Fund

Dotti V (2020) Income inequality, size of government, and tax progressivity: a positive theory. Eur Econ Rev 121:103327

Easterly W, Rebelo S (1993) Fiscal policy and economic growth. J Monet Econ 32(3):417–458

Gründler K, Scheuermeyer P (2018) Growth effects of inequality and redistribution: what are the transmission channels? J Macroecon 55:293–313

Gu Y, Wang Z (2022) Income inequality and global political polarization: the economic origin of political polarization in the world. J Chin Polit Sci 27(2):375–398

Gunasinghe C et al (2020) The impact of fiscal shocks on real GDP and income inequality: what do Australian data say? J Policy Model 42(2):250–270

Gupta S, Jalles JT (2022) Do tax reforms affect income distribution? Evidence from developing countries. Econ Model 110:105804

Katic I, Ingram P (2018) Income inequality and subjective well-being: toward an understanding of the relationship and its mechanisms. Bus Soc 57(6):1010–1044

Kouadio HK, Gakpa L-L (2022) Do economic growth and institutional quality reduce poverty and inequality in West Africa? J Policy Model 44(1):41–63

Lee CC et al (2022) The impact of FDI on income inequality: evidence from the perspective of financial development. Int J Financ Econ 27(1):137–157

Malla MH, Pathranarakul P (2022) Fiscal policy and income inequality: the critical role of institutional capacity. Economies 10(5):115

Moene KO, Wallerstein M (2003) Earnings inequality and welfare spending: a disaggregated analysis. World Politics 55(4):485–516

Moyo C et al (2022) Human capital development, poverty and income inequality in the Eastern Cape province. Dev Stud Res 9(1):36–47

Muinelo-Gallo L, Miranda Lescano R (2022) Redistribution and efficiency: an empirical analysis of the relevant trade-offs of welfare state fiscal policies. Rev Dev Econ 26(1):562–586

Muinelo-Gallo L, Roca-Sagalés O (2013) Joint determinants of fiscal policy, income inequality and economic growth. Econ Model 30:814–824

Ofori IK et al (2023) Bridging Africa’s income inequality gap: how relevant is China’s outward FDI to Africa? Econ Syst 47(1):101055

Rezk H et al (2022) The impact of FDI on income inequality in Egypt. Econ Chang Restruct 55(3):2011–2030

Richards-Melamdir M (2021) Can progressive taxation address gender inequality in income? Cross-national evidence of gender differences in income tax payment patterns and post-tax income, LIS Working Paper Series

Wienk MN et al (2022) The social psychology of economic inequality, redistribution, and subjective well-being. Eur Rev Soc Psychol 33(1):45–80

World Bank (2020) World development indicators. World Bank

Zuazu I (2022) Electoral systems and income inequality: a tale of political equality. Empir Econ 63(2):793–819

Funding

Open Access funding enabled and organized by CAUL and its Member Institutions. The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that there are no financial interests/personal interest which may be considered as potential competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Musibau, H.O., Zakari, A. & Taghizadeh-Hesary, F. Exploring the Fiscal policy—income inequality relationship with Bayesian model averaging analysis. Econ Change Restruct 57, 21 (2024). https://doi.org/10.1007/s10644-024-09577-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10644-024-09577-1