Abstract

Financial inclusion is fundamental for increasing the nation’s performance and green economy has emerged as one of the dominant factors to ecological sustainability, but how will these two factors connect? This research analyzes the correlation between the two in the case of China, which is undergoing a transformation to a green economy, using state-level statistics from 2008 to 2020 to evaluate the connection between financial inclusion and the green economy. By taking into account the fast-expanding technology banking system, as well as the application of the minimum distance to the weak efficient frontier framework (MinDw), a comprehensive assessment of financial inclusion is created, as is an assessment of green economic productivity. The findings show that the expansion of financial inclusion may contribute to increased green economic proficiency, which is primarily achieved via the tightening of credit restrictions on carbon emitting companies. The results have more consequences for the implementation of a financial development strategy and the maintenance of healthy associations between the state, banking institutions, and businesses.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Enhancing energy efficiency is one of the most important agenda issues for countries in modern times, and China has embraced the green economy’s sustainable development objective. Ehsanullah et al. (2021) stated that the world’s financial inclusion targets are to “promote inexpensive, efficient, and sufficient access to all forms of managed banking commodities and to expand their use by all social classes”. Public assistance considerations identify under-served customer groups; microfinance companies construct their customers’ value to maximize profit margins (Ma et al. 2021). These considerations emphasize accessibility limitations that may be in place depending on circumstances like nationality, identity, occupational prestige, or seniority (Wu et al. 2022) and (Lei et al. 2021) The uses of money managers and insurance schemes are some long-term investment inclusions. Patrons with somewhat desired qualities, like physical or learning disabilities, non-nuclear generational, or transportation, tend to constitute the preponderance of a user base or perhaps engage in inequitable activities based on their ethnicity (Wang 2020). If we can figure out which features of under-served communities are most closely aligned with existing market offers, we may begin to consider how representation problems could be addressed. As some studies have shown that macroeconomic periods are causally linked to economic cycles (Ullah et al. 2018; Zafar et al. 2021). In the recent study, Zafar et al. (2021) have discussed that due to the global financial development freeze, a connection is made between a narrower order to use this information and drearier economic forecasts. As a result, our business situations and market indexes serve as useful research instruments for objectively investigating the previously stated connections empirically (Zhuo et al. 2020) and (Hakuzimana and Masasi 2020).

For the promotion of economic growth, financial inclusion has emerged as a vital component of China’s financial reform (Wang 2020). Our new database’s purpose is to provide signs of potential for possible economic instabilities in their economic, institutional, and governmental aspects. A particular focus is placed on how much of the administrative structure that enables the timely implementation of the required financial markets to reduce the impacts of shocks (Sinha et al. 2020c). When it comes to financial inclusion, it is critical to ensure that everyone has access to the appropriate financial sector. In reality, this involves providing moderate families and remote towns with fair access to investment techniques as well as other financial derivatives that were previously inaccessible (Sinha et al. 2020a). Measurements of FI include things like the geographical barriers to investment bankers, the quantity of structured wealth leagues, and the total amount of term deposits. Expanding the financial intermediation company’s overall scope and decreasing economic social marginalization are both important components of strengthening FI.

Mortgage repayments, income and profits for individuals and companies are highly dependent on the state of the economy at the present stage of the economic cycle. The connection among the macroeconomic economies and banking sector works the other way as well—increasing portions of the accounting records of mortgage holders while the sector is in an economic growth period (Sinha et al. 2020b). Receding economies, on the other hand, result in lower profits and reliability. Money transmitters’ payments and market share earnings include some constant cost ingredients, which are somewhat more relevant. It can be deduced that profit growth and preparing the financial point of the banking system are closely linked to accessing financial repayment capacity and, thus, reacting appropriately to fluctuating stock returns, leading to financial transitions between distinct theories of economic iterations (Shahbaz et al. 2020). Like the economic experts before them, Shahbaz et al. (2019) offer evidence of simultaneous changes in home and equity values at the same time. They put a 16-year limit on the length of international financial markets, which has been on the rise since the mid-1980s. The impacts of a recessionary period after a financial crisis incidence on the economy’s rehabilitation process are studied by Sim and Zhou (2015) in a related development. Their analysis focused on market statistics, with emphasis on companies that are highly reliant on external funding for their activities.

Financial institution and exchange emergencies, economic wellbeing and viability of facilitators, banking system convergence, the budgetary environment in the industry, and interest rates and commercial bank capabilities all may have an impact on profitability (Schoderer et al. 2021). Addressing environmental challenges is a global issue that is handled at the state level. This is an especially interesting subject for future research since it relates to “Sustainable Switchover,” which was one of the most major conclusions of COP 24 (COP24, Declaration, 2018). The Regime’s Strategic Framework’s Objective 11 directly related to sustainable consumption and production. This paper, meanwhile, mainly focuses on environmental consequences. On the other hand, one of the more specific aims of this study is global warming mitigation and adaptation efforts which are really carried out at the regional scale, rather than at the domestic and global level.

Conventional wealth distribution and sustainable economic development have been an attraction for several researchers (Urban et al. 2018) lately, however efforts to enhance sustainability and environmental sustainability have received less attention. In an effort to address this gap, this research utilizes DEA to assess green productive viability and the fundamental design of complexes in boosting green profitability beyond. Economic reform and revamping operations are enhanced by financial inclusions because they are actually confronted with higher credit limitations, which were already rationalized by analyzing greater CO2 emitter-enterprises. Economic development in other words, enhances production network efficiency while revamping since they are directly confronted through longer repayment restrictions and limitations. This paper contributes to the existing previous research by (1) using the less-studied liquidity problems to vindicate the restricting impact of capital structure integration and (2) establishing a MinDW framework to calculate green profitability, which modifies the good organizational horizon in the conventional directional framework and adds to our comprehension of how financial inclusion reinforces green profitability.

The rest of the paper are organized as follows: the relevant literature is reviewed in Sect. 2. The framework definition, dataset and method of analysis are discussed in Sect. 3. The empirical findings and robustness tests are presented in Sect. 4. Conclusion and policy implications are provided in Sect. 5.

2 Literature review and hypothesis development

Everything associated with green economy whether its economic growth supports environmental correctness, hinders it, or has no effect on it has become a hot debate among researchers. When it comes to the results of these relationships, different estimations, panelists (states), and durations studied examined (taking into consideration) for the study all have large discrepancies (Sharif et al. 2019). As a result, there are three different theories which have already been proposed in the research. The very first theory is that the established finance industry has an influence on global harm caused by industrialization and traditional energy use (Ramsey 1999). People may get customers credits for ancient hydrocarbon cars and electronic items from the nation’s advanced economy industry, which raises typical power requirements and, as a result, causes ecological damage (Kovilage 2021). Organizations benefit from lower operational expenses when the banking industry is established because it allows them to purchase more equipment and materials and build additional components (plants) that increase incineration and generate additional dependence on fossil fuel use (Granger 1969). A well-developed financial services sector in the home nation also increases the rate of industrialization, which in turn raises the volume of environmental pollution and worsens contamination (Ngo et al. 2021) and (Umar and Akhtar 2021). Because of the extrinsic benefits of such a study, citation-based techniques have received much interest, and their numbers are actually steadily spreading across fields. Two studies by Cornish et al. (2006) and Sinha et al. (2021) have previously described the basic process of a methodical scientific cartography, which may be broken down into five phases. First stage, defines the study issue and choose suitable content analysis techniques that allows to address the issues asked.

