Abstract

In this paper, we first show the importance of financial inclusion for poor households for the economy. We also study the impact of the social planner financial policy that helps offset entrepreneurs’ credit risk exposure and guarantee greater inclusion. We estimate one-country GIMF-DSGE model with financial accelerator based on Ivory Coast’s economy, which is a developing country where financial inclusion for households and businesses still remains a major challenge for policy makers. First, in response to monetary, technology and investment demand shocks, poor households’ consumption rises. This results in an increase in total consumption and output. Further, the quantitative magnitudes of these aggregates are higher when poor households have access to credit. Second, while the planner policy is zero in normal times, it rises during the financial crisis. Further, the macroprudential policy works to reduce the external finance premium. As a result, bank credit and investment increase. Without monitoring, entrepreneurs are subject to risk, whereas introducing the regulation mitigates their credit risk exposure, as leverage declines. Lastly, regulation usefully complements monetary policy and is realized to be welfare improving.

Similar content being viewed by others

Notes

The statistics and information come from the National Institute of Statistics and the Ministry of Finances and Economy www.finances.gouv.ci of Ivory Coast, respectively.

The number of banks and financial institutions, insurance companies, and the proportion of market capitalization are provided by Central Bank of West African States (BCEAO), www.bceao.int; the Association of Insurance Companies of Ivory Coast (ASACI), www.asaci.net, and World Bank statistics, respectively.

\(D_{t}^{j} \, {\text{and}} \, B_{t}\) are gross variables and \(d_{t}^{j} \, {\text{and}} \, b_{t}\) are their real counterparts, where \(b_{t} = B_{t} /P_{t}\) and \(d_{t}^{j} = D_{t}^{j} /P_{t}\).

For more details about derivatives, see Kumhof et al. (2010).

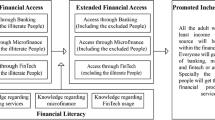

This implies financial inclusion of poor households. Indeed, financial inclusion are three main dimensions, namely formal account, savings and borrowing. In this paper, we consider formal borrowing, referring to the fact that individuals in particular low-income households borrowed from a financial institution (banks in our model) in the past 12 months according to the Global Findex of World Bank.

When liquidity-constrained households have not access to loans, their budget constraint is introduced as follows: \(P_{t}^{R} C_{t}^{{{\text{LIQ}}}} + P_{t}^{C} C_{t}^{{{\text{LIQ}}}} \tau_{C,t} = w_{t} l_{t}^{{{\text{LIQ}}}} \left( {1 - \tau_{L,t} } \right) + \tau_{T,t}^{{{\text{LIQ}}}} + {\Upsilon }_{t}^{{{\text{LIQ}}}} - \tau_{t}^{{{\text{ls}},{\text{LIQ}}}} .\)

The Lagrange functions for both households are set in Appendix B.

For simplicity, we drop the imports part in this paper, including raw-materials sector.

We assume T=1 in this paper.

\(\lambda_{t}^{J} 1\) is set to 1 at the steady state.

See the financial contract’s derivation in Appendix A.

According to Bernanke and Gertler (1989), the external finance premium is the difference between the cost to borrowers of raising external finance and the opportunity cost of using internal funds (or net worth).

In these models, impatient households are the poor, while patient households are the wealthy. The first ones borrow from the latter who are savers and lenders.

IMF: International Monetary Fund.

According to Global Findex Database of World Bank, Demirgüç-Kunt et al. (2018), the share of financially included (OLG) households is 41% in the population of Ivory Coast. In particular, the dimension of financial inclusion we consider in this work is the accessibility to bank credits.

These taxes are applicable in the 2020 tax regime in Ivory Coast.

Some important reasons include not enough collateral for borrowing and high interest rates.

See Bigio and d’Avernas (2021).

Data about equity are provided by Economic Policy Analysis Unit (CAPEC) of Ivorian Social and Economic Research Center (CIRES).

See https://courses.edx.org, for transaction and relationship lending.

\(\Upsilon \;\;{\text{and}}\; \tau^{ls}\) are both set to 4% as in the 2020 tax regime in Ivory Coast.

References

Alfaro L, Chanda A, Kalemli-Ozcan S, Sayek S (2010) Does foreign direct investment promote growth? Exploring the role of financial markets on linkages. J Dev Econ 91:242–256

Angelucci M, Karlan D, Zinman J (2015) Microcredit Impacts: evidence from a randomized microcredit program placement experiment by Compartamos Banco: dataset. Am Econ J 7(1):151–182. https://doi.org/10.1257/app.20130537

Annim SK, Frempong RB (2018) Effects of access to credit and income on dietary diversity in Ghana. Food Secur 10(6):1649–1663

Aportela F (1999) Effect of financial access on savings by low-income people. Banco de Mexico

Bacchetta P, Gerlach S (1997) Consumption and credit constraints: international evidence. J Monet Econ 40:207–238. https://doi.org/10.1016/S0304-3932(97)00042-1

Baharumshah AZ, Slesman L, Devadason ES (2015) Types of foreign capital inflows and economic growth: new evidence on role of financial markets. J Int Devel. https://doi.org/10.1002/jid.3093

Banerjee AV, Newman AF (1993) Occupational choice and the process of development. J Polit Econ 101:2

Banerjee A, Karlan D, Zinman J (2015) Six randomized evaluations of microcredit: introduction and further steps. Am Econ J Appl Econ 7(1):1–21. https://doi.org/10.1257/app.20140287

