Abstract

This paper analyzes the dynamic effects of economic disasters, captured by cumulative decline in output of at least 10% over 1 or more years, on disposable income inequality of a sample of 99 countries over the annual period of 1960–2017. Based on impulse response functions derived from a robust local projections method, we find that economic disasters increase inequality by 4%, with the overall effect being statistically significant and highly persistent over a period of 20 years following the shock. When we repeat the analysis by categorizing the 99 countries based on income groups and regions, we find that the strongest effects are felt by high-income countries (8%), and in Europe, Central Asia and North America (16%) taken together, as primarily driven by ex-socialist economies. Though of lesser magnitude, statistically significant increases in inequality are also observed for low-, and upper-middle-income economies, and the regions of Latin America and Caribbean, Middle East and North Africa (MENA) and South Asia, and to some extent also for Sub-Saharan Africa. Our findings have important policy implications. Our findings suggest that the avoidance of economic crises is of paramount importance to ensure the sustainability of the welfare state, which in turn would allow for sound redistributive policies to reduce inequality, which can also help in indirectly reducing the negative impact of rare disasters on asset markets. In other words, our results have both economic and financial implications.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The objective of this paper is to analyze the dynamic impact of economic disasters on income inequality of 99 countries over the annual period of 1960–2017. In this regard, we utilize an improved version of the local projection method of Jordà (2005) and investigate the evolution of inequality following the impact of a shock associated with economic disaster events for all the countries in the sample, as well as for countries categorized as per income and regional location. Understandably, the idea behind the sub-sample analyses is to detect possible heterogeneous impact and draw appropriate groups-specific policy conclusions in the process.

In this regard, note that Barro (2006) uses the term “economic disasters” to identify especially large economic crises, later defined as a cumulative decline in consumption or output of at least 10% over 1 or more years. Given this, economic crises can be linked to income inequality through the effect of slowed economic growth, investment and rising unemployment of the lower income classes, as well as through lower wages linked to the weakened bargaining power of labor during crises [see the discussions in Ćorić (2018), Bodea et al. (2021), and Ćorić and Šimić (2021)]. Put alternatively, in the wake of such negative aggregate shocks (irrespective of their underlying reason(s)), it is not incorrect to expect the rich to smooth faster their income and consumption to the pre-shock levels due to their existing higher endowment levels relative to the poor, resulting in more skewed income distributions, i.e., higher levels of inequality (Baldacci et al. 2002).

At this stage, we can look into the above-mentioned channels linking economic disasters to inequality a bit more closely, based on the discussions in Ćorić (2018), Bodea et al. (2021), and Ćorić and Šimić (2021). One of the first effects of economic disasters is a slowdown in economic growth and a rise in unemployment. The associated recessions usually translate in lost jobs, and unemployment has been shown to affect more severely low-skill, low-income individuals. Moreover, the long-term unemployed suffer from declining re-employment wages and structural unemployment is directly linked to increased income inequality. Thus, economic crises can be expected to have a direct effect through output loses and unemployment that increases the discrepancy of incomes going to the poor versus the rich. Compounding the effect of recession, crises may reduce labor’s bargaining power and contribute to income inequality as workers accept lower wages in order to restore firm profitability. At the same time, probability of infrequent but large economic disasters would reduce the risk-adjusted return on capital and hence reduces investment and output growth to translate into higher inequality. On the other hand, different mechanisms may be at work such that some crises, especially those that are financial in nature, would disproportionately influence the income of the rich, to the extent that the poor in a society who do not own assets, are likely to be less affected. But, such dynamics do not imply that middle class wealth is unaffected by (financial) crises, especially in developed countries. In fact, in developed countries the rising indebtedness in the household sector and the increasing role of the financial sector in the functioning of domestic economies leave middle-class wealth vulnerable to financial meltdowns. In addition to the effects of crises themselves, policy responses can further influence the distribution of income in the aftermath of crises, with different constituencies vying for state support, which in turn are again likely to go to organized bigger agents than individual household. As is observed from this discussion, at this stage however, there is no unified theoretical framework that has been developed to relate rare disasters to inequality, and requires future investigation.