The literature of this study aims to analyze the connection between investments in real business and to determine the awareness and intellectual framework. Thus, the objective is to establish important scientific achievements, researchers, and institutions that have had the strongest influence on the growth of the studied area. Investigating if times of greater technological prowess are correlated with financial or economic hardship might be intriguing as well. The project will also provide portions devoted to examining the implications of the findings.

2.1 Index of financial inclusion

Financial inclusion is a crucial element that boosts industrial performance, according to Setyawati (2020), who categorizes middle-income countries into three categories: “stuck intermediate civilizations, graduating middle-income societies, and rising middle markets”. Taghizadeh-Hesary and Yoshino (2019, 2020) also found a positive relationship between economic growth and a rise in the value of equity in countries. Reis et al. (2019), investigates the links among cash advancement, productivity expansion, and ecological equity using a sample of high-income economies (China) and finds a positive correlation between social advancement, banking sector growth, and productivity expansion. As with the research of Pyrgou et al. (2016), which examines the impact on bank planning and sustainable advancement in 42 developing nations, the results indicate a positive correlation studied.

The findings of other studies investigations are inconsistent and contradictory Lazzeroni et al. (2020) explore the impact of financial advancement on ecosystems and discover a link between the two. Using data from China, Lang et al. (2016) show an inverse relationship between financial inclusion and greenhouse gas emissions due to the ability of entrepreneurs to adopt sustainable processes as a result of growth in the financial sector. The findings by Huang et al. (2021) suggested that financial inclusion could boost remittances’ growth-enhancing effect. According to Kwon (2018), financial growth may help improve green development by giving businesses access to cutting-edge energy-efficient technologies. Kazhamiaka et al. (2017), for example, studied that how economic growth impacts sustainable energy sources, study concluded that producing alternative sources is prohibitively costly. As a result, countries that have achieved financial inclusion are able to create green economic efficiency resources that have a less harmful effect on the environment. In both the complete sample and sub-samples, the study by Taghizadeh-Hesary and Taghizadeh-Hesary (2020) finds that financial institution access, depth, efficiency, and overall development have a significant beneficial impact on economic growth. They also discovered that capital, labor, energy consumption, and trade openness all play a role in promoting economic growth in these panels. Furthermore, financial inclusion has a greater influence on economic output in low-income and new-EU member countries than in high-income and old-EU member countries.

2.2 Hypothesis development

2.2.1 Assessment of financial inclusion and green economy performance

Current literature has shown that financial inclusion improves green economic efficiency. Comprehensive economics opens the door for customers to interact with green purchasing from a financial standpoint. Individuals’ buying intentions may be sparked by aspirations of a renewable energy industry since environmental impacts are by far the most pressing societal considerations (Zapata Riveros et al. 2019). Allowance is given to ecological responsible investments that cater to product purchase behavior demands through economic advancement, and users’ sustainable procurement behavior perpetuates the development of these efficient and sustainable installations, resulting in a sustainable consumption configuration for employment creation. Accessible companies (Talavera et al. 2019) benefit from funding, which has been linked directly to entrepreneurship, employment opportunities, and development (Reis et al. 2019). As an alternative, there are abundant data indicating the benefits of creating an enabling environment in predicting sustainable growth as well as in maximizing profits and bringing about technical progress (Pyrgou et al. 2016). According to Zhao et al. (2021) a more effective business strategy will encourage entrepreneurs to participate in financial operations, reduce the borrowing barrier, ease their financial sanctions, and increase the number of economic transformations (such as equipment and technology upgrading). Luthander et al. (2016) in their study they claimed that comprehensive economics may assist businesses in broadening their financing streams by supplying funding assistance for capital expenses and research and development expenditure, as well as encouraging firms to pursue digital transformation. It also managed to increase ecologically sound investments in cleaner energy and resource systems, and to optimize the configuration of energy demand by pursuing alternative sources to enable new fuels, efficiently and successfully reducing waste generation, and promoting environmental effectiveness (Dong and Sigrin 2019; Cambini et al. 2020). There will be more companies engaged in the renewable energy industry as a consequence of the effective promotion of accessible financing (Taghizadeh-Hesary et al. 2021).

Hypothesis 1: The expansion of financial inclusion improves the viability of the green economic development.

The component segments into the productivity of key parameters, such as worker productivity, renewable energy, financial returns, GDP cost-effectiveness, and ecosystem performance. We can learn which control signals are most affected by banking services on environmental regional economic productivity by looking at the effect on element efficiencies. Financial inclusion, according to research, has the ability to inspire people and has an effect on both energy production and the ecosystem. The growth of the financial sector and the use of energy have been shown to have a strong correlation (Esquivias et al. 2021; Ingrao et al. 2018). Population development may be seen when moving away from conventional energy sources (Invidiata et al. 2018). This suggests that making the switch to alternative energy sources is linked to employment generation. They also confirm that financial inclusion works in improving the environment, using the STIRPAT model in their study (Cabeza et al. 2014). Furthermore, inclusive banking directs financing to companies that use less energy and pollute less. Reduced deposit insurance for banks offering green financing is an important technique in an organization (Wijesiri et al. 2015).

Hypothesis 2: Renewable energy and ecological sustainability are the primary ways in which financial inclusion affects the viability of green economics.

2.3 Mechanism

Currently available research on the connection between commodity price discrepancies and good grief relates to a specific element of commodity price deviation socioeconomic and environmental impact (Ismaeel and Elsayed 2018) and (Lavee and Menachem 2018). Economic activity is aided by reduced operating costs and relatively low gasoline prices as a consequence of industrial financial frictions (Syamni and Abd Majid 2016; Amelia and Hardini 2017). Low-cost energy is a huge boost to the economy, but it also has a detrimental effect on the environment. A number of studies have found that commodity price fluctuations impede the spread of fossil fuels, causing environmental damage (Scanlon et al. 2019), increased use of high-emission energy sources as a consequence of disproportionate government influence on energy pricing worsens soil degradation, the price of crude inefficiencies (Wasiaturrahma et al. 2020), and boosted greenhouse gas emissions while hindering attempts to reduce pollutants (Biswas and Koufopoulos 2020). Corporate subsidies, according to Wang et al. (2017), harm energy efficiency and therefore increase carbon emissions, while removing them harms the national economy. Firm effectiveness, innovativeness, and socioeconomic development are all attributed to technology (Wu et al. 2021). However, financing restrictions may limit spending in companies’ research and development projects since these initiatives are often marked by a substantial percentage of unpredictability, sophistication, and individuality (Wiser and Pickle 1998). Credit restrictions, on the other hand, are not the same for every business. Interestingly, entrepreneurs may have financial constraints when it comes to sustainability management since they have fewer prior earnings assortments and largely rely on external investment options for new initiatives (Mohsin et al. 2019), (Mohsin et al. 2020) and (Mohsin et al. 2021). Because of the knowledge mismatches among customers and banks, these companies are particularly susceptible to lending activities. Even if they can take advantage of those opportunities and have fewer total commodities, that might minimize the damage, but they have a greater limit than big manufacturing companies (Yildirim and Onder 2019) and (Geghamyan and Pavlickova 2019).

Hypothesis 3: With financing restrictions, high-polluting companies can’t grow as quickly as other, more efficient ones.

