Abstract

One of the most debated issues in migration economics regards the effects of remittances in receiving countries. In this paper, we test whether the economic complexity of a country is relevant for understanding the impact of remittances on new firms’ birth. We find evidence that the impact of real per capita remittances on new firms’ creation is inversely mediated by economic complexity. More (less) complex economies generate opportunities to found new firms which need high (low) funding. Since economic complexity is positively correlated with economic development, remittances are more likely to facilitate the establishment of new firms in less developed economies rather than in more advanced ones. We also examine the link between remittances and new firm creation for Africa, Asia, Europe, and Latin America and the Caribbean countries, finding very heterogeneous patterns. Hence, policy implications aiming at attracting remittances to create new firms should respond to the challenges posed by specific countries and be tailored to their peculiar needs. Countries of origin should build institutions and facilitate the creation of networks to bridge the diaspora abroad with their home country to increase awareness of new business opportunities. Policy initiatives could spur investment in the formal economy by making regulations less stringent, discouraging the use of remittances for consumption purposes, reducing informality, improving competition, reducing remittance transfer costs, and giving incentives to new firms created through remittances.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

International migration is a multifaceted phenomenon that includes forming large communities of people living abroad, resulting in diasporas. These diasporas significantly affect their countries of origin, including their social, political, and economic environments, as discussed by social scientists. Economists have investigated how diasporas impact the economy of the origin countries, particularly in terms of economic development (Bahar 2020). One of the most hotly debated issues is the role of remittances, with two opposing views: an optimistic one that sees positive effects and a pessimistic one that denies them (Clemens and McKenzie 2018; Naudé et al. 2017; Yang 2011). One less explored issue regarding the role of remittances in the economy is their impact on creating new firms. This paper aims to address this gap and examine whether the economic complexity of a country is relevant for understanding the impact of remittances on new firm creation. Our research is framed around three key points.

Firstly, in the last few decades, remittances have grown exponentially from $122 million in 2000 to $706 million in 2020, representing a more than fivefold increase (Fig. 1) (World Bank 2021). In many countries, remittances have become the primary financial flow, surpassing foreign direct investment and official development assistance flows. Furthermore, a significant portion of international remittances is transmitted through informal channels and goes unrecorded in official statistics.Footnote 1 The growing importance of remittances for investment purposes has drawn the attention of scholars in various fields, such as economics, management, entrepreneurship, and international development agencies (Ratha 2003, 2007). Although remittances are primarily used for non-investment purposes, such as food, housing, and education, they have been shown to stimulate new investments as a source of financial funds. In fact, many studies have suggested that remittances play a potentially positive role in new business creation. Single-country (e.g., Kiliç et al. 2009; Woodruff and Zenteno 2007) and cross-country studies (e.g., Cummings et al. 2021; Yavuz and Bahadir 2022) have found a positive correlation between remittances and new business activities. These studies hypothesize that remittances increase entrepreneurial activities by providing financial resources for new investments.

Secondly, new firms generate more employment than larger incumbent firms (Haltiwanger 2015), and this explains why policymakers try to design policy incentives to promote entrepreneurship (Ratinho et al. 2020). However, in many countries, particularly low-income ones, there is a lack of capital needed to start new firms. If remittances from migrants can provide an alternative and additional source of funding for new businesses, it could significantly benefit the economic and social well-being of these countries.

Thirdly, it is surprising that the connection between economic complexity and entrepreneurship has received little attention in the literature. According to Nguyen et al. (2021), existing empirical studies on the determinants of entrepreneurship tend to adopt either a micro- or macro-perspective, occasionally exploring the impact of government efficiency and institutional quality. However, they overlook the crucial role of the economy’s structure in entrepreneurship. In a recent survey, Ratinho et al. (2020) suggest that future research should investigate the relationship between economic structure and entrepreneurship.

In this paper, we make several contributions to the literature. Firstly, we show that the impact of real per capita remittances (REM) on new firm creation is inversely mediated by economic complexity. Since economic complexity is positively correlated with economic development, remittances are more likely to facilitate the establishment of new firms in less developed economies rather than in more advanced ones. Secondly, our sub-sample analysis for high and upper-middle-income (HUMI) countries on the one hand and low- and lower-middle-income (LLMI) countries on the other corroborates our hypothesis regarding the positive impact of REM on new limited liability company (NLLC) creation in LLMI countries and the negative impact in HUMI countries. Furthermore, in both sub-samples the economic complexity index (ECI) negatively mediates the impact of REM on NLLC. Thirdly, the sub-sample analysis at the regional level (Africa, Asia, Europe, Latin America and the Caribbean) reveals that in Africa, the average marginal effect of REM on NLLC creation is negative, despite increasing as ECI grows. In Asia, the average marginal effect of REM on NLLC creation is positive and decreases as ECI increases. In Europe, we do not find any positive or negative role, whereas, in Latin American and the Caribbean countries, we observe a consistently positive average marginal effect of REM on NLLC creation, which increases as ECI increases. Fourthly, based on our empirical results, we present and discuss some policy implications. Our findings suggest that economic policies should be tailored to the specific needs of each country to address the challenges they face. Policy initiatives such as reducing informality, improving competition, lowering remittance transfer costs, and introducing a special legal status for new firms created through remittances would facilitate the channelling of remittances toward new business creation. Additionally, institutions in origin countries should encourage the creation of diaspora networks to increase awareness of new business opportunities in their respective countries of origin.

Due to data availability constraints, we examine 78 countries from 2006 to 2020 in our empirical analysis, and we use a negative binomial regression model to estimate the relationship between remittances, economic complexity, and new firm creation. This estimation strategy is suitable because our dependent variable is an over-dispersed count variable.

The remainder of the paper is structured as follows. In the next section, we review the relevant literature. Section 3 provides a detailed account of our empirical investigation, and Sect. 4 presents our results. Policy implications are discussed in Sect. 5, and the paper concludes with Sect. 6.

2 Literature review

The literature on the impact of remittances on economic complexity, its effect on new firms, and the role of remittances in new firm creation are still in its early stages, with only a few studies available for citation. To our knowledge, the interrelated connections among remittances, economic complexity, and the creation of new firms have never been explored.

Saadi (2020) analyzed the impact of remittances on economic complexity and found that they have a significant positive effect on the complexity of products exported by developing and emerging countries. Using an unbalanced panel from 2002 to 2014, he maintains that remittances encourage business investment and that the entrepreneurial use of remittances enables developing countries to upgrade their production and diversify their exports into more complex goods (Saadi 2020, p. 19).

Nguyen et al. (2021) and Ajide (2022) have recently analyzed the impact of economic complexity on entrepreneurship. Nguyen et al. (2021) argue that “improvements in economic complexity reflect the development of the economic systems and conditions that boost industrial production and enhance product quality” and that “these improved conditions are usually associated with business opportunities (demands for new products and services) as well as risks (competition with multiple newcomers) for entrepreneurs” (Nguyen et al. 2021; p. 2). Following these premises, they show that entrepreneurship density, i.e., the number of new firms over the working-age population, follows an inverted U-shaped function of economic complexity. They conceptualize this finding as increasing economic complexity leading to two potentially conflicting results: creating new opportunities for opening new firms and bringing higher levels of competition and uncertainties for entrepreneurs, particularly if a country has already achieved high levels of complexity. Ajide (2022) evaluates the impact of economic complexity on entrepreneurship in 18 African countries between 2006 and 2017. He finds a positive relationship between new firm density and economic complexity and suggests that entrepreneurship is “strengthened by ethnic and religious diversity but reduced by weak political institutions” (Ajide 2022, p. 383). Given that most African countries operate at low levels of economic complexity, these findings are not surprising.

Several other studies have explored the impact of immigrants’ remittances on new firm creation.Footnote 2 The seminal work in this area is Vaaler’s (2011) analysis of 61 non-OECD and other developing countries between 2002 and 2007. Among other findings, Vaaler reports that remittances alone do not affect new firm creation. However, when he introduces an interaction term between remittances and the state share of the economy (measured by the share of GDP accounted for by the government and state-owned enterprises), he observes a positive impact of remittances on new firm creation at low levels of the state share of the economy, which disappears as the state share of the economy increases.