Beck T (2016) Financial inclusion in Africa. Cass Business School, London

Bernanke B, Gertler M (1989) Agency costs, net worth and business fluctuations. Am Econ Rev 79:14–31

Bernanke BS, Gertler M, Gilchrist S (1999) The financial accelerator in a quantitative business cycle framework. In: Taylor JB, Woodford M (eds) Handbook of macroeconomics. Elsevier, Amsterdam

Bianchi J (2011) Overborrowing and systematic externalities in the business cycle. American Economic Review

Blanchard OJ (1985) Debt, deficits, and finite horizons. J Polit Econ 93:223–247

Brune L, Giné X, Goldberg J, Yang D (2016) Facilitating savings for agriculture: field experimental evidence from Malawi. Econ Dev Cult Change 64(2):187–220

Buera F, Kaboski J, Shin Y (2012) The macroeconomics of microfinance. In: NBER working papers, 17905, National Bureau of Economic Research, Inc. https://doi.org/10.3386/w17905.

Chakrabarty M, Mukherjee S (2021) Financial inclusion and household welfare: an entropy-based consumption diversification approach. Eur J Devel Res. https://doi.org/10.1057/s41287-021-00431-y

Christiano L, Motto R, Rostagno M (2007) Financial factors in business cycles. In: Working paper

Crépon B, Devoto F, Duflo E, Pariente W (2014) Estimating the impact of microcredit on those who take it up: evidence from a randomized experiment in Morocco.

Dejong DN, Dave C (2011) Structural macroeconometrics, 2nd edn. Princeton University Press

Demirgüç-Kunt A, Klapper L, Singer D, Ansar S, Hess J (2018) The global findex database 2017: measuring financial inclusion and the fintech revolution. World Bank, Washington

Foster A, Geanakoplos J (2009) Leverage cycles and the anxious economy. Am Econ Rev 94:1211–1244

Geanakoplos JD (2010) Solving the present crisis and managing the leverage cycle. In: Cowles foundation discussion paper No.1751, https://doi.org/10.2139/ssrn.1539488.

Gilchrist S, Ortiz A, Zakrasjek E (2009) Credit risk and the macroeconomy: evidence from an estimated DSGE model. Boston University, Mimeo

Giroud X, Mueller H (2017) Firm leverage, consumer demand and employment losses during the great recession. Q J Econ 132(1):271–316. https://doi.org/10.1093/qje/qjw035

Guerrieri L, Iacoviello M (2015) OccBin: a toolkit for solving dynamic models with occasionally binding constraints easily. J Monet Econ 70:22–38

Guerrieri L, Iacoviello M (2017) Collateral constraints and macroeconomic asymmetries. J Monet Econ 90(2017):28–49

Jappelli T, Pagano M (1989) Consumption and capital market imperfections: an international comparison. Am Econ Rev 79(5):1088–1105

Jayaratne J, Phillip ES (1996) The finance-growth nexus: evidence from bank branch deregulation. Quart J Econ 111(August):639–670

Judd KL (1998) Numerical methods in economics. MIT Press, Cambridge

Judd KL, Guu SM (1997) Asymptotic methods for aggregate growth models. J Econ Dyn Control 21:1025–1042

Justiniano A, Primiceri GE, Tambalotti A (2015) Household leveraging and deleveraging. Rev Econ Dyn 18(1):3–20

Kaboski JP, Townsend RM (2012) The Impact of credit on village economies. Am Econ J Appl Econ 4(2):98–133. https://doi.org/10.1257/app.4.2.98

Kamps C (2004) New estimates of government net capital stocks for 22 OECD countries 1960–2001. In: IMF working paper series, WP/04/67

Kannan P, Rabanal P, Scott A (2009) Macroeconomic patterns and monetary policy in the run-up to asset price busts. In: IMF working paper 09/252.

Karlan D, Zinman J (2009) Expanding credit access: using randomized supply decisions to estimate the impacts. Rev Finan Stud 23(1):433–464. https://doi.org/10.1093/rfs/hhp092

King R, Levine R (1993) Finance and growth: Schumpeter might be right. Quart J Econ 108:717–737

Korinek A (2009) Systematic risk-taking amplification effects, externalities and regulatory responses. University of Maryland, Mimeo

Kumhof M, Laxton D, Muir D, Mursula S (2010) The global integrated monetary and fiscal model (GIMF)-theoretical structure. In: International monetary fund: WP/10/34. SSRN-id1555486 GIMF

Levine R (2005) Finance and growth: theory and evidence. In: Aghion P, Durlauf SN (eds) Handbook of economic growth. Elsevier, Amsterdam, pp 865–934

Levine R, Zervos S (1998) Stock markets, banks, and economics growth. Am Econ Rev 88(June):537–558

Lorenzoni G (2008) Inefficient credit booms. Rev Econ Stud 75:809–833

Lubik TA, Schorfheide F (2004) Testing for indeterminacy: an application to US monetary policy. Am Econ Rev

Ludvigson S (1999) Consumption and credit: a model of time-varying liquidity constraints. Rev Econ Stat 81(3):434–447

Maih J (2015) Efficient perturbation methods for solving regime-switching DSGE model. In: Norges bank working paper, available at SSRN: https://ssrn.com/abstract=2602453. https://dx.doi.org/https://doi.org/10.2139/ssrn.2602453.