3 Data and methodology

3.1 Model specification

Non-parametric methods such as DEA do not need a growth model to assess efficiency when dealing with numerous inputs and outputs. Because of its adaptability, data envelopment analysis has steadily risen to prominence as the standard technique for assessing the energy crisis and environmental sustainability. Systems like CCR and Banker, Chames and Cooper (BCC) are classic circumferential theories used in initial DEA research. To determine how efficient a system is, these approaches increase the outcomes while decreasing the intakes. Greenhouse gases are an unintended side effect of the ACEP proposed study. Inappropriate data are commonly presented as a contribution or processed via data transformation prior to actually being used in the CCR or BCC. Neither method adheres to the work and make, despite having significant advantages in dealing with undesirable outcomes. As a result, the assessment will always deviate (Sun et al. 2019) and (Tiep et al. 2021).

Narayan and Sharma (2011) developed the DDF to eliminate undesirable outputs from the performance assessment system. The DDF included different contaminants as undesired outputs. The DDF is in compliance with the rules of organization since it does not need undesired outcomes to be processed. Therefore, to effectively manage the growth of desired outputs, this model needs to assume that undesirable outputs may be inadequately addressed and set the optimal choice of each impact test. So, the DDF has a high degree of subjectivity to it (Sun et al. 2020c), (Sun et al. 2020a) and (Sun et al. 2020b). According to this research, the MinDW is used to assess the GEE of energy consumption to address DEA issues. There is a key aspect to this new approach: no matter how efficient a DMU projection’s location on the border is, it will always be near to the indifference curve. With this approach, you will not have to deal with the drawbacks of conventional DEA of CCR or SBM. With MinDW, arbitrary variables, such as data abnormalities and biases, are substantially reduced, and the reliability of efficiency assessment is significantly improved. Because the model’s DMU-border range is so near to the indifference curve, adjustments in transmitter and receiver may be made with little impact on mobility or cost as the effectiveness improves (Agyekum et al. 2021) and (Zhang et al. 2021).

With reference to Gallagher et al. (2018), MinDW is set up throughout this work that has an undesirable consequence. Assume there are n DMUs in the manufacturing operation, which together has m intakes (x), p desired outputs (y), and q undesired by-products (b) in common. Matrices are used to represent the inputs \(X = \left( {x_{1} ,x_{2} , \ldots ,x_{n} } \right) \in R_{ + }^{m \times n}\), output values \(Y = \left( {y_{1} ,y_{2} , \ldots ,y_{n} } \right) \in R_{ + }^{p \times n}\), and undesired results \(B = \left( {b_{1} ,b_{2} , \ldots ,b_{n} } \right) \in R_{ + }^{q \times n}\) so that they may be easily understood. We will start with DMU \({\text{DMU}}_{k} = \left( {x_{k} ,y_{k} ,b_{k} } \right)\) as the kth candidate to be assessed. This means that the MinDW may be represented as combinatorial optimization using the equations: m + p + q in Eqs. (1)–(4).

Components and corresponding outputs are represented by x, y, and b, respectively. • intake and production flexibility (i.e., the percentage of dependent and independent variables that may be decreased (increased)); The DEA’s target weight is ei, er, and et; the parameters are and each one of the 3 parameters is 1 during combinatorial optimization; some other 2 are 0 in Eq. 5:

Equation (7) characterizes the performance of any framework may be calculated using the following formula under the aforementioned restrictions:

where \(\phi^{*} = (\max \beta_{z} ,z = 1,2, \ldots ,m + p + q)\) is the value of MinDW in Eq. (8).

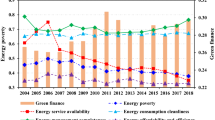

3.2 Measure of green economic efficiency

According to Criscuolo and Menon (2015), green economic efficiency can only be accurately assessed by taking into consideration combined planned and unintended outputs. Financial inclusion is factored into the equation in the performance evaluation paradigm of Arabi et al. (2014), who created the Malmquist–Luenburger (ML) index. To assess green economic efficiency, this metric has been widely used (Al-Najjar and Clark 2017). Each city is treated as a DMU in this research, and this is indicated by the letter k. For this research, the efficiency component is used as a conventional input element, utilizing (Cronqvist et al. 2012)’s approach, and a (PPS) is created that includes both desirable and unwanted outcomes. Think about how many categories there are in the input for every city (DMU) (Li et al. 2021), (Chien et al. 2021) and (Iqbal et al. 2021). A mixture of acceptable and undesirable results is produced as an output of the process. M classifications \(x = \left( {x_{1} ,x_{2} , \ldots ,x_{N} } \right) \in R_{N}^{ + }\) are included in the intended outcome yg, which could also be represented as \(y^{g} = \left( {y_{1}^{g} ,y_{2}^{g} , \ldots y_{M}^{g} } \right) \in {\text{R}}_{M}^{ + }\). It is possible to specify the kinds of unwanted output \(y^{b} = \left( {y_{1}^{b} ,y_{2}^{b} , \ldots y_{M}^{b} } \right) \in {\text{R}}_{I}^{ + }\) have as well. Furthermore, given province k, the following manufacturing options may be shown for each time period t in Eq. (9):

Equation can be further justified as Eq. (10)

Because the manufacturing opportunities are considered to be restricted, they must comply with the following requirements: favorable outputs and inputs are completely dispensed of, whereas undesirable results appease the inadequate availability and accessibility hypothesis and the no combinations principle. Using comprehensive comparative methodology, we can simulate all of the aforementioned manufacturing options.

Using a mediating effect approach in Eq. (11), it can be seen more clearly how transnational accumulation impacts green economic efficiency. To be more precise, and to denote operational city specialization \({\text{FS}}_{i,t}\) and technological development \({\text{TI}}_{i,t}\), accordingly, as the mediator variables, the preceding study aims to test if transnational concentration has a substantial impact on GEE.

When the moderating effect parameters are denoted (Eq. 12) by an estimated coefficient through using hypothesis testing, it can be determined whether or not the chosen factors usually are truly significant conduits via which Regio centric centralization influences green economic efficiency.

3.3 Empirical models

To investigate the three components, several experimental analyses were done. Because the response variable, green economic efficiency, is a variable with a range of [0, 1], a panel data Tobit model is used. The accompanying model is used to investigate the correlation between financial inclusion and green economic efficiency for hypothesis 1.

In which the dependent variables west id and west t represent the area and time periods, correspondingly. When area I is part of the implementation group, then west id = 1 is available. It is worth noting that west t is always 0, except for when the period t falls until the year 2000. The expertise to develop green economic efficiency technologies is frequently provided by a better-quality work force. As a result, the procedure is outlined: When innovative elements are directed into western regions, it helps achieve green economic growth by advancing institutional policy upgrades, urbanization, and labor quality improvements. This transmission mechanism’s reliability is checked by performing the tests listed below, Eq. (14),

As Eq. (17) shows that the PSTR model employs a regression analysis method to effectively convert subsystems and is a generic version of the Hansen Panel Threshold model. As a result, a comprehensive minimum paradigm modification may be required. The following model has been created using transportation infrastructure improvement as an illustration, Eq. (18).

