Abstract

The purpose of this research is to understand the impact of technological innovation on corporate social responsibility and corporate environmental performance, as well as the difference in the measurement of this impact between domestic and foreign companies. Supply chain management is an essential tool to promote environmentally sustainable manufacturing by owning green products, green supply chain management and green manufacturing processes, believes that companies should participate in inappropriate policies, assessments, practices and activities while achieving all components of economy, environment, charity and ethics. The hierarchical regression model is used to analyse 175 small and medium enterprises samples. The survey results show that technological innovation will affect environmental performance and will also have a positive impact on company performance. Efficient companies can bring greater financial success, which not only supports economic community projects but also supports social welfare. Innovating through the participation of management and employees in environmental protection practices can not only improve the company’s performance but also enhance the company’s image among stakeholders. The findings of this article strengthen existing theories and help establish sustainable practices in Chinese and other developing and developed countries.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Ecological, environmental, and management or supply chain management are often used terms for corporate initiatives in this area (Supply chain management) (Stedinger and Tasker 1985). According to the Management & Decision-making Centre, 82% of major corporations submitted environmental or business ethics reports in 2019, up from just below 25% in 2012. This shows that corporations are interested in ESG/SCM. 2. There has been a significant increase in investor interest in ESG and SCM, as shown by the $21 billion in net movements that 300 investments with ESG requirements earned in 2017 (Zhao et al. 2021) and (Awawdeh et al. 2021). The Standards of Economic Co-operation, an accord to include ESG/SCM problems into financial research and decision analysis, has more than 3300 large shareholders and telecommunications companies pledged on to it. Since 2006, these managers’ total management fees have grown from $6.5 trillion to nearly $86 trillion. Because industrial expansion is a major catalyst for economic growth, one may argue that the path of industrialization is influencing the course of climate change (Sun et al. 2020b) and (Baloch et al. 2020). However, because of the higher maintenance costs, the industrial sector is primarily concerned with decreasing operating expenses, which might result in a short-term decrease in profit (Haddad and Rahman 2012). As the rate of industrialization continues to climb, so does the level of financial mobilisation inside countries, further aggravating the problem of environmental deterioration. SDG 13’s climate action goals may be in jeopardy as a result of this development (Mohsin et al. 2019), (Mohsin et al. 2020) and (Mohsin et al. 2021).

Additionally, this process is increasing health and environmental difficulties, such as a rise in health care costs for the population (Lian and Chen 2017). To achieve SDG 8’s goals of decent employment and economic development may be in jeopardy if social concerns have a detrimental influence on the economic growth phase itself (Xu et al. 2021). The banking business has seen a number of changes in the last decade, with an increasing emphasis on environmental responsibility (Gao et al. 2020). China has a greater prevalence of this occurrence. China, for example, has been promoting green credit policies since 2012 in an effort to combat pollution. When financing eco-friendly businesses, this legislation mandates that banks offer a green channel. In order to convey the sustainability initiatives to the borrowers, lenders might use this method (Mwanyoka et al. 2019) and (Boshoff 2019). The impact of green credit is becoming more obvious as it grows at such a fast pace. In fact, (Zhuo et al. 2020) evaluated the effect of green loans on bank financial performance (Huang et al. 2018). To be sure, they overlook the important role that green loans play in balancing CSR with financial success (Lan et al. 2020). As a result, this subject merits more investigation, which is why the focus of this work is on it. Competition for SME talent is based on how well current executives perform compared to their peers in the same sector and of a similar size (Sun et al. 2019) and (Tiep et al. 2021). As a result, SMEs with a compensation difference are more likely to engage in competitive tournaments with their sector rivals in order to raise their profile in the job market (Ozoike-Dennis et al. 2019) and (Hilbers et al. 2019).

SME CE competitions have been shown to target clients who can improve the important locations of vulnerability and acquisition, cash management, R&D spending and capital expenditures, corporation taxes, and liquidity of the company (Durocher et al. 2018). As a result, CEOs naturally react by delivering tangible results that are appreciated by the local labour market. Despite the fact that supply chain management (SCM) is becoming an increasingly significant business choice, there is no evidence to suggest that the external labour market influences supply chain management policy. We are attempting to remedy this shortcoming. (Genest et al. 2009) Furthermore, the inadequacy of police officers and the Chinese tradition of reporting only positive news may undermine the trustworthiness of SCM reports, as pointed out by (Accastello et al. 2019), (Molla et al. 2019) and (Pinto et al. 2019). The fact that Chinese listed firms have only been required to release corporate responsibility statements since 2008 and that the substance of those reports does not need to be inspected means that many of them may adopt a superficial approach to the subject. For instance, (Kordej-De Villa and Slijepcevic 2019) and (Khosravi et al. 2019) corporate responsibility reports were almost identical between 2009 and 2012, aside from a few particular events and numbers, with the rest of the content remaining intact. Shanghai’s stock price plummeted when surveillance cameras uncovered the company’s usage of clenbuterol, a cancer-causing compound, in the company’s pig-raising operations on March 15, 2011(Valle et al. 2013). Accordingly, it is impossible to appropriately analyse earnings quality solely on firms’ self-reporting in China because of poor oversight norms and rules. SCM fulfilment and stock price collapse risk may be different in developing economies than in established ones (Banerjee and Magnus 1999).

To determine whether the quality of financial reporting of publicly listed companies is continuous and shareholders’ interests, placing emphasis on protracted value and public image worker comp, or whether SCM uses hierarchical as a preparation and application mechanism by administration according to agency, it is necessary to conduct an empirical investigation. The primary tools for this reconfiguration have been characterised as financial sector products and business finance systems. As part of the effort to better fit with the Sustainable Development Goals, a product was developed that focuses on climate change adaptation. As a result, the global financial market became aware of SMEs and their potential. The World Bank in 2009 launched this product in an effort to restore equilibrium in the international environmental biodiversity prompted by participants’ rising concern about ESG (environmental social governance) issues (Noor et al. 2010). Individual and institutional investors began to notice green bonds after the Addis Ababa Action Agenda, and borrowers from China, the Eurozone, and the United States of America began to dominate the sector in 2016. It was not long after the release of the United Nations (2019) report that SMEs began to regain popularity among investors worldwide, after a decline in 2018.