Originally, rare disaster risks-based models were developed to solve various observations associated with the financial markets, for example, the equity premium puzzle and its predictability (Barro 2006; Watcher, 2013), volatility of equity and currency returns (Farhi and Gabaix 2016; Barro and Jin 2021), among others. As economic disasters are events with the risk of low-probability but large negative economic effects, such as that of financial crises and natural disasters due to climate change, in light of the theoretical channels discussed above, many studies have related inequality to such extreme episodes. Papers such as Bui et al. (2014), Thiede (2014), Sakai et al. (2017), Sedova et al. (2020), Cappelli et al. (2021), Chisadza et al. (2023), Sheng et al. (2023) highlight the role of climate-related disasters in enhancing income inequality. At the same time, Maarek and Orgiazzi (2013), de Haan and Sturm (2016), Bazillier and Najman (2017), Amate-Fortes et al. (2017), Baiardi and Morana (2017), Bodea et al. (2021), among others (which involves references cited in these papers for earlier works), depict the negative influence of financial crises, primarily dealing with the banking sector and the currency market, on income inequality.

Realizing that economic crises can also be caused by geopolitical events (Berkman et al. 2011, 2017) and outbreaks of contagious diseases (Bouri et al. 2022), our study is relatively broader than the existing literature in terms of associating rare disaster risks with financial crises and natural disasters only. To the best of our knowledge, our paper makes the first attempt to understand the dynamic impact of economic disasters in the broadest sense of the term on inequality, without identifying the source of the economic disaster. With us analyzing periods of cumulative decline in consumption or output of at least 10% over 1 or more years, our work is less likely to suffer from biases due to selection of disaster events originating from either the financial markets or climate change only, and hence should provide a more accurate estimate of the effect of economic disasters on inequality. The only other available (working) paper in this regard is of Atkinson and Morelli (2011), wherein the authors used an event study-based approach involving a window of ± 5 years around declines of 10% of gross domestic product (GDP) per capita and consumption per capita for a set of 24 countries, to depict weak effects of economic disasters on inequality over the period of 1911 to 2006. Unlike this work, relying on a broader set of countries, and the local projection method, we are able to provide a complete picture of the dynamic effects following rare disaster events-based shock on inequality, rather than around an event-window, the choice of which could be arbitrary and make the results sensitive to its length. At the same time, we also look at the impact by categorizing our 99 countries based on income groups and regions to detect possible heterogeneous effects, with results presented for not only declines in GDP per capita, but also consumption per capita as robustness. Analyzing the possibility of non-uniform impacts is surely important from the perspective of policymaking, as the strength of policy decisions to counteract the possible negative influence on income distribution emanating from rare disasters is likely to be contingent on levels of economic development. Clearly, our paper, in terms of the data and methodology and economic approach is likely to provide more reliable results than the existing literature on this topic, especially with the recent COVID-19 pandemic being a health-related crises that translated into a global rare disaster event, not due to financial collapse or climate change.

The remainder of the paper is organized as follows: Sect. 2 discusses our data set and methodology. Section 3 presents the empirical findings, with Sect. 4 concluding the paper.

2 Data and methodology

To improve our understanding of the relationship between inequality and economic disasters, we employ the country-level annual data on the Gini index of economic inequality based on disposable (post-tax, post-transfer) income, and obtained from the Standardized World Income Inequality Database (SWIID). The SWIID, as developed by Solt (2020), currently incorporates comparable Gini indices for 198 countries for as many years as possible from 1960 to 2020.Footnote 1 The data on economic disasters are retrieved from a new datasets on economic disasters in the post-WWII period constructed by Ćorić (2021, 2022). The data on economic disasters are available for 212 countries from 1950 to 2017. Following Barro and Ursúa (2008), economic disasters are identified by using annual GDP per capita and consumption per capita data separately, as cumulative declines in these two variables of at least 10% for over 1 or more years. Our focus will be the disasters identified using GDP per capita in the main text, while results from consumption per capita-based disasters will be presented in the Appendix of the paper. The descriptive statistics and the correlation matrix for the variables under consideration are provided in Tables 1 and 2 in the Appendix. In line with theory and intuition, as can be seen from Table 1, inequality is positively correlated with economic disasters in a statistically significant manner and hence provides preliminary evidence of the fact that rare disaster risks negatively impacts income distributions.