The SBM-DEA system is capable of avoiding directional and angular velocity variance. This approach may also assess efficiency while generating undesired results (Guo et al. 2011). The SBM-DEA approach is used in this research to compute the green economic efficiency of China’s regions because of this. Here is how it works, Eq. (19) and its constraints in Eqs. (20) and (21):

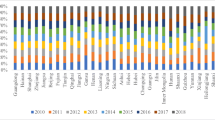

3.4 Control variables

Environmental management and financial capital investment extent are monitored by referencing because a municipality seems to be more inclined to take part when China has implemented a series of optimistic green economy goals (Mohan et al. 2021). The proportion of a city administrations pollution abatement expenditure to city-level GDP is used to calculate ecosystems. National sustainable economic efficiency rises in direct proportion to global management. Financial expenditure and economic growth in the sector contributed measures the form of state involvement. Furthermore, the research monitors the Northeast regions of China and differentiates between both the Western region of China and the Southeast and Southwest regions of China, due to the fact that China’s various regions show various levels of economic development in financial inclusion in China (Peng and Zheng 2021). Study analysis also includes the normalized values of international economic reliance (the proportion of total imports and exports to GDP) and the normalized valuation of FDI dependence on direct investment, even though trade liberalization has been shown to have a significant effect on financial development by bringing competition and international goods to local producers that are more productive (Huang et al. 2018).

Ultimately, Rdit and HRit are used to measure provincial and municipal research, and innovation and human resource management spending. Rdit is based on the amount of money a municipality spends on research and development activities compared to the territory’s gross domestic product. It is a measure of the institutional capital investment proportion for municipal governments since intellectual capital may have increased by capturing the professional skills of workers (Greenwood and Jovanovic 1990). Optimal utilization of human assets successfully moves real growth points forward to generate a comprehensive, improving green economy efficiency through teaching and research (Hauner and Kyobe 2010).

3.5 Data and variables

On the premise of data availability, the research objects selected in this paper are 244 regional-level cities in China. The research objects come from Ultimate sample consisted of 244 regional-level cities from 2008 to 2020 from the China urban data analysis. In this research, the important contributors are labor, power, and resources. To begin, the labor contribution is calculated using the workload per team at the end of the year, as in prior research (Geddes et al. 2018). The data are all from the China Stock Market and Accounting Research Database (CSMAR) and the world development indicators. According to the information disclosures in annual reports, social responsibility reports, environmental reports and sustainable development reports of listed cities.

Multiple elements of multiple shapes, i.e., input, desired output, and undesirable efficiency, to maintain the summary statistics similar and trustworthy for measuring green economic efficiency are used. Our energy intake predictions are based on the yearly economic powerhouse use in areas with reasonably accurate statistics, which were adopted from Ji and Zhang (2019). The “accounting system procedure” of physical capital estimate and the corresponding output of the financial assets of regional capital cities predicated on depreciating years of dependency on the government are used as an indication of plant and equipment input for the evaluation of national wealth.

To calculate the intended output, the city’s true Gross domestic product in 2010 used as the desired output. To be more detailed, study computed the real local gross domestic product and gross domestic product inflation figures index (the year 2004) for every regional capital city using the gross domestic product from the China n Urban Official Book, which represents genuine gross domestic product (last year 100). When an undesirable result is produced, industrial pollution releases are released into the atmosphere. Diverse types of pollutant emissions lead to various environmental indicators that may be utilized in several investigations. Three criteria, industrial effluent release, commercial particulate disposal, and commercial sulfur dioxide release, are chosen as undesired outcomes for the explanatory parameters in this article because of the analysis of information and the earlier studies by Ahmad et al. (2016). It is important to keep in mind that all three determinants are included in the analysis at around the same time, independently. Equations may be used to determine the efficiency of every unwanted output. Considering the weighted mean of the efficiency of the unwanted by-products, they may provide an overall increasing environmental efficiency and pollution prevention efficiency.

4 Results and discussion

4.1 Financial inclusion and green economic efficiency

Model 1 takes into account the environment, fiscal spending, regional disparities, and the relationship between economic growth and corporatization. Model 2 regulates the competitiveness of the company, research and development spending, and human resources spending. Regression Model 2 is used to test the robustness of our findings toward a number of different parameters, whereas regression Model 1 is used to examine the sensitivity of our findings. There must be substantial positive factors of financial inclusion for all three indices, suggesting that increased financial inclusion improves green economic efficiency. Increasing access to quality health care can have a major impact on the economy, enhancing economic activity and payment information, which then results in more income and a strong credit foundation for the mortgage company (Sadiq et al. 2021). This allows business owners to solve shortfalls and put more money into the renewable energy industry. The more local firms use wealth management, the fewer financial constraints they would face, which will allow them to focus on their core business rather than worrying about money. This will free up capital for them to participate in other areas of their business, such as research and development, manufacturing, and marketing (Guo et al. 2011). To evaluate and oversee the practical applicability of the green economy, environmental policy is essential (Bai-Chen et al. 2012). The very significant level shows cultural development in affecting green market prosperity. According to Shao et al. (2020b) findings, China’s green economy expansion is uneven, with moderate bandwidth and companies (Table 1).

A lot of research has been done at the micro-level to better understand how trade balance affects the management of micro-businesses, focusing mostly on strategy development, acquisitions, and the proper deployment of current assets (Zhang et al. 2016). Existing research mainly offers two conflicting perspectives on whether a start-up export growth impacts its management. However, when businesses are confronted with an increasing exchange rate, larger firms will correctly direct measure, analytically answer, and make aggressive adjustments. Public funding from financial assistance and legislation helps create a favorable country’s economy for firms, which helps them achieve long-term growth in their effectiveness. This is a win–win situation. On the other hand, when confronted with an uncertain austerity development, entrepreneurs are more likely to take a conservative stance and think more carefully before engaging. This is because it is impossible to anticipate the potential world, which really is unfavorable for the strategies of companies (Table 2).

4.2 Financial services and green economic performance

A company’s ability to increase organizational effectiveness while also enhancing its credibility is aided by becoming green. According to Cull et al. (2017), operators in Southern California are less productive than refineries situated abroad that are not susceptible to almost the same environmental quality restrictions. As a result of these regulations, manufacturers in Southern California incur higher costs, but they also produce more quickly than samples obtained. As a result, strict environmental regulations aid production efficiency indirectly by pressuring companies to use environmentally friendly manufacturing methods. In other research, ecological operations have been shown to create growth, particularly in companies with strong organizational capital. By making payments in formal financial institutions more popular through technological communications and virtual means, even those who do not have a bank account will be able to make payments more easily and efficiently. This kind of cost-effective payment method will help increase overall economic efficiency, including green economic efficiency, while also saving money (Xiao et al. 2019). As the reimbursement industry expands, it has the potential to offset the uncertainties correlated with increasing using security to provide monetary support and facilitate social administration, as well as contribute to sustainable growth itself. Additionally, financial inclusion benefits entrepreneurs by lowering their related costs of investment, easing capital constraints, and lowering their credit benchmark. The elevated use payment official investigation businesses can also solve the ambiguity in enterprises investments and mitigate the possibility of banking institutions lending to enterprises with adverse credit archives (Sadiq et al. 2021). As a result, small businesses with decent credit archives are somewhat more successful in obtaining lines of credit that will help them convert into modern industries.

4.3 Factor efficiency analysis

It is also possible that the connection exists, but it is difficult to see since the indices fluctuated so much throughout the study period. The bottom line is that drawing conclusions are based on unreliable assessments of the sequences. As a first step in proving the validity of our hypotheses, numerous researches have been conducted to determine the functional consequences of repatriation in recipient nations due to the increase in the amount and significance of these payments. The results of the few studies that have looked at this nexus have been equivocal. According to Long et al. (2019), remittances have a large influence on accumulating capital but have little effect on increasing in TFP. However, the absence of a performance influence or a potential detrimental impact on macroeconomic performance could make the net contribution to the economy unclear because of these results. Contributions may influence gross domestic product in a variety of ways, as shown by Li et al. (2013). LE, EE, CE, ENE and ECNE shows efficiency in terms of labor energy capital environment and economic respectively (Table 3).