Since Vaaler’s (2011) pioneering work, empirical research on the relationship between remittances and new firm creation has grown, with studies including Martinez et al. (2015), Hanusch and Vaaler (2015), Cummings and Gamlen (2019), Cummings et al. (2021), Yavuz and Bahar (2022), Bettin et al. (2022), Ajide and Osinubi (2022), Nanyiti and Sseruyange (2022), and Alhassan (2023).

Martinez et al. (2015) examine the relationship between informality, remittances, venture funding availability, and the new firm starts in a sample of 38 developing countries from 2001 to 2009. They find that remittances increase new firms starts when informality increases. Interestingly, they also find that when informality is nil, the effect of remittances on new firms starts is negative, pointing toward a re-direction of remittances toward household consumption rather than investments. Similarly, Hanusch and Vaaler (2015) investigate whether the positive impact of remittances on new firm creation is constrained by capital access in a sample of 47 developing countries for the 2002–2007 period. They find that remittances increase new firm birth, but the effect diminishes as capital access increases. Cummings and Gamlen (2019) study whether diaspora engagement policies pursued by many developing or emerging countries amplify the positive impacts of remittances on entrepreneurship. They consider a sample of 35 countries observed from 2001 to 2010 and find that remittances positively affect new venture funding availability and new firm creation. Moreover, they confirm their conjecture about the magnifying effect of diaspora engagement institutions on remittances in favor of new firm creation. Cummings et al. (2021) focus on a sample of 29 developing countries from 2001 to 2010 and find that remittances from migrants residing abroad for less than a year significantly increase venture founding rates, measured by newly registered firms. They interpret this result as reflecting a stronger home-country identity for migrants who reside abroad and remit to agents at home to help found new ventures that provide livelihoods for those migrants upon return. Yavuz and Bahadir (2022) are primarily interested in the role of ethnic diversity in new business creation. Using data on 64 developing countries from 2006 to 2016, they find that migrant remittances correlate positively with new business creation, and ethnic diversity strengthens this positive association. According to Yavuz and Bahadir 2022, p. 1943), this positive link depends on the special relationship that migrants maintain with those they left behind. In their view, not only do migrants’ remittances act as founding resources for new firms, but they also inject new knowledge, skills, and practices into their home countries. Authors (2022) studied a very large panel of 143 countries from 2006 to 2018 and investigated the role of social and financial remittances in new firm creation. They find that both kinds of remittances are positively and significantly correlated with new firm creation for the entire sample of 143 countries and that the effect of financial remittances depends on the level of social remittances. Once social remittances exceed a threshold level, financial remittances do not contribute to new firm creation. They also perform a disaggregated analysis, separating developing and developed countries and non-OECD and OECD countries. The results for both developing and non-OECD countries are similar to those for the entire sample, while developed and OECD countries do not seem to benefit from remittances as a booster for new firm creation.

The last three papers on remittances and new firm creation, namely Ajide and Osinubi (2022), Nanyiti and Sseruyange (2022), and Alhassan (2023), use firms’ density (NLLC per 1000 working-age population) as the dependent variable instead of the absolute number of new firms’ creation. Ajide and Osinubi (2022) use a sample of 19 African countries from 2006 to 2017 and find that foreign aid and remittance harm new firms’ density. However, remittances mitigate the negative impact of foreign aid on entrepreneurship, indicating that both variables are complementary in improving the level of entrepreneurship in Africa. They claim that formal entrepreneurship involves high start-up costs in Africa, discouraging potential entrepreneurs from starting a new business. To become a formal entrepreneur, one needs to bear the higher cost of formalizing operations and higher risks compared with other alternatives, and this trade off disincentives to engage in entrepreneurship. Nanyiti and Sseruyange (2022) analyze 63 developing and developed countries and find a positive effect of remittances on firms’ density, which is stronger for LLMI countries and disappears for HUMI countries. Alhassan (2023) investigates the effectiveness of e-government as a mechanism for reducing migrants’ transaction costs and promoting remittance-based opportunity entrepreneurship in 55 African, Asian, Oceanian, and Latin American countries from 2007 to 2019. The empirical results for the entire sample indicate no role for remittances, but a statistically negative direct effect is found for African countries. However, he also finds that e-government positively moderates the association between remittances and new firms’ density.

A summary of the findings regarding the link between remittances and new firms is presented in Table 1. Three main results emerge from this field of research. First, most studies find a positive (or non-negative) link between remittances and new firm creation. Second, the role of remittances can be mediated by other factors. Third, empirical research focuses almost exclusively on developing or African countries.

This study aims to extend the literature by exploring the interconnected relationships among remittances, economic complexity, and new firm creation. To achieve this, we use a large sample of heterogeneous countries and split it into LLMI and HUMI countries. We also conduct a more disaggregated regional analysis at the continental level, focusing on Africa, Asia, Europe, Latin America and the Caribbean.

3 Empirical investigation

3.1 Sample description, summary statistics, and data sources

Limited by data availability, our dataset consists of an unbalanced panel comprising 78 countries from 2006 to 2020. As Table 2 indicates, the dataset is highly heterogeneous regarding the income levels of the countries included. According to the 2022 World Bank Income Classification, 22 countries are considered high-income, 24 are upper-middle-income, 23 are lower-middle-income, and nine are low-income. The majority of the countries included are African (23), followed by Asian (21), European (16), Latin American and the Caribbean (15), Oceanian (2), and North American (1) countries.

Table 3 provides names, descriptions, and sources of all variables used in this study. The World Bank development indicators (WDI) were used to retrieve data on NLLC, remittances received,Footnote 3 real per capita GDP growth rate (GDPPCGR), real per capita GDP level (GDPPC), openness to trade (TRADE), net foreign direct investment,Footnote 4 real interest rate (RIR), domestic credit to the private sector (CREDIT), total population (POP), percentage of the population using the Internet (INTERNET), and the share of employment in the agricultural (EMPAGR) and industrial (EMPIND) sectors. The economic complexity index (ECI) was obtained from the MIT Observatory of Economic Complexity. The ease of doing business (EDB) score was taken from the World Bank’s (WB) Doing Business database. The share of gross capital formation (SGCF) and the human capital index (HCI) were sourced from the Penn World Tables (PWT). Finally, the voice and accountability index (VAI), the size of the government index (SGI), and the democracy index (DI) were obtained from Kaufmann (2010), Gwartney et al. (2022), and Coppedge et al. (2023), respectively.

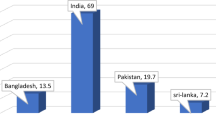

Tables 4 and 5 provide summary statistics demonstrating considerable heterogeneity across countries. In this section, we briefly discuss the summary statistics of NLLC and the two main independent variables, i.e., REM and ECI. On average, the number of new firms for the whole sample is 49,993, but it is much lower for LLMI countries (19,610), substantially higher for HUMI countries (65,334), and peaks at 90,717 in Europe. The minimum and maximum values of NLLC vary enormously, ranging from 226 (Paraguay in 2020) to 774,854 (The United Kingdom in 2020). Real per capita remittances received on average are 1.79 dollars (expressed in real terms, base year 2010), but significant differences emerge between LLMI (1.04) and HUMI (2.20) countries. Even more striking differences emerge at the continental level, with European countries at the top (2.78), followed by Latin American and the Caribbean (2.18), Asian (1.75), and African countries (0.39). On average, real per capita remittances received in Africa are just 14% of that of Europe, about 18% of Latin America and the Caribbean, and 22% of Asia. REM is equal to zero in Qatar, Serbia, Singapore, and Zimbabwe in various years, and it attained its maximum value for Jamaica in 2005 (15.12). The mean value of the ECI for the whole sample is 0.03, but significant differences emerge between LLMI (-0.68) and HUMI (0.51) countries. As regards continents, Europe records the highest value (0.82), followed by Asia (0.24), Latin America and the Caribbean (-0.09), and Africa (-0.76). The differences are more evident looking at the single country-year minimum and maximum: ECI ranged between -2.70 for Kuwait in 2008 and 2.65 for Japan in 2005.