Mallick D, Zhang Q (2019) The effect of financial inclusion On household welfare in China. MPRA_paper_95786.pdf

McKinnon RI (1973) Money and capital in economic development. The Brookings Institution, Washington

Mehrotra AN, Yetman J (2015) Financial inclusion - issues for central banks. In: BIS quarterly review march 2015, Available at SSRN: https://ssrn.com/abstract=2580310.

Miao J, Wang P (2010) Credit Risk and Business Cycles. https://doi.org/10.2139/ssrn.1707129

Nikolov K (2009) Is private leverage excessive? LSE, Mimeo

Ozili PK (2020) Financial inclusion research around the world: a review. Forum Soc Econ. https://doi.org/10.1080/07360932.2020.1715238

Rajan RG, Zingales L (1998) Financial dependence and growth. Am Econ Rev 88(June):559–586

Romer P (1986) Increasing return and long-run growth. J Dev Econ 39:5–30

Roubini N, Sala-i-Martin X (1992) Financial repression and economic growth. J Dev Econ 39:5–30

Schmitt-Grohe S, Uribe M (2004) Solving dynamic general equilibrium models using a second-order approximation of the policy function. J Econ Dyn Control 28:755–775

Schumpeter JA (1911) Theory of economic development. Havard University Press

Somville V, Vandewalle L (2016) Saving by default: evidence from a field experiment in rural India. Graduate Institute of International and Development Studies Geneva Working Paper Series, No. HEIDWP02–2016.

Stein JC (2012) Monetary policy as financial stability regulation. Q J Econ 127(1):57–95. https://doi.org/10.1093/qje/qjr054

Suri T, Jack W (2016) The long-run poverty and gender impacts of mobile money. Science 354(6317):1288–1292

Zhang Q, Posso A (2019) Thinking Inside the box: a closer look at financial inclusion and household income. J Dev Stud 55(7):1616–1631

Acknowledgements

We thank so much Professors NAKAMURA Tamotsu (our Advisor) and NISHIYAMA Shin-Ichi for helpful comments. Likewise, we are grateful to Junior MAIH for teaching us courses about RISE software.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: The financial contract

The bank’s zero profit or participation constraint in nominal term is given by:

This relationship stipulates that the stochastic payoff to lending must equal the non-stochastic payment to depositors. This cash flow is based on the return \({\text{Ret}}_{k,t} w\) on capital investment \(Q_{t} \overline{K}_{t + 1} \left( j \right),\) but multiplied by the factor \(\left( {1 - \mu_{t + 1} } \right)\) to reflect a proportional bankruptcy cost \(\mu_{t + 1}\).

Recall that

and

Therefore, the participation constraint can be rewritten as follows:

Note that capital earnings are given by \(Q_{t} \overline{K}_{t + 1} \left( j \right){\text{Ret}}_{k,t}\).

The lender’s gross share in capital earnings is defined as:

while his monitoring costs share in capital earnings is given by \(\mu_{t + 1} G\left( {\overline{w}_{t + 1} } \right),\)where

The lender’s net share in capital earnings is therefore \({\Gamma }\left( {\overline{w}_{t + 1} } \right) - \mu_{t + 1} G\left( {\overline{w}_{t + 1} } \right).\)

The entrepreneur’s share in capital earnings on the other hand is given by:

Let \(\lambda_{t}\) be the participation constraint, then the entrepreneur’s maximization problem is:

By dividing through \({\check{i}}_{t} N_{t} \left( j \right)\) and expressing in normalized terms and real returns, the previous equation becomes:

The expectation operator means that the entrepreneur is risk-neutral and absorbs all aggregate risk, so that his realized profits depend on time \(t + 1\) shocks.

Define \({\Gamma }_{t + 1} = {\Gamma }\left( {\overline{w}_{t + 1} } \right),\) \(G_{t + 1} = G\left( {\overline{w}_{t + 1} } \right),\) \({\Gamma }_{t + 1}^{^{\prime}} = \partial {\Gamma }_{t + 1} /\partial \overline{w}_{t + 1}\) and \({\text{G}}_{t + 1}^{^{\prime}} = \partial {\text{G}}_{t + 1} /\partial \overline{w}_{t + 1} .\)

The first-order-condition with respect to \(\overline{w}_{t + 1} :\)

implying

Deriving by \(\overline{K}_{t + 1} \left( j \right)\), we obtain the condition for the optimal loan contract:

The normalized lender’s zero profit condition is therefore

As in BGG, the bound on \({\Gamma }\left( {\overline{w}} \right)\) is observed from the fact that both \({\Gamma }\left( {\overline{w}} \right) = E\left( {w{|}w < \overline{w}} \right)\Pr \left( {w < \overline{w}} \right) + \overline{w}{\text{Pr}}\left( {w \ge \overline{w}} \right)\) and \(1 - {\Gamma }\left( {\overline{w}} \right) = \left( {E\left( {w{|}w \ge \overline{w}} \right) - \overline{w}} \right){\text{Pr}}\left( {w \ge \overline{w}} \right)\) are positive. The limits on \({\Gamma }\left( {\overline{w}} \right) - \mu G\left( {\overline{w}} \right)\) can be seen by recognizing that \(G\left( {\overline{w}} \right) = E\left( {w{|}w < \overline{w}} \right){\text{Pr}}(w < \overline{w})\) so that \(\mathop {\lim }\limits_{{\overline{w} \to \infty }} G\left( {\overline{w}} \right) = E\left( w \right) = 1.\)

Appendix B: Optimization problem of households and manufacturers

Appendix B presents OLG households and manufacturers optimization problem in nominal terms. Thereby, the Lagrange function for households is denoted by:

where \(u_{t} = \left( {\frac{1}{1 - \gamma }\left( {C_{t}^{{{\text{OLG}}}} )^{\eta } \left( {S_{t}^{L} - l_{t}^{{{\text{OLG}}}} } \right)^{1 - \eta } } \right)} \right)^{1 - \gamma } ,\) and \(\lambda_{a,t} = {\Lambda }_{t} P_{t}\).