For example, under Mundaca’s conceptual model, transfers may have a large impact on growth. In addition, with work revenue, families get contributions, which they invest in lending institutions, as per his research. By allocating these payments to effective initiatives, these financial institutions may affect actual economic performance. This approach has been used in other empirical studies (Ouertani et al. 2018) to assess the effect of money transfers and economic deepening on output growth. They believe that the banking system can replace money transfers and that this reduces the overall growth-pushing impact of these transfers. Giuliano et al. (2009) claim that now the banking system can also compensate for transfer payments, on the other hand, Lin and Xu (2020) described a comparable result. Capital inflows have a beneficial effect on economic growth because of the economic development. It is possible that the disparities across empirical research are due to the various empirical methods used, the wide range of nations examined, and the stock market development metrics that were employed.

4.4 Financial inclusion and green economic performance

Advancement and rationalization of the structural transformation may influence GEE via significant effects, which primarily entail competitive effects and economic effects as well as technological advancement. Promoting industrial improvement will unavoidably result from excessive rivalry among local businesses, leading to an environment of natural selection and survival (Shan et al. 2017). By increasing their investments in research and development, businesses will be compelled to enhance their production processes constantly while simultaneously reducing their natural resource intake (Sun et al. 2012).

Table 4 shows that the trade openness, financial flows, and import substitution are all characteristics of global capitalism, and they all have an effect on economic growth as well as environmental stewardship. Improved globalization may enhance the impact of hydrocarbon resources, which may lead to a rise in pollutants if operational volumes are increased. Other people believe that financial integration may help enhance soil sustainability by transferring clean technologies. In spite of this, some academics believe that equity fund decisions may even worsen environmental protection via price marketing practices. The effects of globalization on present and future generations and the achievement of SDGs have been well documented (Shao et al. 2020a). Sustainable energy advocates (Xiao et al. 2021) urge globalization and greater prosperity while conserving natural resources and reducing waste generation, (see Table 5). Ecology or ecological entrepreneurship is called for as part of a new industrial fundamental change.

To obtain optimal estimates, the impact of a few key variables is mitigated. Local economic growth and performance are strongly influenced by the availability of assets as an “additional stimulus” (Apergis and Payne 2014). Connectivity may also facilitate the transfer of information between regions, speed up the spread of new technologies, and enhance greenhouse gas reduction systems in an indirect way. Regional development output is directly influenced by expenditure. Government interference, according to Luo et al. (2020), has an impact on green economic efficiency. Economic expansion necessitates large amounts of energy consumption, but it may also offer a substantial foundation for environmental protection. The sector of the economy often generates trash that contributes to pollution or creates climate change. There is evidence to suggest that urbanization has a significant impact on per capita energy usage and may be utilized to help curb that use. Having better-quality workers means having more information resources to invest in hydrocarbon technological improvements, strengthening local research and innovation exchanges, which aids economic development innovation, deployment of network infrastructure (Gallagher et al. 2018). As a result, these factors must be taken into consideration.

Table 6 shows that GEE is significantly affected by financial inclusion, mostly via financing restrictions placed on contaminating companies. Including more people in the financial system does not seem to have any effect on green economic efficiency. To summarize, the access to finance of financing restrictions on close-to-the-edge businesses substantially validates the approach. Financial inclusion may make it harder for damaged companies to get loans, which will speed up and improve the efficiency of economic growth and modernization.

4.5 Robustness analysis

Statistical assessments, such as using various assessment approaches and incorporating control variables, determine the reliability of the findings. While GEE may help with financial inclusion, it can also have adverse effects on economic organizations like businesses.

Xiang et al. (2021) saw economic progress as being inextricably linked to state interference. In the opinion of Xiang et al. (2021), government-implemented carbon reduction measures may hasten the growth of the effort to develop while decreasing contamination risks and the endurance of potential pollution. Public expenditure on ecological sustainability is a major source of finance for ecological sustainability in China. A framework for GEE has been used to arrive at these conclusions. It is called the MinDW model. The measurement of the MinDW is less stringent than the conventional radical framework requirements of a “strong production possibility frontier” and the SBM approach communications network.

Tables 7 and 8 show the robustness analysis. In principle, the more urbanized a country or region is, the more developed its economy is. There are several debates going on right now about the connection between urbanization and green economic efficiency. There is always the argument that as cities grow and as businesses expand, energy requirements rise rapidly, culminating in more contaminants and a decrease in energy efficiency (Shen et al. 2021). Other people believe that as cities get more developed, their economic and environmental efficiency will increase as well. It is sufficient to justify a better ecological environment since they live in cities where there are so many of them. In response to the regional administration’s increased concern for environmental conservation, local businesses are obliged to make changes and adopt new technologies to decrease energy demand and emission levels. According to Tian et al. (2021), urbanization benefits local sustainability. The effect of urbanization level on green economic efficiency is a subject of debate.

5 Conclusion and policy implications

This research is a pioneering effort to establish a connection between financial inclusion and environmental sustainability. Since the 21st Democratic Party session, China has made increased attempts to improve reserves and reduce environmental impact, strengthening the strategic framework that clear rivers and green hills are essential pieces. An important aspect of economic growth frameworks is to look at the connection among economic advancement and GEE, as well as how to promote sustainable economic growth. A number of empirical results provide credence to the theories. For the latter, component segmentation shows that financial inclusion has a significant impact on GEE, particularly in terms of energy and climate change performance. Another finding from the research shows that financial inclusion may boost GEE by tightening credit restrictions on contaminating companies and speeding up those firms’ becoming green via structural revolution and modernization.

In addition, the results have significant ramifications for nations like China, which are rapidly recognizing the need to move to a green economy. Benefits of financial inclusion include improved labor conditions, increased eco-efficiency, and a more sustainable environment. However, benefits in terms of financial inclusion ought to be incorporated into policies promoting financial inclusion. This will assist in redistributing resources effectively, which promotes environmental and economic efficacy. It is also critical that new ties be established between governments, banking firms, and businesses to encourage economic development that is also ecologically sound. A green economy requires social, commercial, and technological activities all at once. These initiatives include making the changeover, an extremely important part of the policy platform, improving the financial system’s inclusion, and updating corporate technologies and institutions. The synchronization of accessible financing and the modification of specific RRR is another important factor in raising credit restrictions on polluting companies and promoting structural revolution and innovation performance.