3.2 Dependent variable

The number of NLLCs is defined as those registered in the private, formal sector per calendar year. It should be noted that in many countries, particularly developing ones, informal firms account for up to half of economic activity (La Porta and Shleifer 2014). The exclusion of the informal sector is based on the challenges of quantifying them. The World Bank employs consistent measurements and concepts applicable across countries in data collection. Specifically, national business registries are the primary sources of information. In limited liability firms, the financial liability of the owners is limited to the value of their investment in the company.

3.3 Main independent variables

Personal remittances are the sum of personal transfers and compensation of employees. To obtain real per capita remittances (REM) used in the empirical analysis, we standardize remittances by country population and express them in real terms using the GDP deflator, where the GDP deflator is from the United States Department of Agriculture (USDA). Since price levels and inflation rates vary enormously across countries, we maintain that real rather than nominal remittances should be used when analyzing their role in the real economy.Footnote 5

The literature reviewed above suggests that the direct link between remittances and new firm creation is mostly positive (or non-negative) and that other variables can moderate (i.e., magnify or cushion) the effects of remittances on new firm creation. In this paper, we aim to examine the mediating role of ECI in this relationship, and the interaction between REM and ECI is considered.

The economic complexity index was first introduced by Hidalgo and Hausmann (2009). According to Hausmann et al. (2014, p. 18), “complex economies are those that can weave vast quantities of relevant knowledge together, across large networks of people, to generate a diverse mix of knowledge-intensive products. By contrast, simpler economies have a narrow of productive knowledge and produce fewer and simpler products, which require smaller webs of interaction”. The core idea of ECI is that it captures the sophistication of a given economy’s products. Economic complexity includes the breadth of an economy’s exports and how knowledge-intensive they are. A country that produces many products that few other countries can produce has a broad range of productive capacities. Conversely, a country that produces few products that many other countries can make is likely to have few productive capabilities. Therefore, economic complexity is a crucial factor that can help explain entrepreneurship and new firm creation. If a country takes on more innovative activities, it will likely produce a broad range of products, making it more complex. Thus, complex economies generate more opportunities to start a business venture and innovate. At the same time, they will need higher funding to start a new business. On the contrary, less complex economies produce fewer and simpler products and require lower funding levels to create new businesses. In this regard, Nguyen et al. (2021) found that entrepreneurship density is an inverted U-shaped function of economic complexity. This relationship exists because an increase in economic complexity reflects the rise in economic diversification that leads to new business opportunities. However, new opportunities also mean higher competition and uncertainty, and beyond some level of economic complexity, higher competition might stop or even discourage new business opportunities (Nguyen et al. 2021, p. 4).

According to these theoretical premises, countries with low levels of economic complexity presumably produce goods and services that do not require particularly complex technologies and can be realized with relatively low investments. Therefore, ECI will likely negatively mediate the impact of REM on NLLC. Countries with low levels of economic complexity will probably engage in producing goods and services with newly created firms that do not need high start-up costs, precisely the kind of new firms that can be established with relatively low initial investments that can be set up with the aid of remittances coming from abroad. Conversely, in countries with high economic complexity, new firms must bear high initial start-up investments, and remittances from abroad may not provide adequate founding resources. Hence, the effect of REM on NLLC is expected to be positive at a low level of ECI and negative at high levels of ECI. Furthermore, we also predict that for HUMI countries, the positive impact of REM on NLLC might not be observed in the data precisely because these countries, on average, are likely to produce highly complex goods and services that require high founding sources that cannot be provided by remittances alone.

3.4 Control variables

The analyzed control variables encompass economic, financial, socio-political, socio-demographic characteristics, along with the international and institutional dimensions. These variables can potentially influence the attractiveness or de-attractiveness of each economy for creating new firms.

Within the economic variables, GDPPCGR and GDPPC provide a broad overview of the economic environment and are anticipated to positively impact the creation of new firms. At a macroeconomic level, SGCF is a crucial variable influencing GDP growth. SGCF can influence investment decisions toward new economic activities and, indirectly, affect the creation of new firms. EMPAGR and EMPIND are economic variables that account for a country’s economic structure. In every country, rates of new business creation differ considerably by sector, and we do not have a priori expectations regarding the impact of these two shares on the creation of new firms.

CREDIT serves as a proxy for financial development, with higher levels of financial development expected to facilitate the creation of new firms. Conversely, RIR measures the cost of capital, and it is expected to harm the creation of new firms.

The socio-political variables in this study are the voice and accountability index (VAI) and the size of the government index (SGI). These variables reflect the social characteristics of the countries and the government policy environment. The VAI comprises several indicators that measure various aspects of the political process, civil liberties, and political rights. These indicators gauge the extent to which citizens can participate in selecting governments. Higher values of VAI are expected to foster a better environment for creating new firms. The SGI is based on general government consumption spending as a percentage of total consumption, transfers and subsidies as a percentage of GDP, government enterprises and investment as a percentage of total investment, and the top marginal tax rate. The effect of this variable is ambiguous since, on the one hand, larger governments may drain private resources that could otherwise be invested in productive activities (including new firms) by the private sector. On the other hand, some public expenditures, such as public infrastructure and education, may benefit a country’s overall productivity and encourage private economic initiatives and the creation of new firms.

The socio-demographic variables in this study include HCI and POP. HCI is a synthetic indicator of the average human capital based on the average years of schooling and return to education. We anticipate that this variable will positively impact the creation of new firms. POP should also positively affect the creation of new firms, as it captures the role of a large home market.

The variables TRADE, FDIPOP, and INTERNET are associated with the level of country internationalization. TRADE is almost invariably linked to better economic opportunities, including creating new firms; therefore, it is expected to have a positive impact. As for foreign direct investment, they are used in nearly all of the studies mentioned above, but their role needs clarification, as forecasting their effects is more complex.Footnote 6 According to The World Bank “Foreign direct investment are the net inflows of investment to acquire a lasting management interest (10 per cent or more of voting stock) in an enterprise operating in an economy other than that of the investor". Therefore, foreign direct investments refer to direct investment equity flows in the reporting economy, and there is no strong reason to believe that they could favor the creation of new firms. Regarding INTERNET, some studies have documented a positive relationship between internet connectivity and aggregate measures of economic progress (Hjort and Tian 2021, p. 17). For example, Cariolle et al. (2019), using a sample of 30 thousand firms, found a positive effect of internet usage on firm performance. Analogously, Hjort and Poulsen (2019) documented a large and significant increase in net firm entry after the arrival of submarine internet cables in South Africa. More generally, Alhassan (2023) found that online services and telecommunication infrastructure positively moderate the association between remittances and entrepreneurship.

The variables EDB and DI capture the institutional dimension. EDB is a score that measures the difficulty of starting a business in a country based on the gap between its performance and the regulatory best practices worldwide. A higher score indicates better performance, positively affecting the creation of new firms. EDB also captures the entrepreneurial capacity of entrepreneurs, as well as a business-friendly environment characterized by competitive market factors. DI is a measure of a country’s degree of democracy that attempts to quantify the extent to which the ideal of democracy is achieved. As socially inefficient regulations and rent-seeking activities are less likely to be imposed in democratic countries, it is expected that the higher the DI, the greater the number of new firms. According to World Bank (2014), there is a strong correlation between democratic institutions, respect for human rights, and better conditions for business. However, the relationship between democracy and the creation of new firms could be more complex. In this regard, Sima and Huang (2023, p. 2) claim that “the initial condition in terms of economic development is crucial for countries to embark on a path of faster economic growth after democratization”. They find that strong democracies (defined as democracies with adequate economic development at transition) grow faster than weak democracies (defined as democracies with poor economic development at transition).