Thus, knowledge of the determinants of whether SMEs implement sustainable practices and the factors that facilitate or hinder their implementation remains fragmented. This study addresses this lack of scientific literature by answering the following questions (Pillai and Al-Malkawi 2018): Does technology innovation help in performance improvement of environmental sustainability practices among SMEs in developing countries? What internal or external contextual elements would promote the engagement of SMEs in the implementation of sustainable practices? What are the entrepreneur characteristics related to the implementation of sustainable practices by SMEs?

Therefore, the knowledge about the determinants of whether SMEs implement sustainable practices and the factors that promote or hinder their implementation is still fragmented. This study addresses the lack of scientific literature by answering the following questions: Does technological innovation matter to improve the performance of environmental sustainability practices of SMEs? What internal and external factors will motivate SMEs to engage in the development of sustainable practises? What are the entrepreneurial characteristics of SMEs implementing sustainable practices?

2 Literature review

2.1 Corporate reputation in SMEs

According to much research, ESG/SCM traits are linked to market features. In many cases, these qualities are dependent on the geographic proximity of enterprises or the attributes of the businesses in which they operate. ESG/SCM effectiveness is used as a regression model in all the research reviewed in this area, even when the degree of causation is not explicitly stated (Taghizadeh-Hesary and Taghizadeh-Hesary 2020) and (Taghizadeh-Hesary and Yoshino 2015) was one of the first researchers to do a political and social impact evaluation of green bonds by analysing the influence of ecological priorities on the high price of debt instruments in the economy. According to the author, the increased concern for environmental quality is a major factor fuelling the market for green bonds (Alemzero et al. 2020b), (Sun et al. 2020a) and (Alemzero et al. 2020a). The findings of (Guo et al. 2020), who focused on the supply side, are in line with the literature. According to the authors, corporation ecological consciousness and government transcriptional co-tax incentives were shown to have a beneficial influence on the pricing of financial products. There is a strong supply-side bias in the literature on this topic, which is consistent with the focus of our research. A recent study by (Lundby et al. 2021) examined how green bond issuance statements affected SCM activities, which in turn influenced the social and environmental initiatives undertaken by Chinese listed companies. According to (Hao et al. 2021), the trading in green bonds has a greater environmental influence that makes it easier to adopt and spread clean and sustainable energy throughout a country. Some academics, on the other hand, argue that social responsibility and financial success are not always linked (Taghizadeh-Hesary and Yoshino 2019), (Taghizadeh-Hesary and Yoshino 2020).

As a part of their research, (Chai et al. 2017) used data gathered from 156 financial firms in 24 countries between 2005 and 2010 to examine how SCM affects an organization’s bottom line. Particular emphasis was placed on the economic recession in this research. The study found that their connection has changed from a good one to an unfavourable one because of the economic meltdown, the study found. (Zhang et al. 2021), (Hsu et al. 2021) and (Ehsanullah et al. 2021) note that firms that do not engage in socially responsible activities have a longer lifespan than those that do, and companies that do not engage in socially responsible activities have greater profitability than those who engage in SCM activities in general (Khatibisepehr et al. 2012). Demand-driven external employment market tournaments push CEOs to make firm investment choices to boost international transparency in order to achieve their goal of increased labour market visibility. As (Dagum and Luby 1993) illustrate, CEO industry competition rewards have a positive effect on company profitability, notably in terms of better efficiency and effectiveness in the distribution and deployment of capital as well as in the programmes and initiatives and uncertainty approaches. CITI even encourages CEOs to implement unfair tax practises for their companies in order to boost their worth and prominence (Khosbayar et al. 2021). As proven by their firm's financial results, CEOs’ remarkable morale and productivity may help them win the sector award, which includes a high salary, a wide range of authority, and visibility (Iqbal et al. 2021) and (Zhang et al. 2021).

By meeting the needs of the market and their own company, CEOs may aim to build a strong brand for their human capital. When it comes to maximising one’s livelihood, a CEO may take into account the company’s internal environment, external stakeholders, one’s own ethics, and the total distribution of resources. For example, they spend a lot of effort on improving their company’s reputation and exposure by allocating forms of intervention in a smart manner. Companies’ spending on SCM operations may be influenced by SMEs’ outside workforce motivations. This research will answer the following question:

H1

Small and medium-sized enterprises (SMEs) benefit from technological innovation while implementing sustainable practises.

3 Research model and hypotheses

Structured performance was better for firms with low profitability elasticity in response to aggregation disturbances, which leads to greater SMEs values. Strong SCM effectiveness results in higher revenue margins and improved product pricing for SMEs; this is also essential since high investment ratios lead to reduced profit sensitivity to accumulate events. The supply curve may be reduced if a business identifies the fulfilment of its SCM commitments as a differentiating strategy, and the impact of economic shocks on the firm’s profitability will be lessens (Bhattacharjya et al. 2020). Among other things, the COVID-19 epidemic has resulted in significant stock market losses. Company-wide risk is manifested in the stock market performance, and Quality of financial reporting is a critical tool for mitigating it (Li et al. 2021), (Chien et al. 2021) and (Iqbal et al. 2021).

From the standpoint of lengthy, functions successfully, SCM’s worth is obvious. An increase in social responsibilities may help to improve one’s track record and spread good word-of-mouth. As a result, it may draw investors’ attention, reduce agency issues resulting from adverse selection, and moderate the market’s overreaction in the case of bad occurrences. Maintaining and improving a company’s internal and external harmony as well as its stock price stability are all made possible by an organization’s corporate responsibility efforts. Competitive incentives at the enterprise level encourage SMEs to devise plans, expend effort, and use company’s resources in a method of reaching that may result in better organizational effectiveness and concurrently boost their chances of winning the tournament on the recruitment of new employees. SCM actions may be used by SMEs to strengthen their company’s performance, strengthen their reputation, and increase their awareness in the workforce (Chandio et al. 2020) and (Sun et al. 2020a). Because Social responsibility improve business performance, lower a firm’s value of the stock, the cost of debt, and reduce informational asymmetries, this is an important determining factor. It also lowers risk exposure and the likelihood of financial hardship. (Agyekum et al. 2021) and (Zhang et al. 2021) found that CSR initiatives lower risk exposure and the likely hood of dire straits.