References

Agyekum EB, Amjad F, Mohsin M, Ansah MNS (2021) A bird’s eye view of Ghana’s renewable energy sector environment: a multi-criteria decision-making approach. Util Policy. https://doi.org/10.1016/j.jup.2021.101219

Ahmad A, Zhao Y, Shahbaz M et al (2016) Carbon emissions, energy consumption and economic growth: an aggregate and disaggregate analysis of the Indian economy. Energy Policy 96:131–143. https://doi.org/10.1016/j.enpol.2016.05.032

Al-Najjar B, Clark E (2017) Corporate governance and cash holdings in MENA: evidence from internal and external governance practices. Res Int Bus Finance 39:1–12

Amelia E, Hardini EF (2017) Determinant of mudharabah financing: a study at indonesian islamic rural banking. Etikonomi 16:43–52. https://doi.org/10.15408/ETK.V16I1.4638

Apergis N, Payne JE (2014) The oil curse, institutional quality, and growth in MENA countries: evidence from time-varying cointegration. Energy Econ 46:1–9. https://doi.org/10.1016/J.ENECO.2014.08.026

Arabi B, Munisamy S, Emrouznejad A, Shadman F (2014) Power industry restructuring and eco-efficiency changes: a new slacks-based model in Malmquist–Luenberger Index measurement. Energy Policy 68:132–145

Bai-Chen X, Ying F, Qian-Qian Q (2012) Does generation form influence environmental efficiency performance? An analysis of China’s power system. Appl Energy 96:261–271. https://doi.org/10.1016/J.APENERGY.2011.11.011

Biswas S, Koufopoulos K (2020) Bank competition and financing efficiency under asymmetric information. J Corp Finance. https://doi.org/10.1016/j.jcorpfin.2019.101504

Cabeza LF, Rincón L, Vilariño V et al (2014) Life cycle assessment (LCA) and life cycle energy analysis (LCEA) of buildings and the building sector: a review. Renew Sustain Energy Rev 29:394–416

Cambini C, Congiu R, Jamasb T et al (2020) Energy systems integration: implications for public policy. Energy Policy. https://doi.org/10.1016/J.ENPOL.2020.111609

Chien F, Pantamee AA, Hussain MS et al (2021) Nexus between financial innovation and bankruptcy: evidence from information, communication and technology (ict) sector. Singap Econ Rev. https://doi.org/10.1142/S0217590821500181

Cornish SL, Thompson ST, Wieman CE (2006) Formation of bright matter-wave solitons during the collapse of attractive bose-einstein condensates. Phys Rev Lett. https://doi.org/10.1103/PHYSREVLETT.96.170401

Criscuolo C, Menon C (2015) Environmental policies and risk finance in the green sector: cross-country evidence. Energy Policy. https://doi.org/10.1016/j.enpol.2015.03.023

Cronqvist H, Makhija AK, Yonker SE (2012) Behavioral consistency in corporate finance: CEO personal and corporate leverage. J Financ Econ 103:20–40

Cull R, Xu LC, Yang X et al (2017) Market facilitation by local government and firm efficiency: evidence from China. J Corp Finance 42:460–480. https://doi.org/10.1016/J.JCORPFIN.2015.06.002

Dong C, Sigrin B (2019) Using willingness to pay to forecast the adoption of solar photovoltaics: a “parameterization + calibration” approach. Energy Policy 129:100–110. https://doi.org/10.1016/J.ENPOL.2019.02.017

Ehsanullah S, Tran QH, Sadiq M, Bashir S, Mohsin M, Iram R (2021) How energy insecurity leads to energy poverty? Do environmental consideration and climate change concerns matters. Environ Sci Pollut Res 28(39):55041–55052

Esquivias MA, Sethi N, Ramandha MD, Jayanti AD (2021) Financial inclusion dynamics in Southeast Asia: an empirical investigation on three countries. Bus Strateg Dev 4:203–215. https://doi.org/10.1002/BSD2.139

Gallagher KP, Kamal R, Jin J et al (2018) Energizing development finance? The benefits and risks of China’s development finance in the global energy sector. Energy Policy 122:313–321

Geddes A, Schmidt TS, Steffen B (2018) The multiple roles of state investment banks in low-carbon energy finance: An analysis of Australia, the UK and Germany. Energy Policy. https://doi.org/10.1016/j.enpol.2018.01.009

Geghamyan S, Pavlickova K (2019) Does the current state of environmental impact assessment in armenia pose a challenge for the future? J Environ Assess Policy Manag. https://doi.org/10.1142/S1464333219500042

Granger CWJ (1969) Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37:424. https://doi.org/10.2307/1912791

Greenwood J, Jovanovic B (1990) Financial development, growth, and the distribution of income. J Polit Econ 98:1076–1107. https://doi.org/10.1086/261720

Guo XD, Zhu L, Fan Y, Xie BC (2011) Evaluation of potential reductions in carbon emissions in Chinese provinces based on environmental DEA. Energy Policy 39:2352–2360. https://doi.org/10.1016/J.ENPOL.2011.01.055

Hakuzimana J, Masasi B (2020) Performance evaluation of irrigation schemes in Rugeramigozi Marshland, Rwanda. Water Conserv Manag. https://doi.org/10.26480/wcm.01.2020.15.19

Hauner D, Kyobe A (2010) Determinants of government efficiency. World Dev 38:1527–1542. https://doi.org/10.1016/J.WORLDDEV.2010.04.004

Huang J, Li S, Duan Q (2018) Constructing multicast routing tree for inter-cloud data transmission: an approximation algorithmic perspective. IEEE/CAA J Autom Sin 5:514–522. https://doi.org/10.1109/JAS.2017.7510460

Huang SZ, Sadiq M, Chien F (2021) The impact of natural resource rent, financial development, and urbanization on carbon emission. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-16818-7

Ingrao C, Messineo A, Beltramo R et al (2018) How can life cycle thinking support sustainability of buildings? Investigating life cycle assessment applications for energy efficiency and environmental performance. J Clean Prod 201:556–569. https://doi.org/10.1016/J.JCLEPRO.2018.08.080

Invidiata A, Lavagna M, Ghisi E (2018) Selecting design strategies using multi-criteria decision making to improve the sustainability of buildings. Build Environ 139:58–68

Iqbal W, Tang YM, Chau KY et al (2021) Nexus between air pollution and NCOV-2019 in China: application of negative binomial regression analysis. Process Saf Environ Prot. https://doi.org/10.1016/j.psep.2021.04.039

Ismaeel WSE, Elsayed MA (2018) The interplay of environmental assessment methods; characterising the institutional background in Egypt. J Environ Assess Policy Manag. https://doi.org/10.1142/S1464333218500035

Ji Q, Zhang D (2019) How much does financial development contribute to renewable energy growth and upgrading of energy structure in China? Energy Policy 128:114–124

Kazhamiaka F, Jochem P, Keshav S, Rosenberg C (2017) On the influence of jurisdiction on the profitability of residential photovoltaic-storage systems: a multi-national case study. Energy Policy 109:428–440

Kovilage MP (2021) Influence of lean–green practices on organizational sustainable performance. J Asian Bus Econ Stud 28:121–142. https://doi.org/10.1108/JABES-11-2019-0115

Kwon T (2018) Policy synergy or conflict for renewable energy support: case of RPS and auction in South Korea. Energy Policy 123:443–449

Lang T, Ammann D, Girod B (2016) Profitability in absence of subsidies: a techno-economic analysis of rooftop photovoltaic self-consumption in residential and commercial buildings. Renew Energy 87:77–87

Lavee D, Menachem O (2018) Identifying policy measures for reducing expected air pollution across Israel and analyzing their expected effects. J Environ Assess Policy Manag. https://doi.org/10.1142/S1464333218500011

Lazzeroni P, Moretti F, Stirano F (2020) Economic potential of PV for Italian residential end-users. Energy. https://doi.org/10.1016/j.energy.2020.117508

Lei X, Xu Q, Jin C (2021) Nature of property right and the motives for holding cash: empirical evidence from Chinese listed companies. Manag Decis Econ. https://doi.org/10.1002/mde.3469

Li H, Long R, Chen H (2013) Economic transition policies in Chinese resource-based cities: an overview of government efforts. Energy Policy 55:251–260. https://doi.org/10.1016/J.ENPOL.2012.12.007

Li W, Chien F, Hsu CC et al (2021) Nexus between energy poverty and energy efficiency: estimating the long-run dynamics. Resour Policy. https://doi.org/10.1016/j.resourpol.2021.102063