In concluding this section, it is important to remember that various other country-specific factors influence the creation of new firms, and it is nearly impossible to account for all of them. Including country-fixed effects allows for controlling all time-invariant country-specific factors, which is the best way to handle them econometrically. Additionally, dividing the sample into more homogeneous sub-samples is a complementary approach to dealing with the country-specific heterogeneity arising from these unobserved factors. In the empirical analysis, we employ both strategies.

3.5 Methodology and econometric specification

Our dependent variable is a count variable that takes on only non-negative integer values and linear regression models are inappropriate since the basic assumptions of the ordinary least squares model are violated leading to biased and inconsistent coefficient estimates. Conversely, count data models such as Poisson and negative binomial are more suitable for our empirical analysis (Allison and Waterman 2002; Cameron and Trivedi 1986). Figures 2, 3, and 4 show that the distribution of NLLC is right-skewed in the total sample and in the different sub-samples we study. In addition, the likelihood ratio test LR2 reported for all regressions indicates that NLLC is over-dispersed (i.e., the variance is greater than the mean); thus, the Poisson regression model is inappropriate because the over-dispersion could result in the spurious significance of the coefficient estimates due to underestimated standard errors (Cameron and Trivedi 1986; 2013).Footnote 7 On the contrary, negative binomial models allow over-dispersion through separate parameterization of the dispersion parameter. Expressed in terms of its log-likelihood function, the negative binomial model takes the following general form:

where \({y}_{it}\) is the dependent variable, \({x}_{it}^{^{\prime}}\) is a vector of explanatory variables, possibly including unit and time effects, α is the over-dispersion parameter, β is a vector of coefficients, and Γ is the gamma function. In our study, the dependent variable is the number of new limited liabilities companies (\(\left( {{\text{NLLC}}_{{{\text{it}}}} } \right)\), and \(\exp \left( {x_{{{\text{it}}}}^{^{\prime}} \beta } \right)\) corresponds to:

where for each country i at time t, the number of new limited liabilities companies is related to real per capita remittances (\({\mathrm{REM}}_{\mathrm{it}-1}\)), the economic complexity index \(\left( {{\text{ECI}}_{{{\text{it}} - 1}} } \right)\), their interaction term \(\left( {{\text{REM}}_{{{\text{it}} - 1}} \times {\text{ECI}}_{{{\text{it}} - 1}} } \right)\), and the set of control variables \(z {\prime }_{{{\text{it}} - 1}}\) described in Sect. 3.4. To cope with possible reverse causality issues, all explanatory variables are lagged at time t-1. Furthermore, country (\({\mu }_{i}\)) and time (\({\tau }_{t}\)) fixed effects are included.

As discussed above, we assume that ECI mediates the relationship between NLLC and REM. Thus, finding \({\beta }_{1}>0\) or \({\beta }_{1}<0\) says nothing regarding the impact of real per capita remittances on new firms’ creation. To obtain the effect of REM on NLLC, we must look at the average marginal effect of the former on the latter at different levels of ECI. However, to better appreciate this marginal effect, in the following section, first, we present the regression with the control variables alone; second, we introduce the two main dependent variables without the interaction term; finally, we present the estimate for the complete model.

4 Results

4.1 Full sample analysis

In this subsection, we will discuss the estimation results and provide a graphical representation of the average marginal effect of REM on NLLC at different centiles of ECI. Table 6 reports the results for the entire sample of countries. Column (1) includes only the control variables, while columns (2) and (3) introduce REM and ECI separately. In column (4), both variables are considered simultaneously, and in column (5), their interaction is added.

Table 6 shows that the estimated coefficients of the control variables agree with theoretical expectations. GDPPCGR, TRADE, CREDIT, EOB, POP, HCI, INTERNET, EMPAGR, EMPIND, and DI have positive estimated coefficients, while RIR’s coefficient is negative. Almost all coefficients are highly statistically significant, up to 1%. On the other hand, the estimated coefficients of GDPPC, FDIPOP, SGCF, VAI, and SGI are not statistically significant. Additionally, the magnitude of these coefficients remains stable across all regressions in Table 6, even when ECI, REM, and their interaction are included.

Columns (2) and (3) show negative coefficients for both REM and ECI when introduced separately, but only REM in column (2) is statistically significant. The same result is seen in column (4) when they are considered jointly. However, in column (5), the introduction of their interaction causes the sign of ECI to become positive and the estimate of REM to become statistically insignificant. Interestingly, the interaction term is negative and highly statistically significant, indicating an inverse relationship between REM and new firms’ creation as the level of ECI increases. Thus, the impact of real per capita remittances on new firms’ creation depends on the level of the ECI.

To better understand this role, Fig. 5 illustrates the (nonlinear) average marginal effect of REM on NLLC at different centiles of ECI (continuous line), with the vertical bars representing the 90% confidence interval. As shown, the effect is positive and statistically significant up to the 15th centile. It then becomes insignificant until the 55th centile. Finally, above the 55th centile, the effect of REM on NLLC becomes negative and statistically significant. This finding supports our hypothesis about the role of ECI in the impact of REM on NLLC. Countries with low levels of ECI produce goods and services with new firms that can be established with relatively low initial investments provided by remittances from abroad. Conversely, countries with high levels of ECI produce goods and services with new firms that require high initial investments. In such circumstances, it is unlikely that single remittances alone can provide sufficient resources to start new firms.

To understand the practical implications of these results, at the 5th centile of ECI, an increase of real per capita remittances by one dollar would increase the number of new firms by 3069 units. Note that a one-dollar increase in real per capita remittances could represent a significant surge. To provide a concrete example, let us consider Mali, which was at the 5th centile of ECI in the final year of our sample (2020). Mali had a population of approximately 19.1 million in the same year, and real per capita remittances were 0.48 dollars. Therefore, a one-dollar increase in real per capita remittances would represent about a 200% growth, resulting in a $19.2 million increase in total real remittances, which would help create 3069 new firms. In the same year, Mali had a real GDP (constant US dollars) of 15,830 million, and a $19.2 million increase in total real remittances would be equivalent to 0.12% of real GDP.

Moving beyond the 5th centile of ECI, at the 10th centile, the number of new firms would increase by 2498, while at the 15th centile, the number of new firms would increase by 1988. No statistically significant effect is observed between the 15th and 55th centile. However, a statistically significant adverse impact is detected above the 55th centile. With a few exceptions (Vietnam, Ukraine, India, and The Philippines), all countries in the negative section of the average marginal effect of REM on NLLC are high-income or upper-middle-income countries, indicating a structural difference between HUMI countries on the one hand, and LLMI countries on the other. More generally, countries differ significantly in political economy, social culture, institutions, traditions, etc. As said above to account for these factors, we included the country’s fixed effects in all regressions, thus controlling for all the time-invariant country-specific factors. Additionally, in the following subsection we partition the sample into relatively more homogeneous sub-samples. Firstly, we split the sample into HUMI and LLMI countries. Secondly, we exploit the regional dimension of our data set and estimate separate regressions for Africa, Asia, Europe and Latin America and the Caribbean countries.

4.2 Sub-sample analysis

4.2.1 HUMI versus LLMI countries

Table 7 follows the same structure as Table 6. Columns (1) and (2) consider only the control variables for the two sub-samples of LLMI and HUMI countries. Columns (3) to (6) present the regression results when REM and ECI are introduced separately, followed by their joint inclusion in columns (7) and (8). Finally, their interaction is included in columns (9) and (10). The control variables show the expected signs and are statistically significant most of the time. TRADE, RIR, EMPAGR, and EMPIND are statistically significant in almost all regressions, while others (GDPPCGR, CREDIT, EOB, HCI, INTERNET, and DI) are significant only for the HUMI sample. In contrast, FDIPOP, POP, and VAI show a statistically significant coefficient in the LLMI sample only, while GDPPC, SGCF, and SGI are never statistically significant. These findings suggest a heterogeneous role of these variables in the two sub-samples, reinforcing the validity of our empirical approach, which aims to distinguish the distinct impact of remittances on new firms’ creation based on the countries’ income level.