The first-order conditions are shown in households’ Sect. 2.1.

We note that LIQ households’ optimization problem is similar to that of OLG.

The next sets manufacturers’ optimization problem. The Lagrange for manufacturers is defined as follows:

The variable \({\Lambda }_{t}^{J}\) equals the nominal marginal cost of producing one more unit of good \(i\) in sector \(j,\) where \({\uplambda }_{t}^{J} = {\Lambda }_{t}^{J} /P_{t}\). The first-order conditions with respect to \(P_{t}^{J} \left( i \right)\) and labor demand \(U_{t} \left( i \right)\) yield Eqs. (35) and (36), respectively.

Appendix C: The remainder of the model

3.1 C1: Unions

There is a continuum of unions indexed by \(i \in \left[ {0,1} \right]\). Unions buy labor from households and sell labor to manufacturers. They are perfectly competitive in their input market and monopolistically competitive in their output market. Their wage setting is subject to nominal rigidities. We first analyze the demands for union output and then describe their optimization problem.

Demand for unions’ labor output varieties originate from manufacturing firms \(z \in \left[ {0,1} \right]\) in sector \(J\). The demand for union labor by firm \(z\) in sector \(J\) is given by a CES production function with time-varying elasticity of substitution \(\sigma_{{U_{t} }} ,\)

where \(U_{t} \left( {z,i} \right)\) is the demand by firm \(z\) for the variety supplied by union \(i.\) Given imperfect substitutability between the labor supplied by different unions, they have market power regarding manufacturing firms. Their demand functions are given by:

where \(V_{t} \left( i \right)\) is the wage charged to employers by unions \(i\) and \(V_{t}\) is the aggregate wage paid by employers which is given by:

The demand (95) can be aggregated over firms \(z\) and sector \(j\). to obtain:

where \(U_{t}\) is aggregate labor demand by all manufacturing firms. Sticky wage inflation takes the form:

The level of world technology enters as scaling factor in (99) as otherwise these costs would become insignificant overtime. The stochastic wage markup of union wages over household wages is set as: \(\mu_{t}^{U} = \frac{{\sigma_{{U_{t} }} }}{{\left( {\sigma_{{U_{t} - 1}} } \right)}}\).

The objective function of unions is therefore:

subject to labor demand (98) and adjustment costs (99). The first-order condition for this problem rescaled by technology is therefore:

where \(\pi_{t}^{V} = \frac{{V_{t} }}{{V_{t - 1} }}.\)

Real dividends from union organization, dominated in terms of final output, are redistributed lump-sum to households in proportion to their share in aggregate labor supply. After rescaling they take the form:

We also have \({\raise0.7ex\hbox{${v_{t} }$} \!\mathord{\left/ {\vphantom {{v_{t} } {v_{t - 1} }}}\right.\kern-0pt} \!\lower0.7ex\hbox{${v_{t - 1} }$}} = \frac{{{\raise0.7ex\hbox{${V_{t} }$} \!\mathord{\left/ {\vphantom {{V_{t} } {P_{t} T_{t} }}}\right.\kern-0pt} \!\lower0.7ex\hbox{${P_{t} T_{t} }$}}}}{{{\raise0.7ex\hbox{${V_{t - 1} }$} \!\mathord{\left/ {\vphantom {{V_{t - 1} } {P_{t - 1} T_{t - 1} }}}\right.\kern-0pt} \!\lower0.7ex\hbox{${P_{t - 1} T_{t - 1} }$}}}},\) so that:

Finally, the labor market-clearing condition is given by:

3.2 C2: Distributors

Distributors produce domestic final output \(Z_{t}^{D}\). They buy domestic tradable from domestic manufacturers, and foreign tradable from import agents. They also use the stock of public infrastructure free of a user charge. Distributors sell their final output composite to consumption goods producers \(Y_{t}^{{{\text{CH}}}}\), investment goods producers \(Y_{t}^{{{\text{IH}}}}\) and final goods import agents in foreign countries (the latter is excluded from this work). They are perfectly competitive in both their output and input markets.

The tradable composite \(Y_{t}^{T}\) is produced by combining foreign produced tradable \(Y_{t}^{{{\text{TF}}}}\) with domestically produced tradable \(Y_{t}^{{{\text{TH}}}} ,\) in a CES technology with elasticity of substitution \(\xi_{T}\).