To estimate the inequality dynamic after economic disasters, we use Teulings and Zubanov’s (2014) extension of the Jordà’s (2005) local projection method. This method estimates the impulse response function (IRF) directly from the forecast equation for inequality k periods ahead. Note that Jordà’s (2005) estimator is robust to specification errors arising in shocks identified using the Cholesky/recursive scheme (which requires specific ordering of variables to identify the structural shocks) due to usage of more lags of the explanatory variables and higher length of the forecast horizon (Auerbach and Gorodnichenko 2013). However, Teulings and Zubanov (2014) show that the method of Jordà (2005) can be subject to bias that occurs due to the failure of the estimator to use information on the crises occurring within the forecast horizon. Therefore, to estimate the inequality dynamic after economic disasters, in line with the theoretical discussion presented in the preceding section, we employ the following empirical panel autoregressive model of inequality comprising current, lagged and variables for economic disasters occurring within the forecast horizon (i.e., between t and t + k):

where I denotes the logarithm of Gini index, while the k superscript represents the considered time horizon. i and t superscripts index countries and time, respectively. ED is the variable for economic disasters, created as discussed above. It is a dummy variable that equals to 1 if an economic disaster in country i starts in year t and 0 otherwise. \(\alpha_{i}\) indicates country-specific fixed effects, while \(\varepsilon_{i, t}\) is the error term.

The employed local projection method estimates separate regressions for the horizons between time t and time t + k. The sequence of estimates on the current ED, \(\phi_{0}^{k}\), provides the average responses of the Gini index over the forecast horizon to an economic disasters. The corresponding serially correlation-robust standard errors are used to construct 95% confidence intervals.

At this stage, it must be pointed out that the use of country fixed effects raise a well-known issue of dynamic panel bias, but Teulings and Zubanov (2014) demonstrate that the bias is very small for panels with T = 30 and above, as in our case. In other words, our results are based on a robust approach, which not only allows us to get around the issues of misspecification associated with identification of structural shocks associated with Choleski decomposition via usage of more lags of the explanatory variables and higher length of the forecast horizon, but also produces unbiased results by accounting for the information of the shock that impacts the economic system within the forecast horizon. Further note that, with economic disaster events identified as a dummy variable corresponding to large cumulative declines in annual GDP per capita or consumption per capita data of at least 10% for over 1 or more years, the shock is completely exogenous in this model likely being associated with major economic catastrophes (such as, financial crises, sovereign defaults, revolutions, wartime destructions, natural disasters and epidemics of disease), and does not suffer from any issues of endogeneity in light of the possible feedback of inequality on growth (see, Chang et al. (2018), Çepni et al. (2020), and Balcilar et al. (2021) for detailed discussions of this literature).

3 Results

We run a separate regression for each forecast horizon up to k = 20. As both data samples are unbalanced, we include only countries with at least 30 consecutive observations on the Gini index of inequality. Hence, our effective sample comprises 99 countries with 3,664 observations at k = 0, with a complete list of countries being provided in Table 3 in the Appendix of the paper. As the forecast horizon increases, the effective sample size reduces gradually to 1,684 at k = 20, but the number of countries in the sample remains constant.

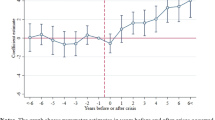

Figure 1 plots the estimates of \(\phi_{0}^{k}\), from our overall sample of 99 countries that comprise 129 economic disasters identified as cumulative declines in GDP per capita of at least 10% over 1 or more years. The plotted results show the statistically significant increase of economic inequality after the onset of typical economic disaster. Particularly, the results indicate that an average economic disaster leads to a gradual increase of the Gini index reaching the maximum of 4.4%, 12 years after the start of economic disaster. The increase of inequality remains statistically significant and around 4% for the rest of the forecast horizon, with it declining to 3.3% at k = 20. In other words, we do observe a significantly persistent effect of economic disasters on increases of inequality.

Figure 5 in the Appendix plots the estimates of \(\phi_{0}^{k}\), from the sample that comprise 203 economic disasters identified as cumulative declines in consumption per capita of at least 10% over 1 or more years. While a similar pattern of the effect on inequality is observed, the impact in general is comparatively smaller (i.e., below 4%), as observed with the case of the GDP per capita-based economic disasters.