Let us now focus on the primary variables of interest. First, when REM is introduced alone, it has opposite signs in the two sub-samples: a positive impact on NLLC is found for LLMI countries (column 3) and a negative one for HUMI countries (column 4); in both cases, the estimated coefficients are highly statistically significant. Second, ECI correlates negatively with NLLC in LLMI countries (column 5) but is statistically insignificant in the HUMI sample (column 6). Third, these signs and statistical significance patterns are confirmed in columns (7) and (8) when both variables are included in the regressions. Fourth, when the interaction term is added to the LLMI sample, REM and ECI lose their statistical significance, but their interaction is negative and highly statistically significant (column 9). In contrast, in the HUMI sample, all estimated coefficients are statistically significant: REM is negative, ECI is positive, and their interaction is negative.

Figure 6 shows the (nonlinear) average marginal effect of REM on NLLC for the two sub-samples, clearly demonstrating the opposite role of real per capita remittances in new firm creation for LLMI and HUMI countries. In Panel (a), let us first consider the LLMI sub-sample. REM’s statistically significant positive impact on NLLC is confirmed up to the 65th centile. Above the 65th centile and up to the 90th centile, the estimated impact is not statistically significant. In contrast, beyond the 90th centile, the effect of REM on new firm creation turns out to be negative and slightly statistically significant. As before, we can quantify this effect at different centiles of ECI for each sub-sample. For example, in LLMI countries, at the median value of ECI = − 0.7374, an increase of one dollar in real per capita remittances would lead to an increase of 5500 new firms (see Panel (a)). Conversely, in the HUMI sub-sample, Panel (b) of Fig. 6 shows that the effect of REM on NLLC, when statistically significant, is negative.

In summary, the first step of our sub-sample analysis supports our hypotheses regarding the positive impact of REM on NLLC in LLMI countries and the negative impact of REM on NLLC in HUMI countries on the one hand, and the negative mediating role of ECI in both sub-samples, on the other. This finding aligns with the results of Nguyen et al. (2021), who found that the effects of economic complexity on new firms depend on the country’s economic development levels. Specifically, they found that economic complexity can increase entrepreneurship density in low and middle-income economies but not in high-income ones. Our results also agree with the findings of Nanyiti and Sseruyange (2022), who found that the positive effect of remittances on firms’ density is more robust for LLMI countries and disappears for HUMI countries.

4.2.2 Regional analysis

In the second step of our sub-sample analysis, we estimate separate regressions for Africa, Asia, Europe,Footnote 8 and Latin America and the Caribbean. Tables 8 and 9 present the results, from which very different patterns emerge. Let us first examine the results concerning the control variables.Footnote 9 Among them, only TRADE has an estimated coefficient consistent with theoretical expectations across all regions. The coefficient is strongly statistically significant for African, Asian, and Latin American and the Caribbean countries in all regressions and significant at 5% for Europe in three out of five regressions. As for the other two variables linked with internationalization, FDIPOP and INTERNET, the former exerts a negative role, particularly for Latin American and the Caribbean and, partially, for African countries. On the contrary, the latter is positively associated with the birth of new firms in Latin American and the Caribbean countries and, in a few regressions at 10% significance, in African and Asian countries.

Among the economic variables, GDPPCGR is strongly statistically significant only for Latin American and the Caribbean countries. Analogously, GDPPC is significant only for Latin American and Caribbean countries, for which it turns out significant but with the wrong negative sign in columns (7), (9), and (10) of Table 9. SGCF is mildly significant in column (2) of Table 8 for Africa and in column (7) of Table 9 for Latin American and the Caribbean countries, where, however, a negative sign is found. EMPAGR and EMPIND are always statistically significant for Africa in Table 8, while EMPIND is significant for Europe in Table 9.

As for the socio-political variables VAI and SGI, the former is strongly positively associated with the creation of new firms in Europe across all estimates of Table 9, in three out of five estimates for both African (Table 8) and Latin American and the Caribbean countries (Table 9). Conversely, the latter turns out never statistically significant. The financial (CREDIT and RIR) and the socio-demographic variables (HCI and POP) display contrasting results. On the one hand, CREDIT supports the creation of new firms in Asia and, partially, Latin America and the Caribbean. On the other hand, it seems to hinder new firms’ creation in Europe and Africa. RIR reports the expected negative sign across all estimates of Tables 8 and 9; it turns out statistically significant for African and Latin American and the Caribbean countries, and in columns (6) and (7) of Table 8 for Asian countries.

Regarding the socio-demographic variables, HCI is positively associated with new firms’ creation only in Asia; conversely, the estimated coefficient for POP is positive and statistically significant for Asian, European, and Latin American and the Caribbean countries but negative and statistically significant for African countries. Finally, regarding the institutional dimension captured by EDB and DI variables, Tables 8 and 9 show that the ease of doing business score matters for creating new firms in Europe and, perhaps, Asia. In contrast, the coefficient of the DI is positive and significant in Europe and partially in Asia but negative and statistically significant in Latin America and the Caribbean.

Having seen the heterogeneous impact of control variables in new firms’ creation, it is no surprise that the two main explanatory variables, REM and ECI, play very different roles across continents.

In Africa (Table 8), the estimated impact of REM is always negative; on the contrary, ECI is never statistically significant, while their interaction is positive and mildly statistically significant. Panel (a) of Fig. 7 shows that the average marginal effect of REM on new firms’ creation, though increasing, is negative. There are at least two possible explanations for this result. The first is that remittances in Africa are mainly used for consumption rather than investment purposes. The United Nations Economic Commission for Africa (UNECA 2005; 2006) reports that around 80% of remittances in Africa are used for consumption and schooling. Thus, while remittances might contribute to increasing human capital accumulation through schooling, their use to spur investment and new firm creation seems to be residual. The second explanation is that remittances sent to Africa are the lowest across all continents. As we have seen in subSect. 3.1, real per capita remittances received in African countries are 14% of those received by European countries, 18% compared to Latin American and the Caribbean countries, and 22% compared to Asian countries. Hence, this result is unsurprising and confirms similar findings of Ajide and Osinubi (2022) and Alhassan (2023).

Conversely, in Asia (Table 8), the estimated coefficient of REM is positive and statistically significant in column (10) when the interaction term is included. ECI is negatively linked with NLLC in columns (8) and (9) of Table 8, but its sign turns out positive, albeit statistically insignificant, in column (10). Finally, the interaction term is negative and statistically significant in column (10). Panel (b) of Fig. 7 shows that for Asian countries, the average marginal effect of REM decreases as ECI increases. It is positive up to the 58th percentile, not statistically significant between the 59th and the 70th percentile, and negative above the 70th percentile. Thus, the pattern of the average marginal effect of REM for Asian countries is very similar to what was previously found for the sub-sample of LLMI countries.

The results for Europe shown in Table 9 clearly indicate that REM has no role in creating new firms; ECI correlates negatively with NLLC, while the interaction term is not significant. As Panel (c) of Fig. 7 demonstrates, the average marginal effect of REM on NLLC is zero for all percentiles of ECI. In some sense, this result is not surprising since the great majority of European countries (along with Australia, Canada, and New Zealand) are highly developed countries that are complex and competitive. It is unlikely that remittances alone can help establish new firms in such countries.

Finally, let us examine the results for Latin American and the Caribbean countries. As shown in columns (5) to (10) of Table 9, REM and ECI are always positive and statistically significant for this region, while their interaction is positive but not statistically significant. This pattern of signs and significance leads to an average marginal effect of REM on NLLC, which is always positive and increases as ECI increases (see Panel (d) of Fig. 7). Therefore, for these countries, the potential role of real per capita remittances in creating new firms is crucial.

5 Policy implications

Based on our empirical analysis, it has been found that the impact of remittances and economic complexity on the creation of new firms varies among LLMI and HUMI countries, as well as across different continents. It should also be noted that a macroeconomic approach, like ours, cannot account for all the microeconomic factors that undoubtedly influence this complex relationship. Our results suggest that any policy initiative should avoid a one-size-fits-all approach. Instead, economic policies should be responsive to the specific challenges faced by individual countries and tailored to their unique needs. With that said, it is evident that policy implications will differ across various countries.