The sub-production function for tradable then has the following form:

To prevent an excessive responsiveness of international trade to real exchange rate movements in the very short term, the model introduces adjustment costs \(G_{F,t}^{T} ,\) that makes it costly to vary the share of foreign produced tradable in total tradable production \({\raise0.7ex\hbox{${Y_{t}^{{{\text{TF}}}} }$} \!\mathord{\left/ {\vphantom {{Y_{t}^{{{\text{TF}}}} } {Y_{t}^{T} }}}\right.\kern-0pt} \!\lower0.7ex\hbox{${Y_{t}^{T} }$}}\) relative to the value of that share in the aggregate distribution sector in the previous period \({\raise0.7ex\hbox{${Y_{t - 1}^{{{\text{TF}}}} }$} \!\mathord{\left/ {\vphantom {{Y_{t - 1}^{{{\text{TF}}}} } {Y_{t - 1}^{T} }}}\right.\kern-0pt} \!\lower0.7ex\hbox{${Y_{t - 1}^{T} }$}}\). Thus,

We obtain the following first-order conditions for optimal input choice:

The domestic tradable share parameter is:

where \(Y_{t}^{{T,{\text{pot}}}}\) stands for long-run or potential output of tradable composite \(Y_{t}^{T} .\)

The real marginal cost of \(Z_{t}^{D}\) is denoted by \(P_{t}^{{{\text{DH}}}} ,\) while the real marginal cost of \(Y_{t}^{T}\) is \(P_{t}^{T} .\) After expressing prices in terms of the numeraire, and after rescaling by technology and population, we obtain the normalized production function and the following first-order condition:

The term \(S\) is a technology scale factor that can be used to normalize steady-state technology to one, \(\left( {\overline{K}_{t}^{G1} } \right){ }^{\alpha G1} \left( {\overline{K}_{t}^{G2} } \right){ }^{\alpha G2} S = 1.\) The stocks of public capital \(K_{t}^{G1}\) and \(K_{t}^{G2}\) which are identical for all firms and provided free of charge.

The rescaled aggregate dividends of distributors (equal to zero in equilibrium) are:

Finally, the market-clearing conditions for this sector is given as:

3.3 C3: Investment goods producers

Investment goods producers buy domestic final output \(Y_{t}^{{{\text{IH}}}}\) directly from domestic distributors, and foreign final output \(Y_{t}^{{{\text{IF}}}}\) indirectly via import agents. They sell the final composite \(Z_{t}^{I}\) to capital goods producers, to the government, and back to other investment goods producers for the purpose of fixed and adjustment costs. There is a continuum of investment goods producers indexed by \(i \in \left[ {0,1} \right].\) They are perfectly competitive in their input markets and monopolistically competitive in their output market. Their price setting is subject to nominal rigidities.

Demand for investment goods varieties comes from multiple sources. Let \(z\) be an individual purchaser of investment goods. Then, his demand \(D_{t}^{I} \left( z \right)\) is for a CES composite of investment goods varieties \(i,\) with time-varying elasticity of substitution \(\sigma_{{I_{t} }} .\)

with associated demand

where \(P_{t}^{I} \left( i \right)\) is price of variety \(i\) of investment goods output, and \(P_{t}^{I}\) is the aggregate investment goods price level given by:

Furthermore, the total demand facing a producer of investment goods variety \(i\) can be obtained by aggregating over all sources of demand \(z\). We obtain:

where \(D_{t}^{I} \left( i \right)\) and \(D_{t}^{I}\) remain to be specified by way of a market-clearing condition for investment goods output. The exogenous and stochastic price markup is given by: \(\mu_{t}^{I} = \frac{{\sigma_{{I_{t} }} }}{{\sigma_{{I_{t} }} - 1}}.\)

The technology of investment goods producers consists of a CES production function that uses domestic final output \(Y_{t}^{{{\text{IH}}}} \left( i \right)\) and foreign final output imported via import agents \(Y_{t}^{{{\text{IF}}}} \left( i \right)\), with a share coefficient for domestic final output of \(\alpha_{{H_{t} }}^{I}\) and an elasticity of substitution \(\xi_{I} .\) The model introduces adjustment costs \(G_{F,t}^{I} ,\) that makes it costly to vary the share of foreign produced tradable in total tradable production \({\raise0.7ex\hbox{${Y_{t}^{{{\text{IF}}}} \left( i \right)}$} \!\mathord{\left/ {\vphantom {{Y_{t}^{{{\text{IF}}}} \left( i \right)} {Z_{t}^{I} \left( i \right)}}}\right.\kern-0pt} \!\lower0.7ex\hbox{${Z_{t}^{I} \left( i \right)}$}}\) relative to the value of that share in the aggregate distribution sector in the previous period \({\raise0.7ex\hbox{${Y_{t - 1}^{{{\text{IF}}}} }$} \!\mathord{\left/ {\vphantom {{Y_{t - 1}^{{{\text{IF}}}} } {Z_{t - 1}^{I} }}}\right.\kern-0pt} \!\lower0.7ex\hbox{${Z_{t - 1}^{I} }$}}\). We have therefore:

where \(Z_{t}^{{I,{\text{pot}}}}\) stands for long-run or potential output of investment goods \(Z_{t}^{I} .\)

We obtain the following first-order conditions for optimal input choice:

The real costs that have to be paid out of investment goods output

Fixed costs are given by:

It is assumed that the producer pays out each period’s nominal net cash flow as dividends \(D_{t}^{I} \left( i \right).\) The objective function is:

subject to product demands (119), and given marginal cost \(P_{t}^{{{\text{II}}}}\). We obtain the first-order condition for this problem, again using the fact that all firms behave identically in equilibrium. Using the equilibrium condition \(D_{t}^{I} = Z_{t}^{I} .\) We get:

The rescaled (real) aggregate dividends of investment goods producers are:

Specifically, the net output of investment goods producers,

is converted to final output of investment goods \(Y_{t}^{I}\) using the technology:

where \(A_{t}^{I}\) is a stationary technology shock and \(T_{t}^{I}\) is a unit-root technology shock with zero trend growth. We define the relative price terms \(\tilde{P}_{t}^{I} = \frac{1}{{T_{t}^{I} }}\) and \({\check{P}}_{t}^{I} = \frac{1}{{A_{t}^{I} }}\). Competitive pricing means that the price of final investment goods equals:

The market-clearing condition for investment goods is given by:

3.4 C4: Consumption goods producers

Consumption goods producers buy domestic final output \(Y_{t}^{{{\text{CH}}}}\) directly from domestic distributors, and foreign final output \(Y_{t}^{{{\text{CF}}}}\) indirectly via import agents. They sell the final composite \(Z_{t}^{C}\) to capital goods producers, to the government, and back to other consumption goods producers for the purpose of fixed and adjustment costs. There is a continuum of consumption goods producers indexed by \(i \in \left[ {0,1} \right].\) They are perfectly competitive in their input markets and monopolistically competitive in their output market. Their price setting is subject to nominal rigidities.

Demand for consumption goods varieties comes from multiple sources. Let \(z\) be an individual purchaser of consumption goods. Then, his demand \(D_{t}^{C} \left( z \right)\) is for a CES composite of consumption goods varieties \(i,\) with time-varying elasticity of substitution \(\sigma_{{C_{t} }} .\)

with associated demand

where \(P_{t} \left( i \right)\) is price of variety \(i\) of investment goods output, and \(P_{t}\) is the aggregate consumption goods price level given by:

Furthermore, the total demand facing a producer of consumption goods variety \(i\) can be obtained by aggregating over all sources of demand \(z\). We obtain:

where \(D_{t}^{C} \left( i \right)\) and \(D_{t}^{C}\) remain to be specified by way of a market-clearing condition for consumption goods output. The exogenous and stochastic price markup is given by: \(\mu_{t}^{C} = \frac{{\sigma_{{C_{t} }} }}{{\sigma_{{C_{t} }} - 1}}\)

The technology of consumption goods producers consists of a CES production function that uses domestic final output \(Y_{t}^{{{\text{CH}}}} \left( i \right)\) and foreign final output imported via import agents \(Y_{t}^{{{\text{CF}}}} \left( i \right)\), with a share coefficient for domestic final output of \(\alpha_{{H_{t} }}^{C}\) and an elasticity of substitution \(\xi_{C} .\) the model introduces adjustment costs \(G_{F,t}^{C} ,\) that makes it costly to vary the share of foreign produced tradable in total tradable production \({\raise0.7ex\hbox{${Y_{t}^{{{\text{CF}}}} \left( i \right)}$} \!\mathord{\left/ {\vphantom {{Y_{t}^{{{\text{CF}}}} \left( i \right)} {Z_{t}^{C} \left( i \right)}}}\right.\kern-0pt} \!\lower0.7ex\hbox{${Z_{t}^{C} \left( i \right)}$}}\) relative to the value of that share in the aggregate distribution sector in the previous period \({\raise0.7ex\hbox{${Y_{t - 1}^{{{\text{CF}}}} }$} \!\mathord{\left/ {\vphantom {{Y_{t - 1}^{{{\text{CF}}}} } {Z_{t - 1}^{C} }}}\right.\kern-0pt} \!\lower0.7ex\hbox{${Z_{t - 1}^{C} }$}}\). We have therefore:

where \(Z_{t}^{{C,{\text{pot}}}}\) stands for long-run or potential output of investment goods \(Z_{t}^{C} .\)

We obtain the following first-order conditions for optimal input choice:

The real costs that have to be paid out of consumption goods output:

Fixed costs are given by:

It is assumed that the producer pays out each period’s nominal net cash flow as dividends \(D_{t}^{C} \left( i \right).\) The objective function is:

subject to product demands (140) and given marginal cost \(P_{t}^{{{\text{CC}}}}\). We obtain the first-order condition for this problem, again using the fact that all firms behave identically in equilibrium. Using the equilibrium condition \(D_{t}^{C} = Z_{t}^{C} .\) We get:

The rescaled (real) aggregate dividends of consumption goods producers are:

The market-clearing condition for consumption goods yields:

3.5 C5: Retailers

There is a continuum of retailers indexed by \(i \in \left[ {0,1} \right].\) Retailers use final output purchased from consumption goods producers, and sell it to households. They are perfectly competitive in their input markets and monopolistically competitive in their output market. Their price setting is subject to real rigidities in that they find it costly to rapidly adjust their sales volume to changing demand conditions.

The raw-materials sector is excluded from our model, in that the marginal cost of raw-materials \(P_{t}^{C} = 1.\)

Demand for the output varieties \(C_{t} \left( i \right)\) supplied by retailers comes from households as:

The quantity adjustment costs take the form:

It is assumed that each retailer pays out each period’s nominal net cash flow as dividends \(D_{t}^{R} \left( i \right).\) The objective function of retailers is:

subject to demands (155) and adjustment costs (156). The first-order condition of this problem, after dropping firm specific subscripts, and letting \(\mu_{t}^{R} = \frac{{\sigma_{{R_{t} }} }}{{\sigma_{{R_{t} }} - 1}}\) rescaling by technology and population has the form:

The real dividends and rescaled adjustment costs of this sector are given by:

3.6 C6: Government

The government uses consumption goods \(Y_{t}^{GC}\) and investment goods \(Y_{t}^{GI}\) to produce government output \(Z_{t}^{G}\) according to a CES production function with consumption goods share parameter \(\alpha_{GC}\) and an elasticity of substitution \(\xi_{G} :\)