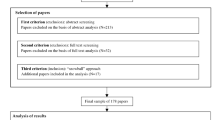

Financial statements by SMEs may also strengthen their reputation between many stakeholders, resulting in increased exposure and prestige in the labour market, as a result of competitive championship considerations. CSR investments may be increased by identity SMEs, despite the fact that excessively CSR may have a negative effect on corporate value (Xin et al. 2021) (Fig. 1).

H2

Sustainable practices by small and medium-sized enterprises (SMEs) are encouraged by economic incentives.

Accordingly, the following hypotheses are developed for further investigation:

H3

Sustainable business practises are more likely to be adopted by small and medium-sized enterprises (SMEs) when social issues are included.

H4

SMEs’ adoption of sustainable practices is aided by environmental considerations.

H5

Sustainable practices by small and medium-sized enterprises (SMEs) are encouraged by financial considerations

4 Data and methodology

4.1 Collection of data and sample profile

Different agricultural executives in Chinese cities were the study’s major units of analysis. Due to the obvious following factors, these places were designed by the researcher: Textiles, fruit, leafy greens, gardening, farming, seafood and jewels are the primary sources of income in these regions. No nation’s industrialization would be complete without the contribution of small and medium enterprises. 85% of Chinese’s businesses are small and medium-sized. The entrepreneurial sector is responsible for over 45% of the country’s yearly gross domestic product and about 80% of the non-agricultural workforce. Small and medium-sized businesses, in contrast to their formal sector counterparts, are hampered by a lack of company assets. Small and medium-sized enterprises (SMEs) have a particular characteristic that necessitates the establishment of an aid system to assist them in a variety of business operations (including digitalization, brand management, financial management, training and capacity building, etc.)

SMEDA, China’s flagship agency, offers essential services to assist small and medium-sized enterprises (SMEs) manage their inherent disadvantages. China’s Ministry of Industry and Production has established an independent agency, the China’s Small and Medium Enterprises Development Authority (PSMEDA), to support the development and progress of China’s SMEs. (I) Establish favourable regulation and supervision; (II) Encourage the growth of industrial clusters; and (III) Provide assistance to small and medium-sized businesses (SMBs) in all aspects of company development. Aside from that, SMEDA works to achieve measurable objectives by following a well-defined strategy that includes a thorough examination of worldwide trends, national regulations, and other independent factors that impact China’s small and medium-sized companies (SMEs). We also work with businesses in the industries of agriculture, fishing and handicrafts, as well as handicraft spinning, mass transit, leatherette, limestone, sandstone and floor coverings. In order to meet the preventive economic, technological, managerial and commercial needs of small and medium businesses, this engagement occurs at the individual and social levels.

4.2 Sample characteristics

One-quarter of the 180 people who took part in the survey were male (70.54%), and the highest age range represented by those who took part was 36–40 years old (38.56%), as shown in Table 1. Of those polled, a whopping 22% were over the age of 42. A bachelor’s degree is held by 36.54% of those we surveyed, a master’s by 38.34%, and other degrees by the remaining respondents. On average, small and medium-sized business personnel have three to four years of experience.

4.3 Measurement, scale development and analysis

Studies on the subject address a major gap in the existing literature by analysing ecological entrepreneurial techniques’ upstream and downstream reactions. China’s SCM policy would also have a significant influence on the manufacturing of new technology. Studies have examined the relationship between various ownership arrangements and a company’s SME policy. As we have shown in earlier sections, the SME actions of a company may either serve stockholders’ interests or be the result of agency difficulties. As proxies for external governance, several studies use the firm’s SMEs score as the dependent variable, with the explanation that it demonstrates strong or bad external management, depending on the results. The SCM score may be used as an explanatory variable in other studies that utilise managerial ownership as a proxy for investor choices and analyse how corporate structure affects a company effectiveness. For that reason, this study explores both directions of causation: whether stakeholders influence a company’s SCM strategies or specific SCM features draw a particular sort of business owner. In addition, researchers encounter difficulties linking to characteristics that may be linked to either management or SCM ratings, like quality and performance.

5 Results and discussion

5.1 Analysis of the model results

Cronbach’s alpha was used to measure the reliability and validity of the variables in this research. Cronbach’s alpha is a number that runs from 0 to 1. In other words, if the result is closer to 1, it signifies that the things being measured have a greater level of internal dependability. The alpha value should be greater than 0.80. Reliability in all experimental factor configurations was found to be above 0.8 in this study’s findings. It was determined that all 52 research programmes passed the concurrent reliability analysis since their average load was more than or equal to 0.7. An appropriate threshold for the entire dependability is also met. But this is more than 0.50. The extraction latent variable is also appropriate for all dependent constructions. As indicated in Table 2, all of the study items have efficient internal dependability (Cronbach’s alpha value is greater than or equal to 0.70). The outcome falls within the acceptable range. The finding that all levels of multilayer logistic regression exhibit completion and successful classification reinforces the belief in the models.

In the assessment of sustainable practises (see Table 3), a non-significant value was found for the aggregate score of the degree to which sustainable growth activities have been implemented in the assessment. (β = 0.111, t = 3.845, p = 0.023). As a result, SMEs have the strongest opportunity to enhance the environmental performance of their products. We think that SMEs are dedicated to SD for non-business-related objectives because the business context of SD is the least obvious in SMEs. Sustainable economic and social practises’ second feature is significant (t = 2.055, p 0.000): the average score for the amount of implementation of green social practises. Findings show that the social component is most disproportionately represented in businesses, which underlines the relevance of these activities to SME owners, as shown by these findings. According to the authors, companies in economic development and energy are more likely than others to be held by the government. Using a difference-in-difference approach, the researchers found state-owned corporations enhanced their sustainability practises more than many other businesses after the 2009 Copenhagen Accord. (Orphanou et al. 2018) found that before their privatisation, the privatised enterprises had higher sustainability performance ratings overall and, on both health, and environmental components than all the other companies quoted. They also discover that the link between nationalisation and the political scene of the nation is influenced. Despite this (Zhou and Wang 2019) found evidence of a bidirectional link between anarcho-communism and business corporate environmental profiles when investigating one nation (China). At reduced levels of parental ownership, the correlation is negative, whereas at greater levels of state shareholdings, it is positive. Future studies may be able to resolve these contradicting findings. According to (Sun et al. 2021), managers of small- and medium-sized enterprises (SMEs) need to take ethical factors into account.