As discussed earlier, the positive impact of real per capita remittances on new firm creation in LLMI countries is attributed to their low economic complexity. This implies that relatively low initial investments are sufficient to establish new businesses, and even small amounts of real per capita remittances can be helpful. Thus, even individual migrants’ remittances can be used to found new firms, and countries of origin can encourage this by raising awareness among migrants settled abroad about the possibility of starting new businesses with low levels of investment. Informative campaigns in host countries could be implemented to make expatriates aware of this opportunity. However, to be more effective and achieve a “critical mass”, remittances could be raised collectively by involving diaspora communities abroad, collecting them in their country of residence, and sending them to their country of origin to create new firms. Two well-known examples of collective remittances are the 3 × 1 program of the Mexican government and the PARE 1 + 1 initiative in Moldova. The former, which began in 2001, involved three levels of government (local, state, and federal), and each level of government matched each dollar sent by collective remittances. Although this program was primarily intended to finance public infrastructure, in 2009, the Mexican federal government started a 1 × 1 program specifically designed to promote private investments. Under this program, a migrant had to provide a business plan for a new investment in Mexico, and the federal government matched the same amount with a three-year interest-free loan of up to an equivalent of 25,000 dollars. The PARE 1 + 1 initiative in Moldova, which started in 2010 and lasted five years, was designed to create new businesses through a mechanism similar to the Mexican program. It is estimated that about 500 firms were financed through this initiative.Footnote 10 While these avenues might be challenging for LLMI countries, as seen earlier, national and local investment promotion agencies can work alongside international development agencies to actively intervene and support new firm creation.

Other policy initiatives aimed at directing remittances toward productive ends, particularly toward new business creation, should focus on reducing informality, improving competition, and lowering remittance transfer costs. Reducing transfer costs is one of the specific targets of the sustainable development goals (SDGs) outlined in the 2030 Agenda for Sustainable Development, which was adopted by all United Nations Member States in 2015. Lowering costs is considered a necessary preparatory step to maximize the productive impact of remittances (Olivié and Santillán O’Shea 2022). According to the World Bank (2019), African remittance transaction costs are the highest at 9% compared to the global average cost of 7%. High costs are also prevalent within Africa, with transactions originating from South Africa having the highest costs, as high as 18%. Orozco and Ellis (2014, p. 93) report that the cost of remitting varies worldwide from 2 to 10%. Transfers from Spain to Latin America and the Caribbean cost 4%, 5.5% from the United States to Latin America and the Caribbean, 8% from Japan, 6% from Singapore and Hong Kong to South-East Asia, and 10% to most African countries from Europe or the United States. Therefore, it is evident that reducing remittance transfer costs would benefit remittance-receiving countries and promote investment and new firm creation.

On the other hand, HUMI countries are characterized by higher economic complexity, and establishing new firms requires significant investment. In these countries, it is unlikely that low levels of real per capita remittances would be sufficient to create new businesses. Much higher funding resources are required to produce complex goods, which cannot be provided by remittances sent by single individuals or even collective remittances below a critical mass, and other types of instruments are necessary. One of these instruments could be establishing diaspora networks to promote diaspora investments. Diaspora investment encompasses various financial instruments, such as equities, loans, and bonds. While these instruments vary on different grounds, overall, they are better suited for large-scale investment than single or collective remittances. According to Gelb et al. (2021; p. 11), diaspora investors are more likely to invest in their country of origin than in other countries due to their affective ties and information advantages, which allow them to lower transaction costs. These advantages range “from greater cultural familiarity and higher levels of trust, from greater knowledge about business opportunities or potential obstacles in the business environment, and from access to business networks such as potential customers and suppliers or to government policymakers”. Diaspora members create networks and contacts that can be as crucial as financial capital for new firm creation. Encouraging diaspora investments provides ample space to create policy initiatives to close the gaps between migrants’ sending and receiving countries.

Diaspora finance initiatives can promote investments and new firm creation in both LLMI and HUMI countries. Gelb et al. (2021) have identified over 300 diaspora finance mechanisms, 46 of which are remittance-based, aimed at improving economic productivity “by making funds and/or knowledge available to initiatives to prepare individuals to enter into business, to support new organizations and start-ups, to expand existing enterprises or to impact on capital markets where businesses face constraints” (Gelb et al. 2021; p. 28). As mentioned earlier, equity-based instruments can also be used to encourage investments and the creation of new firms. Typically, these instruments require that the investment necessary to establish new businesses in the migrants’ country of origin is collectively raised by the diaspora abroad, an entrepreneur in the country of origin, and the government of the migrants’ country of residence. For example, the WIDU.africa program, created by the German government to develop small businesses in Cameroon, Ghana, Kenya, Togo, Ethiopia, and Morocco, requires 25% of the funding to come from within the diaspora, another 25% from the entrepreneur or small businesses, and the remaining 50% from the German government. Further policy initiatives could incentivize remittances through fiscal incentives. One straightforward fiscal incentive of this kind would be to reduce (or exempt for a certain number of years) taxes paid by firms created through remittances (Bahar 2020).

In general, countries of origin should establish institutions and facilitate the creation of networks capable of bridging the diaspora abroad with their home country to increase awareness of productive investment and, more specifically, new business opportunities. Countries of residence, typically more economically advanced, can play a crucial role in supporting countries of origin in building these institutions and networks through their technical support. Productive cooperation among national governments, multilateral organizations, and private companies could encourage emigrants to invest their remittances in their home countries.

Finally, specific questions need to be addressed for African countries. In Africa, the informal sector forms a significant part of the economy, and investments in this sector constitute a substantial portion of diaspora investment activity (Leandro et al. 2017). Many people prefer to operate in the shadow economy due to stringent regulations in the formal sector (Laniran and Adeniyi 2015). Additionally, while efforts have been made to incentivize remittances for productive purposes and divert them from consumption, this goal may be challenging to achieve. Given these circumstances, it is not surprising that our empirical analysis found that the average marginal effect of REM on new firms’ creation while increasing as ECI increases, is negative. Therefore, if the productive use of remittances is to be incentivized, policy measures should address all these issues, and special attention should be given to favoring investing conditions (Olivié and Santillán O’Shea 2022). Policy initiatives should aim to incentivize investment in the formal economy by making regulations less stringent and simultaneously providing incentives to new firms established through remittances from abroad. For example, these could include tax breaks or special legal status for new firms founded through remittances. Further efforts should also be made to discourage the destination of remittances for consumption and encourage their use for investment in new businesses.

6 Final discussion

6.1 Main conclusions and results

This paper has contributed to a better understanding of the intertwined role of remittances, economic complexity, and new firm creation. The work was motivated by the fact that remittances have grown at very high rates in recent years, recent empirical evidence showing a positive (or non-negative) role of remittances on new business creation, recognition of the central role of firms in creating new jobs, and the consideration that a country’s economic complexity influences new business starts. Although several studies have focused on the measurement and impact of economic complexity on socio-economic development, insufficient attention has been paid to its impact on entrepreneurship in general and none on new firm creation.