Denoting the marginal cost of producing \(Z_{t}^{G}\) by \(P_{t}^{{{\text{ZG}}}} ,\) and normalized by technology and population, we obtain the normalized version (161) and the following standard input demands:

We allow for unit-root shocks to the relative price of government output. In particular, the output of government goods \(Z_{t}^{G}\) is converted to final output of government goods \(Y_{t}^{G}\) using the technology:

where \(T_{t}^{G}\) is a unit-root technology shock with zero trend growth. We define the exogenous and stochastic relative price as \(\tilde{P}_{t}^{G} = \frac{1}{{T_{t}^{G} }}\). Then competitive pricing means that the final price of government output equals:

Demand for government \(G_{t}\) comes from government consumption and investment:

and the market-clearing condition is given by \(G_{t} = Y_{t}^{G} ,\) and thus by:

Government investment and consumption spending \(G_{t} = G_{t}^{{{\text{cons}}}} + G_{t}^{{{\text{inv}}}}\) represents a demand for government output. Both types of government spending are exogenous and stochastic. Government investment spending has a critical function in this economy since it increases the stock of publicly provided infrastructure capital \(K_{t}^{G1} ,\) the evolution of which is, after rescaling by technology and population given by:

where \(\delta_{G1}\) is the depreciation rate of public capital. Government consumption accumulates a second productive capital stock:

The government’s policy rule for transfers partly compensates for the lack of asset ownership of LIQ agents by redistributing a small fraction of OLG agents’ dividend income receipts to LIQ agents. Specifically, dividends of the retail and union sectors are redistributed in proportion to LIQ agents’ share in consumption and labor supply, while the redistributed share of dividends in the remaining sectors is \(\iota ,\) which is calibrated as half the share of LIQ agents.Footnote 21

Finally, fiscal instruments can be expressed by:

\(\tau_{C,t} ,\) \(\tau_{k,t}\) and \(\tau_{L,t}\) stand for consumption, corporate capital income and labor income tax rates, respectively. At the steady-state \(d^{{{\text{ctax}}}} = d^{{{\text{ktax}}}} = 0\).

The sources of real government tax revenue are labor income taxes \(\tau_{L,t} w_{t} L_{t} ,\) consumption taxes \(\tau_{C,t} P_{t}^{C} C_{t} ,\) taxes on the return to capital \(\tau_{k,t} \left[ {r_{k,t} - \delta P_{t} q_{t} } \right]\overline{K}_{t}\) and lump-sum taxes \(P_{t} \tau_{t}^{ls}\). Thus, the aggregate real tax variable is defined as:

Finally, the government issues nominally non-contingent one period nominal debt \(B_{t}^{G}\) at the gross nominal rate \(i_{t} .\) The real government budget constraint is therefore:

where \(\tau_{t}^{ls} = \tau_{t}^{{{\text{ls}},{\text{OLG}}}} + \tau_{t}^{{{\text{ls}},{\text{LIQ}}}}\) and \({\Upsilon }_{t} = {\Upsilon }_{t}^{{{\text{OLG}}}} + {\Upsilon }_{t}^{{{\text{LIQ}}}}\).

3.7 C7: Monetary policy

Monetary policy follows a modified Taylor rule that features interest rate smoothing and which responds to deviations of one-year-ahead year-on year inflation \(\pi_{t + 1}\) from the inflation target \(\overline{\pi }_{t}\), the output gap, and deviations of current exchange rate depreciation from its long run value \(\overline{\varepsilon }_{t} = \frac{{\overline{\pi }_{t} }}{{\overline{\pi }_{t} }}.\) The term proxying the nominal interest rate \(r_{t}^{{{\text{eq}}}} \tilde{\pi }_{t}\) includes a geometric moving average of real interest rates containing the risk premium \(\xi_{t}^{{{\text{ma}}}} .\) We adopt the notation \(r_{t}^{{{\text{pre}}\xi }} = r_{t} /\left( {1 + \xi_{t}^{b} } \right)\) and \(\xi_{t} = \left( {1 + \xi_{t}^{b} } \right)\). We also allow for the inflation rate targeted by monetary policy, \(\tilde{\pi }_{t} ,\) to be a weighted average of current and one-year-ahead inflation, where the weights \(\delta_{{\overline{\pi }}}\) and \(1 - \delta_{{\overline{\pi }}}\) can be estimated along with the rest of the policy rule parameters. Then, the complete monetary rule is given by:

We redefine the moving average expression for potential output as a function of current and potential-weighted primary production (manufacturing production). Therefore:

Finally, the level of aggregate output is given by the following expression:

Appendix D: Perturbation techniques of DSGE model

The stochastic representation of the model is expressed as:

where \(c_{t}\) is \(\left( {n_{c} \times 1} \right)\) control variable, \(s_{t}\) is \(\left( {n_{s} \times 1} \right)\) state variable, and \(n_{c} \times n_{s} = n\). Moreover, \(s_{t}\) is decomposed as:\(s_{t} = \left[ {\begin{array}{*{20}c} {s_{t}^{1} } \\ {s_{t}^{2} } \\ \end{array} } \right],\) where \(s_{t}^{1}\) is an \(n_{s1} \times 1\) vector consisting of endogenous state variables (such as physical capital), \(s_{t}^{2}\) is an \(n_{s2} \times 1\) vector of exogenous state variables or shocks. \(s_{t}^{2}\) evolves as:

where \(\tilde{\mu }\) is an \(m \times m\) covariance matrix, \(\eta_{t + 1}\) is \({\text{iid}}\) with zero mean and covariance matrix \(I,\) \(v_{t + 1} = \tilde{\mu }\eta_{t + 1} ,\) and \(\sigma\) is a perturbation parameter. Note when \(\sigma = 0,\) stochastic innovations are turned off, and the evolution of the model is purely deterministic.