With the help of social practise, owners and managers may implement ethical practises in their firm and build strong relationships with important participants. The finding was substantial (p = 0.000) for the third aspect of environmentally friendly behaviour. The findings support the notion that this aspect is an important part of SD in small- and medium-sized enterprises. It is in agreement with the predictions of (Neri et al. 2020), who observed that approximately half of the unsustainable measures adopted by SMEs are designed to lessen the ecological impact of industrial operations. We may draw a connection to (Alekseichuk et al. 2016) because environmental issues provide an altruistic opportunity and open the door to additional SD-related searches. It is clear that SMEs need to work together to incorporate sustainable business practises into their operations because the collaborators for their operation, including organisational culture change and support from the government, were found to be non-significant. This shows that SMEs need to work together to incorporate sustainability practises because the assistants, including organisation development and government assistance, were found to be non-significant.

In the study by (Thut et al. 2017) sustainability performance adds value, but only for companies that spend a lot of money on marketing. For enterprises that promote sustainability, (Ezzyat et al. 2017) shows a correlation between enterprise value and corporate sustainability qualities. According to the study’s authors, services on the basis of efforts help enterprises with a strong product difference. To examine the relationship between profitability and corporate environmental practises (Smith et al. 2011) examine the value of an extra dollar in capital reserves by comparing primary and secondary businesses. They find that organisations with better corporate governance ratings have a higher company value if they have more cash. At least at the outset, these findings suggest that SMEs may have a beneficial effect on ESR (ESRI). With the increase of both indexes, it can be shown that GRBI is decreasing its influence on SMEs. Firms’ concentration on industrial output rather than political outcomes may be to blame for this occurrence, which echoes the traditional trade-off between growth and development.

Due to the lack of recommendations for providing the necessary support via economic operations, companies may utilise GRBI to save money on taxes rather than as a means of delivering social and environmental benefits. Family-owned companies are expected to have a more socially responsible report (6.36) than non-family-owned firms, according to the association of family individual characteristics and the presence of a report (0.053–0.10). A greater emphasis on ethical behaviour in the workplace (6.08). Non-family firms that have no construction company statement (7.34) or no sole proprietorship (6.09) favour corporate governance over non-family enterprises. Table 3 depicts these variations more explicitly, showing that family companies have a better grasp of SCM due to the presence of a SCM report. Furthermore, for non-family businesses, the presence or absence of a socially responsible report is an important factor to consider. Cigarettes, liquor, and military-related products, in addition to betting and gun manufacturing companies, all take part in SCM initiatives. (Neuling et al. 2017) Since CSR is more common in problematic sectors, consumers aren’t pleased with the conflicting attempts of these companies to concurrently participate in SCM as a means of rehabilitating their image (Alekseichuk et al. 2019). As a result, it’s more probable that these “sin” companies will only invest in SCM after they’ve met their usual operational and economic needs. Companies in “sin” sectors are less likely to prioritise socially responsible operations in favour of employing limited resources for core business reasons (e.g. capital expenditures). It was shown that the decrease in water and air release (β = 0.543, t = 18.093, p 0.001) was much greater than the release produced using these approaches (β = 0.202, t = 6.094, p 0.001). According to a survey by (Reinhart and Nguyen 2019), at least half of companies have adopted this strategy. Reductions in the use of building ingredients, freshwater, and energy were also considered (p > 0.001 for both t and x). corresponding with the consequences of purchasing initiatives (Rugg and Vilberg 2013). By and large, owner-managers who understand their company’s energy usage are more inclined to find ways of reducing their energy consumption. Barriers to the adoption of sustainable practises by small- and medium-sized enterprises (Table 4).

5.2 Comparative analysis

Table 5 indicates Small and medium-sized enterprises (SMEs) are plagued by a lack of financial resources (β = 0.254, t = 5.867, p 0.001). According to research by, resource scarcity is a common concern. Our findings show that this problem is inevitable for small businesses. It is suggested that the lack of clarity in SD rules is a second impediment to the adoption of long-term solutions by small- and medium-sized enterprises (SMEs). SME owners may find the SCM language difficult to understand and even unpleasant, and it may be more difficult for SME owners to understand than it is. Another issue that frequently appears in the research after difficulty comprehending SD is a lack of time (β = 0.302, t = 6.342, p 0.001) of their smaller budgets, small businesses have more difficulty adopting sustainable practises because they lack the effort and time to do so.

Rotation Method: Table 6, columns 2 and 3, the correlations on Scoret-1 are considerably negative at 10% and 5%, showing that the SMEs are lower for businesses with a relatively high CSR assessment, as indicated in the first and second rows. Thus, argument H1A is upheld and assumption H1B is disproved. Investor accountability, environmental protection, and communication and engagement authorities all appear in columns 3–8 of the regression findings. The Staket-1 and Envt-1 coefficients are all underlying information, indicating that firms with higher corporate sustainability ratings have a reduced crash risk. Social contributions, such as charitable contributions, have no substantial influence on stock collapse risk according to Societyt-1 coefficients, which are positive but small. On the other hand, (Violante et al. 2017)found a link between cause marketing and a higher probability of a stock market meltdown. Hypothesis H2 has been shown to be true. Component Methodology containing 1 using Kaiser normalisation and extraction mode. Since the adjusted R-squared is now positive (adjusted R2 = 0.085, p 0.001), the phenomena of SMEs implementing sustainable practises may finally be explained by including the control factors. SME’s varying levels of success in implementing sustainable practises may be explained in part by the large variety in the coefficient of determination. In our study, the adjusted R2 climbs to 0.123 (p 0.001) when we include organisational factors in our analysis of sustainable practises. The remaining three models have a marginally significant variation in their F statistic, which indicates that the predictive capacity of the model does not increase with the inclusion of the block of organisational factors. According to (Wixted 2007)all variables in the fourth model have a R = 0.601 (p 0.001) correlation with model estimates of the explanatory variables. The adjusted R2 jumps to 0.345 (p 0.001) when individual factors are included (Table 6).