Next, we revert back to the economic disasters identified via GDP per capita, but now we aim to look at its effects on inequality with countries categorized based on income groups (low; low-middle; upper-middle; high),Footnote 2 and regions (East Asia and Pacific; Europe, Central Asia and North America; Latin America and Caribbean; Middle East and North Africa (MENA) and South Asia; Sub-Saharan Africa), with the results reported in Figs. 2 and 3, respectively. As can be seen from the various sub-figures of Figs. 2 and 3, the overall results are driven by high-income countries, as well as the region of Europe, Central Asia and North America, with the latter also representing high-income countries. In other words, this category of income and region are found to experience the strongest impact on inequality following economic disasters, registering peaks of 8% and 16%, respectively, after 10 years following the shock. Also, as observed from Fig. 2, significant increases in inequality are also observed for low-, and upper-middle-income countries. As far as regions are concerned, as can be seen from Fig. 3, significant rises in inequality are also detected for Latin America and Caribbean, Middle East and North Africa (MENA) and South Asia, and to some extent also for Sub-Saharan Africa. Figures 6 and 7 in the Appendix report qualitatively similar observations based on economic disasters detected using consumption per capita.

In Fig. 4, we delve a bit more into this issue of why we observe stronger effect for the high-income countries and that for the region of Europe, Central Asia and North America by excluding from them the ex-socialist economies. As can be observed now from Fig. 4a, c, when doing this separation, the inequality effects of GDP per capita-based disasters on the remaining countries in the high-income group and the Europe, Central Asia and North America region decrease substantially when compared to Figs. 2d and 3b, when the ex-socialist countries were not excluded. As revealed in Fig. 4b, d, the ex-socialist countries experience stronger impact of disasters relative to the corresponding categories of income and regions that excludes them.Footnote 3 This observation is understandable since, while communism had the “homogenizing” effect of compressing income inequality, the fall of communism resulted in a rise in inequality in all ex-socialist countries, which in turn should not be surprising, given very (and to some extent artificially) low income inequality during communism (Novokmet 2021). In other words, economic disasters tended to exacerbate the already high inequality that resulted from the end of communism, and transition of these countries into market economies.

4 Conclusion

As per the World Inequality Report in 2022 by the World Inequality Lab,Footnote 4 the richest 10% today snap up 52% of all income, with the poorest half getting just 8.5%. In sum, global inequalities are in bad shape and mostly do not appear to be getting better. Hence, understanding what drives income inequality is an important policy question. In this paper we analyze the role of the multifaceted nature of economic disasters, capturing economic crises, measured by the cumulative decline in output (GDP per capita) of at least 10% over 1 or more years, on disposable income inequality. Based on impulse response functions derived from a robust local projections method, applied to a sample of 99 countries over the annual period of 1960–2017, we find that economic disasters increase inequality by 4% in a statistically significant fashion, with the overall effect being highly persistent over a period of 20 years following the shock. When we re-conduct the analysis by categorizing the 99 countries based on income groups and regions, we find that the strongest effects are felt by high-income countries (8%), and in Europe, Central Asia and North America (16%) combined, and are primarily driven by ex-socialist economies. Statistically significant increases in inequality, but of relatively lesser size, are also observed for low- and upper-middle-income economies, and the regions of Latin America and Caribbean, Middle East and North Africa (MENA) and South Asia, and to some extent also for Sub-Saharan Africa. Our results are robust, when we measure economic disasters by the cumulative decline in consumption per capita (of at least 10% over 1 or more years).