Lin B, Xu B (2020) Effective ways to reduce CO2 emissions from China’s heavy industry? Evidence from semiparametric regression models. Energy Econ. https://doi.org/10.1016/J.ENECO.2020.104974

Long X, Wang X, Mensah CN et al (2019) Spatial and temporal heterogeneity of environmental efficiency for China’s hotel sector: new evidence through metafrontier global Malmquist–Luenberger. Environ Sci Pollut Res 26:27534–27541. https://doi.org/10.1007/S11356-019-05963-9

Luo Y, Lu Z, Long X (2020) Heterogeneous effects of endogenous and foreign innovation on CO2 emissions stochastic convergence across China. Energy Econ. https://doi.org/10.1016/J.ENECO.2020.104893

Luthander R, Widén J, Munkhammar J, Lingfors D (2016) Self-consumption enhancement and peak shaving of residential photovoltaics using storage and curtailment. Energy 112:221–231. https://doi.org/10.1016/J.ENERGY.2016.06.039

Ma Q, Murshed M, Khan Z (2021) The nexuses between energy investments, technological innovations, emission taxes, and carbon emissions in China. Energy Policy. https://doi.org/10.1016/j.enpol.2021.112345

Mohan P, Strobl E, Watson P (2021) Innovation, market failures and policy implications of KIBS firms: the case of Trinidad and Tobago’s oil and gas sector. Energy Policy. https://doi.org/10.1016/j.enpol.2021.112250

Mohsin M, Rasheed AK, Sun H et al (2019) Developing low carbon economies: an aggregated composite index based on carbon emissions. Sustain Energy Technol Assess. https://doi.org/10.1016/j.seta.2019.08.003

Mohsin M, Nurunnabi M, Zhang J et al (2020) The evaluation of efficiency and value addition of IFRS endorsement towards earnings timeliness disclosure. Int J Finance Econ. https://doi.org/10.1002/ijfe.1878

Mohsin M, Hanif I, Taghizadeh-Hesary F et al (2021) Nexus between energy efficiency and electricity reforms: a DEA-based way forward for clean power development. Energy Policy. https://doi.org/10.1016/j.enpol.2020.112052

Narayan PK, Sharma SS (2011) New evidence on oil price and firm returns. J Bank Finance 35:3253–3262

Ngo QT, Tran HA, Tran HTT (2021) The impact of green finance and Covid-19 on economic development: capital formation and educational expenditure of ASEAN economies. China Finance Rev Int. https://doi.org/10.1108/CFRI-05-2021-0087

Ouertani MN, Naifar N, Ben Haddad H (2018) Assessing government spending efficiency and explaining inefficiency scores: DEA-bootstrap analysis in the case of Saudi Arabia. Cogent Econ Finance 6:1–16. https://doi.org/10.1080/23322039.2018.1493666

Peng J, Zheng Y (2021) Does environmental policy promote energy efficiency? Evidence from China in the context of developing green finance. Front Environ Sci. https://doi.org/10.3389/FENVS.2021.733349

Pyrgou A, Kylili A, Fokaides PA (2016) The future of the Feed-in Tariff (FiT) scheme in Europe: the case of photovoltaics. Energy Policy 95:94–102

Ramsey JB (1999) The contribution of wavelets to the analysis of economic and financial data. Philos Trans R Soc A Math Phys Eng Sci 357:2593–2606. https://doi.org/10.1098/RSTA.1999.0450

Reis V, Almeida RH, Silva JA, Brito MC (2019) Demand aggregation for photovoltaic self-consumption. Energy Rep 5:54–61

Sadiq M, Alajlani S, Hussain MS, Ahmad R, Bashir F, Chupradit S (2021) Impact of credit, liquidity, and systematic risk on financial structure: comparative investigation from sustainable production. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-17276-x

Scanlon CC, Scanlon K, Scanlon T (2019) Chapter 6 The Influence of Collectivism on Microfinance in Senegal. Entrep Dev 21st Century 139–160. https://doi.org/10.1108/978-1-78973-233-720191009

Schoderer M, Karthe D, Dombrowsky I, Dell’Angelo J (2021) Hydro-social dynamics of miningscapes: obstacles to implementing water protection legislation in Mongolia. J Environ Manag. https://doi.org/10.1016/j.jenvman.2021.112767

Setyawati D (2020) Analysis of perceptions towards the rooftop photovoltaic solar system policy in Indonesia. Energy Policy. https://doi.org/10.1016/j.enpol.2020.111569

Shahbaz M, Balsalobre-Lorente D, Sinha A (2019) Foreign direct Investment-CO2 emissions nexus in Middle East and North African countries: importance of biomass energy consumption. J Clean Prod 217:603–614

Shahbaz M, Nasir MA, Hille E, Mahalik MK (2020) UK’s net-zero carbon emissions target: Investigating the potential role of economic growth, financial development, and R&D expenditures based on historical data (1870–2017). Technol Forecast Soc Change. https://doi.org/10.1016/j.techfore.2020.120255

Shan Y, Guan D, Liu J et al (2017) Methodology and applications of city level CO2 emission accounts in China. J Clean Prod 161:1215–1225. https://doi.org/10.1016/J.JCLEPRO.2017.06.075

Shao S, Yang Z, Yang L et al (2020a) Synergetic conservation of water and energy in China’s industrial sector: from the perspectives of output and substitution elasticities. J Environ Manag. https://doi.org/10.1016/J.JENVMAN.2019.110045

Shao S, Zhang Y, Tian Z et al (2020b) The regional Dutch disease effect within China: a spatial econometric investigation. Energy Econ. https://doi.org/10.1016/J.ENECO.2020.104766

Sharif A, Afshan S, Qureshi MA (2019) Idolization and ramification between globalization and ecological footprints: evidence from quantile-on-quantile approach. Environ Sci Pollut Res 26:11191–11211. https://doi.org/10.1007/S11356-019-04351-7

Shen Y, Su ZW, Malik MY et al (2021) Does green investment, financial development and natural resources rent limit carbon emissions? A provincial panel analysis of China. Sci Total Environ. https://doi.org/10.1016/j.scitotenv.2020.142538

Sim N, Zhou H (2015) Oil prices, US stock return, and the dependence between their quantiles. J Bank Finance 55:1–8

Sinha A, Sengupta T, Kalugina O, Gulzar MA (2020a) Does distribution of energy innovation impact distribution of income: a quantile-based SDG modeling approach. Technol Forecast Soc Change. https://doi.org/10.1016/j.techfore.2020.120224

Sinha A, Sengupta T, Saha T (2020b) Technology policy and environmental quality at crossroads: designing SDG policies for select Asia Pacific countries. Technol Forecast Soc Change. https://doi.org/10.1016/j.techfore.2020.120317

Sinha A, Shah MI, Sengupta T, Jiao Z (2020c) Analyzing technology-emissions association in Top-10 polluted MENA countries: how to ascertain sustainable development by quantile modeling approach. J Environ Manag. https://doi.org/10.1016/j.jenvman.2020.110602

Sinha A, Mishra S, Sharif A, Yarovaya L (2021) Does green financing help to improve environmental and social responsibility? Designing SDG framework through advanced quantile modelling. J Environ Manag 292:112751. https://doi.org/10.1016/J.JENVMAN.2021.112751

Sun W, Li Y, Wang D, Fan J (2012) The efficiencies and their changes of China’s resources-based cities employing DEA and Malmquist index models. J Geogr Sci 22:509–520. https://doi.org/10.1007/S11442-012-0943-0