The environmental component best explains the collection of variables under investigation, with an adjusted R2 of 0.3487 (p = 0.001). According to (Sestieri et al. 2017) interpersonal behaviour theory, SMEs with owner-managers who have a positive emotional reaction after implementing sustainable development strategies are more likely to continue doing so. Additionally, SD’s normative force and perceived repercussions help to create environmental protection behaviours. SME owners that make an effort to improve their corporate environment and improve their organization’s environmental performance are more proactive on environmental issues. As a result, people are more likely to follow these practises if they can see the advantages. It is also likely that environmental policies are the biggest source of energy and that shareholders believe that their businesses ought to prioritise the adoption of sustainable practises but lack the cash to do so. According to the findings, SMEs' financial health is a precondition for advancing the adoption of environmentally sound business practises.

All the engagement characteristics are included in the multilevel multivariate regression at once, using the step-by-step procedure in Table 7. The coefficient of determination, R = 0.803 (p 0.001), shows that the data matched the model well. Incorporating interaction factors boosts adjusted R2–0.502 (p 0.001), explaining a considerably bigger portion of the CSR performance. As a result of this study, we can conclude that the F statistic is statistically significant for the economic component and very significant for implementing sustainable activities, such as social and environmental practises.

Our findings reveal that throughout the crisis, stakeholders’ strong positive impacts on financial practises and strategic social conscience have impacted the relationship between these two concepts. Stakeholders are critical to the success of small- and medium-sized businesses that want to improve financial performance via corporate social responsibility. It is imperative that small and medium-sized businesses put forth the effort to develop strategies to quickly choose the ones that are most vital to them. In order to examine whether small- and medium-sized businesses gain equally from identical corporate social responsibility measures, the practise of stockholder theory is important. Researchers think that CSR is executed based on the demands and pressures of various stakeholders. It is, however, difficult for a business to fulfil the requirements of all of its constituents. Because they tend to prioritise social duty above pure profit maximisation, small- and medium-sized businesses face an especially dire position.

Research shows that individuals who are more powerful or who need SMEs to meet more urgent or legal needs are more vital to SMEs. On the other hand, SCM plans for corporate suppliers are more likely to benefit large corporations than small businesses, despite the fact that small businesses may have a harder time locating suppliers. The study’s findings also demonstrate that the relevance of SMEs to consumers is influenced by their tight ties with one another. According to new research, location and ethically tight connections with populations and vendors have been shown to have a beneficial impact on financial success. If the ethical and physical distances between suppliers and communities are kept closer by small businesses (SMEs), they will reap higher rewards in terms of their SCM activities for these stakeholders. In the SME literature, it is clear that SMEs and local communities have a very tight connection and a high level of contact. Since the distance between consumers and suppliers influences the link between SCM and financial success for small businesses, this aspect has been mostly overlooked.

5.3 Robustness analysis

The study’s findings did not include any other possible effects that might improve SCM activities and financial success. Regression analysis and the Hausman test are utilised to remove any subjectivity and unobserved heterogeneity, and an extrinsic method is used to investigate if our findings are skewed owing to omitted variables. It is possible to identify serious disparities in raw data (i.e. financial success without the indirect influence of corporate social responsibility). Examples of variables that have been utilised in the past include CEO salary, the degree of asset disclosure, or the visibility of the organisation. The foregoing requirements are not met by the firm or other factors (such as the size or age of the company, for example). Recent research has shown that corporate governance has no effect on the financial performance of small and medium-sized enterprises (SMEs), but that participation in social responsibility rewards for SMEs and businesses is closely relevant to SMEs’ activities.

Last but not least, we use the Granger Causality Test in quantiles for the SCM and its numerous decomposition series, as well as the Environmental and Social Responsibility Index. Table 8 shows the results of the robustness analysis in data points for variables of the study. The robustness analysis from GRBI is clearly seen in Table 8 where it is divided into CSR at all quantiles. Even after taking into account all of the time delays evaluated, the Granger causality test results are the same. The findings show that changes in the SMEs and their decomposition series have a considerable impact on the International Ecological and Community Engagement Index. Nevertheless, we may see some evidence of input and output causality tests in deciles seen between dependent parameters at extremely lower (0.1) or extremely higher (0.7 or 0.9) quantiles. This study’s results show that the greater levels of SCM demand for an equal penetration of green bonds, which is represented in the low and high returns on GRBI in the last portion of the conclusions. In a situation where a greater SME may have a negative impact on ESRI, this causation could be crucial from a regulatory standpoint.

6 Conclusion and policy implication

When small and medium enterprises embrace environmental management practices, this essay tries to fill the gap between technology innovation and the performance of small and medium enterprises. Small and medium enterprises’ digitalization and implementing sustainable practises is vital in today’s complex business climate for ecological sustainability. There are three variables in this study: different phases of development, organisational aspects and environmental factors. Product, process, and marketing innovation, and SCM practises of enterprises are examined in the study under technical innovation. A theoretical framework is used to examine the connections between approach, choice style, entrepreneurship, economic success, and the execution of long-term strategies in organisations, which are the focus of this study. Furthermore, environmental protection research focuses on policy requirements, participation and monetary support.