In light of the seriousness of the issue of inequality globally, our findings have important implications, especially due to the persistent effect of economic disasters on income distribution detected by us. In particular, the avoidance of economic crises may be necessary to ensure the sustainability of the social institutions we have developed, such as the welfare state and the stability of democratic political governance, besides the undertaking of climate change-related policies to prevent natural disasters, and in the process keep inequality in check. With strongest inequality effects due to rare disasters felt in high-income economies, which in general are also the epicenter of economic disasters, emanating particularly from financial crises, and climate change, being major polluters, the onus falls to a greater degree on the developed world to eradicate global inequality. Having said that, individual economies would also need to ensure sound governance to eradicate economic and financial instability leading to rare disasters, and in the process allowing the distributive policies to work in an efficient manner through the channel of higher, but more importantly inclusive, economic growth. Rare disaster have asset price implications, with the risk getting reflected into equity, bonds and currency markets globally (see for example, Berkman et. al. (2011, 2017), Gupta et al. (2019a, b)). At the same time, inequality is known to also raise the risk of investing in financial markets (Gupta et al. 2019c; Christou et al. 2021). Naturally, with rare disaster events driving inequality, the adverse effect on asset markets is likely to be prolonged via the indirect channel of inequality, which, in turn, needs to be accounted for by asset managers when evaluating the risks associated with asset markets, and the associated design of optimal portfolio weights.

One of the limitations of our work, driven by data availability issues is that, our sample period ends in 2017, and hence misses the rare disaster event associated with the recent outbreak of the COVID-19 pandemic. In light of this, as part of future research, when updated data including the COVID-19 episode are available across the countries for us to compute our metrics of rare disasters, it would be interesting to re-evaluate our findings. As stated in the introduction, economic disasters have not been theoretically link to inequality in a formal manner, and hence, we needed to rely on the literature that associates growth with inequality. Now that we have provided statistically significant evidence of the negative effect of economic disasters on inequality, research should be devoted to developing theoretical models that formalize our empirical findings, whereby link should also be made with the size of the effect being contingent on the level of development of an economy .

Notes

The SWIID Version 9.3 (as of June 2022) is available for download from: https://fsolt.org/swiid/.

The countries corresponding to these four income categories are identified in Table 3.

Similar conclusions are reached when we use declines in consumption per capita to measure economic disasters, with the results available upon request from the authors.

References

Amate-Fortes I, Guarnido-Rueda A, Molina-Morales A (2017) Crisis and inequality in the European Union. Eur Rev 25(3):438–452

Atkinson AB, Morelli S (2011) Economic crises and inequality. United Nations Development Programme (UNDP) Human Development Research pp 2011/06.

Auerbach A, Gorodnichenko Y (2013) Fiscal multipliers in recession and expansion. In: Alesina A, Giavazzi F (eds) Fiscal policy after the financial crisis. University of Chicago Press, Chicago

Baiardi D, Morana C (2017) Financial development and income distribution inequality in the euro area. Econ Model 70:40–55

Balcilar M, Gupta R, Ma W, Makena P (2021) Income inequality and economic growth: a re-examination of theory and evidence. Rev Dev Econ 25(2):737–757

Baldacci E, de Mello L, Inchauste G (2002) Financial crises, poverty, and income distribution. International Monetary Fund Working Paper No. 2002/004.

Barro RJ (2006) Rare disasters and assets markets in the twentieth century. Quart J Econ 121(3):823–866

Barro RJ, Jin T (2021) Rare events and long-run risks. Rev Econ Dyn 39(1):1–25

Barro RJ, Ursúa JF (2008) Macroeconomic Crises since 1870. Brooking Papers Econ Act 1(Spring):255–335

Barro RJ, Ursúa JF (2012) Rare macroeconomic disasters. Ann Rev Econ 4:83–109

Bazillier R, Najman B (2017) Labour and financial crises: Is labour paying the price of the crisis? Comp Econ Stud 59(1):55–76

Berkman H, Jacobsen B, Lee JB (2011) Time-varying rare disaster risk and stock returns. J Financ Econ 101:313–332

Berkman H, Jacobsen B, Lee JB (2017) Rare disaster risk and the expected equity risk premium. Account Finance 57(2):351–372

Bodea C, Houle C, Kim H (2021) Do financial crises increase income inequality? World Dev 147:105635

Bouri E, Gupta R, Nel J, Shiba S (2022) Contagious diseases and gold: over 700 years of evidence from quantile regressions. Financ Res Lett 50:103266

Bui AT, Dungey M, Nguyen CV, Pham TP (2014) The impact of natural disasters on household income, expenditure, poverty and inequality: evidence from Vietnam. Appl Econ 46(15):1751–1766