Sun H, Tariq G, Haris M, Mohsin M (2019) Evaluating the environmental effects of economic openness: evidence from SAARC countries. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-019-05750-6

Sun H, Pofoura AK, Adjei Mensah I et al (2020a) The role of environmental entrepreneurship for sustainable development: evidence from 35 countries in Sub-Saharan Africa. Sci Total Environ. https://doi.org/10.1016/j.scitotenv.2020.140132

Sun L, Cao X, Alharthi M et al (2020b) Carbon emission transfer strategies in supply chain with lag time of emission reduction technologies and low-carbon preference of consumers. J Clean Prod. https://doi.org/10.1016/j.jclepro.2020.121664

Sun L, Qin L, Taghizadeh-Hesary F et al (2020c) Analyzing carbon emission transfer network structure among provinces in China: new evidence from social network analysis. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-020-08911-0

Syamni G, Abd Majid MS (2016) Efficiency of Saving and Credit Cooperative Units in North Aceh, Indonesia. Signifikan J Ilmu Ekon 5:99–118. https://doi.org/10.15408/SJIE.V5I2.3193

Taghizadeh-Hesary F, Taghizadeh-Hesary F (2020) The impacts of air pollution on health and economy in Southeast Asia. Energies. https://doi.org/10.3390/en13071812

Taghizadeh-Hesary F, Yoshino N (2019) The way to induce private participation in green finance and investment. Finance Res Lett. https://doi.org/10.1016/j.frl.2019.04.016

Taghizadeh-Hesary F, Yoshino N (2020) Sustainable solutions for green financing and investment in renewable energy projects. Energies. https://doi.org/10.3390/en13040788

Taghizadeh-Hesary F, Rasoulinezhad E, Yoshino N et al (2021) The energy-pollution-health nexus: a panel data analysis of low-and middle-income Asian countries. Singap Econ Rev. https://doi.org/10.1142/S0217590820430043

Talavera DL, Muñoz-Cerón E, Ferrer-Rodríguez JP, Pérez-Higueras PJ (2019) Assessment of cost-competitiveness and profitability of fixed and tracking photovoltaic systems: the case of five specific sites. Renew Energy 134:902–913. https://doi.org/10.1016/J.RENENE.2018.11.091

Tian S, Wang S, Bai X et al (2021) Global patterns and changes of carbon emissions from land use during 1992–2015. Environ Sci Ecotechnol. https://doi.org/10.1016/j.ese.2021.100108

Tiep NC, Wang M, Mohsin M et al (2021) An assessment of power sector reforms and utility performance to strengthen consumer self-confidence towards private investment. Econ Anal Policy. https://doi.org/10.1016/j.eap.2021.01.005

Ullah S, Akhtar P, Zaefarian G (2018) Dealing with endogeneity bias: the generalized method of moments (GMM) for panel data. Ind Mark Manag 71:69–78

Umar M, Akhtar M (2021) Financial inclusion and bank risk-taking nexus: evidence from China. China Finance Rev Int. https://doi.org/10.1108/CFRI-08-2021-0174

Urban F, Siciliano G, Wallbott L et al (2018) Green transformations in Vietnam’s energy sector. Asia Pacific Policy Stud 5:558–582. https://doi.org/10.1002/APP5.251

Wang Y (2020) Evaluation of the role of offshore finance in promoting port economy based on big data analysis. J Coast Res. https://doi.org/10.2112/SI103-029.1

Wang P, Wen Y, Singh H (2017) The high-volume return premium: does it exist in the Chinese stock market? Pac Basin Finance J 46:323–336

Wasiaturrahma SR, Ajija SR et al (2020) Financial performance of rural banks in Indonesia: a two-stage DEA approach. Heliyon 6:e04390. https://doi.org/10.1016/J.HELIYON.2020.E04390

Wijesiri M, Viganò L, Meoli M (2015) Efficiency of microfinance institutions in Sri Lanka: a two-stage double bootstrap DEA approach. Econ Model. https://doi.org/10.1016/j.econmod.2015.02.016

Wiser RH, Pickle SJ (1998) Financing investments in renewable energy: the impacts of policy design. Renew Sustain Energy Rev 2:361–386

Wu H, Hao Y, Ren S et al (2021) Does internet development improve green total factor energy efficiency? Evidence from China. Energy Policy. https://doi.org/10.1016/j.enpol.2021.112247

Wu B, Monfort A, Jin C, Shen X (2022) Substantial response or impression management? Compliance strategies for sustainable development responsibility in family firms. Technol Forecast Soc Change. https://doi.org/10.1016/j.techfore.2021.121214

Xiang H, Ch P, Nawaz MA, Chupradit S, Fatima A, Sadiq M (2021) Integration and economic viability of fueling the future with green hydrogen: An integration of its determinants from renewable economics. Int J Hydrogen Energ 46(77):38145–38162

Xiao H, Shan Y, Zhang N et al (2019) Comparisons of CO2 emission performance between secondary and service industries in Yangtze River Delta cities. J Environ Manag. https://doi.org/10.1016/J.JENVMAN.2019.109667

Xiao H, Wang D, Qi Y et al (2021) The governance-production nexus of eco-efficiency in Chinese resource-based cities: a two-stage network DEA approach. Energy Econ 101:105408. https://doi.org/10.1016/J.ENECO.2021.105408

Yildirim K, Onder M (2019) Collaborative role of metropolitan municipalities in local climate protection governance strategies: the case of Turkish Metropolitan Cities. J Environ Assess Policy Manag. https://doi.org/10.1142/S1464333219500066

Zafar MW, Sinha A, Ahmed Z et al (2021) Effects of biomass energy consumption on environmental quality: the role of education and technology in Asia-Pacific Economic Cooperation countries. Renew Sustain Energy Rev. https://doi.org/10.1016/j.rser.2021.110868

Zapata Riveros J, Kubli M, Ulli-Beer S (2019) Prosumer communities as strategic allies for electric utilities: exploring future decentralization trends in Switzerland. Energy Res Soc Sci. https://doi.org/10.1016/J.ERSS.2019.101219

Zhang N, Wang B, Chen Z (2016) Carbon emissions reductions and technology gaps in the world’s factory, 1990–2012. Energy Policy 91:28–37. https://doi.org/10.1016/J.ENPOL.2015.12.042

Zhang D, Mohsin M, Rasheed AK et al (2021) Public spending and green economic growth in BRI region: mediating role of green finance. Energy Policy. https://doi.org/10.1016/j.enpol.2021.112256

Zhao L, Zhang Y, Sadiq M, Hieu VM, Ngo TQ (2021) Testing green fiscal policies for green investment, innovation and green productivity amid the COVID-19 era. Econ Change Restructuring. https://doi.org/10.1007/s10644-021-09367-z

Zhuo W, Ding C, Xiong Y, Peng J (2020) Construction of legal system for maritime international trade financial supervision cooperation. J Coast Res. https://doi.org/10.2112/SI103-030.1

Acknowledgements

This research is partly funded by University of Economics Ho Chi Minh City, Vietnam. This research is also partly funded by Van Lang University, Ho Chi Minh City, Vietnam.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Liu, Z., Vu, T.L., Phan, T.T.H. et al. Financial inclusion and green economic performance for energy efficiency finance. Econ Change Restruct 55, 2359–2389 (2022). https://doi.org/10.1007/s10644-022-09393-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-022-09393-5