Two new and different theories have emerged as a result of this study. First, we look at the financial performance of selected enterprises (SMEs) from the theoretical viewpoint of strategic management. During the economic downturn, we looked at which constituents SMEs should prioritise. Although managers have come to a decision, they still need to come to a conceptual agreement and address the concerns of stakeholders. As far as I can tell, there is been very little development since then in determining which participants' concerns should be given attention to. Because of this, we broadened the client research aspects already done by conducting empirical tests and further developing shareholder saliency models in response to the request to examine the personal influence of stakeholders on the implementation of sustainable methods by SMEs. To learn more and get a better understanding of the world. This project’s knowledge base is covered. There are just a few academics who use it despite its widespread acceptance.

As the second example, this study examined a model that was specifically designed for SME businesses and acknowledged that the operating procedures of SME organisations varied from those of SME major businesses. Because SMEs have unique characteristics, the research acknowledges that this is a distinct problem from that of big corporations. It is common practise to apply the stakeholder model to both big and small businesses without recognising the unique features of small businesses. Stakeholders’ prominent positions are especially critical for SMEs. Because small and medium-sized businesses are more likely to be active members of their local communities, as a rule, small- and medium-sized businesses (SMEs) wield less influence; they alleviate the burden on key stakeholders and enjoy a greater level of credibility with these individuals. As a result, a tight connection with small- and medium-sized enterprises (SMEs) may be necessary, particularly when the firm is tiny and there are no anonymous employees in most divisions. In most cases, the owner-manager is to blame for any mistakes or questionable actions that occur at the business, and he or she will be held accountable.

Managers who are looking to comprehend how business potential might develop commercial opportunities via the value provided by their corporate social responsibility need to grasp the complexities of the link between SCM and financial performance success. Despite the fact that researchers have responded by pointing out that companies must not only consider the valuation approach but also take into account the method of valuation, it is complicated for most SME businesses to go outside the daily economic principles of the range of banking and financial factors that hinder their growth. Their skill set is very impressive. (SCM) is an important concept to consider. SME businesses, on the other hand, may choose to fulfil their corporate social obligations as per measurement standards, but the choice of particular activities is frequently decided for personal or even arbitrary reasons. Due to a lack of resources, small-business management teams should focus more on particular approaches and techniques, according to the findings of this research. Our suggested framework demonstrates the need to prioritise effective, lawful, and close-organization initiatives, as well as make compelling proposals.

Lastly, the findings suggest that SCM is spreading across the supply chain as a whole. Researchers found that there is little evidence to support the claim of corporations abandoning their own technology in order to address environmental concerns. Because of a lack of public rules, there isn’t enough focus and incentive for considerable improvement in productivity. To fulfil the aim of ecological sustainability, some sort of public oversight is needed. The SEES approach provides for a rigorous evaluation of business practises based on empirical facts.

References

Accastello C, Bieniasz A, Blaško R et al (2019) Conflicting demands on the natural resources in northern sweden: a participatory scenario development study. J Environ Assess Policy Manag. https://doi.org/10.1142/S1464333219500170

Agyekum EB, Amjad F, Mohsin M, Ansah MNS (2021) A bird’s eye view of Ghana’s renewable energy sector environment: a multi-criteria decision-making approach. Util Policy. https://doi.org/10.1016/j.jup.2021.101219

Alekseichuk I, Turi Z, Amador de Lara G et al (2016) Spatial working memory in humans depends on theta and high gamma synchronization in the prefrontal cortex. Curr Biol 26:1513–1521

Alekseichuk I, Mantell K, Shirinpour S, Opitz A (2019) Comparative modeling of transcranial magnetic and electric stimulation in mouse, monkey, and human. Neuroimage 194:136–148

Alemzero DA, Iqbal N, Iqbal S et al (2020a) Assessing the perceived impact of exploration and production of hydrocarbons on households perspective of environmental regulation in Ghana. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-020-10880-3

Alemzero DA, Sun H, Mohsin M et al (2020b) Assessing energy security in Africa based on multi-dimensional approach of principal composite analysis. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-020-10554-0

Awawdeh AE, Ananzeh M, El-khateeb AI, Aljumah A (2021) Role of green financing and corporate social responsibility (CSR) in technological innovation and corporate environmental performance: a COVID-19 perspective. China Financ Rev Int. https://doi.org/10.1108/CFRI-03-2021-0048

Baloch ZA, Tan Q, Iqbal N et al (2020) Trilemma assessment of energy intensity, efficiency, and environmental index: evidence from BRICS countries. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-020-09578-3

Banerjee AN, Magnus JR (1999) The sensitivity of OLS when the variance matrix is (partially) unknown. J Econ 92:295–323

Bhattacharjya D, Shanmugam K, Gao T et al (2020) Event-driven continuous time bayesian networks. AAAI 2020 – 34th AAAI Conf Artif Intell 34:3259–3266. https://doi.org/10.1609/aaai.v34i04.5725

Boshoff DS (2019) Of smoke and mirrors: (Mis)communicating EIA results of solar energy projects in South Africa. J Environ Assess Policy Manag. https://doi.org/10.1142/S1464333219500145

Chai H, Lei J, Fang M (2017) Estimating Bayesian networks parameters using em and Gibbs sampling. Procedia Comput Sci 111:160–166. https://doi.org/10.1016/j.procs.2017.06.023

Chandio AA, Jiang Y, Rehman A et al (2020) Determinants of demand for credit by smallholder farmers’: a farm level analysis based on survey in Sindh, Pakistan. J Asian Bus Econ Stud. https://doi.org/10.1108/jabes-01-2020-0004

Chien F, Pantamee AA, Hussain MS et al (2021) Nexus between financial innovation and bankruptcy: evidence from information, communication and technology (ict) sector. Singap Econ Rev. https://doi.org/10.1142/S0217590821500181

Dagum P, Luby M (1993) Approximating probabilistic inference in Bayesian belief networks is NP-hard. Artif Intell 60:141–153. https://doi.org/10.1016/0004-3702(93)90036-B

Durocher M, Burn DH, Mostofi Zadeh S (2018) A nationwide regional flood frequency analysis at ungauged sites using ROI/GLS with copulas and super regions. J Hydrol 567:191–202. https://doi.org/10.1016/J.JHYDROL.2018.10.011