The solution we look for is of the form:

where

It is built through the use of Taylor Series expansions of (184) and (185) around the non-stochastic steady state of the model, defined as:

In addition,

since for \(\sigma = 0,\)

In short, we need to approximate (184) and (185) through Taylor Series expansions around \(\left( {c_{t} ,s_{t} ,\sigma } \right) = \left( {\overline{c},\overline{s},0} \right).\)

It is tricky to construct Taylor Series approximations in this case since \(c\left( {s_{t} ,\sigma } \right)\) and \(s\left( {s_{t} ,\sigma } \right)\) are unknown. This difficulty is overcome via application of the Implicit Function Theorem.

Accordingly, for the DSGE model expressed by (182) and (183), the purpose is to construct a \(k{\text{th}}\)-order Taylor Series approximation to the unknown solution (184) and (185).

Let \(\left[ {c_{s} } \right]_{a}^{i} ,\) \(\left[ {c_{{{\text{ss}}}} } \right]_{{{\text{ab}}}}^{i}\) denotes the \(\left( {i,a} \right)\) and \(\left( {i,{\text{ab}}} \right)\) elements of the \(n_{c} \times n_{s}\) and \(n_{c} \times n_{s}^{2}\) matrices:

\(\frac{{\partial c\left( {s_{t} ,\sigma } \right)}}{{\partial s_{t} }},\) \(\frac{{\partial^{2} c\left( {s_{t} ,\sigma } \right)}}{{\partial s\partial s^{\prime}}},\) evaluated at \(\left( {\overline{s},0} \right).\)

Likewise, let

From the first-order perturbation of the model solution, the second-order expansion is given by:

Accordingly, focusing on the above derivation of second-order approximations, the representation of \(c\left( {s_{t} ,\sigma } \right)\) is of the form:

Also, the representation of \(s\left( {s_{t} ,\sigma } \right)\) is of the form:

\(j = 1, \ldots ,n_{s} ;a,b = 1, \ldots ,n_{s} .\) Note that if \(\left[ {c_{s} } \right]_{a}^{i} ,\) \(\left[ {c_{{{\text{ss}}}} } \right]_{{{\text{ab}}}}^{i} ,\) and so on are the form of elasticities, then \(\left[ {s - \overline{s}} \right]_{a} ,\) and so on, represent logged deviations from steady states. That is, approximations (191) and (192) can be interpreted both linear and log-linear model representations.

To get these approximations, we replace \(\left( {c_{t} ,c_{t + 1} ,s_{t + 1} } \right)\) in (182) using (183) and (184), eliminating time subscripts yields:

To construct the linear approximation, the Implicit Function Theorem is used to obtain:

where the first expression represents a set of \(n \ldots n_{s}\) equalities, and the second a set of \(n\) equalities. Denoting

\(\left[ {fc_{t + 1} } \right]_{a}^{i} \left[ {c_{s} } \right]_{b}^{a} \left[ {s_{s} } \right]_{j}^{b} = \mathop \sum \limits_{a = 1}^{{n_{s} }} \mathop \sum \limits_{b = 1}^{{n_{s} }} \frac{{\partial f^{i} }}{{\partial c_{t + 1}^{a} }}\frac{{\partial c_{t}^{a} }}{{\partial s_{t}^{b} }}\frac{{s_{t}^{b} }}{{\partial s_{t}^{j} }},\) and so on, \(F_{s} \left( {\overline{s},0} \right) = 0\) is given by:

\(i = 1, \ldots ,n;j,b = 1, \ldots ,n_{s} ;a = 1, \ldots ,n_{c}\). The derivatives of \(f\left( \ldots \right)\) with respect to \(\left( {\overline{c},\overline{s}} \right)\) are known, so \(\left[ {F_{s} \left( {\overline{s},0} \right)} \right]_{j}^{i} = 0,\) is a system of \(n \ldots n_{s}\) quadratic equations in the \(n \ldots n_{s}\) unknown elements of \(c_{s} \left( \ldots \right)\) and \(s_{s} \left( \ldots \right)\).

Similarly, \(F_{\sigma } \left( {\overline{s},\sigma } \right) = 0,\) which is given by:

\(i = 1, \ldots ,n;a = 1, \ldots ,n_{c} ,b = 1, \ldots ,n_{s}\). Note that expressions embedding \(\eta_{t + 1}\) are eliminated by application of the expectations operator. Since these expressions are linear and homogeneous in \(\left[ {c_{\sigma } } \right]^{a}\) and \(\left[ {s_{\sigma } } \right]^{b} ,\) they equal zero.

Accordingly, by using (191) and (192), the first-order perturbations of the solution of the DSGE model, are given by:

where \(i = 1, \ldots ,n;j = 1, \ldots ,n_{s} ,\) with \(\left[ {c_{s} } \right]_{b}^{i}\) and \(\left[ {s_{s} } \right]_{b}^{j}\) obtained from (195). These are approximations to the solution.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Toure, T.A. Financial inclusion, entrepreneurs’ credit risk exposure and social planner financial policy. Econ Change Restruct 56, 2747–2799 (2023). https://doi.org/10.1007/s10644-023-09533-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-023-09533-5