Cappelli F, Costantini V, Consoli D (2021) The trap of climate change-induced “natural” disasters and inequality. Glob Environ Chang 70:102329

Çepni O, Gupta R, Lv Z (2020) Threshold effects of inequality on economic growth in the US states: the role of human capital to physical capital ratio. Appl Econ Lett 27(19):1546–1551

Chang S, Gupta R, Miller SM (2018) Causality between per capita real GDP and income inequality in the U.S.: evidence from a wavelet analysis. Soc Indic Res 135:269–289

Chisadza C, Clance M, Sheng X, Gupta R (2023) Climate change and inequality: evidence from the United States. Sustainability 15(6):5322

Christou C, Gupta R, Jawadi F (2021) Does inequality help in forecasting equity premium in a panel of G7 countries? North Am J Econ Finance 57(C):101456

Ćorić B (2018) The long-run effect of economic disasters. Appl Econ Lett 25(5):296–299

Ćorić B (2021) Economic disasters: a new data set. Financ Res Lett 39:101612

Ćorić B (2022) Consumption disasters after World War II. University of Split, Mimeo

Ćoric B, Šimic V (2021) Economic disasters and aggregate investment. Emp Econ 61(6):3087–3124

de Haan J, Sturm J-E (2016) Finance and income inequality: a review and new evidence. Eur J Polit Econ 50:171–195

Farhi E, Gabaix X (2016) Rare disasters and exchange rates. Quart J Econ 131(1):1–52

Gupta R, Pierdzioch C, Vivian AJ, Wohar ME (2019a) The predictive value of inequality measures for stock returns: an analysis of long-span UK data using quantile random forests. Financ Res Lett 29(C):315–322

Gupta R, Suleman MT, Wohar ME (2019b) Exchange rate returns and volatility: the role of time-varying rare disaster risks. Eur J Finance 25(2):190–203

Gupta R, Suleman MT, Wohar ME (2019c) The role of time-varying rare disaster risks in predicting bond returns and volatility. Rev Financial Econ 37(3):327–340

Jordà Ò (2005) Estimation and inference of impulse responses by local projections. Am Econ Rev 95(1):161–182

Maarek P, Orgiazzi E (2013) Currency crises and the labour share. Economica 80(319):566–588

Novokmet F (2021) Long-run inequality in Communist countries: before, during and after. In: Douarin E, Havrylyshyn O (eds) The Palgrave handbook of comparative economics. Palgrave Macmillan, Cham

Sakai Y, Estudillo JP, Fuwa N, Higuchi Y, Sawada Y (2017) Do natural disasters affect the poor disproportionately? Price Change Welfare Imp Aftermath Typhoon Milenyo Rural Philippines World Dev 94:16–26

Sedova B, Kalkuhl M, Mendelsohn R (2020) Distributional impacts of weather and climate in rural India. Econ Disasters Clim Change 4(1):5–44

Sheng X, Chisadza C, Gupta R, Pierdzioch C (2023) Climate shocks and wealth inequality in the UK: evidence from monthly data. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-023-27342-1

Solt F (2020) Measuring income inequality across countries and over time: the standardized world income inequality database. Soc Sci Q 101(3):1183–1199

Teulings CN, Zubanov N (2014) Is economic recovery a Myth? Robust estimation of impulse responses. J Appl Economet 29(3):497–514

Thiede BC (2014) Rainfall shocks and within-community wealth inequality: evidence from rural Ethiopia. World Dev 64:181–193

Wachter JA (2013) Can time-varying risk of rare disasters explain aggregate stock market volatility? J Financ 68(3):987–1035

Acknowledgment

We would like to thank the Editor, Professor George Hondroyiannis, and an anonymous referee for many helpful comments. However, any remaining errors are solely ours.

Funding

Open access funding provided by University of Pretoria. This work was supported by Croatian Science Foundation [IP-2020-02-9710].

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

None.

Human and animals rights statement

Not Applicable.

Informed consent

Not Applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ćorić, B., Gupta, R. Economic disasters and inequality: a note. Econ Change Restruct 56, 3527–3543 (2023). https://doi.org/10.1007/s10644-023-09543-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-023-09543-3