Ehsanullah S, Tran QH, Sadiq M et al (2021) How energy insecurity leads to energy poverty? do environmental consideration and climate change concerns matters. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-14415-2

Ezzyat Y, Kragel JE, Burke JF et al (2017) Direct brain stimulation modulates encoding states and memory performance in humans. Curr Biol 27:1251–1258. https://doi.org/10.1016/j.cub.2017.03.028

Gao H, Hsu PH, Li K, Zhang J (2020) The real effect of smoking bans: evidence from corporate innovation. J Financ Quant Anal 52:387

Genest C, Rémillard B, Beaudoin D (2009) Goodness-of-fit tests for copulas: a review and a power study. Insur Math Econ 44:199–213. https://doi.org/10.1016/j.insmatheco.2007.10.005

Guo F, Bai W, Huang B (2020) Output-relevant variational autoencoder for Just-in-time soft sensor modeling with missing data. J Process Control 92:90–97. https://doi.org/10.1016/j.jprocont.2020.05.012

Haddad K, Rahman A (2012) Regional flood frequency analysis in eastern Australia: Bayesian GLS regression-based methods within fixed region and ROI framework - quantile regression vs parameter regression technique. J Hydrol 430–431:142–161. https://doi.org/10.1016/j.jhydrol.2012.02.012

Hao X, Gao Y, Yang X, Wang J (2021) Multi-objective collaborative optimization in cement calcination process: a time domain rolling optimization method based on jaya algorithm. J Process Control 105:117–128. https://doi.org/10.1016/j.jprocont.2021.07.012

Hilbers AM, Sijtsma F, Busscher T, Arts J (2019) Understanding added value in integrated transport planning: exploring the framework of intelligence, design and choice. J Environ Assess Policy Manag. https://doi.org/10.1142/S146433321950011X

Hsu CC, Quang-Thanh N, Chien FS et al (2021) Evaluating green innovation and performance of financial development: mediating concerns of environmental regulation. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-14499-w

Huang K, Chen L, Zhou J et al (2018) Flood hydrograph coincidence analysis for mainstream and its tributaries. J Hydrol 565:341–353. https://doi.org/10.1016/j.jhydrol.2018.08.007

Iqbal W, Tang YM, Chau KY et al (2021) Nexus between air pollution and NCOV-2019 in China: application of negative binomial regression analysis. Process Saf Environ Prot. https://doi.org/10.1016/j.psep.2021.04.039

Khatibisepehr S, Huang B, Xu F, Espejo A (2012) A Bayesian approach to design of adaptive multi-model inferential sensors with application in oil sand industry. J Process Control 22:1913–1929

Khosbayar A, Valluru J, Huang B (2021) Multi-rate Gaussian Bayesian network soft sensor development with noisy input and missing data. J Process Control 105:48–61. https://doi.org/10.1016/j.jprocont.2021.07.003

Khosravi F, Fischer TB, Jha-Thakur U (2019) Multi-criteria analysis for rapid strategic environmental assessment in tourism planning. J Environ Assess Policy Manag. https://doi.org/10.1142/S1464333219500133

Kordej-De Villa Z, Slijepcevic S (2019) Assessment of local councillors’ attitudes towards energy efficiency projects in croatia. J Environ Assess Policy Manag. https://doi.org/10.1142/S1464333219500121

Lan G, Lv Y, Kuang X, Wu Y (2020) Effect of China coastal aera’s income distribution based on the network financial environment. J Coast Res. https://doi.org/10.2112/SI103-053.1

Li W, Chien F, Hsu CC et al (2021) Nexus between energy poverty and energy efficiency: estimating the long-run dynamics. Resour Policy. https://doi.org/10.1016/j.resourpol.2021.102063

Lian L, Chen C (2017) Financial development, ownership and internationalization of firms: evidence from China. China Financ Rev Int. https://doi.org/10.1108/CFRI-06-2016-0054

Lundby ETB, Rasheed A, Gravdahl JT, Halvorsen IJ (2021) A novel hybrid analysis and modeling approach applied to aluminum electrolysis process. J Process Control 105:62–77. https://doi.org/10.1016/j.jprocont.2021.06.005

Mohsin M, Rasheed AK, Sun H et al (2019) Developing low carbon economies: an aggregated composite index based on carbon emissions. Sustain Energy Technol Assess. https://doi.org/10.1016/j.seta.2019.08.003

Mohsin M, Nurunnabi M, Zhang J et al (2020) The evaluation of efficiency and value addition of IFRS endorsement towards earnings timeliness disclosure. Int J Financ Econ. https://doi.org/10.1002/ijfe.1878

Mohsin M, Hanif I, Taghizadeh-Hesary F et al (2021) Nexus between energy efficiency and electricity reforms: a DEA-based way forward for clean power development. Energy Policy. https://doi.org/10.1016/j.enpol.2020.112052

Molla MB, Ikporukpo CO, Olatubara CO (2019) Evaluating policy and legal frameworks of urban green infrastructure development in ethiopia. J Environ Assess Policy Manag. https://doi.org/10.1142/S1464333219500169

Mwanyoka I, Selestine WE, Nuhu S (2019) EIA practices in the natural gas extraction sector in tanzania: does local community contribution matter? J Environ Assess Policy Manag. https://doi.org/10.1142/S1464333219500157

Neri F, Mencarelli L, Menardi A et al (2020) A novel tDCS sham approach based on model-driven controlled shunting. Brain Stimul 13:507–516. https://doi.org/10.1016/j.brs.2019.11.004

Neuling T, Ruhnau P, Weisz N et al (2017) Faith and oscillations recovered: on analyzing EEG/MEG signals during tACS. Neuroimage 147:960–963

Noor RAM, Ahmad Z, Don MM, Uzir MH (2010) Modelling and control of different types of polymerization processes using neural networks technique: a review. Can J Chem Eng 88:1065–1084. https://doi.org/10.1002/cjce.20364

Orphanou K, Thierens D, Bosman PAN (2018) Learning Bayesian network structures with GOMEA. GECCO 2018–Proc 2018 Genet Evol Comput Conf. https://doi.org/10.1145/3205455.3205502