Our results can be summarized as follows. First, we have shown that the impact of real per capita remittances on new firm creation is inversely related to economic complexity: at low levels of economic complexity, real per capita remittances spur the creation of new firms, while at high levels of economic complexity, real per capita remittances do not contribute to new firm creation. Second, motivated by the evidence that almost all countries for which an adverse effect has been detected are high-income or upper-middle-income countries, we have shown that real per capita remittances positively impact low- and lower-middle-income countries. These results confirm the theoretical expectations based on the pioneering works of Hidalgo and Hausmann (2009) and Hausmann et al. (2014), according to whom economic complexity is a crucial element in explaining entrepreneurship. More complex economies will likely generate more opportunities to start new firms and innovate. However, higher funding levels are needed to create more complex products, while new firms can be founded with a lower financial effort to produce less complex products. The financial resources channelled through remittances can help establish new firms in traditional sectors in less advanced economies. In more advanced economies, remittances sent by single individuals are unlikely sufficient to establish new firms. Third, the sub-sample analysis performed for Africa, Asia, Europe, Latin America, and the Caribbean revealed a heterogeneous relationship between remittances and new firm creation. In Africa, the average marginal effect of remittances on new firm creation is negative, while in Asia and Latin American and the Caribbean countries, it is positive, and no significant relationship was found in Europe. Fourth, our results suggest that economic policy should be tailored to the country’s specific characteristics, reducing informality and improving competition. Policy initiatives should also aim to reduce remittance transfer costs and introduce special legal status for new firms created using remittances. Finally, institutions in the origin countries should encourage the creation of diaspora networks to increase awareness of new business opportunities in the origin countries.

6.2 Limitations and future research

The present study has some limitations that suggest directions for further research. Remittances consist of personal transfers (current transfers in cash or in kind between resident and non-resident households) and compensation of employees (the income of border, seasonal, and other short-term workers who are employed in an economy where they are not residents and of residents employed by non-resident entities). This distinction, based on residency, is not always highlighted when working on remittances. However, it might be that these two components provide different incentives to invest and create new firms in the origin country. Additionally, recorded remittances are those sent through formal channels, while official data do not capture informal remittances sent through informal channels. Since unrecorded flows are estimated to be at least 50 percent larger than recorded flows, it is likely that the number of new firms created through remittances is underestimated.

Similarly, our dependent variable measures the number of new formally registered limited liability companies, but many new business activities take place in the informal sector and are not recorded in official data, leading to an underestimation of the actual number of new firms. Since new firms in the informal sector are likely to be micro-enterprises, they can be established even with small financial resources accrued through remittances, and hence the positive role of remittances on new firms’ creation is probably underestimated. Finally, our macroeconomic analysis cannot account for the microeconomic factors that operate at the individual firm level. At the microeconomic level, many specific factors certainly affect the entrepreneurial capacity and willingness to invest and create new firms. To investigate these factors, survey data or other more detailed data is required.

Data availability

Data for this study will be made available upon a reasonable request.

Notes

Ratha (2017) claims unrecorded flows through informal channels are at least 50 per cent larger than recorded flows.

In the present study, we analyze the role of real per capita remittances on new limited liabilities companies (new firms’ registration) and take data from the world development indicators (see sub-Sect. 3.1 for more details). Another strand of empirical literature studies the impact of remittances on entrepreneurship using the Global Entrepreneurship Monitor (GEM) database. The data collected by GEM comprises two complementary tools: the Adult Population Survey (APS) and the National Expert Survey (NES). The former explores the individual's role in the entrepreneurial process's lifecycle through an administered survey (2000 adults are interviewed). The latter assesses the status of the Entrepreneurial Framework Conditions (EFCs) through interviews with at least 36 experts. Our research questions cannot be satisfactorily addressed as it consists of self-reported data rather than company registration data. For this reason, in this literature section, we do not review any of these works; the interested reader can see the recent paper of Bedi et al. (2020) and the references therein. For more general surveys regarding new firms’ creation, see the recent contributions of Ratinho et al. (2020) from the perspective of the managerial sciences and of Lu et al. (2020) for a more general approach that also includes works in the fields of accounting, economics, finance, innovation, and organization studies. Quite surprisingly, neither the former nor the latter cite papers dealing with the role of remittances in entrepreneurship.

In the empirical analysis, we use real per capita remittances (REM) as an explanatory variable (see below).

In the empirical analysis, we use net foreign direct investment divided by total population (FDIPOP).

Among other things, a possible explanation of why empirical results on the role of remittances on the economy often produce conflicting results might be that almost all empirical studies utilize nominal rather than real remittances.

Authors (2022), Ajide and Osinubi (2022), and Cummings et al. (2021) find that the estimated coefficient of foreign direct investment either is not significant or, when it is, it has a negative sign. Depending on the specific model, Yavuz and Bahadir (2022) find that it is usually not significant, although sometimes they find it positive and statistically significant. In Cummings and Gamlen (2019) and Martinez et al. (2015), the sign is positive but never statistically significant. Finally, Vaaler (2011) finds that foreign direct investments positively and statistically significantly affect new firms’ creation.

The LR1 (p-value) test reported at the bottom of the tables is the probability of the likelihood ratio test statistic on the null hypothesis that all regression coefficients in the model are simultaneously equal to zero.

The whole sample includes Australia, Canada, and New Zealand. Considering their social, cultural, and economic affinities, we include these three countries in the European sample. We have performed separate regressions excluding them from the European sample, and all the main findings remained unchanged. For the results, see the online Appendix.

Given the focus of the paper, here we provide only a brief examination of the effects of control variables on new firms’ creation without further investigation of why, in some circumstances, these effects do not show up as expected. However, this brief discussion demonstrates that, at the regional level, the role of these variables is heterogeneous and reflects the very different social, political, economic, and institutional characteristics of the regions. Further research is called for to shed light on all these issues.

For a more general appraisal of these two programs, see Gelb et al. (2021; p. 31).

References

Ajide F (2022) Economic complexity and entrepreneurship: insights from Africa. Int J Dev Issues 21(3):367–388. https://doi.org/10.1108/IJDI-03-2022-0047

Ajide FM, Osinubi TT (2022) Foreign aid and entrepreneurship in Africa: the role of remittances and institutional quality. Econ Chang Restruct 55(1):193–224. https://doi.org/10.1007/s10644-020-09305-5

Alhassan, (2023) E-government and the impact of remittances on new business creation in developing countries. Econ Chang Restruct 56:181–214. https://doi.org/10.1007/s10644-022-09418-z

Allison PD, Waterman RP (2002) Fixed-effects negative binomial regression models. Sociol Methodol 32(1):247–265. https://doi.org/10.1111/1467-9531.00117

Bettin G, Massidda C, Piras R (2022) The intertwined role of social and financial remittances in new firms’ creation (Under review)

Bahar D (2020) Diasporas and economic development: a review of the evidence and policy. Comp Econ Stud 62:200–214. https://doi.org/10.1057/s41294-020-00117-0

Bedi JK, Jia S and Williamson CR (2020) Brain gains: a cross-country study on the relationship between remittances and entrepreneurship. In: International Journal of Entrepreneurship and Small Business (Forthcoming). Retrieved from: https://ssrn.com/abstract=3686277

Cameron AC, Trivedi PK (1986) Econometric models based on count data: comparisons and applications of some estimators and tests. J Appl Economet 1(1):29–53. https://doi.org/10.1002/jae.3950010104

Cameron AC, Trivedi PK (2013) Regression Analysis of Count Data, 2nd edn. Cambridge University Press, New York

Cariolle J, Le Goff M and Santoni O (2019) Digital vulnerability and performance of firms in developing countries. Banque de France Working Paper, February 2019, WP 709

Clemens MA, McKenzie D (2018) Why don’t remittances appear to affect growth? Econ J 128(July):F179–F209. https://doi.org/10.1111/ecoj.12463

Coppedge M, Gerring J, Knutsen CH, Lindberg SI, Teorell J, Altman D, Bernhard M, Cornell A, Fish S, Gastaldi L, Gjerløw H, Glynn A, God AG, Grahn S, Hicken A, Kinzelbach K, Krusell J, Marquardt KL, McMann K, Mechkova V, Medzihorsky J, Natsika N, Neundorf A, Paxton P, Pemstein D, Pernes J, Ryden O, von Romer J, Seim B, Sigman R, Skaaning S-E, Staton J, Sundstrom A, Tzelgov E, Wang Y, Wig T, Wilson S and Ziblatt D (2023). V-Dem [Country-Year/Country-Date] Dataset v13” Varieties of Democracy (V-Dem) Project. doi:https://doi.org/10.23696/vdemds23