Ozoike-Dennis P, Spaling H, Sinclair AJ, Walker HM (2019) SEA, urban plans and solid waste management in Kenya: participation and learning for sustainable cities. J Environ Assess Policy Manag. https://doi.org/10.1142/S1464333219500182

Pillai R, Al-Malkawi HAN (2018) On the relationship between corporate governance and firm performance: evidence from GCC countries. Res Int Bus Financ. https://doi.org/10.1016/j.ribaf.2017.07.110

Pinto E, Morrison-Saunders A, Bond A et al (2019) Distilling and applying criteria for best practice EIA follow-up. J Environ Assess Policy Manag. https://doi.org/10.1142/S146433321950008X

Ping SH, Tariq G, Haris M, Mohsin M (2019) Evaluating the environmental effects of economic openness: evidence from SAARC countries. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-019-05750-6

Reinhart RMG, Nguyen JA (2019) Working memory revived in older adults by synchronizing rhythmic brain circuits. Nat Neurosci 22:820–827. https://doi.org/10.1038/S41593-019-0371-X

Rugg MD, Vilberg KL (2013) Brain networks underlying episodic memory retrieval. Curr Opin Neurobiol 23:255–260. https://doi.org/10.1016/j.conb.2012.11.005

Sestieri C, Shulman GL, Corbetta M (2017) The contribution of the human posterior parietal cortex to episodic memory. Nat Rev Neurosci 18:183–192. https://doi.org/10.1038/NRN.2017.6

Smith CN, Wixted JT, Squire LR (2011) The hippocampus supports both recollection and familiarity when memories are strong. J Neurosci 31:15693–15702. https://doi.org/10.1523/JNEUROSCI.3438-11.2011

Stedinger JR, Tasker GD (1985) Regional hydrologic analysis: 1. ordinary, weighted, and generalized least squares compared. Water Resour Res 21:1421–1432. https://doi.org/10.1029/WR021I009P01421

Sun H, Pofoura AK, Adjei Mensah I et al (2020a) The role of environmental entrepreneurship for sustainable development: evidence from 35 countries in Sub-Saharan Africa. Sci Total Environ. https://doi.org/10.1016/j.scitotenv.2020.140132

Sun L, Cao X, Alharthi M et al (2020b) Carbon emission transfer strategies in supply chain with lag time of emission reduction technologies and low-carbon preference of consumers. J Clean Prod. https://doi.org/10.1016/j.jclepro.2020.121664

Sun B, Zhou Y, Wang J, Zhang W (2021) A new PC-PSO algorithm for Bayesian network structure learning with structure priors. Expert Syst Appl 184:115237. https://doi.org/10.1016/J.ESWA.2021.115237

Taghizadeh-Hesary F, Taghizadeh-Hesary F (2020) The impacts of air pollution on health and economy in Southeast Asia. Energies. https://doi.org/10.3390/en13071812

Taghizadeh-Hesary F, Yoshino N (2015) Macroeconomic effects of oil price fluctuations on emerging and developed economies in a model incorporating monetary variables. Econ Policy Energy Environ. https://doi.org/10.3280/EFE2015-002005

Taghizadeh-Hesary F, Yoshino N (2019) The way to induce private participation in green finance and investment. Financ Res Lett. https://doi.org/10.1016/j.frl.2019.04.016

Taghizadeh-Hesary F, Yoshino N (2020) Sustainable solutions for green financing and investment in renewable energy projects. Energies. https://doi.org/10.3390/en13040788

Thut G, Bergmann TO, Fröhlich F et al (2017) Guiding transcranial brain stimulation by EEG/MEG to interact with ongoing brain activity and associated functions: a position paper. Clin Neurophysiol 128:843–857

Tiep NC, Wang M, Mohsin M et al (2021) An assessment of power sector reforms and utility performance to strengthen consumer self-confidence towards private investment. Econ Anal Policy. https://doi.org/10.1016/j.eap.2021.01.005

Valle JA, Zhang M, Dixon S et al (2013) Impact of pre-procedural beta blockade on inpatient mortality in patients undergoing primary percutaneous coronary intervention for ST elevation myocardial infarction. Am J Cardiol 111:1714–1720. https://doi.org/10.1016/j.amjcard.2013.02.022

Violante IR, Li LM, Carmichael DW et al (2017) Externally induced frontoparietal synchronization modulates network dynamics and enhances working memory performance. Elife. https://doi.org/10.7554/ELIFE.22001

Wixted JT (2007) Dual-process theory and signal-detection theory of recognition memory. Psychol Rev 114:152–176. https://doi.org/10.1037/0033-295X.114.1.152

Xin G, Wang P, Jiao Y (2021) Multiscale quantum harmonic oscillator optimization algorithm with multiple quantum perturbations for numerical optimization. Expert Syst Appl 185:115615

Xu X, Wang C, Zhou P (2021) GVRP considered oil-gas recovery in refined oil distribution: From an environmental perspective. Int J Prod Econ. https://doi.org/10.1016/j.ijpe.2021.108078

Zhang D, Mohsin M, Rasheed AK et al (2021) Public spending and green economic growth in BRI region: mediating role of green finance. Energy Policy. https://doi.org/10.1016/j.enpol.2021.112256

Zhao L, Zhang YQ, Sadiq M et al (2021) Testing green fiscal policies for green investment, innovation and green productivity amid the COVID-19 era. Econ Change Restruct. https://doi.org/10.1007/s10644-021-09367-z

Zhou Y, Wang P (2019) An ensemble learning approach for XSS attack detection with domain knowledge and threat intelligence. Comput Secur 82:261–269

Zhuo W, Ding C, Xiong Y, Peng J (2020) Construction of legal system for maritime international trade financial supervision cooperation. J Coast Res 103:143–146. https://doi.org/10.2112/SI103-030.1

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhao, W., Luo, Z. & Liu, Q. Does supply chain matter for environmental firm performance: mediating role of financial development in China. Econ Change Restruct 56, 3811–3837 (2023). https://doi.org/10.1007/s10644-022-09410-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-022-09410-7