Cummings ME, Deeds DL and Vaaler PM (2021) Migrant tenure and the venture investment use of remittances to developing countries. In: Academy of Management Proceedings, 1. Retrieved from: https://ssrn.com/abstract=3460442

Cummings ME, Gamlen A (2019) Diaspora engagement institutions and venture investment activities in developing countries. J Int Bus Policy 2:289–313. https://doi.org/10.1057/s42214-019-00035-8

Gelb S, Kalantaryan S, McMahon S and Perez-Fernandez M (2021) Diaspora finance for development: from remittances to investment, Publications Office of the European Union, Luxembourg. Retrieved from: https://op.europa.eu/en/publication-detail/-/publication/1025d604-cf15-11eb-ac72-01aa75ed71a1/language-en

Gwartney J, Lawson R, Hall J, and Murphy R (2022) Economic Freedom Dataset, published in Economic Freedom of the World: 2022 Annual Report. Fraser Institute. Retrieved from: https://www.fraserinstitute.org/studies/economic-freedom-of-the-world-2022-annual-report

Haltiwanger J (2015) Job creation, job destruction, and productivity growth: the role of young businesses. Ann Rev Econ 7(1):341–358. https://doi.org/10.1146/annurev-economics-080614-115720

Hanusch M and Vaaler PM (2015) Migrant remittances, capital constraints and business starts in developing countries. Macroeconomic and Fiscal management MFM Practice Notes, August No. 8, World Bank Group. Retrieved from: http://documents.worldbank.org/curated/en/634721467999988162/Migrant-remittances-capital-constraints-and-new-business-starts-in-developing-countries

Hausmann R, Hidalgo CA, Bustos S, Sarah Chung MC, Jimenez J, Simoes A and Yıldırım MA (2014) The Atlas of Economic Complexity: mapping paths to prosperity. 2nd ed., Cambridge: MIT Press. Retrieved from: http://www.tinyurl.com/y67m6n72

Hidalgo CA, Hausmann R (2009) The building blocks of economic complexity. Proc Nat Acad Sci 106:10570–10575. https://doi.org/10.1073/pnas.0900943106

Hjort J and Tian L (2021) The economic impact of internet connectivity in developing countries. PEDL Synthesis Paper Series, No. 6. http://dx.doi.org/https://doi.org/10.2139/ssrn.3964618

Hjort J, Poulsen J (2019) The arrival of fast internet and employment in Africa. Am Econ Rev 109(3):1032–1079. https://doi.org/10.1257/aer.20161385

Kaufmann D, Kraay A and Mastruzzi M (2010) The worldwide governance indicators: a summary of methodology, data and analytical issues. World Bank Policy Research Working Paper, 5430. Retrieved from: https://ssrn.com/abstract=1682130

Kiliç T, Carletto G, Davis B, Zezza A (2009) Investing back home: return migration and business ownership in Albania. Econ Transit Inst Change 17(3):587–623. https://doi.org/10.1111/j.1468-0351.2009.00357.x

La Porta R, Shleifer A (2014) Informality and development. J Econ Perspect 28(3):109–126. https://doi.org/10.1257/jep.28.3.109

Laniran TJ, Adeniyi DA (2015) An evaluation of the determinants of remittances: evidence from Nigeria. Afr Hum Mobil Rev 1(2):179–203. https://doi.org/10.14426/ahmr.v1i2.739

Leandro M, Andrew J and Mehmet C (2017) The informal economy in Sub-Saharan Africa: size and determinants. IMF Working Paper WP/17/156. Washington, DC: International Monetary Fund. Retrieved from: https://ssrn.com/abstract=3014086

Lu R, Lu Q, Lv D, Huang Y, Li S, Jian Z, Reve T (2020) The evolution process of entrepreneurship studies in the 21st century: research insights from top business and economic journals. J Econ Surv 34(4):922–951. https://doi.org/10.1111/joes.12365

Martinez C, Cummings ME, Vaaler PM (2015) Economic informality and the venture funding effect of migrant remittances to developing countries. J Bus Ventur 30(4):526–545. https://doi.org/10.1016/j.jbusvent.2014.10.004

Nanyiti A, Sseruyange J (2022) Do remittances impact on entrepreneurial activities? Evidence from a panel data analysis. J Int Trade Econ Dev 31(4):553–565. https://doi.org/10.1080/09638199.2021.1995466

Naudé W, Siegel M, Marchand K (2017) Migration, entrepreneurship and development: critical questions. IZA J Migr. https://doi.org/10.1186/s40176-016-0077-8

Nguyen CP, Nguyen B, Tung BD, Su TD (2021) Economic complexity and entrepreneurship density. A non-linear effect study. Technol Forecast Soc Change 173:121107. https://doi.org/10.1016/j.techfore.2021.121107

Olivié I and Santillán O’Shea MS (2022) The role of remittances in promoting sustainable development. Directorate-General for External Policies, European Parliament. Retrieved from: https://www.europarl.europa.eu/RegData/etudes/IDAN/2022/702563/EXPO_IDA(2022)702563_EN.pdf

Orozco M and Ellis C (2014) Impact of remittances in developing countries. In: A new perspective on human mobility in the South, edited by Anich R, Crush J, Melde S, Oucho J, 89–118. Springer and IOM: London. doi:https://doi.org/10.1007/978-94-017-9023-9_5

Ratha D (2003) Workers’ remittances: an important and stable source of external development finance, Global Development Finance, 157–175. Retrieved from: https://ssrn.com/abstract=3201568

Ratha D (2007) Leveraging remittances for development, Policy Brief, No. 3, Migration Policy Institute, Washington, DC. Retrieved from: https://www.migrationpolicy.org/sites/default/files/publications/MigDevPB_062507.pdf

Ratha D (2017) What Are Remittances?, Finance and Development, IMF, Retrieved from: https://www.elibrary.imf.org/view/journals/022/2017/005/article-A035-en.xml

Ratinho T, Amezcua A, Honig B, Zeng Z (2020) Supporting entrepreneur. A systematic review of literature and an agenda for research. Technol Forecast Soc Change 154:119956. https://doi.org/10.1016/j.techfore.2020.119956

Saadi M (2020) Remittance inflows and export complexity: new evidence from developing and emerging countries. J Dev Stud 56(12):2266–2292. https://doi.org/10.1080/00220388.2020.1755653

Sima D, Huang F (2023) Is democracy good for growth? | Development at political transition time matters. Eur J Political Econ. https://doi.org/10.1016/j.ejpoleco.2022.102355

UNECA (2005) Economic Report on Africa 2004: meeting the Challenges of Unemployment and Poverty in Africa. Addis Ababa, Ethiopia. Retrieved from: https://hdl.handle.net/10855/15489

UNECA (2006) Economic Report on Africa 2005: Capital Flows and Development Financing in Africa. Addis Ababa, Ethiopia. Retrieved from: https://hdl.handle.net/10855/15492

United States Department of Agriculture (USDA), Economic Research Service (2022) International macroeconomic data set. Retrieved from https://www.ers.usda.gov/data-products/international-macroeconomic-data-set/

Vaaler PM (2011) Immigrant remittances and the venture investment environment of developing countries. J Int Bus Stud 42(9):1121–1149. https://doi.org/10.1057/jibs.2011.36

Woodruff C, Zenteno R (2007) Migration networks and microenterprises in Mexico. J Dev Econ 82(2):509–528. https://doi.org/10.1016/j.jdeveco.2006.03.006

World Bank (2014) Doing business 2015: going beyond efficiency. World Bank, Washington, DC. https://doi.org/10.1596/978-1-4648-0351-2

World Bank (2019), Migration and remittances: recent developments and outlook, migration and development brief 31. Retrieved from: https://www.knomad.org/sites/default/files/2019-04/Migrationanddevelopmentbrief31.pdf

World Bank (2021) RECOVERY. Covid-19 crisis through a migration lens. Migration and Development Brief 35. Retrieved from: https://documents.worldbank.org/en/publication/documents-reports/documentdetail/989721587512418006/covid-19-crisis-through-a-migration-lens